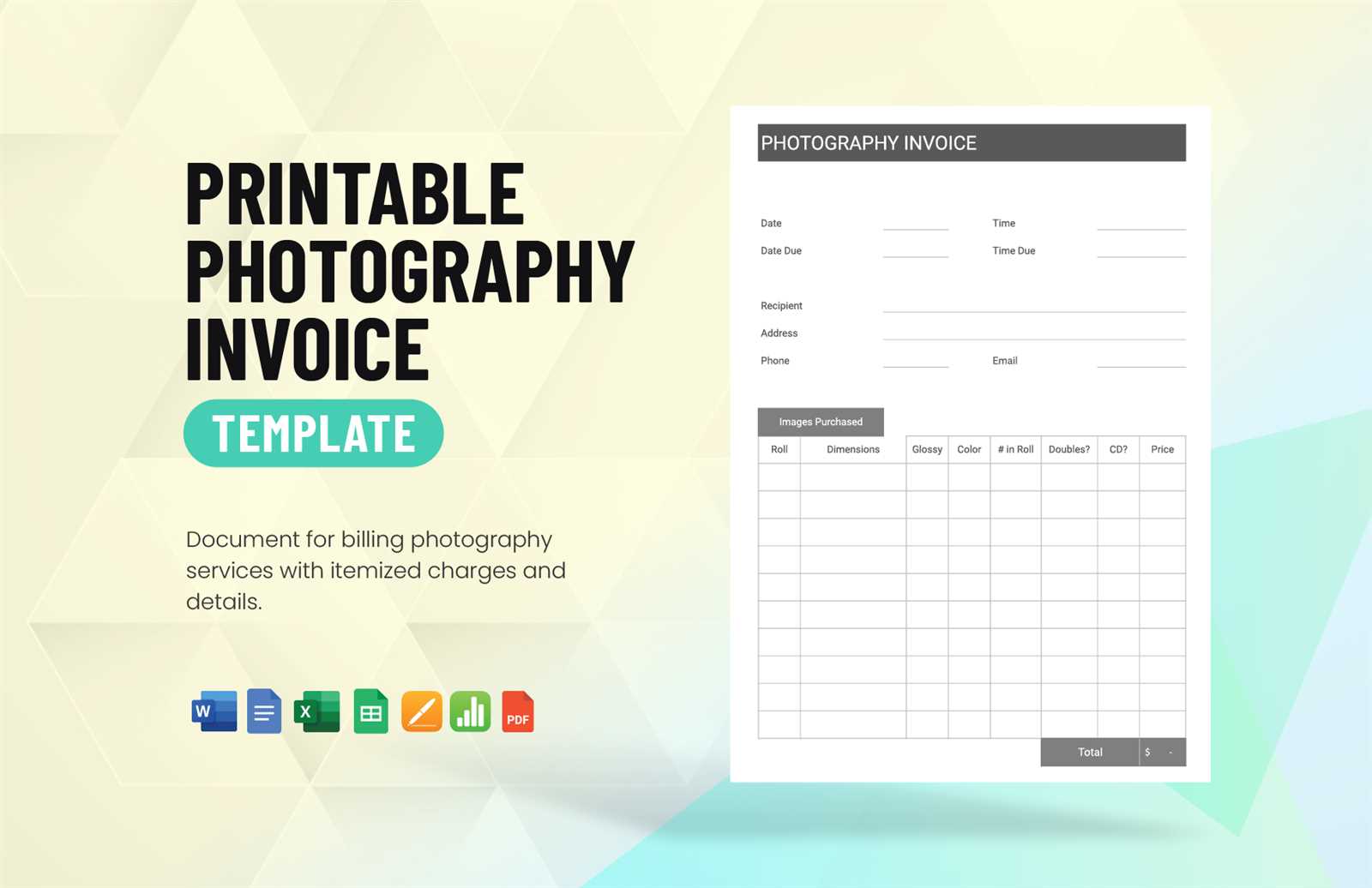

Photography Invoice Template Excel for Easy Billing and Customization

Managing payments and maintaining professional records is crucial for any freelance business. One of the best ways to stay organized is by using a structured document that helps outline the services rendered, payment terms, and total amounts due. Such a document not only ensures clarity but also serves as a formal record for both the provider and the client.

