Top Professional Invoice Templates for Streamlined Billing

Managing financial transactions and ensuring timely payments is crucial for any business. One of the simplest yet most effective ways to streamline this process is by using well-designed documents for requesting payments. These tools not only help maintain professionalism but also improve clarity and accuracy, minimizing potential errors and misunderstandings.

Creating a clear, concise, and easy-to-understand billing statement is essential for maintaining positive client relationships. Whether you’re a freelancer, small business owner, or part of a larger organization, having a structured approach to payment requests can save time and reduce administrative hassle. By choosing the right format, you can ensure that each bill is tailored to your needs while remaining adaptable for different purposes.

In this article, we’ll explore various options for crafting effective billing documents, discuss how they can be customized to suit different industries, and provide tips on how to choose and use them effectively. Whether you need a simple layout or a more detailed one, you’ll find useful insights to enhance your billing practices.

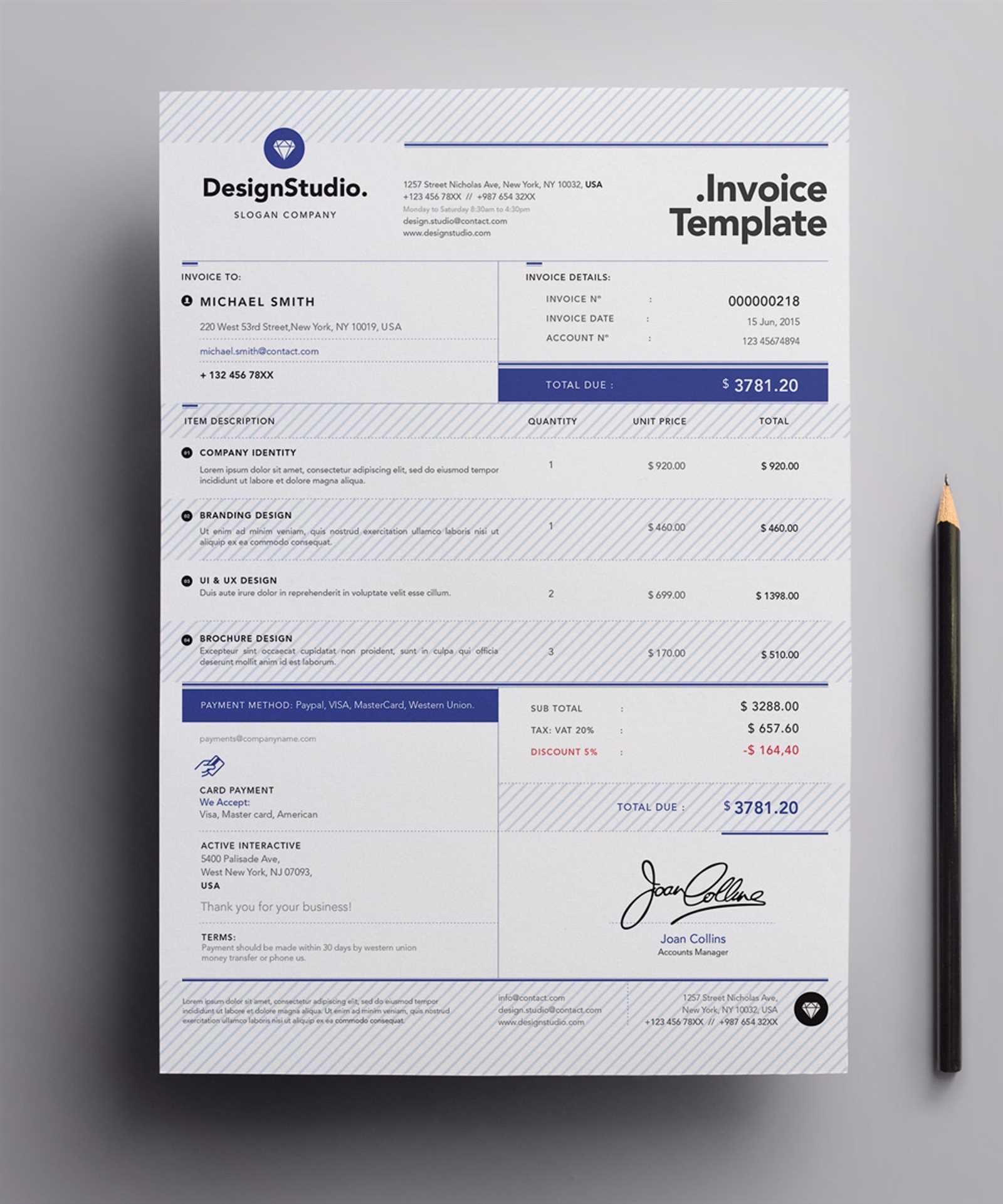

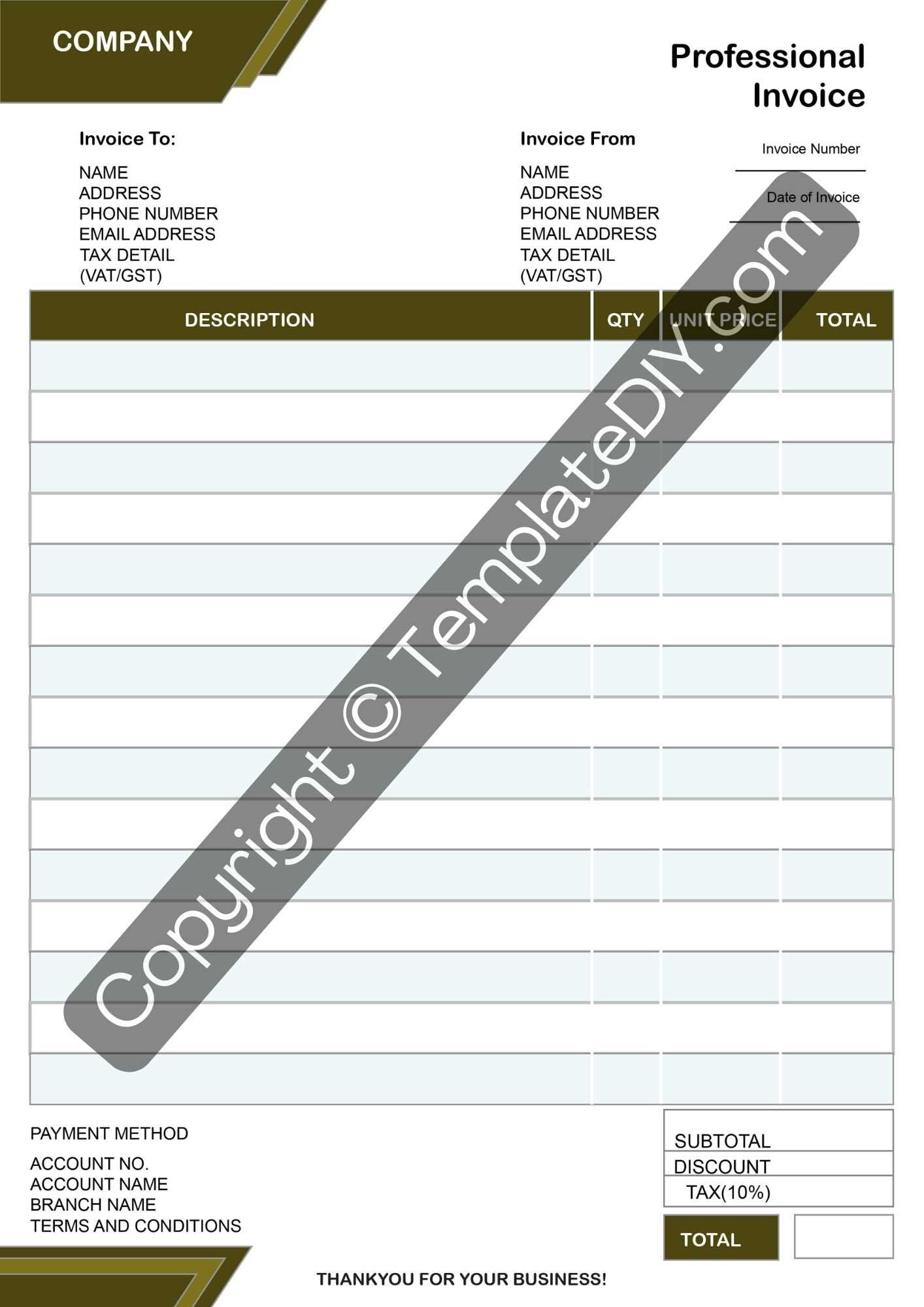

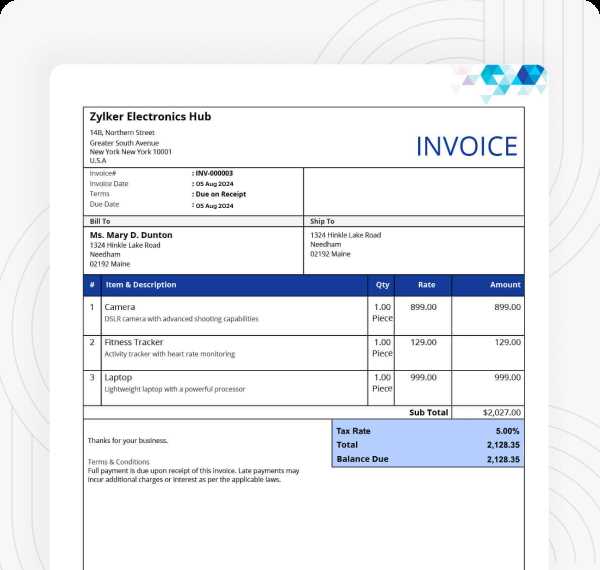

Professional Invoice Templates Overview

Efficient billing solutions are essential for smooth financial transactions between businesses and their clients. Having a well-organized document for requesting payments not only ensures clarity but also reflects the professionalism of the service provider. These documents can vary in complexity, but their core function remains the same: to clearly outline the terms of the transaction and ensure both parties are on the same page regarding expectations and due amounts.

Many businesses, whether small or large, rely on customizable formats to streamline the payment process. These formats are designed to be user-friendly, allowing businesses to input relevant details quickly and accurately. From simple designs to more intricate layouts, these tools offer flexibility and can be adapted to suit various industries and services.

With a vast selection available, it’s important to understand the different styles and features of these documents. Some formats may include advanced options like automatic calculations, while others focus on clean, minimalistic designs for quick and easy editing. Understanding the range of options will help you choose the most effective solution for your billing needs.

Benefits of Using Invoice Templates

Utilizing structured billing documents offers numerous advantages for businesses of all sizes. By using a standardized format, companies can save time, reduce errors, and present a more professional image to clients. These tools simplify the process of tracking payments, organizing records, and ensuring consistency across all financial communications.

One of the key benefits is time efficiency. With pre-designed layouts, there is no need to create a new document from scratch for each transaction. The ability to quickly fill in the relevant information accelerates the billing cycle, leading to faster payments and improved cash flow management.

