Simple and Free Plain Invoice Template for Easy Billing

Managing financial transactions effectively is crucial for any business or freelancer. Having a straightforward and professional way to request payment ensures clarity and avoids misunderstandings with clients. A well-structured payment request is essential for maintaining healthy cash flow and ensuring prompt compensation for your services or products.

In this guide, we’ll explore how to create easy-to-use billing documents that suit different business needs. Whether you’re a small business owner, a freelancer, or managing a larger enterprise, a well-crafted request for payment can streamline your operations and enhance your professional image.

We will cover practical advice on the key components of a payment request, including the necessary information to include, how to personalize your format, and tips for making your documents look polished and clear. With the right tools, you can create a professional-looking document in no time, even without prior design experience.

Understanding Simple Billing Documents

Creating clear and effective payment requests is essential for ensuring smooth transactions between businesses and clients. These documents serve as formal notices detailing the amount due for goods or services provided. Having a well-organized and easy-to-understand structure helps avoid confusion and promotes timely payments.

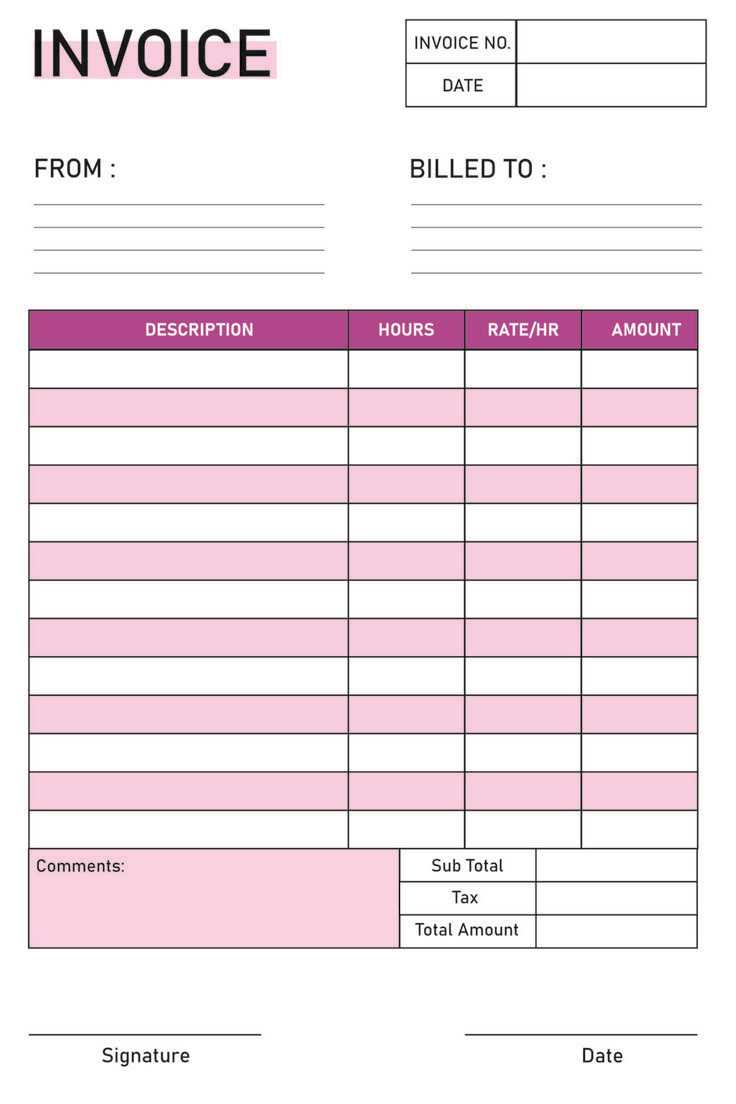

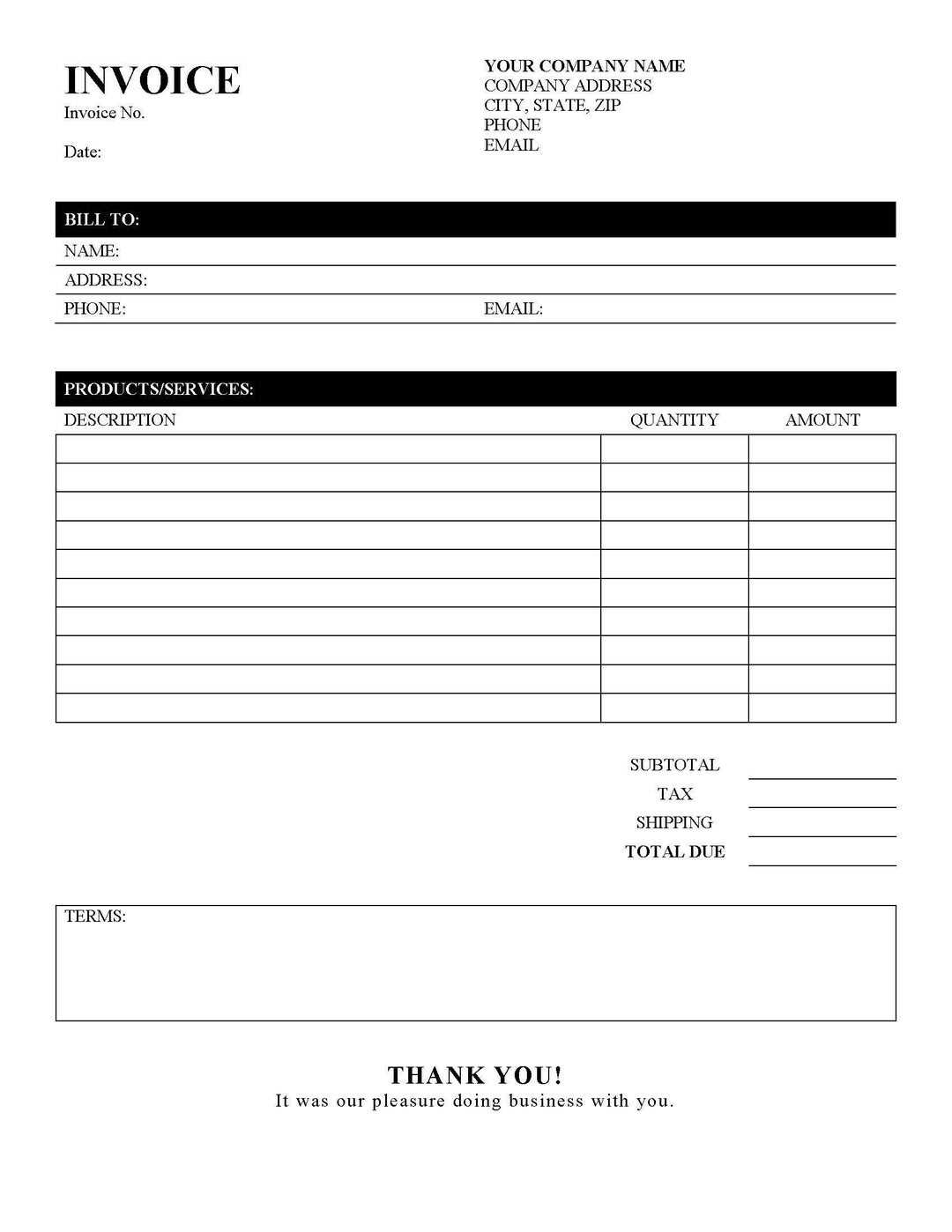

A simple billing document typically includes several core elements that ensure both parties are on the same page. These elements are usually straightforward, and their purpose is to communicate key details about the transaction in a clear manner. By using a basic yet effective layout, you can achieve professional results without unnecessary complexity.

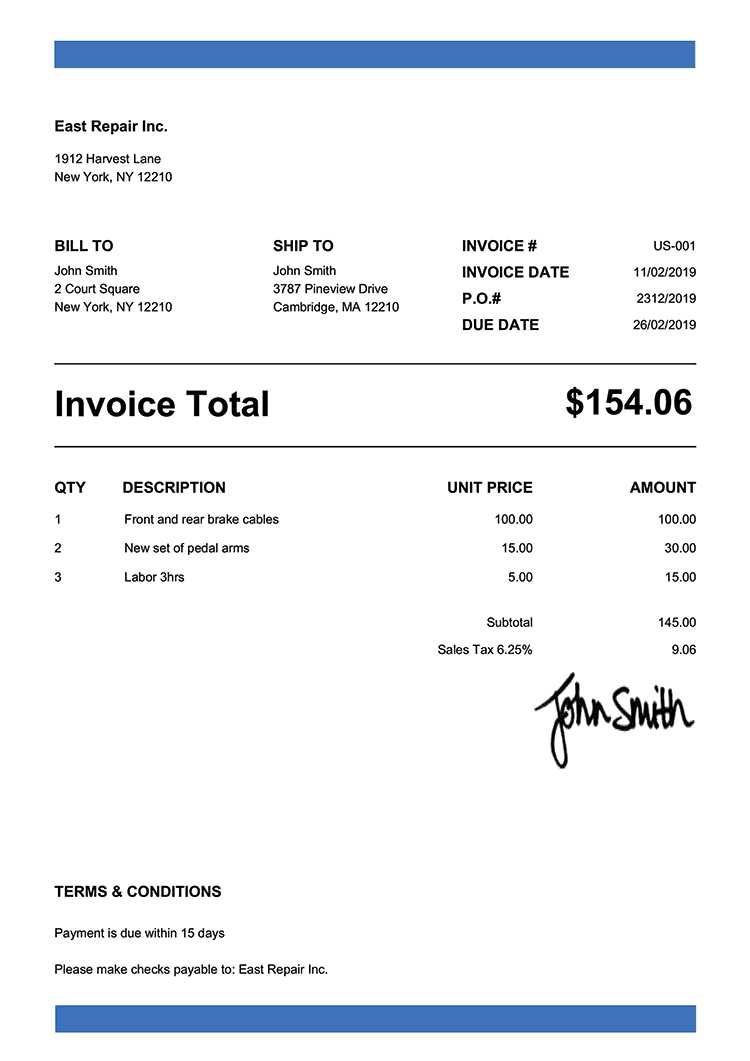

- Header Section: Contains business and client information, along with the document title.

- Description of Services: A list of the goods or services provided, including dates and quantities if applicable.

- Total Amount Due: The exact payment requested, often with itemized details for clarity.

