Top Printable Invoice Templates for Simple and Professional Billing

Managing financial transactions efficiently is crucial for businesses of any size. Whether you’re a freelancer, a small business owner, or part of a larger organization, having the right tools to issue billing statements can save time and ensure accuracy. Customizable documents designed for this purpose allow you to maintain a consistent, professional appearance while keeping track of payments seamlessly.

By utilizing pre-made designs, you can avoid the hassle of starting from scratch each time you need to send an account statement. These ready-to-use formats offer a wide range of styles and layouts, making it easier to tailor them to suit your specific needs. Streamlining your billing process ensures you meet client expectations and maintain an organized financial workflow.

In this guide, we explore how to select the ideal formats, customize them to match your brand, and use them effectively for smooth business operations. With the right approach, you’ll be able to send out polished, error-free documents every time.

Printable Invoice Templates Overview

Efficient billing is essential for smooth business operations. Having a standardized document that can be quickly customized for each client ensures consistency and professionalism in every transaction. With the right format, you can easily include all necessary details like payment terms, itemized services, and due dates, streamlining the entire process. These ready-to-use formats eliminate the need to create documents from scratch, saving valuable time and reducing the chance of errors.

Key Features of Billing Documents

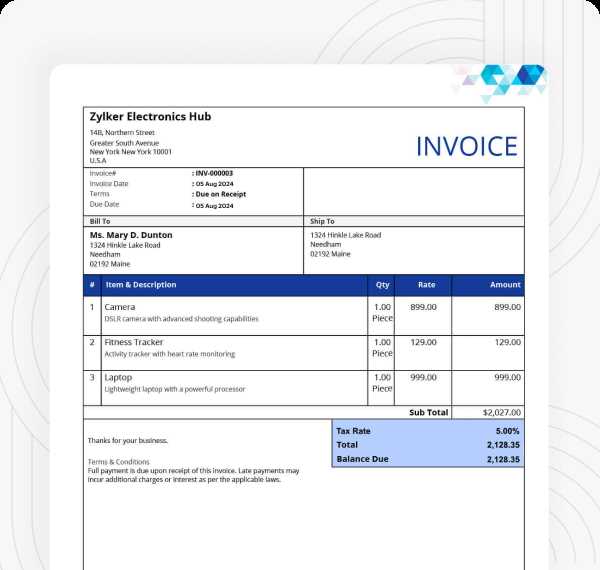

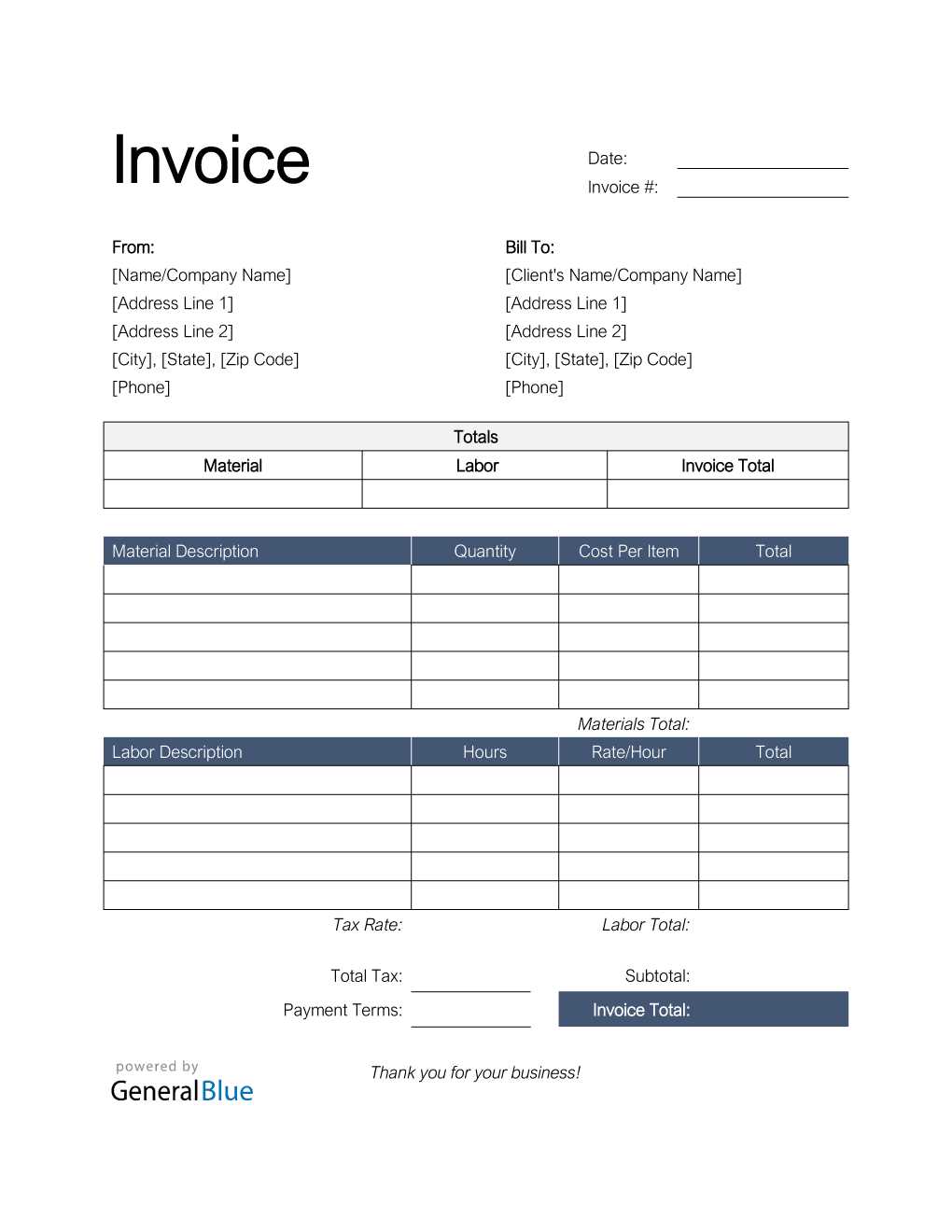

When selecting a layout for your billing needs, it’s important to look for certain features that will make your process more effective. These include clearly defined sections for client information, service descriptions, payment breakdowns, and company branding. Flexibility is another key aspect, allowing you to adapt the format for different business models and industries. Whether you’re dealing with a one-time project or ongoing services, having a format that adjusts to your needs can improve both your efficiency and your client’s experience.

Choosing the Right Design for Your Business

Different businesses have different requirements, so it’s crucial to find a design that reflects your brand and fits your workflow. Some formats are simple, clean, and minimalist, while others offer more detailed layouts with additional options like tax calculations or payment links. Customizability is also essential, as you may need to modify certain fields or add extra information depending on your business type. Finding the perfect balance between functionality and aesthetics can help you create a document that is both practical and visually appealing.

Benefits of Using Printable Invoices

Utilizing standardized billing documents offers numerous advantages for businesses looking to streamline their financial processes. By relying on pre-designed formats, you can save valuable time, reduce the risk of errors, and ensure that your financial communications remain professional. These benefits extend to both small enterprises and large organizations, helping to maintain consistency across transactions and foster trust with clients.

One of the key advantages is the simplicity and efficiency that come with ready-made designs. You no longer need to manually structure each bill from scratch, allowing you to focus on your core business activities. Below are some of the most significant benefits:

| Benefit | Description |

|---|---|

| Time-saving | Ready-made formats allow for quick customization, reducing the time spent on generating each document. |

| Consistency | Pre-set layouts ensure that every bill sent out maintains a professional and uniform appearance. |

| Accuracy | Fewer chances for human error as key fields and calculations are already formatted correctly. |

| Cost-effective | Using ready-to-go formats can cut down on software costs and reduce the need for additional resources. |

| Customization | These formats can be easily personalized to reflect your business’s branding, payment terms, and other specifics. |

By integrating these designs into your billing workflow, businesses can ensure faster processing, fewer discrepancies, and a more professional relationship with their clients.

How to Customize Invoice Templates

Adapting billing documents to suit your specific business needs is an essential part of maintaining professionalism and efficiency. Customization allows you to align your financial statements with your brand, ensuring they reflect your unique identity while still containing all necessary details. By making simple adjustments, you can create a document that meets your requirements and delivers a consistent message to clients.

The first step in personalizing your format is adjusting the layout to include your company’s logo, contact information, and preferred color scheme. This creates a cohesive experience for the client and strengthens your brand recognition. Incorporating business details such as tax identification numbers, payment methods, and terms of service also enhances the credibility of your documents.

Another important aspect of customization is adding or removing sections based on the specific products or services you offer. For example, if your business charges different tax rates, make sure to include a field for tax breakdowns. Similarly, if you provide discounts, payment schedules, or recurring billing, adjust the format to reflect these variations. Modifying sections based on the nature of your transactions ensures that every statement is clear, accurate, and suited to the business model.

Finally, consider saving your customized design for future use. Once you’ve tailored the format to your liking, you can easily replicate it for all future transactions, ensuring consistency while saving time.

Choosing the Right Invoice Format

Selecting the appropriate document layout is a critical step in ensuring your financial communications are both clear and professional. The format you choose should match the nature of your business, the complexity of your transactions, and the expectations of your clients. By considering these factors, you can create a seamless billing experience that is both efficient and effective.

For businesses with straightforward services, a simple and minimalistic design may be sufficient, allowing you to present essential details such as client information, services provided, and payment terms. On the other hand, if you deal with more complex transactions or multiple itemized services, a detailed structure with additional sections may be necessary. Ensuring clarity is key–both for your team and your clients–so they can quickly understand the charges and terms.

Additionally, consider how your document will be delivered. If your clients prefer digital formats, choose a layout that is easy to read on various devices. Alternatively, if you still print and mail your statements, focus on designs that look equally professional in print as they do on screen. Balancing functionality and visual appeal will ensure your financial communications are as effective as possible.

Top Invoice Templates for Small Businesses

For small business owners, managing financial transactions efficiently is crucial to ensure smooth operations. Having an organized approach to billing can significantly improve cash flow and professionalism in dealing with clients. There are numerous options available that help streamline the process, making it easier to create documents that reflect the company’s brand while maintaining clarity and accuracy. These solutions allow businesses to produce well-structured and customizable billing documents that meet various needs and industry standards.

