Printable Handyman Invoice Template for Efficient Billing

When managing a business that involves offering skilled services, keeping track of completed tasks and the corresponding payments is essential. One of the most effective ways to streamline this process is by using well-structured documentation to present charges to clients. Having a professional document helps ensure clarity, accuracy, and prompt payment.

Proper documentation is crucial for both the service provider and the customer. It not only acts as proof of the work done but also establishes transparency between both parties. With the right tools, this task can be quick and efficient, allowing you to focus more on the work itself and less on the paperwork.

In this guide, we will explore how to create an effective billing document that meets both your professional standards and legal requirements. Whether you are new to this or looking for ways to improve your current process, understanding the key components and customization options will help you build a reliable system for managing payments.

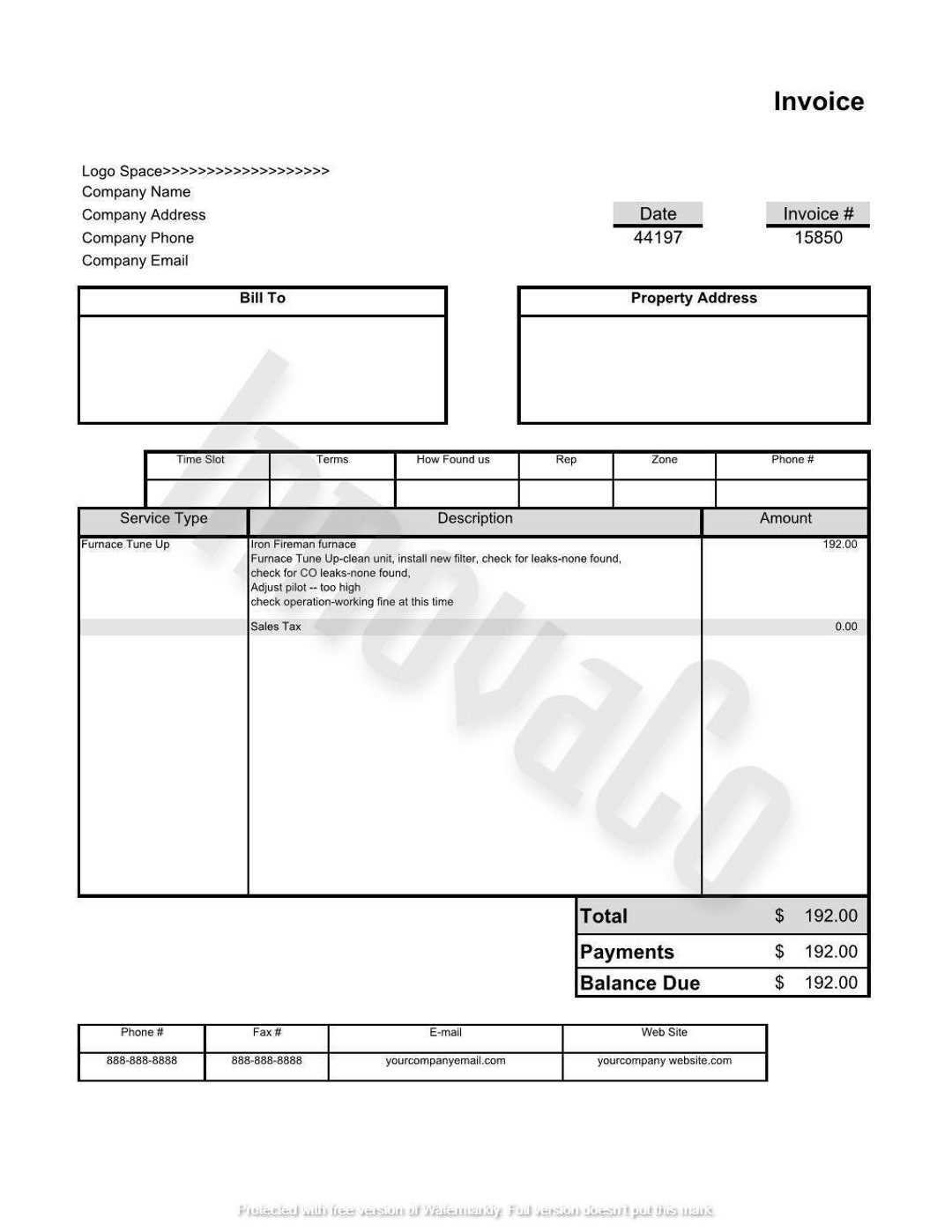

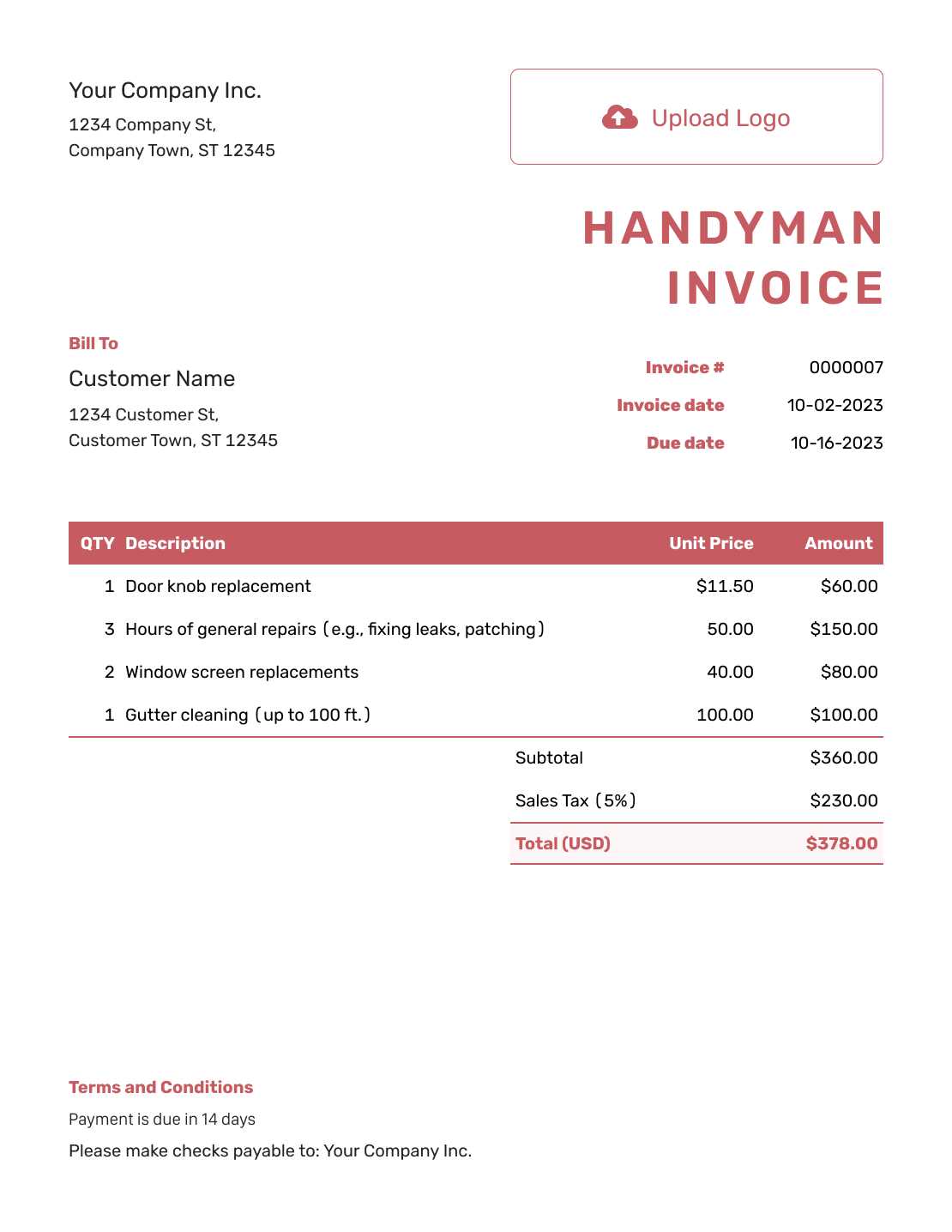

Printable Handyman Invoice Template Overview

Having a clear and organized billing document is essential for any service provider. It helps ensure that the charges are well-documented, transparent, and easy for clients to understand. This document serves as a formal request for payment after a job has been completed and outlines the services rendered, their costs, and payment terms.

