Free Printable Independent Contractor Invoice Template

For freelancers and small business owners, having a clear and professional way to request payment is essential. A well-designed billing document ensures transparency and makes it easier to track payments. It not only serves as a formal request for compensation but also strengthens your relationship with clients by presenting a polished and organized image.

In this guide, we’ll explore the key elements of an effective billing form, how to customize it to fit your needs, and why using a pre-made design can save you time and effort. With the right approach, you can streamline your payment process and maintain a high standard of professionalism in every transaction.

Whether you’re just starting out or have years of experience, mastering the art of creating accurate and easy-to-understand payment requests will help ensure you get paid on time and without confusion. Let’s dive into how you can create these documents that are both functional and aesthetically pleasing.

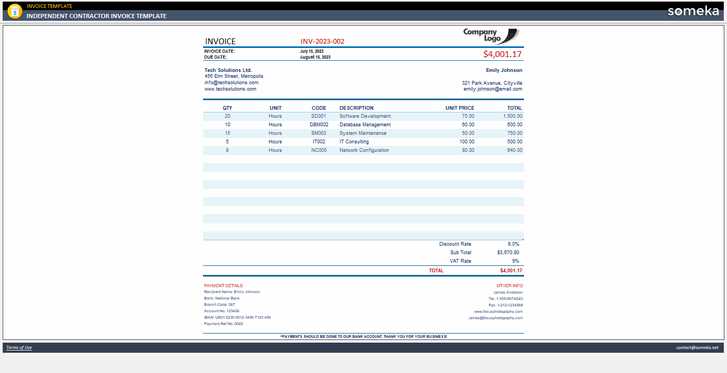

Printable Independent Contractor Invoice Template

When working with clients on a freelance basis, it’s important to have a clear and professional way to request payment. A well-structured billing document ensures both parties understand the terms of the transaction and provides a record for future reference. By using a ready-made format, you can streamline your payment process, save time, and present a polished image to your clients.

A typical billing document for freelancers includes several important components that help maintain clarity and avoid confusion. Key sections include the description of services, payment terms, and any additional charges such as taxes. These documents are essential for organizing financial transactions and providing an official record of work completed.

- Header: Your business name, contact information, and a unique reference number for tracking purposes.

- Client Information: The client’s name, contact details, and billing address.

- Work Description: A detailed list of services or products provided, along with the agreed rates.

- Payment Terms: Clear instructions on when payment is due and acceptable payment methods.

- Taxes and Additional Fees: If applicable, include any relevant taxes or extra costs that apply to the transaction.

- Total Amount: The final amount owed, including any additional charges.

- Payment Instructions: Details on how to make a payment, including bank account information or payment platforms.

By utilizing a standardized format, you can ensure that your billing documents are consistent and easy for clients to understand. Many professionals choose to download pre-designed forms to save time on formatting and focus more on the work itself. These forms can be easily customized with your specific details and adjusted to match your business needs.

Maintaining accuracy and professionalism in your billing process reflects positively on your business and helps to avoid misunderstandings with clients. A well-organized payment request can lead to quicker payments and more efficient project management.

Why Use an Independent Contractor Invoice

Having a clear and professional method to request payment is essential for any freelancer or small business owner. A well-designed billing document ensures that both parties are on the same page regarding the services provided, payment terms, and deadlines. It is a formal way to communicate financial expectations and create a transparent record of transactions.

Here are several reasons why using a structured payment request is important:

- Clarity and Transparency: A detailed document eliminates confusion by outlining what services were provided and the agreed-upon price.

- Professionalism: Using a formal document demonstrates professionalism and helps establish trust with your clients.

- Legal Protection: A well-documented record can serve as evidence in case of any disputes or misunderstandings about payment terms.

- Tracking and Organization: It helps you keep track of payments, outstanding balances, and due dates, making your financial management easier.

- Timely Payments: Clear instructions and deadlines on the document can encourage clients to pay on time.

- Tax and Recordkeeping: Properly issued documents are useful for tax purposes and maintaining organized financial records.

By using a consistent format, you ensure that all important details are included, making it easier for both you and your client to track the work done and payments owed. This practice not only saves time but also promotes a professional relationship that can lead to long-term collaborations.

How to Create a Professional Invoice

Creating a professional payment request document is essential for freelancers and small business owners. It not only ensures that your clients understand the terms of payment but also establishes your credibility and professionalism. A well-structured form reflects positively on your business and can help streamline the payment process.

