Photography Invoice Template for Mac to Simplify Your Billing Process

Managing payments and keeping track of financial records is essential for any creative professional. When you’re handling multiple clients and projects, maintaining clear, organized documentation can become overwhelming. Fortunately, with the right tools, this process can be simplified, allowing you to focus more on your craft and less on administrative tasks.

One of the most effective ways to handle this is by utilizing pre-designed structures that allow for easy customization. These ready-made solutions are tailored to suit the needs of individuals in visual arts and other creative fields, making it easier to issue professional, consistent documents for every transaction. Whether you’re just starting or managing an established business, having a reliable system can save time and reduce errors.

In this guide, we’ll explore how to find and customize these resources for your specific requirements, ensuring that you stay organized and maintain a professional image across all your business interactions.

Why Choose a Billing Solution for Mac

For creative professionals, keeping financial records accurate and organized is crucial. Using a dedicated billing structure designed specifically for your needs can help streamline this process. With the right tools, you can create consistent, professional documents in minutes, saving valuable time that can be better spent on client work.

Mac users have the advantage of integrated tools that work seamlessly with their operating system, offering easy customization and a smooth experience. These solutions are designed to fit into the workflow of creative individuals, ensuring that each document looks polished and meets industry standards. Whether you’re a freelancer or part of a larger studio, a tailored billing system can simplify the way you manage transactions.

Choosing a pre-designed solution ensures you don’t have to start from scratch. With easy-to-use features and options for customization, you can quickly generate documents that reflect your unique brand and style while maintaining professionalism across all your client interactions.

How to Create Bills on Mac

Generating clear and professional billing documents on your computer can be a simple and efficient process. By utilizing the right software, you can easily create customized records that meet your specific needs. Whether you are working with clients in creative fields or providing services in other industries, having a consistent way to document payments is essential for maintaining a smooth workflow.

To begin, start by choosing a tool that allows for easy customization of payment records. Many applications available on your device offer pre-designed layouts that can be tailored to your business, enabling you to input necessary details such as client information, services provided, and payment terms. These programs are intuitive and user-friendly, ensuring that even those with minimal technical experience can create professional-grade documents.

Once you’ve selected the right software, you can quickly fill in the relevant fields and adjust the design to match your brand’s identity. After completing the document, you can easily save, print, or send it electronically, making the entire process more streamlined and efficient.

Top Features of Billing Solutions

When selecting a document layout for managing client payments, it’s important to choose one that not only looks professional but also offers practical features to simplify the billing process. These key elements help create clear, concise records while saving time and reducing errors in your financial documentation. Here are some of the most valuable features to look for when using billing solutions designed for creative professionals.

