Free Plumbers Invoice Template for Easy Professional Billing

Running a service-based business requires efficient ways to manage finances and maintain clear communication with clients. One of the most important aspects of this is ensuring that you provide accurate and professional documents for payment requests. Using the right documents can help speed up payments and keep your business operations running smoothly.

Creating well-structured billing documents doesn’t have to be a complicated task. With the right resources, you can easily generate detailed receipts that reflect the work you’ve done. These tools allow you to customize your paperwork to fit your specific needs, ensuring that both you and your clients are clear on the terms of payment.

In this guide, we will explore various options available for streamlining this essential task, helping you save time and avoid errors. Whether you are just starting out or looking to improve your current system, the right approach can make a significant difference in your overall business efficiency.

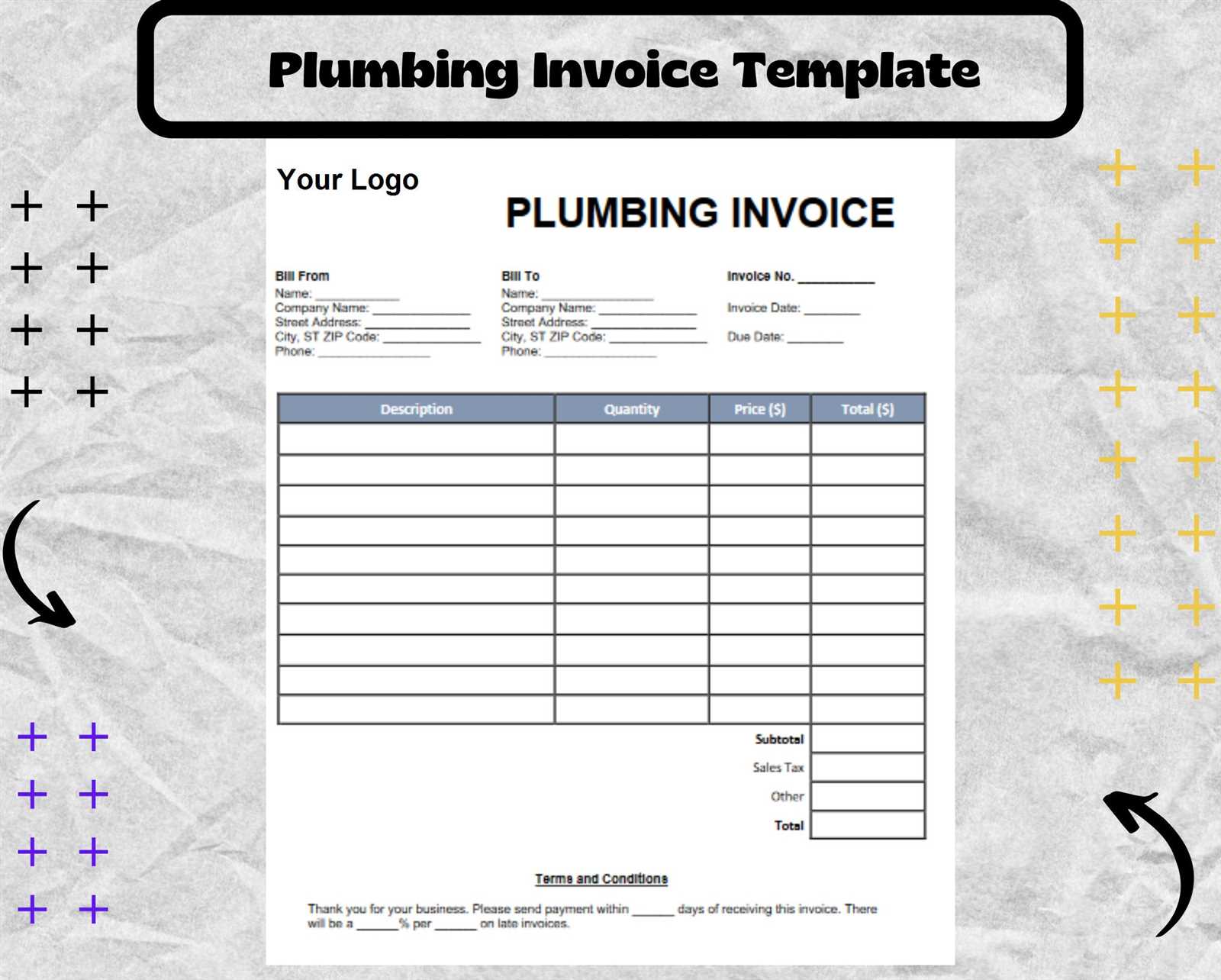

Free Invoice Template for Plumbers

Having a professional document for billing is essential when requesting payments for services rendered. A well-structured form not only helps ensure you get paid on time but also communicates your business’s credibility. The right document allows you to clearly outline the details of your work and the costs associated with it, minimizing misunderstandings and delays in payments.

Fortunately, there are several resources available that allow you to easily access ready-to-use forms. These documents can be customized to suit your specific requirements, helping you create accurate records for each project. Whether you need to add payment terms, service descriptions, or specific client information, these tools make the process quick and straightforward.

Why You Should Use a Pre-Formatted Document

Using a pre-made form saves you time and effort, eliminating the need to create one from scratch every time. With a few simple adjustments, you can tailor the content to reflect the particular needs of your client or the specifics of each job. This ensures consistency and professionalism across all transactions, which can enhance customer trust and satisfaction.