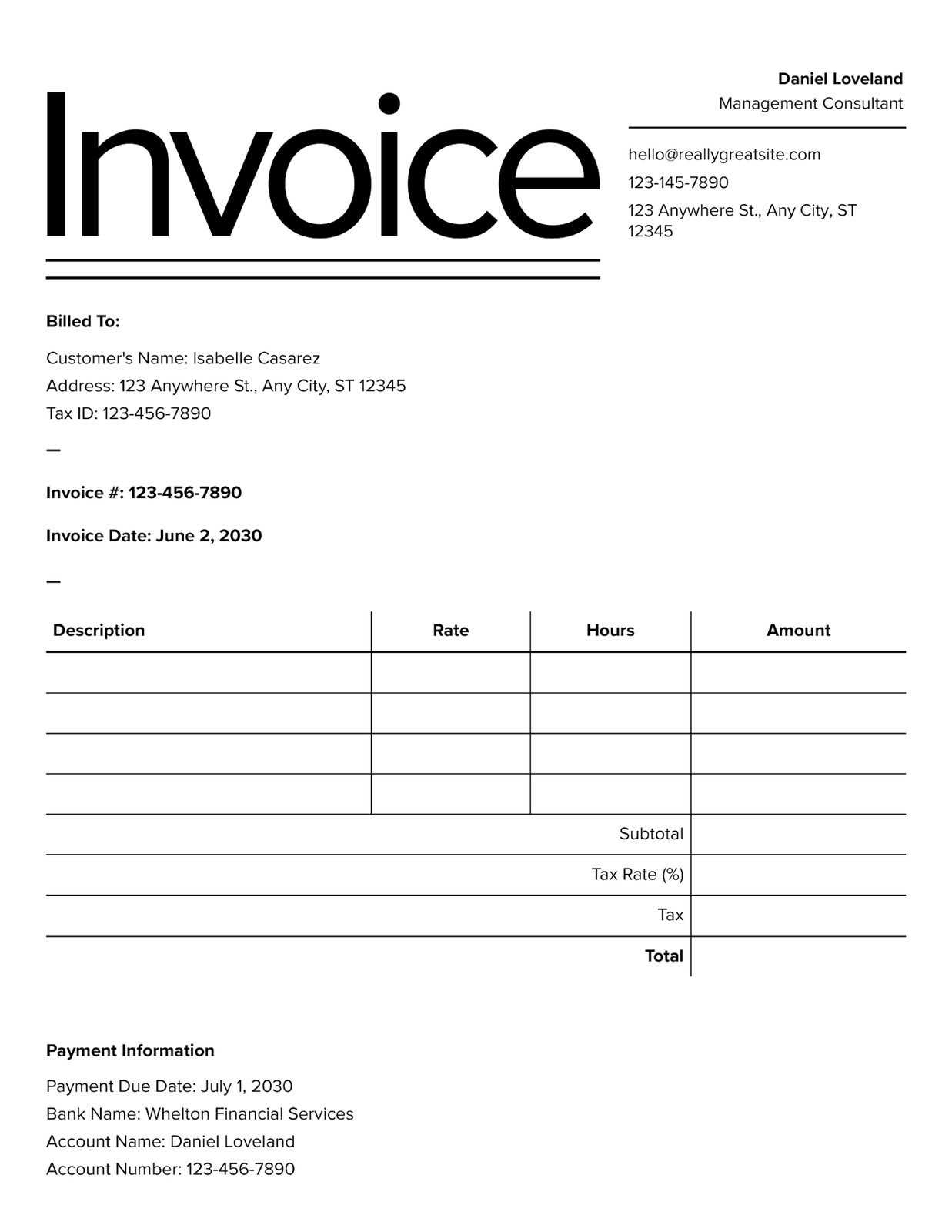

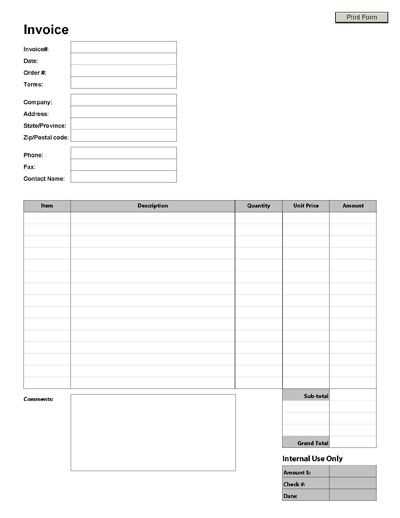

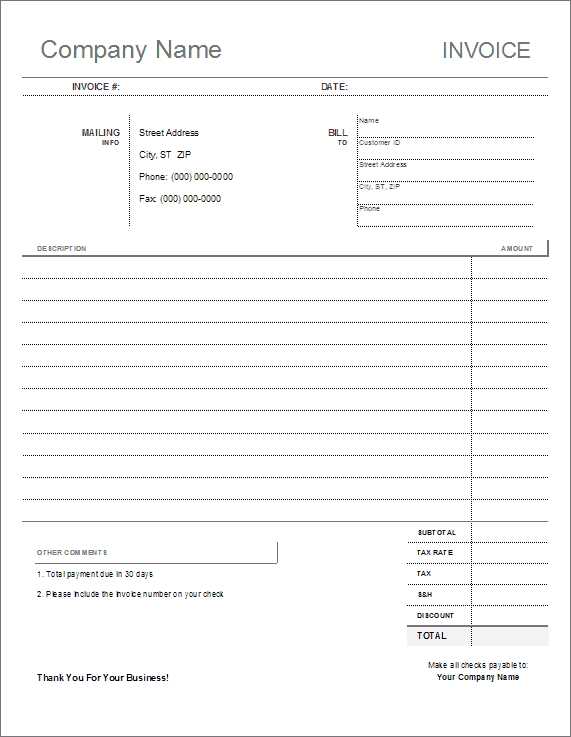

1. Simple and Clean Designs

Minimalist layouts with clear sections for payment details, client information, and services provided work best for small businesses that prefer no-frills documents. Such formats are ideal for freelancers, consultants, or any company that provides a straightforward list of services. Clean designs improve readability and ensure that important details stand out without overwhelming the recipient.