To create an effective billing document, make sure to include the following key elements:

- Your Contact Information: Include your name or business name, address, phone number, and email to make it easy for the client to reach you.

- Client’s Contact Information: Clearly list your client’s name, company name (if applicable), and contact details.

- Unique Invoice Number: Assign a unique identifier to each billing request to make tracking and referencing easier for both parties.

- Date of Issue: Include the date the document was issued to establish when the payment request was made.

- List of Services Provided: Clearly outline the services or products delivered, including a detailed description and the agreed-upon rate for each.

- Amount Due: Clearly state the total amount owed, breaking down individual charges if necessary.

- Payment Terms: Specify when payment is due and acceptable payment methods, such as bank transfer, credit card, or other platforms.

- Additional Charges: If applicable, include any extra fees like taxes, late fees, or additional costs incurred during the project.

- Payment Instructions: Provide clear instructions on how the client can make the payment, including account details or links to payment platforms.

Once you’ve included all the necessary details, double-check the document for accuracy. It’s important that everything is clear and easy to understand. A professional document should have a clean, organized layout that avoids clutter and presents the information in a straightforward manner.

Finally, save the document in a widely accessible format, such as PDF, so it can easily be shared and viewed by your client. A professional-looking payment request not only enhances your business image but also helps ensure that payments are made promptly and without confusion.

Key Elements of a Contractor Invoice

Creating a clear and accurate billing document is essential for both the freelancer and the client. A well-structured document ensures that all relevant information is included and prevents misunderstandings. By including the right elements, you create a transparent and professional record of the services rendered and the amount due.

Here are the key components to include in your billing document:

| Element | Description |

|---|---|

| Your Information | Include your name, business name (if applicable), address, phone number, and email. This ensures the client knows who issued the document. |

| Client Information | Provide the client’s name, company name, and contact details for easy reference. |

| Unique Identifier | Assign a unique reference number for the document to help with future tracking and communication. |

| Issue Date | The date the document is issued is critical for setting payment timelines and understanding the terms of the agreement. |

| Detailed List of Services | Provide a breakdown of the services or products provided, including quantities, rates, and descriptions. |

| Total Amount Due | Clearly list the total amount owed, including any applicable taxes, fees, or additional costs. |

| Payment Terms | State when the payment is due and what methods are acceptable, such as bank transfers, credit cards, or online payment platforms. |

| Payment Instructions | Provide clear instructions on how the client can make the payment, including bank details or payment links. |

By including these essential elements, you ensure that the document is complete and serves as a clear, legal request for payment. A well-prepared billing document not only helps you manage your finances but also promotes professionalism and fosters trust with your clients.

Benefits of Using a Template

Using a pre-designed format for payment requests can save significant time and effort for freelancers and small business owners. A structured document ensures that all necessary details are included, reducing the risk of errors or omissions. Templates provide consistency and professionalism, helping you maintain a high standard of communication with your clients.

Time-Saving

One of the main advantages of using a pre-made design is the time it saves. Rather than creating a new document from scratch each time, you can simply fill in the relevant details and send it off quickly. This allows you to focus more on your core work while still ensuring your financial documents are accurate and professional.

Consistency and Professionalism

Consistency is key when dealing with clients. By using the same format for every payment request, you establish a professional brand image. A uniform layout also helps clients easily find important information, such as the amount due, services provided, and payment terms.

| Benefit | Description |

|---|---|

| Reduced Risk of Errors | A pre-designed format ensures that all the necessary sections are included and reduces the likelihood of missing key details. |

| Customization | Templates can be easily personalized to reflect your specific business needs while maintaining a professional look. |

| Improved Efficiency | Filling in a ready-made document is quicker than creating one from scratch, making your workflow more efficient. |

| Professional Image | Using a well-designed document helps convey professionalism to your clients, enhancing your business reputation. |

By utilizing a pre-designed format, you streamline your financial processes, reduce the chances of mistakes, and ensure that your clients receive clear, well-organized payment requests. This simple step can have a significant impact on your overall business efficiency and client satisfaction.

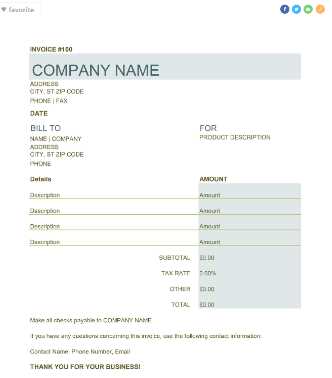

Choosing the Right Invoice Format

Selecting the appropriate format for your payment request is crucial to ensure that the document is both professional and easy for clients to understand. The right format can help improve the clarity of the details, facilitate faster processing, and prevent any confusion or delays. Whether you’re sending it electronically or in print, the format you choose should reflect your business standards and meet your clients’ needs.