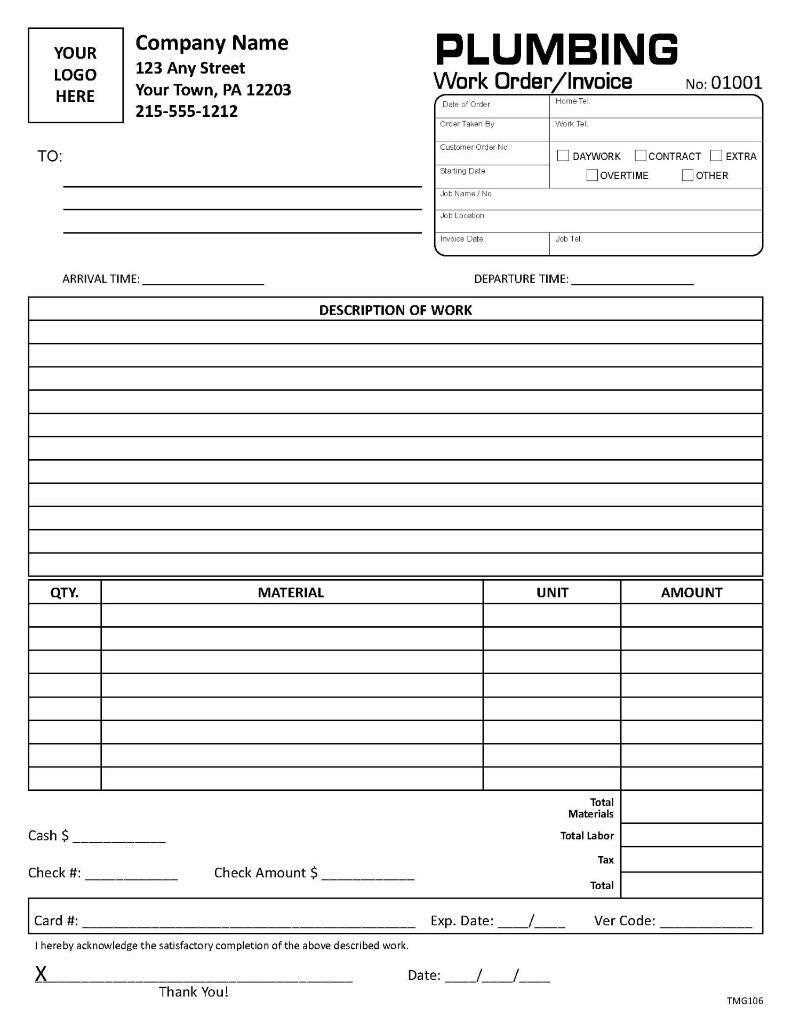

How to Customize Your Billing Document

Most of these forms allow for easy customization, so you can add your company logo, adjust the layout, and input specific service details. Some even allow you to include payment instructions, late fees, or tax information. Customizing your document to align with your business’s standards can help you present a polished image while keeping your records organized.

Why Plumbers Need an Invoice Template

Running a service-based business requires precise and professional documentation, especially when it comes to billing customers. Having a consistent way to request payment not only ensures that you are paid accurately but also helps you maintain clear financial records. Without a standardized document, misunderstandings can arise, leading to delayed payments or confusion about service charges.

By using a structured form for each transaction, you can streamline the billing process, keep track of services rendered, and ensure clarity for both you and your clients. The use of such documents is not just about collecting payment; it’s about maintaining professionalism and credibility in your business operations.

Key Reasons for Using a Standardized Document

- Consistency: Every customer receives the same professional experience, reducing the risk of errors or confusion.

- Efficiency: You can quickly generate and customize the necessary documents, saving time on each job.

- Clarity: Clear terms and itemized charges make it easy for clients to understand what they are paying for, reducing disputes.

- Record Keeping: Easily store and access past transactions, making accounting and tax reporting simpler.

- Legal Protection: Properly documented payments and agreements provide evidence of completed work in case of disputes.

How It Improves Business Operations

Using an organized method for requesting payment helps improve cash flow by ensuring that you invoice clients promptly and consistently. It also enables you to track unpaid balances and follow up with clients if necessary. By implementing this practice, you enhance your business’s financial stability while providing clients with a more professional experience.

How to Create Your Own Invoice

Creating your own payment request document allows you to tailor it to your specific needs, making it easier to maintain control over your financial processes. Whether you prefer a digital or paper format, designing a custom form can ensure that all the necessary details are included, giving your clients clear and concise information. This approach not only saves time but also improves accuracy and professionalism.

To create an effective document, you need to include essential elements such as service descriptions, payment terms, and client information. Below is a step-by-step guide to help you design your own custom payment request form.

Essential Components of a Payment Request

Each document should contain certain key elements to ensure clarity and to avoid any confusion. Here is a list of items you should always include:

- Your contact details: Name, business name, address, phone number, and email.

- Client’s contact details: Name, address, and contact information.

- Service description: A clear and concise breakdown of the services rendered.

- Payment terms: Specify due dates, late fees, and acceptable methods of payment.

- Total amount due: Ensure that charges are listed in a way that is easy to understand, including taxes if applicable.

Example Layout for a Payment Request

Here is a simple layout for a payment request that includes all the essential components:

| Item | Description | Amount |

|---|---|---|

| Service 1 | Plumbing repair in kitchen | $150 |

| Service 2 | Leak detection and fix | $80 |

| Total | Total amount due | $230 |

By following this simple layout and adding the necessary details, you can quickly create a clear and professional document for any project you complete.

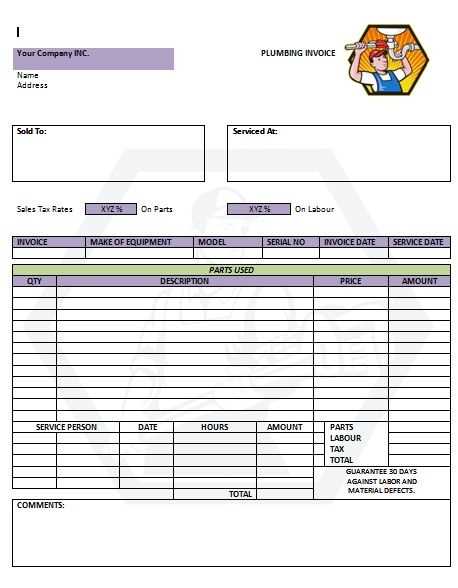

Key Elements of a Plumber’s Invoice

When requesting payment for services, it’s important to include all the necessary information that ensures transparency and clarity for both parties. A well-crafted payment request document not only helps avoid misunderstandings but also demonstrates professionalism. By including the right details, you can ensure timely payments and maintain good relationships with clients.

There are several essential components that must be present in any payment request document to ensure that it serves its purpose effectively. These elements outline the work completed, the amount owed, and the terms of the transaction.