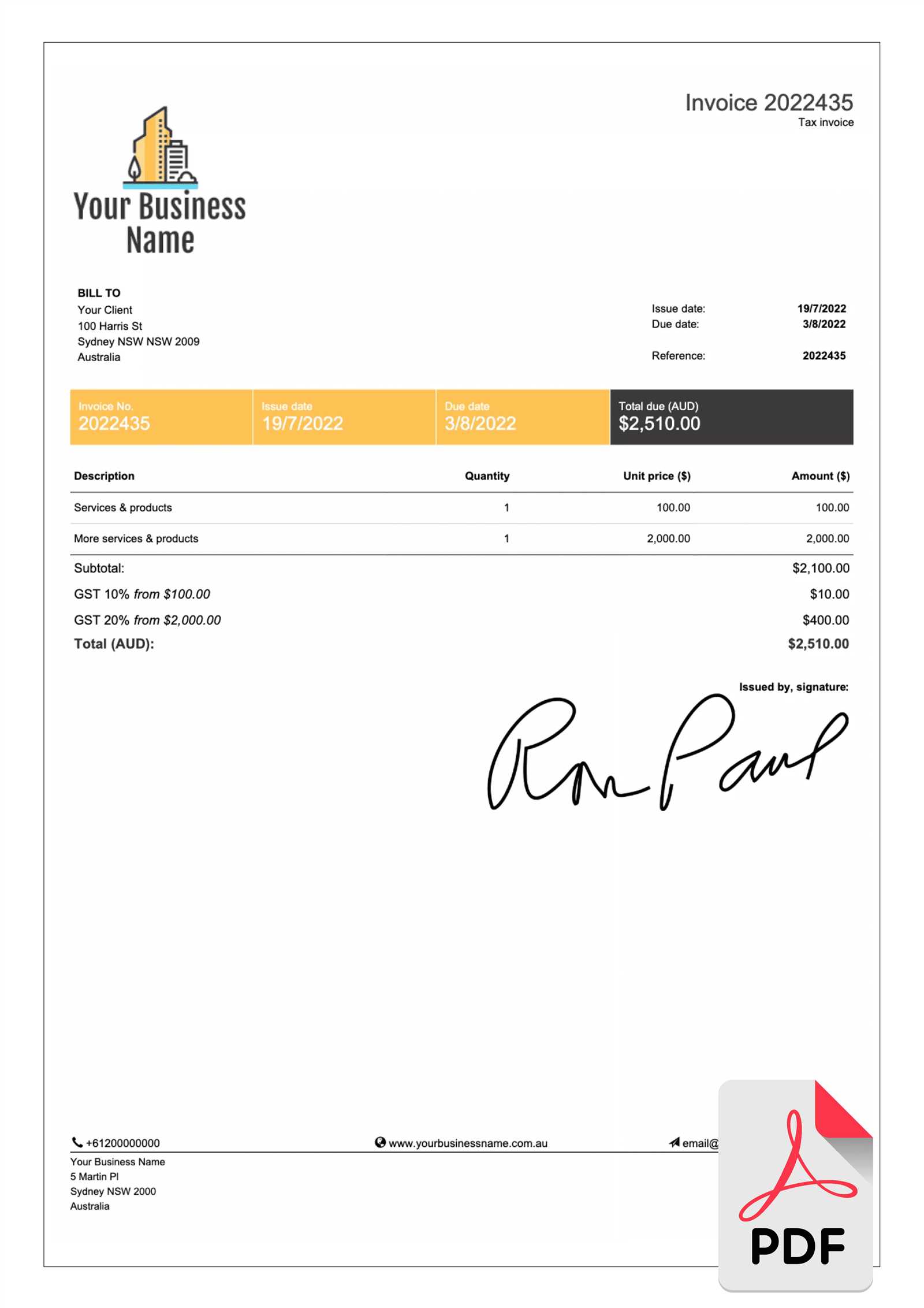

2. Professional Corporate Styles

Businesses that want to convey a more formal, corporate appearance can benefit from templates featuring structured headers, footers, and company branding options. These layouts include space for a company logo and payment terms, creating a polished, professional look that reflects the company’s seriousness and attention to detail.