Key Features of an Effective Billing Document

- Clear service details: List the services provided in a concise manner to avoid any confusion.

- Accurate cost breakdown: Include individual prices for each service or task performed.

- Payment terms: Specify due dates, accepted payment methods, and any late fees if applicable.

- Contact information: Provide your business or personal contact details for communication purposes.

Why This Document is Important for Your Business

Using an organized payment request document enhances professionalism and ensures that you maintain a steady cash flow. It serves as a record of work completed, making it easier to track payments and manage finances. Additionally, providing a well-structured billing document can improve client trust and facilitate faster payments.

Benefits of Using a Handyman Invoice

Utilizing a well-structured document for payment requests offers numerous advantages for service providers. It ensures that both parties are on the same page regarding the work performed and the charges associated with it. With clear documentation, service providers can streamline their billing process and improve the overall efficiency of their business operations.

Improved Professionalism

By presenting a formal request for payment, service providers can project a more professional image. Clients are more likely to trust a business that uses clear, organized records for transactions, which can enhance client relationships and foster repeat business.

Faster Payments and Better Cash Flow

Using an organized document helps reduce misunderstandings or delays in payments. When all charges are laid out clearly, clients can quickly review and process the payment. This leads to faster transactions and better management of cash flow for service providers.

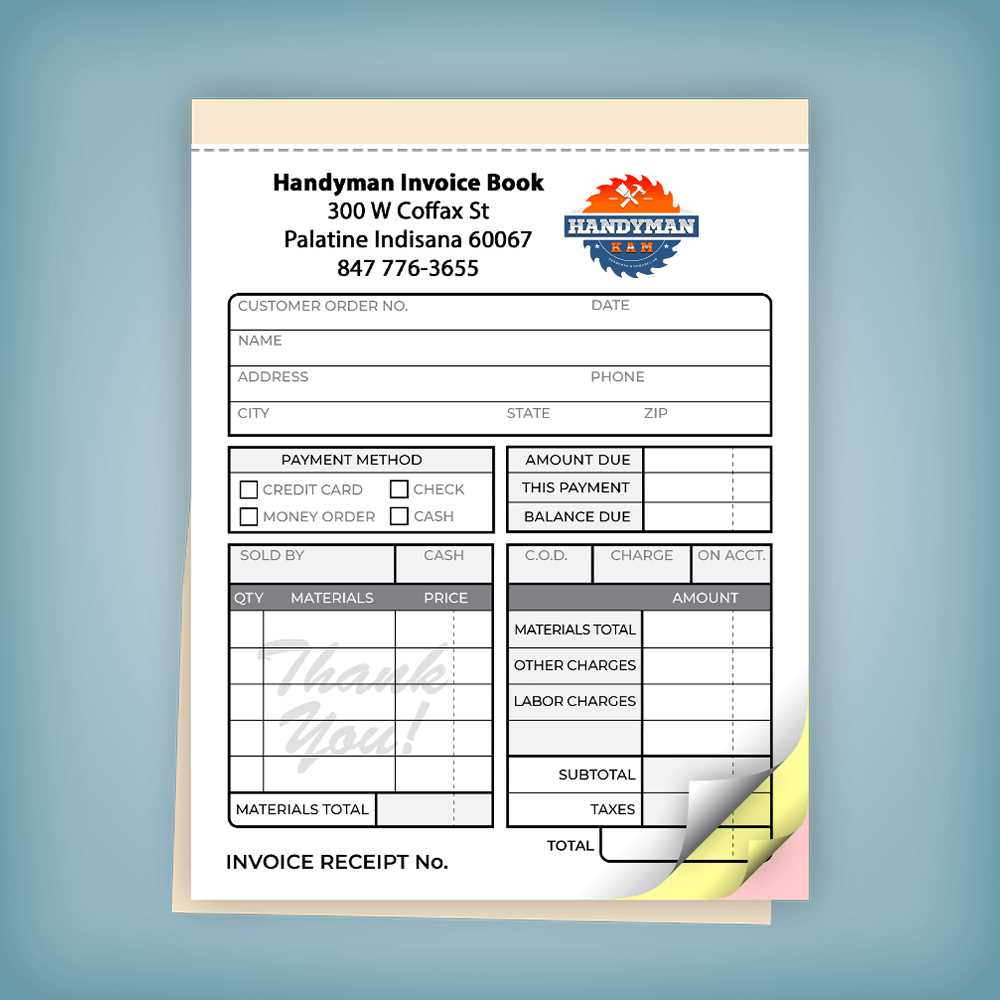

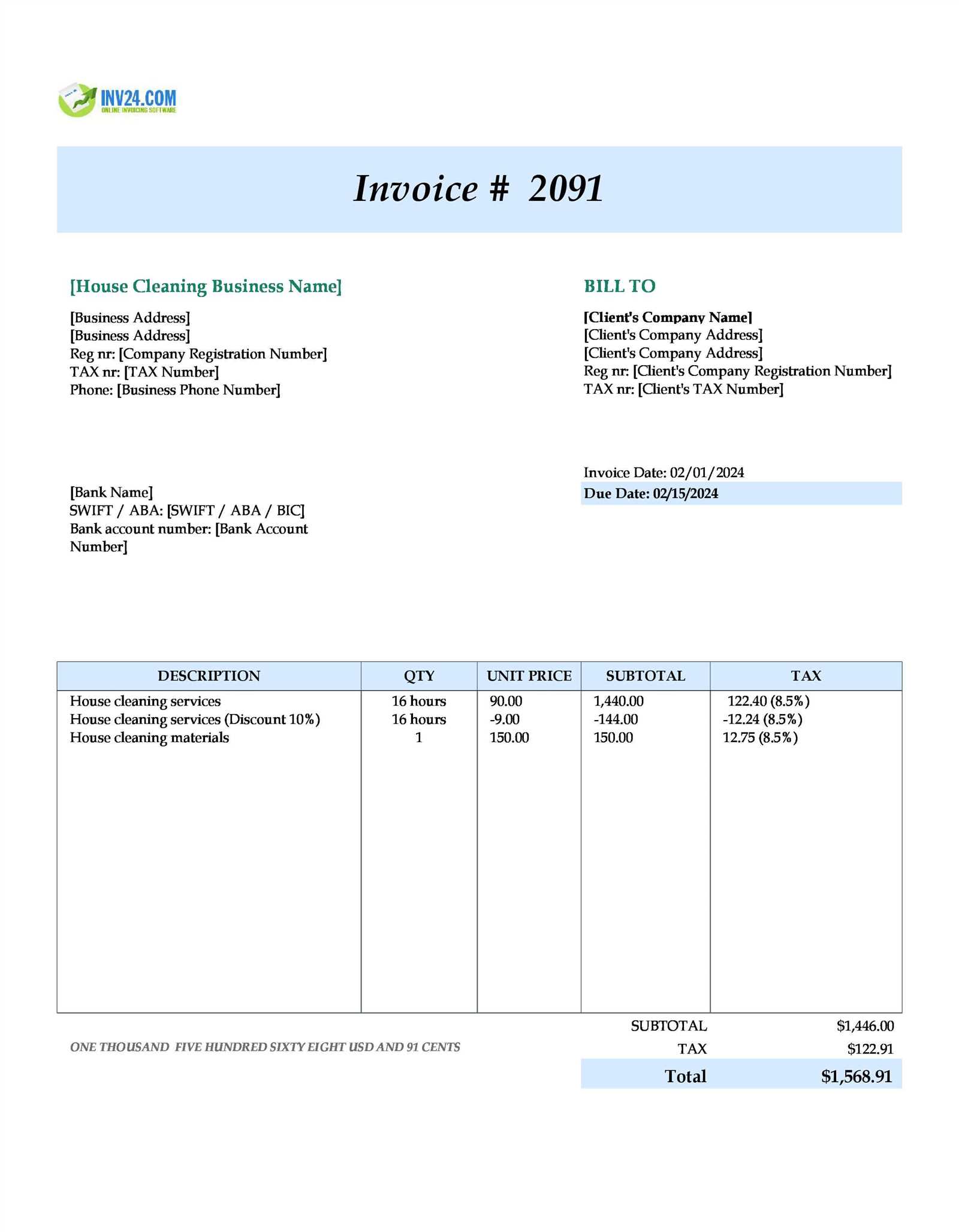

How to Create a Custom Invoice

Creating a personalized payment request document is a straightforward process that can be tailored to fit your business needs. This document should reflect your brand and clearly outline the work completed, the charges for each service, and the terms of payment. Customization ensures that the document meets both legal requirements and client expectations.

Steps for Crafting Your Payment Request

- Include your business details: Ensure your business name, address, and contact information are at the top of the document.

- Describe the services provided: List each task or service performed with a clear, brief description.

- Set pricing: Specify the price for each service or item, and provide a total cost.

- State payment terms: Include the due date, payment methods accepted, and any penalties for late payments.

- Finalize the document: Review the information for accuracy, and then save or print it for distribution to the client.

Customizing for Your Business

Adjusting the design and content of your document is important to match your branding and the type of work you perform. You can add your company logo, choose a professional font, or incorporate specific language that aligns with your services. The goal is to make the document not only functional but also reflective of your business image.

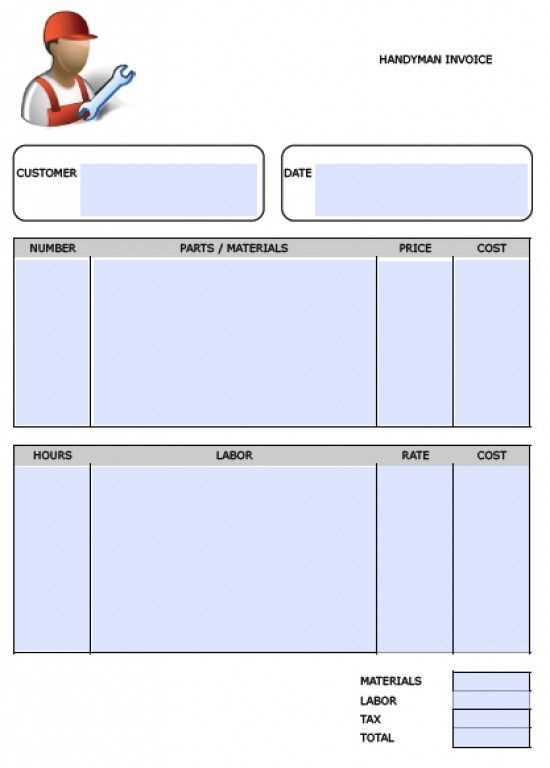

Key Elements to Include in an Invoice

When creating a payment request document, it is essential to include all relevant details that ensure clarity and professionalism. A well-structured record of services will help both the provider and the client understand the charges, deadlines, and expectations clearly. Below are the most important components to include in your document.

Important Components for Clear Documentation

- Business Information: Include your business name, address, phone number, and email for easy contact.

- Client Details: Make sure to list the client’s full name or company name, along with their contact information.

- Description of Services: Provide a detailed description of the work performed, specifying the type of service and any items used.

- Pricing Breakdown: Clearly list the price for each service or task and provide a total amount due at the end.

- Payment Terms: Include the due date, accepted payment methods, and any late fees or interest charges for overdue payments.

- Unique Reference Number: Assign a unique number to each document for tracking and reference purposes.

Additional Information to Enhance the Document

- Discounts or Offers: If applicable, include any special discounts or promotions for the client.

- Terms and Conditions: You can also add any legal or service-related terms that are relevant to the work performed.

Choosing the Right Invoice Format

Selecting the right format for your payment request document is crucial for ensuring that the information is clear, professional, and easy to process. Different formats may suit different types of businesses or client preferences. By considering your specific needs, you can choose a structure that aligns with your workflow and enhances the client experience.

Factors to Consider When Choosing a Format

- Ease of Use: Choose a format that is easy to fill out and edit. A simple, straightforward layout ensures that you can quickly generate and send documents.

- Professional Appearance: Your document should reflect your business’s professionalism. Select a clean, organized format with a clear layout for a polished presentation.

- Customization Options: Look for a format that allows for customization. You may need to add your logo, business details, or adjust the design to match your brand.

- Client Preferences: Some clients may prefer digital formats, while others may prefer physical copies. Consider what works best for your customers.