In the world of creative services, a customizable tool can greatly simplify the task of generating these records. With the right solution, you can quickly generate a clean, professional-looking statement that includes all necessary details. Whether you’re a freelancer or running a small business, this tool helps you stay on top of your financials with minimal effort.

Using a digital approach to create these documents can streamline your process, offering flexibility for personal adjustments and allowing easy updates for different projects. A simple, yet effective way to maintain order in your billing routine is to utilize a well-organized document structure that minimizes errors and saves valuable time.

Photography Invoice Template Excel Overview

For any creative professional, managing financial transactions efficiently is key to maintaining a smooth workflow. Using a structured document for billing not only helps organize payments but also establishes professionalism when dealing with clients. A well-designed document that clearly outlines services, costs, and payment terms can save time and prevent errors.

The solution for many in the creative field is to utilize a digital system that allows for quick customization and easy updates. Such a system simplifies the creation of detailed records, ensuring that all essential information is included, and can be adjusted to meet specific client needs. This approach minimizes the complexity of handling finances while enhancing the overall business experience.

Key Features of the System

- Customization – Adjust the document to suit different types of services or client requirements.

- Professional Layout – A clean and organized format that enhances the presentation of financial details.

- Calculation Assistance – Automatic calculations for totals and taxes, reducing the risk of manual errors.

- Trackable Records – Easy storage and retrieval of previous records for future reference.

- Time-saving Automation – Generate new entries quickly with minimal input, ideal for multiple clients or projects.

Advantages of Using This System

- Reduces administrative workload by automating repetitive tasks.

- Ensures accurate calculations and consistent formatting across all documents.

- Provides an efficient way to manage and track payments, improving cash flow management.

- Enhances the overall client experience with clear, easy-to-read financial documents.

Why Use an Invoice Template

Having a consistent and professional way to document transactions is essential for any business. Whether you’re offering creative services or consulting, ensuring that all necessary details are included in the final statement helps maintain transparency and avoid misunderstandings. Using a pre-designed structure allows you to focus more on your work while ensuring the financial aspect is handled correctly.

By adopting an organized framework, you can save time, reduce errors, and keep a clear record of your activities. This approach is especially valuable for small businesses or freelancers who need to streamline their billing process without sacrificing accuracy or professionalism.

Benefits of Using a Structured Approach

- Time-saving – Quickly generate a record without needing to start from scratch each time.

- Consistency – Ensure all documents follow the same format, improving your business’s overall presentation.

- Accuracy – Built-in fields for calculations help eliminate common mistakes.

- Professionalism – Clients will appreciate the clean, organized layout of the statement.

- Record Keeping – Easy to track past transactions and maintain organized files for future reference.

Common Elements in Such Documents

| Field | Description |

|---|---|

| Client Information | Name, address, and contact details of the recipient. |

| Service Details | A breakdown of the services provided, including descriptions and quantities. |

| Payment Terms | Details about the payment schedule, due dates, and methods. |

| Total Amount | The final sum to be paid, including taxes and any discounts. |

Features of a Photography Invoice Template

A well-organized billing document offers a variety of features that enhance the efficiency and professionalism of any business. These characteristics make it easier to manage transactions, keep track of payments, and ensure accuracy. Whether for a one-time project or an ongoing contract, having a structured format helps ensure that all necessary information is presented clearly and consistently.

Using a detailed and customizable document allows for flexibility, ensuring that the content can be tailored to meet the specific needs of both the service provider and the client. Key functionalities help automate repetitive tasks, reducing the risk of human error and improving the overall workflow.

Key Functionalities and Tools

- Pre-set Fields – Fields like service descriptions, quantities, and rates are easily customizable to fit each project.

- Automatic Calculations – Automatic totals and tax calculations help avoid manual errors and save time.

- Client Information Storage – Save time by storing frequent client details for easy reuse in future documents.

- Adjustable Payment Terms – Flexibility to set custom due dates, deposit amounts, and payment methods.