- Payment Instructions: Clear guidelines on how the client should submit the payment.

- Due Date: The date by which payment should be received to avoid delays.

By focusing on these essential elements, anyone can create a document that is both functional and professional, helping to streamline the billing process. Whether you’re a freelancer or a business owner, this type of document will support efficient transactions and reduce the chances of payment issues.

Why Use a Simple Billing Document

Adopting a straightforward format for requesting payments offers several advantages, particularly for small businesses and independent professionals. These documents provide a clear, standardized way to communicate the amount due, the services rendered, and payment instructions. The simplicity of such a structure helps avoid errors and confusion while ensuring that clients understand the terms of the transaction.

Efficiency and Time-Saving

Using a basic structure to create your payment requests can save a considerable amount of time. Instead of spending hours designing complex layouts or formatting intricate details, a simple document allows you to focus on the important elements of the transaction. This streamlined approach means you can quickly generate payment requests and keep your business moving forward.

- Quick Setup: A basic document can be set up in minutes without the need for complicated software or design skills.

- Faster Payment Processing: Clients are more likely to pay promptly when the request is clear and easy to understand.

- Minimal Errors: Fewer design elements reduce the risk of mistakes or misinterpretation of the details.

Professional Appearance

Even a simple payment document can look polished and professional. The key is clarity–clients appreciate a well-organized format that gets straight to the point. By using an easy-to-read structure, you can create a document that reflects your business values while avoiding unnecessary distractions or clutter.

- Consistent Branding: Maintain a consistent look that aligns with your company’s branding without needing complicated design.

- Enhanced Client Trust: A well-crafted document signals professionalism and reliability, which helps build trust with clients.

Overall, using a simple approach to request payments is a smart choice that boosts efficiency and professionalism while minimizing confusion for both parties involved.

How to Create a Billing Document

Creating a professional and effective payment request doesn’t have to be complicated. A simple structure can help you communicate the necessary details to your clients clearly and efficiently. Whether you’re a freelancer, small business owner, or service provider, having a ready-to-use format can save time and reduce the chances of errors in your financial communications.

To create a functional document for requesting payment, focus on the essential information that needs to be included. By organizing your details in a clean, easy-to-follow layout, you can ensure that clients have all the information they need to process payments quickly. Here’s a step-by-step guide on how to build your own payment request document.

Step 1: Include Basic Information

The first step is to ensure that your document includes all the necessary details for identification and reference. This makes it easy for both you and the client to track the transaction.

- Your Contact Details: Include your business name, address, phone number, and email.

- Client Information: Clearly list the client’s name, company (if applicable), and contact details.

- Document Title: Label the document as a “Payment Request,” “Billing Statement,” or any term that clearly indicates its purpose.

Step 2: Add Transaction Details

Next, outline the specifics of the services or products provided. This section should be clear and detailed so the client knows exactly what they are being charged for.

- Description of Services/Items: List each item or service with a brief description, quantity, and price.

- Dates: Include the dates when services were rendered or goods were delivered.

- Amount Due: Clearly specify the total amount to be paid, including any applicable taxes or discounts.

Step 3: Provide Payment Instructions

Once the details of the transaction are listed, provide your client with clear instructions on how to pay. This will ensure that payments are processed smoothly and without confusion.

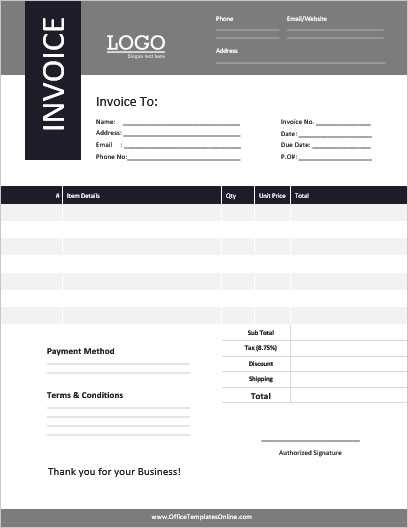

Benefits of Customizable Billing Documents Having the ability to tailor your payment request documents allows you to create a professional and consistent experience for both your business and clients. Customizing your documents means you can adjust the layout, content, and branding to match your needs, ensuring each communication feels personal and aligned with your business identity. This flexibility not only streamlines your workflow but also enhances your professional image.

Here are some of the key benefits of using customizable formats for your billing documents:

1. Brand Consistency

Customizable documents provide an opportunity to incorporate your business branding into your payment requests. This can help reinforce your company’s identity and create a more cohesive experience for your clients.

- Logo Placement: Include your business logo to make the document instantly recognizable.

- Color Scheme: Use brand colors for headings, borders, and accents to maintain visual consistency.

- Font Style: Choose fonts that reflect your brand’s tone and professionalism.

2. Flexibility and Control

With customizable documents, you have complete control over how the information is presented. This flexibility allows you to adjust the layout to fit your specific needs, whether you want to add additional details, remove unnecessary sections, or reorganize content.

- Tailor Content: Add or remove specific fields based on the nature of each transaction.

- Personalize Sections: Include special notes, discounts, or payment instructions that are relevant to the client.

- Adaptable Layouts: Customize the structure to suit your business size or service complexity.

3. Time Efficiency

Once you create a customizable format, you can reuse it for future transactions, significantly reducing the time spent creating new documents from scratch. With saved sections and consistent formats, all you need to do is plug in the details of each new transaction.

- Pre-filled Fields: Save frequently used details like payment terms, contact informatio

Free Resources for Payment Request Documents

If you’re looking to create professional payment request documents without the need for expensive software or design tools, there are plenty of free resources available online. These resources provide easy-to-use formats that allow you to customize and generate billing documents quickly. Whether you’re just starting your business or need a simple solution for occasional transactions, free tools can offer everything you need to create clear and effective communication with your clients.

Here are some great places to find free formats for your payment requests:

1. Online Platforms and Tools

There are various websites that offer customizable formats for payment requests, many of which are free to use. These platforms provide a range of styles and formats that can be easily adjusted to fit your business needs.

- Canva: Offers a variety of pre-designed billing documents that you can easily edit and download for free.

- Zoho Invoice: A free tool that provides customizable layouts and allows you to send documents directly to clients.

- Wave Accounting: Provides free and customizable billing documents, with added features for tracking payments and finances.

2. Downloadable Document Files

If you prefer to work offline, you can find a variety of free downloadable formats for payment requests. These files can be customized in word processors like Microsoft Word or Google Docs.

- Microsoft Office Templates: Free templates available for download that can be modified to suit your needs.

- Google Docs: Offers free, editable payment request formats that can be customized and stored online for easy access.

- Invoice Generator: A free online tool that allows you to create and download a payment request document in minutes.

These resources are perfect for anyone who needs to create a professional payment request document without spending a lot of time or money. Whether you prefer working with online tools or offline documents, you’ll find plenty of free options to meet your needs and help you maintain a smooth billing process.

Common Mistakes in Creating Payment Requests

When creating documents for requesting payment, small mistakes can lead to confusion, delays, and missed payments. Whether you are new to managing your business finances or just need a refresher, avoiding common errors in these documents is crucial for maintaining professionalism and ensuring timely payments. Simple oversights can cause frustration for both you and your clients, so it’s important to get the details right from the start.

1. Missing or Incorrect Client Information

One of the most basic mistakes is failing to include accurate or complete client details. If the recipient’s name, address, or contact information is incorrect, it can lead to issues in communication or payment processing.

- Incorrect Client Name: Double-check that the correct name is used, especially for businesses or organizations.

- Missing Contact Information: Always include the client’s email, phone number, or address to ensure they can reach you if needed.

- Incorrect Address: Make sure the billing address is up to date to avoid delays in processing payments or sending physical reminders.