Popular Formats to Choose From

- Word Documents: Ideal for those who want to create a custom document with easy editing capabilities.

- PDFs: Perfect for a professional and secure format that ensures the document looks the same on any device.

- Online Billing Platforms: Useful for businesses that want to automate the process and send invoices directly through a digital platform.

Tips for Organizing Handyman Invoices

Keeping payment request documents organized is essential for maintaining smooth business operations. By establishing a clear system for tracking and storing these documents, service providers can ensure that payments are processed efficiently and that they have easy access to important information when needed. Below are some tips for organizing these documents to improve your workflow and minimize errors.

Create a Clear Filing System

It’s important to have a consistent method for storing your payment records. Whether you prefer physical copies or digital files, having a well-structured filing system will help you easily find and reference documents when necessary.

- Digital Folders: Create dedicated folders on your computer or cloud storage for each year or project. Name them systematically to make searching easier.

- Physical Filing: Use clearly labeled folders or binders to store printed payment requests. Make sure the documents are organized by date or client name for easy retrieval.

Track Payments Effectively

Monitoring the payment status of each document is critical for staying on top of cash flow. Maintaining a record of paid and unpaid requests can help prevent confusion and ensure timely follow-ups.

| Invoice Number | Client Name | Date Issued | Amount Due | Status |

|---|---|---|---|---|

| 001 | John Doe | 01/10/2024 | $500 | Paid |

| 002 | Jane Smith | 02/10/2024 | $350 | Unpaid |

Use Software for Automation

Consider using accounting or invoicing software to automate the organization and tracking of payment requests. These tools can generate reports, send reminders, and keep all documents in one place for easy access.

Customizing Your Handyman Invoice Template

Adapting a payment request document to reflect your business’s branding and specific needs is crucial for creating a professional and cohesive client experience. Customizing these documents allows you to add personal touches, ensure clarity, and present information in a way that aligns with your business values. This section will explore ways to personalize your billing documents to stand out and ensure all relevant details are included.

Branding Your Document

One of the first steps in customizing your payment request document is incorporating your business’s branding elements. This not only enhances your professional image but also makes the document instantly recognizable to clients. Here are a few ways to brand your document:

- Logo: Include your business logo at the top of the document to establish brand identity.

- Business Information: Add your contact details, such as your phone number, email, and website, to make it easy for clients to reach you.

- Color Scheme: Use your brand’s colors for headings, borders, and text to maintain a consistent visual appearance.

Including Necessary Information

Make sure that your document includes all the essential details to avoid confusion and ensure timely payments. A well-structured payment request should clearly outline services rendered, costs, and payment terms.

- Detailed Descriptions: Include a breakdown of the services provided, including quantity, rates, and total amounts.

- Payment Terms: Specify due dates, late fees, and accepted payment methods to avoid misunderstandings.

- Client and Service Provider Information: Clearly list the client’s name and contact details, as well as your own, for easy reference.

Why a Professional Invoice Matters

Creating a well-organized and clear payment document is essential for establishing credibility and maintaining strong client relationships. A professional-looking document not only ensures that you are paid on time but also reflects your commitment to quality service. It serves as both a legal record and a tool to streamline business operations. Here are some key reasons why presenting a polished payment request is important.

Builds Trust and Credibility

A well-crafted payment document gives clients confidence in your professionalism. When clients see a structured and detailed document, it assures them that you are a reliable and organized service provider. This trust can lead to repeat business and positive word-of-mouth recommendations.

Minimizes Disputes

Clarity in the details of the services rendered and the amounts due helps prevent misunderstandings. By clearly outlining each item and ensuring all terms are easily understood, you reduce the chances of disputes arising over payment expectations.

Improves Cash Flow

When payment requests are clear, clients are more likely to pay promptly. Clear documents with specified due dates, payment methods, and late fees encourage timely payment, helping to maintain a steady cash flow for your business.

Tracking Payments and Due Dates

Maintaining accurate records of payments and due dates is essential for running a smooth business operation. Keeping track of when payments are due and whether they have been received helps you stay organized and ensures that clients are paying on time. This section will discuss the importance of monitoring payments and how to efficiently manage deadlines.

