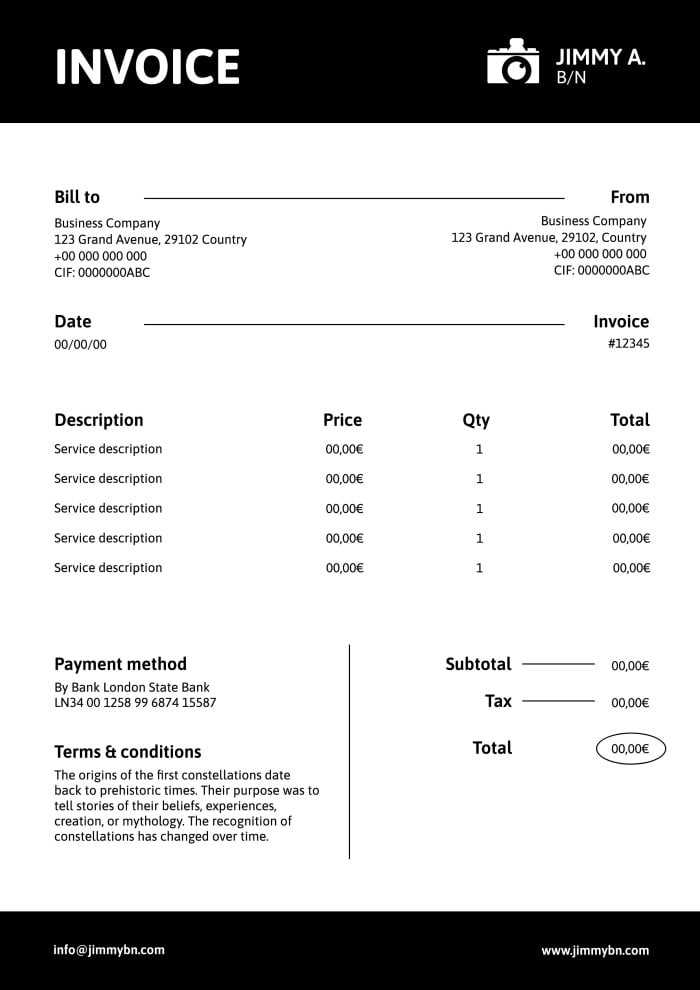

Photography Invoice Template for Easy Billing and Professional Invoices

For any creative business, managing payments and ensuring smooth financial transactions with clients is crucial. Whether you are a freelance artist, designer, or photographer, presenting your work with professionalism extends beyond the project itself–it includes how you handle the business side of things. A clear and structured document that outlines services rendered and payment expectations can significantly improve client trust and streamline your workflow.

Creating a polished and customizable payment document is an essential tool for any professional. It provides clarity, avoids misunderstandings, and ensures that both parties are on the same page regarding pricing, terms, and deadlines. A well-organized billing system helps maintain healthy financial management, especially when working with multiple clients or managing various projects simultaneously.

In this article, we’ll explore how you can craft the perfect document to fit your needs, with guidance on the most important elements to include, design tips, and the best practices for ensuring you get paid on time. A comprehensive and easy-to-use form can save time, reduce errors, and help you keep track of your earnings effortlessly.

Photography Invoice Template Guide

Creating a professional billing document is essential for any creative professional offering services to clients. It ensures clarity and transparency in the business relationship while providing a structured way to track payments. Whether you’re working on a single project or managing multiple assignments, a well-organized billing statement can help maintain consistency and reduce the risk of misunderstandings.

The key to an effective document lies in the details. It’s important to include all relevant information such as the client’s contact details, a breakdown of services rendered, agreed-upon pricing, payment terms, and due dates. A clear layout not only makes the statement easy to understand but also showcases your professionalism and helps foster trust with clients.

In this guide, we’ll cover the crucial components to include, how to format the document, and tips on how to personalize it for your specific needs. By the end, you’ll be equipped to create a document that simplifies the billing process, ensures timely payments, and reflects your professional brand.

Why You Need a Photography Invoice

Having a well-structured billing document is essential for any creative professional. It serves as a formal record of the services provided, ensuring that both the client and the service provider are on the same page regarding expectations, pricing, and payment terms. Without a clear, written agreement in the form of a payment request, misunderstandings and delays can arise, potentially affecting your business reputation and cash flow.

