Process Server Invoice Template for Streamlined Billing

Professionals who deliver legal documents often face challenges in managing their billing practices. Organized and clear documentation of services can simplify client interactions, ensuring smooth and professional transactions. A well-structured billing tool allows these professionals to focus on their work without spending extra time on payment-related concerns.

Using a structured billing approach brings clarity to the payment process, enhancing transparency between clients and professionals. With a reliable method in place, it’s easier to track completed tasks, record essential details, and manage outstanding fees effectively. Clear, consistent billing practices can help establish trust, giving clients the reassurance they need when hiring legal services.

This guide will explore how to create effective billing methods tailored to document delivery services. From essential components to customization tips, you’ll find practical advice for building a comprehensive system that simplifies transactions and strengthens client relationships.

Understanding the Role of a Process Server

The responsibilities involved in delivering legal documents are essential for upholding the judicial process. This role requires meticulous attention to detail, timely actions, and an understanding of the legal implications tied to each delivery. The work is critical, as it directly impacts the rights of individuals and the outcomes of various legal proceedings.

Key Duties and Responsibilities

Professionals in this field ensure that all parties involved in a legal case receive necessary documentation according to legal standards. This may include summonses, subpoenas, and other formal notifications, each with specific handling and delivery protocols. These tasks demand not only accuracy but also adherence to legal timelines, as delays or errors could affect case progress.

Importance of Legal Knowledge and Communication Skills

Working in this capacity often requires a strong understanding of legal procedures, confidentiality, and privacy standards. Professionals

What is a Process Server Invoice

In legal support services, proper documentation of provided tasks and associated costs is crucial for maintaining professionalism and clarity. A structured billing document serves this purpose, enabling professionals to formally outline their services, charges, and payment terms for clients. Such records ensure that both parties have a clear understanding of financial obligations and completed work.

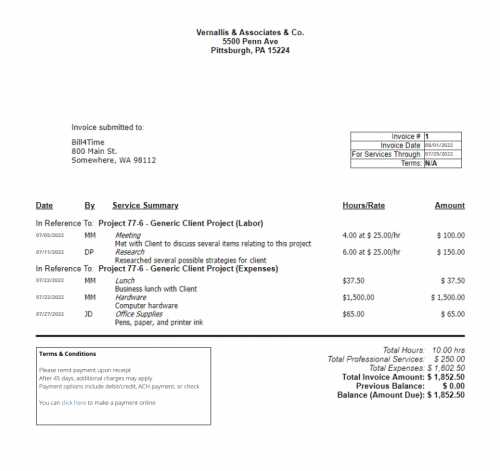

This type of billing record itemizes tasks performed, dates of completion, and fees owed. It provides clients with transparent details regarding the services they received, fostering trust and accountability. Additionally, having well-organized financial records is helpful for tax purposes, as it allows for easy tracking of income and expenses throughout the year.

