How to Create a Personal Assistant Invoice Template for Efficient Billing

Managing payments and documentation can often feel overwhelming, but having an organized approach makes it easier to maintain professional standards and efficiency. Using structured billing documents helps in keeping track of earnings, managing client interactions, and ensuring payments are timely. By implementing a personalized format, you can focus more on your tasks while minimizing administrative work.

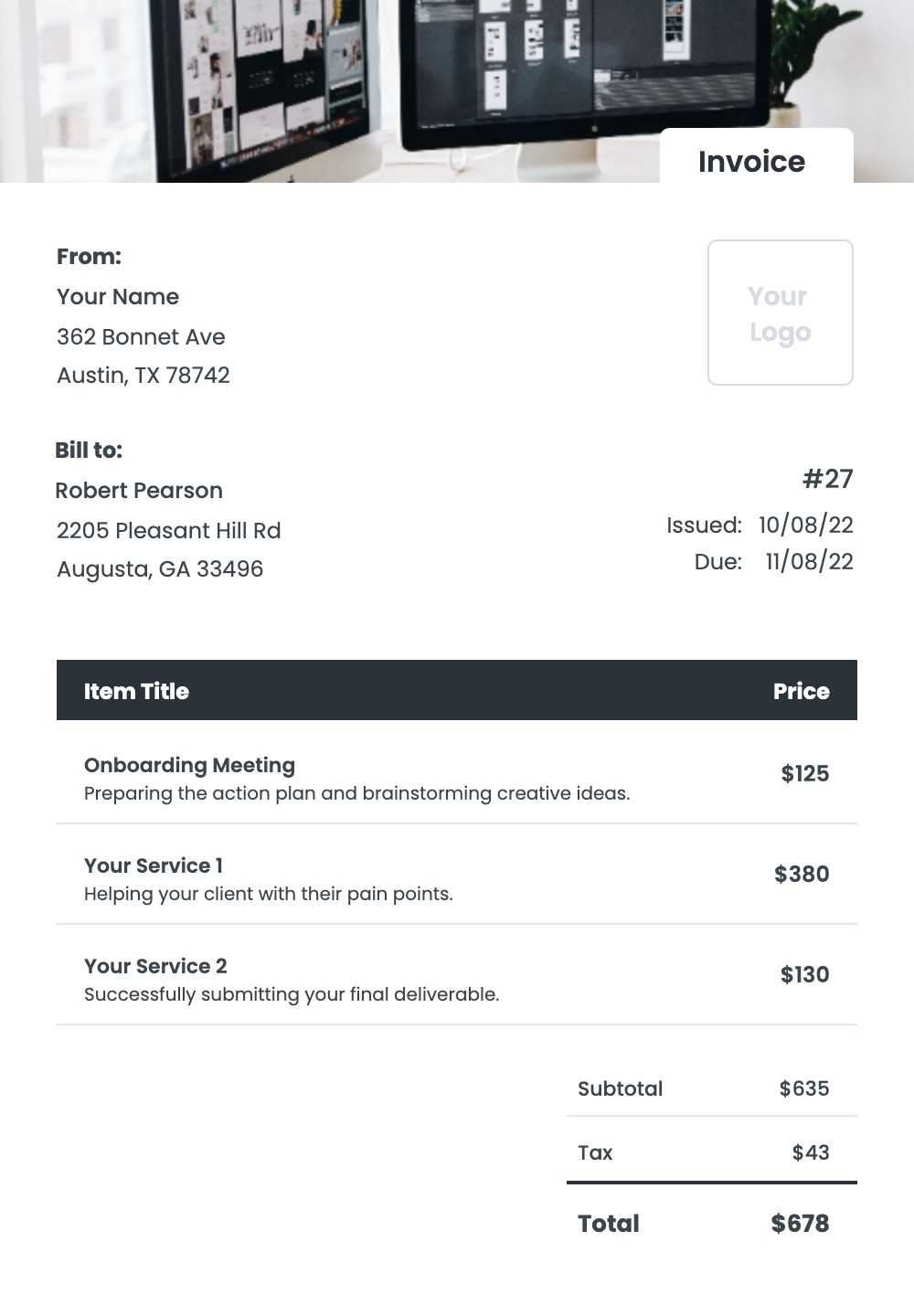

A well-designed form with essential details and a clear layout allows for seamless transactions and reduces misunderstandings. Adding elements such as branding, detailed service descriptions, and clear payment instructions fosters trust with clients, highlighting professionalism and transparency.

With a streamlined and customized approach, it’s possible to

Comprehensive Guide to Personal Assistant Invoicing

Building an efficient billing system requires a thoughtful approach to ensure accuracy and professionalism. A structured form for billing not only facilitates clear communication but also supports effective time management. By using a well-organized layout, you can reduce the administrative burden and focus on core responsibilities.

In this guide, you’ll find essential tips for creating a tailored form that aligns with your unique workflow. Key elements like service details, dates, and payment methods should be clearly outlined to make transactions smoother. Customizing your document allows you to adjust to specific client needs, which enhances clarity and reliability.

Including branded elements and specific terms enhances the form’s appearance and reinforces your credibility. Consistent use of this structure ensures that clients receive the same level of detail and clarity each time, promoting trust and efficient communication. Following these steps can help establish a streamlined, professional billing process that benefits both you and your clients.

Why Personal Assistants Need Invoicing Templates

For those managing various tasks and client interactions, having an organized system for billing is essential. A structured document for requesting payments simplifies the process, making it easier to handle transactions and keep records up-to-date. By using a well-prepared format, professionals can ensure they communicate clearly and maintain a reliable workflow.

There are several reasons why a customized billing form is advantageous:

- Consistency: A standardized document helps present information uniformly, reducing potential misunderstandings with clients.

- Time Efficiency: Reusable formats save time by eliminating the need to recreate each bill from scratch, allowing for faster processing.

- Professional Appearance: A polished, branded document adds a professional touch, fostering a trustworthy image.

- Easy Tracking: Including essential details like dates, services, and payment terms helps organize f

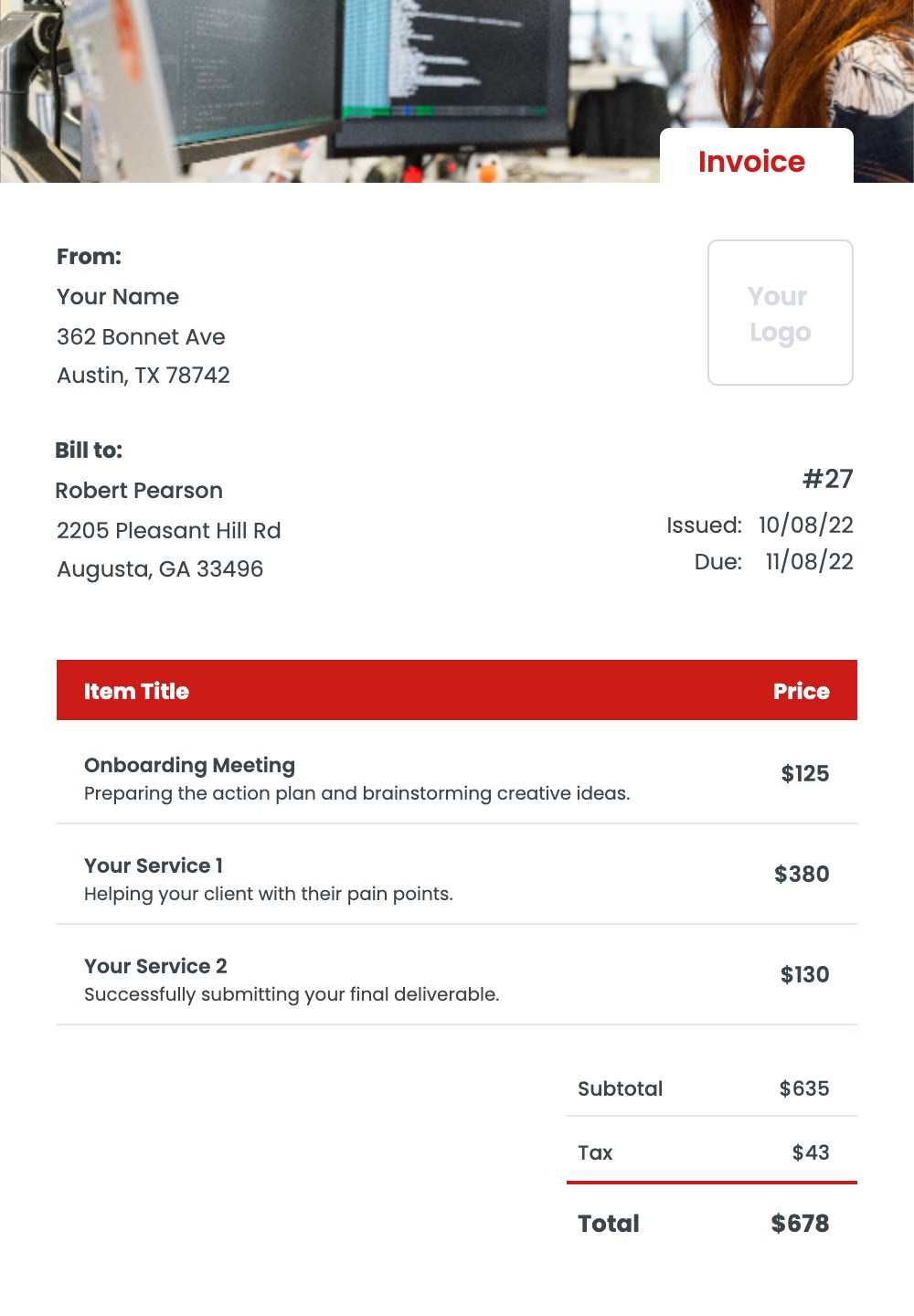

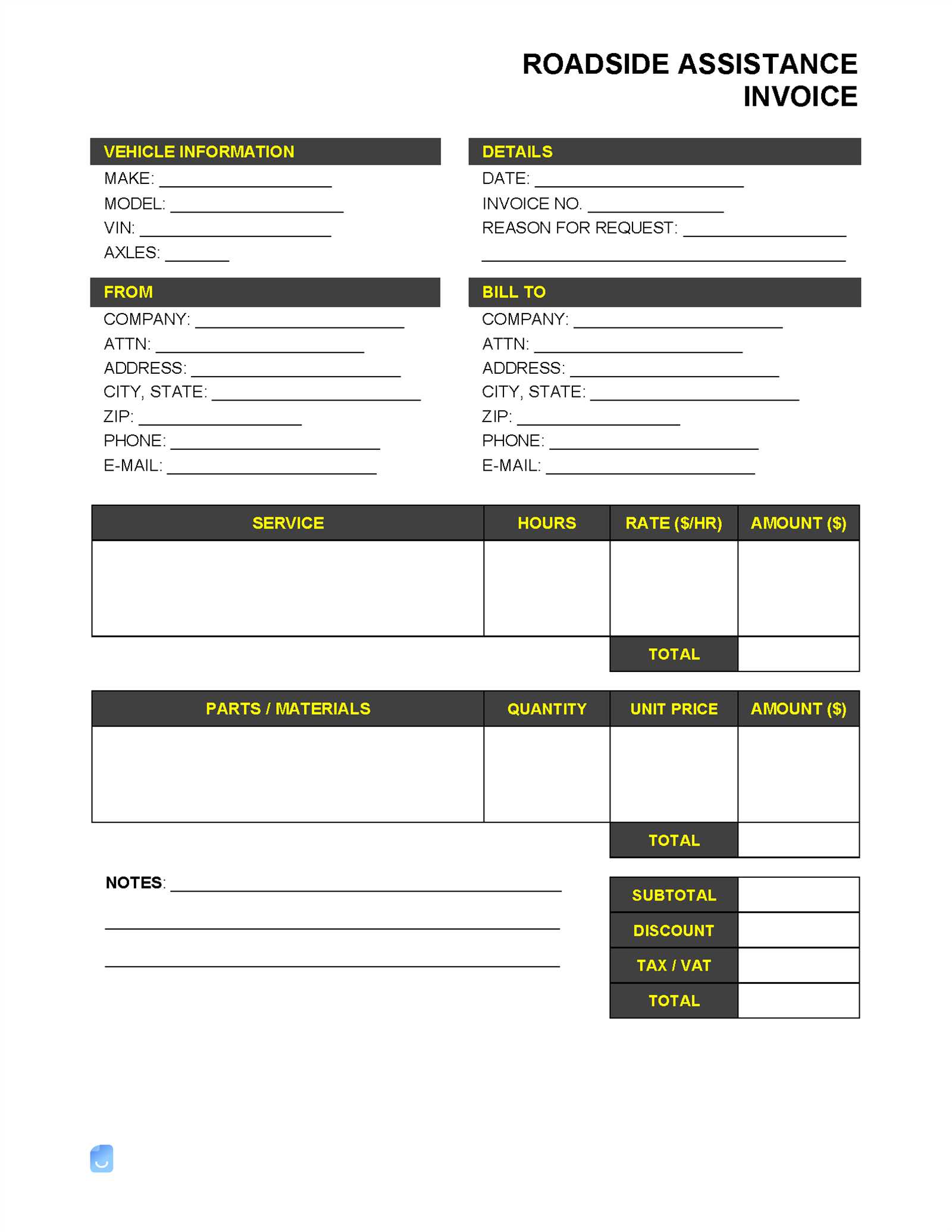

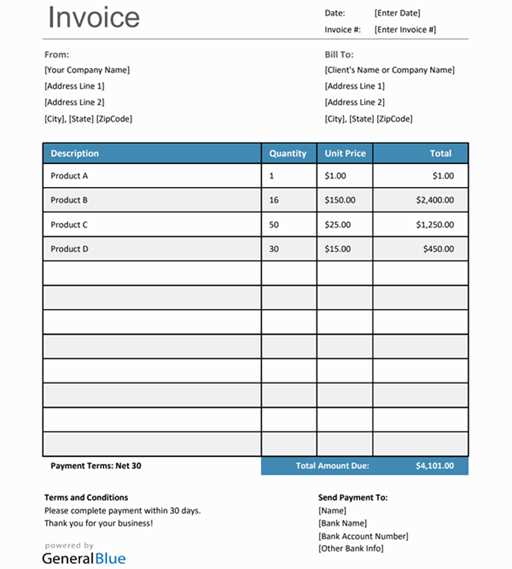

Essential Elements of an Effective Invoice

Creating a detailed and organized billing document is key to ensuring clarity and professionalism in financial transactions. Each section should convey essential information clearly, helping both parties understand the terms and specifics of the services provided. Including all necessary components in an orderly format can make a lasting positive impression on clients.

An effective billing document typically includes the following elements:

Element Description Contact Information Clearly display names, addresses, phone numbers, and email contacts for both parties involved, ensuring easy communication. Billing Date Include the date when the document is issued to provide a clear starting point for p Choosing the Right Format for Your Template

Selecting an effective format for a billing document can make a significant difference in efficiency and client satisfaction. The chosen layout should be easy to read, adaptable to different types of services, and professionally designed. By tailoring the structure to meet specific needs, you can streamline the billing process and create a more organized approach to record-keeping.

Factors to Consider in Layout Selection

- Complexity of Services: For varied or highly detailed tasks, a structured format that includes space for detailed descriptions is beneficial.

- Frequency of Use: Regular billing may require a streamlined, reusable design, while occasional requests might need a more flexible layout.

- Client Preferences: Understanding client expectations can guide decisions, especially in terms of style and detail level.

Popular Formats for Billing Documents

- Creating a Customizable Invoice Design

Designing a flexible billing document can enhance both functionality and presentation, allowing for adjustments that reflect unique services and branding. A personalized format offers the advantage of easy modifications, ensuring that each detail aligns with specific business needs and provides a clear, professional structure for clients.

Key Components of a Flexible Layout

A well-crafted layout should include essential information while allowing space for individual adjustments. Adding distinct sections for service descriptions, payment details, and contact information helps maintain clarity and organization. Consider using consistent fonts and balanced spacing to ensure readability, as well as sections that can be easily edited for each new transaction.

Tips for Enhancing Design Customization

Here are some useful suggestions to create a design that is both effective and adaptable:

- Brand Elements: I

Top Tools for Making Invoices Easily

Creating a professional and accurate billing document can be streamlined with the right software tools. These tools help automate calculations, store client information, and ensure a clean design. With the right resources, you can focus on providing quality service while leaving the details of financial records to an efficient system.

Here are some of the most popular tools for creating billing documents:

- QuickBooks: This widely used software allows for easy creation and customization of billing documents, and also provides accounting and bookkeeping features.

- FreshBooks: Known for its user-friendly interface, FreshBooks enables the creation of clear, professional-looking billing documents with automated reminders and reporting tools.

- Zoho Invoice: A cloud-based tool that provides customizable options and automation for creating detailed records, making it great for managing multiple clients.

- Wave: This free tool is perfect for small businesses, offering simple document creation with the added benefit of integration with accounting features.

- Microsoft Excel or Google Sheets: Ideal for those who prefer a more hands-on approach, these spreadsheet programs allow full customization of billing layouts and can automate calculations with formulas.

Each of these tools offers different benefits depending on your business needs, from basic billing to comprehensive financial management. By choosing the right software, you can simplify the billing process and maintain an organized approach to your financial documentation.

Best Practices for Accurate Billing

Ensuring precision in financial records is crucial for maintaining trust and transparency with clients. Following best practices in creating billing documents not only helps avoid errors but also establishes a professional reputation. Accuracy in calculations, clear itemization of services, and consistent documentation are key to achieving effective billing.

Here are some essential practices to follow for precise billing:

- Double-Check Calculations: Always verify that all figures are correct, including service rates, hours worked, and any applicable taxes. Even minor errors can lead to client dissatisfaction.

- Clearly Define Services: Break down the tasks performed with detailed descriptions. This ensures that clients understand exactly what they are paying for and reduces the likelihood of disputes.

- Maintain Consistent Formats: Use a consistent structure for all billing documents to help both you and your clients easily navigate the information. This includes maintaining uniform fonts, headers, and sections.

- Track Payments and Due Dates: Keep a record of all payments and clearly state payment terms and deadlines on your billing document. This helps both parties stay on track with financial commitments.

- Include Contact Information: Make sure that your contact details, as well as those of the client, are prominently displayed. This ensures clear communication if any issues arise.

By following these practices, you can create clear, accurate billing records that foster strong client relationships and minimize misunderstandings regarding financial transactions.

Tracking Payments and Managing Finances

Effective financial management requires careful tracking of all incoming payments and clear documentation of your financial transactions. By staying organized and monitoring your earnings, you can ensure timely payment and maintain a healthy cash flow. Additionally, proper financial management helps in budgeting, forecasting, and avoiding late payment issues.

Tools for Monitoring Payments

There are various tools available to help manage payments, track due dates, and generate reports. These tools can automate payment reminders, track overdue balances, and even offer integrated solutions for reconciling accounts.

- Accounting Software: Programs like QuickBooks, FreshBooks, and Wave offer built-in payment tracking and invoicing capabilities to help you monitor incoming payments efficiently.

- Spreadsheet Templates: For a more hands-on approach, spreadsheet programs like Google Sheets or Microsoft Excel can be customized to track payment status and store financial information in an organized manner.

- Online Payment Platforms: Tools such as PayPal, Stripe, or Square not only allow you to receive payments but also provide insights into payment histories and trends, making it easier to track your finances in real time.

Best Practices for Managing Finances

In addition to tracking payments, effective management of your financial records is essential to maintaining a stable and growing business. Follow these practices to stay on top of your finances:

- Set Clear Payment Terms: Clearly communicate payment expectations, including due dates and payment methods, to avoid misunderstandings.

- Regularly Reconcile Accounts: Periodically review your financial records to ensure that payments have been accurately recorded and all transactions are accounted for.

- Plan for Taxes: Keep track of any taxes due and set aside funds to ensure that you can meet your tax obligations without any issues.

By incorporating these tools and practices, you can streamline payment tracking and gain better control over your financial health, ensuring timely payments and long-term business success.

How to Ensure Timely Payments

Ensuring timely payments is a crucial part of maintaining healthy cash flow and keeping your business operations running smoothly. There are several proactive steps you can take to ensure that payments are received on time and that your financial obligations are met without delays.

Clear Communication of Payment Terms

One of the first steps in ensuring timely payments is to set clear expectations with clients regarding payment deadlines and methods. Ambiguity can lead to delays and confusion. Be sure to establish and communicate payment terms upfront.

- Define Payment Deadlines: Clearly state when payments are due and whether there are any penalties for late payments.

- Offer Multiple Payment Options: Provide a range of payment methods to make it easier for clients to pay you on time.

- Specify Late Fees: If applicable, mention the charges for overdue payments to encourage clients to settle their balances promptly.

Send Timely Reminders

Sending payment reminders is an effective way to ensure clients do not forget their payment obligations. Automated reminders help keep you on track without requiring manual follow-up.

- Automated Reminders: Use software that automatically sends reminders a few days before and after the due date to prompt clients to pay on time.

- Personal Follow-Ups: If automated reminders don’t work, follow up with a personalized message to maintain good client relationships while ensuring payment.

Offer Early Payment Discounts

Incentivizing early payments can encourage clients to pay before the due date, helping you improve cash flow. Offering a small discount in exchange for early settlement can make this an appealing option.

- Discounts for Early Settlements: Offer a small percentage discount (e.g., 2%) for payments made before the due date.

- Clear Instructions: Be sure to highlight the discount offer in your communication to make it clear that this option is available.

Establish a Payment Policy

Having a defined payment policy in place is essential for both you and your clients. This policy should outline how payments will be processed, when late fees apply, and the steps to take if a payment is not received.

- Set Expectations for Payment Schedules: Whether you are billing weekly, monthly, or per project, make sure clients understand the timeline for payments.

- Enforce Late Payment Policies: Be consistent with late payment penalties and communicate these policies clearly to encourage on-time payments.

By taking these steps, you can minimize late payments and ensure that your business remains financially stable, leading to long-term success and reliable cash flow.

Improving Client Communication with Clear Invoices

Effective communication is key to maintaining strong client relationships. One of the most important ways to ensure transparency and avoid misunderstandings is through the use of well-structured financial documents. When these documents are clear and organized, they help foster trust and reduce the likelihood of disputes.

Providing clients with easy-to-understand records of services rendered or products delivered helps them quickly identify what they are being charged for. This clarity ensures both parties are on the same page and minimizes the chance of confusion over payment details.

Key Elements to Include

To enhance communication, it’s essential to include all necessary details that clients need to understand the charges and payment terms.

- Detailed Descriptions: Break down each service or product to make it clear what is being paid for.

- Accurate Dates: Clearly specify the dates of service delivery or product provision to avoid ambiguity.

- Transparent Costs: Include the cost for each item or service, as well as any applicable taxes or discounts.

- Clear Payment Instructions: Provide straightforward payment methods and deadlines to avoid delays.

Benefits of Clear Financial Documents

When financial statements are easy to read and well-organized, clients feel more confident in the process and are more likely to pay on time. This reduces the need for follow-ups and ensures a smooth business transaction for both parties.

- Builds Trust: Clients appreciate transparency, which helps in building long-term relationships.

- Reduces Disputes: A clear breakdown of charges reduces the risk of clients questioning the costs or terms.

- Improves Payment Timeliness: When clients can easily understand what they owe and when it is due, they are more likely to pay promptly.

Incorporating these elements into your financial communications can help you maintain positive client interactions, ensuring clarity and preventing unnecessary misunderstandings.

Adding Professionalism with Branded Invoices

Presenting a professional appearance in all business communications, including financial documents, helps create a lasting impression on clients. When these records are designed with consistent branding elements, they not only reflect the company’s identity but also convey attention to detail and reliability. Incorporating your brand into financial documents fosters trust and demonstrates a commitment to quality in all aspects of your business.

Branded documents enhance the overall customer experience by providing a visually cohesive and polished look. This not only boosts your credibility but also differentiates you from competitors, showing that you value professionalism in every interaction.

Key Branding Elements to Include

To elevate the appearance of your financial documents, consider incorporating the following branding elements:

Element Importance Logo Including your logo reinforces brand recognition and establishes credibility. Brand Colors Using consistent colors helps create a unified and professional look. Typography Choose fonts that align with your brand style, making the document easy to read while maintaining consistency. Contact Information Providing clear and professional contact details ensures clients can easily reach you if necessary. Benefits of Branded Documents

Incorporating branding into your financial records not only enhances the look and feel of the documents but also provides several key advantages:

- Improved Brand Recognition: Clients instantly associate the professional look with your company, reinforcing your identity.

- Increased Trust: Well-branded documents show attention to detail, helping clients feel more confident in their transactions with you.

- Consistency Across Touchpoints: A cohesive branding strategy strengthens your reputation and makes all communications look professional.

By adding branding elements to your financial documents, you communicate professionalism and dedication to providing an exceptional client experience.

Common Mistakes to Avoid in Invoicing

Accurate financial documentation is critical for maintaining smooth business operations. However, errors in the preparation of these documents can cause delays in payment, confusion, and strained client relationships. Understanding and avoiding common mistakes in the billing process is essential to ensure efficiency and professionalism.

1. Missing or Incorrect Details

One of the most frequent mistakes is failing to include necessary information or providing incorrect data. Missing contact details, service descriptions, or pricing errors can lead to misunderstandings and delay payments. Double-checking all sections of the document ensures that everything is accurate and clear.

2. Lack of Clear Payment Terms

Ambiguity in payment terms can cause confusion and delays. Always make sure that your payment expectations are clearly stated, including deadlines, late fees, and accepted payment methods. This will help clients know exactly when and how to pay, reducing the likelihood of overdue payments.

3. Failure to Follow Up

Sometimes, even after sending a document, payments are delayed due to a lack of follow-up. Without reminders or clarification, clients may forget or delay the payment process. Regularly follow up with clients and maintain a professional approach to ensure timely transactions.

4. Not Using a Consistent Format

Inconsistent formatting can make your financial documents look unprofessional and hard to follow. Consistency in layout, font style, and section order is key to presenting a polished image. Ensure that all your documents follow the same template to make them easy to read and process.

By avoiding these common mistakes, you can streamline your billing process, improve client relationships, and ensure more timely payments.

Benefits of Using a Digital Invoice Template

In today’s fast-paced business environment, efficiency is key. Utilizing a digital document format for financial transactions offers several advantages over traditional methods. These tools streamline the process, making it easier to manage and track payments while ensuring accuracy and professionalism in every communication.

1. Increased Efficiency

By using a digital document, businesses can generate and send financial records quickly. This eliminates the need for manual entries and reduces the time spent on paperwork. With pre-designed structures, creating these documents becomes a much faster process.

2. Improved Accuracy

Digital documents minimize human error. With fields automatically populated, the chance for mistakes such as incorrect numbers or missing information is greatly reduced. This ensures that the details are accurate, and clients receive clear, professional records.

3. Easy Tracking and Organization

Keeping track of past transactions is much simpler with digital records. A digital document format allows for easy storage and retrieval, making it possible to organize and categorize transactions based on date, client, or project. This streamlines accounting and financial planning tasks.

4. Customization for Branding

Using a digital document format gives you the flexibility to customize the design to reflect your company’s branding. From logos to color schemes, you can ensure that your financial documents look polished and professional, helping to create a strong brand image.

5. Enhanced Communication

Sending documents electronically makes it easier for clients to review and respond. They can receive the document in real time, make necessary adjustments, and send back confirmations or payments faster, improving overall communication.

Overall, using a digital document format for your financial transactions offers numerous benefits that can improve operational efficiency, reduce errors, and enhance the client experience.

How to Automate Financial Documentation

Automation is a powerful tool that can save time and reduce errors when it comes to managing financial records. By integrating automated systems, businesses can streamline repetitive tasks, ensuring efficiency and consistency in every step of the process. This section will explore methods to automate your financial documentation workflows.

1. Utilize Automation Software

Using dedicated software is one of the most effective ways to automate financial record creation. Many platforms allow users to create customizable templates that can be filled automatically based on inputs. This eliminates the need to manually create each document, reducing human error and saving time.

2. Set Up Recurring Transactions

For businesses with regular clients, automating recurring payments or records is highly beneficial. Many digital systems allow users to set up repeat transactions, where the same details are applied every month or on a set schedule. This ensures consistency and prevents delays in creating financial documents.

3. Automate Reminders and Notifications

Automation doesn’t just stop at creating documents–it can also help with reminders and follow-ups. Setting up automated notifications for clients can help ensure payments are made on time, without the need for manual intervention.

4. Integrate with Accounting Systems

Linking your document creation system with accounting software can help automate the entire process. Once a document is created, it can be seamlessly transferred to your accounting system, where records are updated automatically, reducing double entry and maintaining consistency.

5. Utilize Cloud Storage

Cloud storage solutions allow for automatic saving of documents, making them easily accessible and ensuring that important files are backed up. Cloud-based systems can also be integrated with various tools to ensure that files are properly organized and available at all times.

Benefits of Automating

- Faster document generation

- Reduced human error

- Time savings

- Better organization

- Improved accuracy in financial tracking

By automating key aspects of financial documentation, businesses can focus more on their core activities while ensuring their financial records are always accurate and up-to-date.

- Brand Elements: I