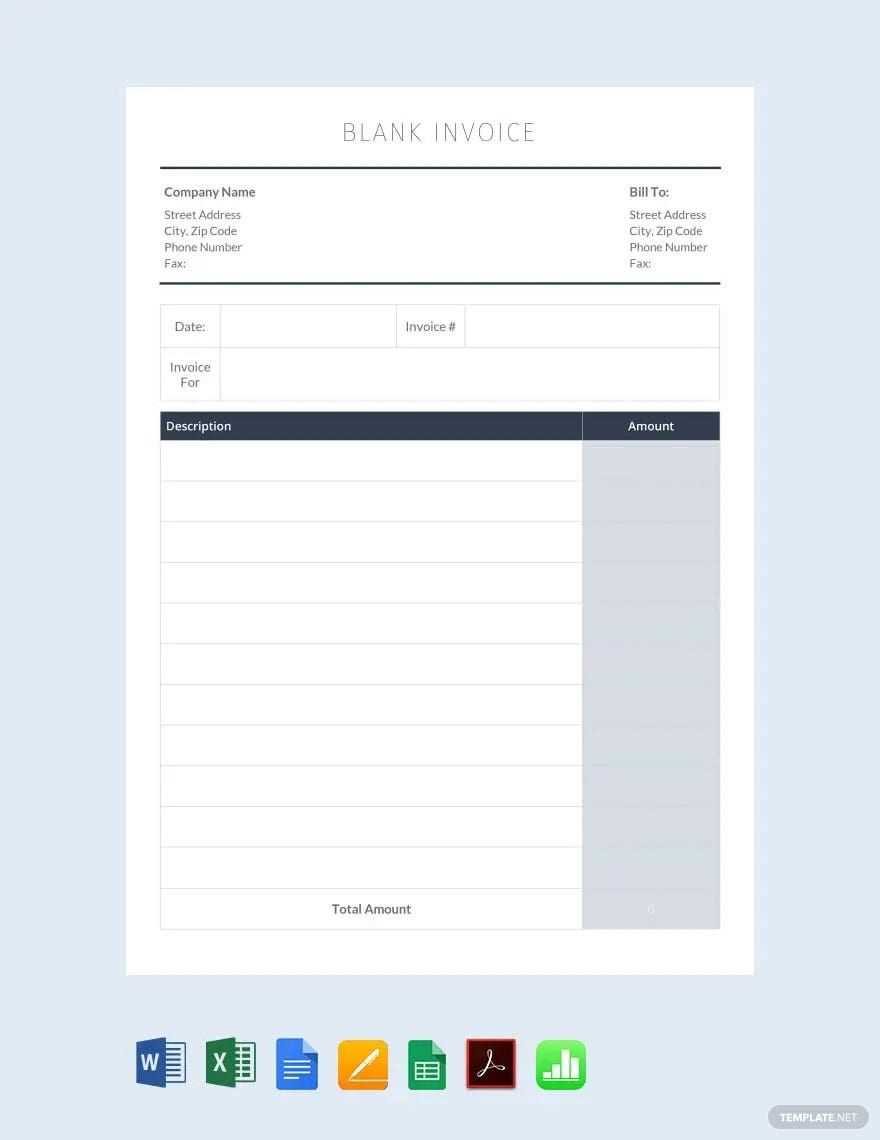

Download Printable Blank Invoice Template for Easy Invoicing

In the modern world of business, having a reliable and efficient way to issue payment requests is essential. Whether you’re a freelancer, small business owner, or entrepreneur, knowing how to generate formal financial records quickly and accurately is crucial. Fortunately, there are simple and customizable ways to create these essential documents without the need for expensive software or complicated systems.

By using easily accessible resources, anyone can craft a clear and professional statement that ensures transparency between service providers and clients. These tools allow users to personalize their documents according to the specific needs of their business, from adding logos and contact details to adjusting the layout and design for different industries.

Streamlining your billing process not only saves time but also helps to avoid errors and miscommunications. With the right resources, you can create clear, concise, and accurate records that maintain a professional image and ensure prompt payment from clients. In this guide, we will explore how to efficiently use these tools for all your billing needs.

Why Use a Printable Invoice Template

For any business, providing clear and professional payment requests is key to maintaining good client relationships and ensuring timely payments. Having an easy-to-use solution for generating these documents can save both time and effort, streamlining your administrative tasks. By utilizing customizable formats, you can focus on your core activities while ensuring accuracy and consistency in your financial communications.

Efficiency and Time Savings

Using a ready-made document structure allows you to create well-organized payment records quickly. Instead of manually formatting each request or relying on expensive software, you can easily input necessary details into pre-designed fields, cutting down the time spent on creating professional-looking bills. This efficiency is especially valuable for small business owners and freelancers who need to focus on their services rather than on paperwork.