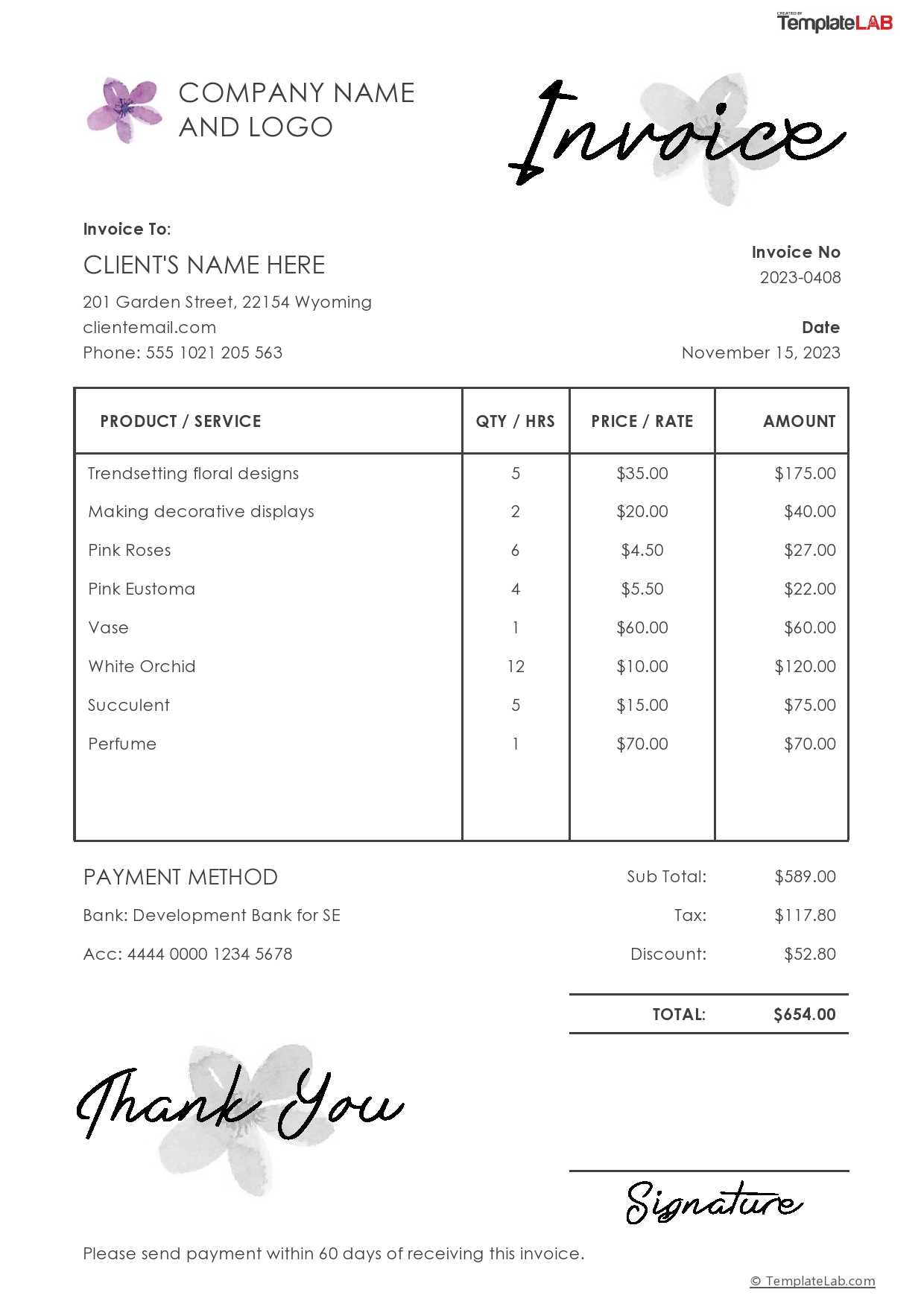

3. Creative and Customizable Formats

Creative industries like design or marketing often prefer more flexible and visually engaging documents. These formats allow for bold colors, creative fonts, and unique designs that help express the personality of the business. Customizable sections let owners add a personal touch, which can be particularly important when working with long-term clients.

4. Time-Saving Automated Solutions

For businesses that need to generate numerous billing documents each month, automated tools offer a great way to save time. These platforms typically include features like automatic calculations, recurring billing options, and the ability to quickly adjust the format based on specific client requirements. Automation streamlines the billing process and reduces the chances of errors.

