Production Assistant Invoice Template for Easy Billing

Managing financial transactions efficiently is a crucial part of any business, especially in industries requiring project-based work. Proper documentation ensures that all parties are compensated fairly and timely. One of the most practical ways to maintain smooth operations is by using organized billing structures that help both service providers and clients keep track of payments and terms.

In this guide, we will explore the tools and methods that can simplify this process. Whether you’re a freelancer, contractor, or part of a larger team, understanding how to structure and organize your payment requests will lead to better workflow and fewer misunderstandings. By incorporating clear and professional documentation, you create transparency that benefits everyone involved.

Learning how to craft professional billing records ensures that you can quickly adapt to various client needs while also streamlining the payment process. With the right approach, your financial documents will reflect your professionalism and attention to detail.

Production Assistant Invoice Template Overview

Creating clear and well-organized financial documents is essential for any project-based work. These records help ensure transparency between service providers and clients, detailing services rendered, payment amounts, and payment terms. A well-structured document not only reflects professionalism but also streamlines the billing process, reducing confusion and errors.

Why Organized Records Matter

In any business relationship, clear financial documentation fosters trust and accountability. Well-drafted billing statements make it easy to track payments, avoid disputes, and ensure both parties are satisfied with the terms of the agreement. By maintaining consistency in your financial documents, you also ensure that all necessary information is easily accessible and understandable for clients.

Key Benefits of Using a Structured Document

Efficiency is one of the main advantages of using a standardized approach to creating payment records. When you use a structured format, you save time on each transaction, reduce the likelihood of mistakes, and make the overall process more efficient. Additionally, customizing the format for your specific needs ensures it remains relevant to your business and clients.

Why Use an Invoice Template

Having a standardized approach to documenting financial transactions offers numerous advantages for both service providers and clients. By using a pre-designed structure, you ensure consistency in each record, making it easier to manage payments, track services, and avoid mistakes. A well-organized format helps save time and effort in creating detailed documents from scratch every time a payment needs to be requested.

One of the main reasons for using a structured document is that it helps streamline the billing process. Instead of reinventing the wheel with every transaction, you simply fill in the relevant details, making the entire workflow faster and more efficient. Furthermore, such documents can be easily customized for specific needs, ensuring they align with the unique requirements of each project or client.

Additionally, using a ready-made format enhances professionalism in the eyes of your clients. When financial records are clear, organized, and accurate, it builds trust and reduces the potential for confusion or disputes. By maintaining a consistent format, you also make it easier to track and reference past transactions as your business grows.

