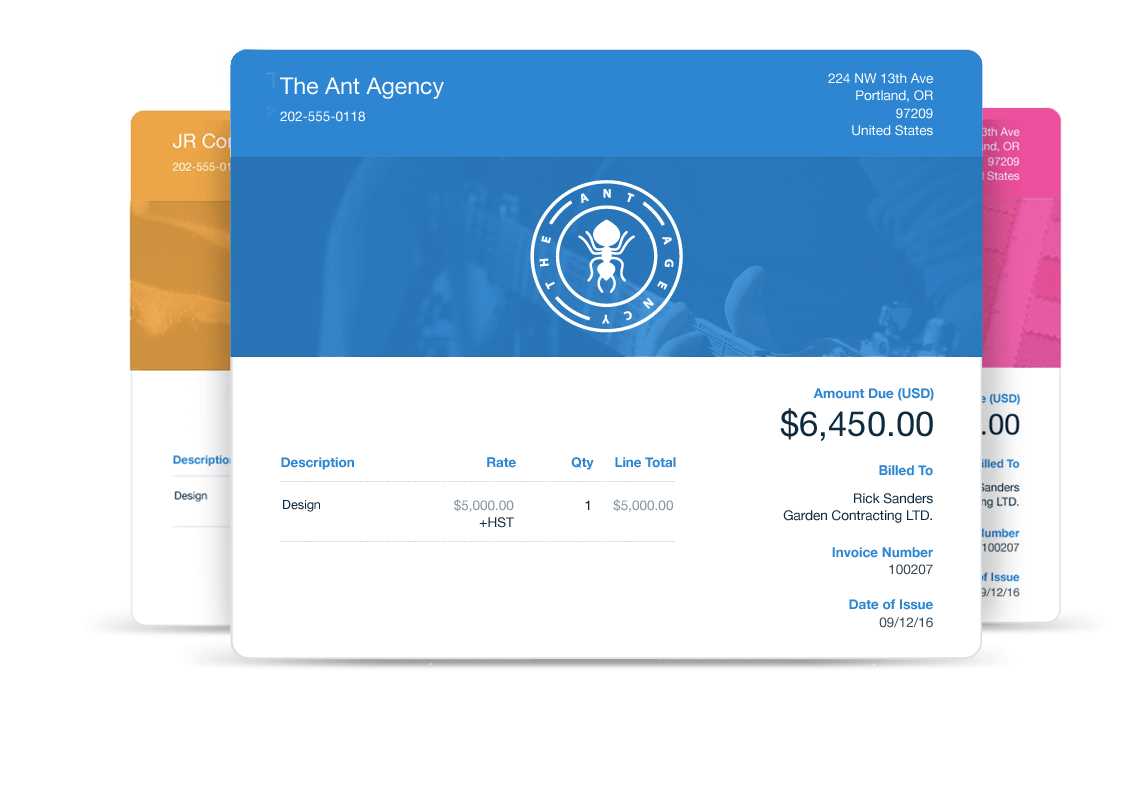

Professional Looking Invoice Template for Your Business

In any business, ensuring that your payment requests are clear, well-organized, and visually appealing is crucial for maintaining professionalism and encouraging prompt payments. The format in which you present financial details plays a significant role in how your clients perceive your company. A polished, structured document not only makes your work stand out but also helps establish trust with your clients.

Having an efficient and well-crafted layout for billing is essential for simplifying the process of managing transactions. This type of document serves as a representation of your business, and it’s important that it conveys both clarity and reliability. With the right approach, creating these documents can become a quick and seamless task.

Customizing such documents to suit the needs of your business is also an effective way to make your brand more recognizable. By incorporating specific elements that align with your company’s style, you can ensure that your requests for payment are consistent and professional. Moreover, a well-thought-out design can significantly enhance the client experience.

Professional Document Design for Billing

When creating a document to request payments from clients, the design and structure are key components that influence the effectiveness of your communication. A well-organized and clear document helps reinforce your brand image and ensures the transaction process is smooth for both parties involved. Crafting a visually appealing and easy-to-read document can leave a lasting impression, encouraging timely payments and building trust.

