Download Printable Sales Invoice Template for Easy Billing and Customization

Managing financial transactions is a crucial aspect of any business, and having an organized method for issuing documents that outline payments is essential for smooth operations. A well-structured billing document ensures clarity, prevents errors, and provides a professional touch to every business interaction. Whether you’re a freelancer, small business owner, or part of a larger company, adopting a reliable system for tracking payments can significantly enhance your workflow.

In this article, we explore how easy-to-use formats can simplify the billing process, providing a standardized approach to creating documents that reflect both your brand and the services or products you offer. These customizable formats can be tailored to suit various needs, offering flexibility and consistency across different transactions.

With the right tools, you can easily create documents that are clear, precise, and legally compliant, reducing the chance of disputes or confusion. Read on to discover how to streamline your billing process, save time, and present your business in a more organized, professional light.

Why You Need a Printable Sales Invoice

Having a clear and professional document to record financial transactions is essential for every business. It helps establish trust with clients, ensures accurate record-keeping, and can be crucial for tax and legal purposes. Whether you run a small business or manage a larger company, using a structured format to detail the products or services provided and the payment terms is an important step in maintaining financial transparency.

One of the main advantages of using a well-designed document for your transactions is the ability to maintain consistency across all dealings. A standardized format makes it easier to track payments, identify outstanding amounts, and keep a professional image in front of clients. Additionally, having an accessible and customizable layout saves time and effort, allowing you to focus on more critical tasks in your business.

Furthermore, these records can serve as proof of the agreement made between parties, which can be beneficial in case of disputes. The document provides a clear breakdown of the services rendered, the amount due, and payment deadlines, all of which are essential for ensuring smooth business operations.

