Power BI Invoice Template for Simplified Financial Management

In today’s fast-paced business world, managing financial records and documents efficiently is crucial. The need for accurate and timely tracking of transactions, payments, and other business metrics has led many organizations to seek automated solutions that enhance their workflow. With the right tools, companies can create dynamic reports that are easy to update and understand, saving both time and effort in the long run.

One of the most effective ways to manage this process is by using advanced data visualization software. By customizing reports to reflect real-time financial data, businesses can gain a clearer overview of their cash flow, outstanding amounts, and much more. These solutions are designed to handle large datasets and present them in a digestible, visually appealing format that simplifies decision-making and tracking.

Whether you’re a freelancer, small business owner, or part of a large organization, the ability to quickly generate and manage financial documents plays a vital role in maintaining operational efficiency. Customizing reporting formats to meet your specific needs allows for a seamless integration with existing accounting systems, making the overall experience more intuitive and precise.

Power BI Invoice Template Overview

Efficiently managing financial documents and reports is essential for businesses of all sizes. The ability to automate the creation and tracking of financial records ensures accuracy, reduces manual effort, and improves overall productivity. By leveraging advanced data management tools, companies can design custom reporting solutions that integrate seamlessly with their existing workflows, making financial monitoring and reporting both intuitive and dynamic.

In this context, specialized reporting solutions allow users to create flexible and interactive documents that automatically pull data from various sources. This approach not only streamlines the creation of financial statements but also enables real-time updates and easy customization based on specific business requirements. The ability to visually present important financial metrics further enhances decision-making and tracking processes.

With the right setup, these systems offer a comprehensive solution for managing finances efficiently. They can automatically calculate totals, apply relevant tax rates, and even generate detailed records for each transaction. This level of automation reduces the risk of errors and saves valuable time for businesses, allowing them to focus on growth and strategy.

Why Use Power BI for Invoicing

Managing financial documentation effectively is essential for any business. Traditional methods of generating and tracking financial records can be time-consuming and prone to human error. By adopting modern data analysis platforms, businesses can streamline the entire process, ensuring accuracy and saving time. Here are some key reasons why using a data visualization tool for financial reporting is a game-changer:

- Real-time Data Updates: With dynamic reports, you can access up-to-date financial information at any time, reducing the risk of outdated or inaccurate figures.

- Automation: Automation helps eliminate manual tasks such as calculations and data entry, reducing the chances of mistakes and speeding up the workflow.

- Customizable Reports: Users can tailor reports to meet specific business needs, whether it’s adjusting the layout or incorporating different financial metrics.

- Interactive Features: Interactive elements, such as clickable charts and tables, allow for deeper insights and easier navigation through complex financial data.

- Improved Decision Making: By providing clear, actionable insights, these tools support faster and more informed business decisions.

- Centralized Data: Integration with various data sources means all your financial records can be stored in one central location, making it easier to manage and retrieve information.

Overall, utilizing an advanced platform for financial reporting can drastically improve both efficiency and accuracy in managing business records. Whether for generating statements or tracking payments, this approach simplifies the process and enhances overall financial control.

Setting Up a Power BI Invoice Template

Creating an efficient reporting structure for financial records requires careful planning and setup. By using an advanced data analysis platform, you can automate the creation of essential documents and ensure all necessary information is consistently included. Setting up a customized document format allows for easy tracking and reporting, making financial management simpler and more efficient.

To get started with configuring your custom report, follow these basic steps:

- Choose Your Data Source: Begin by selecting the data sources that will be used in your report. This could include financial systems, spreadsheets, or databases containing transaction records.

- Design the Layout: Customize the layout to suit your needs. Define which sections to include, such as client details, itemized charges, payment terms, and tax calculations.

- Define Calculations: Set up automatic calculations for totals, taxes, and discounts. This ensures accuracy and reduces the chance of human error.

- Integrate Data Fields: Map the relevant fields from your data sources into your report template, so each document is automatically populated with the latest information.

- Apply Conditional Formatting: Use conditional formatting to highlight key information such as overdue payments or discounts applied, making it easier to spot important details at a glance.