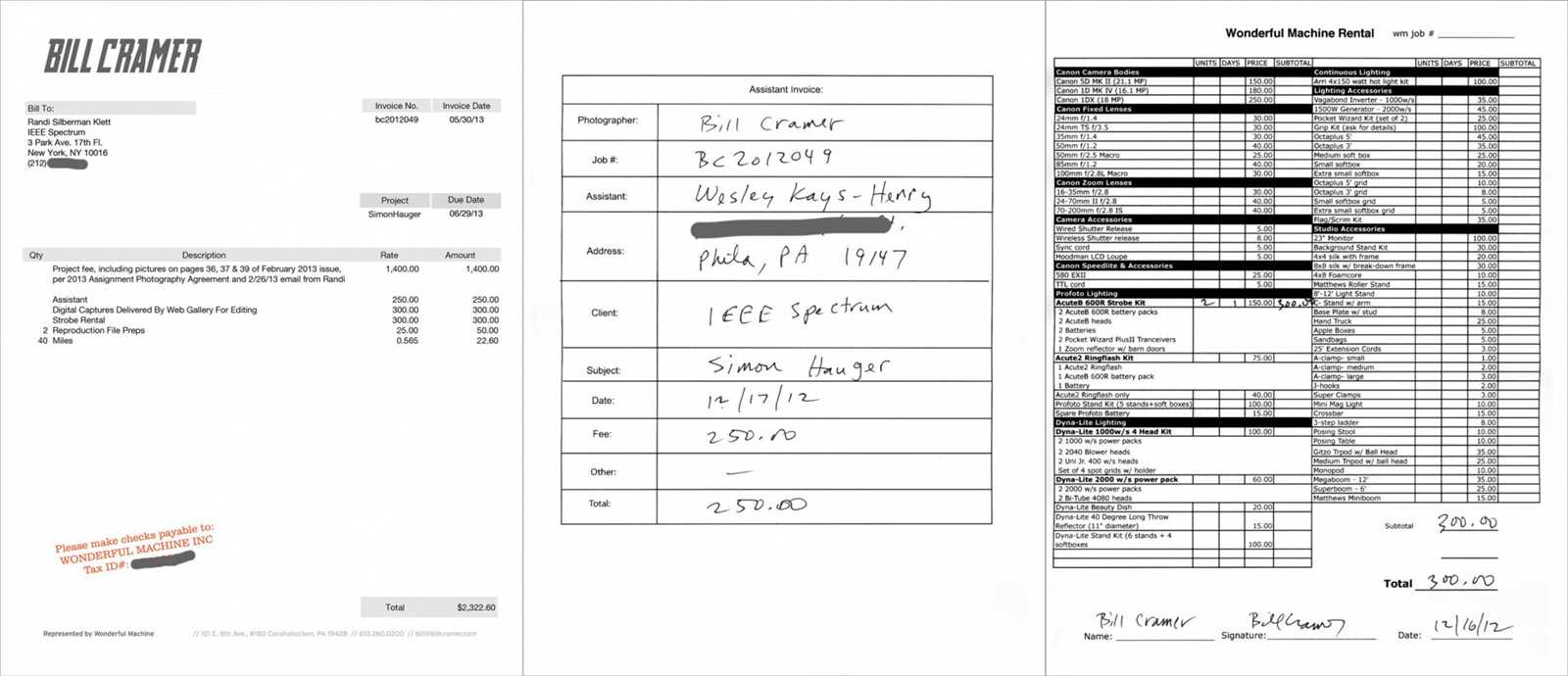

Key Features of a Production Invoice

Effective financial documentation must include specific elements that make the record clear, organized, and easy to understand. A well-crafted document not only details the services provided but also specifies terms, amounts, and payment instructions. These key components ensure that both the service provider and client are on the same page, reducing the chance of errors or disputes.

| Feature | Description |

|---|---|

| Service Description | Clearly outlines the work completed, providing a breakdown of the tasks performed. |

| Payment Terms | Defines the due date and any conditions related to payment, such as late fees or discounts. |

| Amount Due | Displays the total cost for the services rendered, including taxes and any additional fees. |

| Contact Information | Includes the names, addresses, and communication details of both parties involved. |

| Unique Reference Number | Assigns a unique number to each document for easy tracking and record keeping. |

