Professional Invoice Template for Easy Customization and Billing

Efficient billing is a crucial aspect of managing any business. Whether you are a freelancer, small business owner, or part of a larger organization, having a structured and professional approach to creating payment documents can save time and prevent errors. A well-designed billing document not only reflects professionalism but also ensures clarity and consistency in transactions.

Customizable payment templates allow you to create polished and accurate documents quickly. By using pre-made formats, you can easily input the necessary details without starting from scratch every time. This approach helps you maintain uniformity across your financial communications and reduces the likelihood of missing essential information.

With the right tools, setting up payment records becomes an effortless task. This guide will explore the benefits of using structured forms, how to tailor them for your specific needs, and tips for ensuring your clients receive clear and professional requests for payment. From beginners to seasoned professionals, streamlining this process can make a significant difference in efficiency and productivity.

Pro Invoice Template Guide

Creating a well-organized document for billing purposes is essential for any business. A structured format ensures that both parties involved in the transaction are on the same page, minimizing the chance of confusion or disputes. Using a pre-designed document can help you save time, while also presenting your business in a professional light. This guide will walk you through the key elements of an effective billing document and how to make the most of customizable formats.

Key Elements of a Professional Billing Document

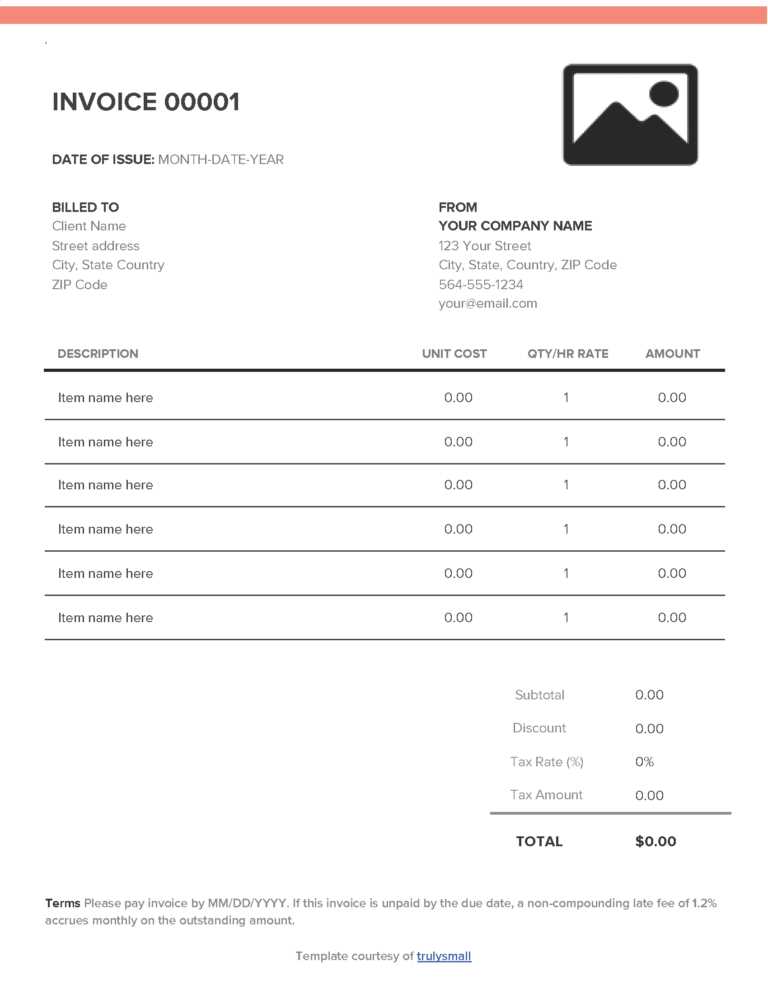

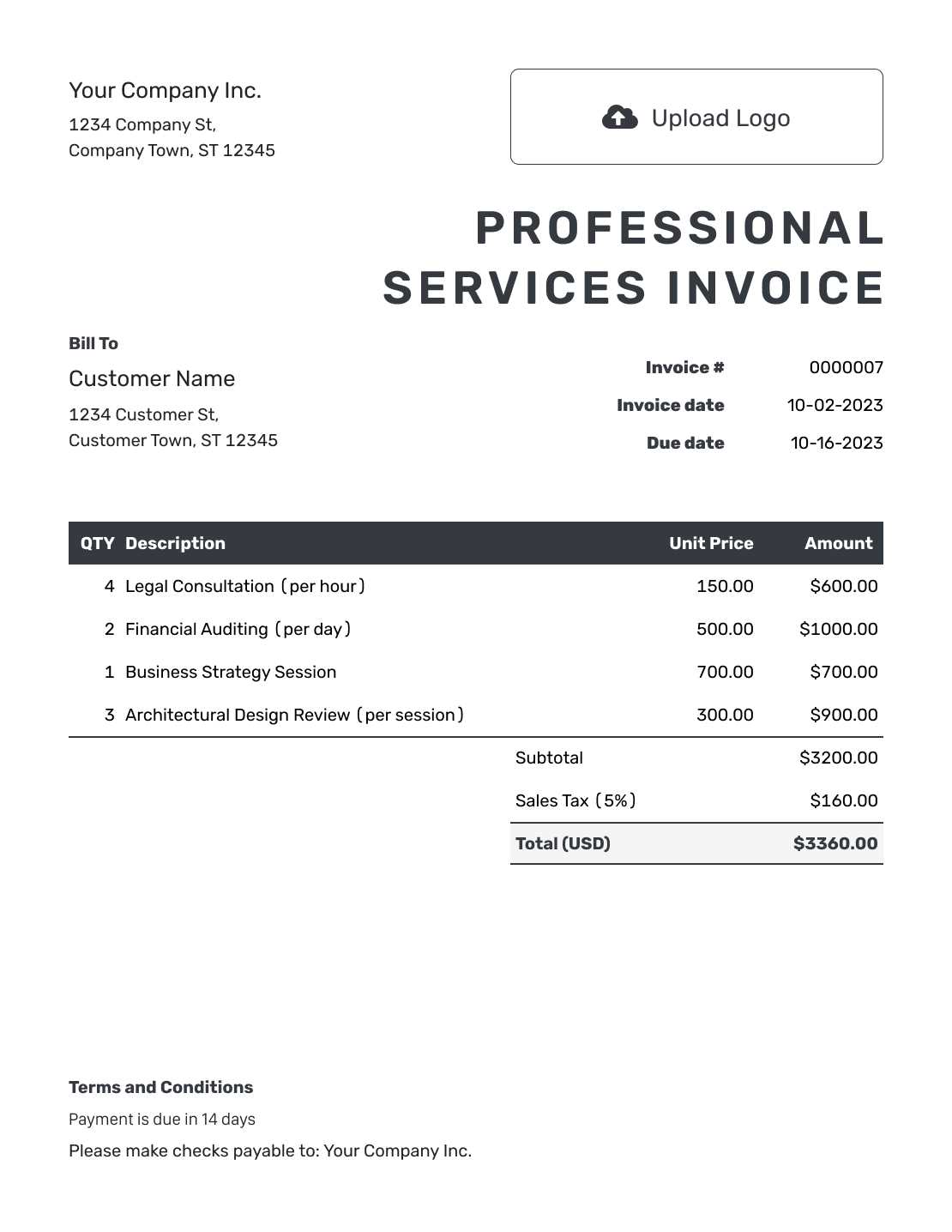

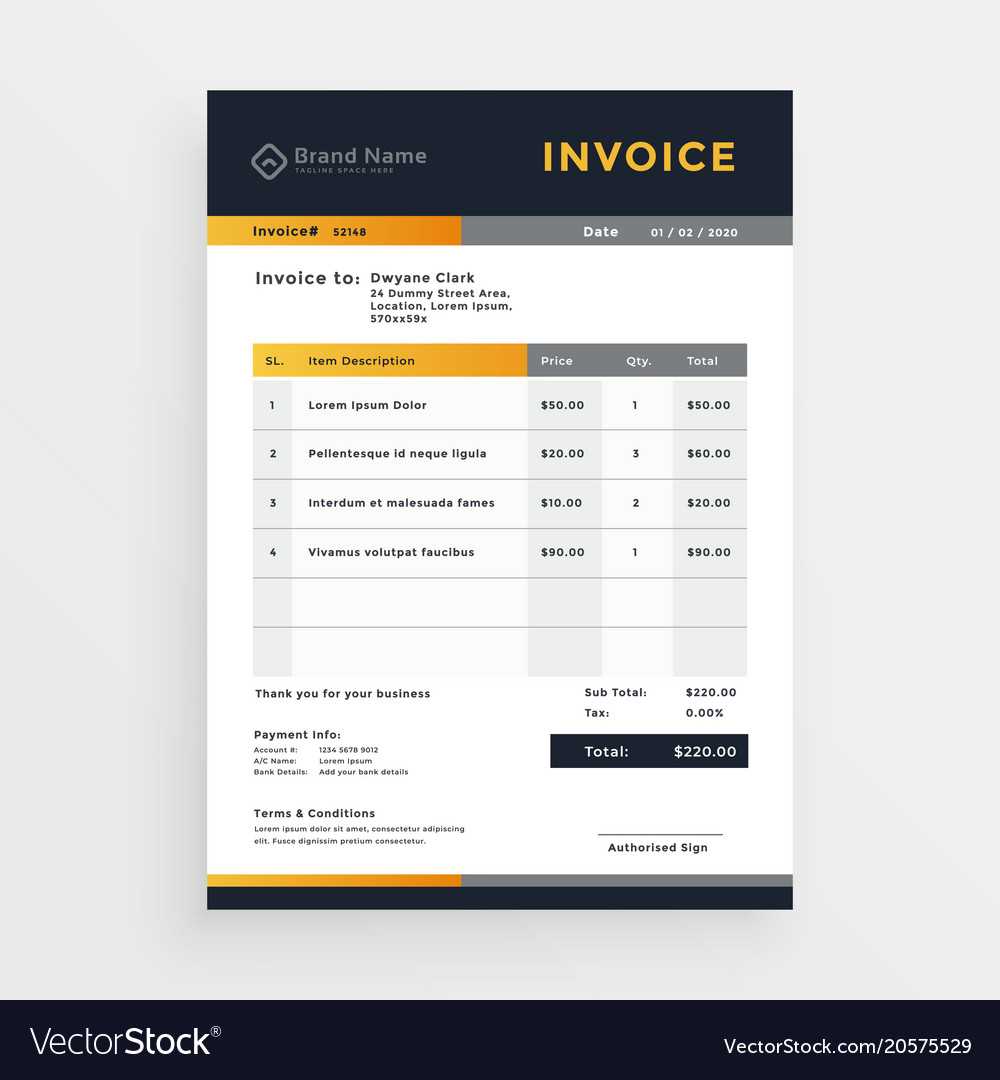

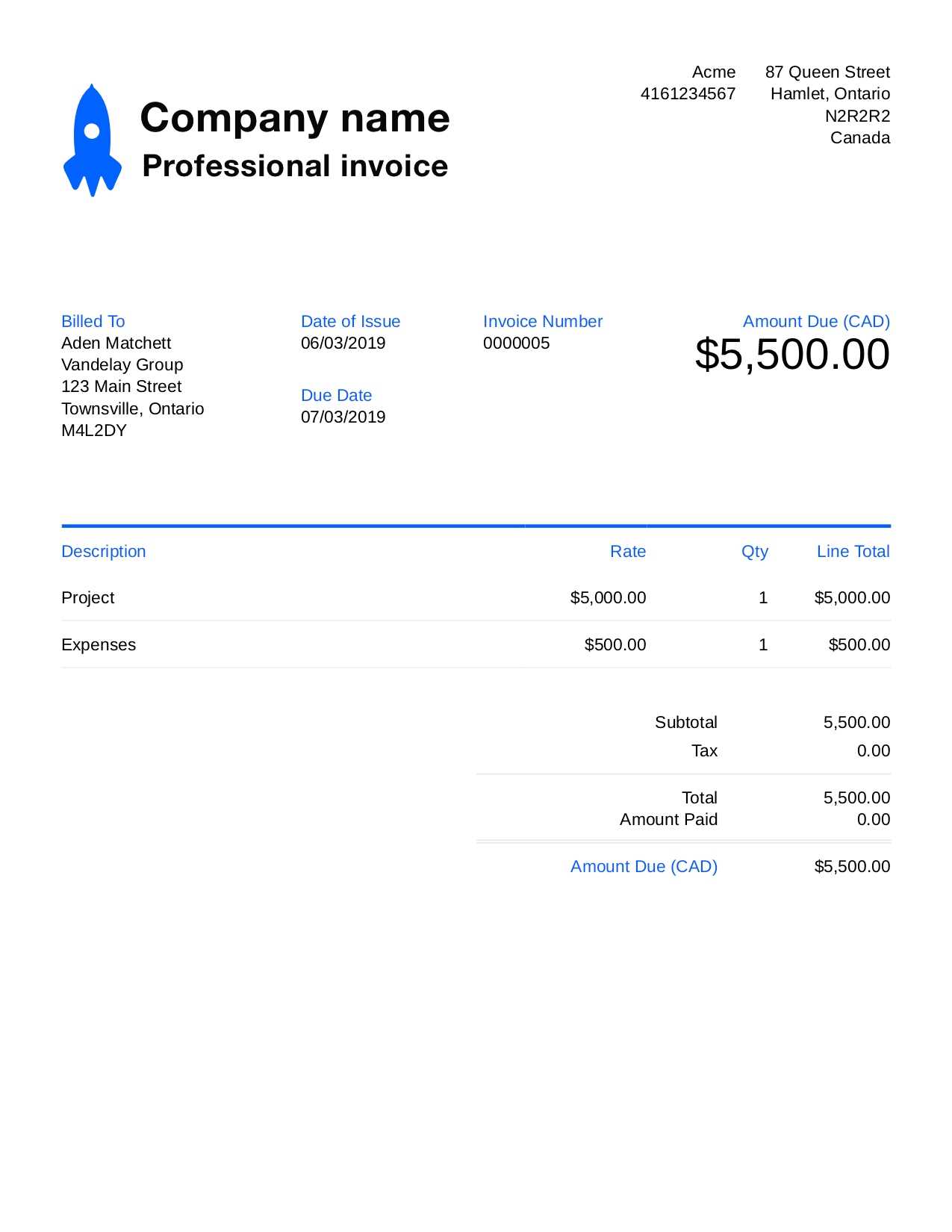

To create a clear and comprehensive request for payment, there are certain components that should always be included. These elements ensure the document is both functional and legally sound. A typical payment request will include business details, such as your company name, address, and contact information, along with your client’s information. Additionally, it’s essential to include itemized services or products with their corresponding prices and quantities. This transparency helps build trust and avoids any confusion.