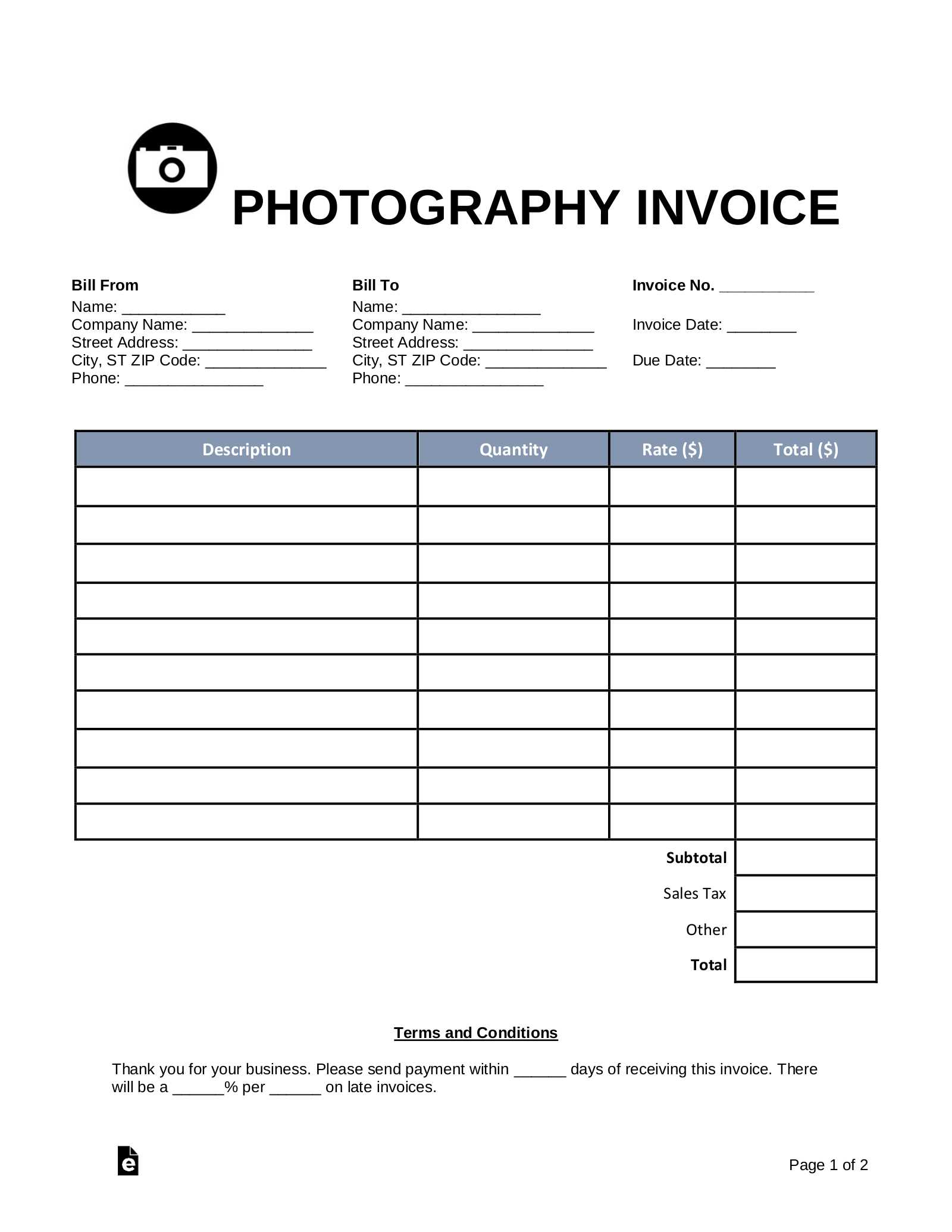

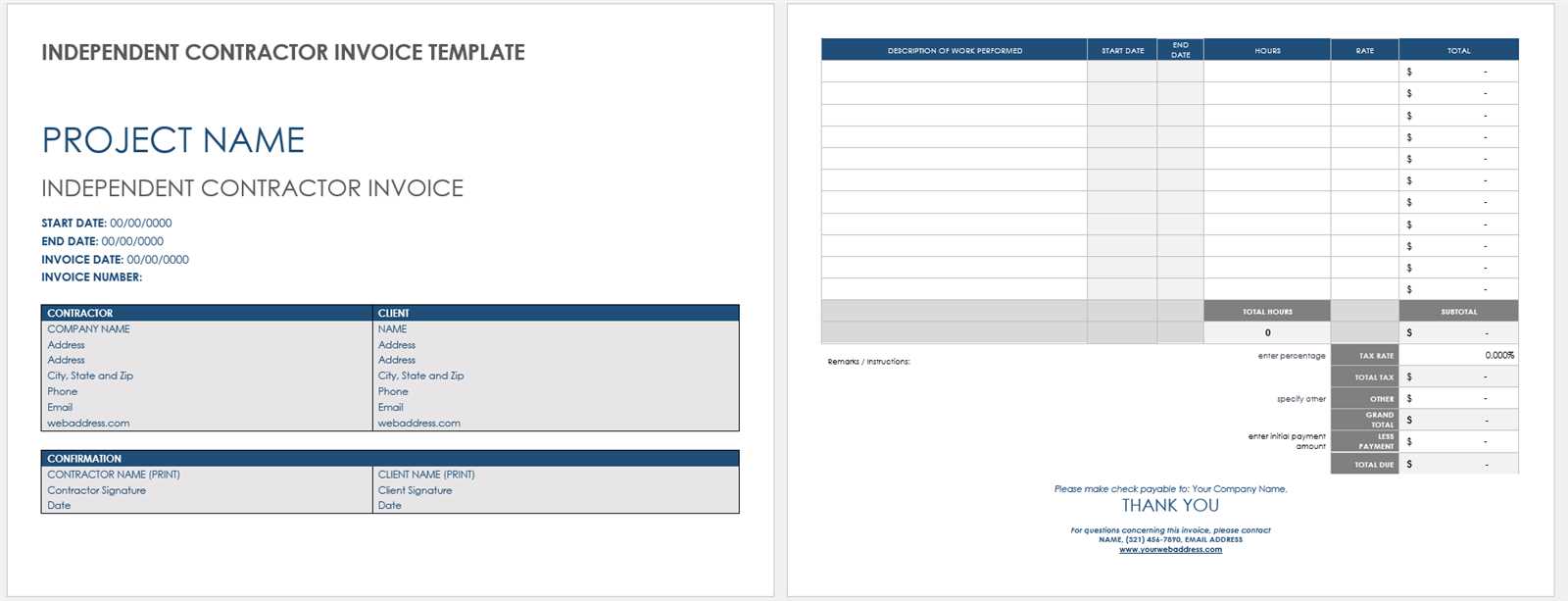

5. Industry-Specific Billing Documents

Some businesses operate in niches where specialized documentation is required. Whether in construction, retail, or professional services, there are tailored solutions that address specific industry needs. These options often come with pre-designed sections for hourly rates, project milestones, and other essential details that cater to the particularities of each field.

Top Invoice Templates for Small Businesses

For small business owners, managing financial transactions efficiently is crucial to ensure smooth operations. Having an organized approach to billing can significantly improve cash flow and professionalism in dealing with clients. There are numerous options available that help streamline the process, making it easier to create documents that reflect the company’s brand while maintaining clarity and accuracy. These solutions allow businesses to produce well-structured and customizable billing documents that meet various needs and industry standards.

1. Simple and Clean Designs

Minimalist layouts with clear sections for payment details, client information, and services provided work best for small businesses that prefer no-frills documents. Such formats are ideal for freelancers, consultants, or any company that provides a straightforward list of services. Clean designs improve readability and ensure that important details stand out without overwhelming the recipient.

2. Professional Corporate Styles

Businesses that want to convey a more formal, corporate appearance can benefit from templates featuring structured headers, footers, and company branding options. These layouts include space for a company logo and payment terms, creating a polished, professional look that reflects the company’s seriousness and attention to detail.

3. Creative and Customizable Formats

Creative industries like design or marketing often prefer more flexible and visually engaging documents. These formats allow for bold colors, creative fonts, and unique designs that help express the personality of the business. Customizable sections let owners add a personal touch, which can be particularly important when working with long-term clients.

4. Time-Saving Automated Solutions

For businesses that need to generate numerous billing documents each month, automated tools offer a great way to save time. These platforms typically include features like automatic calculations, recurring billing options, and the ability to quickly adjust the format based on specific client requirements. Automation streamlines the billing process and reduces the chances of errors.

5. Industry-Specific Billing Documents

Some businesses operate in niches where specialized documentation is required. Whether in construction, retail, or professional services, there are tailored solutions that address specific industry needs. These options often come with pre-designed sections for hourly rates, project milestones, and other essential details that cater to the particularities of each field.

Top Invoice Templates for Small Businesses

For small business owners, managing financial transactions efficiently is crucial to ensure smooth operations. Having an organized approach to billing can significantly improve cash flow and professionalism in dealing with clients. There are numerous options available that help streamline the process, making it easier to create documents that reflect the company’s brand while maintaining clarity and accuracy. These solutions allow businesses to produce well-structured and customizable billing documents that meet various needs and industry standards.

1. Simple and Clean Designs

Minimalist layouts with clear sections for payment details, client information, and services provided work best for small businesses that prefer no-frills documents. Such formats are ideal for freelancers, consultants, or any company that provides a straightforward list of services. Clean designs improve readability and ensure that important details stand out without overwhelming the recipient.

2. Professional Corporate Styles

Businesses that want to convey a more formal, corporate appearance can benefit from templates featuring structured headers, footers, and company branding options. These layouts include space for a company logo and payment terms, creating a polished, professional look that reflects the company’s seriousness and attention to detail.

3. Creative and Customizable Formats

Creative industries like design or marketing often prefer more flexible and visually engaging documents. These formats allow for bold colors, creative fonts, and unique designs that help express the personality of the business. Customizable sections let owners add a personal touch, which can be particularly important when working with long-term clients.

4. Time-Saving Automated Solutions

For businesses that need to generate numerous billing documents each month, automated tools offer a great way to save time. These platforms typically include features like automatic calculations, recurring billing options, and the ability to quickly adjust the format based on specific client requirements. Automation streamlines the billing process and reduces the chances of errors.