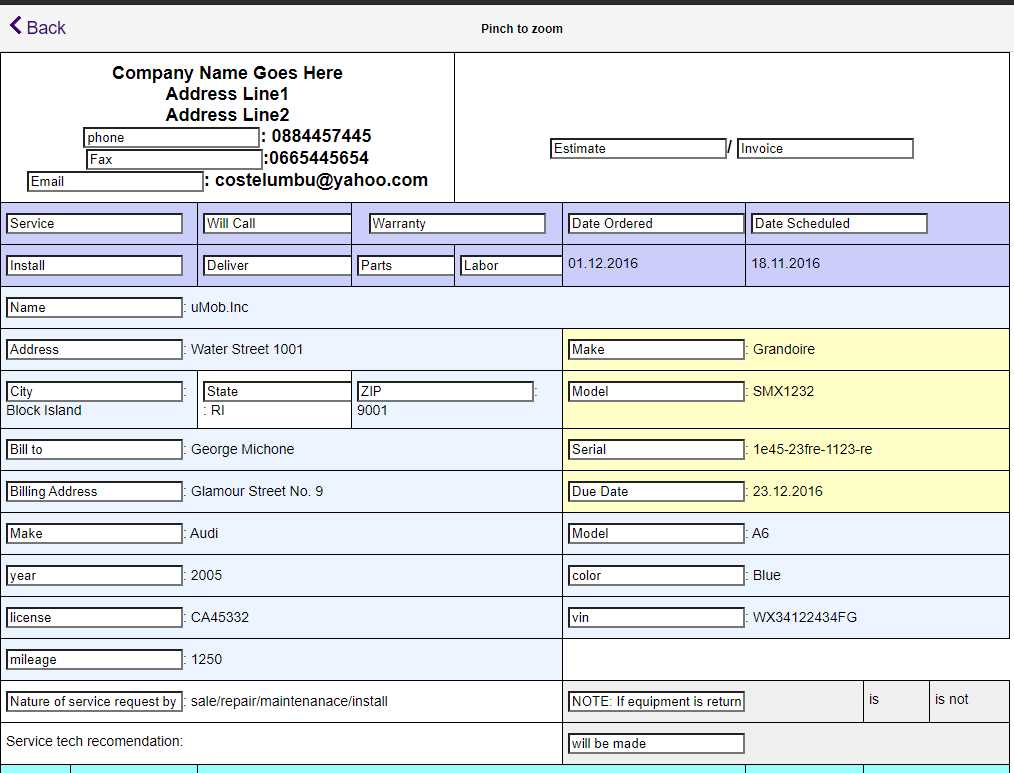

How to Customize Your Template

Personalizing your financial documents allows you to tailor them to your specific needs, making them more relevant and efficient for your business. By adjusting various elements, you can ensure that the document suits your branding, meets client expectations, and reflects the details of each project. Customization gives you control over the appearance and functionality of your records, streamlining your workflow.

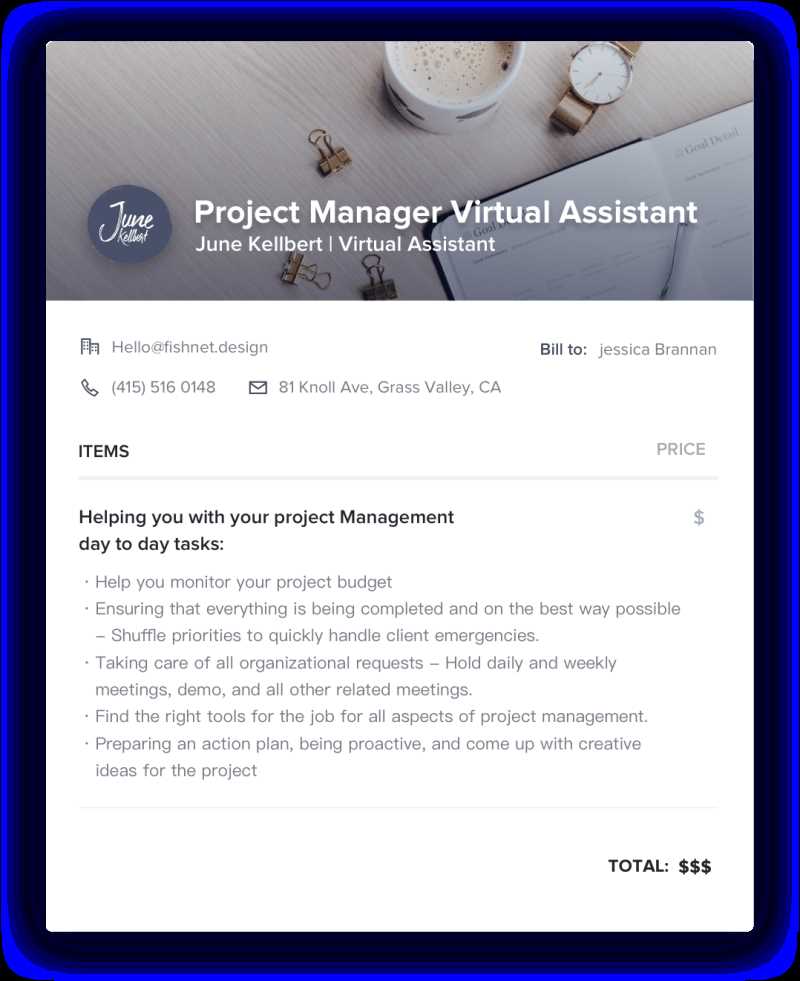

Adjusting Layout and Design

One of the first steps in customization is modifying the layout. You can change the font style, size, and color to match your company’s branding. Additionally, altering the position of certain sections, like the total amount or contact details, can help emphasize key information and make the document easier to read for clients.