Customizing and Personalizing Your Format

While many pre-made formats are available for download, it’s important to customize them to reflect your branding and specific business needs. By adding your company logo, adjusting fonts, and selecting appropriate color schemes, you can make the document uniquely yours. Furthermore, consider including payment terms, deadlines, and preferred methods of payment. These small changes can make a big impact in ensuring your client understands the full scope of the transaction and is more likely to make timely payments.

Why Use a Professional Invoice Template

Having a standardized method for creating billing documents offers numerous advantages for any business, from freelancers to larger organizations. Using a pre-structured format ensures that all essential information is included consistently, making it easier to track payments and manage finances. A polished, clear document not only streamlines the process but also enhances your business’s credibility and professionalism in the eyes of clients.

One of the primary benefits of using a well-designed format is efficiency. Rather than spending time formatting and organizing data each time, a pre-built structure allows you to simply input details, saving you valuable time. This efficiency is especially important for small business owners and freelancers who may need to generate multiple documents quickly without sacrificing quality.

Additionally, using a well-crafted billing document helps to avoid common mistakes such as missing client information, incorrect pricing, or unclear payment terms. By following a proven structure, you ensure that all necessary details are consistently included. This reduces the chance of misunderstandings or delayed payments, which can negatively impact cash flow and client relationships.

Benefits of Customizing Invoice Templates

Personalizing billing documents is an important step for any business looking to stand out and build strong client relationships. By adjusting standard formats to meet your unique needs, you can improve both the appearance and functionality of your payment requests. Customization allows you to ensure the document aligns with your brand and provides the clarity clients expect, ultimately improving communication and efficiency.