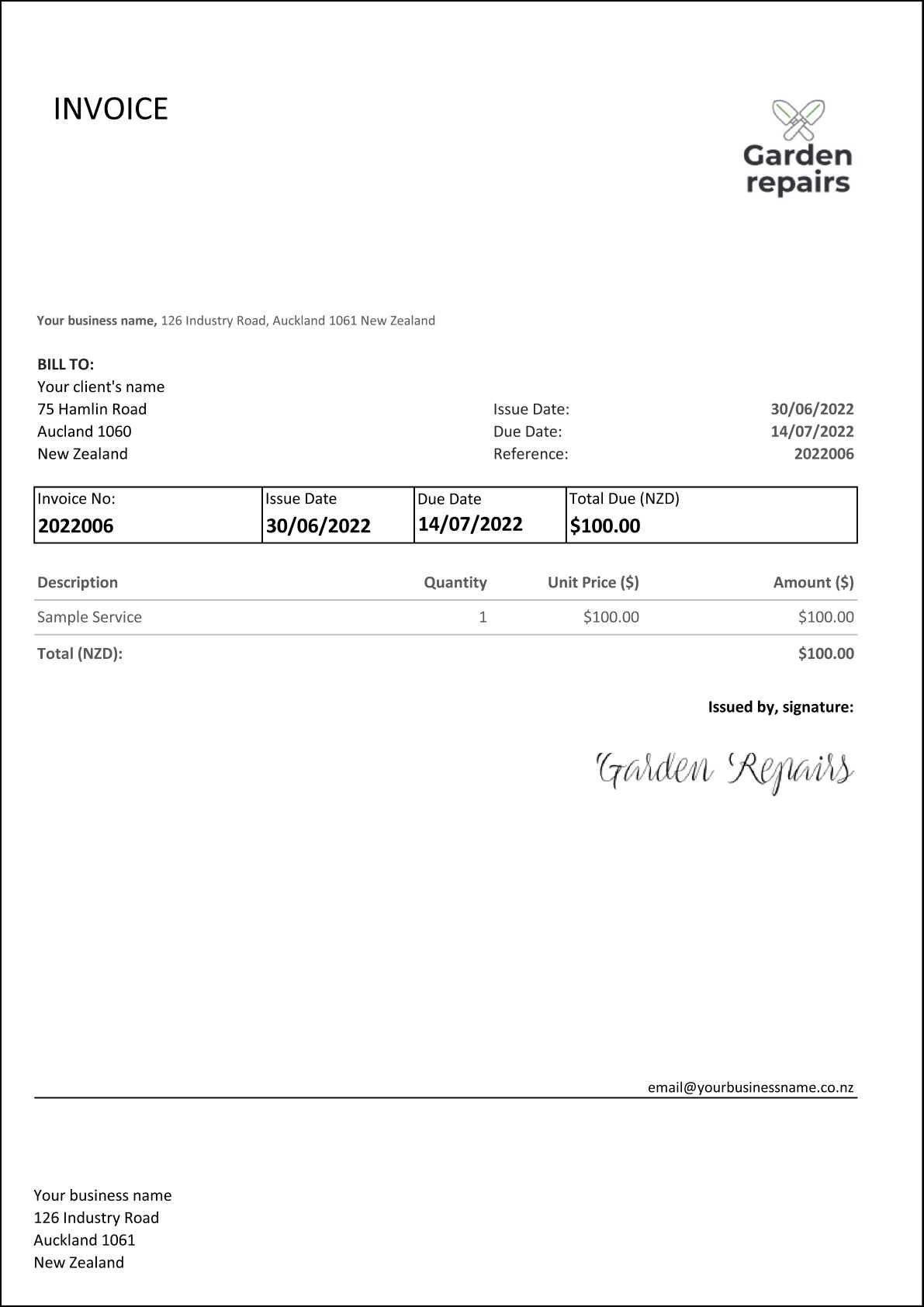

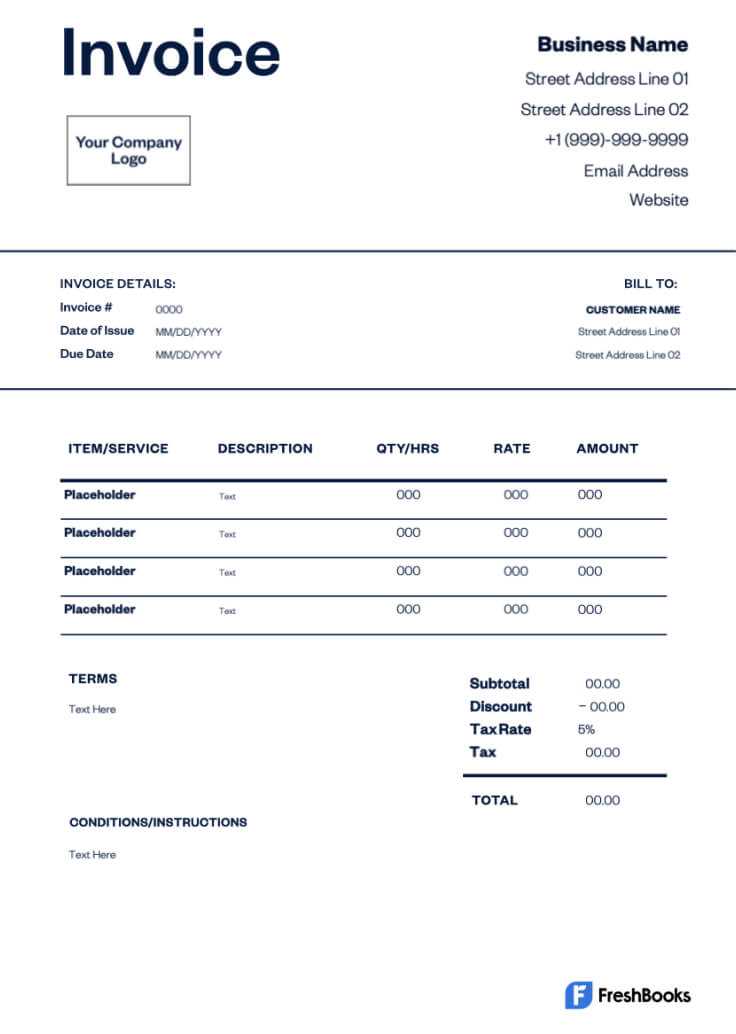

Professional Appearance and Customization

Another major advantage is the ability to customize the design according to your branding needs. Whether you’re adding your logo, adjusting the color scheme, or including personalized information, these resources offer flexibility to ensure your documents match your business’s style. This attention to detail not only creates a professional image but also fosters trust with clients, which is crucial in maintaining long-term business relationships.

