Download Printable PDF Invoice Template for Easy Billing

Managing business transactions effectively requires clear and professional billing methods. Having access to ready-made documents that can be easily modified and printed allows for a seamless invoicing process. These documents can be customized with your company’s details, services, and payment terms, helping you maintain a polished image with clients.

Simple yet effective solutions make it easier to generate billing forms that align with your brand identity. Instead of creating each document from scratch, you can use pre-designed formats that only require minimal adjustments. This efficiency saves time while ensuring accuracy and consistency in your business communications.

Whether you are a freelancer, small business owner, or part of a larger company, these tools offer the flexibility you need to create documents that look professional and are easy to share with clients. By incorporating your branding, you create an impression of trustworthiness and attention to detail, which is essential for maintaining positive client relationships.

How to Use PDF Invoice Templates

Using pre-made billing documents can simplify the process of managing payments and transactions. These documents are designed to be easily customized, allowing you to add necessary details such as client information, payment terms, and amounts owed. The goal is to streamline the billing process and ensure consistency across all your communications with customers.

To get started, first select a suitable document format that meets your needs. Many formats are designed to be user-friendly and can be opened and edited using standard software. Once you’ve chosen a format, you can begin by inputting the relevant details for each transaction, such as the names and addresses of both parties, descriptions of the services or goods provided, and the total amount due.

After entering the required information, review the document to ensure all details are correct. You can then save it and share it with clients via email or other electronic means. The key benefit of using these pre-designed solutions is that they not only save time but also help maintain a professional appearance, which is essential for building trust with clients.

Benefits of Printable Invoice Templates

Using pre-designed billing documents brings a host of advantages that can greatly improve the efficiency and professionalism of your business transactions. These ready-to-use formats allow for quick customization and ensure that all essential details are included, reducing the chances of errors or omissions that could lead to confusion or delays in payment.

One of the key benefits is time-saving. Instead of creating a new document from scratch for each transaction, you can simply modify an existing design. This significantly reduces administrative workload, enabling you to focus on other important tasks. Additionally, having a consistent format across all your documents helps maintain a professional and cohesive appearance, which builds trust and credibility with your clients.

Another important advantage is the ease of sharing and storing these documents. Digital formats can be quickly emailed or uploaded to cloud storage, making it simple to access or send them whenever needed. This flexibility enhances workflow and ensures that records are safely kept for future reference or accounting purposes.