Consider the Nature of Your Business

The format you choose may vary depending on the type of services you offer. For example, a creative professional might prefer a more visually appealing document that reflects their design skills, while a consultant might opt for a simpler, more straightforward layout. Think about the impression you want to give to your client and how best to present your information clearly.

Electronic vs. Paper Formats

Another important consideration is whether to use an electronic or paper format. Many businesses today prefer digital payment requests because they are easier to store, share, and track. However, some clients may still prefer paper forms, particularly in industries where paperwork is standard. Choose the format that aligns with both your preferences and your clients’ practices.

When choosing the right structure, ensure that your document is well-organized and includes all the necessary sections, such as:

- Clear Identification: Include your name, your client’s name, and a unique reference number for easy tracking.

- Services Description: List the services provided in detail, with any agreed-upon rates or amounts.

- Amount Due: State the total amount owed, including any applicable taxes or fees.

- Payment Terms: Clearly outline when payment is due and the acceptable methods of payment.

Ultimately, the format you choose should balance professionalism with practicality. A clean, well-organized document will not only make it easier for your client to understand the charges but will also reflect your business’s attention to detail and reliability.

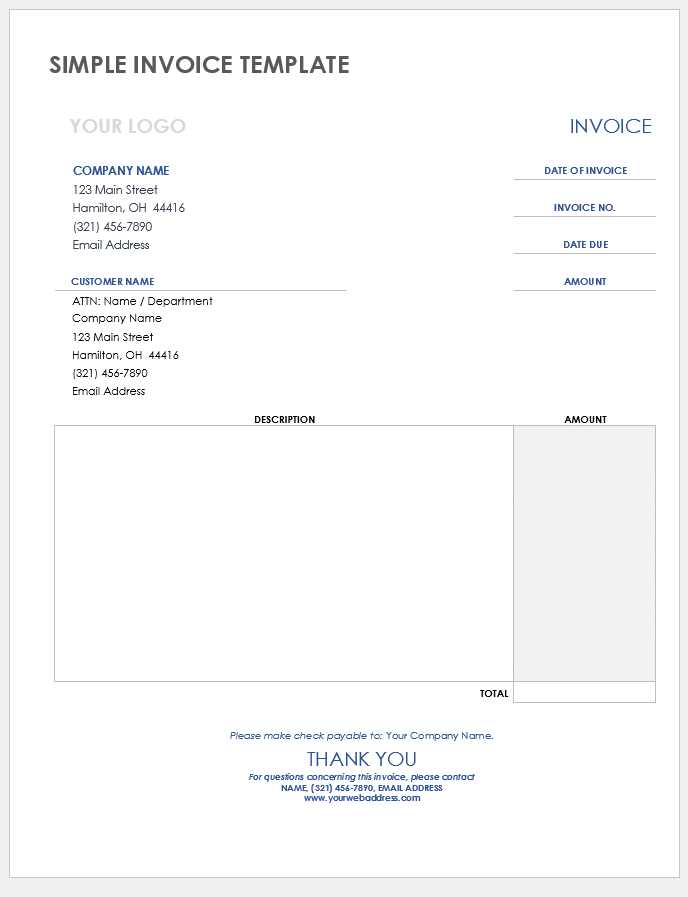

Free vs Paid Invoice Templates

When it comes to creating professional payment requests, you can choose between free or paid formats. Both options come with their own set of advantages, but understanding the differences can help you determine which one is best suited for your business needs. While free formats are often accessible and easy to use, paid formats may offer additional features and customization that can enhance your overall billing process.

Benefits of Free Formats

Free billing documents are a great option for freelancers or small businesses just starting out or those with a limited budget. They provide basic functionality and can usually be downloaded or accessed online without any cost. Free formats are typically easy to use, often requiring little more than entering your business and client information, as well as the details of the services provided.