Adding or Removing Fields

Each business has unique requirements, so it’s important to add or remove fields that are not relevant. For example, you may want to include a project code, specific taxes, or payment milestones, while removing unnecessary sections. Customizing the content ensures that your records remain concise and focused on the most important details.

Essential Elements of an Invoice

Every financial record must contain specific details that ensure clarity and accuracy in transactions. These key components provide the necessary information for both the client and service provider to verify the work completed and the payment due. Without these essential elements, documents may cause confusion or result in payment delays.

- Unique Identifier: A reference number to distinguish the document from others.

- Service Description: A breakdown of the tasks completed, including quantities and rates.

- Amount Due: The total cost for services, taxes, and any other applicable charges.

- Payment Terms: Conditions such as due date, payment methods, and any late fee policies.

- Contact Information: Details of both the service provider and client for communication.

Including these core elements in your documentation ensures transparency and helps avoid potential disputes, ultimately creating a professional and efficient billing process.

Steps to Create Accurate Invoices

Creating precise and reliable financial documents requires careful attention to detail. Following a clear process helps eliminate errors and ensures that both parties involved are on the same page regarding payment terms and amounts. By staying organized and systematic, you can improve the efficiency of your billing process and maintain a professional approach in all your transactions.

1. Gather Necessary Information

Before creating your document, make sure you have all the relevant details at hand. This includes the service performed, the rates agreed upon, client information, and any applicable taxes or fees. Accurate and complete data will make the process smoother and prevent any future issues related to discrepancies.

2. Choose the Right Format

Select a format that suits your needs, whether it’s a digital template or a custom-designed document. Make sure it’s easy to edit and include all necessary sections such as contact details, payment terms, and a breakdown of services provided. The more organized and clear your format is, the easier it will be to generate consistent and accurate records.

Common Mistakes to Avoid in Invoices

When creating financial documents, small errors can lead to confusion, delays, or even disputes. Ensuring accuracy in each aspect of your records is crucial to maintaining a smooth billing process. By avoiding common mistakes, you can create documents that are clear, professional, and efficient, ultimately leading to faster payments and better relationships with clients.

1. Missing Key Information

Omitting essential details such as payment terms, contact information, or a unique reference number can lead to confusion or prevent timely processing of payments. Ensure that all sections are filled out completely and accurately to avoid unnecessary delays. Double-check all fields before finalizing the document to ensure nothing is left out.

2. Incorrect Calculations

Errors in calculating totals, taxes, or rates can cause frustration and result in the need for revisions. Always verify amounts and percentages to ensure the document reflects the correct charges. Using automated tools or formulas can help reduce the risk of human error in complex calculations.

Benefits of Digital Invoice Templates

Using digital records for financial transactions offers numerous advantages over traditional paper-based methods. These electronic solutions streamline the process, making it faster, more accurate, and easier to manage. The convenience and flexibility of digital formats allow for customization and efficiency, ultimately enhancing both your workflow and client relationships.

| Benefit | Description |

|---|---|

| Speed | Digital records can be created, sent, and processed quickly, reducing the time spent on administrative tasks. |

| Accuracy | Using pre-set fields and calculations ensures that numbers are consistent, reducing the risk of human error. |

| Accessibility | These records can be accessed from anywhere, making it easy to update, send, and store them securely. |

| Cost-Effective | Eliminates the need for printing and postage, saving money on materials and shipping. |

| Environmentally Friendly | Digital formats reduce paper waste, contributing to a more sustainable business practice. |

How to Track Payments Efficiently

Keeping track of payments in an organized and efficient manner is crucial for maintaining healthy cash flow and ensuring all financial transactions are accounted for. A well-structured approach to monitoring payments reduces the risk of missed or overdue payments and helps prevent any discrepancies. By using the right tools and methods, you can stay on top of all incoming funds and improve your financial management.

