How to Use a PO Invoice Template for Efficient Billing

Managing financial transactions between businesses and suppliers can be a complex task. To ensure smooth operations and clear communication, it’s essential to have a standardized method for documenting orders and payments. A well-structured document that records the terms of a purchase can save time and prevent errors during the invoicing process.

Efficient financial tracking is a key factor in maintaining accurate records. By using pre-designed forms that are tailored to your specific needs, you can eliminate confusion and ensure all the necessary information is included in each transaction. This not only speeds up the workflow but also reduces the likelihood of disputes or delays in payment.

Whether you’re a small business owner or a large corporation, having a consistent approach to managing orders and payments is crucial. By adopting a customizable and user-friendly format, you can ensure your transactions remain organized, transparent, and easy to track over time. By automating this process, you also free up valuable time to focus on other aspects of your business.

What is a PO Invoice Template

A purchase order document plays a crucial role in business transactions, acting as a formal agreement between a buyer and a supplier. It outlines the goods or services requested, their quantities, and the agreed-upon prices. This document ensures that both parties are aligned on the terms before the transaction proceeds.

This structured approach to managing purchases helps eliminate misunderstandings and sets clear expectations regarding payment and delivery. When used correctly, it can streamline your accounting and procurement processes. By using a predefined format for each order, you ensure that no important details are overlooked, making the overall process more efficient and organized.

Instead of starting from scratch with each new transaction, businesses can rely on these ready-made forms to quickly fill in the relevant information. By doing so, you not only save time but also maintain consistency across all your records, simplifying both internal operations and communication with suppliers.

Benefits of Using a PO Invoice Template

Using a predefined structure for managing purchase orders and payments can significantly improve efficiency and accuracy within your business. Instead of relying on handwritten or manually created forms, a standardized format allows you to handle transactions quickly and with fewer mistakes. This approach not only simplifies administrative tasks but also ensures consistency in every document you create.

Time Savings and Efficiency

One of the biggest advantages of using a standardized format is the time saved during the ordering and billing process. By filling in key details in an already prepared structure, you eliminate the need to create each document from scratch.

- Quickly input essential data such as item descriptions, quantities, and prices.

- Reduce the chance of missing important details that could lead to delays or errors.

- Streamline approval processes by using a format that is easy to review and understand.

Improved Accuracy and Consistency

Another benefit of using a pre-made structure is the consistency it offers. When all your purchase records follow the same format, it’s easier to track and compare transactions over time. This consistency also helps minimize human error, ensuring that no key information is left out or misstated.

- Maintain uniformity across all transactions.

- Ensure that all necessary terms are included, reducing confusion for both buyers and sellers.

- Provide a professional look to all of your financial documentation.

Ultimately, by relying on an established format, your business can enjoy smoother operations, reduced administrative workload, and better communication with suppliers and partners.