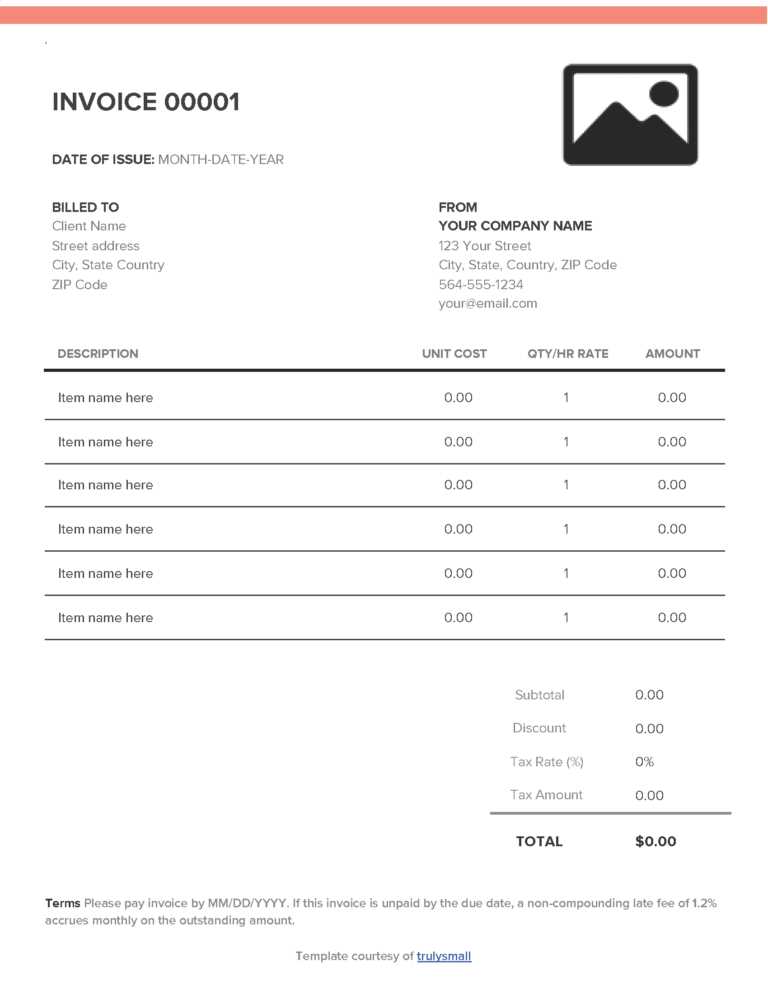

Key Features to Include

- Company name, logo, and contact details for clear identification

- Client’s information for accuracy and personalization

- Detailed list of products or services with clear descriptions

- Precise payment terms, due date, and any applicable taxes

- Easy-to-follow layout with organized sections and clear headings

Tips for Customization

- Ensure the document matches your company’s brand colors and style

- Choose an appropriate font for readability and professionalism

- Use tables to organize product/service details, making the information easy to scan

- Include payment methods and instructions clearly to avoid confusion

By incorporating these elements, you can create a well-organized and visually appealing document that not only serves its purpose but also reinforces your business’s image and reliability.

Why a Professional Document Matters

The way you present your billing details can have a significant impact on how clients perceive your business. A well-designed and clearly structured document not only helps you convey essential information efficiently but also contributes to the professionalism of your company. Properly formatted payment requests can build trust and enhance your reputation, ultimately leading to faster payments and better business relationships.

Benefits of a Well-Designed Payment Request

- Establishes a strong, professional brand image

- Minimizes misunderstandings by presenting clear and concise details

- Encourages timely payments by clearly outlining payment terms and deadlines

- Improves client relationships by showing attention to detail and professionalism

What Can Go Wrong with Poorly Designed Documents

- Confusing or incomplete information can lead to payment delays

- Lack of organization may give clients a negative impression of your business

- Failure to include necessary details such as taxes, discounts, or due dates may create misunderstandings

- Unprofessional layouts can harm your company’s credibility

Investing time in creating clear, visually appealing payment requests can lead to better outcomes for your business, ensuring smooth transactions and positive client interactions.

Choosing the Right Design for Billing Documents

Selecting the right structure and layout for your payment requests is essential for creating an efficient and effective document. The design should balance clarity, organization, and branding while being easy for your clients to understand. An intuitive layout helps your clients quickly find the information they need, while a clean, well-thought-out style strengthens your business’s image.

When choosing the right format for your payment requests, consider the following factors:

- Clarity: Make sure your layout is simple and easy to navigate, with sections that highlight essential details like amounts, dates, and services/products.

- Consistency: Ensure the design matches your overall branding, from the logo and color scheme to fonts and style. This helps reinforce your business identity.

- Responsiveness: Choose a layout that adapts well to both print and digital formats, ensuring that it looks good across various devices and platforms.

- Functionality: The design should facilitate clear communication, so include space for all necessary details without overcrowding the document.