A proper billing record also plays a crucial role in maintaining organized financial documentation for tax purposes. It provides a traceable history of your income, making it easier to manage your business finances and comply with tax regulations. Moreover, it demonstrates professionalism and can help build trust with clients by showing that you have a clear, transparent process in place.

Here’s a basic breakdown of the elements to include in your billing statement:

| Component | Description |

|---|---|

| Client Information | Contact details of the client receiving the service. |

| Service Breakdown | Detailed list of services provided, including quantities and descriptions. |

| Pricing | Amount due for each service rendered, along with any applicable taxes. |

| Payment Terms | Due date, late fees, and accepted payment methods. |

| Additional Notes | Any relevant additional information or special instructions. |

By incorporating all these elements, you can create a professional and effective document that ensures timely payments and avoids disputes with clients.

How to Create a Custom Invoice

Designing a tailored billing document allows you to reflect your unique business style while ensuring that all essential information is included. A customized payment statement not only makes your financial transactions more professional but also helps clients easily understand the charges and terms. Creating your own document gives you flexibility, allowing you to choose the layout, details, and format that work best for you and your clients.

To start, you’ll need to include key components that make the document clear, concise, and legally binding. Here’s a simple guide to help you structure your own customized payment request:

| Section | Description |

|---|---|

| Your Contact Information | Include your business name, address, phone number, and email to ensure clients can easily reach you. |

| Client Information | Provide your client’s name, address, and contact details for reference. |

| Services Rendered | List the specific tasks completed, including quantities, hours worked, or any other relevant details for transparency. |

| Cost Breakdown | Detail the pricing for each service provided, including taxes, discounts, or additional charges if applicable. |

| Payment Terms | Clearly state the total amount due, payment methods accepted, and the due date. |

| Notes and Instructions | Include any important additional information, such as payment instructions or cancellation policies. |

Once all the key elements are in place, choose a clean and simple design that aligns with your brand. Whether you use a word processor, an online tool, or professional software, your goal should be to create a document that is easy to read and well-organized. By doing this, you ensure that clients can process payments without confusion, keeping your business running smoothly.

Essential Details to Include in Invoices

When creating a payment document for your services, it’s important to include all the necessary information that ensures clarity and professionalism. A well-crafted document not only outlines the work completed but also serves as a formal request for payment, making it easier for both you and your client to keep track of transactions. Including key details is vital for avoiding confusion and ensuring timely payments.

Client and Service Information

The most basic but essential details in any billing document are the client’s and service provider’s contact information. This ensures that both parties can easily refer back to the document if there are any questions or concerns. Additionally, a clear description of the services performed, including dates, hours worked, or items delivered, helps the client understand exactly what they are being charged for.

Payment Terms and Breakdown

Providing a breakdown of the total cost, including individual prices for each service or item, is essential for transparency. Clearly state the total amount due and specify the payment terms–such as due dates, late fees, or discounts for early payment. Including the payment methods you accept will help facilitate a smooth transaction. These details prevent misunderstandings and provide clear expectations for both you and your client.

Choosing the Right Photography Invoice Template

Creating a streamlined document for your work transactions ensures clarity and professionalism. The format you select can impact how your clients perceive your business and can make the entire payment process easier and more organized. Considering layout, detail, and customization options can help you find the best fit for your needs.

Essential Elements to Include

A successful design should contain core elements that make transactions clear. Key details include client and business information, itemized services, dates, and final amounts. Including these details can help avoid misunderstandings and ensure clients have all necessary information.

Organizing Your Document

A structured layout helps clients quickly locate the information they need

Freelance Photographers and Invoice Management

Managing financial documentation effectively is essential for independent creatives who handle multiple projects and clients. Keeping accurate records not only supports business growth but also helps maintain professional relationships by ensuring clear communication and reliable payment tracking.

For those working on a freelance basis, organizing each transaction with clarity can simplify accounting and streamline tax preparation. Consistent record-keeping lets freelancers focus on their creative work without the stress of financial inconsistencies. It’s essential to establish a system that allows flexibility, yet is detailed enough to capture all relevant data.

