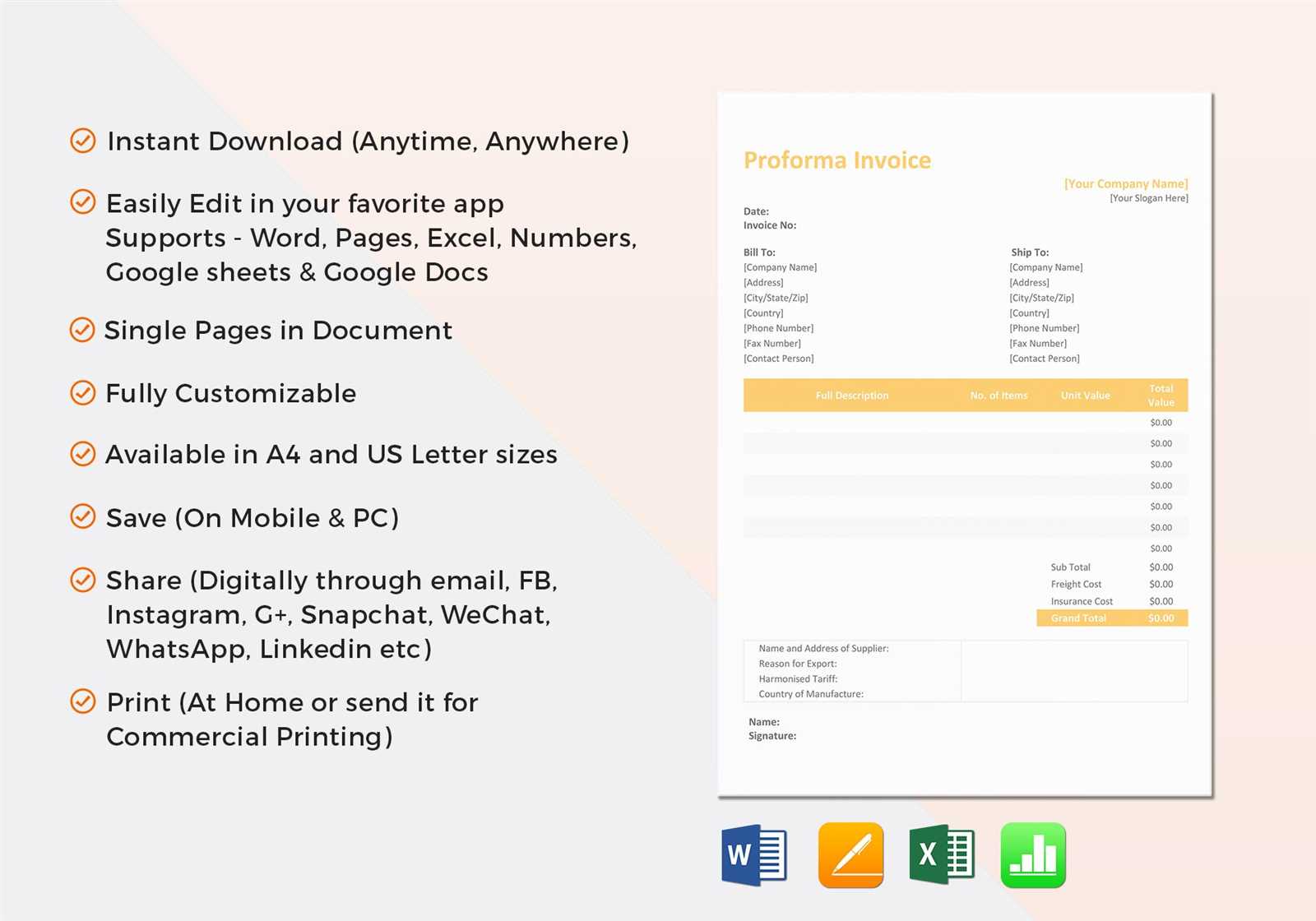

Pro Forma Invoice Template for Excel Free Download and Customization

When managing business transactions, having a clear and professional document to outline the details of an agreement is crucial. These documents help clarify the terms, prices, and expectations between parties before finalizing any sales or services. Whether you’re a small business owner or part of a larger corporation, using the right tools to draft such paperwork can streamline your operations and prevent misunderstandings.