Advantages of Paid Formats

Paid options often come with advanced features that can save time and provide a more polished look. These formats may include additional customization options, such as personalized branding, automatic tax calculations, and integrated payment processing. They also tend to offer more professional designs, which can make a strong impression on clients. Paid services may also provide ongoing support and updates to ensure your documents are always up-to-date and compliant with any legal changes.

| Feature | Free Option | Paid Option |

|---|---|---|

| Customization | Limited customization, usually only basic edits. | Extensive customization, with options to add logos, colors, and personalized sections. |

| Design Quality | Simple, basic designs. | More polished, professional designs with better aesthetics. |

| Additional Features | Minimal features, usually manual calculations and entry. | Advanced features, such as automatic tax calculations, payment reminders, and integration with accounting software. |

| Support | Community-based support, with no direct assistance. | Customer support available for troubleshooting and assistance. |

| Cost | Free to use. | Subscription or one-time purchase fee required. |

Ultimately, the decision between free and paid formats depends on your business needs and budget. If you’re looking for a simple, no-cost option, free formats can be a great starting point. However, if you’re looking for advanced features, a professional design, or extra functionality, investing in a paid format may be a worthwhile decision to help streamline your billing process.

Customizing Your Invoice for Clients

Customizing your payment request document for each client is an important step in maintaining a professional and personalized relationship. By tailoring the design and content of the document to your client’s specific needs, you demonstrate attention to detail and an understanding of their preferences. A personalized document can help ensure that all the necessary information is included and presented in a way that resonates with the client.

Personalizing Content

Customizing the content of your billing document involves more than just filling in names and amounts. You should consider the nature of the work completed and adjust the language and format to reflect the client’s expectations and industry standards. This can include:

- Service Descriptions: Tailor the descriptions of the services provided to match the specific terms discussed with the client.

- Payment Terms: Adjust payment deadlines, discounts, or late fees based on your agreement with each client.

- Client’s Branding: Include the client’s company logo, colors, or any specific details they prefer to see on official documents.

Design Customization

In addition to content, the design of your document plays a key role in making it stand out and feel unique. Consider the following design elements to personalize your payment request:

- Logo and Branding: Include your company logo and select a color scheme that aligns with your brand identity.

- Font Style and Size: Choose fonts that are professional and easy to read, while keeping in line with your brand’s style.

- Layout: Organize sections in a way that makes sense for the services provided and ensures the client can quickly find the relevant information.

By customizing the document, you not only make the payment process clearer but also reinforce the professionalism of your business. This attention to detail can help foster long-term relationships with clients and ensure they feel valued and confident in working with you again in the future.

Common Mistakes in Invoice Creation

Creating a payment request document might seem straightforward, but there are several common mistakes that can lead to confusion or delays in payment. These errors can create unnecessary complications with clients and can even impact your cash flow. By being aware of the typical pitfalls, you can ensure that your documents are clear, accurate, and professional, making the payment process smoother for both you and your clients.

Here are some of the most frequent mistakes to avoid when preparing a payment request:

- Missing or Incorrect Contact Information: Failing to include the correct details for both your business and the client can delay payments or cause confusion.

- Unclear Service Descriptions: Not providing enough detail about the services or work completed can lead to misunderstandings or disputes. Be specific about what was delivered.

- Inaccurate Amounts: Double-check that all calculations are correct, including the total amount, taxes, or any additional fees. Incorrect amounts can lead to delays or lost trust.

- Omitting Payment Terms: Not clearly specifying when payment is due, acceptable methods, or any penalties for late payments can create confusion and delays.

- Not Including a Unique Reference Number: Every payment request should have a unique identifier for easy tracking. Without it, clients may struggle to reference or pay the correct amount.

- Failure to Add a Thank You or Closing Statement: Leaving out a polite closing remark or thank-you note can make your document feel impersonal and may not leave the best impression.

By ensuring that all critical elements are accurate and clear, you avoid these common issues and present yourself as a reliable and professional business partner. Always review your document before sending it to clients to make sure everything is in order and ready for prompt payment.

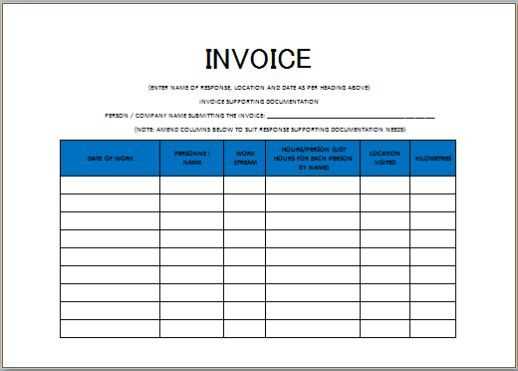

Legal Requirements for Contractor Invoices

When creating a payment request document, it’s essential to ensure that it meets the legal requirements set forth by local and national regulations. Certain elements must be included to comply with tax laws, business practices, and contractual obligations. Understanding these requirements helps protect both the business issuing the request and the client paying it, ensuring that transactions are transparent and legally sound.

