Professional Invoice Template Excel for Easy Billing Management

For any business, having an organized and effective method of documenting transactions is essential. One of the most crucial aspects of managing payments is generating clear and accurate records for clients. By using structured layouts, you can ensure consistency and reduce the chance of errors in your financial processes.

There are various ways to create such documents, but digital solutions offer flexibility and customization. With a spreadsheet application, users can tailor designs to fit their specific needs while ensuring ease of use and quick access. Whether you are a freelancer or running a small enterprise, having a ready-to-use solution can save both time and effort.

Streamlining the process involves selecting the right format and understanding how to adjust it to suit different requirements. From adding essential fields to formatting calculations, the goal is to simplify financial tracking and communication with clients. With the proper tools, this task becomes more manageable and can be done in a matter of minutes.

What is a Professional Invoice Template?

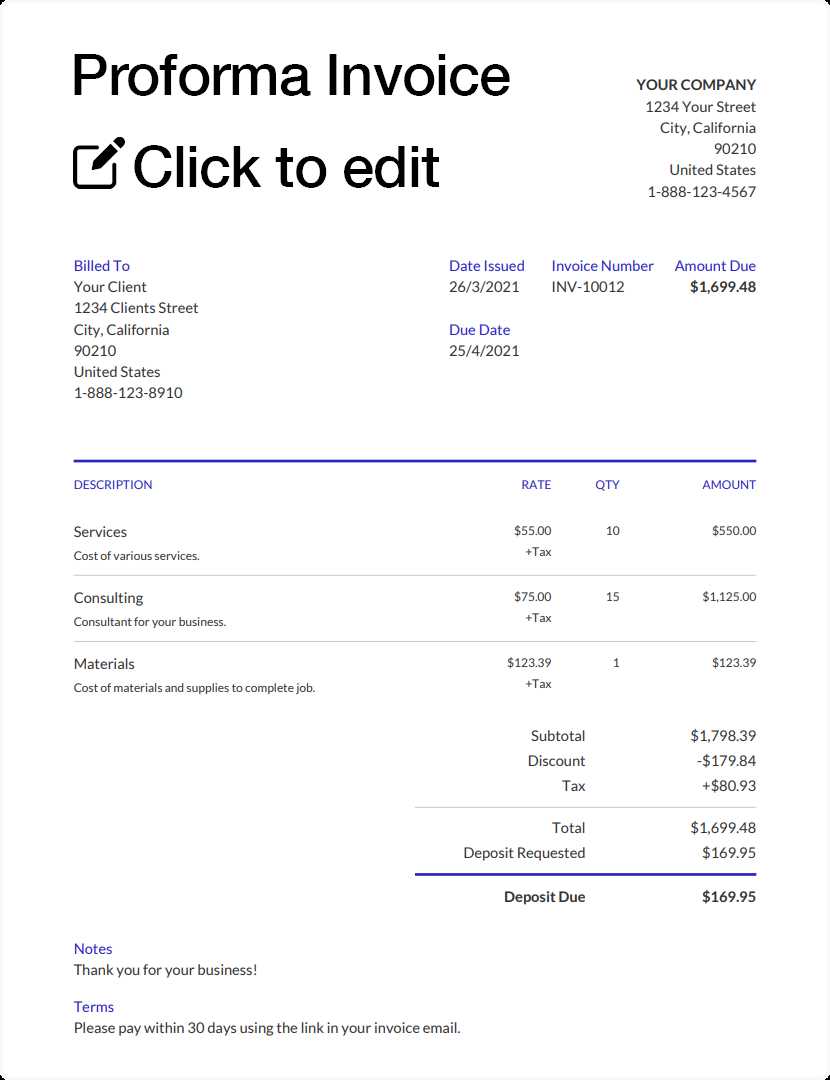

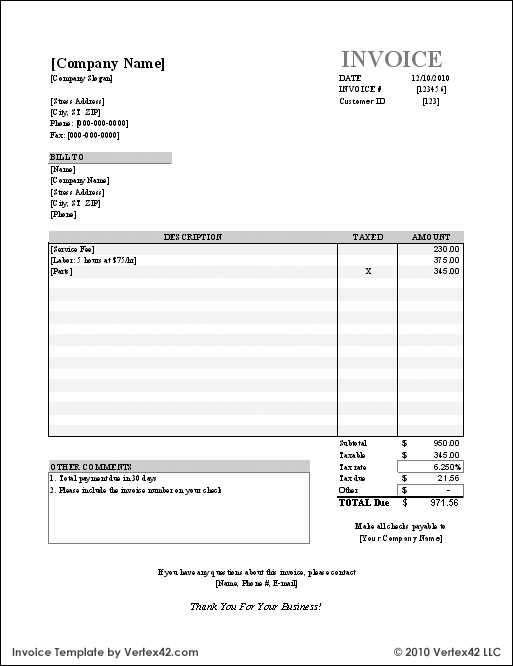

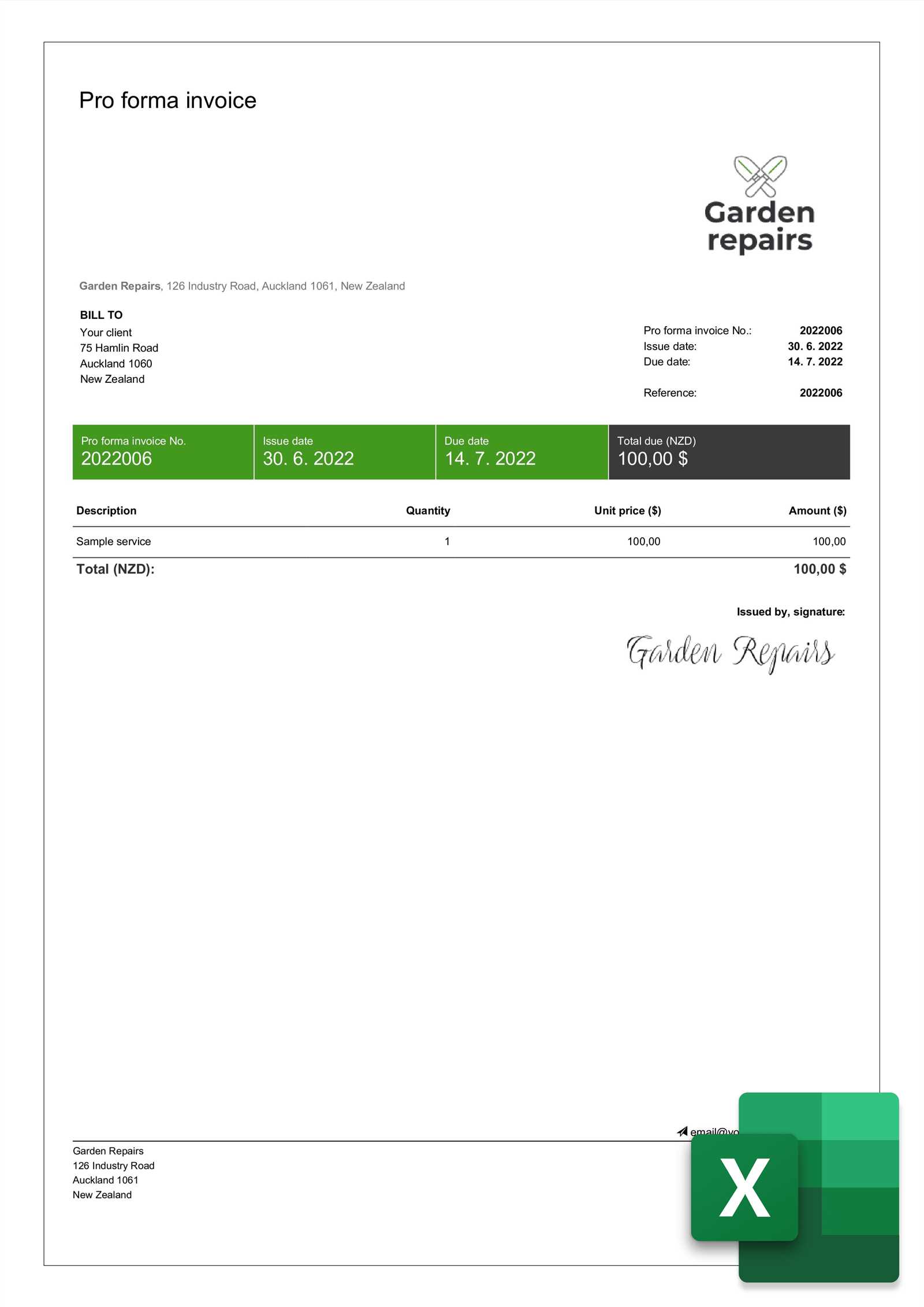

A structured document used for billing is essential for any business to maintain clear communication with clients regarding services provided or products sold. Such a document not only serves as a request for payment but also acts as a formal record for both parties, helping to track transactions accurately. This tool ensures that all necessary details, like amounts due, dates, and terms, are clearly presented and easy to understand.

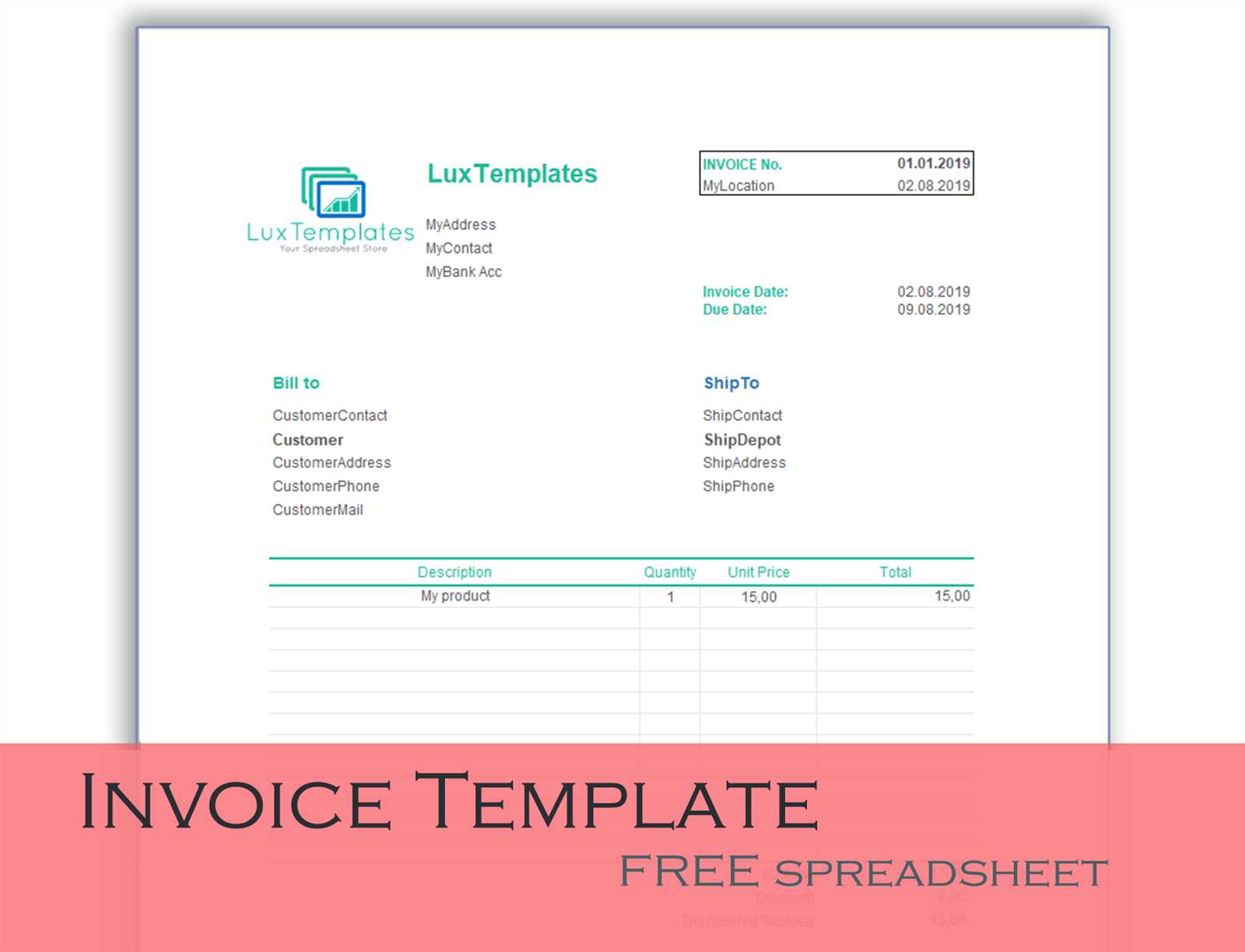

Customization is key when creating these documents, as businesses may have specific requirements depending on their field or customer preferences. By using an adaptable structure, businesses can easily modify the layout to suit their needs while maintaining a consistent and professional appearance. This flexibility allows for the inclusion of important fields, such as contact details, payment instructions, and tax calculations, ensuring that nothing is overlooked.

Using a digital approach to create these records offers many advantages, including ease of updates and the ability to store documents securely. With the right layout and setup, these documents can be generated quickly and tailored to meet specific business requirements. This approach makes the entire process smoother for both the creator and the recipient of the document.

Benefits of Using Excel for Invoices

Using a spreadsheet application for generating billing documents offers significant advantages, especially when it comes to flexibility and ease of use. This approach allows users to create and manage their records in a digital format, streamlining the process of creating detailed, organized statements that are both professional and easy to update.

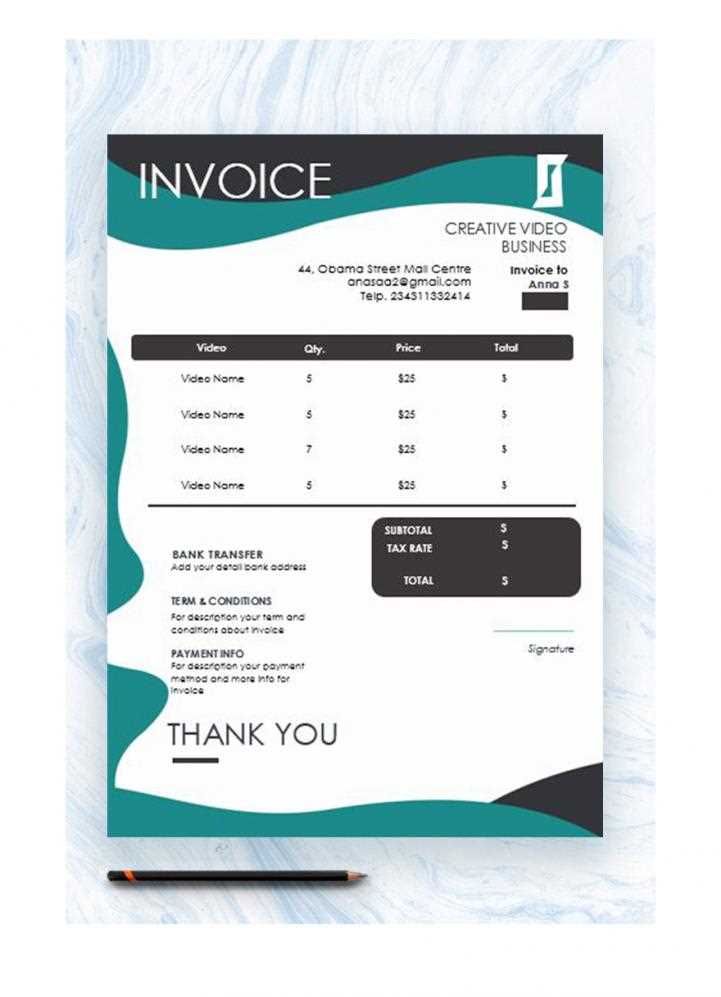

Customization is one of the key benefits of using a spreadsheet. Users can adjust the layout, colors, and structure to match their business branding or personal preferences. This flexibility ensures that every document is tailored to meet specific needs while maintaining consistency across all transactions.

Additionally, with built-in features like automated calculations, users can save time and reduce the risk of errors. Adding totals, taxes, and discounts becomes an effortless task, as formulas can be applied to automatically compute final amounts. This eliminates manual entry, making the process faster and more accurate.

Data management is another advantage of this approach. Information stored in a spreadsheet is easily searchable and editable, providing quick access to past records. Whether it’s for tracking payments or adjusting pricing, managing multiple entries becomes simple with organized sheets that can be updated in real-time.