Excel provides a versatile platform to design customizable forms that meet specific business needs. With its user-friendly interface and powerful calculation features, it offers an efficient way to produce accurate and professional-looking documents. This allows businesses to present proposals, outline costs, and facilitate smoother transactions with clients.

In this guide, we will explore how to create a detailed and editable business document using Excel, providing all the necessary fields for your transactions. You’ll learn how to customize the structure, integrate essential data, and save time by automating calculations. This method not only saves you money on specialized software but also ensures that each document is tailored to your unique requirements.

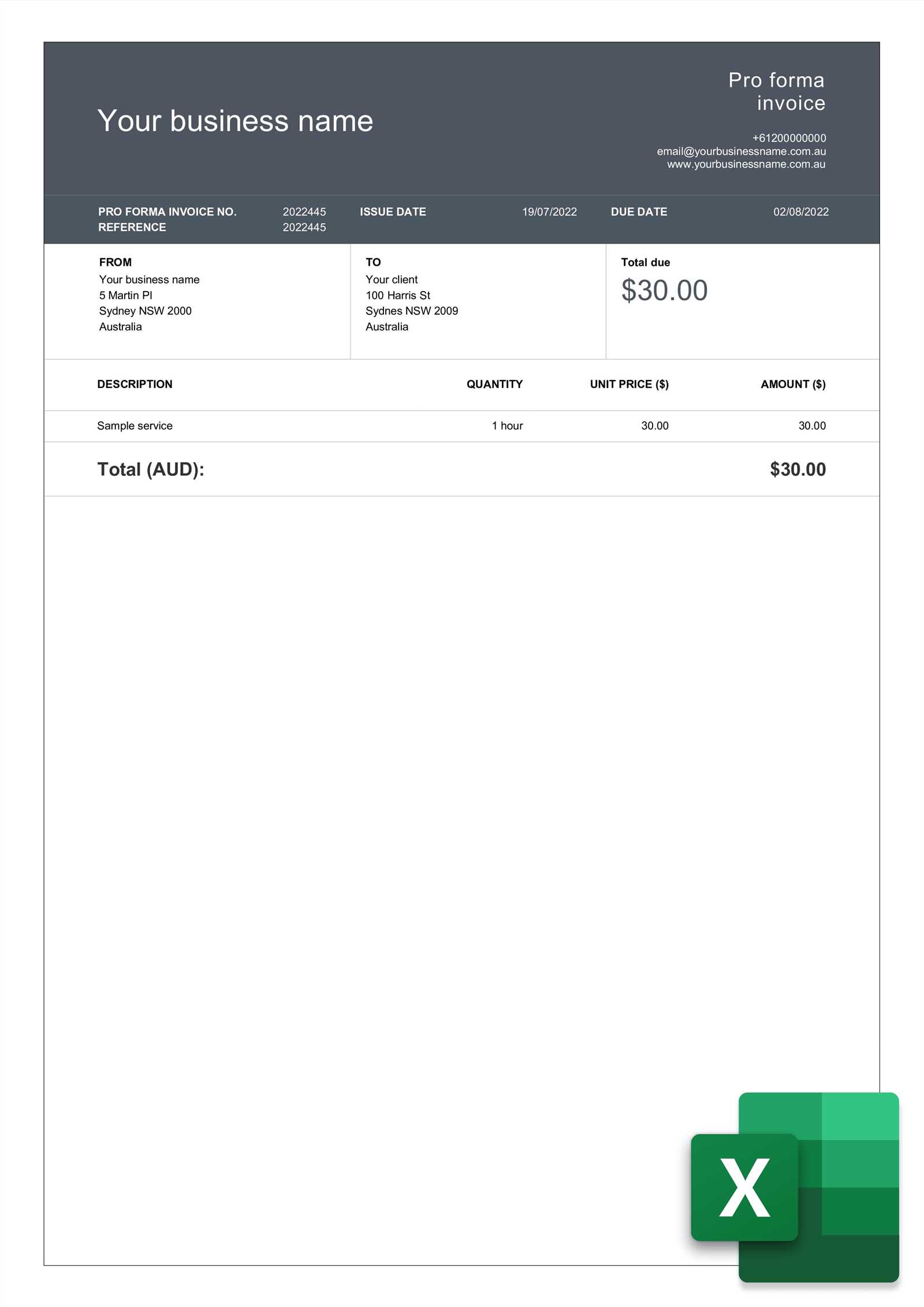

Pro Forma Invoice Template for Excel

Creating a professional document to outline the preliminary details of a transaction is an essential part of managing business deals. A well-designed document helps clarify terms, prices, and services before finalizing agreements. Using a digital spreadsheet for this purpose offers flexibility, accuracy, and ease of customization, allowing you to adapt the document as per specific requirements.