1. Use Digital Tools for Tracking

One of the most effective ways to track payments is by utilizing accounting software or digital spreadsheets. These tools automatically update records when payments are received, allowing for real-time tracking. Additionally, many software solutions can send reminders and alerts when payments are overdue, helping you stay proactive.

2. Create a Payment Log

Another simple but effective method is to maintain a payment log. This can be a spreadsheet or a physical ledger where each payment is logged with essential details such as the amount, client name, due date, and payment status. Regularly updating this log helps you visualize your income flow and quickly identify any outstanding payments.

Design Tips for Clear Invoices

Effective document design plays a crucial role in ensuring that all essential information is easy to understand and well-organized. A clean, visually appealing layout can help your clients quickly grasp the details of the transaction, reducing confusion and improving the chances of timely payment. By following some simple design principles, you can enhance clarity and professionalism in every document you create.

1. Keep it Simple and Organized

A cluttered document can overwhelm clients and make it harder to locate key details. Focus on simplicity by using clear headings and ample spacing. Ensure that each section, such as client information, service descriptions, and payment terms, is easily distinguishable. Minimalistic design often leads to greater readability and fewer chances of mistakes.

2. Use Clear Fonts and Color Schemes

Choosing the right fonts and color combinations can greatly impact the readability of your document. Opt for professional fonts that are easy to read, such as Arial or Times New Roman. Avoid using too many different colors, as this can distract from the content. Stick to a neutral color scheme with high contrast to make important details stand out, such as the total amount due or due date.

Ensuring Legal Compliance in Invoices

Maintaining legal compliance in financial documents is crucial for protecting both your business and your clients. Adhering to local tax laws, including necessary business information, and following industry standards ensures that your records meet all regulatory requirements. Failing to comply with these rules can lead to penalties or disputes, so it’s important to stay informed and up-to-date with legal obligations.

Key legal elements to include in your records are your business registration number, tax identification number, and clear payment terms. Depending on your location, you may also need to include specific tax rates or references to tax-exempt status. By ensuring these details are present, you can avoid potential issues and demonstrate professionalism and transparency.

It’s also important to keep records of all transactions for a required period, as this can be necessary for audits or resolving disputes. Proper documentation not only protects you legally but can also foster trust with clients, ensuring that all parties are aligned in their expectations.

How to Manage Invoice Templates

Effectively organizing and managing your billing documents can save time, reduce errors, and ensure consistency across all client transactions. By maintaining a structured approach to these documents, you can streamline your administrative processes and improve overall workflow. Whether you’re using digital tools or manual systems, proper management helps keep everything in order and easily accessible.

One key strategy is to create a clear naming and filing system for each document. Ensure that every record is labeled correctly with identifiable information such as the client’s name, date, or project number. This allows for easy retrieval when needed. Additionally, regularly review and update your formats to ensure they are in line with any changes in legal requirements or business practices.

Using software to automate and store your documents offers further advantages. These tools can track payments, generate reports, and store all necessary files securely in the cloud. Automated reminders for upcoming payments or overdue accounts can significantly reduce the risk of missed deadlines and enhance overall efficiency.

Invoice Template Software vs Manual Methods

When it comes to managing financial documents, businesses often face the choice between using specialized software or relying on manual methods. Both options have their pros and cons, depending on your specific needs, resources, and the complexity of your processes. Understanding the benefits and limitations of each can help you decide which approach is more suited for your operations.

1. Benefits of Software Solutions

Using automated software to create and manage your billing records offers a range of advantages. First, it significantly reduces the time spent on document creation by automating many aspects of the process. Automation tools can quickly generate accurate records with minimal effort, allowing you to focus on other important tasks. Furthermore, many software solutions offer built-in features such as automated payment reminders and real-time updates, which help maintain consistent cash flow and reduce administrative overhead.

