Free Printable Invoice Template PDF

Managing financial transactions efficiently is essential for every business. Using a well-structured document for billing helps maintain professionalism and ensures accurate record-keeping. With the right resources, creating such documents becomes quick and easy, allowing business owners to focus on their core operations.

By leveraging customizable documents, you can avoid mistakes and streamline the process of charging clients. These resources are often designed to be easily edited and printed, making them accessible for both large corporations and small startups. Whether you need to modify specific sections or add personalized details, these documents offer flexibility without the need for expensive software.

Adopting such a solution can save time, reduce errors, and help businesses stay organized. The convenience of having an efficient method to handle transactions can make a significant difference in how quickly you manage payments and track your financial progress. Get ready to experience a smoother billing process with simple yet effective tools that help you get the job done right.

Why Use a Printable Invoice Template

Using a pre-made document to create billing statements provides an efficient and organized approach to managing financial transactions. This method helps businesses ensure consistency, reduce errors, and streamline their entire billing process. Whether you run a small business or manage a larger operation, having a well-structured document to send to clients can save you valuable time and effort.

Efficiency and Accuracy

Creating professional statements manually can be time-consuming and prone to mistakes. By using a ready-to-use document, you can quickly fill in the required information, ensuring accuracy every time. These ready-to-use solutions offer predefined sections for all necessary details, reducing the likelihood of forgetting crucial information like payment terms or service descriptions.

Customization and Flexibility

Many of these documents allow for easy customization, meaning you can adjust them to suit your specific business needs. Whether you want to include your company logo, change the layout, or add personalized messages, these documents can be modified effortlessly. This flexibility ensures that your billing method aligns perfectly with your brand identity while still being highly functional.

| Feature | Benefit |

|---|---|

| Pre-structured Format | Ensures all necessary details are included, saving time. |

| Customizable Design | Can be adapted to reflect your company’s branding and specific needs. |

| Simple to Use | Minimal effort required to create professional documents. |

By using a pre-built document, businesses can create accurate, professional billing statements with ease. This approach not only improves efficiency but also ensures that each transaction is documented clearly, leading to smoother payment processes and stronger client relationships.

Benefits of Free Invoice Templates

Using pre-designed documents for creating billing statements offers numerous advantages, particularly for small businesses and freelancers. These resources simplify the process of preparing professional documents without the need for expensive software or complex formatting. By adopting a ready-to-use solution, you can save both time and money while ensuring high-quality results.

Cost-Effective Solution

One of the primary benefits of using a no-cost billing document is the financial savings. Many businesses, especially startups or independent contractors, are mindful of their budgets. Using a pre-made document that requires no purchase or subscription means you can allocate funds to other critical areas of your business.

Ease of Use

Ready-made documents are designed to be user-friendly, allowing anyone to create professional billing statements with minimal effort. You don’t need advanced design or technical skills to get started. Simply fill in the required fields such as client information, services provided, and payment terms, and you’ll have a polished document ready to send out.

By utilizing such tools, businesses can improve their operational efficiency. They help ensure accuracy and consistency across all billing transactions, reducing the chances of mistakes or delays in payments. Effortless document creation is key to maintaining a smooth workflow, and this approach offers just that.

How to Download a Free Template

Obtaining a pre-designed document for creating billing statements is a simple and quick process. There are various platforms that offer these resources, allowing you to choose the one that best suits your needs. Whether you prefer a basic or more sophisticated layout, the steps to acquire these documents are straightforward and easy to follow.

Steps to Download

- Search for reliable websites that offer these resources.

- Browse through the available designs to find the one that fits your requirements.

- Select the document format that works best for you.

- Click the download button to save the file to your device.

Things to Keep in Mind

- Ensure the website is reputable to avoid downloading malicious files.

- Check the document’s compatibility with your software before downloading.

- Look for options that allow customization to fit your branding needs.

Once the document is downloaded, you can easily edit it to include necessary details like client names, payment amounts, and terms. This streamlined process eliminates the need for creating billing statements from scratch and helps maintain a professional appearance with minimal effort.

Customizing Your Invoice for Business

Adapting a billing document to reflect your company’s specific needs is an essential step in maintaining professionalism and consistency. Customization allows you to incorporate unique branding elements, payment terms, and specific information relevant to your services or products. This ensures that each document aligns with your business identity while fulfilling all necessary legal and transactional requirements.

One of the key benefits of using a customizable resource is the ability to personalize it with your company logo, color scheme, and contact details. You can also add fields that are particular to your business operations, such as project descriptions, tax rates, or unique service terms. This level of customization helps reinforce your brand image while ensuring clarity and transparency in all communications with clients.

In addition to visual customization, adjusting the document’s structure can be equally important. You may want to modify the layout to highlight specific payment instructions or deadlines, making it easier for clients to understand the key details. Tailoring the document in this way not only enhances its effectiveness but also reduces confusion, ensuring smoother transactions and faster payments.

