How to Create and Use a Private Invoice Template for Your Business

For any business or freelancer, maintaining a clear and organized method for requesting payments is essential. A well-structured billing document not only ensures that you receive the right compensation but also reflects your professionalism and attention to detail. Customizing such documents can help streamline your financial processes and leave a lasting impression on your clients.

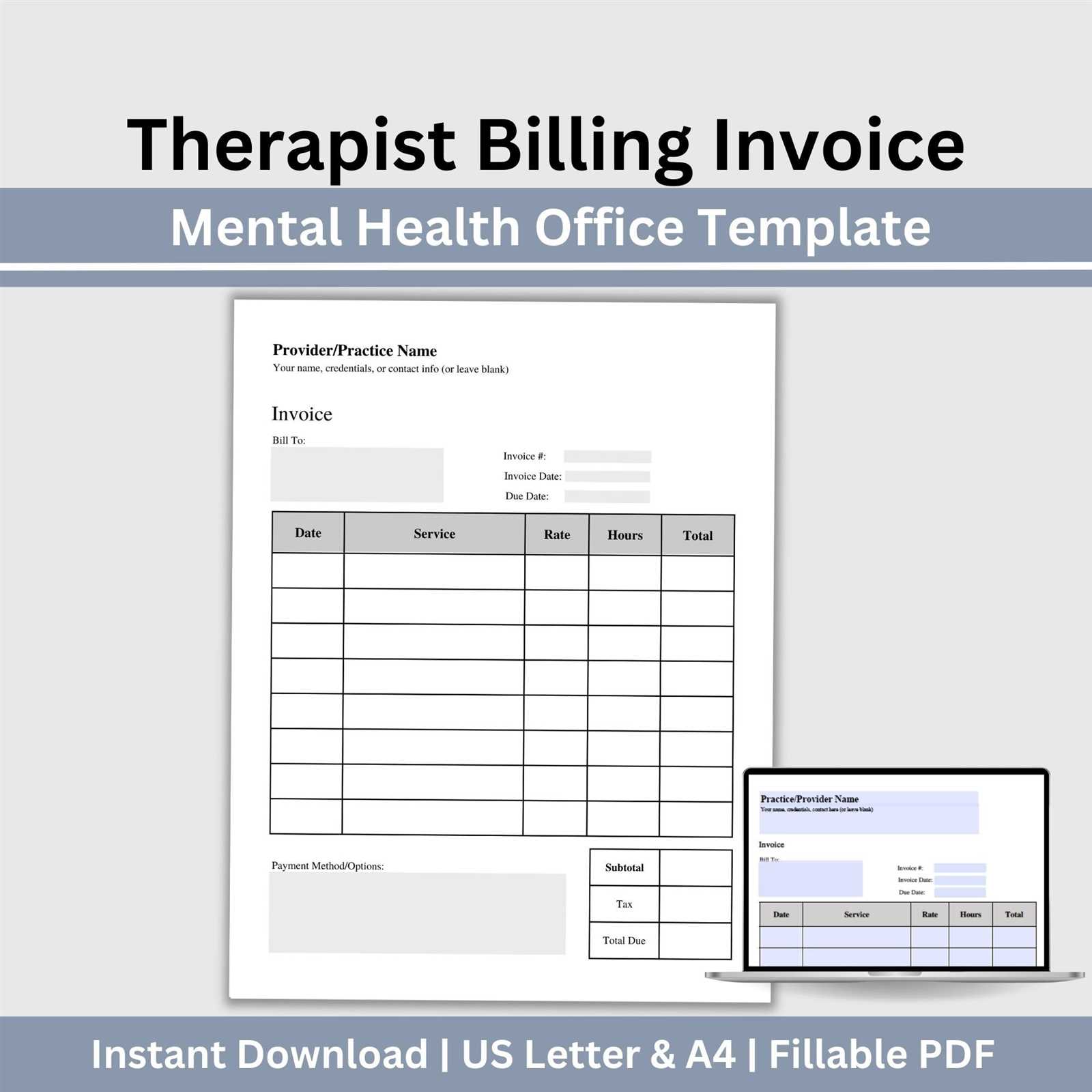

Designing a custom billing document allows you to include all the necessary information, such as payment terms, contact details, and a breakdown of services or products provided. Whether you’re a freelancer, a small business owner, or a contractor, having a personalized document can help you maintain consistency and transparency in your transactions.

In this guide, we’ll explore the importance of crafting effective billing documents, what to include in them, and how to use various tools to create one that suits your needs. With the right approach, you can ensure that each request for payment is clear, professional, and prompt.

Private Invoice Template for Freelancers

As a freelancer, having a well-organized and professional document for billing your clients is crucial for managing your finances and maintaining a good relationship with those you work with. A personalized document helps communicate the details of your services and payment expectations clearly, ensuring that there are no misunderstandings when it comes time to settle the bill. It also serves as an official record for both you and your clients, which can be important for tax and accounting purposes.

