How to Use a Perpetual Invoice Template for Efficient Billing

Managing finances is crucial for any business, and finding an efficient way to handle recurring charges can save both time and resources. One of the most effective tools for streamlining this process is the use of pre-designed documents that automatically populate necessary information for each transaction. This approach allows businesses to stay organized and maintain a professional image while reducing the manual effort involved in billing.

Customizable solutions are available that allow you to tailor your documents to specific needs, ensuring that every detail is in place. Whether you are invoicing clients on a regular basis or offering subscriptions, having a structured and easy-to-use system makes all the difference. With the right setup, businesses can focus on growth rather than spending excessive time on administrative tasks.

By incorporating such tools into your workflow, you can easily manage finances, track payments, and ensure accuracy. The key is to choose a system that fits your unique business requirements, allowing you to handle all transactions smoothly and efficiently. The ease of use and flexibility of these solutions ultimately contribute to better cash flow management and improved client relationships.

Comprehensive Guide to Perpetual Invoice Templates

For businesses looking to streamline their billing process, using an automated document solution can simplify tracking and organizing recurring payments. By relying on a pre-structured format, you can reduce errors, save time, and maintain consistency across all client transactions. This guide explores how to effectively use such systems and how they can enhance your financial management.

Key Features of Automated Billing Solutions

These ready-made documents are designed to handle repetitive tasks like setting dates, amounts, and client details. Key features to look for include:

- Customizability: Adapt the format to your business needs, ensuring it meets all the specific details of your transactions.

- Automation: Automatically populate fields such as amounts, due dates, and client names to save time and reduce errors.

- Tracking: Keep track of payments and outstanding balances in one centralized place.

- Professional Design: Present a polished, professional appearance with minimal effort.

Advantages of Using Pre-Structured Billing Documents

By implementing these systems, businesses experience numerous benefits:

- Efficiency: Reduce time spent creating individual documents for each transaction.

- Consistency: Maintain a uniform appearance for all transactions, ensuring your business always looks professional.

- Accuracy: With automatic population of data, the risk of manual errors is minimized.

- Better Cash Flow Management: Track outstanding payments easily and set up reminders for clients to ensure timely payments.

Incorporating these solutions into your business will help improve operational efficiency, leading to smoother processes and better financial oversight. By using tools that are designed for recurring tasks, you free up valuable time for more important aspects of business growth.

What is a Perpetual Invoice Template?

In the world of business, automating routine tasks can significantly enhance productivity. One such task is managing recurring charges, which can be streamlined using a pre-designed structure that ensures consistency and reduces manual effort. These systems are created to simplify the process of generating documentation for ongoing transactions, making them an invaluable tool for businesses that require frequent and predictable billing cycles.

How Does This System Work?

This automated billing method is designed to eliminate the need for creating a new document from scratch each time a payment is due. Key features include:

- Pre-filled Data: Automatic insertion of customer information, dates, and amounts to minimize human error.

- Recurring Schedule: Set up to generate documents at regular intervals, ensuring timely delivery without extra effort.

- Customization: Adjust fields and details to suit the unique requirements of each client or service.

- Streamlined Process: Simplifies the entire billing process, from generation to tracking of payments.

Why Businesses Use This Approach

Businesses benefit from using this approach for several reasons:

- Time-Saving: Eliminate the need to create individual records repeatedly, saving valuable time.

- Consistency: Maintain uniformity in all transactions, helping to project a professional image.

- Improved Accuracy: Reduces the risk of manual errors and ensures that all relevant details are captured correctly.

- Efficient Payment Tracking: Easily monitor outstanding payments and manage follow-ups for overdue balances.

By using this system, businesses can simplify their financial management, ensuring that each transaction is completed accurately and on time, without the need for manual intervention every time a new bill is issued.

Benefits of Using a Perpetual Invoice Template

Utilizing an automated system for managing recurring financial transactions provides businesses with numerous advantages. These ready-made solutions can simplify billing processes, improve accuracy, and help maintain a professional image. By minimizing the need for manual intervention, businesses can save time and reduce the risk of errors while ensuring that payments are processed smoothly and on schedule.