By carefully considering these factors, you can choose a format that aligns with your company’s goals and delivers a seamless experience for your clients. A well-chosen layout helps set a professional tone and ensures your payment requests are both effective and easy to process.

Key Elements of a Billing Document

Creating an effective document for requesting payment requires including certain essential details. Each section of the document plays a critical role in ensuring that your client understands the services provided, the total cost, and the payment terms. A well-organized document will minimize confusion and speed up the payment process.

Essential Information to Include

- Business Information: Your company’s name, address, phone number, and email make it easy for clients to reach you if needed.

- Client Information: Include the client’s name and contact details to ensure the document is personalized and accurate.

- Details of Services or Products: Clearly list what was provided, including descriptions, quantities, and rates.

- Payment Terms: Clearly state the due date and any penalties for late payments to avoid misunderstandings.

- Total Amount: Highlight the total amount due, including any applicable taxes, discounts, or additional fees.

Layout Considerations

- Simple and Organized: Use headings and spacing to separate sections, ensuring the document is easy to navigate.

- Clear Date and Reference Numbers: Include the issue date and a unique reference number to help keep track of payments.

Including these critical elements ensures that your payment request is clear, professional, and effective in facilitating quick and accurate payments.

How to Customize Your Billing Document

Customizing your payment request is an essential step to ensure it aligns with your company’s branding and effectively communicates the necessary details to your clients. Personalizing your document helps make it more recognizable and professional, ensuring that clients can easily identify the document and understand its content.

Steps to Personalize Your Payment Request

- Incorporate Your Branding: Add your business logo, use brand colors, and select a font that reflects your company’s identity.

- Modify the Layout: Rearrange sections or adjust spacing to make sure the document is easy to navigate and visually appealing.

- Include Custom Fields: Add extra fields that might be specific to your industry, such as project codes, order numbers, or client-specific instructions.

- Adjust Payment Terms: Make sure the payment terms reflect your business’s unique needs, such as early payment discounts or custom due dates.

Considerations for Customization

- Ensure Readability: Avoid cluttered designs and overly complex language. Keep the layout simple, and use headings and bullet points for easy scanning.

- Be Consistent: Keep the design consistent across all your business documents for a cohesive brand presence.

By customizing your payment request, you enhance its clarity and strengthen your business’s professional image, leading to better client interactions and quicker payments.

Using a Template for Faster Billing

Utilizing a pre-designed structure for your payment requests can significantly speed up the billing process. By having a consistent format in place, you can reduce the time spent creating new documents from scratch and ensure that all necessary details are included every time. This not only helps with efficiency but also enhances accuracy by reducing the chances of missing important information.

Here are a few reasons why using a pre-made layout is beneficial:

- Consistency: With a ready-to-use design, you ensure all your billing documents are uniform, making it easier for clients to understand and process them.

- Time-saving: Instead of starting from zero each time, you can simply fill in the specific details, such as the amount and service provided.

- Less Mistakes: Having a fixed structure helps eliminate the chances of forgetting key details or misplacing essential information.

- Customization Ease: Pre-built designs can be easily adjusted to meet your unique needs, allowing you to modify details like payment terms or client information quickly.

By leveraging a pre-designed structure, you streamline your workflow, enhance productivity, and ensure that your payment requests are sent out promptly and accurately, improving overall cash flow.

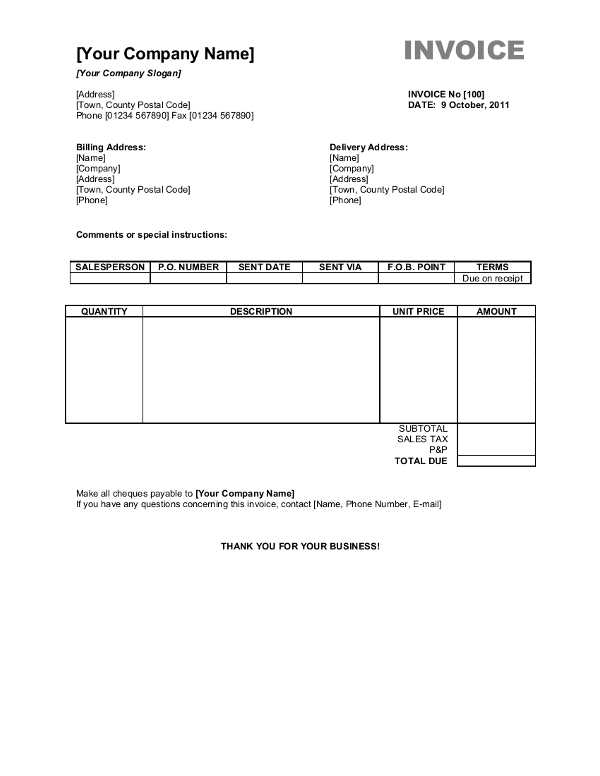

Simple Billing Layout Tips

Creating a straightforward and clear design for your payment request is crucial for ensuring that all the necessary information is easily accessible to your client. A well-structured layout minimizes confusion, enhances readability, and ensures that your clients can quickly understand the details of the transaction. Below are some tips for achieving a clean and simple design.