One of the key advantages of using a digital spreadsheet is the ability to include formulas for automatic calculations, ensuring that all values, such as totals, taxes, and discounts, are updated instantly when any changes are made. Furthermore, the format allows for easy sharing and editing, making collaboration with clients or colleagues straightforward. This makes the tool highly practical for businesses of all sizes.

Key Features of an Effective Document

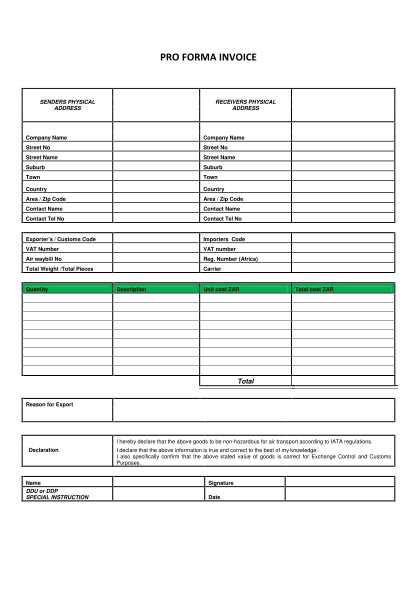

When creating such a document in a spreadsheet program, it’s important to include the following elements:

- Transaction details: Company name, address, and contact information.

- Client information: Name, address, and contact details.

- Itemized list: A detailed description of the products or services provided.

- Pricing and discounts: Clear breakdown of costs before and after any reductions.

- Payment terms: Information about due dates and acceptable payment methods.

- Additional terms: Any other necessary legal or contractual clauses.