How to Customize Invoice Templates

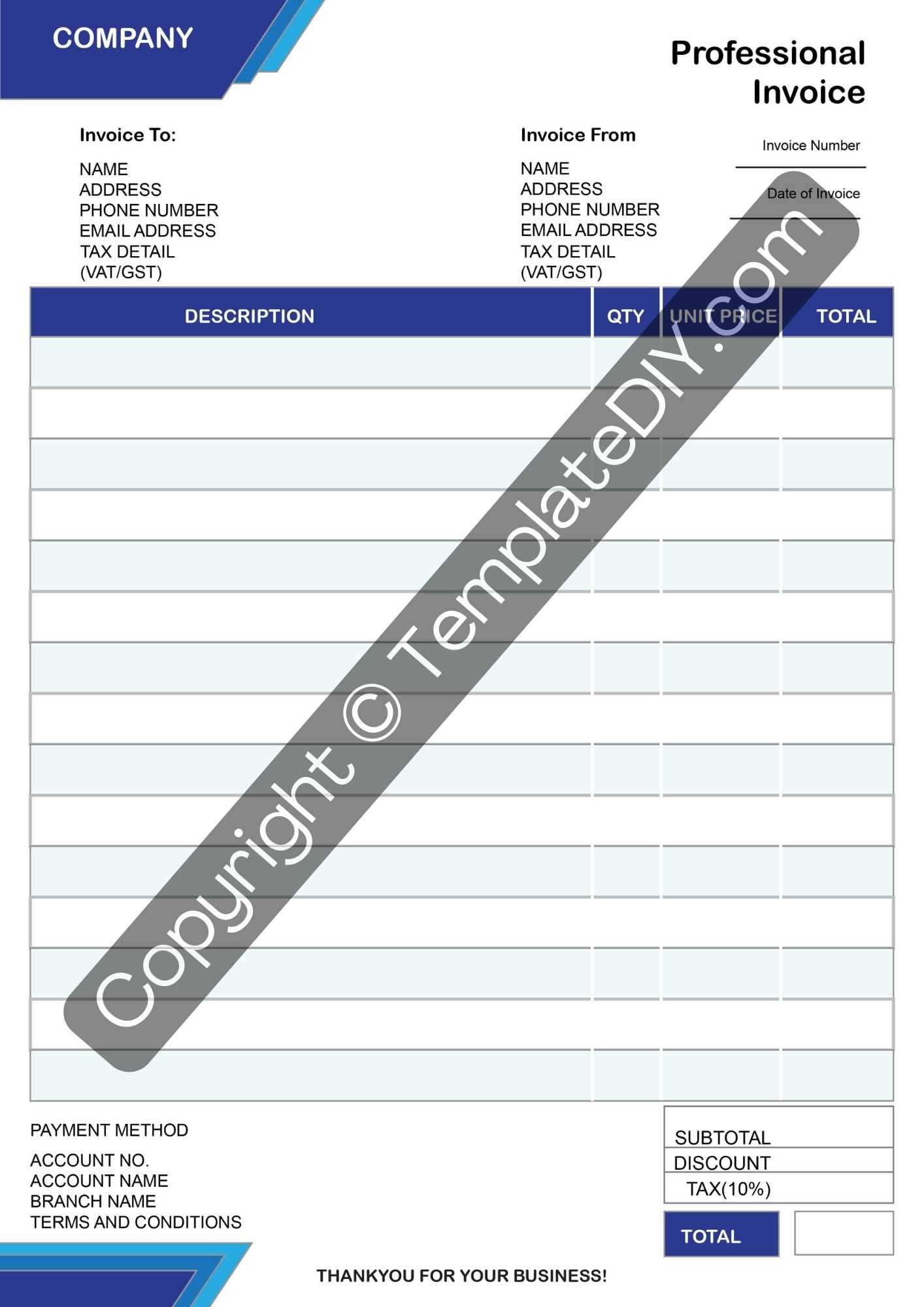

Customizing a billing document involves adjusting the layout and content to fit your specific business needs. By tailoring the structure, you can ensure that all necessary details are included and presented clearly, making it easier for clients to understand the charges and payment terms.

Here are the key steps for modifying a billing document:

- Adjust the layout: Change the font, colors, and overall design to reflect your company’s brand. A clean, professional layout is crucial for making a good impression.

- Include essential information: Ensure that important fields such as client contact details, service descriptions, dates, and payment instructions are clearly displayed.

- Automate calculations: Use formulas to automatically calculate totals, taxes, and discounts. This saves time and reduces the chances of human error.

- Add custom fields: Depending on your business, you may want to add specific fields for tracking project codes, itemized lists, or payment due dates.

- Save as a reusable document: Once customized, save the layout for future use, ensuring consistency across all your billing records.

By following these simple steps, you can create tailored documents that are not only functional but also aligned with your business style and goals. Customizing your billing process enhances professionalism and makes it easier to track financial transactions.

Common Invoice Template Mistakes to Avoid

When creating billing documents, small mistakes can lead to confusion and delays in payment. It’s essential to be mindful of details that may seem insignificant but can have a big impact on how clear and professional the final document appears. By avoiding common errors, you ensure that your clients receive accurate, easy-to-understand records.

Overlooking Essential Information

One of the most frequent mistakes is leaving out crucial details, such as contact information, due dates, or a clear breakdown of charges. These elements are vital for both the payer and the payee to understand the document fully. Failing to include this information may lead to confusion or delays in payments.

Formatting and Calculation Errors

Another common issue is errors in calculating totals or misaligning columns in the layout. These problems can make the document appear unprofessional and might result in discrepancies when clients review the amounts owed. Always double-check the accuracy of formulas, calculations, and the general formatting of your document.

Consistency is key when it comes to maintaining a professional image. Ensuring that every document you create is clean, organized, and includes all necessary information will help you avoid misunderstandings and improve client trust.

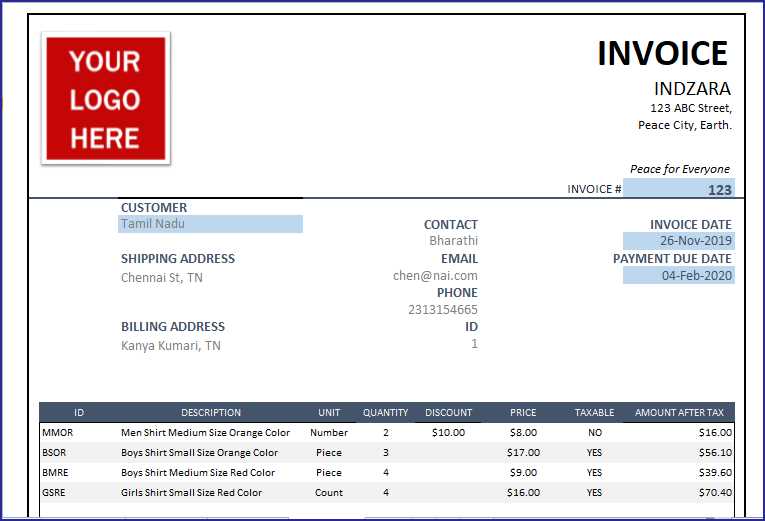

Creating Professional Invoices in Excel

Designing clear and organized billing documents is crucial for maintaining a smooth financial workflow. With the right approach, you can easily create a well-structured record that includes all necessary details, such as amounts due, client information, and payment terms. By using a spreadsheet, the process becomes more efficient and customizable, making it easier to manage and update your documents.

