How to Create a Personalized Invoice Template for Your Business

When managing financial transactions, having a professional and clear method to request payments is essential. A well-designed document not only helps in organizing billing processes but also leaves a lasting impression on your clients. Creating a document that reflects your brand identity while being practical for everyday use can significantly streamline your operations.

In today’s fast-paced business environment, efficiency and clarity are key. By using a document that suits your specific needs, you can simplify invoicing, reduce errors, and ensure timely payments. Customizing your billing statements can help you maintain consistency in your communication with clients, fostering trust and professionalism.

Whether you’re a freelancer, small business owner, or part of a larger company, creating an adaptable and easy-to-use billing document can save time and reduce administrative hassle. With the right tools, you can design a solution that fits both your style and functional requirements, allowing you to focus more on what truly matters–growing your business.

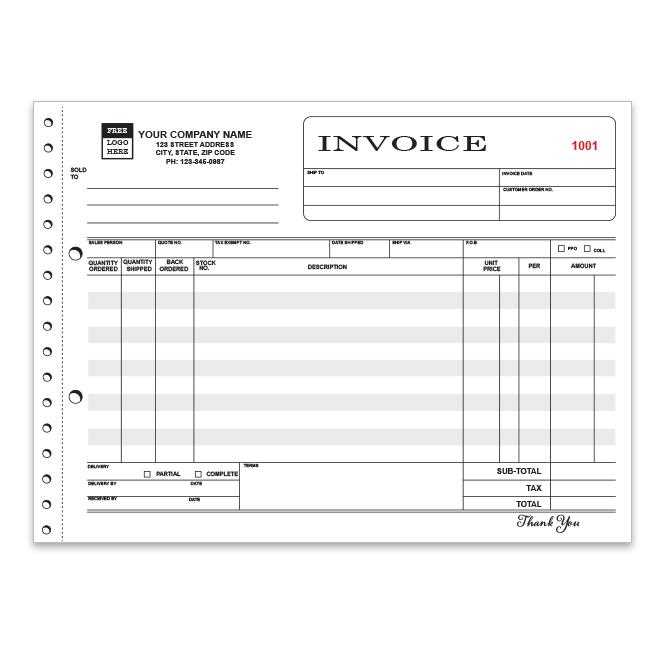

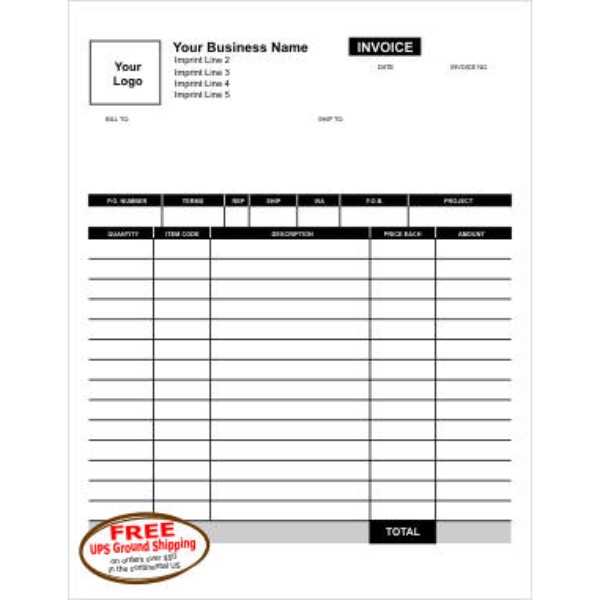

Custom Billing Document Overview

When running a business, having a clear and consistent way to request payments from clients is crucial for maintaining cash flow and professionalism. A well-crafted billing statement serves not only as a tool for financial management but also as a representation of your brand. Customizing such a document to suit the unique needs of your business can help streamline your processes, reduce errors, and create a professional image in the eyes of your customers.

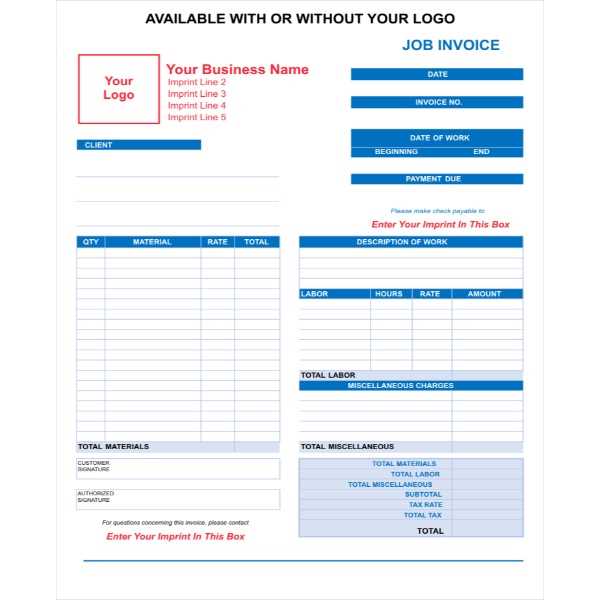

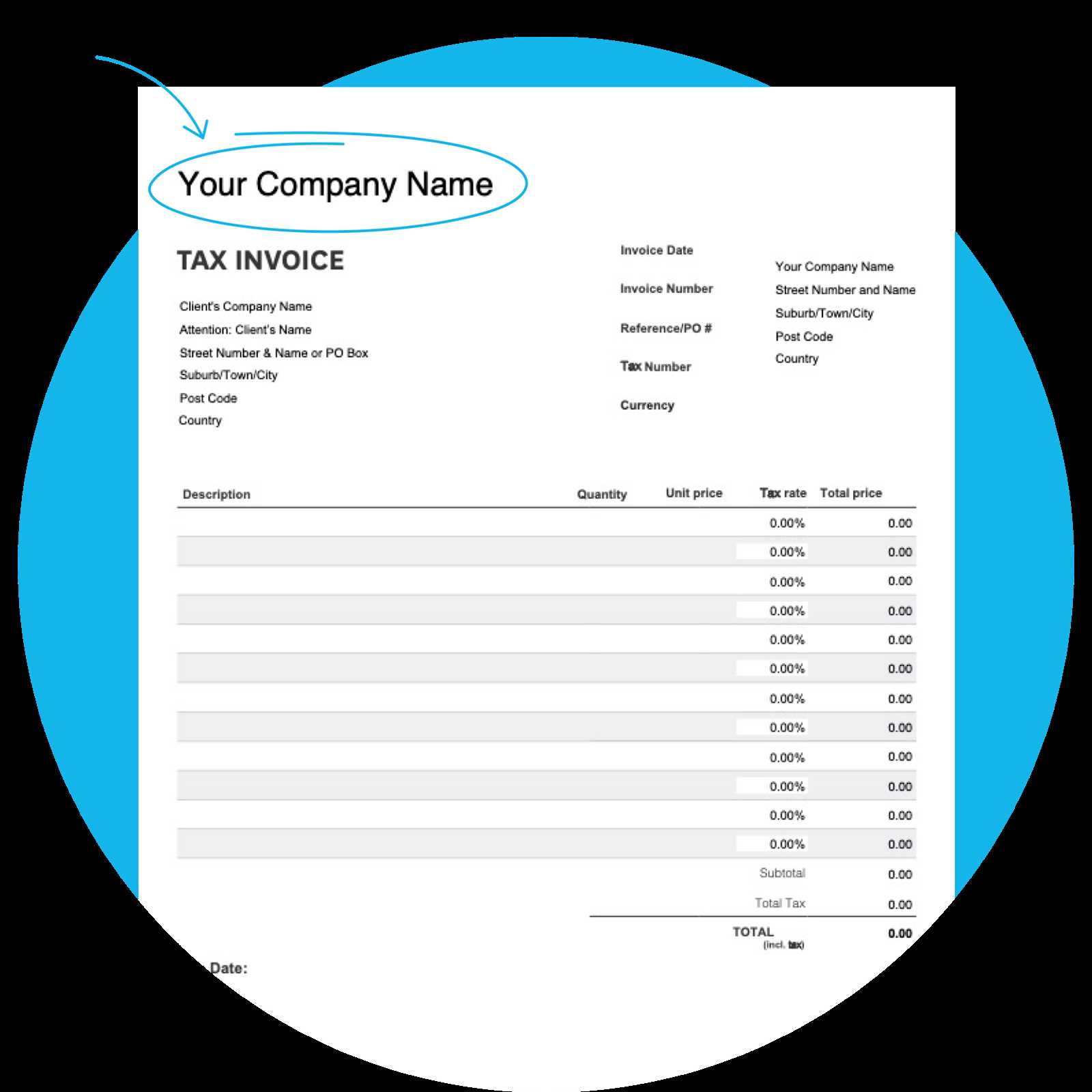

Tailoring these documents ensures that they are both functional and aligned with your business’s aesthetic. By adjusting the layout, adding logos, and including specific details that reflect your company’s values, you can transform a simple financial request into a statement of your brand’s commitment to quality. The result is a smoother billing experience for both you and your clients, making transactions more efficient and professional.

Key Features of a Customized Billing Document

There are several features that make these documents effective for any business, including:

| Feature | Description |

|---|---|

| Branding | Incorporate company logos, colors, and fonts to reinforce brand identity. |

| Clear Payment Terms | Clearly outline payment deadlines, methods, and any late fees to avoid confusion. |

| Customizable Sections | Adjust sections based on your industry, such as itemized lists for services or products. |

| Tax Information | Include necessary tax details specific to your region or business requirements. |

Why Customizing Matters

Using a standard, one-size-fits-all billing format might suffice in the short term, but as your business grows, the need for more tailored documents becomes apparent. A customized approach not only improves the presentation but also ensures that all relevant information is included and easy to understand. The ability to quickly generate accurate and professional documents is an invaluable asset in today’s competitive market.

Why Use a Custom Billing Document

Having a billing document tailored to your business needs can significantly improve your financial management process. Generic billing formats may not effectively convey important details or reflect your company’s branding. A customized solution allows you to create a seamless and professional experience for both you and your clients, ultimately helping to build stronger relationships and ensuring clarity in every transaction.

By adapting your financial documents to fit your unique requirements, you ensure that every element serves a purpose–whether it’s to streamline the payment process, reinforce your brand identity, or ensure that all necessary information is present and accurate. A tailored approach minimizes errors, simplifies communication, and speeds up the billing cycle, making it easier for clients to understand and pay their bills on time.

Moreover, a custom approach enables you to include specific details that reflect your business model. For example, freelancers can add service breakdowns, while retail businesses can include product descriptions and quantities. This flexibility enhances your professionalism and can even increase customer satisfaction by providing exactly the information they need in a clean and easy-to-understand format.

Benefits of Tailoring Your Documents

Customizing your billing documents offers numerous advantages that go beyond simple aesthetics. A tailored approach ensures that all critical information is clearly presented and aligned with your business’s specific needs. By adjusting the design and content, you can make sure that your documents are functional, professional, and easy for clients to understand, improving overall communication and reducing misunderstandings.

One of the key benefits of customizing your billing documents is the ability to reinforce your brand identity. By incorporating your company’s logo, colors, and fonts, you create a cohesive experience for clients that reflects your attention to detail and professionalism. This small yet powerful touch helps build brand recognition and trust, which can encourage repeat business and positive referrals.

Additionally, tailoring your documents makes it easier to include relevant details that may be specific to your industry or customer relationships. Whether it’s adding product descriptions, adjusting payment terms, or listing multiple services, a customized format ensures that all necessary information is included and clearly laid out, saving time for both you and your clients. This level of clarity leads to faster payments, fewer follow-up requests, and a smoother financial process overall.

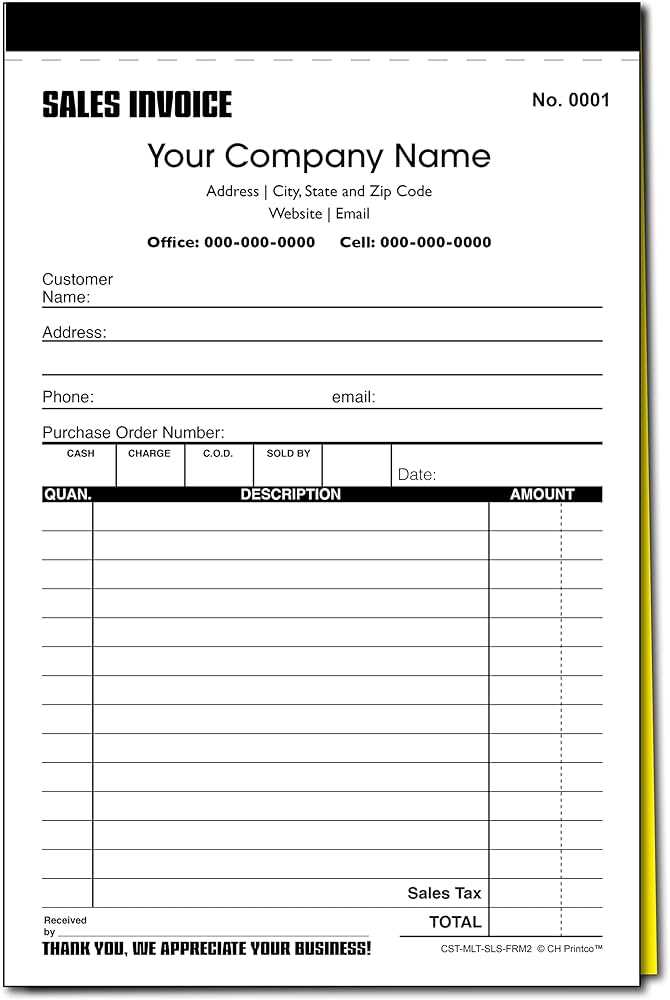

How to Design a Unique Document

Creating a distinct and functional billing document requires a thoughtful design process that balances aesthetics with clarity. A well-designed document not only helps communicate essential information but also leaves a lasting impression on your clients. By following a few key principles, you can ensure that your document is both professional and aligned with your business’s needs.

Here are the steps to follow when designing your own customized billing document:

- Understand Your Requirements: Identify what specific information needs to be included, such as services provided, payment terms, and taxes. This ensures your document meets all legal and practical requirements.

- Choose a Layout: Decide on a clean, organized structure. Use headings, subheadings, and bullet points to break down information for easy readability.

- Incorporate Branding Elements: Include your logo, brand colors, and fonts to reinforce your business identity. A consistent look across all your documents builds brand recognition.

- Ensure Legal Compliance: Make sure your document includes all the necessary details, such as tax information, business registration number, and payment terms, to comply with regulations.

- Use Clear Fonts and Colors: Choose fonts that are easy to read and use a limited color palette to avoid overwhelming your client. Keep the design professional and straightforward.

- Leave Room for Customization: Design your document so that it can be easily modified for future use. This includes flexible fields for adding new clients, items, or services.

By following these steps, you can create a unique and effective document that not only enhances the client experience but also reflects your professionalism and brand values.

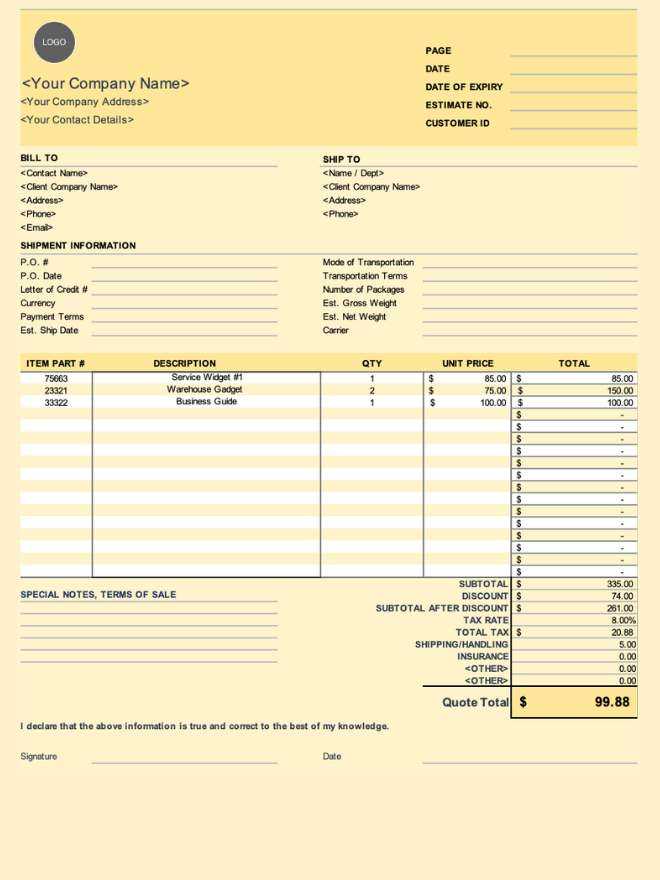

Key Elements of an Effective Billing Document

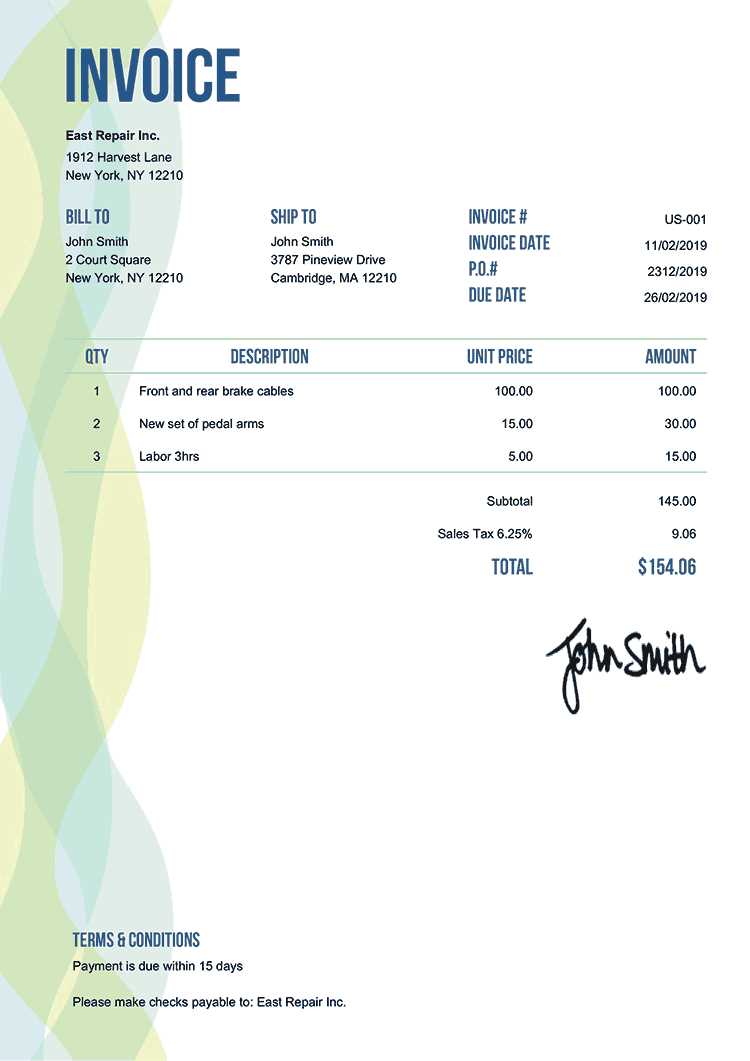

An effective billing document not only communicates the necessary financial information but also ensures that the transaction process is smooth and clear for both parties involved. A well-structured and informative document helps avoid misunderstandings and delays while maintaining a professional appearance. To achieve this, several key elements should be included to ensure all essential details are captured and presented clearly.

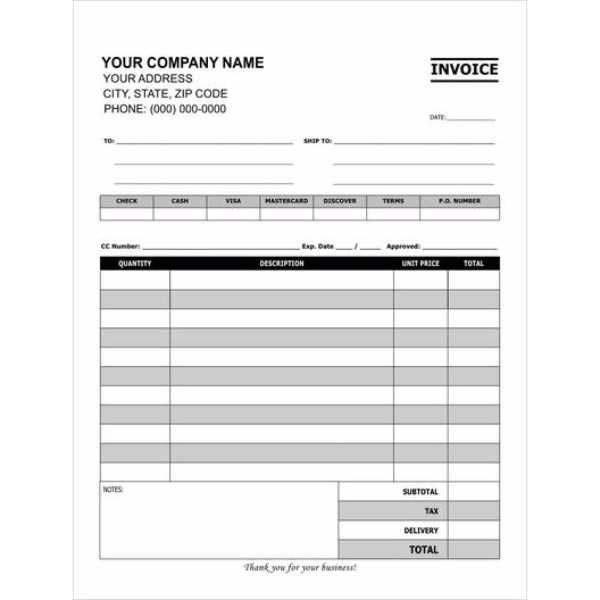

1. Contact Information

The first element of any effective billing document is the inclusion of both the business’s and the client’s contact details. This includes:

- Your business name, address, phone number, and email

- Client’s name and contact information

Having this information clearly displayed ensures both parties can easily communicate if there are any questions or issues regarding the payment.

2. Clear Breakdown of Charges

One of the most important features is a clear breakdown of services or products provided. It should be easy to see what the client is being charged for, including:

- Description of each item or service

- Quantity or hours worked

- Rate per unit or hourly rate

- Total amount for each item

Including this detailed breakdown helps the client understand exactly what they are paying for and can prevent confusion or disputes over the charges.

3. Payment Terms

Clearly stating the terms of payment is crucial. This includes:

- Due date for payment

- Accepted payment methods

- Late fees or penalties for overdue payments

By outlining payment expectations upfront, both you and your client can avoid unnecessary delays or misunderstandings. It’s also important to include any additional instructions for payments or methods that might apply to your business.

4. Tax and Legal Information

Depending on your location and the nature of your business, including tax details may be required. This could involve:

- Tax identification number

- Applicable taxes or VAT

- Legal disclaimers or terms and conditions

Including this information not only ensures compliance with local regulations but also helps build trust with your clients by showing transparency and professionalism.

By incorporating these essential elements, you can create a well-organized and professional document that will help facilitate a smooth transaction process and maintain clear communication with your clients.

Choosing the Right Billing Software

Selecting the right software for creating and managing your financial documents is a key decision that can greatly impact the efficiency and accuracy of your business operations. With many options available, it’s important to choose a tool that aligns with your needs, whether you’re a freelancer, small business owner, or part of a larger organization. The right software will help streamline your processes, reduce manual errors, and save time, all while ensuring that your documents maintain a professional and consistent format.

When choosing billing software, consider the following factors to make the best choice for your business:

1. Ease of Use

The software should be intuitive and easy to navigate, even for those who may not have advanced technical skills. Look for a platform with a user-friendly interface that simplifies creating and sending documents. A steep learning curve can delay the adoption process and create unnecessary frustration.

2. Customization Options

Flexibility is essential, as you’ll want to be able to tailor your documents to suit your business model. Look for software that allows you to adjust layouts, add your logo, and modify fields to reflect your unique requirements. This will ensure that your financial documents are not only functional but also aligned with your brand.

3. Integration with Other Tools

If you use other software tools for accounting, project management, or customer relationship management (CRM), it’s important to choose a solution that integrates seamlessly with these platforms. This will allow you to sync data and automate repetitive tasks, saving you time and reducing the risk of errors.

4. Payment Options and Automation

The right software should support a variety of payment methods and allow for automation of payment reminders, recurring billing, and invoicing schedules. This ensures timely payments and reduces the administrative burden on your team.

5. Security and Compliance

Security is paramount when handling sensitive financial data. Choose a platform that offers encryption and follows industry-standard security protocols. Additionally, ensure that the software complies with local tax laws and regulations, including features like automatic tax calculations or support for multiple currencies.

By carefully evaluating these factors, you can select the best billing software to meet your business’s specific needs, streamline your operations, and ensure timely, accurate financial transactions.

Best Practices for Billing Document Formatting

When creating billing documents, it’s essential to maintain a clear and organized format that makes it easy for both you and your clients to understand the details of the transaction. A well-structured document helps minimize confusion, ensures that all necessary information is included, and promotes timely payment. By following best practices for formatting, you can improve the overall presentation and effectiveness of your financial documents.

1. Maintain Consistent Layout and Design

A clean, consistent layout is key to making your document easy to read and professional. Ensure that key elements such as the company name, client details, and payment information are prominently displayed. Use headers, subheaders, and bullet points to organize information in a way that’s straightforward and intuitive. Consistency in fonts, colors, and spacing contributes to a polished look that will leave a positive impression on your clients.

2. Include Clear Section Labels

Each part of the document should be clearly labeled to guide the reader through the information. This includes:

- Client Information: Name, address, and contact details

- Services/Products Provided: Itemized list with descriptions and quantities

- Payment Details: Payment terms, due date, and accepted methods

- Totals and Taxes: Subtotals, applicable taxes, and final amount due

Using bold or slightly larger text for section titles helps differentiate each part of the document and makes it easy to find the necessary information quickly.

3. Ensure Readable Font and Size

Choosing the right font and size is essential for clarity. Opt for simple, professional fonts like Arial, Times New Roman, or Calibri. Make sure the text size is large enough to be easily readable, typically between 10pt and 12pt for body text. Avoid overly decorative fonts or overly small text, as these can make the document difficult to read and appear unprofessional.

4. Use White Space Effectively

White space–empty space between sections and elements–plays a significant role in readability. A cluttered document can be overwhelming and confusing. Allow enough space between different sections to give the reader room to breathe and navigate the content comfortably. Proper spacing improves the overall flow of information and enhances the visual appeal of your document.

By following these formatting practices, you can create billing documents that are not only visually appealing but also easy for your clients to understand, improving both professionalism and the likelihood of timely payments.

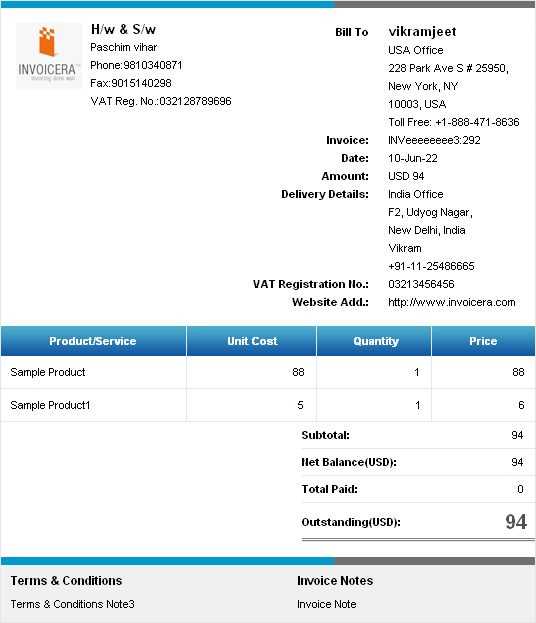

Incorporating Your Brand in Billing Documents

Incorporating your business’s unique identity into your financial documents helps create a professional, cohesive experience for your clients. Just as you carefully design your website, marketing materials, and business cards, it’s equally important to make sure your billing statements reflect your brand’s image. This reinforces your business’s identity and builds recognition, while also enhancing the overall customer experience.

By including your logo, brand colors, and consistent fonts, you create a visually unified look across all your communication channels. Not only does this help establish trust and professionalism, but it also sets you apart from competitors. Clients will associate your billing documents with your brand, creating a stronger, more memorable impression.

Here are a few ways to integrate your brand into your financial documents:

- Logo Placement: Place your business logo at the top of the document to make it immediately recognizable.

- Brand Colors: Use your company’s color palette for headings, borders, and other elements. This adds personality and cohesion to the document.

- Consistent Fonts: Choose fonts that match your brand’s style guide. Whether formal or casual, fonts contribute to the tone of your document.

- Tagline or Message: Include your business’s tagline or a brief message that reflects your company’s values, such as “Thank you for your business” or “Quality service every time.”

Incorporating these elements not only improves the aesthetics of your financial documents but also enhances the relationship with your clients by presenting a consistent and professional image every time they interact with your business.

Creating a Billing Document in Word

Microsoft Word is a powerful tool for creating professional, customizable financial documents. With its user-friendly interface and flexible formatting options, you can design a document that suits your business needs without needing advanced technical skills. By using Word, you can easily create a layout that is both functional and visually appealing, allowing you to present your billing information in a clear and professional manner.

Steps to Create a Billing Document in Word

Follow these simple steps to design your own financial document using Word:

- Start with a Blank Document: Open Microsoft Word and select a blank document to begin designing from scratch or use a pre-designed template as a base.

- Set Up the Page Layout: Choose a page size that suits your business needs. Typically, a standard 8.5 x 11-inch layout works well. You can adjust margins, orientation, and spacing to fit your content.

- Insert a Header: At the top of the document, add your company name, logo, and contact information. This is where your branding elements should go, as they will be the first thing your client sees.

- Create Section for Client Information: Include a section where you can input the client’s name, address, and contact details. This ensures clarity and makes it easy to keep track of your clients’ information.

- Detail the Services or Products: Create a table or list where you can itemize the services or products provided. Include columns for description, quantity, unit price, and total cost.

- Include Payment Terms: Below the list of services, specify payment terms such as due dates, accepted payment methods, and any penalties for late payments.

- Add a Footer: Include any legal disclaimers, your tax ID, or additional contact details in the footer section for compliance and customer reference.

Tips for Formatting Your Billing Document in Word

Here are some helpful formatting tips to enhance the appearance and clarity of your document:

- Use Tables for Organization: Tables are a great way to structure your billing details. Ensure that all columns are aligne

Using Excel for Billing Customization

Microsoft Excel offers a powerful platform for creating and customizing billing documents. Its spreadsheet format allows for flexibility in organizing and calculating data, making it an ideal choice for businesses that need to frequently update or modify their billing statements. With Excel, you can easily tailor your document to suit your business’s needs, whether you’re tracking hours, itemized services, or managing varying rates for different clients.

Excel’s ability to use formulas, automated calculations, and cell formatting makes it a great tool for customizing and streamlining the billing process. By leveraging these features, you can save time, reduce errors, and ensure that all details are correctly displayed every time you create a new document.

Key Features for Customizing Billing Documents in Excel

Here are some key features in Excel that can help you effectively customize your billing documents:

- Formulas for Calculations: Excel allows you to automatically calculate totals, taxes, discounts, and other financial figures using built-in formulas. This reduces manual work and ensures accuracy.

- Customizable Columns: You can create custom columns to track items such as quantity, unit price, description, and total cost. This flexibility allows you to include the specific information relevant to your business.

- Cell Formatting: Excel provides various options to format cells, such as currency symbols, date formats, and custom fonts. This ensures that your document looks professional and is easy to read.

- Dropdown Lists: You can create dropdown lists for repeating data, such as payment terms or service descriptions. This streamlines data entry and ensures consistency.

- Conditional Formatting: Excel allows you to apply conditional formatting to highlight certain cells based on specific conditions, such as overdue payments or large amounts, making important information stand out.

Steps for Customizing Your Billing Document in Excel

Follow these steps to customize your billing document in Excel:

- Create a New Workbook: Open Excel and start with a blank workbook or use a pre-built template to save time. Choose a layout that suits your needs and customize it further as required.

- Set Up Your Columns: Add columns for the necessary data such as client name, services or products, description, quantity, unit price, and total amount. You can adjust column widths to ensure readability.

- Insert Formulas: Use formulas to calculate totals, taxes, and discounts. For example, use SUM to calculate total costs or multiplication formulas to calculate the price per item and total price.

- Apply Branding: Add your logo and use your business’s color scheme and font style to ma

Custom Billing Documents for Freelancers

Freelancers often manage multiple clients with varying needs, and creating clear, professional financial documents is essential for getting paid on time. Customizing your billing statements allows you to reflect your unique services, pricing structure, and personal brand. A well-designed billing document can help build trust with your clients, streamline the payment process, and ensure all necessary details are included, minimizing the chance of confusion or delays.

With the right customization, freelancers can make their billing documents not only functional but also reflective of their brand identity, showcasing a professional approach that stands out to clients. This approach is particularly important in freelance work, where first impressions and clear communication are key to building lasting relationships.

Key Features for Freelance Billing Documents

When designing a customized billing document, freelancers should include the following elements to ensure clarity and professionalism:

- Client Details: Include the client’s full name or company, address, and contact information to ensure that the billing document is easily traceable.

- Services Provided: A detailed list of services or deliverables, including descriptions, quantities (if applicable), and rates, makes it clear what the client is paying for.

- Payment Terms: Clearly state the agreed payment terms, including due dates, accepted payment methods, and any late fees for overdue payments.

- Tax Information: Include any applicable taxes or VAT, along with the total amount due, ensuring transparency for both parties.

- Branding: Customize your document with your logo, color scheme, and contact information to create a cohesive and professional look that aligns with your business identity.

Why Custom Billing Documents Are Essential for Freelancers

Freelancers often juggle several clients and projects, and having a consistent and professional billing format helps streamline the financial side of their business. Here’s why customizing your billing documents is crucial:

- Professional Image: A polished, well-designed billing document gives clients the impression of a serious, organized freelancer, which can positively influence their trust in you.

- Clarity and Accuracy: A customized document that clearly lists services, rates, and payment details reduces confusion, ensuring both parties are on the same page.

- Efficiency: By reusing a customized format, freelancers can save time on creating new documents for every project, focusing on their work rather than administrative tasks.

- Brand Recognition: By adding branding elements such as your logo and color scheme, you reinforce your professional image and build recognition with clients.

Custom billing documents help freelancers maintain a professional and organized approach to managing payments, making the process more efficient and reducing the chances of payment delays or disputes. With a clear and personalized approach, you ensure that clients receive accurate and timely financial statements, ultimately leading to stronger, more positive business relationships.

How to Automate Your Billing Process

Automating your billing process can save you time and reduce the likelihood of errors. Instead of manually creating financial documents for each transaction, you can implement systems and tools that automatically generate and send them to clients based on pre-set parameters. This not only streamlines the process but also ensures that you stay organized and maintain consistent cash flow without having to manage each billing task individually.

By automating certain aspects of your financial documentation, such as recurring charges, payment reminders, and updates, you can free up time to focus on your core work while still ensuring timely and accurate payments from clients. Here’s how you can effectively automate your billing process:

Steps to Automate Your Billing System

- Choose the Right Software: Select a tool or platform that suits your business needs. Many accounting and billing software options, such as QuickBooks, FreshBooks, or Zoho Invoice, allow you to automate billing, reminders, and payment tracking.

- Create Recurring Billing Schedules: Set up recurring billing for regular services or subscriptions. Automation will handle the generation and delivery of these documents on a fixed schedule, saving you from manually creating them each time.

- Integrate Payment Gateways: Link your billing system to payment processors like PayPal, Stripe, or bank accounts. This allows clients to pay directly from the document, streamlining the payment collection process and reducing delays.

- Set Up Payment Reminders: Most automated billing systems allow you to schedule payment reminders. Set these up to automatically notify clients of upcoming or overdue payments, reducing the need for follow-up emails.

- Customize Your Documents: Customize your automated documents to include your branding, client information, and other details that are relevant to your business. Most automation tools allow you to set up templates that can be reused across different clients.

Benefits of Automating Your Billing Process

Automating your billing system offers several advantages, including:

- Efficiency: By reducing the amount of time spent on manual billing tasks, you can focus on other areas of your business, such as customer service or expanding your client base.

- Consistency: Automation ensures that your financial documents are consistent in format, ensuring professional communication with clients every time.

- Timely Payments: Automation eliminates delays in sending out billing documents, which can improve your cash flow and reduce late payments.

Setting Payment Terms on Your Billing Document Clear payment terms are crucial for ensuring that both you and your clients have a mutual understanding of when and how payments should be made. Well-defined terms help prevent confusion, late payments, and potential disputes. By specifying the exact details in your billing document, you establish expectations from the outset, making it easier to manage financial transactions and maintain healthy cash flow.

When setting payment terms, it’s important to consider factors like the due date, payment methods, late fees, and any discounts for early payments. These details can vary depending on the nature of the services or products provided, but they should always be clear and transparent to avoid misunderstandings.

Key Payment Terms to Include

Here are the most important elements to include when setting payment terms on your billing documents:

- Due Date: Clearly state the date by which payment is expected. A specific date or timeframe, such as “Net 30” (meaning payment is due 30 days from the issue date), helps to set expectations for both parties.

- Accepted Payment Methods: Specify the methods through which clients can pay, such as credit card, bank transfer, PayPal, or checks. This ensures clients know their options and can choose the most convenient payment method.

- Late Payment Fees: If applicable, include details about any penalties for late payments. This could be a fixed fee or a percentage of the total amount due, such as “1.5% per month after the due date.” Make sure this is communicated clearly to encourage timely payments.

- Early Payment Discounts: Offer incentives for clients to pay early. For example, “2% discount if paid within 10 days” can encourage clients to settle their bills sooner, improving cash flow.

- Partial Payments: If you allow clients to pay in installments, outline the conditions clearly, such as the amount and frequency of payments. This makes the payment process more manageable for clients who may not be able to pay the full amount at once.

How to Communicate Payment Terms Effectively

Ensuring your payment terms are clear and easy to understand is essential for avoiding any confusion or delays. Here are some tips for communicating your terms effectively:

- Be Specific: Use precise language and avoid ambiguity. Terms like “due within 30 days” or “payment due upon receipt” should be clearly defined.

- Highlight Important Information: Make your payment terms stand out by using bold or underlined text. This ensures that clients can quickly spot the most important details.

- Include a Reminder: Add a reminder of the due date at the bottom of the document or in the email accompanying the document. A gentle reminder can help clients prioritize your payment.

- Consistent Application: Apply the same payment terms to all clients to ensure consistency and avoid any misunderstandings.

By setting clear and fair payment terms, you can improve the efficiency of your business’s financial operations. It also creates a professional atmosphere, showing clients that you are organized and transparent in your business practices.

Ensuring Legal Compliance with Billing Documents

Ensuring that your financial documents comply with the law is essential for maintaining a professional and trustworthy business. Legal compliance protects both you and your clients, ensuring that all transactions are clear, transparent, and enforceable. Failing to adhere to legal requirements can lead to disputes, fines, or even legal action. Therefore, it is important to be aware of the necessary components to include in your billing statements and understand the regulations that govern them in your country or region.

By incorporating all required legal elements into your financial documents, you ensure that your business remains compliant with tax laws, industry standards, and any other relevant regulations. This also helps to avoid potential misunderstandings and protects both parties involved in the transaction.

Key Legal Requirements for Billing Documents

Different jurisdictions have specific laws that dictate what must be included in billing documents. Here are some common legal requirements that you should consider when creating your financial statements:

- Business Identification: Include your business’s name, address, and registration number (if applicable). This allows clients to identify the business and ensures that the document is legally valid.

- Client Information: The name and address of the client should be clearly stated to avoid confusion. In some cases, tax information such as the client’s VAT number may be required.

- Transaction Details: The document should specify a clear description of the goods or services provided, including quantities, unit prices, and any applicable taxes. This ensures that both parties understand the nature of the transaction.

- Tax Information: If applicable, make sure to include any relevant taxes, such as sales tax, VAT, or other levies. Specify the tax rate and amount clearly so that both you and the client are aware of the tax obligations.

- Payment Terms: Clearly outline the payment terms, including the due date, accepted payment methods, and any penalties for late payments. In many regions, these terms are required to be stated explicitly.

- Legal Disclaimers: Depending on your location, you may need to include certain legal disclaimers or notices, especially if the document pertains to a contract or agreement between parties.

How to Ensure Compliance

Here are a few practical steps to help you stay compliant with legal requirements when creating your billing documents:

- Stay Informed: Regularly review and update your knowledge of local laws and regulations related to business transactions, taxes, and record-keeping. This can vary depending on your industry and location.

- Use Accounting Software: Many accounting and billing tools come with built-in features that help ensure compliance by automatically generating documents with the necessary legal components, such as tax information and registration details.

- Consult a Professional: If you are unsure about specific legal requirements, it’s always a good idea to consult with an accountant or legal professional who can advise you on the rules that apply to your business.

- Regular Audits: Conduct regular audits of your financial documents to ensure that they meet the legal standards and include all required information. This helps prevent errors and ensures ongoing compliance.

By following these steps and making sure your billing documents are legally compliant, you protect both your business and your clients. Compliance not only prevents legal issues but also builds credibility and trust in your business operations.

Managing Billing Numbers and References

Properly managing reference numbers and identifiers in your financial documents is crucial for maintaining organized and efficient record-keeping. A unique numbering system helps you track transactions, streamline communication with clients, and avoid confusion or duplication. Additionally, well-managed references provide a clear audit trail, which is important for accounting, tax filings, and resolving disputes. Establishing a consistent system for assigning numbers and references is a key element in building a reliable and transparent business.

Having a standardized approach to billing numbers can prevent errors, make it easier to locate past transactions, and ensure that you meet legal or industry-specific requirements. Whether you are handling a few clients or hundreds, implementing a proper system ensures you can stay organized and professional at all times.

How to Manage Billing Numbers Effectively

Here are some best practices for managing your billing numbers and references:

- Use Sequential Numbering: Always assign a unique, sequential number to each document. This can be as simple as starting with 001 and increasing by one for each new transaction. Sequential numbering ensures that each document can be easily identified and tracked.

- Incorporate Date Information: Adding a date-based reference to your numbering system can help you quickly identify when a document was created. For example, you could use the format “2024-001” for the first transaction in the year 2024.

- Avoid Reusing Numbers: Never reuse a reference number once it has been issued. This prevents confusion when tracking payments or looking up past documents. Each billing statement should have a unique number.

- Include Client or Project Codes: If your business handles multiple clients or projects, consider including a short client or project code in the reference number. This can help you quickly identify which client or project the document pertains to without needing to search through records.

- Clearly Label References: Make sure that your billing number and any additional references are clearly labeled on the document, so clients can easily locate the information they need for payment or communication.

Benefits of Organized Billing Numbers

Maintaining an organized system for your reference numbers brings several key benefits:

- Improved Organization: A consistent numbering system helps you keep track of all your transactions in a structured way, making it easier to retrieve past documents when needed.

- Enhanced Communication: When you have a clear and unique number for each billing document, you can easily reference specific transactions when discussing payments with clients, reducing confusion and errors.

- Better Record Keeping: A logical numbering system ensures that you can easily match payments to the correct documents and provides a clear audit trail for accounting and tax purposes.

- Legal and Tax Compliance: Many jurisdictions require businesses to maintain seq

How to Handle Currency and Taxes

Properly managing currency and taxes in your financial documents is essential for ensuring accuracy and compliance with local regulations. Whether you’re dealing with international clients or operating in a specific country, clearly defining the currency and tax rates helps to avoid confusion and ensures that both you and your clients are on the same page. Understanding how to handle these elements not only facilitates smoother transactions but also helps you maintain proper financial records and comply with tax laws.

Each transaction must reflect the correct currency, applicable tax rates, and any other necessary fees. By setting clear expectations and providing precise details, you can reduce the risk of misunderstandings and potential disputes while also ensuring that your business remains compliant with legal requirements.

Managing Currency in Financial Documents

When dealing with multiple currencies, especially for international transactions, it’s important to clearly state the currency used and the exchange rate if necessary. Here are some key points to consider:

- Specify the Currency: Always indicate the currency used in the transaction. This could be in the form of a currency symbol (e.g., $ for US dollars, € for euros, etc.) or the full name (e.g., US Dollars, Euros) to avoid any confusion.

- Use Currency Codes: For clarity, especially in international transactions, use standard currency codes such as USD, EUR, or GBP. This is especially important for businesses that operate across multiple regions.

- Exchange Rates: If your business involves exchanging currencies, it’s a good practice to specify the exchange rate used for conversion at the time of the transaction. This helps clients understand the value of the amount in their local currency and provides transparency.

- Handling Fluctuations: Be aware of currency fluctuations, especially for ongoing contracts or long-term services. It’s important to set terms regarding how currency exchange rate changes will affect the final amounts due or paid.

- Due Date: Clearly display the payment due date on each document. This helps clients understand the timeframe for payment and ensures that you can easily track whether payments are made on time.

- Payment Status: Indicate the current status of the payment (e.g., “Paid,” “Pending,” “Overdue”). This allows you to quickly assess the state of each transaction and follow up when necessary.

- Outstanding Amount: Specify the remaining balance if partial payments have been made. This ensures that both you and your client are aware of what is still owed.

- Payment Method: Include the payment method used (e.g., bank transfer, credit card, PayPal). This provides additional clarity and records the transaction details for future reference.

- Common Mistakes to Avoid in Billing Documents

While creating billing documents may seem straightforward, there are several common errors that can lead to confusion, delayed payments, or legal issues. By understanding these pitfalls and taking steps to avoid them, you can ensure your financial paperwork remains clear, accurate, and professional. Identifying and correcting mistakes in billing statements can improve client relationships and streamline your financial processes.

Here are some of the most frequent mistakes that businesses make when preparing their financial documents and tips on how to avoid them.

Frequent Mistakes in Billing Documents

- Missing or Incorrect Contact Information: Failing to include complete contact details, such as your business name, address, and phone number, can cause confusion and delays in payments. Always double-check that this information is accurate and easy to locate.

- Unclear Payment Terms: Not specifying clear payment terms, such as due dates or accepted payment methods, can result in misunderstandings and delayed payments. Always set clear expectations on when and how payments should be made.

- Incorrect or Missing Tax Information: Incorrect tax rates or missing tax identification numbers can cause legal issues. Ensure that the appropriate tax is applied based on the location of your business and your client’s, and include any necessary tax registration numbers.

- Not Including a Unique Reference Number: A lack of unique identifiers for each transaction can make it difficult to track payments, especially if you’re dealing with multiple clients or recurring services. Always assign a unique reference or invoice number to each billing statement.

- Vague Descriptions of Products or Services: Avoid vague or unclear descriptions of the services rendered or goods provided. Detailed, itemized descriptions help clients understand exactly what they are paying for and reduce the likelihood of disputes.

- Forgetting to Account for Discounts or Adjustments: If you’ve agreed on a discount or made adjustments to the total amount, ensure that these are clearly stated. Failing to show discounts or other changes can cause confusion and delay payment.

How to Avoid These Mistakes

- Double-Check All Details: Before sending out any document, review all information thoroughly to ensure accuracy. Verify contact details, payment terms, and itemized lists to make sure everything is clear and correct.

- Use Clear and Standardized Formats: Adopt a consistent format for all your billing documents. A clear, professional structure makes it easier for clients to understand the charges and track payments.

- Automate Where Possible: Using accounting software or automated tools can help eliminate human errors in your documents. Automated systems often ensure that tax rates, payment terms, and other critical information are consistently applied.

- Communicate with Clients: If there is any ambiguity or if terms change, communicate directly with your clients beforehand to avoid misunderstandings. Always send confirmation of adjustments or agreements in writing.

- Include Clear Payment Instructions: Make sure to include easy-to-follow payment instructions, especially if you accept multiple forms of payment. Specify the preferred method and provide any necessary payment links or details.

By addressing these common mistakes and following best practices for financial documentation, you can ensure smoother transactions, minimize delays, and foster stronger relationships with your clients.

Tracking Payments with Custom Billing Documents

Efficiently tracking payments is crucial for maintaining healthy cash flow and ensuring timely settlements in your business. Customizing your financial statements to include clear payment tracking features helps both you and your clients stay organized, reducing the chances of overdue payments and miscommunication. By incorporating specific elements into your documents, you can easily monitor outstanding balances, due dates, and payment statuses, which simplifies accounting and improves financial management.

Effective tracking not only helps you know when to follow up on unpaid balances but also provides clarity for clients, fostering transparency and trust. Including payment-related details in your documents ensures that both parties have access to consistent and up-to-date information, helping avoid confusion and disputes.

Essential Elements for Payment Tracking

To accurately track payments through your financial documents, include the following essential elements: