Easy-to-Use Personal Service Invoice Template for Professionals

In any profession that involves offering skills or expertise directly to clients, having a clear and reliable way to document each project’s details is essential. Effective billing not only ensures timely payments but also reflects a professional approach that builds trust with clients. Setting up a streamlined document for every project can simplify work processes and save time, which is vital for maintaining focus on core activities.

A structured billing document helps outline each task, its cost, and any other relevant information, making transactions smooth and transparent. Whether you’re working with repeat clients or handling one-time projects, such a format can provide clarity and reinforce a polished image of your business. From displaying costs to clarifying terms, a ready-made format tailored to individual needs can be invaluable in managing these records consistently.

Furthermore, organizing billing records in a standard format can assist in tracking earnings, forecasting income, and simplifying tax preparation. With a well-designed document, freelancers and entrepreneurs can focus less on administrative tasks and more on their core expertise. Adopting a reliable format not only enhances professionalism but also improves overall workflow.

How to Create an Invoice for Personal Services

For those offering specialized skills directly to clients, setting up a clear and organized billing document is a practical step in ensuring smooth transactions. A structured format allows professionals to present the details of their work, costs, and any additional terms efficiently. Building such a document with attention to layout and clarity helps in maintaining professional relationships and eases the payment process.

Organizing Key Project Details

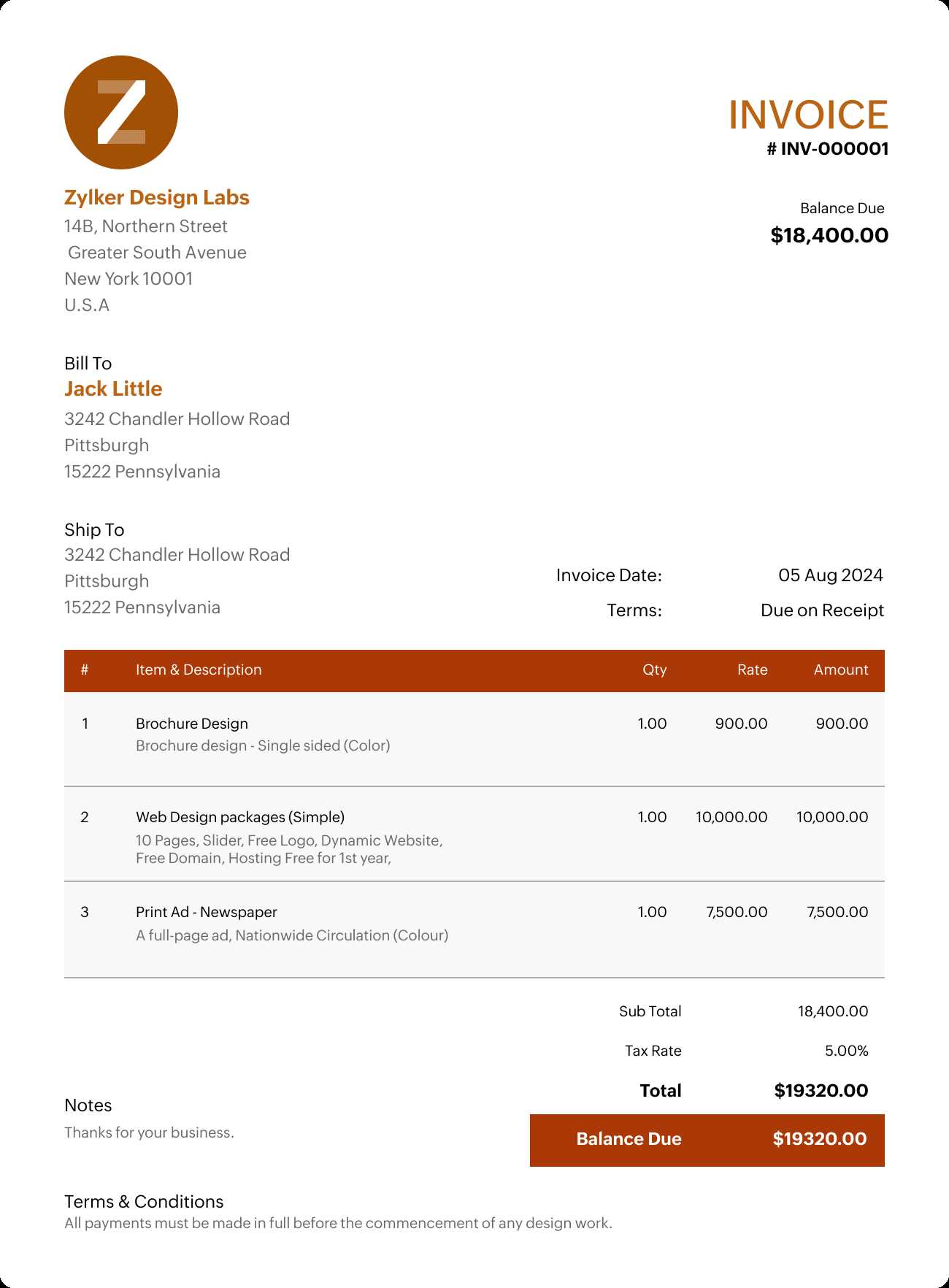

Begin by listing essential information, including your business name, contact details, and the client’s information. Next, provide a detailed breakdown of the tasks or projects completed. Each item should include a short description, the time spent (if applicable), and the cost associated with it. A clear breakdown of activities helps clients understand the scope of work, enhancing transparency and minimizing potential misunderstandings.

Summarizing Totals and Payment Terms

At the bottom of the document, include a section summarizing the total amount due. Be sure to specify the preferred payment methods and any relevant terms, such as deadlines or late fees. Adding a polite reminder of the due

Understanding the Basics of Personal Invoices

For professionals who regularly provide specialized work to clients, having a well-structured method for outlining tasks and payments is essential. This type of document organizes all necessary information regarding the services rendered, ensuring both clarity and professionalism. By understanding the core components of such a document, you can create an effective record that facilitates smooth financial transactions and fosters trust.

Essential Components to Include

A basic billing document should begin with details such as your name or business name, contact information, and the client’s details. This provides an identifiable starting point. Additionally, each task or item should be clearly described, alongside the corresponding rate or fee. Adding a date of completion or delivery helps set expectations, while keeping a record of past work.

Ensuring Clarity and Consistency

Consistency in the format and language used in these documents helps clients easily understand each line item and related costs. Including a clear total amount and payment terms at the end is

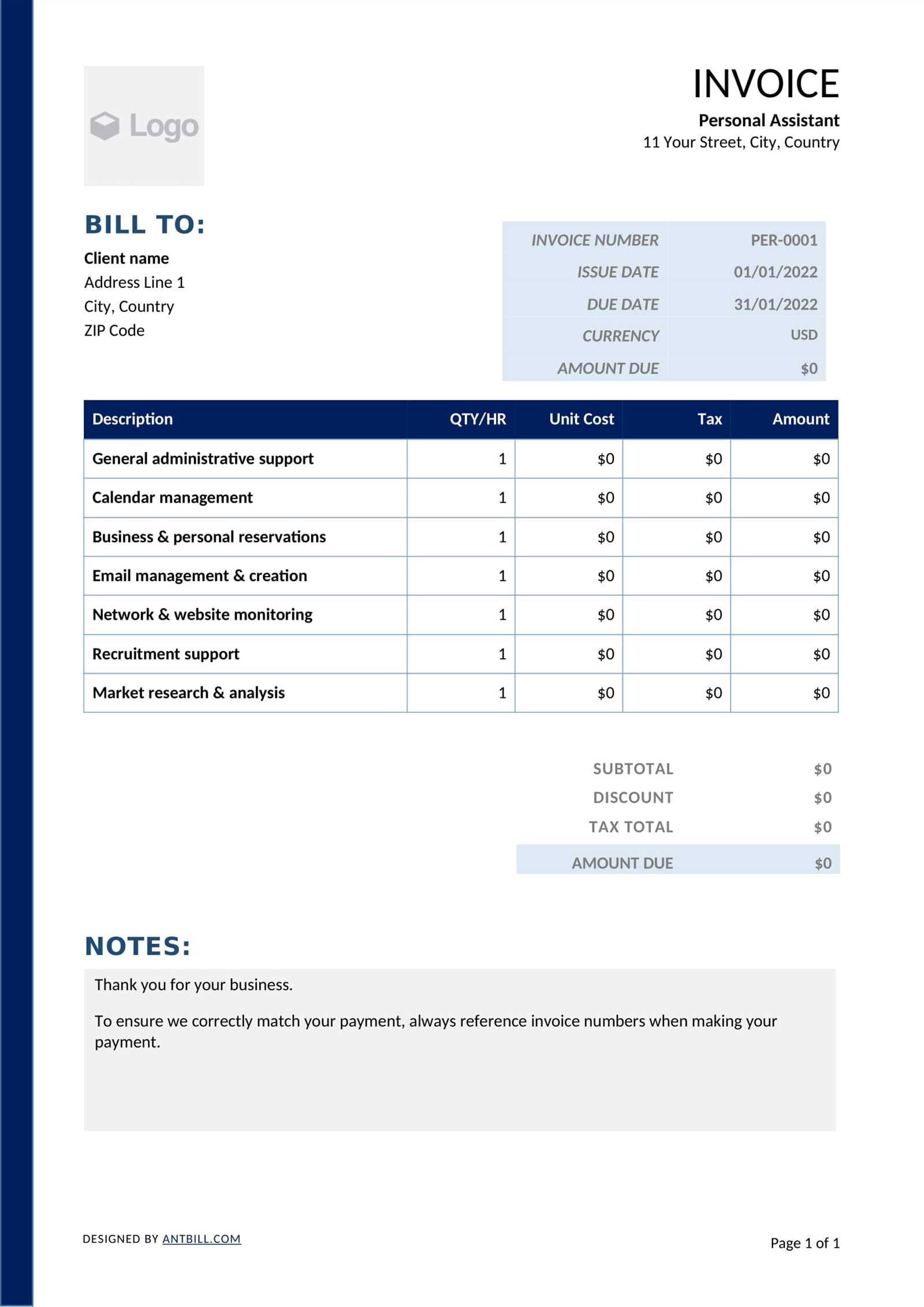

Key Elements of a Service Invoice

To create a professional and effective billing document, certain essential elements should be included to ensure clarity and completeness. Each section serves a purpose, helping both parties understand the scope of work, the financial details, and the terms of payment. Including these key components enhances transparency and reinforces a structured approach to business transactions.

Header Information is crucial as it identifies both the provider and recipient of the work. This part typically includes your business name, address, contact details, and client information. It establishes a clear starting point, making the document easier to track and reference.

Following this, a comprehensive list of tasks or items provided should be presented. Each entry should contain a brief description, quantity (if applicable), and the associated rate or fee. This detailed breakdown enables clients to understand the charges and ensures accuracy in billing.

The total amount due, along with payment instructions, is essential to finalize the document. Including the preferred methods of payment and any applicable deadlines or late fees helps to avoid misunderstandings. Each of these elements plays a role in creating a document that is both functional and professional.

Why Use a Template for Invoicing

Using a pre-designed structure for billing documents can streamline the process, ensuring accuracy and saving time. By having a consistent format, professionals can focus on their core work without having to recreate basic billing elements each time. This approach not only improves efficiency but also helps maintain a polished and organized presentation, reinforcing credibility with clients.

One of the main benefits of a ready-made format is that it includes standard fields that cover all necessary information. Below is a table showing how such a format can simplify the billing process:

| Benefit | Description | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Consistency | Maintains a uniform look for all documents, enhancing professional appearance. | ||||||||

| Time Savings | Reduces the need to create new layouts from scratch for each project. | ||||||||

| Error | Impact |

|---|---|

| Missing Contact Information | Without clear contact details, clients may struggle to get in touch or clarify any questions, which can delay payment. |

| Incorrect Payment Terms | Ambiguities in payment terms can cause confusion about when payments are due, leading to delayed or missed payments. |

| Unclear Breakdown of Charges | If charges aren’t clearly detailed, clients may not understand what they are being billed for, leading to disputes or delayed approval. |

| Failure to Include Dates | Not including the date of service or issue date can make it hard for clients to determine the timeframe of the charges, creating potential payment delays. |

Ensuring that your billing document is free from these mistakes will help maintain professionalism and foster smoother transactions with clients.

Legal Considerations for Personal Service Invoices

When creating a billing document, it’s essential to ensure that it complies with relevant laws and regulations. A properly formatted document can help prevent misunderstandings and provide legal protection in case of disputes. Here are key legal considerations to keep in mind when drafting your billing statement.

Key Legal Requirements

- Clear Terms and Conditions: Always outline the terms of payment, including due dates, late fees, and accepted methods of payment. This helps avoid potential disagreements.

- Accurate Documentation: Ensure that all charges are clearly documented and accurately reflect the work performed. This can serve as proof in case of legal disputes.

- Compliance with Local Laws: Different regions may have specific laws regarding business transactions, including tax regulations and data protection laws. Make sure your billing statement follows these rules.

Essential Details to Include

- Client Identification: Make sure the client’s name and contact details are correctly included to avoid confusion or errors in the billing process.

- Service Description: Clearly describe the work completed, including dates, hours, or quantities, to ensure both parties understand the charges.

- Tax Information: Depending on your jurisdiction, including relevant tax rates and calculations may be required to comply with tax laws.

By ensuring that your document includes these legal elements, you can protect your rights while maintaining professionalism in your business transactions.

How to Keep Track of Your Invoices

Tracking your billing statements is crucial for managing your finances and ensuring timely payments. A well-organized system allows you to monitor outstanding amounts, avoid mistakes, and stay on top of your financial records. Below are some effective strategies to help you keep track of your transactions.

Using Digital Tools

One of the most efficient ways to manage your records is by using digital tools or software designed for financial tracking. These tools can help you categorize and store your statements, making it easy to retrieve them when needed. Many programs also allow you to set reminders for payments, ensuring you never miss a due date.

Creating a Manual System

If you prefer a hands-on approach, consider keeping a physical ledger or spreadsheet. A simple method like logging each transaction with corresponding dates and amounts can be effective for those who are more comfortable with non-digital tracking. Make sure to update the records regularly to avoid missing important details.

Staying organized and maintaining accurate records will help you avoid disputes, track overdue payments, and keep your finances in order.

Using Digital Tools for Invoicing Efficiency

Digital tools have revolutionized how businesses manage their billing processes. By adopting modern software, individuals and companies can streamline their administrative tasks, reduce errors, and save time. These tools offer various features that simplify creating, sending, and tracking transactions. Here are some benefits of using digital tools to enhance your efficiency:

- Automation: Many tools allow you to automate the creation and delivery of documents, reducing manual work and ensuring consistent formats.

- Real-Time Tracking: You can track the status of your transactions instantly, ensuring that you stay informed about pending payments or disputes.

- Customization: Customize your documents to suit your needs, including adding logos, payment terms, and specific itemized charges.

- Security: Digital systems often come with encryption and backup features, providing an added layer of protection for sensitive data.

Using these tools helps minimize administrative overhead and allows businesses to focus on their core operations. It also ensures a higher level of accuracy and organization in your financial processes.

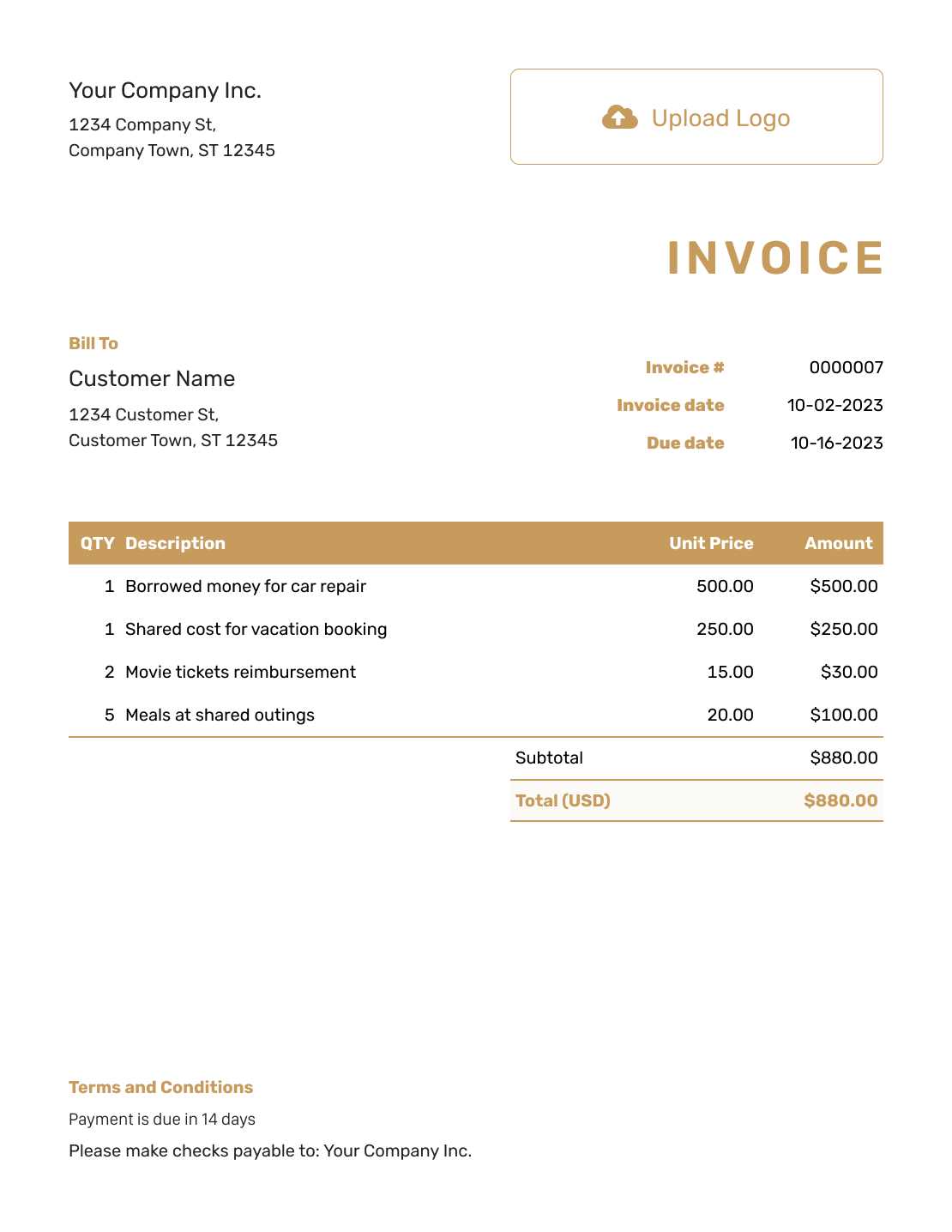

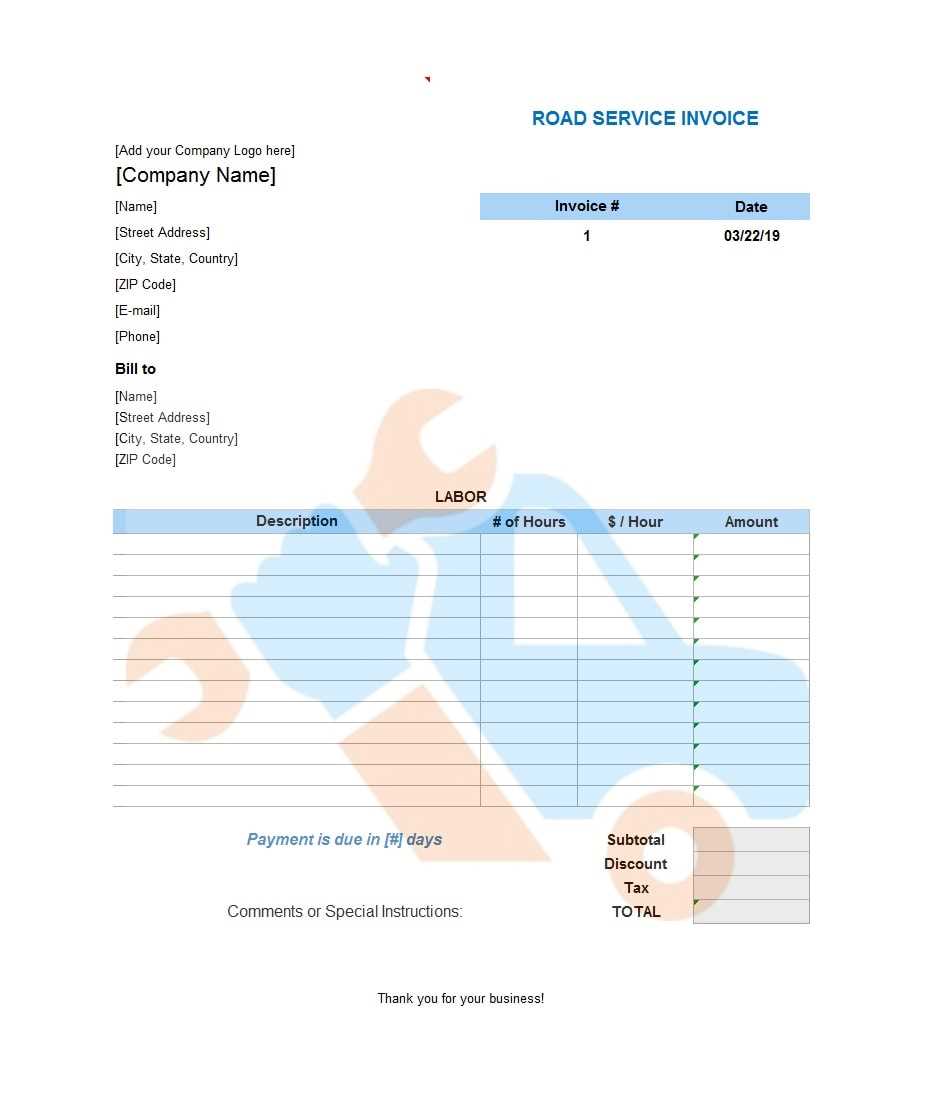

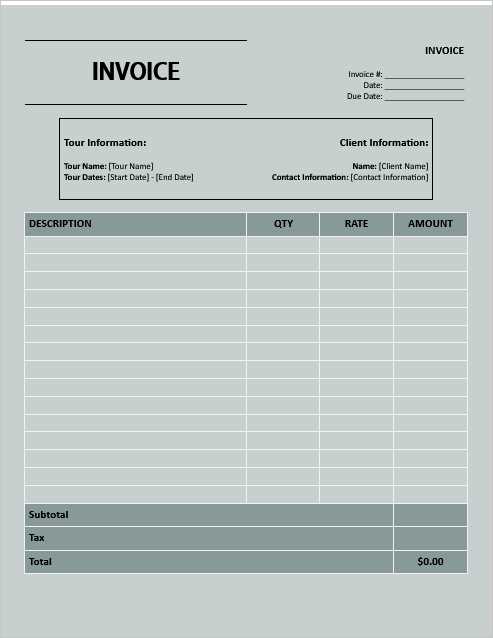

Sample Layouts for Service-Based Invoices

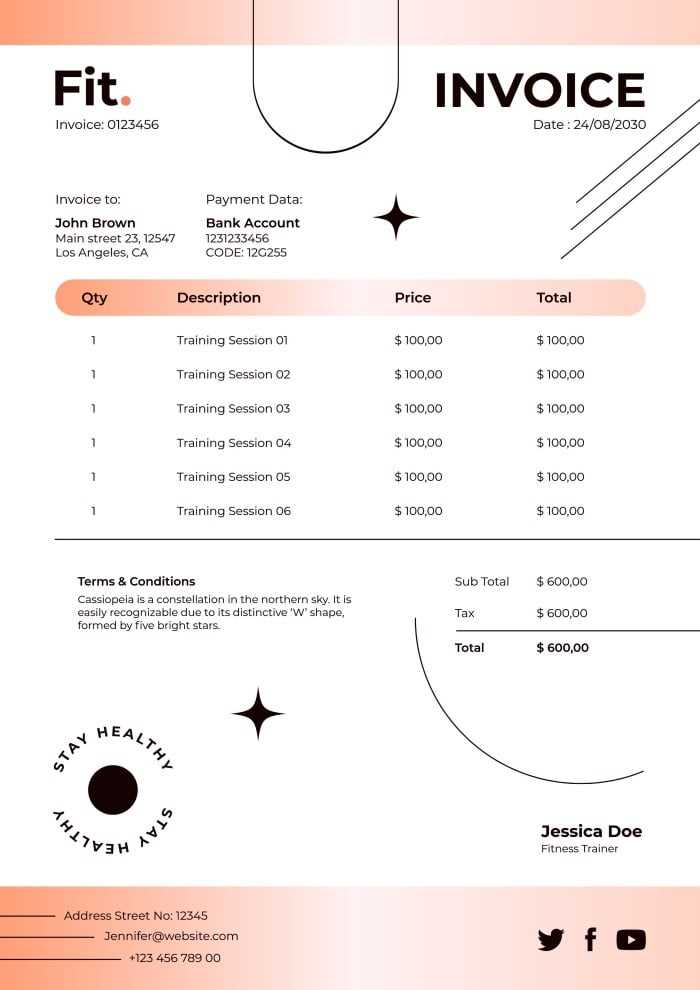

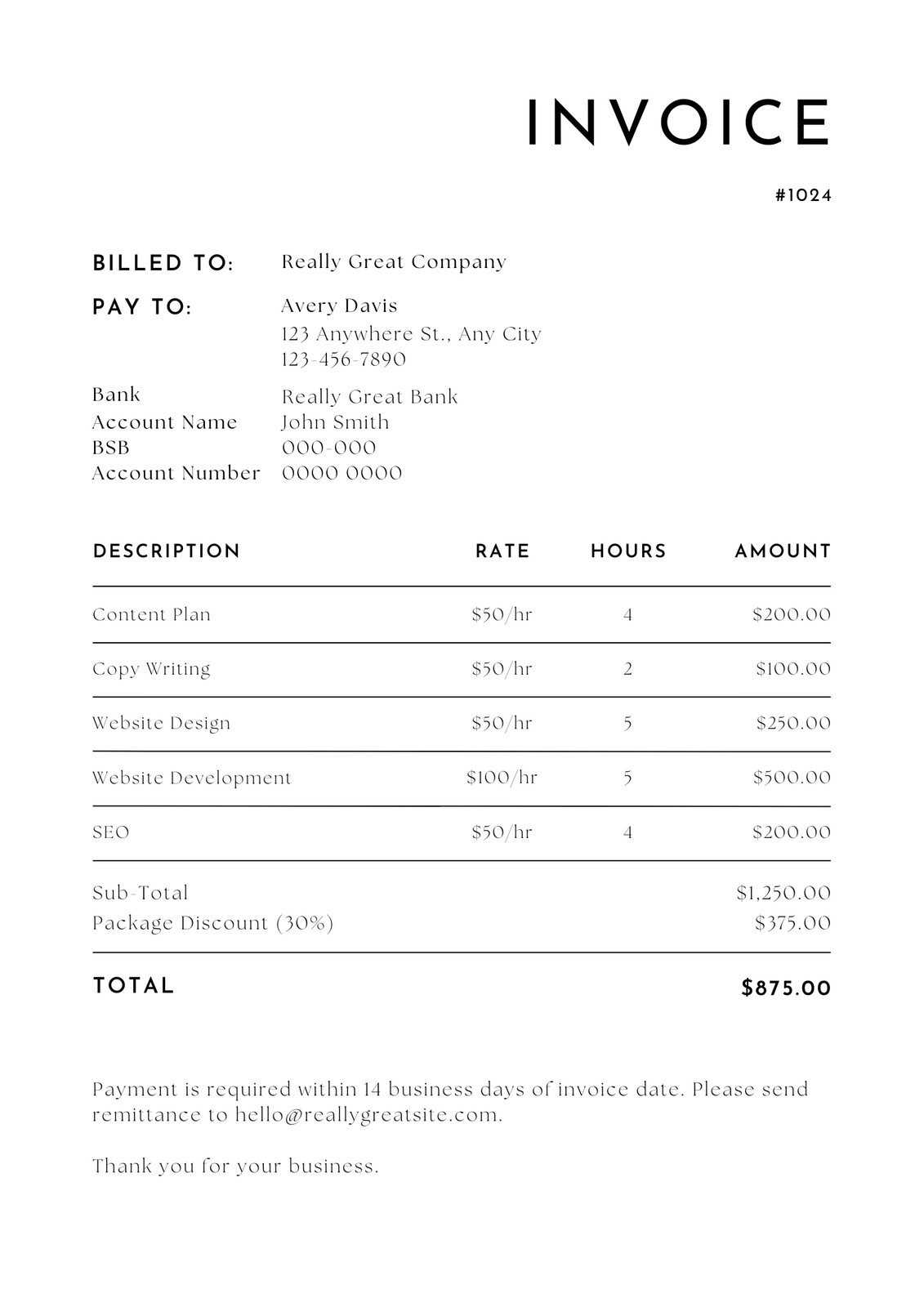

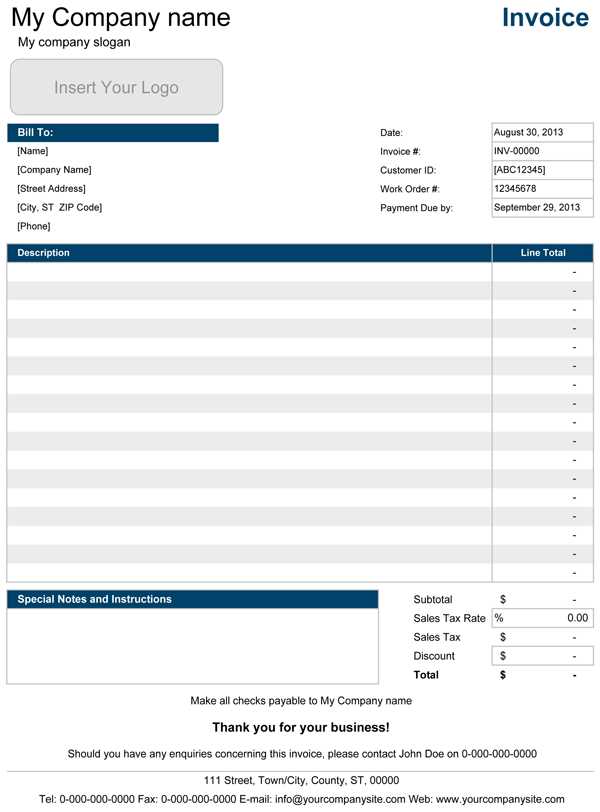

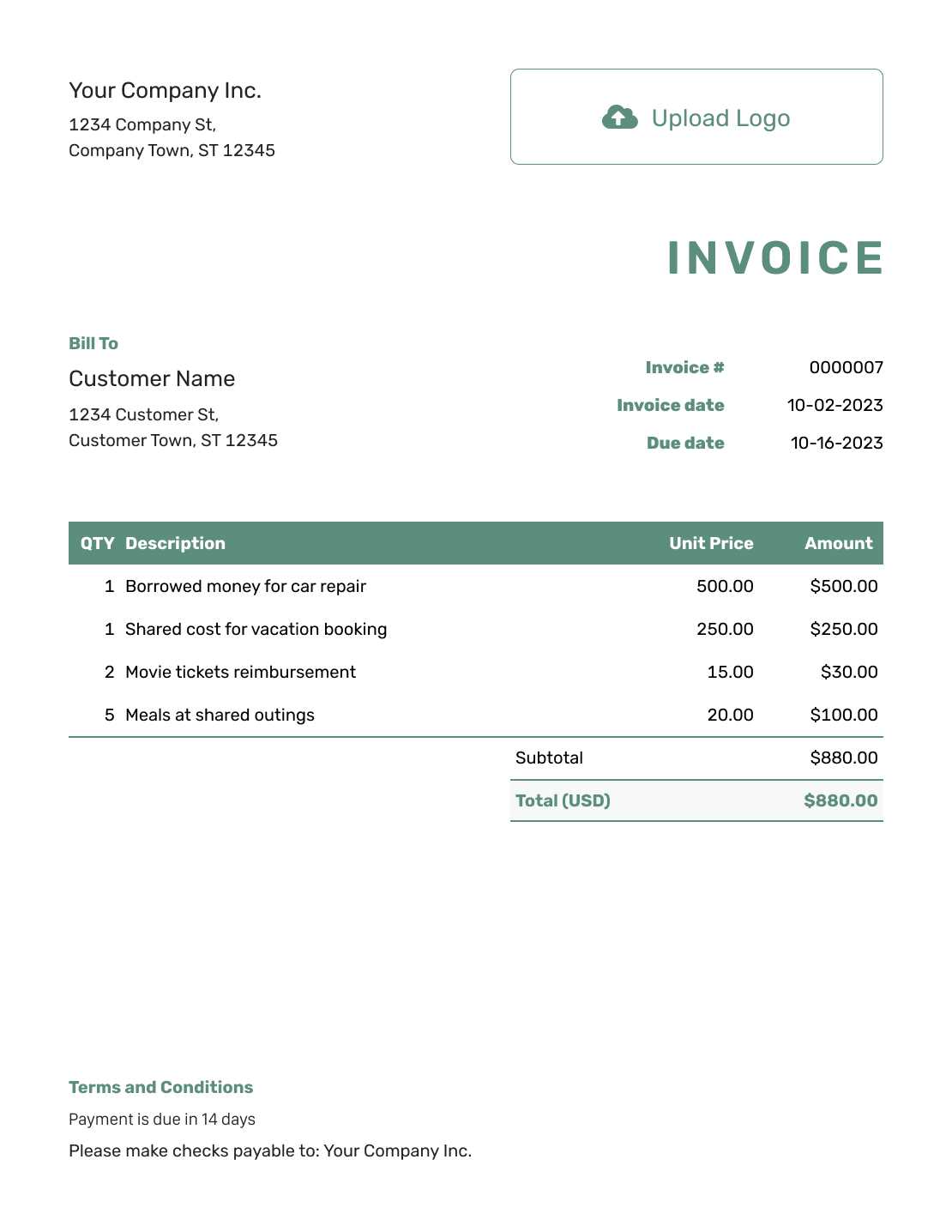

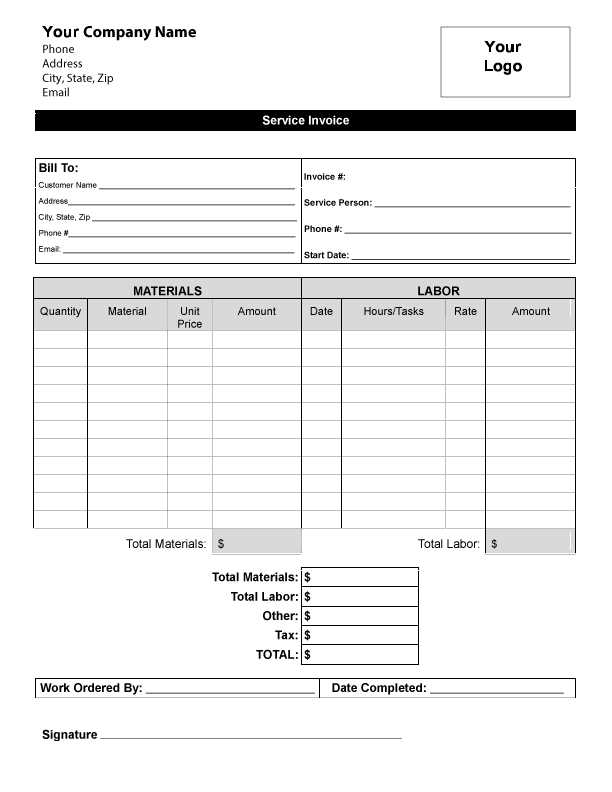

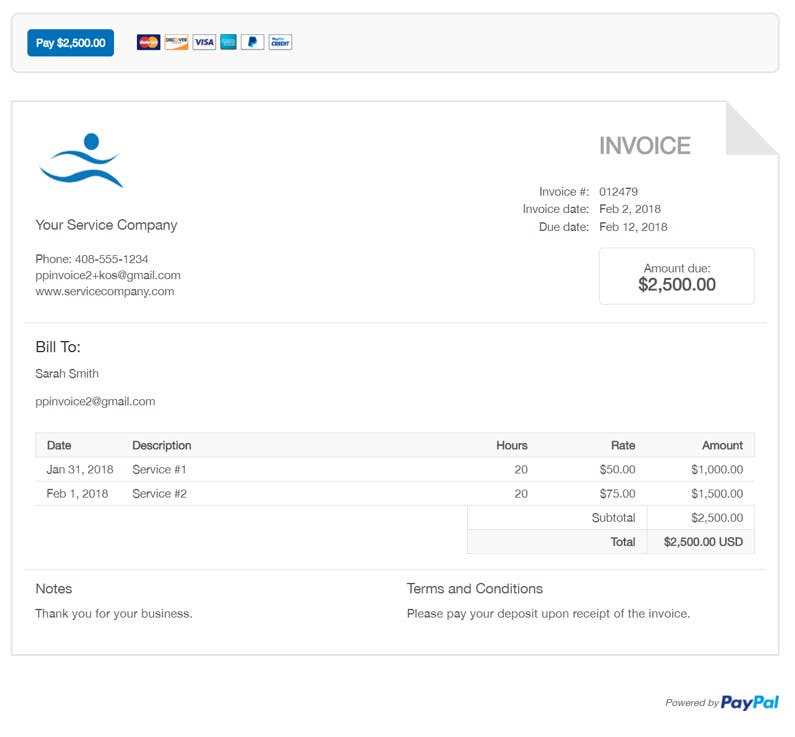

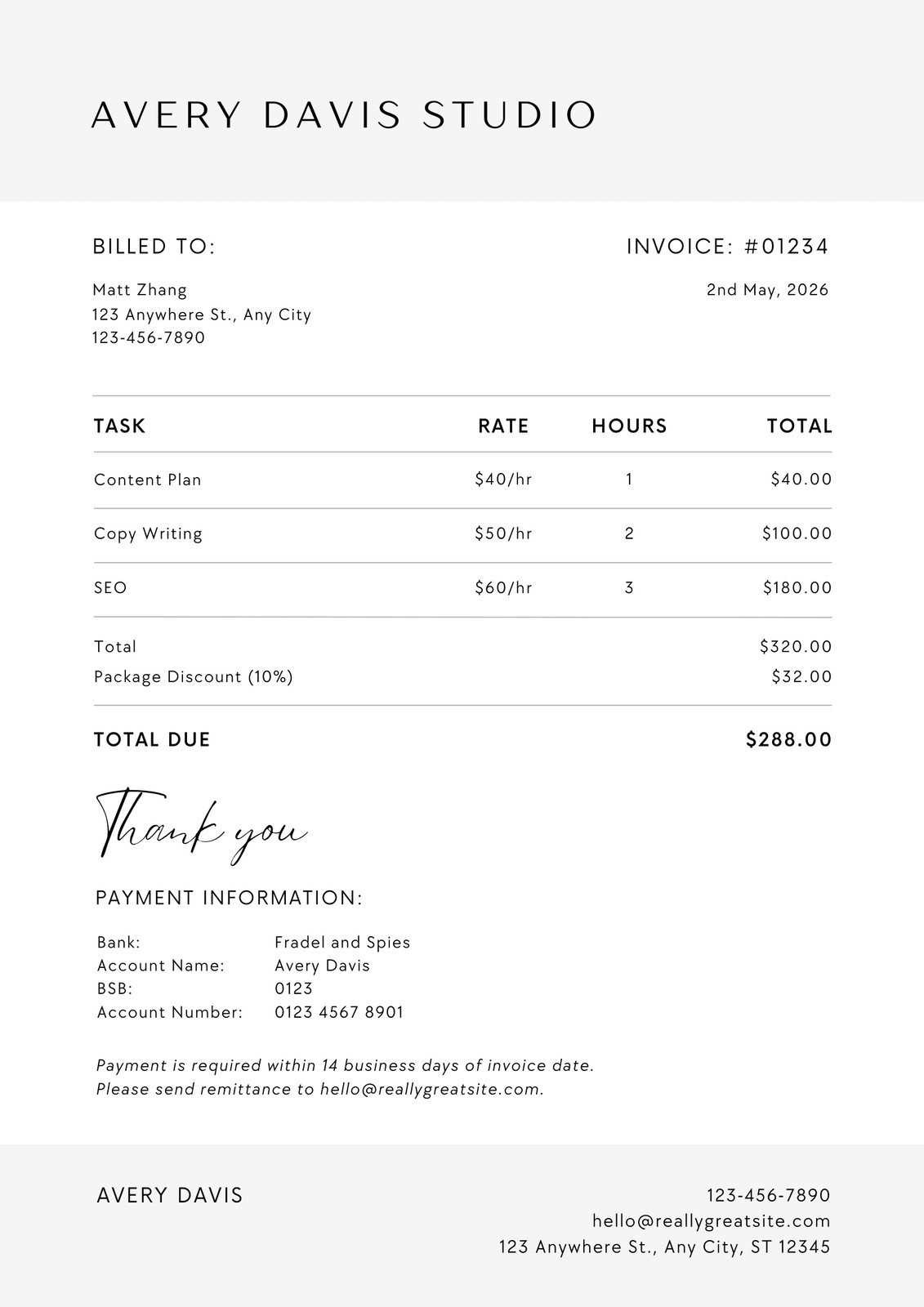

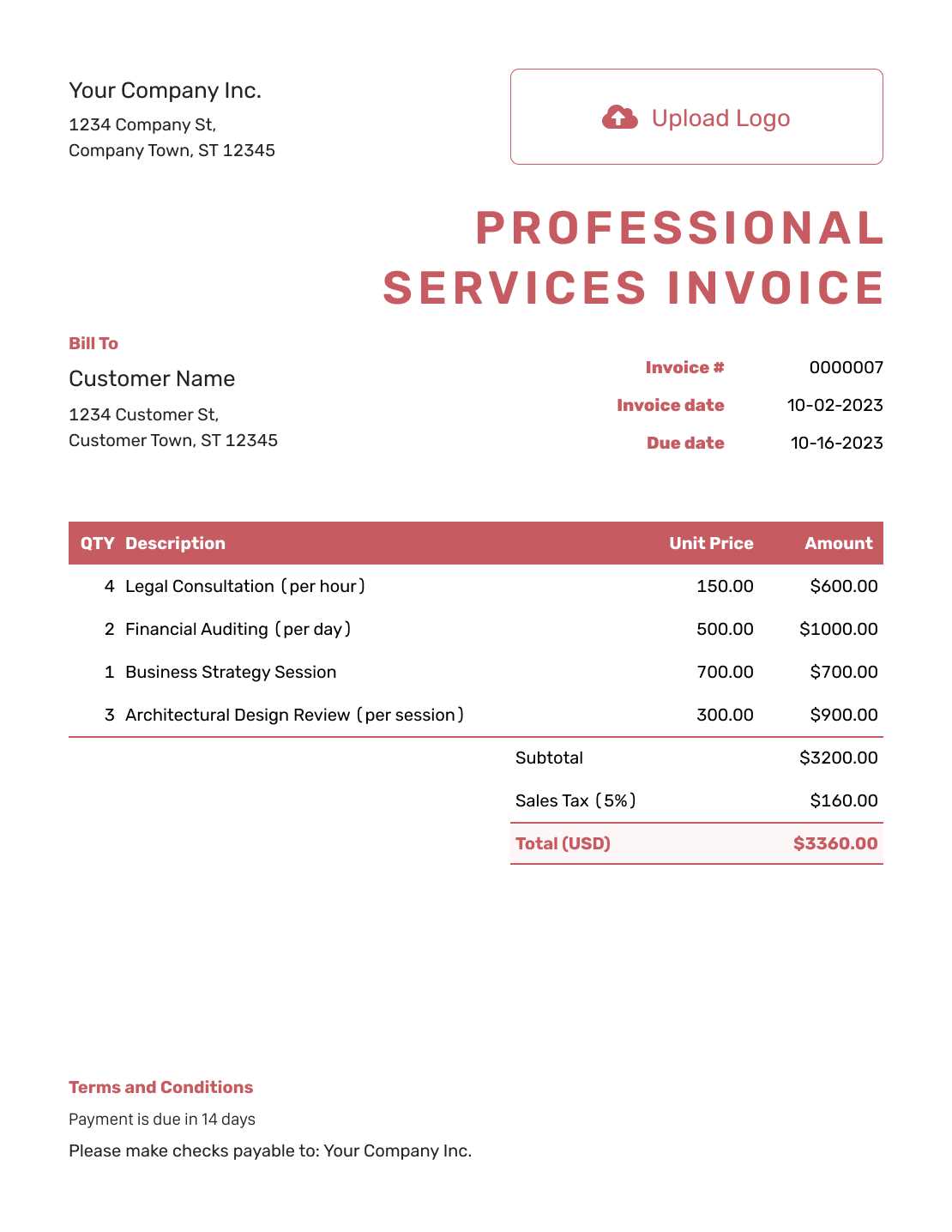

When creating a document for tracking payments, the layout plays a crucial role in presenting information clearly and professionally. A well-structured format ensures that all essential details are easily understood by both the provider and the client. Below are a few examples of how you can organize the content to maintain clarity and improve communication:

Simple Layout

A basic format includes key elements such as the provider’s contact information, recipient details, a description of the tasks completed, and the total amount due. This layout is ideal for straightforward transactions without too many line items.

- Provider’s Information: Name, address, and contact details

- Recipient’s Information: Client’s name and address

- Description: Brief description of the completed tasks

- Total Due: The amount requested for payment

Detailed Layout

This layout includes more detailed line items for each service provided, allowing for a more comprehensive breakdown of charges. It’s suitable for transactions involving multiple tasks or ongoing projects.

- Provider’s and Recipient’s Information: Contact details for both parties

- Itemized Charges: Breakdown of each task performed with associated costs

- Payment Terms: Payment methods, due date, and any discounts offered

- Additional Notes: Space for further instructions or terms

Both layouts ensure clear communication, but choosing the right one depends on the complexity and number of tasks involved. A simple format is perfect for one-time or straightforward services, while a detailed layout helps clarify complex or extended engagements.

Making Invoices User-Friendly for Clients

Creating a document for payment requests that is easy to understand is essential for building trust with clients and ensuring smooth transactions. A well-organized and clear layout reduces confusion and helps clients process payments efficiently. Here are some key tips for making your payment requests more user-friendly:

- Clear and Concise Language: Use simple, easy-to-understand terms. Avoid jargon or overly complex wording to ensure your client can quickly grasp the details of the document.

- Organized Structure: Arrange information logically, with clear headings and bullet points where necessary. This will guide the reader’s eye and make it easier to find relevant details.

- Itemized Breakdown: List services or tasks separately with corresponding costs. This allows clients to see exactly what they are paying for, which builds transparency and trust.

- Readable Fonts and Size: Choose legible fonts and an appropriate font size. Overly small or difficult-to-read text can lead to misunderstandings.

- Simple Payment Instructions: Provide easy-to-follow instructions on how clients can settle their balance. Include details like accepted payment methods, payment due dates, and any additional fees.

- Visual Design: Incorporate ample white space to prevent the document from feeling cluttered. A clean and minimal design allows the important information to stand out.

By focusing on clarity, organization, and simplicity, you can ensure that your payment requests are accessible, straightforward, and easy for your clients to navigate.

How to Simplify Invoice Management

Efficiently handling payment requests is crucial for businesses looking to stay organized and streamline their financial processes. Simplifying management not only saves time but also reduces the risk of errors and missed payments. Here are some strategies to improve the way you handle your billing:

1. Automate Your Tracking System

Using digital tools to automate tracking can significantly reduce the amount of manual work required. Set up reminders for due dates and create recurring entries for regular clients or tasks. This minimizes the need to remember every detail and ensures no payment is overlooked.

2. Organize Your Files

Having a clear, consistent filing system for your payment requests is essential. Whether you keep physical copies or digital files, make sure they are well-organized by client or project. This will make it easy to locate past records, track payment status, and identify any outstanding amounts quickly.

By implementing these methods, you can enhance your ability to manage financial documents with less stress and more accuracy.