Free Printable Invoice Template PDF for Easy Customization and Use

When managing a business or freelance work, one of the essential tasks is generating clear, accurate, and well-structured financial records. These records are vital for tracking payments, ensuring proper communication with clients, and maintaining a professional appearance. Having a ready-made solution to generate such documents can save significant time and effort, making the process smoother for both you and your clients.

There are various tools available today that allow users to quickly create structured documents to outline charges for services or goods. These documents can be customized to include necessary details such as company information, pricing, and payment terms. By using these resources, you can ensure consistency, reduce errors, and enhance the professionalism of your business.

Streamlining the process of creating financial documents helps you focus on what matters most–growing your business. With the right tools, generating these files becomes a straightforward task, providing a solid foundation for your billing cycle. Whether you’re a freelancer or a small business owner, the ability to produce accurate records in minutes can significantly improve your workflow.

Why Use a Printable Invoice Template PDF

Creating professional financial documents quickly and efficiently is crucial for any business or freelance operation. With the right resources, you can ensure that every billing statement you send out is clear, consistent, and well-organized. Using a pre-designed layout allows you to save time and eliminate the need for manual formatting each time you need to issue a record of services rendered or goods sold.

Standardization is one of the key benefits of using ready-made designs. By leveraging a pre-structured file, you ensure that every document looks uniform and follows a professional standard. This is especially important when dealing with multiple clients or customers, as it builds trust and improves the perception of your business.

Moreover, these files often come with customizable fields that allow you to easily insert specific details such as pricing, dates, and client information. This flexibility ensures that each document is tailored to the individual transaction while maintaining a consistent format. Efficiency is another significant advantage, as you can create and send documents in just a few steps, rather than starting from scratch every time.

Lastly, many of these resources are available in formats that are easy to print or share digitally. This makes it convenient for businesses of all sizes to provide their clients with quick access to financial records without the need for specialized software or complicated workflows.

Benefits of Printable Invoice Templates

Using pre-designed documents for billing offers numerous advantages that can greatly enhance the efficiency and professionalism of any business. These resources streamline the process, allowing you to quickly generate consistent, well-structured records for each transaction. Whether you are a freelancer or a small business owner, having an easy-to-use format ensures that your paperwork is handled efficiently and effectively.

Time-Saving and Convenience

One of the biggest advantages of these pre-built documents is the amount of time they save. Instead of starting from scratch each time you need to generate a bill, you can simply open an existing file and input the relevant details. This reduces the time spent formatting and ensures that all necessary information is included without having to worry about missing key elements.

Professional Appearance and Consistency

Another significant benefit is the consistent, professional look these files provide. With a standardized format, you create a polished image for your business that reflects attention to detail and reliability. Clients and customers will appreciate receiving clearly organized records that reflect the quality of your services or products.

Customization is also an important factor. These files often come with fields that can be easily adjusted to suit individual client needs, ensuring that each document is personalized while maintaining the same professional structure. Reliability in the presentation of financial details fosters trust, which is vital for long-term business relationships.

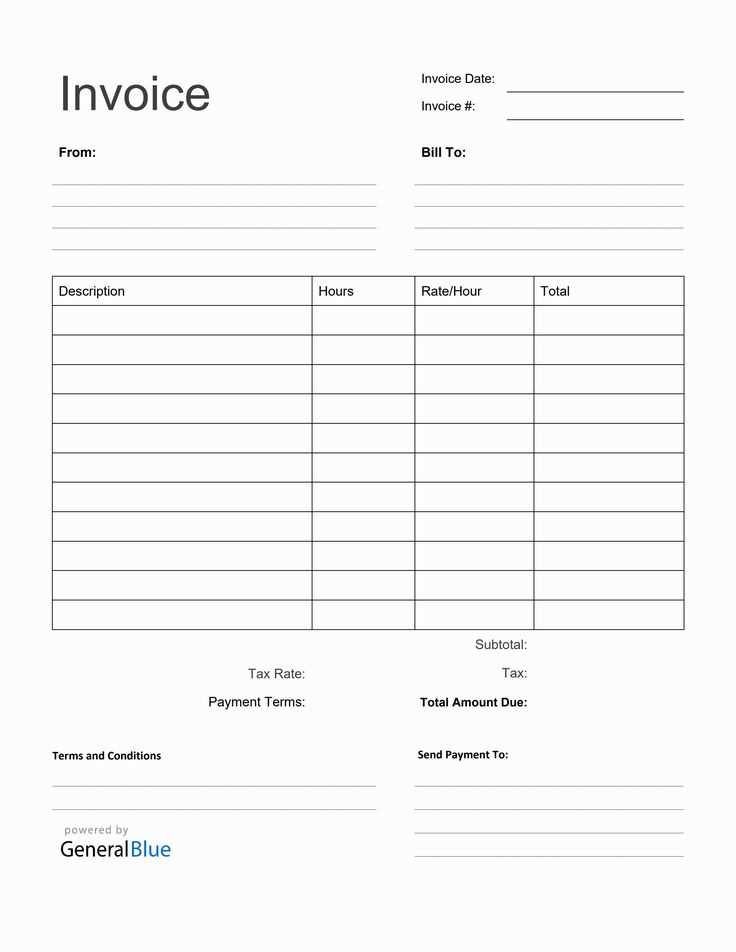

How to Customize Your Invoice Template

Customizing your billing documents is a key step in ensuring they align with your business needs and personal branding. By adjusting the layout and content, you can make each document specific to a particular client or service while maintaining a professional and consistent appearance. Personalization helps convey trustworthiness and attention to detail, which are essential for fostering strong client relationships.