| Tip | Description |

|---|---|

| Clear Headings | Use bold or larger fonts for key sections like the total amount, client details, and payment terms to make them stand out. |

| Use Columns for Details | Arrange service descriptions, quantities, rates, and totals in neatly organized columns for easier reading. |

| White Space | Ensure there is enough space between sections so the content doesn’t look crowded. This enhances legibility and makes the document less overwhelming. |

| Consistent Alignment | Align text and numbers consistently throughout the document to keep it neat and professional. |

By following these simple layout tips, you can create a clean, easy-to-read document that clearly communicates the payment details, helping to ensure timely processing and a smooth transaction experience for your clients.

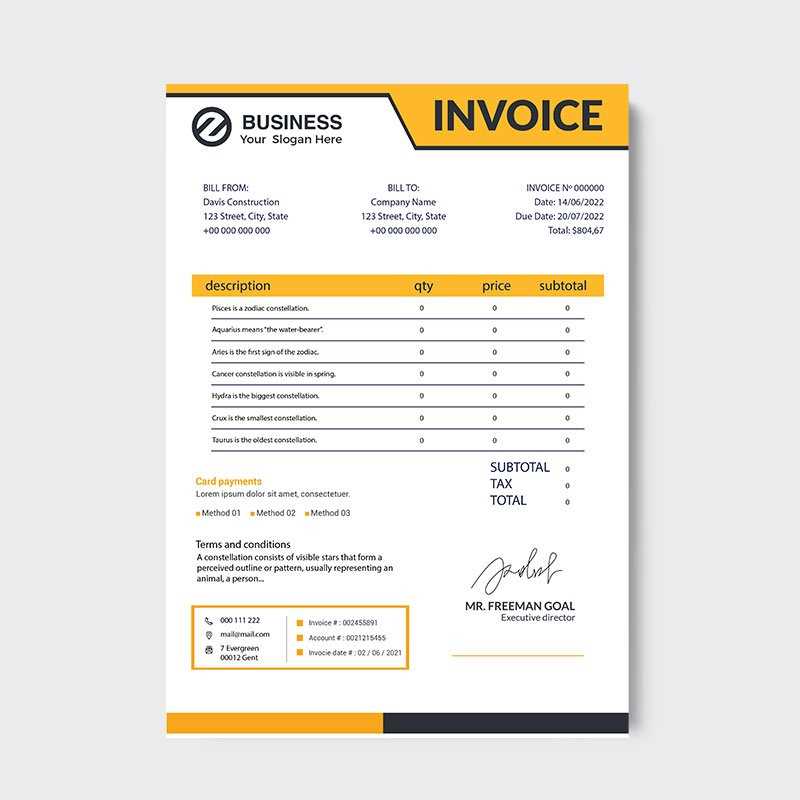

Incorporating Your Brand into Invoices

Including elements of your company’s identity in payment documents is essential for maintaining brand consistency across all communications. This approach not only reinforces your image but also ensures that clients easily recognize your business in every interaction. By customizing these documents with specific branding features, you can create a cohesive experience that leaves a lasting impression.

Key Branding Elements to Consider

- Logo: Place your logo at the top of the document to ensure it is the first thing the client sees.

- Colors: Use your brand’s color scheme for headings, borders, and accents. This helps the document feel aligned with your overall visual identity.

- Font Style: Choose fonts that match your brand’s style guide. Consistency in typography will further reinforce your business identity.

- Contact Details: Include your company’s website, social media handles, and phone number, making it easy for clients to get in touch or follow your business.

Why Branding Matters

- Trust: A well-branded document can help establish trust and professionalism, showing that your business is serious and organized.

- Recognition: Clients will quickly identify your business, leading to better brand recall and potentially more repeat business.

- Consistency: Branding in all aspects of your business, including billing documents, ensures a unified message and experience for your clients.

Incorporating your company’s identity into billing documents is a simple yet effective way to enhance your brand’s presence while making sure your business stands out in the eyes of clients.