Additionally, these documents help reduce the risk of mistakes. By following a consistent format, businesses are less likely to miss important details such as payment terms, service descriptions, or contact information. This minimizes misunderstandings and disputes with clients.

| Benefit | Description |

|---|---|

| Time-saving | Pre-designed layouts allow for quick customization, speeding up the billing process. |

| Consistency | A standardized format ensures all required information is included in every document. |

| Accuracy | Reducing errors helps prevent payment disputes and ensures a smooth transaction process. |

| Professional appearance | A polished and organized document reflects positively on your business reputation. |

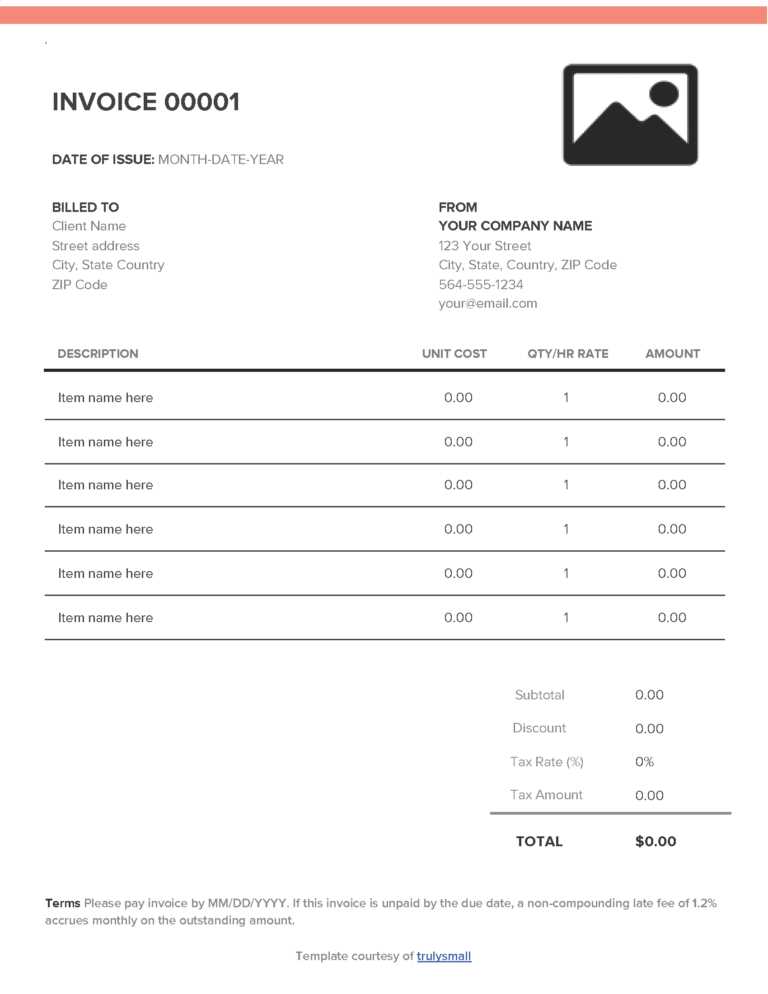

How to Choose the Right Template

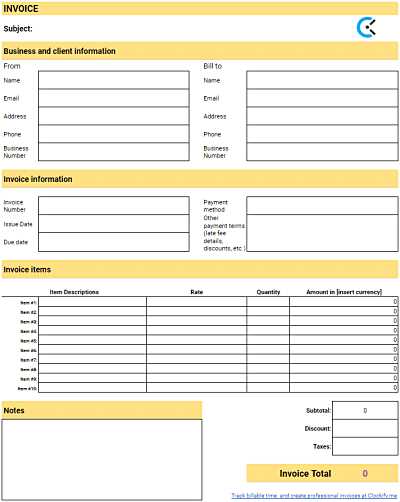

Selecting the right format for your billing needs is crucial to maintaining efficiency and professionalism. The layout you choose should not only meet your business requirements but also align with your branding and the expectations of your clients. It’s important to consider factors like the complexity of your services, the frequency of transactions, and how much customization is needed.

When choosing a layout, start by evaluating the specific information you need to include. For example, some businesses require detailed descriptions of products or services, while others may need to keep it simple with just the essential payment details. Look for a design that allows you to input this information quickly without overcrowding the document.

Additionally, consider the format’s visual appeal. A well-organized document with clear headings, readable fonts, and logical sections can help avoid confusion. Depending on your business type, you may prefer a more minimalist approach or a document with additional fields to accommodate more detailed data.

Lastly, ensure the format is flexible enough to adapt to different needs. For businesses with varying billing cycles or multiple clients, having a customizable solution can save time in the long run. Templates that are easy to update or modify as your business grows will provide ongoing value.

Customizing Your Invoice Template

Adapting a billing document to fit the specific needs of your business can enhance its functionality and improve its effectiveness. Customization allows you to tailor the layout, content, and design elements to reflect your brand identity and accommodate the details that matter most to your clients. Personalizing your billing documents can also help streamline your workflow and ensure that all necessary information is included.

Key Elements to Customize

- Branding: Include your company logo, color scheme, and font style to ensure the document reflects your business identity.

- Payment Details: Add specific fields for payment terms, late fees, or discounts to suit your financial arrangements.

- Client Information: Adjust the sections where you enter client contact details, making sure you have space for all relevant data.

- Service Descriptions: Modify the service or product descriptions section to accommodate your offerings in detail.

- Additional Notes: Include space for any notes or special instructions you need to convey to the client.

Tools for Customization

- Word Processing Software: Programs like Microsoft Word or Google Docs offer built-in tools for modifying text, layout, and design elements.

- Specialized Billing Software: Some software solutions allow you to create and customize billing documents with automated features for calculations and data entry.

- Online Platforms: Websites that offer customizable formats enable quick and easy editing, often with drag-and-drop features.

By customizing your billing documents, you can ensure that each one meets your specific business needs while maintaining a professional appearance. This personalized approach can make a significant difference in how clients perceive your business and can help you maintain a more organized financial system.

