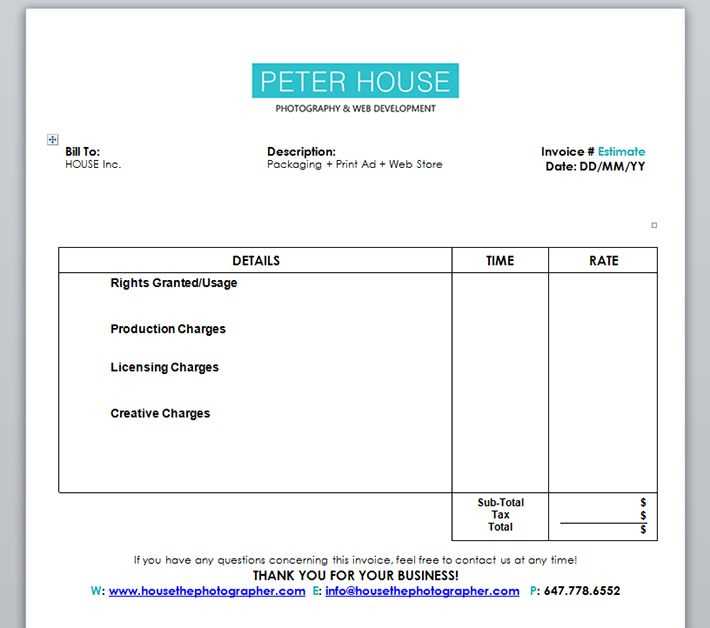

Easy Photoshoot Invoice Template for Photographers

Running a photography business requires not only creativity but also efficient management of administrative tasks. One crucial aspect of this is handling client payments and ensuring that your services are properly compensated. A well-organized billing document can help you keep track of transactions, provide clear communication with clients, and maintain professionalism in your operations.

Creating a document that outlines the services rendered, payment terms, and other necessary details is essential for any photographer. By using a professional, customizable layout, you can ensure that every transaction is transparent and straightforward. This simple yet effective tool can save you time, reduce confusion, and ultimately streamline your workflow.

Whether you are a freelance photographer or running a larger studio, having a standardized method for invoicing clients is important. Not only does it protect your business, but it also builds trust with clients by offering clarity and consistency in your financial dealings.

Essential Guide to Photography Billing Documents

Managing financial transactions is a key aspect of running a successful photography business. Whether you’re a freelance professional or part of a larger studio, having a structured and reliable way to request payments from clients is essential. A well-crafted billing document not only helps you get paid on time but also ensures clear communication between you and your clients.

There are several components that make up a strong billing system. A detailed, easy-to-understand layout allows both you and your client to quickly review services provided, payment amounts, and due dates. Using a consistent format for each transaction helps establish professionalism and builds trust with your clients.

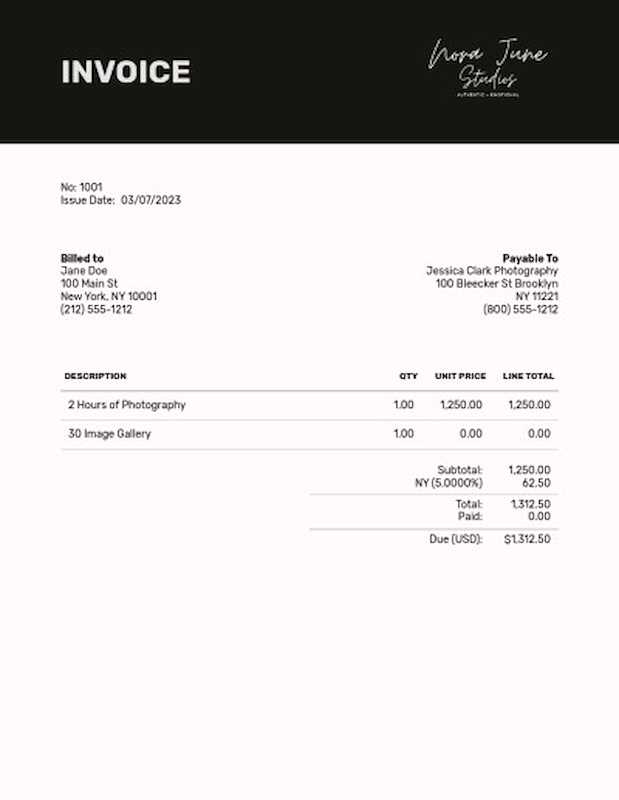

- Clear Service Breakdown: Specify each service offered and the associated cost. This avoids confusion and provides transparency.

- Payment Terms: Clearly state when the payment is due and the accepted methods for completing the transaction.

- Client Information: Include your client’s contact details, along with your business information, to ensure proper identification.

- Unique Reference Number: Adding a reference number helps both you and the client track the transaction.

