Photography Billing Invoice Template for Your Business

As a professional in the creative industry, managing payments and keeping financial records organized is essential for maintaining smooth business operations. Whether you are a freelancer or running a small studio, having a structured way to document charges and payments ensures clarity for both you and your clients. An efficient system helps avoid misunderstandings and keeps your business running smoothly.

One of the most effective tools for this is a well-organized document that clearly outlines the services provided, amounts due, and payment instructions. Customizable forms tailored to your specific business needs can save time and effort, making transactions more professional and straightforward. By using a structured approach, you can focus more on your craft while the administrative side of your business remains efficient and hassle-free.

In this guide, we will explore various aspects of creating and using such a document, from the essential components to tips for customization. With the right approach, you can make your financial dealings as polished and professional as the work you deliver to your clients.

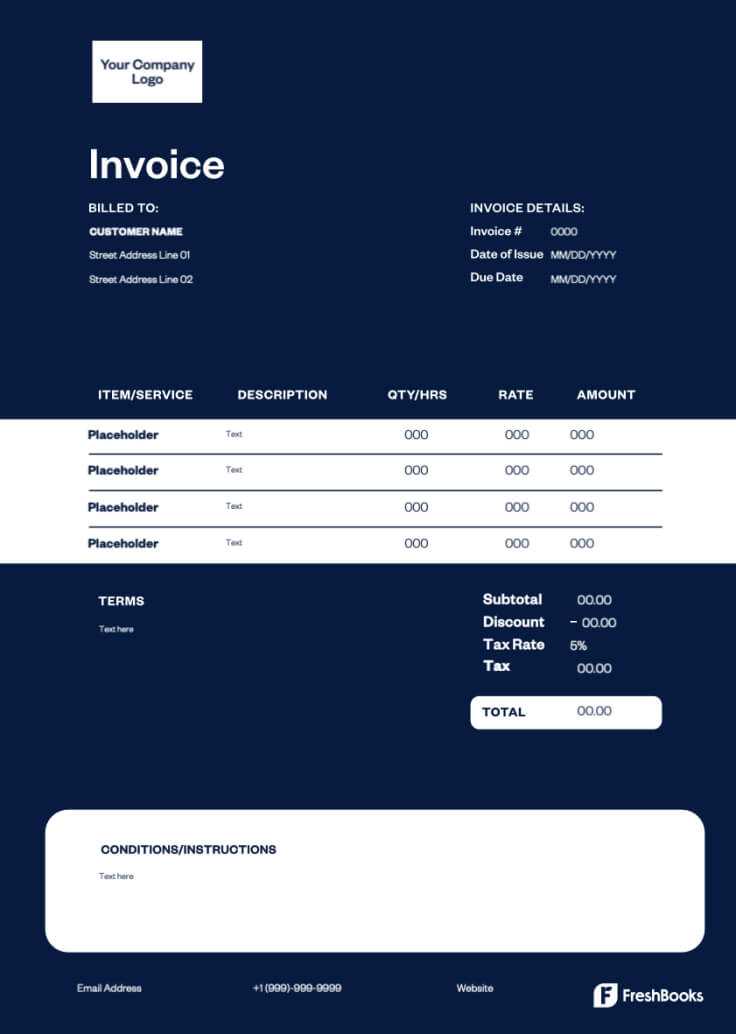

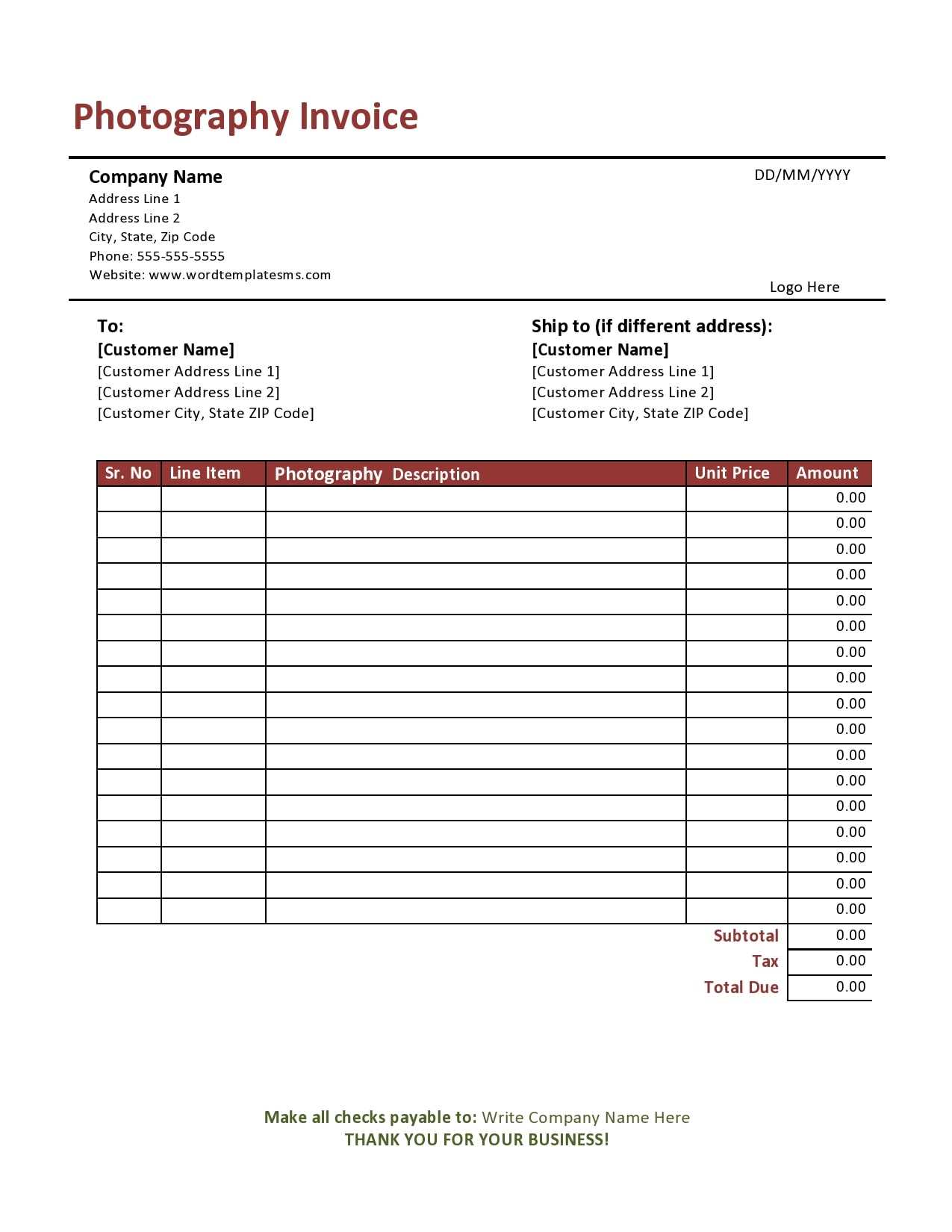

Photography Billing Invoice Template Overview

Managing payments effectively is crucial for any creative professional. A well-organized document that outlines the services rendered, the corresponding fees, and payment terms ensures both the client and the provider have a clear understanding of the transaction. This tool helps streamline the process, ensuring all necessary details are accounted for, and reducing the chances of confusion or errors.

For those in the creative industry, using a structured format to request payments not only enhances professionalism but also saves time. With customizable options available, you can create a document that fits your business style and operational needs. A carefully designed document reflects the quality of your work and promotes trust with clients.