Step-by-Step Guide to Creating a Billing Document

Follow these steps to create a properly formatted and effective document:

- Set up the layout: Start with a clean and simple layout. Include sections for your company name, contact information, and a title for the document.

- Include customer details: Ensure that client information is correctly placed, including their name, address, and any reference numbers, if applicable.

- Detail the services or products: List the services or products provided, along with their descriptions and individual prices. Be clear and concise in your descriptions to avoid confusion.

- Incorporate totals and calculations: Use formulas to calculate totals, taxes, discounts, and the final amount due. This ensures accuracy and saves time on manual calculations.

- Set payment terms: Clearly state the payment due date, any late fees, and acceptable payment methods to avoid misunderstandings.

Finalizing Your Document

Once you have entered all the necessary information, review the document for consistency and accuracy. Ensure that all amounts are correctly calculated, the layout is easy to read, and there are no missing fields. Save the document as a reusable template so you can quickly generate similar records in the future.

Integrating Payment Details in Your Invoice

When creating billing documents, it’s essential to clearly outline the payment terms to avoid confusion and ensure timely transactions. Providing detailed payment instructions helps clients understand how to pay, when to pay, and the exact amount due. Properly integrating these details into your document makes the process smoother for both parties involved.

Essential Payment Information to Include

To make the payment process as clear as possible, include the following details in your document:

- Due date: Specify the exact date by which the payment is expected. This helps clients prioritize their payments and prevents overdue issues.

- Accepted payment methods: List all the ways you accept payments, such as bank transfer, credit card, or online payment platforms.

- Late fees: If applicable, mention any late fees that may apply if the payment is not received by the due date.

- Bank account details: For clients paying via bank transfer, ensure your bank details are clearly stated, including account number, sort code, and any relevant reference numbers.

- Payment reference: Include a reference number or code that clients can use when making their payment to ensure it’s correctly linked to their account.

Formatting Payment Information for Clarity

Make sure the payment details are prominently displayed and easy to find. A separate section towards the bottom of the document works well for this information. By making payment instructions clear and easy to follow, you minimize the chances of errors and delay in processing payments.