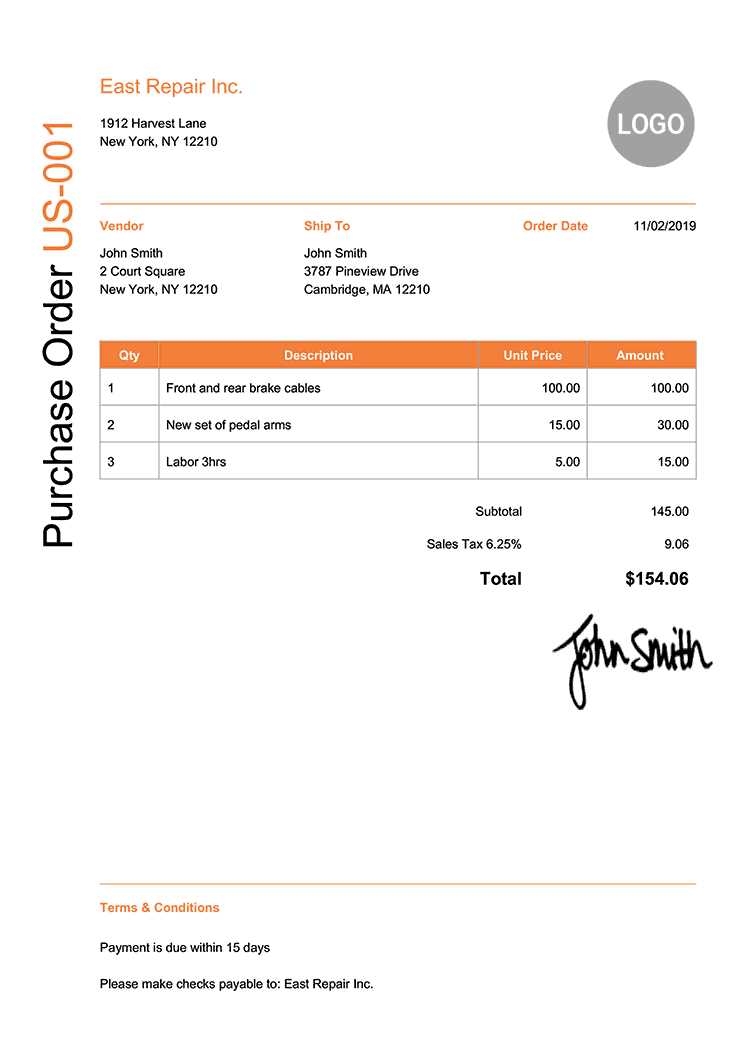

How to Create a PO Invoice

Creating a structured document for your purchase transactions is an essential part of maintaining smooth operations. By following a few simple steps, you can ensure that all necessary details are included, providing clarity for both your business and your suppliers. The process of generating such a document can be quick and efficient if you follow a set structure and include the correct information.

Step 1: Gather the Required Information

Before starting, make sure you have all the key details needed to complete the document. This includes basic information about both the buyer and the supplier, along with the specifics of the transaction.

- Buyer and supplier contact information (names, addresses, phone numbers, etc.)

- Description of the products or services being purchased

- Quantity, price, and total cost

- Delivery and payment terms

- Unique reference number for easy tracking

Step 2: Fill Out the Document

Once you have all the necessary information, begin populating the fields of the document. Ensure that the structure is clear and organized for easy readability.

- Start with the header section containing your company name and contact details.

- Include the supplier’s information and transaction number to ensure traceability.

- List the products or services, specifying each item’s quantity, unit price, and total cost.

- Detail any terms of delivery and payment deadlines for clarity.

By following these steps, you can create a well-organized and professional document that will streamline your purchasing and payment processes. With a clear and consistent format, all parties involved will have a better understanding of the terms and details of the transaction.

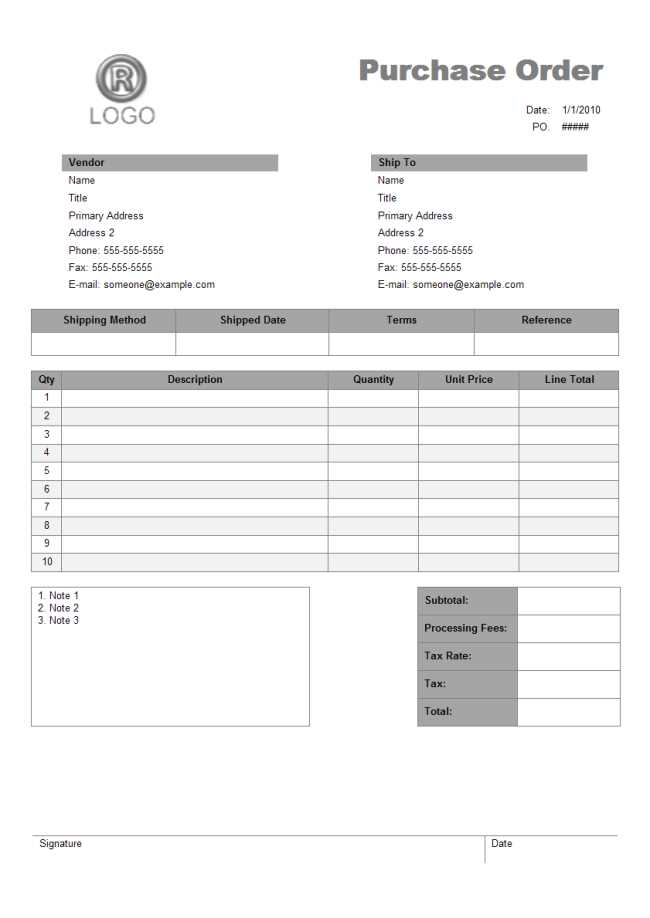

Key Elements of a PO Invoice

To ensure a smooth and transparent transaction, certain key details must always be included when documenting purchase agreements. These essential elements help clarify the terms, provide a clear record, and ensure that both parties are aligned on the expectations for the order. Without these key components, confusion and errors could arise during processing or payment.

- Purchase Order Number – A unique reference number to identify and track the transaction.

- Seller and Buyer Information – The full names, addresses, and contact details of both the buyer and the supplier.

- Itemized List of Products or Services – A clear breakdown of the items or services being purchased, including descriptions, quantities, and prices.

- Payment Terms – Clear information on how and when payment is to be made, including any discounts, due dates, or late fees.

- Delivery Information – The expected delivery date, location, and any relevant shipping details or instructions.

- Total Amount – The final total cost of the transaction, including taxes, shipping, and any additional fees.

- Authorized Signatures – Signatures from both parties, confirming their agreement to the terms outlined in the document.

Including these elements in each purchase order ensures clarity and professionalism while helping to avoid potential issues. By standardizing the format, businesses can improve their record-keeping and communication with suppliers, making the entire process more efficient.

Why Use a PO Invoice Template

Standardizing the process of documenting purchase orders can save time, reduce errors, and improve overall business efficiency. A consistent format not only helps to ensure that all essential information is included, but it also streamlines communication between businesses and suppliers. With a pre-designed structure, creating purchase records becomes a faster and more reliable process.

Here are some key reasons why using a predefined structure is beneficial:

| Benefit | Explanation |

|---|---|

| Time Efficiency | Using a ready-made structure reduces the time spent on creating each new document, allowing for quicker transactions. |

| Consistency | A uniform format ensures all necessary details are included, minimizing the risk of overlooking important information. |

| Accuracy | A standardized approach minimizes human error, making it less likely for critical information to be omitted or entered incorrectly. |

| Professionalism | By using a well-organized structure, businesses present a more professional image to suppliers, building trust and credibility. |

| Tracking and Record-Keeping | Predefined formats make it easier to track and store documents, which simplifies audits and future reference. |

By utilizing a consistent and clear structure, businesses can avoid confusion, reduce administrative overhead, and ensure that transactions are handled efficiently and professionally.