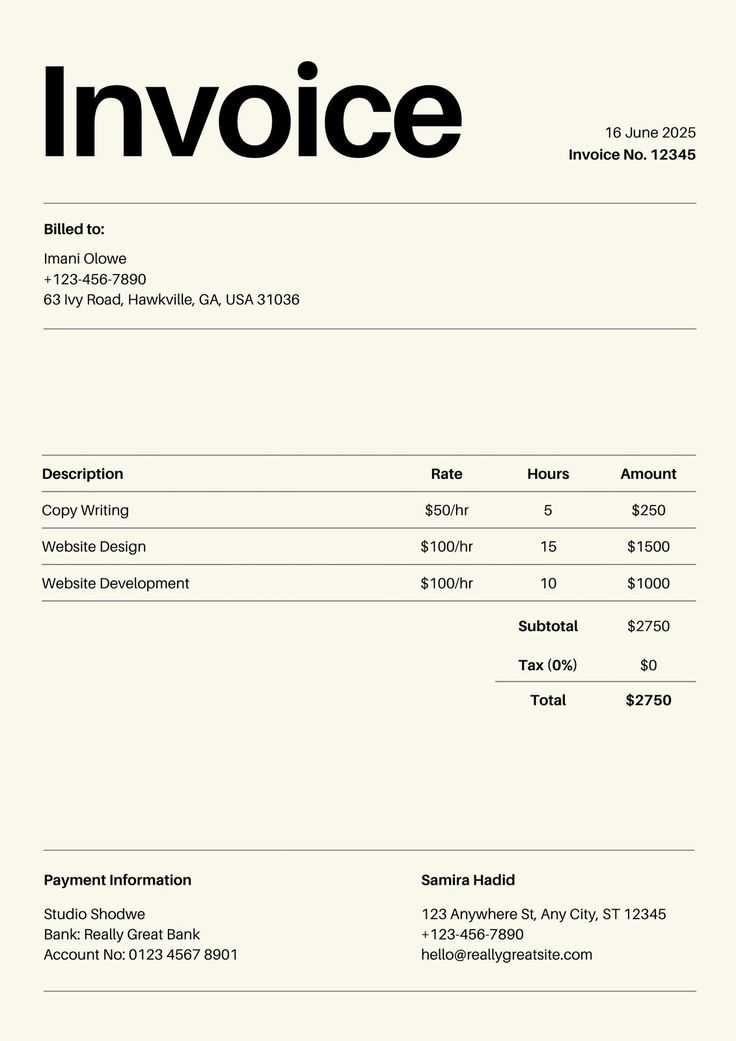

One key advantage of personalizing your payment forms is the ability to reflect your business’s identity. By incorporating your logo, choosing a consistent color scheme, and using fonts that match your branding, you create a cohesive professional image that clients will recognize and trust. This small detail can help enhance your brand’s presence and reinforce credibility.

Another benefit is the opportunity to tailor the content to suit your specific business practices. Customizing payment details, such as adding personalized payment instructions, specific terms, or even discounts for early payment, ensures that every aspect of your transaction is clear. This not only helps clients understand the expectations but also reduces the likelihood of misunderstandings or late payments.

Top Features to Look for in Templates

When selecting a pre-made structure for billing, it’s important to consider the essential features that will make your financial documents not only visually appealing but also practical and functional. The right design should make it easy to input information, track payments, and present a professional image to your clients. In this section, we’ll explore the most important aspects to look for in any customizable billing format.

Ease of Use and Flexibility

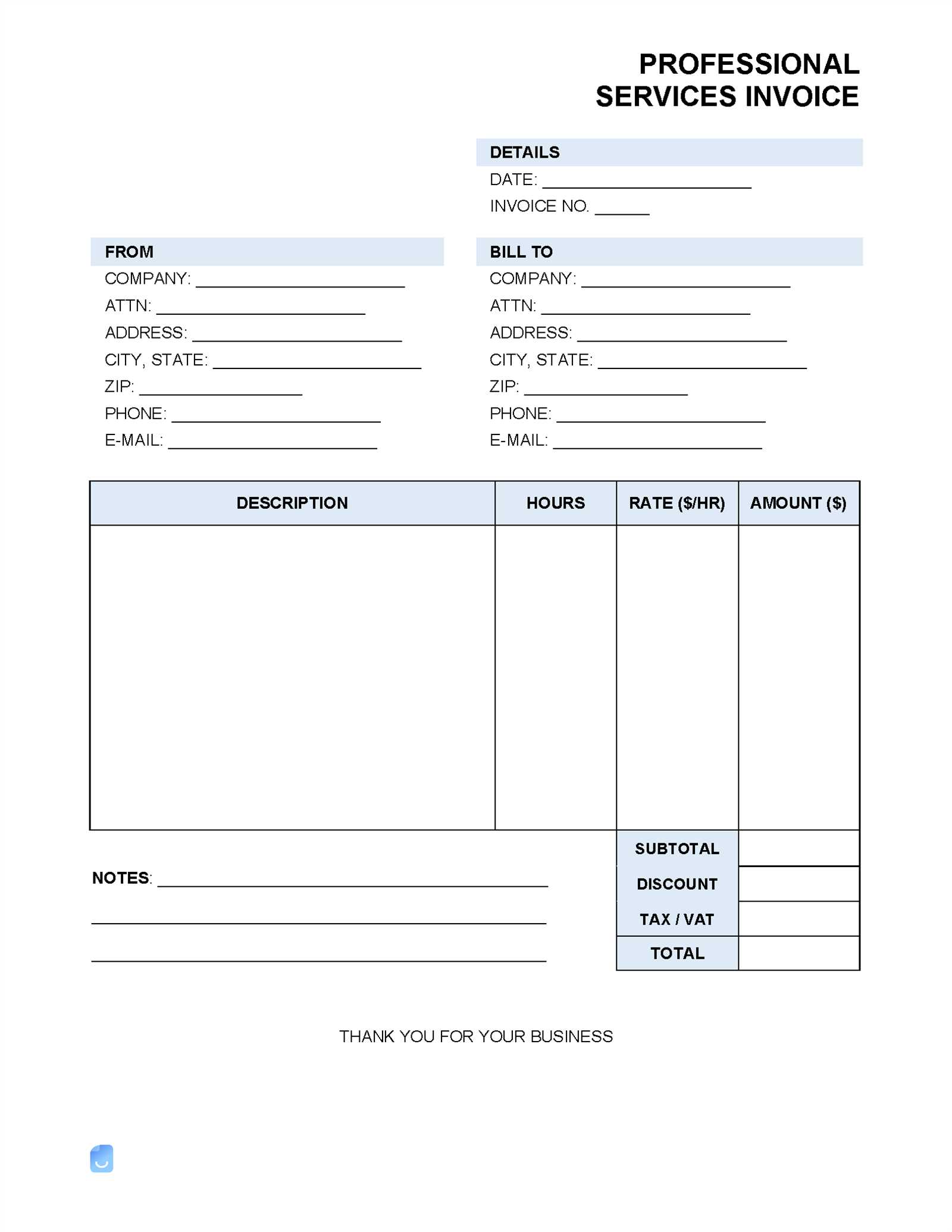

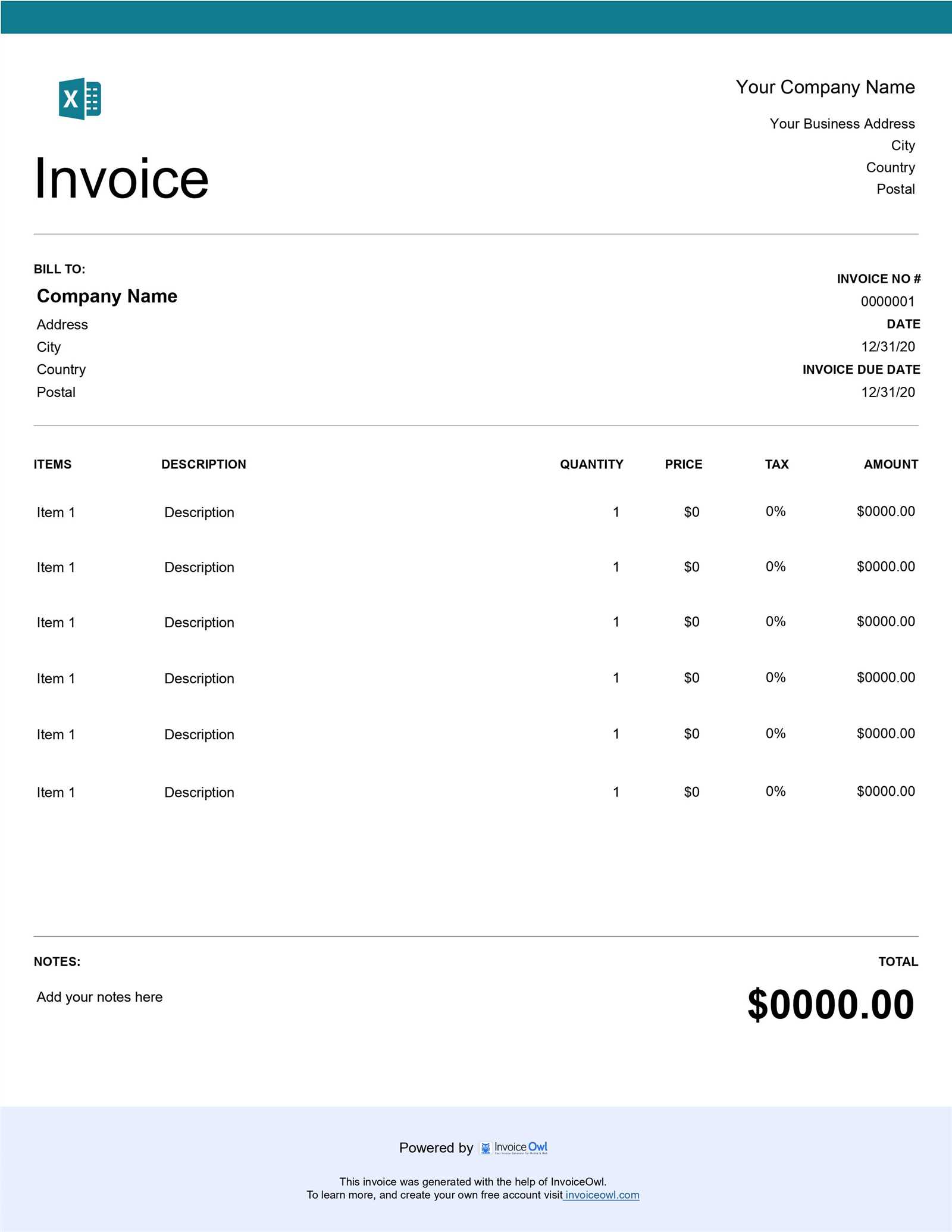

The first thing to prioritize when choosing a document format is user-friendliness. Look for a layout that is easy to fill out, with clearly marked sections for different types of information such as client details, payment terms, and itemized services or products. The best formats allow for quick edits and flexibility in adding or removing sections to match your unique business needs.

Professional Design and Structure

A well-designed document should also be structured in a way that makes it easy to read and visually appealing. Choose a format that balances clarity and aesthetics. Important sections like payment deadlines, pricing, and terms should be easy to locate, while the overall design should feel cohesive with your brand. A good structure not only makes the document look professional but also helps avoid confusion and reduces the likelihood of errors during data entry.

Free vs Paid Invoice Templates

When choosing a pre-made document structure for billing purposes, businesses often face the decision of whether to use free or paid options. While both have their benefits, it’s important to understand the key differences between them to make an informed decision. Free formats can be a great starting point for small businesses or individuals with basic needs, while premium options may offer more advanced features and customization for a professional edge.

Advantages of Free Formats

Free formats can be an excellent choice for businesses just starting out or those with simple billing requirements. These formats often come with essential features, such as basic sections for itemized services, client details, and pricing. Free options allow for quick and easy access without any initial cost, making them ideal for small businesses looking to save money.

Advantages of Paid Formats

On the other hand, paid formats typically offer more advanced features and greater customization options. With a premium option, you may gain access to additional designs, better support, and more advanced tools for tracking payments or managing invoices. These features can help businesses present a more polished image and streamline their billing processes with minimal effort.

| Feature | Free Options | Paid Options |

|---|---|---|

| Cost | Free | Varies (Subscription or One-time fee) |

| Design Options | Limited | Wide variety and customization |

| Support | Basic | Priority or dedicated support |

| Features | Basic functionality | Advanced tools for tracking, automation, and customization |

| Branding | Minimal customization | Full customization to match your brand |

How to Choose the Right Template

Selecting the right structure for your billing documents is crucial for ensuring clarity, professionalism, and efficiency in your transactions. The right choice will depend on several factors, such as your business needs, the complexity of your services, and how much customization you require. By evaluating key features and aligning them with your specific requirements, you can find the ideal solution that works for your company.

When making your decision, consider the following points:

- Business Type: Different businesses have unique needs. A freelancer may need a simple format, while a larger company might require more advanced features such as payment tracking and multiple line items.

- Customization Needs: Think about how much you need to personalize your documents. Some formats offer basic fields, while others allow for full branding and detailed adjustments to suit your business style.

- Ease of Use: Choose a format that is easy to fill out and edit. A complicated structure can waste time and lead to errors, so look for something user-friendly with clearly defined sections.

- Budget: Consider your budget and whether you are willing to invest in premium features. Free options may work for some, but if you need advanced functionalities, a paid solution might be a better fit.

- Support and Updates: Some paid formats offer ongoing support and regular updates, which can be valuable as your business grows and your needs change.

By evaluating these factors, you can select a format that will best suit your business’s workflow and provide a professional experience for your clients.

Creating Invoices with Easy-to-Use Tools

Creating professional billing documents doesn’t have to be complicated or time-consuming. With the right tools, you can generate clear and accurate payment requests in just a few clicks. Whether you’re a small business owner, freelancer, or part of a larger company, using simple, intuitive software can streamline the process and reduce the chances of errors.