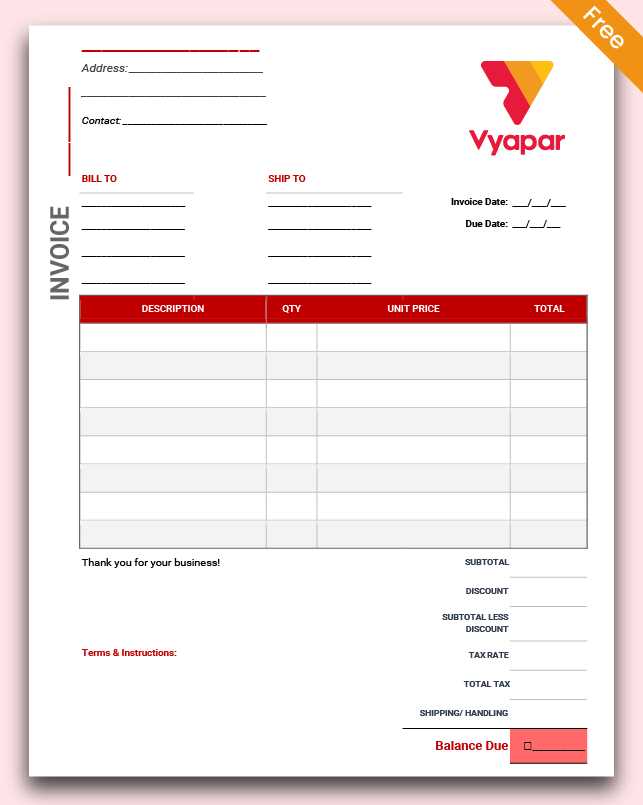

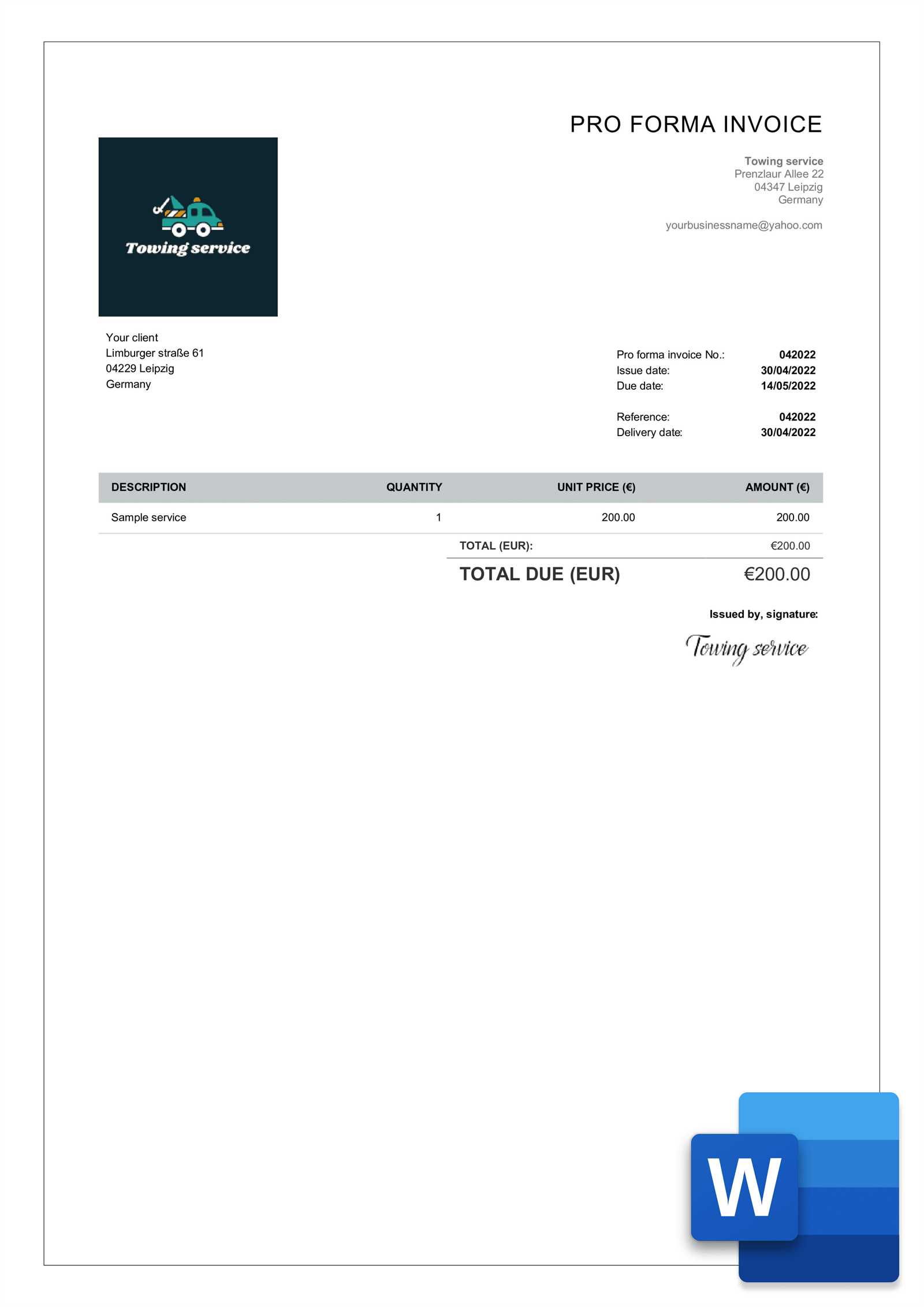

Choosing the Right Invoice Layout

Selecting the right structure for your billing documents is crucial to ensure clarity and professionalism. A well-organized layout enhances readability, making it easier for clients to understand the details of the transaction. The layout should reflect your business style while providing essential information in an accessible format.

Factors to Consider When Choosing a Layout

When selecting a structure for your billing records, consider the following aspects to ensure your document is both functional and visually appealing:

- Clarity: Ensure that each section of the document is clearly labeled, with enough space between elements to avoid clutter. The design should facilitate easy reading and quick understanding of key details.

- Consistency: The layout should align with your brand’s overall style. Use consistent fonts, colors, and formatting to create a unified look across all your business documents.

- Logical flow: Arrange the sections in a logical order, starting with your business information, followed by the client details, services or products, and finally, payment instructions.

- Room for customization: Choose a structure that allows for easy adjustments. You may need to add new fields or alter existing ones depending on the type of work or client needs.

Popular Layout Styles

Here are some common layout styles that can suit different business needs:

- Column-based layout: Organizes information into clear columns, making it easy to compare services, prices, and totals side by side.

- Minimalist layout: Focuses on a clean, simple design with minimal distractions. Ideal for businesses looking for a sleek, modern appearance.

- Detailed layout: Includes more sections for additional information, such as itemized lists, project codes, or special terms. Best for companies with complex billing needs.

Choosing the right layout is key to ensuring your document is functional, professional, and easy for clients to navigate. A well-structured format not only reflects your attention to detail but also enhances the overall experience for the recipient.

Understanding Invoice Numbering System

A clear and organized numbering system is vital for keeping track of financial records and ensuring consistency in your business transactions. By assigning unique identifiers to each document, you can easily reference and manage them. This system also helps with organization and ensures that both you and your clients can quickly locate and follow up on specific records.

When setting up a numbering system, consider these key factors:

- Sequential order: The most common method is to use a simple, sequential numbering system (e.g., 001, 002, 003). This ensures that each document has a unique and easy-to-follow number.

- Year or date-based numbers: Some businesses prefer to include the year or date in the number (e.g., 2024-001). This can help to quickly identify when the transaction took place and assist with year-end accounting.

- Customizable prefixes or suffixes: Depending on your business needs, you might add prefixes or suffixes to distinguish between different types of records, clients, or projects (e.g., INV-001 for a specific project or customer).

Having a clear and structured numbering system is crucial for tracking payments, managing records, and providing accurate references for both internal and external communication. A well-thought-out system can help avoid confusion and ensure that each document is accounted for properly.

How to Track Payments with Excel

Managing payments efficiently is a crucial part of maintaining healthy cash flow in any business. By using a spreadsheet, you can easily monitor the status of outstanding balances, track received payments, and ensure timely follow-ups. With the right setup, you can quickly assess which transactions are pending and which have been settled.

Setting Up Your Payment Tracking System

Follow these steps to set up a basic payment tracking system in a spreadsheet:

- Organize your columns: Create a new sheet with columns for essential details such as transaction date, client name, amount due, payment status, payment method, and payment date.

- Enter payment details: After sending a bill, enter the details of each payment as they come in, updating the status to reflect whether it’s paid, partially paid, or unpaid.

- Use conditional formatting: Highlight unpaid or overdue balances using color coding. This can help you quickly identify outstanding payments and take action when needed.

Additional Features to Enhance Tracking

For more advanced tracking, consider adding the following features to your system:

- Automated calculations: Use formulas to automatically calculate totals, taxes, discounts, and the balance remaining. This ensures accuracy and saves time on manual calculations.

- Payment history: Keep a record of all previous payments, including amounts, dates, and any notes related to the transaction.

- Client reminders: Set up reminders for clients with overdue payments. This can be done using built-in features or by manually adding reminder dates to follow up.

By organizing your records in a well-structured and automated way, you can efficiently track payments, reduce errors, and maintain smoother financial operations.

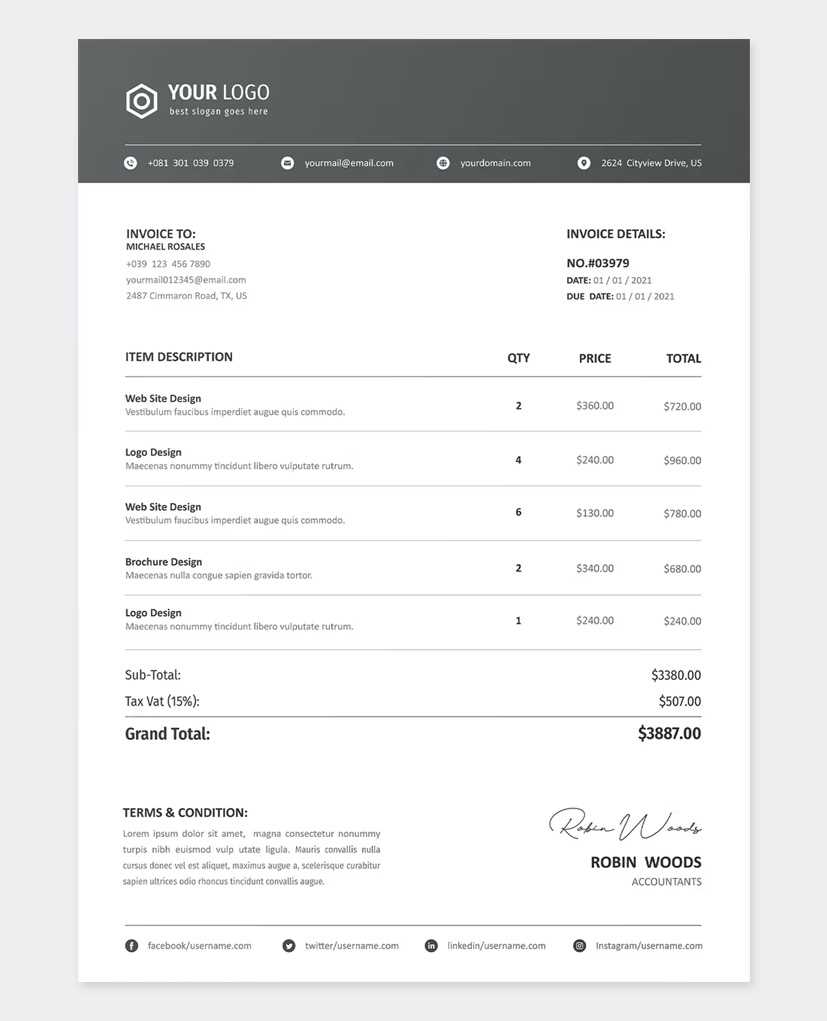

Design Tips for a Clean Invoice

A well-organized and aesthetically pleasing billing document not only enhances your professionalism but also ensures that your clients can easily understand the details of their charges. The design should be simple, clear, and functional, allowing the recipient to quickly find the necessary information. A clean layout reduces the chance of errors and promotes efficient payment processing.

Key Design Elements to Focus On

When creating your billing document, prioritize these design elements to keep it looking neat and structured:

- Consistent fonts: Choose a clear, professional font and stick to it throughout the document. Avoid using too many font styles, as this can make the document look cluttered.

- Logical spacing: Ensure there is enough space between sections to prevent a crowded appearance. Adequate margins and spacing between line items can improve readability.

- Simple color scheme: Use a minimal color palette. A neutral background with subtle accents for headings or important sections can make the document look polished and easy to navigate.

- Organized layout: Keep the structure intuitive by grouping related information together. Typically, start with your business details, then the client’s, followed by the itemized list of services or products, and end with payment terms.

Enhancing Readability with Visual Hierarchy

To make your billing document even more accessible, consider using visual hierarchy to guide the reader’s eye through the information:

- Bold headings: Use bold text for section titles to help them stand out, making it easy to locate specific information.

- Aligned columns: Organize information into well-defined columns. This is especially useful for itemized charges, where alignment makes comparison easier.

- Clear totals: Make the final amount due prominent by using a larger or bolder font. This ensures that clients can quickly identify the amount they need to pay.

By focusing on simplicity and clarity in your design, you’ll create a document that looks professional, is easy to read, and facilitates a smooth billing process.

Automating Invoice Generation with Excel

Automating the process of creating billing documents can save valuable time, reduce human error, and ensure consistency across all transactions. By setting up automated systems, you can streamline the creation of financial records, making it easier to generate accurate and professional reports with minimal effort.

Steps to Set Up Automation

Here are the essential steps to automate the creation of your documents:

- Data Entry Automation: Use data input fields to automate the process of entering client and transaction information. Set up predefined fields for client details, products or services, and pricing, which can be updated automatically.

- Formulas for Calculations: Incorporate formulas to automatically calculate totals, taxes, and discounts. These can be set up to adjust based on the data you input, ensuring that all numbers are accurate without manual recalculation.

- Template-based Automation: Create a master template where common information like business details, payment terms, and item categories are pre-filled. With this setup, you only need to update the dynamic fields for each new transaction.

Advanced Automation Features

If you are looking to take automation a step further, you can integrate additional features for even greater efficiency:

- Drop-down Lists: Use drop-down menus for recurring items or client information. This allows you to select from preset options quickly and reduces the chance of input errors.

- Automated Reminders: Set up reminders to notify you when a payment is due or when a document needs to be sent. This can help ensure that you stay on top of pending transactions without having to track them manually.

- Integration with Accounting Tools: For even more streamlined processes, integrate your document creation system with accounting software. This can automatically import data and generate records that are consistent with your financial management system.

By automating the generation of these documents, you can save time, improve accuracy, and ensure that all of your transactions are tracked and managed efficiently.