How to Create Custom Sales Invoices

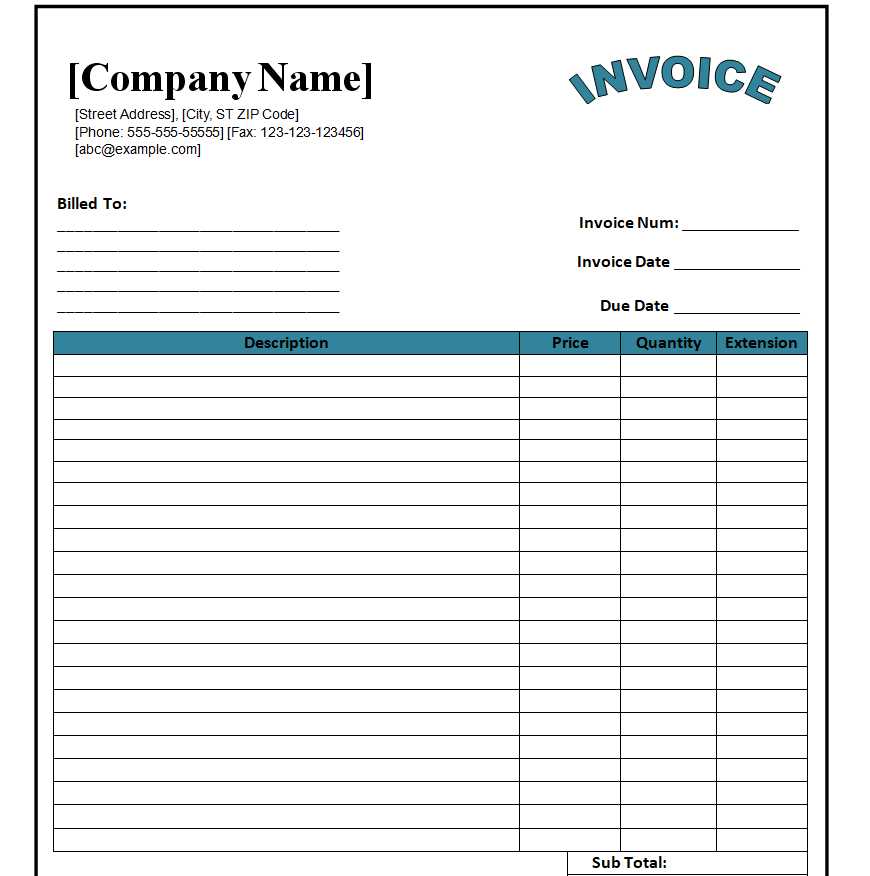

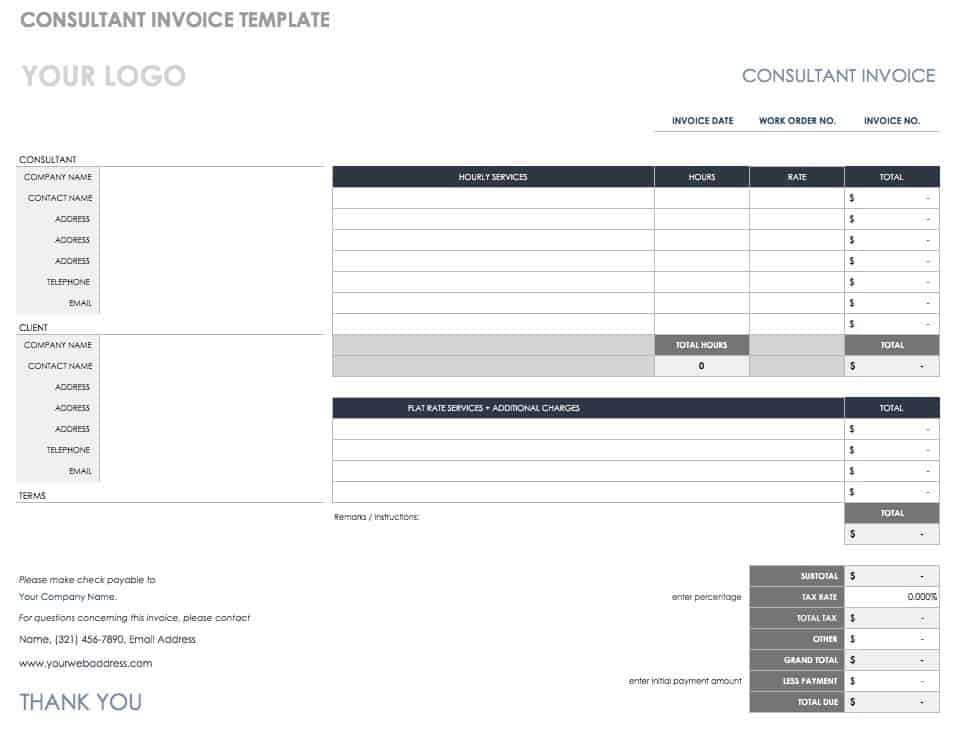

Creating a tailored document to record transactions is essential for any business. Customizing this document allows you to align it with your brand and business needs while ensuring that all important details are included. A personalized approach not only helps maintain consistency but also enables you to meet specific legal or industry requirements. Below are the key steps to craft a document that suits your business operations.

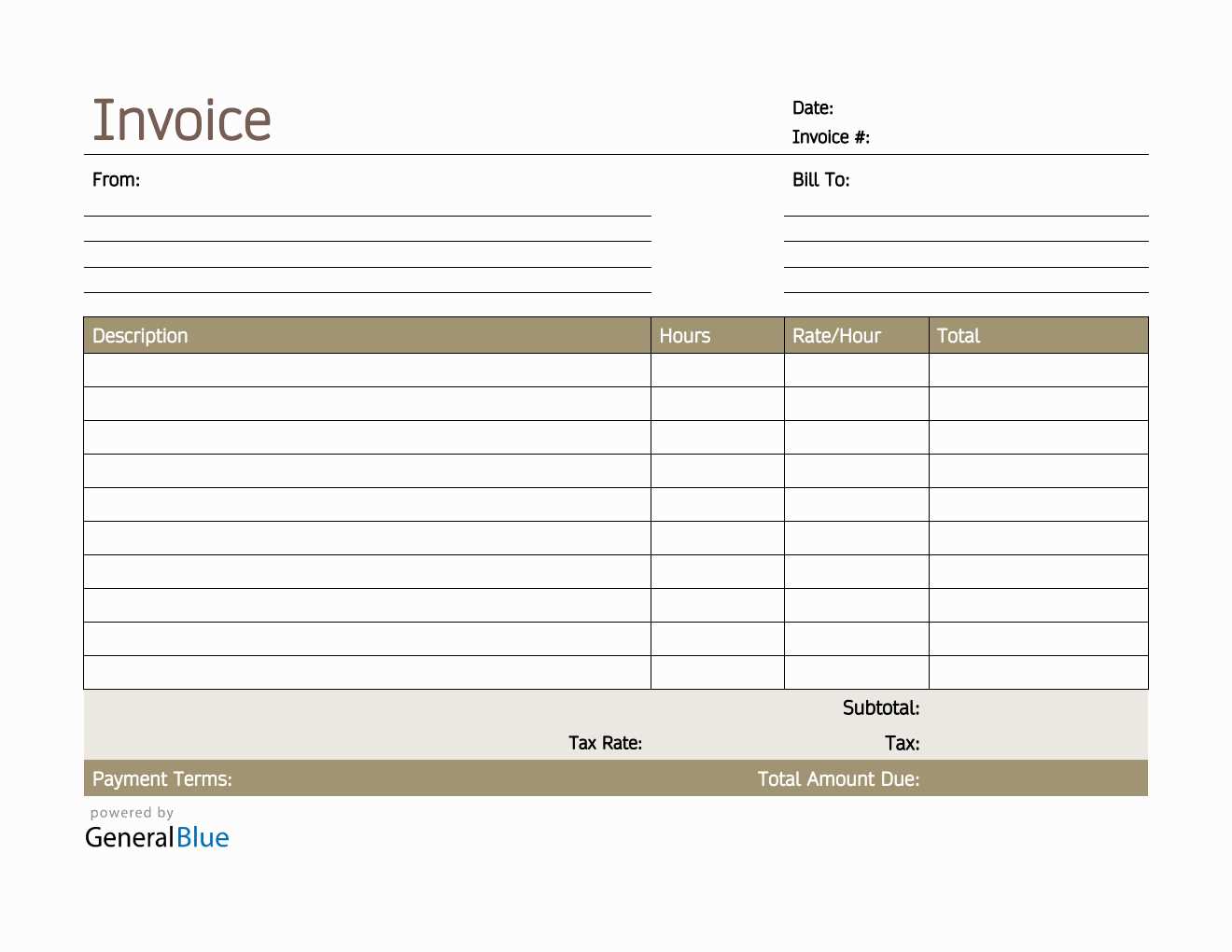

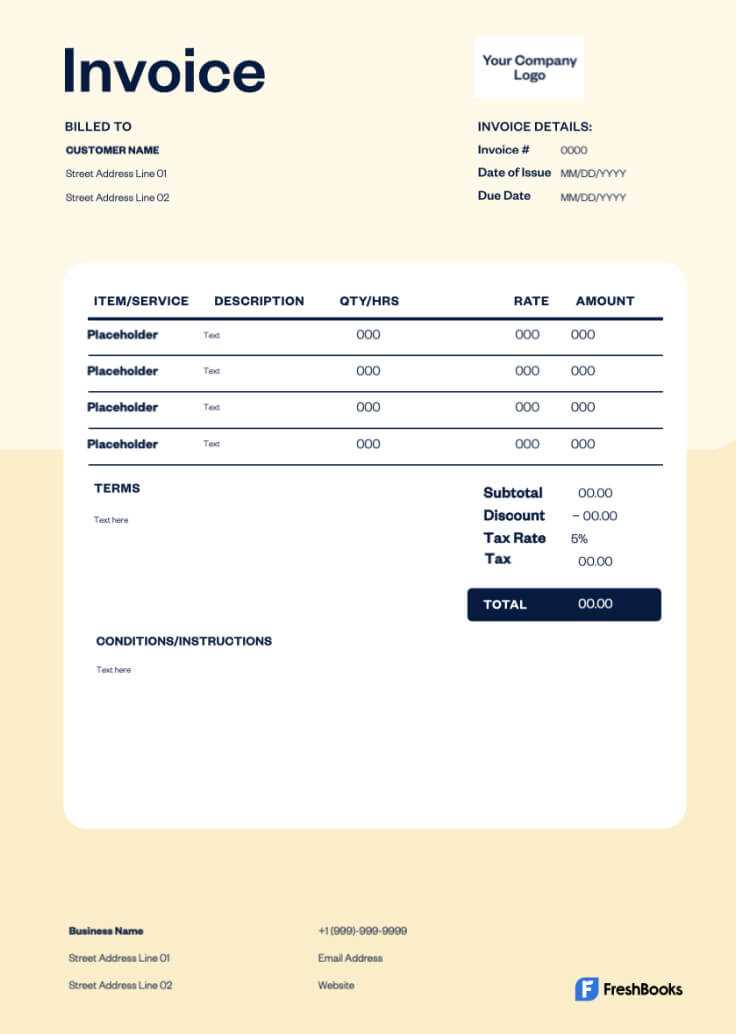

Design the Layout

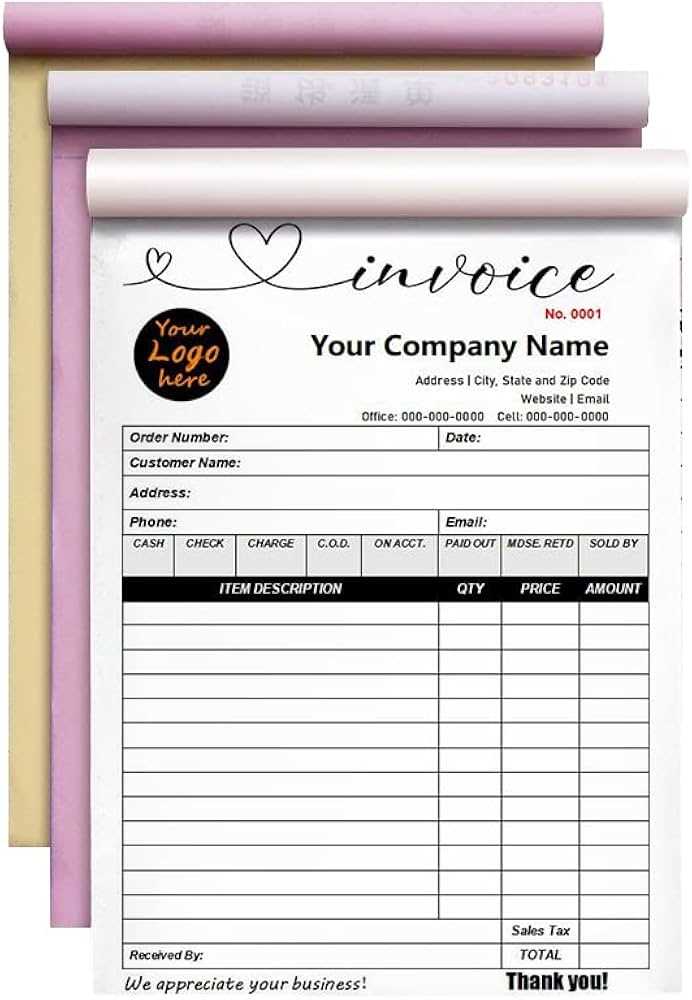

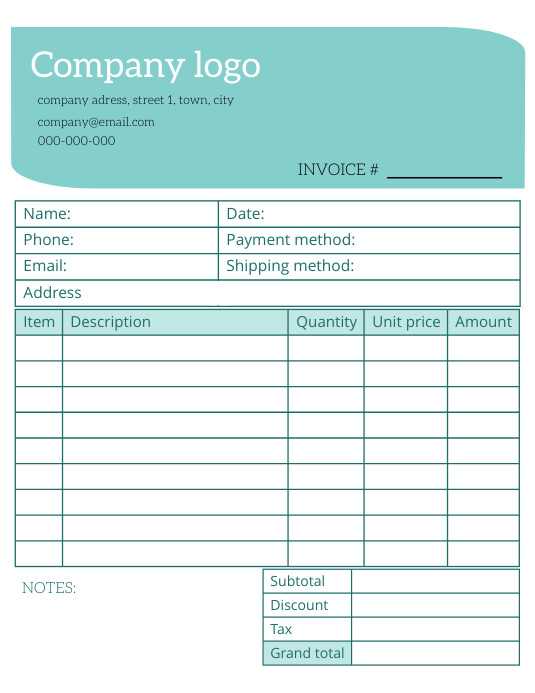

The first step is designing a layout that clearly presents all necessary information. Focus on including sections such as the client’s details, the products or services provided, the total amount due, and payment terms. Ensure that the structure is simple to follow and visually appealing, so that it’s easy for both you and your clients to understand. Choose a clean font and layout that reflects your company’s professionalism.

Include Relevant Details

Next, include essential information such as unique identification numbers, dates, and payment deadlines. These elements help track the transaction and avoid confusion. Additionally, customize the document by adding your business logo and contact details, creating a branded experience for your clients. Including terms of payment or late fees, if applicable, ensures that both parties under

Top Benefits of Printable Invoice Templates

Using a pre-designed format for recording transactions offers numerous advantages for businesses. These ready-to-use documents not only save time but also provide consistency and accuracy. By streamlining the billing process, they allow business owners to focus on growth and client relationships rather than spending unnecessary time on paperwork. Below are the key benefits that businesses can gain from utilizing these structured formats.