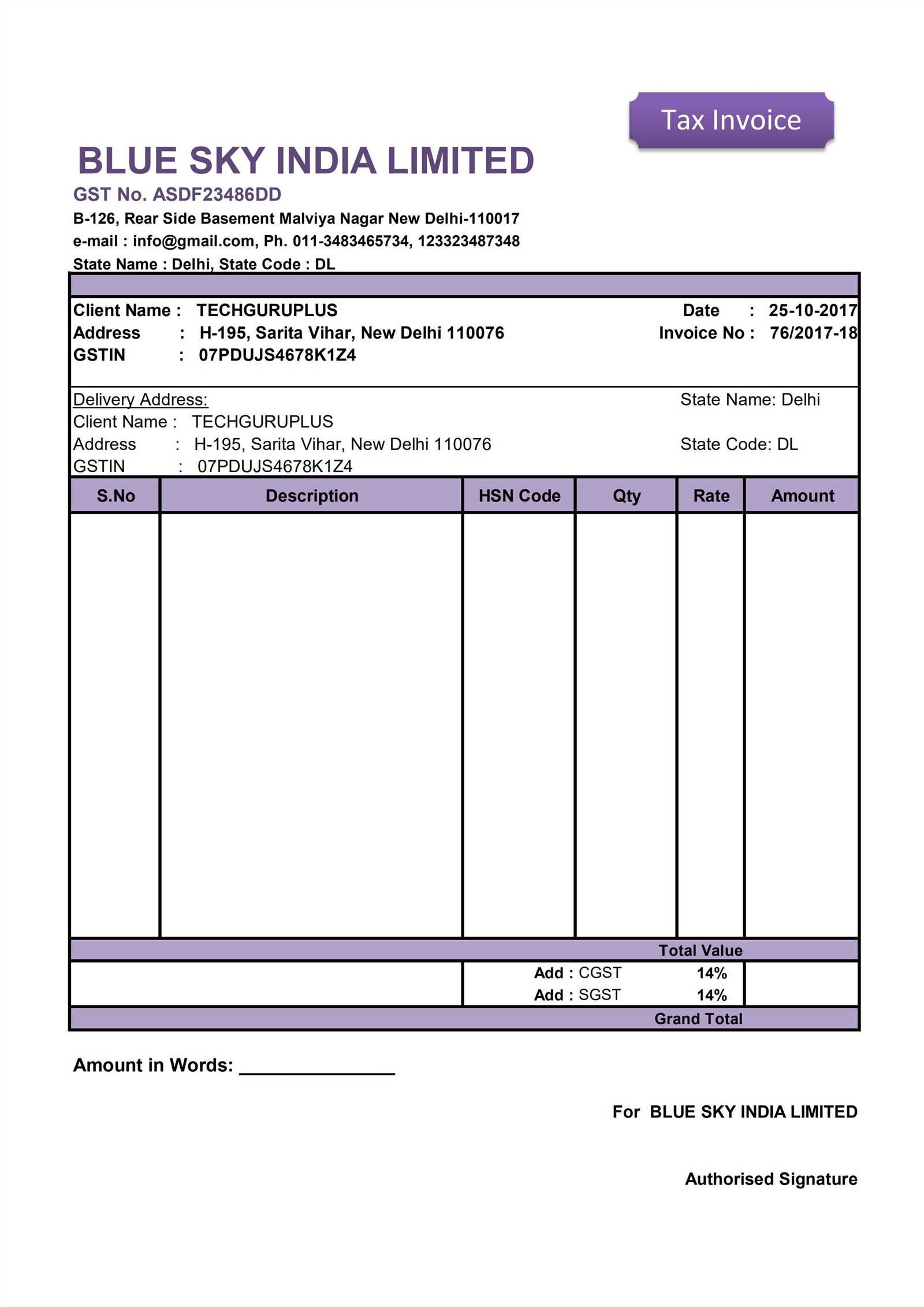

Essential Information on Every Invoice

To ensure clear communication and avoid payment disputes, certain details must be included in every billing document. These key elements provide the necessary information for clients to understand what they are being charged for, how to make payment, and when to do so. A well-structured bill not only helps with timely payments but also serves as an important reference for both the service provider and the client.

Key Details to Include

| Information | Description |

|---|---|

| Unique Identifier | Each document should have a unique number to differentiate it from others for tracking purposes. |

| Business Information | Include your company name, address, phone number, and email to make it easy for clients to contact you. |

| Client Details | Provide the name, address, and contact information of the client receiving the bill. |

| Description of Goods/Services | Clearly outline what has been provided, including quantity, unit price, and any additional details necessary for the client to understand the charges. |

| Total Amount Due | Include a clear summary of the total amount owed, including taxes, discounts, and any applicable fees. |

| Payment Terms | Specify the due date, payment methods accepted, and any penalties for late payments. |

Why These Details Matter

Including all relevant information ensures that both parties are on the same page and prevents confusion or delays. A comprehensive bill not only speeds up payment processing but also helps in managing financial records, offering a clear audit trail for your business.