Customizing Your PDF Invoice Template

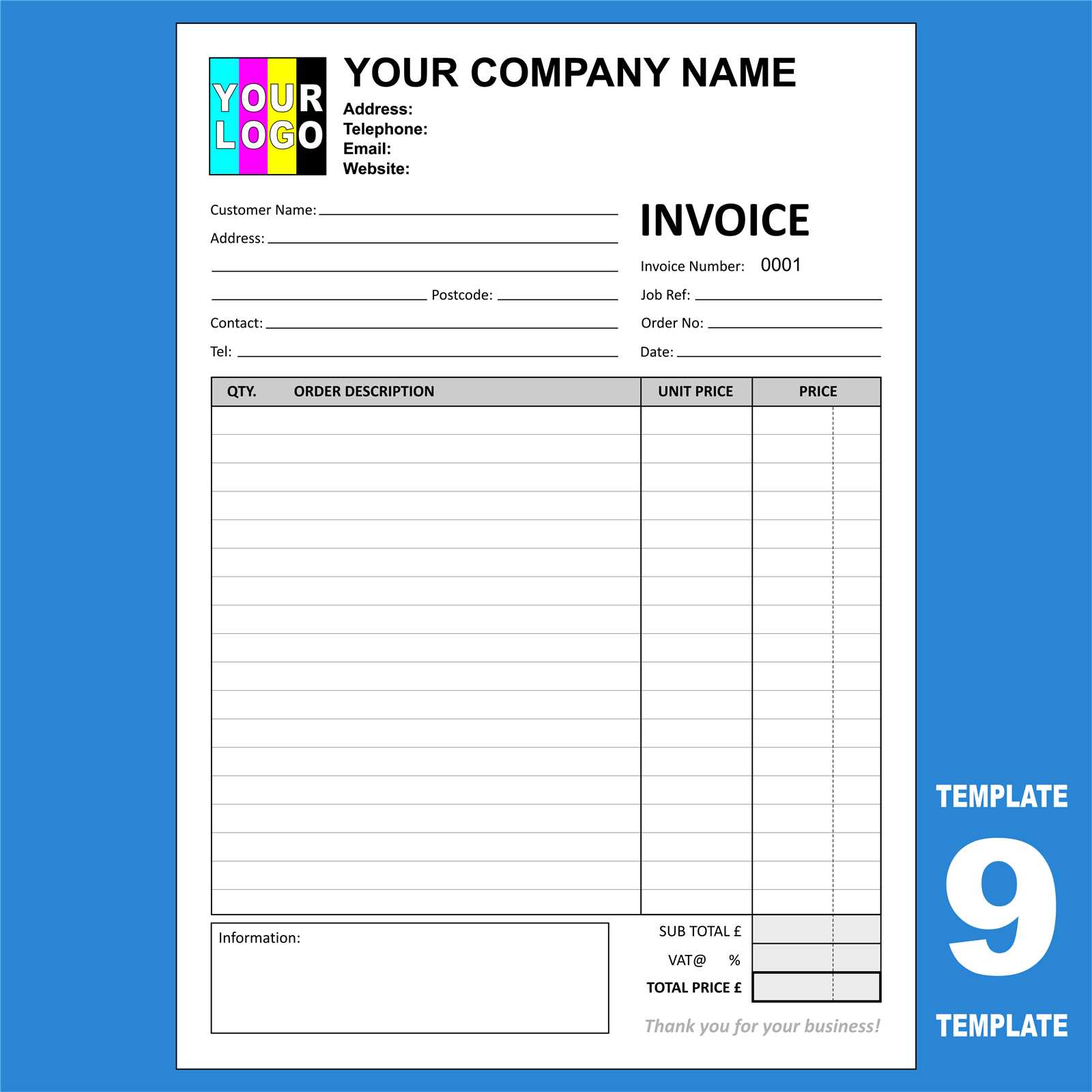

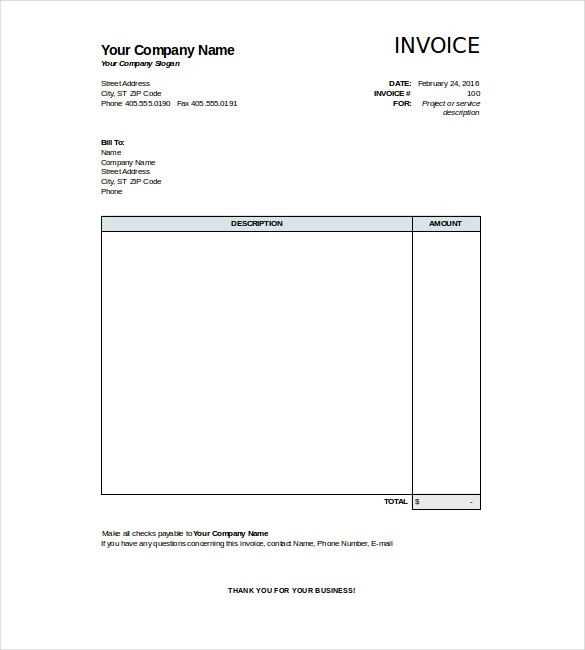

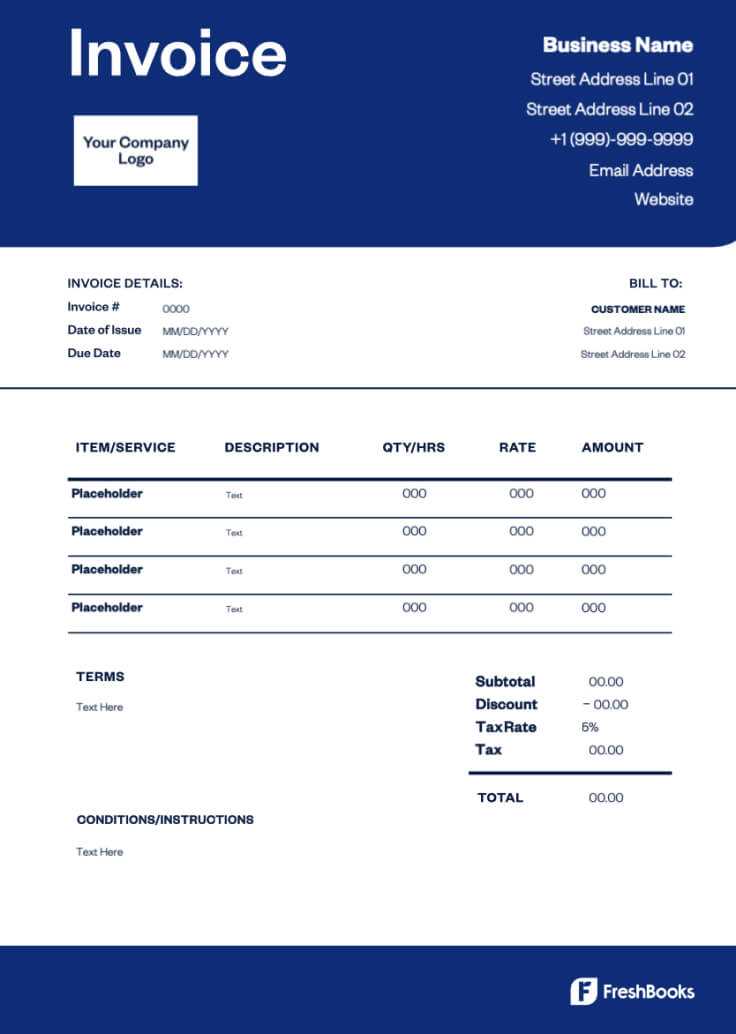

Personalizing your billing documents allows you to tailor them to your business needs and brand identity. Customization ensures that all relevant details are included, such as client-specific information, your company logo, and payment instructions. A well-designed document not only improves communication with your clients but also enhances your professionalism and helps maintain consistency across all transactions.

Steps to Personalize Your Document

To begin, choose a format that is easy to modify and meets your specific requirements. Most pre-designed documents allow for straightforward customization, whether you are adding text, adjusting layout, or incorporating visual elements like logos and color schemes. It is important to include fields such as the date, description of services, amount due, and payment terms. These elements ensure that your documents are both clear and informative for your clients.

Key Customization Elements

| Element | Customization Options |

|---|---|

| Logo and Branding | Add your company logo and use brand colors to make the document reflect your business identity. |

| Contact Information | Include your business address, phone number, and email for easy client communication. |

| Payment Terms | Specify payment deadlines, late fees, or discounts for early payments to clarify payment expectations. |

| Service Descriptions | Provide clear descriptions of products or services offered, helping clients understand what they are being billed for. |

Once customized, these documents can be saved and used repeatedly, streamlining your billing process. Regularly reviewing and adjusting your design ensures it stays up to date with your business needs and client expectations.

Choosing the Right Invoice Template for Your Business

Selecting the right billing document is crucial for ensuring that your financial transactions are clear, professional, and easy to process. The ideal format should reflect your company’s branding, be simple to customize, and include all the necessary fields to avoid confusion. A well-chosen design can make a significant difference in how clients perceive your business and how efficiently payments are processed.

When choosing a format, it’s important to consider the nature of your business, the complexity of your transactions, and your client’s preferences. Some businesses may require detailed breakdowns of products or services, while others may need a simpler layout. Additionally, your billing documents should be compatible with your accounting system and allow for easy updates as needed.

Factors to Consider When Selecting a Document Format

| Factor | Considerations |

|---|---|

| Business Type | Choose a layout that matches the level of detail required for your industry, whether you’re a freelancer or running a large corporation. |

| Customization Options | Ensure the format allows easy modifications such as adding your logo, adjusting colors, and updating client information. |

| Ease of Use | Select a design that is straightforward to fill out and doesn’t require specialized software or skills. |

| Professional Appearance | Opt for a clean, modern layout that enhances your credibility and reflects the quality of your business. |

By carefully considering these factors, you can select the right billing solution that enhances your workflow, builds client trust, and ensures that payments are processed smoothly and on time.