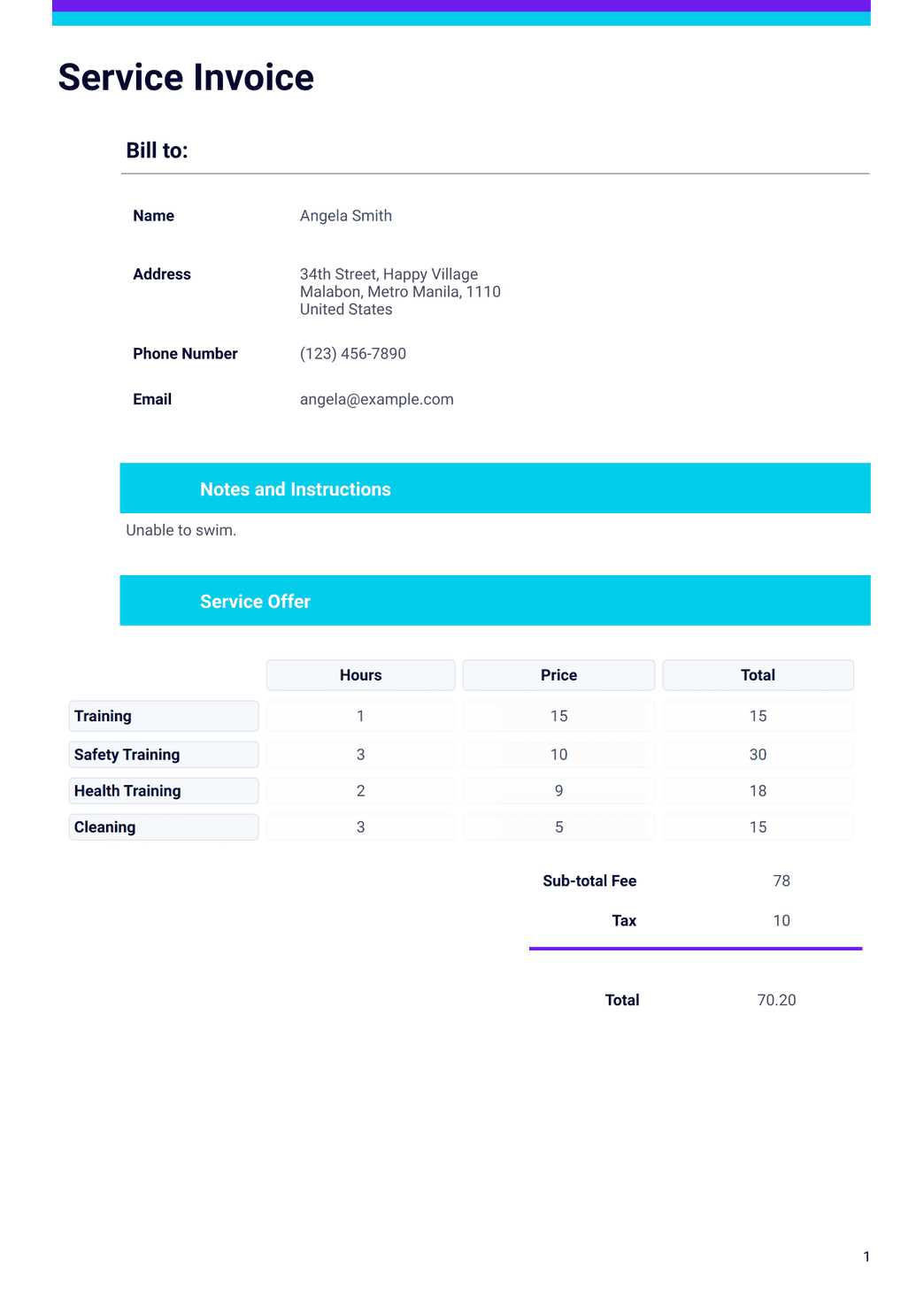

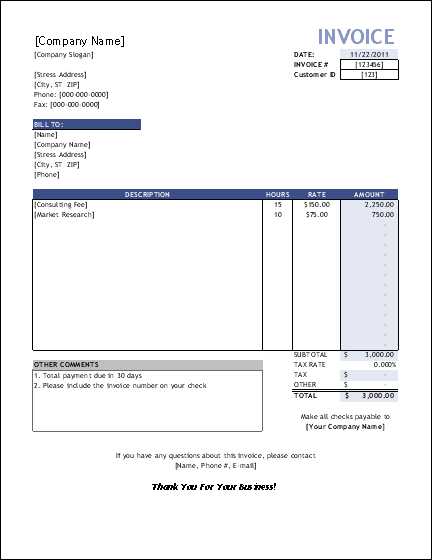

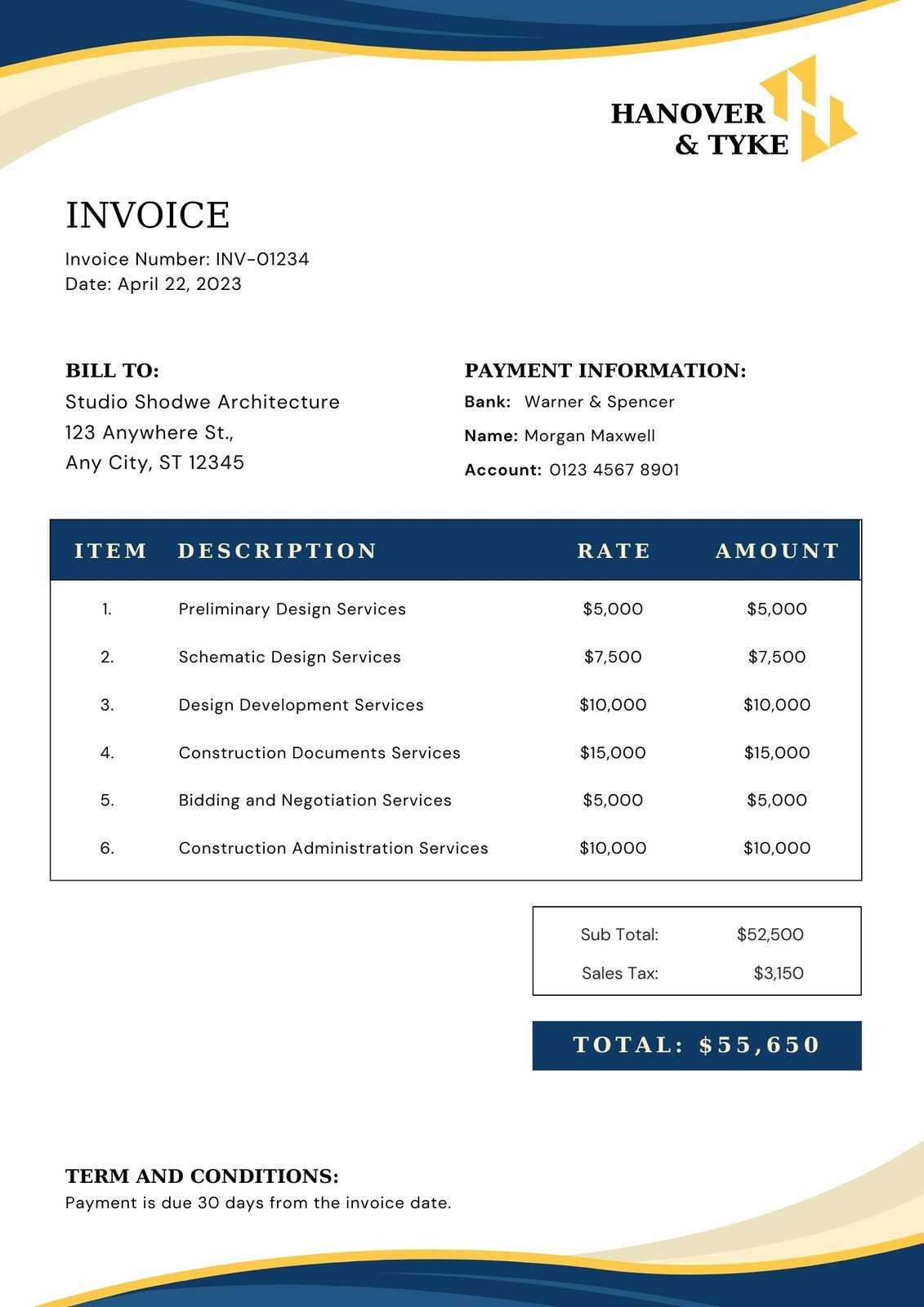

Essential Elements of a Service Invoice

A well-structured billing document for professional services includes specific details that enhance clarity and ensure accurate record-keeping. By organizing these key components, service providers can present clear, professional, and comprehensive documentation for their clients. Each element contributes to transparency and helps avoid misunderstandings regarding payments and services rendered.

Core Details to Include

- Contact Information: Both the service provider’s and the client’s names, addresses, and phone numbers should be clearly listed to establish official records and facilitate communication.

- Date of Service: The date when the task was completed is essential for accurate tracking, especially in cases where timelines are critical.

- Description of Services: Each task performed should be briefly but accurately described, providing a clear picture of the work completed for the client’s understanding.

Financial Components

- Itemized Costs:

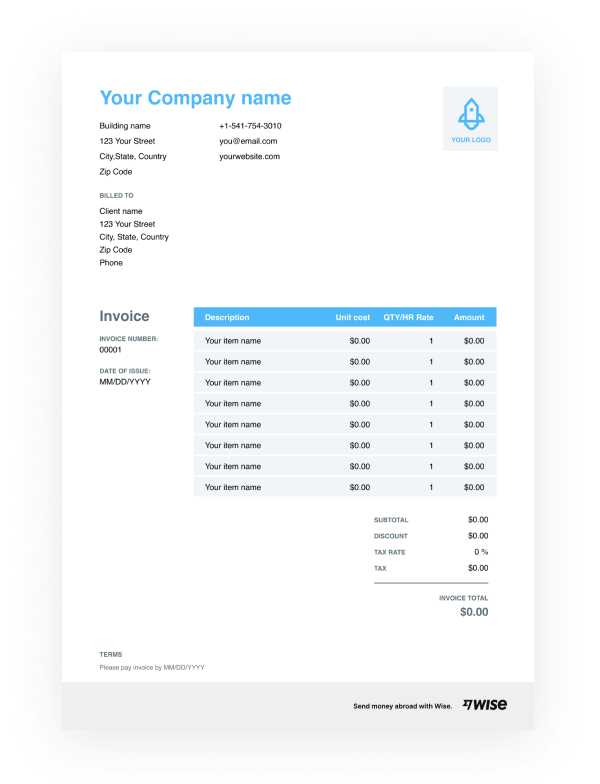

Why Process Servers Need a Template

For professionals who handle legal document delivery, maintaining consistency and organization in billing is essential. Using a structured format not only simplifies their own workflow but also provides clients with clear, detailed accounts of the services performed. With a pre-designed layout, service providers can ensure every billing statement includes the necessary information in a polished, standardized format.