Benefits of Using User-Friendly Software

Easy-to-use tools allow you to quickly input essential information, such as client details, services provided, and payment terms, without any complicated formatting. These tools often come with predefined fields, making the entire process straightforward and efficient. A major advantage of using such software is automation–you can save and reuse client information, which eliminates the need to enter the same details repeatedly. This feature is especially helpful for businesses with regular clients or recurring services.

Customizing Your Documents with Simple Features

While simplicity is key, most user-friendly tools still offer the flexibility to customize the layout and design of your documents. You can add your logo, adjust colors, and choose from a range of fonts to match your brand’s identity. Even without extensive design experience, these tools provide a range of options to personalize your billing documents. Additionally, many software options allow you to save documents in multiple formats, making it easy to send them via email or print for physical delivery.

Tips for Personalizing Your Invoice

Personalizing your billing documents is a great way to stand out and create a more professional and engaging experience for your clients. By adding customized elements, you not only make your documents more visually appealing but also reinforce your brand’s identity. Simple adjustments can go a long way in ensuring your business maintains a cohesive look and fosters trust with clients.

Key Areas to Personalize

There are several key areas of your billing document that can be easily customized to reflect your brand’s style and your business’s unique needs:

- Company Logo: Including your logo at the top of the document makes it instantly recognizable and reinforces your brand identity.

- Business Information: Always make sure your contact details are up-to-date, including your company’s address, phone number, and email. You may also include links to your website or social media accounts.

- Color Scheme: Select colors that align with your branding, but ensure they don’t distract from the content. A clean, professional look is key.

- Terms and Conditions: Customizing payment terms, discounts for early payment, or late fees ensures clarity and sets expectations for both parties.

- Font Style: Choose fonts that match your brand’s personality. While a formal look is often preferred, make sure the text remains legible and clear.

Personalization Beyond Design

Personalizing your billing document isn’t just about aesthetics. It’s also important to tailor the content to fit your business’s specific services or payment structure:

- Itemized Services: Clearly list the products or services you provided, along with their costs, to avoid confusion and ensure clients know exactly what they are paying for.

- Custom Payment Instructions: If you have specific payment methods, such as bank transfers or online payments, include detailed instructions for your clients.

- Thank You Notes: Adding a personalized note of appreciation can help foster positive relationships with your clients and make them feel valued.

How to Organize Your Invoice Data

Efficiently managing and organizing your billing information is essential for maintaining clear financial records and streamlining payment processes. A well-structured approach ensures that all necessary details are easy to find, reducing the risk of errors and improving the overall efficiency of your business operations. Proper data organization also helps with tracking payments and managing client relationships.

Key Data to Track

To keep your financial records organized and consistent, ensure that the following key elements are clearly defined and easy to access:

- Client Information: Always keep accurate and up-to-date details for each client, including their name, address, and contact information. This allows for fast reference and avoids errors when creating payment requests.

- Service/Item Descriptions: Clearly list the services provided or products sold, including their quantities, unit prices, and any applicable taxes or discounts.

- Payment Terms: Establish and record clear terms for each transaction, such as payment due dates, late fees, or discounts for early payment.

- Invoice Numbers: Assign a unique number to each document for easy tracking and future reference. This helps with organization and is useful when reconciling accounts or auditing records.

- Payment Status: Track whether a payment has been made, is pending, or overdue. This is vital for cash flow management and following up with clients when necessary.

Best Practices for Organizing Billing Data

To keep everything organized, consider implementing these best practices:

- Use Accounting Software: Consider using accounting or financial management software that can automatically store and categorize your data. This will simplify tracking, invoicing, and reporting.

- Consistent Naming Conventions: Maintain consistent naming conventions for your documents and data entries. For example, always label invoices with clear, sequential numbers or dates to avoid confusion.

- Regular Updates: Update your records regularly to ensure that any changes in client details, services, or payment terms are accurately reflected. This will help prevent mistakes in future transactions.

Essential Information to Include on Invoices

To ensure that your billing documents are complete, accurate, and professional, it’s important to include all the necessary details. A well-organized payment request should provide clarity to your client and help facilitate a smooth transaction. Including the right information not only minimizes confusion but also protects both parties by outlining clear terms and expectations.

Key Details to Include

Here are the essential elements that should always be part of your billing document:

- Business and Client Information: Always include your company name, address, contact details, and any other relevant business identification numbers (e.g., tax ID). Similarly, make sure to include the client’s name, address, and contact details for clear identification.

- Unique Reference Number: Assign a unique identification number for each document to track and organize your records. This can be a sequential number or a specific format that suits your business.

- Description of Products or Services: Provide a detailed list of all the products or services provided, including quantities, unit prices, and any applicable taxes. A clear breakdown will help avoid confusion and disputes later on.

- Payment Terms: State the due date for payment and any terms associated with it, such as discounts for early payment or penalties for late payments. This helps set expectations upfront and ensures timely payments.

- Total Amount Due: Clearly display the total amount owed, including all taxes and additional fees. Break down any charges to make the total amount easy to understand.

Additional Considerations

There are also a few extra details that can further clarify your payment requests and enhance your professionalism:

- Payment Methods: Include the available payment methods, such as bank transfer, credit card, or online payment options. Providing this information upfront can help clients pay faster.

- Notes or Special Instructions: Use this space for any additional information, such as a thank-you note, specific instructions for the client, or reminders about future business opportunities.

- Legal Disclaimers: Depending on your location and industry, you may need to include legal terms or disclaimers that protect both parties in the event of a dispute.

Common Mistakes When Using Invoice Templates

While using pre-made formats for billing can simplify the process, it’s easy to make mistakes that can lead to confusion or delays in payment. Whether it’s due to oversight or misunderstanding, even small errors in your financial documents can negatively impact your business relationships. Being aware of common pitfalls will help you avoid costly mistakes and maintain professionalism in your transactions.

Common Errors to Avoid

Here are some of the most frequent mistakes made when working with billing formats:

- Missing Key Information: One of the most common issues is leaving out important details, such as client contact information, payment terms, or a breakdown of services rendered. Ensure that every field is filled out accurately to avoid confusion or disputes.