2. Advantages of Manual Methods

On the other hand, manual methods offer flexibility and simplicity for small-scale operations or businesses with less complex billing needs. With this approach, there is no need for external software or technical expertise, making it a cost-effective solution for freelancers or startups. However, it requires more attention to detail and can be time-consuming when handling multiple clients. Without the benefits of automation, manual methods may increase the risk of errors, but for those who prefer a hands-on approach, this could still be a viable option.

Best Practices for Invoice Formatting

Proper document formatting is essential for creating clear and professional records. A well-structured format ensures that all necessary information is easily accessible and comprehensible, reducing the risk of mistakes or confusion. By adhering to best practices, businesses can present themselves as organized and reliable, which can also improve client relationships and expedite payment processing.

1. Clear and Logical Layout

Start with a layout that divides the document into clearly defined sections. Group related information together, such as the client’s details, services rendered, and payment terms. Each section should have a clear heading, and sufficient spacing should be maintained between them to avoid clutter. A clean and straightforward structure makes the document easier to read and less overwhelming for the recipient.

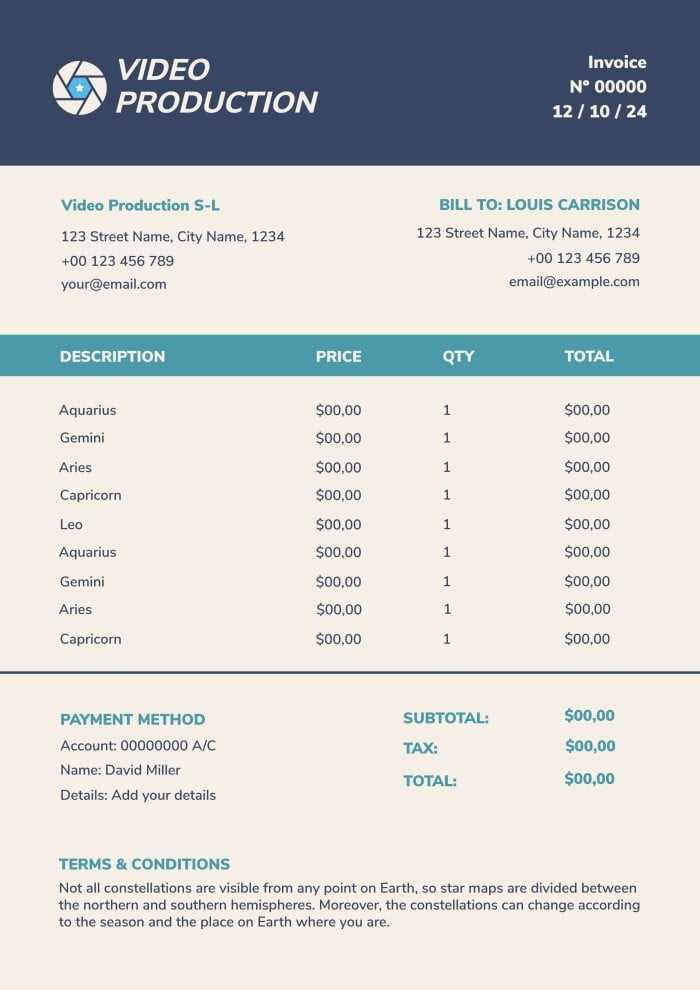

2. Use of Tables for Itemized Details

To display itemized information like services or products provided, a table format is ideal. This allows for easy comparison and ensures that all charges are clearly outlined. For example, the table can include columns for descriptions, quantities, unit prices, and total amounts. Here’s an example of how to format this section:

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Consulting Services | 5 hours | $50 | $250 |

| Project Management | 10 hours | $40 | $400 |

This approach not only makes it easier for clients to verify charges but also ensures greater accuracy in tracking costs.