Adjusting Basic Information

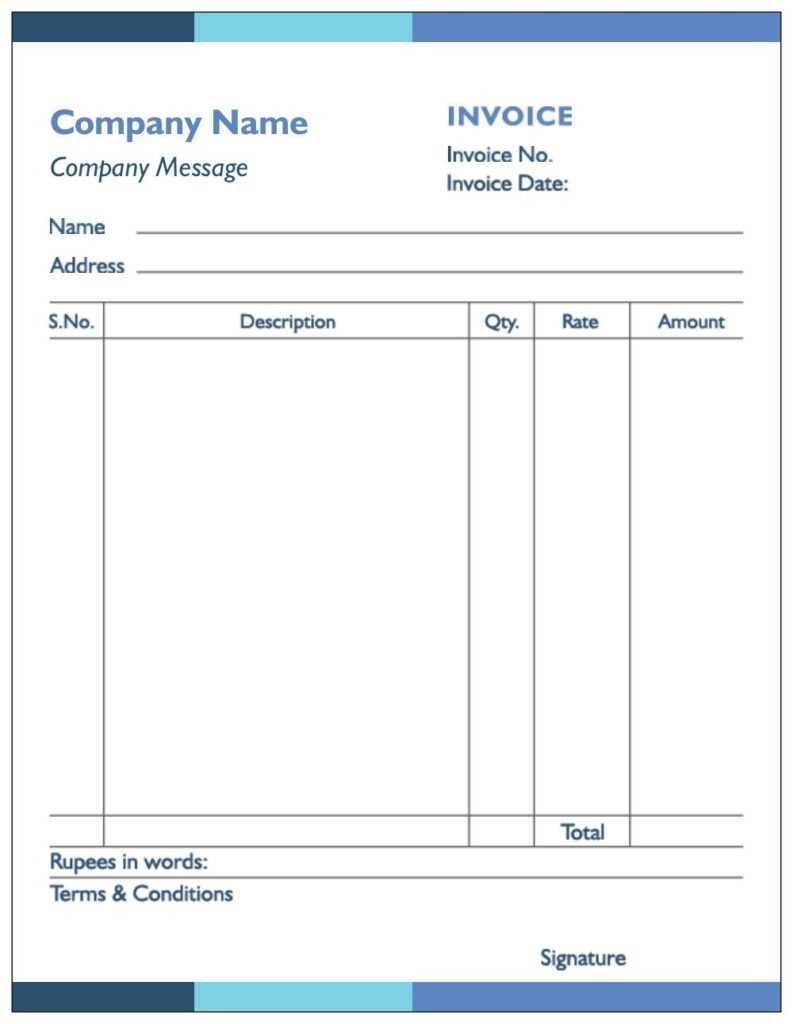

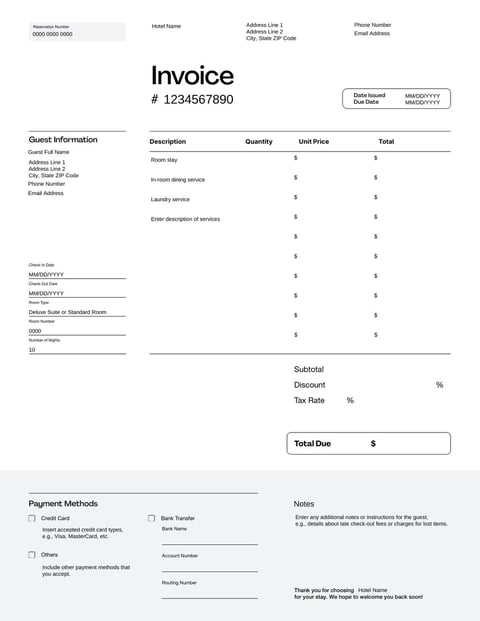

The first step in customizing your document is to update the basic information fields. This includes adding your company name, address, and contact details. You should also ensure that your client’s information is accurate, including their name, business details, and the agreed-upon terms. With the right adjustments, you can make the document clearly reflect the specifics of the transaction while providing the recipient with all necessary details.

Personalizing the Layout and Design

Next, you can modify the layout to suit your style or brand identity. Many of these files allow you to change fonts, colors, and logos, making it easy to align the document with your overall branding. You can also rearrange sections to prioritize certain details, such as payment terms, line item descriptions, or due dates. Consistency in design ensures that each document you send out reinforces your business image, while flexibility allows you to tailor each record for different clients or services.

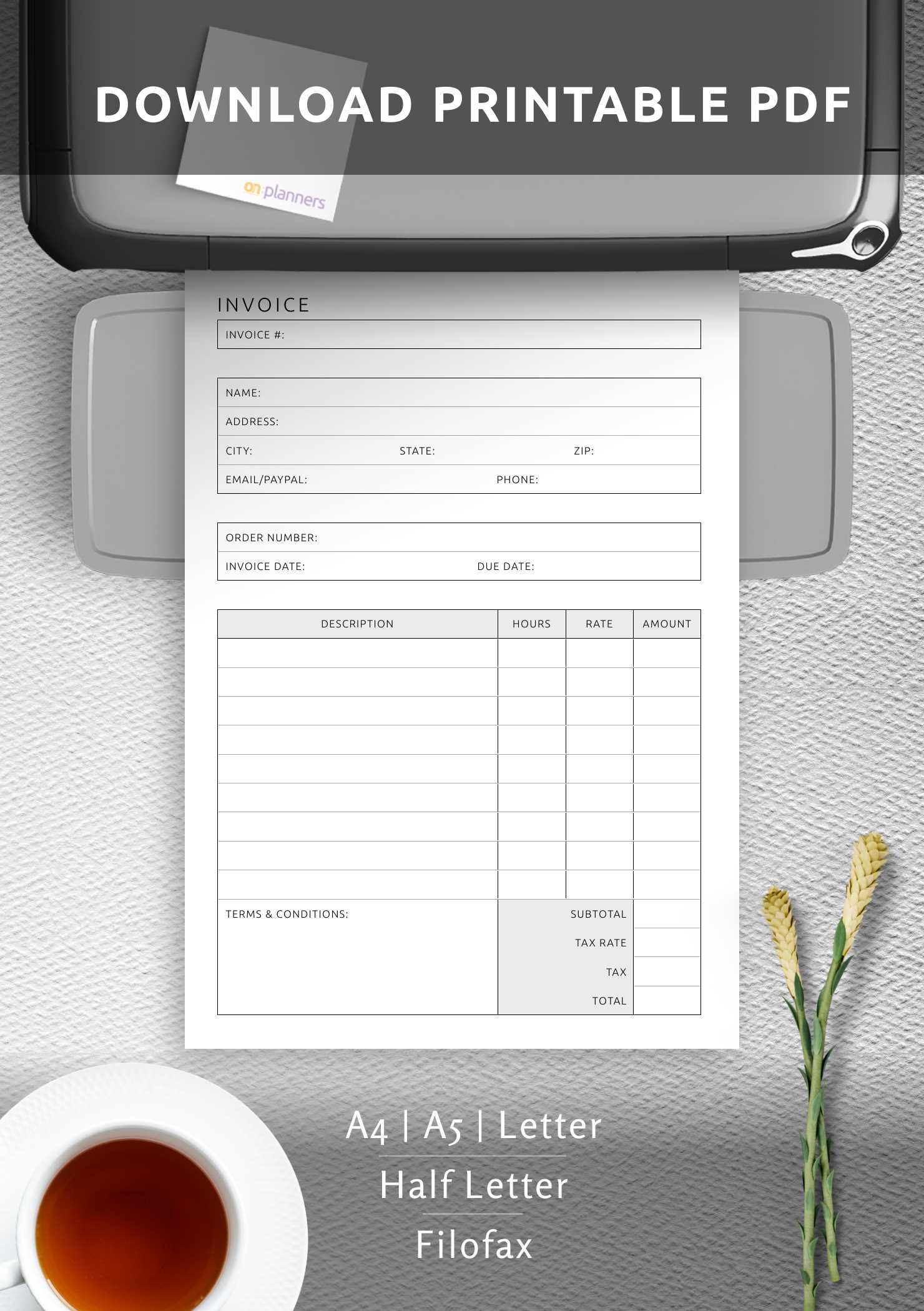

Choosing the Right PDF Invoice Format

Selecting the appropriate file format for your billing documents is crucial for ensuring smooth transactions and easy accessibility for your clients. Different formats offer various benefits, and choosing the right one can streamline your workflow and improve your professional image. The ideal format should be compatible across multiple devices, secure for sharing, and easy to modify or print when necessary.