Time Efficiency

One of the most significant advantages of using a pre-designed document is the time saved in creating it from scratch. With a ready-made structure, you can quickly input the relevant information without worrying about formatting or layout. This efficiency allows you to process more transactions in less time, which ultimately contributes to a smoother operation.

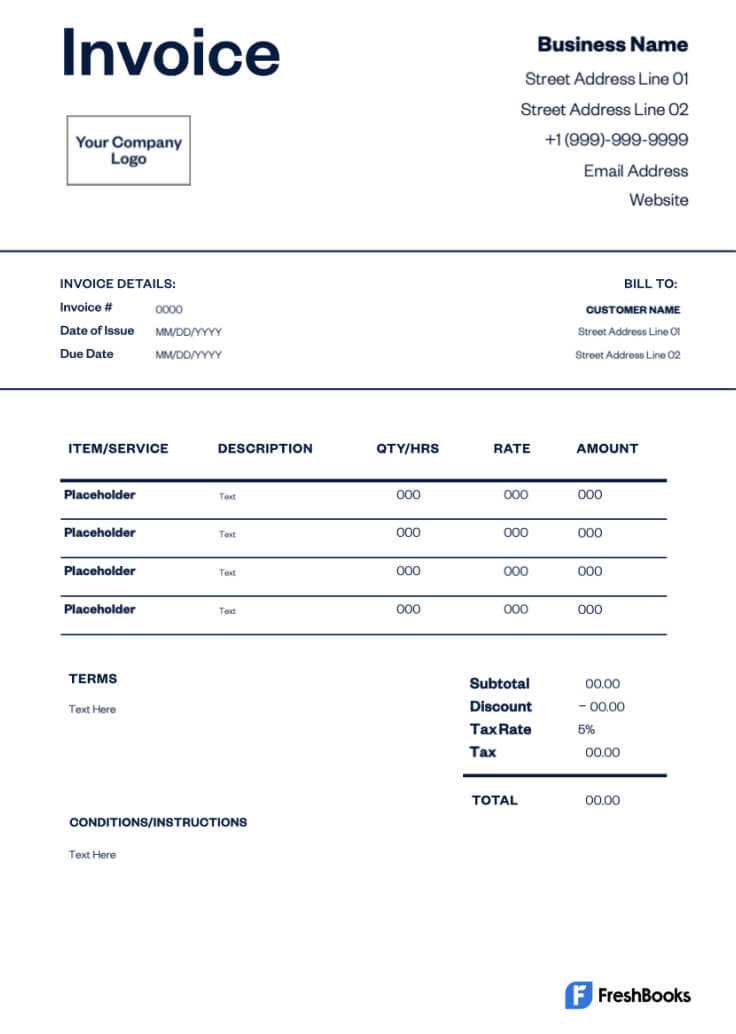

Consistency and Professionalism

Using a standard format ensures consistency across all your business dealings. Every document will look professional and maintain a consistent style, which helps build trust and reliability with clients. A uniform approach to billing makes it easier to organize and track payments, reducing the risk of mistakes or discrepancies.

| Benefit | Description | |||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Time Efficiency | Quick creation of transaction records without worrying about design or layout. | |||||||||||||||||||||||||||||||||||||||||

| Consistency | Uniform appearance across all documents, enhancing brand reliability. | |||||||||||||||||||||||||||||||||||||||||

| Accuracy | Reduces errors by following a proven structure for every transaction. | |||||||||||||||||||||||||||||||||||||||||

Custo

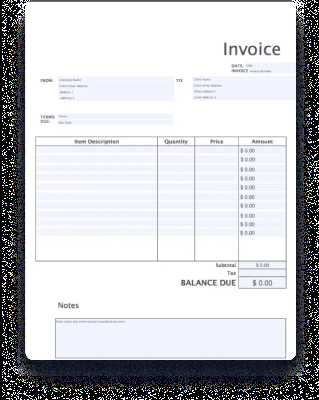

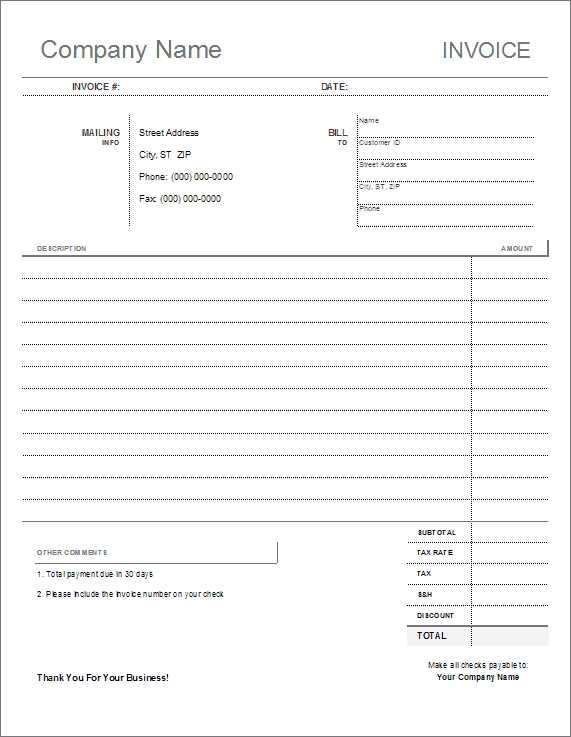

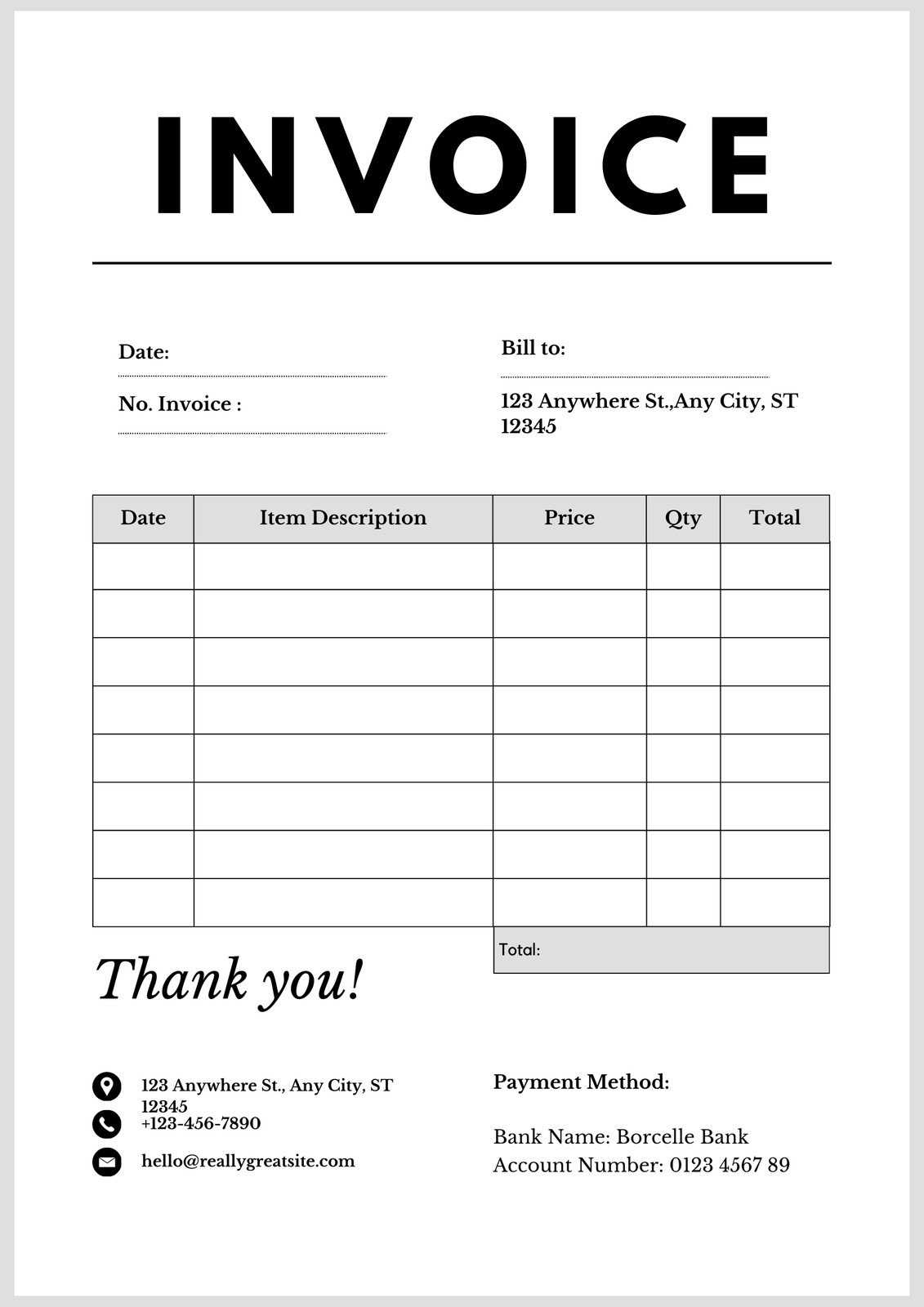

Free Sales Invoice Templates for Businesses

For any business, having access to no-cost, pre-designed documents that help record transactions is invaluable. These free resources make it easier to maintain accurate records and streamline the billing process without the need for costly software or manual design. By utilizing these tools, businesses can focus on growth and client relations, while ensuring their financial documentation is both professional and organized. Many businesses, especially small startups or freelancers, rely on these free formats to handle billing efficiently. These free resources are often customizable, allowing you to tailor them to your specific needs. Whether you are providing services, selling products, or operating in a niche market, you can find a design that suits your business style while maintaining clarity and professionalism in every transaction. Essential Elements of an Invoice TemplateWhen creating a document to record payments and transactions, it’s crucial to include key details that ensure both clarity and legality. These elements help establish a clear understanding between the parties involved, outline payment terms, and provide a reference for future financial record-keeping. A well-structured format ensures that no important information is missed and minimizes the risk of confusion or errors. At a minimum, the document should include the transaction date, identification number, and a clear breakdown of goods or services provided. Additionally, it is important to list total amount due, payment due date, and payment methods accepted. These basic components make the document not only functional but also professional. Without these details, businesses risk delays in payments or misunderstandings about terms. Including your business name and contact information, as well as your client’s details, helps personalize the document while providing a point of contact if there are questions about the transaction. Clear, concise information is essential to maintaining positive business relationships and ensuring smooth financial operations. Common Mistakes in Sales Invoices

When creating documents for transactions, even minor errors can lead to confusion, delayed payments, or strained business relationships. Avoiding these common mistakes can save time, reduce disputes, and ensure that your records are clear and accurate. Below are some of the most frequent issues that businesses encounter when preparing payment requests.

By carefully reviewing and double-checking these key aspects, businesses can avoid costly mistakes and maintain professionalism in all their financial dealings. Best Practices for Invoice Formatting

