Download Printable Editable Invoice Template for Your Business

Creating clear and professional billing documents is essential for any business. A well-designed bill not only reflects the professionalism of your brand but also helps to streamline financial transactions. Customization options allow you to tailor the document to your specific needs, ensuring that it accurately represents your services or products.

Using a flexible format can save valuable time while maintaining consistency across all your financial records. Whether you’re a freelancer or run a large company, having a document that can be quickly adjusted and reused is crucial for smooth operations. This type of solution allows you to focus on what matters most–your work–while the paperwork stays organized and efficient.

Personalization of such documents is straightforward, making them a practical choice for anyone looking to enhance their billing process. With just a few simple adjustments, you can match the document to your business’s branding and client requirements.

Why Use an Editable Billing Document

Having a flexible and customizable billing document is essential for managing your business transactions smoothly. It allows you to create consistent and professional records while adjusting them according to specific needs. Customizing the structure and content helps maintain accuracy and reduces the time spent on paperwork, allowing you to focus on your core business activities.

One of the major advantages of such documents is their ability to accommodate a wide range of details. From client information to payment terms and itemized lists, these documents can be tailored to reflect the unique aspects of each transaction. This flexibility ensures that you provide clear, organized, and precise statements, which helps in building trust with your clients.

Efficiency is another key benefit. By using a format that can be easily modified, you eliminate the need to manually create new records from scratch each time. This saves time and ensures uniformity across your billing system. Furthermore, having a ready-to-use structure minimizes the risk of errors, ensuring that your financial documents are both accurate and professional.

Benefits of Customizing Your Billing Document

Personalizing your billing document offers significant advantages for both your business and your clients. By adjusting the format to fit your specific needs, you ensure that each transaction is clearly presented, with relevant details that reflect your company’s unique services and branding. This approach not only enhances professionalism but also streamlines your accounting processes.

