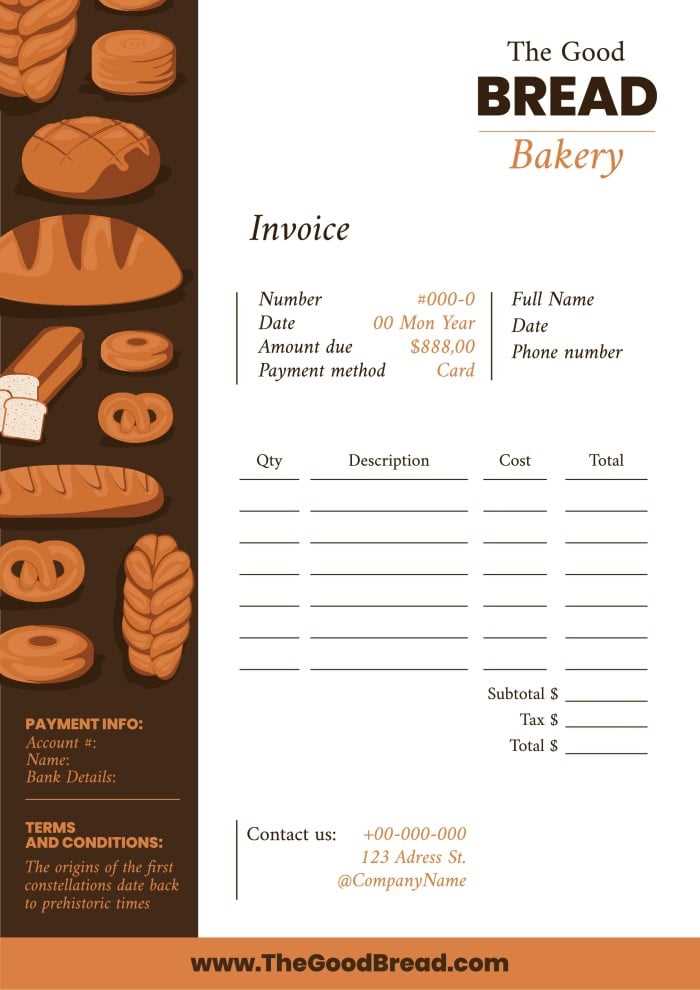

Printable Cake Invoice Template for Bakery Businesses

Running a successful bakery requires more than just great recipes. Organizing orders, tracking payments, and maintaining clear communication with clients are all crucial aspects of business management. One of the most effective ways to streamline these tasks is by using a well-structured document that helps both the seller and buyer keep track of transactions. This tool not only ensures accuracy but also adds a level of professionalism to your business operations.

Having a well-designed document for every sale helps clarify the details of each transaction, from the products ordered to the total cost. It can serve as both a formal receipt for customers and a record for financial purposes. When designed properly, this document becomes an essential part of your business, making transactions smoother and more organized.

In this guide, we will explore how you can create and customize a simple yet effective document to suit your needs. Whether you’re a small home-based bakery or a larger establishment, this tool can be tailored to match your workflow and enhance your customer service. By the end of this article, you’ll understand the key features to include and how to use them to your advantage.

Printable Cake Invoice Template for Bakers

For any baker, having a clear and organized method for tracking sales and managing customer orders is vital. A detailed and professional document helps ensure both accuracy and transparency in business transactions. This essential tool simplifies the process of recording transactions, making it easier to stay on top of payments and order details. A well-structured format is especially useful for small businesses and freelance bakers who may not have access to advanced accounting software.

Why This Tool is Essential for Bakers

Using a custom document can make the difference between a disorganized operation and a smoothly running business. It offers multiple benefits for both the baker and the customer:

- Clarity and Transparency: Clearly outlines the details of the order, such as the quantity, type, and price of products.

- Professionalism: Establishes trust with customers by providing a formal, neat, and easy-to-understand summary of the transaction.

- Record-Keeping: Provides an important tool for financial tracking and budgeting, helping you stay on top of income and expenses.

- Time Efficiency: Saves time during the checkout process and reduces errors compared to handwritten or manually tracked records.