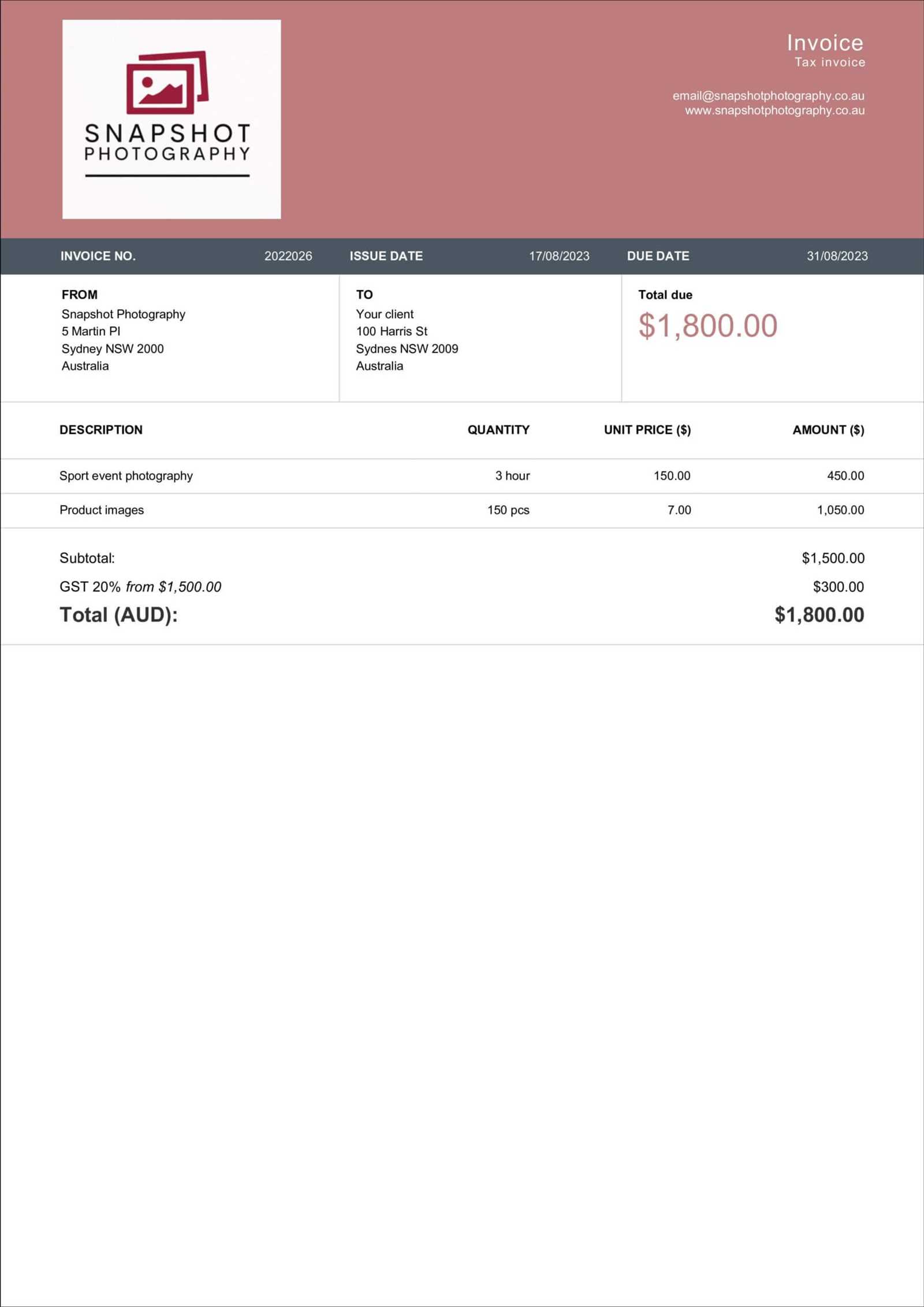

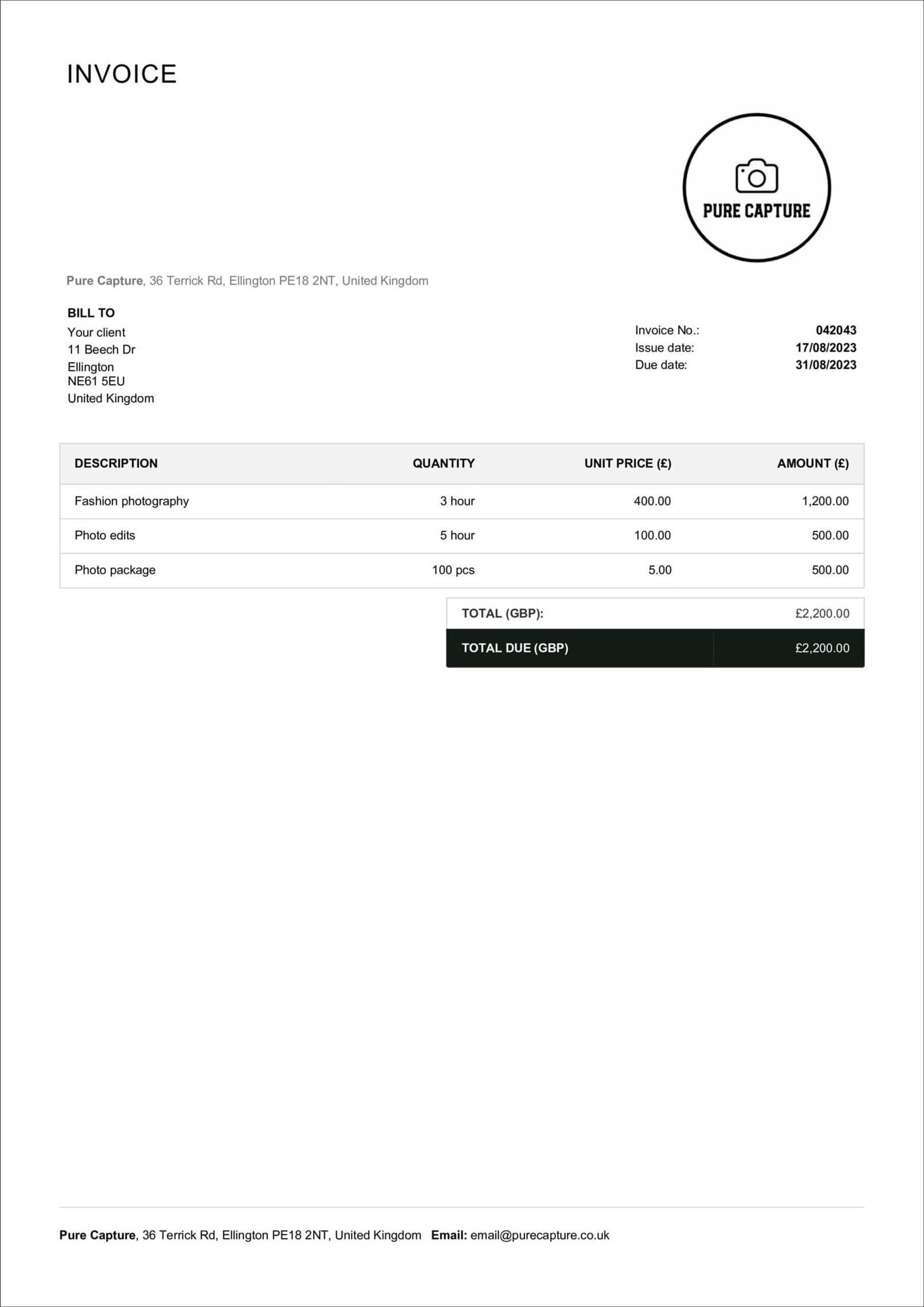

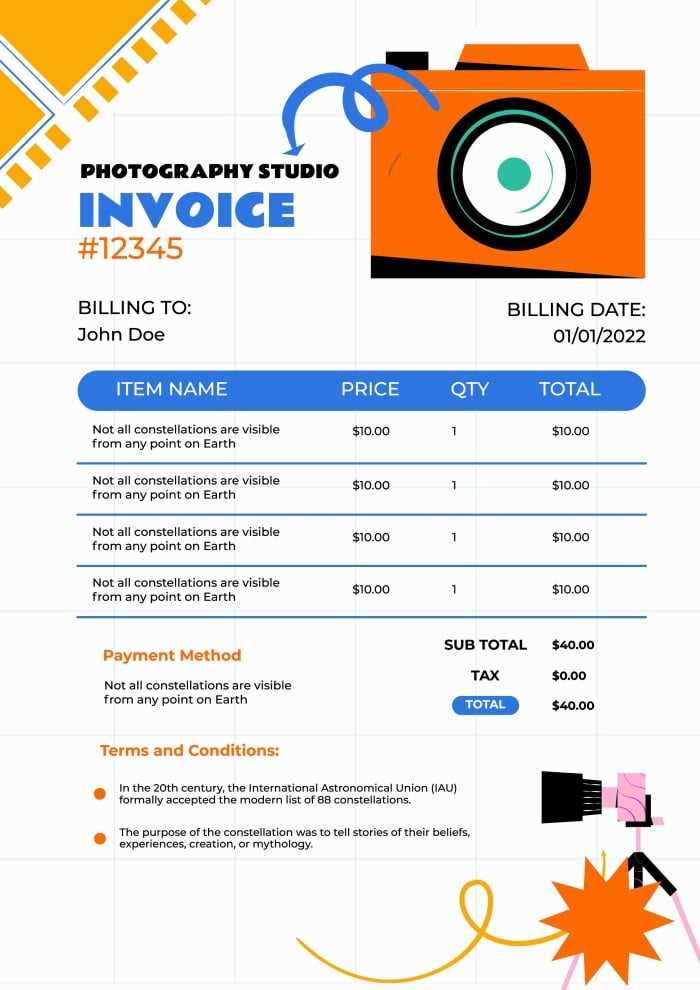

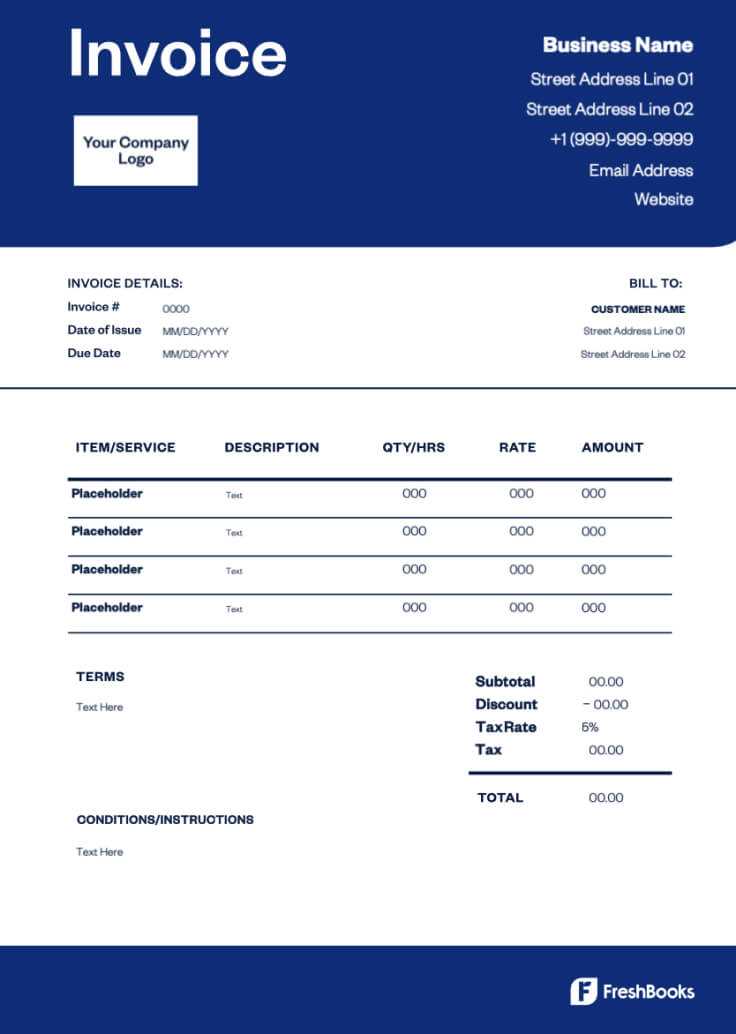

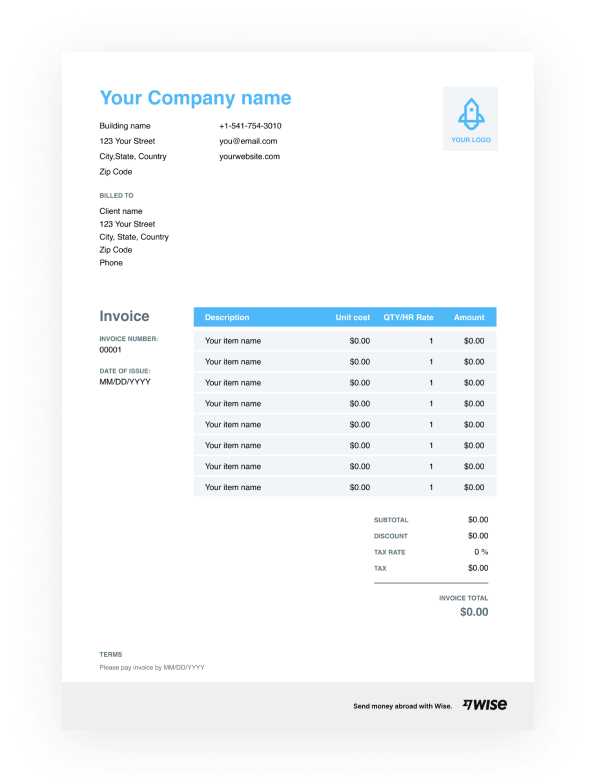

Customizable Design

One of the most important features is the ability to easily adjust the design to suit your brand’s identity. With customizable sections for logos, color schemes, and fonts, you can ensure that each document aligns with your personal or business aesthetic. Personalization helps maintain a professional appearance and creates a cohesive brand experience for clients.

Automatic Calculations

Another valuable feature is the inclusion of automatic calculation tools. These systems can quickly compute totals, tax, discounts, and other financial details, reducing the chance of human error and speeding up the process. With automated calculations, you don’t need to manually input figures or worry about discrepancies, making your work more efficient and reliable.

These essential functions are what make modern billing systems so effective, providing an easy-to-use and highly functional approach to managing client transactions.

Customizing Your Billing Document Design

Creating a personalized and professional look for your billing records is essential for leaving a lasting impression on your clients. Customization allows you to align your financial documents with your brand identity, ensuring that each record not only serves its functional purpose but also reflects your unique style. Adjusting key elements of the layout can make your documents more polished and easier to read, which helps improve the overall client experience.

Adjusting Layout and Sections

When customizing your document, one of the first steps is to adjust the overall layout. Many solutions offer flexible layouts with various sections such as client details, services provided, and payment terms. You can modify these sections to suit your needs, ensuring that the most important information is clearly presented. Having an intuitive and easy-to-navigate format contributes to better organization and professionalism.

Adding Branding Elements

Another key aspect of customization is incorporating your branding elements, such as logos, colors, and fonts. This helps reinforce your business identity and creates a cohesive, branded experience for clients. By including a logo or choosing colors that align with your brand, you make the document feel more personalized and less generic. Small design adjustments like these can elevate the quality of your financial records while showcasing your professionalism.

With these customization options, you can create a design that not only meets your practical needs but also presents your business in the best light possible. A well-designed record can help build trust and make your interactions with clients more efficient and effective.