Having a prepared billing structure reduces the time spent on administrative tasks, allowing more focus on core responsibilities. By eliminating the need to create a new document from scratch each time, a ready-to-use format increases efficiency and helps prevent errors or omissions that could lead to misunderstandings or delayed payments.

Additionally, a standardized approach helps enhance the professional image of the service provider. Clients receiving a consistent, well-organized bill feel reassured about the reliability and credibility of the services they are paying for. In this way, a structured format not only supports efficient transactions but also strengthens the trust between the service provider and their clients.

Benefits of Using an Invoice Template

A structured billing format offers significant advantages for professionals, making the management of financial records simpler and more efficient. By using a pre-designed layout, service providers can save time, ensure accuracy, and maintain a consistent, professional image in all their client interactions. These benefits extend beyond convenience, supporting both effective bookkeeping and positive client relationships.

One of the primary advantages is increased efficiency. With a ready-made layout, there’s no need to start from scratch each time a bill is created, reducing repetitive tasks and freeing up time for more critical work. Additionally, the consistent format minimizes the chances of errors, ensuring that all necessary details–such as service descriptions, dates, and costs–are included every time.

Another key benefit is improved professionalism. Clients appreciate receiving clear, organized statements, and a uniform billing format reflects well on the service provider’s reliability and attention to detail. This polished approach builds trust, showing clients that their transactions are handled with care and transparency.