Key Components for a Freelancer’s Billing Document

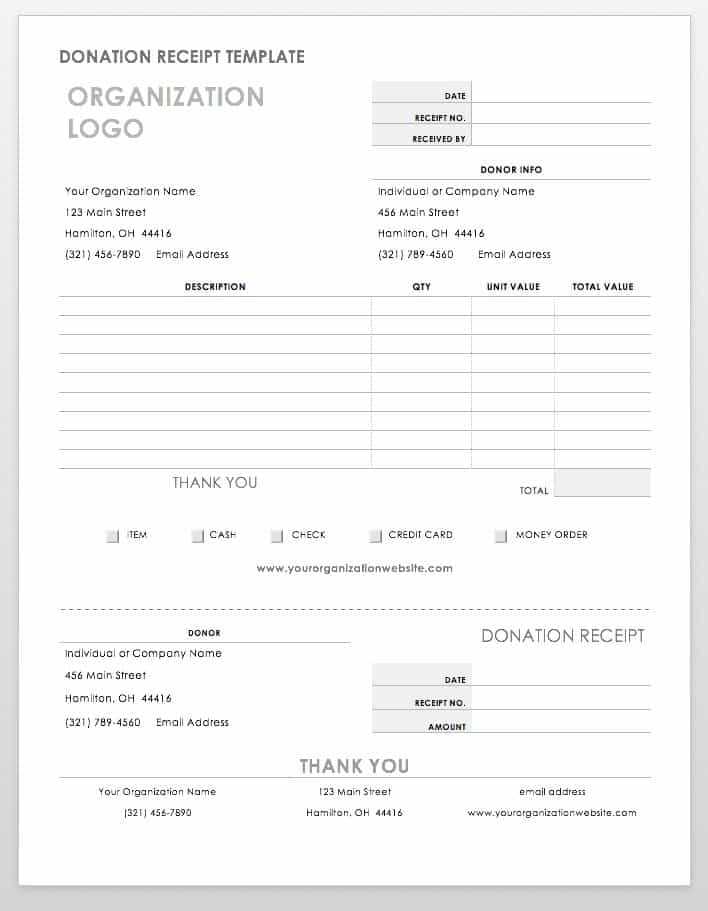

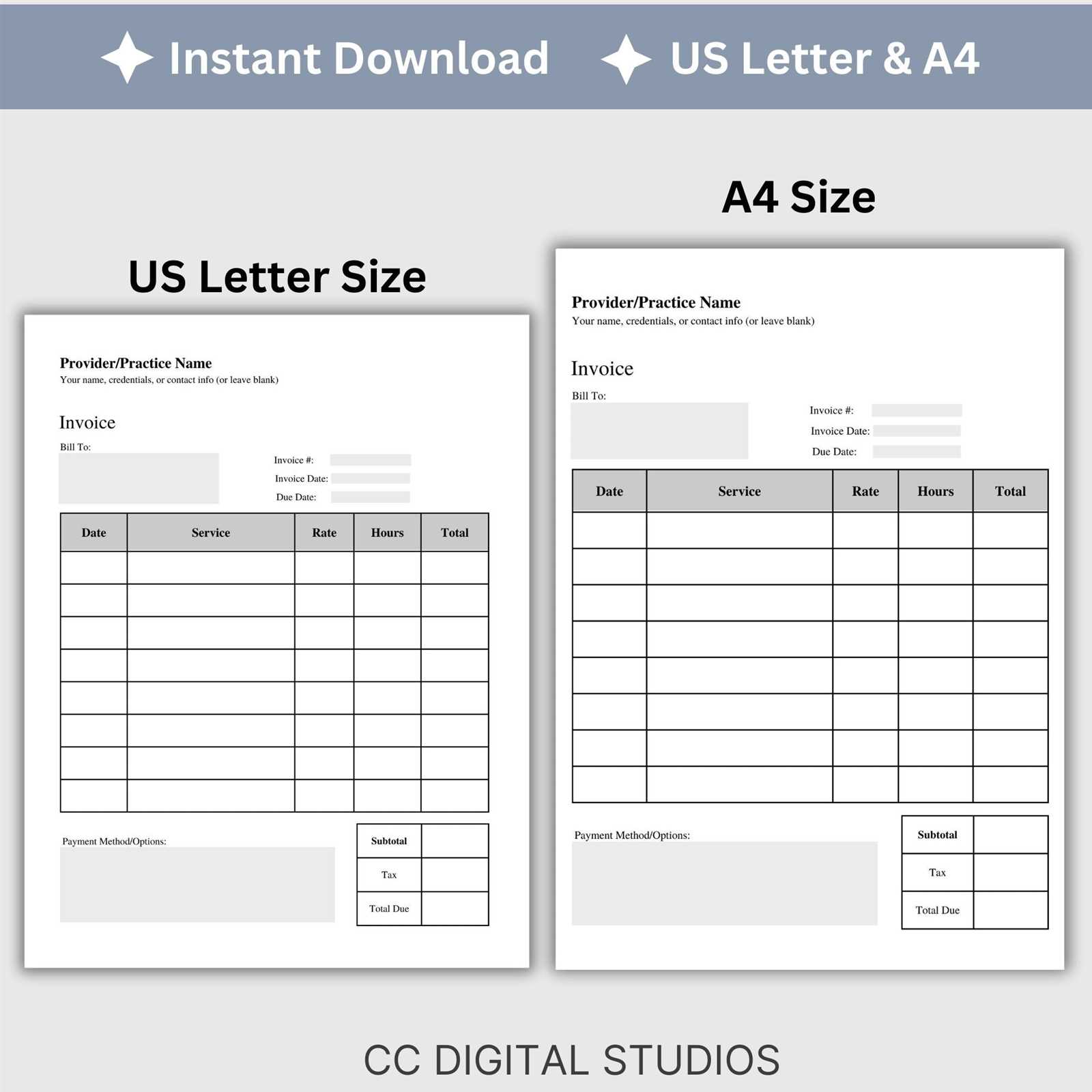

When creating a billing document, it’s important to include all the essential information that reflects your work and payment terms. This includes your name, business contact details, a breakdown of the services or products provided, the agreed-upon payment rate, and the total amount due. You should also specify the due date and any additional payment instructions, such as bank account details or preferred payment methods. This clarity helps avoid delays and ensures that your clients know exactly what they are paying for.

Benefits of a Custom-Built Document

Using a custom-built document allows freelancers to personalize the layout and structure according to their brand and preferences. You can adjust the document’s look to match your business identity, whether it’s formal or creative, and create a consistent experience for your clients. Additionally, having a tailored document makes it easier to track payments, handle follow-ups, and maintain professional records over time, giving you more control over your business operations.

How to Customize Your Billing Document

Creating a personalized document for requesting payment allows you to present your services in a professional way while ensuring that all necessary details are clear and organized. Customization gives you the flexibility to adjust the format, layout, and content to match your specific needs and brand identity. By tailoring the document to your preferences, you can improve the clarity of your billing process and establish a more professional relationship with your clients.