- Taxes and Discounts: Be sure to include any applicable taxes or discounts to ensure the total amount is clear.

By organizing all of these elements into a single, consistent document, you can simplify your financial transactions and focus more on your creative work. The key is to develop a system that is not only easy for you to use but also convenient for your clients to understand and process.

What is a Photography Billing Document?

In the world of photography, having a clear and structured method to request payment is essential for managing your business. A billing document is a formal record used to outline the services provided, the total amount due, and the terms of payment between the photographer and the client. This document helps to formalize the financial aspect of the transaction, ensuring both parties are on the same page.

Key Elements of a Photography Billing Document

A well-organized document typically includes the following details:

- Service Description: A clear breakdown of what was delivered–whether it’s a shoot, editing, prints, or any additional services.

- Cost: The total amount due for the services rendered, along with any applicable taxes or discounts.

- Payment Terms: Information on when and how the client should pay, including the payment methods accepted and due dates.

- Contact Information: Your business details, including name, address, and phone number, as well as the client’s details for reference.

Why You Need a Billing Document

Using this type of document not only makes financial transactions smoother but also ensures a professional approach to business. It serves as a reference for both the photographer and the client in case of any discrepancies, and it’s also vital for tax and accounting purposes. Having a standardized format can save time and avoid misunderstandings, allowing you to focus more on your craft and less on paperwork.

Why You Need a Photography Billing Document

For any professional photographer, managing finances efficiently is just as important as delivering quality work. Having a formal record to request payment not only ensures clarity between you and your clients but also protects your business interests. This document serves as both a financial record and a communication tool, helping both parties stay organized and aligned throughout the transaction process.

- Professionalism: A detailed document adds a level of professionalism to your business. It shows clients that you take your work seriously and value transparency in financial dealings.

- Clear Communication: By breaking down the costs and payment terms, both you and the client can avoid misunderstandings about the services provided and the amount due.

- Legal Protection: A well-drafted billing document can serve as legal protection in case of disputes, providing a clear reference point for both parties.

- Tax and Record Keeping: Proper documentation is essential for tax purposes. It ensures you can easily track your earnings and expenses for accurate financial reporting.

- Efficient Payment Process: With clear payment terms and deadlines, you can encourage timely payments and reduce the risk of delayed or missed transactions.

In short, having a standardized financial record is crucial for any photographer looking to maintain a professional image, streamline their business operations, and ensure a smooth payment process. Whether you are working with one client or many, these documents help establish clear expectations and provide both parties with a reliable reference.

How to Create a Photography Billing Document

Creating a well-structured financial document is essential for any photographer looking to streamline their payment process and maintain professionalism. This document should clearly outline the services provided, the amount due, and the payment terms. By following a few simple steps, you can create a polished and effective tool that helps keep your business organized and ensures that clients understand the financial details of your work.

Step-by-Step Guide

To build an effective billing record, follow these basic steps:

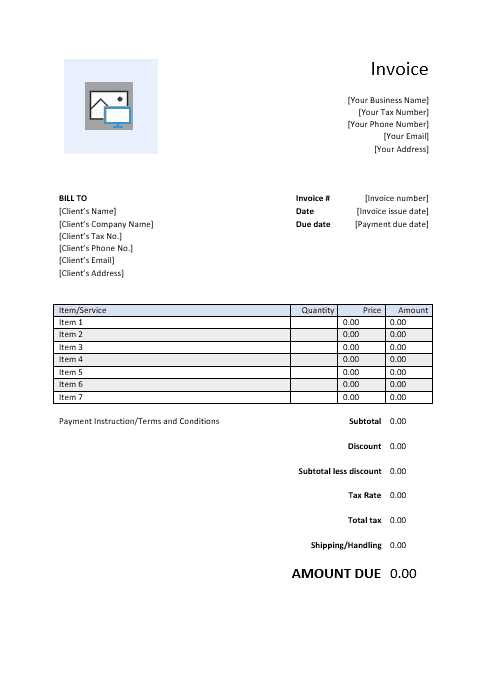

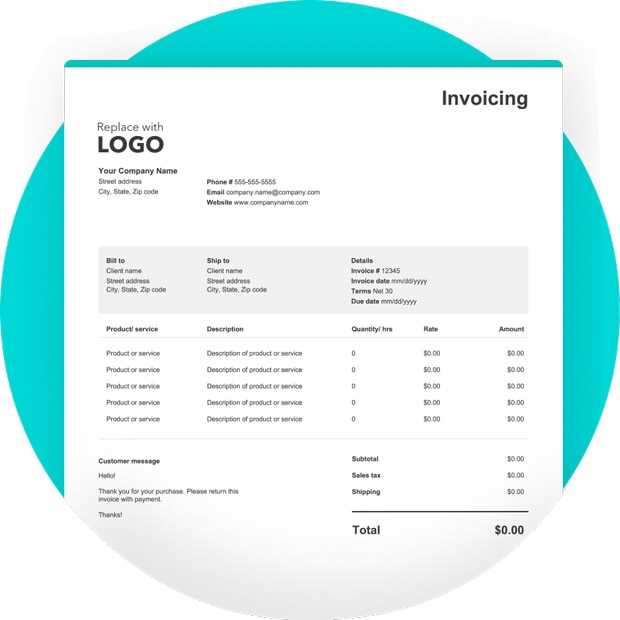

- Include Your Business Information: Always start by listing your name or business name, address, phone number, and email. This makes it easy for clients to identify you and contact you if needed.