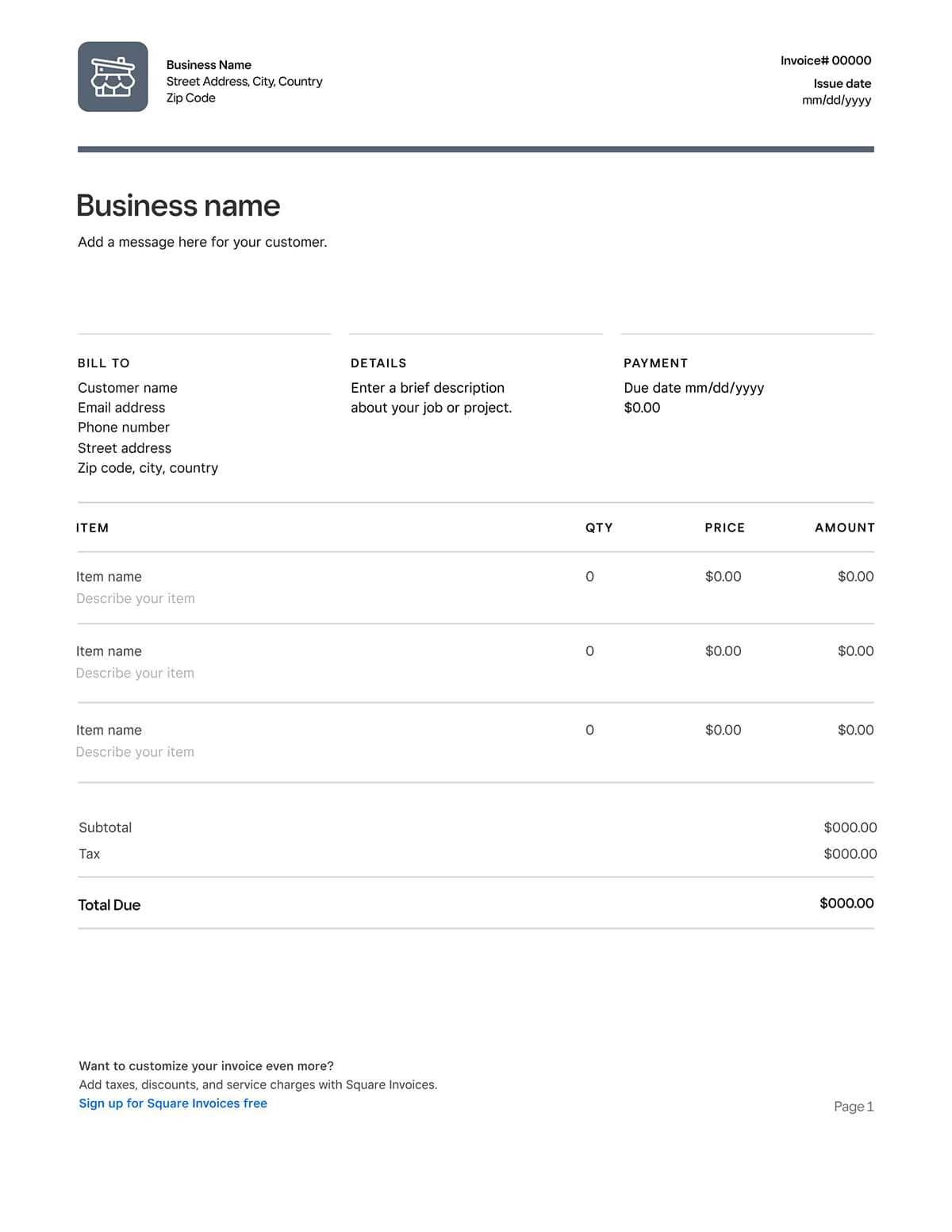

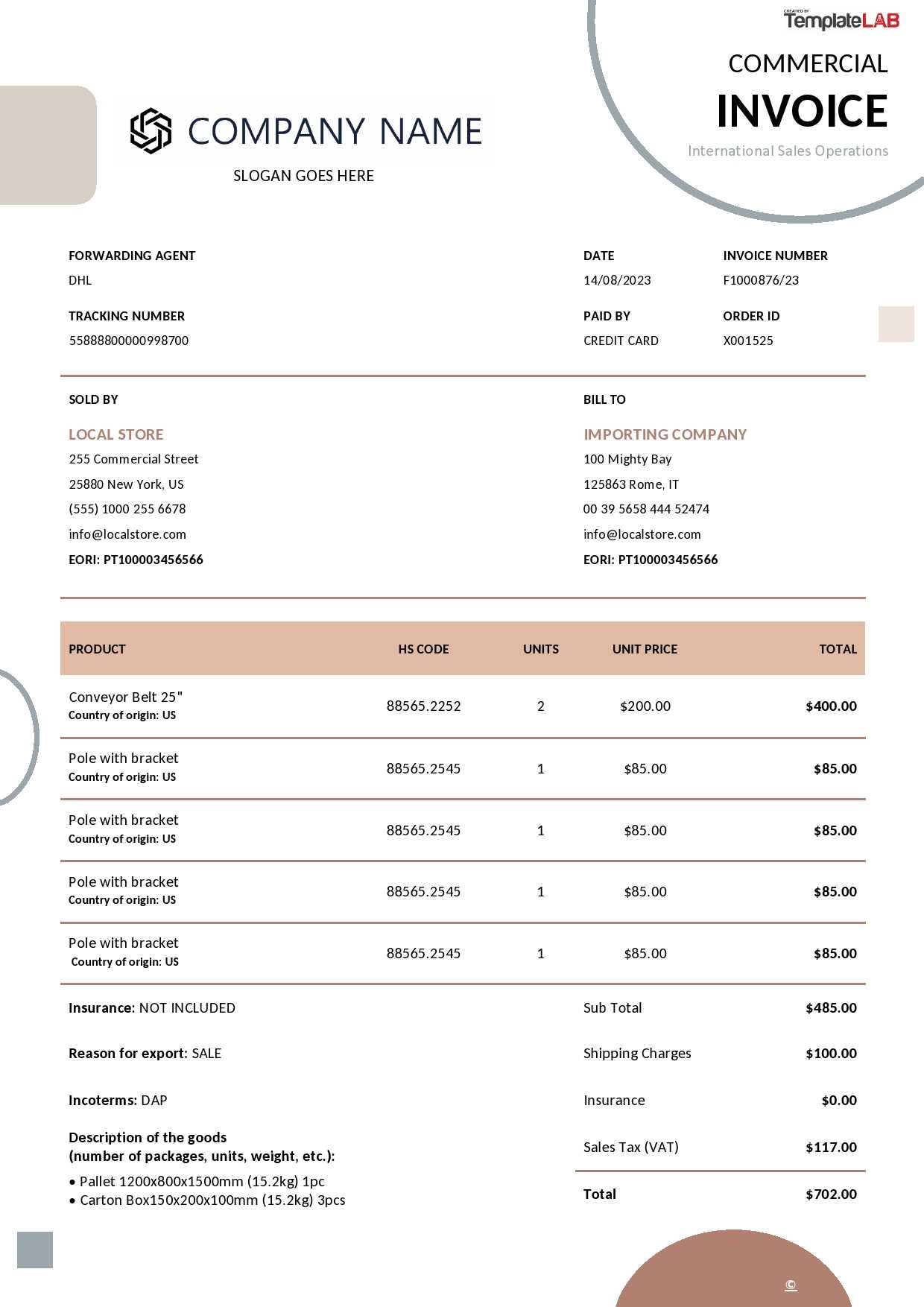

Choosing the Right Format for Invoices

Selecting an appropriate layout for billing documentation is crucial for ensuring clarity and efficiency in financial transactions. The right design not only simplifies the process of creating and sending statements but also enhances the overall professionalism of the service provider. A well-chosen format can facilitate better communication with clients and contribute to a smoother payment process.

Key Considerations for Format Selection

- Clarity: Ensure that the format allows for easy readability. Important details should be prominently displayed, minimizing the chance of confusion.

- Flexibility: Choose a design that can be easily customized to accommodate different services and pricing structures, allowing for adaptability as your business grows.

- Professional Appearance: Opt for a format that reflects the professionalism of your services, reinforcing trust and credibility with clients.

- Compatibility: Consider formats that are compatible with various software applications, making it easier to create, send, and store documentation.

Popular Formats to Consider

- Digital Documents: PDF files are widely accepted and maintain formatting across different devices, ensuring consistency.

- Word Processing Files: These allow for easy editing and customization, which can be beneficial for frequently changing service details.

- Online Billing Platforms: Utilizing cloud-based solutions can simplify the invoicing process by automating calculations and reminders.

By carefully considering these factors and selecting the right format, service providers can streamline their billing process, enhance client satisfaction, and improve overall operational efficiency.

Legal Considerations in Billing

When managing financial records in the realm of legal services, it is essential to be aware of various legal implications associated with billing practices. Understanding these considerations helps ensure compliance with applicable laws and regulations, which can safeguard professionals from potential disputes or legal challenges. Proper adherence to legal standards not only enhances credibility but also fosters trust with clients.

Compliance with Local Laws

Each jurisdiction may have specific rules governing the fees that can be charged for services, as well as regulations regarding the documentation required for billing. Professionals must familiarize themselves with these laws to avoid legal issues. This includes being aware of limitations on service fees, acceptable billing practices, and the necessary disclosures that must be provided to clients.

Confidentiality and Privacy Obligations

Maintaining the confidentiality of client information is a critical legal obligation. Billing records may contain sensitive details, and service providers must take precautions to protect this information. Proper handling of billing documents, including secure storage and controlled access, is necessary to comply with privacy laws and regulations.