Sample Structure

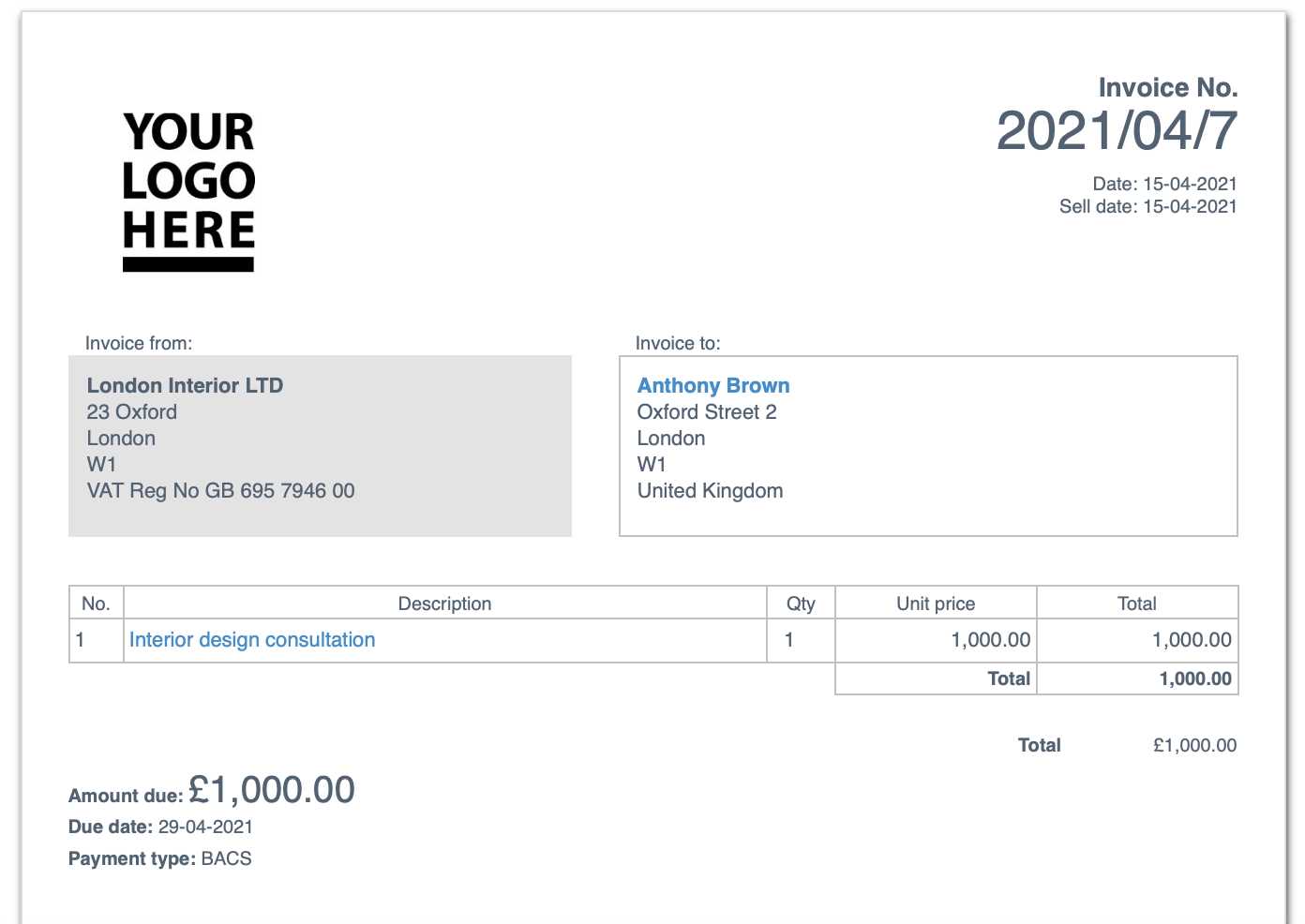

The following table represents a typical structure for a preliminary transaction document:

| Item Description | Quantity | Unit Price | Total | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Product A | 2 | $50.00 | $100.00 | ||||||||||

| Product B | 3 | $30.00 | $90.00 | ||||||||||

| Service Charge | 1 | $20.00 | $20.00 | ||||||||||

| Total Amount | $210.00 | ||||||||||||

| Item Description | Quantity | Unit Price | Total Price |

|---|---|---|---|

| Item A | 5 | $15.00 | $75.00 |

| Item B | 2 | $30.00 | $60.00 |

| Shipping Costs | – | – | $20.00 |

| Total Estimated Cost | $155.00 | ||

This example highlights the ty

Benefits of Using Pro Forma Invoices

Using a preliminary document to outline the details of a transaction before finalizing it brings several advantages to businesses. This draft version of a formal bill serves as an important tool for both buyers and sellers, providing clarity and transparency in the negotiation process. The benefits of using such a document extend beyond simple cost estimation, offering a range of practical uses throughout the sales process.

One of the main advantages is that it ensures both parties are aligned on the specifics of the transaction before any financial commitment is made. It helps prevent misunderstandings regarding pricing, terms, or services, and provides a reference point should any issues arise later. Furthermore, this document is valuable for managing expectations, particularly in large-scale or international transactions where the cost breakdown is more complex.

Key Benefits

- Clear Financial Breakdown: It offers a detailed and transparent breakdown of all associated costs, including items, services, taxes, and shipping fees.