- Professional Layout – Clean, organized designs that enhance the professionalism of each document.

Essential Components in a Well-Designed Document

| Feature | Description |

|---|---|

| Service Details | Clearly defines the work completed, including rates, hours, and specific services offered. |

| Tax Calculation | Automatic calculations of applicable taxes based on the total amount. |

| Payment Methods | Allows the client to choose from various payment options like credit, bank transfer, or cash. |

| Due Date and Terms | Sets clear payment expectations, including due dates and any early-payment discounts or late fees. |

How to Customize Your Template

Customizing your billing document is an essential step to ensure it aligns with your business needs. Personalizing it to reflect your brand, adjusting for specific client requirements, and incorporating essential fields can significantly improve efficiency and professionalism. The process allows you to create a version that works best for you while maintaining consistency across all transactions.

By making simple adjustments, such as modifying headings, changing fonts, or adding your logo, you can ensure that your document is both functional and visually appealing. Customization also enables you to quickly adapt to different project types or client preferences without starting from scratch every time.

Steps to Personalize Your Document

- Adjusting Contact Information – Update fields for your name, business address, and contact details to reflect your current information.

- Adding Your Logo – Insert your logo or branding elements to personalize the layout and make your document look more professional.

- Customizing Payment Terms – Modify payment due dates, discounts, and late fee terms based on the agreement with each client.

- Service Descriptions – Tailor the service fields to accurately reflect the nature of the work completed and provide specific details that clients may need.

Useful Fields to Modify

| Field | How to Modify |

|---|---|

| Client Name | Enter the client’s full name or business name to ensure accurate billing information. |

| Service Breakdown | Specify each service provided, including rates, hours worked, and any custom pricing. |

| Tax Rates | Update tax rates to comply with local regulations or specific client agreements. |

| Payment Methods | List available payment options (bank transfer, credit card, etc.) to offer flexibility to the client. |

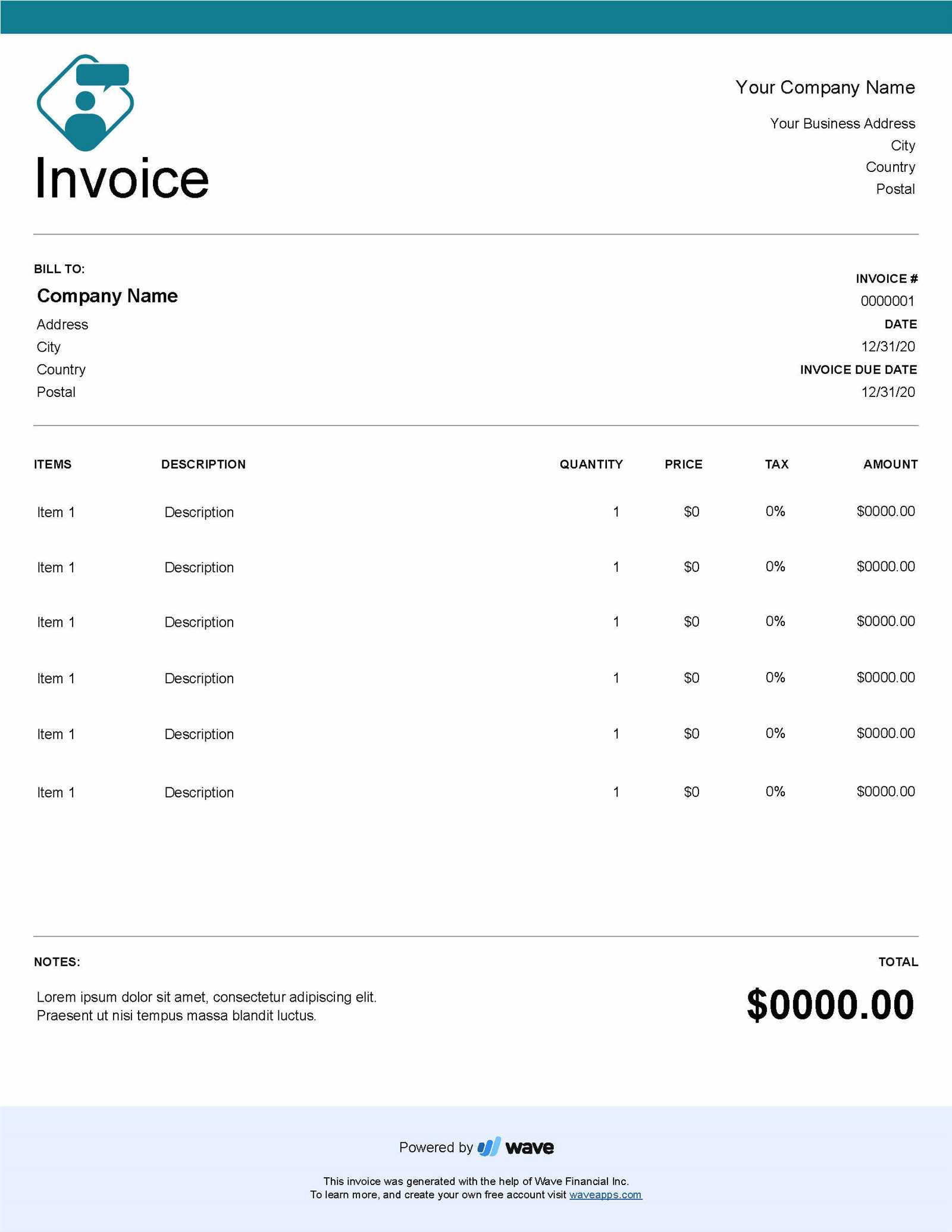

Creating Professional Invoices with Excel

Crafting polished and accurate billing records is crucial for any business. Using a digital tool to generate these documents provides a streamlined way to create clear and professional statements. This method not only saves time but also enhances the accuracy and consistency of your financial records. By leveraging the features of a spreadsheet program, you can quickly assemble a document that includes all necessary information in a structured and easy-to-read format.

With the right setup, this approach allows you to generate a document that looks professional while handling complex calculations automatically. From adding service details to tracking payment status, this tool ensures that every transaction is recorded correctly, reducing the chances of errors and providing a smooth experience for both you and your clients.

Key Benefits:

- Streamlined Process – Quickly generate professional documents without the need for advanced design skills.

- Automated Calculations – Easily calculate totals, taxes, and discounts to avoid manual errors.

- Consistency – Use the same format for every client, ensuring uniformity across all your records.

- Customization – Modify the structure to fit specific needs or client preferences, allowing for flexibility.

Benefits of Excel for Invoicing

Using a digital spreadsheet program for generating billing documents provides several advantages that make the process more efficient and accurate. It offers a combination of flexibility and automation, allowing businesses to create, modify, and manage their financial records with ease. The ability to structure these documents and apply built-in functions can save significant time and reduce the potential for errors.

From simple calculations to tracking payment histories, the program simplifies the process of managing finances. Whether you’re a small business owner or a freelancer, this tool provides a convenient and customizable solution to handle your financial documentation needs.

Key Advantages

- Automation of Calculations – Automatically sum totals, apply taxes, and calculate discounts, minimizing the risk of manual errors.

- Customizable Layout – Tailor the design and structure of your document to match specific needs or branding.

- Ease of Use – Simple to set up and use, even for those with limited technical skills.

- Data Tracking – Easily track payment status, amounts due, and overdue invoices in one central location.

- Cost-Effective – No need for specialized software; spreadsheet programs are often included in office suites or available at low cost.

Additional Benefits

- Speed – Generate professional documents quickly and efficiently without needing to start from scratch every time.

- Integration with Other Systems – Easily export data to other financial tools or reports for further analysis or record-keeping.

- Consistency – Use the same structure and format for all your billing documents, ensuring a unified look across your business.

Essential Information to Include in an Invoice

When preparing a billing statement, it is important to ensure that all relevant details are included for clarity and accuracy. The document should contain key elements that outline the services provided, the amount owed, and the payment terms. By including this critical information, both the service provider and the client will have a clear understanding of the transaction, which helps avoid disputes and ensures timely payment.

Besides the basic financial figures, including contact information, due dates, and other relevant details adds a layer of professionalism and organization. The following list highlights the essential components that should always be present in any statement of this type.

Key Elements to Include

- Contact Information – Include both your business details and the client’s information, such as names, addresses, and phone numbers.

- Service or Product Description – Clearly outline the services rendered, including any specifics that may affect pricing (e.g., hourly rates, quantities, or special requests).

- Itemized Costs – Break down the charges for each service or item to show how the total amount is calculated.

- Payment Terms – Specify the due date, any late fees, and acceptable payment methods (e.g., credit card, bank transfer).

- Tax Information – Include applicable taxes or VAT to ensure transparency about the total cost.

Additional Details to Consider

- Invoice Number – A unique identifier for the document, which helps keep records organized.

- Project or Reference Number – If applicable, include a reference code that ties the transaction to a specific project or contract.

- Due Date – Clearly state when payment is expected, along with any payment terms or conditions (e.g., early payment discounts).

Best Practices for Invoicing Photographers

For any professional offering creative services, having a clear and organized method for billing is essential. A well-crafted billing document not only ensures timely payments but also maintains a professional relationship with clients. It’s important to follow industry best practices when creating and sending your financial records to avoid confusion, prevent delays, and ensure both parties are on the same page regarding the terms of the transaction.

By incorporating clear language, accurate calculations, and consistent formats, you can simplify the payment process for clients and avoid common mistakes. The following guidelines are designed to help photographers stay organized, professional, and efficient when handling their financial documentation.

Key Tips for Professional Billing

- Clear Itemization – Break down all charges by service, making it easy for clients to understand exactly what they are paying for. This helps avoid confusion and disputes over costs.

- Consistent Branding – Use a uniform style for all your billing records, incorporating your logo, colors, and font. This reinforces your business identity and creates a polished, professional appearance.

- Timely Delivery – Send your documents as soon as possible after completing the work. Quick billing not only speeds up payments but also reinforces your professionalism.

- Payment Terms – Be clear about payment deadlines, accepted methods, and any penalties for late payments. Having these terms specified upfront helps prevent misunderstandings.

- Follow-Up – If payments are delayed, don’t hesitate to send a polite reminder. Keeping track of payments and following up when necessary is key to maintaining a steady cash flow.

Additional Considerations

- Deposit Requirements – For larger projects, consider requesting a deposit upfront. This secures the booking and ensures that you’re compensated for your time and effort.

- Client Communication – Include contact information and the option for clients to reach out if they have questions. Open lines of communication build trust and make the process smoother.

- Tax Information – Make sure to include any relevant tax information, especially if you are required to charge VAT or other taxes in your region. Transparency in this regard can avoid confusion later.

Using Excel Functions for Better Invoices

Leveraging the built-in features of a spreadsheet program can significantly enhance the accuracy and efficiency of generating billing documents. By utilizing functions such as automatic calculations, data validation, and custom formatting, you can ensure that each document is professional, error-free, and easy to update. These tools not only streamline the creation process but also improve overall financial management by reducing manual input and eliminating common mistakes.

Incorporating these functions allows for quick adjustments, accurate totals, and streamlined workflows. The following are some of the most useful functions that can elevate the quality of your billing documents, ensuring a smooth and efficient billing experience for both you and your clients.

Key Functions to Improve Your Billing Process

- SUM – This function automatically adds up values, such as totals for services or items, helping you avoid manual calculations and ensuring accuracy.

- IF – Use this function to apply conditions, such as offering discounts or applying tax rates based on certain criteria, making your billing process more dynamic.

- VLOOKUP – This function helps quickly retrieve information from large datasets, such as client details or item pricing, to speed up document creation.

- DATE – Automatically insert the current date or due dates for payment to ensure your documents are up-to-date and time-sensitive.

- TEXT – This function allows you to format numbers or dates in a consistent and professional way, ensuring your billing records look polished.

Additional Excel Tools for Efficiency

- Data Validation – Use this tool to limit the types of data entered into your document (e.g., preventing invalid date or currency entries), ensuring consistency across all records.

- Conditional Formatting – Highlight specific cells based on criteria (e.g., overdue payments or unpaid balances) to make it easier to spot issues at a glance.

- Templates – Create reusable templates that automatically populate client and service information, saving time on repetitive tasks while maintaining consistency.

Adding Your Logo and Branding

Incorporating your brand identity into your billing documents not only enhances their professional appearance but also strengthens your business’s presence. By adding elements like your logo, business colors, and fonts, you create a visually cohesive document that reflects your style and promotes brand recognition. This small yet impactful addition can leave a lasting impression on clients and help differentiate your business from others.

Branding your financial documents is more than just an aesthetic choice; it signals professionalism, builds trust, and reinforces your business identity in every transaction. The following tips will help you effectively add your logo and branding to your documents, ensuring they are both functional and visually appealing.

Steps to Incorporate Your Brand

- Insert Your Logo – Position your logo at the top of the document, typically in the header section, so it is immediately visible. Ensure the image is high resolution and fits the design.

- Use Consistent Fonts – Apply the same fonts that you use on your website and other marketing materials. This consistency helps reinforce your brand identity.

- Color Scheme – Match your document’s color palette with your brand’s official colors to create a unified look. This can be applied to headers, borders, and text highlights.

- Professional Layout – Arrange your branding elements in a clean, organized manner that does not overwhelm the content. Keep a balance between aesthetic appeal and functionality.

Additional Branding Tips

- Footer Information – Include your business’s website, contact details, or social media links in the footer to maintain consistency throughout the document.

- Custom Design Features – Add custom elements like watermarks or background images that are subtle but contribute to your branding without distracting from the important details.

Tracking Payments with Excel

Keeping track of payments is a vital part of managing any business, ensuring that transactions are recorded accurately and that financial records remain organized. Using a digital tool to monitor the status of each payment helps you stay on top of incoming funds, detect overdue balances, and make informed decisions regarding cash flow. With the right approach, you can quickly track payments, identify outstanding invoices, and ensure timely follow-ups with clients.

Leveraging spreadsheet software for this purpose offers a straightforward way to automate calculations, track payment dates, and create detailed reports. Below are some methods and best practices to help you efficiently track payments and maintain a smooth billing process.

Setting Up a Payment Tracking System

- Payment Status Columns – Include columns that clearly indicate whether a payment has been made, is pending, or overdue. This makes it easy to filter and identify outstanding payments.

- Use Date Fields – Add fields for payment due dates and actual payment dates. This helps you keep track of deadlines and monitor when payments are received.

- Automatic Calculations – Set up formulas to automatically calculate outstanding amounts, discounts applied, and total amounts received, ensuring your records are always accurate.

Helpful Tips for Efficient Payment Tracking

- Reminders for Overdue Payments – Use conditional formatting to highlight overdue payments, making them easier to spot and prioritize for follow-up.

- Reconcile Payments Regularly – Set a schedule for regularly reviewing your payment records, ensuring that any discrepancies are resolved promptly.

- Maintain Separate Reports – Keep separate sheets for client payments and overall financial summaries, which helps you generate quick reports and understand your cash flow more easily.

Automating Invoice Generation in Excel

Automating the creation of billing documents is an effective way to save time and reduce human error. By setting up templates that can generate new documents automatically based on predefined criteria, you can ensure that each record is consistent, accurate, and professionally formatted. Automation allows you to streamline the process, ensuring that you only need to input minimal data for each transaction, while the system takes care of calculations, formatting, and organization.

Utilizing advanced features such as macros, formulas, and data connections, you can create a fully automated workflow that generates new records with just a few clicks. This not only speeds up the task but also ensures that your records remain up to date, reducing the risk of oversight or mistakes. Below are some ways to automate your document generation and improve efficiency in your workflow.

Methods to Automate Your Billing Documents

- Using Macros – Macros can be recorded and assigned to buttons to automatically fill in repetitive fields, such as client names, addresses, and pricing details, based on a set template.

- Setting Up Formulas – Use formulas to automate calculations like totals, taxes, and discounts. For example, a SUM formula can quickly calculate the total cost, while a VAT formula can apply taxes without manual input.

- Data Validation Lists – Create drop-down lists to automatically populate specific fields, such as client names, service descriptions, and payment terms, ensuring accuracy and consistency.

Building an Automated System

| Step | Description |

|---|---|

| Step 1: Create a Master Template | Design a document layout that includes all necessary fields for the billing process. Set up placeholders for dynamic data. |

| Step 2: Add Formulas for Calculations | Include formulas that automatically calculate totals, taxes, and discounts based on the data you enter. |

| Step 3: Set Up Macros | Record macros that can generate new documents with preset details, reducing the amount of manual entry. |

| Step 4: Create Drop-Down Lists | Set up data validation drop-downs to quickly select client details, services, and payment terms from predefined lists. |

By automating your billing document creation, you can streamline your business’s financial processes, improve accuracy, and save valuable time. This automation not only reduces the risk of errors but also increases overall productivity, giving you more time to focus on other important aspects of your business.

Integrating Invoice Templates with Accounting Software

Integrating billing documents with accounting platforms is a smart approach to enhance efficiency and accuracy in financial management. By syncing your records with accounting software, you can ensure that all transactions are properly documented, reducing the need for manual data entry and minimizing the risk of errors. This integration allows for automatic updates, streamlined reporting, and seamless communication between different systems, improving both your workflow and financial oversight.

With the right tools and setup, you can create a streamlined process where your billing data is directly transferred to your accounting software. This eliminates duplication of effort and ensures that both systems remain in sync. Below are some strategies for integrating your records with accounting solutions to improve the efficiency of your business’s financial operations.

- Automatic Data Syncing – Set up your system to automatically transfer client details, payment amounts, and due dates from your billing documents to the accounting software.

- Streamlined Record Keeping – Integration can automatically update your financial ledgers, ensuring that your income, expenses, and taxes are always up-to-date.

- Real-Time Financial Reporting – With integrated systems, you can access live data on your business’s financial health, improving decision-making and planning.

By integrating your billing documents with accounting software, you not only save time but also ensure that your financial records are accurate, accessible, and aligned across different platforms. This setup is an invaluable tool for business owners looking to optimize their financial processes and reduce the administrative burden associated with manual tracking and reporting.

Customizing Templates for Different Services

Customizing billing documents to reflect the unique requirements of various services is essential for maintaining accuracy and professionalism. Each service may have different pricing structures, delivery timelines, and terms of agreement, so it’s important to adjust your document layout accordingly. By tailoring your records, you can ensure that all relevant information is clearly presented, which helps build trust with your clients and makes the billing process more efficient.

There are several ways to customize your documents to suit specific services. From modifying section headings to adjusting pricing models, personalizing your billing format ensures that you can accommodate the diverse nature of your work while maintaining consistency and clarity. Below are some key elements to consider when customizing your records for different services:

- Service-Specific Descriptions – Customize the description fields to accurately reflect the nature of each service, whether it’s a one-time project or an ongoing subscription.

- Pricing Models – Adjust the pricing fields to match different billing models, such as hourly rates, flat fees, or per-project charges.

- Payment Terms – Tailor payment terms according to the service, for example, offering discounts for early payments or specifying milestones for project-based work.

- Additional Fees – Include any applicable extra charges, such as travel expenses or equipment rental fees, based on the specifics of the service rendered.

By customizing your billing documents for each service, you ensure that your clients have a clear understanding of what they are being charged for, while also streamlining the process for you as a service provider. This level of personalization adds a professional touch to your business and helps foster long-term client relationships.

How to Protect Your Invoice Templates

Protecting your billing documents is crucial for maintaining confidentiality and preventing unauthorized alterations. These documents often contain sensitive client information, payment details, and pricing structures, making them a potential target for fraud or misuse. By securing your templates, you can ensure that only authorized individuals can access, modify, or share your financial records. There are several strategies you can implement to protect your billing documents effectively.

1. Use Password Protection

One of the simplest ways to secure your files is by setting a password. This prevents unauthorized access to your records, ensuring that only those with the correct credentials can view or edit the content. Most document editing software allows you to add password protection to your files, making this an easy and effective solution for securing sensitive information.

2. Limit Editing Permissions

If you’re sharing your files with colleagues or clients, consider restricting editing rights. You can configure your document settings to allow users to view but not modify the content. This way, you can share necessary information without worrying about accidental or intentional changes.

By implementing these security measures, you can safeguard your financial documents and maintain the integrity of your billing process. Protecting your records not only prevents unauthorized access but also helps you maintain professionalism and trust with your clients.

Common Mistakes to Avoid When Invoicing

When creating billing documents, even small errors can lead to confusion or delayed payments. Whether you are working with clients for the first time or managing long-term contracts, it is important to avoid common mistakes that can undermine your professionalism and cause financial setbacks. Understanding the common pitfalls and how to avoid them can streamline your billing process and improve your relationship with clients.

1. Missing Essential Details

Omitting important information can create misunderstandings and result in delayed payments. Some key details to always include are:

| Essential Information | Why It Matters |

|---|---|

| Client name and contact details | Ensures that the document is linked to the correct recipient. |

| Service descriptions | Clarifies what has been provided and prevents disputes over the terms. |

| Payment due date | Sets clear expectations for when payment is expected. |

| Payment methods | Gives clients the information they need to settle the bill easily. |

2. Not Double-Checking for Accuracy

Simple mistakes like incorrect pricing, calculation errors, or wrong dates can lead to confusion and even cause delays in payment. It is always best practice to double-check all figures and verify that the client’s information is correct before sending the document.

By avoiding these common mistakes, you can ensure smoother transactions, reduce the risk of misunderstandings, and establish a more professional and efficient billing process. Taking time to verify the details not only reflects positively on your business but also helps build trust with your clients.

Tips for Professional Invoicing in Photography

When managing business transactions, clear and professional billing practices are key to ensuring smooth operations and maintaining strong client relationships. A well-structured billing document not only reflects your professionalism but also ensures that your clients know exactly what to expect. Here are some tips to help you elevate your billing process:

- Be Clear and Transparent: Always outline the services you provided in detail. This helps avoid any confusion and ensures your clients understand what they are paying for.

- Set Clear Payment Terms: Define your payment expectations upfront, including when payments are due and what methods of payment are accepted.

- Use Professional Branding: Include your business logo, colors, and other branding elements to make the billing document reflect your brand’s identity.

- Break Down Costs: Provide a breakdown of charges, especially for large projects. This transparency fosters trust and clarity.

- Include Contact Information: Make it easy for clients to get in touch with you regarding questions or payment concerns by including relevant contact details.

- Proofread Your Document: Double-check all details, including client information, amounts, and dates to avoid any costly mistakes.

By following these tips, you ensure that your billing process remains efficient and professional, helping to build long-lasting relationships with clients and ensuring timely payments.

Updating Your Photography Invoice Template

Maintaining an up-to-date billing document is crucial for ensuring consistency and clarity in all your transactions. Regular updates help reflect any changes in your pricing structure, services, or contact details. This process not only keeps you organized but also ensures your clients receive the most accurate and professional documents. Here are some steps to consider when updating your billing structure:

- Review Contact Information: Ensure that your business details, including name, address, email, and phone number, are correct. This is vital for easy communication and timely payments.

- Adjust Pricing and Services: If you’ve made adjustments to your rates or expanded your offerings, update the billing document accordingly. It’s essential to reflect these changes in the document to avoid misunderstandings.

- Enhance Design and Layout: A clean, visually appealing document not only looks professional but also makes the process easier for your clients. Periodically evaluate the layout and design to ensure it aligns with your brand and is user-friendly.

- Ensure Legal Compliance: Verify that your billing document includes any required legal language, tax information, or terms and conditions that comply with local regulations.

- Test Functionality: If you use automated systems or formulas within your billing document, ensure that all fields update correctly and that calculations are accurate.

By regularly updating your billing documents, you ensure that your business remains organized, professional, and responsive to changing needs.