- Enable Automation: Automate document generation and ensure it is ready for distribution when needed. This saves time and ensures consistency across all financial records.

Once these steps are complete, you’ll have a robust system for creating detailed, accurate reports without the need for manual data entry. With this setup, you can easily generate reports as required, reducing both time and effort while improving the overall accuracy of your financial documentation.

Customizing Power BI Invoice Fields

One of the key benefits of using an advanced data visualization platform is the ability to tailor financial documents to suit the unique needs of your business. Customizing fields allows you to highlight specific data points and ensure that the necessary details are included in each report. This flexibility ensures that the reports are aligned with your business model and provide all relevant information to stakeholders.

To customize the fields in your report, it’s essential to understand how to modify the layout and configure data elements. This process enables you to add or remove sections, adjust formatting, and ensure that each report reflects the most important aspects of your financial records. Below are some common field customizations you can make:

Common Fields to Customize

| Field | Description |

|---|---|

| Client Name | Include the full name or company name of the client to personalize the report. |

| Transaction ID | Use unique identifiers for each transaction to facilitate tracking and referencing. |

| Amount Due | Show the total amount payable, including any applicable taxes and fees. |

| Payment Terms | Customize the payment terms, including due dates, discount offers, and late fees. |

| Items/Services | List the items or services provided, along with descriptions, quantities, and individual prices. |

Adjusting Field Formatting

Once the necessary fields are added, it’s important to format them in a way that ensures clarity and readability. This may involve adjusting font sizes, colors, and alignment to highlight important details like overdue payments or discounts. Additionally, you can apply conditional formatting to draw attention to specific data points that require immediate action, such as overdue balances or high-value transactions.

By customizing these fields, you not only create a more professional-looking report, but also ensure that the financial information presented is relevant, accurate, and easy to understand. This level of customization improves the overall experience for both internal and external stakeholders, making it easier to manage and track financial operations.

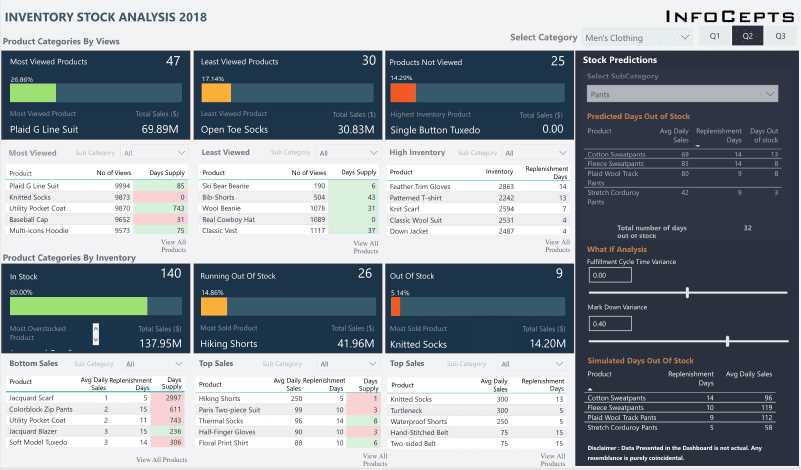

Key Features of Power BI Templates

Data visualization tools offer a range of features that simplify the creation and management of financial records. These tools are designed to enhance productivity, accuracy, and decision-making by providing key insights and streamlining processes. Below are some of the most important features that make these solutions valuable for businesses looking to optimize their reporting systems:

- Automated Data Updates: Automatically refresh data to ensure that reports reflect the most current financial information without the need for manual intervention.

- Customizable Layouts: Tailor the layout of reports to match your specific needs, adjusting sections, fields, and overall design to highlight relevant details.

- Dynamic Calculations: Automatically calculate totals, taxes, discounts, and other important values based on the data entered, minimizing the risk of errors.

- Interactive Visuals: Use charts, graphs, and tables that allow users to interact with the data, enabling deeper analysis and easier exploration of financial information.

- Real-time Reporting: Generate reports instantly, ensuring that business leaders can make decisions based on up-to-date financial data.

- Data Integration: Integrate with various data sources such as databases, spreadsheets, and cloud services to consolidate all your financial information in one place.

- Custom Fields and Filters: Add custom fields to capture unique data points and use filters to refine and sort data to fit specific reporting needs.

- Security Features: Ensure that sensitive financial information is protected with built-in security features like user access controls and data encryption.

These features not only save time and reduce errors but also provide a more streamlined approach to managing and presenting financial data. By leveraging these capabilities, businesses can gain better insights into their financial performance and improve their overall reporting efficiency.

Integrating Data into Power BI Invoices

Efficient data management is crucial for creating accurate and timely financial reports. Integrating various data sources into your reporting system allows for seamless updates, real-time accuracy, and comprehensive tracking of transactions. By linking data from multiple platforms, you can automate and streamline the process of document generation while ensuring consistency and reliability in the final output.

Integrating external data into your reports ensures that key information, such as customer details, payment histories, and product/service charges, is always up to date. This integration allows you to create dynamic reports that reflect the latest figures, minimizing the risk of discrepancies or outdated information.

Common Data Sources to Integrate

- CRM Systems: Integrate customer relationship management data to automatically populate client details and transaction histories.

- Accounting Software: Connect with accounting platforms to include accurate figures for amounts due, payments received, and tax calculations.

- ERP Systems: Sync with enterprise resource planning systems to capture inventory details, shipping charges, and product costs in real-time.

- Spreadsheet Data: Import data from Excel sheets or Google Sheets for flexible reporting based on manually collected or custom data points.

Steps to Integrate Data

- Connect to Data Sources: Use built-in connectors or APIs to link your data sources to the reporting system. These may include cloud-based or on-premise solutions.

- Map Data Fields: Define which fields in your data source correspond to the fields in your report. This ensures that customer names, amounts, and other relevant information are correctly displayed.

- Automate Data Refresh: Set up automated refresh schedules to ensure that your reports always reflect the most current data, reducing manual updates and potential errors.

- Validate Data Accuracy: Periodically check that the data being integrated is accurate and complete, preventing issues from being carried over into the final documents.

By successfully integrating your data sources, you can create reports that are not only accurate but also highly efficient and tailored to your specific business needs. This integration significantly reduces the time spent on manual data entry and ensures that all necessary information is readily available and properly reflected in your financial reports.

Designing a User-Friendly Invoice Layout

Creating a clear and intuitive design for financial documents is crucial for effective communication. A well-structured layout not only makes it easier for users to navigate but also ensures that key information stands out. By prioritizing readability and clarity, you can help both your internal team and clients quickly understand the essential details of the document.

When designing a user-friendly layout, it’s important to focus on elements such as hierarchy, spacing, and consistency. This ensures that users can easily locate information like transaction amounts, dates, and payment terms. A clean and organized layout can also improve the overall experience, reducing errors and misunderstandings.

Here are some design principles to keep in mind:

- Logical Structure: Arrange information in a way that follows a natural flow, such as placing customer details at the top and transaction information below.

- Highlight Key Details: Use bold or larger fonts for important sections like amounts due or due dates to make them stand out at a glance.

- Consistent Formatting: Ensure that the formatting remains consistent throughout the document, such as using the same font style and size for similar data points.

- Clear Labeling: Clearly label sections and fields to avoid confusion. For instance, use labels like “Total Due” or “Payment Terms” to guide the reader.

- Whitespace: Leave sufficient whitespace around elements to prevent the document from appearing crowded. This improves readability and helps separate different sections.

By focusing on these design elements, you can create documents that are not only visually appealing but also practical and easy to understand. A well-designed report reduces the chances of confusion and ensures that all important information is communicated effectively.

Automating Invoice Generation with Power BI

Automating the creation of financial documents streamlines the process, reduces the likelihood of errors, and saves valuable time. By leveraging advanced data tools, businesses can set up systems that automatically generate reports based on real-time data. This automation ensures that the financial reports are always up to date, improving efficiency and minimizing the need for manual intervention.

Setting up automated document generation involves connecting data sources, configuring triggers, and defining how reports should be formatted and populated. By doing so, businesses can create customized reports that are instantly generated whenever certain conditions are met, without requiring any manual input.

Here’s an example of how automated data might be populated into a financial document:

| Data Source | Automatically Populated Field |

|---|---|

| Customer Database | Client Name, Address, Contact Information |

| Accounting Software | Amount Due, Transaction History, Taxes |

| Inventory Management | Item Descriptions, Quantities, Prices |

| Payment Systems | Payment Method, Payment Date, Status |

By integrating various data sources, you can automatically populate all necessary fields without having to manually enter information each time. Additionally, automating this process ensures that the financial documents are generated promptly and consistently, helping to maintain smooth business operations.

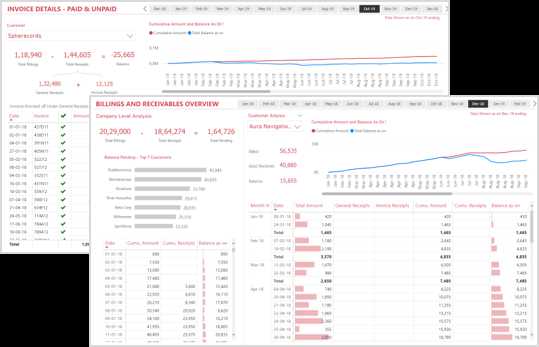

Tracking Payments in Power BI Templates

Efficiently monitoring payments is essential for businesses to maintain cash flow and ensure timely financial operations. By integrating payment tracking into reporting systems, companies can gain a clear view of outstanding balances, payment statuses, and overdue amounts. This level of detail helps to reduce manual tracking efforts and improve accuracy in financial documentation.

With advanced reporting solutions, businesses can automatically update payment statuses as transactions are processed. This ensures that all payments are accurately reflected in real-time, allowing stakeholders to track incoming funds and plan accordingly.

Key Benefits of Tracking Payments Automatically:

- Real-Time Updates: Payments are instantly reflected in reports, reducing the need for manual data entry and keeping financial records up to date.

- Improved Cash Flow Visibility: Businesses can quickly assess whether payments are on time, which helps in forecasting and making better financial decisions.

- Reduced Errors: Automation minimizes human error, ensuring that payments are correctly recorded and categorized in the system.

- Easy Reconciliation: Payment statuses can be cross-checked with transaction histories, making it easier to reconcile accounts.

Integrating payment tracking into the reporting workflow helps ensure that all relevant information is captured accurately and promptly, improving financial transparency and operational efficiency.

Visualizing Invoice Data with Power BI

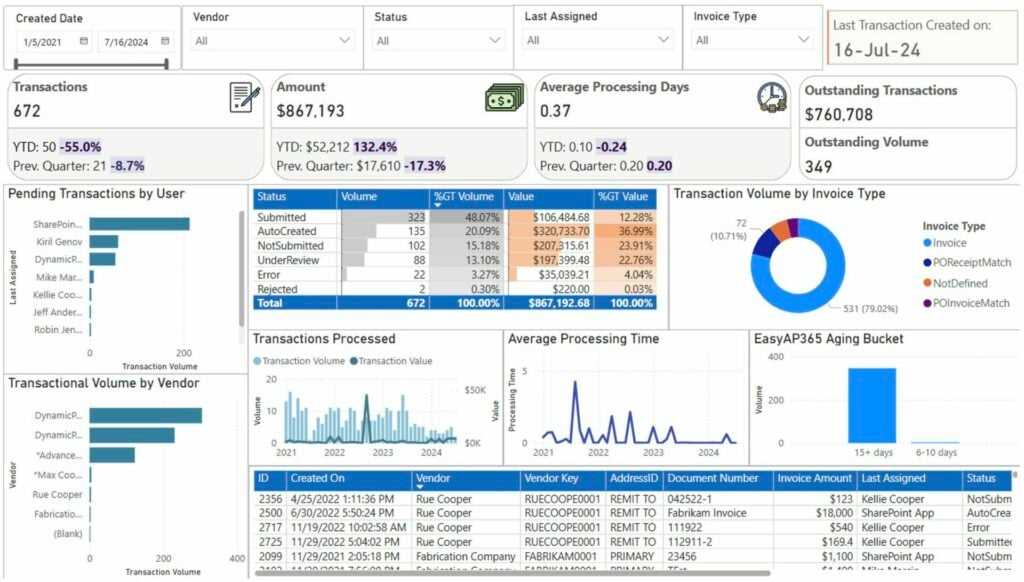

Effective data visualization is key to understanding and interpreting financial data. By transforming raw numbers into easily digestible charts and graphs, businesses can gain insights into their financial performance at a glance. Visualizing payment information and transaction details helps decision-makers identify trends, track performance, and make data-driven choices.

Using advanced visualization tools, you can present complex financial data in a more intuitive way. This allows users to track key metrics such as outstanding balances, payment histories, and revenue growth. These visualizations are essential for quick analysis, providing businesses with an overview of their financial health and helping them identify areas for improvement.

Popular Visualization Techniques

- Bar and Column Charts: These are useful for comparing amounts over time, such as monthly payments or revenue by product category.

- Pie Charts: Ideal for showing the distribution of different payment methods or revenue sources.

- Line Graphs: Help track trends over time, such as changes in outstanding balances or payment trends.

- Heat Maps: Used to highlight areas with the highest or lowest activity, such as late payments or high-value transactions.

Benefits of Visualizing Financial Data

- Quick Decision Making: Visual reports help businesses quickly spot trends and make timely decisions based on real-time data.

- Improved Accuracy: Charts and graphs reduce the risk of misinterpretation, offering a more accurate representation of data.

- Enhanced Stakeholder Communication: Easy-to-understand visuals can be shared with clients, executives, and team members to ensure everyone is on the same page.

Incorporating visual elements into financial reporting enhances data accessibility, making complex numbers more understandable and actionable for everyone involved in the business process.

Power BI Invoice Template Best Practices

When creating financial reports, it’s important to follow best practices that ensure accuracy, clarity, and efficiency. Well-designed documents help avoid errors, streamline workflows, and present data in a manner that is easy to interpret. Following proven guidelines when setting up automated reporting can significantly enhance the quality and usability of the final document.

To achieve the most effective results, here are some key recommendations to keep in mind when designing and structuring reporting documents:

| Best Practice | Description |

|---|---|

| Consistency in Design | Ensure uniform formatting throughout the report, including font size, color, and alignment, to create a professional appearance and make information easier to read. |

| Clear Data Labels | Label all fields clearly, such as dates, amounts, and payment statuses, to eliminate confusion and make it easy for the reader to understand what each section represents. |

| Real-Time Data Integration | Integrate live data feeds to ensure that all financial details, such as payments and outstanding balances, are always up to date and reflect the latest information. |

| Automated Calculations | Use built-in formulas and automated calculations to reduce manual errors and ensure consistency in values such as tax rates, totals, and balances. |

| Responsiveness | Design the document to be responsive, ensuring that it can be viewed on different devices, including desktops, tablets, and smartphones, without losing readability or functionality. |

By adhering to these best practices, businesses can create reporting systems that are not only accurate but also easy to use and interpret. Consistency, clarity, and real-time integration are essential for generating reliable and effective reports that support efficient financial management.

How to Share Power BI Invoices

Sharing financial documents with stakeholders is an essential part of business operations. Whether for clients, internal teams, or auditors, it’s crucial to ensure that financial data is accessible in a secure, efficient, and user-friendly manner. Fortunately, modern reporting tools offer multiple ways to share documents seamlessly across different platforms and devices.

In this section, we will discuss the most effective methods for distributing reports generated within a business intelligence platform, ensuring that recipients can access the information they need without encountering issues. Sharing options should be chosen based on the audience and the level of interactivity required.

Sharing Options for Business Reports

- Direct Email: Sending reports directly via email is one of the most straightforward methods. Many tools allow users to export reports in PDF or Excel formats, making them easy to share as attachments.

- Cloud Sharing: Uploading reports to cloud storage platforms, such as Google Drive, OneDrive, or Dropbox, enables easy access and collaboration. This method is ideal for sharing large documents or when multiple people need to access the same file.

- Embedding in Websites: For public reports or customer-facing financial summaries, embedding live dashboards on a company website allows viewers to access real-time data.

Ensuring Secure Sharing

- Password Protection: Secure financial data by adding password protection to shared reports, ensuring only authorized users can view sensitive information.

- Access Control: Restrict access to specific sections of the report based on user roles, ensuring that confidential information remains protected.

- Encryption: When sharing reports over email or cloud services, consider encrypting documents to add an extra layer of protection.

Choosing the right sharing method depends on the needs of the organization and the recipients. Whether you choose email, cloud sharing, or embedded links, ensuring that access is secure and the data is presented clearly is key to maintaining trust and transparency.

Securing Your Power BI Invoices

When dealing with financial data, it is essential to prioritize security to protect sensitive information from unauthorized access and potential breaches. With digital tools that store and share such data, safeguarding reports and documents has become more crucial than ever. Implementing proper security measures ensures that only authorized personnel can access, edit, or share the documents, thereby preserving the integrity and confidentiality of the information.

In this section, we will explore best practices and strategies to secure reports and financial documents generated in business intelligence platforms, ensuring that the data is protected at every stage of its lifecycle.

Key Security Measures for Financial Reports

- Role-Based Access Control: Limit access to reports based on user roles within the organization. By assigning permissions, you can control who can view, edit, or share documents, preventing unauthorized changes.

- Data Encryption: Encrypt reports both during storage and transmission. This protects the information from being intercepted or accessed by unauthorized parties, even if the report is shared online or through email.

- Secure Authentication: Use multi-factor authentication (MFA) to add an extra layer of security. This ensures that only authorized users can log in and access sensitive documents, even if login credentials are compromised.

Methods for Safeguarding Shared Documents

- Password Protection: Apply password protection to exported reports, making sure that only those with the correct credentials can open and view the document.

- Audit Trails: Enable logging and tracking of document access and edits. This creates an audit trail that can be reviewed in case of suspicious activity, ensuring accountability for anyone interacting with the data.

- Cloud Security: When using cloud-based storage or sharing services, ensure that the platform provides strong security features, such as end-to-end encryption and regular security updates.

By implementing these security strategies, businesses can safeguard their financial reports against unauthorized access and potential risks, ensuring that sensitive data remains protected and compliant with regulations.

Power BI Templates for Small Businesses

For small businesses, managing finances and tracking performance is crucial for growth and sustainability. However, many smaller companies lack the resources to invest in expensive enterprise solutions. This is where affordable business intelligence tools can make a significant difference. By leveraging ready-made solutions that provide quick insights and comprehensive reports, small business owners can make data-driven decisions without the need for specialized knowledge.

In this section, we will explore how ready-to-use solutions designed for small businesses can simplify the process of financial management, reporting, and analysis. These tools enable small business owners to generate professional-quality reports, track performance, and stay on top of their finances with minimal effort.

Benefits for Small Business Owners

- Cost-Effective Reporting: Small businesses can access advanced analytics and reporting capabilities at a fraction of the cost of enterprise-level solutions. These tools provide essential financial data without the need for expensive software or consultants.

- Ease of Use: Ready-made solutions are often designed with user-friendliness in mind, making them accessible even for business owners without technical backgrounds. The intuitive interfaces and customizable dashboards allow users to create reports quickly and easily.

- Time-Saving Automation: Small businesses often face resource constraints, so automation of routine tasks like financial report generation can save significant time. With pre-built structures and automated data processing, these tools allow owners to focus on more strategic tasks.

Common Features for Small Business Solutions

- Pre-Built Dashboards: Small businesses benefit from visual dashboards that present financial data in an easy-to-understand format. These dashboards can be customized to reflect key performance indicators (KPIs) and business goals.

- Real-Time Data Access: Real-time data allows business owners to track current financial status and performance metrics instantly, helping them stay agile and make informed decisions quickly.

- Easy Integration: These solutions can easily integrate with other software or accounting tools used by small businesses, such as payroll systems, payment processors, and invoicing platforms.