Effective formatting is essential for ensuring that financial documents are easy to read, professional, and functional. A well-organized structure not only makes it easier for clients to understand the charges, but it also minimizes the risk of errors or confusion. By following a few best practices, businesses can create clear, concise documents that reflect professionalism and maintain consistency. Keep It Simple and Clear

The key to good formatting is simplicity. Ensure that the document is easy to navigate by keeping the layout clean and uncluttered. Here are some tips to improve readability:

Ensure Accurate Alignment and ConsistencyProper alignment is crucial for ensuring that the information flows logically. Misaligned text can cause confusion or make the document look unprofessional.

By following these best practices, businesses can create clear, professional documents that are easy to read, understand, and track, improving both client satisfaction and operational efficiency. How to Personalize Your Sales InvoiceCustomizing your billing document can help create a unique and professional identity for your business. Personalization not only makes the document look more polished but also strengthens your brand presence with clients. By incorporating specific design elements and business details, you can make your documents stand out while ensuring they are functional and easy to understand. Incorporate Your BrandingOne of the easiest ways to personalize your document is by adding your company’s branding elements. This includes:

Include Relevant Business InformationIncluding detailed information about your company not only helps clients identify your brand but also provides them with essential contact information. Be sure to include:

By personalizing your billing document, you create a seamless brand experience that reflects your business values, enhances customer trust, and helps ensure a smooth transaction process. How to Automate Your Invoice ProcessAutomating the process of generating and managing payment records can significantly save time and reduce the chances of errors. By implementing automation tools, you can streamline your entire billing cycle, from creating documents to sending them to clients and tracking payments. Automation not only ensures consistency but also enhances efficiency, allowing businesses to focus more on growth and customer service. Here are some key steps to help you automate your payment documentation process:

By adopting these strategies, you can reduce manual tasks, improve accuracy, and ensure timely payments, allowing you to focus on other critical aspects of your business. Choosing the Right Template for Your Needs