5. Industry-Specific Billing Documents

Some businesses operate in niches where specialized documentation is required. Whether in construction, retail, or professional services, there are tailored solutions that address specific industry needs. These options often come with pre-designed sections for hourly rates, project milestones, and other essential details that cater to the particularities of each field.

Creating Professional Invoices with Ease

For any business, delivering clear and well-structured payment documents is key to maintaining a professional image and ensuring prompt settlements. The process doesn’t have to be time-consuming or complicated. With the right tools and a few simple steps, anyone can craft documents that are not only functional but also visually appealing and in line with business branding.

Key Elements of a Well-Structured Payment Document

- Client Information: Always include the client’s name, contact details, and address for clear identification.

- Company Branding: Ensure your logo, business name, and contact information are easily visible to reinforce brand identity.

- Description of Services: Provide a clear breakdown of products or services, including quantities, prices, and a brief description of each item.

- Total Amount Due: Clearly state the total amount due, with an itemized list if necessary to avoid confusion.

- Payment Terms: Specify payment deadlines, methods, and any late fees to set clear expectations.

How to Streamline the Process

- Use Software Tools: Leverage automated solutions that generate payment documents quickly, saving time and reducing human error.

- Customize for Specific Clients: Tailor each document to reflect the client’s unique needs and preferences, whether it’s offering discounts or adding special payment terms.

- Maintain Consistency: Keep the format consistent across all documents to establish professionalism and familiarity with clients.

By following these simple practices, creating polished and professional payment documents becomes a fast and efficient task, enabling businesses to focus on what matters most–growing their operations and building client relationships.

Creating Professional Invoices with Ease

For any business, delivering clear and well-structured payment documents is key to maintaining a professional image and ensuring prompt settlements. The process doesn’t have to be time-consuming or complicated. With the right tools and a few simple steps, anyone can craft documents that are not only functional but also visually appealing and in line with business branding.

Key Elements of a Well-Structured Payment Document

- Client Information: Always include the client’s name, contact details, and address for clear identification.

- Company Branding: Ensure your logo, business name, and contact information are easily visible to reinforce brand identity.

- Description of Services: Provide a clear breakdown of products or services, including quantities, prices, and a brief description of each item.

- Total Amount Due: Clearly state the total amount due, with an itemized list if necessary to avoid confusion.

- Payment Terms: Specify payment deadlines, methods, and any late fees to set clear expectations.

How to Streamline the Process

- Use Software Tools: Leverage automated solutions that generate payment documents quickly, saving time and reducing human error.

- Customize for Specific Clients: Tailor each document to reflect the client’s unique needs and preferences, whether it’s offering discounts or adding special payment terms.

- Maintain Consistency: Keep the format consistent across all documents to establish professionalism and familiarity with clients.

By following these simple practices, creating polished and professional payment documents becomes a fast and efficient task, enabling businesses to focus on what matters most–growing their operations and building client relationships.

Creating Professional Invoices with Ease

For any business, delivering clear and well-structured payment documents is key to maintaining a professional image and ensuring prompt settlements. The process doesn’t have to be time-consuming or complicated. With the right tools and a few simple steps, anyone can craft documents that are not only functional but also visually appealing and in line with business branding.

Key Elements of a Well-Structured Payment Document

- Client Information: Always include the client’s name, contact details, and address for clear identification.

- Company Branding: Ensure your logo, business name, and contact information are easily visible to reinforce brand identity.

- Description of Services: Provide a clear breakdown of products or services, including quantities, prices, and a brief description of each item.

- Total Amount Due: Clearly state the total amount due, with an itemized list if necessary to avoid confusion.

- Payment Terms: Specify payment deadlines, methods, and any late fees to set clear expectations.

How to Streamline the Process

- Use Software Tools: Leverage automated solutions that generate payment documents quickly, saving time and reducing human error.

- Customize for Specific Clients: Tailor each document to reflect the client’s unique needs and preferences, whether it’s offering discounts or adding special payment terms.

- Maintain Consistency: Keep the format consistent across all documents to establish professionalism and familiarity with clients.

By following these simple practices, creating polished and professional payment documents becomes a fast and efficient task, enabling businesses to focus on what matters most–growing their operations and building client relationships.

Creating Professional Invoices with Ease

For any business, delivering clear and well-structured payment documents is key to maintaining a professional image and ensuring prompt settlements. The process doesn’t have to be time-consuming or complicated. With the right tools and a few simple steps, anyone can craft documents that are not only functional but also visually appealing and in line with business branding.

Key Elements of a Well-Structured Payment Document

- Client Information: Always include the client’s name, contact details, and address for clear identification.

- Company Branding: Ensure your logo, business name, and contact information are easily visible to reinforce brand identity.

- Description of Services: Provide a clear breakdown of products or services, including quantities, prices, and a brief description of each item.

- Total Amount Due: Clearly state the total amount due, with an itemized list if necessary to avoid confusion.

- Payment Terms: Specify payment deadlines, methods, and any late fees to set clear expectations.

How to Streamline the Process

- Use Software Tools: Leverage automated solutions that generate payment documents quickly, saving time and reducing human error.

- Customize for Specific Clients: Tailor each document to reflect the client’s unique needs and preferences, whether it’s offering discounts or adding special payment terms.

- Maintain Consistency: Keep the format consistent across all documents to establish professionalism and familiarity with clients.

By following these simple practices, creating polished and professional payment documents becomes a fast and efficient task, enabling businesses to focus on what matters most–growing their operations and building client relationships.

Creating Professional Invoices with Ease

For any business, delivering clear and well-structured payment documents is key to maintaining a professional image and ensuring prompt settlements. The process doesn’t have to be time-consuming or complicated. With the right tools and a few simple steps, anyone can craft documents that are not only functional but also visually appealing and in line with business branding.

Key Elements of a Well-Structured Payment Document

- Client Information: Always include the client’s name, contact details, and address for clear identification.

- Company Branding: Ensure your logo, business name, and contact information are easily visible to reinforce brand identity.