Choosing the Right Format and Design

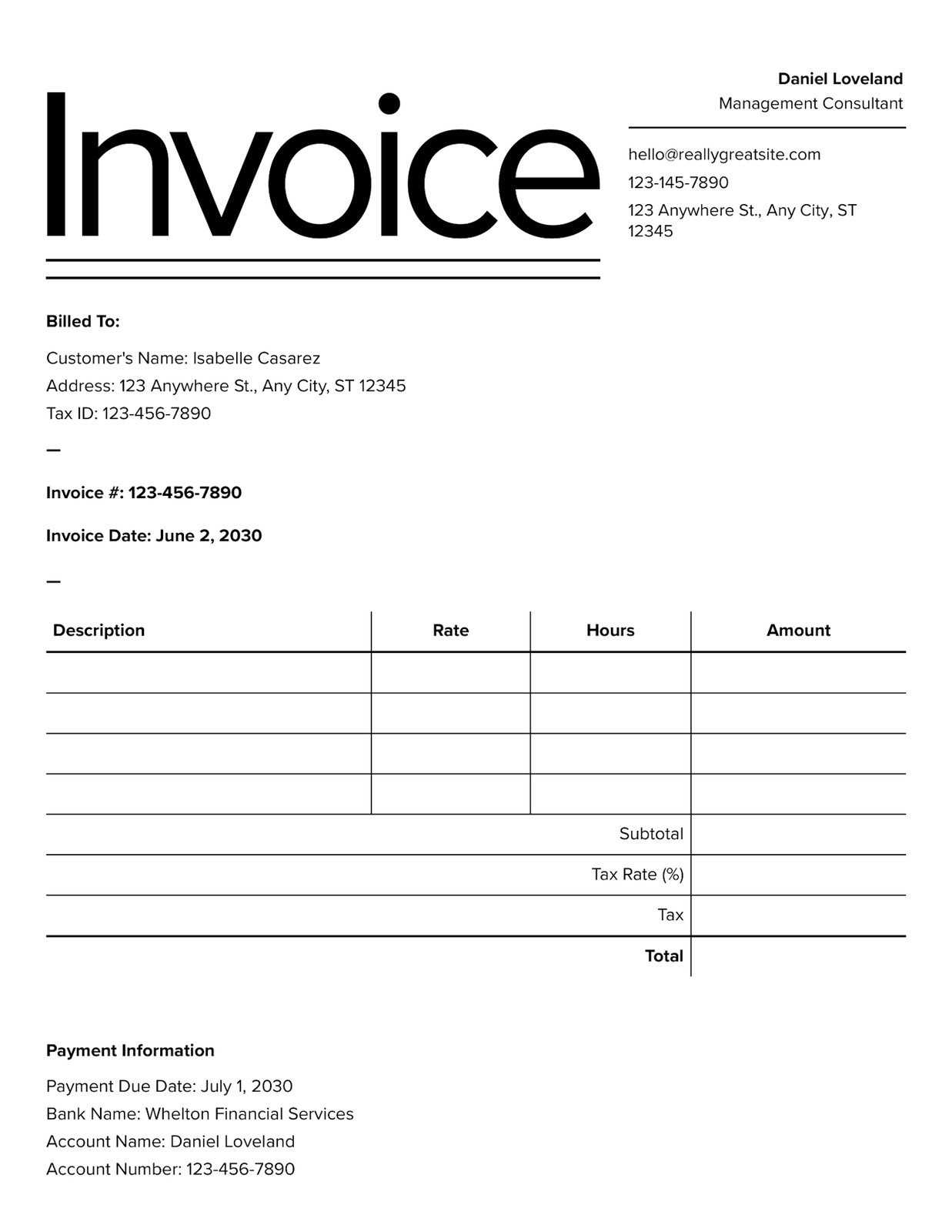

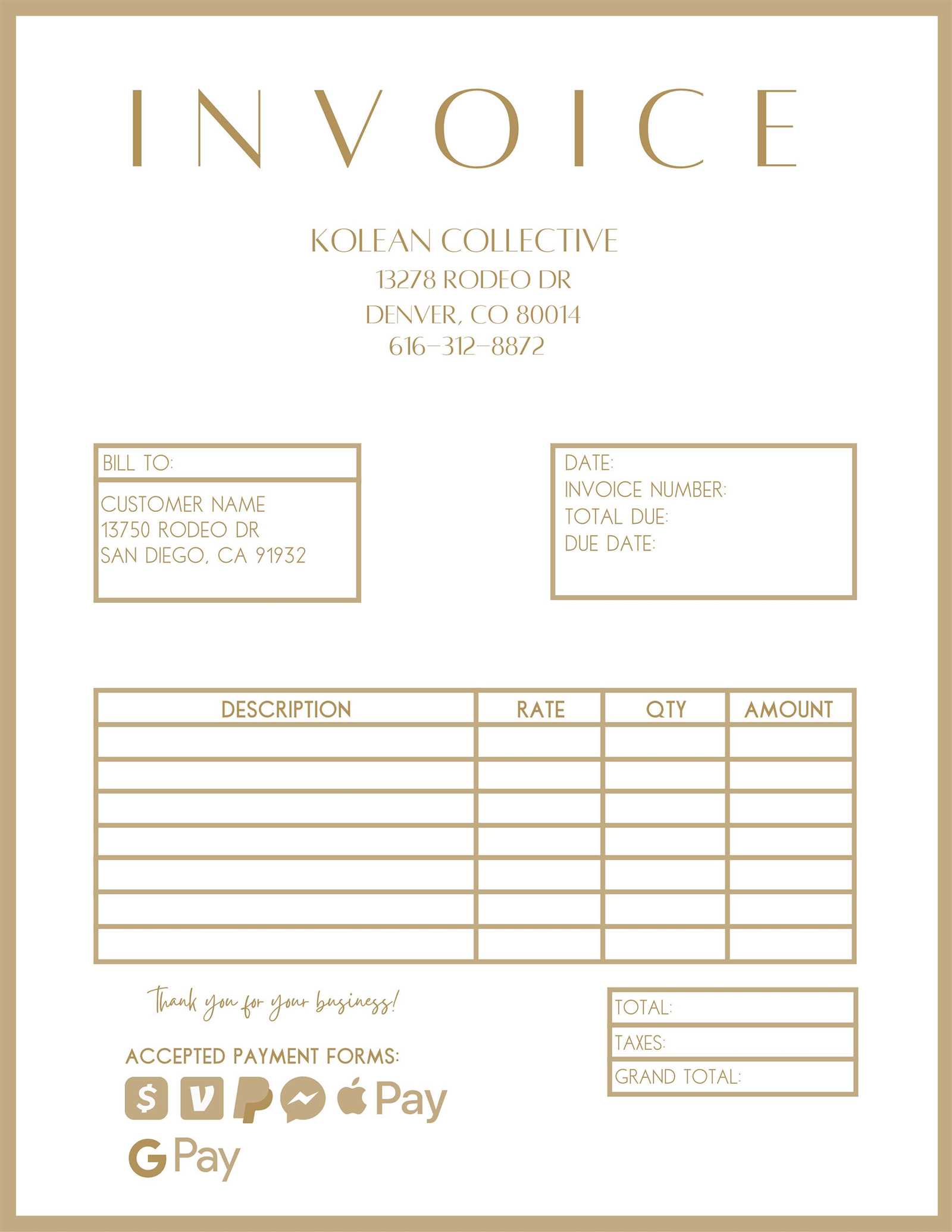

One of the first steps in customizing your billing document is selecting the appropriate format. You can choose from simple, minimalistic designs or more detailed, branded layouts, depending on your business type. For instance, creative freelancers might prefer a visually appealing design that reflects their artistic style, while service-based professionals may opt for a cleaner, straightforward approach. The key is to maintain clarity and ensure that all the essential details stand out. Use a consistent font, layout, and color scheme to make your document visually appealing without being overwhelming.

Essential Customization Features to Include

When customizing your billing document, make sure to include all the key details necessary for the client’s understanding. At a minimum, you should feature your business name, contact information, and the services rendered. Additionally, include the agreed-upon rates, any applicable taxes, payment terms, and the total amount due. It’s also useful to add a section for notes or special instructions, such as payment methods or discounts. Customizing these elements allows you to better reflect your business values and provide a more seamless experience for your clients.

Benefits of Using a Customized Billing Document

Utilizing a pre-designed document for requesting payments can save time, reduce errors, and help maintain a professional image. By using a structured layout, you ensure that all essential details are included, which can enhance the efficiency of your billing process. This streamlined approach helps avoid confusion and makes it easier for clients to understand the charges, leading to faster payments and fewer disputes.

Time Efficiency and Consistency

One of the primary benefits of using a pre-made billing document is the time it saves. With a ready-to-use structure, you can quickly generate accurate billing requests without starting from scratch each time. This consistency not only reduces administrative workload but also helps establish a uniform approach that clients can easily recognize. Consistency in design and format promotes trust and makes your communications more professional.

Improved Accuracy and Professionalism

By incorporating the necessary elements into your customized document, you significantly reduce the chances of leaving out critical details, such as the payment due date or service breakdown. This accuracy ensures that both parties are on the same page, preventing misunderstandings. Furthermore, a well-organized document enhances your credibility and promotes a professional image, which is essential for building long-term business relationships. Having a polished, standardized format also makes your business appear more established and trustworthy.

Essential Elements of a Billing Document

To ensure a smooth payment process and avoid any confusion, it’s crucial to include all the necessary details in your billing request. A well-structured document not only outlines the services or products provided but also communicates payment terms, timelines, and contact information clearly. By including key components, you make it easier for your clients to understand the charges and respond promptly, reducing the risk of delays or disputes.