When choosing a file type for your financial records, consider the following factors:

- Compatibility: Ensure the format is widely accepted and can be opened by most devices or software without any issues.

- Security: A secure format prevents unauthorized changes and ensures that your sensitive information is protected.

- Ease of Editing: Choose a format that allows for simple updates, especially if you need to make changes frequently.

- Printing Readiness: Ensure the format retains its layout and design when printed or converted to paper.

For many businesses, the most popular file type is the PDF. It’s easy to share, preserves the document’s formatting, and is widely supported across platforms. However, depending on your business needs, you might also consider other formats, such as DOCX or Excel files, if you require more flexibility in editing or integrating with accounting systems.

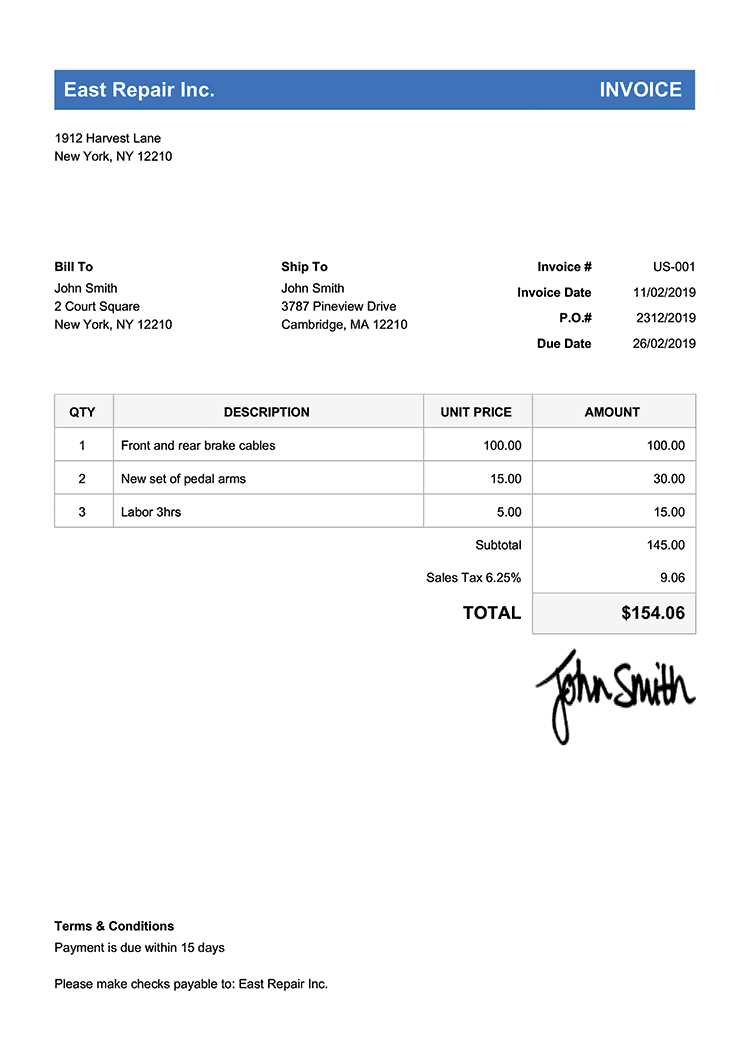

Step-by-Step Guide to Creating Invoices

Creating clear and accurate billing documents is an essential task for any business. A well-structured document not only ensures that your clients know exactly what they’re being charged for, but also helps maintain a professional image. Follow these simple steps to easily generate a detailed and organized statement for each transaction.

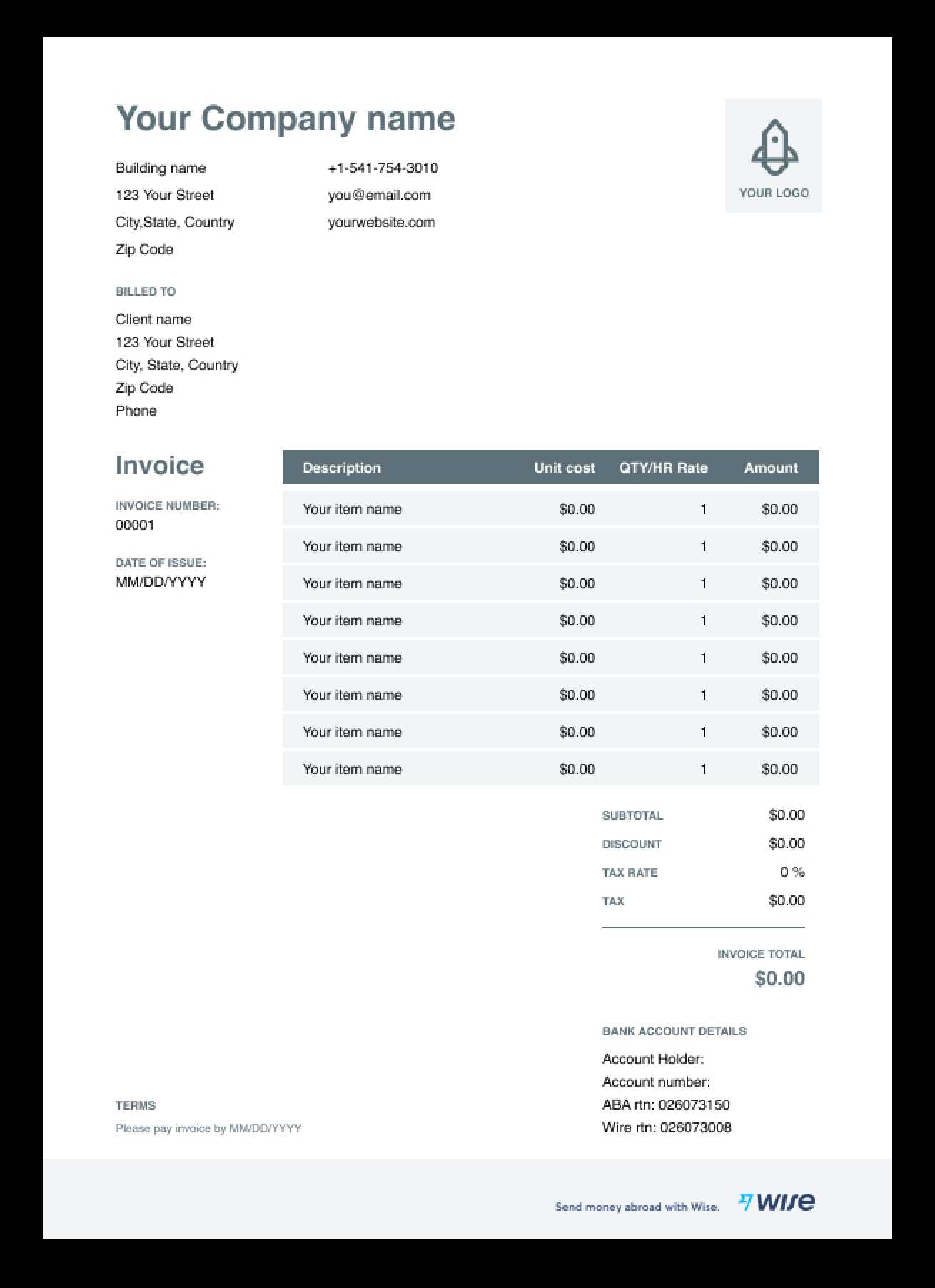

Step 1: Add Business and Client Information

The first step is to include the necessary details about both your business and your client. This helps establish a clear connection between the transaction and the parties involved.