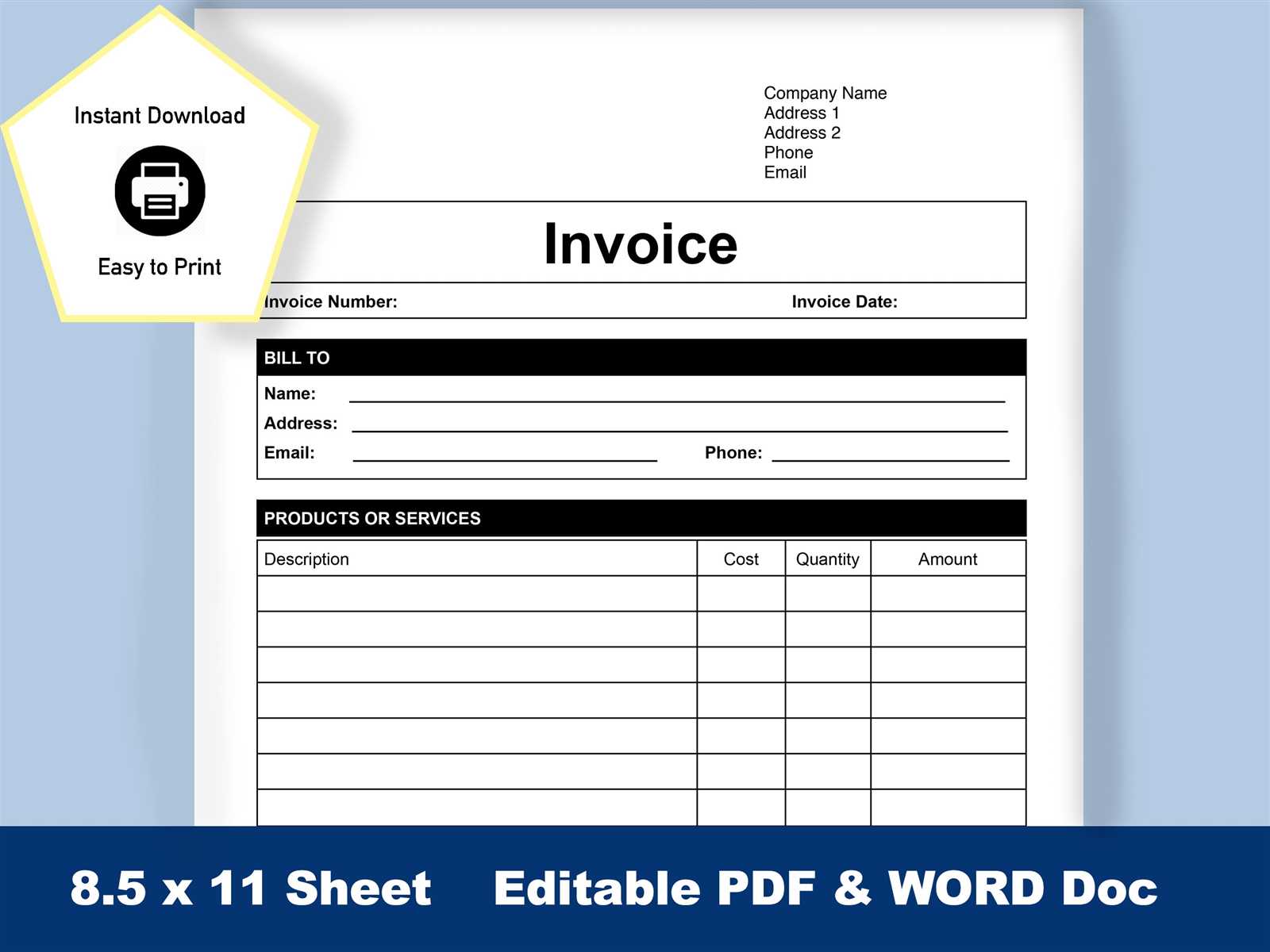

Step-by-Step Guide to Downloading Invoice Templates

Downloading ready-made billing documents is an easy and efficient way to handle transactions without the need to create them from scratch. By following a simple process, you can quickly access a variety of formats that suit your business needs. This guide will walk you through the steps to download and use pre-designed billing solutions for your company.

- Choose a Trusted Source – Begin by selecting a reliable platform or website that offers customizable billing documents. Make sure it’s a reputable site that provides secure downloads.

- Select the Right Format – Browse through the available options and select a format that fits your business model. Look for one that includes all the necessary fields, such as client information, services provided, and payment terms.

- Click on the Download Button – Once you’ve found the right layout, click on the download button. Ensure the file is in a format that’s compatible with your preferred software, like Word or Excel.

- Review the Downloaded File – Open the downloaded document to check that it’s formatted correctly and contains all the necessary fields. This step ensures there are no issues before you start using it for your transactions.

- Save and Organize – After reviewing, save the document in an easily accessible folder on your computer or cloud storage for future use. Consider organizing it by client or project for quick retrieval.

Following these steps will help you quickly download and start using a professional, pre-designed billing document, saving you time and ensuring that your transactions remain organized and consistent.

Top Features to Look for in Invoice Templates

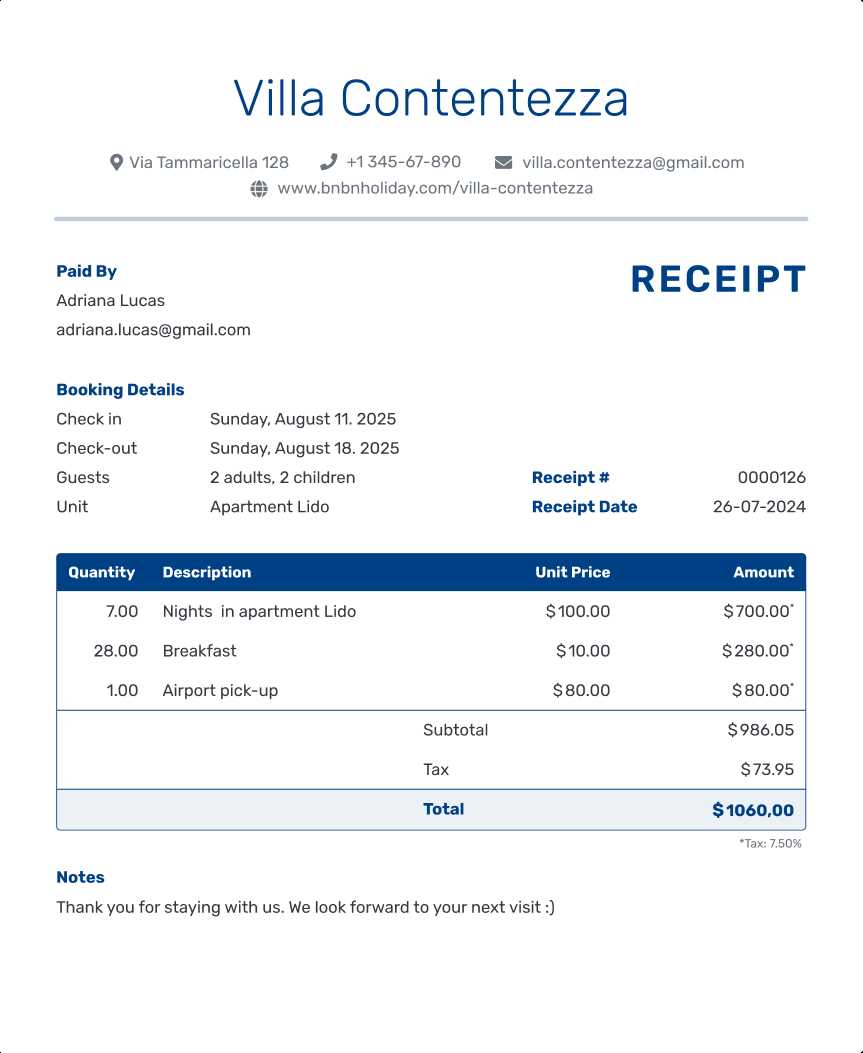

When selecting a pre-designed billing format for your business, it’s essential to ensure it includes the right features that make the process efficient and professional. A well-structured document not only improves clarity but also helps maintain consistency and accuracy in all transactions. The following are key elements to consider when choosing the best billing solution for your needs.

Essential Information Fields

A good billing document should include fields for all the necessary information that both you and your client will need. Look for formats that allow you to easily input:

- Client Details: Name, address, and contact information of the customer.

- Business Information: Your company’s name, address, and contact information.

- Description of Services: Clear breakdown of services or products provided, with individual costs if necessary.

- Payment Terms: Due date, late fees, discounts for early payments, and accepted payment methods.

Customizable Design and Layout

The ability to personalize the document is crucial for maintaining a professional appearance that reflects your brand. Look for formats that offer the following:

- Branding Options: Ability to add your logo, brand colors, and fonts to match your company’s identity.

- Flexible Layout: Space to adjust the number of items or services, allowing you to scale the document to your needs.

- Clear and Simple Structure: A layout that is easy to read and navigate, ensuring clients can quickly understand the billing details.

By focusing on these features, you can ensure that the billing document you choose will meet your business needs, help maintain clear communication, and promote a professional image with clients.

Common Mistakes to Avoid with Invoices

When creating billing documents, it’s easy to overlook small details that can lead to confusion, delays, or even disputes with clients. Whether you’re a freelancer or managing a large business, understanding and avoiding common mistakes is crucial for maintaining professional relationships and ensuring timely payments. Below are some of the most frequent errors to watch out for when preparing financial documents.

Incorrect or Missing Information

One of the most critical mistakes is failing to include all the necessary details. Missing information can lead to misunderstandings and payment delays. Common errors include:

- Missing Client Details: Not including the client’s full name, address, or contact information can delay payments and lead to confusion.

- Incomplete Service Descriptions: Failing to clearly describe what services or products were provided can result in questions or disputes about the charges.

- Omitting Payment Terms: Always ensure that payment due dates, late fees, or early payment discounts are clearly stated to avoid confusion about when and how payments should be made.

Formatting and Presentation Issues

The way your document is structured plays a significant role in how professional and understandable it appears. Poor formatting can make it difficult for clients to process payments or even lead to errors in the amounts. Common formatting mistakes include:

- Unclear Layout: A cluttered or confusing layout can make it hard for clients to read the details or find important information quickly.

- Unprofessional Appearance: Avoid using inconsistent fonts, colors, or logos. A lack of branding or unorganized design can make the document appear less credible.

- Unformatted Numbers: Ensure all amounts, totals, and taxes are clearly separated and easy to identify. This includes using proper currency symbols and decimal places.

By paying attention to these common mistakes, you can ensure that your billing documents are clear, professional, and free from errors, which will help maintain smooth business operations and positive client relationships.

How to Include Payment Terms on Invoices

Clearly stating payment terms is essential for ensuring both you and your client are on the same page regarding when and how payments are expected. By specifying these terms in your billing document, you help avoid confusion, prevent late payments, and maintain professionalism in your business transactions. Below are key steps to follow when including payment terms in your financial documents.

Steps for Including Payment Terms

- Specify the Due Date – Always include a clear payment deadline, specifying the exact date by which payment should be made. This helps clients understand the timeframe they have for settling the bill.

- State Accepted Payment Methods – Make sure to list all available payment options, such as bank transfers, credit card payments, checks, or online payment platforms like PayPal.

- Outline Late Fees or Penalties – If applicable, include any charges for late payments. For example, you could add a note such as, “A 2% late fee will be applied for payments received after [date].” This encourages timely payment and helps cover any additional administrative costs.

- Offer Early Payment Discounts – If you offer a discount for early payments, be sure to specify the discount rate and the conditions for qualifying. For example, “5% discount if paid within 10 days.” This motivates clients to settle their accounts sooner.

Additional Considerations

In addition to basic payment terms, you may want to clarify the consequences of non-payment. Some businesses include a statement about suspending services or charging interest after a certain period of non-payment. These terms should be clear, concise, and fair to avoid any misunderstandings.

- Interest on Overdue Payments: Specify the interest rate that will apply to overdue balances (e.g., “1.5% interest per

Printable Invoice Templates for Freelancers

For freelancers, having a reliable and professional way to bill clients is crucial for maintaining smooth financial transactions. A well-structured document helps freelancers communicate the value of their services clearly, ensures clients understand payment expectations, and facilitates timely payments. By using pre-designed formats, freelancers can save time and focus more on their work rather than on administrative tasks.

Freelancers often face unique billing challenges, such as varying project scopes, irregular working hours, and different client payment schedules. It’s important that the billing solution chosen accommodates these variables while maintaining a professional appearance. Many formats are tailored to meet these specific needs, offering flexibility to list services provided, calculate hourly rates, and track payment statuses.

Key Features for Freelancers

When selecting a billing solution, freelancers should look for formats that allow for:

- Hourly and Project-Based Rates: Ability to easily calculate and display both hourly rates and fixed project fees.

- Service Descriptions: Space to describe the specific tasks or projects completed, which is especially important for clients who request detailed breakdowns.

- Flexible Payment Terms: Options to specify unique payment arrangements, such as deposits or installment plans.

- Professional Branding: Ability to add logos, contact information, and other branding elements to maintain consistency with other business materials.

With the right document format, freelancers can streamline their billing process, ensure their work is properly compensated, and present a polished, professional image to clients.

Why PDF Is the Best Format for Invoices

Choosing the right file format for your billing documents is crucial for ensuring they are professional, secure, and easy to use. One of the most popular and widely accepted formats is the one that offers universal compatibility, preserves the document’s appearance across different devices, and ensures the information is safely shared. Below, we explore why this format is considered the best option for managing your business transactions.

Advantages of Using a Secure Document Format

There are several benefits to using this widely recognized file format for your billing documents, including:

- Universal Compatibility: This format can be opened on almost any device, including computers, smartphones, and tablets, without worrying about software compatibility issues.

- Maintains Document Integrity: When you use this format, the layout, fonts, and images remain consistent, ensuring that the document appears exactly as you intended, regardless of where it is opened.

- Security Features: The format allows you to add password protection and encryption to your documents, ensuring sensitive financial details remain secure when sharing with clients or colleagues.

How This Format Enhances Business Transactions

Besides compatibility and security, this file format offers additional features that make it ideal for business use:

Feature Benefit Easy to Share Documents can be quickly emailed or uploaded to online platforms without losing formatting or quality. Compact File Size It compresses files without losing quality, making it easier to store and transfer documents without taking up too much space. Professional Appearance It’s a widely accepted format, giving a polished and professional look to any financial document. By using this format for your billing documents, you can ensure smooth and efficient business operations, providing a high level of professionalism while safeguarding your financial information.

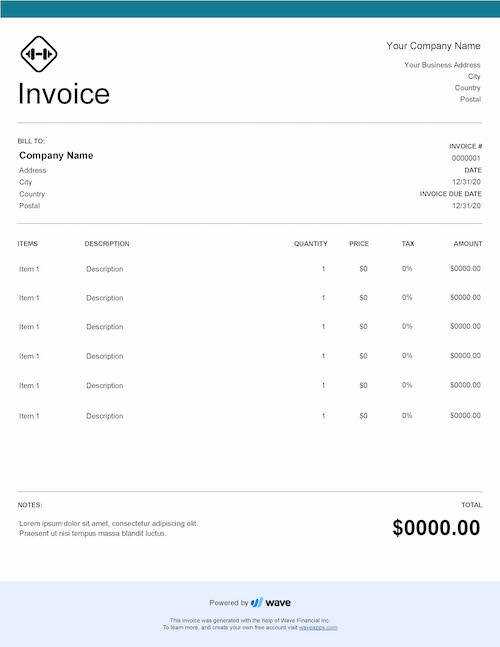

How to Make Invoices Look Professional

Creating a polished and professional billing document not only ensures that your clients take you seriously but also helps maintain clear and transparent communication. A well-designed document reflects your business’s credibility and attention to detail, making it easier for clients to understand the charges and payment expectations. Below are key tips for making your billing documents look more professional and trustworthy.

Key Design Elements for a Professional Look

The visual presentation of your document plays a critical role in its overall professionalism. Here are some important design elements to consider:

- Logo and Branding: Always include your company’s logo and use brand colors or fonts to create a consistent look across all business materials.

- Clear and Structured Layout: Ensure the document is organized with sections that are easy to navigate, such as client details, itemized services, totals, and payment instructions.

- Readable Fonts: Choose clean and easy-to-read fonts for the text, especially for key details like amounts, due dates, and contact information.

- Use of White Space: Don’t overcrowd the document. Proper spacing between sections helps keep it looking neat and readable.

Content to Include for a Clear and Professional Document

In addition to design elements, the content you include is just as important for creating a professional impression. Consider these important details:

- Accurate and Detailed Descriptions: Make sure to provide a clear breakdown of the services or products, including quantity, rate, and total cost.

- Clear Payment Terms: Specify the payment due date, accepted payment methods, and any l

Free vs Paid Invoice Templates

When it comes to choosing the right billing solution, businesses often face the decision of whether to use a free or a paid option. Both have their pros and cons, depending on the complexity of your needs and the level of customization you require. While free options may seem appealing, paid solutions often come with added features that can save time and enhance professionalism. This section explores the differences between these two choices to help you determine which one is best for your business.

Benefits of Free Billing Formats

Free formats are often a great starting point for small businesses or freelancers who need a basic solution without any upfront costs. Some of the advantages include:

- Cost-Effective: Free formats come at no cost, making them ideal for businesses with limited budgets or those just starting out.

- Simple and Easy to Use: Many free options are straightforward and easy to fill out, which makes them ideal for basic transactions.

- Quick Setup: Free solutions typically don’t require any special setup or technical knowledge, allowing you to start billing immediately.

Advantages of Paid Billing Solutions

While free formats may work for some businesses, paid options can provide additional features and benefits that are more suitable for growing companies or those with specific needs. Some of the advantages include:

- Customization Options: Paid solutions often provide greater flexibility for design and customization, allowing you to tailor your documents to match your branding.

- Advanced Features: These may include automated calculations, recurring billing options, payment tracking, and integrations with accounting software.

- Professional A

Integrating Invoice Templates with Accounting Software

Integrating your billing documents with accounting software can significantly streamline your financial management process. By automating the creation and tracking of transactions, you can ensure accuracy, save time, and minimize errors. This integration allows for seamless synchronization between your billing records and financial reports, which ultimately enhances business efficiency and reduces the manual work involved in tracking payments.

Benefits of Integration

When you integrate billing documents with accounting software, there are several advantages that can simplify your financial workflow:

- Automated Data Entry: With integration, client details, services, and amounts automatically populate in the accounting software, reducing the need for manual input and the risk of errors.

- Real-Time Updates: Payments, credits, and other updates made in the accounting software are automatically reflected in your billing records, keeping everything up to date in real time.

- Easy Tracking of Payments: This integration allows you to quickly track which payments have been made, which are pending, and which are overdue, offering more visibility into your cash flow.

- Financial Reporting: Integrated software can generate detailed financial reports, including profit and loss statements, tax summaries, and accounts receivable reports, making it easier to manage your finances.

How to Integrate Billing Documents with Accounting Software

Integrating your billing system with accounting software typically involves a few simple steps:

- Choose Compatible Software: Ensure the accounting software you use supports integration with your chosen billing solution. Many popular platforms like QuickBooks, FreshBooks, and Xero offer this feature.

- Link Accounts: Conne

How to Track Payments with Invoice Templates

Tracking payments is an essential part of managing your business finances. Properly monitoring the payments received ensures you stay organized and can easily follow up on any overdue amounts. By including specific fields and tools in your billing documents, you can streamline the process of tracking and reconciling payments, making it easier to keep your records up to date and avoid mistakes.

Key Elements to Track Payments

To effectively track payments, your billing documents should include key information that helps you stay organized and ensure nothing slips through the cracks. Here are some important elements to include:

- Payment Due Date: Clearly indicate when the payment is expected. This will serve as a reminder for both you and the client of the payment deadline.

- Payment Status: Add a section to indicate whether the payment is pending, completed, or overdue. This helps you track the progress of each transaction easily.

- Amount Paid: Include a field where clients can mark the amount they have paid. This makes it easy to identify partial payments or discrepancies.

- Outstanding Balance: Clearly state any remaining balance that needs to be paid. This helps both you and the client keep track of what is still owed.

Steps for Tracking Payments Efficiently

Incorporating payment tracking into your billing process is simple with a well-structured document. Here’s how to manage it effectively:

- Use Payment Tracking Fields: Make sure your document includes fields for payment status, date of payment, and remaining balance. These fields will help you monitor every transaction easily.

- Update Your Records Regularly: Once a payment is received, update the payment status and mark the amount paid. Keep track of any outstanding balances and follow up promptly if payments are overdue.

- Set Up Payment Reminders: Use the due date as a reminder to follow up with clients if p

Secure Ways to Share PDF Invoices with Clients

When sharing important business documents, such as billing statements, ensuring their security is crucial to protect both your and your clients’ sensitive information. Using secure methods to transmit these documents minimizes the risk of data breaches, fraud, and unauthorized access. Below are several secure ways to share your billing documents, making sure they remain safe throughout the sharing process.

Methods for Secure Document Sharing

There are a variety of ways to send billing documents safely. Some methods include:

- Email Encryption: Sending documents through email is common, but it’s important to use encryption to protect the content. Many email services offer built-in encryption options that ensure only the recipient can open the file.

- Cloud Storage with Password Protection: Upload your document to a secure cloud storage service, such as Google Drive or Dropbox, and share a link with your client. You can set password protection on the file or the shared link to restrict access.

- Secure File Transfer Services: For higher levels of security, use professional file transfer services that offer end-to-end encryption, such as WeTransfer Pro or SendSafely. These services provide secure and temporary links for downloading documents.

- Secure Client Portals: If you regularly share sensitive information, setting up a secure client portal is an excellent option. Portals require login credentials, ensuring only authorized individuals have access to the shared documents.

Additional Security Measures

Beyond choosing the right method, you can take extra precautions to further protect your documents:

- Watermarking: Add a watermark to your document, displaying the client’s name or your company logo. This discourages unauthorized sharing and adds a layer of security.

- Password Protection: Before sharing, protect your document with a strong password. Share the password through a different communication channel, such as a phone call or a secure messaging app.

- Expiration Dates: If you’re using a file transfer service, set expiration dates for the links so that they become inaccessible after a certain period, reducing the chance of unauthorized access later on.

By using secure sharing methods and additional protective measures, you can confidently share your documents while safeguarding sensitive information, ensuring both you and your clients remain protected.