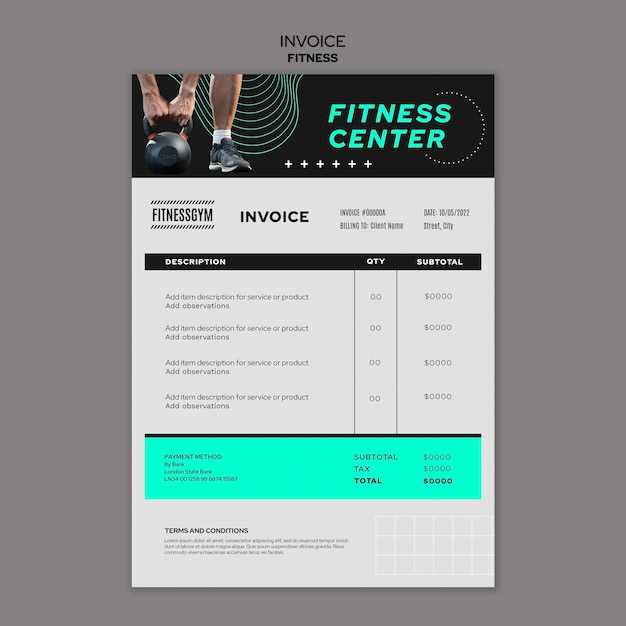

Free Personal Training Invoice Template Download

For fitness instructors and coaches, managing financial transactions is a crucial part of maintaining a professional business. Whether you’re an independent trainer or part of a larger gym, providing clear and organized documentation for services rendered ensures smooth client relationships and timely payments. Having the right tools can simplify the entire process.

Creating professional receipts doesn’t have to be complicated. With the right tools at your disposal, it’s possible to generate accurate records that reflect all services, charges, and payments in a matter of minutes. This eliminates the need for manual calculations and streamlines administrative tasks, allowing more time to focus on clients.

By using customizable solutions, you can tailor your documents to suit your needs, whether you’re invoicing for single sessions, packages, or monthly subscriptions. This flexibility not only enhances professionalism but also helps maintain consistency and transparency with your clientele.

Free Personal Training Invoice Template Overview

Providing clients with well-structured financial statements is essential for any fitness business. These documents ensure transparency, streamline payment processes, and help maintain professional relationships. Using an organized document that clearly outlines charges, services, and due amounts simplifies the overall experience for both the service provider and the client.

What to Expect from a Professional Billing Document

A comprehensive billing document typically includes several key components that guarantee clarity and accuracy. These elements are designed to break down the services offered and the corresponding charges, making it easy for clients to understand their financial obligations. Key details often found in such statements include:

- Client Information – Name, address, and contact details

- Service Description – Clear breakdown of the services provided

- Payment Due Date – When the payment is expected

- Total Amount Due – The total cost of services provided

- Payment Methods – Options for settling the bill

Why Use Customizable Billing Solutions

Opting for customizable solutions enables fitness professionals to tailor the document to their specific needs. Whether you’re working with one-time clients or offering subscription-based plans, having the flexibility to adjust your document makes the billing process more efficient and personalized. You can adjust the structure, add your branding, and ensure that all necessary information is clearly presented for each client interaction.

Why Use an Invoice Template

Efficient and professional documentation is essential for any business, especially when it comes to financial transactions. Having a pre-designed structure allows service providers to quickly generate accurate and consistent records without the need for starting from scratch each time. This not only saves valuable time but also ensures that every document maintains the same level of professionalism.

Key Advantages of Using a Pre-Designed Document

Using a pre-made document can simplify the billing process while ensuring accuracy and clarity. Some of the key benefits include:

- Time-Saving – Reduces the need to manually create documents from the ground up each time.

- Consistency – Maintains uniformity across all client documents, enhancing your business’s professionalism.

- Organization – Keeps all relevant information in one place, making it easier to track and manage payments.

- Customization – Allows for easy modifications to suit the specific services offered and client preferences.

- Accuracy – Ensures that no important details are missed, preventing errors in billing.

How a Structured Approach Improves Client Trust

Clients appreciate transparency and clarity in their financial interactions. By using a structured document, you show that you take your business seriously and that you respect their time and money. When clients receive a well-organized statement, it fosters trust and can improve the overall client experience, making them more likely to return for future services.

Benefits of Customizing Your Invoice

Tailoring your financial documents to suit your business needs offers several advantages, from improving clarity to reinforcing your brand. Customizing your records allows you to highlight important details, streamline communication, and ensure that your clients have all the necessary information at their fingertips. This level of personalization not only helps you stay organized but also enhances professionalism.

| Benefit | Description |

|---|---|

| Branding | Including your business logo, colors, and fonts reinforces your brand identity and creates a cohesive experience for your clients. |

| Clarity | Customizing the layout allows you to organize information in a way that’s easier for clients to understand, reducing confusion. |

| Specific Details | You can highlight specific terms, such as payment methods, due dates, or special agreements, ensuring all crucial information is clear. |

| Flexibility | Personalizing your documents gives you the flexibility to adjust the content based on the service rendered, making each record more relevant to the client. |

| Professionalism | A custom document tailored to your services can enhance your professional image, helping to build trust and credibility with clients. |

Key Elements in a Training Invoice

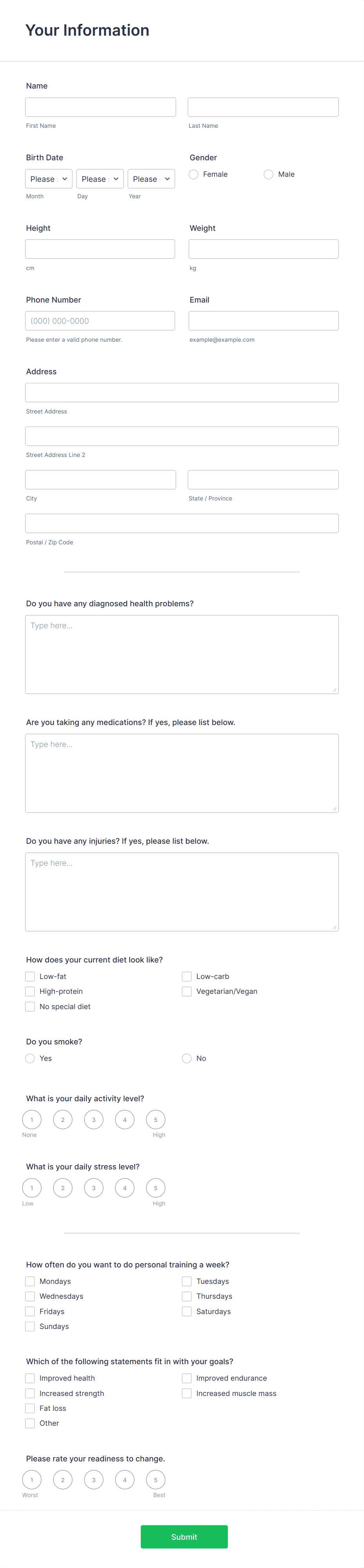

When creating a financial record for services rendered, it’s important to include certain essential details to ensure clarity and accuracy. A well-structured document helps avoid misunderstandings and keeps both the service provider and client on the same page. There are several components that should always be present to make the record comprehensive and professional.

Essential Information to Include

Each document should contain key details that allow both parties to understand the scope of the service and the total charges. The most important elements include:

- Client and Service Provider Information – Names, addresses, and contact details for both parties involved.

- Description of Services – A clear breakdown of what was provided, including dates, session lengths, and any other specifics relevant to the service.

- Amount Due – The total cost of the service, including any taxes, fees, or discounts applied.

- Payment Terms – A section detailing when payment is due, preferred payment methods, and any late payment policies.

Additional Helpful Components

Beyond the basics, there are a few optional additions that can enhance the document’s clarity and usefulness. These might include:

- Payment Instructions – Information on how to make the payment, such as bank account details or online payment links.

- Notes or Comments – A space to add any extra instructions or details, such as special offers or terms of service.

- Unique Invoice Number – To track each document and create a clear record-keeping system.

How to Download Free Templates

Accessing pre-designed financial documents is easier than ever, with many resources available online offering downloadable options for various needs. These ready-to-use structures can save time and effort, allowing service providers to focus on their core work rather than spending time designing paperwork from scratch. The process of finding and downloading these documents is simple and straightforward.

To get started, search for reliable websites that offer customizable documents in various formats, such as Word or PDF. Many platforms provide a selection of options, ranging from basic versions to more detailed documents with advanced features. Once you find a document that suits your needs, simply click the download link and save it to your device.

Most resources allow for quick access without the need for creating an account or providing personal information. However, some platforms may require a quick registration process or offer additional premium features for those who want more customization options. Be sure to review the available options and choose the one that best matches your business style and requirements.

Common Mistakes to Avoid

When creating a financial record for services provided, it’s easy to overlook certain details or make simple errors that can lead to confusion or delays in payment. Avoiding these common mistakes will ensure that your records are clear, accurate, and professional, ultimately helping to maintain positive relationships with your clients.

Top Errors to Watch Out For

- Missing Client Information – Failing to include the client’s name, address, and contact details can create confusion and make it difficult to track payments.

- Unclear Service Descriptions – Not providing enough detail about the services rendered can lead to misunderstandings. Be specific about the sessions, dates, and any special request

Understanding Payment Terms for Clients

Clear and transparent payment terms are essential for fostering smooth financial transactions between service providers and clients. By outlining the specifics of when and how payments are expected, both parties can avoid confusion and ensure that the process runs efficiently. Properly communicated terms also contribute to maintaining a professional relationship and setting clear expectations from the outset.

Key Elements of Payment Terms

To make sure clients understand their obligations, it is important to outline the following elements in your financial documents:

- Due Date – Clearly specify when the payment should be made, whether it’s immediately after the service, within a set number of days, or at a later agreed-upon time.

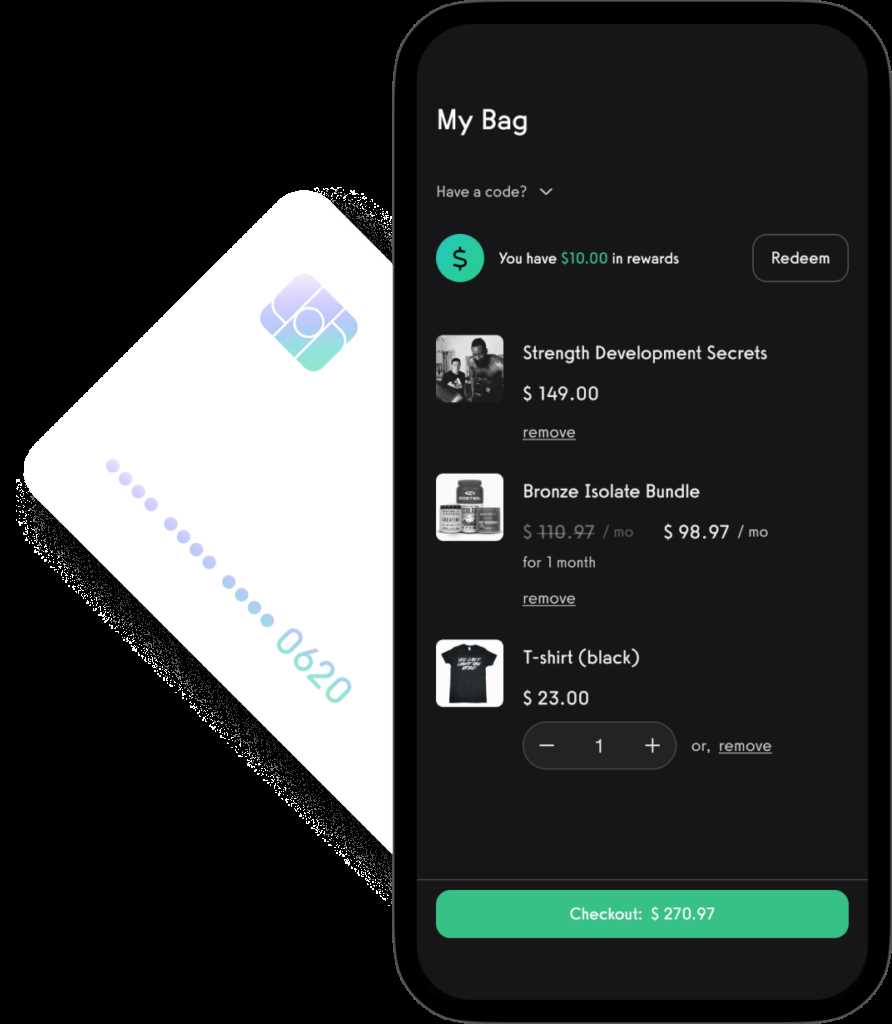

- Accepted Payment Methods – Detail the types of payment you accept, such as credit cards, bank transfers, or online payment systems. This helps prevent any confusion about how payments should be made.

- Late Payment Fees – Outline any penalties or interest that will apply if the payment is not received by the due date. This encourages clients to make timely payments.

Clear Communication of Terms

Ensuring that payment terms are easy to understand is essential for both service providers and clients. Use simple language and avoid jargon that may confuse clients. Clearly state whether payments are due upfront, on a regular basis, or after each session, and be transparent about any additional charges, such as late fees or taxes.

Establishing clear payment guidelines from the beginning will not only help secure timely payments but also build trust and credibility with your clients.

Best Software for Invoice Customization

Customizing financial records and payment requests has never been easier with the right software tools. These platforms offer various features that allow users to personalize their documents, from adding logos to adjusting layouts and formatting. Whether you’re looking for a simple solution or something more advanced, selecting the right tool can help you create professional-looking statements that match your business needs.

The best software for document customization offers intuitive interfaces, flexibility in design, and additional features to enhance your workflow. Below are some top recommendations for tailoring your financial documents with ease:

- QuickBooks – Known for its comprehensive accounting capabilities, QuickBooks also offers robust options for creating and customizing records. Users can choose from a variety of templates and easily add logos, colors, and other branding elements.

- Wave – A free platform that’s perfect for small businesses. Wave provides simple and professional customization tools, allowing you to easily create and manage your documents without any upfront costs.

- Zoho Invoice – This software offers a wide range of customization features, including the ability to modify the design and structure of your documents. It also integrates well with other tools, making it ideal for businesses that require more complex financial management.

- FreshBooks – A user-friendly solution for freelancers and small business owners, FreshBooks provides customizable design templates and also tracks payments and expenses in real-time.

- Microsoft Word or Google Docs – For those who prefer a more manual approach, using word processing software like Word or Docs can also be an excellent option for creating customized documents. While more time-consuming, it allows for complete flexibility in design.

Each of these tools offers unique features and benefits, so it’s important to assess your business needs before selecting the right one for you. Whether you need a simple layout or a fully customizable design, there’s software available to meet your requirements.

How to Track Payments Efficiently

Keeping track of payments is essential for maintaining healthy cash flow and ensuring that all financial transactions are accurately recorded. Efficient tracking helps avoid missed payments, reduces administrative errors, and ensures that both you and your clients are on the same page regarding financial obligations.

Tools for Effective Payment Tracking

There are several tools available that make it easier to keep track of incoming payments, whether they are manual or digital. Some of the most effective methods include:

- Accounting Software – Platforms like QuickBooks, Xero, or Wave automatically update records, track payment status, and provide reminders for overdue payments.

- Spreadsheets – Simple and customizable, spreadsheets are a cost-effective solution. You can create a payment tracker with columns for due dates, amounts, and payment statuses.

- Payment Processors – Tools like PayPal, Stripe, or Square allow you to track payments in real-time. These platforms typically provide detailed reports and payment histories that are easily accessible.

Best Practices for Monitoring Transactions

To keep your records accurate and avoid any confusion, follow these best practices:

- Set Clear Payment Terms – Ensure your clients know when payments are due and what methods are accepted. This reduces the likelihood of delayed payments.

- Record Payments Immediately – Always update your records as soon as a payment is made. This will prevent errors and help you stay organized.

- Use Reminders and Alerts – Utilize automated reminders or set alerts on your software to notify you when payments are due or overdue.

- Reconcile Regularly – Regularly cross-check your records with actual payments to identify any discrepancies early and resolve them promptly.

By implementing efficient tracking methods and maintaining accurate records, you’ll improve your financial management and reduce the risk of payment issues with clients.

How to Add Tax to Your Invoice

Including tax on financial documents is crucial for maintaining compliance with local tax regulations and ensuring that the amounts due are accurate. Properly calculating and adding tax not only helps avoid legal issues but also keeps your business finances transparent and organized.

Understanding Tax Rates

Before you add tax to your records, it’s essential to understand the tax rate applicable in your region or industry. Tax rates can vary based on the type of service you provide, the location of your business, and local or national tax laws. Common tax categories include:

- Sales Tax – Often applied to goods or certain types of services based on your location.

- VAT (Value-Added Tax) – A consumption tax added to the value of goods or services at each stage of production or distribution.

- Service Tax – Applied to services rendered in some countries, based on the agreed-upon price.

Steps to Include Tax in Your Record

Here’s a straightforward process for adding tax to your payment request:

- Identify the Tax Rate – Research and confirm the correct tax rate based on your location or industry.

- Calculate the Tax – Multiply the taxable amount by the applicable tax rate. For example, if the service costs $100 and the tax rate is 10%, the tax would be $10.

- Add the Tax to the Total – Once calculated, add the tax amount to the total cost. In this case, the total amount due would be $110 ($100 + $10).

- Label the Tax Clearly – Ensure that the tax is clearly labeled in your document, so the client can easily see the breakdown of costs.

By following these steps, you can easily include taxes in your documents, ensuring that both you and your clients are clear on the amounts due and that your business stays compliant with tax laws.

Design Tips for Professional Invoices

Creating polished and visually appealing documents not only enhances your business image but also makes it easier for clients to understand the breakdown of charges. A well-designed document communicates professionalism, encourages timely payments, and helps you stand out in a competitive market.

Key Elements of Effective Design

There are several important design principles to consider when creating your financial records to ensure they are both functional and professional:

- Clarity – Ensure the text is legible by using simple, easy-to-read fonts like Arial or Times New Roman. Avoid overly decorative fonts that may confuse the reader.

- Consistent Layout – Organize the document in a clear, logical manner. Common sections include service details, payment terms, and contact information. Use headings and subheadings to break up the content.

- Branding – Incorporate your business logo, colors, and branding elements to make your document instantly recognizable. This adds a professional touch and strengthens brand identity.

- White Space – Don’t overcrowd the page with too much information or graphics. Proper use of white space allows for easier readability and a cleaner layout.

Practical Tips for Layout and Formatting

In addition to visual appeal, the layout and formatting of your document play a crucial role in ensuring that all relevant information is presented clearly:

- Use Tables – Tables are perfect for organizing details such as dates, item descriptions, and amounts. This makes it easy for clients to find what they need without confusion.

- Highlight Important Information – Use bold or larger fonts to emphasize the total amount due, payment due dates, or important instructions. This ensures that critical details stand out.

- Include Clear Instructions – If applicable, add instructions on how payments can be made, or include payment options that are relevant to your business model.

By following these tips, you can create visually appealing documents that reflect your professionalism, ensuring both you and your clients are clear on all financial details.

How to Include Discounts or Offers

Including discounts or special offers in your financial records is an effective way to incentivize clients and build long-term relationships. It’s important to communicate these discounts clearly, ensuring that your clients understand the original cost, the discount applied, and the final amount due. Properly documenting offers not only shows transparency but also encourages prompt payments.

Steps to Include Discounts

To incorporate discounts in your records, follow these steps for clarity and accuracy:

Original Price Discount Percentage Discount Amount Final Amount $100 10% $10 $90 - Calculate the Discount – First, determine the discount amount by multiplying the original cost by the discount percentage. In the example above, $100 * 10% = $10.

- Deduct the Discount – Subtract the discount amount from the original price to get the final amount due. This will be the amount your client will pay.

- Clearly Label the Discount – Ensure that the discount is clearly mentioned in the document. You can add a line stating “Discount Applied: 10%” followed by the amount reduced.

- Include Any Conditions – If the discount is tied to specific conditions (e.g., for first-time clients or a limited-time offer), make sure to mention these details explicitly to avoid confusion.

By following these guidelines, you can effectively include discounts and offers while maintaining transparency in your financial documents. This helps build trust and encourages clients to take advantage of your promotions while keeping your business organized.

Why Timely Invoicing Matters

Sending financial documents promptly is essential to maintaining healthy cash flow and ensuring smooth operations. Delaying these records can create confusion, lead to missed payments, or damage your professional reputation. The timing of when these documents are issued can significantly impact both the client’s perception of your business and the efficiency of your financial management.

Key Reasons for Prompt Documentation

Here are some of the main reasons why issuing these records on time is crucial:

- Faster Payments – The sooner your clients receive a request for payment, the sooner they can process it. Sending documents promptly reduces the likelihood of delays in receiving payments.

- Better Cash Flow – Consistent and timely issuing of these documents ensures that you have predictable revenue streams, which is important for budgeting and covering operating expenses.

- Builds Trust – Clients appreciate businesses that are organized and professional. Sending documents on time shows that you value their time and business.

- Reduces Disputes – If clients receive their documents without unnecessary delay, there is less room for confusion about the amounts owed, leading to fewer disputes or misunderstandings.

How to Stay On Track with Documentation

Maintaining a routine for issuing these documents can prevent delays and ensure that your processes are streamlined:

- Set Reminders – Use a digital calendar or project management tool to remind you of upcoming deadlines to send out financial documents.

- Automate When Possible – Consider using invoicing software that can automatically generate and send documents on a predefined schedule.

- Use Consistent Time Frames – Establish a regular timeframe for issuing these documents, such as immediately upon completion of services or within a set number of days.

By being prompt and efficient with your record-keeping, you not only ensure timely payments but also improve your business’s overall reputation and financial health.

Sending Documents Electronically vs Paper

Choosing the right method for sending financial records can have a significant impact on both the efficiency of your business and the experience of your clients. While traditional paper-based methods have been used for centuries, electronic submissions are becoming increasingly popular due to their speed, convenience, and environmental benefits. However, both methods come with their own advantages and challenges, and it’s important to weigh them based on your business needs and client preferences.

Benefits of Sending Documents Electronically

Sending records digitally has become the standard for many businesses. Here are some of the main reasons why electronic methods are preferred:

- Speed – Electronic submissions are instant, ensuring that clients receive their documents quickly and can act on them without delay.

- Cost-Effective – There are no printing or postage costs associated with sending documents electronically, making it a more affordable option for businesses of all sizes.

- Convenience – Clients can receive and pay their financial documents from anywhere, at any time, making the process more flexible for both parties.

- Environmental Impact – By going digital, you reduce paper waste and contribute to a more sustainable business model.

Advantages of Paper-Based Documents

Despite the increasing shift toward digital methods, some businesses and clients still prefer the traditional paper format. Here’s why:

- Physical Record Keeping – Some clients may prefer to keep physical copies of documents for their records, which can be more tangible than electronic files.

- Perceived Formality – For certain clients, receiving a paper document may appear more professional or official, especially for larger businesses or industries that are less familiar with digital methods.

- Less Dependence on Technology – Paper documents do not rely on an internet connection or electronic devices, making them more reliable in some situations.

Ultimately, the choice between sending documents electronically or by paper depends on your business type, client preferences, and operational priorities. By considering the unique benefits of each method, you can select the one that best suits your needs.

How to Create Recurring Documents

For businesses that offer ongoing services, creating recurring payment requests can streamline the process and ensure consistent cash flow. Rather than manually generating new requests each time, automating this process saves time and reduces the chance of error. Setting up recurring charges involves defining the schedule, amount, and other necessary details so that clients are billed on a regular basis without needing to be reminded.

Step-by-Step Guide to Setting Up Recurring Charges

Follow these steps to establish an automated system for periodic payments:

- Determine the Billing Frequency: Decide how often you need to bill your clients (weekly, monthly, quarterly, etc.) and ensure it aligns with your service or product offerings.

- Set Payment Amounts: Make sure the charge is accurate and reflects the correct service or product rate, including any applicable taxes or discounts.

- Choose a Billing System: Use a software tool or payment gateway that allows you to set up recurring charges. Many accounting tools offer this functionality and can automate the process.

- Include Clear Terms: Be explicit about the payment schedule, any late fees, and the duration of the agreement. This transparency can prevent misunderstandings later.

- Notify Your Clients: Let your clients know that their payments will be recurring. Send them a clear summary of the charges and the billing schedule to keep them informed.

Benefits of Automating Regular Payments

Automating the process of recurring payments offers several advantages:

- Time-Saving: Set up once and let the system automatically generate requests, saving you valuable time.

- Consistency: Automation ensures clients are billed on time, every time, which helps with predictable cash flow.

- Improved Client Relations: Clients will appreciate the convenience of not having to manually settle every charge. It also helps avoid missed payments.

With the right setup, recurring charges can be a simple and efficient way to manage ongoing payments for both your business and your clients.

Integrating Documents with Accounting Tools

Automating the connection between financial documents and your accounting software is a smart way to simplify bookkeeping and reduce manual errors. By syncing your payment records directly with accounting systems, you can ensure real-time updates, accurate financial reports, and better decision-making. This integration saves time and provides more efficiency in managing your business finances.

How Integration Enhances Financial Management

Integrating payment records with accounting tools brings numerous advantages to your business:

- Accuracy: Automating data transfers ensures that financial records are always up to date, preventing mistakes from manual entry.

- Efficiency: With integration, there’s no need to enter information multiple times in different systems. This streamlines the entire financial management process.

- Real-Time Updates: Any changes made to records are instantly reflected in your accounting software, helping you maintain accurate, up-to-the-minute financial data.

- Time Savings: Automating the tracking of payments means you can focus on other aspects of your business rather than spending time on repetitive data entry tasks.

Popular Tools for Integration

Several accounting software options allow for seamless integration with payment tracking systems:

- QuickBooks: A widely used tool that offers automatic syncing with various payment platforms, making financial management easier for businesses of all sizes.

- FreshBooks: Known for its user-friendly interface, FreshBooks offers easy integration with many payment systems, allowing businesses to manage their finances with minimal effort.

- Xero: This cloud-based software enables businesses to link invoices directly with bank accounts and payment processors, providing smooth and accurate accounting automation.

By integrating your payment documents with reliable accounting software, you can streamline your business operations, minimize errors, and ensure your financial records are alw

Tips for Getting Paid Faster

Getting payments on time is crucial for maintaining a steady cash flow in any business. There are several strategies that can help encourage prompt payments from clients, reducing delays and improving your overall financial health. Implementing these simple tips can make a significant difference in your payment timelines and business efficiency.

Clear and Concise Payment Terms

One of the most important factors in receiving payments quickly is ensuring your payment terms are clear from the start. Clearly outline your expectations and payment deadlines to avoid confusion. Here are some tips to include in your terms:

- Set clear due dates: Specify the exact date by which payments are due, whether it’s within 30 days, 15 days, or another agreed-upon timeframe.

- Late fees: Consider adding a reasonable late fee for overdue payments to motivate clients to pay on time.

- Payment methods: Offer multiple convenient payment methods such as bank transfers, online payment platforms, or credit cards to make the process as easy as possible.

Automate and Streamline Your Payment Process

Automating your payment system can help reduce delays and prevent missed payments. Using a digital payment platform or software that automatically sends reminders and tracks outstanding balances ensures that clients never forget to pay. Here are some ideas to optimize your payment process:

- Automatic reminders: Set up automated reminders that are sent a few days before the payment is due, followed by additional reminders if the payment is late.

- Online payment links: Provide clients with an easy-to-use online link or portal where they can make immediate payments, minimizing friction in the payment process.

By making the payment process as simple and straightforward as possible, you increase the chances of timely payments and reduce the time spent chasing overdue accounts.

Protecting Your Invoice Information

When handling financial documents, it’s crucial to ensure that sensitive details are kept secure to avoid potential fraud or unauthorized access. By taking steps to safeguard your payment records, you protect not only your own business but also your clients’ privacy and trust. Implementing proper security measures can help mitigate risks associated with information leaks or cyber threats.

Use Secure Communication Channels

One of the first steps in protecting your financial data is to choose secure communication methods. Avoid sending sensitive details via unsecured channels, such as standard email or unencrypted files. Instead, consider the following:

- Encrypted emails: Use encrypted email services or secure file-sharing platforms to send payment records and related documents to clients.

- Secure portals: Encourage clients to access billing information through a secure, password-protected portal to ensure their data is protected during transmission.

Implement Strong Passwords and Authentication

Protecting access to your documents requires strong passwords and robust authentication methods. Weak passwords make it easier for unauthorized individuals to access your data. Follow these tips to enhance your security:

- Strong passwords: Use complex passwords combining letters, numbers, and special characters. Avoid common phrases and update passwords regularly.

- Two-factor authentication: Enable two-factor authentication on any system or software that stores financial data for an added layer of security.

By employing secure practices, you ensure that your financial information remains confidential and protected from potential threats.