Benefits of Using Pre-Designed Billing Documents for Creatives

For creative professionals, managing business finances efficiently is key to staying organized and maintaining a professional reputation. Pre-designed solutions for creating financial documents offer a wide range of benefits, allowing you to focus on your work without getting bogged down by administrative tasks. These ready-made formats can help streamline your billing process, saving you both time and effort.

- Time-Saving: Pre-built layouts allow you to quickly generate documents without starting from scratch, cutting down on time spent formatting and organizing each record.

- Consistency: Using a uniform design ensures that all your documents look professional and align with your brand, regardless of how many clients or projects you manage.

- Accuracy: With pre-configured fields and automated calculations, you reduce the chances of errors in your financial records, such as incorrect totals or missing details.

- Customization: These solutions are highly flexible, allowing you to personalize elements like fonts, colors, and logos to better represent your style and business identity.

- Efficiency: Easily inputting client details and services saves time and helps you maintain an organized approach to managing client payments.

By using these pre-designed structures, you can ensure that your business stays efficient and professional, all while reducing the stress of managing client payments. These tools offer the perfect balance of convenience and customization, helping you maintain smooth operations without sacrificing quality.

Choosing the Right Billing Format for Your Mac

Selecting the right format for creating financial documents is essential to ensure that you maintain accuracy, professionalism, and efficiency in your business. Different formats offer varying levels of customization and ease of use, making it important to choose one that fits your workflow and needs. Whether you are handling simple transactions or more detailed contracts, the right layout can help streamline the process and save you time.

Key Factors to Consider

When choosing the best layout for your financial records, it’s crucial to consider several factors to make the process smooth and efficient:

- Ease of Use: Look for formats that are intuitive and easy to navigate, especially if you have little experience with creating billing documents.

- Customizability: Choose a solution that allows for easy personalization, so you can adjust it to fit your specific needs, whether for branding purposes or detailed transaction records.

- Compatibility: Ensure that the format you choose works seamlessly with your existing software and operating system, avoiding any technical difficulties.

- Automation: Formats with built-in automation features can save you time by automatically calculating totals, taxes, and other important details.