Common Mistakes to Avoid in Billing Documents

Creating clear and effective payment requests is key to ensuring smooth transactions and maintaining strong client relationships. However, there are several common errors that can make these documents less effective, potentially leading to confusion or delays in payment. Avoiding these mistakes can help you maintain a professional image and improve the efficiency of your billing process.

Frequently Made Errors

- Missing or Incorrect Contact Information: Always double-check that your company’s details are accurate. Missing or incorrect information can lead to communication delays and confusion.

- Unclear Payment Terms: Clearly outline payment deadlines, methods, and any penalties for late payments to avoid misunderstandings.

- Not Including an Itemized List: Make sure to include a detailed breakdown of goods or services provided. This helps clients understand exactly what they’re paying for and prevents disputes.

- Errors in Calculations: Double-check your math to avoid any discrepancies in totals. Mistakes in pricing or tax calculations can damage your credibility.

- Failure to Include a Unique Reference Number: A reference number ensures that both you and your client can track the payment easily. Without it, payments may get lost or delayed.

Why These Mistakes Matter

- Delays: Mistakes often result in delayed payments, as clients may need additional clarification before making a payment.

- Client Distrust: Inaccurate or confusing documents can make clients question your professionalism, potentially harming future business relationships.

- Legal Issues: Some errors, like incorrect billing amounts or missed details, can cause legal disputes if not corrected promptly.

By carefully avoiding these common mistakes, you ensure that your payment requests are clear, professional, and facilitate smooth transactions with your clients.

How to Add Tax Information Properly

Including the correct tax details in your billing documents is essential for ensuring compliance with tax laws and maintaining transparency with your clients. Properly documenting taxes helps avoid misunderstandings and ensures that both you and your clients are on the same page when it comes to financial transactions.

Key Elements of Tax Information

- Tax Identification Number: Always include your business’s tax ID number. This is crucial for tax reporting and ensures your clients can verify your business’s legitimacy.

- Tax Rate: Specify the applicable tax rate based on your location and the type of service or product provided. Ensure this rate is clearly visible to prevent confusion.

- Tax Amount: List the exact tax amount applied to the total. Clearly separating this amount from the product or service charges makes the document more understandable.

- Tax Breakdown: If there are multiple tax rates or jurisdictions involved, break down the amounts clearly. For example, separate state and federal taxes if both apply.

- Exemptions or Deductions: If certain products or services are tax-exempt, indicate this clearly on the document to avoid discrepancies with clients or tax authorities.

Why Accurate Tax Information Matters

- Compliance: Properly including tax details ensures you comply with local tax regulations, which is crucial for avoiding penalties or audits.

- Transparency: Clear tax information enhances trust with clients, showing that you are transparent in your financial dealings.

- Prevention of Disputes: When tax amounts are clearly stated, clients are less likely to challenge the final bill, reducing the risk of disputes or delays.

By following these guidelines, you ensure that tax information is correctly presented, fostering professionalism and helping to streamline the payment process.

Creating Professional Invoices on a Budget

For small business owners or freelancers, creating quality billing documents doesn’t have to come with a hefty price tag. With the right tools and strategies, you can craft clean and clear financial statements without spending much money. Here are a few effective ways to make polished documents while keeping costs low.

Utilizing Free Online Tools

- Free Software: Many free programs and online platforms allow you to generate customized documents with a professional appearance. Tools like Google Docs, Microsoft Word, and others offer templates that can be adapted for your needs.

- Online Generators: Websites like PayPal, Zoho, or Wave provide free billing solutions, often including customizable fields, tax calculations, and easy export options.

- Spreadsheet Solutions: Spreadsheets (e.g., Google Sheets or Excel) can be used to create your own simple billing formats. With a little design effort, you can create a clean, functional document.

DIY Customization

- Personal Branding: Add a logo, brand colors, and consistent fonts to reflect your style without needing to hire a designer. These small details can elevate the overall look and feel of the document.

- Simplified Design: Focus on a minimalist approach that emphasizes clarity and organization. Use grids and tables to break down the information neatly.

- Template Customization: Start with a free template and personalize it with your business information, making it unique to your brand. This can be done quickly with most word processors or design tools.

Creating clean and effective billing documents doesn’t require expensive software or outsourcing. By using free tools and customizing simple designs, you can maintain a professional appearance while staying within your budget.

Benefits of Using Digital Invoices

In the modern business world, transitioning to digital billing solutions offers numerous advantages. The process of sending, receiving, and managing financial documents electronically not only streamlines operations but also enhances the overall efficiency of transactions. Here’s a look at the key benefits of using digital billing methods.

- Faster Delivery and Processing: Digital documents can be sent instantly, ensuring quick delivery to clients. This accelerates the payment cycle and minimizes the waiting time compared to traditional paper-based methods.

- Cost Savings: Eliminating the need for printing, paper, and postage reduces operational costs. Digital solutions also allow for easier record-keeping, cutting down on storage expenses.

- Environmentally Friendly: By using electronic means for billing, businesses can significantly reduce their carbon footprint. Going paperless helps contribute to a greener, more sustainable future.

- Improved Accuracy: Digital formats minimize the risk of human error, especially with automated calculations for totals and taxes. This leads to more accurate financial records and fewer disputes with clients.

- Convenient Payment Options: Many digital billing systems integrate with online payment platforms, allowing clients to make payments quickly and securely, directly from the document.

- Enhanced Organization and Tracking: Digital records can be easily organized, searched, and retrieved when needed. This provides better tracking of due dates, payment histories, and outstanding balances.

By embracing digital solutions, businesses not only improve operational efficiency but also enhance customer experience, making it easier for clients to view and pay their bills in a timely and secure manner.

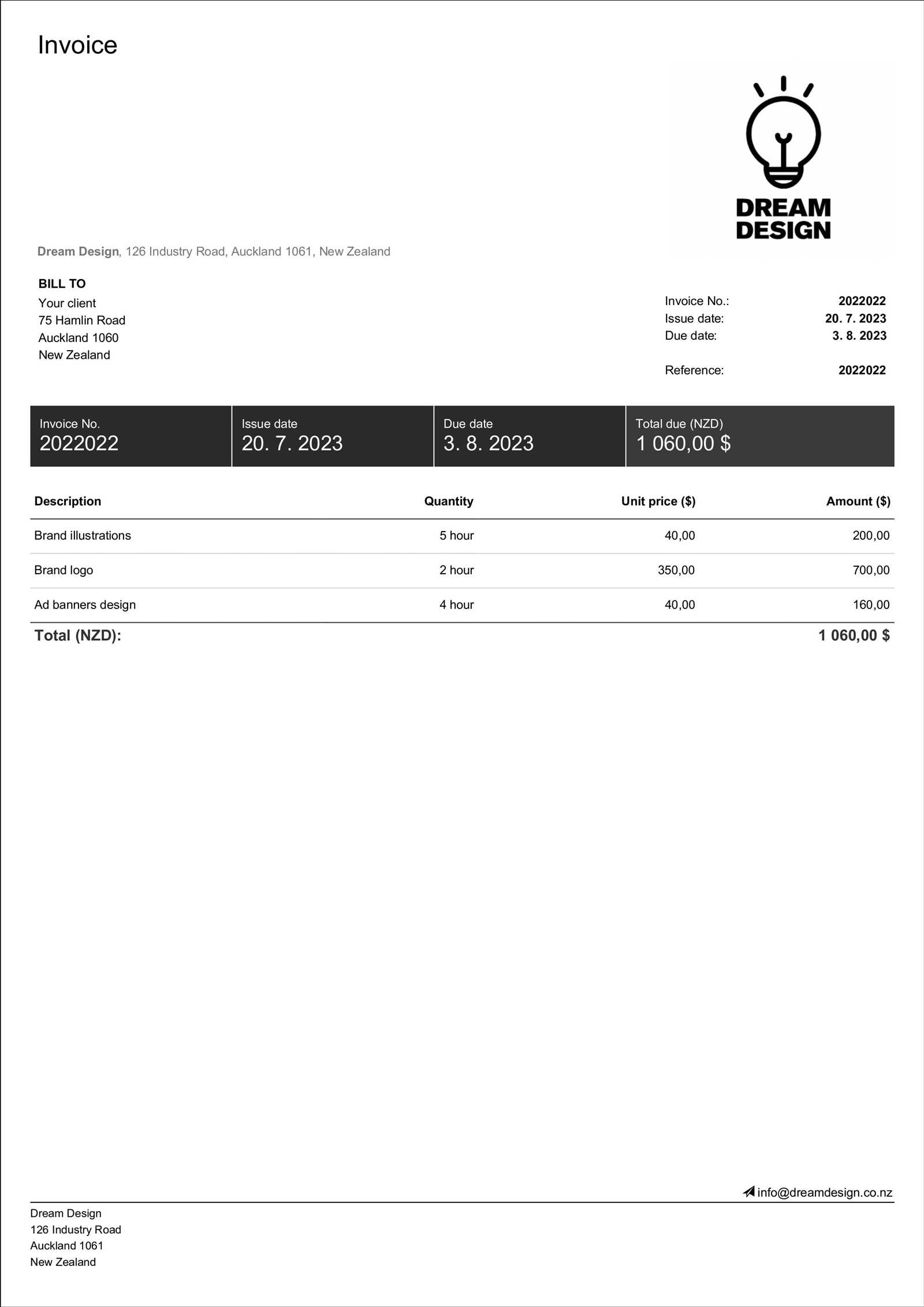

Invoice Templates for Different Business Types

Every business has unique needs when it comes to managing payments and transactions. The structure of financial documents should be tailored to suit the specific nature of the business, ensuring clarity and efficiency in the billing process. Below are some common formats suited for various industries, each designed to meet different requirements and help streamline the payment process.

| Business Type | Key Features | Common Elements |

|---|---|---|

| Freelancers and Consultants | Simple, easy-to-read design with itemized services and rates. | Project description, hourly rate, total hours, and payment terms. |

| Retail Stores | Comprehensive document that includes detailed product descriptions and quantities. | Product names, prices, quantities, taxes, and payment due date. |

| Service-Based Businesses | Focus on service descriptions and fees, often with a summary of work completed. | Service details, service date, rate, and payment instructions. |

| Subscription-Based Services | Regular billing, often with recurring charges and periodic payment schedules. | Subscription period, recurring fee, and next billing date. |

| Wholesale Businesses | Detailed breakdown of bulk items, quantities, and unit prices. | Bulk items, unit price, total cost, and delivery details. |

Understanding the specific needs of your industry helps in crafting a document that aligns with your business operations while offering a professional and consistent experience for your clients. Tailoring these records based on your business type ensures smoother transactions and helps avoid confusion.

How to Make Invoices Look Credible

To ensure that your financial documents are taken seriously, it’s essential to establish trust through clear, precise, and organized information. A well-structured document not only reflects your professionalism but also helps avoid confusion or disputes. Here are a few key strategies to enhance the credibility of your financial records.

1. Use Consistent Branding

Incorporating your company’s logo and branding elements ensures recognition and adds legitimacy. Keeping a consistent design throughout your financial records gives your business a polished and trustworthy appearance.

- Include your business logo and contact information at the top.

- Use your brand colors and fonts for a cohesive look.

- Make sure your design aligns with other communication materials like business cards or your website.

2. Provide Detailed Information

Being transparent with details helps avoid misunderstandings. Always include all necessary information in your documents.

- Clearly state the services or products provided, along with their respective costs.

- Include the date of the transaction and payment terms.

- List any additional charges or taxes applied to the total amount.

3. Ensure Accuracy

Accurate records are essential for building trust. Double-checking numbers and ensuring all relevant information is correct will demonstrate attention to detail and professionalism.

- Verify the customer’s information and ensure all amounts are correct.

- Cross-check your tax rates and payment terms.

By following these guidelines, you can significantly enhance the credibility of your financial documents and establish trust with your clients, ensuring smoother transactions and better business relationships.

Automating Invoice Creation for Efficiency

Automating the process of generating financial documents can save valuable time and reduce the risk of errors. By streamlining this task, businesses can focus on core operations while ensuring that records are accurate and consistent. Here are some ways to integrate automation into your billing process.

1. Choose the Right Software

Selecting software that suits your business needs is crucial. Many tools offer customizable options that can automatically generate documents based on pre-set data.

- Look for features such as recurring billing, payment tracking, and customizable fields.

- Ensure the software integrates with your accounting system for seamless data transfer.

- Consider cloud-based solutions for easy access and real-time updates.

2. Set Up Templates for Different Services

Automating document creation becomes much easier when you have pre-designed formats for various services or products. This allows you to generate accurate documents quickly without having to manually input data each time.

- Create a standard format for common transactions to reduce the time spent on each new document.

- Use placeholders for dynamic information like customer details, dates, and amounts.

- Ensure your system can automatically adjust totals based on the items selected.

3. Automate Notifications and Reminders

Automation can also help with follow-ups and reminders. By scheduling notifications, you can ensure that customers are aware of outstanding payments without any manual effort.

- Set up automatic reminders for upcoming payments or overdue balances.

- Send confirmation emails once a document is issued or when a payment is received.

By incorporating automation into the creation and management of your financial documents, you can greatly improve your workflow, reduce human error, and increase overall efficiency.

Mobile-Friendly Invoice Templates for Entrepreneurs

For modern entrepreneurs, having the ability to create and send financial documents on the go is essential. With increasing reliance on smartphones and tablets, it’s important to choose designs that are not only functional but also easy to read on smaller screens. Adapting your billing method to mobile devices can streamline operations and ensure you never miss a payment request.

1. Choose a Responsive Design

A responsive design automatically adjusts to different screen sizes, ensuring your document looks great on any device, whether it’s a phone, tablet, or laptop. This eliminates the need for zooming or scrolling, providing a seamless experience for clients.

- Ensure text is legible without the need for zooming.

- Use clear sections that are easy to read on a small screen.

- Make sure buttons or links are clickable without being too close together.

2. Streamline the Layout

For mobile-friendly designs, simplicity is key. Focus on presenting only the essential information in a concise and clear manner. Avoid cluttering the document with excessive details that may not be necessary for a quick overview.

- Use a clean, minimalist layout to avoid overwhelming small screens.

- Prioritize critical details, such as amounts, due dates, and contact information.

- Consider using bullet points or tables for easier navigation and better organization.

3. Optimize for Easy Sharing and Payment

Entrepreneurs should also look for designs that make it easy to share and make payments directly from the document. Integrated payment options or clear instructions for payment methods can help clients complete transactions faster and more efficiently.

- Provide payment links or QR codes that clients can scan directly from their phones.

- Ensure the document can be easily shared via email or messaging apps.

By focusing on mobile optimization, entrepreneurs can enhance their client’s experience and improve their business efficiency, making billing easier, faster, and more accessible.

How to Keep Your Invoices Organized

Staying organized when managing billing documents is crucial for maintaining a smooth workflow and avoiding errors. Keeping these financial records well-ordered ensures that you can quickly locate information when needed and helps streamline your business operations. Below are some practical strategies to keep everything in order.

1. Use a Consistent Naming Convention

One of the simplest ways to stay organized is by adopting a consistent naming system for your documents. This makes it easier to search and retrieve specific files later on.

- Include key details such as the client’s name, the date, and a unique reference number.

- Use a standard format, for example: “ClientName_Invoice_001_Date”.

- Avoid using vague file names like “doc1” or “new_invoice”.

2. Categorize Your Documents

Properly categorizing your records helps maintain clarity and efficiency. Group related documents together and organize them by year, client, or project.

- Create folders for each client or project and store their respective files in those folders.

- Sort documents into subfolders based on months or payment statuses (paid, unpaid, overdue).

- Ensure that every document is correctly labeled and filed after each transaction.

3. Utilize Digital Tools

Taking advantage of digital tools can significantly improve your organization. There are numerous applications available to track, store, and manage financial records securely.

- Use cloud storage services for easy access and backup.

- Consider using invoicing software to automate the process and ensure consistency.

- Set up automatic reminders for upcoming payments or overdue accounts.

By staying consistent and utilizing digital tools, you can maintain an efficient and organized record-keeping system, reducing stress and improving your overall business management.

How to Track Invoice Payments Effectively

Managing and tracking payments efficiently is essential for ensuring that your business maintains a steady cash flow. By organizing your financial records and having a clear system in place, you can easily monitor due payments and avoid misunderstandings with clients. Here are some tips to help you stay on top of your payments.

1. Use a Payment Tracking System

Establishing a payment tracking system is crucial for keeping tabs on outstanding amounts. Whether it’s a simple spreadsheet or specialized software, having a structured method allows you to track when payments are made and when they are due.

- Record key details such as the date, amount, client, and payment status.

- Update the status immediately when a payment is received or when a follow-up is needed.

- Use color coding or status markers (e.g., “paid”, “pending”, “overdue”) to visually organize payments.

2. Set Up Automatic Reminders

Automatic reminders can help you ensure that clients are notified of due payments without having to manually follow up each time. Many invoicing platforms allow you to set reminders for upcoming or overdue payments.

- Set up reminders to send a few days before the payment due date.

- Include polite, professional reminders for overdue payments to prompt clients without being pushy.

- Ensure that the reminders are consistent, but not too frequent, to avoid customer frustration.

3. Keep Communication Clear

Clear communication with clients about payment expectations is crucial for timely payments. Make sure that all payment terms are agreed upon before work begins and that both parties are on the same page regarding due dates and amounts.

- Communicate payment expectations upfront and confirm the due date on each billing document.

- If payments are delayed, reach out early to resolve the issue professionally and amicably.

By organizing your payment tracking system, setting up reminders, and keeping communication clear, you can ensure timely payments and maintain a smooth financial operation for your business.