- Better Negotiation: With all the terms laid out in a clear document, both sides can negotiate more effectively on pricing, discounts, and delivery terms.

- Improved Cash Flow Management: By having a clear estimate, businesses can plan their finances better and ensure that adequate funds are available to cover future expenses.

- Risk Reduction: It reduces the chances of errors or disputes later on by confirming all details in advance, allowing both parties to agree on the terms before proceeding.

- Enhanced Professionalism: Presenting a professional, organized document demonstrates credibility and can improve the overall customer experience.

- Regulatory Compliance: In some industries or countries, preliminary documents are required for customs clearance or regulatory purposes, especially for international transactions.

Practical Uses

For businesses, a preliminary document can be a tool for securing financing, getting approvals, or providing transparency to stakeholders. It can also be used for tax purposes, as it often contains detailed information that is helpful during audits or for compliance with local laws.

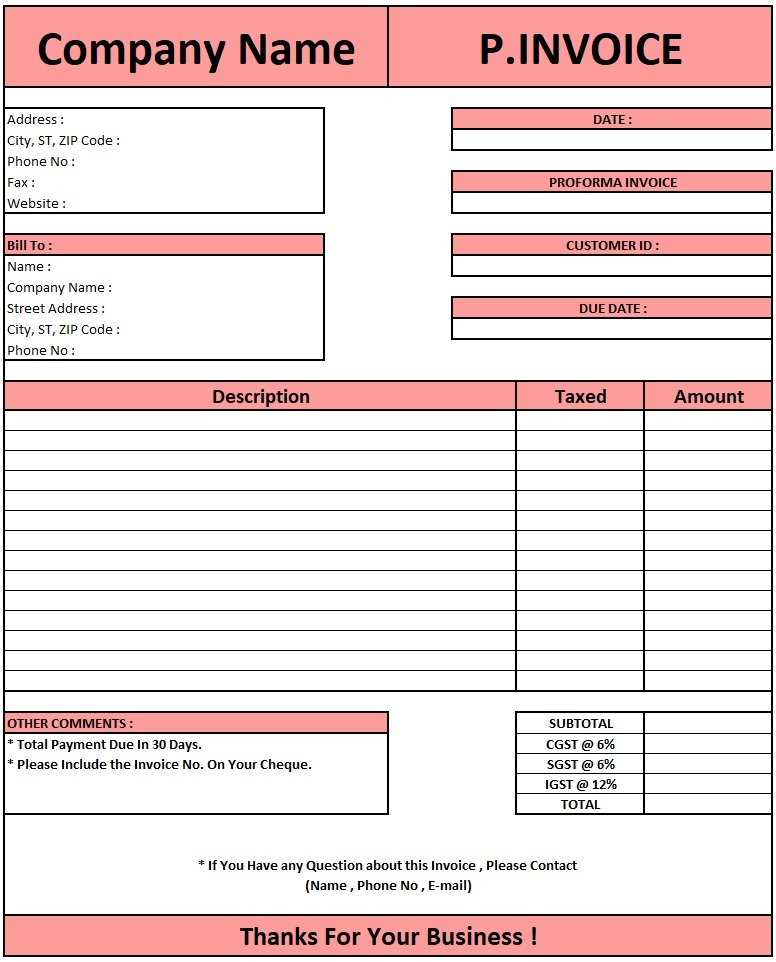

How to Create an Invoice in Excel

Creating a professional document for billing purposes using a digital spreadsheet is a straightforward process. This tool allows businesses to craft custom forms that include all necessary details, such as products, services, payment terms, and totals. With its powerful features, a spreadsheet can automate many calculations, making it easy to generate accurate documents each time. Below, we’ll walk you through the steps to create a functional and professional billing statement using this accessible software.

Start by designing a clear layout that includes key fields such as the client’s name, product or service descriptions, pricing, and payment terms. By setting up a structured format, you ensure that all critical information is easy to input and review. Using formulas for automatic calculations helps avoid errors and speeds up the process, particularly for larger transactions.