Popular Formats to Explore

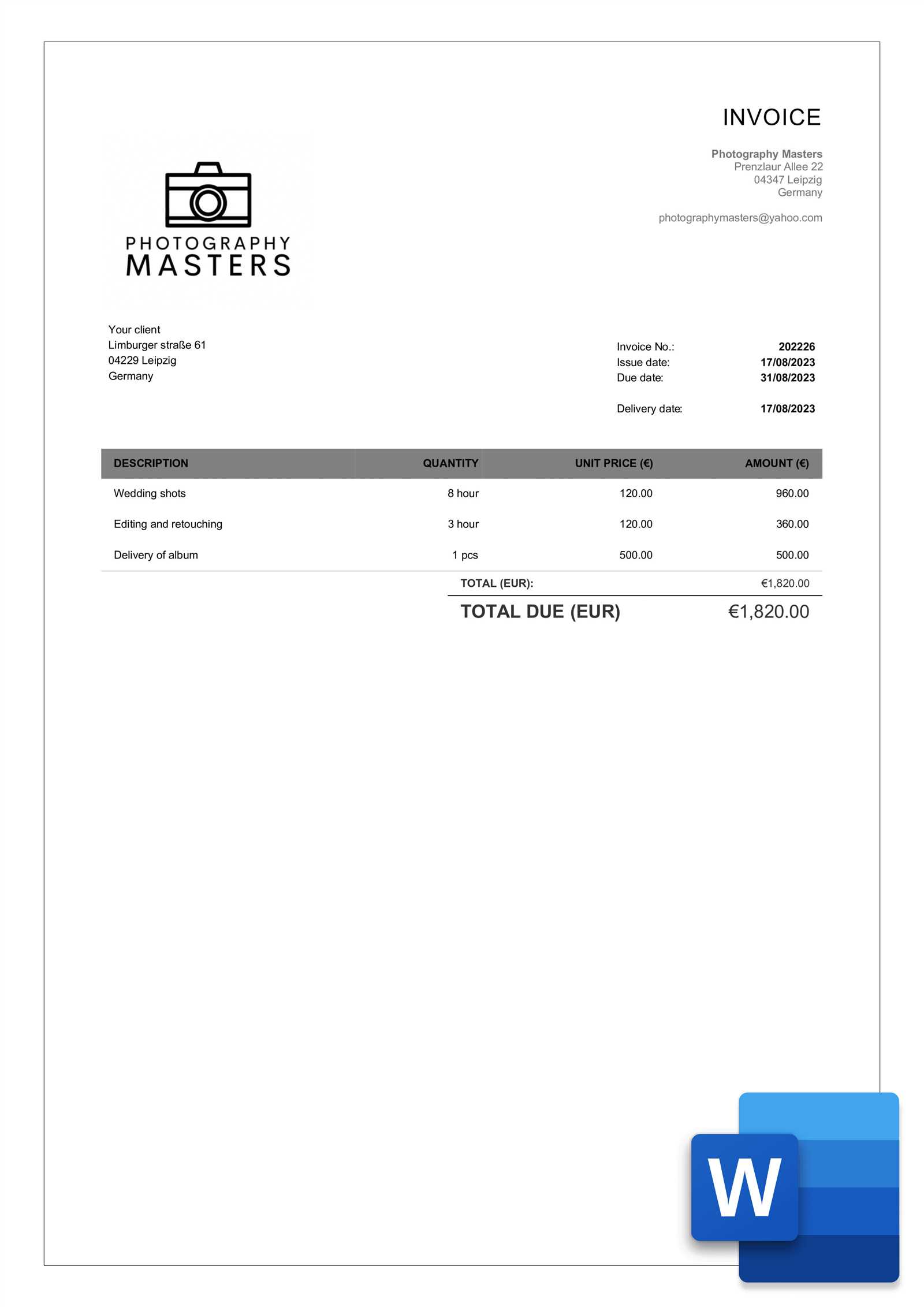

There are several popular formats available for professionals looking to create efficient billing documents:

- PDF: Portable and universally accepted, PDF formats ensure that your documents maintain their layout and design when shared or printed.

- Excel or Numbers: These spreadsheet-based formats offer built-in calculation tools, making them ideal for those who need to track complex transactions.

- Word or Pages: Simple yet flexible, these formats are perfect for users who prefer a more text-based approach with basic design options.

By selecting the right format, you can streamline your financial documentation process, reduce errors, and ensure that your records reflect your professionalism. Carefully consider the options available, keeping in mind both your business needs and the software you’re using, to make an informed decision.

Best Software for Billing Documents on Mac

Choosing the right software for generating financial records is crucial for maintaining an organized and professional workflow. On Mac, several applications are designed to help users create accurate, polished, and customizable payment documents. These tools offer a variety of features such as templates, automatic calculations, and integration with other business tools, making it easier for creatives to manage their business finances. Below are some of the best options available for creating payment records on your Mac.

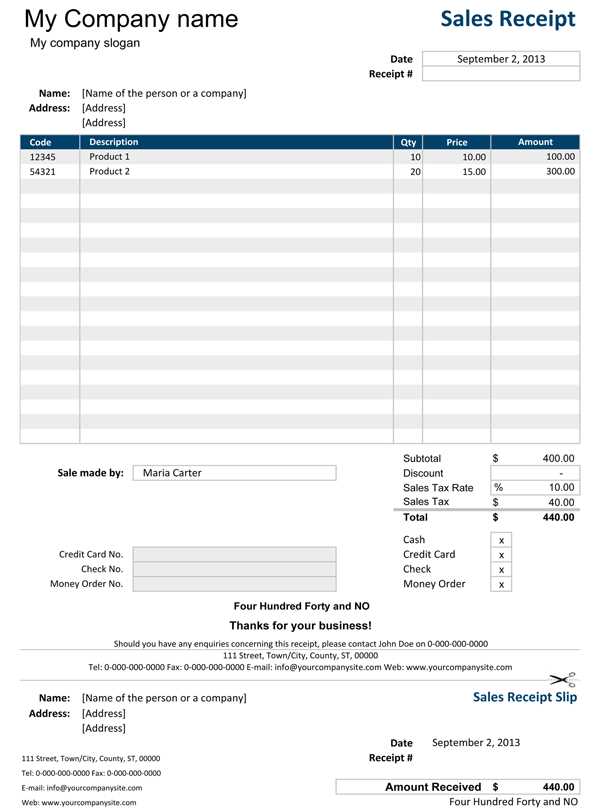

Top Software Options

Here’s a breakdown of the most popular software for creating billing records on your Mac, each with unique features and benefits to suit different needs:

| Software | Key Features | Price |

|---|---|---|

| QuickBooks | Comprehensive accounting tools, automatic tax calculations, invoice tracking | $25/month (Simple Start) |

| FreshBooks | Easy-to-use interface, time tracking, customizable documents | $15/month (Lite) |

| Invoice2go | Mobile-friendly, quick invoicing, multiple templates | $5.99/month (Essential) |

| Zoho Books | Integration with payment gateways, recurring billing, detailed reports | $15/month (Basic) |

Choosing the Right Tool for Your Business

The best software for your billing needs depends on your business model and the level of complexity you require. For those just starting out or working with simple projects, more affordable options like Invoice2go or FreshBooks might be a good fit. For those managing multiple clients or projects with more advanced accounting needs, QuickBooks or Zoho Books may offer the comprehensive tools necessary to manage both finances and client relationships effectively.