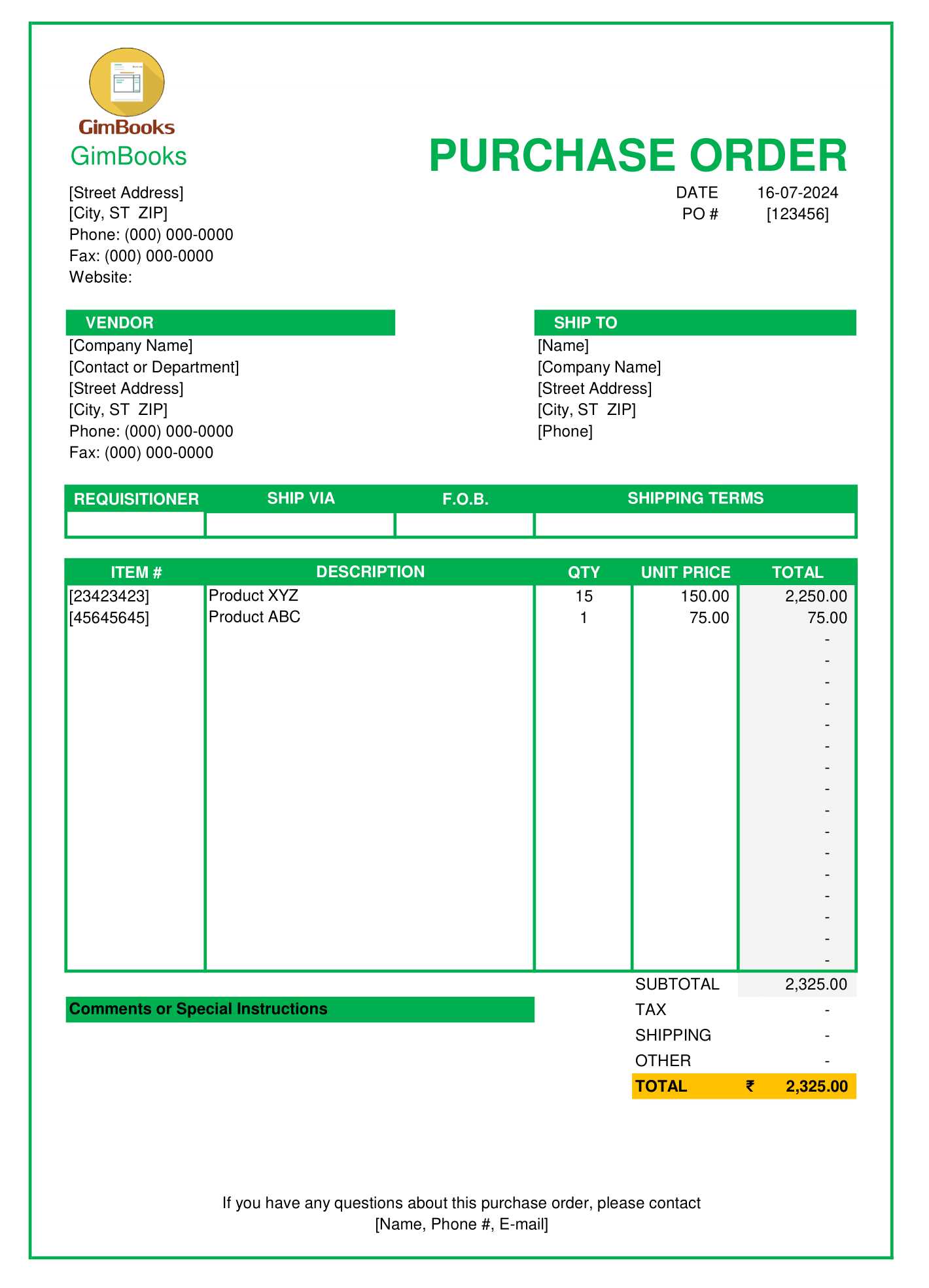

Customizing a PO Invoice Template

Every business has unique needs when it comes to managing purchase orders and transactions. Customizing your purchase documentation structure allows you to better align it with your company’s specific requirements and workflow. By tailoring the document, you can ensure that all relevant information is captured and presented in a way that suits your processes.

When personalizing your format, consider the following aspects:

| Customization Aspect | Purpose |

|---|---|

| Company Branding | Include your logo, colors, and company details for consistency and to present a professional appearance to clients and suppliers. |

| Fields and Layout | Adjust the structure to highlight the most important information for your business, such as order numbers, payment terms, or item specifications. |

| Additional Terms | Include any extra clauses or special instructions relevant to your business, such as shipping preferences or tax exemptions. |

| Automation Options | Integrate automation features such as date fields, numerical totals, or automatic calculations to speed up the process and reduce errors. |

| Language and Currency | Modify language options and currency formats to cater to international clients or different regions. |

By customizing your structure, you make it more functional for your specific needs, improving overall efficiency and ensuring that the final document meets your exact requirements.

PO Invoice Template for Small Businesses

For small businesses, managing purchase records efficiently is crucial for maintaining smooth operations and accurate financial tracking. Using a standardized structure for documenting orders helps reduce errors, saves time, and ensures professionalism. Whether you’re a sole proprietor or a growing company, adopting a clear and organized approach to handling purchases can significantly improve your workflow.

Why Small Businesses Need a Structured Document

As a small business, every transaction counts, and the details need to be handled with precision. A structured document simplifies the process of managing orders and payments, ensuring that both the seller and the buyer are aligned on the terms of the transaction. By using a ready-made format, small businesses can:

- Save time by not needing to create documents from scratch each time.

- Minimize errors by ensuring all relevant details are included in every transaction.

- Maintain a professional image when dealing with suppliers and clients.

Customizing for Small Business Needs

Small businesses can easily customize their purchase order documents to fit their specific requirements. For instance, they can choose to include payment terms, discounts, or product descriptions that are most relevant to their business. A clear structure helps small businesses keep track of important information, such as:

- Product and service details with clear descriptions and quantities.

- Pricing breakdown for transparency on costs and taxes.

- Supplier and contact information for easy reference in case of follow-ups or issues.

By utilizing a well-organized format, small businesses can ensure that all their transactions are documented accurately and consistently, ultimately leading to better record-keeping and easier audits.

How PO Invoices Streamline Payments

When businesses adopt a structured approach to documenting purchases and transactions, they can significantly streamline the payment process. Having clear, well-organized records helps avoid confusion, speeds up approvals, and ensures that both buyers and suppliers are on the same page regarding payment terms. A formalized structure makes it easier to track outstanding payments, confirm amounts, and ensure timely processing of financial transactions.

Clear Documentation Leads to Faster Approvals

A structured document allows for quick review and approval by all parties involved. With all the necessary details–such as payment terms, quantities, prices, and delivery dates–readily available, approval processes are faster, reducing delays in payment. This transparency also minimizes the chances of disputes, ensuring a smoother workflow.

| Benefit | How It Streamlines Payments |

|---|---|

| Clarity and Transparency | Clear, itemized documentation allows both parties to quickly understand the payment obligations and confirms the agreed terms. |

| Reduces Errors | By ensuring that all details are included and accurate, the risk of miscalculations or missing information is minimized. |

| Faster Payment Processing | With everything in order, businesses can process payments without unnecessary delays, improving cash flow. |

| Tracking and Reminders | Having a clear record of transaction details makes it easier to track outstanding payments and send reminders when necessary. |

Reducing Delays and Disputes

By providing a formalized record of the transaction, structured documents reduce the potential for misunderstandings and disputes. Both the buyer and the supplier have a clear reference, making it easier to resolve any issues quickly. This results in faster payments, ensuring that businesses maintain healthy relationships with their suppliers and stay on top of their financial obligations.

Common Mistakes in PO Invoices

Despite the benefits of using structured purchase documentation, mistakes can still occur during the creation and processing of these records. Small errors can lead to delays, confusion, and even payment disputes. Identifying and understanding these common mistakes can help businesses avoid them, ensuring a smoother and more efficient transaction process.

- Missing or Incorrect Purchase Order Numbers

One of the most common issues is forgetting to include or incorrectly entering the unique order number. Without a proper reference, it can be challenging to track transactions, leading to confusion or missed payments.

- Incomplete or Inaccurate Product Information

Missing descriptions, incorrect quantities, or inaccurate prices can lead to misunderstandings between the buyer and supplier. Clear, detailed product listings help ensure the right items are delivered and billed accordingly.

- Not Including Payment Terms

Failure to specify payment terms–such as due dates, discounts, or late fees–can cause delays and disagreements. Clear terms help both parties understand the expectations regarding payment and avoid confusion later.

- Incorrect Delivery Details

Omitting or mistyping delivery addresses or shipping instructions can lead to late or misplaced deliveries. It’s vital to double-check these details before finalizing any purchase documentation.

- Omitting Taxes or Additional Fees

Not including applicable taxes, shipping fees, or other additional costs can result in inaccurate totals. This can create issues when processing payments, as the final amount may differ from what was initially agreed upon.

- Using Outdated Information

Outdated contact details, company information, or pricing can cause significant confusion. Always ensure that your records reflect the most current and accurate data before finalizing any transaction.

By staying vigilant and addressing these common mistakes, businesses can streamline their processes and avoid unnecessary complications when handling transactions and payments.

How to Avoid PO Invoice Errors

Errors in purchase order documentation can lead to payment delays, disputes, and confusion. By adopting careful practices and using standardized formats, businesses can significantly reduce the chances of mistakes. Ensuring accuracy at every stage of the transaction process will help maintain smooth operations and positive relationships with suppliers.

- Double-Check Essential Information

Always verify key details such as order numbers, product descriptions, quantities, and prices. Small mistakes in these areas can lead to incorrect orders and financial discrepancies.

- Use Predefined Structures

Using a consistent format for all your records ensures that important information is never overlooked. A structured format helps reduce the likelihood of missing essential details such as delivery terms or payment instructions.

- Clarify Payment and Delivery Terms

Clearly define payment terms, delivery dates, and any other special conditions. Ambiguity in these areas can lead to misunderstandings or delays in processing payments.

- Automate Calculations and Totals

Use automated tools to calculate totals, taxes, and discounts to minimize human error. This ensures that all figures are accurate and consistent with the agreed terms.

- Review Before Submission

Before finalizing any transaction documentation, take the time to review all the information. A quick check can catch errors that may have been overlooked during initial data entry.

- Update Information Regularly

Ensure that all business and contact details are up-to-date. Using outdated information can lead to confusion, delayed payments, and missed communications.

By following these best practices, businesses can avoid common mistakes in their purchase documentation, ensuring a smoother, error-free transaction process and improving financial accuracy.

Free PO Invoice Templates Online

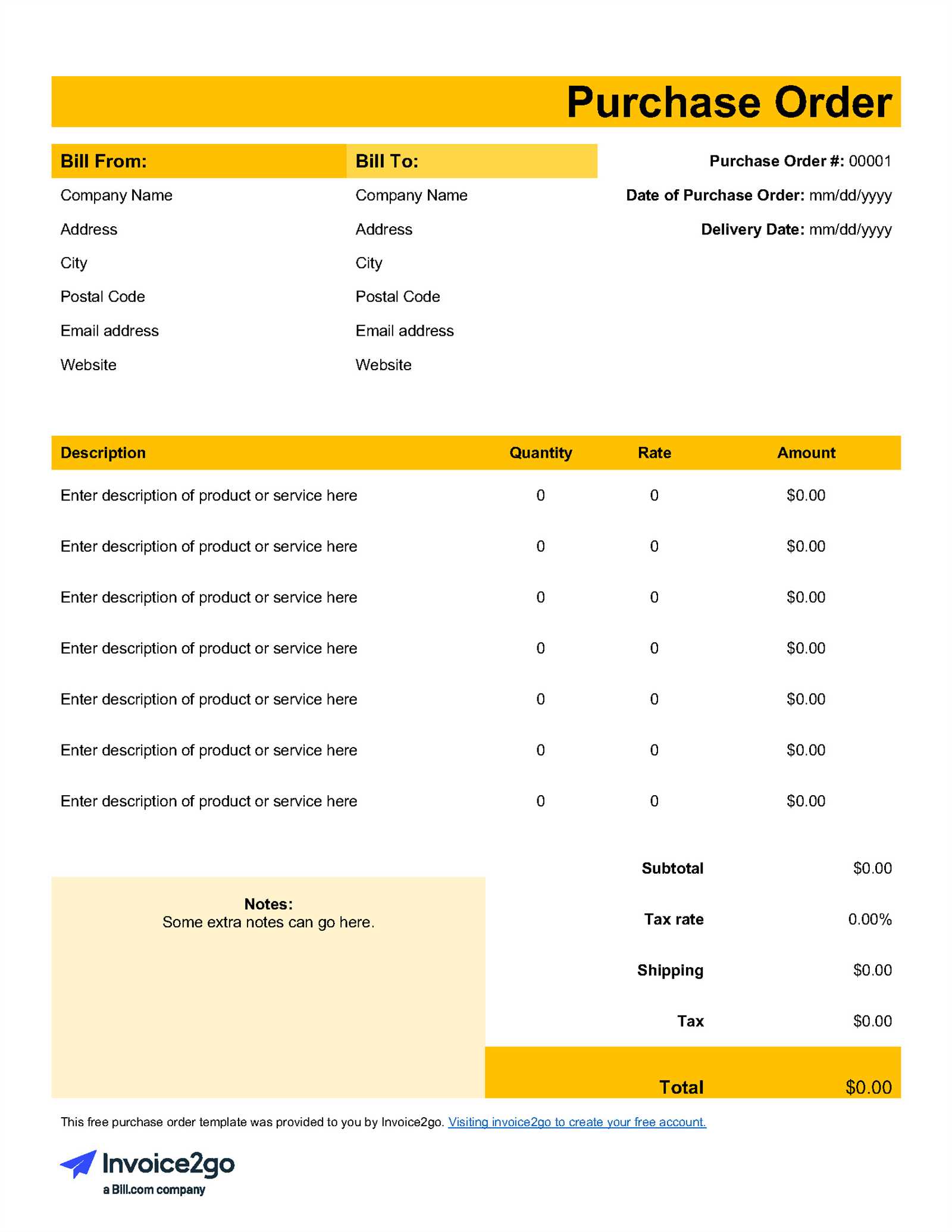

For businesses looking to streamline their purchase order process, free online resources offer customizable documents that can save time and reduce errors. These ready-made structures allow businesses to create professional purchase records without the need for complex software or manual document creation. With a variety of options available, companies can select a format that best suits their needs and begin using it right away.

Many platforms provide free downloadable files, which can be customized to include the specific details required for each transaction. These online resources typically feature:

- Predefined Fields – Sections for entering company information, order details, payment terms, and delivery instructions.

- Easy Customization – Simple tools for editing text, adding logos, and adjusting the layout to match your business style.

- Downloadable Formats – Common formats such as Word, Excel, or PDF, allowing for easy integration with existing workflows.

- No Cost – Free to use, with no hidden fees or subscription requirements, making it accessible for small businesses or startups.

By utilizing these free resources, businesses can quickly implement a structured, efficient system for documenting purchase agreements, helping to ensure accurate records and timely payments. Whether you need a simple order form or a more detailed record, these online tools offer an effective solution without the need for expensive software or templates.

Best Tools for Creating PO Invoices

When it comes to managing purchase orders and financial transactions, having the right tools can significantly improve efficiency and reduce errors. With the right software or platform, businesses can create clear, accurate, and professional purchase records without needing specialized knowledge. These tools often come with user-friendly features that allow for quick generation, customization, and tracking of purchase-related documents.

Top Features to Look for in PO Creation Tools

Whether you’re a small business or a growing enterprise, the right tool can make a big difference in how you handle purchasing. Some of the top features to look for in tools designed for creating purchase records include:

- Customizable Fields – Allows you to personalize documents with your company’s branding, specific payment terms, and product descriptions.

- Automation – Automated calculations for totals, taxes, and shipping costs to reduce manual input and avoid errors.

- Integration Capabilities – The ability to integrate with accounting and ERP systems to streamline the entire procurement process.

- Cloud Access – Access to your documents from anywhere, with the ability to collaborate with team members or suppliers in real time.

Recommended Tools for Creating Purchase Records

Here are some of the best tools available for businesses looking to create structured, professional purchase documents:

- QuickBooks – A well-known accounting software that allows users to create, track, and manage purchase records, invoices, and payments with ease.

- Zoho Books – Offers customizable purchase order forms, automatic tax calculations, and real-time reporting features, making it ideal for small businesses.

- Microsoft Excel – A powerful spreadsheet tool that can be easily customized to create order forms with itemized lists, totals, and payment terms.

- FreshBooks – A cloud-based tool designed for small businesses that enables simple creation and tracking of purchase records with automated invoicing features.

- Bill.com – Focuses on simplifying the accounts payable and receivable process, with an intuitive interface for creating purchase orders and managing payments.

By choosing the right tool, businesses can not only save time but also ensure that their purchase records are accurate, organized, and accessible. These tools help eliminate errors, enhance productivity, and foster better relationships with suppliers by maintaining transparent and efficient documentation processes.

How to Automate PO Invoice Creation

Automating the creation of purchase records can greatly improve efficiency and accuracy in business operations. By utilizing automation tools, companies can reduce manual data entry, eliminate errors, and ensure that purchase-related documents are generated consistently and on time. Automation also helps streamline the overall process by connecting various stages, such as order creation, approval, and payment tracking, into a seamless workflow.

There are several steps businesses can take to automate the process of creating purchase documents:

| Step | Description |

|---|---|

| Step 1: Use Automated Software | Choose a software solution that offers automated document generation. These tools typically allow you to input order details once, and they will automatically generate the corresponding records based on predefined fields and templates. |

| Step 2: Integrate with Inventory and Accounting Systems | Integrating your purchase creation tool with inventory and accounting software ensures that product details, prices, and taxes are automatically pulled into the order. This minimizes manual errors and keeps everything synchronized across platforms. |

| Step 3: Set Up Reusable Fields | Define reusable fields like company name, payment terms, product categories, and discount rates. This allows the system to autofill common details every time you create a new purchase record. |

| Step 4: Automate Notifications and Approvals | Set up automated notifications to alert the relevant teams when a purchase document is created. Additionally, implement approval workflows that route the document for review automatically, reducing the need for manual intervention. |

| Step 5: Track Changes and Updates | Use automation tools that can track revisions and updates to purchase orders, ensuring that every change is logged and approved. This makes it easy to maintain an accurate record and audit trail for future reference. |

By following these steps, businesses can automate much of the creation process, reducing administrative overhead and freeing up time for other important tasks. Automation also ensures greater accuracy, faster turnaround times, and better overall management of procurement workflows.

Legal Requirements for PO Invoices

When creating purchase-related documents, it’s essential for businesses to adhere to legal standards and regulations. These documents often serve as official records that not only guide internal processes but also help comply with tax laws, accounting standards, and contractual obligations. Ensuring that all the required legal elements are included is critical for avoiding disputes, audits, or penalties.