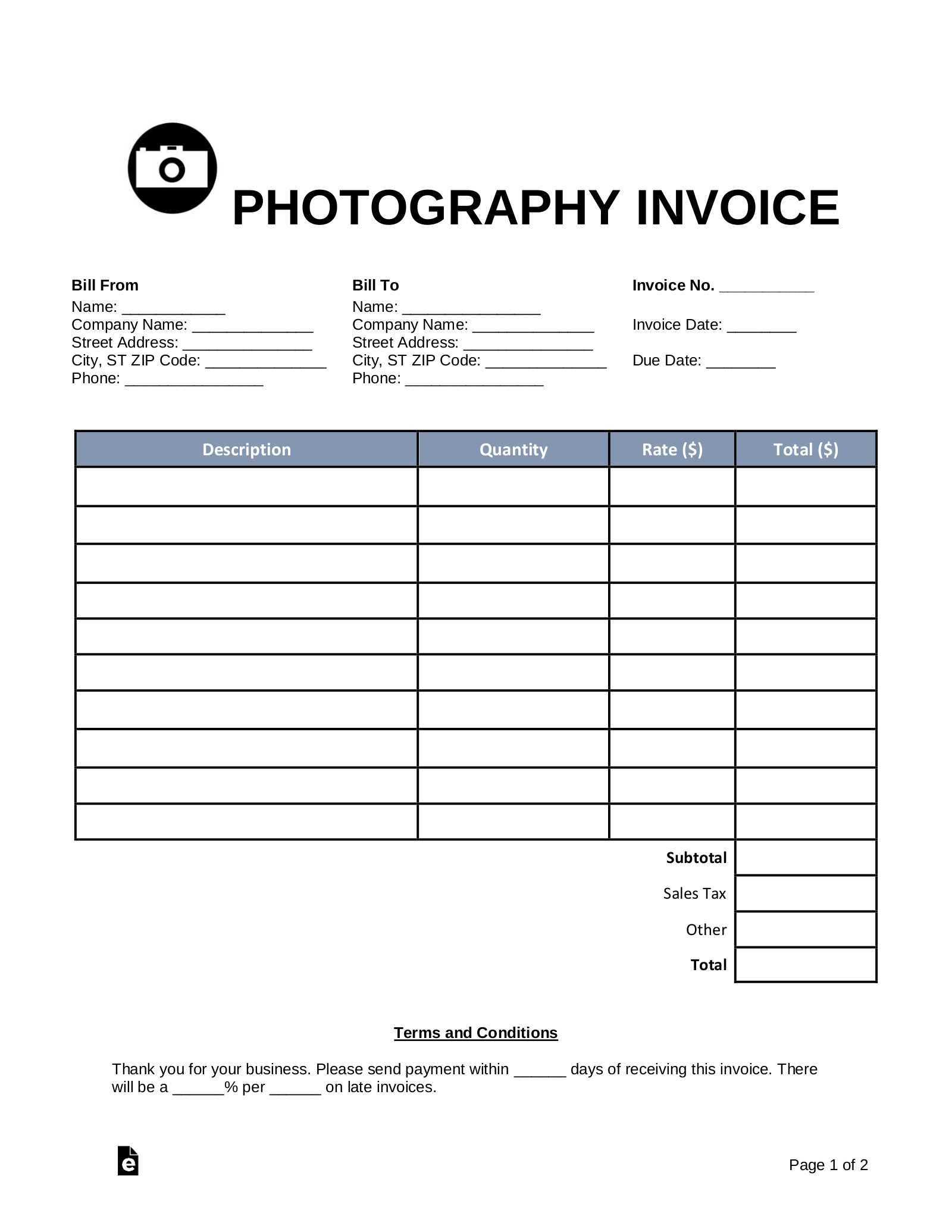

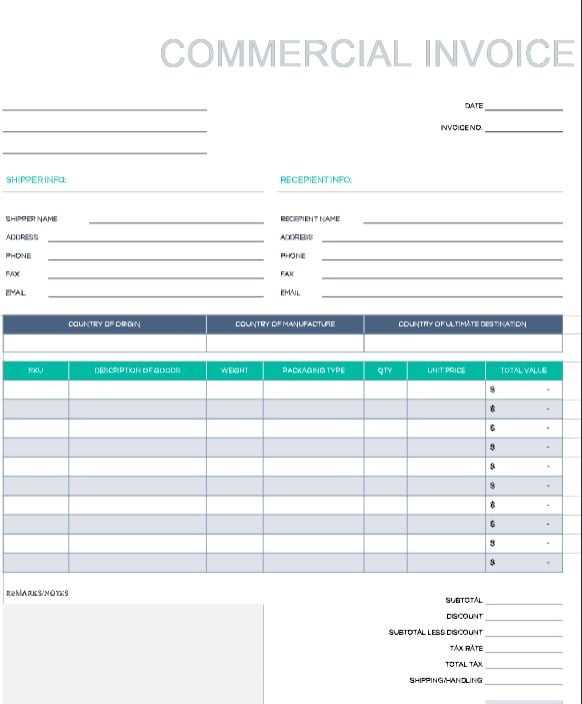

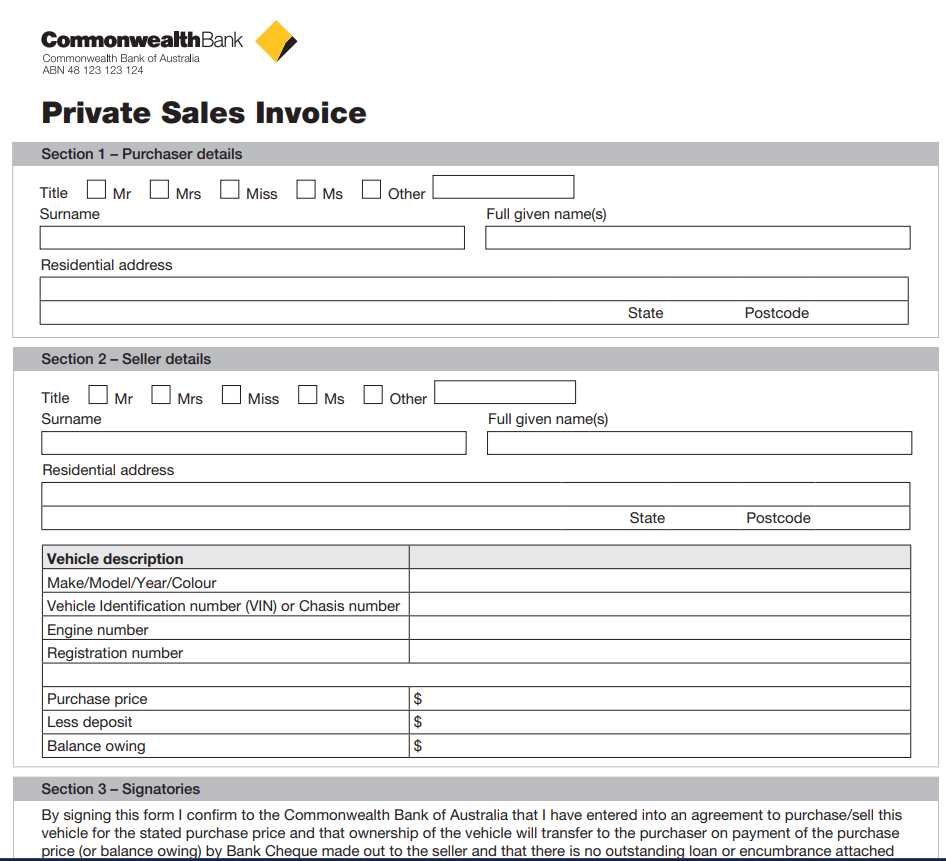

Selecting the right structure for documenting transactions is crucial for ensuring clarity, professionalism, and efficiency in your business operations. The document should align with your specific industry, the nature of your services or products, and the preferences of your clients. By choosing the right design, you can create a seamless experience for both you and your customers, ensuring that all necessary information is clearly presented. Consider the Type of BusinessDifferent businesses have different needs when it comes to payment records. A freelancer offering services may require a simpler layout, while a company selling physical products may need a more detailed structure. Consider the following:

Look for Customization OptionsWhile many formats are available, finding one that allows easy customization is important. Ensure that the structure can be adjusted to reflect your branding, such as adding your logo, adjusting fonts, and selecting colors that match your business identity. The ability to modify details such as payment terms, due dates, and discount options is equally important. Choosing the right format for your business ensures that your transaction records are professional, comprehensive, and aligned with both your needs and your clients’ expectations. Printable vs Digital Sales Invoices

When it comes to managing payment records, businesses often face the choice between traditional paper formats and modern digital solutions. Both options come with their own set of advantages and limitations, depending on the needs of the business and its clients. The decision on which format to use can have a significant impact on workflow efficiency, ease of access, and overall customer experience. Paper-based records have been a long-standing tradition, offering a tangible way to document transactions. They can be printed, signed, and delivered in person, which some clients may prefer for personal or legal reasons. However, they come with certain drawbacks, such as storage space requirements, the risk of losing physical copies, and the environmental impact of paper usage. On the other hand, digital documents offer the convenience of instant delivery and easy storage. They can be sent via email, accessed from any device, and stored securely in the cloud. This method significantly reduces paper waste and can be more environmentally friendly. Digital records are also easier to track, organize, and back up, reducing the likelihood of errors and lost documents. However, they may not be suitable for all clients, especially those who prefer hard copies for official purposes. Ultimately, the choice between printable and digital formats comes down to the preferences of the business and its clients, as well as the specific advantages each method offers for your operational needs. How to Ensure Invoice AccuracyEnsuring the accuracy of your payment documentation is essential for maintaining smooth financial operations and positive client relationships. Errors in amounts, dates, or client details can lead to delays in payments, confusion, or even disputes. By implementing a few key practices, businesses can minimize mistakes and ensure that all transactions are accurately recorded. Here are some steps you can take to guarantee the precision of your billing documents:

By carefully following these steps, you can reduce the risk of mistakes and maintain accurate, professional financial records. Accuracy is not only crucial for internal processes but also builds trust with your clients and helps avoid payment delays. Tips for Organizing Sales Invoices

Efficient organization of payment documents is essential for smooth business operations. By maintaining a structured approach to your financial records, you can ensure that transactions are easy to access, review, and track. Well-organized records not only help with day-to-day management but also make the process of auditing or tax preparation much simpler. Keep Clear Categories

Classifying documents based on relevant criteria is an important first step in staying organized. Here are some common ways to categorize your records:

Leverage Technology for Tracking

Using digital tools can greatly enhance your ability to organize and store payment records. Consider these tips:

By applying these organization strategies, businesses can ensure that payment records are efficiently maintained, easily accessible, and properly tracked–reducing administrative time and increasing overall efficiency. Improving Cash Flow with InvoicesEffective management of payment documents can have a significant impact on your business’s cash flow. Timely and accurate billing is key to ensuring that you receive payments promptly, which in turn helps to maintain a healthy financial position. By optimizing the way you issue and track payment records, you can reduce delays, avoid missed payments, and ultimately improve the overall flow of cash into your business. Streamline Your Billing Process

To improve cash flow, it’s essential to streamline your billing system. By ensuring that all documents are generated and sent promptly, you can avoid unnecessary delays in payments. Consider the following steps:

Offer Flexible Payment Options

Offering multiple payment options can encourage clients to pay on time and in full. The more convenient it is for them to pay, the quicker you can improve your cash flow. Here are some strategies:

By taking these steps to optimize your payment processes, you can ensure that your business receives payments faster, leading to improved cash flow and greater financial stability. Legal Requirements for Sales InvoicesWhen it comes to documenting transactions, certain legal obligations must be met to ensure compliance with tax laws and regulations. These requirements are designed to protect both businesses and consumers, and failure to follow them can result in fines, penalties, or even legal disputes. It is crucial to include specific information on your billing documents to ensure they are both valid and legally binding. Here are the key elements that must be included in any legally-compliant payment document:

|