Step-by-Step Guide

Follow these steps to create an effective billing document:

- Create the Header: At the top of the document, include your business’s name, address, and contact information. Also, include the client’s details, such as name and contact information. Make sure to clearly label the document as a “Billing Statement” or similar title.

- List the Products or Services: Create a table to list each item or service provided. Include columns for description, quantity, unit price, and total price. Make sure each row contains all relevant information, so both parties can easily review the transaction.

- Calculate Totals: Use formulas to calculate the subtotal, any applicable taxes, discounts, and the final total. This ensures accuracy and eliminates the need for manual calculations.

- Add Payment Terms: Clearly state payment methods, due dates, and any penalties for late payments. This helps ensure that both parties understand when and how payment is expected.

- Review and Save: Before finalizing the document, double-check the details for accuracy. Once complete, save it in your preferred file format for easy sharing or printing.

Example Structure

Here is a basic example of how the document might look:

| Item | Description | Quantity | Unit Price | Total | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Item A |

| Mistake | Consequences |

|---|---|

| Failure to Specify Terms | Unclear or incomplete terms can lead to disputes over payment, delivery, and pricing. |

| Inaccurate Pricing or Tax Information | Incorrect pricing or tax details can lead to legal issues or audits from tax authorities. |

| Not Disclosing the Non-binding Nature | Failure to clarify that the document is not an official contract can lead to confusion and possible legal claims. |

By understanding and addressing these legal considerations, businesses can avoid common pitfalls, ensuring that preliminary documents are both clear and legally sound. This helps build trust with clients and partners while protecting your business from potential legal risks.

How Pro Forma Invoices Impact Accounting

While certain business documents are used for actual transactions, others play a crucial role in managing financial records before a deal is finalized. These preliminary documents, though not legally binding, can influence how businesses track, report, and account for their financial activities. Understanding their role in accounting is essential for ensuring accurate financial statements and maintaining compliance with regulatory standards.

Effects on Financial Reporting

- Temporary Financial Entries: Since these documents typically represent an estimate or commitment, they don’t directly affect cash flow but may still need to be recorded for tracking purposes. Businesses may record them in their financial systems as potential sales or liabilities, even if payment has not yet been made.

- Accurate Cash Flow Forecasting: These records help businesses project future income and expenses, providing a more accurate cash flow forecast. By keeping track of these documents, companies can estimate when payments might come in and plan their budgets accordingly.

- Tax Considerations: Though not final transactions, such documents must often include estimated tax amounts. This is especially true for international transactions, where sales tax or VAT may need to be accounted for in advance, ensuring accurate tax reporting when the transaction is completed.

- Inventory Management: For businesses dealing with physical goods, these documents help track what has been agreed upon for delivery. This ensures that inventory systems reflect upcoming sales, which is critical for managing stock levels and fulfilling orders in a timely manner.

How to Account for These Documents

- Creating Provisional Entries: Although these documents aren’t considered final sales, they should still be entered into accounting records as a provisional sale or a future receivable. This allows businesses to track the potential revenue and prepare for its eventual realization.

- Tracking Estimated Taxes: Taxable amounts specified in these documents need to be recorded separately as part of the business’s future tax obligations. This ensures that when the transaction is finalized, the tax entries align with the actual sale.

- Monitoring Pending Transactions: Businesses should set up a system to flag these transactions as pending or in-progress. This helps prevent confusion when the actual sale occurs and ensures that accounting records remain consistent with the final agreements.

Common Accounting Mistakes to Avoid

| Mistake | Impact |

|---|---|

| Not Recording Preliminary Documents | Failure to track such documents can lead to inaccurate financial projections and cash flow forecasting. |

Overestimati

Tips for Professional Invoice Design in ExcelCreating polished and professional business documents is essential for establishing trust with clients. Well-designed documents not only look more credible but also improve clarity and usability. By focusing on layout, formatting, and key details, you can ensure that your records convey a professional image while maintaining accuracy and readability. Essential Design Elements

Improving Functionality with Excel Features

|