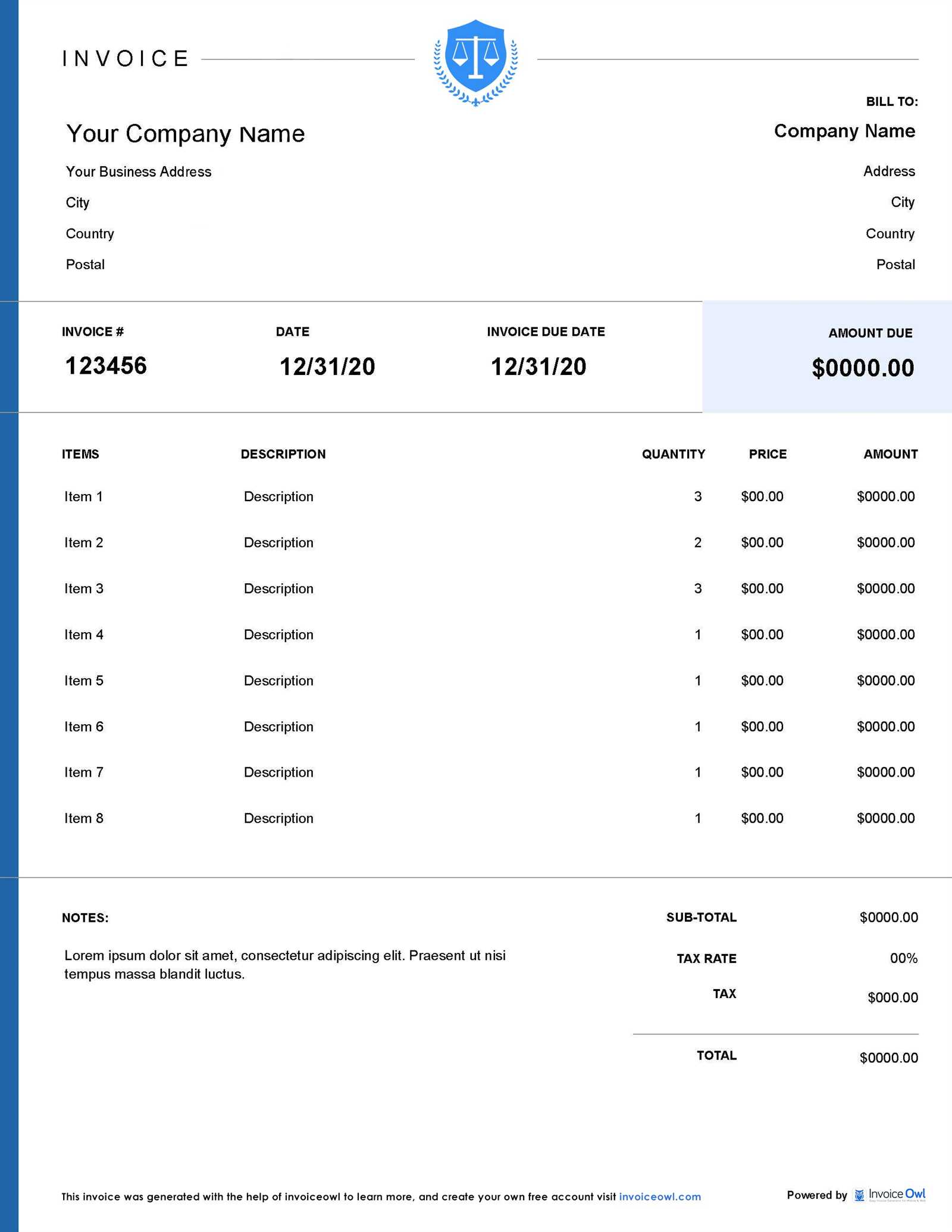

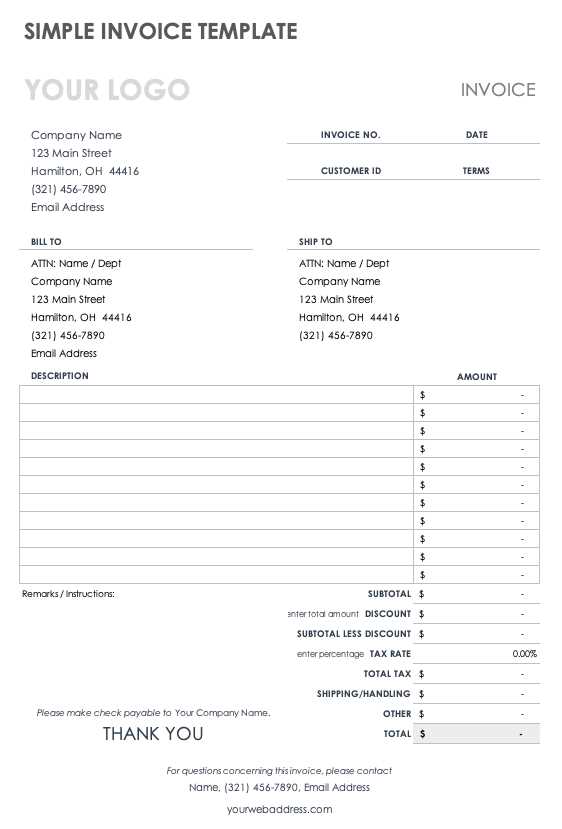

How to Customize Your Invoice Template

Tailoring your billing document to meet specific needs can significantly enhance its effectiveness and usability. Customization allows service providers to reflect their brand identity, ensure clarity, and incorporate essential details that cater to their unique business practices. By adjusting various elements, professionals can create a more personalized and efficient tool for managing their financial records.

Here are some key aspects to consider when modifying your billing format:

Element Customization Options Branding Add your logo, choose specific colors, and select fonts that align with your business identity. Service Descriptions Modify the descriptions to accurately reflect the services you provide, including any relevant details or specifications. Payment Terms Customize the terms and conditions for payments, including deadlines, acceptable methods, and late fees. Contact Information Ensure that all relevant contact details are current, making it easy for clients to reach you with questions or concerns. Currency and Pricing Adjust the currency symbols and format pricing to match local standards, ensuring clients understand the costs involved. By considering these elements and making thoughtful modifications, professionals can create a billing document that not only meets their operational needs but also enhances client satisfaction and trust.

Must-Have Information on Every Invoice

To ensure clarity and professionalism in billing documentation, certain critical details must always be included. Providing comprehensive information not only facilitates the payment process but also reinforces trust and transparency between service providers and their clients. By including all essential elements, professionals can avoid misunderstandings and ensure that their clients have a clear understanding of what to expect.

Essential Components

The following elements should be present in every billing document:

- Service Provider Information: This includes the name, address, and contact details of the professional or company providing the services.

