Pet Sitting Invoice Template for Easy and Professional Billing

Managing financial transactions for animal care can be a daunting task, especially when you’re trying to maintain professionalism and ensure prompt payments. Whether you’re offering services for dogs, cats, or other pets, organizing charges in a clear and structured way is crucial for both you and your clients. A reliable billing method not only ensures that you receive payments on time but also enhances your reputation as a responsible business.

Efficient billing systems help streamline the process of charging clients for your services. By using a well-organized document, you can include essential details like service descriptions, rates, and payment terms. This clarity can eliminate misunderstandings and provide both parties with a sense of security. Adopting a standardized format for your billing documents also allows for easy tracking of transactions, helping you stay on top of your finances.

In this guide, we’ll explore the benefits of having a well-designed payment record and how you can customize it to suit your specific needs. Whether you’re a freelancer or managing a full-fledged animal care business, mastering the art of creating clear, professional financial records will make your work more efficient and your clients more satisfied.

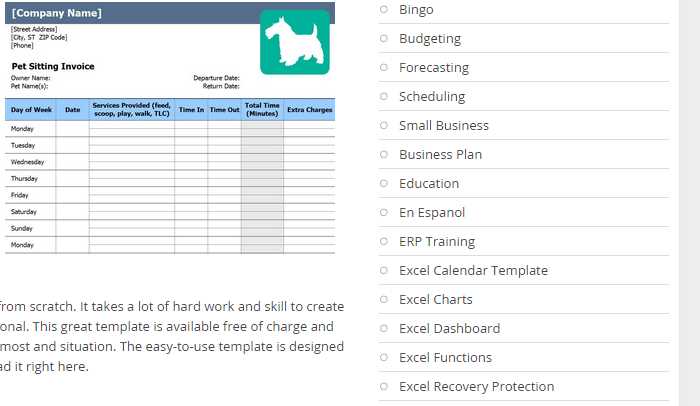

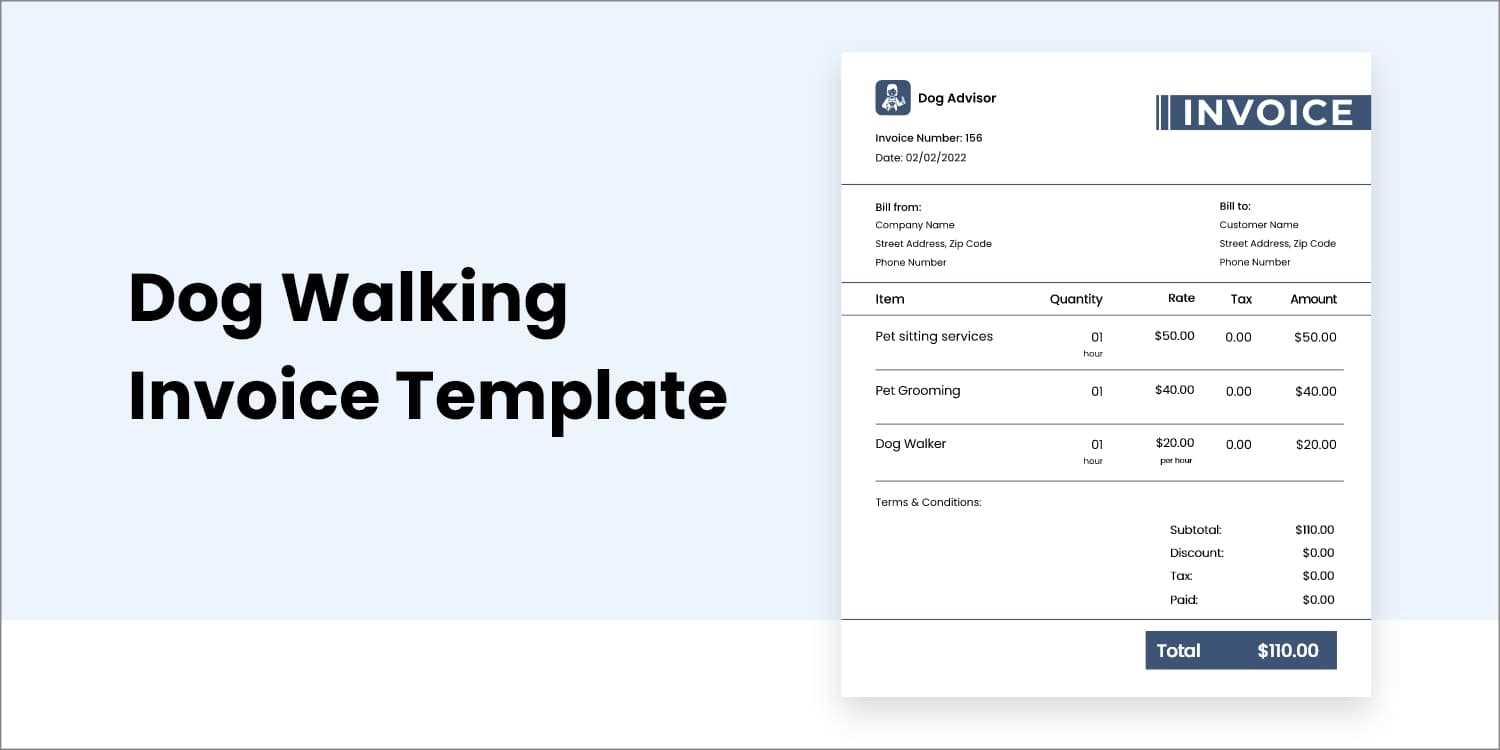

Pet Sitting Invoice Template Overview

When running an animal care service, creating clear and professional financial records is essential for maintaining a smooth operation. A well-structured document designed to outline the costs of the services provided helps both the service provider and the client stay organized. This essential tool not only ensures proper payment collection but also enhances trust and transparency between both parties.

Why You Need a Structured Billing Document

A well-organized record for your services helps you avoid confusion and ensures that both parties understand the charges involved. By listing the tasks completed, the associated costs, and payment terms in an easy-to-read format, you streamline the entire payment process. This kind of clarity prevents any potential misunderstandings, making it easier to manage your business operations.

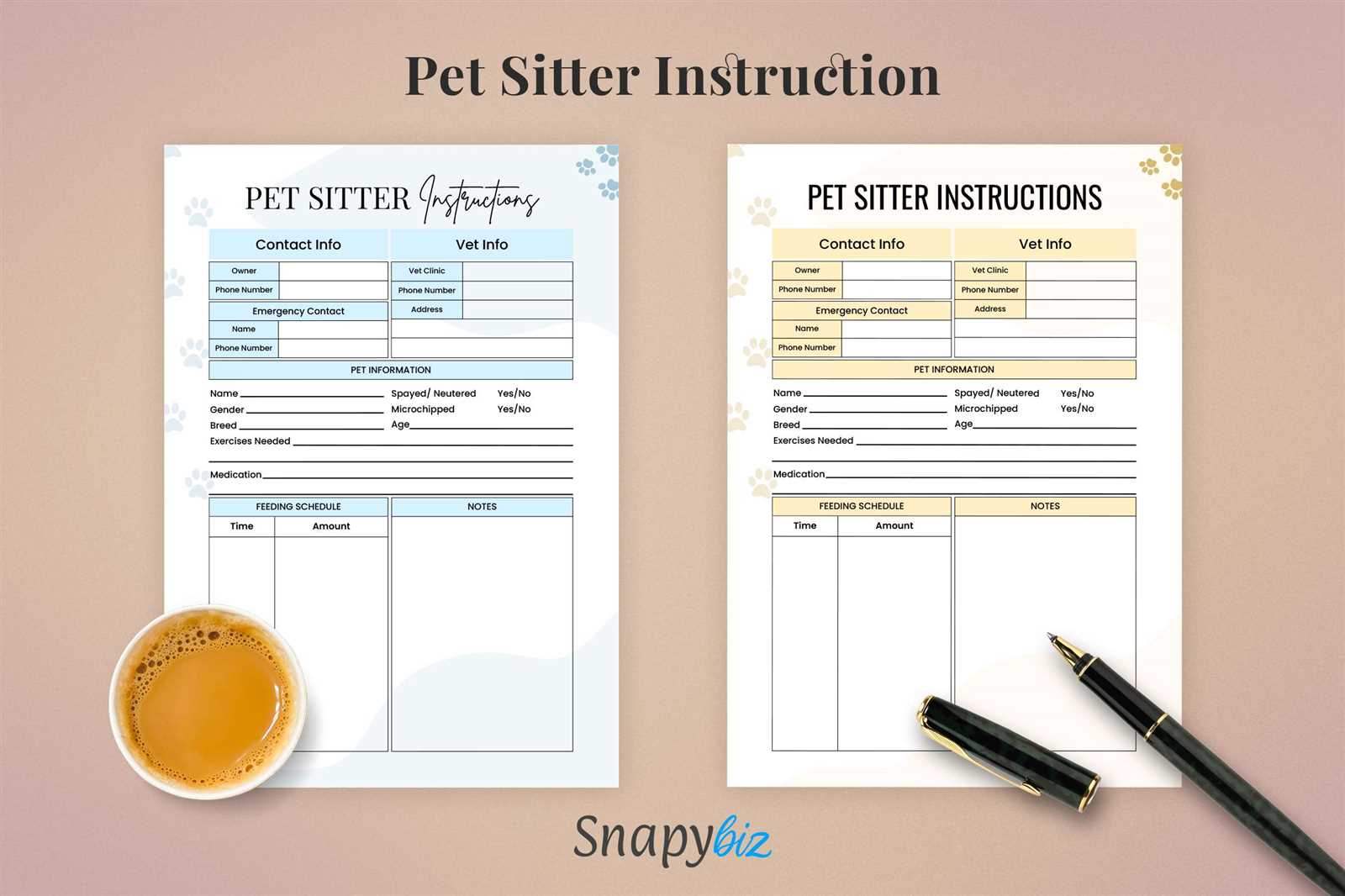

Key Features to Include

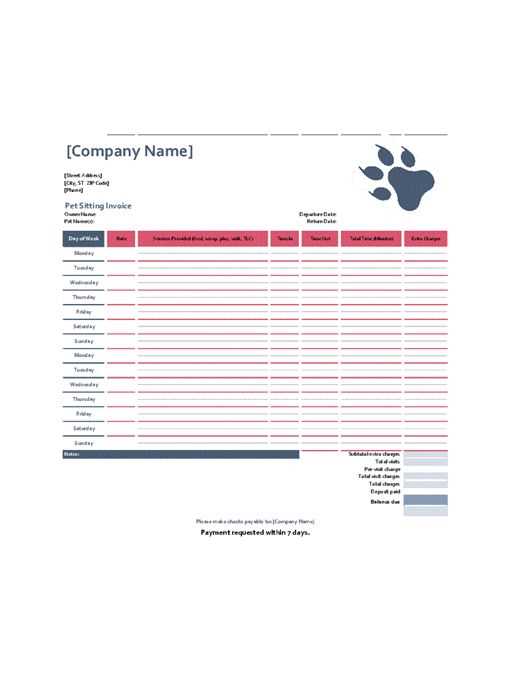

To create a complete and effective billing document, include the following information: the description of services, the duration of care, individual or package rates, the total amount due, and any applicable taxes or discounts. You should also provide payment instructions, due dates, and any other relevant terms. Accurate details not only make it easier for your clients to pay on time but also reflect your professionalism and attention to detail.