Key Features of a Good Document for Bakers

When creating a document for bakery sales, there are several important elements to include to ensure it meets both business and customer needs:

- Business Information: Include your bakery’s name, contact details, and

Why You Need an Invoice Template

For any small business or freelance operation, having an organized and efficient way to document transactions is crucial. Without a standardized method, keeping track of sales, payments, and customer details can quickly become overwhelming. A structured document serves not only as a record of the transaction but also as a professional way to communicate the details of an order to the customer. Whether you’re running a bakery, a catering service, or any other small business, this tool streamlines your processes and ensures that you don’t miss any important details.

Here are some of the main reasons why incorporating this tool into your workflow is essential:

Benefit Description Improved Organization A standardized document helps you track payments, orders, and customer information more easily. Professionalism Providing a clear, formal record boosts your credibility and trustworthiness with clients. Time Savings Automating the process of creating and sending records reduces the time spent on manual tracking. Financial Clarity It simplifies bookkeeping and helps ensure that you are accurately accounting for all payments received. Legal Protection Offers proof of the transaction, which can be useful in case of disputes or disagreements. With these advantages in mind, it’s clear that having a well-organized and efficient method for documenting transactions is not just a convenience–it’s a necessity for mainta

How to Customize a Cake Invoice

Customizing your sales document is an important step in tailoring it to meet the specific needs of your bakery or small business. A personalized record allows you to reflect your brand identity, clearly communicate essential details to your clients, and streamline your internal processes. Whether you choose to design it yourself or modify a pre-existing format, understanding how to adjust the layout and content is key to creating a professional and functional tool for your operations.

Steps to Customize Your Sales Record

Here are the main elements to focus on when personalizing your transaction document:

- Branding: Include your business name, logo, and contact details prominently at the top of the page. This helps establish your identity and makes it easier for clients to reach you.

- Customer Information: Make sure to add fields for customer details such as name, address, and phone number. This is useful for both communication and future follow-ups.

- Order Details: Clearly list each item purchased with its description, quantity, and price. Make the descriptions simple but thorough to avoid any confusion.

- Payment Terms: Specify the agreed-upon payment methods and any deadlines. You may also want to include information about late fees or discounts for early payments.

- Total Amount: Ensure that the total cost is clearly visible and includes any taxes or discounts applied to the order. Breaking down the price helps build trust and transparency.