Key Advantages

Below are some of the major benefits that come with using an automated billing system:

| Benefit | Description |

|---|---|

| Time Efficiency | Reduces the time spent creating individual records for each transaction, automating recurring tasks. |

| Consistency | Ensures all documents follow a uniform format, creating a professional appearance for every transaction. |

| Accuracy | Minimizes human errors by automatically populating data fields, such as client names and amounts. |

| Better Cash Flow Management | Allows businesses to track outstanding balances more effectively and maintain clear records of payments. |

| Reduced Administrative Work | Automates repetitive tasks, freeing up time for more important business functions. |

How It Translates to Improved Efficiency

By using this system, businesses can improve their overall workflow, increase operational efficiency, and focus on strategic growth. Whether it’s managing subscriptions, services, or regular billing, this approach ensures that essential financial tasks are handled with minimal effort, leading to a more productive and streamlined business environment.

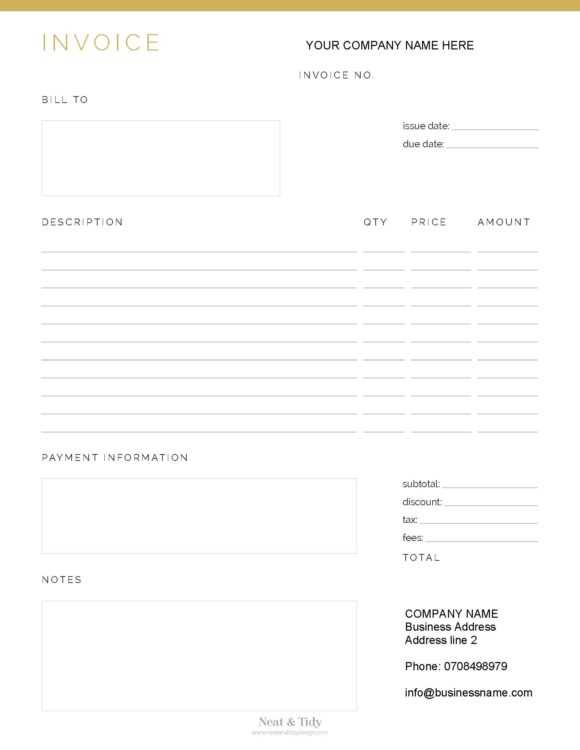

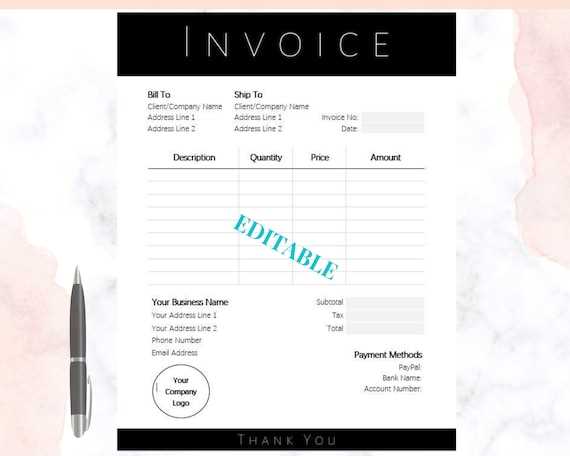

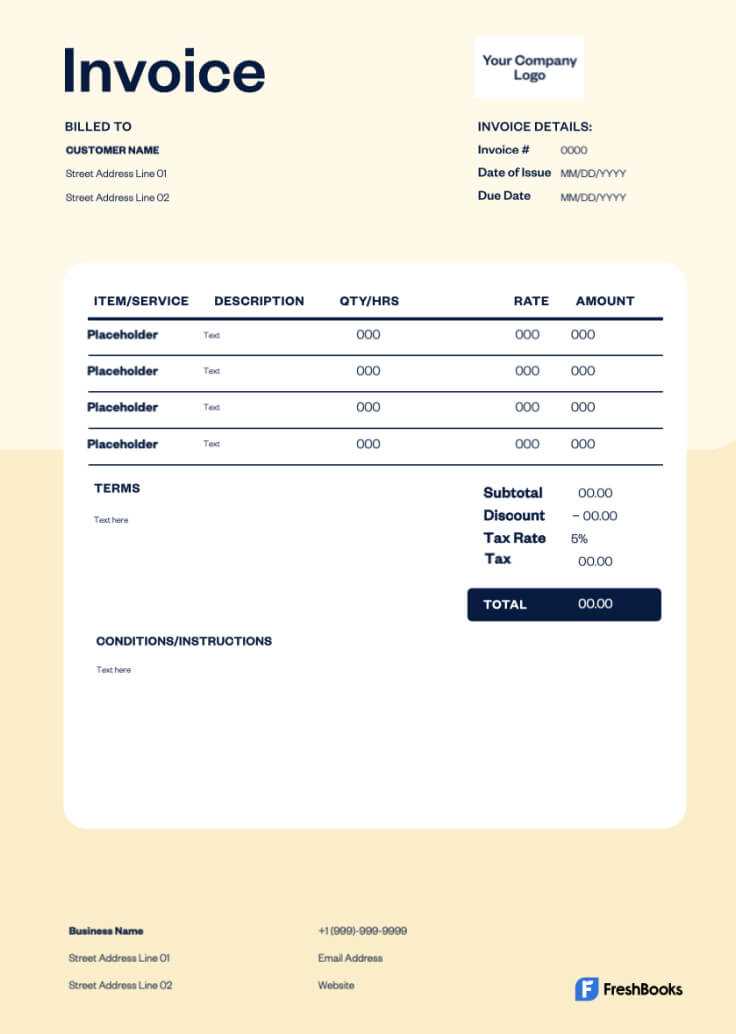

How to Customize Your Invoice Template

Tailoring your billing documents to meet the specific needs of your business and clients is crucial for creating a professional and efficient process. Customization allows you to adjust details such as the layout, color scheme, and data fields to reflect your brand and ensure that all necessary information is included. A well-designed and personalized document can enhance your company’s image while simplifying the entire billing process.

Key Elements to Personalize

There are several areas you can customize to make your documents unique and aligned with your business needs:

- Business Branding: Incorporate your company logo, colors, and fonts to make the document reflect your brand identity.

- Client Information: Ensure fields for client names, addresses, and contact details are clearly formatted and easy to update.

- Payment Terms: Set up default terms that are consistent with your business, including due dates, late fees, and payment methods.

- Itemized Charges: Create clear sections to break down services, products, or subscriptions for easy understanding.

- Tax and Discount Fields: Customize tax rates and offer discount options if applicable to certain clients or orders.

Steps to Customize Your Document

Customizing your billing documents is straightforward and can be done in just a few steps:

- Select a Structure: Choose a layout that suits your business style, ensuring all the necessary information is displayed clearly.

- Input Your Details: Add your company name, contact information, and logo to the header or footer of the document.