Key Legal Considerations for Purchase Documents

To comply with local and international laws, purchase records should contain specific information. The exact requirements may vary depending on jurisdiction, but there are several common legal elements that should be present in every transaction-related document:

| Legal Requirement | Description |

|---|---|

| Company Information | Both the buyer’s and seller’s official business details, including registered company name, address, and tax ID number, should be included to verify the legitimacy of the transaction. |

| Order Number | A unique order number or reference ID is essential for tracking and matching purchase records with payments and deliveries. |

| Transaction Date | The date the purchase order was created is critical for tax reporting and ensuring compliance with payment terms. |

| Detailed Description of Goods/Services | A clear breakdown of the goods or services being purchased, including quantity, description, and price, ensures transparency and helps avoid legal disputes over what was agreed upon. |

| Payment Terms | The payment conditions, including due dates, late fees, and accepted payment methods, must be clearly outlined to avoid misunderstandings between both parties. |

| Tax Information | Include applicable taxes, such as VAT or sales tax, in accordance with local tax laws to ensure compliance and accurate reporting to tax authorities. |

Ensuring Compliance and Avoiding Legal Issues

Failure to include the required information or errors in these key elements can lead to legal challenges, delayed payments, or issues with tax authorities. In addition to ensuring the correct details are included, businesses should also store these records securely and ensure they are easily accessible for audits or legal reviews. By adhering to these legal requirements, companies can protect themselves from potential issues and maintain transparent, compliant purchasing practices.

PO Invoice Template vs Manual Invoices

When handling purchase-related documents, businesses often face the choice between using automated systems or relying on traditional manual methods. While both approaches can serve the same function, each has its own advantages and drawbacks. Understanding the key differences between using a structured format for your records versus creating them manually can help businesses decide the best approach for their operations.

Comparing PO Document Templates and Manual Methods

Each method of creating purchase records comes with its unique set of benefits and limitations. Below is a comparison of using pre-designed document formats versus manually creating purchase records:

| Aspect | PO Template | Manual Creation |

|---|---|---|

| Efficiency | Predefined formats allow for quick and consistent document creation, reducing time spent on repetitive tasks. | Manual creation takes longer as each detail must be entered from scratch, often requiring more effort to maintain consistency. |

| Accuracy | With automated fields and structured layouts, the likelihood of errors is significantly reduced. | Manual entry is more prone to mistakes, especially with complex details or large quantities of items. |

| Customization | Many pre-designed formats allow for some customization, but certain fields may be standardized. | Complete flexibility allows for fully tailored documents, but this can lead to inconsistency if not carefully managed. |

| Compliance | Using a structured format ensures that all required legal and tax details are consistently included in each document. | Manual records may lack important details or risk non-compliance if the person creating them is unaware of legal requirements. |

| Cost | Many digital tools offer free or low-cost templates, making them budget-friendly for businesses of all sizes. | Manual creation doesn’t require additional software but can lead to higher labor costs due to the time spent on each document. |

Which Method Is Best for Your Business?

Choosing between automated and manual document creation largely depends on the size of your business, your specific needs, and the volume of transactions you handle. For small businesses with a low volume of orders, manual methods may be sufficient, but as businesses grow, investing in structured document formats becomes increasingly beneficial. Automated systems reduce human error, improve speed, and ensure compliance, making them an essential tool for larger operations or those looking to scale efficiently.

How PO Invoices Improve Record Keeping

Effective record-keeping is crucial for businesses to ensure accurate financial management, streamline workflows, and maintain compliance with tax regulations. One of the most effective ways to improve the accuracy and organization of transaction records is by using structured purchase documents. These records not only capture the details of a transaction but also help businesses track payments, monitor inventory, and manage supplier relationships.

Structured purchase documents provide several key benefits that enhance overall record-keeping processes:

- Consistency – Using predefined formats for every transaction ensures that all records are consistent, making it easier to compare, analyze, and retrieve data when needed.

- Organization – With a clear structure, these documents categorize critical information such as product details, quantities, prices, and dates, making it easier to organize and access past transactions.

- Audit Trail – A complete, well-organized record allows for easy auditing, ensuring transparency and simplifying the review process when required for compliance or financial audits.

- Accuracy – By automating data entry and using predefined fields, these records help reduce human error, which can lead to discrepancies in financial statements or tax filings.

- Improved Tracking – With structured purchase records, businesses can quickly track the status of orders, deliveries, and payments, ensuring that no transaction is overlooked or forgotten.

By using structured formats, businesses can maintain a more reliable and accurate record-keeping system, which in turn helps with better financial planning, timely payments, and compliance with legal requirements. These documents create an efficient, transparent, and accessible system that supports growth and scalability.