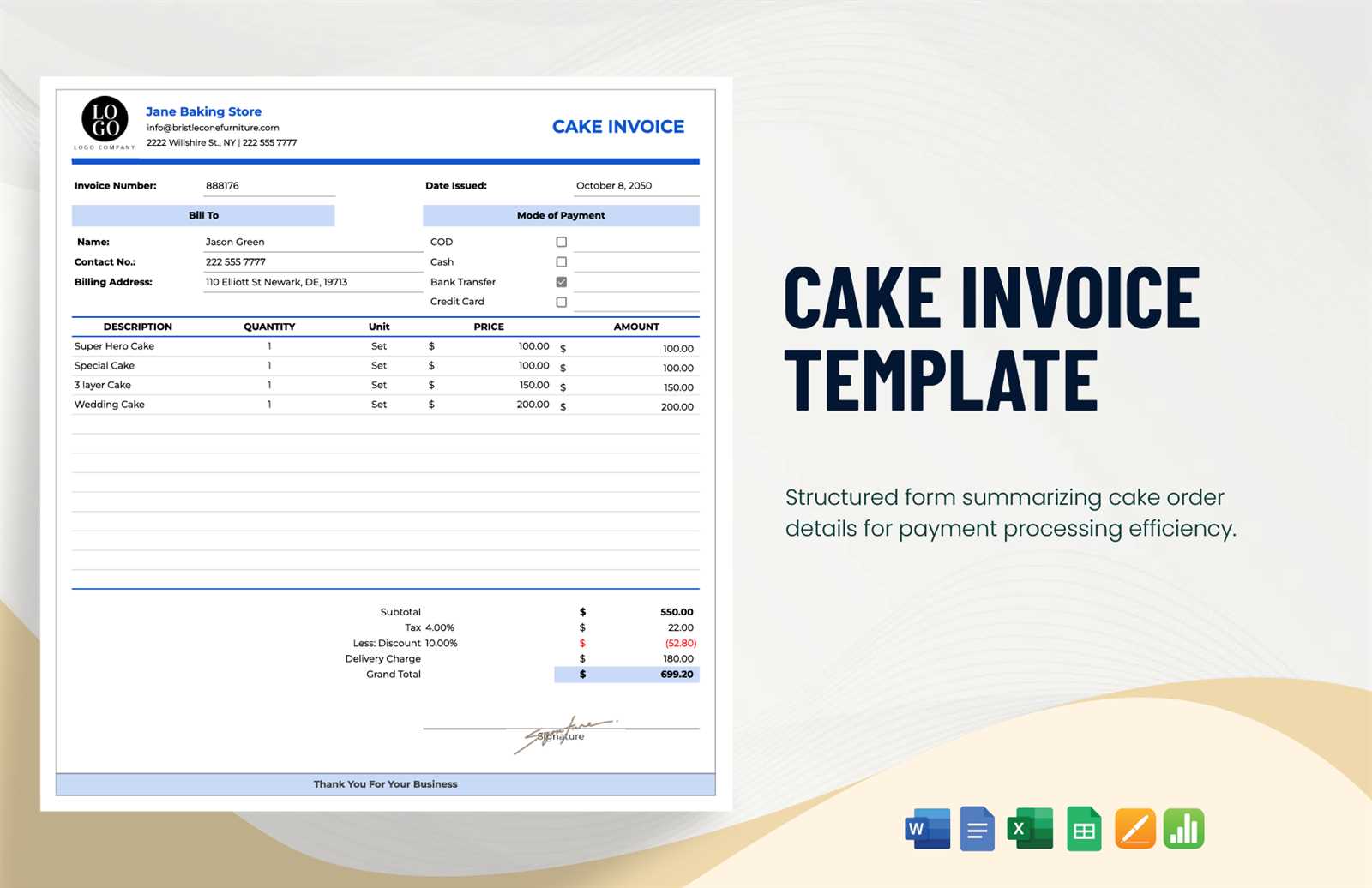

Key Elements of a Cake Invoice

For any bakery or small business, creating a detailed and organized document for each transaction is essential to maintaining clarity and professionalism. This document not only serves as proof of the exchange but also helps ensure that both parties are on the same page regarding order details and payment. There are several important components that every record should include to avoid confusion and maintain a smooth business process.

The following are the key elements to incorporate when creating a detailed transaction document:

- Business Information: At the top of the document, include your business name, address, phone number, and email address. This provides easy access for clients to contact you in case of any queries or follow-up.

- Customer Details: Capture the customer’s name, address, and contact information. This is particularly important for delivering products and for future communications.

- Order Summary: Clearly describe the items or services provided, including quantities and individual prices. This ensures there is no misunderstanding about what was purchased.

- Payment Breakdown: Include an itemized breakdown of the costs, highlighting taxes, discounts, and any additional charges. This transparency helps build trust and avoids confusion.

- Total Amount: Display the final total clearly, so the customer knows exactly how much they are required to pay, including any taxes or fees.

- Payment Terms: Clearly state the payment due date, acceptable payment methods, and any late fees if applicable. This ensures there are no surprises and that payment expectations are clear.

- Transaction Date: Always include the date of the transaction to maintain a proper record for accounting and future reference.

- Notes or Special Requests: This section can include additional details such as custom requests, delivery instructions, or any special agreements made during the transaction.

By including these key elements in your document, you ensure that each transaction is fully documented, making it easier to track and manage both customer orders and payments. Furthermore, it enhances the professionalism of your business and fosters better customer relationships.

Benefits of Using Printable Invoices

Using physical documents for transactions can offer several advantages, especially when managing business dealings. These documents provide a tangible record that can be referred to for clarification, helping to streamline communication and reduce misunderstandings. The convenience of having something in hand, with clear information, supports both clients and providers in maintaining organized financial records.

Improved Record-Keeping

Physical records can serve as a reliable archive for future reference. Storing hard copies ensures that important transaction details remain accessible, even if digital systems fail or data is lost. This method is particularly valuable for those who prefer maintaining a traditional filing system or require a backup for digital records.

Professional Appearance

Providing a well-structured printed document can enhance the professional image of a business. A polished, clearly formatted paper with essential details demonstrates attention to detail, fostering trust and confidence in clients. Clarity and organization of such documents can help establish a positive reputation and encourage repeat business.

Additionally, physical documents can often be signed, offering a sense of formality and commitment that digital agreements sometimes lack. The physical nature of the paper also makes it easier for clients to keep a tangible reminder of their transaction, further strengthening the business relationship.