- Client Information: The recipient’s name, address, and contact information are necessary for proper identification and communication.

- Unique Identifier: A specific number or code assigned to each document helps with tracking and organization.

- Date of Issue: Clearly stating the date the billing document is issued is important for establishing payment timelines.

- Description of Services: A detailed account of the tasks performed should be included, helping the client understand what they are being charged for.

- Total Amount Due: The total cost should be clearly stated, including any applicable taxes or additional fees.

- Payment Instructions: Clear instructions on how to make the payment, including accepted methods and deadlines, should be provided.

Importance of Clarity and Accuracy

Including these components not only streamlines the payment process but also reflects th

Tips for Organizing Client Information

Effectively managing client data is crucial for maintaining professional relationships and ensuring efficient operations in any service-oriented business. A well-organized database not only simplifies the process of creating billing documents but also enhances communication and responsiveness to client needs. Implementing systematic approaches to data management can significantly improve overall productivity and client satisfaction.

Establish a Structured Database

Creating a centralized system for storing client information is essential. This can be done through digital tools or software designed for customer relationship management (CRM). Key components to include are:

- Contact Details: Store names, addresses, phone numbers, and email addresses for easy access and communication.

- Service History: Keep records of previous services provided to each client, including dates and descriptions, to track engagement and preferences.

- Payment Records: Document payment history, including amounts and dates, to manage accounts efficiently and follow up on outstanding balances.

Implement Regular Updates and Reviews

Consistently reviewing and updating client information is crucial to ensure accuracy. Regular audits can help identify outdated details or discrepancies. Additionally, establishing a routine for entering new data or changes promptly will maintain the integrity of the information. Encourage clients to verify their details periodically, which fosters engagement and demonstrates a commitment to quality service.

Creating Invoices for Recurring Clients

When dealing with clients who require ongoing services, establishing an efficient billing process is essential for maintaining strong relationships and ensuring timely payments. A consistent approach to billing for repeat clients not only simplifies the administrative workload but also enhances clarity and professionalism in every transaction. By implementing specific strategies, service providers can streamline their invoicing process and foster trust with their clients.

Establish a Standardized Billing Cycle

Setting up a regular billing schedule can help manage expectations and ensure that clients are aware of when to expect their statements. Consider the following:

- Monthly or Quarterly Billing: Choose a frequency that aligns with the service provided and the client’s preferences.

- Consistent Due Dates: Establish clear deadlines for payments to avoid confusion and late fees.

- Advance Notices: Send reminders before billing dates to prepare clients for upcoming charges.

Utilize Automation Tools

Incorporating automation into the billing process can greatly enhance efficiency. Many software solutions allow for:

- Recurring Billing: Set up automatic billing cycles for repeat clients to minimize manual input.

- Templates for Recurring Statements: Create a standardized layout that can be easily customized for each client while retaining consistent elements.

- Payment Tracking: Use automated systems to monitor payments, sending reminders for outstanding balances and reducing administrative burdens.

By implementing these strategies, service providers can effectively manage billing for recurring clients, ensuring smooth transactions and fostering long-term relationships.

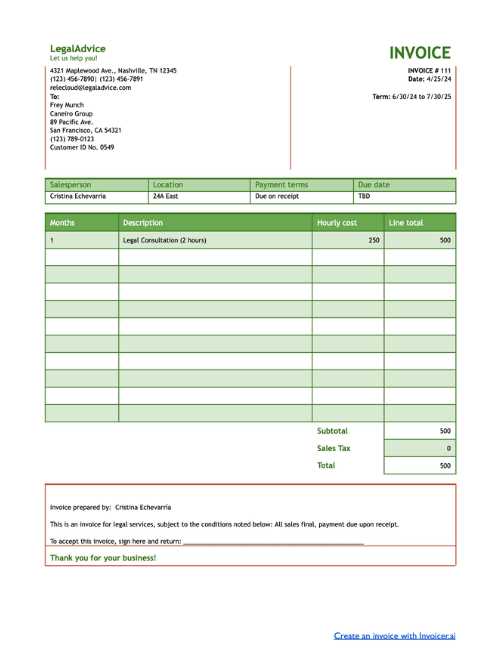

Payment Terms and Conditions for Process Servers

Establishing clear payment terms and conditions is vital for maintaining professional relationships and ensuring timely compensation in any service-oriented business. Well-defined terms help manage client expectations and minimize misunderstandings regarding fees and payment deadlines. By clearly outlining these conditions, service providers can foster transparency and enhance trust with their clients.

Here are essential elements to consider when defining payment terms and conditions:

- Payment Due Dates: Specify when payments are expected, whether upon receipt of the billing document, within a specific number of days, or after service completion.

- Accepted Payment Methods: Clearly state which methods of payment are acceptable, such as credit cards, bank transfers, or checks, to facilitate smooth transactions.

- Late Fees: Outline any penalties for late payments, including specific amounts or percentages that may be charged to encourage timely settlement of accounts.

- Discounts for Early Payments: Consider offering incentives for clients who settle their accounts ahead of schedule, enhancing cash flow and fostering good client relationships.

- Dispute Resolution Procedures: Include guidelines for addressing any billing disputes that may arise, ensuring that clients know the process for resolving issues amicably.