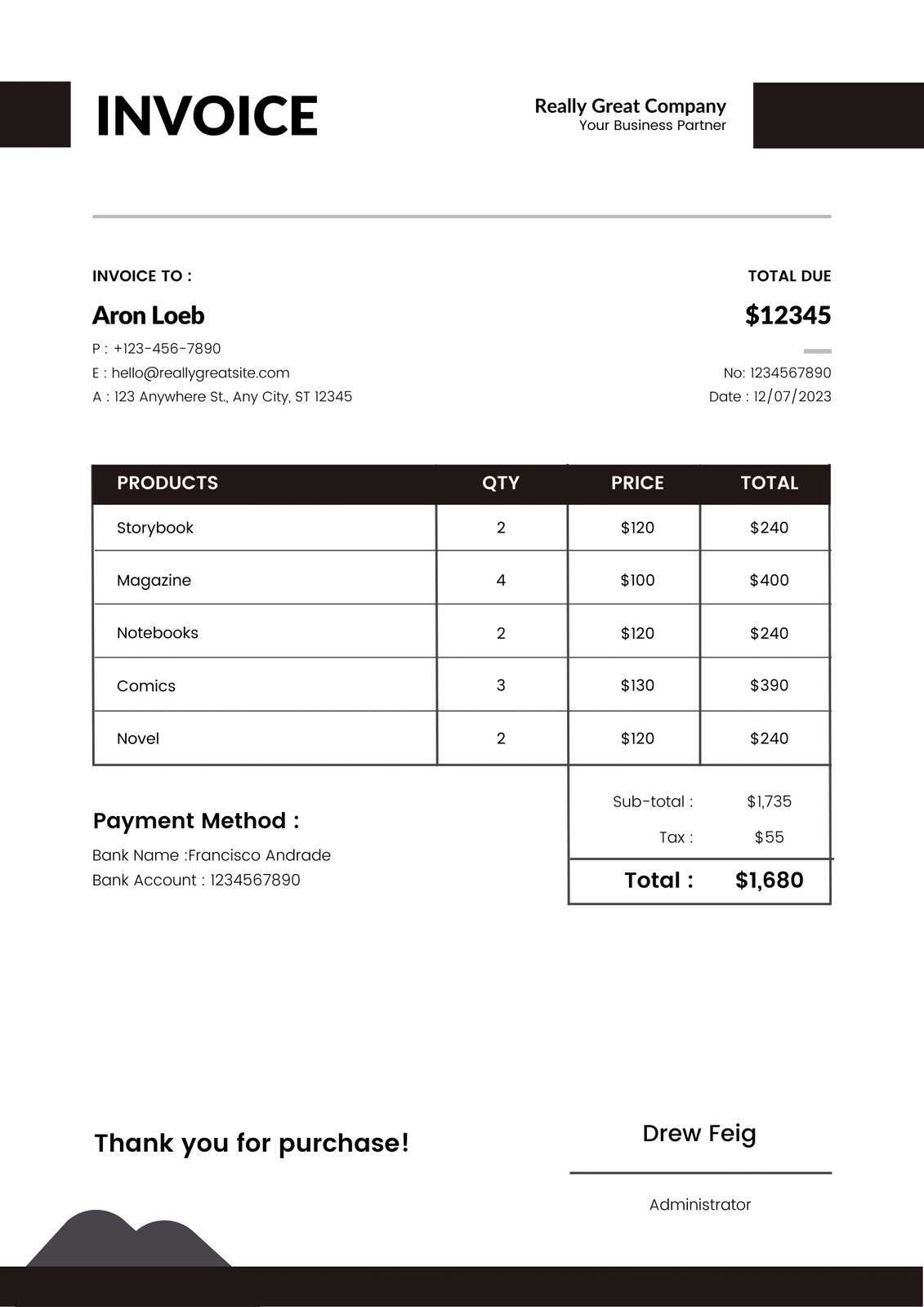

Free vs Paid Invoice Templates

When choosing a billing document format, businesses often face the decision of whether to use a free or paid solution. Both options offer distinct advantages, depending on your specific needs and the level of customization required. While free options can be a great starting point, paid solutions often provide additional features and flexibility that can be beneficial as your business grows.

Free billing formats are widely available and are a good choice for startups or small businesses with simple needs. They typically cover basic requirements, such as service descriptions, payment details, and contact information. However, these free versions may have limitations when it comes to design, customization options, or advanced features such as automatic calculations.

On the other hand, paid solutions often provide more advanced functionality. These may include a wider variety of designs, the ability to integrate with accounting software, automated calculations, and customizable fields. Paid formats can also offer enhanced customer support and additional security features. For businesses that require frequent updates, better scalability, or a more polished appearance, investing in a paid option can save time and improve professionalism in the long run.

Best Invoice Template Software Tools

For businesses looking to streamline their billing process, using specialized software can be a game-changer. These tools provide ready-made formats that can be easily customized to meet specific needs, saving time and reducing the risk of errors. They often come with additional features like automatic calculations, payment tracking, and integration with accounting systems, making them a powerful resource for any business.

The right software can simplify not only the creation of payment requests but also the management of financial records. Whether you’re a freelancer or a large organization, choosing a tool that offers both flexibility and ease of use is crucial for maintaining efficiency in your financial operations.

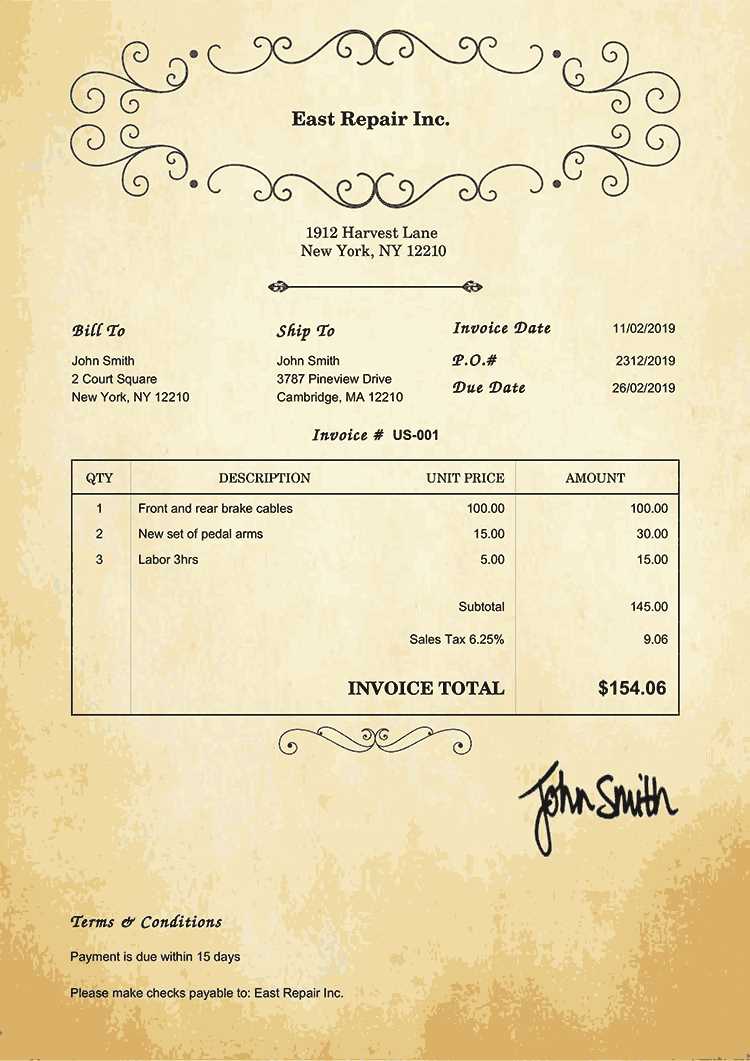

Design Tips for Professional Invoices

Creating a well-designed billing document is essential for ensuring clarity and professionalism in every transaction. The layout and visual appeal of your payment request can impact how clients perceive your business and how easily they can process the details. A clean, organized design can make it easier for your clients to understand the charges and make timely payments.

One of the most important aspects of design is simplicity. Avoid clutter and keep the layout straightforward, focusing on the most critical information. Use headings and sections to break down the content, making it easy to navigate. A clear distinction between service details, amounts owed, and payment instructions helps reduce confusion.

Additionally, branding plays a significant role in how your billing document reflects your business. Ensure that your logo, color scheme, and font choices are consistent with your brand identity. A well-branded document not only looks more professional but also reinforces your business’s credibility.

Lastly, pay attention to readability. Choose fonts that are clear and easy to read, especially for important sections like payment due dates and amounts. Adequate spacing between lines and sections helps ensure that the document is legible, even when printed or viewed on different devices.

Common Invoice Mistakes to Avoid

When preparing a billing document, it’s easy to overlook small details that can lead to confusion or delayed payments. Common errors can range from simple typographical mistakes to more serious issues that affect the clarity or accuracy of the document. Avoiding these pitfalls ensures smooth transactions and helps maintain a professional image with your clients.

Common Mistakes to Watch Out For

- Missing Contact Information: Failing to include correct business and client details can delay communication and payments.

- Incorrect or Missing Payment Terms: Not specifying payment due dates, late fees, or accepted methods can cause confusion and missed payments.

- Unclear Descriptions of Services: Vague or incomplete descriptions of what was provided can lead to disputes or clients questioning the charges.

- Mathematical Errors: Simple mistakes in calculations, such as incorrect totals or taxes, can undermine trust and delay payments.

- Lack of Unique Invoice Number: Without a unique identifier, tracking and referencing past documents can become difficult, especially for larger businesses.

- Failure to Proofread: Typos or formatting issues can make the document look unprofessional and may confuse the client.

How to Prevent These Mistakes

- Always double-check your calculations before finalizing the document.

- Use clear, concise language to describe your services and products.

- Ensure that both business and client information is accurate and up to date.

- Include a unique reference number on every billing document for easy tracking.

- Proofread thoroughly to catch any errors before sending out the document.

By paying attention to these common mistakes and taking steps to avoid them, you can improve the efficiency of your billing process and ensure that your clients receive accurate, professional documents every time.

How to Save Time with Templates

Using pre-designed formats for billing can significantly speed up your workflow. Instead of creating a new document from scratch each time, you can reuse and adjust an existing layout to suit your current transaction. This not only saves time but also reduces the chances of making mistakes, as the structure is already in place. By automating much of the process, you can focus more on your business and less on administrative tasks.

Key Time-Saving Benefits

| Benefit | Description |

|---|---|

| Pre-filled Fields | With a reusable format, you only need to fill in specific details such as dates, services, and amounts, rather than reformatting every line. |

| Consistency | Using the same layout for every transaction ensures consistency, making your workflow more predictable and efficient. |

| Automated Calculations | Some formats can automatically calculate totals, taxes, and discounts, eliminating the need for manual entry and reducing the risk of errors. |

| Easy Customization | Adjusting a pre-designed format for different clients or services is much faster than starting from scratch each time. |

How to Make the Most of Your Formats

- Set up standard fields for your most common services or products to reduce the amount of time spent on each document.

- Use online platforms that allow for easy customization and quick updates to your details.

- Keep a record of your most used formats to ensure you’re always using the most relevant and efficient one for the task at hand.

By incorporating these pre-designed solutions into your billing process, you’ll see a significant reduction in the time spent on administrative tasks, allowing you to focus more on growing your business.