- Incorrect Calculation of Totals: Miscalculating the total amount due or failing to include taxes and fees correctly can create frustration for both you and your client. Double-check all amounts and formulas to ensure accuracy before sending.

- Not Updating Client Information: It’s easy to forget to update details like client addresses or contact information, especially if you have long-term clients. Always verify that the information you’re using is up to date.

- Inconsistent Formatting: Using different fonts, colors, or layouts can make your documents look unprofessional. Consistency in formatting not only improves readability but also creates a stronger brand identity.

How to Avoid These Mistakes

Here are some tips for ensuring your billing documents are error-free:

- Use Templates with Built-In Validation: Some software or formats come with built-in checks to help you avoid mistakes like missing fields or incorrect totals. These tools can save you time and reduce human error.

- Proofread Before Sending: Always review your documents thoroughly before sending them out. Check for both simple spelling errors and more complex mistakes, such as incorrect pricing or missing details.

- Keep Your Records Updated: Make it a habit to regularly update your client information and ensure that your billing terms are consistent across all documents.

How to Avoid Invoicing Errors

Billing mistakes can result in delays, disputes, and financial discrepancies that can negatively affect both your business and your relationships with clients. To ensure smooth transactions, it’s important to take steps to avoid common errors when preparing payment requests. Proper attention to detail, organization, and using reliable tools can go a long way in minimizing mistakes and ensuring accurate billing every time.

Steps to Prevent Common Mistakes

Here are some practical steps to help you avoid errors in your billing process:

- Double-Check All Data: Always review the details before finalizing your document. Check client names, addresses, payment terms, and services or products listed. Even minor errors in this information can cause confusion or delays in payments.

- Use Consistent Formats: Inconsistent formats or layout changes can lead to missing information or misinterpretation. Stick to a clear, consistent design that’s easy to read and navigate. This includes font styles, section headings, and itemized lists.

- Automate Calculations: If you’re manually calculating totals, taxes, and discounts, you’re more likely to make mistakes. Use software with automated calculations to ensure accuracy and save time.

- Verify Payment Terms: Ensure that payment deadlines, late fees, and discounts are clearly stated and correct. Misunderstandings over payment terms can result in delayed or partial payments.

- Send Timely Requests: Sending payment requests too late or too early can confuse your client or cause unnecessary delays. Make sure to send your documents at the appropriate time, ensuring that the payment window is clear and reasonable.

Using Tools to Improve Accuracy

Leverage technology and software to streamline and enhance the accuracy of your billing process:

- Billing Software: Using dedicated billing or accounting software can help you automate many of the tasks, from generating documents to tracking payments. These tools can reduce human error and increase efficiency.

- Predefined Formats: Use pre-designed formats with built-in fields and clear sections. This ensures that no key data points are overlooked and can help standardize your billing process.

- Regular Audits: Periodically audit your billing practices to identify areas for improvement. This can help you spot recurring issues and adjust your approach to reduce errors over time.

Invoice Templates for Different Industries

Different businesses have unique needs when it comes to billing their clients. The type of products or services offered, payment structures, and industry regulations can all influence the format and content of a billing document. By tailoring your billing documents to suit your industry, you can ensure clarity, professionalism, and compliance with any legal or financial requirements specific to your sector.

Here is an overview of common billing document formats used in various industries:

| Industry | Key Features | Recommended Format |

|---|---|---|

| Freelance & Consulting | Clear breakdown of hourly rates, project milestones, and payment terms. | Simple, itemized list with hours worked and deliverables. |

| Retail | Product descriptions, quantities, unit prices, and tax calculations. | Detailed list of products with separate tax breakdown. |

| Construction | Detailed list of materials, labor costs, project phases, and timelines. | Comprehensive breakdown with progress billing, including deposits and retention amounts. |

| Software & Digital Services | Subscription plans, one-time charges, and usage-based pricing. | Recurring billing format with clear service periods and rates. |

| Healthcare | Medical codes, patient information, and insurance details. | Structured layout with sections for patient details, services rendered, and insurance claims. |

By customizing your billing documents according to your industry’s needs, you can make transactions smoother and improve communication with your clients. Tailored formats help avoid misunderstandings and ensure that all necessary information is included for prompt payment.

How to Track Payments with Templates

Efficiently tracking payments is crucial for maintaining healthy cash flow and avoiding missed or delayed payments. With the right structure in your financial documents, you can easily monitor the status of each transaction and ensure timely follow-up when necessary. Having a consistent approach for tracking payments helps you stay organized and maintain transparency with clients.

Key Elements to Include for Payment Tracking

To track payments effectively, it’s important to include specific details in your billing documents that will make it easier to track the status of each payment:

- Payment Status: Clearly indicate whether a payment has been received, is pending, or is overdue. This can be done using a simple checkbox or status field within the document.

- Due Date: Include a clearly visible payment due date to set expectations and help you keep track of when payments should be made.

- Partial Payments: If the payment is being made in installments, make sure to indicate the amount paid and the balance remaining.

- Payment Method: Record the method of payment (e.g., bank transfer, credit card, cash) to have a clear record of how the transaction was completed.

- Reference Number: Including a unique payment reference number allows you to easily match payments with their corresponding bills.

How to Organize Payment Information

Here are some methods for organizing payment data that will make tracking easier:

- Use a Spreadsheet: A spreadsheet can be an effective way to track payments. You can include columns for invoice number, payment due date, status, amount paid, and payment method. This makes it easy to filter and update as payments are received.

- Accounting Software: For more advanced tracking, consider using accounting or financial software that automatically records and updates payment statuses as transactions occur. This can save time and reduce errors.

- Set Up Automated Reminders: Use automated systems to send reminders for overdue payments, helping to ensure timely collections. This can reduce administrative workload and improve cash flow.

Best Invoice Software for Professionals

For businesses and individuals who need to manage billing efficiently, using software designed to automate and streamline the process can save significant time and reduce errors. The right billing software not only allows for quick document creation but also helps track payments, generate reports, and stay organized. Whether you’re a freelancer, a small business owner, or a large enterprise, there’s a tool that fits your needs and budget.