Here are some of the key legal components that must be included in a proper payment request:

- Business Information: Include the full name of the business or individual issuing the request, as well as contact details such as an address, phone number, and email. This allows the client to verify the identity of the issuer.

- Client Information: Clearly list the client’s full name or company name, as well as their address or other contact details. This is necessary for record-keeping and ensures there is no confusion about who the payment is for.

- Unique Reference Number: Every payment request should include a unique invoice number or reference code for tracking purposes. This helps keep both the client and the business organized and can be essential for accounting and tax records.

- Detailed Description of Services: You must provide a clear and accurate description of the services or goods provided. Include the quantity, date, and cost of each service or product. This is required for tax purposes and to ensure both parties understand the terms of the agreement.

- Tax Information: Depending on local laws, you may need to include sales tax, VAT, or other applicable taxes. Ensure the correct tax rates are applied, and indicate the amount of tax being charged.

- Payment Terms: Outline the payment due date and any terms related to late fees or penalties. This helps both parties understand when payment is expected and what happens if the payment is delayed.

- Legal Statements: Some regions require certain legal phrases, such as a statement that the payment request is subject to the terms outlined in a contract, or an indication that the payment is due within a specific time frame (e.g., “Due upon receipt”).

Ensuring your payment request complies with legal requirements not only protects you in the event of a dispute but also maintains your professional standing. When in doubt, consult with a legal or financial advisor to ensure your documents meet all necessary legal standards for your area of business.

How to Include Taxes on Invoices

Including taxes correctly in your payment request is crucial to ensure legal compliance and transparency. Whether it’s sales tax, VAT, or any other applicable tax, the process of adding it to your document must be accurate to avoid any issues with your clients or tax authorities. Properly documenting the tax amount helps clarify the total due and ensures that your business is following the correct tax regulations.

Here’s how you can effectively include taxes in your payment document:

| Step | Description |

|---|---|

| Determine Applicable Tax Rate | Research the applicable tax rate based on your location, the client’s location, and the type of services or goods provided. Different jurisdictions have different tax rules. |

| Calculate the Tax Amount | Multiply the subtotal (the total before tax) by the tax rate. For example, if the subtotal is $100 and the tax rate is 10%, the tax would be $10. |

| List the Tax Separately | Always display the tax amount as a separate line item. This ensures transparency and helps clients clearly understand how much tax they are being charged. |

| Include a Tax Identification Number | In some jurisdictions, you are required to include your tax identification number or VAT number on the payment request. Make sure to check local regulations. |

| State the Total Amount Due | After listing the subtotal and tax, add them together to show the final amount due, including tax. This makes it clear to your client how much they owe in total. |

Including taxes on your payment request is a straightforward process, but it’s essential to be precise and consistent. Incorrect tax calculations can lead to disputes, fines, or other issues, so it’s important to stay informed about local tax laws and apply them correctly in all your transactions.

How to Add Payment Terms to Invoices

Including clear payment terms in your payment request document is essential for setting expectations and ensuring timely transactions. Payment terms outline when the client is expected to pay, how they can make the payment, and what happens if payment is delayed. By clearly defining these terms, you help prevent misunderstandings and avoid delays that could impact your cash flow.

Here are the steps to effectively add payment terms to your payment request:

Key Elements of Payment Terms

Payment terms should be precise and easy for your client to understand. The key elements to include are:

- Due Date: Clearly specify the date by which payment is expected. This could be a specific calendar date or a set number of days from the date the request is issued (e.g., “Due within 30 days”).

- Late Fees: If you charge interest or penalties for late payments, make sure to include these details in the payment terms. For example, “A late fee of 1.5% per month will be applied for overdue payments.”

- Accepted Payment Methods: List the payment methods you accept, such as bank transfers, checks, or online payment platforms (e.g., PayPal or credit cards). This ensures the client knows how to make the payment.

- Discounts for Early Payment: If you offer discounts for early payments, include this incentive in the terms. For instance, “A 5% discount is available for payments made within 10 days.”

Formatting Payment Terms on Your Document

Once you’ve defined your payment terms, it’s important to present them clearly. The payment terms section should be easy to locate, typically at the bottom of the document or just before the total amount due. Here’s a simple structure for how to present them: