Free Photographer Invoice Template for Easy Billing

As a creative professional, managing payments is just as important as producing exceptional work. Having a reliable system in place for issuing bills ensures smooth transactions and fosters professionalism with clients. Whether you’re just starting out or have years of experience, using well-structured documents to request compensation is a key part of running a successful business.

Customizable billing documents can save valuable time and help you maintain consistent records. By using ready-made designs, you can avoid the hassle of creating a new form each time, while still ensuring every detail is accurate and tailored to the services provided. This streamlined approach can also minimize errors and make it easier to track your earnings over time.

In this guide, we’ll explore how these ready-to-use solutions can support your workflow, save you time, and provide a professional touch to your business communications. With the right tools, managing your financials becomes straightforward and stress-free.

Why You Need a Photographer Invoice

In any creative business, it’s crucial to have a system in place for documenting payments and services rendered. Clear and structured payment requests not only protect your work, but also build trust with clients. Without such documentation, misunderstandings can arise, leading to delayed payments or even disputes. A well-designed document serves as both a professional tool and a legal safeguard for both parties involved.

When you offer your services to clients, you’re not just delivering a product; you’re providing an experience that has value. Accurately capturing this value in a formalized manner is essential for ensuring proper compensation. Having a professional system in place can help you avoid complications, keep track of financial records, and demonstrate that you take your business seriously.

Here are some key reasons why using a structured billing system is important:

| Reason | Benefit |

|---|---|

| Clear Payment Details | Ensures that clients know exactly what they are paying for, preventing confusion. |

| Professionalism | Improves your business image and builds trust with clients. |

| Tracking Payments | Helps you keep a clear record of your financials for tax purposes or future reference. |

| Legal Protection | Acts as a binding document in case of payment disputes or legal matters. |

| Efficiency | Saves you time by providing a reusable structure for future transactions. |

By incorporating this practice into your workflow, you’ll ensure that you’re managing your business efficiently while protecting both your creative work and your financial interests.

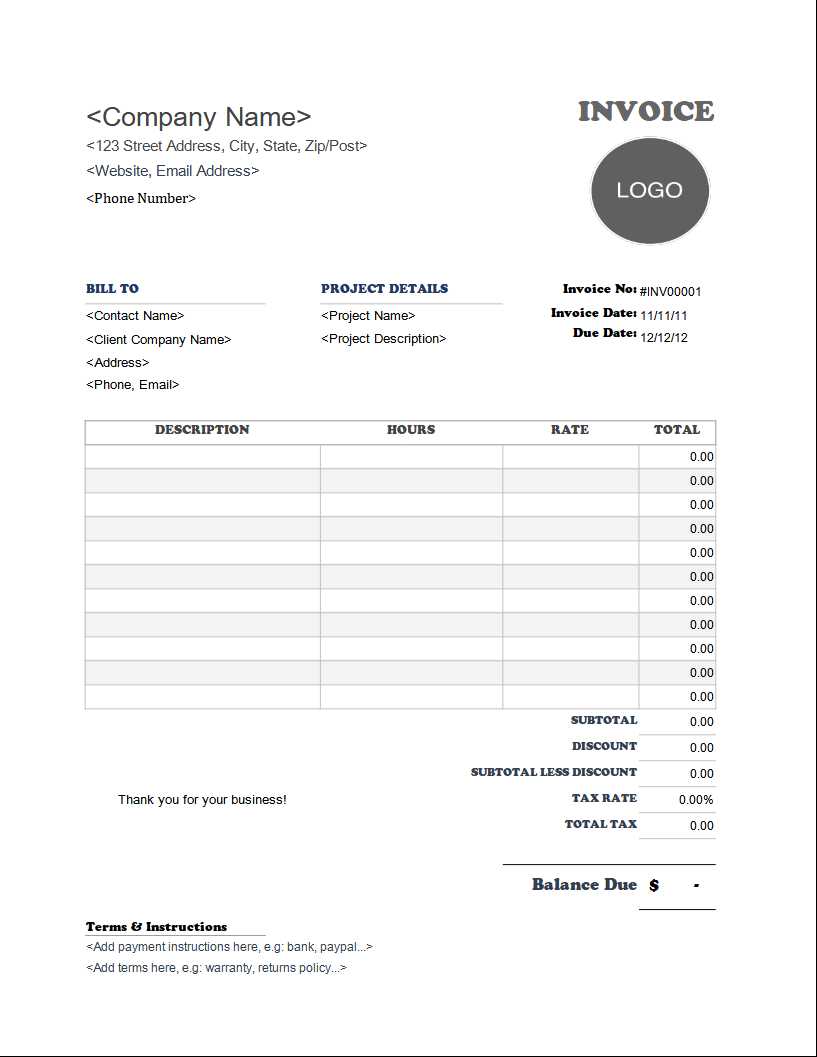

How to Create a Professional Invoice

Creating a professional billing document is an essential step in any business transaction. A well-crafted payment request not only reflects your attention to detail but also ensures smooth communication with clients. By presenting all necessary information in a clear and organized way, you can establish trust and set the right expectations for the financial aspect of your work.