Overall, using these resources ensures that you can quickly create accurate, organized, and visually appealing payment documents while staying focused on your business growth.

Benefits of Blank Invoice Templates

Having a simple, ready-to-use format for billing ensures that you can quickly generate accurate and professional payment requests without starting from scratch. By using a pre-structured design, you can streamline your billing process and focus on other important tasks, all while maintaining consistency and clarity in your financial documents.

Time Efficiency

One of the primary advantages is the significant time savings. With a pre-made structure, you don’t need to waste time manually creating new forms for each transaction. You can simply input the relevant details, saving you from repetitive work and helping you stay organized. This is especially beneficial for freelancers, consultants, and small business owners who need to generate multiple requests in a short time.

Consistency and Accuracy

Using a standardized format reduces the risk of errors and ensures that each document follows the same structure. This consistency not only improves your professional image but also makes it easier for clients to understand and process your billing requests. With clear sections for essential information, such as payment terms, services rendered, and amounts due, there’s little room for confusion or mistakes.

Ultimately, these formats offer a simple yet effective solution for handling your business’s financial communication in a way that is both efficient and reliable.

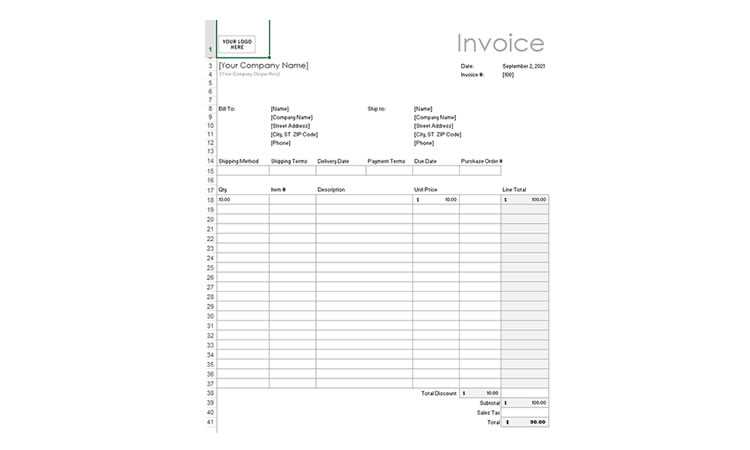

How to Customize Your Invoice Template

Personalizing your billing document is a straightforward way to ensure that it reflects your business identity and meets your specific needs. By adjusting various elements such as layout, content, and design, you can create a document that is both professional and tailored to your services. Customization allows you to add a personal touch and provide clients with all the necessary information in a clear and organized format.

Adjusting the Layout and Design

The first step in customization is deciding on the visual appearance of the document. You can modify the layout by choosing different fonts, colors, or adding your company’s logo and branding elements. Ensuring the document is clean and easy to read is essential. A well-organized structure with clearly defined sections for payment terms, dates, and service descriptions enhances both readability and professionalism.

Including Key Information

Another important aspect of customization is making sure the document includes all the relevant details for your clients. This could involve adding specific fields such as payment methods, discounts, or project milestones. Depending on your business type, you may also want to include your tax identification number, project codes, or other industry-specific data. Adjusting the content to suit the nature of your services or products ensures that you communicate the necessary information effectively.

By taking the time to customize these elements, you create a more personalized experience for your clients while reinforcing your brand’s identity and ensuring that all essential details are presented clearly.

Where to Find Free Invoice Templates

There are numerous resources available online where you can access no-cost documents for billing purposes. Whether you’re looking for simple formats or more sophisticated designs, many websites offer free downloads that can be customized to suit your needs. These resources provide a great starting point for businesses of all sizes, enabling you to create professional-looking records without spending money on software or specialized tools.

Online Platforms for Free Downloads

Several websites provide free access to a wide range of customizable billing documents. Here are some of the most popular platforms where you can find these resources:

- Microsoft Office Templates – Offers a variety of document designs that can be edited in Word or Excel, suitable for any business.

- Google Docs – A great platform for creating and storing your billing records online, with easy customization options.

- Canva – Provides creative, visually appealing document designs that can be personalized and downloaded in multiple formats.

- Template.net – A dedicated website with numerous options for free and paid document structures across different industries.

Industry-Specific Resources

If you’re working in a specific field, you can find industry-focused websites that offer specialized forms to meet your needs. For example, creative professionals may find suitable designs on platforms tailored to freelancers, while construction businesses may find relevant formats on trade-related websites. These resources help ensure that your documents are not only professional but also aligned with the norms of your industry.

By utilizing these free resources, you can streamline your billing process and maintain a high level of professionalism in your financial communications without any additional costs.

Printable Invoices for Small Businesses

For small business owners, managing finances efficiently is crucial to success. One of the key components of financial management is creating clear, professional billing records that ensure smooth transactions with clients. By using ready-made formats, businesses can quickly generate these essential documents, ensuring timely payments and maintaining a professional image.

Benefits of Using Ready-Made Formats

Using a pre-structured document is especially advantageous for small businesses, where time and resources are often limited. These ready-made options save valuable time that would otherwise be spent designing and formatting bills from scratch. Small businesses can easily fill in the necessary details–such as the services rendered, amounts due, and payment terms–without needing any advanced design skills or expensive software.

Customization for Business Needs

While these formats offer simplicity, they are also highly customizable. Small business owners can tailor the design and content to suit their unique branding needs, from adding company logos to modifying the layout to better represent their services. This flexibility ensures that each document maintains a personal touch while remaining professional and aligned with the business’s overall aesthetic.

Ultimately, using a ready-made solution for creating financial records helps small business owners save time, reduce errors, and present a professional image to clients–vital for maintaining healthy cash flow and fostering long-term business relationships.