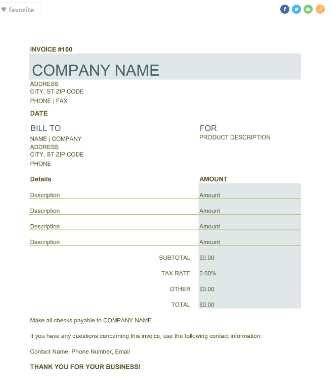

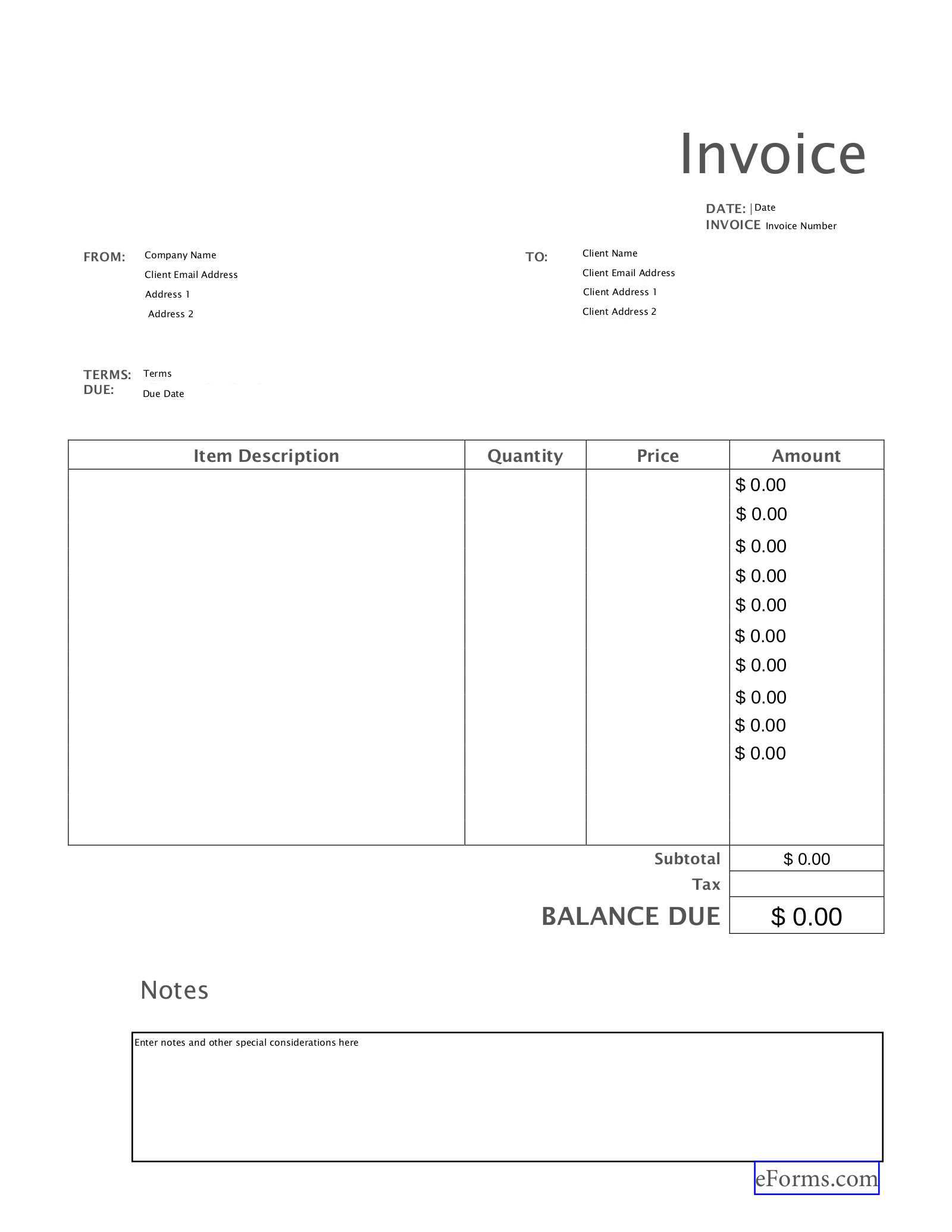

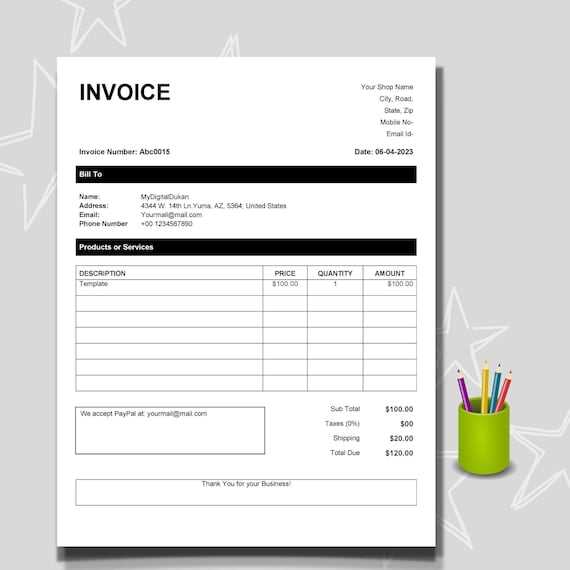

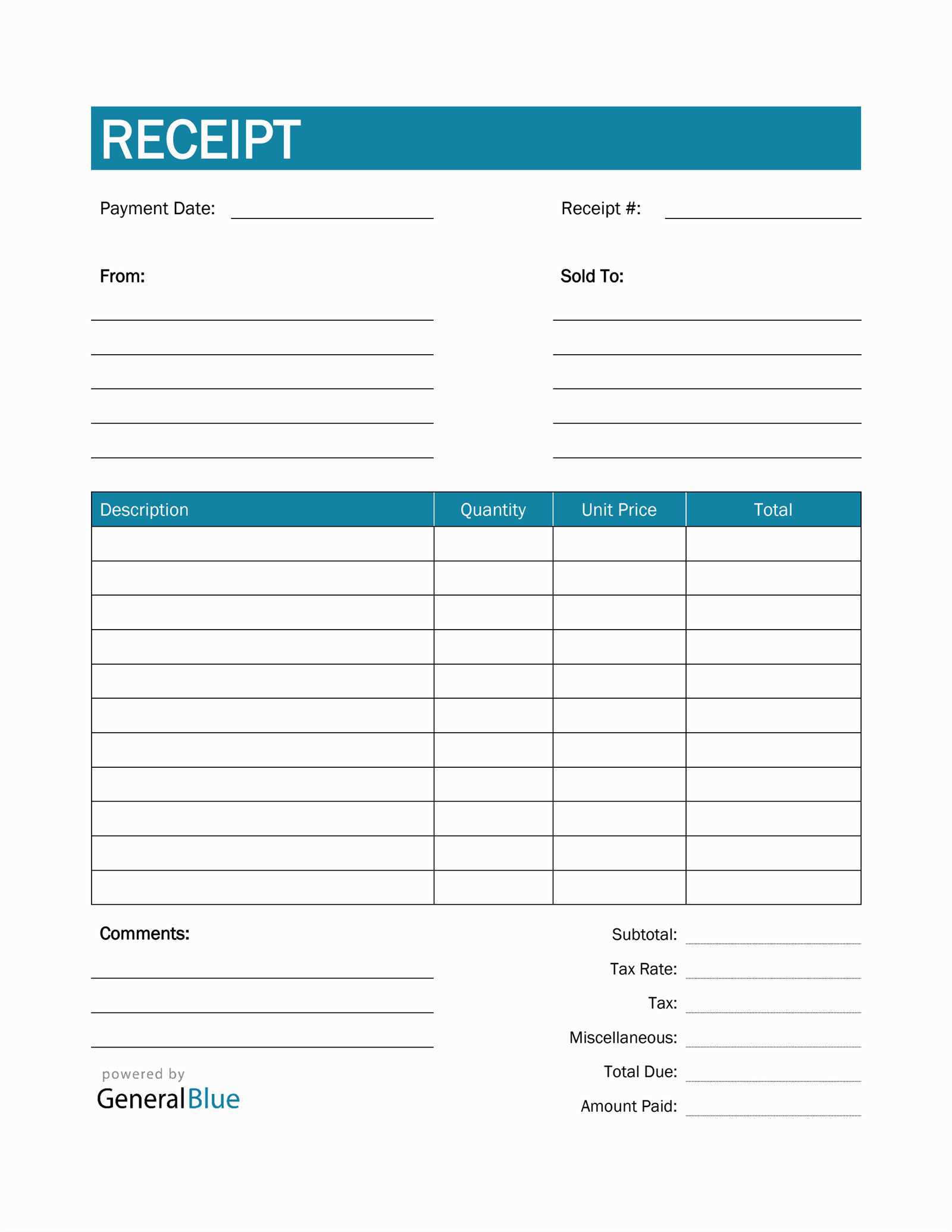

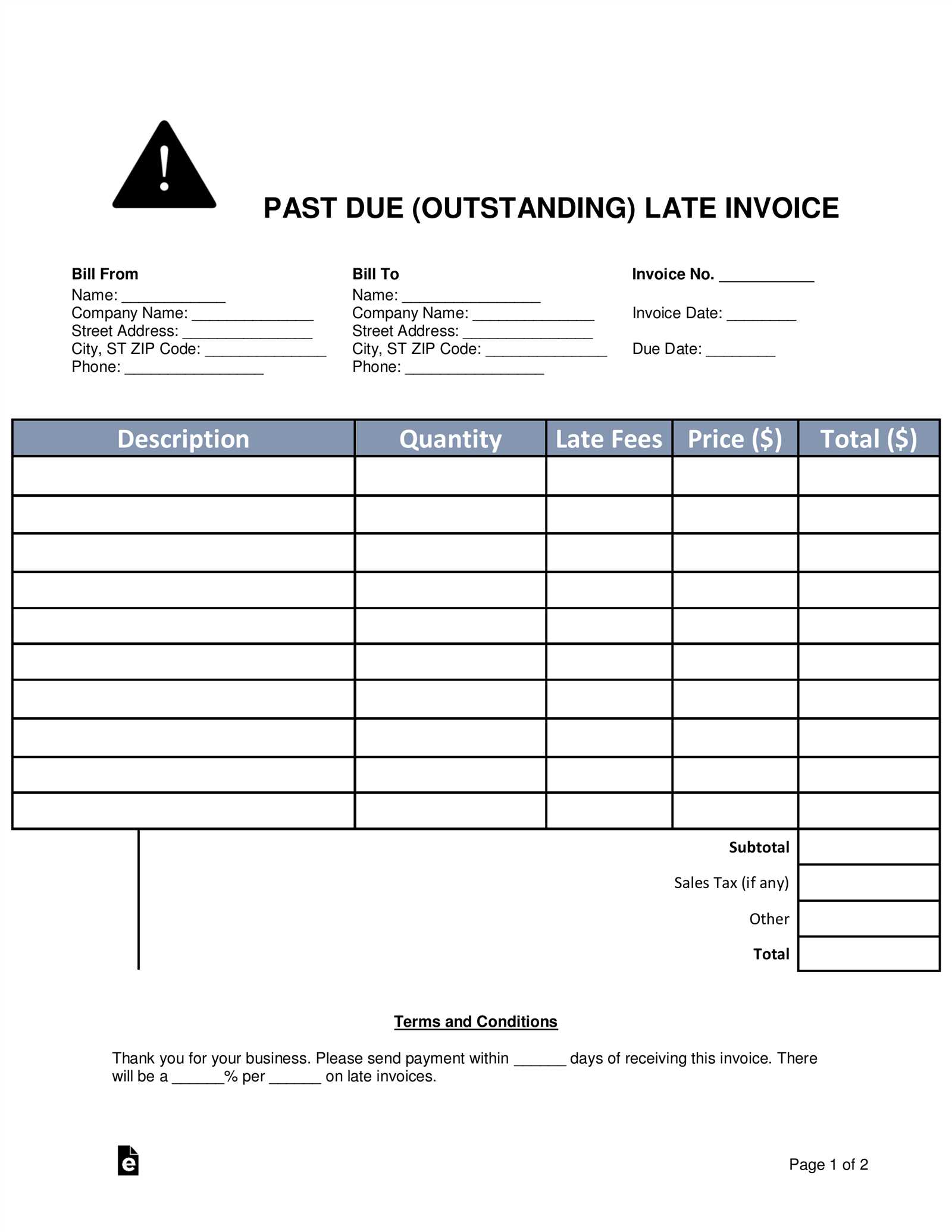

Key Elements in an Invoice Template

For a billing document to be effective, it must include several key components that clearly communicate the necessary details between the business and the client. These elements ensure that both parties understand the payment terms, services rendered, and other important transaction information. Whether you’re creating a document from scratch or using a pre-designed format, these elements are essential for maintaining clarity and professionalism.

Essential Components

- Business Information: Include your company name, address, phone number, and email address.

- Client Details: Ensure the client’s name, company (if applicable), and contact information are listed clearly.

- Unique Identifier: Every document should have a unique reference number to track transactions easily.

- Itemized List of Services or Products: Provide a detailed breakdown of the services rendered or goods supplied, including quantities and rates.

- Payment Terms: Clearly state the payment due date, late fees, or any discounts offered for early payment.

- Total Amount: Include the subtotal, taxes, and final total for the client to review and approve.

Optional but Helpful Additions

- Notes or Terms and Conditions: Include any specific terms related to your services or instructions for the client.

- Payment Methods: Indicate acceptable methods of payment, such as bank transfer, credit card, or check.

- Due Date: Make sure the payment deadline is visible to encourage timely payment.

Including these critical elements in every document will help prevent misunderstandings and ensure smoother financial transactions. A well-organized document can also enhance your professional image, making it easier for clients to process payments and manage their own records.