Ultimately, selecting the right software will help you streamline your billing process, reduce errors, and ensure that all of your financial documents maintain a high level of professionalism.

How Pre-Designed Documents Save Time for Creatives

Managing client payments and financial records can be a time-consuming process, especially when it requires creating new documents from scratch for each project. Pre-designed structures significantly streamline this task, allowing professionals to quickly generate consistent and accurate records without the need for constant formatting or data entry. By using ready-made layouts, you can focus more on your creative work and less on administrative tasks.

Key Time-Saving Benefits

Here are several ways pre-designed solutions can save valuable time in your day-to-day business operations:

- Quick Setup: Pre-made formats provide a ready-to-use foundation, so you can immediately start filling in client details and project information without spending time designing from scratch.

- Consistent Design: With a set structure, you don’t need to worry about adjusting layout and formatting each time. Consistency ensures that every document looks professional and polished.

- Automated Calculations: Built-in features like automatic total calculations and tax adjustments eliminate the need for manual entry, reducing errors and speeding up the process.

- Easy Reuse: Once you’ve customized a document for one client, you can quickly adapt it for future use by simply adjusting the necessary details, which saves you from reinventing the wheel each time.

Reducing Errors and Streamlining Workflow

By eliminating the need for constant manual input and ensuring that documents are generated automatically, these pre-designed solutions help reduce human error. The time spent correcting mistakes or adjusting documents is minimized, allowing you to maintain a more organized and efficient workflow. This efficiency frees up more time for you to dedicate to what truly matters–your creative projects.

Overall, pre-designed solutions not only make administrative tasks faster and easier but also help ensure that your financial records are always accurate and professional.

Free Billing Document Layouts for Mac

For creative professionals who are just starting or those looking to save on software costs, free resources for creating financial records can be a great option. These no-cost solutions provide basic, easy-to-use structures that can be customized to suit your specific needs, all without the financial investment required for premium software. By utilizing free options, you can streamline your business processes while keeping expenses low.

Where to Find Free Billing Resources

There are several platforms offering free layouts for generating professional documents. These resources typically allow for basic customization, so you can input your own branding and adjust the structure to suit your preferences. Here are some places where you can find high-quality free solutions:

- Google Docs: A great option for basic documents, with free, easily editable layouts that you can customize for your business needs.

- Microsoft Office Online: Provides a range of free templates accessible via a Microsoft account, offering a variety of document styles to fit different industries.

- Canva: Known for its user-friendly design tools, Canva offers free customizable layouts with a focus on creating visually appealing documents.

- Zoho Invoice: While primarily a paid service, Zoho offers a free plan with access to a selection of professional billing templates.

Advantages of Using Free Resources

Free layouts come with several benefits, especially for freelancers or small businesses who are looking to minimize costs:

- No Upfront Costs: Free layouts allow you to get started without any financial investment, making them an ideal solution for new businesses or budget-conscious professionals.

- Quick and Easy Setup: These resources are typically ready to use with minimal customization required, helping you generate professional documents in no time.

- Basic Features: While free layouts may not have all the advanced features of paid software, they often include everything necessary for simple, effective document creation.

By using these free resources, you can save time and money, ensuring that your client records are well-organized and professional, even without investing in expensive tools.