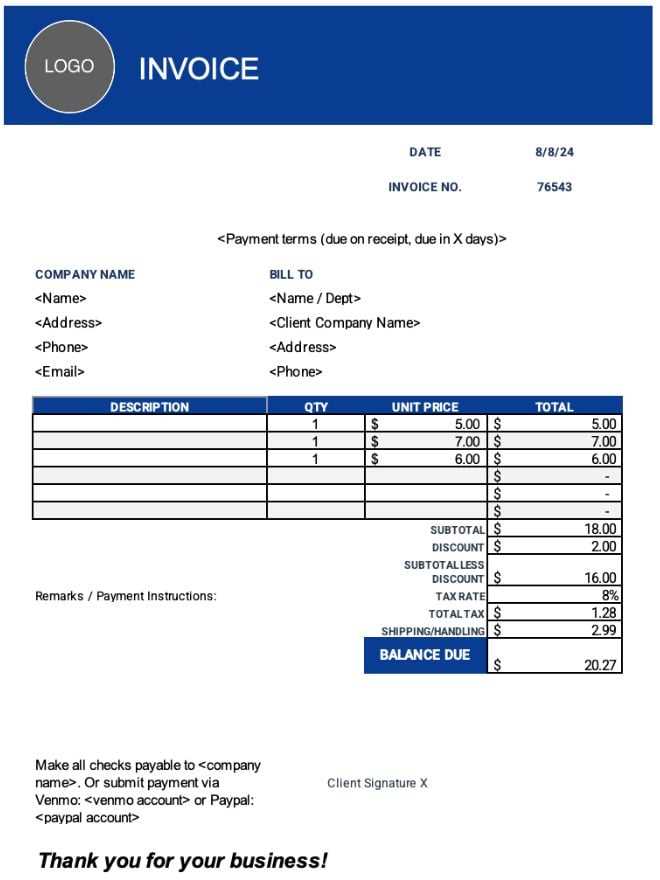

How to Add Tax Calculations

Adding tax calculations to your billing records is essential for ensuring accuracy and compliance with local tax laws. By automating these calculations, you can quickly determine the total amount due, including tax, without manually adding each component. This process can save time and reduce errors, especially when working with varying tax rates or multiple items.

Steps to Implement Tax Calculations

Follow these steps to set up tax calculations in your financial documents:

- Input the Tax Rate: The first step is to define the tax rate applicable to the items or services you are charging for. This rate will depend on your location or the type of product being sold. It can be entered as a percentage (e.g., 8%) in a separate cell for easy reference.

- Apply Formulas for Calculations: Use formulas to calculate the tax for each item. For example, if you have an item price in one cell, and the tax rate in another, you can use a multiplication formula to determine the tax amount.

- Calculate the Total Amount: Once the tax amount is calculated, sum the total cost by adding the tax to the original price. This will give you the final amount that the customer needs to pay, including the tax.

Example of a Tax Calculation Formula

Here’s a simple example of how to structure your tax calculation:

= (Item Price Cell) * (Tax Rate Cell)

This formula will give you the amount of tax for each item. Then, you can add the result to the item price to get the total:

= (Item Price Cell) + (Calculated Tax Cell)

By setting up these formulas, your documents will automatically calculate the tax whenever you input the price and rate, saving you time and ensuring accuracy.

Best Practices for Invoice Formatting

Effective document formatting is key to ensuring clarity and professionalism in your billing records. By following best practices, you can create documents that are not only easy to read but also help avoid confusion for your clients. Clear organization, consistency, and an intuitive structure will ensure that all necessary information is easy to locate and understand.

Here are some essential tips for formatting your billing records:

- Use Clear and Consistent Fonts: Choose simple, readable fonts like Arial or Times New Roman for all text. Ensure font sizes are consistent throughout, with larger sizes used for headings or important sections.

- Organize Information Logically: Divide your document into clearly defined sections, such as business information, client details, itemized charges, and totals. This helps ensure that your client can quickly find the necessary information.

- Keep the Layout Clean and Simple: Avoid clutter by leaving sufficient space between sections. Use borders or lines to separate different sections for a clean and organized appearance.

- Highlight Important Details: Key information, such as the total amount due, payment terms, and due date, should be clearly highlighted using bold text or a larger font size. This makes it easier for clients to quickly spot what they need to know.

- Be Consistent with Numbering and Dates: Ensure that numbering systems and dates are presented consistently. Using a clear and sequential numbering system for each billing document will help keep your records organized and easy to track.

By adhering to these formatting practices, you will create documents that are not only professional but also functional and easy to follow. This will help improve your communication with clients and ensure timely payments.

Managing Multiple Invoice Templates

When handling multiple billing formats for different clients or projects, maintaining organization and consistency is crucial. Using various layouts can help cater to specific needs, but without a structured approach, it can become challenging to track and manage them efficiently. By establishing clear guidelines and systems, you can ensure that each document serves its intended purpose while keeping your workflow streamlined.

Organizing Your Billing Formats

The first step in managing multiple layouts is creating a clear naming system. This can be based on client names, project types, or other identifiers that make it easy to differentiate between the different formats. Keeping your files well-organized in folders or directories will ensure that you can access the right document quickly.

Maintaining Consistency Across Documents

Even though you may use multiple formats, consistency is key to keeping your records professional. Ensure that essential information such as payment terms, due dates, and contact details appear in similar locations across all documents. This consistency will make it easier for your clients to understand the charges and payment process, regardless of the layout you choose.

By implementing these strategies, you can efficiently manage a variety of formats while ensuring that each document remains organized, professional, and easy to understand for both you and your clients.

Why Excel is Ideal for Invoices

Using a spreadsheet application to generate and manage billing documents offers several advantages that make the process efficient and flexible. The ability to customize layouts, automate calculations, and store information in an organized manner makes it an ideal tool for managing financial records. Additionally, its ease of use and wide availability ensures that anyone can create and manage these important documents without needing specialized software.

Here are some reasons why a spreadsheet application is perfect for managing your billing records:

- Customizable Layouts: A spreadsheet allows full control over the design and structure of your documents. You can adjust cell sizes, fonts, colors, and alignments to suit your business needs, creating a polished and professional look.

- Automatic Calculations: With built-in formulas, you can easily calculate totals, taxes, and discounts. This automation reduces the risk of human error and saves valuable time when managing multiple records.

- Data Organization: Spreadsheets offer an efficient way to store client details, transaction histories, and payment statuses in one place. This makes it easy to track payments and monitor outstanding balances.

- Flexibility: You can easily adjust and update your documents as your business grows. Adding new fields, changing calculations, or even creating multiple layouts for different clients is a seamless process.

- Compatibility and Accessibility: Spreadsheet software is widely compatible with various systems, and most businesses already have access to it. The format is easily shareable and can be viewed or edited on almost any device, making it convenient for both you and your clients.

By leveraging the capabilities of spreadsheet applications, you can streamline your billing process, reduce administrative overhead, and maintain a higher level of accuracy and organization.