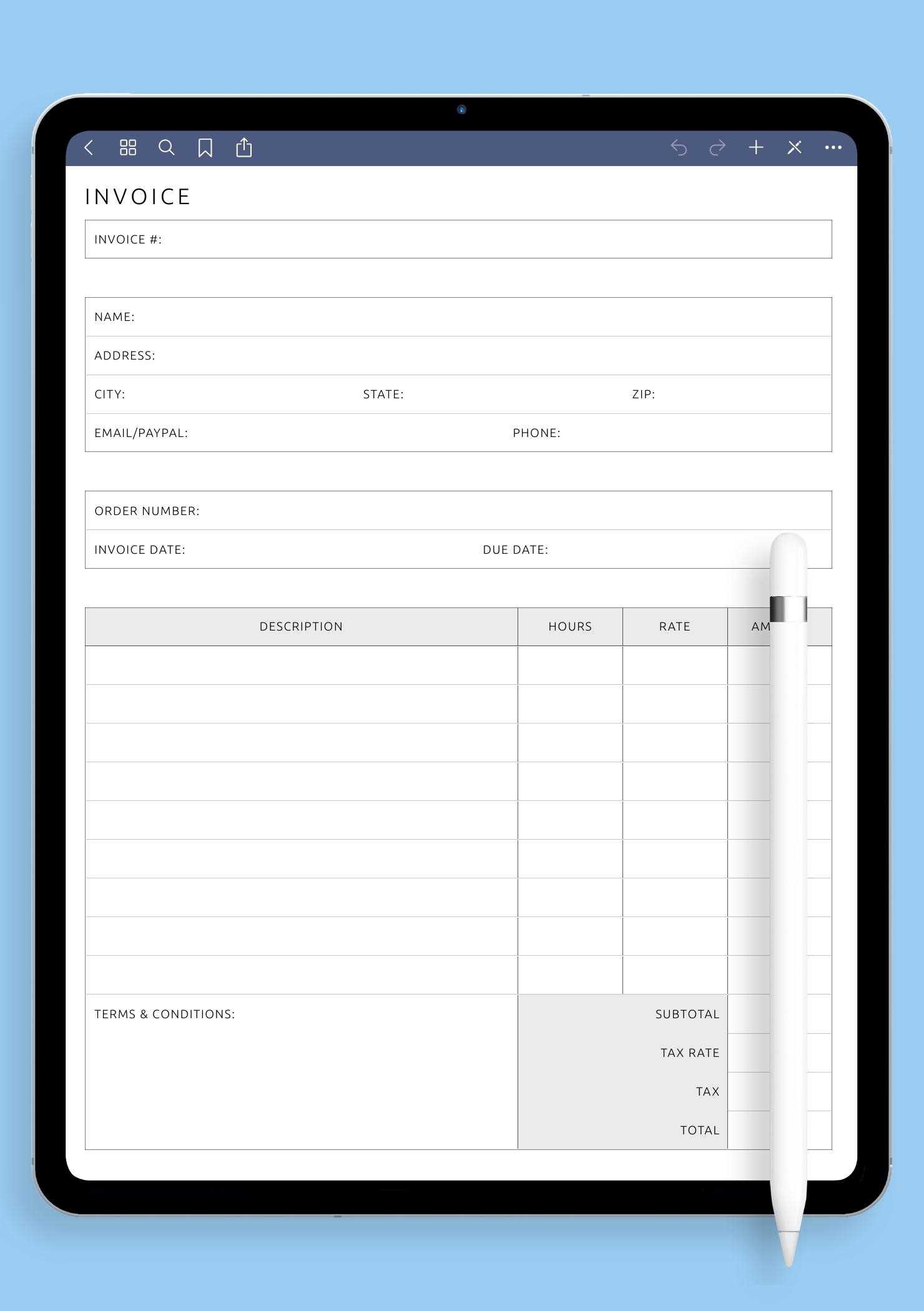

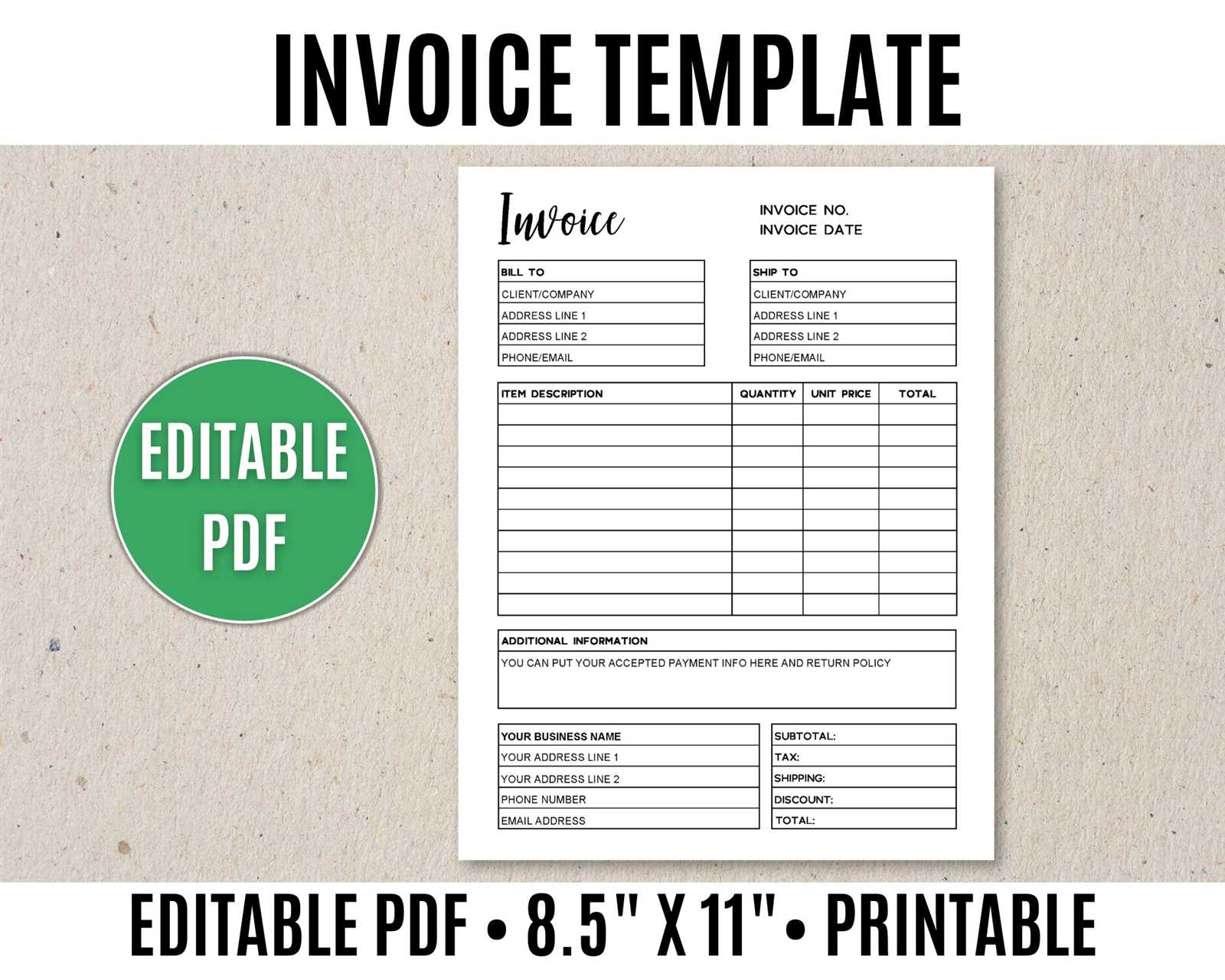

Understanding Invoice Template Formats

When selecting a document for billing, it’s important to understand the different file formats available, as they each offer distinct advantages depending on your needs. The format of the document influences how it can be edited, shared, and stored. Choosing the right one ensures that your billing process remains efficient and compatible with your workflow.

Common Formats

There are several formats available for creating billing documents, each serving different purposes:

- Word Documents: Easily editable and compatible with most word processors. Great for customization but less secure for sharing.

- Excel or Spreadsheet Files: Ideal for itemized calculations and automatically summing totals. However, it may not look as professional as other options.

- Text Files: Simple and lightweight, but lacks advanced formatting options.

- Image Files (JPG/PNG): Not ideal for editing but can be useful for visually appealing documents that are shared as static images.

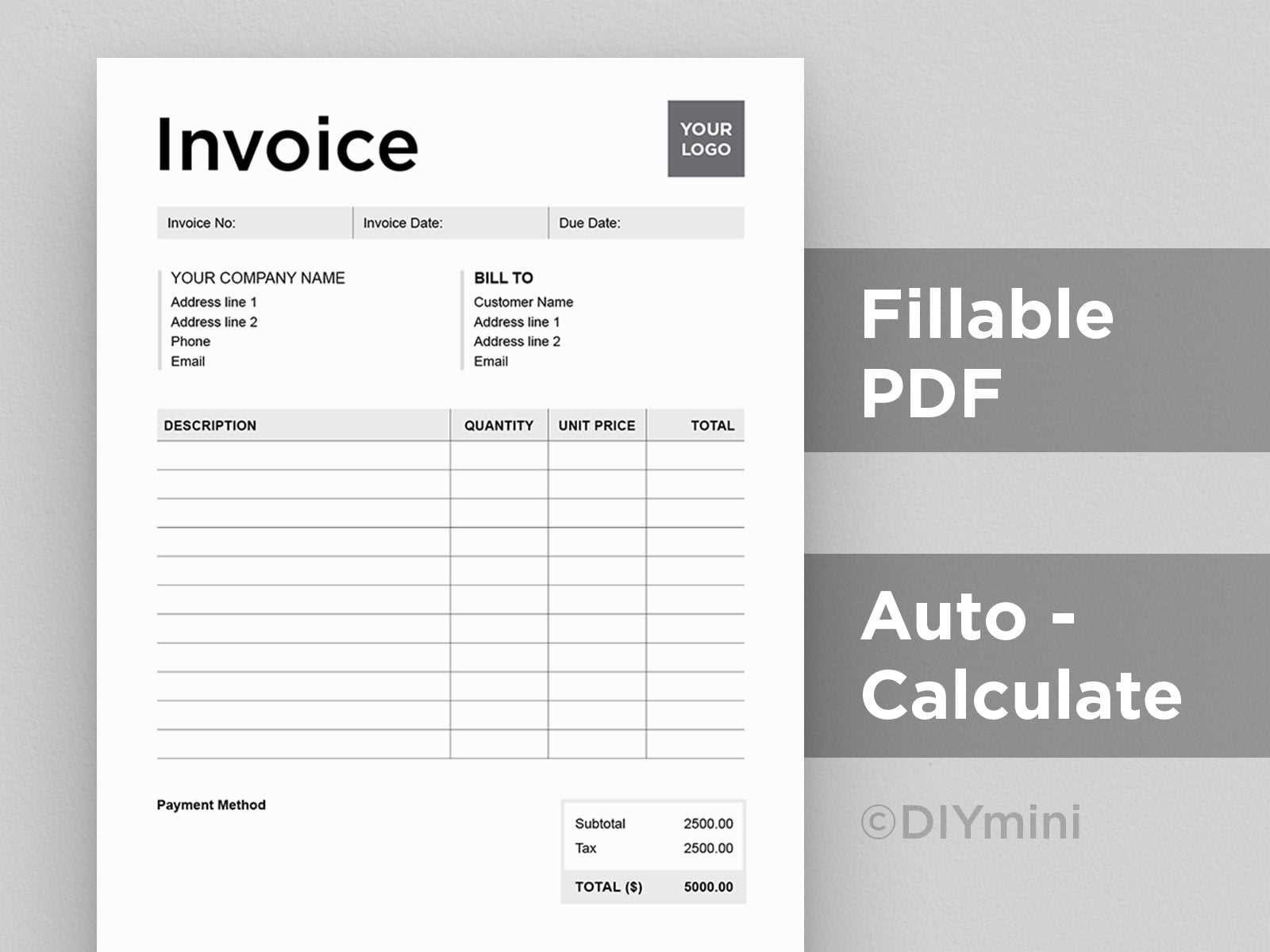

- Portable Document Format (PDF): A widely used format for its compatibility, security, and professional presentation. It can be shared across various devices without altering its appearance.

Choosing the Right Format

PDFs are often the preferred choice for finalizing and sending billing documents because they ensure that the layout, fonts, and formatting remain consistent across all devices. They also provide the option to lock the document, preventing unauthorized changes. Word and spreadsheet formats are more suitable for documents that may require frequent edits before finalization, but they may not have the same level of professionalism when shared with clients.