Integrating Payment Methods into Templates

Incorporating multiple payment options into your financial records can streamline the transaction process and improve the overall experience for both you and your clients. By providing various payment methods, you make it easier for clients to settle balances quickly, which can help reduce delays in receiving funds. A clear and straightforward approach to presenting these options will also minimize confusion and ensure that payments are processed smoothly.

When creating your documents, consider including a dedicated section for payment methods. This section should outline all available payment options, such as bank transfers, online payment platforms, or credit card payments. It’s essential to clearly state the relevant details, such as bank account numbers or links to payment portals, so clients can easily complete the transaction. Additionally, providing payment deadlines or early payment discounts can encourage prompt settlement.

Key Information to Include:

- Bank Account Details: Include account numbers, routing numbers, and other necessary banking information for wire transfers.

- Payment Platform Links: Provide links to online payment services like PayPal, Stripe, or others.

- Credit Card Information: If applicable, offer guidance on how clients can pay using credit or debit cards.

- Payment Terms: Specify any terms related to payment deadlines, late fees, or early payment discounts.

By offering clear payment instructions and options, you make the payment process easier for clients, which can contribute to faster processing times and enhanced customer satisfaction.

How to Handle Disputes Over Invoices

Disagreements over financial documents can sometimes arise between businesses and clients, often due to discrepancies in amounts, unclear terms, or missed payments. It’s essential to address these disputes promptly and professionally to maintain healthy business relationships and ensure that payments are processed fairly. Clear communication, thorough documentation, and a structured approach can help resolve these issues efficiently.

Steps to Resolve Disputes:

1. Review the Details

Before taking any action, carefully review the disputed document, comparing it with the agreed-upon terms. Ensure that the charges are accurate and reflect the services or products provided. Double-check any terms related to payment deadlines, discounts, or additional fees. Often, discrepancies can be resolved simply by verifying the correct figures and conditions.

2. Communicate Professionally

Once you’ve reviewed the document, reach out to the client in a calm and professional manner. Explain your findings clearly, and if an error was made on your end, apologize and offer a solution. If the dispute is due to a misunderstanding or differing interpretations of the terms, aim to clarify the points of contention and find a mutual resolution.

Maintain Clear Documentation: Throughout the process, keep detailed records of all communication and adjustments made. This can serve as evidence if further actions are necessary, such as legal intervention or third-party mediation.

Offer Flexibility: In some cases, offering a payment plan or compromise may help resolve the dispute quickly. Clients may be more willing to settle if they feel their concerns are being addressed fairly.

By staying professional and transparent, you can resolve financial disputes efficiently, ensuring a positive outcome for both parties.

Improving Invoice Workflow in Production

Streamlining the financial documentation process is essential for any business looking to enhance efficiency and reduce errors. Whether you’re managing client payments or internal accounting, optimizing how records are created, processed, and tracked can significantly improve cash flow and reduce administrative burden. A smooth workflow ensures that all parties involved are paid on time and that any discrepancies are identified early.

Steps to Enhance Workflow Efficiency:

- Automate Document Creation: Implement software solutions that generate financial documents automatically based on predefined templates. This reduces manual input errors and speeds up the creation process.

- Centralize Information: Store all essential data, such as client contact details, transaction records, and project specifics, in a centralized system. This allows quick access to necessary information when generating and managing documents.

- Set Clear Payment Terms: Ensure that payment deadlines, methods, and late fees are clearly defined from the beginning. Including these details in all financial documents can help prevent confusion and delays.

- Integrate with Accounting Software: Connect your financial records system with accounting tools to automate the transfer of data, ensuring accurate records and reducing the risk of human error.

- Track Progress and Payments: Use a real-time tracking system to monitor the status of all outstanding payments. This helps quickly identify overdue accounts and ensures prompt follow-up when necessary.

Regular Reviews: Periodically reviewing the entire financial process, from the creation of records to payment receipts, ensures that all steps are still effective. Look for bottlenecks, areas of confusion, or inefficiencies that may require adjustments.

By implementing these strategies, businesses can improve their overall workflow, ensure quicker payments, and minimize the risk of errors in financial documentation.