- Your Business Name and Contact Information: Include your company name, address, phone number, and email.

- Client’s Details: Add your client’s name, address, and other relevant information for easy identification.

- Transaction Date: Clearly mark the date when the services or products were provided.

Step 2: List the Items or Services Provided

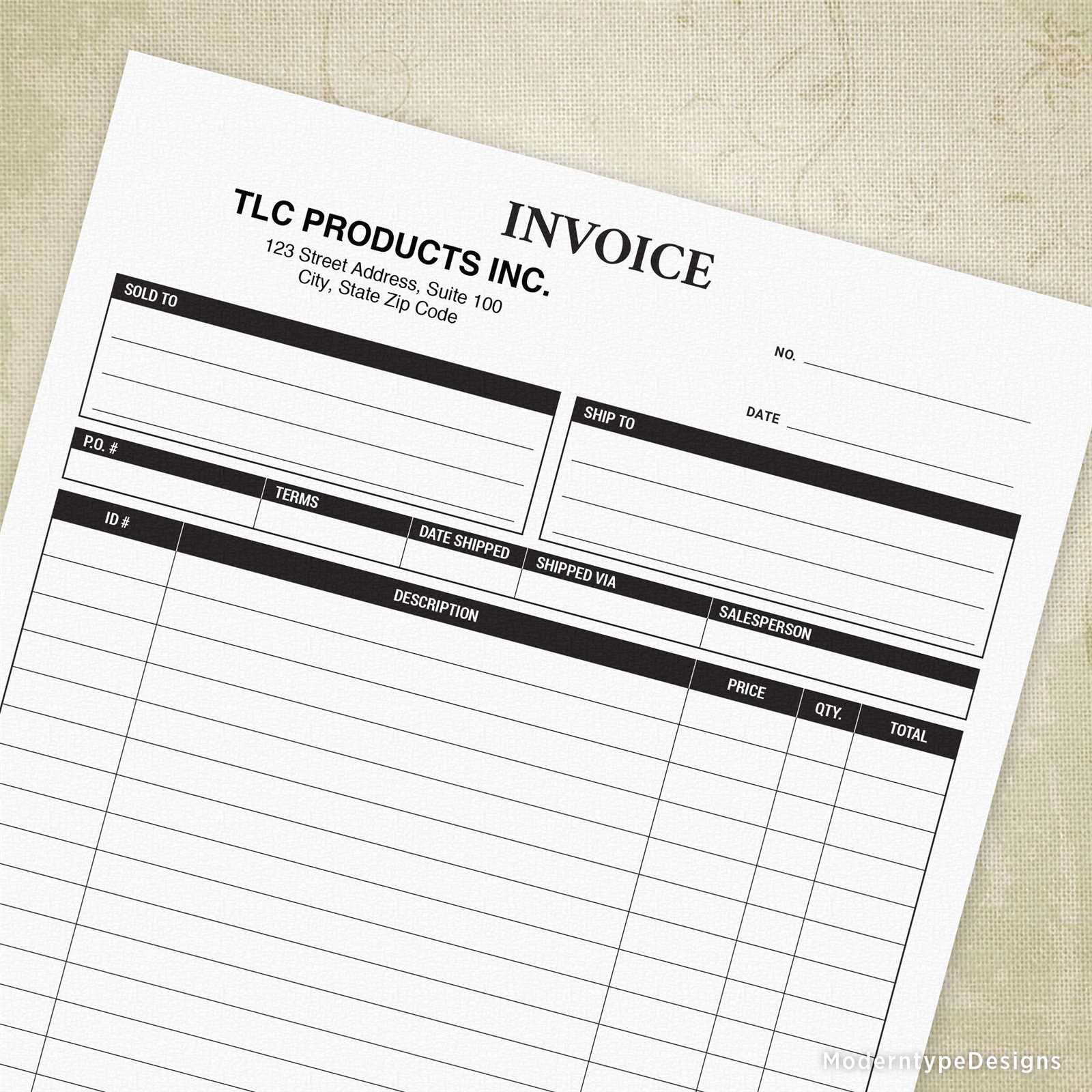

Next, list the items or services that were provided, including a brief description, the quantity, and the rate for each. This ensures that the client has a full understanding of what they’re being charged for.

- Description: Provide a concise but clear description of each service or product.

- Quantity: Specify the amount of each item or service delivered.

- Price: Include the cost for each item or service, along with any taxes or discounts, if applicable.

Step 3: Calculate the Total Amount

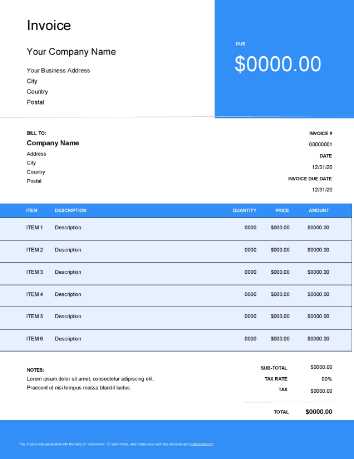

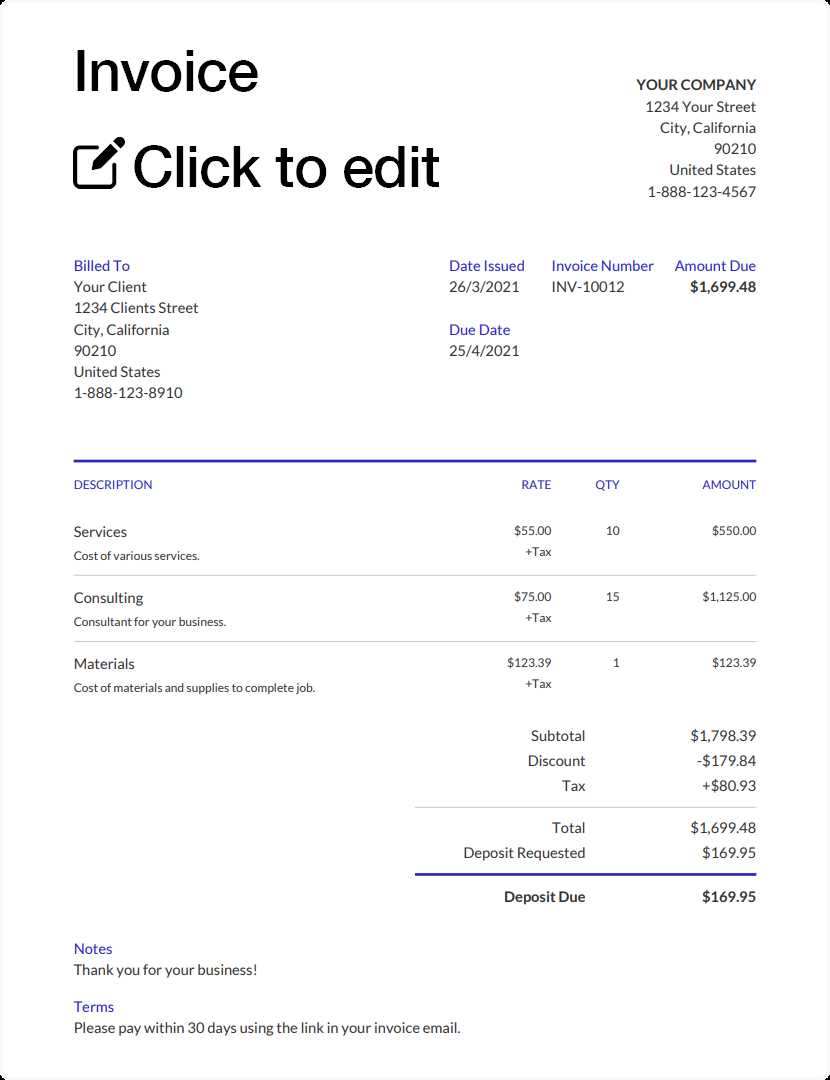

Once all items and services are listed, sum up the charges to arrive at the total amount due. Ensure that any applicable taxes, discounts, or additional fees are clearly itemized and added to the final sum.

- Total Due: Add up all individual charges to determine the total payment required.

- Payment Terms: Specify the payment due date and any late fees if applicable.

Step 4: Finalize and Send the Document

Finally, review the document to ensure all information is correct. Once verified, save the file and send it to your client via email or any other preferred method. Make sure that the document is easily accessible and formatted for easy viewing or printing.

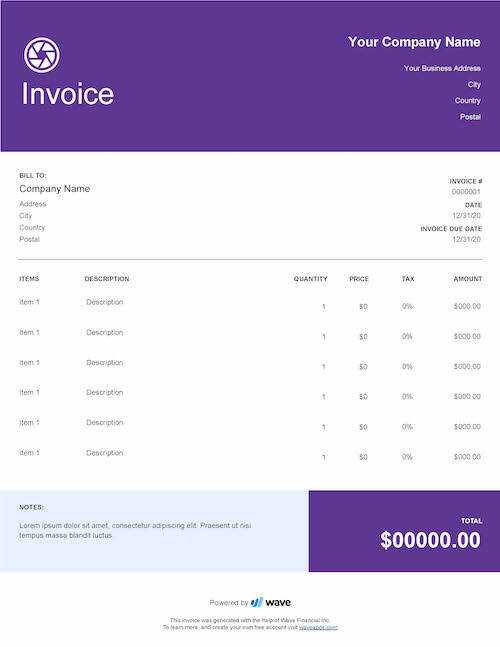

Top Tools for Generating PDF Invoices

Generating professional billing documents doesn’t have to be a time-consuming task. With the right tools, you can create detailed and polished records in just a few clicks. These tools offer easy-to-use interfaces, customizable features, and the ability to save your documents in a secure, universally accepted format. Here are some of the best options available for businesses of all sizes.

- FreshBooks: A popular option for small businesses and freelancers, FreshBooks offers an intuitive platform to create, customize, and send bills. It provides cloud-based access and can automatically calculate taxes, discounts, and late fees.

- Wave: Wave is a free accounting software with the ability to generate professional-looking documents. It allows for easy customization and integration with other accounting features like payments and reporting.

- Zoho Invoice: Zoho Invoice is known for its robust set of features, including the ability to create detailed records, track payments, and manage clients. It also offers templates and allows for easy customization to match your brand.

- QuickBooks: QuickBooks is widely known for its comprehensive accounting services, including the ability to generate precise billing records. It offers an easy-to-use platform with a wide range of customization options for formatting and layout.

- PayPal Invoicing: For users already utilizing PayPal, this tool allows you to create and send detailed billing records directly through the platform. It’s ideal for those who need quick, simple billing with integrated payment solutions.

Each of these tools offers a range of features designed to streamline the process of creating professional records. Depending on your needs, you can choose the one that best fits your business model and volume of transactions.

Common Mistakes in Invoice Creation

Creating billing documents might seem straightforward, but even the smallest mistakes can lead to confusion, delayed payments, or even strained relationships with clients. It’s crucial to pay attention to every detail when preparing these documents. Below are some common errors that many businesses make when generating financial records, along with tips on how to avoid them.

1. Missing or Incorrect Client Information

One of the most common mistakes is failing to include accurate client details. This can lead to confusion and cause delays in payment processing. Always ensure that the client’s name, contact information, and address are correct. Additionally, double-check that the correct recipient is listed if your client has multiple departments or contacts.

- Double-check for typos: Incorrect spelling or missing details can cause misunderstandings.

- Use consistent formatting: Ensure that names, addresses, and contact numbers follow the same format across all records.

2. Not Including Payment Terms

Another common error is the omission of clear payment terms. Without specifying the payment deadline, late fees, or accepted methods of payment, clients may not know when or how to pay. This can lead to confusion and delays. Always outline payment expectations clearly to avoid this issue.

- Specify due dates: Clearly state the date when the payment is due.

- Late payment fees: If applicable, be sure to include any penalties for overdue payments.

- Accepted payment methods: Clearly list the payment methods your business accepts, such as bank transfer, credit card, or online payment platforms.

3. Failing to Include Detailed Descriptions

Clients need to understand exactly what they are being charged for. Failing to provide detailed descriptions of the products or services provided can lead to disputes or delayed payments. Always make sure each item is well described and any applicable quantities or rates are accurate.

- Be specific: Provide clear and concise descriptions for each item or service.

- Include quantities and rates: Specify the number of items or hours worked, along with the unit cost.

By avoiding these common mistakes, you can ensure that your documents are professional, clear, and lead to timely payments.

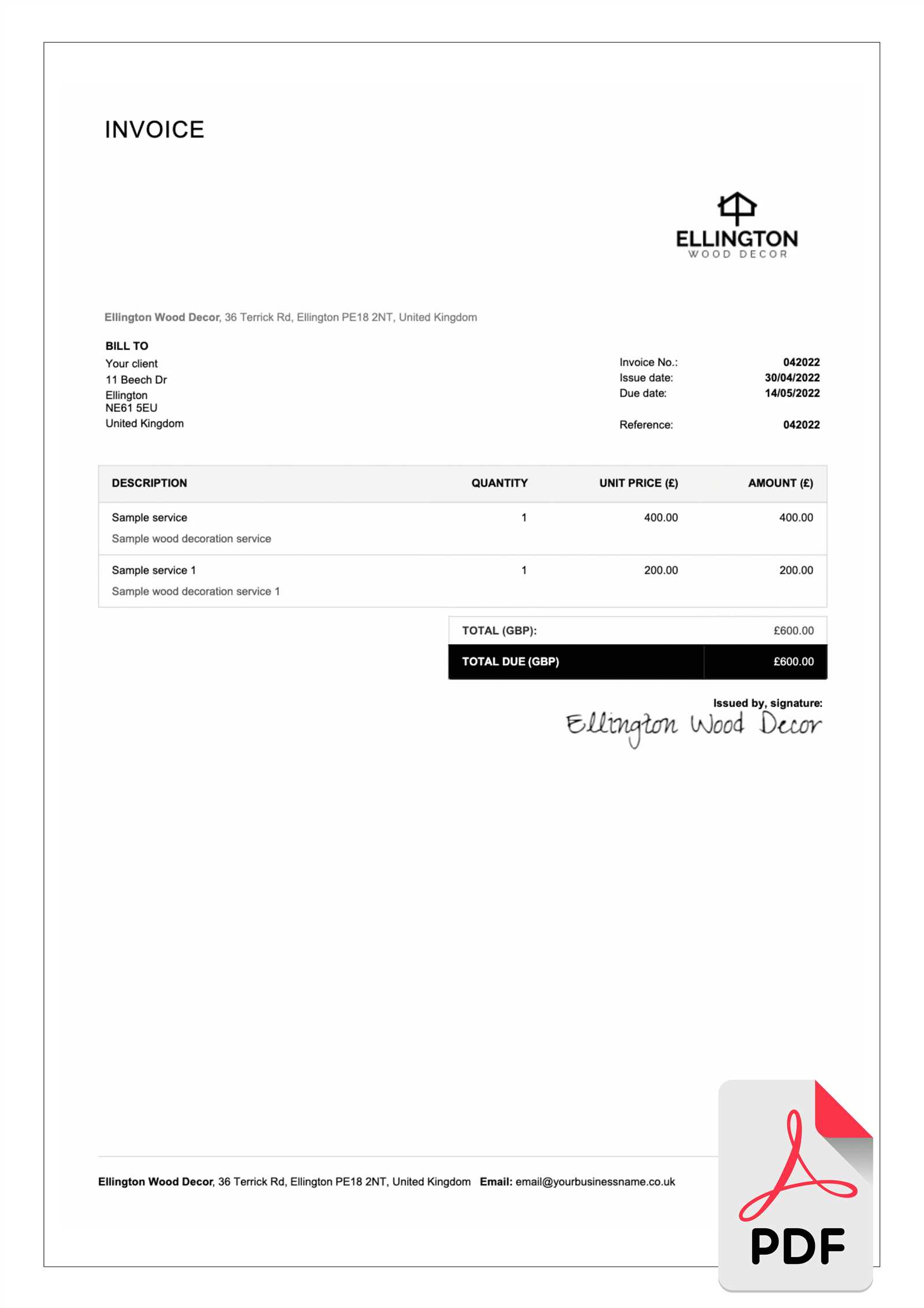

How to Add Your Branding to Invoices

Incorporating your company’s branding into your financial documents is a great way to create a cohesive and professional image. By adding elements such as your logo, color scheme, and specific fonts, you ensure that every document reflects your brand’s identity. This attention to detail can help strengthen your reputation and increase recognition among clients.

Here are some key steps to effectively include your branding in your financial records:

1. Add Your Logo

Your logo is the most recognizable part of your brand and should be placed at the top of your document. This immediately signals to the recipient that the document is from your business. Make sure the logo is high-quality and properly aligned with the overall design of the page.

- Positioning: Place your logo at the top left or center for maximum visibility.

- Size: Ensure the logo is large enough to be visible, but not so large that it overwhelms the content.

2. Use Consistent Colors and Fonts

Incorporating your brand’s color scheme and fonts into your financial documents helps maintain a uniform appearance across all business materials. This includes using your brand’s primary colors for headings, borders, or accents, as well as choosing fonts that align with your overall style.

- Color Scheme: Use your business’s primary and secondary colors for text and design elements like headings, lines, or backgrounds.

- Fonts: Choose fonts that reflect your brand identity while ensuring readability. Stick to two or three complementary fonts to keep the design clean and professional.

3. Customize the Layout

Adjust the layout to match your branding by creating a clean and consistent design. Whether you prefer a minimalist look or a more detailed design, maintaining the same structure for every document ensures clients instantly recognize your business’s style.

- Headers and Footers: Include your contact information, business hours, or social media links in the header or footer to further promote your brand.

- Consistency: Keep the design consistent across all documents to build brand recognition. This includes spacing, margins, and alignment.

By incorporating these branding elements, your financial records not only look more professional but also reinforce your business identity with every transaction. This attention to detail helps build trust and strengthens your relationship with clients.

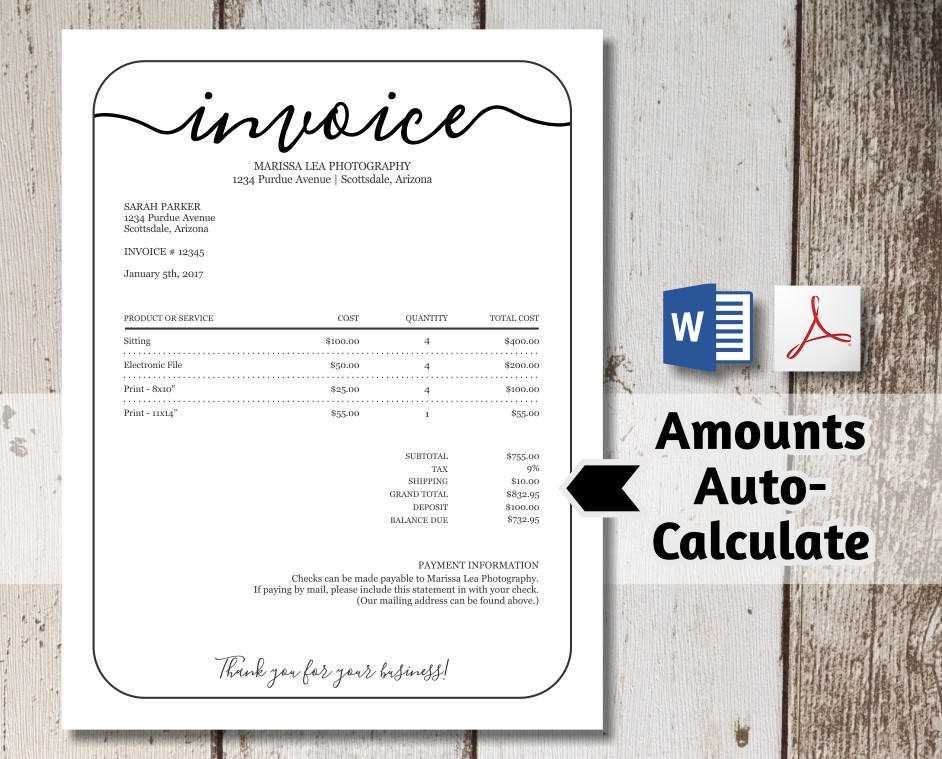

Free vs Paid Invoice Templates

When creating professional billing documents, one of the first decisions you’ll face is whether to use free or paid resources. Both options have their advantages and limitations, depending on your business needs and the level of customization required. Understanding the key differences between the two can help you make an informed choice that aligns with your goals.

Free Resources

Free templates are a great option for businesses just starting out or those with basic needs. These resources are widely available, easy to access, and often come in a variety of formats. While they can be an excellent solution for simple transactions, there are some trade-offs to consider.

- Cost: The most obvious advantage is that free templates don’t require any financial investment.

- Basic Features: Free designs often come with standard fields and limited customization options.

- Limited Support: With free options, you might not have access to customer service or troubleshooting assistance.

Paid Resources

Paid resources, on the other hand, offer more advanced features and greater flexibility. These solutions typically provide enhanced customization, premium designs, and sometimes even integrated tools to help automate or streamline the billing process.

- Customization: Paid options often allow for deeper customization, making it easier to align the documents with your branding and specific business needs.

- Advanced Features: Some paid tools include automatic tax calculations, payment reminders, and other automation features to save time.

- Customer Support: With paid services, you generally get access to customer support for assistance with setup or troubleshooting.

Choosing between free and paid resources depends on your budget, business size, and specific needs. If you’re just starting out and need basic functionality, free options may be sufficient. However, for businesses that require more advanced features and customization, investing in a paid resource can offer greater value in the long run.

Design Tips for Professional Invoices

Creating visually appealing and easy-to-read financial documents is essential for maintaining a professional image. The design of your billing statements plays a crucial role in how your business is perceived and can even impact the likelihood of timely payments. A well-structured and polished document not only conveys trustworthiness but also makes the entire transaction process smoother for both parties. Here are some key design tips to ensure your financial records stand out for all the right reasons.

1. Keep It Clean and Simple

A cluttered or overly complicated design can make your document difficult to read and could result in confusion. Focus on simplicity and clarity. Use plenty of white space to separate different sections and avoid cramming too much information onto a single page.

- Limit colors: Stick to two or three colors that align with your brand, ensuring the document is visually cohesive.

- Readable fonts: Choose legible fonts, such as sans-serif styles, and avoid using too many different font types or sizes.

- Clear section headings: Use bold or larger fonts for headings to create a visual hierarchy and guide the reader’s eye through the document.

2. Consistent Branding

Your financial records should reflect your business’s identity. Consistent branding helps reinforce your company’s image and builds trust with your clients. Incorporating your logo, colors, and fonts into the design creates a cohesive look across all documents.

- Logo placement: Place your logo at the top of the document for easy recognition, typically on the left or center.

- Contact information: Ensure your business’s contact details are visible, ideally in the header or footer, to make it easy for clients to reach you.

- Color scheme: Use your brand’s color palette to highlight key areas, such as headings or borders, while maintaining a professional tone.

By following these design tips, you can create professional, clear, and well-organized billing records that not only look great but also enhance the overall client experience.

How to Automate Invoice Filling

Automating the process of filling out financial documents can save time, reduce errors, and improve overall efficiency. By integrating automation tools into your workflow, you can ensure that important fields such as client information, payment terms, and itemized details are quickly and accurately filled without manual input. This streamlining of the process helps eliminate repetitive tasks and ensures consistency across all your records.

1. Use Accounting Software for Automation

Accounting software is one of the most effective tools for automating document filling. Many modern solutions offer features like client database management, automatic calculations, and customizable fields. Once set up, the software can pull client and transaction data from your system and automatically populate the necessary fields in your billing documents.

- Integration: Many accounting programs can be integrated with your existing systems, pulling data from CRM platforms or online payment systems.

- Automatic Updates: These tools ensure that any changes in client or product information are updated across all documents automatically.

- Recurring Billing: For subscription-based services, you can set up automated recurring records that fill in billing details based on predefined schedules.

2. Leverage Online Platforms with Automation Features

In addition to traditional accounting software, many online platforms provide pre-designed forms and templates that can automatically fill out critical information. These platforms often allow you to set up recurring billing, saving time on creating documents for repeat clients or transactions.

- Client Profiles: Store your clients’ information in their profile, so you don’t need to input details manually for each transaction.

- Custom Fields: Set up specific fields that will be automatically populated based on your preferences, such as discount rates or tax calculations.

- Payment Reminders: Many platforms also send reminders to clients, making the payment process more efficient.

By automating the process of filling out your financial documents, you can ensure faster, more accurate billing and spend less time on administrative tasks, allowing you to focus more on growing your business.

Legal Aspects of Invoicing with Templates

When creating billing documents, it’s essential to ensure that they comply with legal requirements. Using pre-designed forms and automated systems can streamline the process, but they must still adhere to specific rules to avoid legal complications. Properly structured financial records are not only important for maintaining professionalism but also for meeting local tax laws, protecting both the business and the client.

1. Required Information on Billing Documents

Every document must include certain essential details to be legally valid. These elements help ensure transparency and protect both parties involved in the transaction. Failure to include the necessary information could lead to disputes, penalties, or delays in payment processing.

- Business Identification: Include the legal name, address, and tax identification number of your business.

- Client Details: Ensure the recipient’s name and contact information are accurate and up-to-date.

- Clear Breakdown of Services or Products: Provide detailed descriptions of the goods or services provided, including quantities and agreed-upon rates.

- Dates: Include the issue date and the due date for payment. The due date should be clear to avoid misunderstandings.

2. Tax Compliance and Regulations

Different jurisdictions have varying regulations regarding taxes, such as sales tax, VAT, or GST. These taxes must be properly calculated and clearly listed on your documents. Failure to comply with these rules can lead to fines or legal consequences. It’s important to ensure that the software or tools you’re using are set up to account for your specific tax obligations.

- Tax Rates: Ensure you apply the correct tax rate based on your location or the client’s location.

- Tax Breakdown: Clearly show the tax amount separately from the subtotal to avoid confusion.

- Tax ID Number: For some regions, it’s mandatory to include your tax identification number for proper reporting.

3. Retention and Record-Keeping

In many countries, businesses are required to keep accurate records of all transactions for a certain period. These records are often necessary for tax reporting and audits. Using standardized forms makes it easier to maintain a consistent and organized record of all transactions.

- Legal Retention Period: Understand the retention period required by law in your jurisdiction. Typically, this ranges from 5 to 10 years.

- Digital Copies: Ensure that digital versions of your documents are stored securely, in compliance with any data protection regulations.

- Audit Preparedness: A well-maintained document trail helps ensure that your business is prepared for any potential audits.

Incorporating these legal considerations into your billing processes ensures that your financial records are both compliant with the law and protected from potential legal issues. It’s crucial to review your documents regularly and stay informed about changes in local regulations to avoid unnecessary complications.

How to Save Time with Invoice Templates

Streamlining your billing process can significantly reduce the amount of time spent on administrative tasks. By using pre-designed formats or automated systems, you can quickly generate accurate and professional financial documents without the need for manual entry. This allows you to focus more on your core business operations while ensuring that you never miss a detail in your transactions.

1. Reusable and Customizable Formats

One of the biggest advantages of using pre-made forms is the ability to customize them for each transaction while still maintaining consistency. Instead of starting from scratch every time, you can fill in specific client details, product descriptions, and payment terms, all of which are already set up for you. This saves time and reduces the likelihood of errors.

- Quick Setup: Pre-designed fields allow you to input essential information in just a few clicks.

- Save Frequently Used Data: Store client information, payment details, and services to avoid repetitive entry for returning clients.

- Personalize Easily: You can quickly adjust the layout, add or remove fields, and apply your brand’s identity.

2. Automation for Recurring Tasks

If your business involves recurring transactions or subscription-based services, automating document creation can save you even more time. Automation tools can fill in billing information, including dates, amounts, and client data, based on pre-established criteria. This eliminates the need to manually update each record for repeated clients or orders.

- Recurring Billing: Set up automatic generation of documents for clients with regular billing cycles.

- Automatic Calculations: Enable automatic tax and total calculations to minimize manual math errors and speed up the process.

- Scheduled Reminders: Automatically send reminders or follow-up notifications to clients about upcoming payments or overdue amounts.

By utilizing these time-saving tools and processes, you can streamline your entire billing procedure, allowing you to focus on growing your business while maintaining accuracy and professionalism in all of your financial dealings.

Creating Recurring Invoices in PDF

Setting up recurring billing can greatly streamline the process of managing regular payments, whether you are running a subscription-based service or offering ongoing products. By creating automated records that are generated at fixed intervals, you ensure that both you and your clients have a clear understanding of when payments are due, reducing the risk of missed transactions and improving cash flow consistency. These automated documents can be created once and then sent out repeatedly, saving you time and effort.

1. Setting Up Recurring Billing

To set up recurring charges, you’ll first need to establish the details of the transaction, such as the frequency of payments, amounts, and payment terms. Once the template is created, you can easily modify it for future use, automating the process for upcoming cycles.

- Frequency: Decide how often the billing will occur, such as weekly, monthly, quarterly, or annually.

- Payment Amount: Determine if the payment will remain the same each time or vary depending on the service/product provided.

- Due Date: Specify the exact day of the month or week when the payment will be due.

2. Automating the Process

Once you’ve configured the initial document, using automated tools will allow you to generate recurring records with minimal effort. Many invoicing systems provide an option to create and schedule recurring transactions, ensuring that all the necessary fields are filled automatically each time.

| Feature | Benefit |

|---|---|

| Automation Tools | Set up a one-time entry that automatically populates the document on the scheduled date. |

| Recurring Cycles | Customize the frequency to match the client’s subscription or payment schedule. |

| Customizable Fields | Adjust the document as needed without redoing the entire process for every cycle. |

By automating the creation of recurring documents, you reduce the manual work involved in managing multiple clients or ongoing services, ensuring consistency and efficiency. Automation not only improves your workflow but also makes it easier for your clients to receive their billing on time, fostering trust and satisfaction.

How to Protect Your Invoice PDF Files

Ensuring the security of your financial documents is crucial to safeguarding sensitive information and protecting both your business and your clients. These documents often contain personal, financial, and payment details that could be targeted by malicious actors. By implementing proper protective measures, you can prevent unauthorized access, tampering, and fraud, keeping your data safe from potential threats.

1. Password Protection

One of the easiest and most effective ways to secure your documents is by adding password protection. This ensures that only authorized individuals can open and view your financial records. Most document management tools and software provide the option to set a password when saving or sharing files.

- Strong Passwords: Use complex passwords with a combination of letters, numbers, and special characters to reduce the risk of unauthorized access.

- Password Management: Store your passwords securely using a password manager to prevent forgetting or exposing them.

- Encryption: Encrypt your document before sharing it to enhance security and prevent interception during transmission.

2. Watermarking Documents

Another useful measure to protect your financial documents is watermarking. Adding visible or invisible watermarks can deter unauthorized use or distribution of your records. This tactic serves as a deterrent and also helps trace the source of any unauthorized copies if they are circulated without permission.

- Visible Watermarks: Add your company’s name or logo as a watermark to make it clear that the document is copyrighted and belongs to your business.

- Invisible Watermarks: Some tools allow you to add hidden watermarks that are not visible to the naked eye but can be traced if necessary.

- Prevention of Editing: Disable the ability to modify the document to ensure the integrity of the information remains intact.

By implementing these security measures, you can significantly reduce the risk of unauthorized access or tampering with your important financial records. Protecting your data not only safeguards your business but also ensures that your clients feel secure in their transactions with you.

How to Share Invoices Securely

Sharing financial records securely is essential for protecting sensitive information and maintaining confidentiality. Whether you are sending billing documents to clients or vendors, using the right channels and taking appropriate precautions can help prevent unauthorized access or tampering. Ensuring the security of these documents builds trust with your clients and ensures compliance with privacy regulations.

1. Use Encrypted Communication Channels

When transmitting sensitive billing information, always use encrypted channels to protect the data during transit. This ensures that only the intended recipient can access the documents and prevents interception by third parties.

- Email Encryption: Use secure email services that provide encryption options or employ tools like PGP (Pretty Good Privacy) to encrypt email content and attachments.

- Secure File Sharing Services: Utilize cloud storage services with strong encryption protocols, such as Google Drive or Dropbox, that offer password protection and secure file links.

- Direct Client Portals: Consider using a dedicated client portal or invoicing software with secure login systems to allow clients to access their records without email transmissions.

2. Protect Files with Passwords

Password-protecting your financial documents before sharing them adds an extra layer of security. This way, only the recipient with the correct password can open and view the content, reducing the risk of unauthorized access.

- Set Strong Passwords: Use long, complex passwords that are difficult to guess. Avoid using easily identifiable information such as names or dates.

- Share Passwords Securely: Never send passwords through the same communication channel as the document. Instead, share passwords over a phone call, via text, or through secure messaging apps.

- Password Expiration: Set expiration dates for the passwords, especially for documents with sensitive or time-sensitive information, to limit exposure.

By taking these precautions, you can ensure that your financial documents are shared securely, protecting both your business and your clients from potential risks. Secure sharing not only safeguards the privacy of all parties involved but also enhances the credibility and professionalism of your business.