Top Features to Look for in Billing Software

When choosing software for managing payment requests, it’s important to look for key features that will enhance your workflow:

- Customization: The ability to tailor the format and appearance of your documents to suit your brand or business style.

- Automation: Features that allow automatic calculations, recurring billing, and reminders for overdue payments.

- Integration: Compatibility with other software such as accounting tools, bank accounts, or CRM systems.

- Reporting: Ability to generate reports on unpaid balances, revenue, and client histories.

- Mobile Access: Support for creating and managing documents from smartphones or tablets for added convenience.

Top Software Options for Professionals

Here are some of the best billing and accounting software options available for professionals:

| Software | Key Features | Best For |

|---|---|---|

| FreshBooks | Automated billing, time tracking, expense tracking, and client management. | Freelancers and small businesses looking for an all-in-one solution. |

| QuickBooks | Invoicing, expense tracking, tax calculation, and financial reporting. | Small to medium-sized businesses that need comprehensive accounting features. |

| Zoho Invoice | Customizable templates, time tracking, automated reminders, and online payment options. | Businesses looking for an affordable and customizable solution. |

| Wave | Free invoicing, accounting, and receipt scanning features. | Small businesses or freelancers on a budget. |

| And.co | Project management, invoicing, contracts, and client management. | Freelancers and consultants who need a simple and user-friendly platform. |

Choosing the best software depends on the specific needs of your business, such as the volume of transactions, the level of customization required, and your budget. By selecting the right tool, you can make the process of man

How to Automate Invoice Creation

Automating the process of generating billing documents can save businesses significant time and effort. By reducing the need for manual entry and repetitive tasks, automation ensures accuracy, increases efficiency, and allows you to focus on other important aspects of your business. Whether you’re dealing with frequent clients or recurring services, automating document creation helps streamline the process, maintain consistency, and improve cash flow.

Key Steps to Automate Billing

There are several ways to automate the process of creating and sending payment requests:

- Choose the Right Software: Look for software or tools that offer automatic billing features, such as recurring billing or automatic total calculations. These tools can significantly reduce errors and the time spent creating each document.

- Set Up Recurring Billing: For clients with ongoing services or subscriptions, setting up automatic billing cycles can help ensure that invoices are sent on time without requiring manual input each month.

- Integrate with Payment Gateways: Integration with online payment systems enables you to automatically track when payments are made, update payment statuses, and send reminders for overdue balances.

- Use Predefined Formats: Pre-designed document layouts can be used to quickly generate professional-looking payment requests. Automating the population of data, such as client details, services rendered, and due amounts, can save you from re-entering the same information repeatedly.

Tools to Automate Billing Creation

Here are some tools and software options that can help automate the process:

| Software | Key Features | Best For |

|---|---|---|

| QuickBooks Online | Recurring billing, automatic payment reminders, integration with accounting and payment systems. | Small businesses and freelancers who need full accounting and billing automation. |

| FreshBooks | Automated invoicing, time tracking, recurring billing, and expense management. | Freelancers and small businesses that require simple, automated invoicing with professional templates. |

| Zoho Invoice | Customizable automated billing, time tracking, recurring invoices, and client communication tools. | Business owners seeking an affordable, automated invoicing solution with flexibility in customization. |

| Wave | Free automated invoicing, receipt scanning, and expense tracking. | Freelancers and small businesses looking for a cost-effective way to automate their billing process. |

| Invoicely | Automated invoicing, recurring billing, multi-currency support, and customizable templates. | Businesses with international clients who need flexible and automated billing options. |

By implementing automation in your billing processes, you can save time, reduce human error, and ensure that you sta

Legal Aspects of Invoice Templates

When creating financial documents for transactions, it is essential to ensure that the documents comply with legal requirements and accurately reflect the terms of the agreement. These records not only serve as a request for payment but also as legal proof of the transaction. Understanding the key legal elements to include can help prevent disputes and ensure that your billing documents hold up in case of audits, legal challenges, or customer disputes.

Key Legal Considerations

There are several critical factors that should be addressed when creating payment request documents to ensure compliance with laws and regulations:

- Accuracy of Information: All details, such as the date, client information, product or service description, and amounts, must be accurate and verifiable to avoid disputes.

- Clear Terms and Conditions: Include clear payment terms, such as due dates, late fees, and penalties for non-payment, to prevent misunderstandings.

- Tax Information: For businesses operating in regions with sales tax or VAT, it is necessary to include the correct tax rates and tax identification numbers.

- Legal Jurisdiction: Clearly state the legal jurisdiction that governs the transaction, especially in cases of international trade or cross-border transactions.

- Invoice Numbering: Ensure that your payment request documents are sequentially numbered. This helps maintain proper records for both accounting and legal purposes.

What to Include for Legal Compliance

Here are essential elements that need to be included to ensure that your documents comply with legal standards:

| Element | Description | Legal Importance | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Unique Reference Number | A sequential number or identifier for each payment request. | Helps track and reference transactions for legal and tax purposes. | |||||||||||||||||

| Business Information | Includes your business name, address, and contact details. | Required for legal identification and correspondence. | |||||||||||||||||

| Client Details | Complete details of the customer, including name and address. | Ensures proper identification of both parties in case of disputes. | |||||||||||||||||

| Payment Terms | Clearly state payment due dates, late fees, and payment methods. | Sets legal expectations for when payment should be made and any penalties for late payments. | |||||||||||||||||

| Tax Information | Include relevant tax numbers, such as VAT

How to Save Time with TemplatesStreamlining your billing process can significantly reduce the amount of time spent on administrative tasks. By utilizing pre-designed formats, you can eliminate the need to create each document from scratch, allowing you to focus on more important aspects of your business. The right system not only speeds up the creation of payment requests but also ensures consistency, accuracy, and professionalism across all your financial documents. Key Benefits of Using Pre-Designed Formats

Here are several ways that utilizing pre-structured documents can save you valuable time:

Tools to Help You Save TimeThere are a number of tools that offer ready-made formats and automation features to save time on generating payment requests:

By implementing the right tools and formats, you can streamline the invoicing process, reduce the amount of time spent on administrative tasks, and increase overall efficiency. Time saved in document creation can be reinvested into growing your business and |