- Client Details: Ensure the client’s name, address, and contact details are included. This helps in case of any follow-up or payment reminders.

- Describe the Services Provided: Clearly list each service you performed (e.g., session type, editing, prints) and include a brief description if necessary. This ensures both you and the client are on the same page about what was delivered.

- Break Down the Costs: Itemize the charges for each service provided. Be sure to include taxes, if applicable, and any discounts you may have offered.

- Specify Payment Terms: Clearly state when payment is due and what methods are acceptable. Including late fees or discounts for early payment is also helpful.

- Provide a Unique Reference Number: Adding a reference number to each document allows for easy tracking and organization, both for you and the client.

Final Touches

Once you have added all the necessary details, review the document to ensure there are no errors. A professional-looking format with clean, easy-to-read fonts and proper spacing will enhance the overall presentation. Consider saving the document as a PDF to ensure that the formatting remains consistent when shared with the client.

With these simple steps, you can create an efficient and professional financial document that helps you maintain clear and organized records while ensuring timely payments.

Key Components of a Billing Document

Creating a comprehensive and clear financial document is crucial for maintaining transparency between you and your clients. A well-structured document not only ensures proper payment but also serves as a reference for both parties in case of any disputes or confusion. The key components of such a document should include all necessary details about the services provided, the amount due, and the terms of payment.

Important Details to Include

To ensure your document is effective, there are several important elements that should always be present:

| Component | Description |

|---|---|

| Business Information | Your name or business name, address, phone number, and email for identification and contact purposes. |

| Client Details | The client’s name, address, and contact information for clear identification and communication. |

| Service Description | A detailed list of the services provided, including any specific features of the work done (e.g., session details, edits, prints, etc.). |

| Cost Breakdown | Itemized costs for each service, including taxes, discounts, or additional charges to give clarity on the total amount. |

| Payment Terms | Details of when the payment is due and the acceptable methods for payment, such as credit card, bank transfer, or online payment systems. |

| Reference Number | A unique number assigned to each billing document for easy tracking and record-keeping. |

Formatting Your Document

A clean and organized layout is essential to ensure the client can quickly review the necessary information. Make sure the text is clear and easy to read, and use headings, bullet points, or tables where necessary to break down complex details. A well-presented document enhances professionalism and increases the likelihood of prompt payment.

Customizing Your Photography Billing Document

Personalizing your billing document can help you maintain a consistent brand image and ensure that the document reflects your unique style and business needs. A customized document not only helps you stand out but also ensures that all necessary information is presented in a way that suits your workflow and client interactions. Whether you’re adding your logo or adjusting the layout, these small changes can make a big difference in how your clients perceive your professionalism.

Key Customization Options

Here are some essential ways you can personalize your financial document:

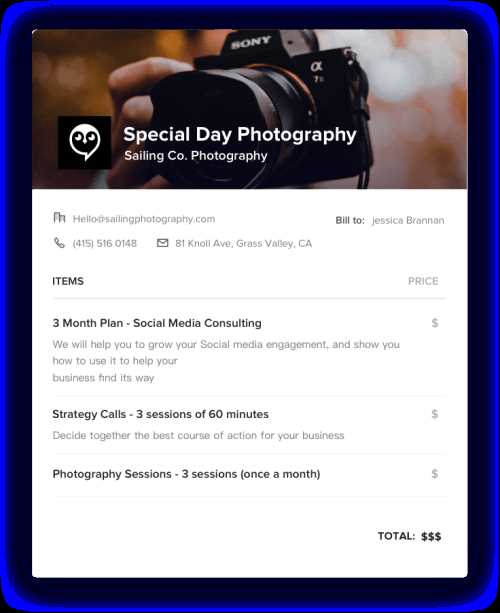

- Branding: Include your logo, business name, and color scheme to create a cohesive look that aligns with your brand identity. This adds a professional touch and makes your document easily recognizable.

- Service Descriptions: Tailor the descriptions of your offerings to reflect the specific details of your photography services. This helps clarify what is included in the price and avoids any misunderstandings.

- Payment Terms: Modify the payment terms to suit your business model. For example, you can include options for upfront payments, late fees, or discounts for early settlements.

- Layout and Design: Adjust the layout to ensure it’s easy to read and visually appealing. Organize sections logically, such as separating the cost breakdown from the terms and conditions.

- Additional Information: Include any special instructions, client notes, or policies that may be relevant to the transaction. For example, you might add cancellation terms or delivery timelines for digital files.

Tools for Customization

There are many tools available to help you create and customize your billing documents. You can use word processors, spreadsheet software, or dedicated invoicing platforms to build a document that suits your needs. Many of these tools also offer pre-designed layouts that you can adjust to fit your brand and style.

By customizing your financial documents, you not only make the process easier for both you and your clients but also enhance your business’s professional image and consistency. Take the time to create a system that works for you, and your clients will appreciate the clarity and attention to detail.

Free Photography Billing Documents Available

For photographers looking to streamline their payment process, there are numerous free resources available to create professional and organized billing records. These resources offer ready-made formats that can be customized to suit your specific needs. Using a pre-designed document can save you time and effort while ensuring that your financial transactions are clearly documented and easy to manage.

Where to Find Free Resources

There are several platforms where you can find free templates for creating your own billing documents. Here are some of the best options:

- Online Invoicing Websites: Many websites offer free downloadable documents that can be easily customized. These platforms often include tools for adding your logo, adjusting prices, and including tax rates.

- Word Processing Software: Programs like Microsoft Word or Google Docs have built-in templates designed for billing purposes. These templates are easy to use and can be tailored to match your business style.

- Spreadsheet Software: If you prefer using numbers and calculations, spreadsheets such as Microsoft Excel or Google Sheets have templates that automatically calculate totals, taxes, and discounts.

- Dedicated Invoice Apps: Some free apps and platforms provide easy-to-use tools to create and send billing documents on the go, perfect for busy photographers who need a mobile solution.

Benefits of Using Free Templates

Opting for a pre-made document offers several advantages:

- Time-Saving: You don’t have to start from scratch. Simply download, fill in the details, and you’re ready to go.

- Professional Design: These documents are created by professionals, ensuring they look clean, polished, and visually appealing.

- Customizable: Free templates are flexible and allow you to adjust the design, services, and terms according to your business needs.

- Cost-Effective: They come at no charge, so you can avoid spending money on expensive software or hiring a designer.

Using free resources to generate your billing documents can be an easy and effective way to keep your finances organized while saving time and money. By customizing these templates to suit your brand and workflow, you can maintain a professional image and ensure smooth transactions with your clients.

Best Tools for Billing Document Creation

Creating professional and accurate financial records is essential for any photographer or business owner. Fortunately, there are several tools available that make it easier to design and manage billing documents. These platforms can help streamline your workflow, reduce errors, and ensure your transactions are well-documented. Whether you prefer online software, desktop applications, or simple templates, the right tool can save you time and increase your efficiency.

Top Online Platforms

Online invoicing tools are a popular choice for many photographers due to their ease of use and accessibility. Here are some of the best options:

- FreshBooks: Known for its user-friendly interface, FreshBooks allows you to create and send professional documents, track expenses, and manage client communication all in one place. It also offers automated payment reminders.

- Wave: This free online platform offers customizable billing documents and simple features for small businesses. Wave also includes accounting tools, making it a great all-in-one solution.

- Zoho Invoice: With a variety of templates and customization options, Zoho Invoice lets you generate professional-looking records and track payments seamlessly. It integrates with various payment gateways for easy transactions.

Desktop Software and Apps

If you prefer offline tools or need more advanced features, desktop software and mobile apps are excellent alternatives. Here are some of the best options:

- QuickBooks: QuickBooks is a powerful accounting tool that provides robust features for billing, expense tracking, and financial reporting. It’s ideal for photographers looking for a more comprehensive solution.

- Microsoft Word/Excel: For those who prefer simplicity and familiarity, both Word and Excel offer pre-built templates that can be easily customized to create professional documents without requiring additional software.

- Invoice2Go: This mobile app allows you to create, send, and track financial documents directly from your phone. With a variety of templates and customization options, it’s perfect for photographers on the go.

By choosing the right tool, you can save time, avoid errors, and maintain a professional approach to managing financial transactions. Whether you prefer a simple template or a comprehensive accounting system, these tools can help streamline your billing process and make your business operations more efficient.

Common Mistakes in Photography Billing Documents

When creating financial records for your photography services, it’s easy to overlook small details that can lead to misunderstandings or delayed payments. Even the most seasoned professionals can make errors in their billing documents, which can affect client relationships and cash flow. Understanding the common mistakes made when preparing these documents is key to ensuring accuracy and professionalism.

Frequent Errors to Avoid

Here are some of the most common mistakes photographers make when preparing financial records:

- Unclear Service Descriptions: Vague or incomplete descriptions can lead to confusion about what is being charged. Always clearly state the services provided, including any additional fees for extra work, prints, or editing.

- Incorrect Pricing or Calculations: Mistakes in pricing, such as applying incorrect rates or missing discounts, can lead to overcharging or undercharging. Double-check your calculations, especially when offering package deals or discounts.

- Missing Payment Terms: Not clearly stating payment deadlines or accepted methods can result in delayed payments. Always specify when the payment is due and how clients can pay (e.g., credit card, bank transfer, etc.).

- Omitting Contact Information: Failure to include your business details, like your phone number, address, or email, can make it difficult for clients to reach you with questions or issues. Make sure your contact information is prominently displayed.

- Lack of Reference Numbers: Without a unique reference number, tracking multiple transactions can become difficult. This can lead to confusion, especially when dealing with repeat clients or large projects. Always assign a distinct reference number to each document.

- Failure to Include Tax Information: If applicable, not including taxes or not clearly breaking down the tax rate can result in misunderstandings. Ensure that tax information is accurate and displayed separately from service charges.

- Ignoring Client’s Information: Sometimes photographers forget to double-check the client’s name, address, or contact details. This can cause issues if the document needs to be re-sent or if it gets lost in their records.

How to Avoid These Mistakes

The key to preventing these mistakes is attention to detail. Always double-check your work before sending a document. Use online tools or templates that help automate calculations and ensure all necessary fields are filled out. If you work with a recurring client, keep detailed records of previous transactions to avoid repeating errors. Most importantly, maintain open communication with your clients so that any misunderstandings can be addressed promptly.

By avoiding these common mistakes, you can ensure that your billing process is smooth, efficient, and professional, ultimately contributing to better relationships with your clients and timely payments.

How to Properly Format Your Billing Document

Formatting your financial records in a clear and structured way is essential for both professionalism and ease of use. A well-organized document not only ensures that clients understand the breakdown of services and charges but also enhances your business’s image. Proper formatting helps avoid misunderstandings, ensures prompt payments, and contributes to smoother communication between you and your clients.

Key Elements of Proper Formatting

Here are some essential components to focus on when formatting your financial record:

- Clean Layout: Use a simple, easy-to-read design. Avoid cluttering the document with too much information. Break down details into sections such as contact information, service description, pricing, and payment terms for clarity.

- Readable Fonts: Choose a professional and legible font. Sans-serif fonts like Arial or Helvetica are ideal for digital documents, while serif fonts such as Times New Roman are good for printed records. Ensure the font size is appropriate (10–12pt) to make reading easy.

- Logical Structure: Start with your business details at the top, followed by the client’s information, the list of services rendered, and finally, the payment details. Keep a consistent order throughout your documents.

- Clear Date and Reference: Include the date of issue and a unique reference number. This helps both you and your client track the document for future reference, ensuring it’s easier to manage payments and follow-ups.

- Itemized Breakdown: Break down each service, along with its cost, tax, and any discounts. This provides transparency and makes it easy for your client to understand exactly what they’re being charged for.

- Payment Terms and Due Date: Clearly state the payment due date, along with any terms, such as late fees or early payment discounts. This ensures that your client knows when and how to pay you.

Visual Appeal and Consistency

Along with functional formatting, pay attention to visual details like spacing and alignment. Use headings and subheadings to separate sections, and make sure all text is aligned properly. Consistency is key–whether you’re using a template or creating a custom design, keep the style uniform across all your documents for a cohesive, professional look.

Properly formatted financial records enhance clarity, reduce errors, and present your business as organized and reliable. Take the time to craft well-structured documents, and your clients will appreciate the effort, leading to smoother transactions and faster payments.

Adding Payment Terms to Your Billing Document

In any financial document, clearly defined payment terms are crucial for establishing expectations and ensuring smooth transactions. By outlining how and when payments should be made, you help prevent misunderstandings, late payments, and unnecessary disputes. Clearly stated terms also make it easier for both you and your client to track and manage the payment process.

Key Payment Terms to Include

When adding payment terms to your billing document, consider including the following details to ensure everything is clear and transparent:

- Due Date: Specify the exact date when payment is due. Common options include “Net 30” (30 days after the document issue date), “Due on receipt,” or a fixed calendar date.

- Late Fees: If applicable, include information about any late fees that may be charged if the payment is not made by the due date. For example, you might charge an interest fee of 1.5% per month on overdue balances.

- Accepted Payment Methods: List the types of payment you accept, such as credit card, bank transfer, PayPal, or checks. Make it easy for the client to know how they can pay you.

- Deposit Requirements: If your business requires a deposit before starting a project, specify the amount or percentage that needs to be paid upfront. Include a note about how this amount will be applied to the final balance.

- Discounts for Early Payment: If you offer discounts for early payment, include the details, such as “2% discount for payments made within 10 days.” This can encourage timely payments.

- Payment Instructions: Provide any necessary instructions to help clients with the payment process. For example, if payments are made by bank transfer, include bank account details or a link to your payment gateway.

Tips for Clear and Effective Payment Terms

To ensure that your payment terms are easily understood and followed, keep the language simple and direct. Avoid using legal jargon that could confuse your clients. Additionally, make sure that the terms are placed in a visible location on the document, such as near the bottom or in a dedicated section, so that clients can easily refer to them.

By clearly outlining the payment terms in your financial documents, you create a framework that sets expectations from the start, helping to ensure timely payments and maintain positive client relationships. Clear terms also protect you and your business in case of late payments or disputes.

How to Include Additional Charges

When providing services, there are often extra costs that need to be accounted for. Whether these are for added time, travel, special requests, or additional materials, it’s important to include them clearly in your financial documents. Transparent communication about extra charges helps avoid confusion and ensures that clients understand what they are being billed for. Clearly outlining these charges can also help protect you from disputes and maintain a professional relationship with your clients.

Types of Additional Charges to Include

There are several types of additional charges that may be applicable depending on the scope of your work. Here are some common examples to consider:

- Travel Fees: If you need to travel for a shoot, include travel-related expenses, such as transportation, lodging, and meals. Be sure to list these costs separately from the base service price to ensure clarity.

- Overtime Charges: If the project takes longer than initially agreed upon, include charges for overtime. Clearly state your hourly or daily rate for any additional time worked beyond the original agreement.

- Equipment Rental: If you need to rent additional equipment (such as lighting, props, or backdrops), itemize these costs in the document. List each item and its associated cost to keep things transparent.

- Editing or Post-Processing Fees: If post-processing or editing is charged separately from the base service, ensure that the rate and scope of the work are clearly defined. This could include retouching, color correction, or delivering additional formats or resolutions.

- Prints or Physical Products: If your client orders prints or physical copies of images, these should be listed as additional charges, with details about the size, quantity, and pricing for each item.

- Rush Fees: If the client requests a fast turnaround, include a rush fee to reflect the expedited service. This fee should be added clearly, with a note explaining why it’s necessary.

How to Display Additional Charges Clearly

To avoid any confusion, it’s crucial to list additional charges in a way that is easy for your client to understand. Here are some tips for displaying these costs clearly:

- Itemize Costs: List each additional charge separately rather than grouping them together. This makes it easier for clients to see exactly what they are paying for.

- Provide Clear Descriptions: Include a brief explanation of each charge to ensure the client understands why it’s being added. For example, “Overtime charge for 2 additional hours at $50 per hour” or “Travel fee for locations 20 miles outside of the city center.”

- Keep the Layout Organized: Ensure that all charges, both base and additional, are presented in a logical and organized format. This helps clients quickly review and understand the total cost.

By clearly outlining and properly documenting additional charges, you ensure that both you and your client are on the s

Importance of Professional Billing for Photographers

For photographers, presenting a polished, well-organized financial record is more than just a way to request payment–it’s a reflection of their professionalism and business practices. A properly crafted billing document is essential for maintaining client trust, ensuring timely payments, and building a reputable business. It helps set clear expectations, avoid misunderstandings, and solidify the photographer’s credibility in the eyes of the client.

Why Professional Billing Matters

Using professional billing practices offers several key advantages that can significantly impact the success of a photography business:

- Builds Trust and Credibility: A professional document reinforces the photographer’s commitment to quality and reliability. Clients are more likely to take a business seriously when they receive clear, detailed, and organized financial records.

- Promotes Timely Payments: A well-structured billing document, with clear payment terms and due dates, helps prevent delays. When clients understand exactly when and how they should pay, it increases the chances of timely transactions.

- Reduces Misunderstandings: Clear descriptions of services, costs, and payment terms help avoid confusion. When everything is outlined clearly, both parties have a better understanding of the expectations, reducing the chance for disputes.

- Enhances Professional Image: Sending a professionally designed and formatted billing document shows that the photographer is serious about their business. It creates a lasting impression and helps differentiate the photographer from others who may use informal methods for requesting payment.

- Improves Record Keeping: A formalized system for billing ensures that both the photographer and the client have proper documentation for future reference. This is especially useful when tracking past jobs or handling taxes.

How to Achieve Professional Billing

Achieving professional billing doesn’t require complex systems or expensive tools. Here are some steps to ensure your billing process is professional:

- Use a Consistent Format: Establish a standard format for your financial records. Consistency in layout, terminology, and structure makes it easier for clients to follow and helps you maintain a professional image.

- Be Detailed and Transparent: Provide clear breakdowns of services, charges, and payment terms. Avoid vague terms and ensure everything is itemized, so clients know exactly what they’re paying for.