In summary, opting for printed documentation contributes to better organization, a more professional approach, and a reliable backup for managing financial interactions.

Choosing the Right Invoice Format

Selecting the appropriate structure for transaction documentation is crucial to ensure clear communication between businesses and clients. The right format should cater to the nature of the transaction, offering a balance between simplicity and detail. A well-organized document not only simplifies record-keeping but also helps avoid confusion in payment processes, ensuring smooth operations.

Consider Business Needs

Each business has unique requirements when it comes to documenting transactions. For instance, a simple service-based company might prefer a more streamlined document, while a business that deals with multiple products or custom orders may need a more detailed layout. Identifying the key elements to include, such as item descriptions, prices, and payment terms, will guide the selection of the most suitable format.

Client Preferences and Industry Standards

Understanding the preferences of your clients and aligning with industry practices is also essential. Some clients may request a specific format, while others may prefer a more traditional or digital approach. Additionally, different industries may have standard elements that should be included in any document, such as tax information, delivery details, or a breakdown of services rendered. Adapting to these expectations can help improve customer satisfaction and ensure that no important details are overlooked.

Flexibility is another key consideration. Choosing a format that allows for easy customization can be beneficial as business needs evolve. Whether you’re managing regular sales or custom projects, having a flexible structure ensures that you can adapt quickly without compromising clarity or professionalism.

In conclusion, selecting the right format depends on understanding both business operations and client expectations, while ensuring that all critical details are clearly presented.