Ultimately, selecting the right format depends on how you plan to use the document, whether it’s for internal use, sharing with clients, or archiving for long-term storage.

How PDF Invoices Simplify Billing

Using secure, universally accepted document formats for billing can significantly streamline the entire payment process. These formats ensure consistency, improve professionalism, and make it easier to manage records. One of the most efficient ways to handle business transactions is by utilizing a widely compatible format that simplifies both creation and sharing, while keeping information secure.

Benefits of Using PDFs for Billing

- Consistency Across Devices: These documents retain their original layout and formatting, regardless of the device or software used to open them. This ensures that your client sees the document exactly as you intended.

- Easy to Share: PDF documents can be easily emailed or uploaded to cloud services, enabling quick delivery and access from anywhere in the world.

- Security Features: PDFs can be encrypted and password-protected, ensuring that sensitive information, such as payment details and client data, is secure during transmission.

- Professional Appearance: The clean, uniform design of these documents helps create a polished and trustworthy image for your business.

- File Size Efficiency: PDF files are relatively small, which makes them easy to store, email, and archive without consuming too much space on your computer or cloud storage.

How PDFs Improve the Billing Process

- Easy Editing and Customization: You can easily add or remove information, update totals, or adjust payment terms without compromising the integrity of the document.

- Clear and Organized Format: This format provides a clean structure, making it simple for both parties to read and understand the information included, minimizing confusion or disputes over billing details.

- Streamlined Archiving: These documents are easy to store for record-keeping, and with the right tools, you can quickly search and retrieve past transactions.

Using secure document formats for billing not only enhances efficiency but also helps businesses stay organized, improve communication with clients, and reduce the chance of errors or disputes in the payment process.