- Incorporate Branding: Include your logo, business name, and contact information on each document. This personal touch reinforces your brand identity and adds to the professionalism of the document.

- Set Clear Payment Terms: Specify payment due dates, late fees, and accepted methods to avoid misunderstandings. Clear payment terms make it easier for clients to know how and when to pay.

Adopting professional billing practices ultimately leads to stronger client relationships, smoother transactions, and a more successful photography business. By investing time in crafting accurate and clear financial documents, photographers not only ensure their payments are handled efficiently but also create a rep

How to Send a Billing Document

Sending a billing document is a key step in completing a project and ensuring timely compensation for your work. Whether you choose to deliver it digitally or physically, it’s important to send the document in a professional manner. This not only ensures that your client receives the necessary details for payment, but it also reflects your professionalism and helps maintain clear communication throughout the transaction.

Steps to Send a Billing Document

Follow these steps to ensure your billing document reaches the client efficiently and is clear and professional:

- Choose the Right Delivery Method: Decide whether you’ll send the document digitally (via email or a file-sharing platform) or physically (by post). Digital delivery is faster, more convenient, and more environmentally friendly, but ensure that the client prefers this method.

- Double-Check the Information: Before sending, review the document for accuracy. Ensure that all details, including your business name, client information, services, charges, and payment terms, are correct.

- Use a Professional Email: When sending the document by email, make sure the email body is clear and professional. Include a short message that references the attached document and specifies the payment terms and due date.

- Attach the Billing Document: If sending electronically, attach the document as a PDF or another secure, accessible format. This ensures the client can open and review it easily. Make sure the document is not password-protected unless previously agreed upon.

- Track Your Delivery: If sending the document by mail, use a service that provides tracking to ensure it reaches the client. This can help prevent disputes over whether or not the client received it.

- Follow Up: After sending, follow up with the client to confirm they’ve received the document. If payment is not received by the due date, send a polite reminder to ensure that payment is processed promptly.

Best Practices for Sending a Billing Document

To ensure a smooth payment process, here are a few additional best practices to keep in mind when sending your billing document:

- Maintain Consistency: Always use the same format and delivery method for all your financial documents to help clients recognize and trust the process.

- Set Clear Payment Terms: Reiterate payment terms in the email or letter, including the payment due date and accepted methods. This reinforces the expectations and reduces confusion.

- Personalize Your Communication: Address your client by name and tailor

Tracking Payments and Outstanding Bills

Keeping track of payments and outstanding balances is essential for any business. Effective tracking ensures that you receive timely compensation for your work while also maintaining organized financial records. By monitoring which payments have been made and which are still due, you can easily follow up with clients and manage your cash flow more efficiently.

Why Tracking Payments is Important

Monitoring payments helps maintain a clear financial picture, enabling you to:

- Ensure Timely Payments: By keeping track of due dates, you can proactively follow up with clients who haven’t paid yet, minimizing the risk of overdue bills.

- Manage Cash Flow: Knowing which payments are outstanding allows you to anticipate cash flow needs, ensuring your business can cover expenses and continue operations smoothly.

- Maintain Accurate Records: Proper tracking helps ensure that your financial records are accurate and up-to-date, which is essential for tax purposes and long-term business planning.

- Prevent Disputes: By keeping clear records of paid and outstanding balances, you can avoid potential conflicts with clients regarding missed or incomplete payments.

How to Track Outstanding Payments

There are several methods you can use to monitor payments and any outstanding balances, ranging from simple manual tracking to using specialized software.

- Manual Tracking: You can maintain a spreadsheet with a list of all clients, amounts owed, payment dates, and payment status. A simple table can help you track everything in one place.

- Accounting Software: Many businesses use accounting software like QuickBooks, FreshBooks, or Wave, which can automatically track payments and generate reports on outstanding balances.

- Payment Reminders: Setting up automated reminders can help you follow up with clients about overdue payments. Most accounting software allows you to set due dates and send reminders at regular intervals.

Example of a Payment Tracking Table

Below is an example of how you might structure a table to track payments and outstanding bills:

Client Name Amount Due Due Date Payment Status Amount Paid Outstanding Balance Client A $500 15/11/20 Legal Considerations for Photography Billing Documents

When managing your business and handling financial transactions, it’s essential to ensure that your billing documents comply with legal requirements. Understanding the legal considerations related to contracts, payments, and client agreements can help protect your interests and avoid potential disputes. Properly structured documentation can also safeguard both you and your clients, creating a transparent, professional, and legally sound process.

Key Legal Aspects to Keep in Mind

There are several legal factors that should be considered when creating and sending your billing documents to clients:

- Clear Payment Terms: It’s crucial to define payment terms in a precise and legally binding way. This includes specifying the amount due, payment due dates, and acceptable payment methods. Clear payment terms prevent confusion and ensure that both parties are aware of their obligations.