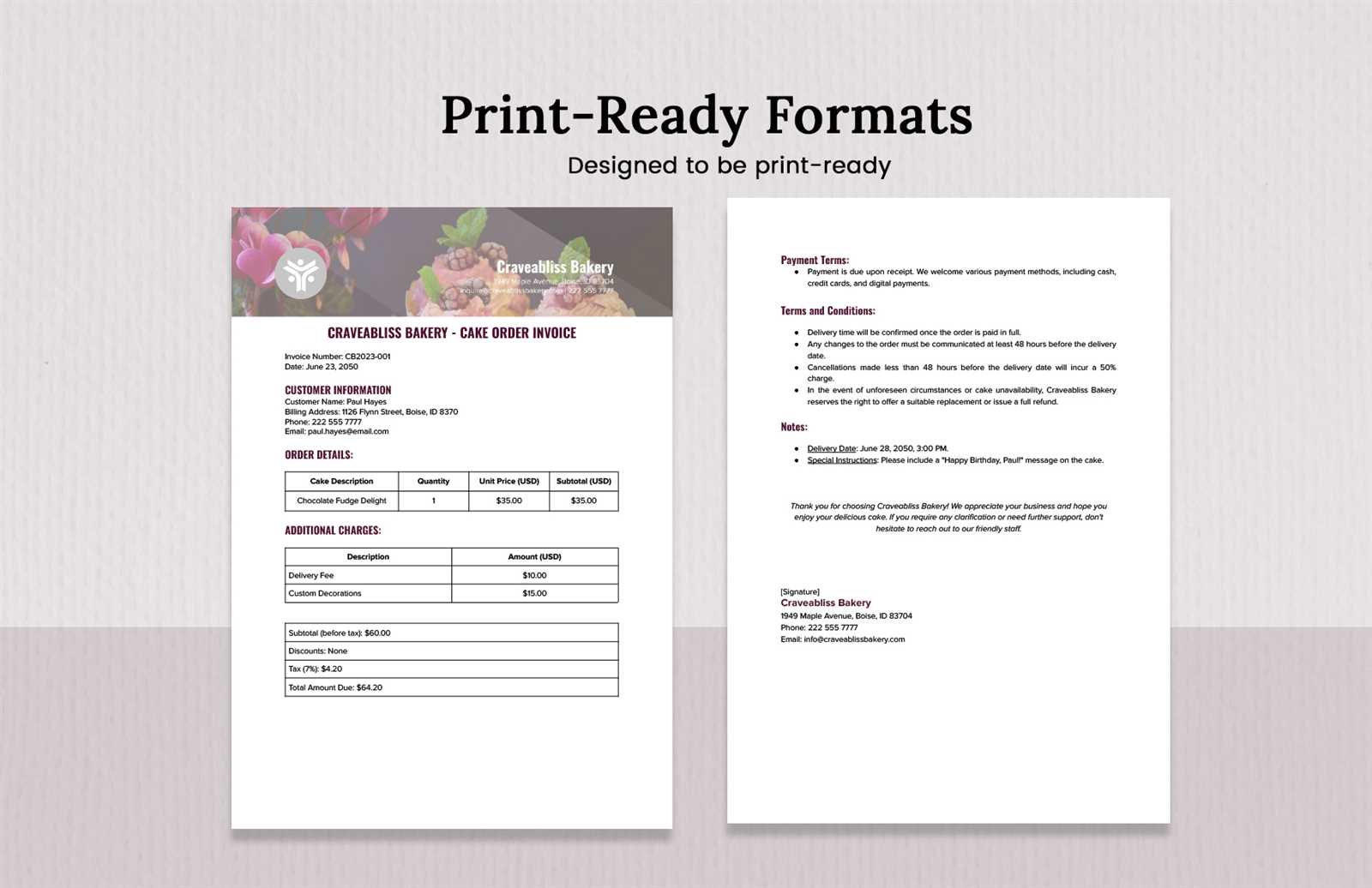

Steps to Create a Cake Invoice

Creating a well-structured document for transactions is essential for both business owners and clients. A clear, organized format ensures that all necessary information is communicated effectively and can be easily referenced later. By following a few straightforward steps, you can design a document that accurately reflects the details of the transaction and facilitates a smooth payment process.

Step 1: Include Essential Business Information

The first step in crafting your document is to provide all necessary business information. This includes your company name, address, contact details, and any relevant tax identification numbers. It’s important that these details are clearly visible at the top of the page, as this allows your clients to easily identify the source of the document and contact you with any questions or concerns.

Step 2: List the Products or Services

Next, clearly outline the products or services provided. Include a detailed description of each item, along with quantities and prices. For complex orders, consider including itemized descriptions or specific customizations requested by the client. This section should be organized in a way that the client can easily match each charge with the corresponding product or service, minimizing confusion and ensuring transparency.

Additional Details, such as discounts, taxes, and delivery fees, should also be clearly stated to avoid misunderstandings. If applicable, be sure to include payment terms, such as the due date and accepted payment methods.

By following these basic steps, you can ensure that your documents are both professional and functional, making the payment process smoother for both you and your client.

Free Printable Cake Invoice Resources

For businesses seeking efficient ways to document transactions, there are many free resources available that provide easy-to-use formats. These tools can help streamline the process, ensuring accuracy and professionalism without the need for expensive software. Whether you are starting a small business or simply need a quick solution, these options offer practical ways to create well-organized records.

Where to Find Free Resources

- Online Platforms: Websites such as Canva, Invoice Generator, and Zoho provide customizable formats that can be downloaded for free.

- Google Docs: Google offers various free templates that can be edited and saved according to your business needs.

- Microsoft Office: Microsoft Word and Excel offer free downloadable formats, allowing for customization and easy editing.

Key Features to Look For

- Customizability: Ensure the resource allows you to add specific business details, such as your logo, contact information, and payment terms.

- Clear Layout: Choose a format that organizes items and prices in an easy-to-read manner, with clear sections for taxes and fees.

- File Type Compatibility: Select resources that allow for saving and sharing in popular formats, such as PDF or Word.

By utilizing these free resources, businesses can create professional and functional transaction records without incurring extra costs, all while maintaining a polished and organized appearance.

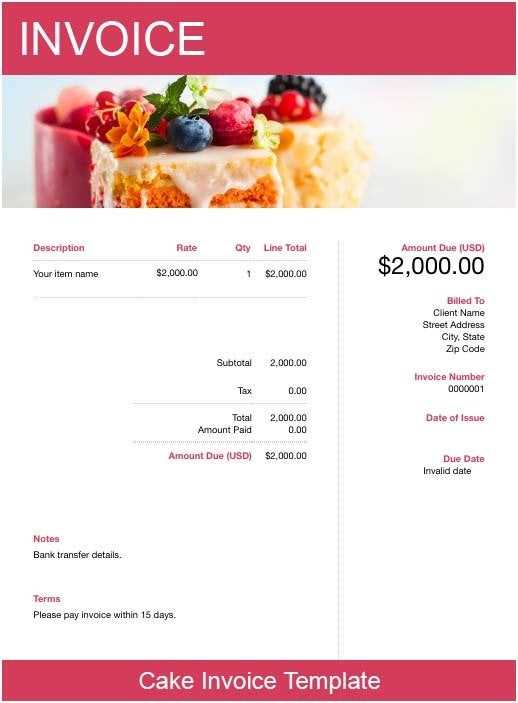

Design Tips for Professional Invoices

Creating a well-designed document for transactions can enhance the credibility of your business and make a lasting impression on clients. A clean, organized structure not only ensures clarity but also reflects professionalism, helping to build trust. Thoughtful design elements can elevate the look and feel, making the document both functional and visually appealing.

Use Clear and Consistent Branding

Your document should incorporate key elements of your business’s brand identity. Include your logo, business name, and consistent fonts that match your overall branding. This creates a cohesive look that reinforces your company’s image. Color schemes should be subtle yet aligned with your brand to avoid overwhelming the reader while maintaining a professional appearance.

Organize Information with Simplicity

Ensure that the content is easy to follow by organizing it into clear sections. Start with business details, followed by a breakdown of products or services provided. Make use of headings, bullet points, and tables to separate different categories. White space is also crucial for readability, preventing the document from feeling cluttered or chaotic.

By focusing on a clean design and consistent branding, you can create a polished document that not only communicates important details but also enhances your business’s professionalism and trustworthiness.

Best Software for Cake Invoice Templates

For businesses looking to create professional documents for their transactions, using the right software can make the process easier and more efficient. The right tools allow for quick customization, accurate calculations, and seamless integration with other business systems. There are a variety of programs available, each offering different features that can help create high-quality, functional records.

1. QuickBooks

QuickBooks is one of the most popular choices for managing business finances, and it offers customizable formats for billing. With an intuitive interface, it allows users to easily generate detailed documents, track payments, and organize records. Automation features also reduce manual entry, making the process faster and more reliable.

2. FreshBooks

FreshBooks is another highly-rated solution that caters specifically to small businesses. Its simple design and user-friendly features make it ideal for entrepreneurs looking to manage their financial paperwork without hassle. Customizable layouts enable users to tailor documents to their specific needs, while its cloud-based nature allows easy access from anywhere.

Both of these options provide the necessary tools to create professional and polished documents, making it easier to manage transactions while keeping track of financial data.

How to Track Cake Orders with Invoices

Keeping track of orders is essential for any business, and using properly structured transaction records can significantly improve organization and accountability. These documents not only provide a clear summary of the products or services delivered but also help businesses monitor payment status, manage customer relationships, and maintain accurate financial records.

Organizing Orders by Number and Date

One of the most effective ways to track orders is by assigning a unique reference number and including the order date on each document. This makes it easy to locate specific transactions and ensures that no orders are overlooked. A chronological system allows you to quickly check the status of pending orders, whether they are completed, in progress, or awaiting payment.

Including Key Details for Easy Tracking

Each document should include essential details, such as customer contact information, order description, quantity, pricing, and due dates. By organizing the information clearly and consistently, businesses can easily identify the specifics of any order. Additionally, you can track the status of payments and mark when orders are paid or still outstanding. This method ensures that all orders are accounted for and helps streamline the fulfillment process.

Saving Time with Pre-made Invoice Templates

Using pre-designed formats can significantly reduce the time spent on creating transaction documents from scratch. These ready-to-use options allow businesses to quickly input essential details, ensuring that the process is efficient and consistent. By relying on structured layouts, you can minimize errors, save time on formatting, and focus more on other important aspects of your business.

Benefits of Pre-made Layouts

Pre-designed formats provide several advantages that save time and effort. They are typically organized in a clear, logical way, ensuring that all necessary information is included without the need for manual design. Additionally, these layouts often come with built-in features that automate certain tasks, such as calculating totals or adding tax, further speeding up the process.

Comparison of Pre-made Options

Software Customization Options Ease of Use Additional Features Canva High Very Easy Drag and drop design tools FreshBooks Medium Easy Automated calculations, cloud access QuickBooks High Moderate Accounting features, invoice tracking By choosing the right pre-made formats, you can streamline your workflow, reduce manual input, and ensure that your documents are professional and accurate in less time.

Integrating Invoices into Your Bakery Workflow

Efficiently incorporating financial documentation into your bakery operations is essential for maintaining smooth workflows and ensuring timely payments. By seamlessly integrating these records into your daily processes, you can manage customer orders, track sales, and streamline accounting. A well-organized system for handling these documents not only saves time but also helps avoid errors and improves overall business efficiency.

Steps to Integrate Financial Records

To effectively integrate transaction records into your bakery’s workflow, it’s crucial to align them with your order management process. Start by generating the necessary documents at the point of sale or order confirmation. Automatically create and send them to customers immediately after an order is placed or fulfilled. This ensures that both you and your customers are on the same page when it comes to payment terms and expectations.

Tracking Sales and Payments

Tracking payments and sales through a consistent documentation system is key to keeping your bakery’s financials in order. Use your records to log each transaction, monitor outstanding balances, and track the status of payments. By linking these documents to your inventory and accounting systems, you can easily see what’s been sold, what needs to be restocked, and what payments are still pending.

Action Best Practices Tools to Use Generate Records Automate document creation at the point of sale POS software, accounting tools Send to Customers Send via email or printed copies a Common Mistakes in Cake Invoices

When it comes to documenting orders and transactions for baked goods, many businesses overlook important details that can lead to confusion or disputes. Even the smallest oversight can create issues for both the baker and the customer, which is why ensuring accuracy is crucial. Below, we highlight some of the most frequent errors to avoid in billing records for custom confectionery orders.

Inaccurate Item Descriptions

One of the most common errors is failing to clearly describe the items provided. When the name, size, flavor, or customization details are vague or missing, it becomes difficult for both the customer and the vendor to understand exactly what was ordered. This can lead to misunderstandings or dissatisfaction. Always make sure each item is listed with enough detail, including any unique specifications, to avoid confusion.

Missing or Incorrect Pricing

Another frequent mistake is incorrectly calculating the cost of products or omitting necessary pricing information altogether. Ensure that all components, including design intricacies, ingredients, and special requests, are reflected in the final price. In some cases, discounts or additional charges may apply, and it’s important to list them clearly. Failure to itemize costs can cause discrepancies when the customer reviews the record, leading to potential disputes.

By avoiding these common issues and being thorough in recording all details, you can ensure smoother transactions and more satisfied customers. Proper documentation not only maintains professionalism but also protects both parties in case of misunderstandings.

How Cake Invoices Improve Customer Trust

Providing clear and professional documentation for custom orders plays a key role in building trust between a business and its customers. When clients receive a detailed breakdown of their purchase, it not only ensures transparency but also reinforces the reliability of the service. By clearly outlining the specifics of the order, including costs and delivery terms, customers can feel confident in their decision and satisfied with the professionalism of the business.

Transparency and Accountability

When the details of a transaction are documented thoroughly, it demonstrates that the business is organized and transparent. Clear communication regarding the scope of the product, pricing, and delivery time creates a sense of security for the customer, as they know exactly what to expect. In case of any issues or disputes, having a documented record helps resolve concerns quickly and fairly, as both parties have agreed upon the terms upfront.

Building Long-Term Relationships

Trust is essential for repeat business. Providing customers with an accurate and professional record of their orders fosters a sense of respect and reliability. Consistent, trustworthy documentation shows that the business values its clients and is dedicated to delivering high-quality service. This strengthens customer loyalty and can lead to positive reviews, referrals, and long-term relationships.

Legal Aspects of Cake Invoices

When it comes to custom orders and transactions, proper documentation is not only a good business practice but also a legal requirement. Ensuring that all relevant details are recorded accurately can protect both the vendor and the customer in case of disputes. Understanding the legal implications of order records is crucial for compliance and to avoid any potential legal complications.

Key Legal Considerations

There are several important legal aspects to consider when documenting custom orders, including but not limited to the following:

- Contractual Agreement: An order confirmation or detailed record can serve as a legal contract, outlining the terms and conditions agreed upon by both parties.

- Consumer Protection Laws: Businesses must comply with local laws that protect consumer rights. Clear documentation ensures transparency and safeguards both parties’ interests in accordance with these regulations.

- Tax and VAT Compliance: Accurately itemizing charges helps ensure compliance with tax laws. Failure to correctly list all costs, including taxes and additional fees, can lead to legal penalties.

Importance of Detailed Records

Having well-structured documentation protects your business and provides legal recourse in case of conflicts. A detailed record ensures that both parties are on the same page regarding payment terms, product specifics, and delivery expectations. Without pr