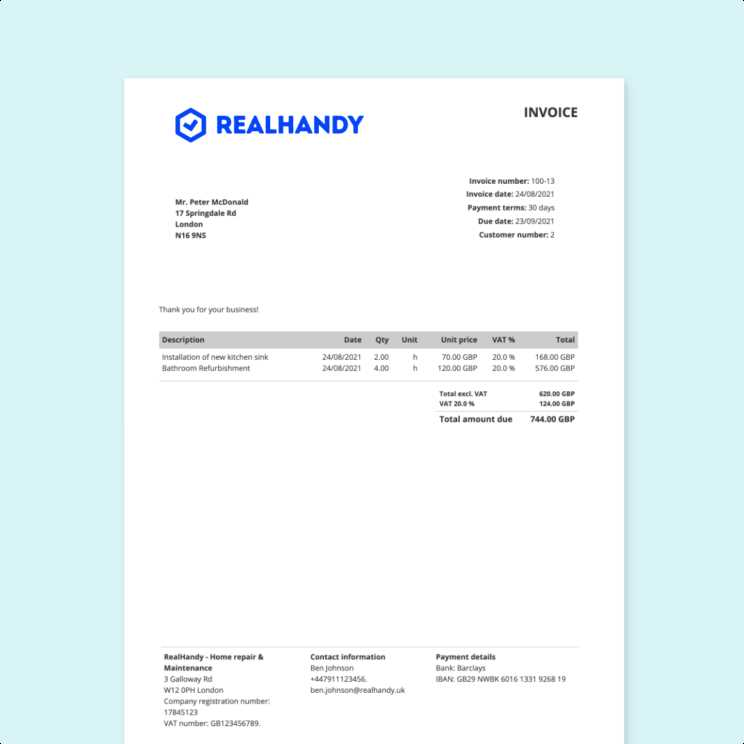

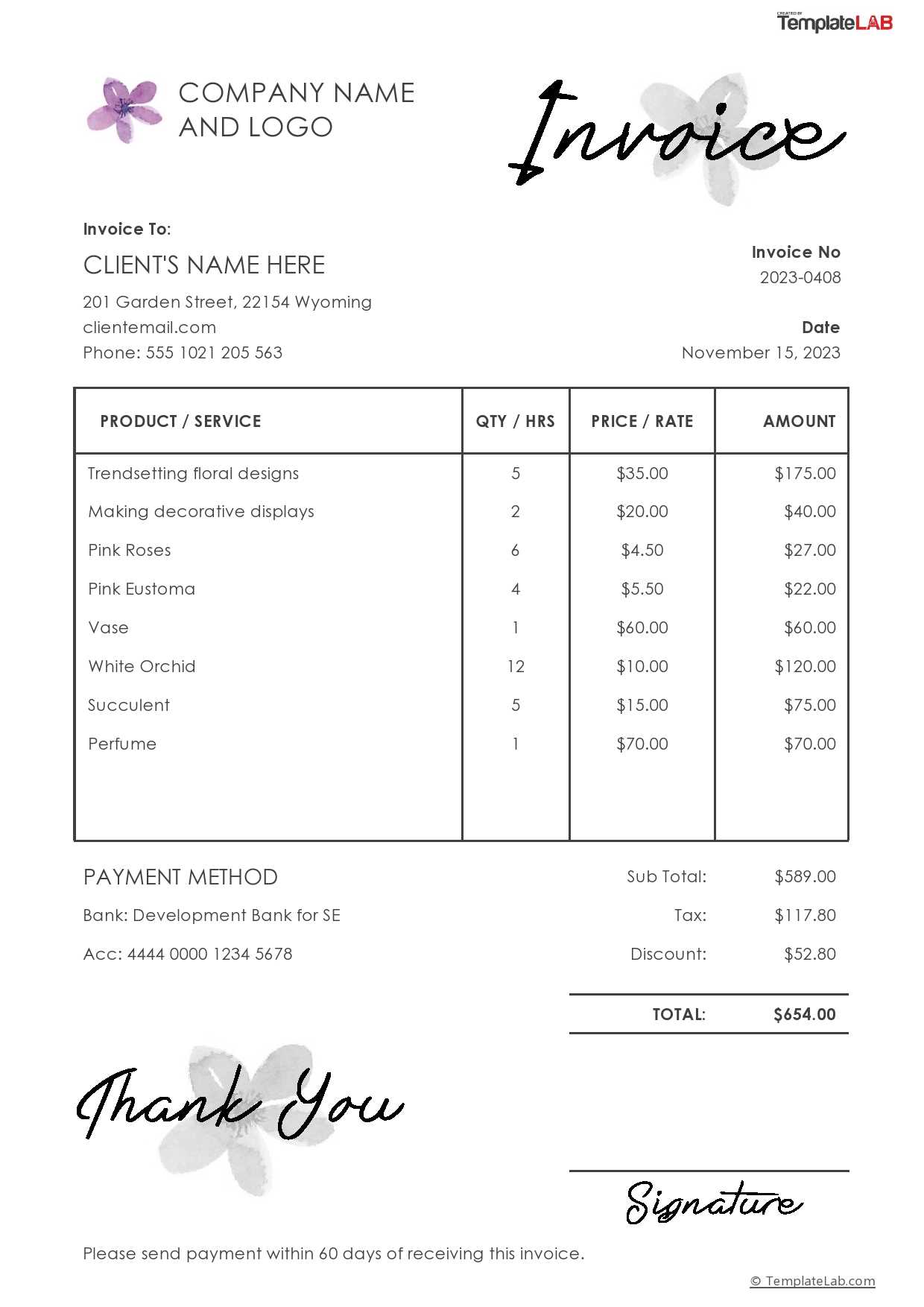

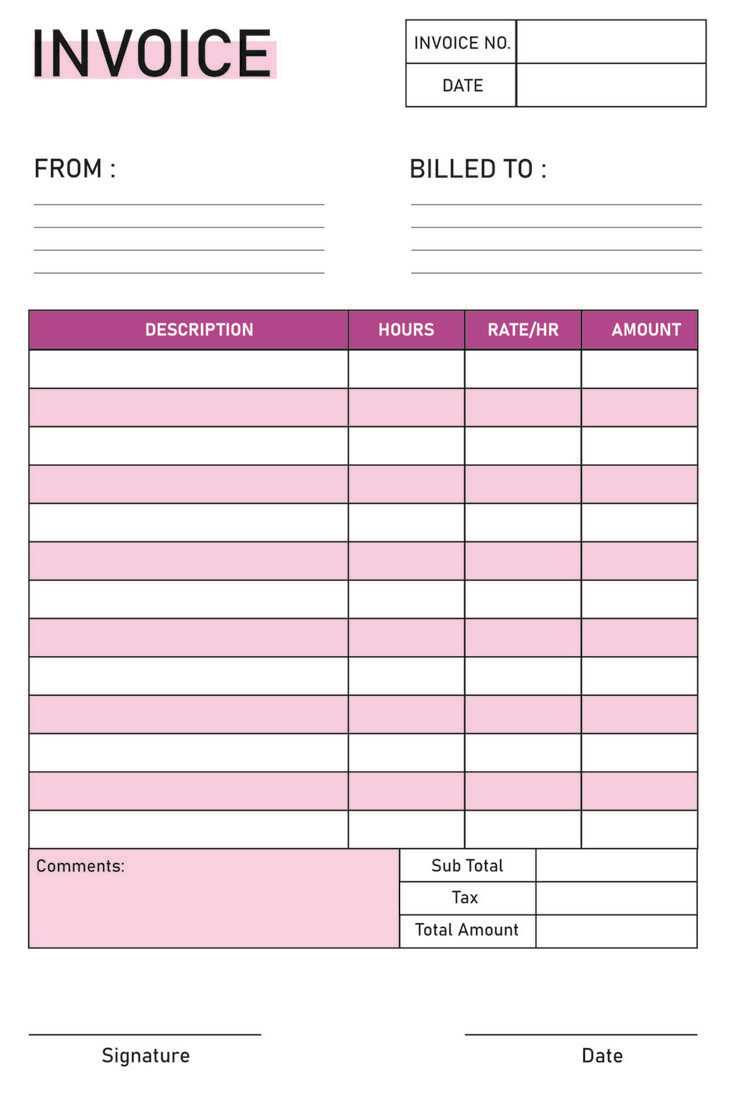

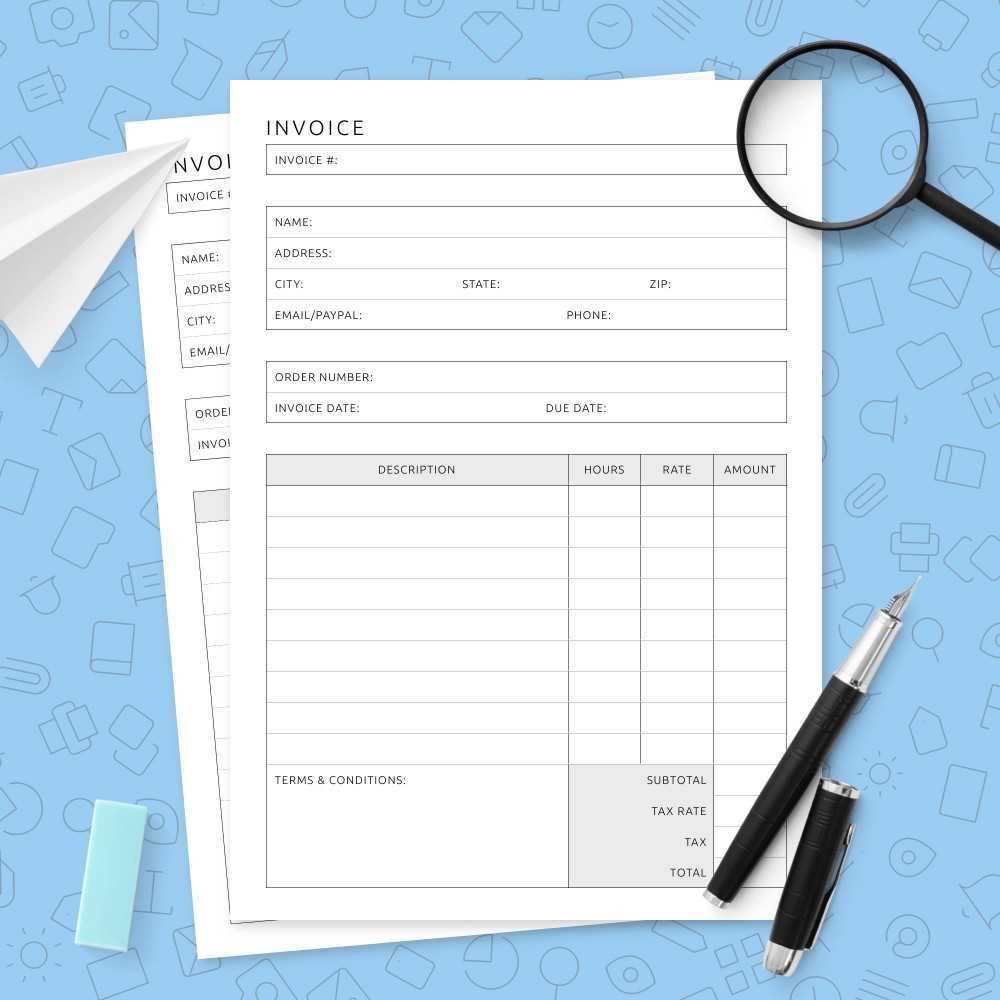

Choosing the Right Invoice Design

Selecting an appropriate design for your billing document is crucial to ensuring clear communication with clients and maintaining a professional image. The layout and structure should reflect your business identity while making it easy for customers to understand the payment details. A well-designed document can enhance the overall client experience and promote trust in your brand.

Factors to Consider

When choosing a layout, several factors should guide your decision to ensure the document serves its purpose effectively:

- Brand Consistency: Your document should align with your business’s branding elements, such as logos, color schemes, and typography.

- Clarity and Simplicity: Ensure the design is not overly complex. A clean, organized layout with clear sections for essential information (such as service details, payment terms, and contact info) is key to minimizing confusion.

- Customizability: The design should be flexible enough to accommodate the specific needs of your business. Consider a design that allows you to easily update or change details as necessary.

Popular Design Layouts

| Design Type | Best For | Key Features |

|---|---|---|

| Minimalist | Small businesses or freelancers | Clean layout, essential details only, easy to customize |

| Professional Corporate | Larger businesses or B2B transactions | Formal, branded with logo, structured sections |

| Creative/Artistic | Design firms or artists | Visually appealing, unique layout, focus on creativity |

Choosing the right design will help ensure that your document is not only visually appealing but also functional. A balance between aesthetics and clarity is key to creating an effective billing document that enhances client relations and encourages prompt payments.

Saving Time with Pre-made Templates

Using pre-designed documents for billing tasks can significantly speed up the process, allowing businesses to focus more on core operations instead of spending time formatting and creating documents from scratch. These ready-to-use solutions eliminate the need for repetitive design work, offering a simple and efficient way to manage financial transactions. By leveraging a well-structured format, you can quickly generate and send out essential documents without sacrificing quality or professionalism.

How Pre-made Documents Save Time

- Quick Setup: Pre-made formats are ready to use immediately. Simply input the specific details, and the document is ready to be shared.

- Consistency: By using a standard layout, you ensure consistency across all transactions, which reduces errors and helps you maintain a professional image.

- Easy Customization: While the basic structure is pre-designed, you can still personalize the content to fit your business needs, such as adding logos or adjusting payment terms.

- Efficiency in Bulk: If you need to send multiple documents, pre-made formats make it faster to generate and send them, improving your overall workflow.

Benefits Beyond Time Savings

- Accuracy: Since the formatting is already set up, there’s less risk of making mistakes, especially with complex calculations or details.

- Professional Appearance: Pre-designed layouts often have polished, well-organized structures, enhancing the presentation of your business.

- Reduced Stress: With one less task to worry about, you can focus on other important aspects of your work, such as client communication or growing your business.

By incorporating ready-to-use documents into your routine, you can save valuable time and streamline your billing process, ensuring smooth transactions with minimal effort.

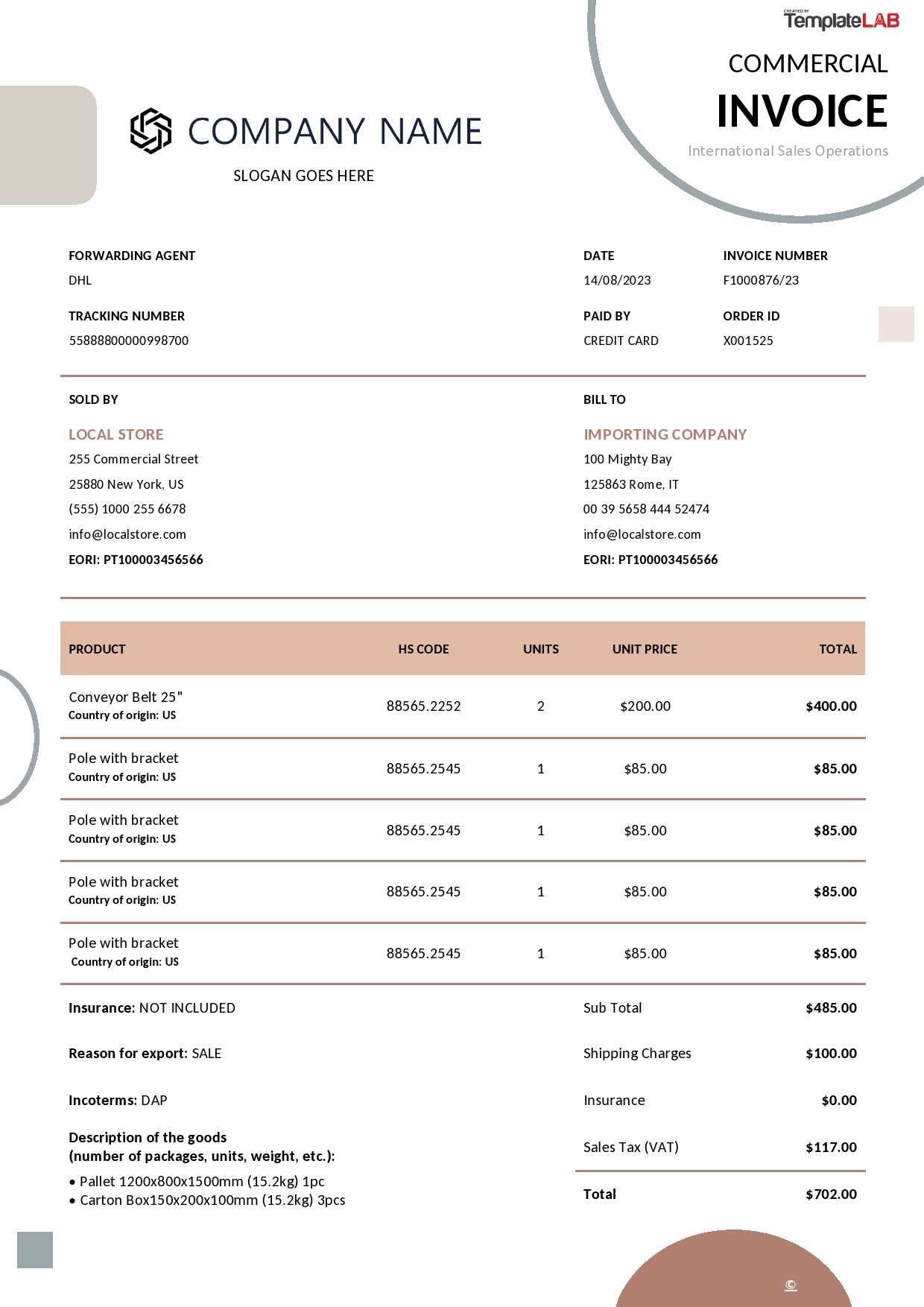

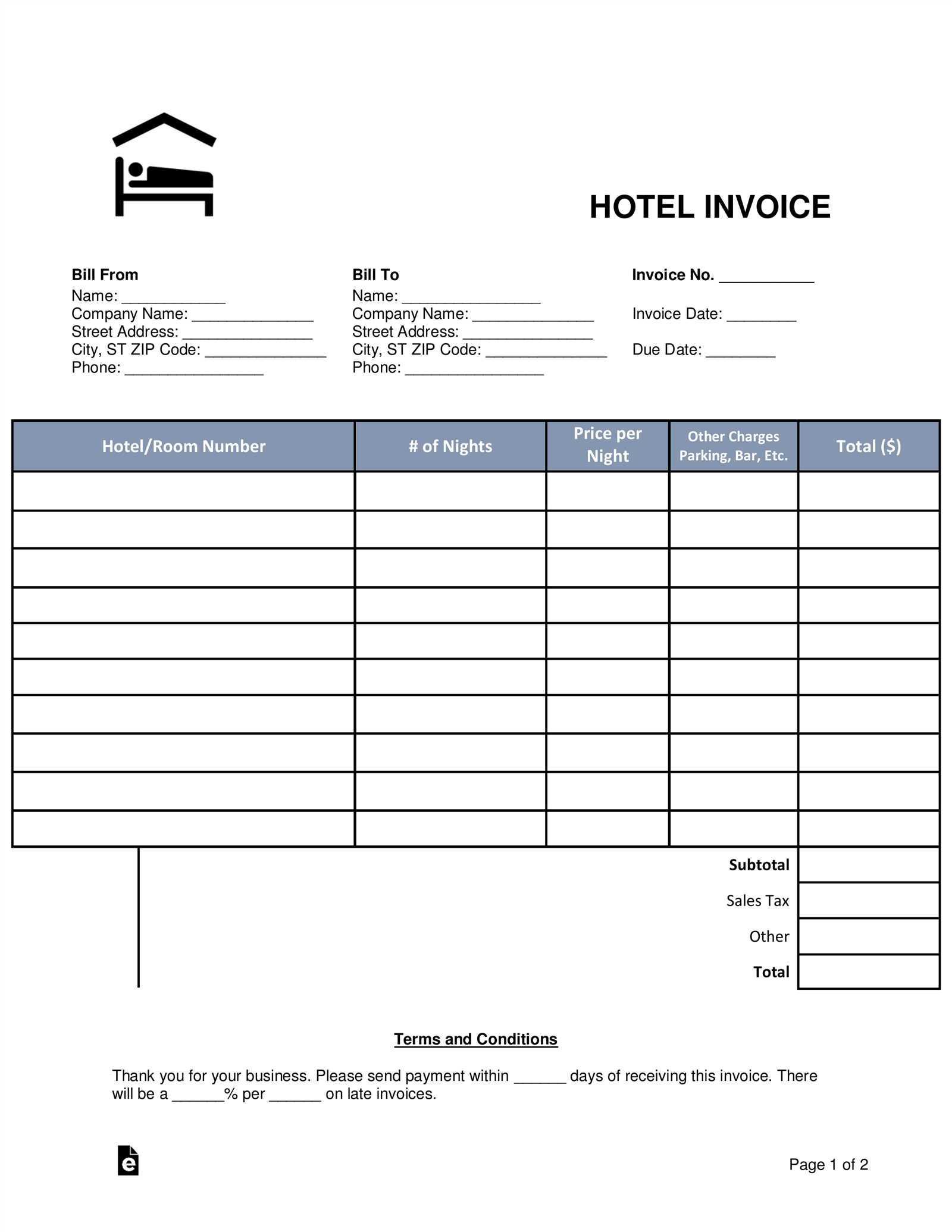

Printable Templates for Small Businesses

For small business owners, managing administrative tasks efficiently is crucial for sustaining growth. One of the most time-consuming aspects of running a business is handling financial transactions and record-keeping. Having a consistent and professional format for documenting payments can save time and reduce errors. Utilizing pre-designed solutions that are easy to personalize allows business owners to focus on what matters most–growing their business.

Benefits for Small Business Owners

Small businesses can greatly benefit from using ready-made documents for their financial records. Here’s how:

- Cost-Effective: Many of these documents are available without additional costs, providing a low-budget solution for small businesses.

- Time Efficiency: Instead of designing documents from scratch, businesses can use templates to quickly generate the necessary paperwork.

- Professionalism: Ready-made formats offer a polished look, enhancing the business’s image and building client trust.

- Flexibility: These documents are adaptable, making it easy to adjust for different services, products, or payment terms.

Choosing the Right Format

When selecting a design for your financial documents, consider the following factors:

| Design Type | Best For | Key Features |

|---|---|---|

| Simple Layout | Freelancers or consultants | Minimal design, quick to fill out, clear payment terms |

| Branded Format | Small retail businesses | Logo inclusion, brand colors, professional look |

| Detailed Layout | Service-based businesses | Sections for services, taxes, and payment breakdowns |

By selecting the appropriate format for your needs, you can streamline administrative processes, save time, and maintain a professional appearance while focusing on growing your business.

Common Mistakes in Invoice Creation

Creating billing documents may seem like a straightforward task, but many businesses unknowingly make mistakes that can lead to confusion, delayed payments, or even legal issues. Whether it’s due to insufficient detail or errors in calculations, such mistakes can disrupt cash flow and damage client relationships. Understanding and avoiding these common pitfalls can help ensure that your documents are clear, accurate, and professional.

Frequent Errors in Financial Documents

- Missing Client Information: Omitting important client details, such as the company name, contact information, or address, can lead to miscommunication and delayed payments.

- Incorrect or Missing Payment Terms: Failing to specify the payment deadline or the agreed-upon method can cause confusion and delay in receiving funds.

- Ambiguous Descriptions: Vague descriptions of goods or services provided can lead to disputes. Always provide clear, concise descriptions of what the client is being charged for.

- Calculation Mistakes: Simple errors in math, such as incorrect totals or tax calculations, can create issues with both your client and your accounting records.

How to Avoid These Mistakes

To ensure your billing documents are effective and error-free, follow these best practices:

- Double-check all details: Ensure that all client information, pricing, and payment terms are correct.

- Use clear language: Be specific about the goods or services you are charging for to avoid misunderstandings.

- Review calculations: Always double-check the math, especially if there are discounts, taxes, or other additional charges involved.

- Include payment instructions: Clearly state how and where the payment should be made, including any account or online payment details.

By paying attention to these details, you can reduce the likelihood of errors and create billing documents that are accurate, professional, and easy for your clients to process.

How to Avoid Invoice Errors

Creating accurate billing documents is crucial for maintaining a smooth workflow and strong client relationships. Errors in these documents can lead to payment delays, confusion, or even disputes. By paying attention to detail and following a few simple steps, you can ensure that your financial records are error-free and professional.

Key Steps to Prevent Common Mistakes

- Verify Client Information: Always double-check client details, such as company names, addresses, and contact numbers. Missing or incorrect data can cause delays in the payment process.

- Use Clear Descriptions: Clearly outline the services or products provided, including quantities, rates, and any applicable discounts. Vague descriptions can lead to misunderstandings and disputes.

- Double-Check Calculations: Incorrect totals or tax rates are among the most common errors in billing. Take time to review all numbers, including taxes, discounts, and any additional charges, to ensure accuracy.

- Specify Payment Terms: Clearly state payment deadlines, methods, and any penalties for late payments. This helps set expectations and prevents any confusion down the line.

Best Practices for Accuracy

Here are some best practices to help you avoid errors and streamline the process:

| Step | Action | Benefit |

|---|---|---|

| Review Client Information | Ensure all client data is correct before finalizing the document. | Prevents miscommunication and payment delays. |

| Use Clear Language | Provide specific and detailed descriptions of services/products. | Avoids misunderstandings and disputes. |

| Double-check Calculations | Ensure all figures are accurate, including taxes and discounts. | Helps maintain accuracy and client trust. |

| Include Payment Instructions | Clearly outline payment terms, methods, and due dates. | Minimizes confusion and delays in payments. |

By following these steps, you can minimize the risk

Ensuring Legal Compliance in Invoices

When generating financial documents for transactions, it is essential to ensure that they meet legal standards. These documents must contain specific details to comply with tax laws and regulations, avoiding potential disputes or legal issues. Failing to follow the required guidelines can result in penalties, delayed payments, or complications in auditing processes.

Important Legal Elements to Include

- Tax Identification Number: Depending on your region, including a business or tax identification number is often required for legal recognition of the document.

- Accurate Tax Rates: Ensure that the correct sales tax, VAT, or any applicable tax is clearly stated. Be aware of regional tax laws, as they can vary depending on location.

- Legal Business Name and Address: Both your business’s name and address should appear clearly, as well as the client’s, to ensure legitimacy.

- Detailed Breakdown of Services: Providing a clear description of the goods or services supplied, including their prices and quantities, helps avoid confusion and ensures transparency.

- Payment Terms: Clearly outline the payment due date, methods accepted, and any penalties for late payments to avoid disputes.

Best Practices for Legal Compliance

To help ensure your documents remain compliant with legal requirements, follow these best practices:

- Consult Local Laws: Familiarize yourself with local business and tax regulations to ensure that you include all necessary information in your documents.

- Stay Up to Date with Tax Rates: Tax rates may change over time. Regularly review and update your documents to reflect the correct rates.

- Maintain Clear Records: Keep accurate, organized records of all transactions for both legal and tax reporting purposes.

- Incorporate Legal Clauses: In some cases, you may need to include specific legal disclaimers or terms regarding disputes or service warranties.

By ensuring that your financial documents meet legal requirements, you protect your business from potential legal troubles and streamline your operations. Being aware of local laws and staying organized is key to maintaining compliance and fostering trust with your clients.

Best Practices for Invoice Clarity

Clear communication is essential in any financial transaction. Ensuring that the documents you issue are easy to understand not only helps build trust with your clients but also minimizes the chance of disputes. Clear documents provide transparency regarding the services or products provided, the cost, and the terms of payment, ultimately improving the overall transaction process.

Key Aspects to Focus On

- Simple and Concise Language: Avoid complex jargon and technical terms. Use clear, simple language that everyone can understand.

- Logical Layout: Organize the information in a way that makes sense. The recipient should easily locate key details like the total amount, payment due date, and service description.

- Clear Descriptions: Always provide detailed descriptions for each product or service, including quantities and unit prices, to avoid confusion.

- Highlight Key Dates: Clearly highlight the payment due date and any other important deadlines to avoid missed payments or misunderstandings.

Additional Tips for Enhanced Clarity

- Use Visuals Effectively: Consider using tables or charts to present numbers, making them easier to read and compare.

- Consistent Formatting: Stick to a uniform font, style, and color scheme. This will make the document look professional and organized.

- Proofread: Always review your document for errors. A small mistake could lead to confusion and delays in payment.

By following these best practices, you can ensure that your financial documents are not only professional but also clear and easy to understand. This will help prevent misunderstandings, facilitate timely payments, and maintain strong relationships with your clients.

Where to Find Free Invoice Templates

When running a business, having a reliable document for managing payments and billing is crucial. There are many resources available online where you can find pre-made documents to assist with this process. These documents can be customized according to your business needs, saving time and effort on formatting while ensuring that your documents are professional and clear.

Popular Online Resources

- Google Docs & Microsoft Office: Both platforms offer free document solutions, including simple and customizable billing formats. You can find them in the