2. Incomplete or Confusing Payment Breakdown

A vague or incomplete breakdown of charges can create misunderstandings and delay payments. Clients need clear, detailed information to understand exactly what they’re being charged for.

- Unclear Descriptions: Provide specific descriptions for each item or service provided, along with quantities and prices.

- Lack of Itemization: Always list individual charges, including taxes, fees, and discounts, rather than just providing a lump sum.

- No Payment Terms: Include payment due dates, accepted methods, and any late fees to avoid confusion.

3. Failing to Include Important Dates

Dates are essential in payment request documents as they provide both parties with a clear timeline for the transaction. Missing or incorrect dates can lead to delayed payments or disputes over when the payment is due.

- Missing Due Date: Always specify when the payment is due t

What to Include in a Payment Request Document

To ensure that your payment request is clear, professional, and complete, it’s important to include all the necessary details that help both you and your client understand the terms of the transaction. A well-structured document not only makes it easier for your client to process the payment but also minimizes the chances of disputes or delays. Below are the essential components to include when creating a payment request document.

1. Business and Client Information

Start by providing all the necessary contact information for both parties. This helps establish a clear connection between the sender and recipient and makes it easier to resolve any issues that may arise.

- Your Business Details: Include your company name, address, phone number, and email address.

- Client Information: Provide the client’s name, business name (if applicable), address, and contact details.

- Document Title: Label the document clearly, such as “Payment Request,” “Billing Statement,” or “Amount Due” to avoid confusion.

2. Transaction Details

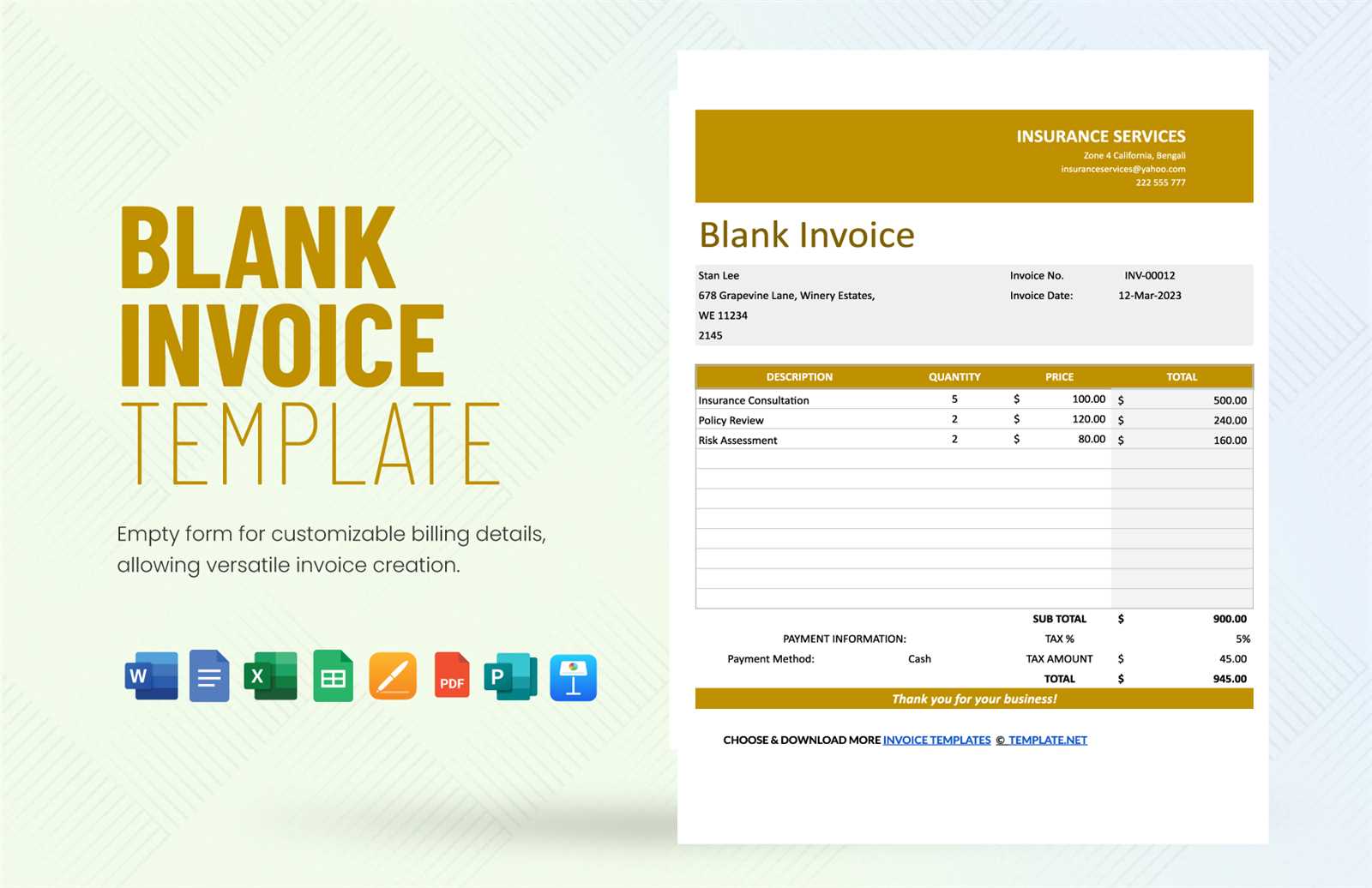

The main body of the document should outline the services or products provided, along with the associated costs. This section ensures that your client understands exactly what they are being charged for.

- Description of Products/Services: List each item or service with a brief description, quantity (if applicable), and unit price.

- Dates: Specify when the service was provided or when the product was delivered.

- Subtotal: Calculate the total amount before taxes or discounts.

- Taxes/Fees: Include any applicable tax rates or additional fees based on the nature of the transaction.

- Total Amount Due: Clearly show the final amount your client needs to pay after any adjustments.

3. Payment Instructions

Make it easy for your client to pay by providing clear instructions on how and where to send the payment. This reduces the chance of delays and ens

How to Edit Your Billing Document Format

Editing your payment request format allows you to personalize and adapt it to your business needs, making the document more professional and fitting for your specific transaction details. Whether you’re adding new sections, updating existing fields, or adjusting the layout for better clarity, editing your document can streamline your workflow and enhance client communication. Below are some simple steps you can follow to make adjustments to your format.

1. Modify the Header Section

The header is one of the most important parts of your document. It’s where you provide the details of your business and the client, as well as the document title. Make sure this section accurately represents your brand and clearly identifies the purpose of the document.

Element Action Business Name & Contact Info Update your business name, address, email, and phone number if there are any changes or updates. Client Information Ensure the client’s name, company name, and contact information are correct. Document Title Change the title if needed, for example, from “Billing Statement” to “Payment Request” or “Amount Due”. 2. Update the Transaction Details

Make sure that each service or product is listed correctly, including prices, quantities, and any additional fees. This section can be easily updated as new charges arise or if prices change. Adjust the layout as necessary to accommodate longer descriptions or multiple items.

Element Action Description of Products/Services Ensure each item is described accurately with the correct price, quantity, and date. Subtotal, Taxes, and Discounts Update the cost breakdown, including adding taxes or applying any available discounts. Total Amount Due Double-check that Choosing the Right Format for Billing Documents

When selecting a format for your payment request documents, it’s essential to consider several factors that align with your business needs. The right layout not only ensures clarity but also helps you maintain a professional image. Whether you’re dealing with a single transaction or regular billing cycles, finding a suitable structure will make your workflow more efficient and your communication with clients clearer. There are various formats to choose from, each offering distinct features that can benefit different types of businesses.

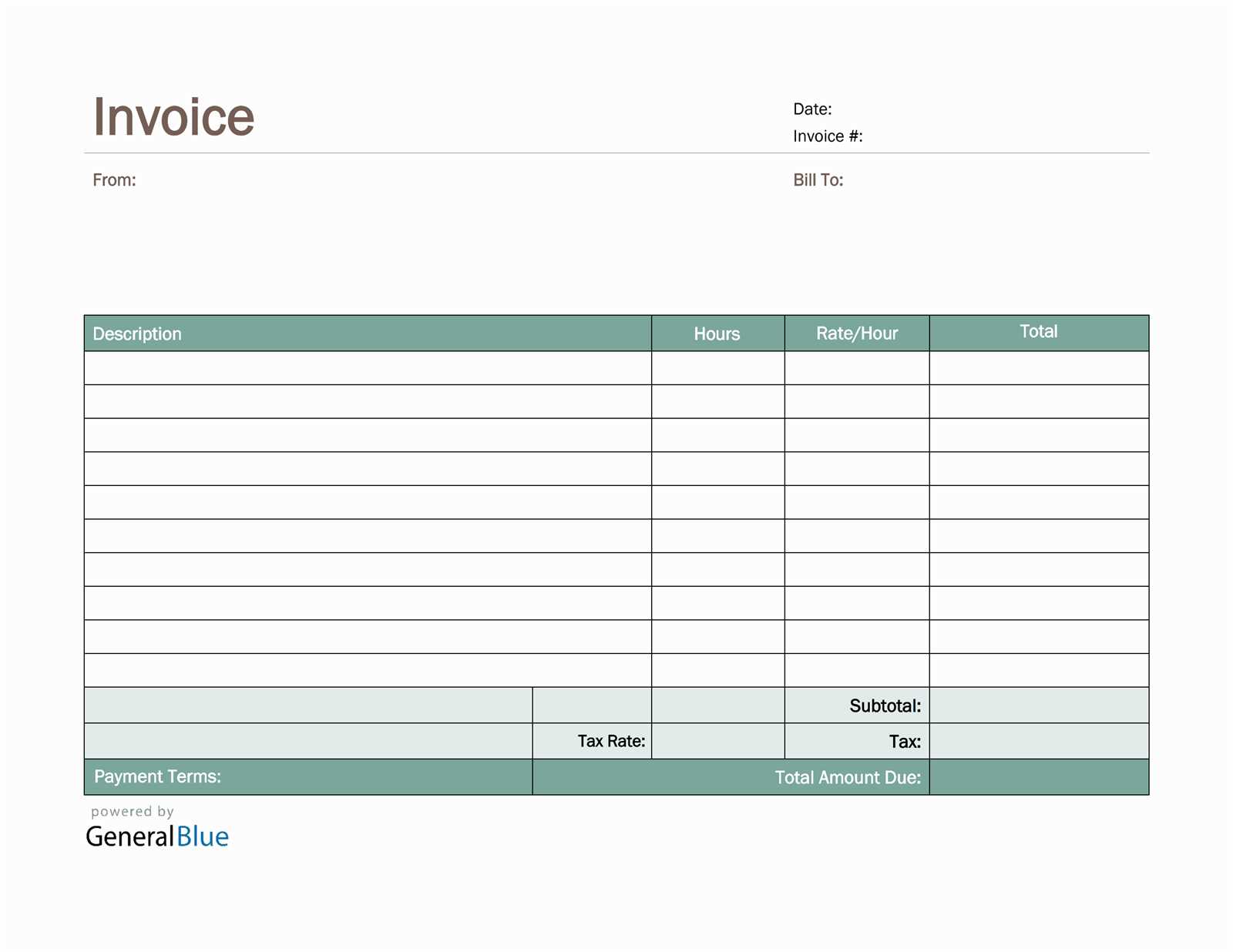

1. Simple vs. Detailed Layout

The first decision when choosing a format is whether you need a simple or more detailed structure. A simple design is ideal for small businesses or freelancers who issue basic payment requests with few items or services, while a more detailed format may be necessary for larger transactions that require itemized lists, taxes, or service breakdowns.