Key Information to Include

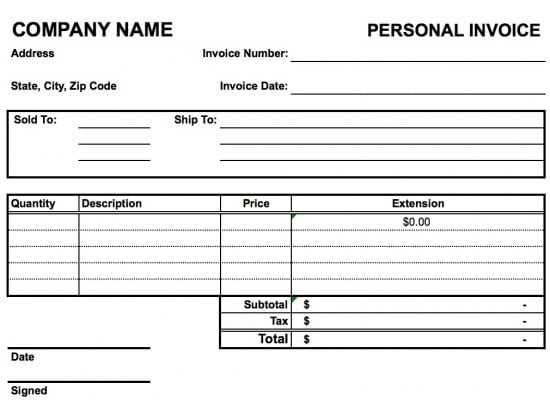

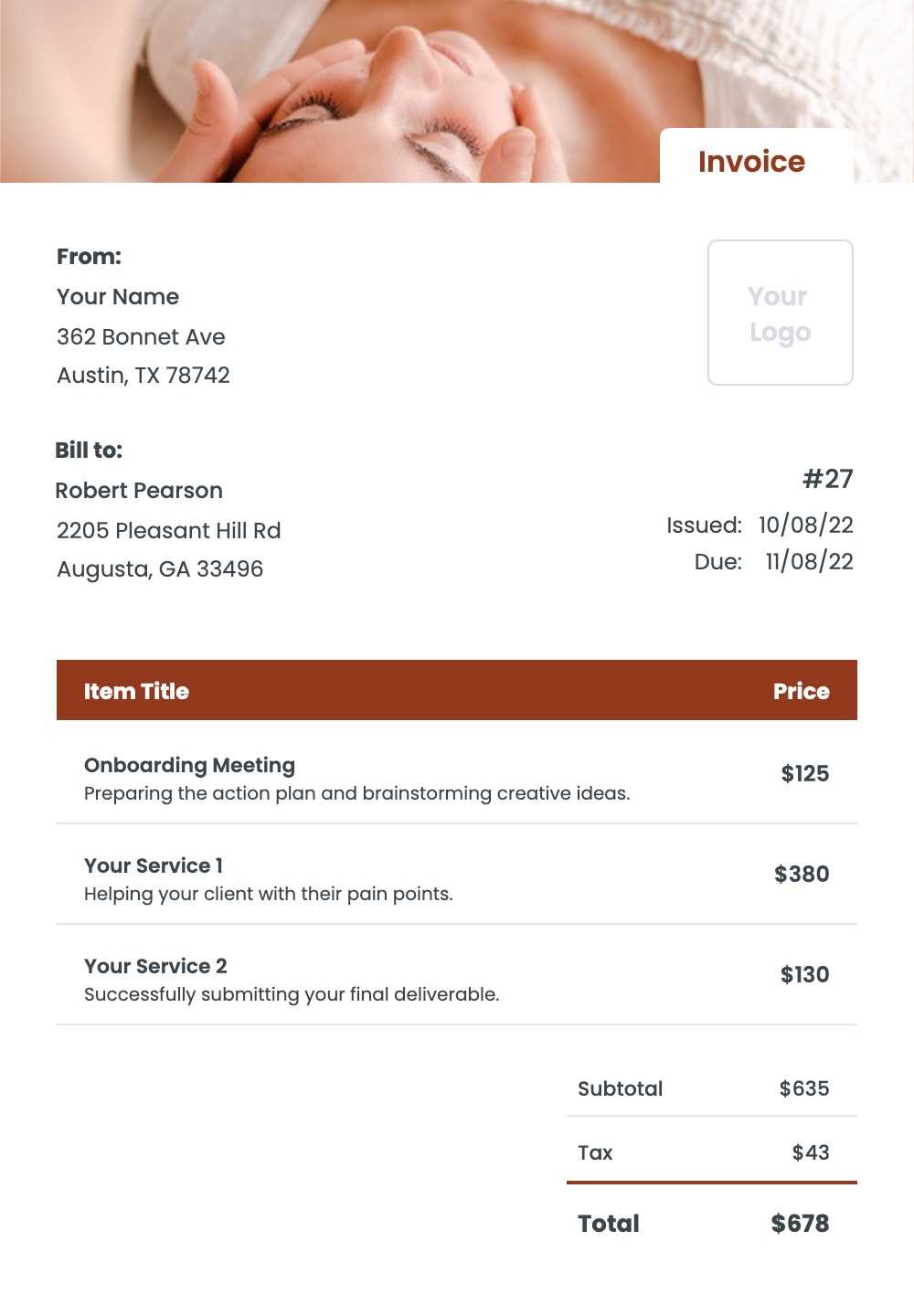

Your billing document should contain several important sections to ensure clarity and professionalism. First, include your full business name and contact details, along with the client’s information for easy reference. A unique document number or reference ID is essential for tracking purposes. You should also clearly list the services rendered or products delivered, along with their corresponding costs. This breakdown helps clients understand exactly what they are paying for. Don’t forget to include payment terms, such as the due date and any late fees, to set clear expectations.

Additional Features for Clarity

In addition to basic details, it’s useful to add a section for special instructions or payment methods. Some clients may prefer bank transfers, credit card payments, or digital payment platforms, so it’s important to specify these options. You can also include a place for notes or reminders, such as thank-you messages or future discounts, which can help improve client relations. By including these elements, you ensure that both you and your client are on the same page, which promotes smoother transactions.

Why You Need a Professional Billing Document

Having a well-designed and professional billing request is essential for maintaining smooth financial operations in any business. Whether you’re a freelancer, contractor, or small business owner, using a formal document to request payments ensures clarity, reduces misunderstandings, and promotes trust with your clients. It serves as an official record for both parties and can even support legal and tax-related processes when needed.

Professionalism and Credibility

A professionally formatted document reflects your business’s level of organization and attention to detail. Clients are more likely to take your services seriously and trust that you are a reliable business partner when they receive clear, accurate, and visually appealing billing documents. This level of professionalism helps set you apart from competitors and builds long-term client relationships.

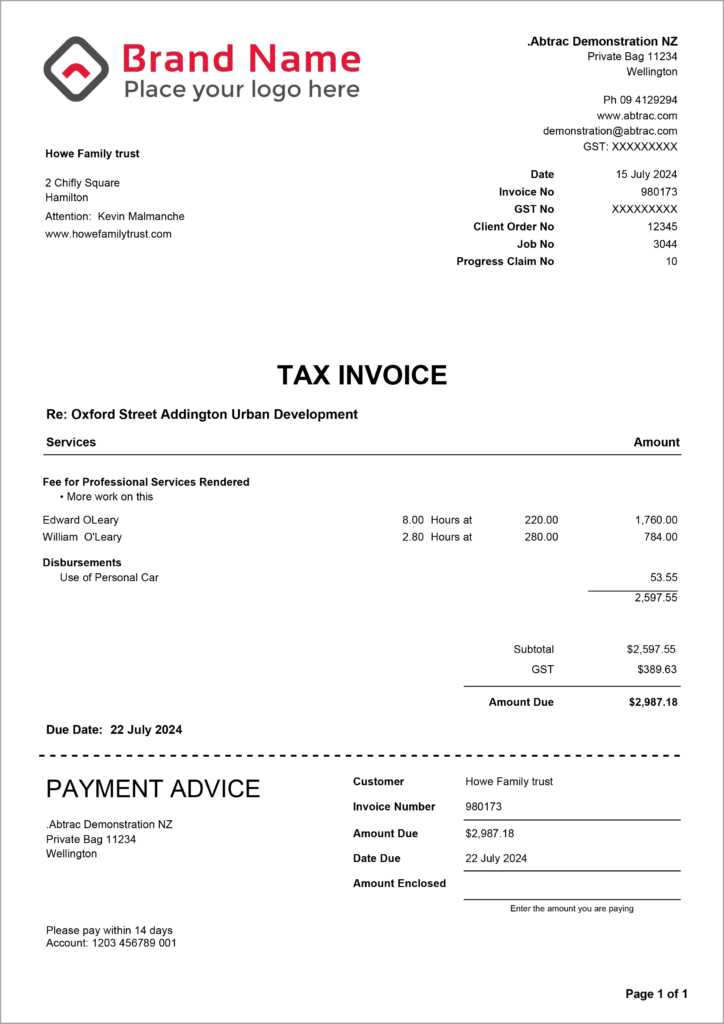

Detailed Breakdown of Costs

Another important reason to use a professional document is to provide a transparent breakdown of costs. A well-structured document clearly lists each service or product with its associated price, which minimizes confusion and disputes. This is particularly important in industries where hourly rates, special charges, or complex services are involved. Including a breakdown of costs helps your clients understand exactly what they are paying for and can lead to faster payments.

| Service/Item | Quantity | Unit Price | Total |

|---|---|---|---|

| Consulting Services | 10 hours | $50 | $500 |

| Graphic Design | 5 hours | $75 | $375 |

| Total | $875 |

By offering a clear and professional breakdown, you establish a transparent payment process and help your clients feel confident in their financial commitments.