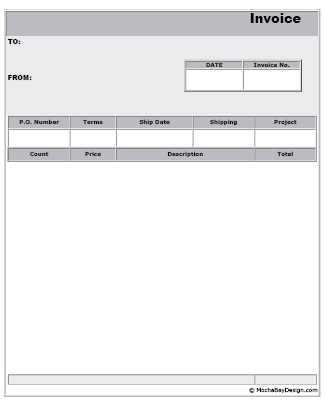

Choosing the Right Invoice Format

Selecting the appropriate structure for your payment requests is essential for ensuring clarity and professionalism in your financial communication. The right format helps organize important information in a way that is easy for clients to understand and process, making it more likely they will settle their accounts on time. Depending on your business type and client needs, you may need to tailor the design and layout accordingly.

Factors to Consider When Choosing a Format

Before settling on a specific layout, there are several factors to take into account to ensure the chosen structure aligns with your business needs:

- Business Type – Different industries may require varying levels of detail. For instance, freelancers may only need basic fields, while service-based businesses may need space for project descriptions and milestones.

- Client Preferences – Some clients may prefer a simpler, more straightforward document, while others may appreciate a more detailed breakdown of services or products.

- Payment Terms – Make sure the format you choose clearly reflects your payment expectations, including due dates, late fees, and accepted payment methods.

- Branding – Consider whether your business’s branding (such as logos and color schemes) should be included in the layout to maintain a consistent image.

Popular Formats for Different Needs

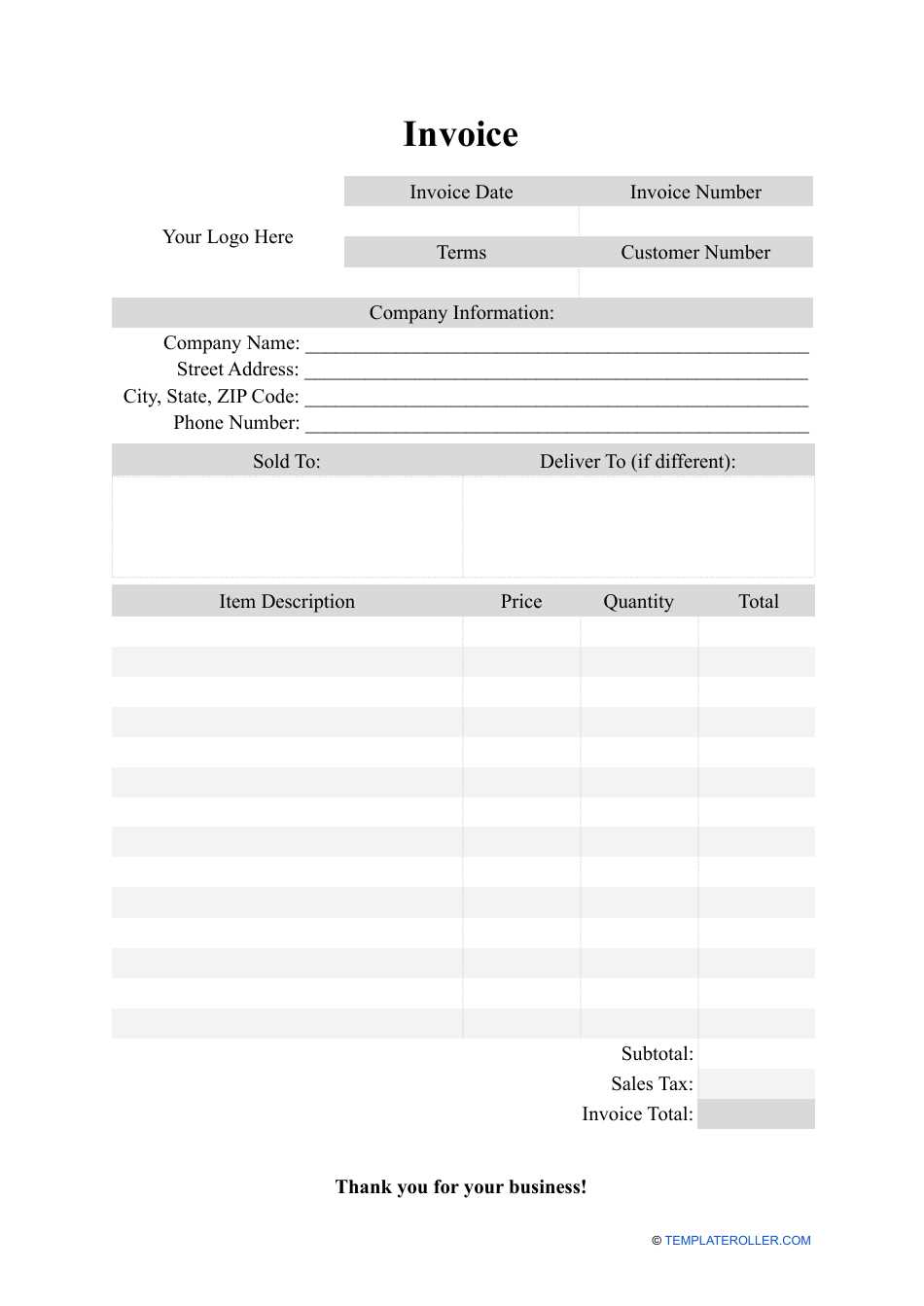

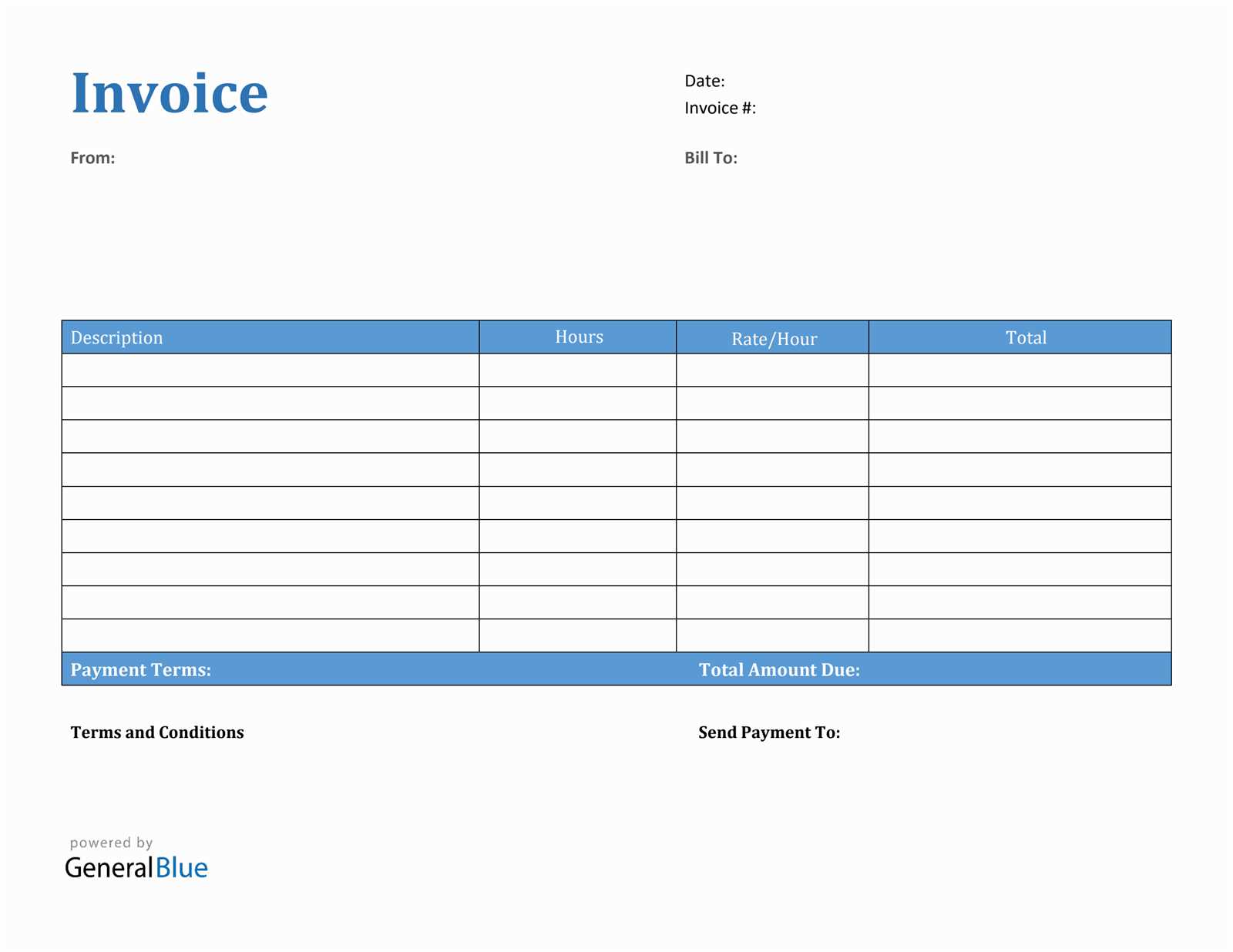

There are several commonly used formats that you can choose from depending on your specific requirements. Here are a few options:

- Basic Design – Simple and easy to read, ideal for small businesses or freelancers with minimal services to detail.

- Itemized Breakdown – Perfect for businesses offering multiple products or services, providing clients with a clear breakdown of charges.

- Professional Design – Includes branding elements and a more polished look, suitable for companies looking to establish a strong brand presence.

Ultimately, selecting the right format ensures that your billing documents are not only clear and functional but also tailored to the needs of both your business and your clients.

Steps to Create a Professional Invoice

Creating a professional billing document is essential for maintaining clarity and fostering trust with your clients. The process involves organizing key information in a way that is both visually appealing and easy to understand. Following a clear set of steps ensures that your payment requests are accurate, consistent, and aligned with business standards.

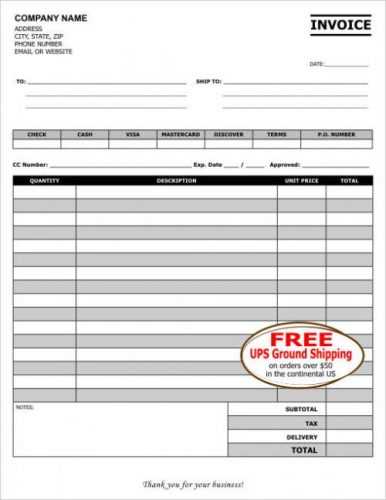

Step 1: Include Your Business Details

The first step in creating a professional document is to add your business information at the top. This should include your company name, logo, contact information, and any other relevant details such as your business address or registration number. Adding this information establishes credibility and helps clients easily reach you if they have any questions.

Step 2: Add Client Information

Next, make sure to clearly list your client’s name, address, and contact details. This ensures that there is no confusion regarding who the payment request is intended for. It also adds a level of professionalism and personalization to each document, making your communication more formal and tailored.

Step 3: List Services or Products

Provide a detailed breakdown of the services or products that were delivered. Each item should have a clear description, the quantity, and the price per unit. This transparency helps avoid misunderstandings and ensures that the client knows exactly what they are paying for.

Step 4: Specify Payment Terms

It’s important to clearly state the payment terms, including the due date, accepted payment methods, and any late fees that may apply. This information helps set expectations and encourages prompt payment. Be sure to also include any relevant taxes or additional charges, so the client knows the total amount due.

Step 5: Add a Personal Touch

Finally, consider adding a personalized message or a thank-you note. This small touch can go a long way in building a positive client relationship and can make your business seem more approachable and customer-focused.

By following these steps, you can ensure that your payment requests are not only professional but also effective in communicating key financial details to your clients.

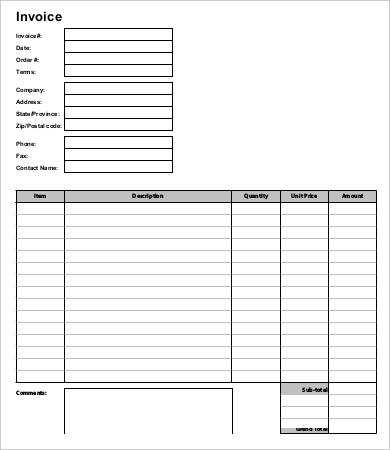

Essential Information for an Invoice

For a billing document to be effective, it must include certain key details that ensure clarity and avoid confusion. These essential elements not only help to communicate the necessary financial information to your clients but also maintain legal and business standards. Including all the required information ensures that payments are processed smoothly and that you maintain a professional relationship with your clients.

1. Business and Client Information

Start by including both your company’s and the client’s contact information. This includes the company name, address, phone number, and email address. For the client, ensure their name and address are clearly listed as well. This basic information helps identify the parties involved and makes it easier for clients to reach out if there are any questions regarding the payment.

2. Unique Document Number

Every billing record should have a unique identifier, usually referred to as an invoice number. This helps both you and your client track payments, refer to past transactions, and avoid any confusion regarding which bill is being discussed. Be sure to number each document sequentially for easy reference and to maintain a consistent record-keeping system.

3. Detailed Description of Goods or Services

Clearly list the products or services provided, along with a description of each item. Include the quantity, unit price, and any applicable taxes. This breakdown ensures transparency and allows your client to see exactly what they are being charged for. Accurate itemization helps prevent disputes over billing and ensures that your records are complete.

4. Payment Terms and Due Date

Make sure to specify the payment terms, such as the due date, accepted payment methods, and any late fees. Including this information ensures that both parties understand the expectations for payment. It also provides a legal reference point should there be a delay or dispute regarding payment.

5. Total Amount Due

Clearly display the total amount due, including any taxes, discounts, or additional charges. The final amount should be prominently shown, making it easy for your client to understand exactly what they need to pay. Including this ensures there’s no ambiguity about the total cost and reduces the chances of errors or delays in payment.

By incorporating these key details into each billing document, you can ensure that your transactions are clear, professional, and legally sound, making it easier for clients to make timely payments.

Common Mistakes in Invoicing

Billing documents are essential for maintaining smooth business operations, but errors in their creation can lead to confusion, delayed payments, and strained client relationships. Even minor mistakes can cause major issues if not addressed properly. It’s important to be aware of the common pitfalls to ensure that each document is accurate, clear, and professional.

1. Missing or Incorrect Contact Information

One of the most common mistakes is failing to include accurate contact details for both the business and the client. This can lead to confusion and delay in communication, especially if a question arises regarding the payment. Always double-check the contact information to ensure that everything is correct and up to date.

2. Failing to Include a Unique Reference Number

Every billing record should have a unique identifier to make it easy to track payments and maintain organized records. Not including this reference number can create confusion for both you and the client when discussing past transactions or making payments. Always assign a distinct number for each document.

3. Inaccurate Pricing or Calculation Errors

Errors in pricing or calculations can lead to significant misunderstandings. These mistakes can range from incorrect rates to wrong totals, often causing delays or disputes. It’s important to carefully review all charges, apply the correct tax rates, and double-check the final amount before sending the document.

4. Ambiguous Payment Terms

Vague or unclear payment terms can result in late payments and confusion. Ensure that the due date, payment methods, and late fees (if applicable) are clearly outlined. This clarity helps prevent any misunderstandings and makes it easier for your clients to follow the agreed-upon payment schedule.

5. Forgetting to Include Necessary Details

Missing important information, such as a description of the services provided or the payment due date, can make the document appear unprofessional and leave the client with questions. Always ensure that all required details are included and that they are clearly presented.

6. Not Including a Thank You or Personal Note

While it may seem small, not including a thank-you note or a personalized message can make your business appear less customer-focused. A simple “Thank you for your business” or “We appreciate your prompt payment” can help build positive client relationships.

Avoiding these common mistakes ensures that your billing documents are both professional and effective, ultimately helping you maintain strong client relationships and ensuring timely payments.

Design Tips for an Effective Invoice

Creating an effective billing document goes beyond just including the necessary information; the design and layout play a significant role in ensuring that your payment request is clear, professional, and easy to read. A well-designed document not only improves client experience but also reflects your business’s credibility and attention to detail. Here are some design tips to help you create a more effective and visually appealing billing record.

1. Keep the Layout Clean and Organized

Clarity is key when designing a billing document. Use a simple layout with clearly defined sections, making it easy for the client to quickly find the information they need. A cluttered design can confuse the recipient, so ensure that each section is neatly separated and that the text is easy to read.

2. Use a Table for Itemized Details

For businesses offering multiple products or services, organizing the details in a table format is essential. A well-structured table allows you to break down each item clearly and enables clients to see the cost per unit, quantity, and total amount. Here’s an example of a clean table layout:

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Consulting Service – Web Development | 5 hours | $50 | $250 |

| Design – Logo Creation | 1 | $150 | $150 |

3. Highlight the Total Amount Due

The final amount due should be clearly visible, preferably at the bottom of the document in a larger or bold font. This makes it easy for clients to find the total cost without having to search through the entire document. This section should stand out to avoid any confusion or misinterpretation.

