Free Pest Control Invoice Template for Easy Billing

Managing payments and creating detailed receipts for your services can be a time-consuming task. However, with the right tools, this process can be simplified significantly. A well-structured document helps ensure accuracy and professionalism, allowing you to focus more on providing quality services to your clients.

Having a pre-designed form that fits your needs can save time and avoid errors. It offers a convenient way to input necessary details such as pricing, service dates, and client information. By using such a system, you reduce the risk of overlooking essential components that ensure smooth transactions.

Whether you’re a small business or an established company, adopting a standard format for all your receipts ensures consistency and fosters trust with your clients. This approach not only enhances efficiency but also helps maintain organized records, which can be crucial for both future billing and tax purposes.

Free Pest Control Invoice Template Benefits

Using a pre-designed document for billing offers several advantages, making the payment process smoother for both service providers and their clients. These ready-to-use forms can simplify the process of documenting charges, saving time and ensuring consistency across all transactions. Whether you’re just starting or looking to streamline your operations, a well-structured receipt format can significantly improve efficiency.

Save Time and Effort

With a standard form, you eliminate the need to create a new billing document from scratch each time. This approach reduces administrative effort, allowing you to quickly fill in relevant details like service dates and amounts. This ensures that your focus stays on providing quality services rather than dealing with paperwork.

Increase Professionalism and Accuracy

Having a professional format shows clients that you take your business seriously. Consistent use of a formal receipt can help prevent mistakes, ensuring that all essential information is included, from payment terms to service descriptions. This clarity fosters trust and smoothens future dealings with clients.

Why Use an Invoice Template

Having a standardized document for billing makes the process more efficient and less error-prone. Instead of spending time drafting a new form for each transaction, you can quickly customize a pre-made structure to fit your needs. This method improves accuracy and ensures consistency, which is crucial for maintaining professional relationships with clients.

Key Reasons for Using a Standardized Form

- Time-saving: You no longer need to create a new document from scratch every time you bill a client.

- Consistency: A consistent layout ensures that all essential details are included in each transaction.

- Professionalism: A well-structured document presents a polished, business-like image to clients.

- Accuracy: A pre-designed format minimizes the risk of forgetting critical information like service descriptions and payment terms.

How It Simplifies the Billing Process

- Quick Customization: You can easily adjust fields like amounts and client details, making it faster to create documents.

- Clear Communication: Clients can easily understand charges and terms, reducing the chance of disputes.

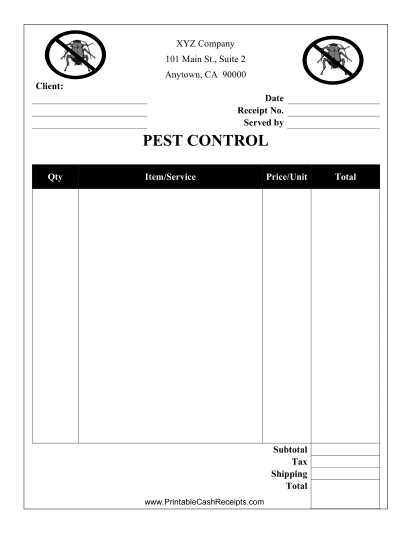

How to Customize Your Invoice

Personalizing your billing documents allows you to adapt them to specific needs, ensuring they align with your business style and the services provided. Customizing ensures that each document contains the necessary details, such as service descriptions, amounts, and terms, in a way that suits both your company and the client’s expectations.

Steps to Modify the Document

- Adjust Client Information: Ensure all client details, including name, address, and contact information, are accurately entered.

- Update Service Descriptions: Modify the list of services to reflect what was actually provided, making each entry clear and specific.

- Set Payment Terms: Customize payment due dates and any specific terms such as late fees or discounts.

- Incorporate Your Branding: Add your company logo, business name, and contact information to give the document a professional appearance.

Enhancing Clarity and Organization

- Organize Line Items: Arrange the charges clearly by category, ensuring that the client can easily follow the breakdown.

- Adjust the Layout: Modify fonts, colors, and spacing to match your preferred style and make the document easy to read.

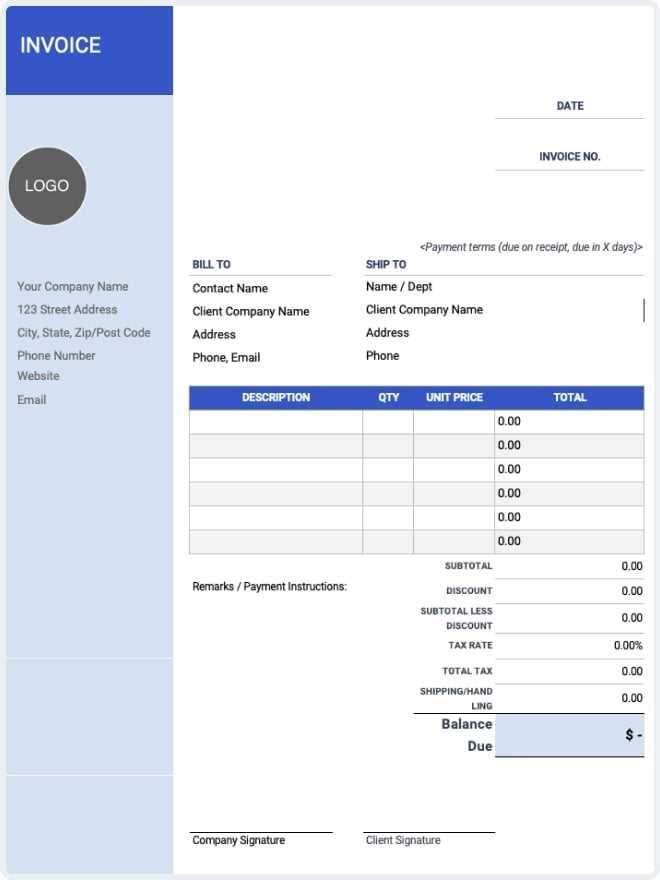

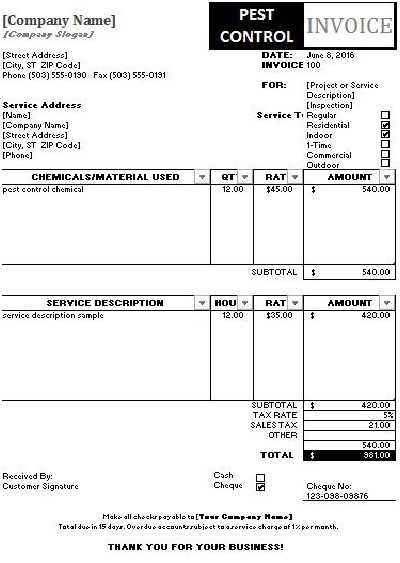

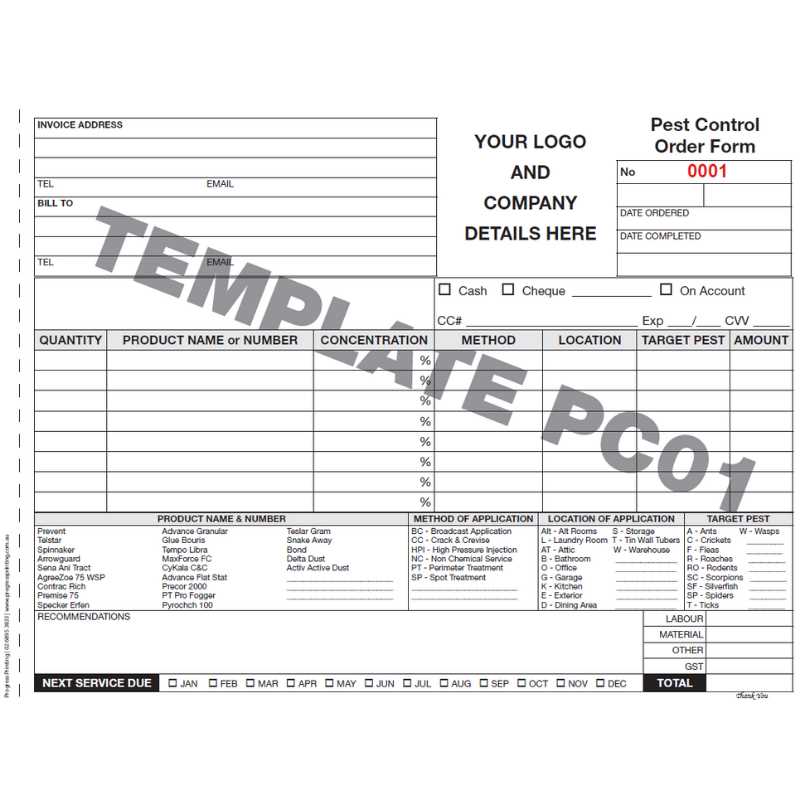

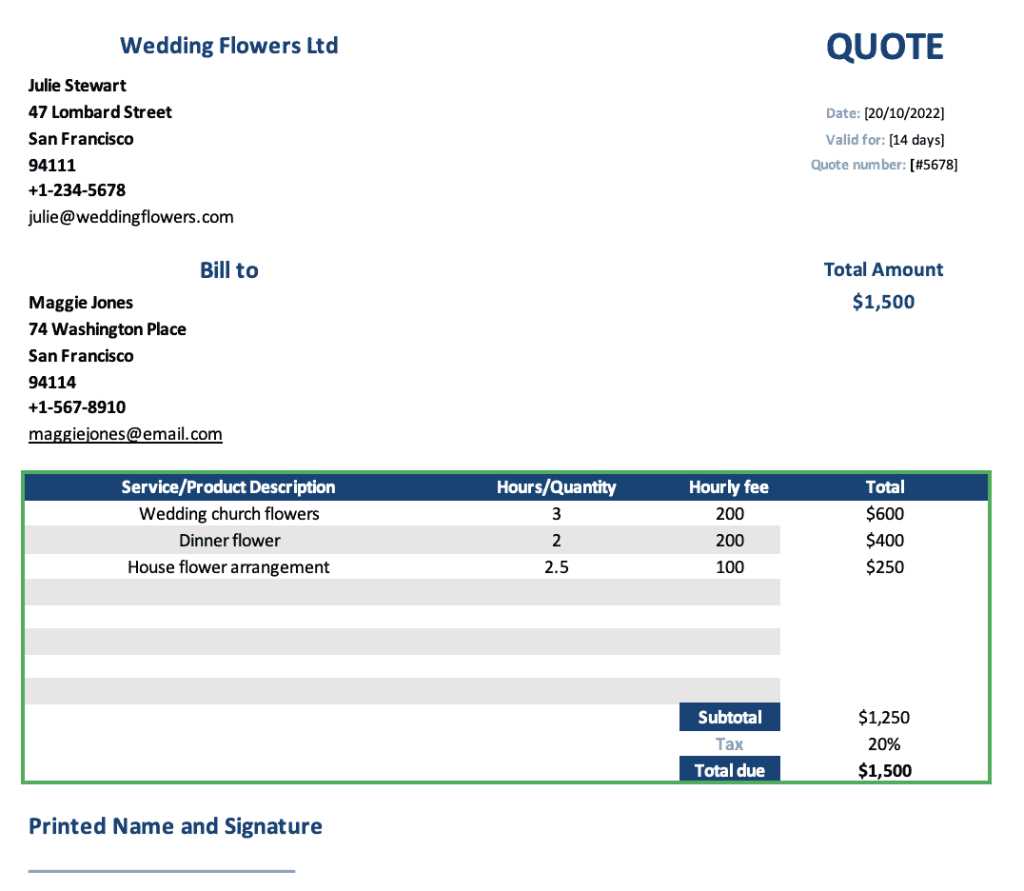

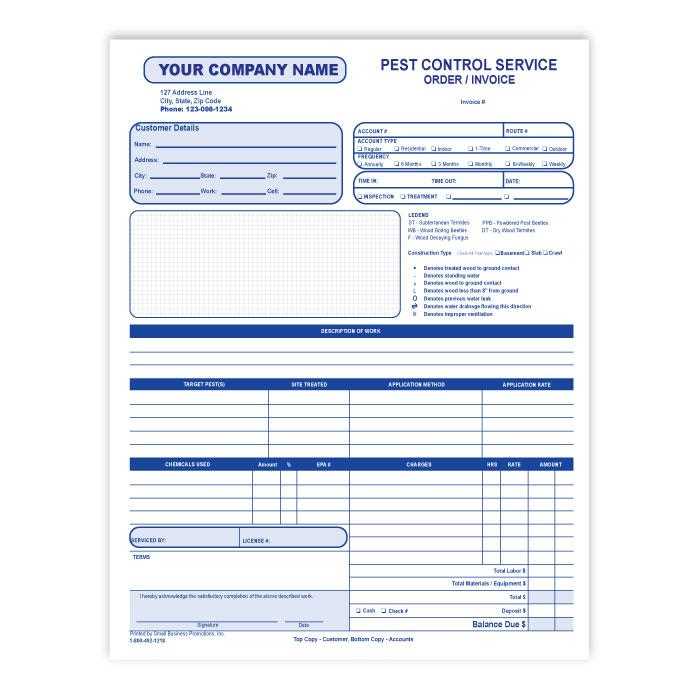

Key Features of a Pest Control Invoice

An effective billing document must include all the essential details that ensure clear communication between the service provider and the client. These key elements help to outline the charges, services rendered, and payment terms, ensuring transparency and professionalism. Understanding these features is crucial for creating a document that avoids confusion and fosters trust.

Essential Elements for Effective Billing

- Service Description: Clearly describe each service provided, including any special tasks or treatments performed.

- Pricing Information: List the charges for each service, ensuring the amounts are accurate and easy to understand.

- Payment Terms: Specify the due date, accepted payment methods, and any late fees if applicable.

- Company Details: Include your business name, logo, and contact information, creating a professional appearance.

- Client Information: Ensure client name, address, and contact details are correct for accurate billing and communication.

Additional Features to Consider

- Itemized Breakdown: Provide a clear breakdown of services by date or category to give more transparency.

- Unique Invoice Number: Use a unique identifier for each document to help track and organize records.

- Tax and Discounts: Include applicable taxes or discounts to give a clear view of the total amount due.

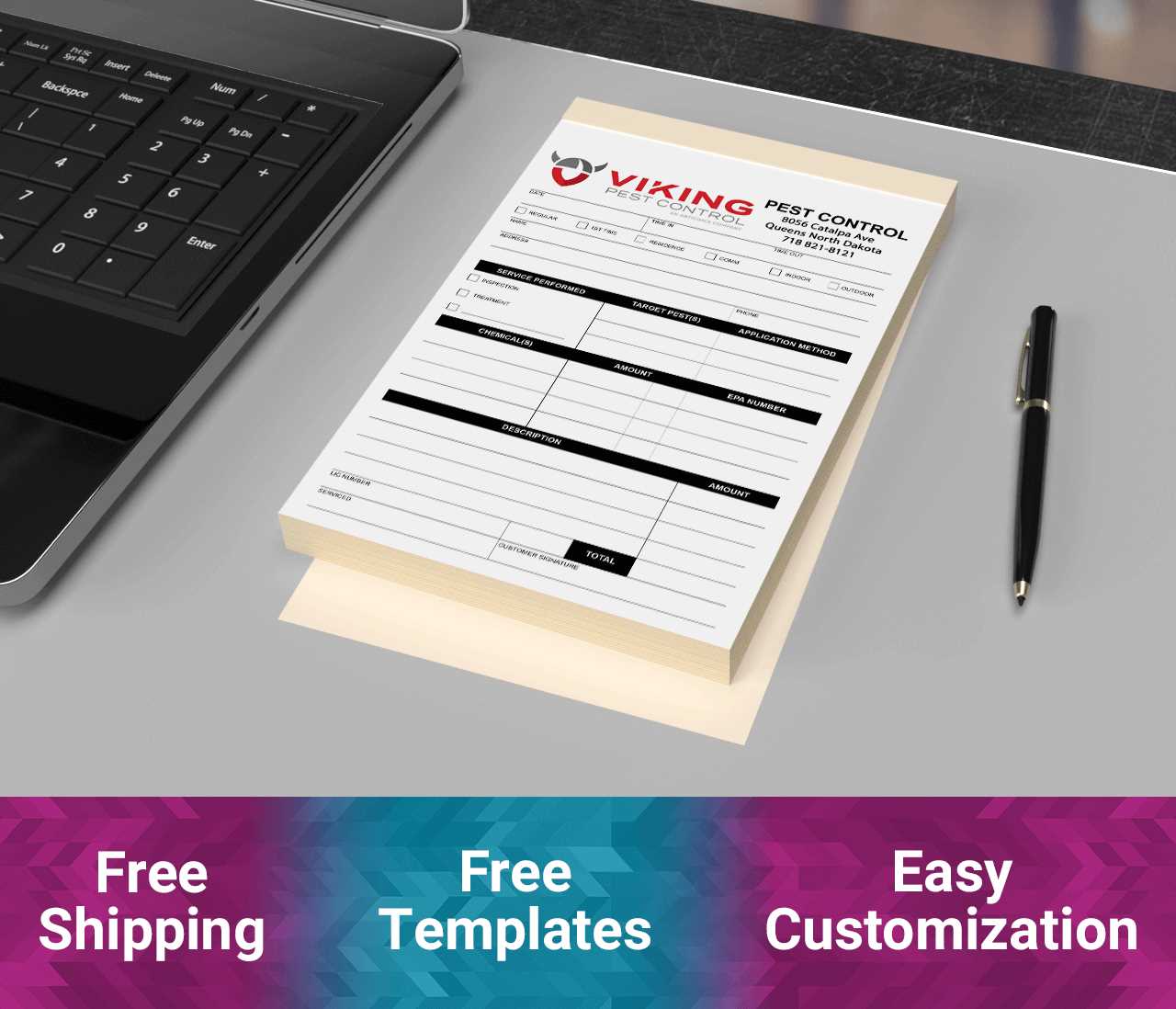

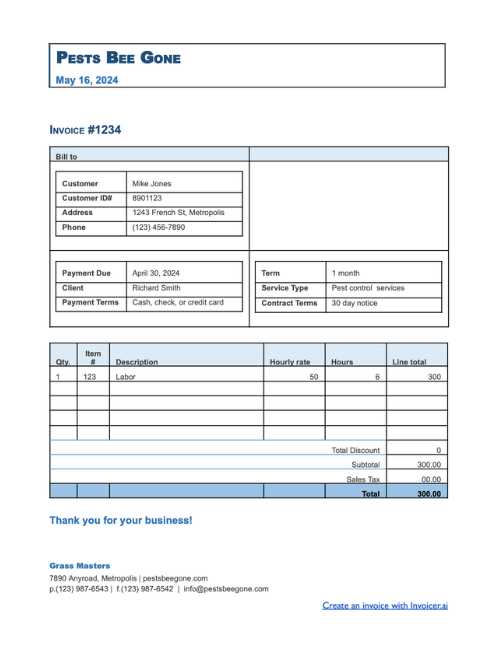

Download Pest Control Templates Easily

Getting your hands on a professionally designed document is a simple and efficient way to improve your billing process. With just a few clicks, you can access ready-to-use formats that are adaptable to your specific business needs. Whether you’re new to the industry or looking to simplify your operations, downloading these forms can save you valuable time and effort.

These downloadable files are often available in various formats, including Word, Excel, and PDF, making it easy to choose the one that best suits your workflow. Most providers offer these options with simple customization features, ensuring you can tailor them to your requirements with minimal effort.

| Format | Features | Customization Options |

|---|---|---|

| Word | Easy editing and text formatting | Text, logos, service details |

| Excel | Supports calculations and totals | Adjust pricing, itemized lists |

| Fixed layout for consistent appearance | Limited editing, best for final version |

Essential Information to Include

For any billing document to be effective, it must contain all the crucial details that ensure clear communication between the service provider and the client. These elements help both parties understand the charges, terms, and expectations, reducing the potential for misunderstandings. Properly structuring this information is vital for a smooth transaction and professional appearance.

Key Elements for a Clear Document

| Information | Description |

|---|---|

| Service Provider Details | Include your company name, contact information, and any relevant business identification numbers. |

| Client Information | Provide the client’s name, address, and contact details to ensure proper identification. |

| Service Description | Clearly describe the services provided, including any special treatments or tasks performed. |

| Charges and Costs | List each charge, including any taxes, fees, or discounts, with the total cost clearly stated. |

| Payment Terms | Specify the due date, payment methods, and any late fees or conditions. |

| Invoice Number | Assign a unique reference number to track and organize your records. |

Why Each Piece Matters

Including these key details not only ensures that the transaction is clear but also helps to avoid disputes. Each item serves a specific purpose, whether it’s ensuring proper identification, clarity on the charges, or establishing the payment timeline. A well-detailed document fosters trust and shows professionalism to your clients.

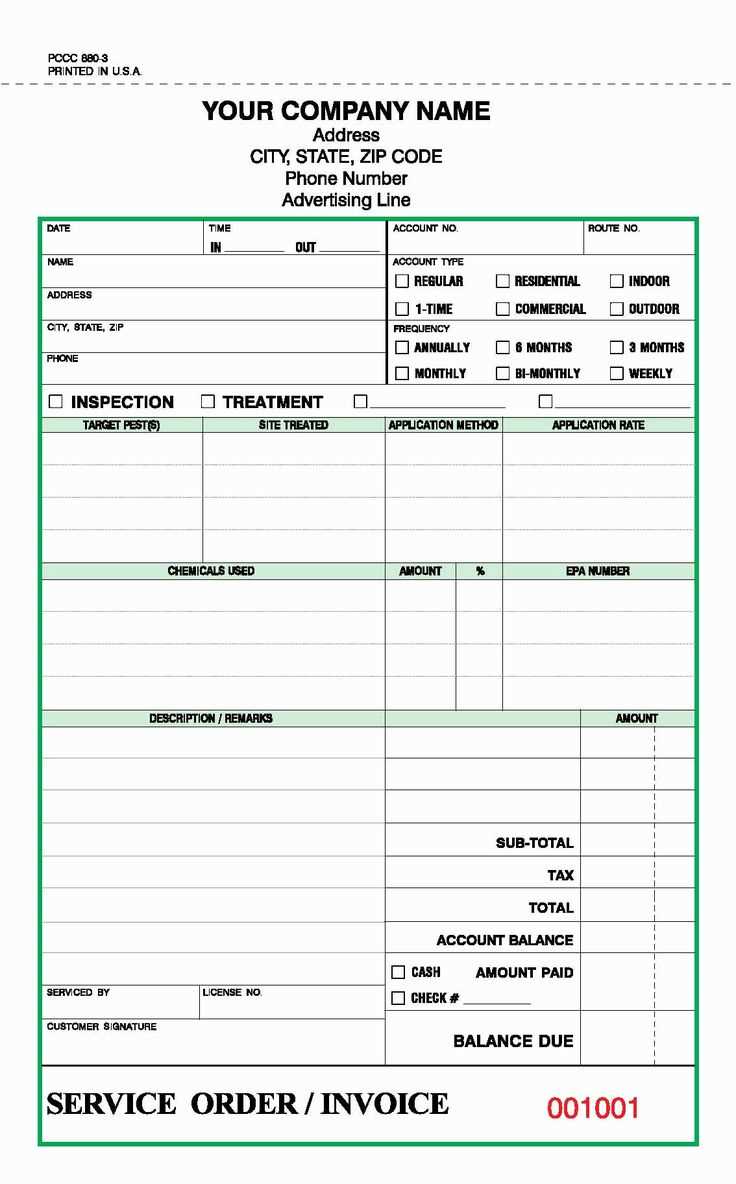

How to Add Service Details

Including accurate and thorough descriptions of the services provided is essential for maintaining clarity and transparency with your clients. By detailing the work completed, you help clients understand what they are paying for, which fosters trust and prevents misunderstandings. A well-documented breakdown ensures that both parties are aligned on expectations and charges.

Steps to Effectively Add Service Information

Start by clearly listing each task performed, providing specific details where necessary. It’s important to be as descriptive as possible to avoid confusion.

- Service Name: State the name or type of service provided. Be clear and specific, avoiding vague terms.

- Quantity and Duration: Include the amount of work done, such as hours worked or the number of visits, along with the time spent on each task.

- Detailed Descriptions: Include any special procedures or treatments that were part of the service. This provides clarity and reinforces the value of the work performed.

- Costs per Service: If services vary in cost, list each one separately along with its corresponding charge.

Why Service Descriptions Are Important

Providing detailed service information ensures that the client is fully informed about the scope of the work completed. It reduces the risk of questions or disputes about what was done and why certain charges were applied. This level of detail shows professionalism and fosters positive client relationships.

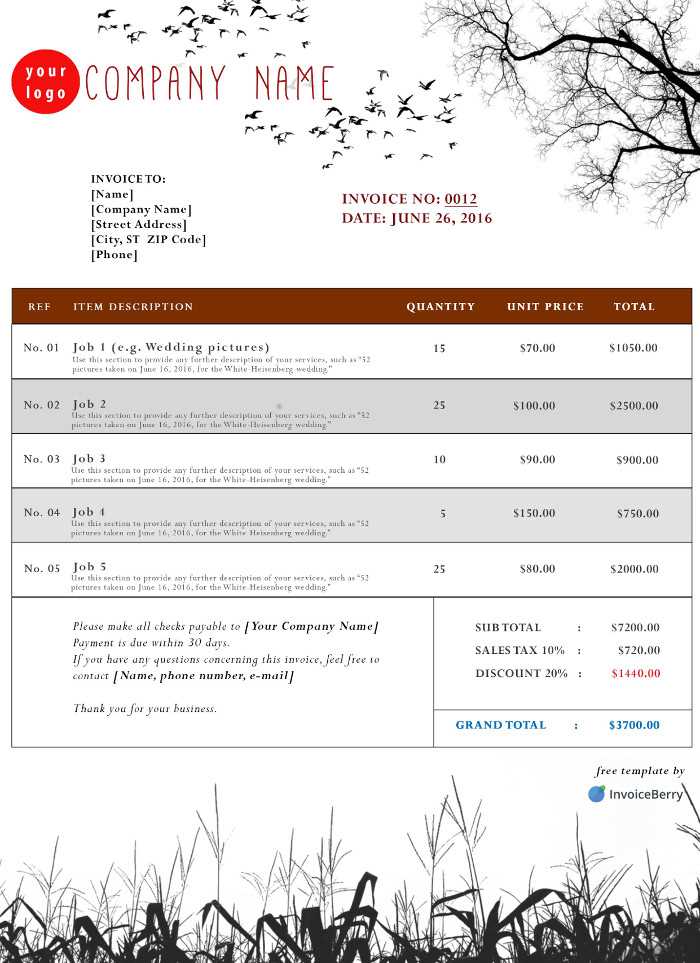

Choosing the Right Template for Your Business

Selecting the right format for your billing documents is crucial to ensure that they align with your company’s needs and the services you offer. The right document structure can make a significant difference in how your business is perceived, and it can also streamline your operations. It’s important to choose a layout that is both professional and functional, allowing for easy customization and adaptation to your unique requirements.

When considering a billing format, think about factors like the complexity of the services you offer, your branding, and how easy it is to modify the document as your business evolves. The goal is to find a structure that is simple, clear, and customizable, while also reflecting your company’s image and maintaining professionalism in every transaction.

Organize Payments and Due Dates Efficiently

Efficiently managing payment schedules and deadlines is vital for maintaining smooth financial operations in any business. Clear payment terms and well-structured due dates help ensure timely payments and reduce the risk of late fees or disputes. By establishing a consistent system for tracking and organizing payments, you can enhance cash flow and maintain positive relationships with clients.

Setting clear due dates, specifying acceptable payment methods, and keeping a well-maintained record of transactions can significantly streamline the payment process. By organizing these elements effectively, you make it easier to monitor outstanding balances and ensure that payments are processed without delays.

How to Track Your Billing Documents

Effectively tracking your billing records is essential for maintaining organized financial operations. By keeping an accurate record of all transactions, you can monitor paid and unpaid balances, prevent errors, and ensure timely follow-ups on overdue payments. Establishing a reliable system for tracking these records helps you stay on top of your finances and manage cash flow efficiently.

Steps for Tracking Billing Records

- Assign Unique Reference Numbers: Use a unique number for each document to simplify tracking and prevent confusion.

- Record Payment Dates: Always note when payments are received or due to stay on top of your outstanding balances.

- Track Payment Status: Clearly mark which transactions have been paid and which are still pending.

- Use Software or Spreadsheets: Digital tools can help streamline the process by automatically organizing and calculating totals.

Why Tracking is Important

Maintaining accurate records not only ensures proper financial management but also helps with auditing and tax preparation. By being diligent about tracking all billing documents, you can identify trends, spot discrepancies early, and keep your business running smoothly.

Invoicing for Recurring Services

Billing for services that are provided on a regular basis requires a structured approach to ensure that both you and your clients remain on the same page regarding payments and timelines. Whether the services are offered weekly, monthly, or annually, it’s important to create a consistent system for generating and tracking charges. This helps build trust with clients and ensures that payments are made promptly and correctly.

Steps for Recurring Billing

When setting up recurring charges, there are a few key elements to consider for a smooth process:

- Clear Payment Terms: Specify the frequency of payments (e.g., monthly, quarterly) and due dates clearly in your documents.

- Automated Billing Options: Consider using software or billing platforms that can automatically generate and send payment requests at set intervals.

- Fixed or Variable Amounts: If charges change, ensure that clients are notified in advance about any adjustments to the fees.

Why Recurring Billing is Beneficial

Recurring billing helps to stabilize cash flow, allowing businesses to plan ahead and allocate resources more effectively. By automating the process, businesses can save time, reduce errors, and focus on providing quality service to their clients.

Benefits of Digital Billing for Service Providers

Adopting digital methods for managing billing can bring several advantages to businesses, making it easier to create, send, and track payment requests. By transitioning from paper-based to electronic documents, companies can streamline their financial processes, reduce errors, and enhance overall efficiency. Digital billing allows for faster transactions and improved organization, contributing to better customer satisfaction and smoother business operations.

Key Advantages of Digital Billing

- Faster Processing: Digital billing enables quicker delivery and processing of payment requests, reducing the wait time for clients and businesses alike.

- Environmentally Friendly: Moving away from paper-based systems helps reduce waste and supports eco-friendly practices.

- Easy Record Keeping: Digital systems automatically organize and store records, making it easier to track past transactions and maintain accurate financial records.

- Improved Accuracy: With automated calculations and easy editing features, digital billing minimizes human error and ensures accuracy in charges and amounts.

- Security and Accessibility: Electronic documents can be securely stored and easily accessed from anywhere, ensuring both safety and convenience.

Why Businesses Should Make the Switch

By moving to digital billing, businesses can enjoy faster turnaround times, lower overhead costs, and a more professional image. Moreover, digital systems can be integrated with other business tools, such as payment platforms or accounting software, creating a seamless workflow that improves efficiency and saves valuable time.

Free Options vs Paid Solutions

When it comes to selecting tools for managing billing and payments, businesses often face the choice between free and paid options. Both have their own set of advantages, but understanding the differences is key to making the right decision for your business. While free solutions may seem like an attractive choice, paid options typically offer enhanced features, better support, and greater flexibility to meet specific needs.

Free tools can be a good starting point for small businesses or those with limited budgets. However, as your business grows or your needs become more complex, you may find that free options lack the functionality and customization that paid solutions can provide. On the other hand, paid options often come with advanced features, robust security, and customer support to ensure smooth operations and professional results.

How to Ensure Accurate Billing

Maintaining precision in your billing process is crucial for both customer satisfaction and business sustainability. Accurate billing helps avoid disputes, ensures timely payments, and fosters trust with clients. To achieve this, it’s important to implement practices that reduce the likelihood of errors and enhance the overall efficiency of your financial processes.

Best Practices for Accurate Billing

- Double-Check Client Information: Verify all client details before generating any payment request, including contact information and services provided.

- Clear Itemization: Break down the charges into clear, understandable categories, ensuring that clients can easily see what they’re being billed for.

- Use Consistent Pricing: Maintain a standard pricing structure for services offered and avoid any discrepancies or changes unless properly communicated to the client in advance.

- Automate Calculations: Utilize software that automatically calculates totals, taxes, and discounts to minimize human error in your records.

- Review Before Sending: Always check the final document for any missing or incorrect details before sending it to the client.

Tools for Ensuring Accuracy

Using billing software or systems that include built-in validation and checks can help prevent common mistakes. Automation features such as auto-population of client data and calculations can reduce errors and save time. Additionally, cloud-based systems ensure that all records are consistently updated and easily accessible, providing a reliable framework for accurate billing.

Options for Different Service Types

When offering a variety of services, it’s important to have documentation tools tailored to each specific type of work you perform. Whether you’re providing regular maintenance, specialized tasks, or one-off projects, customizing your billing records ensures clear communication and efficient processing. Different services often require distinct formats to properly outline the details, such as pricing, timing, and unique requirements.

Service-Based Customization: Each type of service might necessitate different sections on the billing record. For example, ongoing services may benefit from recurring billing options, while one-time jobs will require a more straightforward approach. Additionally, services that involve product supplies, labor charges, or specialized tools should have designated areas to list each cost separately.

Customizing for Recurring Services

For regular services, creating a document with sections that reflect the recurring nature of the work is essential. Features to consider include:

- Frequency of Service: Indicate the schedule for recurring visits (e.g., weekly, monthly).

- Service Duration: Specify the expected time frame for each session.

- Ongoing Discounts: If applicable, include discounts for long-term contracts or repeat customers.

Customizing for One-Time Services

One-off services require clear, itemized listings. Important elements might include:

- Detailed Breakdown: List all individual tasks performed during the service.

- Single Payment: Outline the total cost and specify the payment due date.

- Materials or Products Used: Include any materials or products that were needed to complete the job.

By selecting the right format for each type of service, you can ensure that clients receive accurate and comprehensive billing details, leading to greater satisfaction and improved cash flow management.

Why Billing is Crucial for Service Providers

For any service-based business, proper documentation of services rendered and payments owed is essential for maintaining financial stability and transparency. Clear and accurate records allow for smooth transactions, reduce disputes, and ensure that businesses are paid promptly for their work. Without proper billing, it becomes difficult to track income, manage cash flow, and maintain professional relationships with clients.

When it comes to industries that provide specialized services, such as those dealing with maintenance or treatment plans, accurate billing becomes even more crucial. This is because clients often expect clear explanations of the services performed, associated costs, and payment terms. Failure to provide well-structured records can lead to confusion, delayed payments, and ultimately, dissatisfied customers.

Benefits of Proper Billing Systems

Having a reliable system for managing charges offers numerous benefits for businesses:

- Improved Cash Flow: Timely and accurate billing helps ensure that payments are made on schedule, which is crucial for maintaining healthy cash flow.

- Clear Communication: Well-detailed records reduce misunderstandings between service providers and clients, providing transparency about what was done and what the costs are.

- Easy Record Keeping: With the right documentation, it’s easier to track expenses, revenue, and outstanding payments, making accounting simpler and more accurate.

- Legal Protection: Having a formal record of services and agreed payments can act as protection in case of any future disputes or legal issues.

Establishing Trust with Clients

Providing clear, professional billing records helps build trust with clients. By outlining all services performed and their associated costs, you demonstrate your professionalism and attention to detail. This encourages clients to trust you for ongoing and future services, knowing they will receive transparent and fair treatment.

In summary, accurate billing is not just about requesting payment–it’s an essential practice that helps streamline operations, improve client relationships, and ensure that businesses are paid for their work without unnecessary delays or confusion.

Tips for Maintaining Professional Invoices

Creating and managing clear, accurate, and well-organized billing documents is a key aspect of maintaining professionalism in any business. Whether you are a freelancer or a large company, presenting well-structured payment requests can leave a lasting positive impression on clients. Professional documents help build trust, ensure payments are processed smoothly, and prevent misunderstandings about services rendered or payment terms.

Here are some practical tips for keeping your billing documents professional:

1. Keep the Design Clean and Clear

- Use Simple Layouts: A clutter-free design ensures that all important details are easy to find.

- Branding: Incorporating your company logo and using a consistent color scheme can help reinforce your brand’s identity.

- Readable Fonts: Choose fonts that are easy to read, ensuring all text is clear and legible for your clients.

2. Include All Essential Information

- Client Information: Always include the full name and contact details of both the client and your business.

- Service Details: Clearly state the services provided, with concise descriptions and appropriate pricing.

- Payment Terms: Specify when payment is due and outline any late fees or penalties to avoid confusion.

- Unique Identification: Assign a unique number or code to each document for easy tracking and reference.

3. Stay Consistent with Your Formatting

- Uniform Structure: Use a consistent format for all your documents. This makes it easier for both you and your clients to keep track of payments.

- Clear Dates: Make sure that dates for when services were rendered and when payment is due are clearly visible.

- Standardized Language: Use professional language and avoid jargon that could cause confusion.

4. Provide Easy Payment Methods

- Multiple Options: Offer clients different ways to pay, such as bank transfer, credit card, or online payment platforms.

- Clear Payment Instructions: Include step-by-step instructions on how clients can complete their payments easily and securely.

By adhering to these practices, you not only ensure that your payment requests are professional but also foster better relationships with your clients. Clear, well-maintained documents reflect your attention to detail and contribute to the overall success of your business.

Common Mistakes to Avoid When Invoicing

Billing is a critical aspect of running a successful business, but even small errors can lead to confusion, delayed payments, and dissatisfied clients. To ensure smooth transactions, it’s important to avoid common mistakes that can make your billing process less efficient. From miscalculating amounts to failing to include necessary details, these errors can affect both your reputation and cash flow.

1. Missing Key Information

- Omitting Client Details: Always include the correct name, address, and contact information for both parties to avoid confusion and ensure the right person receives the document.

- Not Including Clear Payment Terms: Clearly state when payments are due and whether any late fees will be applied. Ambiguity here can lead to delays or disputes.

- Unclear Descriptions of Services: Ensure that all services are clearly listed with detailed descriptions so that the client understands what they are paying for. Vague or incomplete service descriptions can lead to misunderstandings.

2. Calculation Errors

- Incorrect Totals: Double-check your math before sending the document. Simple errors in calculations can cause delays or lead clients to question the accuracy of your request.

- Not Accounting for Discounts or Taxes: If you offer discounts or need to include taxes, ensure they are accurately reflected in the final total. Leaving this out could result in undercharging or overcharging.

- Not Including a Breakdown of Costs: Break down your charges into clear categories (e.g., hourly rate, materials, taxes). This transparency helps the client understand how the total was calculated.

By paying attention to these common mistakes, you can streamline your billing process and avoid potential disputes. A well-organized and error-free document reflects professionalism and helps maintain a positive relationship with clients.