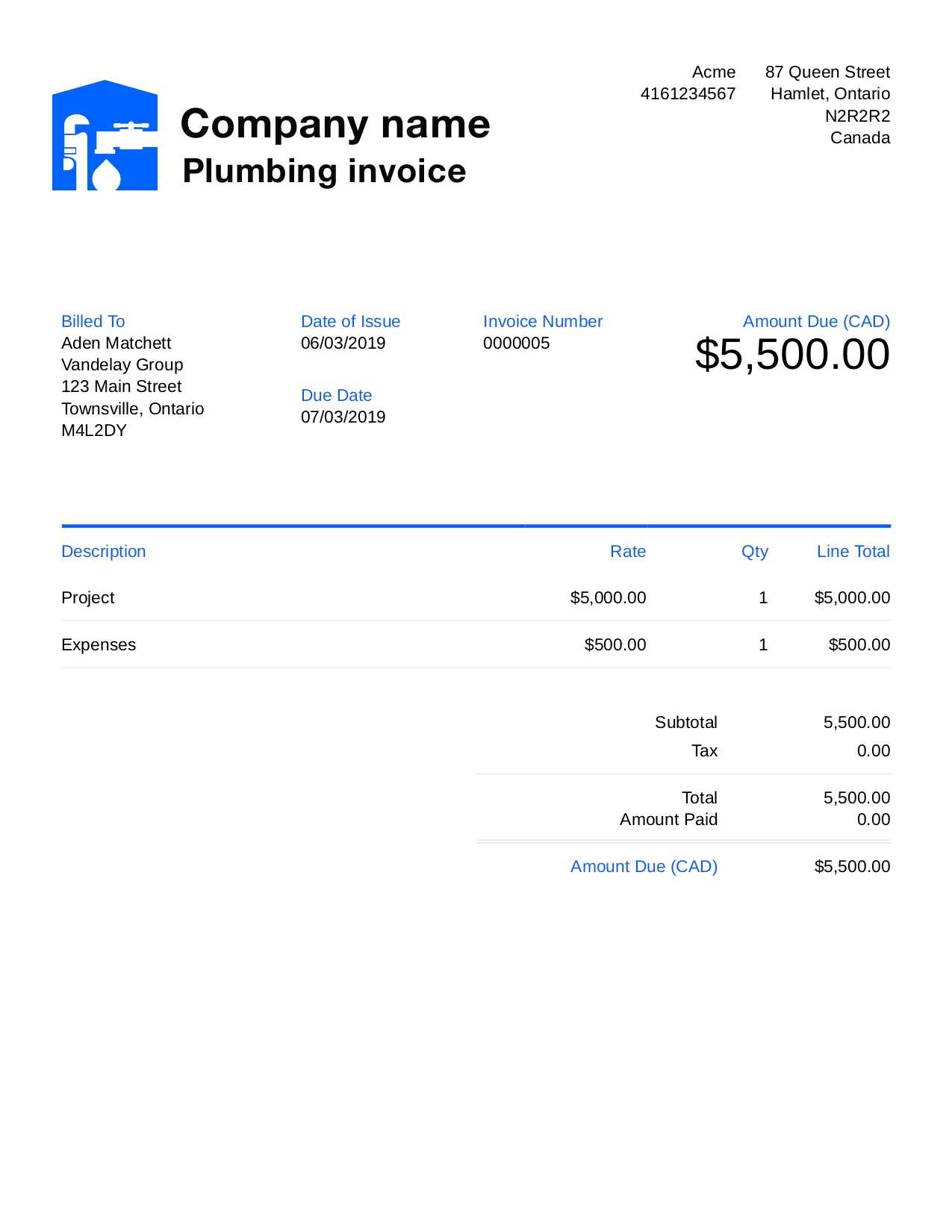

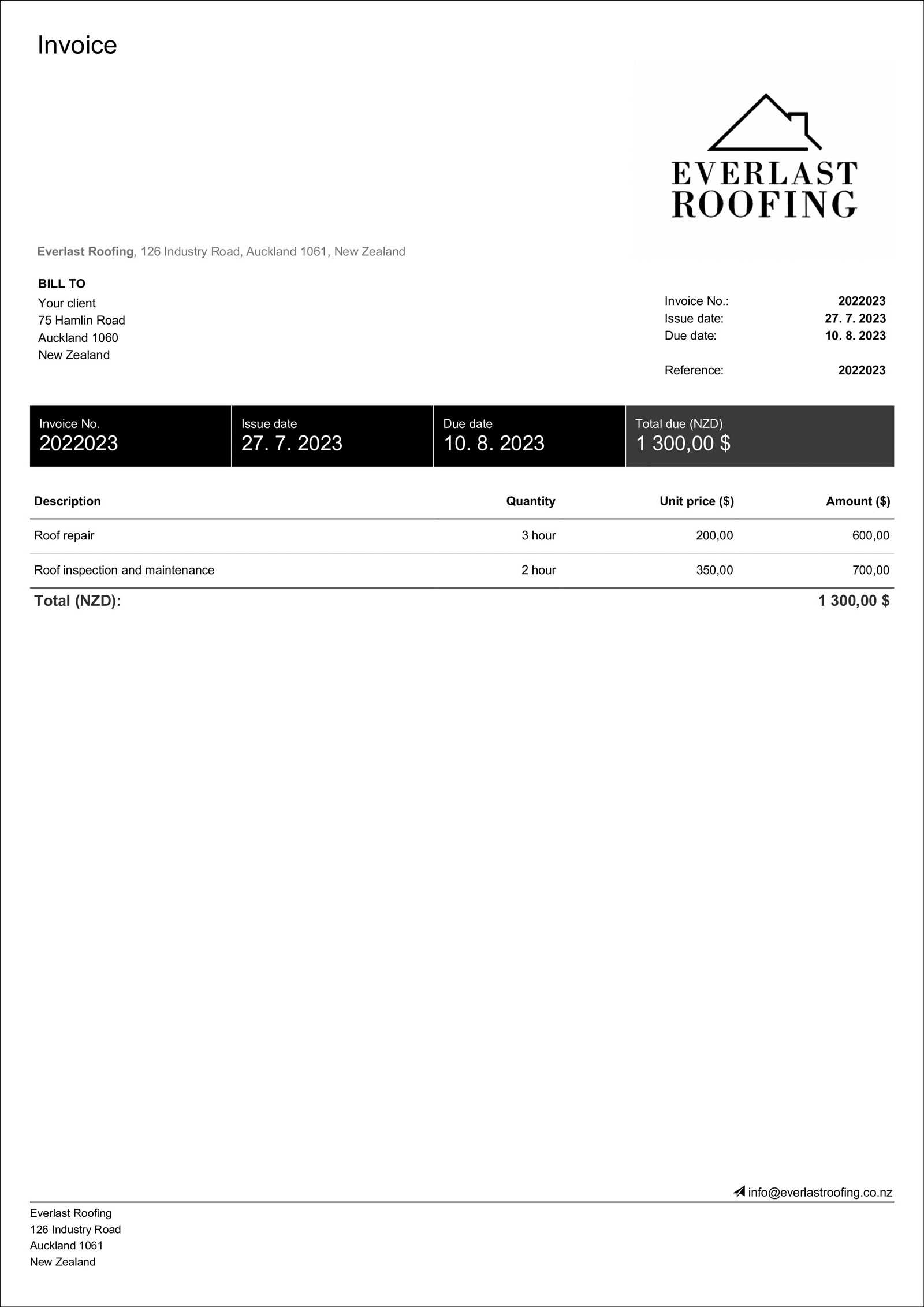

- Business Information: Include your company name, contact details, and logo (if applicable) at the top of the document. This helps your clients easily identify the source of the request.

- Client Information: Clearly list the client’s name, address, and contact details. This ensures that the request is directed to the correct person or organization.

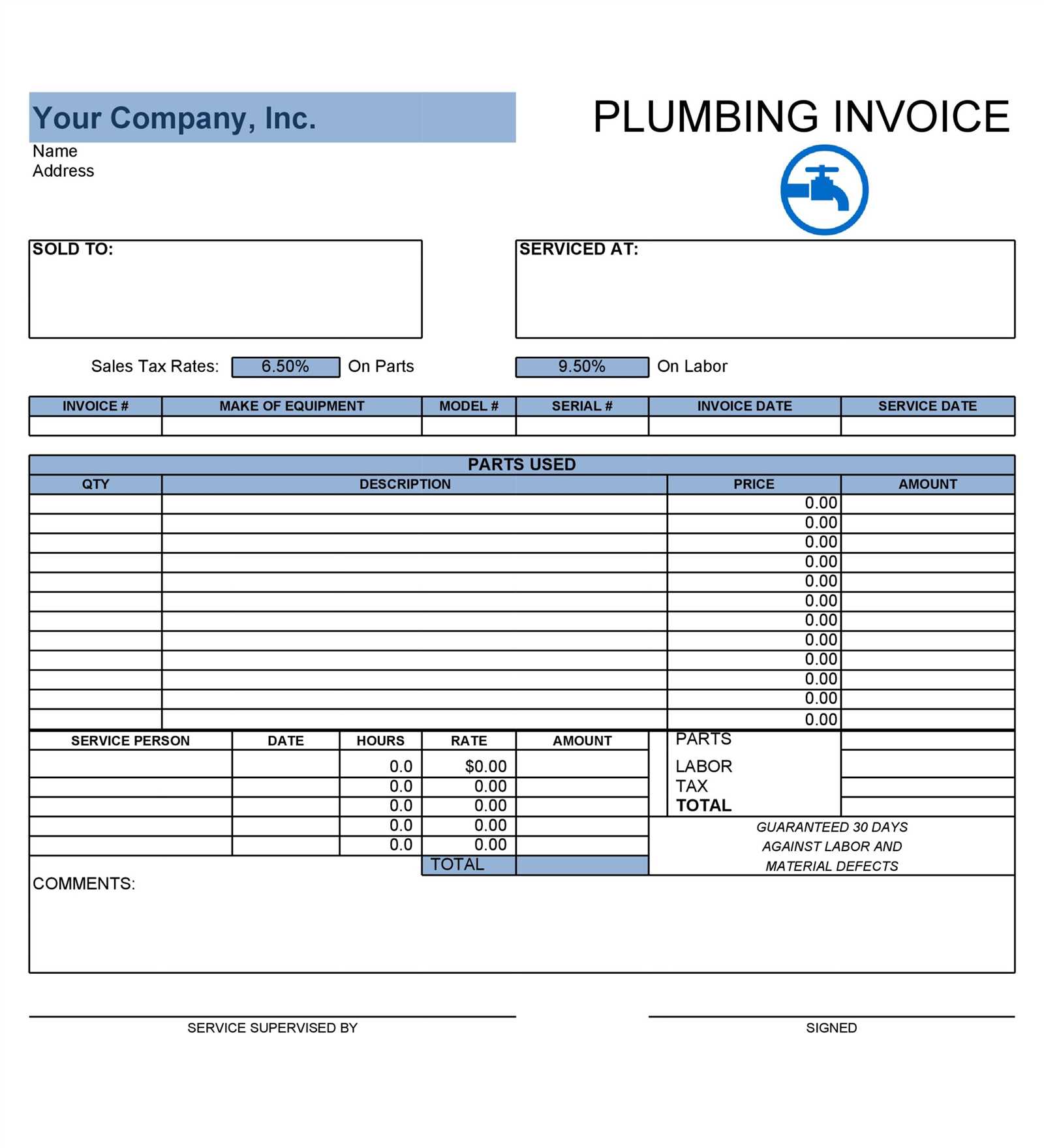

- Service Description: Provide a detailed breakdown of the services provided. Each task should be listed separately with a description of the work done, making it clear what the client is paying for.

- Pricing and Charges: Include a clear breakdown of the costs associated with each service, such as labor, parts, and any additional fees. This helps clients understand how the final total was calculated.

- Payment Terms: Specify the due date for payment, accepted payment methods, and any penalties for late payments. This ensures that both you and the client are on the same page regarding when and how payment will be made.

- Tax Information: If applicable, include details about any sales tax or VAT applied to the total amount due. This provides clarity and ensures that your billing complies with local regulations.

- Unique Reference Number: Including an invoice number helps both you and your clients track and reference the payment easily. It’s a useful tool for record-keeping and managing accounts.

By incorporating these key elements, you create a document that not only facilitates prompt payment but also enhances your reputation as a reliable and organized professional.

Benefits of Using an Invoice Template

Using a ready-made document for payment requests brings numerous advantages to both small and large service providers. By implementing a standardized format, you can streamline your billing process, reduce the chances of errors, and maintain a professional appearance. This approach saves time, enhances productivity, and improves overall business efficiency.

Having a pre-designed structure in place allows you to focus on providing excellent service, rather than worrying about creating payment documents from scratch. It helps ensure consistency in every transaction, which is crucial for maintaining organized records and good client relationships.

Time Efficiency and Convenience

One of the primary benefits of using a pre-built form is the time it saves. Rather than manually creating a new document for each customer, you can simply fill in the relevant details and generate a finished document in a matter of minutes. This efficiency allows you to focus more on completing jobs and less on administrative tasks.

Professionalism and Accuracy

Utilizing a professional-looking form with accurate details shows your clients that you are organized and serious about your work. It reduces the likelihood of errors, such as missing charges or incorrect totals, ensuring that you maintain a trustworthy and reliable image. Clear and precise billing helps avoid confusion and encourages timely payments.

Customizing Your Invoice for Clients

Personalizing your payment request documents allows you to cater to the unique needs of each client, making the process more transparent and professional. By adjusting the format, content, and structure, you can ensure that the document accurately reflects the services provided and addresses any specific requirements. Customization not only improves communication but also strengthens your brand image.

Incorporating your company’s identity, along with specific details related to the job, helps make each request look more tailored and professional. This level of attention to detail can enhance the client’s experience and increase the likelihood of prompt payment.

Adding Personal Touches for a Better Client Experience

Customizing your documents to reflect your client’s particular needs can go a long way in building strong business relationships. Including their name, project-specific details, and even personalized notes can show that you care about their individual needs. Here are a few ways to make the document more personal:

- Client name and address: Ensure that the client’s details are accurate to avoid any confusion.

- Job specifics: Provide detailed descriptions of what was done to make the document easy to understand.

- Personalized message: Adding a note of appreciation or a thank-you message can foster goodwill.

Including Custom Terms and Conditions

Each client may have different expectations regarding payment terms, so adjusting the conditions based on the project can improve clarity and prevent misunderstandings. This includes payment deadlines, accepted methods, and potential late fees. By clearly stating these in your payment request, you ensure that the client knows exactly what to expect, minimizing delays or disputes.

Free Templates vs Paid Options

When choosing a document format for requesting payments, one of the first decisions to make is whether to use a no-cost or paid option. Both have their advantages and drawbacks, depending on your business needs and how much customization or functionality you require. Understanding the differences can help you select the right choice for your specific situation.

Free options often provide basic designs with limited customization, making them suitable for those who need a quick solution or have simple billing requirements. Paid solutions, on the other hand, tend to offer more advanced features, greater flexibility, and better customer support, which can be beneficial for businesses that need more complex documentation.

Advantages of No-Cost Options

Using a no-cost document format can be ideal for those just starting out or those with limited budgets. Here are some of the benefits:

- Quick and easy setup: Many free options are ready to use with minimal customization required.

- No financial investment: Ideal for small businesses or freelancers who are just getting started.

- Basic functionality: Free documents often cover the essential elements needed for a payment request, such as service descriptions and pricing.

Benefits of Paid Options

Paid solutions are typically more robust and feature-rich, offering several advantages for businesses that require more flexibility and professionalism:

- Advanced customization: Paid formats often allow for deeper personalization, including adding your brand logo, adjusting layout, and more detailed terms.

- Integrated features: Many paid options include automation tools, such as payment reminders, tracking, and reporting, which can save time and effort.

- Better support: With a paid service, you usually gain access to customer support, making it easier to troubleshoot any issues.

Ultimately, the choice between free and paid formats depends on the scale of your business and your specific needs. If you require a simple solution, a no-cost option might be sufficient. However, if you are looking for more functionality, customizability, and professional tools, investing in a paid option may be the better choice.

How to Download Free Invoice Templates

If you’re looking for an easy way to create professional payment requests, downloading a pre-designed document from the internet is an efficient option. Many websites offer downloadable formats that can be customized to fit your specific needs. These resources provide a simple solution for those who need to generate billing documents quickly without the hassle of creating one from scratch.

Downloading a ready-made form allows you to avoid the time-consuming process of designing your own document. With just a few clicks, you can have a customizable structure that’s ready to use. Below is a step-by-step guide on how to find and download these resources.

Where to Find Downloadable Forms

There are numerous websites offering no-cost, downloadable documents. Some of the most common places to find them include:

- Online document libraries: Websites dedicated to providing various business forms often have a wide selection of pre-designed documents.

- Freelancer platforms: Some platforms that cater to freelancers and small businesses offer free resources to help with administrative tasks.

- Accounting software websites: Certain accounting tools or invoicing software provide downloadable forms as a free service to attract new users.

Steps to Download and Customize Your Document

Follow these simple steps to download and customize your billing form:

- Search for a reputable website: Use a search engine to find sites that offer the document you need.

- Choose the right format: Select a document that suits your needs, whether it’s a Word, PDF, or Excel file.

- Download the document: Click the download button to save the file to your computer or cloud storage.

- Open and customize: Edit the document to include your company details, client information, and the specific services you’ve provided.

| Website | Format | Customization Options |

|---|---|---|

| Invoice Generator | PDF, Excel | Basic customization (company name, payment terms, and services) |

| Zoho Invoices | PDF, Word | Full customization (branding, colors, tax rates) |

| Template.net | Word, PDF | Basic customization (text fields, logo upload) |

By following these steps, you’ll be able to quickly download a professional document and modify it to suit your specific business needs. This process ensures that your payment requests are clear, organized, and consistent with your brand’s image.

Choosing the Right Template for Your Business

Selecting the right document format for requesting payment can significantly impact your business’s efficiency and professionalism. The right structure ensures clarity, reduces confusion, and enhances your credibility with clients. When choosing a ready-made design, it’s important to consider the specifics of your business and how the document aligns with your operations and client needs.

The key is to find a format that is simple to use, flexible, and customizable. It should allow you to include the necessary details while reflecting the nature of the services you provide. Whether you need a basic structure or something with advanced features, selecting the right document can streamline your billing process and help maintain a professional image.

Key Factors to Consider When Choosing a Document

When looking for the right format, keep the following factors in mind:

- Ease of use: The format should be easy to navigate and fill in, even if you don’t have extensive technical skills.

- Customization options: Ensure that you can adjust elements like branding, terms, and service descriptions.

- Compatibility: Choose a document that can be easily opened and edited with the tools you already use (e.g., Word, Excel, PDF).

- Professional appearance: A well-designed structure enhances your business’s credibility and makes your documents look polished.

Document Comparison Table

| Document Type | Ease of Use | Customization Options | Best for |

|---|---|---|---|

| Basic PDF Format | Easy | Limited | Small businesses, straightforward needs |

| Excel Spreadsheet | Moderate | Flexible (formulas, calculations) | Businesses with complex pricing or calculations |

| Word Document | Easy | Moderate (text editing, basic layout) | Freelancers, contractors with simple tasks |

| Cloud-based Software | Moderate to Advanced | Highly customizable (branding, advanced features) | Growing businesses with recurring jobs and clients |

By considering your business size, complexity of services, and preferred tools, you can choose the best document structure that suits your needs. Whether you need something simple or feature-rich, the right choice can help you stay organized and ensure timely payments.

Common Mistakes to Avoid in Invoicing

Creating accurate and clear payment requests is crucial for maintaining professional relationships with clients and ensuring timely compensation. However, there are several common mistakes that can lead to confusion, delayed payments, or strained client interactions. Avoiding these errors can help streamline your billing process and prevent potential issues down the line.

By paying attention to the details and following best practices, you can ensure that your payment requests are clear, professional, and easily understood by your clients. Below are some of the most frequent mistakes and how to avoid them.

1. Missing or Incorrect Client Details

One of the most common mistakes is failing to include or miswriting important client information. Missing details such as the client’s name, address, or contact information can delay processing and create confusion. Always double-check this information before sending the document to ensure that it is correct and complete.

2. Unclear Service Descriptions

Providing vague or incomplete descriptions of the work performed can lead to misunderstandings about the scope of the job. Make sure to clearly outline what services were rendered, including any additional charges for parts, materials, or specialized labor. A well-detailed description not only helps justify the charges but also helps build trust with your clients.

3. Not Including Payment Terms

Failing to specify payment terms is a common oversight. Without clear payment deadlines, methods, and late fee policies, clients may not understand when payment is expected or how to pay. Always include specific terms such as the due date, accepted payment methods (bank transfer, credit card, etc.), and any penalties for late payment.