Tips for Designing an Effective Billing Document

Creating a well-designed billing document is key to ensuring clarity, professionalism, and a smooth payment process. A visually appealing and easy-to-read layout helps your clients understand the charges, deadlines, and payment instructions without confusion. By focusing on key design elements, you can streamline the process and improve your chances of receiving timely payments.

Keep It Simple and Organized

One of the most important aspects of an effective billing document is simplicity. Avoid cluttering the page with excessive details or distracting design elements. Stick to a clean and organized layout where essential information is easy to find. Use headings, bullet points, and clear sections to help your client quickly locate the service descriptions, payment amounts, and due dates.

Make Key Information Stand Out

Highlight the most important details, such as the total amount due, payment terms, and due date, so they are easy to spot. Using bold fonts or larger text for these elements can help draw attention to them without overwhelming the design. Ensure that your contact information, as well as your client’s, is clearly visible at the top of the document for easy reference.

Incorporate Your Brand Identity

Including your business logo, brand colors, and fonts in the document’s design helps reinforce your brand identity. This small but impactful detail not only makes the document look more professional but also creates a cohesive experience for your clients. A strong brand presence in your billing documents can foster trust and make your business appear more established.

Choosing the Right Billing Format

When it comes to managing financial transactions, selecting the right format for your billing document can significantly impact both your workflow and the client experience. The format should align with your business needs, the complexity of the services or products you’re providing, and your client’s preferences. Choosing a consistent format ensures that your requests for payment are clear, professional, and easy to process.

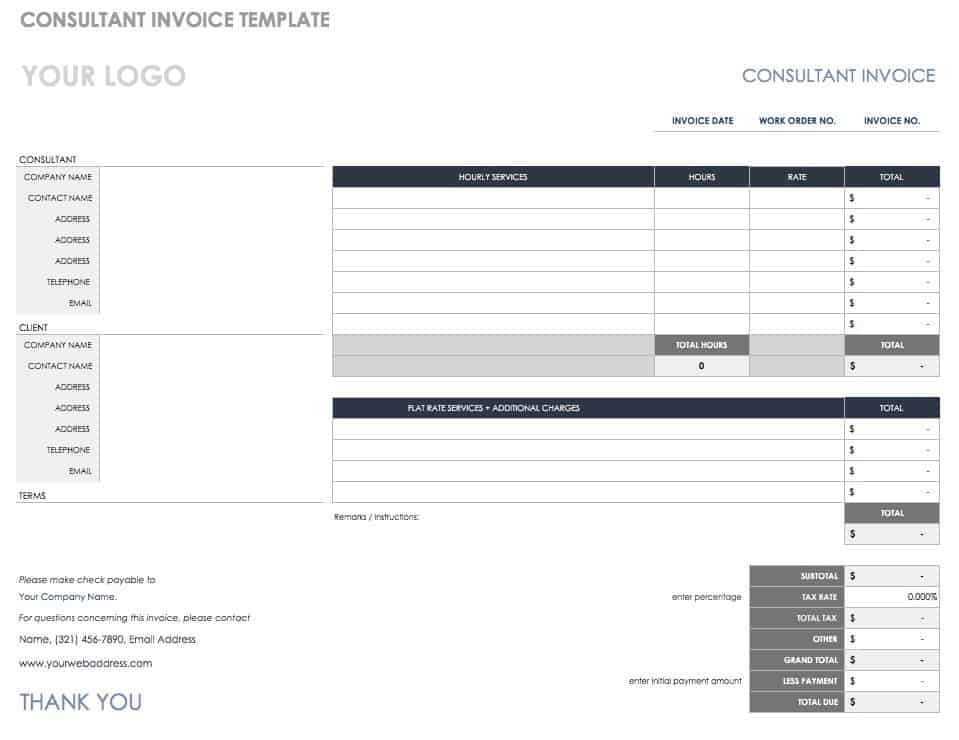

Consider Simplicity vs. Detail

The right format will depend on the level of detail required for each transaction. If you’re providing a simple service, such as a flat-rate consultation, a minimalistic format with basic details might be sufficient. However, for more complex transactions that involve multiple items or variable rates, a more detailed structure will be necessary. Choose a layout that allows you to list each service or item clearly, with spaces for descriptions, quantities, and pricing. Flexibility is key–the format should be adaptable to different types of projects and transactions.

Digital vs. Paper Formats

In today’s digital age, most businesses opt for electronic billing documents, which are easier to track and send. Digital formats, such as PDFs or online forms, also allow for quicker processing and the option to integrate payment links directly into the document. On the other hand, paper invoices may still be necessary in certain industries or for clients who prefer physical copies. Whatever format you choose, ensure that it’s easy to read, professional, and compatible with your client’s preferences.

| Service/Item | Quantity | Unit Price | Total |

|---|---|---|---|

| Web Design | 1 project | $1,000 | $1,000 |

| Hosting Fees | 12 months | $150 | $1,800 |

| Total | $2,800 |

By considering both the complexity of your work and the preferences of your clients, you can choose a format that best suits your business needs while ensuring clarity and ease of payment.

Free Tools for Creating Billing Documents

There are numerous free tools available that make it easy to create professional and customized billing requests. These tools offer ready-made designs and features that allow you to quickly generate accurate and aesthetically pleasing documents without needing advanced design skills. Whether you’re a freelancer, small business owner, or contractor, these free resources can help you save time and ensure consistency in your financial communications.