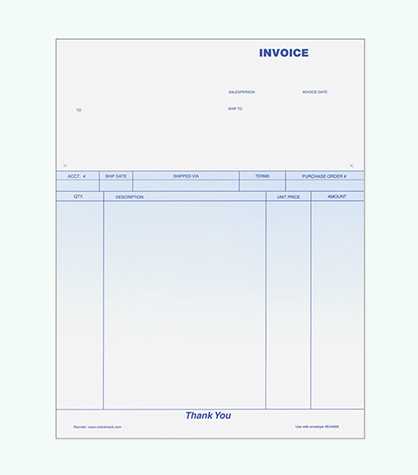

Format Type Best For Simple Layout Freelancers, small businesses, and occasional transactions. Detailed Layout Companies with multiple services, large projects, or clients who require extensive information. 2. Digital vs. Printed Versions

Another important factor is whether you want to create a digital version for email or a printed version to be mailed. Digital documents are convenient for quick turnaround times and easy sharing, whereas printed formats might be necessary for more formal or legal documents that require physical signatures or need to be mailed to clients.

Format Type Advantages Digital Format Fast delivery, easy to store, and environmentally friendly. Can be sent via email or online payment platforms. Printed Format More formal, suitable for clients who prefer paper copies, and necessary for some legal or contractual agreements. Ultimately, the choice of format depends on your business model, the complexity of the transactions, and the preferences of your clients. Carefully considering these factors will help you select the most effective format for your payment requests, ensuring that the process is smooth and professional for both you and your clients.

Top Tools for Creating Payment Request Documents

Creating clear and professional payment requests is essential for smooth business transactions. Fortunately, there are a variety of tools available that can help you generate these documents quickly and efficiently. Whether you’re a freelancer, a small business owner, or part of a large enterprise, using the right tool can save you time and ensure that your documents meet the necessary standards. Below are some of the top tools that can help you create well-structured billing documents tailored to your needs.

1. FreshBooks

FreshBooks is a popular cloud-based accounting software designed for small businesses and freelancers. It offers a wide range of features, including customizable billing documents. With FreshBooks, you can create and send professional payment requests, track payments, and automate follow-up reminders. The tool also integrates with various payment gateways, making it easier for clients to pay directly from the document.

- Features: Customizable layouts, time tracking, expense management, and integration with payment platforms like PayPal.

- Best For: Small businesses and freelancers looking for an all-in-one solution for invoicing and accounting.

2. Zoho Invoice

Zoho Invoice is another excellent tool for creating billing documents. It provides a range of customizable options, including the ability to add your logo, choose from pre-designed layouts, and set up recurring billing for regular clients. Zoho Invoice also offers automation features like payment reminders and thank-you emails, making it easier to stay on top of your transactions.

- Features: Custom branding, recurring billing, time tracking, and automatic reminders.

- Best For: Growing businesses that need a scalable solution for managing payments and billing.

3. Wave Accounting

Wave Accounting is a free tool designed to help small business owners and freelancers manage their financial tasks, including generating payment requests. Wave’s platform allows you to create and customize documents quickly, making it ideal for those who need a simple, no-cost option. In addition to invoicing, Wave offers features for expense tracking, financial reporting, and even payroll.

- Features: Free invoicing, expense tracking, financial reports, and payroll management.

- Best For:

Designing a Professional-Looking Billing Document

Creating a well-designed payment request document not only makes your business look more professional but also enhances the clarity and accuracy of your transactions. A polished document is an essential tool for establishing trust with your clients and ensuring that they have all the necessary information to process their payment. When designing your document, consider the layout, typography, and branding elements that reflect your company’s identity and make the information easy to follow.