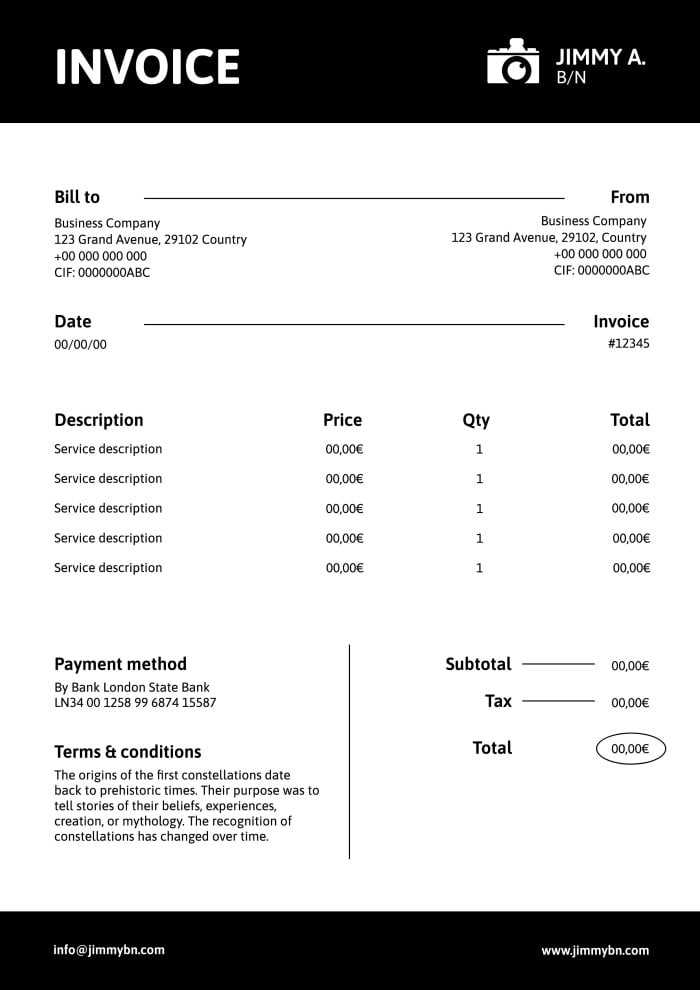

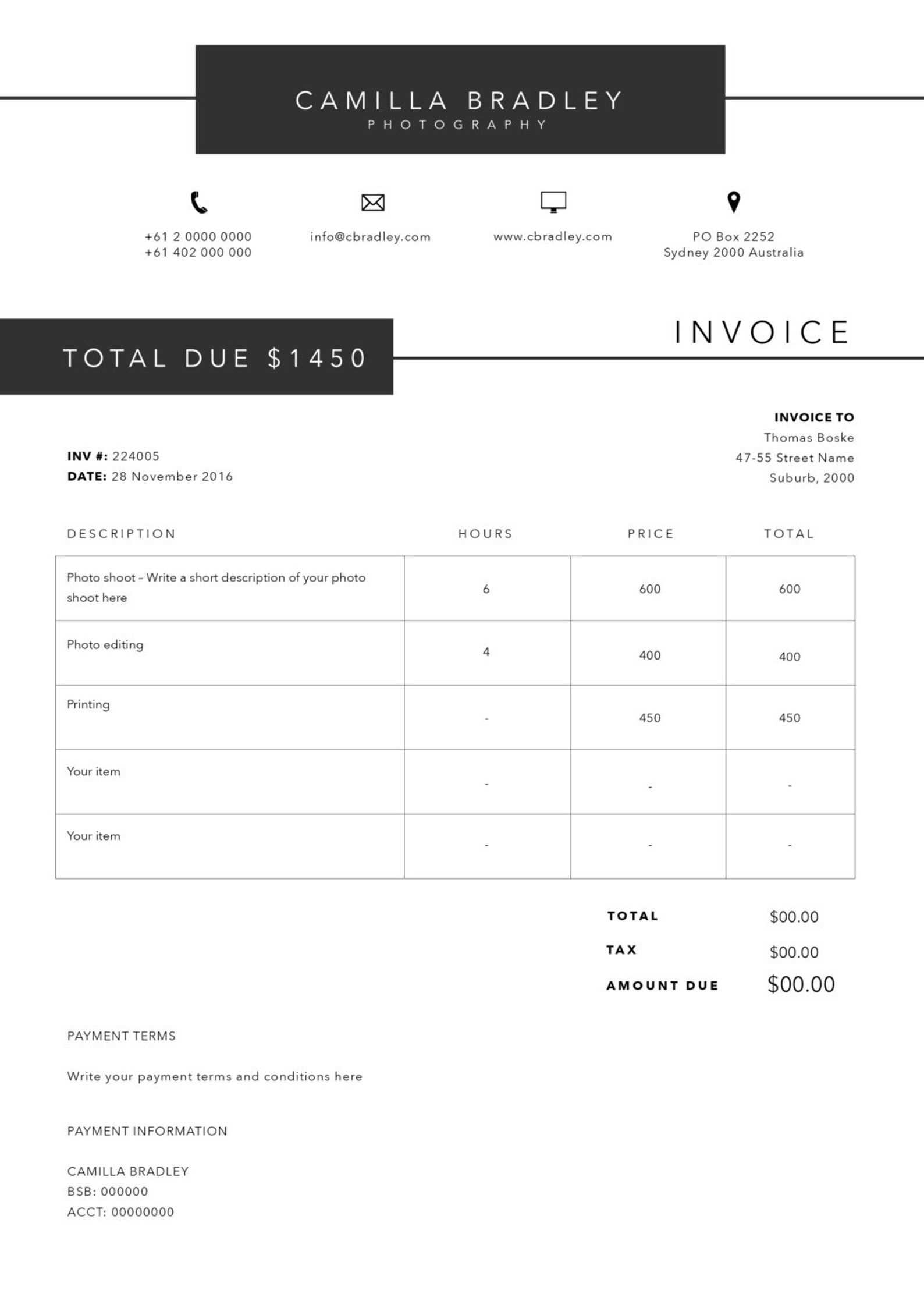

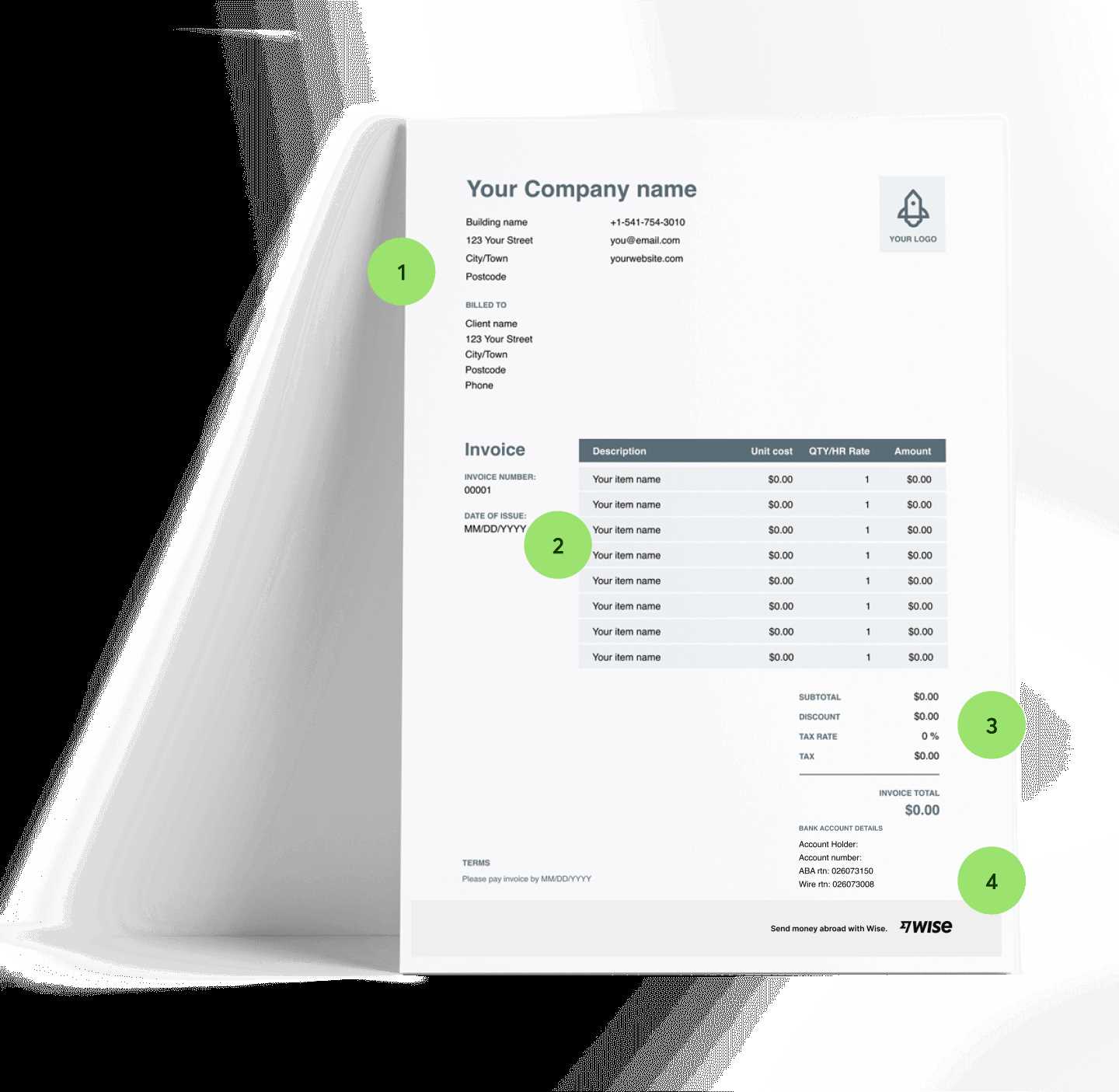

How to Include Essential Billing Information

When creating professional payment documents, it’s important to ensure that all the necessary details are included to avoid confusion and ensure a smooth transaction process. Having the right information not only helps clients understand what they’re being charged for, but also provides clarity for both parties in case of any future queries or disputes. Including the key elements ensures that your records are complete and legally compliant.