Popular Online Platforms

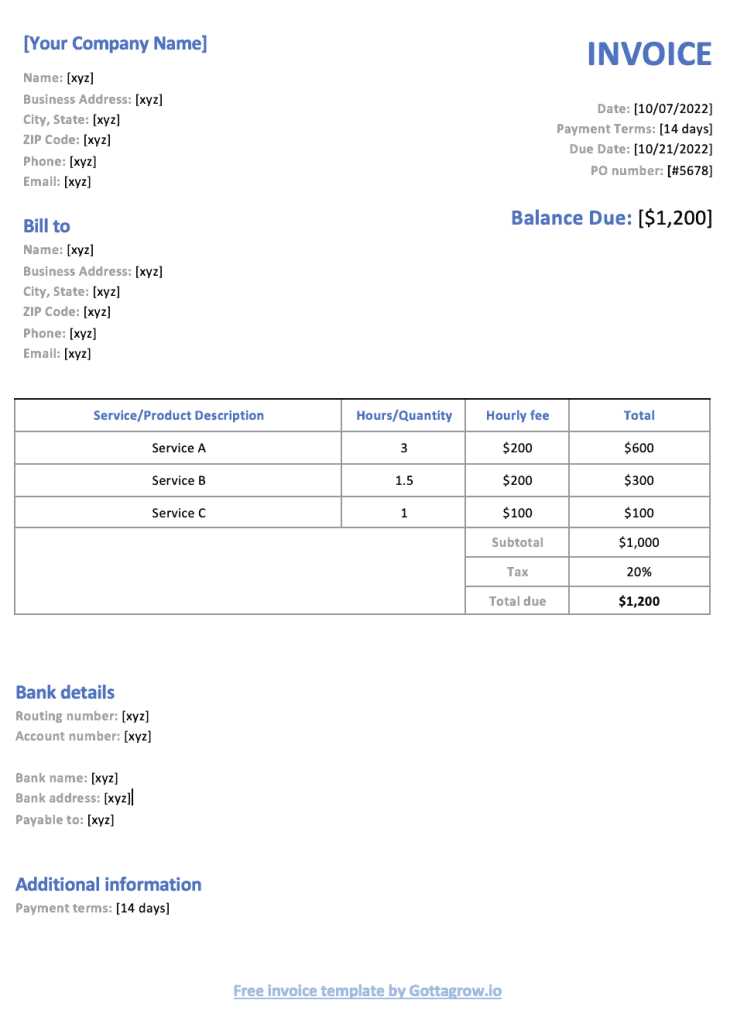

Many online platforms provide free tools to generate billing documents with pre-designed formats. These tools typically allow for customization, so you can easily adjust the content to reflect your services and branding. Some platforms also offer additional features, such as automatic calculations, client management systems, and integration with payment processors. Here are a few options that are particularly user-friendly:

| Tool | Key Features | Website |

|---|---|---|

| Invoice Generator | Simple templates, customizable fields, downloadable PDF | www.invoice-generator.com |

| Zoho Invoice | Multiple templates, time tracking, automatic reminders | www.zoho.com/invoice/ |

| Wave Accounting | Comprehensive features, online payment integration, reports | www.waveapps.com |

Software Options for Desktop Use

If you prefer offline solutions, there are also free software programs that allow you to create detailed and professional documents without an internet connection. These programs typically offer more control over the design, layout, and customization, and are ideal for businesses that prefer to keep their financial data on their local device. Popular options include:

| Software | Key Features | Platform |

|---|---|---|

| LibreOffice | Fully customizable, multiple formats, free and open source | Windows, Mac, Linux |

| Google Docs (Invoice Template) | Cloud-based, easy collaboration, customizable templates | Windows, Mac, Linux (via web) |

By utilizing these free tools,

How to Avoid Common Billing Mistakes

Creating a billing document may seem straightforward, but even small errors can lead to delays in payments, confusion with clients, or missed financial opportunities. Ensuring that your documents are accurate and clear from the start can help maintain professionalism and improve cash flow. By being aware of common mistakes and taking simple steps to avoid them, you can streamline your payment process and prevent unnecessary setbacks.

Double-Check Payment Information

One of the most frequent mistakes when creating a billing request is incorrect or incomplete payment information. Always ensure that your payment details, including your bank account number, PayPal address, or any other payment method you accept, are clearly listed and accurate. Additionally, make sure your client’s payment information is correct, especially if you are sending the document to a new customer. Inaccurate or missing payment instructions can delay processing and result in follow-up requests that could have been avoided.

Clearly Outline Services and Amounts

Another common mistake is not clearly breaking down the services or products provided and their associated costs. Ambiguities in pricing can lead to confusion or disputes over the total amount due. Always ensure that each service or item is listed separately, with the correct quantity, rate, and total. Be transparent and detailed when itemizing your charges, and avoid using vague descriptions. This helps prevent misunderstandings and builds trust with your clients.

Legal Requirements for Billing Documents

When creating billing documents for your business, it is important to understand the legal requirements that apply in your country or jurisdiction. A proper billing document not only ensures that you are paid on time but also helps you comply with tax laws and accounting regulations. Depending on the nature of your business, there may be specific details you are legally obligated to include, which can vary from region to region.

Key Legal Elements to Include

To avoid any legal issues, make sure that your billing document contains the following essential information:

- Unique Invoice Number: Each document should have a unique identifier for easy tracking and reference.

- Business Information: Your business name, address, and contact details should be clearly stated.

- Client Information: Include your client’s full name, address, and contact details.

- Issue Date: The date the document is created should be included.

- Due Date: Clearly state the date by which payment is due to avoid confusion.

- Description of Goods or Services: List all items or services provided along with their costs.

- Tax Information: Depending on your location, you may need to include VAT, GST, or other applicable tax rates.

- Total Amount Due: Clearly state the total payment amount, including any taxes or fees.

Tax and Regulatory Considerations

In many countries, businesses are required to issue billing documents that include specific tax information. This may include your tax identification number or VAT/GST number, which links the transaction to your tax filings. Some regions may also require that certain industries include additional information or follow specific formats, such as providing a breakdown of labor and material costs in construction or consulting industries.

- Make sure to research local regulations regarding sales tax or VAT obligations.

- If you are providing services internationally, consider the need for cross-border tax rules.

- Keep copies of all documents for your own records and tax filings.

By ensuring your billing documents meet all legal requirements, you not only avoid potential fines but also build trust with your clients and make your business operations smoother and more professional.

How to Send a Billing Document Correctly

Sending a well-prepared billing document is crucial for ensuring smooth payment processing and maintaining professionalism in your business dealings. The way you deliver your request for payment can impact your client’s experience and affect how quickly you get paid. Whether you’re sending a document by email, post, or through an online platform, it’s important to follow the proper steps to ensure the process is clear, secure, and efficient.

Choosing the Right Delivery Method

The method you choose to send your billing request should align with your client’s preferences and the nature of your business. Electronic delivery is often the quickest and most convenient option, allowing you to send documents instantly and track whether they’ve been opened. However, some clients may prefer receiving a physical copy, especially if they are accustomed to handling paperwork manually. Regardless of the method, always ensure the document reaches the correct recipient and that any sensitive information is protected.

What to Include Before Sending

Before sending your billing document, make sure it’s complete and contains all necessary details. Double-check for accuracy in the services provided, amounts due, and payment terms. Be sure to include clear payment instructions and any deadlines, as well as contact information for questions. Additionally, ensure that the document is professional, free from spelling errors, and formatted properly. If you’re sending it electronically, consider including the document as a PDF to preserve the formatting and prevent editing.

| Service/Item | Quantity | Unit Price | Total | |||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Website Development | 1 project | $2,000 | $2,000 | |||||||||||||||||||||

| Hosting Fee | 12 months | $100 | $1,200 | |||||||||||||||||||||

| Tracking Payments with Billing Documents

Effectively managing and tracking payments is a key aspect of maintaining healthy cash flow in any business. A well-organized billing document not only serves as a formal request for payment but also acts as a tool for monitoring the status of each transaction. By keeping track of which payments have been made and which are still pending, you can stay on top of your finances and reduce the risk of missed payments or overdue balances. Organizing Payment StatusOne way to keep track of payments is to clearly mark the status of each billing document. Whether you use an online platform, spreadsheet, or a simple paper record, it’s important to indicate whether the payment has been received or if it is still due. This helps avoid confusion and provides an easy way to follow up with clients who have outstanding balances. You can also set up reminders or automated follow-ups for overdue payments, which helps ensure timely collections. Including Payment Status in Billing DocumentsTo better track payments, include a section in your billing document where the payment status can be recorded. This section might include columns for the due date, payment amount, and whether the payment has been completed. Keeping this information updated allows you to stay organized and manage your finances more efficiently.

By tracking the status of payments in each billing document, you can efficiently manage cash flow, follow up with clients as needed, and avoid the risk of overlooking any outstanding balances. Regularly reviewing your records will also help you identify potential issues early, allowing for quick resolutions and continued business growth. Why Billing Documents Matter for Small BusinessesFor small businesses, having a structured and professional method of requesting payments is essential. These documents not only serve as proof of a transaction but also help in managing cash flow, maintaining accurate records, and ensuring that both parties are clear on the terms of the transaction. In addition, they play a critical role in compliance, taxes, and fostering strong relationships with clients. Without a proper system in place, even small mistakes in billing can lead to confusion, delayed payments, or legal issues. For businesses operating with tight budgets and limited resources, it is even more crucial to manage finances efficiently. Clear and professional payment requests help minimize disputes, reduce the likelihood of missed payments, and support timely invoicing, which ultimately aids in securing steady revenue streams. Without proper billing practices, small businesses may face unnecessary hurdles, like delayed cash flow or difficulty tracking outstanding payments. Streamlining Cash Flow ManagementOne of the primary benefits of using proper billing documents is the ability to streamline cash flow. Timely, accurate requests for payment ensure that your business gets paid promptly, helping you maintain a consistent financial outlook. For small businesses that often rely on short-term projects or seasonal sales, maintaining a steady cash flow is essential to sustain operations and avoid financial strain. With a proper billing system in place, you can reduce the risk of cash flow interruptions, enabling your business to thrive. Building Professionalism and Trust

When small businesses present clear, professional documents to clients, it reinforces their credibility and reliability. A well-structured payment request can make a significant difference in how your business is perceived by clients, partners, and suppliers. It helps to establish trust and demonstrates that your business is organized and serious about maintaining professional standards. In turn, this can result in more opportunities for repeat business and positive word-of-mouth referrals. In the long run, implementing a proper billing system helps small businesses avoid costly mistakes, stay on top of financial records, and build stronger relationships with clients. By ensuring that your payment requests are accurate, timely, and professional, you’re not just keeping your business running smoothly–you’re also setting the foundation for sustainable growth and success. How to Protect Billing InformationWhen sending billing documents, protecting sensitive financial information is essential for both your business and your clients. The details in these documents, including payment terms, account numbers, and personal contact information, can be targets for fraud or unauthorized access if not properly secured. Ensuring that this information remains safe and confidential is crucial to maintaining trust and complying with data protection laws. Methods for Securing Your DocumentsThere are several strategies you can implement to protect the information on your billing documents. These measures help reduce the risk of data breaches and ensure that sensitive details remain in the right hands.

Tracking and Monitoring Billing InformationAnother way to safeguard your financial records is by keeping track of who has access to your billing documents and monitoring any changes made to them. For businesses that handle a large volume of billing requests, this is especially important for ensuring that no unauthorized alterations or data breaches occur.

By taking these steps to protect your billing information, you minimize the risk of financial fraud and maintain the confidentiality of both your business and your clients. Staying vigilant about document security is not only a smart business practice–it’s also a necessary component of good business ethics and legal compliance. When to Update Your Billing Document Format

Keeping your billing documents up to date is essential to ensure accuracy, professionalism, and compliance with any changing regulations. Over time, your business needs and legal requirements may evolve, and your payment requests should reflect these changes. Regularly reviewing and updating your document format helps maintain a smooth financial workflow and prevents errors that could delay payments or create confusion with clients. Changes in Business Information

If your business undergoes any significant changes, such as a new address, phone number, or tax identification number, it’s crucial to update your documents accordingly. Even small adjustments, like a change in your business name or bank details, should be reflected on all your billing documents to avoid any miscommunication or payment delays. Tax or Legal RequirementsTax laws and business regulations can change frequently. It’s important to stay informed about any local or national legal updates that may affect how your billing documents should be structured. For example, changes in VAT or sales tax rates, the need to include specific tax numbers, or new invoicing rules for certain industries may require you to revise your document format. Make sure your payment requests comply with the latest requirements to avoid any legal issues or penalties. Introducing New Services or Pricing ModelsIf you expand your range of services or introduce new pricing structures, you’ll need to update your document to reflect these changes. This could include adding new service descriptions, adjusting rates, or modifying payment terms. Keeping your document up to date ensures that clients are accurately charged for what they receive and that your business remains transparent and organized. By regularly reviewing and updating your billing document format, you ensure that your business stays organized, compliant, and ready for future growth. Staying proactive about these updates helps prevent costly mistakes and demonstrates to clients that your business is efficient and reliable. |