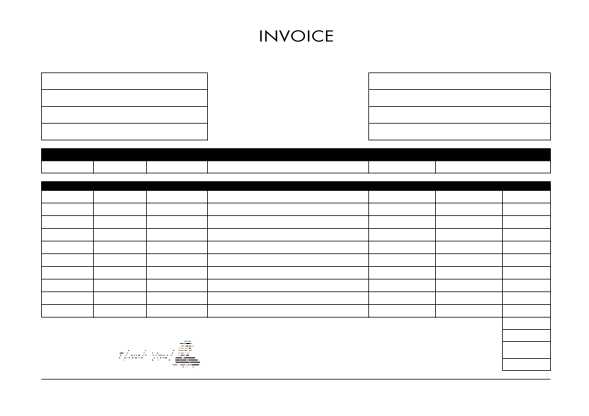

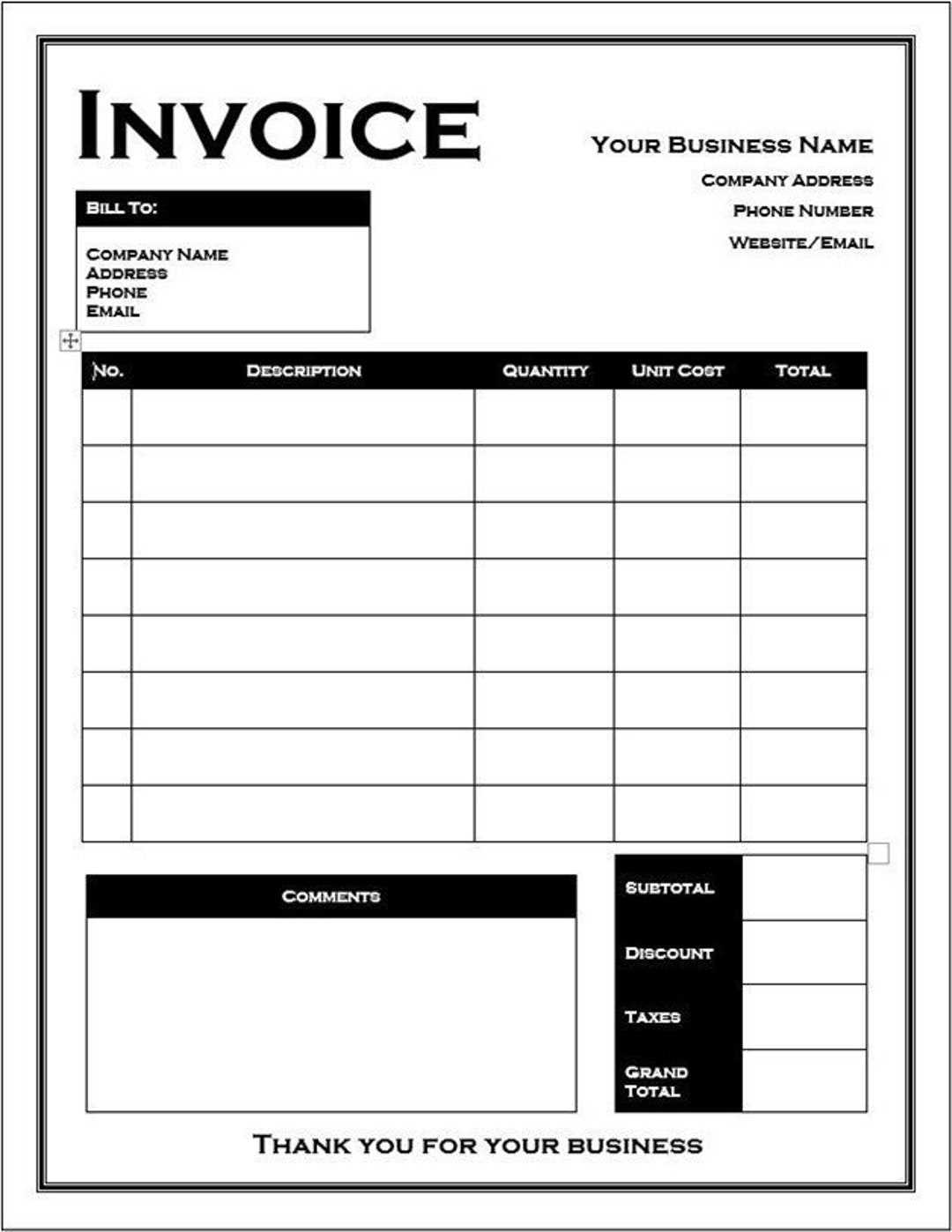

1. Keep the Layout Clean and Organized

A cluttered document can lead to confusion and mistakes. To ensure that your billing document is easy to read, focus on a clean, organized layout. Divide the content into clear sections, such as business details, client information, transaction breakdown, and payment instructions. Using tables or columns to separate the different parts of the document helps create a logical flow and makes it easier for the reader to find what they need.

- Business Details: Position your company’s contact information at the top for easy reference.

- Client Information: Include your client’s name, address, and contact details in a separate section.

- Transaction Breakdown: Organize the list of products or services with descriptions, quantities, prices, and subtotals in a table format.

- Payment Instructions: Make sure the payment terms, due date, and accepted payment methods are clearly stated.

2. Choose a Consistent and Professional Color Scheme

Colors play an important role in the overall aesthetic and professionalism of your payment request document. Stick to a simple color palette that aligns with your brand identity. A consistent color scheme helps reinforce your business’s image and creates a cohesive look across all your documents. Avoid using too many colors or overly bright tones, as these can distract from the key information.

- Brand Colors: Use your company’s brand colors for headings, logos, and borders.

- Neutral Backgrounds: A clean white or light gray background helps the text stand out without overwhelming the reader.

- Minimalist Approach: Limit the use of colors to important sections like totals or headings to maintain a professional look.

Billing Document Format for Small Businesses

For small businesses, having a well-organized and efficient way of managing payment requests is crucial to maintaining cash flow and professionalism. A standardized format allows you to streamline your billing process, ensuring consistency and clarity in every transaction. Whether you’re a freelancer or a small business owner, an effective document structure helps ensure that your clients understand what they owe and when payment is due. Below are key considerations for creating a practical and professional payment request for your business.

1. Essential Sections to Include

A comprehensive payment request should contain all the necessary details to avoid confusion and ensure smooth transactions. Here are the key sections to include:

- Business Information: Include your business name, address, contact details, and logo at the top for easy reference.

- Client Information: List your client’s name, company, and contact details clearly, so they know who the payment is directed to.

- Transaction Details: Provide an itemized list of products or services provided, including quantities, individual prices, and totals.

- Subtotal, Taxes, and Discounts: Ensure a clear breakdown of the amount due, including taxes, discounts, and additional charges, if applicable.

- Total Amount Due: Highlight the final amount the client is required to pay, making it easy to identify at a glance.

- Payment Terms: Include payment methods, due dates, and any late fees for overdue payments.

2. Customization for Your Brand

Personalizing your billing document to reflect your brand is a simple yet powerful way to leave a lasting impression. Customization can be as simple as adding your logo, using brand colors, or adjusting fonts to match your company’s visual identity. This not only enhances professionalism but also helps your clients easily recognize the document as official and related to your business.

- Logo Placement: Position your logo at the top for brand recognition.

- Color Scheme: Use your company’s colors for headings or borders to make the document more visually aligned with your brand.

- Fonts: Choose clean, professional fonts that are easy to read, ensuring that key information stands out.

How to Send a Payment Request to Clients

Once your payment request document is ready, the next step is to ensure it reaches your client in a timely and professional manner. The way you send these documents can impact the efficiency of the payment process and the client’s perception of your business. Whether you choose to send it digitally or via traditional mail, it’s important to follow the right procedure for smooth communication and prompt payments. Below are the most effective methods for sending a payment request to your clients.

1. Digital Delivery Methods

Sending payment requests digitally is the fastest and most convenient way to ensure clients receive them promptly. There are several methods to deliver these documents electronically, each with its benefits and best practices.

Method Advantages Email Quick delivery, easy to track, and allows for immediate follow-up. Attach the document as a PDF for easy viewing and security. Online Payment Platforms Integrates the payment request with the payment gateway, allowing clients to pay directly from the document. Tools like PayPal, Stripe, or QuickBooks offer this functionality. Cloud Storage Links Share a link to the document stored on cloud platforms like Google Drive or Dropbox. This is useful for businesses that want clients to access or download the document at their convenience. 2. Traditional Mail for Formal Requests

For businesses that require a more formal approach or have clients who prefer paper documents, sending a physical payment request through traditional mail may still be necessary. This method is often used for legal contracts or more significant transactions, where clients expect official hard copies.

- Print the Document: Ensure that the document is clear, properly formatted, and free of errors before printing.

- Use Professional Envelopes: Opt for branded envelopes or plain ones with clear return addresses to ensure that your document is handled professionally.

- Send via Certified Mail: For high-value transactions, consider sending the document via certified mail to ensure that your client receives it and signs for it.

Regardless of the method you choose, make sure to include all relevant information in your communication, such as the due date, payment instructions, and any late fee policies. Clear and professional communication incr

Legal Considerations for Payment Request Documents

When creating and sending payment request documents, there are several legal factors to consider to ensure compliance with local laws and to protect both parties involved. A well-structured document not only serves as a professional communication tool but also as a legal record of the transaction. It’s important to understand the elements that make these documents legally binding and what details must be included to avoid future disputes.

1. Necessary Legal Information

To make sure your payment request is legally valid, there are several key pieces of information that must be included. These details ensure that both you and your client are clear on the terms of the agreement and that the document can be used as evidence if needed.

- Business Details: Your company name, address, and tax identification number (TIN) should be clearly listed. This helps establish your business’s legitimacy.

- Client Information: Ensure that your client’s full name, address, and contact details are accurate. This makes the document enforceable by linking it to the correct party.

- Unique Reference Number: Each document should have a unique number for tracking and record-keeping. This helps both parties identify the specific transaction.

- Payment Terms: Clearly state the payment due date, accepted payment methods, and any applicable late fees. This prevents misunderstandings and ensures both parties agree on the financial terms.

2. Tax Compliance and Legal Obligations

Depending on your location, there may be specific tax requirements for payment request documents. It’s essential to be familiar with local tax laws, as these can vary significantly between regions. Failing to comply with tax obligations can lead to fines or other legal issues.

- Sales Tax: If your business is required to collect sales tax, include the applicable tax rate and amount on the document. Ensure that the tax is clearly itemiz

Tracking Payments with Billing Documents

Efficiently tracking payments is essential for maintaining healthy cash flow and ensuring that your business operations run smoothly. A well-organized billing document not only outlines what your clients owe but also provides an excellent way to monitor and follow up on outstanding payments. By using a structured system, you can easily track which payments have been made, which are due, and which need to be followed up on. Below are some strategies for tracking payments effectively using payment request documents.

1. Include Payment Status Fields

One of the simplest ways to track payments is by including dedicated fields for payment status in your document. These fields allow you to record the current state of the transaction, making it easier to keep track of overdue amounts and follow up with clients when necessary.

- Payment Status: Include a section that clearly indicates whether the payment is Paid, Pending, or Overdue. This helps both you and your client quickly identify the current situation.

- Payment Date: Add a field where the payment date is recorded. This is especially helpful for keeping track of when the payment was made and comparing it to the due date.

- Partial Payments: If applicable, add a section to record partial payments. This is particularly useful for larger projects or ongoing work where the total amount is paid in installments.

2. Utilize Software for Tracking

Manually tracking payments on individual documents can be time-consuming, especially as your business grows. Using accounting or billing software that integrates with your payment system can help automate the process and ensure you stay organized.

- Accounting Software: Platforms like QuickBooks or Xero automatically update payment statuses and provide comprehensive tracking reports. These tools allow you to easily see the status of all your transactions in one place.

- Cloud-Based Solutions: Cloud services such as FreshBooks or Wave not only help track payments but also offer features like automatic payment reminders and online payment options, making the process even more efficient.

- Custom Tracking Features: Many software solutions allow for customization, where you can add specific fields to track payments and even generate reports for financial analysis.

3. Set Up Payment Reminders

To ensure timely payments, it’s crucial to set up reminders for clients when their payments are due. A gentle reminder can significantly reduce late payments and keep your business on track financially.

- Automated Reminders: Many billing platforms offer automated email or text reminders for upcoming due dates or overdue payments. Set these up to reduce the need for manual follow-ups.

- Follow-Up Strategy: If a payment is overdue, it’s important to follow up promptly. Include polite but firm reminders within the document itself and consider sending follow-up emails or calling clients to discuss the outstanding balance.

By implementing these strategies, you can keep a clear record of your financial transactions and easily monitor payments. A streamlined system for tracking payments not only saves you time but also helps you maintain healthy relationships with your clients by ensuring timely settlements and reducing the chances of disputes.

When to Update Your Billing Document

Keeping your billing documents up to date is essential for maintaining professionalism and ensuring accuracy in your transactions. Over time, changes in your business operations, tax laws, or customer needs may require updates to your payment request format. Regularly reviewing and updating your documents ensures they reflect current practices, meet legal requirements, and maintain clarity for your clients. Below are key scenarios when you should consider revising your billing documents.

1. Changes in Business Information

Any alteration in your business details, such as a change in address, business name, or contact information, should be reflected in your payment request document immediately. This helps maintain consistency and ensures that clients can easily reach you for inquiries or payments.

- Business Name: If you rebrand your company or alter its legal structure, your billing documents must reflect the new name and entity type.

- Contact Information: Update phone numbers, email addresses, or website URLs to ensure clients can get in touch without issue.

- Banking Details: If you change your payment methods or bank account details, these must be updated on your billing documents to avoid payment errors.

2. Adjustments in Legal or Tax Requirements

Changes in tax rates, government regulations, or legal requirements can have a direct impact on the content of your payment request documents. It’s essential to stay informed about these updates to ensure compliance and avoid potential fines.

- Sales Tax or VAT: If the applicable sales tax rate changes, make sure this is reflected in your document to ensure accurate calculations.

- New Legal Mandates: In some regions, there may be new legal requirements regarding the inclusion of specific information or disclosures on payment requests. Be sure to keep your documents in line with local laws.

- Currency Changes: If you begin offering services in a different currency, update your document to reflect the new rates and exchange policies.

3. Offering New Services or Products

When you introduce new products or services to your offerings, you should update your payment request documents to include these changes. Make sure that the descriptions, pricing structures, and any related information are accurate and up to date to prevent confusion.

- Pricing Updat