4. Incorrect Pricing or Math Errors

Errors in calculations, whether it’s listing the wrong rate or failing to apply taxes correctly, can lead to confusion and disputes. Always double-check the pricing and ensure that the total amount is accurate. Using a calculation tool or formula can help prevent this type of mistake.

5. Lack of Unique Reference Number

Not including a unique reference number for each request can make it difficult to track payments and manage records. Having an invoice number or job reference helps both you and your client stay organized and ensures that payments are easily matched to the correct transaction.

6. Overlooking Taxes or Additional Fees

Leaving out taxes or additional fees, such as travel or emergency service charges, can result in discrepancies between the agreed-upon price and the final amount. Ensure that you clearly list any extra fees that apply to the service, and include tax rates where applicable to avoid confusion.

7. Failing to Send the Document Timely

Sending the document too late can delay the payment process and cause unnecessary frustration. Aim to send the payment request as soon as the work is completed, and be sure to follow up if payment is not received by the due date.

By avoiding these common errors, you can ensure that your payment requests are accurate, professional, and more likely to be paid on time, helping to keep your business running smoothly.

Best Software for Generating Invoices

For businesses that need to send payment requests quickly and efficiently, using dedicated software can streamline the process. The right tool not only automates the creation of these documents but also provides additional features such as tracking, reporting, and managing client accounts. With so many options available, selecting the best software for your needs is crucial to saving time and maintaining professionalism.

From basic templates to advanced tools with integrated payment systems, there is a wide range of software to help businesses of all sizes. Whether you’re a freelancer or running a larger company, the right platform can simplify your administrative work and ensure that your billing is consistent and accurate.

Top Features to Look for in Billing Software

When choosing software for generating payment requests, consider the following key features:

- Customization options: Look for software that allows you to personalize documents with your company logo, colors, and custom terms.

- Payment integration: The ability to accept payments directly through the software can simplify the transaction process.

- Automation: Automated reminders and recurring billing features can help reduce the time spent on administrative tasks.

- Client management: A tool that helps you manage client details and track their payment history can be invaluable for long-term business relationships.

- Multi-device compatibility: Ensure that the software is accessible from various devices, including desktop, mobile, and tablets, for maximum flexibility.

Popular Software Options

Here are some of the best software options available for generating payment requests:

- QuickBooks: Well-known for its comprehensive features, QuickBooks offers invoice creation, payment tracking, and integrated accounting tools.

- FreshBooks: Ideal for small businesses and freelancers, FreshBooks allows easy customization and automates invoicing tasks, including payment reminders.

- Zoho Invoice: A highly flexible and user-friendly platform that lets you create professional documents, track payments, and manage clients.

- Wave: A free tool with excellent features for small businesses, including customizable documents and built-in payment processing.

Using dedicated software to generate payment requests can save time, reduce human error, and help you maintain a professional image. By choosing the right tool for your business, you can focus more on your services and less on administrative tasks.

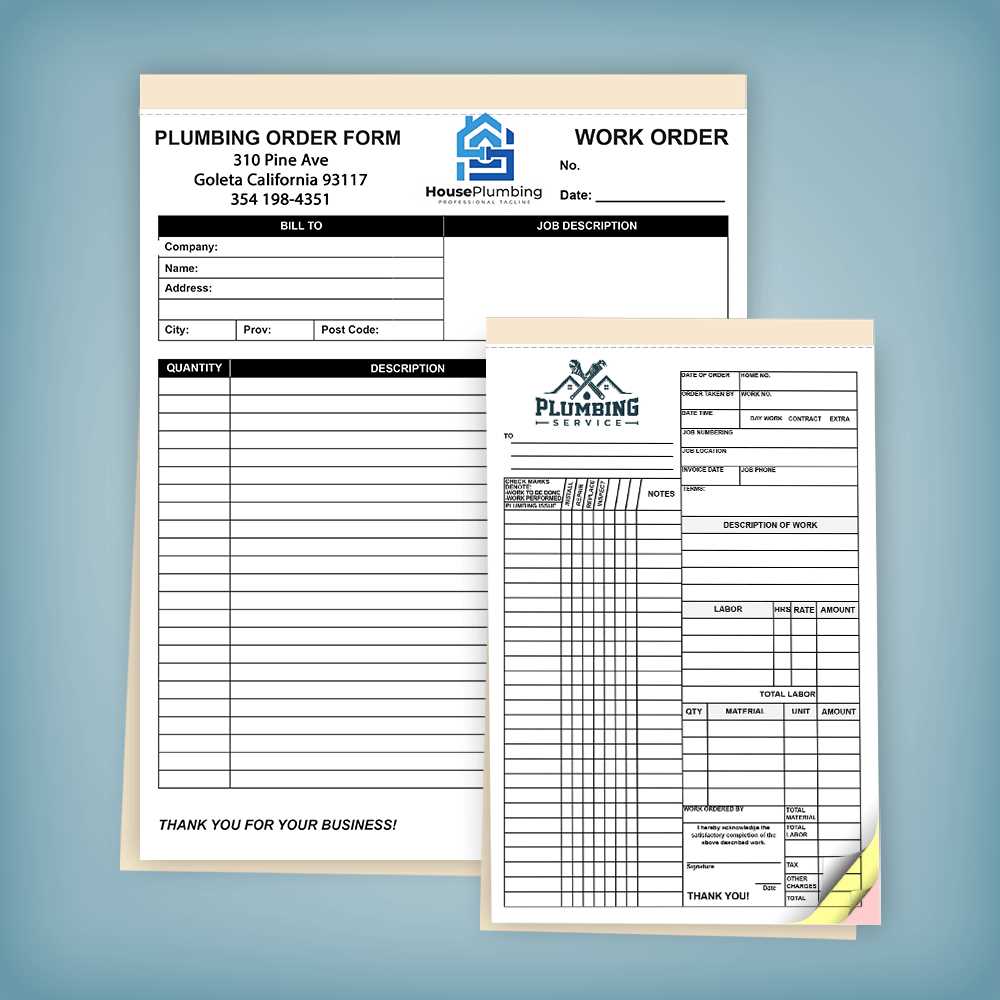

Invoice Templates for Different Services

Different types of businesses and services require distinct payment request documents. While some fields need a basic structure, others may require more detailed descriptions or itemized breakdowns. Choosing the right format can help ensure that all relevant information is captured and presented clearly to your clients.

When working in specific industries, it’s important to select a format that reflects the nature of your work and client expectations. For example, contractors might need to list materials and labor separately, while consultants may only need to outline hours worked. Below are some examples of the types of service-specific formats that can benefit your business.

Types of Service-Specific Formats

The structure of your payment request document will vary depending on the type of service provided. Below are some common service categories and the corresponding document requirements:

| Service Type | Document Features | Best For |

|---|---|---|

| Construction/Contracting | Itemized list of materials, labor charges, taxes, and additional fees. | Contractors, builders, and construction professionals. |

| Consulting | Hourly rate, project milestones, and detailed work descriptions. | Freelancers, consultants, and project managers. |

| Creative Services | Work portfolio, hourly rate or flat fee, and any applicable royalties or licensing fees. | Designers, writers, and content creators. |

| IT Services | Software development costs, hourly rates, hardware costs, and support fees. | IT professionals, web developers, and software engineers. |

| Maintenance/Repair | Labor charge, parts used, service call fees, and any follow-up visits. | Technicians, repairmen, and maintenance workers. |

By tailoring your document to the specific needs of your service, you can ensure that your clients understand the charges and can process payments without confusion. Customizing your documents based on the type of service also helps reinforce your professionalism and attention to detail.

How to Add Payment Terms on Your Invoice

Including clear payment terms in your payment request is essential for managing expectations and ensuring timely transactions. By outlining specific conditions regarding payment deadlines, accepted methods, and penalties for late payments, you create a transparent and professional agreement with your clients. This clarity helps avoid misunderstandings and encourages prompt payment.

Payment terms should be easy to find and clearly worded, so that both parties know exactly when and how payment should be made. The following steps will guide you on how to effectively add these terms to your document.

Key Elements to Include in Payment Terms

When drafting your payment conditions, make sure to include the following details:

- Due Date: Specify the exact date when the payment is due. Common terms include “Net 30” (payment due within 30 days) or a specific calendar date.

- Accepted Payment Methods: List the payment methods you accept, such as credit cards, bank transfers, or checks.

- Late Fees: Mention any late fee charges that apply if payment is not made on time. For example, “A 5% late fee will be added after 30 days.”

- Early Payment Discounts: Offer a discount for early payments, such as “A 2% discount if paid within 10 days.”

- Payment Instructions: Include clear instructions on how clients can pay, such as bank account details or a link to a payment portal.

Examples of Payment Terms

Here are a few examples of how you can phrase your payment terms on your document:

- “Payment is due within 30 days from the date of issue. A 2% discount applies if payment is made within 10 days.”

- “Net 15 days. Late fees of 1.5% per month will be applied to overdue amounts.”

- “Payment due upon receipt. Please submit payment within 15 days via bank transfer to the account below.”

By clearly outlining your payment terms, you reduce the chances of delayed payments and ensure that your clients understand their obligations. Adding this detail to your payment request strengthens your business’s professionalism and supports smoother financial transactions.

What to Include in Invoice Descriptions

A clear and detailed description of the services or products provided is essential for any payment request. These descriptions not only help clients understand what they are being charged for but also serve as a reference for both parties in case of disputes or questions. A well-written description ensures that all the terms and conditions are transparent, and the client knows exactly what they are paying for.

To make sure your payment request is professional and comprehensive, it’s important to include specific details in the service descriptions. This section should not only reflect the work completed but also provide clarity on how the charges were calculated. Below are key components that should be included in any description to avoid confusion and to maintain a professional image.

Key Elements of a Clear Description

When writing service descriptions, include the following elements:

- Service or Product Name: Clearly identify what was provided, such as “Emergency plumbing repair” or “Bathroom faucet replacement.” This sets the foundation for the description.

- Quantity or Hours: If applicable, include the number of units or hours worked. For instance, “5 hours of labor” or “3 plumbing fixtures installed.”

- Rates or Pricing: Specify the rate for each service or product. This can be an hourly rate, flat fee, or cost per unit. For example, “Hourly rate: $50” or “Total for materials: $120.”

- Details of Work Completed: Include any additional information that explains what was done. For example, “Repaired a leaking pipe under the kitchen sink” or “Replaced faulty valve with a new one.”

- Materials Used: If the job required materials, list them along with their cost. For example, “PVC pipe (2 meters) – $20” or “New faucet – $45.”

- Additional Fees: If there were any extra charges, such as a service call fee or emergency rate, make sure to clearly state those charges in the description.

How to Format Descriptions for Clarity

While the content is important, the way you format your descriptions can make a significant difference. To keep things clear and easy to read, consider the following:

- Use bullet points or tables: Breaking down each item or service into a bullet point or table format can help improve readability.

- Keep it concise: Avoid unnecessary jargon and be as direct as possible. Clients will appreciate the clarity.

- Highlight important information: Use bold or italics to emphasize key details like rates, quantities, or special instructions.

By providing detailed descriptions, you not only ensure transparency but also demonstrate professionalism in your business transactions. A well-structured and clear service breakdown will help avoid confusion and make it easier for your clients to process their payments promptly.

How to Keep Track of Invoices

Efficiently managing your payment requests is essential for maintaining financial organization in your business. Keeping track of these documents helps ensure you are paid on time, reduces the risk of errors, and provides a clear record for tax purposes. Without proper tracking, it can be easy to lose track of overdue payments or duplicate transactions.

Implementing a structured system for managing these documents will not only save you time but also enhance your professionalism. Whether you are using manual methods or automated software, having a clear system in place will ensure that you never miss a payment and can quickly retrieve records when needed.

Methods for Tracking Payment Requests

Here are a few effective ways to keep track of your payment documents:

- Spreadsheets: Using spreadsheet software like Excel or Google Sheets is a simple and cost-effective way to track payments. You can create columns for invoice numbers, dates, client names, amounts, and payment status.

- Accounting Software: Specialized accounting software provides a more automated approach. Tools like QuickBooks, FreshBooks, or Wave help manage payments, send reminders, and offer detailed reporting features.

- Cloud-Based Tools: Cloud platforms allow you to store and access your records from anywhere. They also typically include features like automatic backups and document sharing with clients or accountants.

- Manual Logbooks: For those who prefer traditional methods, maintaining a physical ledger or notebook to track transactions can work as long as it is kept organized and updated regularly.

Tips for Effective Tracking

Here are some additional tips to help you keep accurate records:

- Assign Unique Numbers: Ensure each payment request has a unique reference number. This helps you easily identify and organize documents.

- Set Reminders: Use calendar apps or task management tools to set reminders for payment deadlines and follow-ups.

- Regular Updates: Update your tracking system immediately after issuing or receiving a payment to ensure you always have accurate records.

- Maintain Backups: Keep digital and physical copies of payment records in case of technical failures or legal inquiries.

By consistently tracking payment requests, you can keep a smooth flow of cash in your business, reduce overdue accounts, and enhance your financial management overall. Choose the method that works best for your business style, and make it a regular part of your workflow.

Ensuring Professionalism with Your Invoice

Creating a polished and well-organized payment request is a key element in presenting your business as professional and reliable. The way you structure and present your billing documents speaks volumes about your brand and can influence how your clients perceive your work. A professional document not only helps clients feel confident in your services but also ensures smoother transactions and quicker payments.

To maintain professionalism, every detail should be carefully considered, from the format and language to the clarity of terms and conditions. A well-crafted document shows that you value both your work and your client relationships. Below are some essential tips to ensure your billing documents reflect your professionalism.

Tips for Crafting a Professional Document

- Clear and Concise Language: Use simple, straightforward language in your descriptions and terms. Avoid jargon or ambiguous phrases that could confuse your clients.

- Consistent Branding: Include your logo, business name, contact details, and website on your payment requests to reinforce your brand image.

- Well-Structured Layout: Organize your document logically. Include all necessary sections such as services rendered, payment terms, and due date in a clear, easy-to-read format.

- Accurate Information: Double-check that all client details, pricing, dates, and descriptions are correct. Mistakes can undermine your credibility.

- Polite and Professional Tone: Use courteous language when outlining payment expectations. Phrases like “Thank you for your business” or “We appreciate prompt payment” help convey professionalism without being overly formal.

Additional Elements to Enhance Professionalism

Beyond the basic elements, consider these additional touches that can elevate your documents:

- Payment Instructions: Provide clear payment methods and account details to make the payment process as easy as possible.

- Personalized Notes: Adding a personal thank-you note or a brief message can strengthen your client relationship.

- Late Payment Policy: Clearly outline any fees or interest charges for late payments to encourage prompt settlement.

- Tracking Numbers: If applicable, include tracking or reference numbers that correspond to the work or products provided, making the document easy to reference in case of disputes.

By ensuring your payment request documents are professionally crafted and easy to understand, you show your clients that you are serious about your business and value their partnership. A well-prepared document can also streamline your operations and help maintain long-term, positive client relationships.

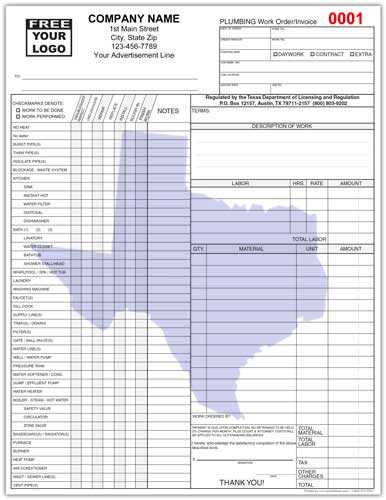

Legal Requirements for Plumber Invoices

When creating payment requests for services rendered, it’s essential to ensure that your documents meet all legal requirements. In many jurisdictions, certain information must be included to comply with tax laws, contractual obligations, and business regulations. Understanding and following these requirements can help protect your business from legal issues and ensure smooth transactions with your clients.

Complying with legal requirements for payment requests also builds trust with your clients, demonstrating that you operate transparently and professionally. Below are some key elements that should be included in your payment documents to ensure they meet legal standards.

Essential Legal Elements to Include

- Business Information: Your business name, address, and contact details should be clearly listed. This ensures that your client can easily reach you if needed and is also a requirement for tax reporting.

- Client Information: Include the client’s name and address to ensure the document is properly attributed. This is also important for legal purposes if any disputes arise.

- Unique Reference Number: Each payment request should have a unique number for record-keeping and reference. This is crucial for accounting and any legal proceedings related to the transaction.

- Detailed Service Description: Provide an itemized list of the services provided, including the date of service, quantities, rates, and any other relevant details. This clarity can help avoid misunderstandings and potential disputes.

- Tax Information: Clearly indicate any applicable taxes, such as sales tax or VAT, and the rate at which they were applied. Businesses are typically required to charge and report sales tax on certain services or goods.

- Payment Terms and Due Date: Clearly state when the payment is due and any penalties for late payments. This helps set clear expectations for both parties and protects your business.

- Legal Disclaimers: If applicable, include any required disclaimers regarding warranties, terms of service, or limitations of liability. This can protect your business from future legal claims.

Additional Considerations for Compliance

Beyond the basics, you may need to include additional information depending on the nature of your business and local regulations:

- License Number: In some areas, contractors are required to list their license number on payment requests, especially for regulated work.

- Business Registration Number: Certain regions require a business registration or tax identification number to be listed for official documents.

- Payment Methods: Make sure to provide clear payment options, as well as instructions for how clients can make payments to ensure compliance with financial regulations.

By ensuring your payment requests comply with legal requirements, you not only protect your business but also build trust with your clients. Adhering to these standards helps avoid potential fines or disputes and keeps your operations running smoothly.

How Invoices Help Improve Cash Flow

Maintaining a steady cash flow is essential for the health and growth of any business. One of the key ways to ensure this is by efficiently managing the documentation that tracks payments for services rendered. When done correctly, these documents play a crucial role in ensuring you are paid promptly and consistently, which directly impacts your business’s ability to manage expenses, pay employees, and invest in growth opportunities.

By clearly outlining the amount due, payment terms, and due dates, these records help set clear expectations for clients, reducing delays and misunderstandings. They also serve as an official record of transactions, which is useful for accounting, budgeting, and financial planning. The more effective your payment documentation system is, the more likely you are to experience smooth and predictable cash flow.

How Timely Payment Requests Impact Cash Flow

Issuing payment documents promptly can greatly enhance your cash flow in several ways:

- Quick Payment Processing: Clear and timely payment requests encourage clients to settle their dues quickly, improving the overall speed at which funds are received.

- Better Budgeting and Planning: With consistent payments coming in on time, you can plan for future expenses and avoid any unexpected cash shortages.

- Reduced Delays: A well-structured payment request reduces the chances of clients delaying payment due to confusion over the amount owed or payment terms.

Optimizing Cash Flow with Proper Follow-Up

In addition to issuing payment documents, following up on overdue accounts is crucial for maintaining a healthy cash flow:

- Automated Reminders: Many businesses use automated systems to send reminders as the due date approaches or if payments are overdue. This saves time and ensures consistency in follow-ups.

- Clear Terms and Conditions: Including clear payment terms and policies in your documents ensures that your clients know exactly when to pay and what penalties they might incur for late payments.

- Incentives for Early Payments: Offering small discounts or incentives for early payments can motivate clients to settle their balances faster, further improving your cash flow.

By managing your payment requests effectively, you can improve your cash flow, reduce the risk of financial instability, and ensure that your business has the resources it needs to grow and thrive. Whether through clear documentation, timely follow-ups, or incentives, well-managed payment records are key to securing the financial health of your business.