Pro Forma Invoice Template for the UK

For businesses in the UK, preparing a document that outlines a transaction before the final sale can be an essential part of the process. This preliminary document serves as a clear communication tool, ensuring both the seller and buyer are aligned on the details of the trade. It plays a vital role in international dealings, where customs and regulations often require specific documentation before goods are shipped.

By using a structured format, businesses can streamline their operations and avoid confusion regarding costs, product details, and terms of service. With the right document in place, sellers can confidently move forward with shipments and buyers can be assured of the accuracy of their orders. Creating this type of paperwork does not need to be complicated, and there are many resources available to help businesses quickly generate a document that meets all necessary requirements.

Understanding how to create and utilize such a document is crucial for maintaining smooth transactions and protecting both parties’ interests. In the following sections, we will explore how this document is used, its key components, and how businesses in the UK can easily create their own versions for any transaction type.

Pro Forma Invoice Template for UK Businesses

For UK businesses, creating an official document that outlines the specifics of a sale before the final transaction is essential for clear communication and smooth operations. This document acts as a preliminary agreement between the seller and buyer, ensuring that both parties are fully informed of the terms, pricing, and product details. Whether for local or international sales, having a standardized structure for this type of paperwork simplifies the process and helps avoid misunderstandings.

When drafting such a document, it is important to include all relevant details that will help both the buyer and seller stay on track. Key elements should be clearly outlined to ensure transparency and prevent errors during the actual transaction. A well-organized document not only fosters trust but also ensures that all requirements, including customs regulations, are met when shipping goods abroad.

Key Elements of a Sales Document

- Seller Information: Include company name, address, and contact details.

- Buyer Information: Ensure the buyer’s full name, address, and contact info are listed.

- Product Description: List the goods or services being provided with clear descriptions.

- Pricing Details: Provide the unit price and total amount for each item or service.

- Payment Terms: Specify when the payment is due, including any advance payments or deposits required.

- Shipping Information: Include delivery method, cost, and expected shipping date if applicable.

- Additional Notes: Any extra terms, such as discounts or special conditions, should be listed here.

Why a Standardized Format is Important

- What is a Pro Forma Invoice?

This type of document serves as an initial outline of a transaction, providing a detailed summary of the goods or services being sold before the final sale takes place. It helps both the seller and the buyer agree on the terms and conditions of the deal, including pricing, quantities, and delivery expectations. While it is not a legally binding contract, it is often used in international trade to ensure all details are clear prior to the shipment of goods.

Typically, this document is issued before the final payment and acts as a preview of what the buyer can expect. It ensures that both parties are on the same page and helps avoid misunderstandings once the final invoice is generated. It is also used for customs purposes in international transactions, providing authorities with an early record of the sale.

Key Features of This Document

- Preliminary Agreement: It outlines the terms and conditions before the final sale occurs.

- Detailed Product Information: Descriptions, quantities, and pricing for all items or services are included.

- Non-binding: Unlike a final invoice, this document does not require payment at the time of issuance.

- Shipping Details: Expected delivery methods and dates are often included for clarity.

- Used for Customs: It is commonly required for international shipments to help with customs clearance.

Why It Is Used

- For Clarity: It provides both buyer and seller with a detailed overview of the transaction to prevent confusion.

- International Sales: It is often required f

Importance of Using a Pro Forma Invoice

Creating a detailed document outlining the terms of a sale before the final transaction is completed is essential for ensuring both parties are in agreement. This early-stage record provides an opportunity to confirm important details such as pricing, quantities, and delivery methods. For businesses in the UK, using this type of document is not just helpful but often necessary to avoid confusion and reduce the risk of disputes later in the process.

Having a clear agreement in place helps businesses manage expectations, especially in international transactions where customs regulations and international laws can complicate the process. By using a standardized format for this document, sellers can confidently move forward with the sale, knowing that all the key details have been reviewed and agreed upon. It also plays a crucial role in maintaining transparency and trust with customers.

Benefits of Using This Document

- Clarity for Both Parties: It ensures the seller and buyer understand the terms and pricing before the sale is finalized.

- Helps with Customs and Shipping: For international sales, this document is often required for customs clearance and efficient shipping.

- Establishes Professionalism: A well-organized document reflects professionalism, which can enhance the business reputation.