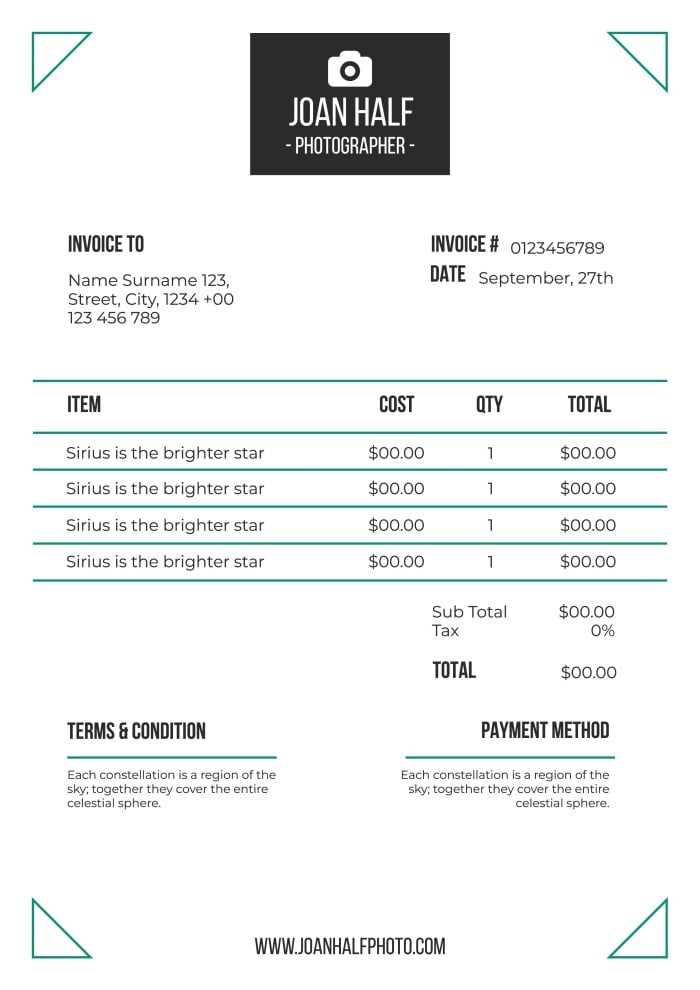

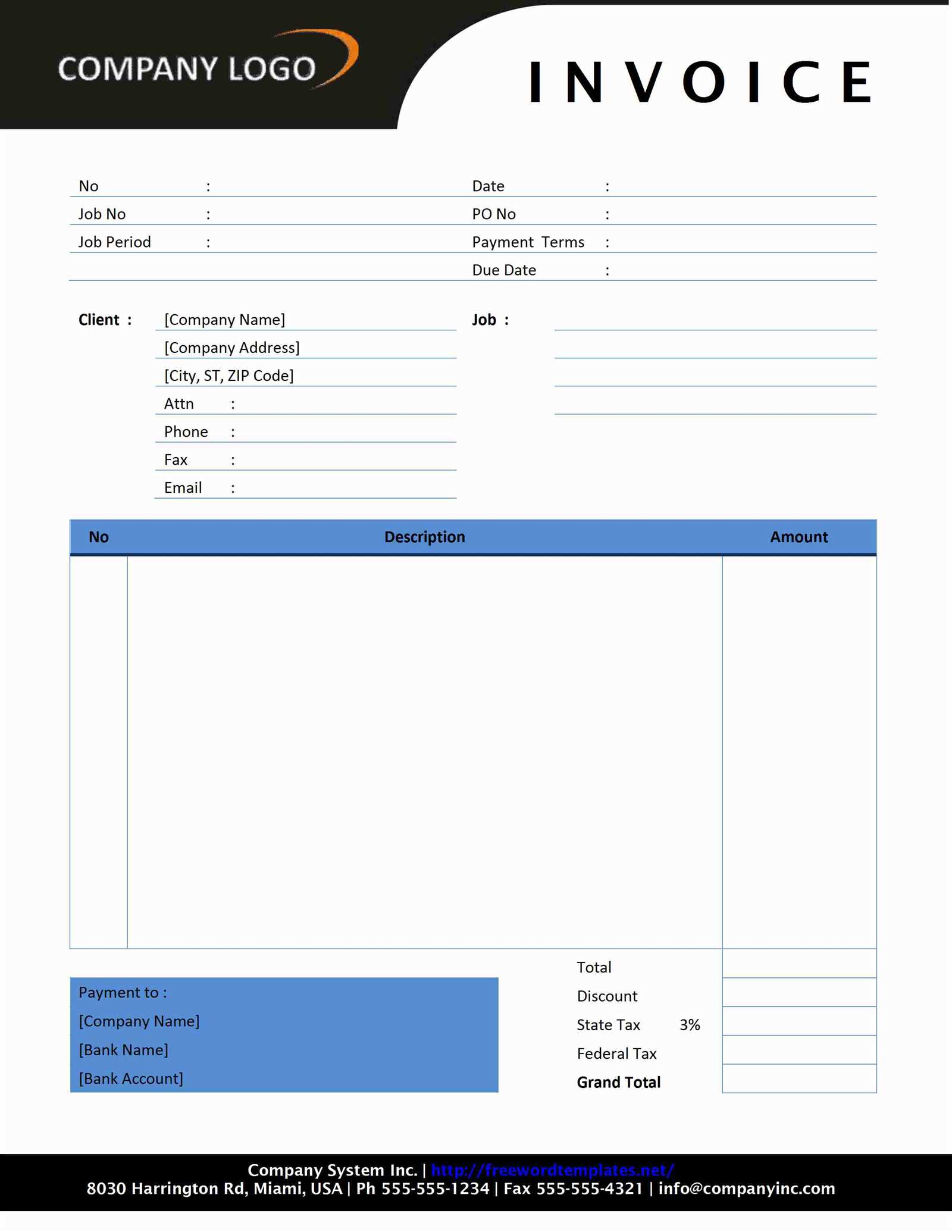

Below is an overview of the key elements typically included in such a document:

| Section | Description |

|---|---|

| Contact Information | Includes your name, business name, and contact details, along with the client’s information. |

| Service Description | A clear outline of the work done, including any specific services provided during the session or project. |

| Payment Terms | Details regarding the total cost, payment due dates, and any applicable taxes or additional fees. |

| Due Date | Specifies when the payment is expected, helping avoid delays. |

| Payment Instructions | Information on how to submit payment, including bank details or preferred online payment methods. |

By using a standardized structure, you ensure that all critical details are captured in a professional manner. This not only helps with internal organization but also builds a reputation for your business as transparent and trustworthy.

Why Use a Photography Invoice Template

For creative professionals, staying organized is key to managing a successful business. A structured approach to requesting payments helps ensure that every detail is accounted for, and that both you and your clients are clear about the financial terms. Using a pre-designed form to outline charges makes the entire process more efficient and professional.

When you adopt a standardized format for financial transactions, you eliminate confusion and reduce the time spent on paperwork. Instead of starting from scratch each time, a ready-made structure allows you to simply fill in the relevant details, leaving you with more time to focus on your creative work.

Consistency and Professionalism

Using a predefined structure for all your financial requests ensures consistency across all transactions. This consistency helps establish a professional reputation, as clients will recognize that you have a clear, organized way of managing payments. Having a uniform approach also makes it easier to track previous transactions and maintain accurate records for tax purposes.

Time-Saving Benefits

By relying on a customizable structure, you save valuable time that would otherwise be spent drafting new documents for every project. You only need to input the specific details for each client or service, reducing administrative overhead. Efficiency is key, especially when you’re juggling multiple projects at once.

Ultimately, a well-structured form helps you maintain a seamless workflow and ensures that payments are processed on time, making your business run more smoothly. Streamlining your financial documentation not only improves your efficiency but also enhances your client’s experience.

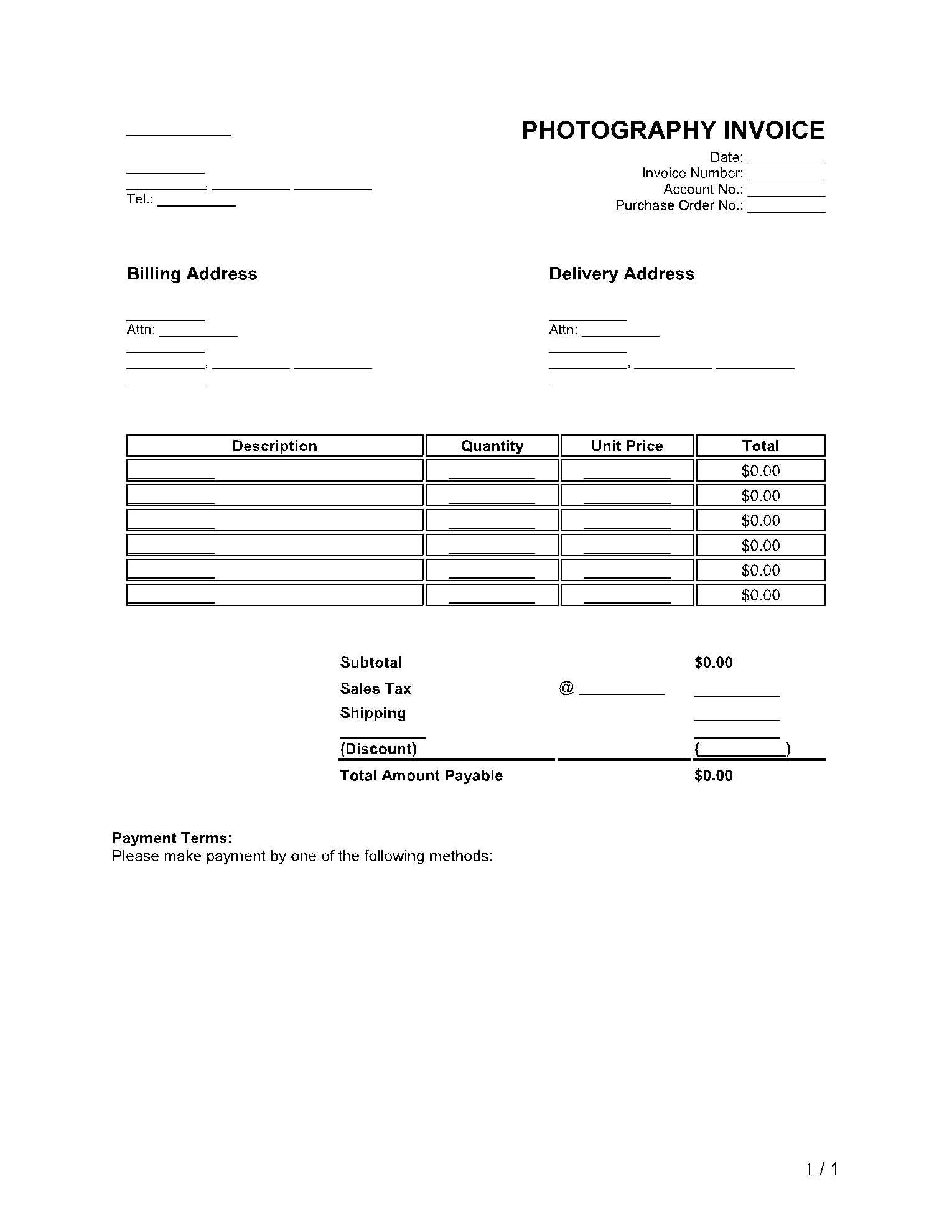

Key Elements of an Invoice

A well-crafted payment request document is essential for ensuring clarity and professionalism in financial transactions. To avoid misunderstandings, it is important to include specific details that outline the services provided, the amount owed, and the terms of payment. A comprehensive record not only helps with transparency but also contributes to smooth business operations.

Here are the core components that should be included in every payment request document to ensure that all necessary information is communicated effectively:

- Contact Information – The document should clearly display both your business details (name, address, phone number) and the client’s information, making it easy for both parties to reference.

- Service Description – An accurate description of the work completed, including specific tasks, hours worked, or packages offered, provides clear insight into what the client is paying for.

- Total Amount Due – This should be a clear breakdown of the total cost, including any applicable taxes, discounts, or additional fees, to avoid confusion.

- Due Date – Specifying when the payment is expected helps set clear expectations and encourages timely settlement.

- Payment Instructions – Clear instructions on how the client can make the payment (bank transfer details, online payment methods, etc.) help avoid delays.

- Unique Reference Number – Including a reference number for each request can help both you and your client keep track of transactions more easily.

By including these key elements, you create a clear, professional document that fosters trust and reduces the risk of payment-related issues.

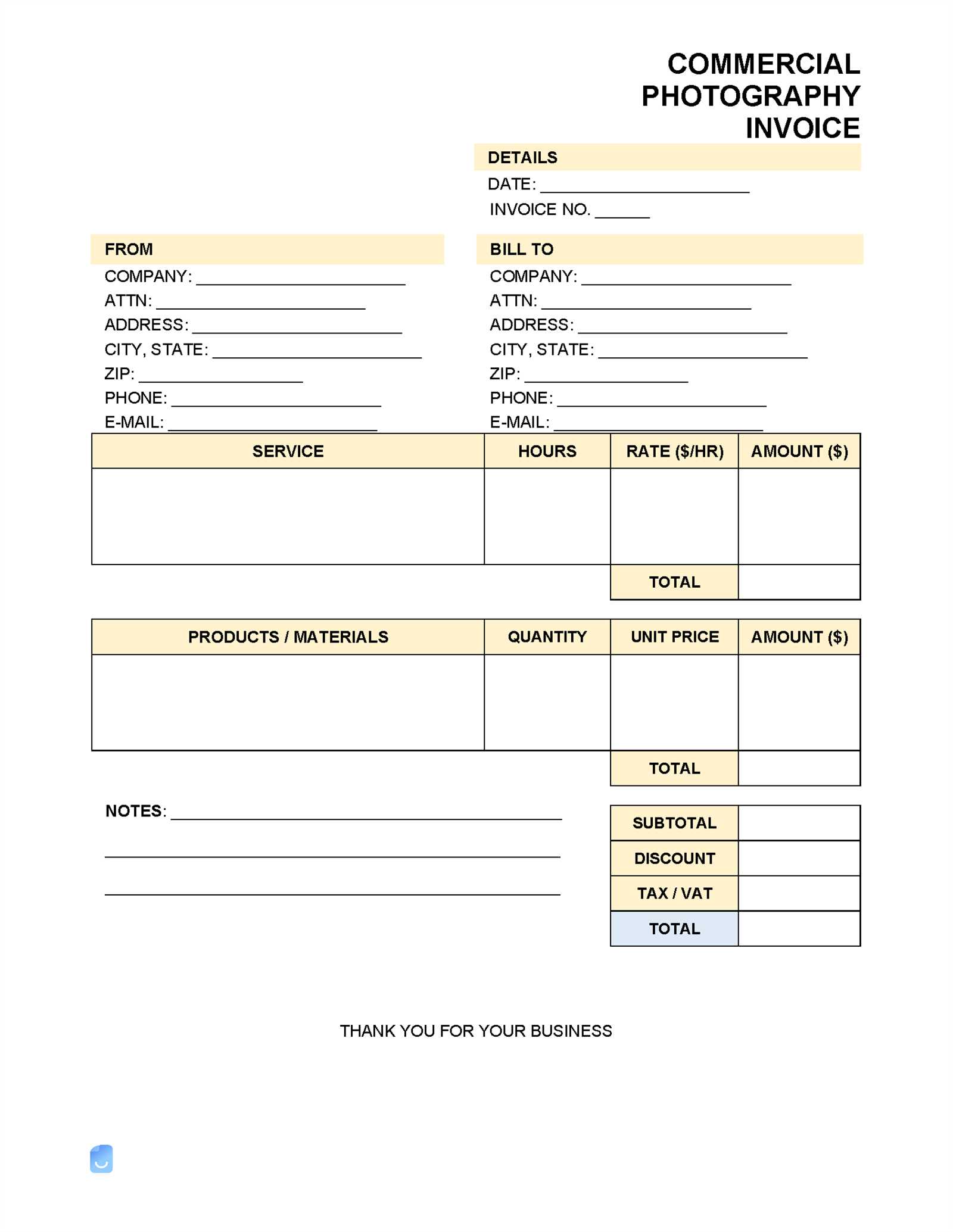

Customizing Your Payment Request Document

Every business has unique needs when it comes to handling financial transactions. Customizing your payment request form allows you to reflect your brand’s identity, adjust for specific services, and meet the expectations of your clients. Tailoring the structure of this document ensures that it is not only functional but also aligns with your professional style.

Here are several ways you can personalize your payment request document to suit your business needs:

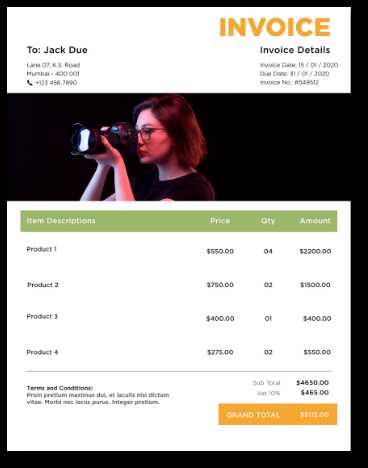

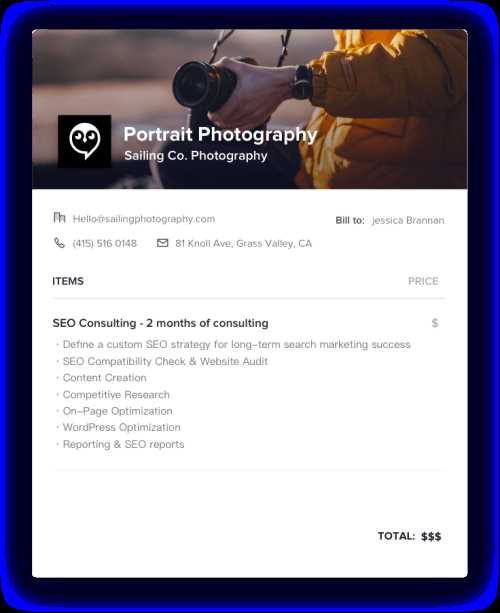

Branding and Design

- Logo and Colors – Incorporating your business logo and brand colors creates a cohesive look and reinforces your identity with every transaction.

- Fonts and Layout – Choose fonts and formatting that reflect the tone of your brand. A modern, clean design can help convey professionalism, while a more creative layout might suit an artistic business.

Adding Specific Sections

- Service Customization – If you offer different service packages or custom solutions, ensure that these are clearly listed. You can include detailed descriptions or bullet points outlining what each service entails.

- Discounts and Promotions – Include fields to apply discounts or promotional offers, so clients are aware of any savings they’re receiving.

- Client References or Testimonials – Adding a brief testimonial or reference section can serve as a marketing tool and remind your clients of your past work together.

Customizing this document doesn’t just make it more professional, it also allows you to build a stronger connection with clients by ensuring that your requests are clear, aligned with your brand, and easy to understand.

Free vs Paid Payment Request Forms

When it comes to choosing a structured document for requesting payments, businesses often face the decision between using a free version or opting for a premium option. Both free and paid formats have their advantages, but the right choice largely depends on your specific needs, the complexity of your business, and the level of customization you require.

Each type of option offers distinct features, and understanding the differences can help you make an informed decision. Below, we’ll compare the pros and cons of free and paid forms:

Free Payment Request Forms

- Cost-Effective – As expected, free options require no upfront investment, making them ideal for businesses just starting out or those with limited budgets.

- Basic Features – These documents typically include the essential fields, such as service description, total amount, and payment instructions. However, they may lack advanced customization features or specialized design options.

- Pre-Designed Layouts – While free forms are convenient, they may come with limited design flexibility. Customization options may be minimal, meaning you might not be able to fully align the form with your brand style.

Paid Payment Request Forms

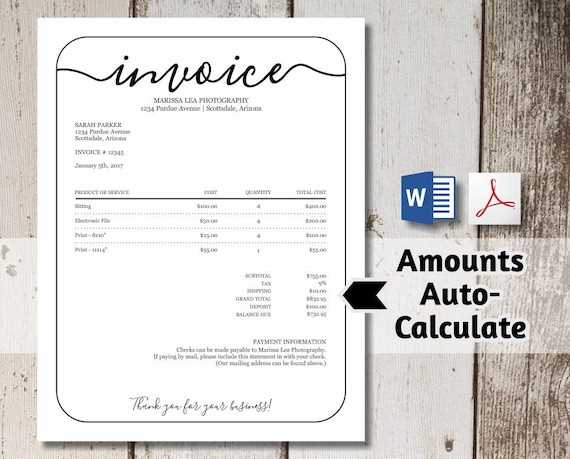

- Advanced Features – Premium options often come with a range of additional features, such as automatic calculations, tax inclusions, or multi-currency support. These forms are tailored to offer more comprehensive solutions for businesses with complex needs.

- Full Customization – Paid versions usually offer greater flexibility, allowing you to adjust design elements, add company branding, and tailor the document layout to your exact specifications.

- Customer Support – Many paid solutions include customer service support, offering assistance with troubleshooting or customizing the document as needed.

Ultimately, the decision between free and paid options will depend on the size of your business and the complexit

How to Add Taxes on Payment Requests

In many cases, businesses need to include taxes in the final amount due from clients. Accurately calculating and displaying these charges is essential for maintaining transparency and ensuring compliance with local regulations. By properly adding taxes to your financial documents, you can avoid misunderstandings and ensure that your payment requests are clear and legally correct.

Here are some steps you can follow to correctly add taxes to your payment request:

- Determine the Applicable Tax Rate – Before adding taxes, ensure that you know the correct tax rate for your location or the location of your client. This could be a general sales tax, a value-added tax (VAT), or another type of levy based on your jurisdiction.

- Calculate the Tax Amount – To calculate the tax, multiply the subtotal of the services or goods by the applicable tax rate. For example, if your subtotal is $500 and the tax rate is 10%, the tax would be $50. Add this amount to the total due.

- List the Tax Separately – To avoid confusion, it is important to show the tax as a separate line item. This allows your client to clearly see the amount being charged for tax and the total cost of the services.

- Include a Tax Identification Number – Some regions require that businesses include their tax identification number (TIN) on financial documents. This helps to verify the legitimacy of your business and ensures proper tax reporting.

- Provide a Breakdown of the Calculation – Especially for larger transactions, it’s helpful to include a breakdown of how the tax was calculated. This adds clarity and ensures your client understands how the final amount was determined.

By following these steps, you can ensure that taxes are properly included in your payment requests, avoiding mistakes and potential issues with clients or tax authorities.

Incorporating Payment Terms in Payment Requests

Clear payment terms are essential for ensuring both you and your client have a mutual understanding of the expectations surrounding financial transactions. By specifying when and how payment should be made, you can avoid confusion and potential delays. Including these terms in your financial documents is a professional practice that helps establish trust and sets clear boundaries for both parties.

Here are some key elements to consider when adding payment terms to your financial requests:

- Due Date – Specify when the payment is expected to be made. Common terms include “Due upon receipt” for immediate payments or specific dates like “Due within 30 days of receipt.” This helps the client plan accordingly and ensures timely payment.

- Late Payment Fees – To encourage timely payments, consider adding a clause for late fees. For example, “A 5% fee will be charged for payments received after the due date.” This provides an incentive for clients to settle their bills on time.

- Accepted Payment Methods – Clearly outline the methods by which you accept payments. Whether it’s bank transfer, credit card, or online payment systems, providing this information upfront makes the process smoother and eliminates confusion.

- Deposit Requirements – If you require a deposit before beginning work, include this detail. For example, “A 50% deposit is required before work begins, with the remaining balance due upon completion.” This ensures that both parties are clear on the payment structure from the outset.

- Currency and Taxes – If you’re working with international clients or offering services in multiple regions, clearly specify the currency and any taxes that will apply. This ensures both parties know the total amount and prevents misunderstandings.

Including these payment terms not only helps manage expectations but also protects your business by setting clear guidelines for your clients. A well-defined payment structure encourages smoother financial interactions and minimizes the risk of late or missed payments.

How to List Services in Payment Requests

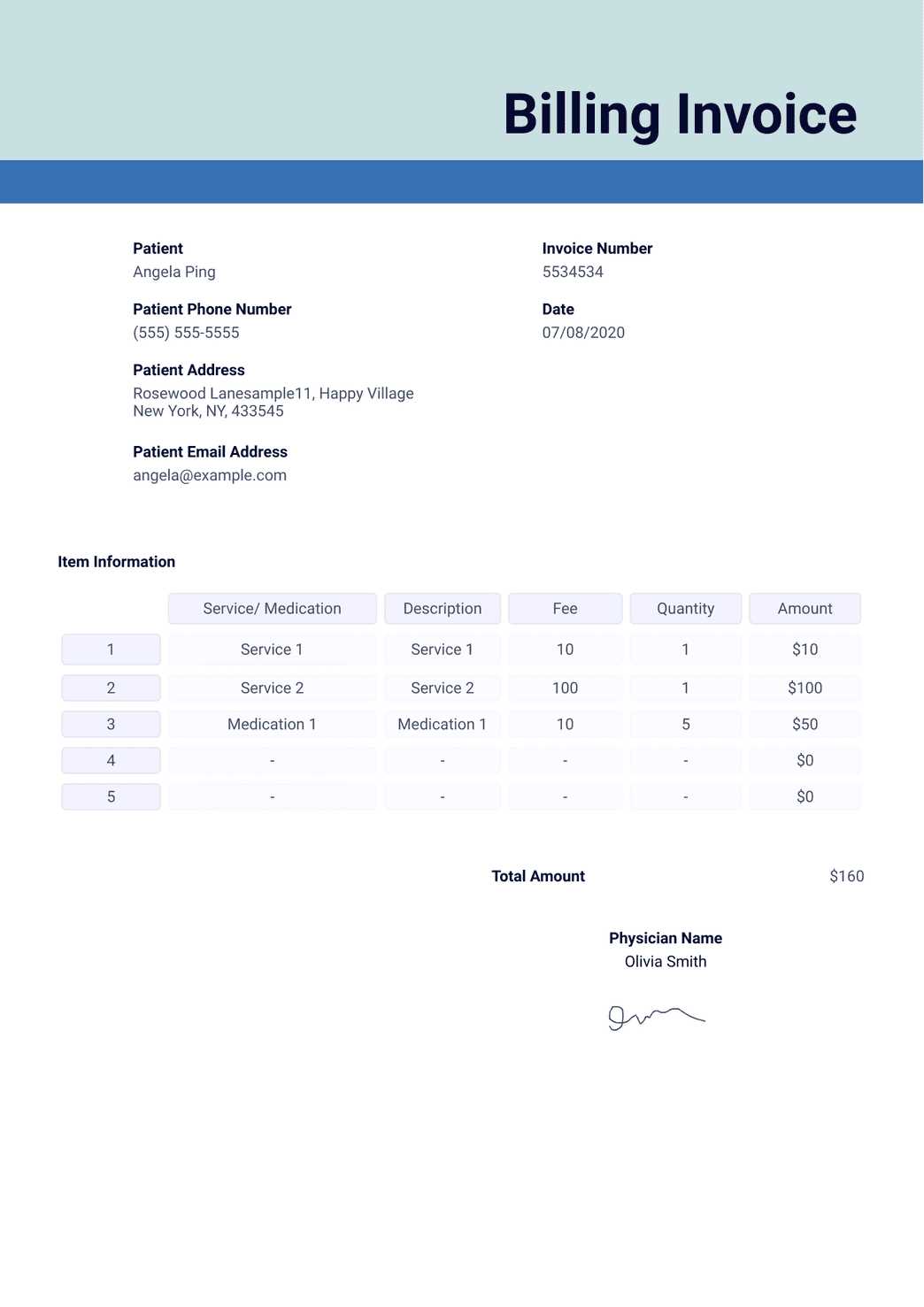

Accurately listing the services provided is crucial for maintaining clarity and transparency with clients. By clearly outlining the work you’ve completed, you ensure that the client understands exactly what they are paying for, avoiding confusion and potential disputes. This detailed breakdown helps to establish professionalism and keeps both parties aligned on the terms of the agreement.

When listing services on a payment request, here are some key steps to follow:

- Be Specific – Clearly describe each service provided. Instead of using general terms like “shooting,” break it down into specifics, such as “Event photography for 4 hours” or “Portrait session with 20 edited images.” The more specific you are, the easier it is for the client to understand the value of each service.

- Include Quantity and Time – If applicable, list the duration of each service or the quantity of items delivered. For example, “5 hours of shooting” or “10 high-resolution edited images.” This helps the client understand how their total cost is calculated.

- Group Related Services – If you offer packages or bundles, group related services together to give a clear overview. For example, “Wedding package: 6 hours of coverage, 1 album, and 100 edited images.” This method makes it easier for clients to see what’s included in each package or deal.

- Use Clear Language – Avoid jargon or technical terms that the client may not understand. Keep the descriptions simple and straightforward, focusing on what the client needs to know about the service provided.

- Highlight Additional Services – If you offer extras such as rush editing, travel, or additional prints, make sure these are listed separately with their associated fees. This ensures clients are aware of any optional services they may choose to add.

By following these guidelines, you can create a detailed, easy-to-understand list of services that reflects the true value of your work. This not only helps prevent misunderstandings but also reinforces your professionalism and commitment to transparency with your clients.

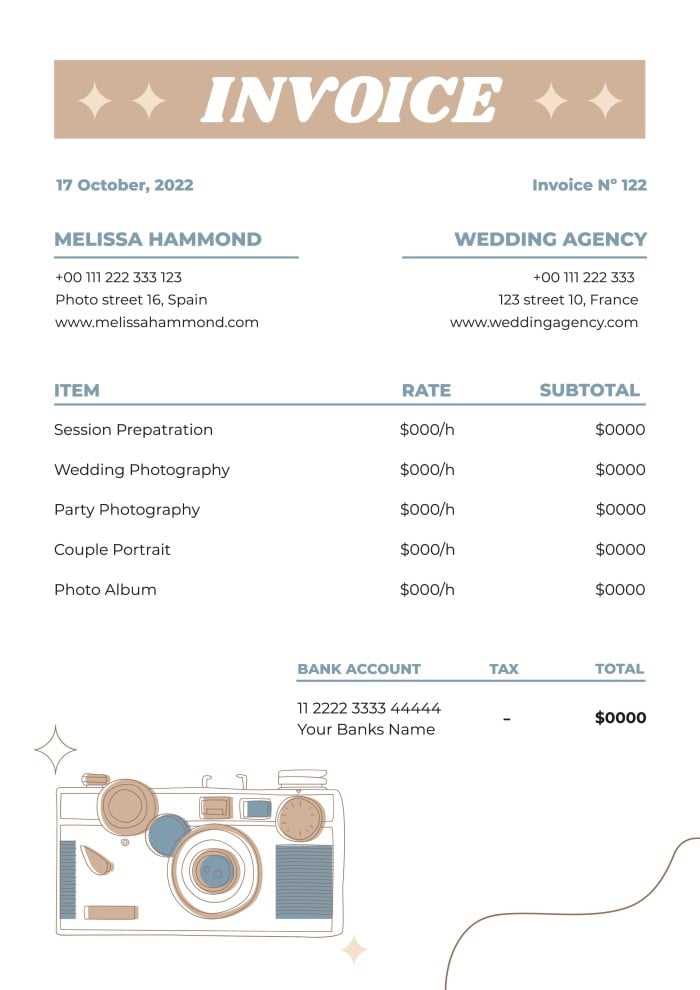

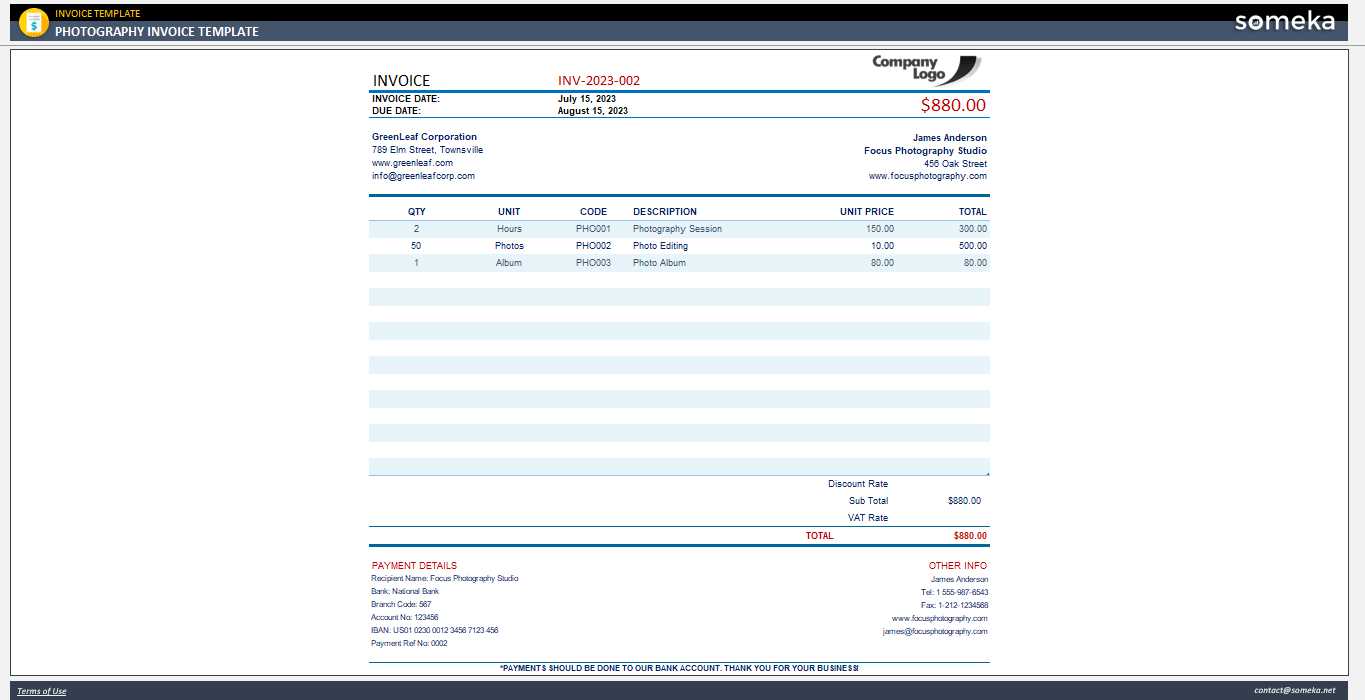

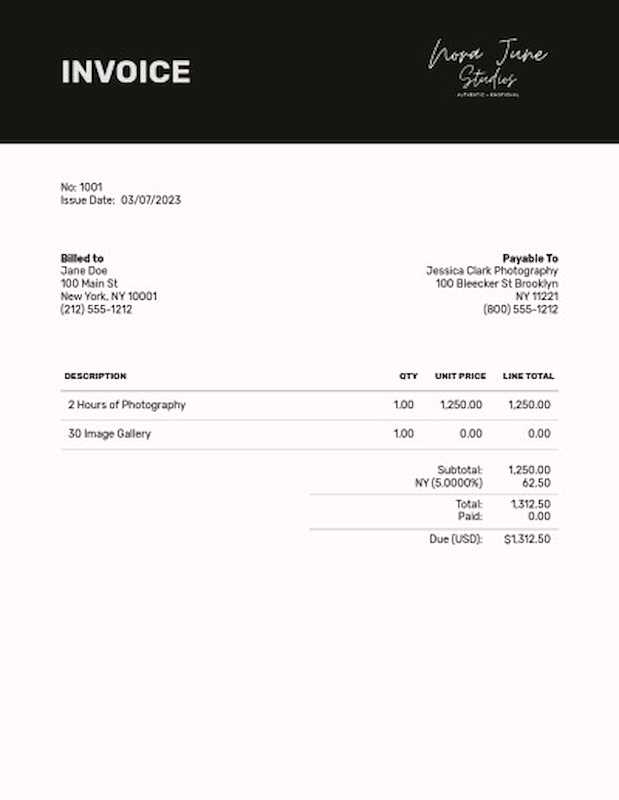

Invoicing for Photo Packages vs Hourly Rates

When it comes to requesting payments for your services, there are two common approaches: charging by the package or by the hour. Both methods have their advantages, and the choice often depends on the nature of the project, the preferences of your clients, and the structure of your business. Understanding how to structure each method effectively will help you present clear and professional payment requests.

Below, we’ll compare the two approaches and discuss when each might be more appropriate:

Invoicing for Packages

When you offer bundled services, charging a flat rate for a package can provide clarity and convenience for both you and your clients. A package typically includes multiple services or features that are priced together at a discounted rate. This method is often preferred for events, such as weddings or portrait sessions, where clients need a comprehensive set of services.

Invoicing for Hourly Rates

Charging by the hour is ideal for projects where the amount of time spent varies or when clients only need a specific part of your services. This approach allows flexibility, as clients only pay for the hours you actually work, making it suitable for shorter or more unpredictable assignments.

| Method | Advantages | When to Use |

|---|---|---|

| Photo Packages | Clear pricing for bundled services, easier for clients to budget, and often includes discounts for multiple services. | For events, weddings, or projects with defined services (e.g., a full-day event or a portrait session with a set number of photos). |

| Hourly Rates | Flexible for varying work hours, clients pay only for the time spent, and ideal for smaller or one-off sessions. | For shorter assignments, such as headshots, consultations, or projects with undefined time requirements. |

Choosing between photo packages and hourly rates depends on the nature of your services and how you want to manage your client relationships. Packages provide simplicity and value, while hourly rates offer flexibility and precision in charging for your time. Both methods, when clearly explained, can help you build stronger business practices and improve client satisfaction.

Ensuring Accuracy in Payment Requests

When it comes to requesting payment for your services, accuracy is crucial. Providing precise details helps avoid misunderstandings and fosters trust between you and your clients. Ensuring that all the information in your financial documents is correct not only supports professional relationships but also helps maintain the smooth flow of business operations. From the services rendered to the total amount due, each element needs to be clear and accurate to guarantee timely payments.

Here are several steps to ensure the accuracy of your financial documents:

- Double-Check Service Descriptions – Ensure that the services listed are detailed and match the work you’ve completed. Avoid vague descriptions and be specific about what was delivered, including the hours worked or the number of deliverables provided.

- Verify Pricing and Rates – Confirm that the pricing structure is correct, including any agreed-upon discounts or promotional rates. Double-check that the correct tax rates have been applied and that they align with current local tax laws.

- Review Dates and Deadlines – Ensure the dates for the work performed and the payment due date are accurate. Errors in dates can cause confusion and delay payments.

- Confirm Client Details – Make sure that all client information, including their name, address, and contact details, is correct. This ensures that the document is addressed properly and that any correspondence reaches the right person.

- Use Automated Calculations – To avoid manual errors, use tools that automatically calculate totals, taxes, and discounts. These tools help reduce human error and ensure the final amount due is accurate.

By paying attention to these details and reviewing your documents before sending them, you can minimize the risk of mistakes. Accuracy is key to keeping your financial transactions smooth, professional, and on time.

Common Mistakes in Payment Requests

When creating financial documents for clients, small errors can lead to confusion, delays in payment, or even lost business opportunities. These mistakes are often overlooked but can have a significant impact on the overall professionalism and efficiency of your operations. Recognizing and correcting common issues in these documents can help ensure smoother transactions and better relationships with your clients.

Common Errors to Avoid

- Missing or Incorrect Contact Information – Failing to include accurate client or business details can cause communication issues and delay payment processing. Always double-check names, addresses, and contact numbers.

- Unclear Service Descriptions – Vague or ambiguous descriptions of services can lead to misunderstandings. Clearly specify what was provided, the time spent, and any additional items delivered to avoid confusion.

- Incorrect or Missing Tax Information – Failing to apply the correct tax rate, or omitting tax altogether, can lead to legal issues or client dissatisfaction. Ensure that taxes are calculated and clearly listed on the document.

- Errors in Pricing – Incorrect pricing or missing discounts can cause discrepancies and delays. Always double-check the prices and any applicable discounts to ensure everything is accurate.

- Not Including Payment Terms – Leaving out payment terms such as due dates, late fees, and accepted payment methods can cause confusion and delay payments. Make sure to clearly outline when and how payment should be made.

How to Avoid These Mistakes

The best way to avoid these common errors is to implement a checklist system. Before sending any payment requests, review each document carefully to ensure that all information is accurate and complete. Using automated tools or templates can help reduce human errors and save time, but manual checks are still crucial for accuracy.

By being aware of these common mistakes and taking the necessary steps to avoid them, you can ensure that your financial documents remain professional and effective, leading to smoother transactions and better client relationships.

How to Track Payments on Payment Requests

Tracking payments is an essential part of managing your financial transactions. By keeping an accurate record of received payments, you can easily monitor outstanding balances, prevent overdue payments, and stay organized. A clear tracking system also helps you maintain transparency with clients and ensure timely follow-ups when necessary.

Effective Ways to Track Payments

- Use a Payment Log – Keep a dedicated record for each payment received, including the amount, date, and payment method. This log will help you quickly reference past transactions and identify any missed payments.

- Mark Payments on Your Documents – Once a payment is made, update the original financial document to indicate the amount paid and the remaining balance. This helps both you and your client keep track of what is still owed.

- Utilize Software Tools – Accounting software or specialized tools can automate payment tracking, providing real-time updates on paid and outstanding amounts. These tools often send automated reminders to clients when payments are due or overdue.

Payment Tracking Table

| Client | Amount Due | Amount Paid | Remaining Balance | Payment Date |

|---|---|---|---|---|

| Client A | $500 | $300 | $200 | 10/15/2024 |

| Client B | $750 | $750 | $0 | 10/10/2024 |

Tracking payments in a consistent and organized manner ensures that you always have a clear overview of your finances. Whether using a manual log or an automated system, keeping detailed records helps prevent errors and ensures smoother financial operations.

Digital vs Printed Payment Requests

When deciding how to send payment requests, you have two primary options: digital or printed formats. Both methods have their benefits and drawbacks, depending on your workflow, client preferences, and the nature of your business. Choosing the right format can improve communication, streamline processes, and ensure that your requests are clear and professional.

Advantages of Digital Payment Requests

Digital payment requests are becoming increasingly popular due to their convenience and efficiency. Sending documents electronically allows for quicker delivery, immediate acknowledgment, and easier record-keeping. Many businesses and clients prefer digital formats as they are easier to manage, especially for recurring transactions.

- Fast Delivery – Digital documents can be sent instantly via email or online platforms, reducing the time between creating and receiving a payment request.

- Eco-Friendly – By going paperless, you reduce waste and contribute to more sustainable business practices.

- Easy to Track – Digital records are easier to organize, search, and back up. You can quickly track payments and follow up on overdue requests.

- Automation – Many digital tools allow you to automate reminders, due dates, and payment processing, saving time and effort.

Advantages of Printed Payment Requests

Although digital options are on the rise, printed payment requests still have a place in many businesses. Some clients may prefer a physical document, and printed requests can feel more formal or official. Printed documents also provide a tangible record, which some clients find reassuring for bookkeeping or tax purposes.

- Physical Record – A printed document provides a tangible copy that clients can file or store for their records, which some may find more reliable than digital files.

- Formality – For some businesses or industries, sending a physical request can add a level of professionalism and seriousness to the transaction.

- Client Preference – Some clients, particularly older generations or those in certain regions, may prefer physical documents over digital ones.

Choosing between digital and printed payment requests depends on your specific needs and the preferences of your clients. Both methods offer unique advantages, and many businesses use a combination of both to ensure they meet client expectations and maintain efficient operations.

Benefits of Using Online Payment Request Tools

Online payment request tools have transformed the way businesses manage their financial transactions. These platforms offer a range of features that make creating, sending, and tracking requests simpler and more efficient. By leveraging these tools, you can save time, reduce errors, and streamline your entire payment collection process, all while maintaining a professional appearance with your clients.

Key Advantages of Online Tools

- Time-Saving – Online tools often automate many steps in the payment request process, from calculating totals to sending reminders. This allows you to focus more on your core work rather than spending time on administrative tasks.

- Professional Appearance – These tools offer a range of customizable templates that help you create polished, branded payment requests. You can add your logo, business details, and even tailor the layout to suit your brand’s style.

- Accurate Calculations – Most online platforms automatically calculate totals, taxes, and discounts, reducing the risk of errors and ensuring your clients receive accurate payment information every time.

- Easy Tracking – With online tools, you can easily track whether a payment has been made, when it was made, and if there are any overdue amounts. Some platforms even send automated reminders to clients about outstanding balances.

- Access Anywhere – Online platforms are cloud-based, meaning you can access and manage your payment requests from any device, whether at the office, on the go, or working from home.

- Integration with Accounting Software – Many online tools integrate seamlessly with other accounting or financial management software. This allows you to track your earnings, generate reports, and manage expenses more effectively.

Additional Features of Online Payment Request Tools

- Multi-Currency Support – For businesses that work with international clients, many online tools allow you to create and send requests in different currencies, simplifying the process of global transactions.

- Recurring Billing Options – If you offer subscription services or ongoing work, these platforms often allow you to set up automated recurring billing, ensuring clients are charged consistently and on time.

- Secure Payment Processing – Many platforms include secure payment gateways, enabling clients to pay directly online. This increases convenience and can speed up the payment cycle.

Overall, using online payment request tools can significantly improve your business’s efficiency, reduce administrative overhead, and help you maintain a more professional image with clients. These tools are especially valuable for those who manage multiple transactions and need to stay organized while providing a smooth experience for their clients.

How to Send Payment Requests

Sending payment requests to clients is a crucial step in ensuring timely compensation for your services. Whether you are working on a one-time project or a recurring contract, the way you deliver these documents can affect both client satisfaction and the speed of payment. Using the right method to send these documents, as well as making sure they are clear and professional, helps maintain smooth business operations.

Methods to Send Payment Requests

- Email – Sending digital payment requests via email is one of the most efficient ways to deliver them. Most clients prefer receiving their documents electronically, and it allows for instant delivery and quick acknowledgment.

- Online Payment Platforms – Many businesses use online platforms that allow you to send payment requests directly through a secure portal. This option not only delivers the request but also allows clients to pay instantly through integrated payment gateways.

- Printed Copies – For clients who prefer physical documents, printing and mailing a hard copy of your payment request ensures they receive a formal, tangible record. This is more common in industries or regions where paper documentation is still widely used.

Best Practices for Sending Payment Requests

- Double-Check Details – Before sending your request, make sure all the information is correct, including the services provided, payment amount, and client contact details. Accuracy ensures smooth processing and prevents delays.

- Include Clear Instructions – Clearly outline the payment terms, such as the due date, accepted payment methods, and any late fees or penalties for overdue payments. This reduces confusion and sets expectations.

- Personalize the Message – While the payment request itself should contain the necessary details, adding a personalized note in your email or cover letter can improve the relationship with your client and make the process more cordial.

- Set Up Reminders – If the payment is not received by the due date, follow up with a polite reminder. Many online platforms can automate these reminders for you, ensuring that nothing slips through the cracks.

By following these steps, you can ensure that your payment requests are sent effectively, professionally, and on time. This will help streamline your financial processes and maintain positive client relationships.

How to Handle Late Payments

Dealing with delayed payments can be frustrating, especially when it affects your cash flow. However, it’s important to approach the situation with professionalism and tact. Addressing overdue payments effectively ensures that your business remains financially stable while maintaining positive relationships with clients. The key is to strike a balance between being firm on due payments and understanding of your client’s situation.

Steps to Take When Payments Are Late

- Send a Friendly Reminder – If a payment is a few days overdue, send a polite reminder. This could be in the form of an email or a phone call, gently nudging your client to settle the balance. Sometimes, the delay may be an oversight.

- Review Your Payment Terms – Before following up aggressively, make sure your client is aware of your payment terms. If your terms were clearly stated, you have the right to expect payment by the agreed-upon date. A quick reference to these terms can often clarify the situation.

- Send a Formal Request – If the payment remains overdue after the initial reminder, send a more formal request. Include the outstanding amount, the payment due date, and any applicable late fees. This helps to reinforce the seriousness of the situation.

- Offer Payment Plans – If the client is unable to pay the full amount at once, consider offering a payment plan. This allows them to pay in smaller installments, which can help ease their financial burden while still ensuring that you receive payment.

- Charge Late Fees – If late payments are a frequent issue, include late fees in your payment terms. Having a set penalty for overdue amounts can encourage timely payments and compensate for any inconvenience caused by delays.

When to Consider Legal Action

- Repeated Late Payments – If a client consistently misses payment deadlines, it may be time to take more formal action. Keep a record of all communications and payment attempts to present a clear case should you need to escalate the matter.

- Inability to Reach a Resolution – If you’ve exhausted all other avenues–sending reminders, offering payment plans, and charging late fees–and still haven’t received payment, it may be necessary to consult with a collections agency or take legal steps to recover the amount owed.

Handling late payments with professionalism and clear communication helps protect your business without damaging client relationships. By setting clear expectations, following up timely, and knowing when to take further action, you can keep your financials in check and minimize the impact of overdue payments.

Keeping Your Payment Requests Professional

Maintaining a professional appearance in all business communications, especially when requesting payments, is essential for building trust and credibility with your clients. A well-designed and clearly written payment request not only reflects positively on your business but also helps ensure that transactions are smooth and timely. Professionalism in your documents sets the tone for a productive and respectful business relationship.

Elements of a Professional Payment Request

- Clear and Concise Language – Avoid jargon and overly complicated language. Your payment request should be easy to understand, with straightforward terms and conditions. Keep the message polite and direct, stating the amount due, due date, and payment options clearly.

- Accurate Information – Double-check that all details are correct before sending, including your business name, client’s information, the services provided, and the payment amount. Mistakes can create confusion and may delay payment.

- Proper Formatting – Ensure your document is well-organized and easy to read. Use a consistent font, spacing, and alignment. Break the information into sections, such as client details, services rendered, payment terms, and total amount due, to make it easy for clients to find key details.

- Branding – Include your company logo, business name, and contact information in a professional manner. This reinforces your brand identity and lends credibility to the request.

- Respectful Tone – While your payment request should be firm and clear, always maintain a respectful and courteous tone. A polite reminder can go a long way in preserving good relationships with clients, even when payments are overdue.

Additional Tips for Maintaining Professionalism

- Use Proper Client Addressing – Address your client by their proper title (e.g., Mr., Ms., Dr.) and full name, unless you have a more informal relationship. Personalizing the communication helps to establish respect and formality.

- Set Clear Payment Terms – Clearly state your payment terms, including the due date, any late fees, and the methods of payment accepted. This will minimize any misunderstandings and ensure clients know exactly what to expect.

- Consistent Layout – Ensure consistency across all your payment requests. Whether you are using a software tool or a manual template, maintain the same style, structure, and tone for all documents to establish brand recognition and professionalism.

By following these guidelines and ensuring that your documents are neat, professional, and accurate, you can maintain a positive image with your clients and foster long-term relationships built on trust and respect.

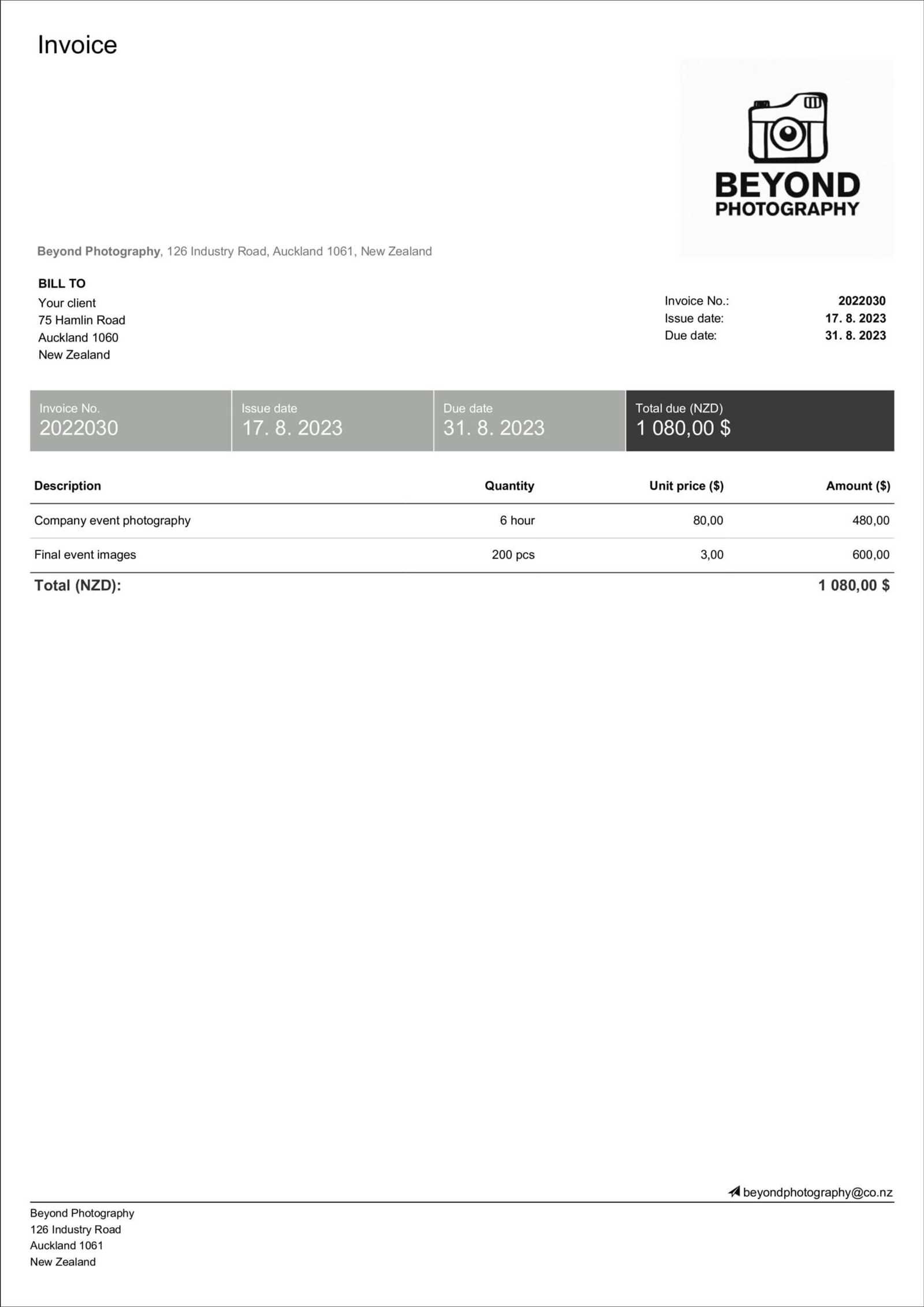

How Invoices Improve Client Relations

Effective financial communication is crucial for fostering strong relationships with clients. The way you present payment details not only reflects your professionalism but also plays a significant role in how clients perceive your business. Clear and well-structured payment requests help set expectations, build trust, and ensure that both parties are on the same page regarding terms and agreements.

Building Trust Through Transparency

When payment requests are clear and detailed, they show clients that you value transparency. Clients appreciate knowing exactly what they are paying for, how much they owe, and when payment is due. This level of clarity minimizes confusion and prevents potential disputes, which can strengthen the client relationship.

Improved Communication and Professionalism

- Clear Payment Terms – Stating clear payment terms, including due dates and acceptable methods of payment, ensures that both you and your client understand the financial agreement. This reduces the likelihood of misunderstandings or missed payments.

- Timely Follow-Ups – Sending payment requests promptly and following up on overdue amounts in a polite and professional manner helps maintain open lines of communication. It shows that you are organized and serious about your business operations, while still respecting the client’s time.

- Consistency – Using a consistent format and structure for all your payment requests reinforces a sense of professionalism. Clients feel more confident in working with a business that is organized and operates with consistency.

Encouraging Repeat Business and Referrals

When clients receive well-organized and professional payment details, it enhances their overall experience. Clients are more likely to return for future projects if they feel that the financial aspects of the work were handled smoothly. A positive payment experience can also lead to referrals, as satisfied clients are more inclined to recommend your services to others.

Example of Clear Payment Breakdown

| Service Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Consultation | 1 | $100 | $100 |

| Event Coverage | 5 hours | $150/hour | $750 |

| Total | $850 | ||

Providing clients with a detailed breakdown of the services rendered, along with clear pricing, makes the payment process straightforward and reduces the risk of disputes. This transparency not only helps in avoiding misunderstandings but also contributes to a stronger and more positive client relationship.