Personal Trainer Invoice Template for Simple and Professional Billing

As a fitness expert, keeping track of your earnings and maintaining clear records for your clients is crucial for both your business and peace of mind. Whether you’re working independently or as part of a larger organization, having a reliable way to document transactions is essential for smooth financial management. With a well-structured billing document, you can ensure clarity, avoid misunderstandings, and build a more professional relationship with your clients.

One of the easiest and most efficient ways to streamline your payment process is by using a pre-designed document that helps you organize key information such as services provided, payment details, and contact information. This simple tool can save you time, prevent errors, and help you maintain consistency across all your transactions. In this guide, we will explore how to create, customize, and use such a document effectively in your business.

From formatting to legal requirements, you’ll discover the essential elements that make this document both professional and legally compliant. Whether you’re new to managing payments or looking to improve your current approach, this resource will equip you with the knowledge you need to simplify your financial transactions and focus on what you do best.

Personal Trainer Invoice Template Guide

Managing financial transactions in the fitness industry can be a complex task without the right tools. Keeping accurate records and ensuring clients understand their charges is vital for any service provider. A structured document designed to outline the services rendered, fees, and payment terms is an essential part of this process. This guide will walk you through the key components of creating an efficient and professional document that serves both your business and your clients.

Understanding how to format and organize the necessary information will not only make your transactions smoother but will also enhance your professional image. From listing the specific services provided to detailing the payment instructions, every element plays a role in ensuring transparency and accuracy. In the following sections, we’ll cover the most important aspects to consider when building a billing document that suits your needs.

By the end of this guide, you’ll be equipped to create a clear, easy-to-understand record for each service, making it easier for you to get paid on time and for your clients to stay informed about their financial obligations. Whether you choose to design one from scratch or modify an existing layout, having this tool in place will help you streamline your business operations.

Why You Need an Invoice Template

Keeping clear and professional records of your services is essential for any business. Without a standardized document to outline transactions, it can be easy to overlook important details, leading to confusion and delayed payments. A well-structured record provides both the service provider and the client with a clear understanding of charges, terms, and deadlines, reducing the potential for disputes.

Using a pre-designed form helps you save time and effort while ensuring that all necessary information is included. It allows you to consistently deliver professional-looking documents that convey trustworthiness and reliability. Whether you’re an independent fitness professional or part of a larger organization, having this kind of tool simplifies the billing process and ensures that you stay organized and efficient.

Additionally, this document can serve as an important reference for both parties in case of any payment issues or discrepancies. By providing a clear breakdown of the services provided and the corresponding fees, you not only improve your business operations but also reinforce your professional image.

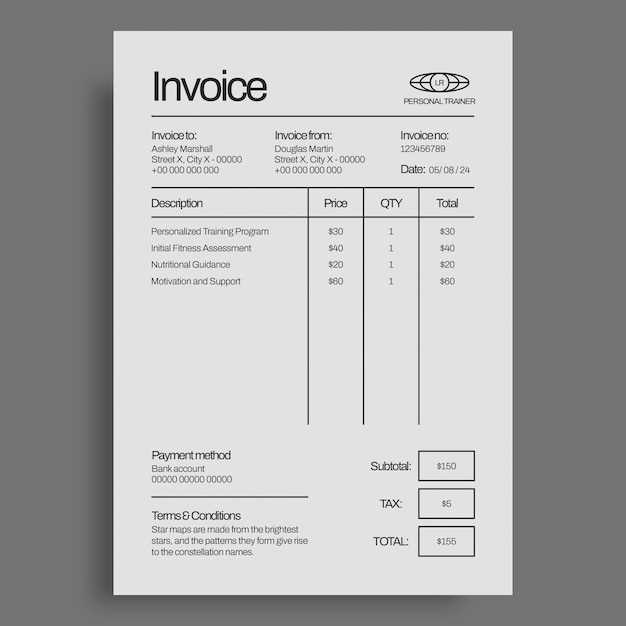

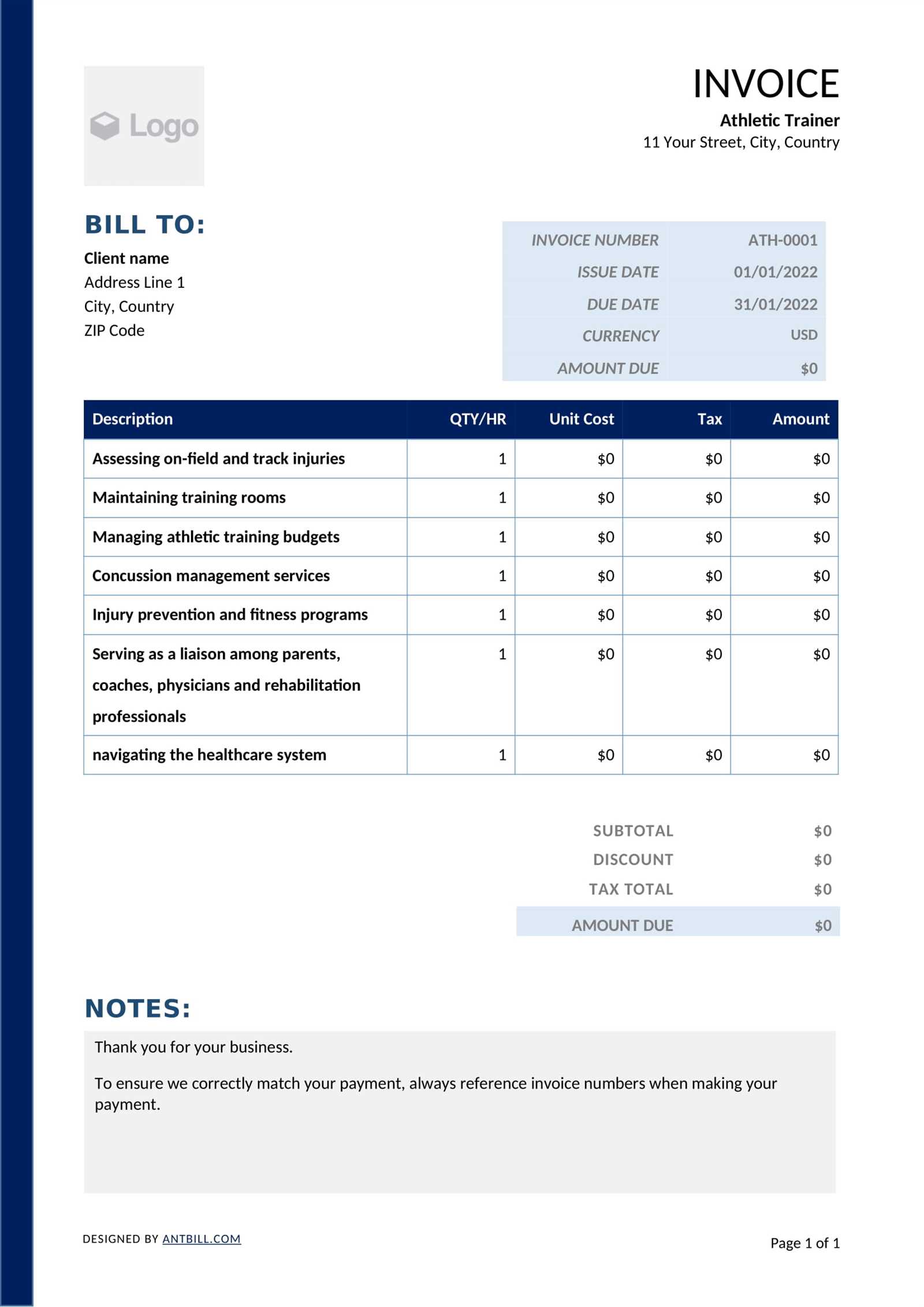

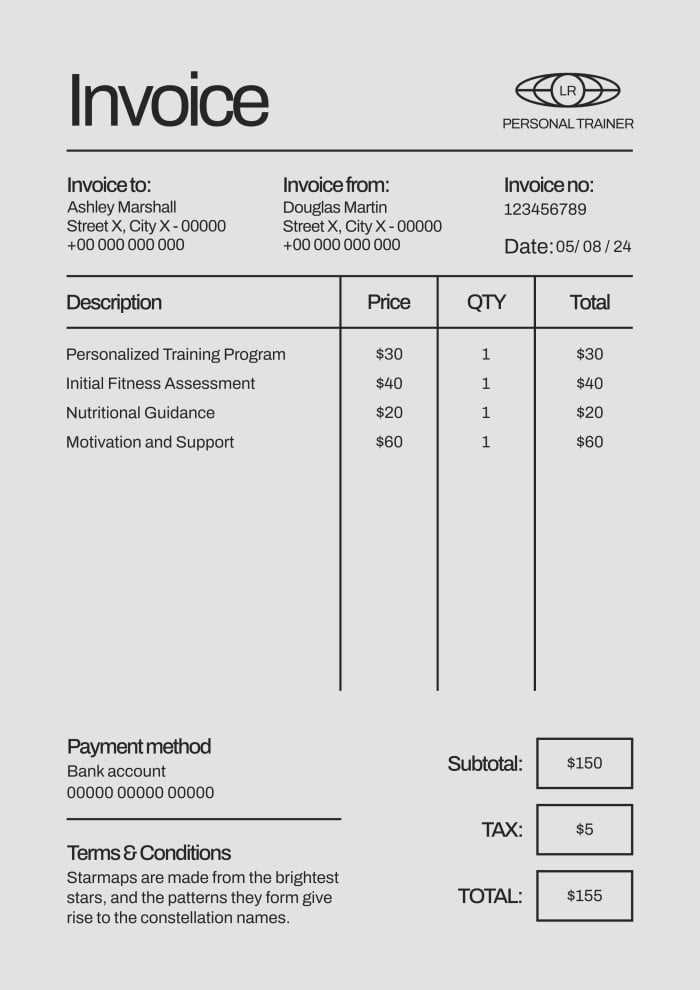

Key Features of an Effective Invoice

An effective billing document not only provides necessary financial details but also enhances your professionalism. To ensure clarity and avoid confusion, it’s important that your document includes key elements that both you and your clients can easily understand. Below are some essential features that make up a well-organized and professional record of services rendered:

- Clear Client Information: Include the client’s full name, address, and contact details. This ensures the document is easily traceable and associated with the correct person.

- Service Description: Provide a detailed breakdown of the services provided, including dates, types of sessions, and any additional notes about the work done. Clear descriptions prevent misunderstandings.

- Accurate Payment Details: Clearly state the total amount due, along with the payment terms, such as due dates and accepted payment methods. This helps set expectations upfront.

- Unique Identification Number: Assign a unique number to each billing document for easy tracking and reference. This helps with organization and future follow-ups.

- Payment Instructions: Include any necessary instructions on how to pay, whether it’s through bank transfer, online payment systems, or checks.

- Taxes and Fees: If applicable, clearly list taxes, additional fees, or discounts. Transparency in this area prevents confusion and ensures clients understand what they are being charged for.

- Professional Design: A clean, well-organized layout is key for making a positive impression. Use clear headings, consistent fonts, and enough space to avoid a cluttered look.

Including these elements ensures that your billing documents are not only functional but also reflect the professionalism of your business. With the right details, both you and your clients can be confident in the transaction process, making it easier to maintain a positive working relationship.

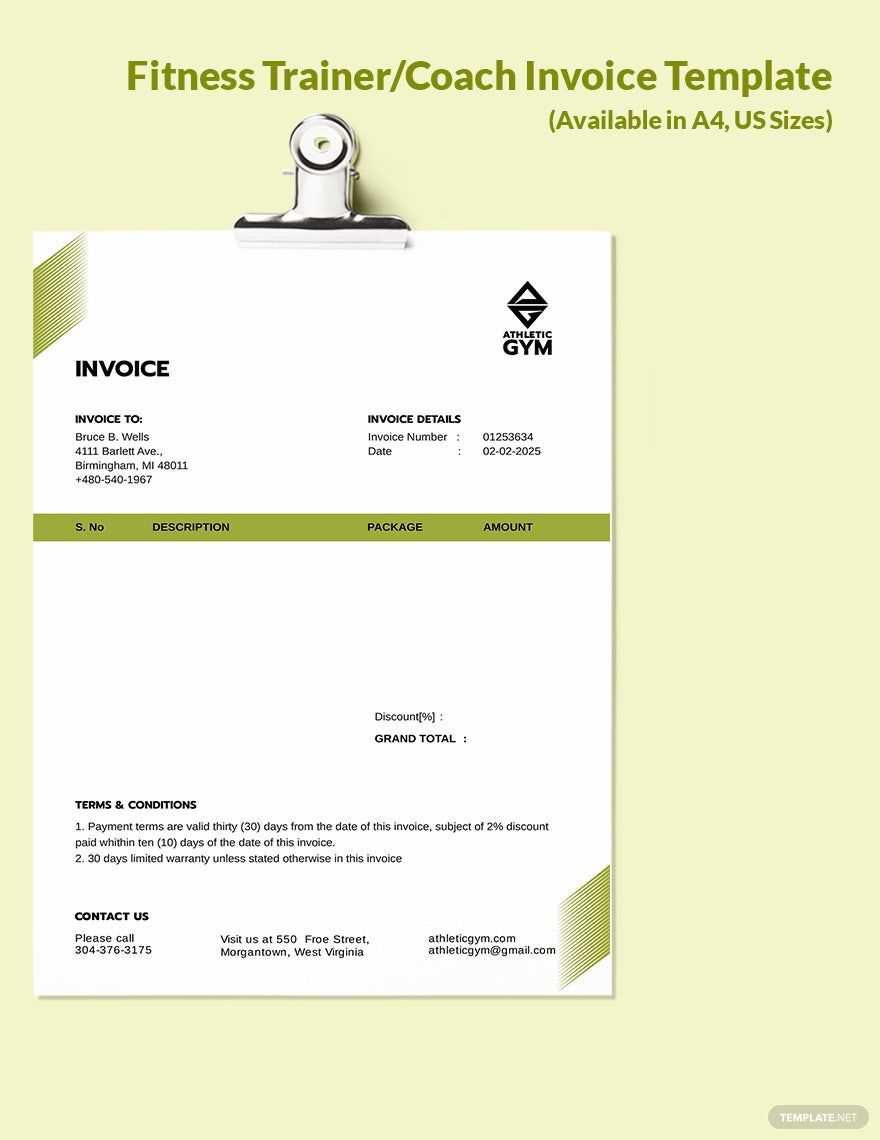

How to Customize Your Invoice Template

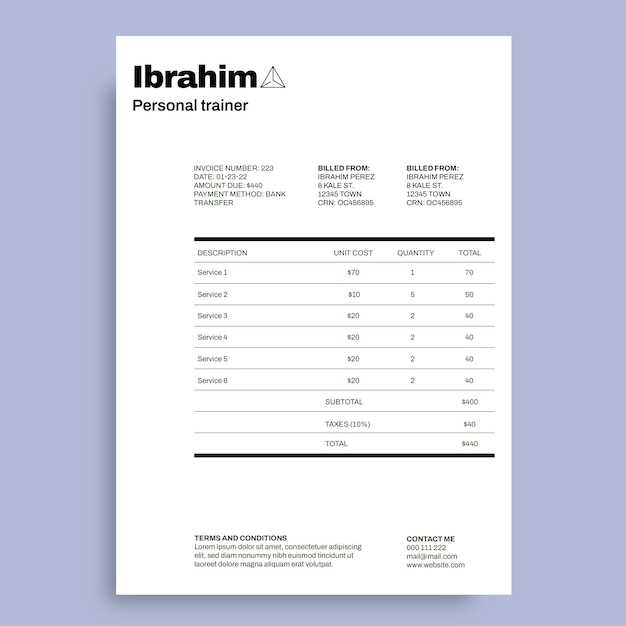

Customizing your billing document is crucial for making it align with your business needs and personal style. By adjusting key sections, you can ensure that the document represents your brand and communicates all relevant details clearly. Whether you are adjusting the layout, adding your logo, or changing the structure of the information, personalization is key to making the document uniquely yours.

Start by adding your business logo and contact information at the top of the document. This establishes a professional appearance and ensures that clients can easily reach you for questions or follow-ups. Include your business name, address, email, and phone number–making your contact details easily accessible enhances the trustworthiness of the document.

Modify the sections for services provided to fit your specific offerings. Whether you offer one-on-one sessions, group classes, or packages, make sure each service is clearly defined and easy to understand. Include space for the date and duration of each session to ensure accuracy. You can also adjust pricing structures based on your services and client agreements.

Customize the payment terms and instructions to match how you prefer to be paid. If you use a particular payment platform or have specific due dates, make sure that’s reflected in your document. This will help prevent delays and ensure that your clients know exactly how to proceed with payments. You can also offer discounts or include late fees to keep everything transparent.

Finally, review the layout and design to ensure it reflects your professionalism. Keep the design clean and uncluttered. Adjust font sizes, spacing, and margins for readability. A well-structured and visually appealing document will not only be functional but will also leave a positive impression on your clients.

By tailoring your billing documents, you enhance your credibility and streamline your financial process. Customizing your forms to fit your specific business practices ensures efficiency and consistency in your transactions.

Understanding Invoice Terms and Language

When creating billing documents, using clear and precise language is crucial for effective communication with your clients. The terms you include not only reflect the professionalism of your business but also ensure that both parties are on the same page regarding payment expectations. Understanding the common terminology and their meanings will help you craft accurate and easy-to-understand records.

Key terms such as due date, payment terms, and services rendered are important to define clearly. The due date specifies when the payment is expected, while payment terms outline conditions like discounts for early payments or penalties for late payments. Clearly detailing the services rendered section helps to avoid confusion by specifying exactly what services were provided, their duration, and cost.

Another important concept is subtotal, which represents the total cost of services before taxes or additional charges. Including this figure helps clients understand the base cost of your services. Similarly, terms like taxes, fees, and total amount due must be carefully explained to avoid misunderstandings about the final payment. These figures show the breakdown of the final cost and help establish transparency.

Using professional language in your records also involves clarity in payment instructions. Be sure to outline acceptable payment methods, such as bank transfer, online payment systems, or credit cards, along with any required details like account numbers or payment links.

By understanding and accurately using these terms, you ensure that your billing documents are easy to follow, reduce potential disputes, and create a more efficient transaction process.

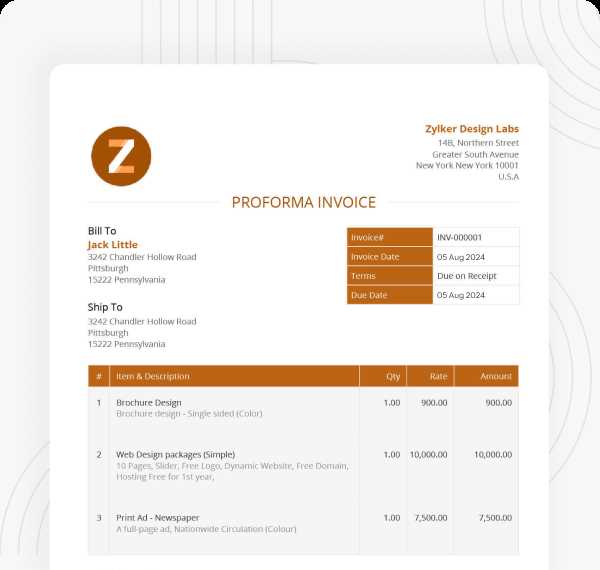

Top Tools for Creating Invoices

To efficiently manage billing and streamline the payment process, having the right tools can make a world of difference. With a variety of software and online platforms available, you can create professional, customized documents quickly and accurately. These tools not only save time but also ensure consistency, reduce errors, and help you stay organized.

Cloud-based platforms like Wave and FreshBooks are popular choices for creating and managing billing records. These services offer easy-to-use interfaces, customizable options, and automatic calculations, making them perfect for both beginners and experienced professionals. Many of them also allow you to store client information securely, track payments, and send reminders for overdue balances.

Microsoft Excel or Google Sheets can be used to create a custom layout from scratch, providing flexibility in design and formatting. Although these tools require more manual input, they offer full control over your document structure and allow for quick adjustments when needed. With the right formulas, you can automate calculations like totals, taxes, and discounts.

Invoice generators, such as Zoho Invoice or PayPal Invoicing, allow you to create documents directly from your account. These services often include pre-designed templates and the ability to add your branding. They also integrate with payment systems, making it easier to receive payments and track transactions in real-time.

Finally, custom design tools like Canva or Adobe Spark let you design unique billing records from scratch. While these are more focused on the aesthetic side, they allow you to incorporate your personal branding, such as logos and color schemes, creating a polished, professional appearance.

Choosing the right tool depends on your needs and preferences. Whether you’re looking for simplicity, customization, or full integration with your accounting system, there’s a solution available to help you create accurate, professional records quickly and easily.

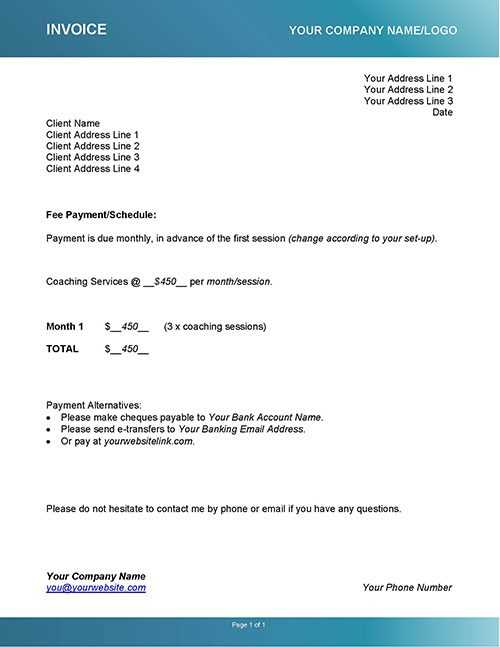

Setting Payment Terms for Clients

Establishing clear and transparent payment terms is essential for any service-based business. By defining how and when clients are expected to pay, you can avoid confusion and ensure timely compensation for your work. Setting clear expectations from the start fosters trust and helps maintain a positive business relationship.

Key Considerations for Payment Terms

When determining payment terms, it’s important to outline several key factors to avoid misunderstandings. These include:

- Due Date: Specify when payment is expected, whether it’s immediately after services are rendered or within a set number of days (e.g., 30 days).

- Accepted Payment Methods: Clarify the forms of payment you accept, such as credit/debit cards, bank transfers, checks, or online payment platforms like PayPal or Venmo.

- Late Payment Fees: Define what happens if payment is delayed. For example, you may charge a late fee or interest after a specific grace period.

- Deposit Requirements: If necessary, request a deposit upfront to secure a booking or commitment, especially for long-term services or packages.

- Discounts and Promotions: Specify if any discounts are available, such as for early payments, bulk sessions, or referral incentives.

How to Communicate Payment Terms Effectively

Once you have determined your payment terms, it’s important to communicate them clearly to your clients. Consider these strategies:

- Written Agreement: Always outline your payment terms in writing, whether through an email, contract, or a formal document that both parties can refer to.

- Clear Documentation: Ensure that the payment terms are included in any billing document or receipt you provide to clients, making the expectations explicit.

- Regular Reminders: Send friendly reminders as payment due dates approach, especially if you’re working with clients over a longer period or for ongoing services.

By setting clear payment terms and ensuring clients are well-informed, you reduce the risk of misunderstandings and ensure smoother financial transactions. This clarity can also help build a stronger, more professional relationship with your clients, making them more likely to return for future services.

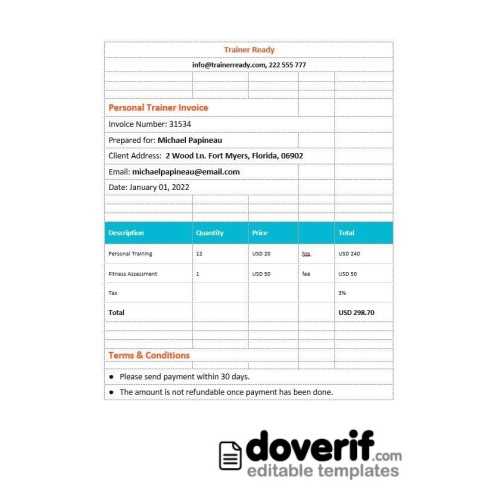

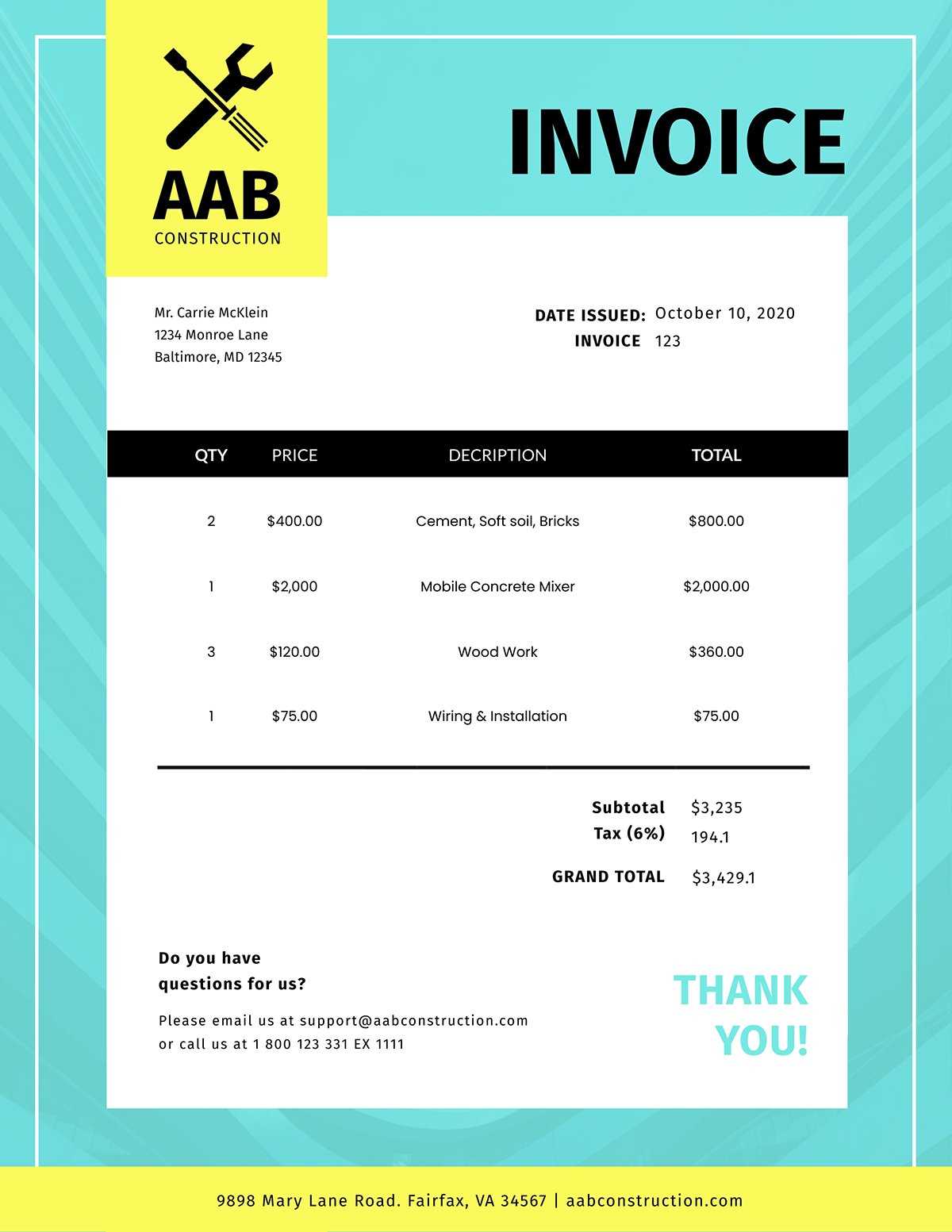

How to Calculate Taxes on Services

When offering services, it’s important to understand how to properly calculate and apply taxes to ensure compliance with local tax laws. Depending on your location, different tax rates may apply to various types of services. Accurately calculating taxes not only helps you meet legal requirements but also ensures that your clients are charged appropriately for the services they receive.

Understanding Sales Tax on Services

In many regions, sales tax is not applied to all services. However, some types of services, such as those related to health and fitness, may be subject to taxation. To determine whether your services are taxable, check with your local tax authority or consult a tax professional. If applicable, follow these steps:

- Identify the tax rate: Determine the applicable tax rate for your services. This rate can vary depending on your location, and it may change based on the type of service you provide.

- Calculate the tax amount: Multiply the cost of your services by the tax rate. For example, if your service costs $100 and the tax rate is 8%, the tax amount would be $8 (100 x 0.08).

- Add the tax to the total: After calculating the tax, add it to the base amount of the service. In this example, the total amount due would be $108 ($100 + $8).

Additional Considerations for Tax Calculation

There are other factors to consider when calculating taxes on your services:

- Exemptions and deductions: Some services may be tax-exempt or eligible for deductions, such as services for non-profit organizations. Make sure to check the regulations in your area.

- Different tax rates for different regions: If you provide services in multiple locations, you may need to apply different tax rates depending on the client’s location. Some regions have higher or lower tax rates, so always ensure you’re using the correct rate.

- International clients: If you work with international clients, be aware that some countries have different VAT (Value Added Tax) systems or sales tax rules. Make sure to research the tax laws for each country where your clients are located.

By correctly calculating and applying taxes, you ensure that your billing records are accurate and legally compliant, while also helping clients understand the full cost of services rendered. Always stay informed about tax laws to avoid mistakes and ensure your business runs smoothly.

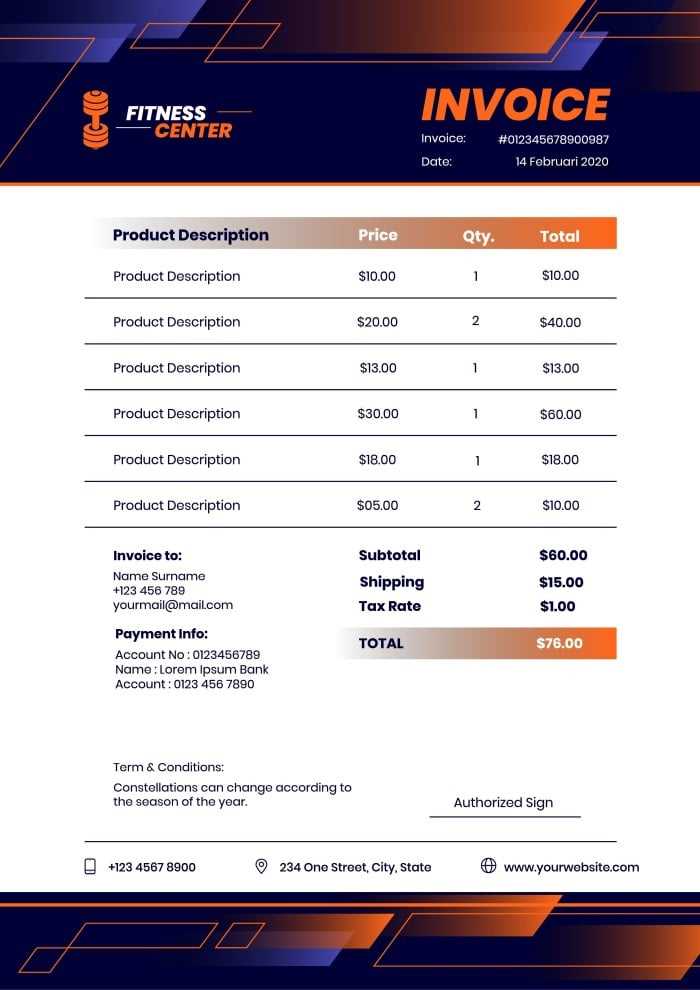

Best Practices for Professional Invoices

Creating clear and professional billing documents is crucial for maintaining a successful business. Well-structured records not only ensure that clients are well-informed, but they also reflect the credibility and professionalism of your business. By following best practices, you can streamline the payment process, reduce errors, and create a more positive experience for your clients.

Consistency and Clarity

One of the most important aspects of a professional billing document is consistency. Always use the same format, layout, and language for every document to create a cohesive and trustworthy experience. Here are some tips to maintain clarity and consistency:

- Use a clear and readable font: Stick to professional fonts like Arial, Calibri, or Times New Roman. Avoid overly decorative or difficult-to-read fonts.

- Organize information logically: Arrange details in a consistent order, starting with your business information, followed by client details, services, pricing, taxes, and payment instructions.

- Double-check for accuracy: Ensure that all information, such as dates, amounts, and descriptions, is accurate to avoid confusion or disputes.

Timely and Transparent Communication

Being transparent with your clients about costs, payment terms, and deadlines helps build trust and encourages prompt payments. Follow these practices to communicate effectively:

- Issue documents promptly: Send billing records as soon as the service is completed, so clients know what to expect in terms of payment.

- Provide clear payment terms: Clearly state when payments are due, the accepted payment methods, and any late fees for overdue balances.

- Send reminders: If the payment is approaching or overdue, send a polite reminder to your clients to keep them informed.

By adhering to these best practices, you can ensure your billing process runs smoothly, minimizing misunderstandings and encouraging timely payments. A well-crafted document not only protects your business but also helps to establish your professional reputation.

Common Invoice Mistakes to Avoid

When creating billing records, small errors can lead to delays in payment, confusion, or even disputes with clients. It’s essential to be meticulous when drafting these documents to ensure accuracy and professionalism. Understanding the most common mistakes made during the billing process can help you avoid these pitfalls and keep your financial transactions smooth and efficient.

Common Mistakes to Watch For

Here are some of the most frequent errors that service providers make when preparing their billing documents:

| Common Mistake | Why It Matters | How to Avoid It |

|---|---|---|

| Missing Client Information | Without clear client details, it can be difficult to track payments and follow up on outstanding balances. | Always include full client contact details such as name, address, and email to ensure proper documentation. |

| Unclear Service Descriptions | Vague descriptions may confuse clients, leading to disputes over what was actually provided. | Be specific in listing services, including dates, duration, and any relevant details about the work performed. |

| Incorrect Payment Amounts | Errors in pricing can cause misunderstandings and delay payments. | Double-check the math and ensure that taxes, discounts, or fees are calculated accurately. |

| Omitting Payment Terms | If payment terms are not outlined clearly, it may lead to late payments or confusion regarding deadlines. | Always include clear payment deadlines, accepted methods, and any penalties for late payments. |

| Lack of Professional Design | A cluttered or unprofessional look can make your business seem less credible and cause clients to overlook the document. | Use clean, easy-to-read fonts and a consistent layout to give your billing documents a polished, professional appearance. |

How to Avoid These Mistakes

The best way to avoid these common errors is to double-check your work before sending the document to clients. Implement a system for tracking information accurately and use reliable tools that can help automate calculations and formats. Additionally, using a checklist when preparing your billing documents can ensure that all necessary elements are included and nothing is overlooked.

By avoiding these mistakes and ensuring your documents are accurate and professional, you can minimize p

Free vs Paid Invoice Templates

When it comes to creating professional billing records, there are a variety of options available, from free tools to premium services. Each type offers different features, and choosing between them depends on your needs, budget, and the level of customization you require. Both free and paid options have their advantages, but it’s important to understand what you gain or give up with each choice.

Free billing solutions often come with basic functionalities and pre-designed layouts. These tools are perfect for those just starting out or small businesses with simple needs. They typically offer a straightforward format with limited customization options, which might be suitable if you’re just looking to send out quick and easy documents.

On the other hand, paid tools offer a wider range of features, such as more advanced customization, professional designs, integration with accounting software, and automated calculations. These services often provide added benefits like customer support, tax calculations, and the ability to store client data securely. For growing businesses or those that need to maintain a professional image, paid solutions may offer more value in the long run.

The decision between free and paid options depends on your specific business needs. If you require more advanced features, such as recurring billing or integration with other financial tools, a paid solution might be worth the investment. However, if you only need basic documents to manage payments without additional bells and whistles, free options can get the job done effectively.

Ultimately, both free and paid options can help you stay organized and maintain a professional billing process. By understanding your needs and budget, you can choose the option that best suits your business.

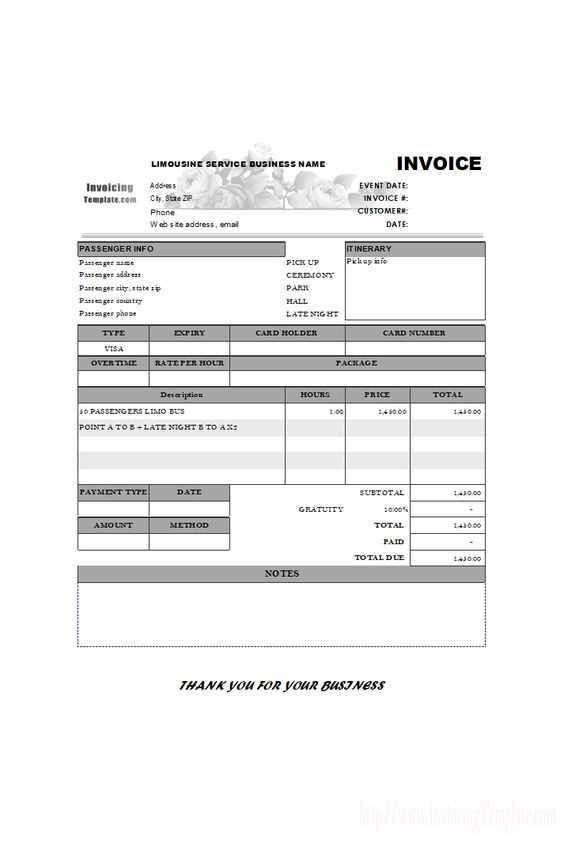

Integrating Payment Methods into Your Invoice

Incorporating multiple payment methods into your billing documents is an essential step for ensuring that your clients can pay you conveniently. By providing various options for payment, you cater to a broader audience and streamline the payment process. This flexibility not only improves customer satisfaction but also accelerates cash flow by making it easier for clients to pay promptly.

Popular Payment Methods to Include

When integrating payment options, it’s important to consider methods that are widely accepted and secure. Here are some common payment methods to include in your records:

- Bank Transfers: Provide your clients with your bank account details, allowing them to transfer funds directly from their bank account.

- Credit and Debit Cards: Accepting card payments through platforms like Stripe or Square can simplify the process for clients who prefer to pay with their cards.

- Online Payment Platforms: Services like PayPal, Venmo, or Apple Pay offer convenient and fast ways for clients to settle bills online.

- Checks: Although less common today, some clients still prefer to pay by check. Ensure you provide clear instructions for mailing checks, including the recipient’s name and address.

- Cash: For in-person services, cash payments may still be an option. Ensure you provide clear guidelines for handling cash payments securely.

How to List Payment Methods on Your Billing Documents

To ensure smooth transactions, clearly outline the available payment methods in your records. Here’s how to do it effectively:

- List each method: Specify the payment options in a dedicated section of your document, such as “Payment Methods Accepted” or “How to Pay.”

- Include necessary details: For bank transfers, include your account name, account number, and routing number. For online payments, provide the relevant payment links or details (e.g., PayPal email or Square link).

- Provide instructions: Make sure to offer clear instructions on how to complete each payment method. For instance, if you’re accepting checks, note who the check should be made out to and the mailing address.

By integrating these options into your billing documents, you create a seamless and efficient payment experience for your clients, increasing the likelihood of prompt payment and reducing any potential confusion.

Legal Requirements for Billing Records

For any business, it is essential to comply with local laws and regulations when preparing billing documents. These records are not just a tool for tracking payments but also a legal requirement in many jurisdictions. Ensuring that your documents meet all legal standards helps protect both you and your clients and ensures transparency in your business dealings. In this section, we’ll discuss the critical legal elements that should be included in your billing records.

Essential Legal Information to Include

To comply with tax and business regulations, there are specific details that must be present in your billing documents. These elements may vary depending on your country or region, but the following are commonly required:

| Required Information | Why It’s Important | How to Include It |

|---|---|---|

| Business Name and Contact Information | Helps identify the entity issuing the record, ensuring proper correspondence and tax tracking. | Include your business name, address, phone number, and email address. |

| Client Information | Ensures that the correct client is billed and that there is a clear record of who is responsible for payment. | Provide the client’s full name, address, and contact details. |

| Unique Billing Reference Number | Helps keep track of transactions and avoid confusion with future payments or records. | Generate a unique reference number for each document (e.g., invoice #001, #002). |

| Date of Issue | Helps establish when the billing document was created and is used for tracking payment deadlines. | Clearly state the date the document was issued. |

| Clear Description of Services | Ensures transparency and helps prevent disputes by listing the exact services provided. | Describe each service provided in detail, including any dates or sessions involved. |

| Total Amount Due | Shows the client the full cost of services rendered, including taxes and discounts. | Clearly list the amount due, including itemized costs and any applicable taxes or fees. |

| Tax Information | Helps businesses comply with tax laws by ensuring the correct taxes are applied and recorded. | List the applicable tax rate and amount if required in your ju

Managing Client Payments with Billing Records

Efficiently managing client payments is a vital aspect of running any service-based business. Clear and well-organized billing documents not only ensure that clients are properly charged, but they also help streamline the payment process, reduce errors, and improve cash flow. By keeping track of transactions and maintaining transparency, you can build stronger relationships with clients while ensuring timely payments. One of the key elements of managing payments effectively is providing clients with clear and accurate records of the services rendered and the corresponding charges. A professional and well-structured document ensures that clients understand the costs and payment terms, which reduces the likelihood of disputes and delays. It also helps both you and the client keep a record of past transactions for future reference. Another critical aspect is setting clear payment terms and deadlines. By specifying due dates and acceptable payment methods, you can avoid confusion and encourage timely settlements. Including late fees or interest charges for overdue payments can provide an added incentive for clients to pay on time, further enhancing your business’s financial stability. Tracking payments and reconciling them against your records is also essential. Regularly updating your financial documents and checking for outstanding balances allows you to follow up with clients when necessary and keep your cash flow in check. Keeping organized records helps ensure that no payment is overlooked and makes it easier to address any discrepancies quickly. In summary, managing client payments requires careful attention to detail and a systematic approach. By providing clear billing records, setting firm payment terms, and staying organized, you can minimize delays, avoid misunderstandings, and maintain healthy financial operations for your business. How to Track Billing Status and Due DatesKeeping track of payment statuses and deadlines is crucial for maintaining a smooth financial operation. By staying organized and regularly monitoring the status of payments, you can ensure that no outstanding balances are overlooked and that your cash flow remains consistent. This process helps you follow up with clients promptly and take necessary actions before payments become overdue. One of the first steps to effectively managing payment timelines is to establish a clear system for tracking due dates. For each transaction, make sure that the payment deadline is clearly stated in the billing document, and that it’s easily accessible in your records. This will allow you to set reminders and follow up on overdue payments as soon as possible. To track the status of each payment, consider creating a simple spreadsheet or using financial software to log details about each bill, such as the date it was issued, the amount due, and the payment status (e.g., paid, pending, overdue). Regularly update this log to reflect the most current information, and keep track of any communications with clients regarding their payments. Another useful strategy is to set up automated reminders for both you and your clients. Many digital tools offer features that allow you to send automatic notifications when a payment is due or overdue. This can help ensure that your clients are aware of upcoming deadlines and encourage prompt action on their part. In cases where payments are overdue, it’s important to follow up professionally and consistently. Send polite reminders, and if necessary, escalate the issue by implementing late fees or discussing alternative payment arrangements. By tracking the payment status and being proactive about due dates, you can prevent cash flow issues and maintain a steady income stream. In conclusion, tracking the status of payments and ensuring that due dates are met requires a well-organized system and proactive approach. By implementing these strategies, you can reduce delays, maintain clear communication with clients, and ensure a smooth financial operation for your business. Ensuring Timely Payments from ClientsGetting paid on time is critical to maintaining a healthy cash flow and running a successful business. To ensure timely payments, it’s essential to establish clear expectations, communicate effectively with clients, and implement strategies that encourage prompt settlement of fees. By taking a proactive approach, you can minimize delays and create a smoother, more efficient payment process for both you and your clients. Clear Payment Terms

One of the most effective ways to ensure timely payments is to set clear payment terms from the beginning. This includes specifying when payment is due, what methods are accepted, and any penalties for late payments. Make sure these terms are communicated upfront and included in all agreements or billing documents. The more transparent you are, the less room there is for confusion or delays. Offer Multiple Payment OptionsProviding a variety of payment methods can make it easier for clients to pay on time. Whether it’s online payment platforms, bank transfers, or credit cards, offering multiple options accommodates clients’ preferences and increases the likelihood of timely payment. The more convenient you make the process, the quicker your payments are likely to be processed. Automated Reminders can also be a helpful tool. Many online platforms allow you to set up automated reminders that notify clients when their payment is due or when it’s overdue. Sending a reminder a few days before the due date and a follow-up after the deadline can keep payment top of mind for clients and prevent unnecessary delays. Another key strategy is to build strong client relationships. Engaging with clients regularly, maintaining a professional yet approachable demeanor, and ensuring they are satisfied with your services can create a sense of trust and responsibility. Clients who value your services are more likely to prioritize timely payments. Lastly, consider implementing a late fee policy. Setting up clear consequences for late payments, such as a small fee or interest on overdue amounts, can provide an added incentive for clients to settle their bills promptly. Ensure that clients are aware of this policy upfront, so they understand the importance of paying on time. By establishing clear payment terms, offering multiple payment options, sending reminders, and maintaining strong relationships, you can significantly reduce delays and ensure that payments are made in a timely manner. |