Here are the key pieces of information that should be included in every payment document:

- Client Information: Include the full name or business name of the client, their address, and contact details. This ensures that the document is properly linked to the correct recipient.

- Your Details: Include your business name, contact information, and any relevant identification numbers (such as tax or business registration numbers). This helps confirm the legitimacy of the document and gives clients a way to reach you for follow-ups.

- Description of Services: Clearly outline the services or products provided, including quantities, rates, and any applicable discounts. This section should be as detailed as necessary to avoid ambiguity.

- Dates: Include the date the service was provided or completed, along with the date the document was issued. This helps track timelines for both parties.

- Payment Terms: Clearly state the payment due date, late fees (if applicable), and accepted methods of payment. This ensures that both you and your client are on the same page regarding expectations.

- Total Amount Due: Make sure the final amount is clearly visible, along with any applicable taxes or additional fees. This ensures there are no surprises for the client.

By incorporating these key details, you create clear and professional documents that reduce the chances of misunderstandings and help maintain smooth financial transactions with your clients.

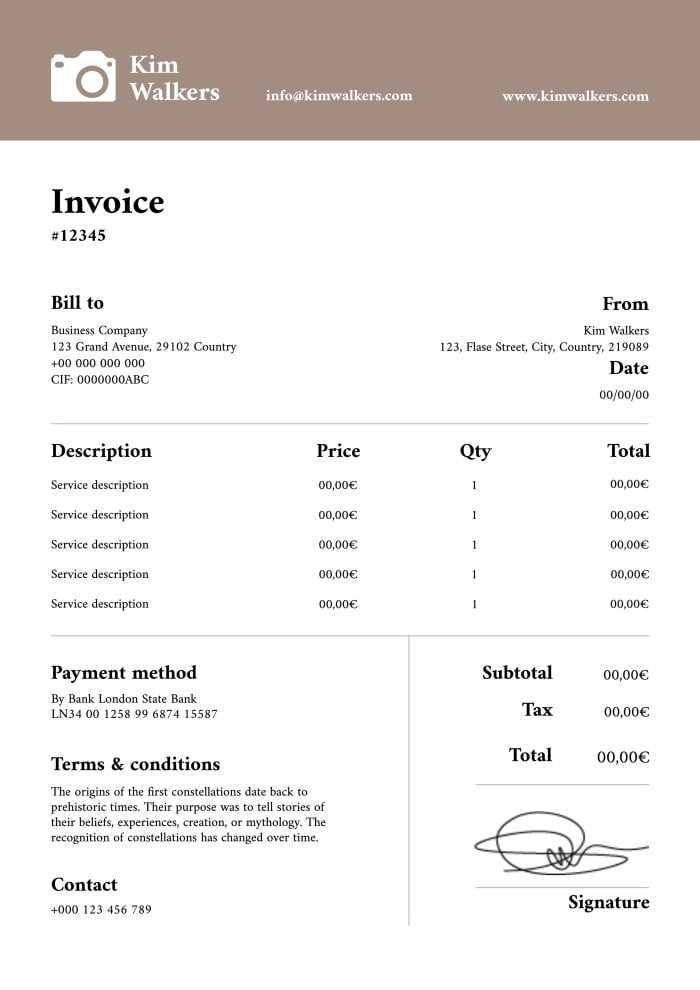

Tips for Professional Billing Documents

Creating polished and professional billing records is essential for maintaining a positive relationship with your clients and ensuring that your business is taken seriously. A well-crafted financial document not only outlines the payment details but also reinforces your brand’s credibility. Here are some tips to ensure that your payment documents meet professional standards and leave a lasting impression.

Best Practices for Creating Professional Documents

By following these best practices, you can create clean, effective, and professional financial records:

- Use Clear and Concise Language: Avoid overly complex terms. Be straightforward and precise with descriptions to ensure the client understands exactly what they are being charged for.

- Keep Your Design Clean: A simple, uncluttered layout improves readability. Use enough white space, clear headings, and well-organized sections so that the key information stands out.

- Include Your Branding: Incorporate your logo, colors, and font style to make the document feel more cohesive with your overall brand image. This helps reinforce your identity and makes the document more memorable.

- Double-Check for Accuracy: Always review your records before sending them out to ensure all the information is correct, including client details, amounts, and dates. Errors can undermine your professionalism and cause unnecessary confusion.

- Provide Multiple Payment Options: Offering different payment methods (bank transfer, credit card, etc.) can make it easier for clients to pay on time, which is a sign of good customer service.

Additional Tips for Improving Client Experience

Here are a few more tips to help you improve the client experience when sending billing documents:

- Be Timely: Send your documents promptly after the completion of the project. This shows your clients that you are organized and on top of your business.

- Offer Detailed Breakdown: If you provide multiple services or products, list each one separately to give clients a clear understanding of how the total amount was calculated.

- Follow Up Professionally: If payment is delayed, send a polite reminder with a clear statement of the overdue amount and any late fees if applicable.

By following these tips, you can ensure that your payment records are professional, clear, and easy for your clients to process. A well-prepared document not only helps you get pa

Organizing Your Billing Records Efficiently

Maintaining an organized system for your financial documents is essential for keeping track of client transactions, managing cash flow, and ensuring timely payments. With the right organizational structure, you can quickly find past records, stay on top of overdue amounts, and streamline your business operations. Whether you are working on multiple projects or handling a growing list of clients, an efficient organization method saves time and reduces stress.

Steps to Organize Your Financial Documents

Implementing a solid organizational system is key to managing your financial records effectively. Here are some strategies to help you stay organized:

- Use Folders for Different Clients: Create separate folders for each client, both digitally and physically if needed. This will help you quickly locate specific documents related to each project.

- Label Files Clearly: Always use clear, consistent naming conventions for your documents (e.g., “ClientName_ServiceDate_Amount”). This makes it easier to search for and find specific records.

- Track Payments and Due Dates: Create a simple tracking sheet or use digital tools that allow you to monitor when payments are due and which clients have paid. This will help you avoid missed payments and improve cash flow management.

- Sort by Date: Organize your records by the date of service or transaction. This ensures that your files are in chronological order and helps you track progress over time.

- Store Backup Copies: Always keep digital backups of your documents in case of loss. Cloud storage services are an easy way to back up important files securely.

Using Software to Simplify the Process

For those managing large volumes of transactions, using software solutions can significantly improve your organizational efficiency. Many accounting and billing tools offer features that automatically categorize and track payments, making it easier to stay organized and up-to-date with client records. Software can also help you generate reports, manage overdue payments, and send reminders to clients.