- Prevents Disputes: By agreeing on the specifics early, businesses can minimize the likelihood of disagreements later on.

- Streamlines the Process: It speeds up transactions by providing a clear and agreed-upon starting point for both buyer and seller.

How It Enhances Business Operations

- Efficient Reco

How to Create a Pro Forma Invoice

Creating a preliminary document that outlines the key details of a transaction before the final sale is essential for any business. This document serves as a draft, providing clarity on the goods or services, pricing, and terms of the deal. Crafting this type of document correctly ensures that both the buyer and the seller are in agreement on all aspects of the transaction before it is finalized. Below are the steps to follow when creating such a document for your business.

Step-by-Step Guide

- Start with Your Company Information: Include your business name, address, and contact details at the top of the document. This ensures the buyer knows exactly who they are dealing with.

- Include Buyer Information: Clearly list the buyer’s name, address, and any relevant contact information. This helps avoid any confusion and ensures the document is specific to the transaction.

- Provide Product or Service Details: Describe the items or services being sold, including quantities, unit prices, and any applicable discounts. This section should be as detailed as possible.

- Outline Pricing and Total Amount: Clearly state the price for each item or service, and calculate the total cost, including any applicable taxes or shipping fees.

- Specify Payment Terms: Indicate when payment is expected, including any deposit requirements or installment plans. Mention the payment methods you accept.

- Include Delivery or Shipping Information: If the goods are being shipped, list the delivery method, shipping costs, and expected delivery date.

- Provide Additional Notes: If there are any specific terms, such as return policies, warranty information, or other special conditions, include them here.