Having a well-organized approach to financial documents can make the billing process smooth and reduce misunderstandings with clients. By focusing on transparency and accuracy, freelancers can build trust and create a solid foundation for sustainable business practices

Common Mistakes in Photography Invoices

Crafting clear and accurate billing documents is crucial for successful client interactions. Small errors in these records can lead to payment delays, misunderstandings, and even impact a professional’s reputation. Knowing the most common pitfalls can help in creating precise documents that reflect the quality of your services.

Missing Key Details – Failing to include essential information such as dates, descriptions, or payment terms can confuse clients and slow down the payment process. Ensure that each document is thorough and includes all necessary details for easy reference.

Unclear Cost Breakdown – Clients should be able to understand exactly what they are being billed for. An itemized list with clear descriptions of each service provided helps build transparency and trust. Without this clarity, clients may question or dispute the charges.

Inconsistent Formatting

How to Set Your Photography Rates

Determining fair rates for your work is essential for building a sustainable and profitable business. Setting prices that reflect your experience, skill, and the value provided to clients helps establish credibility and ensures that both parties are satisfied with the service agreement. Considering factors like project complexity, time invested, and expenses will guide you in developing a well-rounded pricing structure.

Below is a sample rate breakdown that includes common services and typical cost ranges to consider when establishing your rates:

| Service | Rate Range | |||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Basic Session (1-2 hours) | $100 – $300 | |||||||||||||||||||||||||||||||||||

Editing and Retouching (per hour

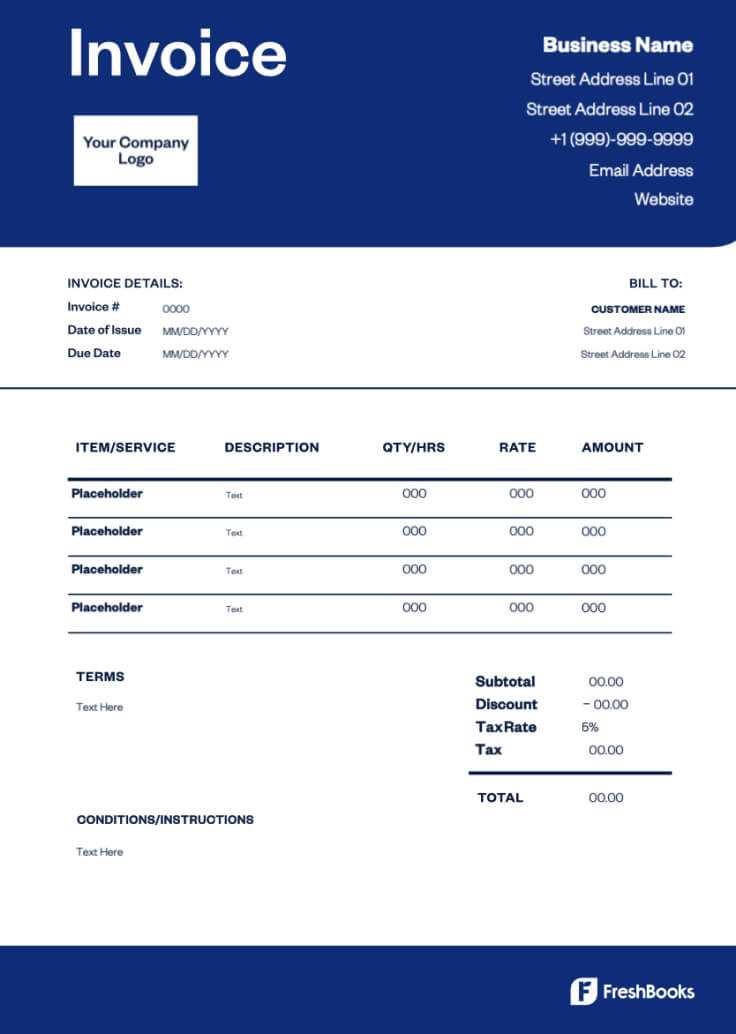

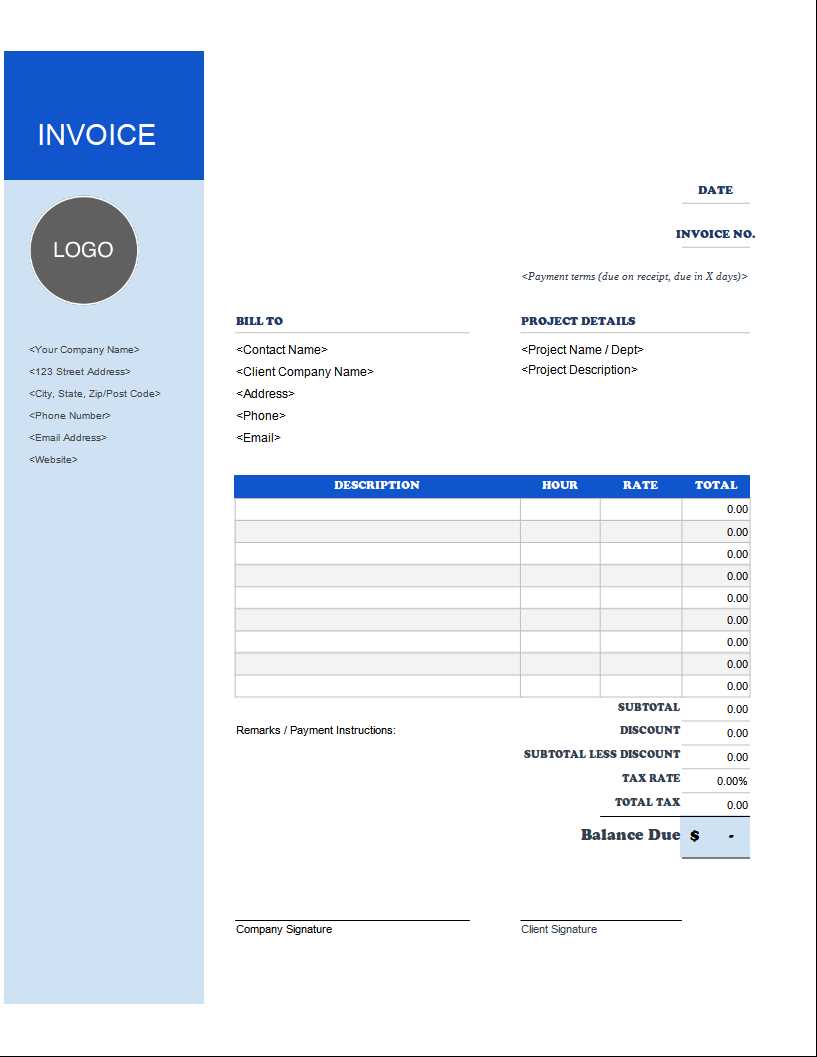

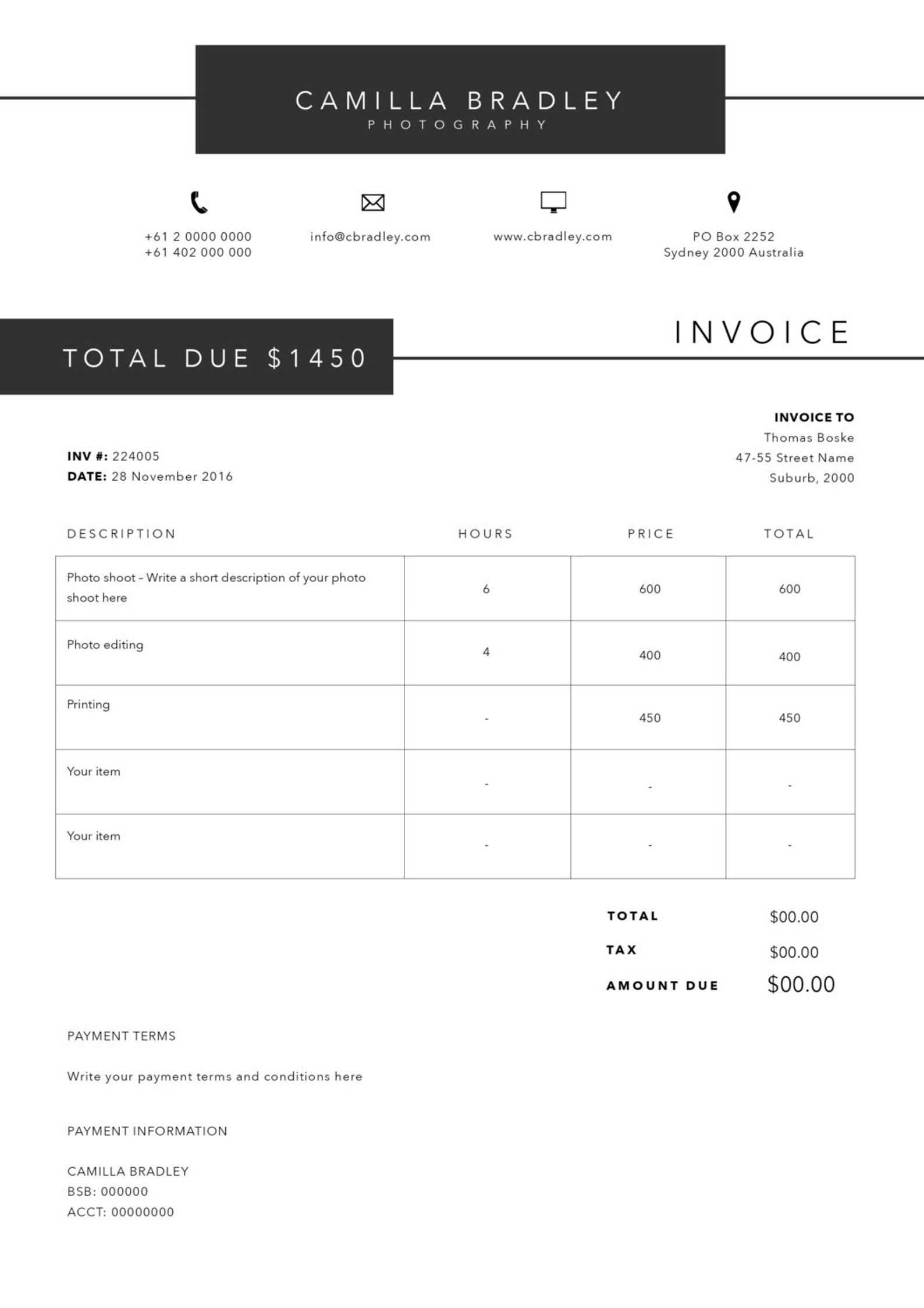

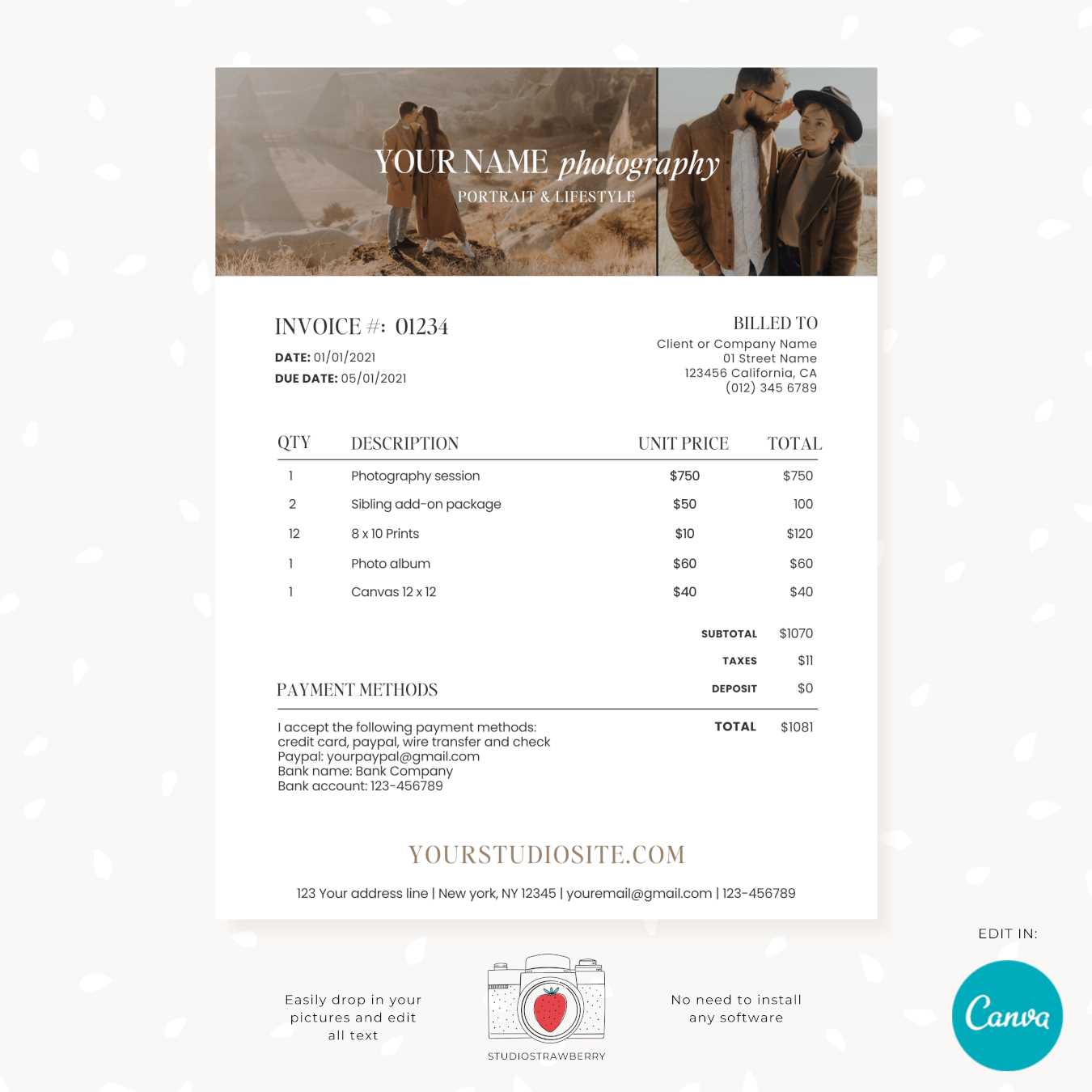

Invoice Payment Terms ExplainedClear payment terms are essential for maintaining smooth business transactions and ensuring that all parties understand their obligations. Establishing specific guidelines for when and how payments are due helps reduce misunderstandings and supports reliable cash flow management. Choosing the right terms can make a significant difference in client relations and overall financial stability. Standard Payment PeriodsCommon payment periods include Net 30, Net 15, or even Net 7, which indicate the number of days a client has to complete the payment after receiving a bill. Specifying a timeframe helps clients plan their expenses and gives you a clear schedule for expected funds. Choosing shorter terms may support faster payments, while longer terms might suit established clients who require flexibility. Early Payment Discounts and Late FeesIncentivizing timely payments with early payment discounts can be effective in encouraging clients to set Design Tips for Photography InvoicesCreating a visually appealing and well-organized billing document can enhance your professional image and make it easier for clients to understand the details. A thoughtfully designed format not only reflects your brand but also helps simplify the transaction process, reducing the chance of confusion and fostering smoother payments. Maintain a Clean and Simple LayoutTo ensure readability, opt for a clean, uncluttered layout with sufficient white space. Use a consistent font and organize information in a logical sequence, guiding the client through each section. A clear structure helps clients quickly find essential details, contributing to a seamless experience. Include Branding Elements

Adding subtle branding elements such as your logo and brand colors can personalize the document and make it instantly recognizable. Below is an example layout th Design Tips for Photography InvoicesCreating a visually appealing and well-organized billing document can enhance your professional image and make it easier for clients to understand the details. A thoughtfully designed format not only reflects your brand but also helps simplify the transaction process, reducing the chance of confusion and fostering smoother payments. Maintain a Clean and Simple LayoutTo ensure readability, opt for a clean, uncluttered layout with sufficient white space. Use a consistent font and organize information in a logical sequence, guiding the client through each section. A clear structure helps clients quickly find essential details, contributing to a seamless experience. Include Branding ElementsAdding subtle branding elements such as your logo and brand colors can personalize the document and make it instantly recognizable. Below is an example layout that organizes key details effectively:

Using a structured table layout not only clarifies the charges but also provides a professional touch that aligns with the quality of your work. Using Software for Invoice CreationAutomating the process of creating professional billing documents can save time and reduce the chances of human error. Digital tools provide customizable features that make it easier to handle multiple clients, keep records organized, and ensure consistency in each document sent. Selecting the right software can simplify your workflow and allow you to focus more on your creative projects. Benefits of Using Digital Tools

|

||||||||||||||||||||||||||||||||||||