- Tax Compliance: Ensure that your billing document complies with local tax regulations, including the appropriate application of sales tax or VAT (if applicable). This is especially important for businesses that operate in regions with specific tax requirements.

- Late Fees and Penalties: If your business includes late fees or penalties for overdue payments, these should be explicitly stated in your billing documents. Make sure to outline the conditions under which late fees will be applied, and ensure that they are legally enforceable.

- Automate Your Billing System: Use software or tools that allow you to create, send, and track documents automatically. This eliminates manual entry and ensures accuracy while reducing the risk of human error.

- Use Pre-Formatted Documents: Having a standard layout for your billing documents can save time when creating them. You can customize pre-designed documents with the necessary details for each project, ensuring consistency.

- Set Up Recurring Billing: For clients who require regular payments, set up recurring billing. This allows you to automate payment collections for ongoing services or subscriptions, reducing the need for repeated actions.

- Incorporate Online Payment Methods: Offering clients the option to pay online makes the payment process faster and more convenient. Set up systems like PayPal, Stripe, or direct bank transfers for easy payments.

- Establish Clear Payment Terms: Clearly define payment terms from the outset and ensure that your clients understand them. This minimizes confusion and ensures payments are processed promptly.

- Track All Transactions: Use accounting software or spreadsheets to log every payment and outstanding amount. Keeping an up-to-date record will help you quickly follow up on overdue payments.

- Set Up Reminders: Set up automatic reminders for clients with pending payments. This ensures timely follow-ups without having to manually track each due date.

- Keep Detailed Notes: When discussing payment terms or delays with clients, document all correspondence. This provides a reference point in case there are any disputes later.

- Stay Calm and Professional: Even if the dispute seems unjustified, always approach the situation with professionalism. Avoid getting defensive or emotional, as this can escalate the issue.

- Review the Details: Before addressing the dispute, review the document thoroughly. Ensure that all charges, terms, and dates are correct and align with what was agreed upon with the client.

- Communicate Clearly: Contact the client promptly and explain the charges in a straightforward manner. Sometimes, misunderstandings arise due to unclear terms or assumptions, and a simple conversation can clear up confusion.

- Provide Supporting Documentation: If needed, share additional documentation that supports the charges, such as contracts, emails, or records of the services provided. This helps reinforce your position and clarifies the situation for the client.

- Negotiate a Compromise: If the client’s concerns are valid, be open to negotiating a solution. This could involve adjusting the amount due, offering a discount, or extending the payment terms.

- Seek Legal Advice if Necessary: If the dispute cannot be resolved amicably, and the amount in question is significant, consider seeking legal advice to understand your options and protect your rights.

Tips for Streamlining Your Billing Process

Efficient billing is a critical part of running a successful business. Streamlining the billing process not only saves you time but also helps ensure that payments are received promptly and that your financial records remain organized. By automating repetitive tasks and keeping your system simple and effective, you can focus more on delivering excellent service to your clients and less on administrative work.

Key Strategies for Streamlining Billing

Here are some practical tips to make your billing process faster and more efficient:

Organizing Your Billing Records

Maintaining organized billing records helps you avoid confusion and ensures you’re always on top of outstanding payments. Here are a few organizational tips:

Example of a Streamlined Billing Table

The table below shows a simple example of how to track payments and due dates in a streamlined manner:

Client Name Amount Due Due Date Payment Status Payment Method Client A $500 15/11/2024 Paid Bank Transfer Client B $75 How to Handle Disputes Over Billing Documents

Disputes over billing can occur in any business, and handling them effectively is crucial to maintaining positive client relationships and ensuring that your financial records remain accurate. It’s important to approach disagreements with professionalism, ensuring that both parties have a clear understanding of the terms and services provided. The following strategies will help you manage disputes calmly and resolve issues efficiently.

Steps to Resolve Disputes Effectively

When a client raises an issue with a billing document, it’s important to follow a clear and systematic approach to reach a resolution:

Common Disputes and How to Address Them

Several common types of disputes can arise when handling billing documents. Understanding these issues will help you handle them more effectively:

Type of Dispute Resolution Approach Overcharging Review the charges and ensure they match the agreed terms. If an error was made, issue a corrected document and adjust the amount. Late Payments Clarify the payment terms and remind the client of the due date. If applicable, apply late fees as per your agreement. Disagreement on Services Provided Provide documentation such as contracts, emails, or project details to confirm the scope of work. If necessary, offer a partial refund or additional services to resolve the issue. Payment Method Issues Confirm the correct payment details and methods. If there was an error with processing, offer alternative ways for the client to complete the payment. By addressing disputes in a calm, systematic way, you can ensure that both you and your clients are satisfied with the outcome. Maintaining clear communication, backing up your claims with documentation, and being willing to negotiate are all crucial steps in managing any billing disagreements.