- Cloud Storage Services: Use cloud services like Google Drive, Dropbox, or iCloud to store and access your files from any device, keeping everything synchronized.

- Accounting Software: Tools like QuickBooks or FreshBooks can automatically categorize and track your transactions, reducing the manual effort required to keep everything in order.

By organizing your financial records effectively, you can reduce administrative headaches and ensure that you never lose track of important details. Whether you choose a digital or physical organization system, consistency and structure are key to keeping your business running smoothly.

Document Format Compatibility with MacOS

When choosing a solution for creating and managing billing documents, it’s important to ensure that the tool you select is fully compatible with your operating system. For Mac users, this means finding formats and applications that work seamlessly with MacOS, offering both ease of use and robust functionality. Compatibility ensures that your documents are easy to create, edit, and share without technical issues or conversion errors.

Compatible File Formats and Tools for MacOS

MacOS supports a wide range of file formats and applications, making it easy to find the right tool for generating financial documents. Here are some popular formats and applications that work well on MacOS:

- PDF Format: Portable Document Format (PDF) is one of the most widely supported formats for billing records. It preserves formatting across different devices, ensuring that your documents look the same regardless of where they are opened.

- Word Documents: Microsoft Word files (.docx) are fully supported on MacOS, and many document creation tools offer Word-compatible layouts, allowing you to work on your billing records without any compatibility issues.

- Excel Spreadsheets: Excel files (.xlsx) are commonly used for financial tracking and calculations. Mac users can open, edit, and save these files with ease using applications like Microsoft Excel or Apple’s Numbers app.

- Apple Pages: For users looking for a native MacOS application, Pages offers a user-friendly interface and compatibility with Word and PDF formats. It’s an excellent option for those who prefer not to use third-party software.

Applications for MacOS to Create Billing Documents

In addition to file formats, there are many applications that are specifically designed for creating and managing financial records on MacOS. These tools offer different levels of functionality, so it’s important to choose one that suits your needs:

- Numbers (Apple): A free spreadsheet application that integrates well with other Apple tools. It’s ideal for users who need basic tracking and document creation.

- Microsoft Word & Excel: These widely used programs are fully compatible with MacOS and offer powerful features for creating and managing professional documents.

- QuickBooks: A popular accounting software that is available for Mac users, offering advanced tools for managing finances, tracking payments, and generating customized billing records.

- FreshBooks: A cloud-based tool that works seamlessly on MacOS, providing an easy-to-use interface for creating, sending, and managing billing documents.

Ensuring compatibility between your operating system and the tools you use is critical for smooth and efficient document creation. MacOS supports a broad range of file formats and applications, so you can easily create and manage professional records without worry

Tracking Payments Using Billing Records

Tracking payments is a crucial part of managing any business. It ensures that you are aware of what has been paid, what is still outstanding, and helps maintain a clear financial overview. With proper tracking, you can avoid overdue payments, easily follow up with clients, and maintain accurate records for tax or accounting purposes. By using well-structured financial documents, you can streamline this process and keep track of all payments efficiently.

How to Effectively Track Payments

To stay on top of your transactions and ensure timely follow-ups, it’s important to use a system that tracks each payment’s status. Here are some key steps to effectively track payments:

- Record Payment Dates: When a client makes a payment, record the exact date. This allows you to know when to expect future payments and keeps you aware of overdue amounts.

- Update Payment Status Regularly: After each payment is made, update the status on your financial record to reflect whether the payment is complete, pending, or overdue.

- Keep a Running Total: Maintain a running total of all payments received and compare this to the total amount due. This helps you easily spot discrepancies or payments that may have been missed.

- Attach Payment References: Always include payment references or transaction IDs, especially if payments are made online. This ensures there’s a clear link between the payment and the associated transaction.

- Use Payment Reminders: Set reminders for follow-ups with clients whose payments are due or overdue. Automated reminders can save you time and ensure you don’t miss any follow-ups.

Tools to Help Track Payments

There are various tools and software that can help automate and simplify the process of tracking payments. Here are some options:

- Spreadsheet Software: Simple tools like Excel or Google Sheets can be used to track payments manually. With custom formulas, you can calculate totals, due dates, and track the status of each payment.

- Accounting Software: Platforms like QuickBooks or FreshBooks automatically track payments, send reminders, and provide detailed reports on your cash flow.

- Online Payment Systems: Payment processors like PayPal or Stripe offer built-in features for tracking payments. These platforms keep detailed logs of all transactions and often send automatic receipts to clients.

- Cloud-Based Tools: Apps like Zoho or Wave are cloud-based and allow you to track payments on the go. They also offer integration with banking systems to automatically update payment statuses.

Using these tools and practices, you can simplify payment tracking, minimize errors, and maintain a professional and organized approach to managing your finances.

Integrating Billing Records with Accounting Software

Efficiently managing your financial documents requires a seamless connection between your payment records and accounting systems. By integrating your billing details with accounting software, you can automate many aspects of your financial management, including tracking expenses, calculating taxes, and generating reports. This integration saves time, reduces the risk of errors, and helps maintain accurate records for tax season or audits.

Benefits of Integrating Billing Records with Accounting Software

Integrating your payment records directly with accounting tools offers numerous advantages for both small businesses and freelancers:

- Time Efficiency: Automatically syncing payment data reduces manual entry, saving valuable time and allowing you to focus on other areas of your business.

- Accurate Financial Records: Integration ensures that your payment records are immediately updated in the accounting system, preventing discrepancies between your documents and financial reports.

- Streamlined Tax Reporting: With integrated software, tax calculations can be automated, making it easier to generate reports at the end of the fiscal year.

- Improved Cash Flow Management: Real-time tracking of payments allows you to monitor outstanding balances and identify overdue payments, helping you maintain a healthy cash flow.

- Reduced Human Error: Automatic syncing reduces the likelihood of errors that can occur when entering data manually, ensuring your records are precise and up to date.

Popular Software for Integrating Payment Records

There are various accounting software tools available that integrate seamlessly with your payment documents. Here are some of the most widely used platforms:

- QuickBooks: One of the most popular accounting tools, QuickBooks offers easy integration with various billing software, allowing you to sync your payment details and automate financial tasks.

- FreshBooks: Designed specifically for small businesses and freelancers, FreshBooks allows you to create, track, and manage financial records while syncing directly with your accounting data.

- Zoho Books: This tool integrates billing, expense tracking, and financial reporting into one platform, streamlining your accounting workflow and enhancing overall productivity.

- Wave: A free accounting software that allows for seamless integration with payment records, making it ideal for freelancers and small business owners.

By integrating your financial documents with accounting software, you create a more efficient, accurate, and reliable system for managing your business’s finances. This integration not only improves your workflow but also gives you peace of mind knowing that your financial data is secure, organize