By establishing comprehensive and clear payment terms, service providers can enhance their operational efficiency while building lasting relationships with their clients.

Best Practices for Sending Invoices

Effectively communicating billing statements is crucial for ensuring timely payments and maintaining strong client relationships. By adopting best practices for sending these documents, service providers can enhance clarity, professionalism, and the likelihood of prompt settlements. Implementing a systematic approach not only reduces confusion but also fosters trust between providers and clients.

Consider the following strategies to optimize the process of sending billing statements:

- Use Clear Subject Lines: When emailing documents, ensure the subject line clearly states that it is a billing statement, including the client’s name or invoice number for easy reference.

- Personalize Communication: Address the client by name and include a brief message that thanks them for their business, reinforcing a positive relationship.

- Send in a Timely Manner: Dispatch billing statements promptly after services are rendered to keep the payment process moving smoothly.

- Provide Multiple Formats: Offer the document in various formats, such as PDF and Word, allowing clients to choose what works best for them.

- Include All Relevant Information: Ensure that each document contains all necessary details, including service descriptions, due dates, and payment methods, to prevent any delays in processing.

- Follow Up: If payments are not received by the due date, send a polite reminder, reiterating the payment terms and expressing appreciation for their attention to the matter.

By implementing these best practices, service providers can enhance the efficiency of their billing processes and improve the overall experience for their clients.

Tracking and Managing Outstanding Payments

Effectively monitoring and managing unpaid balances is essential for maintaining healthy cash flow and ensuring the sustainability of any service-oriented business. By implementing robust tracking methods, service providers can stay informed about overdue accounts and take proactive steps to encourage timely payments. Establishing a systematic approach not only enhances financial stability but also fosters trust and accountability with clients.

Here are several strategies to help track and manage outstanding balances:

- Utilize Accounting Software: Implement software designed for financial management that can automatically track payments, generate reports, and send reminders for overdue accounts.

- Regularly Review Accounts: Schedule periodic reviews of accounts receivable to identify unpaid balances and prioritize follow-ups based on the age of the debt.

- Set Clear Follow-Up Procedures: Establish a protocol for following up on overdue accounts, including the timing and method of communication, to maintain consistency and professionalism.

- Communicate Openly: Reach out to clients with outstanding balances to discuss any issues they may be facing, showing understanding while also reinforcing the importance of timely payments.

- Offer Payment Plans: For clients who may struggle to pay in full, consider providing flexible payment options to facilitate resolution while preserving the relationship.

- Document Everything: Keep accurate records of communications, agreements, and payment history to ensure clarity and provide evidence if disputes arise.

By employing these strategies, service providers can effectively manage outstanding balances, ensuring that their financial health remains strong while building lasting relationships with their clients.

Common Mistakes in Billing Statements

Creating billing statements can be a straightforward task, yet several common pitfalls can lead to confusion, disputes, or delayed payments. Recognizing these frequent errors is crucial for service providers who wish to maintain professionalism and ensure that clients receive accurate and clear documentation. By avoiding these mistakes, businesses can enhance their billing processes and foster better relationships with their clients.

Here are some typical mistakes to watch out for:

- Incorrect Client Information: Failing to verify and include accurate details about the client, such as name, address, and contact information, can cause delays in processing payments.

- Missing Item Descriptions: Not providing clear descriptions of the services rendered can lead to confusion and disputes regarding what the client is being charged for.

- Ambiguous Payment Terms: Lack of clarity regarding payment deadlines, accepted methods, and late fees can create misunderstandings and frustration for clients.

- Calculation Errors: Simple mathematical mistakes in billing amounts can undermine credibility and necessitate corrections that may irritate clients.

- Failure to Send Reminders: Not following up with clients regarding upcoming due dates or outstanding payments can lead to overlooked obligations and cash flow issues.

- Neglecting to Include a Unique Reference Number: Omitting a reference number can complicate tracking payments and reduce efficiency in accounting processes.

Avoiding these common mistakes will not only streamline the billing process but also enhance professionalism and improve client satisfaction. By taking the time to ensure accuracy and clarity in all billing statements, service providers can foster stronger, more trusting relationships with their clients.

Top Tools for Efficient Billing

In today’s fast-paced business environment, utilizing the right tools can significantly enhance the efficiency of billing processes and improve overall financial management. A variety of software and applications are available that cater to different aspects of creating, tracking, and managing billing statements. By selecting the appropriate resources, service providers can streamline their operations and ensure timely payments from clients.

Here are some top tools to consider for effective billing:

- Accounting Software: Programs like QuickBooks or FreshBooks offer comprehensive features for invoicing, expense tracking, and financial reporting, making it easier to manage overall finances.

- Billing Platforms: Solutions such as Zoho Invoice and Wave provide user-friendly interfaces specifically designed for creating and sending billing statements efficiently.

- Payment Processors: Services like PayPal, Stripe, and Square facilitate easy online payments, allowing clients to settle their accounts quickly and securely.

- Time Tracking Tools: Applications such as Harvest or Toggl help in tracking hours worked, making it simpler to create accurate billing statements based on time spent on services.

- Document Management Systems: Tools like Google Drive or Dropbox can assist in organizing and storing all billing documents in one place, ensuring easy access and sharing when needed.

By leveraging these tools, service providers can enhance their billing processes, minimize errors, and improve client satisfaction through timely and accurate financial communications.