Why Use an Invoice Template

Having a standardized document for billing can greatly simplify the financial aspects of your business. Instead of creating a new payment record from scratch for each client, a pre-designed structure allows you to quickly customize and send accurate, professional records. This efficiency not only saves time but also reduces the likelihood of errors in calculations or missed details.

Time-Saving and Consistency

By using a pre-formatted document, you eliminate the need to manually recreate the same sections each time you bill a client. This consistency ensures that your records are uniform across all transactions, making your work look more professional and helping you avoid overlooking important information. It also reduces the chances of errors, which can sometimes lead to delays in payment or confusion with clients.

Enhanced Professionalism

Using a well-crafted billing document shows that you take your business seriously and that you are organized. Clients are more likely to trust a service provider who offers clear and formal payment instructions. A structured record with all the necessary details–such as service descriptions, payment terms, and amounts–demonstrates your commitment to professionalism, encouraging timely and smooth transactions.

Key Information on Pet Sitting Invoices

When creating a billing document for animal care services, it is essential to include certain details that ensure clarity and help both you and your client understand the transaction fully. A well-organized record not only makes it easier to track payments but also sets clear expectations for the services rendered. Here are the key elements to include:

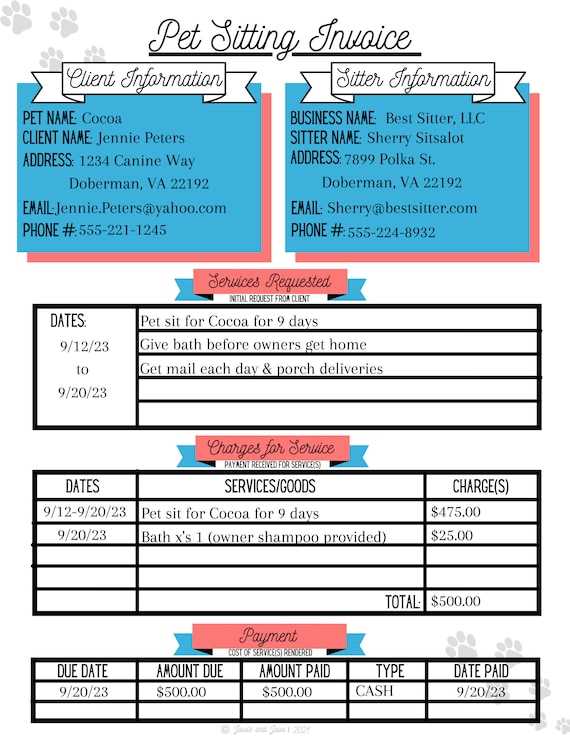

- Client Information: Include the client’s name, address, phone number, and email address to ensure easy communication and accurate record-keeping.

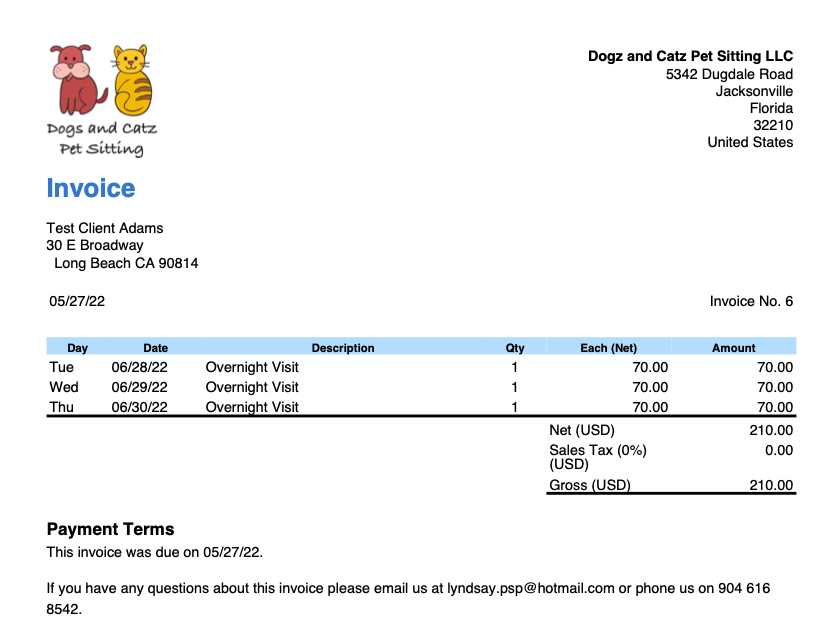

- Service Description: Provide a detailed breakdown of the services performed, including the type of care, the duration, and any special instructions or notes that apply.

- Dates of Service: Specify the exact dates or time period during which services were provided, to avoid any confusion.

- Rates and Charges: Clearly list the cost for each service, whether hourly or flat rate, and include any additional fees or discounts that apply.

- Total Amount Due: Sum up the individual charges, taxes, and fees to show the final amount the client is required to pay.

- Payment Terms: Indicate the due date for payment, acceptable payment methods, and any penalties or late fees for overdue payments.

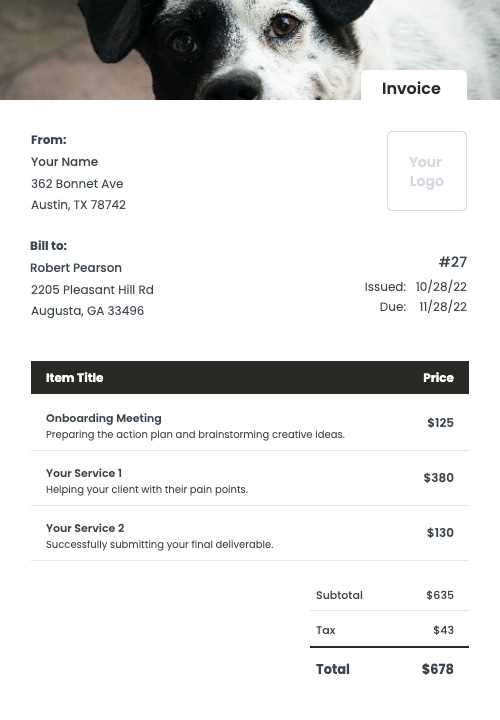

- Business Information: Include your company or personal name, contact details, and tax identification number, if applicable, to provide full transparency and professionalism.

Including these key details not only ensures a smooth transaction but also strengthens the professional relationship with your clients, fostering trust and repeat business.

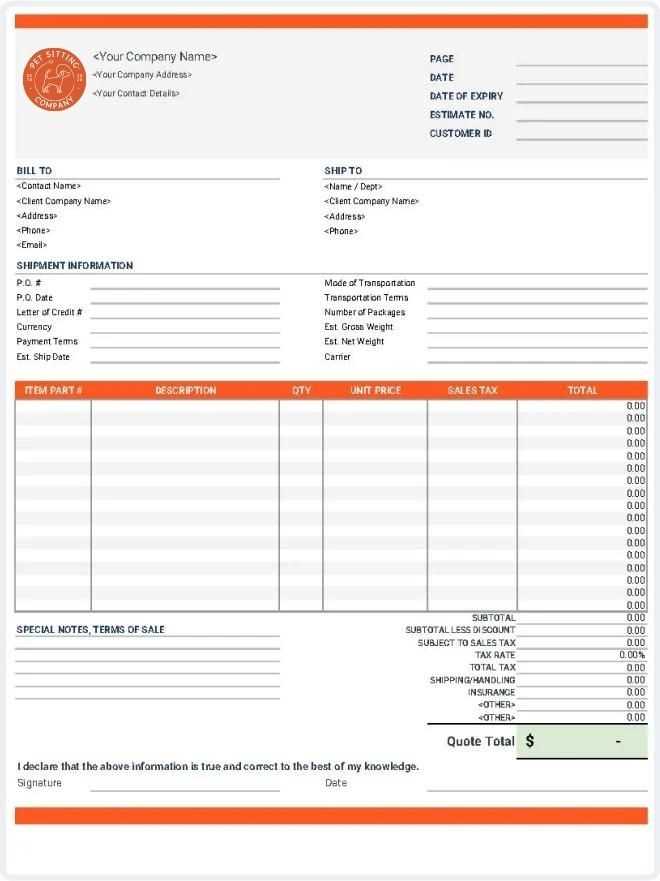

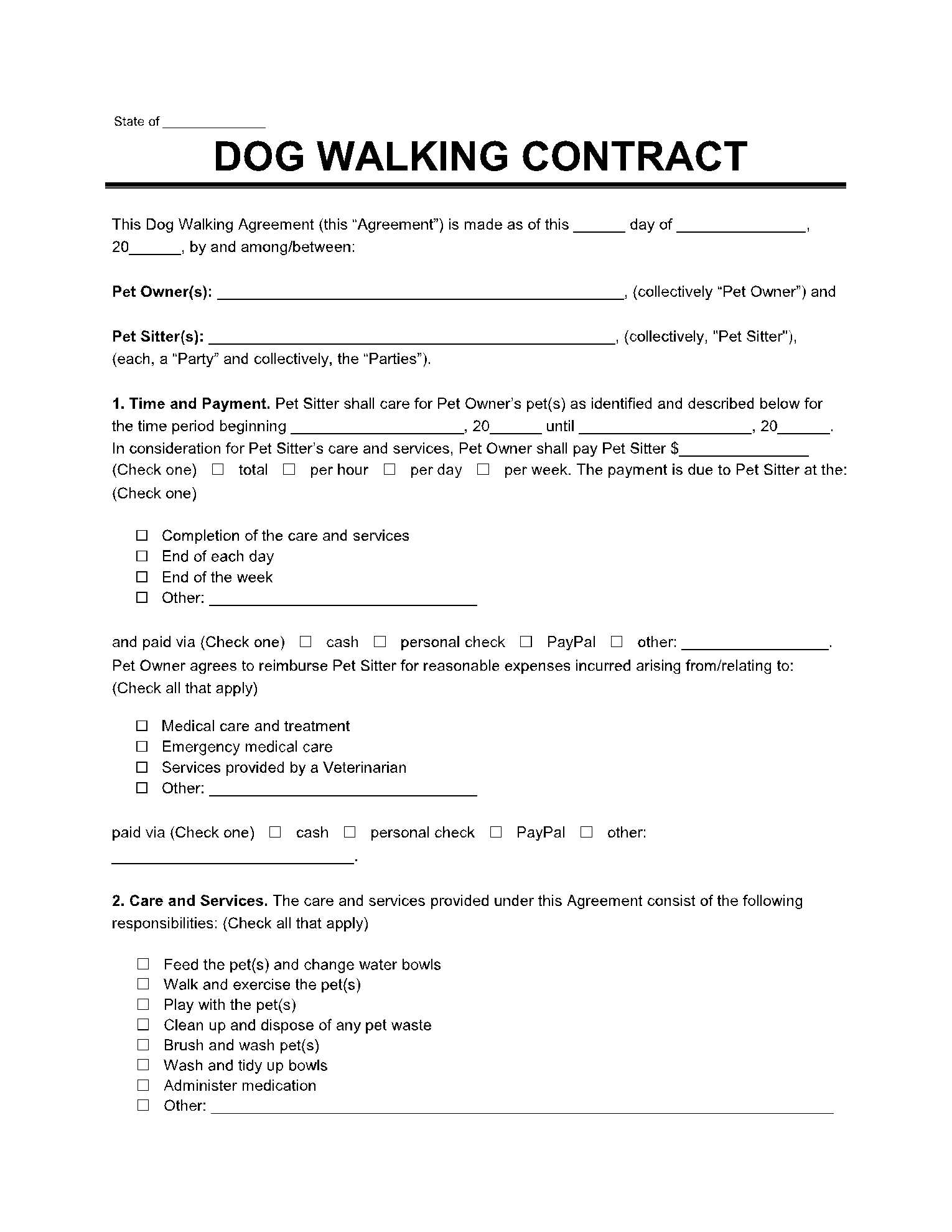

How to Customize Your Invoice Template

Customizing your billing record is essential for making it match your business’s needs while keeping it professional. By tailoring the layout and content, you ensure that the document reflects your brand and communicates the right information to your clients. Whether you’re handling small one-time tasks or ongoing services, a personalized record can streamline the billing process and make the payment experience smoother for both you and your clients.

Step-by-Step Guide to Customization

To customize your document effectively, follow these simple steps:

- Choose a Layout: Select a clean, easy-to-read design that includes sections for all necessary details. Consider using professional software or online tools for creating a consistent layout.

- Branding: Add your business logo, colors, and contact information at the top. This creates a branded document that clients will easily recognize.

- Service Breakdown: Customize the service description section to fit the range of services you offer, from hourly care to special tasks like training or grooming.

- Payment Terms: Adjust the payment terms and methods according to your business policies. Include information about late fees, if applicable.

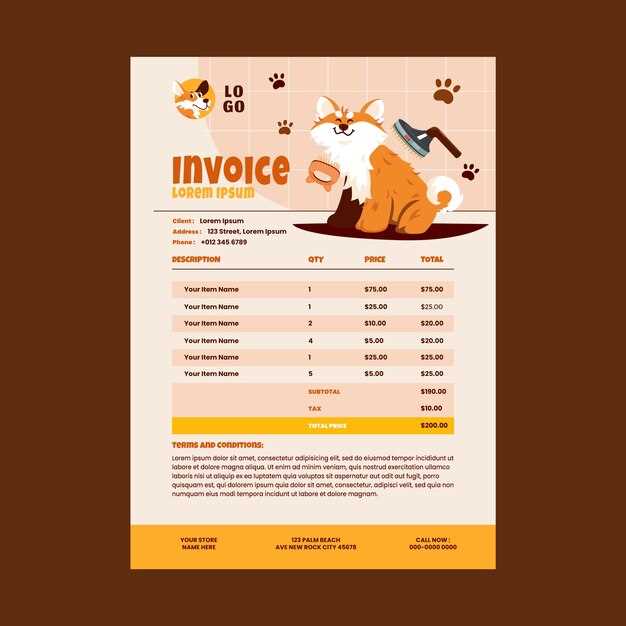

Example of a Customized Billing Record

| Service | Description | Rate | Total |

|---|---|---|---|

| Daily Care | Basic care for a pet, including feeding, walks, and playtime | $20 per hour | $60 |

| Grooming | Bathing and brushing | $30 per session | $30 |

| Transport | Transportation to the vet or grooming appointments | $15 per trip | $15 |

| Total Amount Due | $105 | ||

By organizing these elements clearly and professionally, you create a customized document that is easy for your clients to understand and for you to manage. Personalizing your billing process ensures that each record is accurate and tailored to your specific service offerings, helping you stand out in the competitive market.

Essential Elements of a Pet Sitting Invoice

For any animal care service provider, creating a clear and comprehensive billing document is essential for maintaining professionalism and ensuring timely payments. A well-structured document not only lists the services provided but also serves as a reference for both you and your client, ensuring transparency and preventing confusion. Below are the key elements that should be included to make your billing document both effective and professional.

- Service Details: This section should include a clear description of each service rendered, including the duration, frequency, and specific tasks performed. Detailed descriptions help clients understand exactly what they are paying for.

- Rates and Charges: Specify the pricing for each service, whether hourly, flat rate, or based on a specific package. Be sure to include any additional charges such as travel fees or special requests.

- Dates of Service: Clearly state the start and end dates or timeframes during which services were provided. This helps clients understand the exact period they are being billed for.

- Total Amount Due: Ensure the total amount is clearly displayed, including a breakdown of individual charges, taxes, and discounts (if applicable). This provides full transparency and avoids surprises for your clients.

- Payment Terms: Outline the payment due date, accepted methods (cash, bank transfer, credit card, etc.), and any late payment penalties or discounts for early payment.

- Contact Information: Include your business name, address, phone number, and email. This provides clients with clear ways to reach out for inquiries or concerns.

Incorporating these elements into your billing records ensures that you maintain a professional image while making it easier for clients to understand and process payments. A well-organized document not only facilitates smoother transactions but also helps build trust and long-term relationships with clients.

Common Mistakes in Pet Sitting Invoices

While creating a billing document may seem straightforward, there are several common errors that can lead to confusion, delayed payments, or even disputes with clients. Avoiding these mistakes will help ensure that your records are clear, professional, and prompt. By paying attention to details, you can streamline your billing process and maintain positive relationships with your clients.

- Missing Service Details: Failing to include a clear description of the services provided can lead to misunderstandings. Clients should always know exactly what they are being charged for, including specific tasks and the time spent on them.

- Incorrect Rates or Calculations: Mistakes in pricing or math errors can cause unnecessary confusion. Double-check the rates for each service and ensure that any additional charges or taxes are accurately calculated before sending the final document.

- Omitting Payment Terms: Without clear payment instructions, clients may not know when the payment is due or how to make it. Be sure to specify due dates, payment methods, and late fees, if applicable, to avoid any delays in payments.

- Not Including Business Information: Leaving out your business name, contact details, or tax identification number (if applicable) can make it harder for clients to contact you or process your payments. This is also important for tax and legal purposes.

- Forgetting to Include Dates: A common mistake is not specifying the dates or periods when services were rendered. This information is crucial for both you and your client to ensure that the charges align with the time spent providing care.

- Lack of Professional Formatting: An unorganized or cluttered document can appear unprofessional. Make sure your billing records are easy to read, with a clean layout that highlights important details, such as the total amount due and service descriptions.

Avoiding these common mistakes ensures that your records are clear, professional, and effective in helping you get paid on time. Simple attention to detail can go a long way in maintaining smooth business operations and building trust with your clients.

Best Practices for Professional Billing

Maintaining a professional approach to billing is essential for building trust with clients and ensuring timely payments. By following a few best practices, you can streamline your billing process, reduce errors, and establish a reputation for reliability and professionalism. A well-organized, transparent, and consistent approach to financial records helps foster long-term relationships with your clients and supports the smooth operation of your business.

Consistency and Clarity

One of the most important aspects of professional billing is consistency. Using the same structure for every document ensures that clients always know what to expect, making the process faster and more efficient. A consistent format also reduces the likelihood of mistakes. Along with consistency, clarity is key. Ensure that all charges, dates, and payment terms are clearly outlined and easy to understand.

Timely and Accurate Records

Always issue your billing records promptly after completing a service. This keeps your business cash flow steady and shows your clients that you are organized and professional. Double-check all information before sending to avoid errors in charges, dates, and calculations. Accuracy in your records not only prevents confusion but also enhances your credibility.

In addition, providing clients with multiple payment options–such as credit card, bank transfer, or online payment platforms–makes it easier for them to pay on time. Clear payment instructions and a well-defined due date help ensure there are no delays. By adopting these best practices, you create a seamless, professional experience for both you and your clients.

How to Send Pet Sitting Invoices

Once you’ve created a well-structured billing document, the next step is ensuring it reaches your client in a timely and efficient manner. How you send your payment requests can affect the speed at which you receive payment and also how professional your business appears. Whether you choose to send it digitally or through traditional mail, the method you use should be convenient for both you and your client, and should maintain clarity and professionalism.

Sending Billing Records Digitally

- Email: One of the quickest ways to send a billing document is through email. Attach the file as a PDF to ensure that the format remains unchanged and that your client can easily view and download it. Make sure to include a polite message, briefly explaining the amount due and any necessary payment instructions.

- Online Payment Platforms: If you’re using an online payment service (such as PayPal or Stripe), many platforms allow you to send professional payment requests directly. These platforms also offer tracking and confirmation features that can help ensure your client has received the document.

- Cloud Sharing Services: For larger files or recurring clients, consider using cloud storage services like Google Drive or Dropbox. You can share a link to the document while maintaining control over access, making it easy to update or correct the document if necessary.

Sending Billing Records by Mail

- Postal Mail: While less common in today’s digital age, some clients may prefer to receive a physical copy of the billing record. Ensure that you print the document clearly and include any relevant payment details, such as payment due date and methods. Mailing should be done promptly to avoid delays in the payment process.

- Certified Mail: If the payment is of a large amount, consider sending the billing document via certified mail. This service provides confirmation that your client has received the document, offering an extra layer of security.

Whichever method you choose, always ensure the document is easy to access and that payment terms are clearly stated. A quick, straightforward, and professional delivery of your records helps to reinforce your credibility and encourages clients to pay promptly.

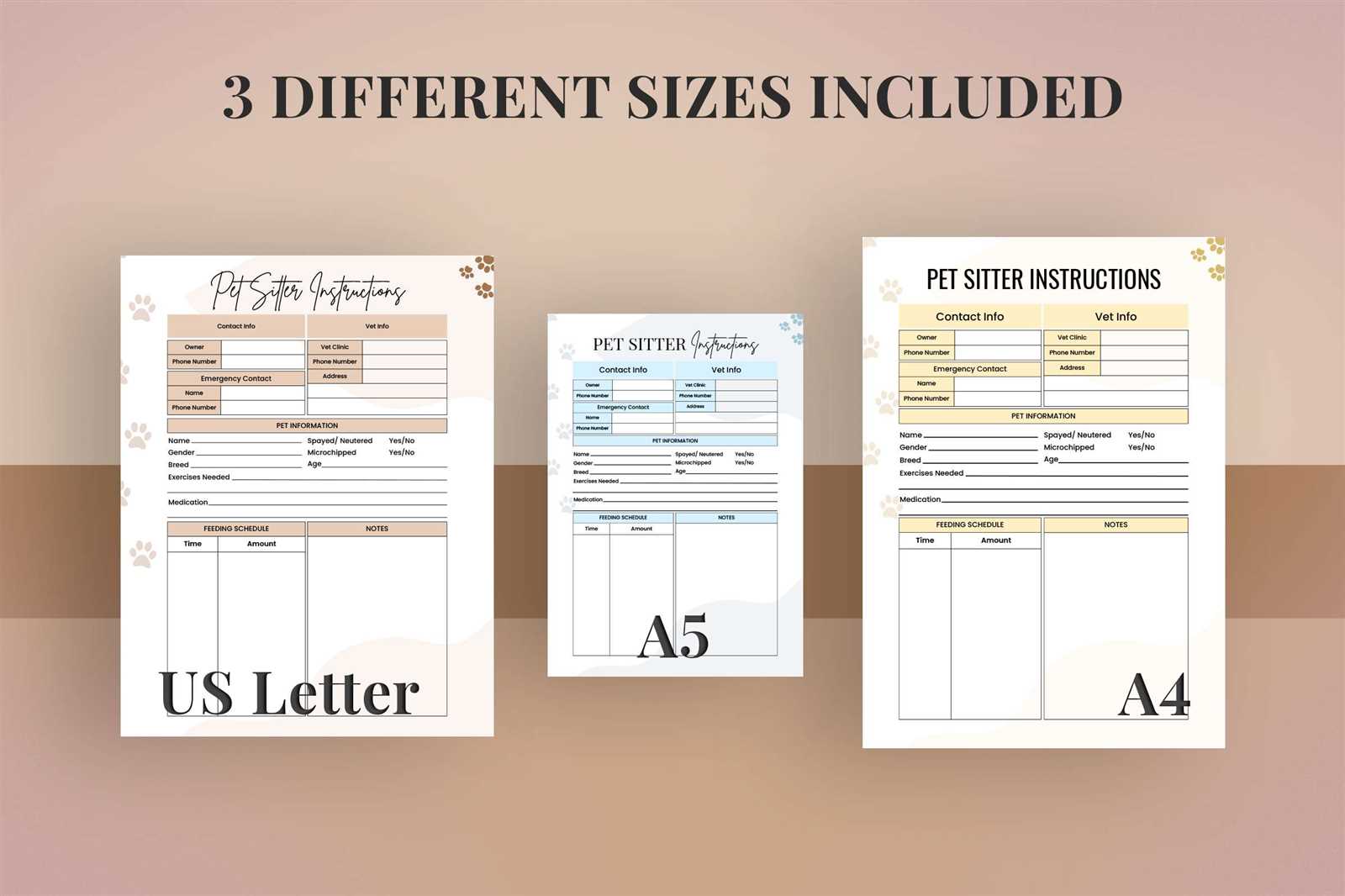

Choosing the Right Format for Invoices

Selecting the appropriate format for your billing documents is essential for both functionality and professionalism. Whether you choose to use a digital or paper format, the structure should be clear, easy to understand, and suitable for your business needs. The right format ensures that your records are accessible, organized, and maintain consistency, which can positively impact payment timelines and client satisfaction.

Digital Formats vs. Paper Documents

In today’s digital world, most businesses prefer electronic formats because they are faster, more cost-effective, and easier to track. Digital records can be sent via email or through payment platforms, offering clients a quick way to review and pay their bills. However, some clients may still prefer a physical copy, especially for larger payments or for legal purposes. Consider your audience when deciding whether to send your records electronically or by mail.

Popular Formats for Billing Documents

| Format | Advantages | Disadvantages |

|---|---|---|

| Universally accepted, easily accessible, maintains formatting, can be sent via email | May require a software update for some clients | |

| Word Document | Easy to edit and customize, familiar format | Formatting may change on different devices, less professional than PDF |

| Paper | Tangible, some clients prefer physical documents | Slower delivery, additional cost for printing and postage |

Each format has its pros and cons, so it’s important to select the one that best fits your business operations and client preferences. For most modern businesses, PDF is often the preferred choice due to its ease of use and universal compatibility, but you should always consider client needs when deciding how to present your financial documents.

Benefits of Automated Invoice Templates

Automating your billing process through pre-designed structures offers numerous advantages that can significantly improve the efficiency and accuracy of your business operations. By reducing manual work, you can save time, minimize errors, and ensure that your payment requests are consistently professional. Automated solutions also offer convenience, allowing you to quickly generate and send documents without having to start from scratch each time.

One of the main benefits of automation is the reduction of human error. By using pre-set structures, you eliminate the chances of overlooking important details, such as dates, charges, or payment terms. This not only helps avoid disputes but also promotes smoother transactions and stronger client relationships.

Another key advantage is the speed of processing. Instead of manually creating each document, an automated system allows you to generate and send billing records in a matter of minutes, ensuring faster payments. Additionally, automation allows for consistent formatting, which helps maintain a professional image across all client communications.

Automated solutions also make it easier to track your financial records. Many systems can store and organize past documents, giving you quick access to all previous transactions. This level of organization helps with record-keeping, tax reporting, and future reference, simplifying your administrative workload.

How to Calculate Pet Sitting Fees

Calculating service fees accurately is essential for maintaining profitability while ensuring your clients feel that they are getting fair value. Whether you charge by the hour, per session, or offer package deals, it’s important to consider all factors involved in the pricing process. Understanding how to structure your rates will help you establish competitive pricing and avoid undercharging or overcharging for your services.

To determine the appropriate fee for your services, take into account factors such as the time spent on each task, any additional expenses, and the level of care required. You may also want to adjust your rates depending on the specific needs of the client or the nature of the job.

Pricing Breakdown Example

| Service | Duration | Rate | Total |

|---|---|---|---|

| Basic Care | 1 hour | $20 | $20 |

| Overnight Stay | 12 hours | $50 | $50 |

| Transportation | One-way | $15 | $15 |

| Total Amount Due | $85 | ||

By breaking down the services and calculating each one individually, you can easily communicate the cost to your clients while also ensuring that all expenses are covered. Always remember to factor in any travel or additional charges that might apply based on the client’s location or special requests.

Invoice Template for Different Services

When providing multiple services, it’s essential to tailor your billing documents to reflect the variety of tasks you complete. Each service type may have different pricing structures, time requirements, and additional fees. By creating distinct billing formats for different service categories, you can ensure clarity and transparency with your clients, leading to smoother transactions and fewer misunderstandings.

Examples of Service Categories and Fees

- Basic Care: This might include tasks like feeding, grooming, or providing companionship. You can charge hourly or per visit, depending on the duration and complexity of the task.

- Specialized Care: For more involved services like administering medication or handling animals with special needs, you may charge a premium due to the extra time or expertise required.

- Transportation: If your services include pick-up and drop-off for clients, transportation fees should be included based on mileage or a flat rate for each trip.

- Overnight Services: If you are staying with the animal overnight, this would typically involve a higher rate due to the length of the service and the personal attention required.

Service Breakdown Example

- Standard Visit (1 hour): $25

- Overnight Stay (12 hours): $70

- Medication Administration (per session): $15

- Transportation (one-way): $10

By breaking down the charges for each service category in your billing documents, clients can clearly see the cost structure and feel confident in their payments. This approach also ensures you are properly compensated for all aspects of your work, especially when handling varied or complex tasks.

Creating Recurring Pet Sitting Invoices

For businesses that offer ongoing services, setting up a system for recurring billing is crucial. A consistent billing schedule not only helps you maintain a steady cash flow but also makes it easier for clients to manage their payments. By automating and structuring recurring charges, you ensure that both you and your clients stay organized and on track. This is especially beneficial for long-term clients who require regular attention.

Steps for Setting Up Recurring Billing

- Define the Service Schedule: Determine how often the services will be provided–weekly, bi-weekly, or monthly. Make sure both you and your client agree on the frequency and the duration of each service.

- Determine Pricing: Establish a clear rate for the service. If there are any changes in the scope of services, such as additional tasks or time, factor those into the recurring price. Include any taxes or additional charges.

- Set Payment Terms: Clearly outline when payments are due (e.g., on the first of the month, every two weeks) and what payment methods are accepted (bank transfer, credit card, online payment systems). Specify if late fees apply.

- Automate the Process: Use software or invoicing tools that can generate recurring payment requests automatically. This reduces the time spent manually creating new documents for each billing cycle.

Example of Recurring Billing Breakdown

- Weekly Visits (3 times per week): $60

- Monthly Package (12 visits): $240

- Additional Charges (e.g., transportation): $10 per trip

With recurring billing, the process becomes efficient for both you and your client. By outlining clear terms and setting up automated systems, you reduce administrative work, maintain transparency, and ensure timely payments. Recurring invoices also help build long-term client relationships by offering convenience and predictability for both parties.

Understanding Payment Terms for Services

Payment terms are crucial for ensuring that both service providers and clients are clear on expectations regarding when and how payments should be made. These terms outline the conditions under which services are provided, how much is owed, and the timeline for payment. Clear and transparent payment terms help avoid misunderstandings and ensure that both parties are satisfied with the financial arrangements.

Key Elements of Payment Terms

Establishing clear payment terms is essential for every transaction. Below are the primary components that should be included in any service agreement:

- Payment Due Date: Specify the exact date when the payment is expected, whether it is immediately upon service completion, within a certain number of days, or on a recurring basis.

- Accepted Payment Methods: Clearly state which methods of payment are acceptable (e.g., credit card, bank transfer, PayPal, cash, etc.) to ensure the client has options for making the payment.

- Late Fees: Include any penalties for late payments, such as a fixed fee or interest charged on overdue balances, to encourage timely payment.

- Discounts for Early Payments: Some service providers offer discounts for early payment to incentivize clients to pay ahead of schedule. Specify the discount terms if applicable.

Payment Terms Example

- Due Date: 15th of each month

- Late Payment Fee: 5% of the total balance if not paid within 7 days of the due date

- Accepted Methods: Bank transfer, credit card, PayPal

- Discount: 10% off if paid within 5 days of the due date

By defining these elements in advance, both you and your client can avoid confusion and ensure that the payment process runs smoothly. Establishing clear payment terms protects both parties and provides a professional framework for the financial aspect of your services.

How to Track Payments and Due Dates

Keeping track of payments and their corresponding due dates is essential for managing your cash flow and ensuring that your business operations run smoothly. A systematic approach to tracking payments helps you stay organized, minimize overdue accounts, and ensure that you receive timely compensation for your services. Whether you manage a few clients or many, setting up a tracking system is key to maintaining financial order.

Methods for Tracking Payments

There are several effective ways to track payments and due dates, depending on the complexity of your business and your preferred tools. Here are some common methods:

- Manual Records: You can track payments and due dates using a physical ledger or spreadsheet. While this method is straightforward, it can be time-consuming and prone to errors, especially as your client base grows.

- Accounting Software: Many modern tools allow you to automate payment tracking. With these systems, you can set due dates, send reminders, and track outstanding balances with ease. Examples include QuickBooks, FreshBooks, and Xero.

- Calendar Alerts: Using a digital calendar, such as Google Calendar or Microsoft Outlook, can be a simple yet effective way to track due dates. You can set reminders for payment deadlines and follow-up notifications for overdue accounts.

Tracking Payments and Due Dates Example

- Client Name: John Doe

- Service Provided: Weekly Visits

- Amount Due: $100

- Due Date: 1st of each month

- Status: Paid (on 2nd of the month)

- Next Payment Due: 1st of next month

By systematically organizing payment information, you can easily track which clients have paid, which owe balances, and when payments are due. This helps you stay on top of your finances and avoid missed payments, leading to better cash flow management.

Free vs Paid Billing Document Solutions

When it comes to generating professional billing documents, there are a variety of options available. You can either opt for free resources or invest in paid solutions. Both options have their advantages and drawbacks, and the right choice depends on your business needs, volume of transactions, and desired features. While free solutions may be sufficient for basic needs, paid options often offer more advanced features, customization, and support for businesses that require more complex functionality.

Advantages of Free Billing Solutions

- Cost-Effective: The most obvious benefit of using free tools is that they come with no upfront cost. This is ideal for small businesses or startups with limited budgets.

- Easy to Use: Many free resources are designed with simplicity in mind, making them accessible for beginners or businesses with straightforward billing requirements.

- Quick Setup: Free templates or software often require little to no setup, allowing you to start generating documents quickly.

Benefits of Paid Billing Solutions

- Customization Options: Paid services often offer greater flexibility, allowing you to fully customize the layout, branding, and content of your documents to match your business needs.

- Advanced Features: Premium options often include advanced functionalities such as automatic reminders, recurring billing, integration with accounting software, and client management tools.

- Customer Support: With paid solutions, you typically have access to dedicated customer service, which can be crucial if you encounter technical issues or need assistance.

Ultimately, whether you choose free or paid billing document solutions depends on the complexity of your needs. For basic businesses or occasional use, free templates may suffice. However, for those who require a more professional approach, advanced features, and custom branding, paid options offer the scalability and support that may be worth the investment.