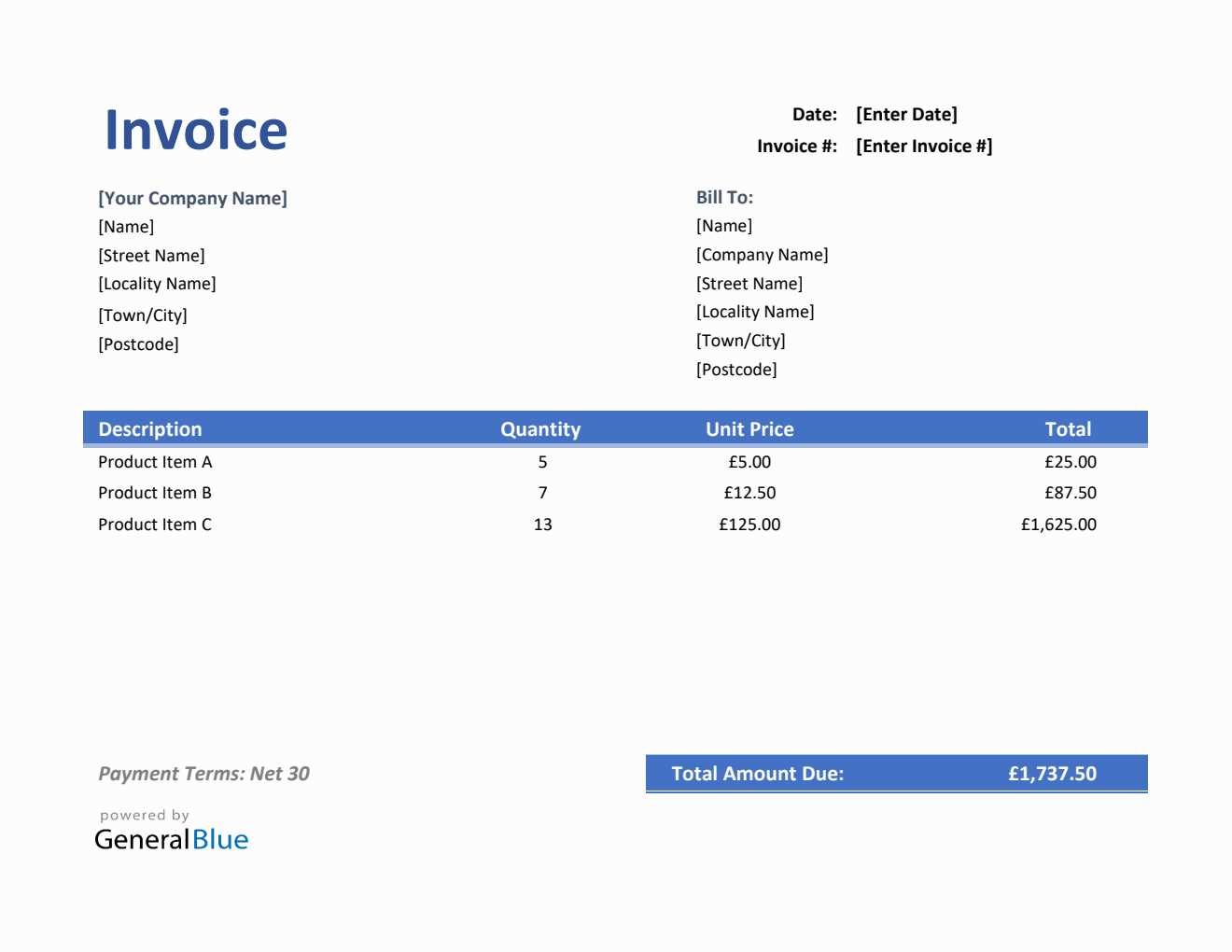

Form

Key Elements of a Pro Forma Invoice

When preparing a preliminary document for a transaction, it is essential to include several key elements to ensure clarity and prevent misunderstandings between the buyer and seller. These components not only define the terms of the sale but also provide a clear outline of what the buyer can expect before the final payment and delivery. Below are the core elements that should be included to ensure that the document is effective and legally sound.

- Seller Information: This should include the full name of the business, physical address, contact details, and any relevant registration or tax identification numbers. This helps the buyer easily identify the seller and verify their legitimacy.

- Buyer Information: Similarly, the buyer’s name, address, and contact information should be clearly listed. This ensures that the document is directly tied to the correct recipient and establishes the terms for that specific buyer.

- Detailed Description of Goods or Services: A clear and thorough description of the items or services being sold should be included. This could include the model numbers, quantities, unit prices, and any other details that help the buyer understand exactly what they are purchasing.

- Pricing Breakdown: Each item or service should be listed with its individual price, as well as the total cost for each line item. Additionally, taxes, shipping fees, and any other charges should be clearly outlined to prevent confusion regarding the total amount due.

- Payment Terms: Specify when payment is due, whether there are any advance payments required, or if payment is to be made in installments. It is also helpful to indicate acceptable payment methods, such as credit card, bank transfer, or cheque.

- Delivery or Shipping Information: If the transaction involves physical goods, include information on the shipping method, estimated delivery date, and who is responsible for the cost of shipping. This e