To create a polished and functional payment document, follow these essential steps:

- Include Your Business Information: Always start by providing your name or business name, address, contact details, and logo (if applicable). This helps clients easily identify who the payment is for.

- List Client Information: Clearly state your client’s name, address, and contact details. This ensures that both parties are on the same page regarding who is responsible for payment.

- Provide a Unique Reference Number: Assigning a unique number to each document is crucial for tracking purposes. This reference number can be used for future correspondence and helps in keeping organized financial records.

- Specify the Services Provided: Break down the specific services or products delivered. Be detailed to avoid any confusion later on. Include dates of service and descriptions of the work done.

- Clearly State the Amount Due: Clearly list the total amount due, along with any applicable taxes, discounts, or additional fees. It’s important to provide a breakdown to avoid misunderstandings.

- Outline Payment Terms: Specify the payment methods you accept, due dates, and any late fees if applicable. Make sure the terms are clear and concise to avoid confusion later.

- Include Notes or Special Instructions: If you have any additional comments, special instructions, or reminders for the client, make sure to add them. This could include information about upcoming projects or additional terms for future work.

By following these steps, you will ensure that the payment request looks polished, professional, and easy to understand. It also demonstrates that you approach your business dealings with care and seriousness, ultimately fostering better client relationships.

Free Templates for Photographers Explained

For creative professionals, managing financial transactions in an organized and efficient way is essential. Pre-designed documents can simplify the billing process, saving you time and ensuring accuracy. These customizable resources allow you to quickly fill in the relevant details, making the task of requesting payment smooth and hassle-free. Understanding how these resources work can help you select the right one for your needs and improve your workflow.

What Makes These Resources Ideal for Creative Professionals?

Many digital creators and service providers use pre-made documents as a way to streamline their financial processes. The primary advantages of using such resources include:

- Customization: These documents can be adjusted to fit specific needs, such as adding a business logo, adjusting payment terms, or including itemized services.

- Efficiency: With a structured format already in place, you don’t need to start from scratch each time, allowing you to focus more on your work and less on administrative tasks.

- Professional Appearance: Pre-designed layouts help ensure your billing documents look polished and cohesive, promoting trust and professionalism with clients.

- Cost-Effective: Since many of these resources are available without charge, they provide an affordable solution to organizing your business transactions.

How to Choose the Right Resource for Your Needs

While there are many options available, it’s important to choose the right kind of document that matches your business style and workflow. Here are some factors to consider:

- Ease of Use: Choose a format that is user-friendly and doesn’t require extensive effort to complete. Look for designs that offer fillable fields or automated calculations.

- Compatibility: Make sure the document can be easily accessed or edited in the software programs you already use, such as Word, Excel, or PDF editors.

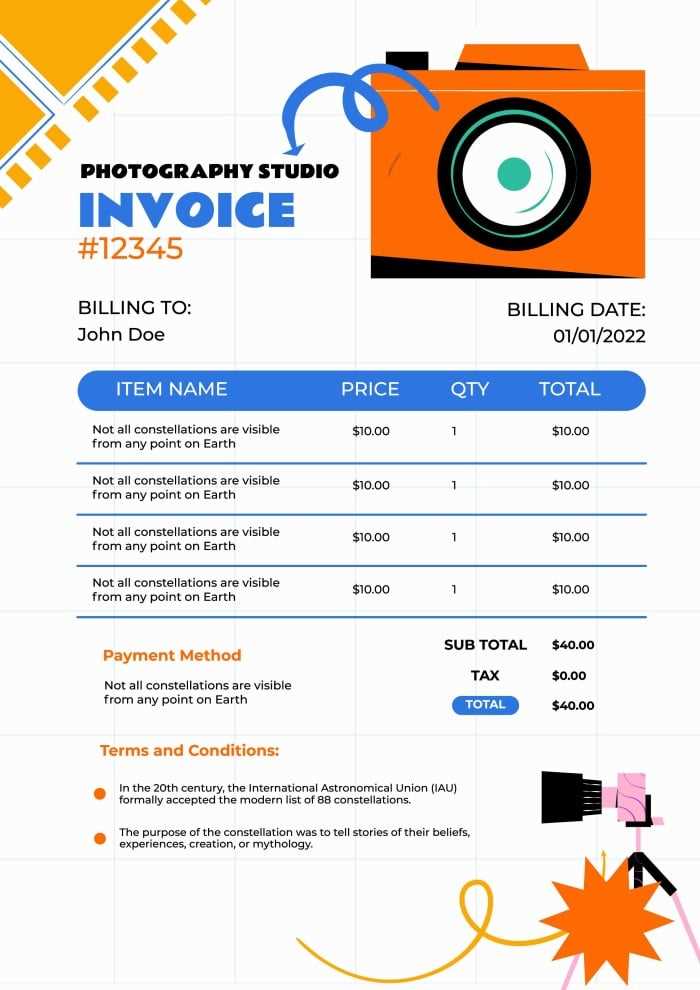

- Design Quality: Select a resource with a layout that fits your brand and aesthetic. The visual appeal of your billing document reflects your business identity.

- Legal and Tax Compliance: Ensure that the document includes necessary sections such as tax information and payment terms that comply with your local laws or regulations.

By using these customizable resources, you can save time on administrative tasks and focus on delivering high-quality work to your clients while maintaining a professional approach to your business operations.

Top Features of an Invoice Template

When managing business transactions, using a structured document can make all the difference. The right set of features ensures that your payment requests are clear, professional, and easy to understand. A well-designed document should not only list the services provided but also present all the necessary details in a way that protects both parties and streamlines the payment process.

Here are the most important features to look for when selecting a ready-made document for billing:

- Clear Identification of Parties: The document should clearly display both your contact information and the client’s details. This helps ensure that both sides are easily identifiable, reducing the chances of confusion.

- Unique Reference Number: A distinct number for each document is crucial for easy tracking and organization. It ensures that both you and your client can reference specific transactions accurately.

- Itemized List of Services: Each service or product provided should be listed individually with a description, unit price, and quantity. This breakdown adds transparency to the transaction and helps avoid any misunderstandings about the work completed.

- Tax and Additional Fees: Including applicable taxes and any extra fees, such as travel costs or rush fees, is essential. This ensures that clients are aware of the full amount they are expected to pay.

- Payment Terms: The document should clearly outline payment due dates, accepted methods of payment, and any penalties for late payments. This helps establish expectations and can protect you in case of overdue payments.

- Professional Design: A visually appealing format with well-organized sections conveys professionalism. It gives your client a positive impression of your business practices and attention to detail.

- Customizable Fields: The ability to easily modify sections of the document to suit specific needs is essential. This flexibility allows you to tailor each bill according to the details of the service provided.

- Notes and Additional Information: Some documents offer a section for additional notes, such as reminders for future services, special client requests, or general terms and conditions. This section adds an extra layer of personalization.

Having these features in a billing document ensures that your transactions are smooth, transparent, and professional, promoting good relationships with clients while protecting your business interests.

Benefits of Using Invoice Templates

Using pre-designed billing documents can significantly improve the efficiency and professionalism of your business operations. These ready-made resources allow you to focus on your work while ensuring that the administrative side of things runs smoothly. With an organized structure, you can streamline the entire payment process, making it easier for both you and your clients to track transactions.

Here are the key advantages of incorporating pre-made billing solutions into your workflow:

- Time Savings: Instead of creating a new document from scratch each time, you can simply customize an existing design to suit each transaction. This saves you valuable time, allowing you to focus on your creative work or other important tasks.

- Consistency: Using the same format for all your transactions helps maintain a consistent look across your business communications. This creates a professional image and fosters trust with your clients.

- Accuracy: With pre-designed documents, key fields are already structured, reducing the likelihood of missing or incorrect information. The organized layout ensures that every detail is accounted for, helping you avoid costly errors.

- Customization: Many of these documents offer customization options, allowing you to adjust sections according to the specifics of each job. You can easily add or remove items, change prices, and update terms as needed, offering flexibility while maintaining a consistent format.

- Improved Cash Flow: Clear and professional payment requests can speed up the payment process. Clients are more likely to pay promptly when the billing information is easy to understand and well-organized.

- Legal Protection: A well-structured billing document provides a record of services rendered and payment terms, which can protect you in the event of a dispute. It serves as a legal document that both parties can refer to if any issues arise.

- Branding: Pre-designed formats often allow you to incorporate your branding elements, such as logos, colors, and fonts. This helps reinforce your business identity and leaves a lasting impression on clients.

By incorporating these resources into your business practices, you not only make the billing process easier but also create a more organized, professional, and effective way to manage financial transactions.

How to Customize Your Invoice

Customizing your billing document allows you to make it more aligned with your business needs while also giving it a personalized touch. Adjusting key elements not only helps reflect the nature of the services you provide but also ensures that all the relevant details are included. Tailoring your document for each transaction helps improve clarity and professionalism, making it easier for clients to understand the terms of payment.

Essential Customizations to Consider

Here are some of the key areas you can customize to make the document work best for your business:

- Business Information: Ensure your company name, address, phone number, and email are accurately displayed. You may also want to add your logo for a more branded look.

- Client Details: Always include your client’s full name or company name, along with their contact details. This personalizes the document and confirms who the payment is for.

- Service Breakdown: Customize the itemized list of services you provided, adjusting the descriptions, quantities, and prices as necessary for each job. This section should clearly outline the value of the services delivered.

- Payment Terms: Adjust the payment due date, accepted payment methods, and any late fees or discounts. Clearly stating these terms helps avoid confusion or delayed payments.

- Additional Notes: Add any relevant instructions, reminders, or custom terms for the client. This might include upcoming deadlines, follow-up dates, or special agreements.

Why Customization Matters

Personalizing your billing document offers several advantages. It ensures that every transaction is accurately represented and shows your clients that you take your business seriously. By providing all necessary details, you also reduce the chances of misunderstandings regarding payment amounts or expectations. Customization also allows you to align the document with your brand, helping maintain a professional and cohesive image.

By taking the time to tailor these elements, you ensure your documents are both effective and professional, enhancing the overall experience for your clients and streamlining your business operations.

Common Mistakes in Photography Invoices

When it comes to requesting payment for services rendered, even small mistakes in your billing documents can lead to confusion, delays, or potential disputes. A well-organized payment request helps ensure that both parties are on the same page. However, there are several common errors that can undermine the clarity and professionalism of your payment communications. By identifying and avoiding these mistakes, you can create a smoother, more efficient process for both you and your clients.

Common Errors to Avoid

Here are some of the most frequent mistakes when preparing payment requests:

- Missing or Incorrect Contact Information: Failing to include accurate details, such as your business name, contact information, or the client’s address, can lead to confusion. Always double-check that both parties’ contact info is correct and up-to-date.

- Vague Descriptions of Services: A lack of detail in describing the services provided can lead to misunderstandings. Be specific about what was delivered, including dates, hours worked, or products provided, to avoid confusion.

- Omitting Tax Information: If applicable, it’s essential to include taxes and explain how they are calculated. Failing to account for taxes can create issues when clients receive the payment request and make them hesitant to pay the full amount.

- Not Including Payment Terms: Clearly stating payment terms, including due dates and accepted methods of payment, is crucial. Without these details, clients may not know when or how to pay you, leading to delayed payments.

- Incorrect Payment Amount: Double-check the total amount due before sending the document. Adding up the individual costs incorrectly or forgetting to add applicable fees can lead to financial discrepancies and delays.

- Failure to Number Documents: Without a unique reference number for each document, it becomes difficult to track payments and address any potential issues. Always ensure each document has its own unique identifier.

How to Avoid These Mistakes

By paying close attention to detail and double-checking your documents before sending them, you can prevent many of these common issues. Here are some tips to help you avoid errors:

- Review All Information: Before finalizing any document, ensure all details are accurate, including both your information and your client’s contact details.

- Be Detailed: Provide clear descriptions for every service you’ve offered. The more information you include, the easier it will be for clients to understand the charges.

- Use Automated Calculations: Using tools or software that automati

How to Include Payment Terms on Invoices

Clearly stating payment terms is crucial for maintaining smooth financial transactions between you and your clients. When these terms are well-defined, both parties know what to expect, reducing the likelihood of confusion or late payments. Including these terms in your billing documents helps set clear expectations and establishes a professional approach to handling payments.

Here are the key components to include when outlining payment terms in your document:

- Due Date: Specify the exact date by which payment is expected. This removes ambiguity and gives clients a clear deadline for settling the amount owed.

- Accepted Payment Methods: Clearly state which payment methods are acceptable, such as bank transfer, credit card, PayPal, or checks. This helps clients choose the most convenient option for them.

- Late Payment Fees: If you charge a fee for late payments, outline the terms clearly. For example, you might specify a percentage of the total amount per day or a fixed fee after the due date passes. This encourages timely payments.

- Discounts for Early Payments: If you offer a discount for clients who pay early, make sure to include the details. For instance, a 5% discount if the bill is paid within 10 days could be a good incentive for prompt payment.

- Payment Installments: If you allow clients to pay in installments, outline the payment schedule, including the amounts and due dates for each installment. This ensures transparency and avoids confusion about when payments are due.

- Currency: Make sure to specify the currency in which payment is expected, especially if you are working with international clients. This helps to avoid any misunderstandings about payment amounts.

Clearly stating your payment terms helps avoid confusion and sets expectations for timely payments. By outlining all the necessary details, you foster professionalism and reduce the chance of misunderstandings that could delay compensation for your work.

Importance of Invoice Numbering System

A proper numbering system for your billing documents is crucial for maintaining organization and tracking transactions efficiently. It not only helps you stay organized but also simplifies the process of managing your financial records, ensuring you can easily reference and track payments. A unique identifier for each document provides clarity and minimizes confusion, both for you and your clients.

Here are the key reasons why an effective numbering system is essential for your business:

- Improves Organization: A structured numbering system allows you to keep all your financial documents neatly organized. This makes it easier to locate past transactions and ensures that everything is accounted for.

- Facilitates Tracking: Each document number acts as a unique reference point. This helps you track the status of payments and follow up on any outstanding balances without confusion.

- Enhances Professionalism: Having a systematic approach to document numbering gives a more professional appearance to your business. Clients appreciate receiving a well-organized and clearly numbered request for payment, which strengthens their trust in your services.

- Legal and Tax Compliance: In many regions, maintaining proper records and a clear numbering system is required for tax purposes. Having an organized set of documents can help you stay compliant with local laws and regulations.

- Minimizes Errors: Using a sequential numbering system reduces the likelihood of accidental duplication or omission of documents. This ensures that no transactions are overlooked or lost.

To implement an effective numbering system, consider the following basic structure:

Format Example Explanation 2024-001 Year followed by a sequential number (e.g., the first document issued in 2024). ABC-1001 Incorporates a client-specific or project-specific identifier, making it easy to track individual clients or jobs. 1001 A simple sequential number starting from a particular number, typically used for a smaller business with fewer transactions. By adopting a consistent and clear numbering system, you can stay on top of your financial documents, improve efficiency, and provide a more professional service to your clients. It is a simple yet effective way to ensure smooth business operations and maintain accurate records.

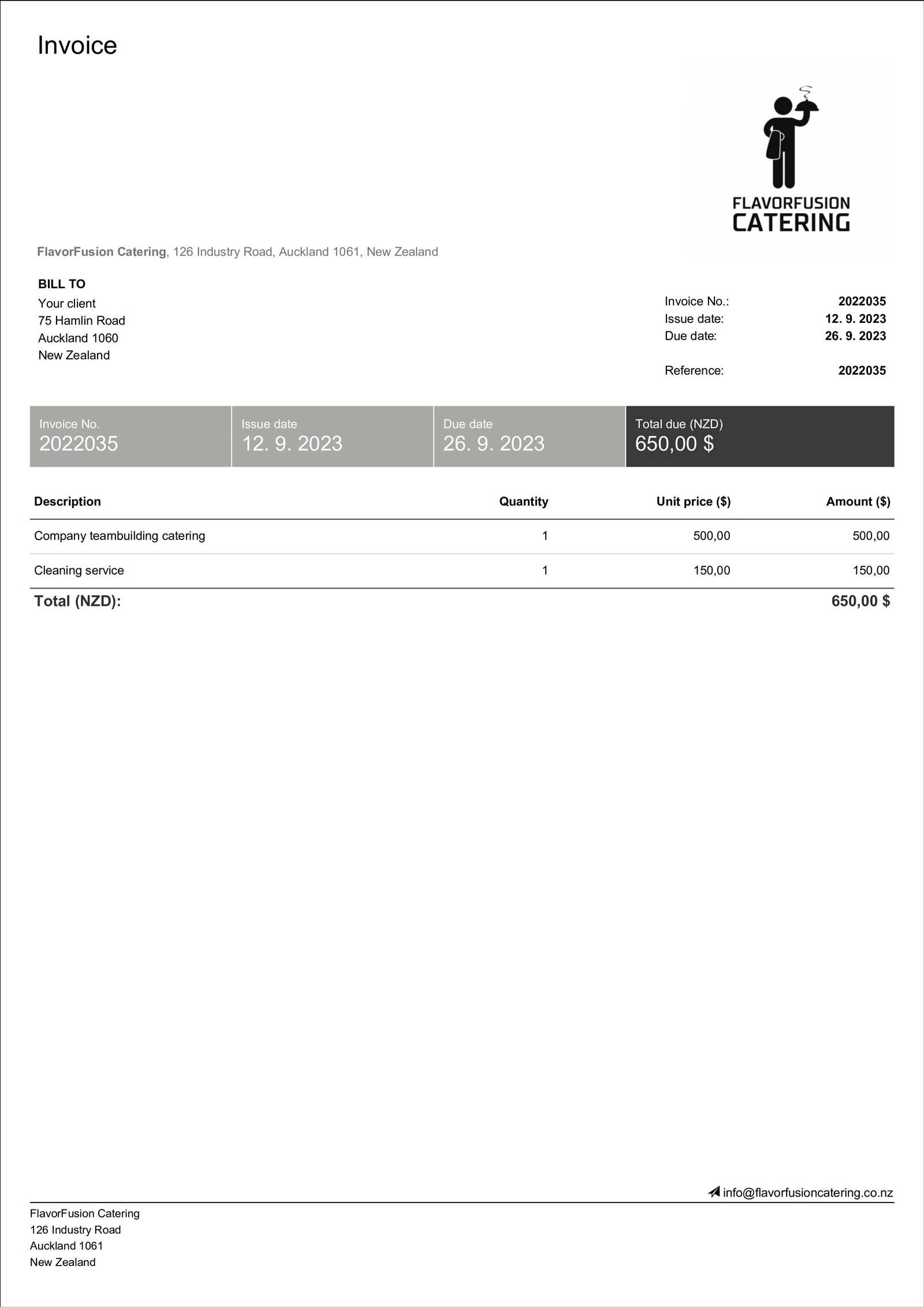

What to Include in Your Photographer Invoice

When requesting payment for services rendered, it is essential to include all the necessary details that ensure clarity and avoid confusion. A well-structured document not only outlines the work completed but also provides all required information for the client to process payment smoothly. Including the right elements ensures that both parties are on the same page and helps maintain a professional relationship.

Here are the key components you should include in your billing document:

- Your Contact Information: Always list your business name, phone number, email address, and physical address. This makes it easy for clients to contact you if they have any questions or need further clarification.

- Client’s Contact Information: Include your client’s full name, company name (if applicable), and their contact details. This helps ensure that the payment request is directed to the correct recipient and prevents any misunderstandings.

- Unique Document Number: Assign a unique reference number to each billing document. This helps with tracking, record-keeping, and simplifies the process if you need to refer back to a particular transaction.

- Date of Issue: Include the date when the document is created. This helps establish the timeline for the payment due date and can be referenced later in case of disputes or delays.

- Description of Services Rendered: Provide a detailed list of services completed or products delivered. This section should be as clear as possible, including the type of work, the hours spent, or any items provided, along with individual pricing for each service.

- Payment Terms: Clearly state the payment due date, as well as the payment methods you accept (bank transfer, credit card, online payment platforms, etc.). If you charge late fees or offer discounts for early payments, include that information as well.

- Total Amount Due: Ensure the total amount owed is clearly stated. This should include any applicable taxes or additional fees, and should match the itemized list of services provided.

- Tax Information: If applicable, include details of taxes such as VAT or sales tax. This ensures compliance with local tax regulations and provides transparency to your client regarding the charges.

- Notes or Special Instructions: If there are any additional terms or special instructions related to the payment or project, make sure to add them here. This could include information about future work, delivery dates, or specific client requests.

By including these essential elements in your billing document, you help ensure that the payment process goes smoothly, avoiding potential delays or misunderstandings. A well-detailed and professional document not only improves your client’s exper

Best File Formats for Invoice Templates

Choosing the right file format for your billing documents is essential for both ease of use and professional presentation. The format you select can affect how easily clients can view, edit, and pay based on the information you provide. Additionally, some formats may offer better security or compatibility with various devices and platforms. Understanding the advantages of different file types will help you make an informed decision that best suits your needs.

Here are some of the most commonly used file formats for billing documents, each offering unique benefits:

- PDF (Portable Document Format): This is one of the most popular formats for business documents. PDFs preserve the layout, fonts, and graphics, ensuring that the document appears exactly as intended on any device. It is easy to email, secure, and non-editable (unless specifically allowed), which makes it ideal for final versions of your documents.

- Word Documents (DOC/DOCX): Word documents are flexible and easy to edit. You can easily customize these files to fit different clients or transactions, making them ideal for internal drafts or documents that may need to be modified frequently. However, Word documents can be prone to formatting issues when opened on different systems unless saved properly.

- Excel Spreadsheets (XLS/XLSX): If you need to include complex calculations or want to track payments over time, Excel is a great option. Excel files allow you to create dynamic billing documents with formulas for taxes, discounts, and totals. However, they may not look as polished as PDFs and may not be ideal for sharing with clients unless they are specifically comfortable with spreadsheets.

- Google Docs/Sheets: For those who want to create documents in the cloud, Google Docs and Google Sheets are excellent choices. These tools allow for real-time collaboration and easy sharing with clients. They also automatically save and back up your documents, ensuring you never lose important files. However, these formats might not be as universally accepted as PDF when it comes to professional communications.

- HTML (HyperText Markup Language): If you prefer sending documents as part of an email body or on a website, HTML is a good option. It allows you to create responsive layouts and customize designs. However, it requires some technical knowledge to set up and may not be as professional in appearance as a PDF document.

Each file format serves a different purpose, so selecting the right one depends on your specific needs. If you are looking for a simple, secure, and universally accepted format, PDF is often the best choice. For editable documents or those requiring complex calculations, spreadsheets or Word d

How to Organize Client Payments with Invoices

Managing payments effectively is a vital part of running a successful business. Clear and organized billing practices help ensure that payments are collected on time and with minimal hassle. By using structured documents, you can not only request payment but also track the status of each transaction, follow up on overdue balances, and maintain accurate financial records.

Here are a few key strategies for keeping your client payments organized:

1. Create Clear and Detailed Payment Requests

Start by providing detailed descriptions of the services rendered, including dates, prices, and any additional costs. This will leave no room for confusion and will make it easier for clients to understand exactly what they are paying for. Clear payment instructions, such as due dates and accepted payment methods, should also be included to prevent delays.

- Itemized List: Break down the services provided with clear pricing, including taxes, discounts, or additional fees if applicable.

- Due Date: Specify when the payment is due, and include a late fee clause if necessary to encourage timely payments.

- Payment Methods: Indicate the types of payment you accept (bank transfer, credit card, online payments, etc.) to ensure that clients can easily make payments using their preferred method.

2. Implement a Tracking System

Using a consistent tracking system for all your payment requests can significantly improve your ability to stay on top of outstanding balances. Assigning unique reference numbers to each document allows you to easily monitor which payments have been made and which are still pending. This can be done manually, but many software tools and online platforms offer automated tracking features to streamline the process.

- Unique Reference Numbers: Number each payment request sequentially to help you track past and present transactions.

- Record Payment Status: Keep a record of when payments are received, and note any late payments or partial payments to stay organized.

- Use Software or Tools: Many invoicing tools offer automated tracking features, which can help you track and manage payments, set up reminders for clients, and generate reports for your financial records.

3. Send Timely Reminders for Overdue Payments

If a client misses a payment deadline, it’s important to follow up with a polite reminder. Keeping clients informed about overdue payments helps ensure that they are aware of the situation and encourages them to pay promptly. You can set up automatic reminders or send personalized follow-ups depending on your preferred approach.

- First Reminder: Send a gentle reminder a few days after the payment due date, expressing appreciation for their business and requesting payment.

- Second Reminder: If payment is still overdue, follow up again with a firmer tone, clearly stating any late fees or consequences if payment is not made soon.

- Late Fee or Interest: If applicable, remind the client about any penalties for late payment as outlined in your payment terms.

By incorporating these methods, you can organize your client payments more effectively, reduce the likelihood of missed payments, and ensure that your cash flow remains steady. Keeping a clear record and communicating payment terms upfront helps build trust and establishes a professional approach to financial transactions.

Legal Considerations for Photography Invoices

When creating payment requests for services rendered, it is essential to ensure that your documents comply with legal standards. Properly drafted billing documents not only protect your rights but also provide clarity to your clients. Understanding the legal aspects of your billing process can help you avoid disputes, ensure you are paid on time, and maintain transparency in your transactions.

Here are some important legal considerations to keep in mind when issuing payment requests for your services:

1. Include Clear Payment Terms

Establishing clear and legally sound payment terms is critical to ensure both you and your client understand the expectations regarding payment timelines, amounts, and methods. It is important to outline the following:

- Due Date: Specify the exact date by which payment must be received. This establishes a clear expectation for when the client is required to pay.

- Late Fees: If applicable, include information about late fees or interest for overdue payments. This can serve as an incentive for clients to pay on time and ensures you are compensated for any delays.

- Accepted Payment Methods: Be explicit about which payment methods are acceptable (e.g., bank transfers, checks, credit cards, or online payment platforms). This ensures that the client knows how they can pay you.

2. Understand Tax Obligations

Tax regulations vary by location, so it is important to familiarize yourself with the tax requirements that apply to your business. Many jurisdictions require that you collect and report taxes on the services you provide, and failure to comply can lead to penalties. Ensure your billing documents are compliant with the following:

- Sales Tax: If applicable, clearly list the sales tax as a separate item on your documents. The rate will depend on your location and the nature of the services provided.

- Tax ID Number: In many cases, you may be required to include your tax identification number (TIN) or employer identification number (EIN) on your billing documents for legal and tax reporting purposes.

- Tax Exemptions: If you or your client qualify for any tax exemptions, make sure to specify this clearly in your document to avoid any misunderstandings or disputes.

By ensuring your payment requests are legally sound and include all the necessary information, you not only protect yourself but also help establish trust and transparency with your clients. A well-constructed document can also serve as a legal reference in case any disputes ar

How to Track Payments Efficiently

Keeping track of payments is essential for maintaining a healthy cash flow and avoiding any confusion with clients. Efficient tracking ensures that you are paid on time, allows you to follow up with clients when necessary, and provides a clear overview of your financial status. Implementing a streamlined payment tracking system can save you time, reduce errors, and help you stay organized.

Here are some effective strategies to help you track payments efficiently:

- Use Accounting Software: Software solutions like QuickBooks, Xero, or FreshBooks are designed to help track transactions, generate reports, and send reminders for overdue payments. These tools often come with automated features that allow you to track payments and manage your finances with ease.

- Implement a Payment Schedule: Set up a payment schedule for each client, including due dates and milestones. This will help you stay on top of what’s expected and make it easier to see when payments are received or overdue.

- Create a Payment Log: Maintain a detailed log (either digitally or on paper) that tracks each payment you receive. Record the date, amount, client name, and any reference number associated with the transaction. This log will act as a comprehensive record of all incoming payments.

- Send Payment Reminders: Set up auto

How Invoice Templates Save Time

Creating payment requests from scratch for every client can be time-consuming and repetitive. However, using pre-designed documents can significantly streamline this process. By relying on reusable and structured formats, you can quickly generate accurate, professional requests without the need to start over each time. This not only saves time but also reduces the potential for mistakes, ensuring consistency across your transactions.

1. Streamlined Creation Process

With a pre-made structure, all you need to do is fill in the specific details of the transaction. Instead of manually formatting each document and ensuring that all essential components are included, the structure is already in place, allowing you to focus on customizing the content. This enables you to create payment requests in just a few minutes rather than spending time designing and formatting each one individually.

- Pre-filled Sections: The structure includes commonly needed fields such as client name, service descriptions, and payment terms, reducing manual entry.

- Consistent Layout: A fixed layout ensures that your documents look professional every time, without needing to adjust fonts or positioning for each new request.

2. Reduces Errors and Ensures Accuracy

Time spent correcting mistakes due to inconsistent formatting or missing information can add up quickly. Using a structured format ensures that key details like payment terms, pricing, and due dates are consistently included in every document, minimizing errors and ensuring the correct information is communicated to your clients.

- Automated Calculations: Some formats include fields where you can input numbers that automatically calculate totals, taxes, and discounts, saving time and reducing the risk of mathematical errors.

- Consistency Across Clients: Using the same format for every client ensures that all documents are uniform, making them easier to manage and understand.

3. Easy Customization and Reusability

Once you have a reliable document structure in place, customizing it for different clients becomes much faster. You can simply update the relevant details for each new project or client, rather than creating an entirely new document from scratch. This reusability ensures that you’re not wasting time on repetitive tasks and helps you maintain a smooth workflow.

Task Time Without Template Time With Template Creating a new document 15-20 minutes 5 minutes Formatting and layout adjustments 10 minutes None Entering service details 5 minutes per field Instant (fields pre-filled) By reducing the time spent on repetitive tasks and ensuring accuracy, you free up more time to focus on delivering excellent service to your clients. The efficiency gained from using structured formats ultimately helps you manage your workload and maintain a professional approach to your business operations.

Free vs Paid Invoice Templates for Photographers

When it comes to creating payment requests, choosing between no-cost options and premium solutions can be challenging. Both options have their pros and cons, and the decision largely depends on your specific needs and how much you are willing to invest in streamlining your financial processes. While free solutions offer simplicity and accessibility, paid alternatives can provide advanced features, greater customization, and professional design.

Below is a comparison of the key differences between free and paid options for creating payment requests:

Feature Free Solutions Paid Solutions Customization Limited customization options, basic design templates Highly customizable with advanced design options Ease of Use Simple to use but may lack advanced functionality More complex, but offers enhanced user experience and features Features Basic features like text fields, dates, and totals Advanced features such as automatic tax calculation, branding options, and integrations with accounting tools Support Limited or no customer support Access to dedicated customer support and troubleshooting Legal Compliance Basic legal requirements, but may lack specific regional tax rules Incorporates up-to-date tax regulations, local laws, and compliance features Cost Free, no cost involved Subscription or one-time fee required While free solutions can be ideal for those just starting out or for individuals who need a simple option without added complexity, paid solutions offer a more comprehensive package with greater flexibility, support, and professional-grade features. Ultimately, the choice depends on your business needs, the volume of transactions you handle, and the level of customization required.

How to Print and Send Your Invoice

Once your payment request document is finalized, the next step is to deliver it to your client. The method you choose to send it can depend on both your preference and the client’s convenience. Whether you choose to send it electronically or by mail, it’s important to ensure that the process is smooth, professional, and timely.

1. Printing and Preparing Your Document

If you prefer to send a physical copy, printing your document correctly is essential for maintaining a professional appearance. Ensure that all details, such as your business name, client’s information, and transaction summary, are clearly visible. Here are the steps to follow:

- Check for Accuracy: Double-check the document for any spelling errors, incorrect amounts, or missing details before printing.

- Choose the Right Paper: Use quality paper, preferably with your logo or branding, to leave a lasting impression.

- Print in High Quality: Ensure that the text is clear and legible, with no smudging or fading.

2. Sending Your Payment Request

Once your document is ready, you can choose from several methods to send it. The choice between physical and digital delivery will depend on your client’s preferences and the nature of your business.

- Email: Sending your document via email is fast and cost-effective. You can attach the file in PDF format to ensure it retains its formatting and is easy to open on any device.

- Mail: If you choose to send a physical copy, make sure to use a reliable postal service to ensure the document arrives on time. Consider using a service that provides tracking for added security.

- Online Payment Platforms: Some platforms allow you to send your payment request directly through their system. This is an efficient option for clients who prefer to pay immediately upon receipt.

3. Best Practices for Follow-up

If you don’t receive confirmation or payment within the expected time frame, it’s essential to follow up in a polite and professional manner. Sending a friendly reminder via email or phone can ensure that your payment request is received and acted upon promptly.

Method Advantages Disadvantages Email Fast, efficient, and cost-effective May end up in the spam folder if not properly addressed Mail Professional and formal, ensures a tangible document