Importance of Accurate Record-Keeping

By keeping track of each payment, you ensure that no payment is missed or overlooked. Detailed records allow you to follow up with clients when necessary and avoid financial discrepancies. Here’s why accurate record-keeping matters:

- Helps Prevent Errors: With precise tracking, you reduce the chances of overlooking a payment or making mistakes when calculating outstanding amounts.

- Improves Efficiency: Tracking ensures you know at a glance which payments are pending and which are completed, saving time and effort.

Setting and Managing Due Dates

Setting clear due dates for payments and managing them effectively is crucial for maintaining healthy cash flow. When clients know exactly when payments are due, they are more likely to pay on time. Here’s how to manage due dates effectively:

- Establish Clear Terms: Clearly state the payment deadline on every document to avoid confusion.

- Send Reminders: Politely remind clients of upcoming or overdue payments to ensure timely settlement.

Common Mistakes in Handyman Invoices

Creating accurate and professional payment requests is crucial for maintaining a smooth business process. However, many people make common mistakes when preparing these documents, which can lead to confusion and delayed payments. This section highlights some of the most frequent errors and how to avoid them.

- Missing or Incorrect Contact Information: Failing to include correct business or client details can lead to delays. Always double-check contact information to ensure accuracy.

- Unclear Payment Terms: Ambiguous payment deadlines can confuse clients. It’s important to state the exact due date and any late payment penalties clearly.

- Incomplete Item Descriptions: Providing insufficient descriptions of services or products can cause misunderstandings. Be specific about the work completed, including quantities and prices.

- Lack of Unique Invoice Number: Without a unique reference number, it becomes difficult to track payments. Always assign a distinct number to each document.

- Failure to Include Tax Information: Not listing taxes or providing inaccurate tax details may lead to legal issues. Ensure all tax information is correct and transparent.

By avoiding these common mistakes, you can create clear, professional, and error-free documents that make the payment process much smoother for both you and your clients.

How to Handle Invoice Disputes

Disputes regarding payment requests are a common challenge in any business. Whether due to misunderstandings, discrepancies in charges, or dissatisfaction with services, it’s important to address these issues promptly and professionally. Handling disputes with care can help preserve customer relationships and ensure timely resolution.

The first step in managing a dispute is to review the details of the request carefully. Ensure that all information is accurate and that the charges reflect the work or products provided. If any errors are found, issue a corrected request to the client.

If the client disputes specific charges or the terms, it’s essential to engage in clear communication. Reach out to the client directly to understand their concerns and explain your position. Keep a calm and professional tone throughout the discussion.

Sometimes, both parties may need to negotiate a compromise. If a client is unwilling to pay the full amount, consider offering a partial payment or an adjustment in the charges. Always document any changes made and ensure both parties agree in writing.

In cases where a dispute cannot be resolved through direct communication, involving a third party, such as a mediator or legal professional, may be necessary. Taking the right steps early on can prevent a simple issue from escalating into a larger problem.

Essential Tools for Invoice Management

Managing payment requests efficiently is crucial for maintaining smooth business operations. Having the right set of tools can help streamline the process, ensure accuracy, and improve cash flow. Whether you’re handling a small number of requests or dealing with high volumes, the right resources can simplify your tasks and reduce the risk of errors.

Accounting Software

Using accounting software is one of the most effective ways to manage payment requests. These tools automate the process, track payments, and generate reports. Popular software options include QuickBooks, FreshBooks, and Xero, which can help you create detailed records of all transactions, monitor outstanding payments, and generate financial reports.

Online Payment Platforms

Integrating online payment platforms into your system makes it easier to receive payments on time. Platforms like PayPal, Stripe, or Square allow clients to pay securely online, often in multiple formats such as credit cards or direct bank transfers. These systems also provide tracking features to keep you updated on incoming payments.

Utilizing these tools together can simplify the process, reduce administrative workload, and increase the chances of timely payments. They also help in maintaining organized records for accounting and tax purposes, allowing businesses to focus more on growth and client relationships.

Printable Invoice Templates for Quick Use

For those who need to send payment requests without delay, using pre-designed forms can save valuable time and effort. These ready-made options provide a quick solution, allowing businesses to focus on their core tasks while ensuring the proper details are included in each request. Customizable formats make it easy to adjust for various industries and services, offering a professional and efficient way to handle transactions.

These tools come in many formats, such as Word, Excel, or PDF files, and can be downloaded and filled out with just a few clicks. By utilizing such resources, you eliminate the need to manually create documents from scratch, which speeds up the process and helps you maintain consistency across all transactions. They also allow you to easily track past payments, as each document includes the necessary fields for amounts, dates, and terms.

How to Send Invoices to Clients

Sending payment requests to clients efficiently is essential for ensuring timely settlements. The process begins by preparing the necessary details and selecting the best method for delivery. Whether by email, physical mail, or through online systems, it’s important to ensure that the communication is clear and professional. Properly formatted documents help avoid misunderstandings and maintain a positive client relationship.

Choosing the Best Delivery Method

Depending on the client’s preferences and business practices, there are several ways to send your payment requests. Some may prefer electronic delivery, while others might opt for a more traditional paper format. Below are common methods:

- Email: Send a digital version of the document directly to the client’s inbox. This is the fastest and most efficient method.

- Postal Mail: For clients who prefer hard copies, physical mail ensures they receive an official document.

- Online Systems: Use a platform designed for sending payment requests, which often includes automated reminders and tracking features.

Tracking Sent Requests

Once the payment request has been sent, it’s important to track its delivery and ensure the client has received it. Some methods, like email, offer delivery confirmations, while others may require follow-ups. An organized system for tracking sent documents helps prevent any missed payments and ensures accountability.

| Method | Pros | Cons |

|---|---|---|

| Fast, cost-effective, instant delivery | Depends on client’s internet access | |

| Postal Mail | Traditional, tangible record | Slower, cost of postage |

| Online Systems | Automated reminders, easy tracking | Requires client to use the platform |

Using Digital Invoices vs. Paper Versions

When managing payment requests, choosing between digital and paper versions can significantly affect the efficiency of your business operations. Both methods have their advantages, depending on the needs of the client and the nature of the transaction. Understanding the differences helps in selecting the right approach for quicker processing and easier tracking of payments.

Benefits of Digital Versions

Digital payment requests are becoming increasingly popular due to their speed, convenience, and cost-effectiveness. Here are some key advantages of using digital formats:

- Fast Delivery: Digital requests can be sent immediately via email or online systems, reducing waiting times for both parties.

- Environmentally Friendly: Reduces the need for paper and postal services, contributing to eco-friendly business practices.

- Easy Tracking and Management: Digital systems allow you to store and organize documents easily, and some platforms even offer automatic reminders for pending payments.

Advantages of Paper Versions

Despite the rise of digital solutions, some clients still prefer paper documents for various reasons. Below are some benefits of using physical copies:

- Traditional Method: Some businesses or clients may trust printed records more and feel comfortable with hard copies.

- Official Record: Physical documents can be kept as legal records and may be easier to store for some businesses.

- No Technology Barriers: For clients who are not tech-savvy or prefer not to use digital platforms, paper is a simple and familiar choice.

Ensuring Legal Compliance with Invoices

It is essential for businesses to follow specific guidelines when preparing payment requests to ensure they meet legal requirements. Adhering to these regulations helps protect your business and ensures that your transactions are legitimate. Understanding the necessary elements and requirements can prevent legal issues and promote smooth business operations.

Key Legal Elements to Include

To ensure your payment requests are legally compliant, include the following essential details:

- Business Information: Clearly state the name, address, and contact information of both the service provider and the client.

- Unique Reference Number: Each request should have a unique identifier for easy tracking and reference.

- Clear Description of Services: Include a detailed breakdown of the services provided or goods sold, including quantities, prices, and applicable taxes.

- Tax Information: Display your tax identification number and the correct tax rate applied to the transaction.

- Payment Terms: Outline the due date for payment and any late fees or penalties for overdue amounts.

Additional Considerations

Along with the legal requirements, there are other practices to follow to ensure full compliance:

- Keep Records: Maintain accurate records of all transactions for financial audits and legal purposes.

- Understand Local Laws: Be familiar with the legal regulations specific to your region, as they may vary.

- Follow Digital Compliance: If using online systems, ensure they adhere to data protection and digital transaction regulations.