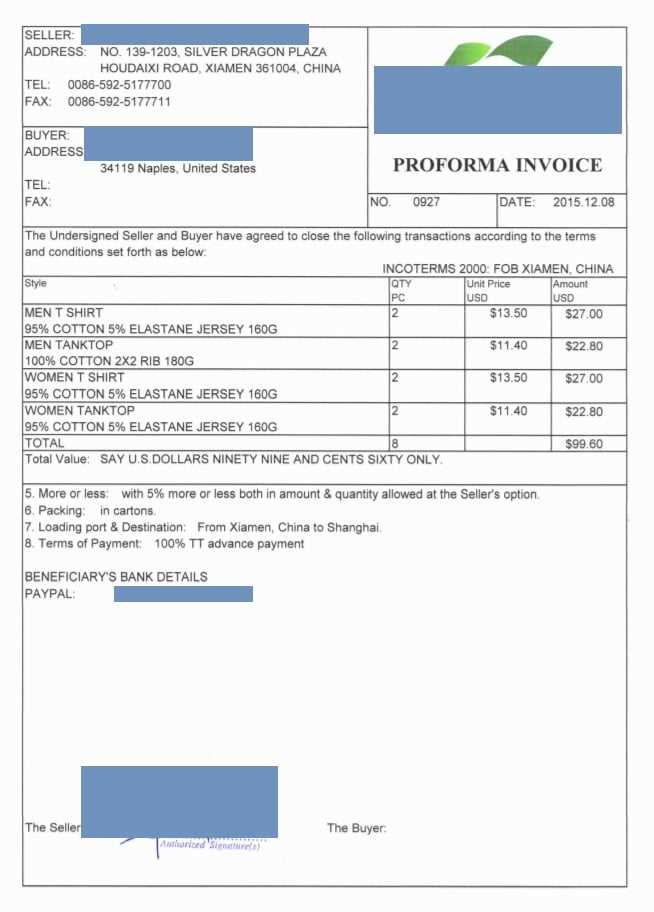

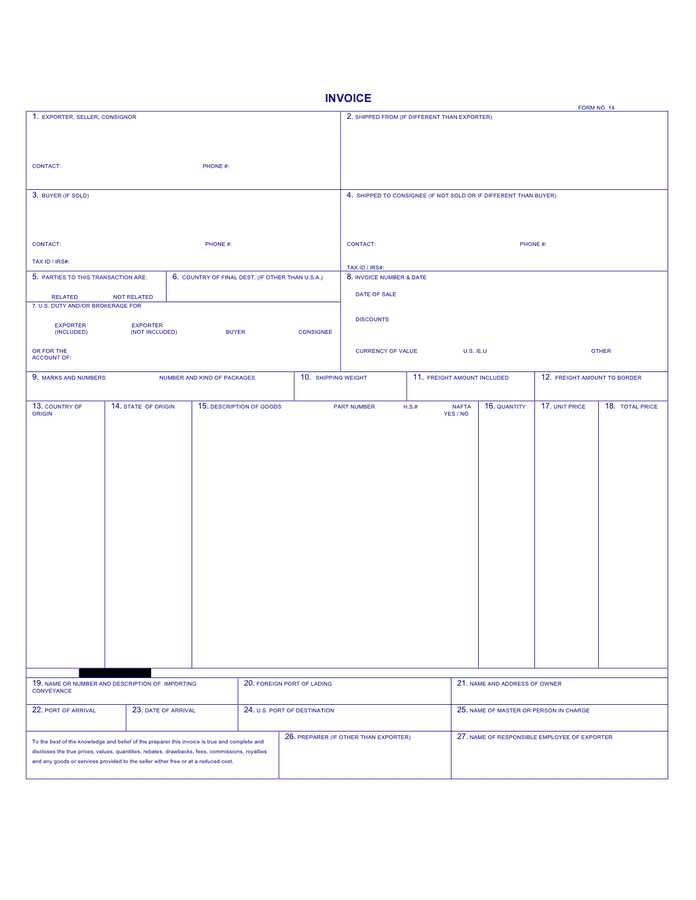

Difference Between Pro Forma and Commercial Invoices

Both documents serve as vital tools in the sales process, but they are used at different stages and for different purposes. The first document is typically created as a preliminary agreement, outlining the terms of the sale before the transaction is completed. In contrast, the second one is a final statement, issued after goods or services have been delivered, and it demands payment. Understanding the key differences between these two types of documents can help businesses avoid confusion and ensure smooth transactions.

- Purpose: The main difference lies in their purpose. The initial document serves as a proposal or estimate, showing what the buyer can expect to pay, while the second document is an official request for payment after the sale has occurred.

- Legality: The preliminary document is not legally binding and does not require payment, whereas the final document is a legally enforceable request for payment and includes terms regarding late fees, if applicable.

- Payment Terms: The first document typically outlines the payment terms before a transaction is completed, often requiring a deposit or full payment in advance. The second document specifies the exact payment due and typically includes instructions on how the buyer should pay.

- Usage in Trade: The first document is often used in international trade to satisfy customs requirements or provide a preliminary record of the sale. The second document is used to finalize the transaction and is required for accounting purposes.

- Details Included: While both documents contain similar details, such as the product description and pricing, the initial document may not include the final total cost or payment instructions, as those det

When to Use a Pro Forma Invoice

Understanding when to issue a preliminary document can help businesses effectively manage their transactions and maintain clear communication with customers. This document is typically used in situations where both parties need to agree on the terms before finalizing the sale or shipment. It provides a way to outline the transaction’s details without binding either party to immediate payment, serving as a way to confirm the terms and prevent future misunderstandings.

Situations for Using This Document

- International Transactions: When dealing with cross-border sales, a preliminary document is often required for customs clearance, as it provides details about the transaction’s value and terms without actual payment.

- Custom Orders: For bespoke or made-to-order products, this document can serve as a quote and outline the exact specifications, ensuring both parties agree before the final order is confirmed.

- Estimating Costs: Businesses can use it to give customers a clear breakdown of potential costs before the final confirmation, allowing customers to review prices and adjust their orders if needed.

- Requesting Deposits: In cases where partial payment is required upfront, this document serves as a request for a deposit before the goods or services are fully delivered.

When Not to Use It

- After Final Delivery: Once the goods or services have been delivered and the sale has been completed, a different type of document should be issued to request payment.

- For Simple Transactions: For straightforward sales where no prior agreements or changes are necessary, a more formal request for payme

How a Pro Forma Invoice Helps with Customs

When conducting international trade, providing the correct documentation is essential for smooth customs clearance. This preliminary document plays a key role in informing customs authorities about the details of the transaction before it is finalized. By including critical information such as the value of the goods, their description, and shipping details, it ensures that all parties–both buyers and sellers–are aligned on what is being shipped and at what value, preventing delays or issues during import and export processes.

Key Benefits for Customs Clearance

- Clarity of Transaction Details: Customs authorities require a clear understanding of the value and nature of goods being shipped. This document provides a comprehensive breakdown, helping to prevent confusion during inspection.

- Accurate Duty and Tax Estimation: By listing the value of the goods and their classification, it enables customs to accurately calculate the applicable duties and taxes, ensuring compliance with local regulations.

- Streamlined Customs Process: With this document in hand, customs officials can process shipments more quickly, as it helps clarify the terms of sale and value without the need for further verification.

- Avoiding Delays: Proper documentation reduces the risk of delays at the border. By outlining key details upfront, it ensures that shipments move smoothly through customs without unnecessary holds or additional inspections.

How to Ensure Effectiveness for Customs

- Provide Accurate Information: Ensure all details, such as product descriptions, quantities, and values, are correct and up-to-date to avoid discrepancies at customs.

- Include Complete Contact Information: Ensure that both the buyer and seller’s contact details are included for easy communication if customs authorities need further clarification.

- Highligh

Legal Requirements for Pro Forma Invoices in the UK

When creating a preliminary document for a transaction in the UK, it is important to ensure that all legal requirements are met. While this type of document is not a legally binding request for payment, it still needs to meet certain standards, particularly when used in international trade or for customs purposes. Understanding these requirements ensures that the document serves its intended purpose without leading to confusion or complications for either party involved.

Essential Legal Considerations

- Clear Identification: The document should clearly state that it is not a final bill but a preliminary statement of sale. This distinction helps prevent any misunderstandings about the status of the transaction.

- Accurate Product Information: The description of goods or services must be detailed and accurate, including quantities, pricing, and specifications. This information is crucial, especially for customs clearance in international trade.

- Business Details: It is important to include both the seller’s and buyer’s contact details, including names, addresses, and business registration numbers (if applicable). This helps authorities verify the legitimacy of the transaction.

- Value of Goods: While the preliminary document does not request immediate payment, it must list the value of the goods or services being sold. This is especially important for customs purposes, where duties and taxes may be calculated based on this value.

- Compliance with VAT Regulations: If VAT applies to the transaction, the document should outline whether VAT is included in the price or if it is subject to additional charges. This ensures clarity in the case of tax audits or disputes.

When to Seek Legal Advice

- Complex Transactions: If

Free Pro Forma Invoice Templates for Download

For businesses looking to create an initial document for their transactions, there are various free resources available online. These documents can help you quickly outline the terms of a sale, ensuring both parties agree on the key details before finalizing the deal. Downloadable versions allow businesses to save time and ensure consistency across their transactions without the need to create a new document from scratch each time.

Benefits of Using Free Resources

- Time-Saving: Pre-designed formats reduce the need to create a document from scratch, allowing you to focus on other aspects of the business.

- Consistency: Using the same format across transactions ensures consistency, helping your business maintain professional documentation practices.

- Ease of Customization: Most downloadable versions can be easily customized to fit your specific needs, such as adding your company logo or adjusting the layout to suit your branding.

- Cost-Effective: These resources are free to download, making them an affordable option for small businesses or freelancers looking to stay organized without additional expenses.

Where to Find Free Downloads

- Business Websites: Many business-oriented websites offer free downloadable files, often in various formats such as Word, Excel, or PDF.

- Accounting and Financial Platforms: Some online accounting services provide free resources as part of their support materials for users.

- Government Websites: In some cases, government sites offer free templates to ensure businesses comply with legal requirements, especially for international trade or VAT calculations.

Customizing Your Pro Forma Invoice Template

When creating a preliminary document for your business transactions, customization is key to ensuring it aligns with your company’s branding and meets your specific needs. Customizing this document allows you to add your personal touch, whether it’s through company logos, contact information, or tailored sections that are specific to the nature of your business. By adjusting the layout and content, you can ensure the document effectively communicates the terms of the sale while maintaining a professional appearance.

Essential Customization Elements

- Company Branding: Add your logo, business name, and contact information at the top to ensure that the document reflects your brand identity.

- Payment Terms: Customize th

How to Use Pro Forma Invoices for International Sales

When engaging in cross-border trade, it is essential to have a document that outlines the terms of a sale before the official transaction takes place. This document provides clarity for both the buyer and the seller, ensuring that all details are agreed upon, including product descriptions, prices, and delivery terms. It also serves as an important tool for customs clearance, helping to streamline the process and prevent any delays in international shipments.

Steps to Use for International Sales

- Provide Clear Product Descriptions: Include detailed information about the goods or services, ensuring that they comply with the import regulations of the destination country.

- Specify Currency and Payment Terms: Clearly state the currency of the transaction and include any payment terms, such as upfront deposits or payment deadlines.

- Include Shipping Details: Outline the delivery method, shipping costs, and expected delivery times to avoid confusion and ensure the buyer is aware of all logistics-related aspects.

- Indicate Country-Specific Taxation and Duties: Ensure that any applicable taxes, tariffs, or duties are mentioned, as these may vary based on the destination country’s customs policies.

Customs and Documentation

In international sales, the document can also serve as an essential tool for customs. When sending goods across borders, customs authorities often require detailed documentation to ensure that shipments are legitimate and comply with all regulations. By providing the relevant information up front, such as the cost of the goods and their intended use, you can facilitate a smoother customs clearance process.

Key Element Details for International Sales Product Description Include full specifications and compliance information for the destination country. Shipping Information Provide the delivery method, expected dates, and tracking options. Currency Common Mistakes in Pro Forma Invoices

When preparing preliminary documents for business transactions, errors can occur that may cause delays or misunderstandings between buyers and sellers. These mistakes can be costly, especially when dealing with international shipments or large contracts. Understanding and avoiding common pitfalls can help ensure that the document is both accurate and effective for all parties involved.

Frequent Errors to Avoid

- Incorrect or Missing Product Details: Failing to provide accurate descriptions or specifications of the goods or services can lead to confusion or disputes. Always include clear, precise information.

- Unclear Payment Terms: Not specifying payment conditions, such as due dates, amounts, and accepted payment methods, can lead to misunderstandings. Clearly outline these terms upfront.

- Omitting Shipping Information: Lack of shipping details like method, costs, and delivery dates can cause delays. Ensure that this information is complete and accurate.

- Not Accounting for Taxes and Duties: In international transactions, failure to include applicable taxes, tariffs, or import duties can result in unexpected costs for the buyer. Always confirm these details before finalizing the document.

- Using Incorrect Currency: Not stating the correct currency can lead to confusion, especially when dealing with international transactions. Make sure to specify the exact currency to avoid exchange rate issues.

Impact of These Mistakes

- Delays in Payment or Delivery: Misunderstandings about payment or shipping terms can result in delays, affecting business relationships and customer satisfaction.

- Legal and Financial Risks: Incorrect or missing information can cause legal complications or financial loss, especially in international trade.

- Customs Issues: Inaccurate documentation can result in shipments being held at customs, causing delays and potentially incurring fines or additional fees.

Best Practices for Pro Forma Invoicing

Creating clear and accurate preliminary documents is crucial for maintaining smooth transactions, particularly in business dealings that involve large sums or international shipments. Adhering to established best practices ensures that all parties are well-informed and helps prevent misunderstandings. By following these guidelines, businesses can streamline their processes, reduce errors, and improve customer satisfaction.

Key Guidelines to Follow

- Use Clear and Consistent Language: Ensure that the terminology used in your document is simple and easily understood by both the seller and the buyer. Avoid jargon or technical terms that could confuse the other party.

- Be Detailed and Accurate: Always include specific details about the goods or services being offered, including quantities, descriptions, and pricing. This will help avoid discrepancies or misunderstandings later on.

- Ensure Correct Currency and Payment Terms: State the correct currency for the transaction and clearly outline payment terms, including any deposits, deadlines, and accepted payment methods.

- Provide Complete Shipping Information: Include all shipping details, such as methods, estimated delivery dates, and any applicable costs. Being transparent about these factors can help prevent delays and disputes.

- Include Tax and Duty Details: When dealing with international transactions, always specify the taxes, duties, or tariffs that apply. This ensures both parties are aware of the total cost of the transaction.

Tips for Maintaining Accuracy

- Double-check All Details: Before finalizing the document, review it carefully to ensure all information is accurate and up to date.

- Use Digital Tools: Take advantage of invoicing software or online tools to automate the process. These tools can reduce errors and streamline document creation.

- Keep Records Organized: Maintain a proper record of all preliminary documents for future reference. This can be useful in case of disputes or for accounting purposes.

How to Track Pro Forma Invoice Payments

Tracking payments for preliminary financial documents is an essential part of ensuring that businesses maintain healthy cash flow and manage their finances efficiently. Keeping track of payments helps businesses avoid confusion, ensures timely follow-ups, and provides a clear record for accounting purposes. Understanding the steps involved in monitoring payments helps both parties stay on top of their obligations.

Steps to Effectively Track Payments

- Set Clear Payment Terms: Clearly define payment due dates and amounts in the initial document to avoid any ambiguity. This will help set expectations for both the seller and the buyer.

- Use a Payment Schedule: Create a schedule or calendar for payments that includes the agreed-upon due dates. This will help you keep track of any upcoming or overdue payments.

- Send Reminders: If a payment is due and hasn’t been received by the deadline, send a polite reminder to your client or customer. Ensure the reminder is professional and clear, detailing the amount owed and the due date.

- Record All Payments: Maintain a record of all payments received and any outstanding amounts. You can use spreadsheets or accounting software to track the payments and reconcile them with your financial records.

Best Tools for Monitoring Payments

- Accounting Software: Many businesses use accounting platforms like QuickBooks or Xero to track payments automatically. These systems often include features that alert you when a payment is due or when a payment has been received.

- Online Payment Gateways: Integrating payment gateways like PayPal or Stripe allows you to monitor payments in real-time. You’ll be notified instantly when a payment is made, and this can help you track outstanding balances more easily.

- Custom Spreadsheets: For small businesses, creating a custom spreadsheet can be an effective way to track payments. You can manually update it as payments are made, keeping it organized and accurate.

Pro Forma Invoice Software Solutions for UK Businesses

Managing preliminary financial documents can be a time-consuming task for businesses, but with the right software solutions, the process becomes much more streamlined and efficient. Businesses in the UK can greatly benefit from various software tools designed to help create, manage, and track these important documents. These solutions not only save time but also ensure accuracy, improve financial record-keeping, and enhance overall business efficiency.

Top Software Options for UK Businesses

- QuickBooks: Known for its robust features, QuickBooks offers easy-to-use tools for generating and managing financial documents, including those that serve as preliminary billing statements. It also integrates seamlessly with other accounting functions to provide a comprehensive financial overview.

- Xero: Xero is another popular option for UK businesses. It simplifies the creation and tracking of sales documentation and includes automated features like reminders and payment tracking, making it easier to keep up with outstanding balances.

- Zoho Books: Zoho Books offers a comprehensive suite of financial management tools, including document generation, invoicing, and expense tracking. It’s particularly useful for businesses looking to manage multiple aspects of their accounting with a single platform.

- Wave: Wave is a free software solution that is well-suited for small businesses in the UK. It provides features like invoicing, accounting, and receipt scanning, all of which can help businesses manage preliminary financial documents efficiently.

Key Features to Look for in Software Solutions

- Customization: Choose software that allows you to fully customize the documents to match your business’s branding and specific needs. Customization features should include logo placement, color schemes, and field adjustments.

- Automation: Look for tools that can automate tasks like sending reminders or recurring payment schedules. Automation saves time and ensures that no steps are overlooked.

- Integration with Accounting Systems: Integration with other accounting software is crucial. It ensures all financial data is synchronized and provides a full picture of the business’s financial health.

- User-Friendly Interface: The software should be e