4. Maintain Consistency in Fonts and Colors

Consistency in design elements, such as fonts and colors, helps establish a cohesive and professional look. Stick to one or two fonts that are easy to read, and use colors sparingly to highlight important information like due dates or the total amount due. Avoid overly bright or distracting colors that can make the document harder to read.

5. Include Your Branding

To reinforce your business identity, include your logo, brand colors, and any other visual elements that align with your branding. This helps clients recognize your business instantly and adds a level of professionalism to your payment request.

By following these design tips,

How to Print Your Invoice Correctly

Printing your billing documents correctly is an important step in ensuring that your communication remains clear and professional. Whether you are sending hard copies by mail or handing them directly to clients, proper printing ensures that the information is legible and formatted correctly. Here are some key steps to ensure your documents are printed correctly every time.

1. Check the Layout and Formatting

Before printing, double-check the layout of your document to ensure that all sections are properly aligned and that no text is cut off. Make sure the page size matches the format you intend to print on, and that margins are set correctly. The document should look exactly as it appears on the screen, with enough space between sections for clarity.

2. Use High-Quality Paper

To give your billing documents a professional appearance, print them on good-quality paper. Standard printer paper (usually 20 lb weight) is fine for most purposes, but for a more polished look, consider using heavier paper (such as 24 lb or 28 lb) that is thicker and more durable. This will help your document feel more substantial and professional when presented to clients.

3. Print in High Resolution

Ensure that your printer is set to the highest resolution available to avoid blurry text or graphics. High-resolution printing ensures that your company logo and any other design elements appear crisp and clear, which is especially important for maintaining your brand’s professional image.

4. Review Before Printing

Always take a moment to review the document on-screen before printing. Look for any missing information, formatting issues, or typos that might have been overlooked. Checking the document one last time before printing can help you avoid wasting paper and ink on incorrect versions.

5. Print Multiple Copies If Needed

If you need more than one copy, ensure that your printer settings are configured to print the correct number of copies. Whether you’re sending documents to multiple clients or keeping copies for your own records, it’s important to ensure the right quantity is printed. Also, make sure that your printer has enough ink and paper to complete the task.

6. Store and File Printed Documents Properly

Once your document is printed, make sure it’s filed or stored correctly to avoid damage. Use a folder or binder to keep physical copies organized, or scan and save them digitally for future reference. Proper storage will help keep your records neat and accessible when needed.

By following these simple steps, you can ensure that your billing documents are printed professionally and accurately, creating a better experience for both you and your clients.

Invoice Template Software vs Printable Versions

When it comes to generating professional billing documents, businesses have a variety of tools at their disposal. Some prefer using software specifically designed for creating customized documents, while others opt for physical or digital documents that can be manually filled out. Each approach offers its own set of advantages and limitations. This section explores the differences between using specialized software and relying on printable versions, helping you determine the best choice for your business.

Advantages of Using Software for Billing Documents

Invoice generation software is designed to streamline the process of creating and managing payment requests. Here are some benefits of using software:

- Automation: Software allows you to automate repetitive tasks like number generation, calculations, and applying tax rates, reducing the chance for human error.

- Customization: You can easily customize the design, layout, and content of each document to fit your business needs, ensuring that each request aligns with your branding.

- Integration: Many invoicing programs integrate with accounting software, payment gateways, and customer management systems, allowing for seamless tracking and easier financial management.

- Time-Saving: With pre-made templates and automated features, software saves you time compared to manually creating each document from scratch.

Benefits of Using Printable Versions

On the other hand, some businesses still prefer to work with physical or static digital documents. Here are some advantages to consider when using printable formats:

- Simple and Accessible: Printable formats don’t require specialized software or an internet connection, making them easy to access and use on any device with basic word processing software.

- Cost-Effective: Many printable options are available for free or at a low cost, making them ideal for small businesses or freelancers with limited budgets.

- Physical Copies: For businesses that need to send hard copies to clients or keep physical records, printable versions are convenient and easy to manage.

- Flexibility: You can quickly modify and print documents without being tied to a particular software system, giving you more control over how the document appears.

Choosing between software and printable formats depends largely on your business needs and preferences. If you require a more automated, professional solution, invoicing software may be the better choice. However, if you value simplicity, flexibility, and cost-efficiency, printable documents may be more suited to your operations.

Using Invoice Templates for Freelancers

For freelancers, managing payments and ensuring timely compensation is essential to running a successful business. Having a consistent, professional method for requesting payments is crucial. While many freelancers opt for custom-built documents, using pre-designed formats can save time, improve efficiency, and maintain a polished image. These tools help streamline the billing process while ensuring all necessary details are included, reducing the risk of errors and disputes with clients.

1. Why Freelancers Need a Structured Payment Request

Freelancers often juggle multiple projects and clients simultaneously, making it vital to stay organized. A structured payment document ensures that both parties are clear on the services rendered, the amount owed, and the due date. It also helps maintain a professional image and can be a valuable tool for tracking payments and managing cash flow. Using a well-organized billing format ensures that all essential information is present, making it easier for clients to pay promptly.

2. Key Features of a Freelance Billing Document

When creating a billing document for freelance work, there are several key features that should always be included to maintain clarity and professionalism:

- Client Information: Clearly list the client’s name, business name, and contact details to avoid any confusion regarding who is receiving the bill.

- Detailed Service Descriptions: Provide a breakdown of the services provided, including the hours worked, rate, and any special project terms.

- Payment Terms: Set expectations by including due dates, payment methods, and any late fees that may apply. This ensures transparency and minimizes potential conflicts.

- Unique Reference Number: Assign a unique number to each document for easy tracking and reference. This is especially important if you deal with multiple clients or projects at once.

Having a standardized, easy-to-edit structure for your billing documents allows you to focus on your work instead of spending time formatting and revising each payment request. It also helps ensure that you don’t forget any important details that could delay the payment process or lead to confusion.

Managing Multiple Invoices with Templates

When you are handling multiple clients or projects simultaneously, keeping track of your billing documents can quickly become overwhelming. Using pre-structured formats helps you stay organized and ensures consistency across all your payment requests. A well-designed framework allows you to easily generate and manage numerous records without missing any important details, saving you time and reducing the chances of errors.

Organizing Multiple Requests Efficiently

For businesses that manage a large volume of transactions, the key to smooth operations lies in organization. Whether you are sending payment requests weekly or monthly, using a consistent approach allows you to maintain an orderly system. Here’s how you can efficiently manage multiple documents:

- Standardized Structure: Using a uniform format ensures that every document includes the necessary details, such as service descriptions, due dates, and payment methods. This reduces the risk of forgetting critical information.

- Quick Edits: When using a structured format, you can quickly fill in the specific details for each client or project, making the process more efficient.

- Tracking Payments: Keeping track of sent documents and received payments is simpler when you have a clear system in place. A unique reference number for each request helps you monitor the status of all transactions at a glance.

Example of Managing Multiple Documents

Here’s a simple example of how you might organize and track multiple records:

| Client Name | Service Provided | Amount Due | Due Date | Status |

|---|---|---|---|---|

| John Doe | Web Design | $500 | 10/15/2024 | Paid |

| Jane Smith | Graphic Design | $300 | 10/20/2024 | Pending |

| Acme Corp | SEO Consulting | $750 | 10/22/2024 | Sent |

By keeping an organize

Integrating Invoice Templates with Accounting Tools

Integrating your payment request formats with accounting software can significantly streamline your financial operations. By linking your billing documents to accounting tools, you can automate data entry, track payments more effectively, and ensure accurate record-keeping without the need for manual updates. This integration helps improve both efficiency and accuracy, providing a seamless experience from creating a payment request to tracking income and expenses.

Benefits of Integration

There are numerous advantages to connecting your billing documents with accounting tools:

- Automated Data Entry: Integration eliminates the need for manual entry of payment details, reducing errors and saving time. When a document is generated, relevant financial information can be automatically transferred to your accounting system.

- Real-Time Tracking: Linking your billing documents to accounting software allows for real-time updates on payments, outstanding balances, and overall financial health.

- Improved Financial Reporting: Having a direct connection between your billing system and accounting software enables more accurate and comprehensive financial reports. You can quickly generate statements, profit-and-loss reports, and tax summaries.

- Time Savings: Instead of switching between different programs, integrating these tools allows for a smoother workflow, saving valuable time that can be spent on growing your business.

Popular Accounting Tools for Integration

Many accounting platforms offer easy integration with payment request systems, making it simpler to manage both aspects of your finances in one place. Some popular tools include:

- QuickBooks: QuickBooks offers integration with numerous document creation tools, making it one of the most commonly used systems for freelancers and small businesses.

- Xero: Known for its user-friendly interface, Xero also integrates seamlessly with various billing platforms, enabling smooth synchronization of payments and financial reports.

- FreshBooks: FreshBooks not only allows you to create custom payment requests but also offers excellent integration with accounting functions such as tracking expenses and generating invoices directly from the system.

- Zoho Books: Zoho Books integrates with a variety of document creation tools, making it easy to manage your entire financial workflow in one place.

By integrating your payment request system with accounting software, you can simplify your financial management, reduce human errors, and gain deeper insights into your business performance. This streamlined approach allows you to focus more on delivering excellent work while your accounting systems handle the administrative tasks seamlessly.

Printable Invoice Templates for Different Industries

Each industry has unique requirements when it comes to requesting payment, and the format used to create these documents must reflect the specific needs of the business. From freelancers to large companies, different sectors require varying levels of detail, design, and customization. Understanding how to adapt your payment documents to suit your industry can help you maintain professionalism and clarity, ensuring both you and your clients are on the same page.

Here are some common industries and how their payment request documents can be tailored:

1. Creative Industries

Freelancers in fields like graphic design, web development, and writing often need to present their services in a visually appealing way while maintaining a professional layout. These industries benefit from clear itemization of services, including hours worked, project milestones, and delivery timelines. Adding space for project-specific details ensures transparency and reduces misunderstandings.

2. Construction and Contracting

For those in construction or contracting, payment requests typically need to include more detailed breakdowns. These documents often feature a section for materials, labor costs, and sub-contractors. Additionally, incorporating terms for progress payments and deadlines is crucial, especially for long-term projects. A structured approach to tracking work completed and outstanding payments is essential in these industries.

3. Consulting and Professional Services

Consultants and service professionals typically bill based on hourly rates or project milestones. For these businesses, a simple and straightforward structure is best, listing services rendered, the number of hours worked, and the applicable rate. Including payment terms and deadlines is important for maintaining cash flow and setting clear expectations with clients.

4. Retail and Wholesale

Retailers and wholesalers often deal with high-volume transactions. In these industries, payment requests may include detailed lists of products sold, quantities, and individual prices. Discounts, taxes, and shipping fees should be accounted for clearly. This ensures customers can easily understand the charges and helps businesses track sales efficiently.

5. Health and Wellness

Health practitioners, including doctors, dentists, and personal trainers, typically need a format that reflects both the professional nature of their services and the specific treatments provided. These documents should include the type of service, date of service, and the cost of each session. Clear billing terms and insurance details are also common for this industry.

Each industry requires specific information to be communicated effectively to clients. By tailoring your documents to fit the unique needs of your business sector, you ensure clarity, professionalism, and smooth transactions, which in turn helps you build stronger client relationships and maintain an organi