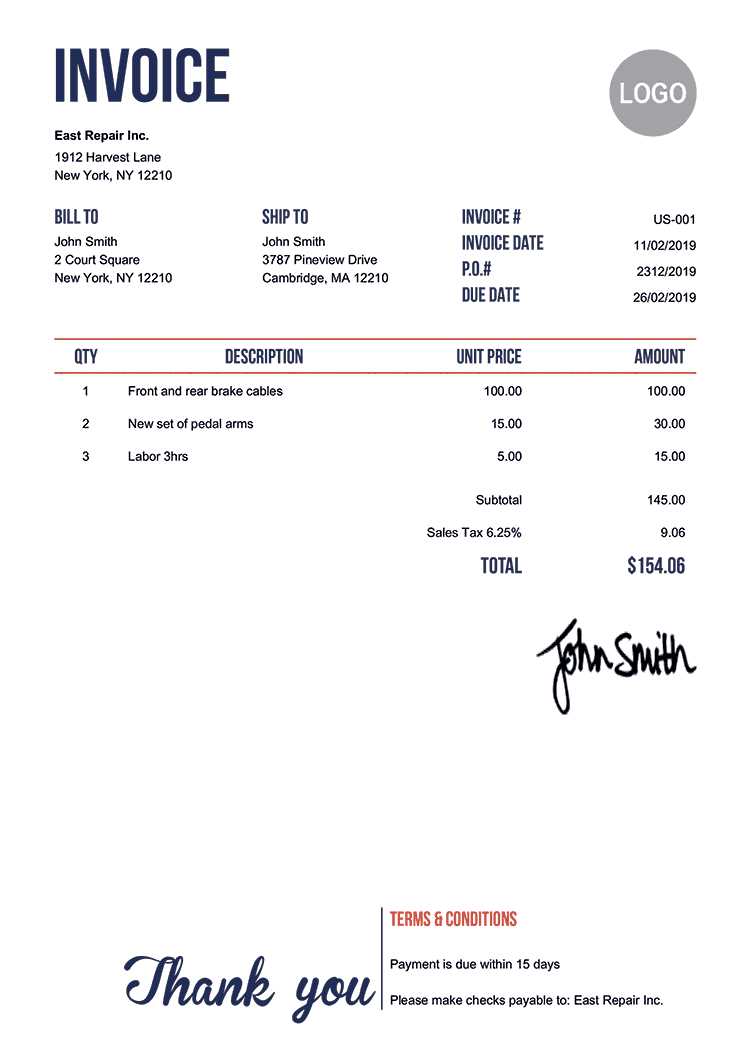

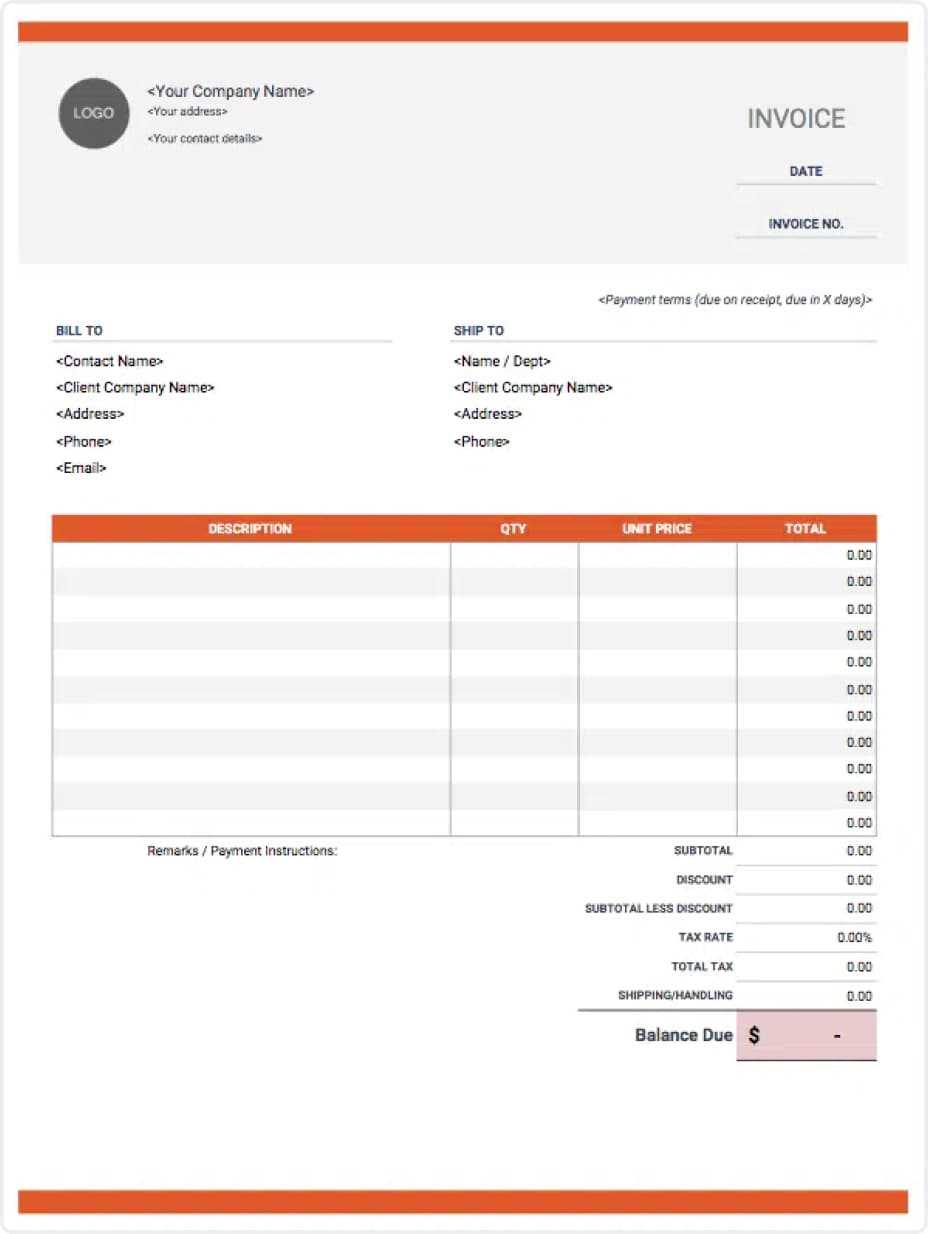

One of the key benefits is the ability to incorporate your business identity. Adding your logo, color scheme, and contact details makes the document more recognizable and aligned with your brand. This consistency fosters trust and strengthens your professional image with clients.

Customization also allows you to include specific terms, payment methods, and itemized breakdowns that are important for both you and your customers. This ensures clarity and transparency, reducing the likelihood of disputes. Additionally, by modifying the layout, you can create a format that works best for your business’s needs, making it easier to track payments and manage your finances effectively.

How to Download a Customizable Billing Document

Getting a ready-to-use billing record that suits your business needs is simple. The process usually involves selecting the right document style, customizing it if needed, and downloading it to your device. These documents are designed for quick access and can be modified to include your unique business details before use.

Selecting the Right Format

Start by choosing a document format that aligns with your preferences and business requirements. Most platforms offer files in various formats such as PDF, Word, or Excel, ensuring compatibility with your software. Once you’ve selected your format, you can proceed to make any necessary adjustments, such as adding your logo or adjusting payment terms.

Downloading the Document

After making the necessary customizations, simply click the “Download” button. The file will be saved to your device, and you can access it whenever you need. Be sure to check that all your information is correctly included before sending it to clients. Convenience and efficiency are the main advantages of using such a system, allowing you to generate and distribute billing records in no time.

Top Features of Customizable Billing Documents

When selecting a document for billing purposes, it’s important to choose one with the right features to enhance both functionality and professionalism. These features make it easier to generate and manage financial records, ensuring that every detail is clear and well-organized. Below are some of the key characteristics that set top billing formats apart:

| Feature | Description |

|---|---|

| Custom Fields | The ability to add or remove fields according to your business needs, such as client information, payment terms, or service descriptions. |

| Branding Options | Incorporate your logo, color scheme, and business details to ensure that the document aligns with your company’s branding. |

| Itemized Breakdown | Clearly list individual services or products with prices, quantities, and any applicable taxes for full transparency. |

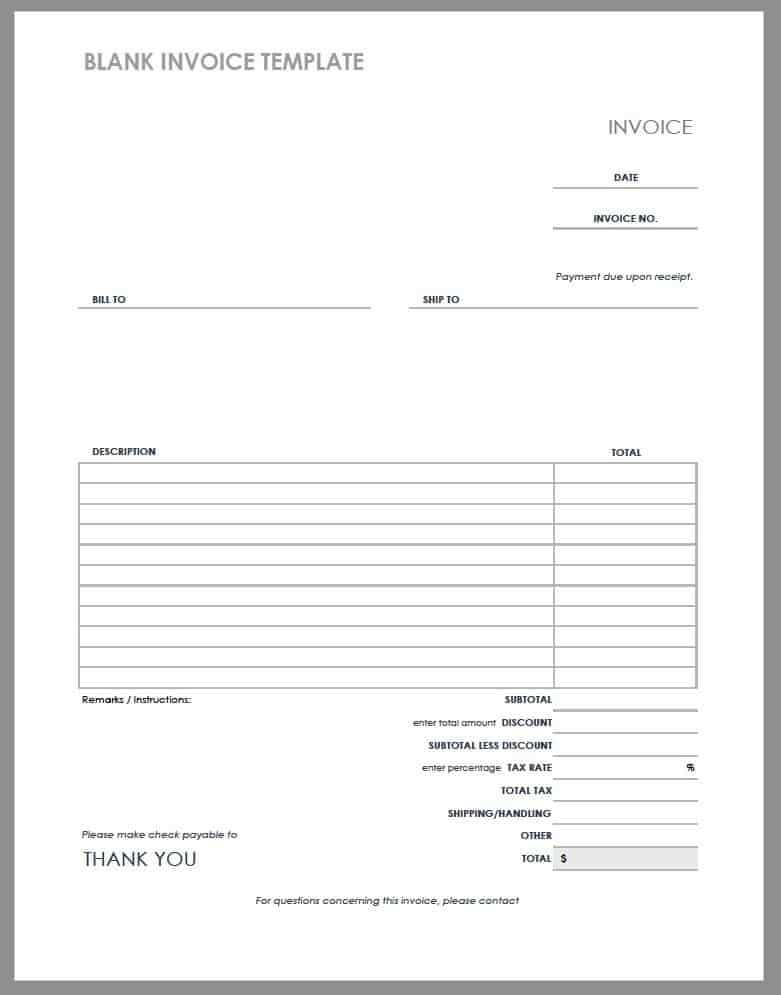

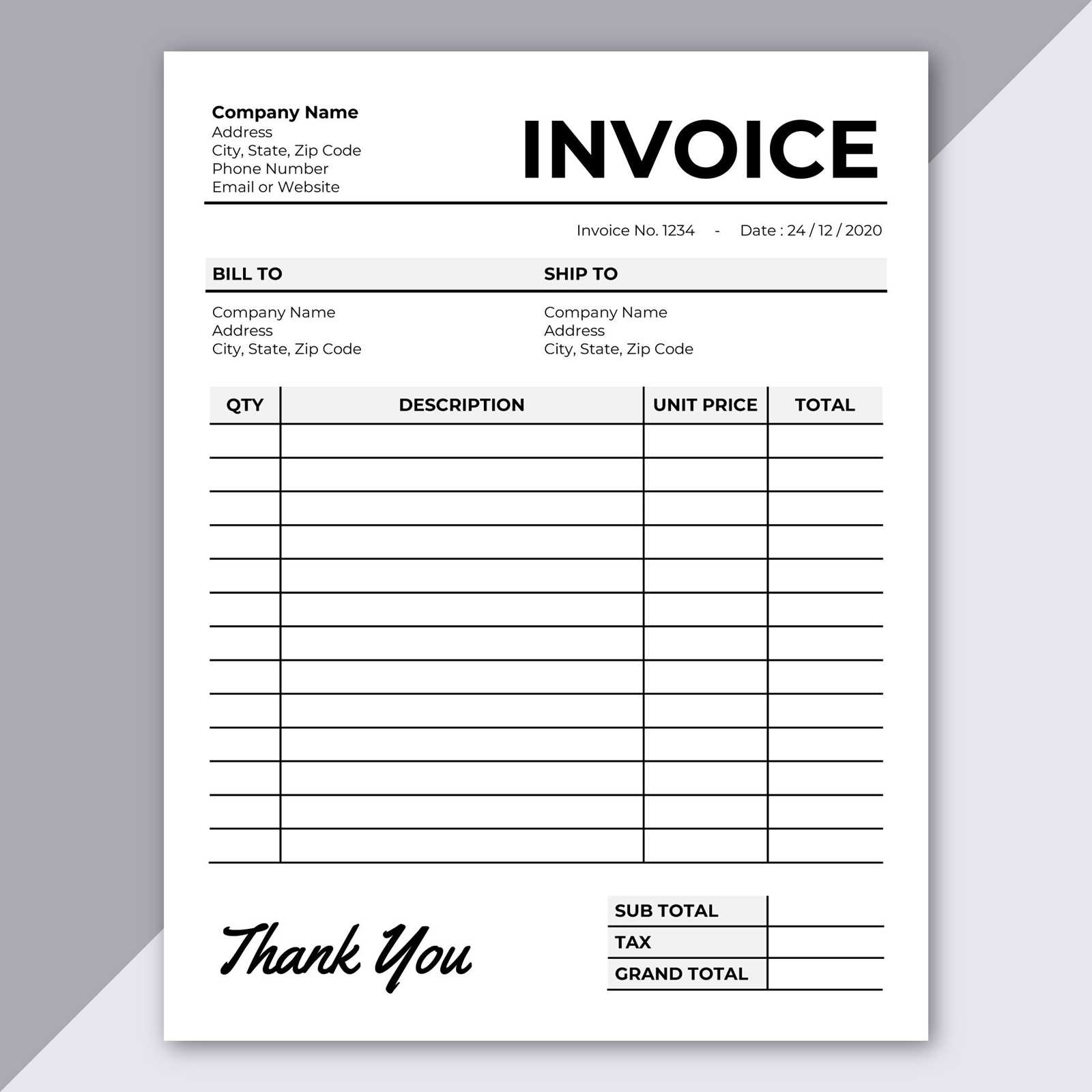

| Easy-to-Use Format | Simple, user-friendly design that allows for quick adjustments and minimal learning curve for users of any experience level. |

| Automated Calculations | Built-in tools that automatically calculate totals, taxes, and discounts, reducing the risk of manual errors. |

These features not only save time but also ensure accuracy and professionalism, making the billing process smoother for both businesses and clients.

Creating a Professional Billing Document for Your Business

Designing a professional document for billing purposes plays a crucial role in how your business is perceived. A well-crafted bill not only ensures that you get paid on time, but it also enhances your company’s image. Customizing the structure and details can help you present a clear, polished record of the transaction, making it easier for both you and your clients to track payments and maintain transparency.

Key Elements to Include

For your document to serve its purpose effectively, there are several key elements that should always be included. These components ensure clarity and consistency while avoiding misunderstandings. Below is a table outlining the most important features:

| Element | Description |

|---|---|

| Company Information | Include your business name, contact details, and any relevant identification numbers like tax IDs or registration numbers. |

| Client Details | Make sure to add the client’s name, address, and contact information to ensure the document reaches the correct person. |

| Detailed Breakdown | List the services or products provided with clear descriptions, quantities, prices, and any applicable discounts or taxes. |

| Payment Terms | Clearly state the payment deadline, accepted methods of payment, and any late fees that may apply if the bill is not paid on time. |

| Unique Reference Number | Assign a unique identifier to each document for easy tracking and reference in future communications. |

Final Touches

Once the essential details are in place, make sure the document looks professional and aligned with your brand. Use a clean, easy-to-read font, and incorporate your logo or brand colors to add a personal touch. Keeping the layout simple and well-organized makes it easier for your clients to review the document and ensures you maintain a professional appearance.

Choosing the Right Document Format for Your Needs

Selecting the ideal format for your billing records is essential to ensure that they meet the specific requirements of your business. Whether you are a freelancer, a small business owner, or part of a large company, the document should be easy to use, professional, and capable of capturing all the necessary details. The right choice will save time, reduce errors, and ensure that your records are clear and well-organized.

When deciding on the best option, consider factors such as the complexity of your transactions, the number of clients you serve, and any specific industry needs. A simple layout may be sufficient for straightforward services, while a more detailed format may be necessary for complex billing situations. Additionally, think about your preferred method of distribution–whether you plan to send documents via email, print them, or both–and ensure that the format you choose is compatible with your distribution method.

How to Personalize Billing Fields

Customizing the fields of your billing document is an important step to ensure that it reflects your business’s unique needs and branding. Personalizing the content allows you to add relevant information, adjust layouts, and highlight specific details that are critical to each transaction. Tailoring the fields makes it easier to track payments, clarify terms, and enhance the overall presentation.

Adding Business and Client Information

Start by including your company’s name, contact details, and logo in the designated fields. This ensures that your clients easily recognize the document and know how to reach you for any inquiries. Also, make sure to input the client’s name, address, and contact information, so they are clearly referenced in the document for accurate communication.

Adjusting Payment Terms and Descriptions

Customizing payment terms is another important step. You can modify fields related to due dates, payment methods, and late fees. Additionally, adjusting the descriptions of services or products helps ensure clarity. For example, if you provide a customized service, you may want to change the default description to include specific details about the work done.

Personalizing these sections helps create a more professional and organized record that is aligned with your business processes and customer expectations.

Tips for Organizing Your Billing Layout

Creating a clear and organized structure for your billing document is crucial for ensuring that both you and your clients can easily understand the information presented. A well-structured layout not only improves readability but also enhances professionalism. When arranging the different sections, it’s important to prioritize key details and maintain consistency throughout the document.

Start by placing the most essential information, such as your business name and contact details, at the top. This ensures that your client can easily find your details for any follow-up questions. Following this, clearly separate sections such as item descriptions, prices, and payment terms. This division helps clients focus on the relevant details without feeling overwhelmed by clutter.

Consider using bold text or borders to differentiate between key sections. A simple, clean layout with ample white space helps prevent the document from feeling crowded and makes it easier for recipients to digest the information quickly.

Best Practices for Document Numbering

Effective numbering of your billing documents plays an essential role in organizing and tracking payments. A well-structured numbering system ensures that you can easily reference past transactions, maintain consistency, and avoid confusion. By adopting a clear and systematic approach to document numbering, you streamline your accounting process and improve the overall efficiency of your business operations.

Key Considerations for Numbering

When creating a numbering system for your billing records, it is important to keep the structure logical and sequential. This will allow you to track every document accurately and prevent duplication. Below is a table outlining some best practices for choosing an effective numbering system:

| Practice | Description |

|---|---|

| Sequential Numbers | Assign a unique, increasing number to each document, starting from 001 or another clear starting point. This ensures that each record is easily identifiable and distinct. |

| Incorporate Dates | Including a year or month in the number (e.g., 2024-001) helps identify the document’s creation date and makes tracking easier over time. |

| Client-Specific Codes | For businesses with multiple clients, adding client-specific codes can further organize documents, making it easy to search for and track transactions by customer. |

| Avoid Gaps | Never skip numbers to avoid confusion and ensure continuity in your records. Each number should reflect a unique document without exceptions. |

Consistency is Key

By following these best practices, you’ll establish a reliable system for organizing your billing documents. This will make your record-keeping more efficient and professional, reducing errors and simplifying audits when necessary.

Adding Your Business Branding to Billing Documents

Incorporating your business’s unique branding into billing records is an important way to reinforce your professional identity and build trust with clients. By adding visual elements such as logos, color schemes, and custom fonts, you can create a consistent, polished image that aligns with the overall look of your business materials. A well-branded billing document not only looks more professional but also helps make your company memorable.

Key Branding Elements to Include

To effectively reflect your brand, consider adding the following elements to your documents:

- Logo: Place your company logo at the top of the page to instantly identify your business. Make sure it’s clear and of high quality to ensure a professional appearance.

- Color Scheme: Use your brand’s primary colors for text or borders to create a cohesive look. This makes your billing records instantly recognizable and consistent with your other marketing materials.

- Font Choices: Choose fonts that match your brand’s style. Use simple, legible fonts that align with the tone of your business.

- Tagline or Slogan: If you have a tagline, consider adding it to your billing documents to reinforce your brand message and add a personal touch.

Tips for Consistency

Maintaining consistency in your branding is key to making a lasting impression. Here are a few tips to ensure that your branding remains coherent across all documents:

- Keep your logo and color scheme consistent across all materials, from your website to your printed documents.

- Avoid overcrowding the page with too many elements. Stick to a clean and simple design that highlights your brand without overwhelming the recipient.

- Ensure that all your employees or team members use the same branded document style, so there is no variation between communications.

By following these guidelines, you can create documents that reflect your business’s personality and build a stronger connection with your clients through consistent branding.

How to Include Payment Terms in Billing Documents

Clearly outlining payment terms in your billing documents is essential for ensuring smooth transactions and preventing misunderstandings with clients. Payment terms provide important details such as due dates, accepted payment methods, and any penalties for late payments. Including these terms helps establish expectations and encourages timely payments.

Start by clearly stating the due date in a prominent position on the document. This could be under the itemized list or as part of the heading section. Make sure the due date is specific, such as “Due within 30 days of receipt” or “Due by [insert date].” This avoids ambiguity and ensures both parties are on the same page.

Accepted payment methods should also be clearly outlined. Whether you accept credit cards, bank transfers, checks, or online payment platforms, list all the available options for your clients. This information should be easy to find and simple to understand to avoid confusion.

If your payment terms include late fees or discounts for early payment, be sure to specify these as well. For example, “A 2% discount will be applied if payment is received within 10 days” or “A late fee of 1.5% per month will be applied to overdue balances.” This encourages timely payments and ensures that clients are aware of any financial consequences.

Including clear payment terms in your billing documents not only protects your business but also helps maintain positive relationships with clients by setting clear expectations from the start.

Using Templates for Consistent Billing

Maintaining a consistent approach to creating billing documents is key to fostering a professional image and ensuring clarity with clients. Using pre-designed formats for your financial records helps you establish a streamlined process that reduces errors and saves time. Whether you’re a freelancer or running a larger business, consistent documentation is crucial for smooth operations and clear communication.

Benefits of Consistency in Billing

Implementing a uniform structure for all your billing documents can greatly improve the organization and professionalism of your business. Some key benefits include:

- Time-Saving: With a consistent structure, you can quickly fill in necessary details without worrying about formatting or design every time.

- Reduced Errors: When the layout is standardized, the likelihood of missing critical information is minimized, making it easier to cross-check and avoid mistakes.

- Professional Appearance: Uniform billing formats give your business a polished, trustworthy look, reinforcing your brand identity.

- Faster Payments: Clear, consistent documents are easier for clients to understand, making them more likely to pay on time.

How to Implement Consistent Billing Documents

To ensure consistency across all your documents, consider the following steps:

- Choose a format: Decide on a standard structure that works best for your business, and use it for every transaction.

- Stick to a layout: Keep the same placement for elements like contact information, itemized lists, payment terms, and due dates.

- Standardize your design: Use the same color scheme, fonts, and logo placement across all documents to strengthen your branding.

- Update periodically: While consistency is important, periodically review and update your format to keep it relevant and aligned with any changes in your business.

By using standardized formats for your billing documents, you not only save time but also improve accuracy, reduce confusion, and project a more professional image to your clients.

Editable Billing Formats for Freelancers

Freelancers often need quick, professional solutions to create financial documents that are both efficient and customizable. Having access to flexible designs for billing makes it easier to adapt the structure of the document to suit various clients and projects. Customizable formats can help freelancers save time, maintain consistency, and ensure their documents meet the unique needs of each transaction.

For independent professionals, it is essential to have a billing method that allows for customization, whether it’s adjusting the layout, adding specific payment terms, or including project details. With the right solution, freelancers can generate clean, professional-looking financial documents in just a few minutes.

Why Freelancers Need Flexible Billing Documents

- Professional Appearance: Having a standardized yet customizable format ensures your documents always look polished and business-like.

- Customizable for Each Client: Easily adjust details such as service descriptions, rates, and payment terms to meet the specific needs of each project.

- Saves Time: With pre-built layouts, you won’t have to design a document from scratch every time you need to bill a client.

- Increased Efficiency: A reusable and adjustable format can help you handle your billing process more quickly and accurately, allowing you to focus on your work.

Key Elements for a Freelancer’s Billing Document

To ensure your billing documents are effective, consider including the following key components:

- Personal and Client Information: Include your name or business name, contact details, and the client’s information.

- Detailed Description of Services: List the tasks completed, including rates and quantities, to avoid confusion.

- Payment Terms: Clearly state payment methods, deadlines, and any penalties for overdue payments.

- Due Date: Always include a clear due date to ensure timely payments.

- Customizable Footer: Include space for your company’s branding, legal information, or any additional notes specific to the project.

By using flexible billing formats, freelancers can create customized, professional documents with minimal effort, improving both their efficiency and client satisfaction.

Saving Time with Pre-designed Billing Formats

Time is a precious resource for any professional or business owner, and optimizing tasks like creating financial documents can lead to significant productivity gains. Pre-designed structures for managing payments allow you to quickly input relevant details without needing to start from scratch each time. These ready-to-use formats eliminate the repetitive work of creating documents manually, letting you focus on more important aspects of your work.

By utilizing pre-built formats, you save valuable time that would otherwise be spent on formatting and layout. The benefit of having a structure already in place is that it reduces the cognitive load of creating a new document each time. You simply fill in the required information, and the layout takes care of itself.

Why Time-saving Solutions Matter

Professionals and business owners alike can benefit from time-saving solutions for generating financial records. Some key advantages include:

- Increased Efficiency: Quickly prepare and send documents, speeding up the billing process.

- Focus on Core Tasks: Spend less time on administrative work and more time on the primary aspects of your business or freelance work.

- Consistency: Having a pre-designed structure ensures that all your documents look professional and follow the same format, saving time on revisions or updates.

- Reduced Errors: A well-organized structure minimizes the chances of forgetting key details or making mistakes in document creation.

How Pre-designed Structures Enhance Your Workflow

Pre-designed billing layouts simplify your workflow in several ways:

- Standardization: Use the same design for every document, ensuring uniformity across all your transactions.

- Customizable Fields: Easily adapt sections to suit each client, such as updating service descriptions, payment terms, or project details.

- Instant Access: Access and use pre-designed formats at any time, minimizing delays in processing payments.

Incorporating pre-built solutions into your billing practices ensures that you complete tasks faster, more accurately, and with less stress, ultimately improving your overall business efficiency.

How to Update Your Billing Document Regularly

Regularly updating your billing documents is essential for maintaining accuracy and relevance in your business transactions. As your business evolves, so do the requirements for your financial records. Whether you’re adjusting your pricing structure, offering new services, or complying with tax regulations, ensuring that your documents are up to date helps maintain professionalism and smooth workflow.

One of the key benefits of keeping your records updated is reducing the risk of errors. Outdated documents can lead to misunderstandings with clients and delays in payments. By staying on top of these updates, you not only enhance your credibility but also ensure that your clients receive accurate and timely information.

Steps to Keep Your Billing Documents Current

Here are some practical steps to help you update your documents regularly:

- Review Client Information: Ensure that contact details, payment terms, and project specifics are always current.

- Adjust for Pricing Changes: If you modify your rates or add new services, reflect these changes in your records to avoid confusion.

- Incorporate Legal Updates: Keep track of any legal or tax changes that may affect the format, terms, or taxes applied to your documents.

- Include New Branding Elements: As your business evolves, update your logo, color scheme, or other branding elements to maintain consistency across all documents.

Best Practices for Document Management

To streamline the updating process and ensure consistency, follow these best practices:

- Set a Schedule: Make updating your documents a routine task. Set a reminder monthly or quarterly to check for necessary changes.

- Use Cloud-Based Tools: Store your documents in cloud storage to easily access and update them from any device, anywhere.

- Version Control: Keep track of document versions to avoid confusion and ensure that the most recent version is always in use.

By regularly updating your documents, you ensure they remain functional, professional, and aligned with your current business needs, leading to smoother financial transactions and stronger client relationships.