In conclusion, using business intelligence tools designed specifically for small businesses enables owners to unlock the full potential of their data. These solutions provide easy access to financial insights, streamlined processes, and the ability to focus on what truly matters: growing the business.

Common Errors in Power BI Templates

When using pre-designed solutions for financial reporting and data analysis, it’s easy to overlook small details that can lead to errors or inaccurate results. While these tools are intended to streamline processes, improper setup or data inconsistencies can lead to common pitfalls. Being aware of these issues can help users avoid mistakes and ensure more reliable outcomes.

In this section, we’ll explore the most frequent errors encountered when working with ready-made reporting solutions. Understanding these mistakes and knowing how to fix them is essential for anyone looking to get the most out of these tools.

Common Issues in Data Integration

- Incorrect Data Mapping: One of the most common mistakes is misaligning data from different sources. When importing information, make sure fields are correctly matched to avoid discrepancies.

- Inconsistent Data Formats: Data inconsistencies, such as differing date formats or currency symbols, can cause issues during analysis. Ensuring all data is standardized before importing is critical.

- Missing Data: Incomplete data sets or missing records can result in inaccurate calculations and insights. Always double-check data integrity before starting the analysis process.

Issues with Report Layout and Design

- Overcomplicated Dashboards: Dashboards that are too cluttered or overly complex can confuse users and obscure key insights. It’s important to keep reports clear, concise, and easy to navigate.

- Poor Visualizations: Using inappropriate charts or graphs for the type of data being presented can lead to misinterpretation. Ensure that the chosen visualizations match the data’s nature and purpose.

- Unclear Labeling: Lack of proper labeling for axes, charts, or tables can make reports difficult to understand. Always include clear titles and labels for all elements to enhance readability.

Performance-Related Issues

- Slow Report Loading: Large data sets and complex calculations can slow down report performance. Optimizing data queries and reducing the complexity of models can help improve speed.

- Excessive Use of DAX Measures: While DAX (Data Analysis Expressions) can be powerful, using too many measures or complex formulas can negatively affect report performance. Simplify calculations where possible.

- Overloaded Models: Adding too many unnecessary columns or tables can overwhelm the system. Keep your data model clean and only include essential information to improve performance.

By addressing these common errors, users can ensure their reports are accurate, efficient, and easy to interpret, leading to better decision-making and enhanced business outcomes.

Tips for Optimizing Power BI Invoices

Optimizing reports and financial statements is essential to ensure smooth operation and effective data management. By refining the setup and layout, users can increase efficiency, reduce loading times, and ensure more accurate results. Here are several strategies to help optimize your reports and enhance the overall user experience.

- Streamline Data Models: A well-structured data model is the foundation of efficient reporting. Avoid unnecessary columns and tables, and focus on including only the essential data for analysis. This reduces complexity and improves performance.

- Use Direct Query When Possible: For large datasets, consider using Direct Query instead of importing data. This allows reports to pull data in real-time from the source, ensuring more up-to-date information without overloading your system.

- Limit Complex Calculations: While DAX (Data Analysis Expressions) formulas can be powerful, using too many complex calculations can slow down performance. Simplify measures and calculations whenever possible to reduce processing time.

- Optimize Visuals for Clarity: Avoid cluttering your reports with excessive visuals. Focus on key metrics and use the most appropriate charts to represent the data. Simplified dashboards are not only faster but also more user-friendly.

- Leverage Aggregations: For large data sets, use aggregation techniques to reduce the amount of data being processed at any given time. This can improve performance significantly without losing critical insights.

- Utilize Bookmarks and Filters: Bookmarks and filters allow users to navigate through the reports more efficiently. By applying pre-set filters or creating bookmarked views, you can reduce the need for users to manually sift through data.

- Implement Incremental Data Refresh: For reports with large data volumes, consider enabling incremental data refresh. This ensures that only new or changed data is refreshed, reducing load times and improving performance.

- Minimize Use of Slicers: While slicers are useful for filtering data, using too many slicers can slow down reports. Limit their use and ensure they are necessary to maintain an optimal user experience.

By following these tips, users can ensure that their reporting tools run smoothly and efficiently, providing fast and accurate insights that support better decision-making and operational effectiveness.