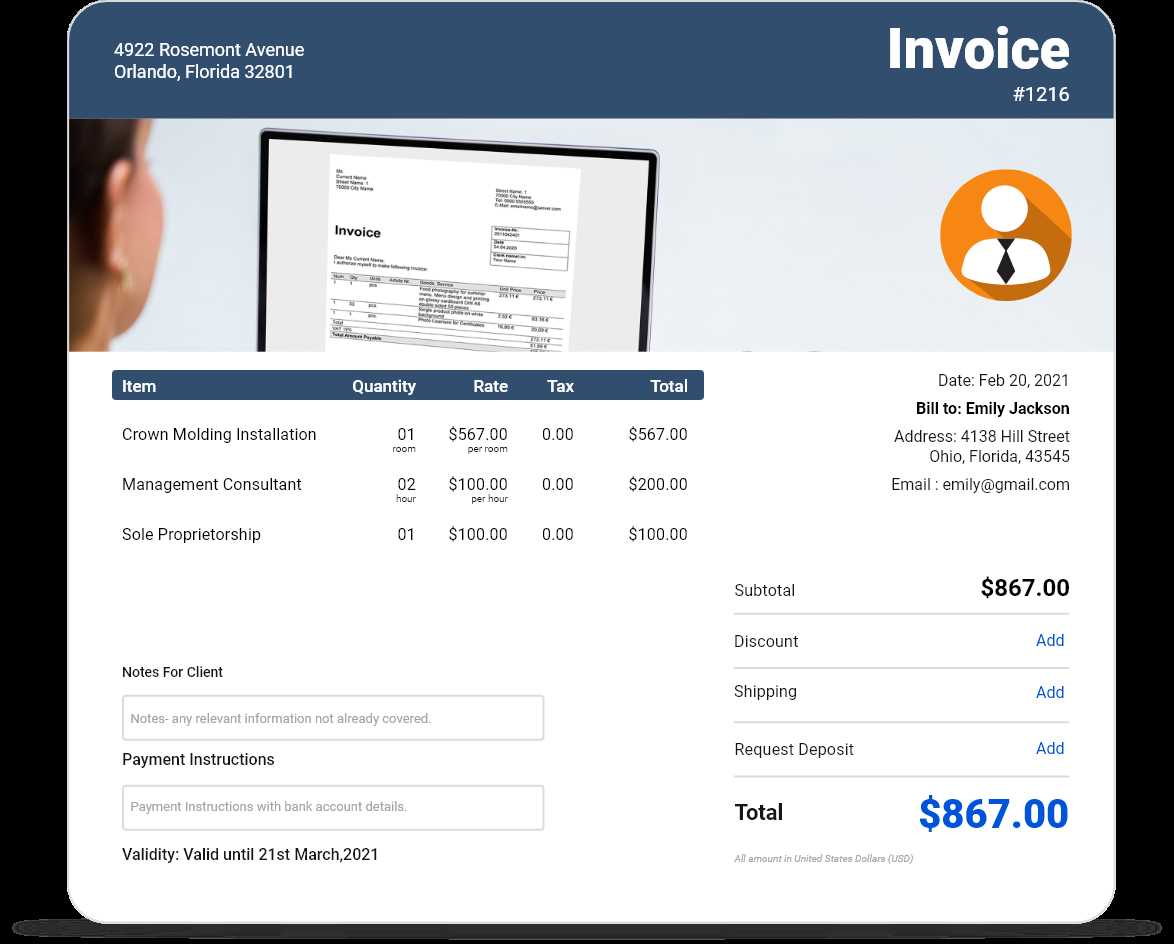

Creating Invoices for Different Industries

Each sector has its own set of requirements when it comes to documenting transactions, and this is reflected in the way they structure payment requests. Understanding the specific needs of each industry helps in crafting an accurate and effective document that not only serves its purpose but also aligns with industry standards and legal regulations. Customization is key to ensuring that the details included match the expectations of both the service provider and the client.

For example, a construction business might require more detailed breakdowns of labor and material costs, while a consulting firm could focus more on hours worked and specific project milestones. Similarly, e-commerce stores may include shipping details and product descriptions, whereas a photographer’s request might emphasize the nature of the service and deliverables. In all cases, the goal remains the same: to clearly communicate the agreed-upon terms and payment expectations.

| Industry | Key Elements | Typical Information |

|---|---|---|

| Construction | Labor and materials breakdown | Project phases, cost of materials, labor hours |

| Consulting | Hourly rates and project milestones | Consultation hours, scope of services, payment schedule |

| E-commerce | Shipping and product details | Product name, quantity, shipping address, shipping charges |

| Photography | Service description and deliverables | Event date, number of photos, post-production services |

Legal Considerations in Invoicing

When creating documents to request payment, it is essential to ensure that they comply with relevant legal standards. These documents are not just tools for tracking payments, but also hold legal weight in case of disputes or audits. Including the correct details and following the right procedures can protect both the service provider and the client, preventing misunderstandings and ensuring that all parties fulfill their obligations. Understanding the legal requirements can help avoid complications down the line.

Required Information

To make sure that the payment request is legally valid, certain details must be included. These might vary depending on local regulations and the nature of the transaction. Generally, it is important to have clear records of the transaction, including the services provided, the amounts due, and any applicable taxes. Failure to include these details could result in confusion or the inability to enforce payment legally.

Compliance with Tax Laws

Another crucial consideration is adhering to tax regulations. Depending on the jurisdiction, specific tax rates may need to be applied, and businesses must ensure they are collecting and remitting the correct amounts. Tax laws often dictate what information must appear on the payment request, such as the tax identification number and the breakdown of applicable taxes. Failing to comply with these regulations can result in fines or legal issues.

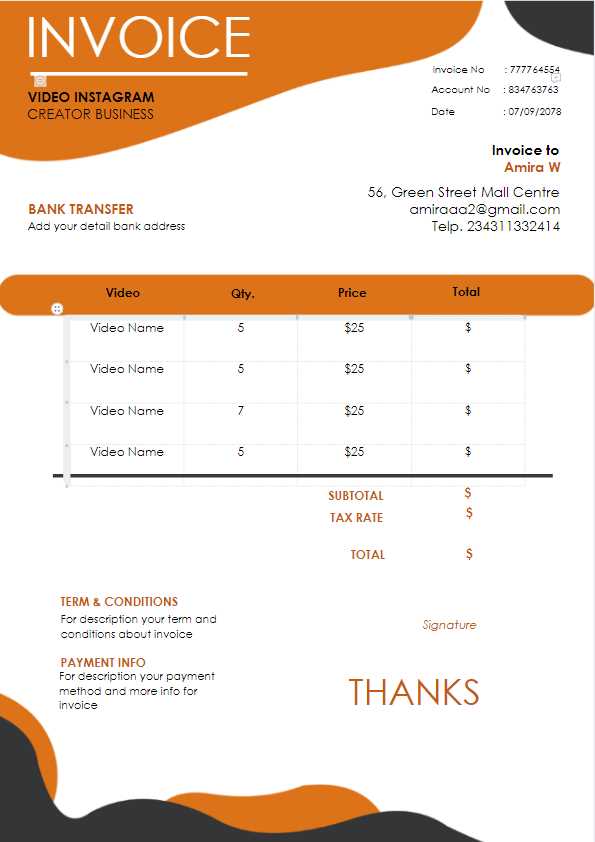

Invoice Templates for Freelancers

Freelancers often face unique challenges when it comes to requesting payment for their services. Since they are typically self-employed, it is essential to have a clear and organized method for documenting transactions. This not only ensures smooth financial operations but also fosters trust with clients. A well-structured document can help avoid misunderstandings and provide a professional image, while also protecting both parties in case of disputes.

Key Components for Freelance Payment Requests

When creating a payment request, freelancers should include specific details to make the document both effective and comprehensive. Key elements include the description of services rendered, payment terms, and the total amount due. This clarity ensures that both the freelancer and the client are on the same page regarding what was delivered and the agreed-upon payment.

Customization and Flexibility

Unlike traditional businesses, freelancers may work with a variety of clients across different industries, so the structure of their payment requests must be adaptable. It is important to customize the document to reflect the specifics of each project. For example, some may prefer to include hourly rates, while others may want a lump sum for completed tasks. Having the flexibility to tailor the content of each request, while maintaining consistency in design and organization, is essential for managing multiple clients.

Additionally, payment schedules (e.g., due on completion, upon milestones, or after a set period) should be clearly outlined to avoid confusion. Clear terms can reduce the risk of delayed payments and strengthen the freelancer’s professional reputation.

Automating Your Invoice Process

Managing payment requests manually can be time-consuming and prone to errors, especially when dealing with multiple clients or projects. Automating this process helps save time, reduces the chance for mistakes, and ensures that all necessary details are included every time. By setting up an automated system, you can streamline your financial operations, improve consistency, and focus more on your core work.

Benefits of Automation

Automating the payment request process offers several key advantages for both freelancers and businesses. Some of the main benefits include:

- Efficiency: Automating repetitive tasks speeds up the process and eliminates the need for manual entry.

- Consistency: Every request generated is uniform, ensuring that nothing is overlooked and all required details are consistently included.

- Accuracy: Automation reduces human error, making it less likely that critical information is missed or entered incorrectly.

- Time-saving: With a set system in place, there’s less time spent on administrative tasks, allowing for more focus on billable work.

How to Automate the Process

There are several ways to implement automation for payment requests, ranging from simple tools to more complex software solutions. Here’s how you can start:

- Use Accounting Software: Many tools allow you to create templates for payment requests, track due dates, and automatically send reminders to clients.

- Set Up Recurring Billing: For clients with ongoing projects or services, setting up automatic billing cycles helps reduce manual work.

- Integrate with Payment Systems: Connect your payment tools to automatically update the status once a payment has been received.

- Customize Workflows: Choose a solution that lets you automate document creation, approval, and sending, with customized fields tailored to your needs.

How to Track Payments Using Templates

Efficiently tracking payments is crucial for maintaining a smooth financial flow. By using structured documents, you can easily monitor whether payments have been made, which amounts are pending, and when to follow up with clients. A well-organized system for payment tracking helps you stay on top of your cash flow, ensuring you never miss a due date or forget about outstanding amounts.

Essential Information for Payment Tracking

When organizing payment records, it’s important to include the following key details:

- Amount Due: The total sum requested for payment, including any taxes or additional fees.

- Due Date: The date by which payment is expected to be made.

- Payment Status: Clearly indicate whether the payment is pending, completed, or overdue.

- Payment Method: Specify how the payment was or will be made (e.g., bank transfer, credit card, etc.).

- Notes: Include any relevant information, such as partial payments or payment discrepancies.

Tracking Payments in an Organized Manner

Using a structured document allows you to easily monitor and update the status of each payment. Here’s a sample format to track your records:

| Client Name | Amount Due | Due Date | Payment Status | Payment Method | Notes |

|---|---|---|---|---|---|

| Client A | $500 | 2024-11-15 | Paid | Bank Transfer | Payment received on time |

| Client B | $350 | 2024-11-20 | Pending | Credit Card | Awaiting payment |

| Client C | $250 | 2024-11-18 | Overdue | Bank Transfer | Follow-up required |

Integrating Invoices with Accounting Software

Integrating payment requests with accounting software is an effective way to streamline financial management and improve accuracy. By syncing your payment records with accounting tools, you can automate the tracking of due amounts, taxes, and payments, saving time and reducing errors. This integration simplifies the overall process, allowing you to focus more on your work and less on administrative tasks.

When integrated, the software can automatically update your financial records, categorize transactions, and generate reports. This not only helps maintain an accurate financial overview but also ensures compliance with tax laws and regulations. By minimizing manual data entry, integration reduces the chances of mistakes, ensuring that your accounts are always up to date.

With integration, reports can be automatically generated, giving you a clear view of your financial standing at any given time. Real-time tracking of payments and expenses makes managing cash flow more efficient and less stressful, particularly when dealing with multiple clients or ongoing projects.

Why Invoice Templates Improve Cash Flow

Having a clear and consistent system for requesting payments is essential for maintaining healthy cash flow. By using structured documents for billing, businesses can ensure that clients are promptly and accurately billed, reducing the likelihood of delayed payments. When payments are made on time, cash flow remains steady, which is crucial for covering operational expenses and planning for future growth.

Streamlining the Billing Process

Structured billing documents make it easier to manage payment requests and track due amounts. With a standardized format, businesses can quickly fill in the relevant details, ensuring that no information is missed. This efficiency reduces delays in sending out payment requests, which in turn accelerates the payment process. The faster the requests go out, the quicker payments are received, helping to maintain a positive cash flow.

Minimizing Disputes and Delays

Using well-organized documents can also help minimize misunderstandings and disputes with clients. When all relevant information is clearly outlined–such as the work completed, payment terms, and agreed-upon amounts–clients are less likely to question the bill. A lack of confusion leads to fewer delays in processing payments. This predictability helps businesses plan their finances with greater confidence.

By ensuring accuracy, clarity, and timeliness, structured billing documents can significantly improve the speed at which businesses receive payments, ultimately boosting their cash flow and financial stability.