- Description of Services: Provide a clear breakdown of products or services, including quantities, prices, and a brief description of each item.

- Total Amount Due: Clearly state the total amount due, with an itemized list if necessary to avoid confusion.

- Payment Terms: Specify payment deadlines, methods, and any late fees to set clear expectations.

How to Streamline the Process

- Use Software Tools: Leverage automated solutions that generate payment documents quickly, saving time and reducing human error.

- Customize for Specific Clients: Tailor each document to reflect the client’s unique needs and preferences, whether it’s offering discounts or adding special payment terms.

- Maintain Consistency: Keep the format consistent across all documents to establish professionalism and familiarity with clients.

By following these simple practices, creating polished and professional payment documents becomes a fast and efficient task, enabling businesses to focus on what matters most–growing their operations and building client relationships.

Creating Professional Invoices with Ease

For any business, delivering clear and well-structured payment documents is key to maintaining a professional image and ensuring prompt settlements. The process doesn’t have to be time-consuming or complicated. With the right tools and a few simple steps, anyone can craft documents that are not only functional but also visually appealing and in line with business branding.

Key Elements of a Well-Structured Payment Document

- Client Information: Always include the client’s name, contact details, and address for clear identification.

- Company Branding: Ensure your logo, business name, and contact information are easily visible to reinforce brand identity.

- Description of Services: Provide a clear breakdown of products or services, including quantities, prices, and a brief description of each item.

- Total Amount Due: Clearly state the total amount due, with an itemized list if necessary to avoid confusion.

- Payment Terms: Specify payment deadlines, methods, and any late fees to set clear expectations.

How to Streamline the Process

- Use Software Tools: Leverage automated solutions that generate payment documents quickly, saving time and reducing human error.

- Customize for Specific Clients: Tailor each document to reflect the client’s unique needs and preferences, whether it’s offering discounts or adding special payment terms.

- Maintain Consistency: Keep the format consistent across all documents to establish professionalism and familiarity with clients.

By following these simple practices, creating polished and professional payment documents becomes a fast and efficient task, enabling businesses to focus on what matters most–growing their operations and building client relationships.

Creating Professional Invoices with Ease

For any business, delivering clear and well-structured payment documents is key to maintaining a professional image and ensuring prompt settlements. The process doesn’t have to be time-consuming or complicated. With the right tools and a few simple steps, anyone can craft documents that are not only functional but also visually appealing and in line with business branding.

Key Elements of a Well-Structured Payment Document

- Client Information: Always include the client’s name, contact details, and address for clear identification.

- Company Branding: Ensure your logo, business name, and contact information are easily visible to reinforce brand identity.

- Description of Services: Provide a clear breakdown of products or services, including quantities, prices, and a brief description of each item.

- Total Amount Due: Clearly state the total amount due, with an itemized list if necessary to avoid confusion.

- Payment Terms: Specify payment deadlines, methods, and any late fees to set clear expectations.

How to Streamline the Process

- Use Software Tools: Leverage automated solutions that generate payment documents quickly, saving time and reducing human error.

- Customize for Specific Clients: Tailor each document to reflect the client’s unique needs and preferences, whether it’s offering discounts or adding special payment terms.

- Maintain Consistency: Keep the format consistent across all documents to establish professionalism and familiarity with clients.

By following these simple practices, creating polished and professional payment documents becomes a fast and efficient task, enabling businesses to focus on what matters most–growing their operations and building client relationships.

Creating Professional Invoices with Ease

For any business, delivering clear and well-structured payment documents is key to maintaining a professional image and ensuring prompt settlements. The process doesn’t have to be time-consuming or complicated. With the right tools and a few simple steps, anyone can craft documents that are not only functional but also visually appealing and in line with business branding.

Key Elements of a Well-Structured Payment Document

- Client Information: Always include the client’s name, contact details, and address for clear identification.

- Company Branding: Ensure your logo, business name, and contact information are easily visible to reinforce brand identity.

- Description of Services: Provide a clear breakdown of products or services, including quantities, prices, and a brief description of each item.

- Total Amount Due: Clearly state the total amount due, with an itemized list if necessary to avoid confusion.

- Payment Terms: Specify payment deadlines, methods, and any late fees to set clear expectations.

How to Streamline the Process

- Use Software Tools: Leverage automated solutions that generate payment documents quickly, saving time and reducing human error.

- Customize for Specific Clients: Tailor each document to reflect the client’s unique needs and preferences, whether it’s offering discounts or adding special payment terms.

- Maintain Consistency: Keep the format consistent across all documents to establish professionalism and familiarity with clients.

By following these simple practices, creating polished and professional payment documents becomes a fast and efficient task, enabling businesses to focus on what matters most–growing their operations and building client relationships.

Creating Professional Invoices with Ease

For any business, delivering clear and well-structured payment documents is key to maintaining a professional image and ensuring prompt settlements. The process doesn’t have to be time-consuming or complicated. With the right tools and a few simple steps, anyone can craft documents that are not only functional but also visually appealing and in line with business branding.

Key Elements of a Well-Structured Payment Document

- Client Information: Always include the client’s name, contact details, and address for clear identification.

- Company Branding: Ensure your logo, business name, and contact information are easily visible to reinforce brand identity.

- Description of Services: Provide a clear breakdown of products or services, including quantities, prices, and a brief description of each item.

- Total Amount Due: Clearly state the total amount due, with an itemized list if necessary to avoid confusion.

- Payment Terms: Specify payment deadlines, methods, and any late fees to set clear expectations.

How to Streamline the Process

- Use Software Tools: Leverage automated solutions that generate payment documents quickly, saving time and reducing human error.

- Customize for Specific Clients: Tailor each document to reflect the client’s unique needs and preferences, whether it’s offering discounts or adding special payment terms.

- Maintain Consistency: Keep the format consistent across all documents to establish professionalism and familiarity with clients.

By following these simple practices, creating polished and professional payment documents becomes a fast and efficient task, enabling businesses to focus on what matters most–growing their operations and building client relationships.