- Adjust Data Fields: Include spaces for service descriptions, quantities, and prices, ensuring everything relevant is covered.

- Set Default Terms: Pre-fill payment terms such as due dates, payment methods, and any legal disclaimers.

- Save for Future Use: Once customized, save your document for quick future use without the need to start from scratch.

By following these steps, you can create a document that not only suits your business needs but also projects a professional image to your clients, ensuring both clar

Key Features to Look for in Templates

When selecting a system for managing recurring payments and financial records, it’s essential to focus on certain features that enhance functionality, ease of use, and professionalism. A well-designed document solution should not only automate repetitive tasks but also ensure accuracy and flexibility. These core elements can help your business streamline its financial management and improve overall efficiency.

Important Aspects to Consider

Here are some of the key features you should look for when choosing a system for your billing process:

| Feature | Importance |

|---|---|

| Customizability | Allows you to tailor the format to suit your business needs and branding, ensuring consistency across all transactions. |

| Automation | Reduces manual work by automatically populating customer details, amounts, and due dates. |

| Flexibility | Gives you the ability to adjust fields or add additional items as your business grows or changes. |

| Data Security | Ensures sensitive financial data is stored safely, protecting both your business and your clients. |

| User-Friendliness | Easy to navigate interface that reduces the learning curve and allows for quick implementation and use. |

Additional Features to Consider

While the core elements are important, there are other advanced features that can further improve the process:

- Recurring Billing Setup: Enables automatic generation of new documents based on a predefined schedule.

- Multi-currency Support: Ideal for businesses with international clients, allowing you to bill in different currencies.

- Payment Tracking: Keeps an eye on outstanding balances and provides reminders for overdue payments.

- Integration with Accounting Tools: Syncs with accounting software to maintain up-to-date financial records.

By choosing a solution with these features, you can improve your billing efficiency, reduce errors, and maintain a professional image in all your financial transactions.

How Perpetual Invoices Simplify Billing

Managing recurring transactions can often be time-consuming and prone to errors when done manually. By adopting an automated system for regular billing, businesses can significantly reduce administrative workload and enhance the accuracy of their financial records. These solutions streamline the process by automating key tasks, ensuring consistency, and allowing for easy tracking of payments.

Key Ways They Simplify the Process

Here are the primary benefits of using an automated approach for handling regular charges:

- Consistency: Automatically generates the same structure for each payment, ensuring that all documents follow the same format and contain the necessary details.

- Time Savings: Eliminates the need to manually create and update records each time a transaction is due, freeing up time for other important tasks.

- Reduced Errors: By auto-populating fields such as amounts, client information, and dates, the risk of human error is minimized, leading to more accurate documentation.

- Easy Tracking: Allows businesses to track outstanding payments more effectively, providing clear visibility into any overdue balances and improving cash flow management.

- Professionalism: Creates a polished and uniform appearance for all transactions, helping to maintain a professional image with clients and partners.

Streamlining Billing for Better Efficiency

By removing the manual steps involved in creating and tracking regular payments, businesses can focus on more strategic activities. Whether it’s managing customer subscriptions, service fees, or other recurring charges, automated solutions ensure that the process is as smooth and efficient as possible. This leads to fewer mistakes, quicker turnaround times, and improved financial oversight.

Choosing the Right Perpetual Invoice Template

Selecting the appropriate document solution for managing recurring charges is essential for streamlining your financial processes. A well-chosen system ensures that all transactions are handled efficiently, with minimal effort and maximum accuracy. The right solution should meet your business needs, reflect your brand, and simplify billing tasks.

Factors to Consider

When evaluating options for recurring billing systems, consider the following key aspects:

- Customization: Ensure the system allows you to tailor fields, design, and content to reflect your brand and business practices.

- Ease of Use: Choose a solution that is simple to navigate, with clear instructions and user-friendly interfaces to minimize the learning curve.

- Automation Features: Look for a system that automates the generation of records, saving time and reducing the potential for manual errors.

- Integration: Consider how well the system integrates with your existing financial tools, such as accounting software or CRM platforms.

- Security: Ensure that sensitive financial information is protected, with secure methods of storing and transmitting data.

Finding the Best Fit for Your Needs

Ultimately, the ideal solution will depend on your specific business requirements. If you manage a high volume of recurring clients or services, automation and integration capabilities should be a priority. For smaller businesses, customization and ease of use may be more important. Whichever system you choose, ensure it can grow with your business and streamline your workflow effectively.

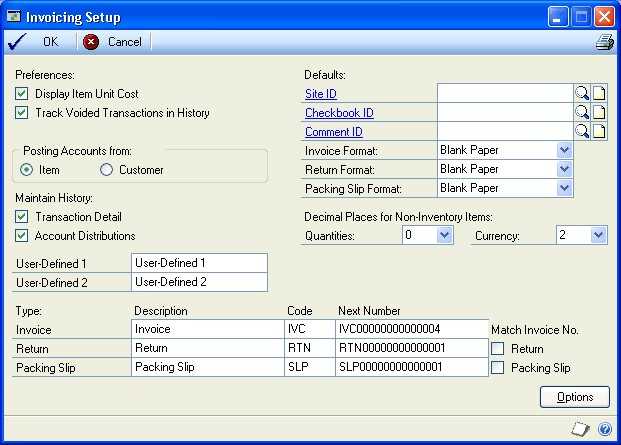

Integrating a Template into Your Workflow

Incorporating a structured document solution into your daily operations can significantly enhance the efficiency of your billing and payment processes. The key is to ensure that the system seamlessly fits into your existing workflow without causing unnecessary disruptions. A well-integrated solution allows you to automate repetitive tasks, reduce errors, and save valuable time.

Steps for Smooth Integration

To successfully integrate a new system into your workflow, follow these essential steps:

- Assess Your Current Workflow: Understand how your current billing process operates, identify bottlenecks, and determine areas where automation can provide the most value.

- Select the Right System: Choose a solution that complements your existing tools and processes, ensuring that it integrates smoothly with your accounting software and CRM platforms.

- Customize for Your Needs: Tailor the document structure and features to match your business requirements, ensuring that all necessary information is included and easy to update.

- Train Your Team: Provide training and resources to ensure that your team understands how to use the new system effectively and efficiently.

- Test and Optimize: Run a few test transactions to ensure that everything works correctly. Adjust settings and workflows as needed to optimize the process.

Benefits of Seamless Integration

Once fully integrated, the new system will automate many aspects of the billing process, including creating and sending documents, tracking payments, and updating financial records. This leads to faster turnaround times, fewer manual errors, and more accurate tracking of outstanding payments. Overall, integration streamlines operations, allowing your team to focus on more important tasks while maintaining a professional image with clients.

Common Mistakes When Using Invoice Templates

While automated systems for creating and managing billing documents can greatly improve efficiency, there are several common pitfalls businesses often encounter. These mistakes can lead to errors in financial records, missed payments, or even damage to client relationships. Understanding these challenges and taking steps to avoid them can help ensure smoother operations and better business outcomes.

Frequent Errors to Avoid

Here are some of the most common mistakes when using automated billing systems:

- Forgetting to Update Client Details: Always ensure that customer information, such as contact details and payment terms, is current. Failing to update this data can lead to miscommunication or delayed payments.

- Incorrect Tax Calculations: Make sure that tax rates are set correctly and are in line with local regulations. An incorrect tax rate can result in compliance issues and customer dissatisfaction.

- Overlooking Payment Terms: Clearly define and update payment terms, including due dates, discounts, and late fees. Missing this information can cause confusion and delayed payments from clients.

- Using Inconsistent Formatting: Consistency in the layout and style of your documents is crucial for professionalism. Ensure your documents have a consistent format for easy readability and brand recognition.

- Not Integrating with Accounting Systems: If the document generation system isn’t connected to your accounting software, manual data entry errors can occur. Ensure that the systems are integrated to reduce errors and streamline financial tracking.

How to Prevent These Mistakes

To minimize these common mistakes, take time to regularly review and update your billing documents. Set up automatic reminders for when client information needs to be updated or when tax rates change. Additionally, regularly check the integration between your document solution and accounting software to ensure smooth synchronization and error-free transactions.

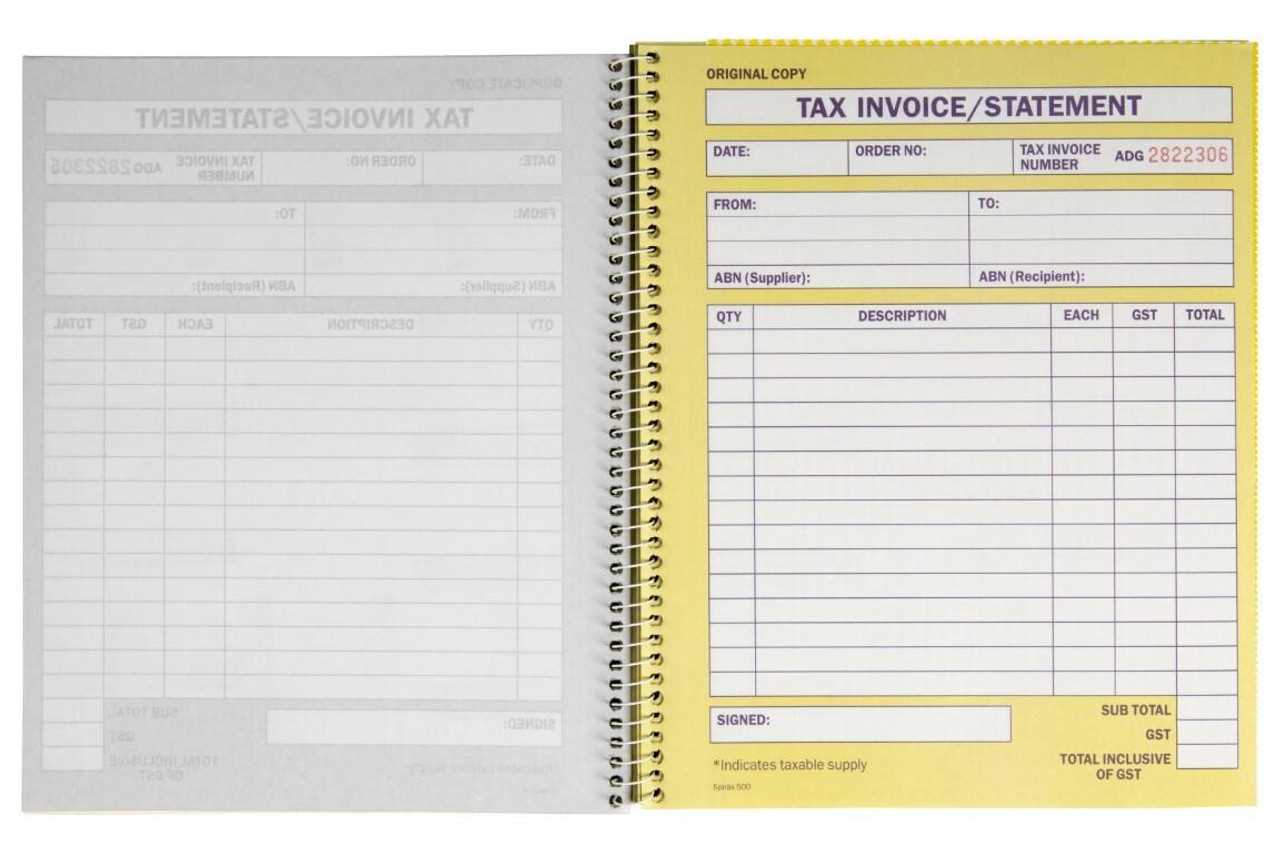

Understanding the Legal Aspects of Invoices

When managing financial transactions, it’s crucial to ensure that all documentation adheres to legal requirements. Properly structured billing documents not only protect businesses but also help maintain transparency and clarity in dealings with clients. Understanding the legal framework surrounding these documents ensures compliance with tax laws, consumer protection rules, and contractual obligations.

Key Legal Requirements

There are several legal elements that must be included in each document to make it legally sound:

- Tax Information: It’s essential to include the correct tax rate and applicable tax number for both the business and the client, where required by law. This ensures compliance with tax authorities.

- Clear Terms of Payment: Clearly state the due date, payment methods, and any penalties for late payments. This helps prevent disputes and clarifies expectations between parties.

- Accurate Business Details: Include accurate information about your business, including the legal name, address, and registration number. This helps establish your legitimacy and provides clients with a point of contact.

- Descriptive Transaction Information: Provide a detailed breakdown of goods or services provided, including quantities, pricing, and total amounts. This prevents misunderstandings and legal disputes over payment terms.

Ensuring Compliance

To avoid legal issues, businesses should regularly review the documentation process and ensure compliance with local and international laws. It’s advisable to consult with legal and financial professionals to ensure that your business is meeting all necessary legal requirements and protecting both parties involved in the transaction.

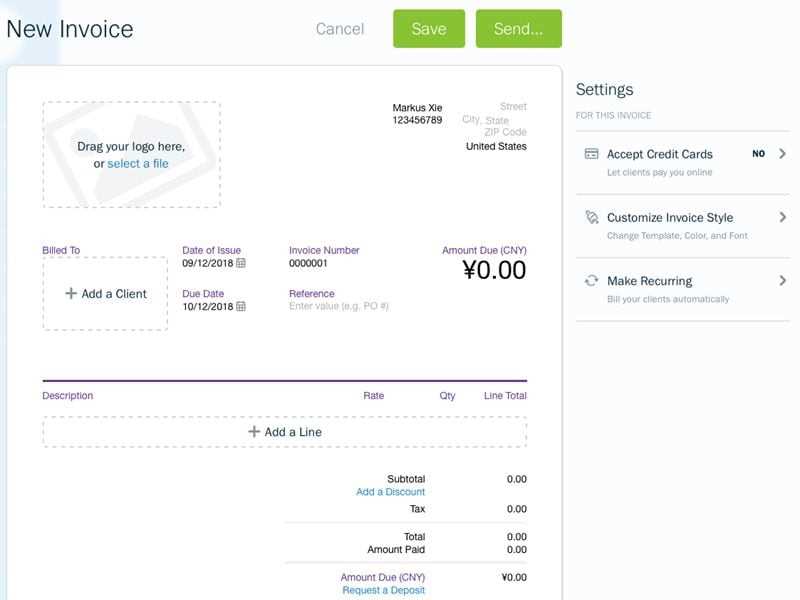

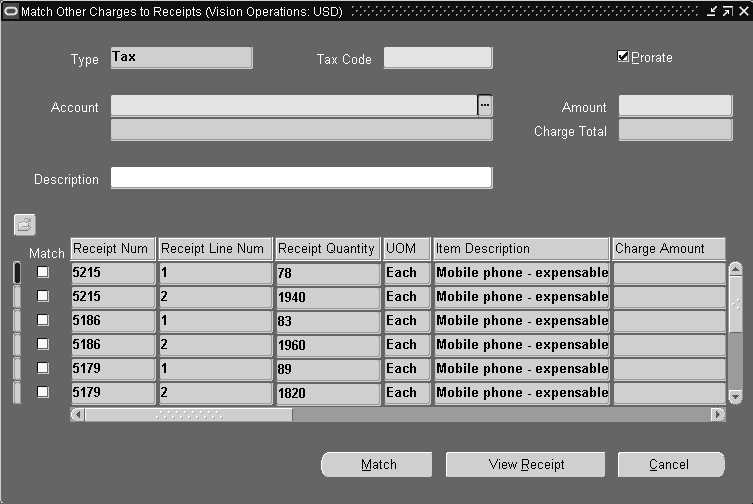

How to Automate Invoice Generation

Automating the process of creating billing documents can save time, reduce human error, and streamline the overall workflow for businesses. By setting up a system that generates these documents automatically, you can ensure that each transaction is accurately recorded and delivered to clients promptly, without the need for manual intervention. This is particularly useful for companies that deal with recurring transactions or a large volume of clients.

Steps to Set Up Automation

Here’s how you can automate the generation of billing documents in your business:

- Select an Automation Tool: Choose software that integrates well with your existing systems, such as accounting platforms or CRM tools, and offers automated document creation capabilities.

- Customize Document Templates: Design your documents with necessary fields (like client name, amount, due date, etc.), and set up default values for recurring transactions to reduce the need for manual entry.

- Set Up Triggers: Define specific triggers, such as payment milestones or subscription renewal dates, that will automatically prompt the system to generate and send the document to the client.

- Review and Test: Run a few test scenarios to ensure that all data is captured correctly and that the documents are being generated as expected. This will help you avoid any mistakes before going live.

Benefits of Automating Document Generation

Once automated, the process becomes more efficient, reducing administrative work and minimizing the potential for errors. Automation allows for quicker response times, consistent formatting, and improved accuracy in financial recordkeeping. Additionally, it frees up your team to focus on more complex tasks, knowing that the documentation process is running smoothly in the background.

Template Design Tips for Professional Invoices

Creating polished and professional billing documents is essential for leaving a positive impression on your clients. A well-designed document not only enhances your brand’s image but also ensures that key information is easy to find and understand. The design of your document should be both functional and visually appealing, contributing to a smooth and efficient transaction process.

Key Design Principles

Here are some key tips to keep in mind when designing your documents:

- Consistency in Branding: Use your company’s logo, color scheme, and fonts consistently to reinforce your brand identity. This helps create a cohesive look that clients will recognize.

- Clear and Readable Layout: Make sure the layout is clean and easy to follow. Group related information together and use headings, bold text, and lines to break up sections and make them more digestible.

- Highlight Key Details: Important information such as the total amount, due date, and payment methods should be easy to spot. Use larger font sizes or different text styles to make these details stand out.

- Keep It Simple: Avoid cluttering the document with unnecessary elements or excessive text. A minimalist design helps keep the focus on the critical information.

Enhancing Functionality

In addition to aesthetics, the functionality of your document plays a crucial role. Consider including the following elements to improve usability:

- Itemized List: Include a clear breakdown of services or products provided with corresponding prices. This helps prevent disputes and ensures transparency.

- Payment Terms: Clearly outline payment terms, including due dates, late fees, and accepted payment methods. This ensures both parties are aligned on expectations.

- Automatic Calculations: If you’re using a digital document, set up automatic calculations for totals and taxes. This reduces human error and saves time.

By focusing on both design and functionality, you can create professional billing documents that look good, are easy to understand, and provide all the information necessary for a seamless transaction.

Why Perpetual Templates Save Time

Using pre-designed billing documents that can be reused for multiple transactions allows businesses to streamline their operations and save valuable time. By eliminating the need to create new documents from scratch for each client or transaction, businesses can focus on more important tasks, such as improving customer service or growing their operations. These reusable structures are particularly helpful for businesses that manage recurring billing, as they allow for faster processing and fewer manual steps.

Efficiency Through Automation

When you have a ready-made format, the time spent on generating documents is drastically reduced. Here’s how it saves time:

- Pre-filled Information: With a reusable structure, many fields, such as client names, service descriptions, and payment terms, can be automatically filled in, saving time on manual entry.

- Quick Adjustments: Instead of starting from scratch, you can simply adjust the necessary fields, like the amount or due date, without having to redo the entire document.

- Consistency: By using the same structure, you ensure consistency across all your documents, eliminating the need to check each one for formatting errors or missing elements.

Fewer Errors, Faster Processing

With fewer manual steps, the risk of mistakes is significantly reduced. Less time spent on inputting data manually means fewer chances for error, which ultimately leads to faster document generation and smoother payment processes. This efficiency is particularly valuable for businesses with high volumes of transactions, where every minute counts.

How to Track Payments with Templates

Effectively managing and tracking payments is essential for maintaining cash flow and ensuring that all transactions are accounted for. By using standardized documents, you can easily track which payments have been made, which are overdue, and which are still pending. This consistency allows you to stay organized and avoid missing any crucial financial details.

Key Information to Include

To track payments effectively, it’s important to include specific details in your documents. These elements will help you monitor the payment status and make follow-ups easier:

- Payment Status: Clearly mark whether a payment has been received, is pending, or is overdue. This visual cue will help you stay on top of outstanding balances.

- Due Dates: Always include clear due dates for payments. This makes it easier to track when payments should have been made and helps prevent late payments.

- Transaction History: Keep a record of all previous payments made for that particular transaction. Include dates and amounts, so you have a clear history at a glance.

Organizing and Updating Payment Records

Once you have the necessary information in your documents, the next step is to organize and keep track of all payments. You can use digital tools or software that automatically update payment status when payments are received. This will save you time and reduce the risk of human error. By regularly reviewing and updating payment statuses, you can stay on top of your finances and ensure smooth operations.

Comparing Free and Paid Invoice Templates

When choosing documents for your billing system, one of the first decisions you’ll face is whether to use free or paid options. Both have their advantages and drawbacks, and understanding these differences can help you make the best choice for your business needs. Free options often come with basic functionality, while paid alternatives provide additional features and customization opportunities.

Benefits of Free Documents

Free billing documents can be an excellent choice for small businesses or freelancers just starting. Here are some of the benefits they offer:

- Cost-Effective: No upfront cost, making it an ideal option for businesses with limited budgets.

- Simplicity: Basic designs and functionality that are easy to understand and use without a steep learning curve.

- Accessibility: Many free options are readily available online and can be downloaded instantly for immediate use.

Advantages of Paid Documents

While free options are great for those starting out, paid documents often come with advanced features that can benefit established businesses. These advantages include:

- Customization: Paid options often allow for more personalization, including your branding, logos, and color schemes.

- Advanced Features: Some paid solutions come with features like automated calculations, recurring billing, and integration with accounting software.

- Better Support: Many paid services offer customer support, which can be invaluable if you run into any issues or need help with specific features.

Improving Cash Flow with Perpetual Invoices

Managing cash flow is a critical aspect of maintaining a healthy business. Ensuring a consistent stream of incoming payments is essential for covering expenses and fueling growth. By adopting streamlined billing practices, businesses can improve the efficiency of their payment collection and reduce delays that often disrupt cash flow.

One effective approach is the use of recurring billing systems, which allow businesses to automate invoicing on a regular basis. This approach ensures that payments are collected promptly and predictably, helping businesses maintain a steady cash flow without the need for constant manual intervention.

Benefits of Recurring Payment Systems

There are several advantages to using recurring payment systems that help improve cash flow:

- Predictability: With automated billing, businesses can anticipate income and plan for expenses more effectively, reducing financial uncertainty.

- Efficiency: Automating the billing process reduces administrative workload, freeing up time to focus on other essential business tasks.

- Reduced Payment Delays: Automated payments minimize the risk of overdue accounts, ensuring that funds are received on time.

- Customer Convenience: Clients benefit from the ease of regular, automated payments, which can improve customer satisfaction and retention.

Integrating Automated Systems into Your Business

To fully realize the benefits of recurring billing, businesses should integrate automated systems into their workflow. There are many software solutions available that can help set up and manage these systems, offering features like:

- Customizable Billing Cycles: Set billing frequencies according to your business model, whether it’s weekly, monthly, or annually.

- Payment Method Flexibility: Allow customers to choose from multiple payment options, such as credit card, bank transfer, or digital wallets.

- Automated Reminders: Set reminders for customers to ensure timely payments, reducing the risk of missed payments.