How to Customize and Use the Perfex CRM Invoice Template

Efficient billing is crucial for any business, and having the right tools to generate professional documents can save time and reduce errors. With the right software, creating customized payment records tailored to your business needs becomes a simple task. From personalized designs to automated features, there are various options to ensure smooth transaction processes and improved client interactions.

Automating the creation of financial documents can greatly reduce administrative workload, allowing businesses to focus more on core operations. Whether you’re looking to adjust tax rates, apply discounts, or add personalized client information, the flexibility of modern software solutions makes it easier than ever to handle these tasks quickly and efficiently.

Moreover, integrating these features into one centralized system means keeping everything organized in one place. Tracking the status of payments, managing recurring transactions, and ensuring security are all part of the experience, offering businesses peace of mind and greater control over their financial operations.

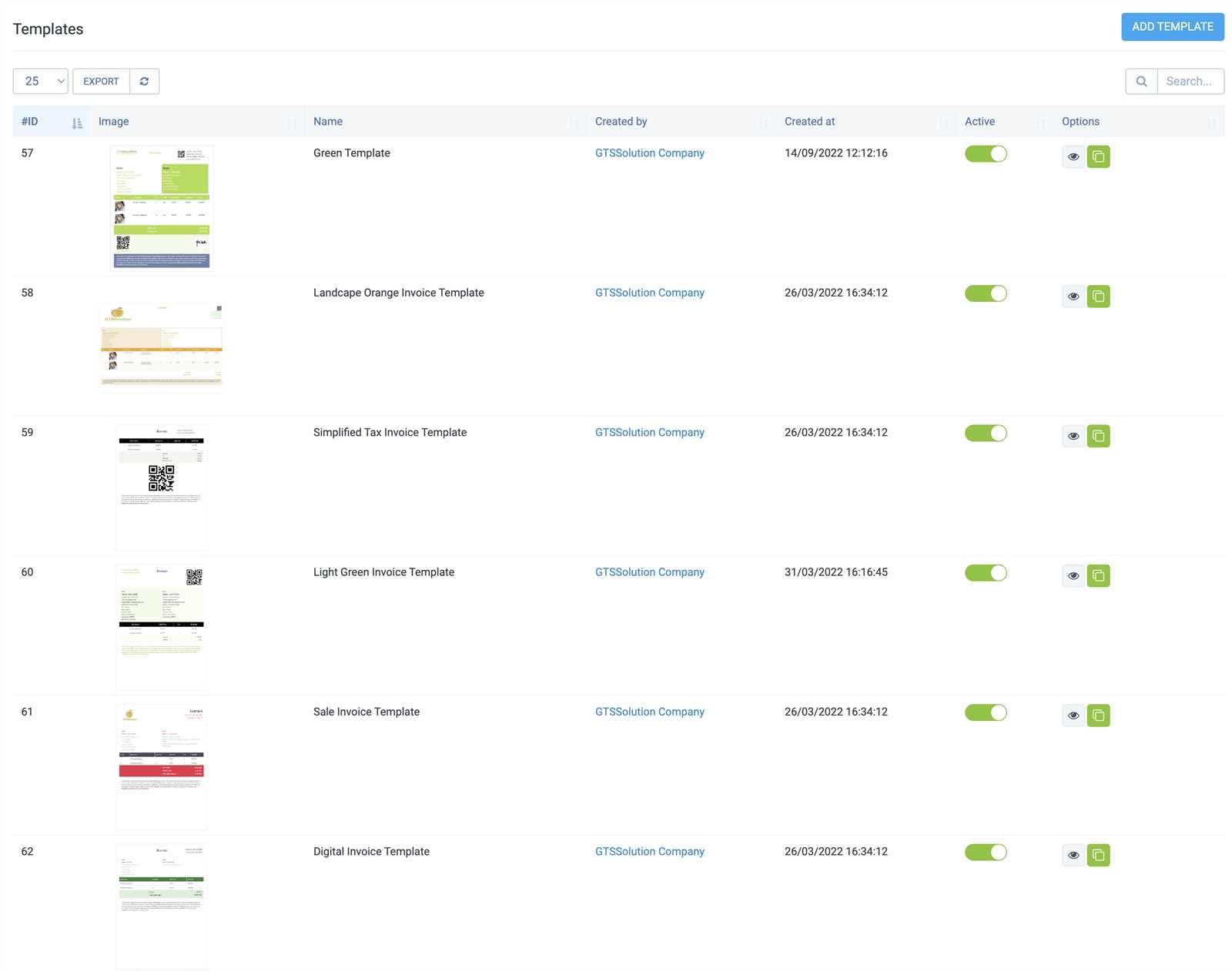

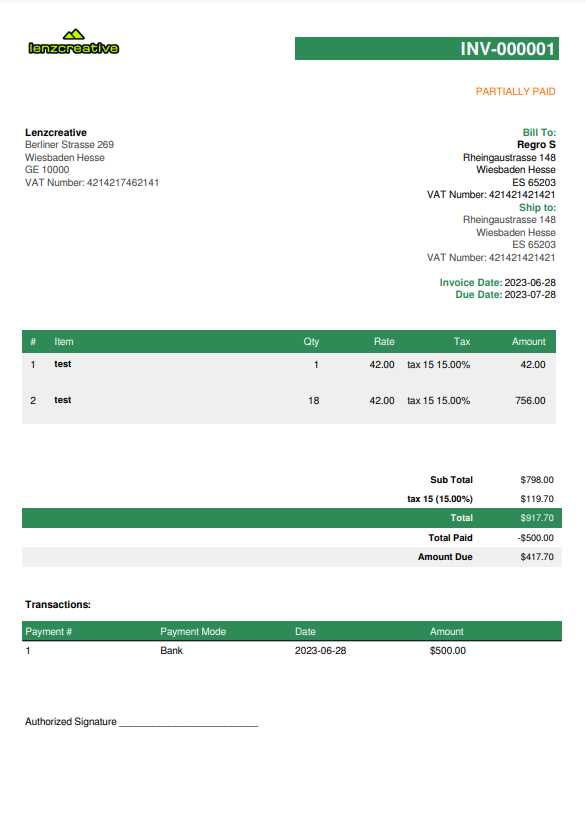

Perfex CRM Invoice Template Overview

Managing financial records efficiently is essential for maintaining smooth business operations. A well-designed document generator allows businesses to create customized billing statements that meet their unique needs. With this powerful tool, users can generate and manage payment details quickly, ensuring accuracy and professionalism in every transaction.

This system offers a wide range of customizable options, allowing businesses to adjust templates according to their preferences. Whether it’s adding company logos, adjusting layout styles, or including specific client data, the flexibility provided ensures that the documents align perfectly with branding and operational requirements.

Additionally, these solutions often come with integrated features to streamline repetitive tasks, such as automated billing cycles or tax calculations, reducing the time spent on manual entries. The ability to manage and organize billing data in one platform enhances overall workflow efficiency and helps maintain a structured approach to client interactions and financial tracking.

Benefits of Using Perfex CRM Invoices

Using a comprehensive billing system can significantly streamline financial operations for any business. By automating and customizing the process of generating financial records, companies can enhance their efficiency and ensure accuracy. This flexibility leads to more effective management of payments and improves overall client satisfaction.

Time Efficiency and Automation

One of the key advantages of such a solution is its ability to automate repetitive tasks. Businesses can set up recurring billing, automate tax calculations, and even create client-specific invoices with just a few clicks. This reduces manual input, saving time and minimizing the chance of errors. Automation also ensures that deadlines are met consistently, keeping cash flow steady and predictable.

Customization and Professionalism

Customization options allow businesses to adjust billing documents according to their brand identity. Logos, color schemes, and personalized content can be seamlessly integrated into each document, maintaining a professional appearance. This not only enhances the client experience but also builds trust by presenting the business in a polished and organized manner.

How to Install Perfex CRM Template

Setting up a document generation system within your software can improve both functionality and appearance of your financial records. The process of integrating a customizable document format involves several steps, but with the right guidance, it becomes a straightforward task. Once set up, the tool will allow you to create and manage client billing effortlessly, enhancing both efficiency and professionalism in your business operations.

Step 1: Download the Required Files

The first step in installation is to download the necessary files from the software provider. These files typically include the document format along with installation instructions and additional plugins. To begin:

- Visit the official website or the platform where the files are hosted.

- Log in to your account and navigate to the download section.

- Select the appropriate version of the files for your system.

- Click the download link and save the files to your computer.

Step 2: Upload the Files to Your System

Once you have the installation files on your computer, the next step is to upload them to your software. This process can usually be done directly through the admin panel of your platform. Follow these steps:

- Log in to your account on the platform where you want to integrate the document system.

- Go to the settings or configuration section.

- Locate the option for adding new modules or templates.

- Upload the previously downloaded files from your computer.

- Once the files are uploaded, follow the prompts to complete the installation.

After the files are uploaded, you should be able to configure the settings and start generating customized documents immediately.

Customizing Your Invoice Design in Perfex

Personalizing the appearance of your financial documents can significantly improve your business’s professional image. A well-designed document not only ensures clarity but also reinforces your brand identity. With the right system, adjusting the layout, adding your logo, and modifying other visual elements can be done effortlessly, ensuring each document is aligned with your business needs.

Here are some key aspects you can customize to make your financial records stand out:

| Customization Option | Description |

|---|---|

| Logo and Branding | Add your business logo and choose colors that reflect your brand. This ensures that every document represents your company professionally. |

| Font and Text Styles | Adjust the font size, type, and alignment to improve readability and match your business’s tone. |

| Layout and Sections | Modify the placement of sections, such as client details, payment terms, and item descriptions, to create a clean and organized format. |

| Tax and Discount Fields | Add fields for taxes, discounts, or any custom charges to tailor documents to your specific needs. |

With these options, you can ensure that each document not only meets functional needs but also reflects your brand’s personality and enhances client trust through clear, professional presentation.

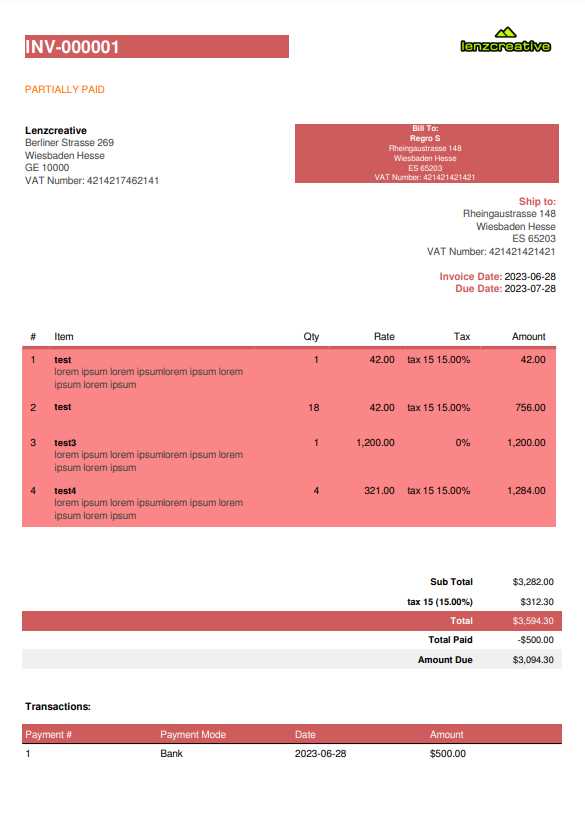

Steps to Generate an Invoice in Perfex

Creating a professional billing document is a straightforward process when you have the right tools in place. By following a simple series of steps, you can quickly generate an accurate statement that includes all the necessary details for both your business and the client. These steps ensure that your documents are not only clear but also consistent and tailored to your needs.

Step 1: Access the Billing Section

- Log in to your account and navigate to the financial or billing section of your platform.

- Click on the option to create a new record or document.

- Select the type of record you wish to generate (e.g., payment request, sales summary, etc.).

Step 2: Enter Client and Payment Details

- Choose the client or business partner from your contact list or add a new one if necessary.

- Input the relevant payment information, such as the amount due, payment method, and due date.

- Add any specific terms, discounts, or additional charges relevant to the transaction.

Step 3: Customize the Document Layout

- Select the desired layout, making adjustments to any sections (e.g., payment breakdown, company info, client info).

- Ensure that all necessary fields, like item descriptions, tax rates, and totals, are filled out properly.

Step 4: Review and Finalize

- Review the document for accuracy, checking all amounts and client details.

- Click the option to preview the document and make any last-minute changes if needed.

- Once satisfied, click “Generate” to create the document or “Save as Draft” if further edits are needed.

Following these steps will ensure that you can generate a precise and professional document every time, making the billing process faster and more efficient.

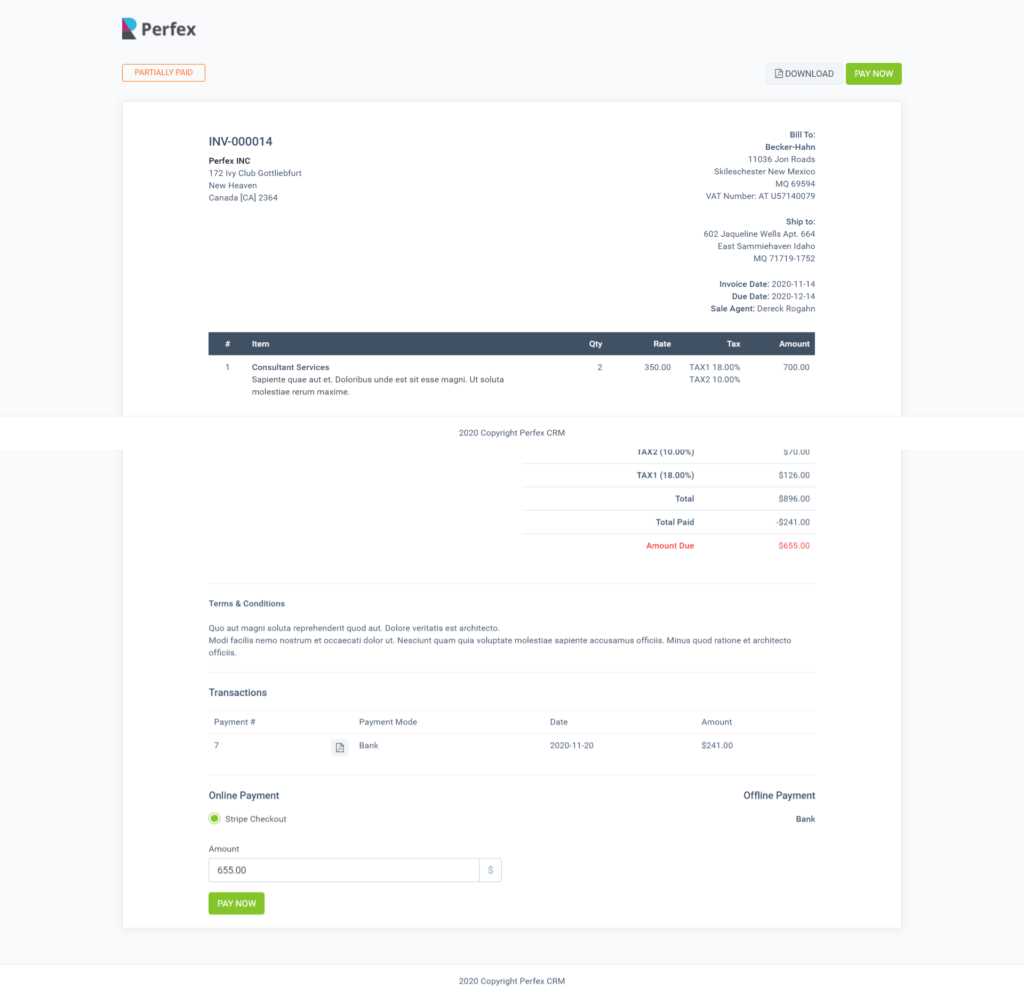

Integrating Payment Methods with Perfex Invoices

Integrating payment methods into your billing system is a vital step for ensuring smooth and timely transactions. By connecting various payment gateways, you allow clients to pay their bills quickly and securely, directly from the generated documents. This integration not only streamlines the payment process but also enhances the overall user experience by offering flexible options for settling amounts due.

Step 1: Select Your Payment Providers

- Choose the payment processors you want to integrate with your system (e.g., PayPal, Stripe, bank transfers, credit card payments).

- Make sure the selected providers are supported by your billing platform.

- If necessary, create accounts with the payment services to obtain API keys or integration credentials.

Step 2: Set Up Payment Gateway Integration

- Access the payment settings section within your platform’s admin interface.

- Enter the required API credentials or integration details for each payment provider.

- Configure any preferences, such as enabling automatic payment confirmation or customizing payment instructions.

Step 3: Enable Payment Options in Documents

- Once the payment methods are integrated, select the available options that will appear on the generated documents.

- Ensure that each payment method is clearly labeled and easy for the client to find.

- Test the payment links to verify that clients can complete transactions smoothly.

By following these steps, you’ll create an efficient and secure payment experience, allowing clients to pay in the way that suits them best while keeping your financial operations organized and up to date.

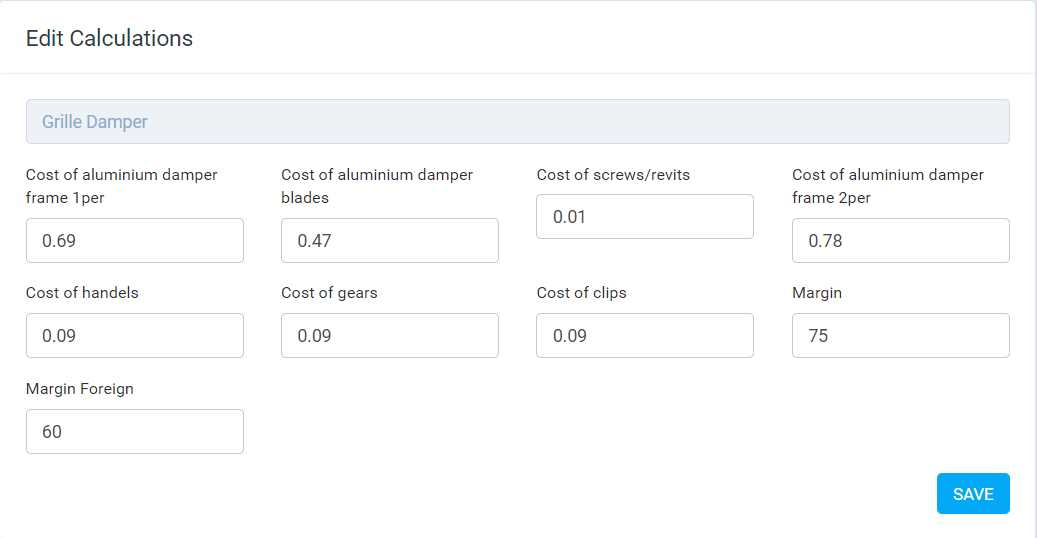

Setting Up Tax Rates in Perfex CRM

Properly configuring tax rates is an essential part of managing financial records, especially for businesses that operate in multiple regions or countries. By setting up accurate tax rates in your system, you can ensure that all generated documents reflect the correct amounts and comply with local tax laws. This setup helps streamline the billing process, reduces errors, and ensures consistency in all transactions.

Step 1: Access the Tax Settings

- Log in to your platform’s administration panel.

- Navigate to the settings or configuration section related to financial or billing settings.

- Look for the tax management or tax rates option in the menu.

Step 2: Add New Tax Rates

- Click on the option to add a new tax rate.

- Enter the tax name (e.g., Sales Tax, VAT, Service Tax) and the applicable rate percentage.

- If needed, select the country or region where this tax applies, ensuring it matches local tax regulations.

- Save the tax rate and repeat for any additional rates needed for different regions or products.

Step 3: Apply Tax Rates to Financial Records

- Once tax rates are set up, you can apply them automatically to any new financial documents.

- Ensure that the correct tax rate is linked to the products or services being billed.

- Verify that tax amounts are calculated accurately in the document preview before finalizing or sending the records.

By following these steps, you can ensure that your business remains compliant with tax regulations and that clients are billed with the correct amounts every time. Accurate tax rate configuration saves you time and avoids costly mistakes in your financial processes.

Managing Clients in Perfex CRM Invoice System

Effectively managing client information is crucial for maintaining smooth financial operations. By keeping detailed and organized client records, businesses can ensure accurate billing, track payment histories, and quickly access relevant contact information when needed. A well-organized system for managing clients not only helps streamline the billing process but also enhances client satisfaction by providing personalized service and transparent communication.

Step 1: Adding New Clients

- Access the client management section of your platform.

- Click the option to add a new client or contact.

- Fill in the client’s details, including name, address, email, phone number, and payment preferences.

- Save the client record to ensure it is stored for future transactions.

Step 2: Updating Client Information

- Navigate to the client’s profile to edit or update their information.

- Make necessary changes, such as updating contact details, adjusting payment methods, or modifying billing addresses.

- Save the updates to ensure the information is always current and accurate.

Step 3: Viewing Client History

- Access the transaction or billing history section within the client profile.

- Review past records, including payments, outstanding balances, and any credits or discounts applied.

- Use this data to personalize future transactions or follow up with clients regarding overdue amounts.

By managing your clients effectively, you can ensure smooth operations and better customer relationships. Keeping your client data organized and up to date not only simplifies billing but also allows you to provide a more personalized experience for each customer.

How to Add Discounts on Perfex Invoices

Offering discounts can be an effective strategy to incentivize clients and improve customer loyalty. Integrating discounts into your billing documents allows businesses to adjust pricing based on promotions, client relationships, or specific circumstances. This feature ensures that you can easily apply discounts and provide transparent pricing, all while maintaining professional documentation for financial tracking.

Step 1: Enable Discount Fields in Your Billing Settings

- Access the settings section of your platform and navigate to the financial or billing configuration.

- Look for the option to enable discounts, either as a percentage or a fixed amount.

- Save the settings to allow discounts to appear in your future billing records.

Step 2: Applying Discounts to Specific Items or Total Amount

- When creating a new record, locate the section where you input pricing details.

- Choose whether to apply a discount to individual items or the total amount of the bill.

- For a percentage-based discount, enter the desired percentage (e.g., 10% off). For a fixed amount, input the specific discount value (e.g., $50 off).

- The system will automatically calculate the new total based on the applied discount.

Emphasize discounts clearly on the document to ensure clients can easily see the reductions and understand how the final total was calculated. This increases transparency and builds trust with your customers.

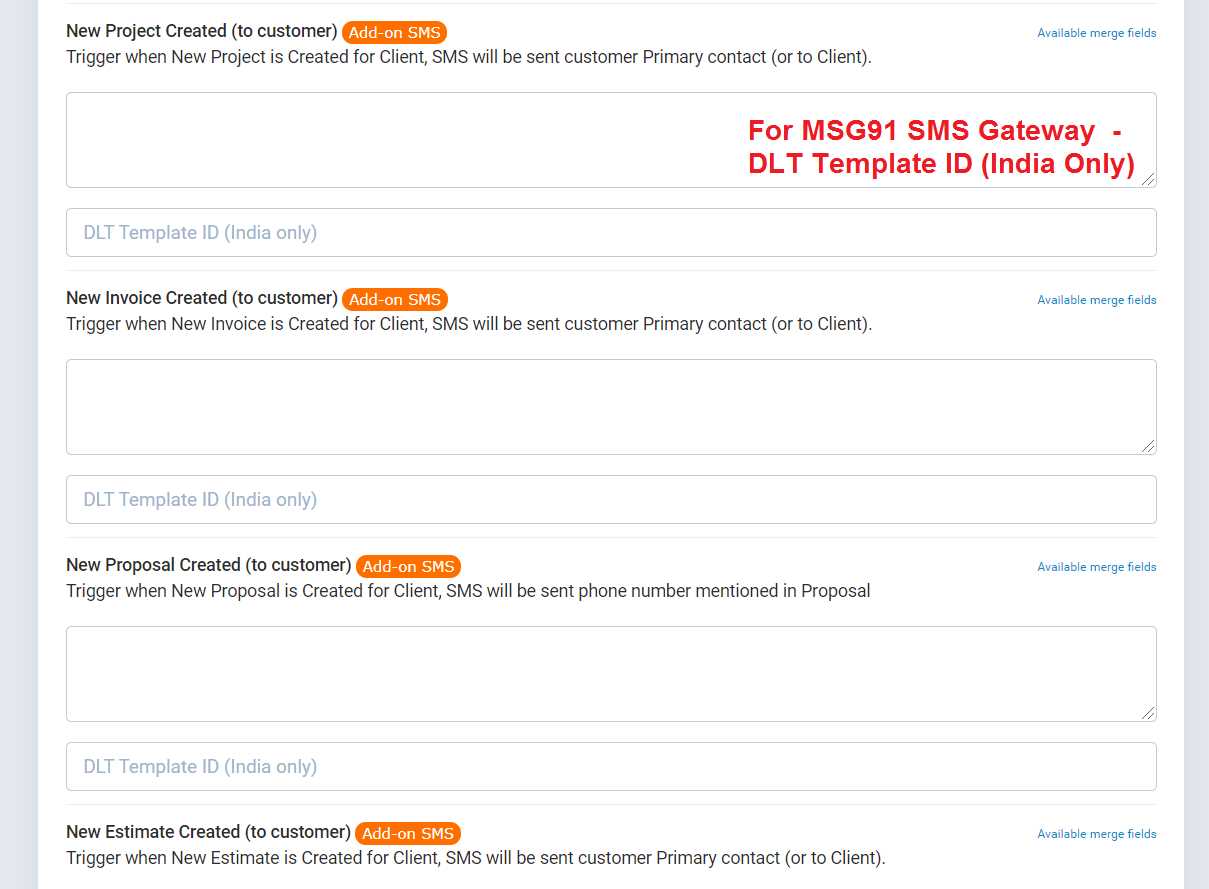

Automating Invoice Generation in Perfex

Automating the creation of financial documents can save businesses significant time and effort, especially when dealing with recurring transactions or large volumes of clients. By setting up automated workflows, you can ensure that billing is consistent, accurate, and timely, all while reducing the manual input required. This process not only enhances efficiency but also minimizes the risk of human error.

With automation, businesses can set parameters such as billing intervals, due dates, and payment terms, ensuring that clients receive their bills automatically. Whether you need to generate documents on a monthly, quarterly, or custom basis, the automation feature streamlines the entire process. It also allows businesses to focus on other aspects of operations, knowing that the billing cycle is being managed automatically.

To set up automation, simply define the criteria for when the documents should be generated and choose the necessary settings for each transaction. The system will take care of the rest, delivering ready-to-send records directly to clients without manual intervention. This reduces workload and ensures that payments are tracked efficiently.

Perfex Invoice Template for Recurring Billing

Managing recurring payments for services or subscriptions can be a time-consuming task, but with the right setup, this process can be fully automated. By utilizing an advanced billing system, businesses can create documents that are automatically generated on a regular basis, reducing administrative workload and ensuring clients are billed consistently. This is especially beneficial for businesses that offer subscription-based services or ongoing contracts.

With recurring billing automation, the system generates new records based on predefined intervals–whether it’s weekly, monthly, or annually–ensuring that clients receive their billing statements on time without manual intervention. Customizing the layout and fields for such recurring transactions helps to provide clients with clear and accurate information, including payment dates, amounts due, and service descriptions. This level of automation not only saves time but also minimizes errors in billing, keeping both the business and clients satisfied.

Customization options within the system allow businesses to adjust the content of each document, whether it’s adding service descriptions, adjusting payment terms, or including specific discount information for repeat clients. Automating recurring billing helps maintain consistent cash flow while giving businesses more time to focus on other key areas of growth.

Tracking Invoice Status in Perfex CRM

Keeping track of the status of your financial records is crucial for managing cash flow and ensuring timely payments. By having a clear overview of whether a payment is pending, completed, or overdue, you can take proactive steps to follow up with clients, adjust your business processes, or resolve issues quickly. A robust system allows you to easily monitor the progress of each transaction, keeping you organized and in control.

Step 1: Access Payment History

- Log in to your account and go to the financial or billing section of the platform.

- Navigate to the “Transaction History” or “Payment Status” tab to view all your issued records.

- Select a specific transaction or document to view its detailed status.

Step 2: Understanding Payment Status Options

- Pending: This status indicates that the payment is still due and has not been processed yet.

- Paid: When the payment has been successfully processed, the status will show as “Paid.”

- Overdue: If the payment has not been received by the due date, the system will mark the document as “Overdue.”

- Partial Payment: This status shows when only part of the total amount has been paid.

Step 3: Updating Status

- If you manually receive payments, you can update the status to “Paid” or “Partial Payment” directly in the system.

- For automated payment systems, the status is updated automatically once the transaction is confirmed.

By tracking the status of each transaction in real time, businesses can improve their cash flow management and ensure that all payments are processed efficiently. This helps prevent late payments and provides a clear record of all financial activity.

Exporting Invoices from Perfex CRM

Exporting financial records is a key feature for businesses that need to keep accurate records, share documents with clients or accountants, or integrate with other software tools. By exporting documents, businesses can easily save, print, or send them for further processing. The ability to quickly export documents into different file formats ensures flexibility and smooth integration with various financial systems.

Most platforms allow you to export billing records in commonly used formats such as PDF, Excel, or CSV, making it easier to store and share the documents as needed. Whether you’re looking to compile reports for internal use, email statements to clients, or share data with third-party software, the export function simplifies these processes.

Step 1: Navigate to the Export Section

- Log in to your account and go to the financial or billing section.

- Look for the option to view all your transactions, records, or documents.

- Filter or search for the specific document you wish to export.

Step 2: Select the Export Format

- Once the document is selected, choose the format in which you want to export the record, such as PDF, Excel, or CSV.

- If necessary, adjust any export settings, such as including additional details or customizing the layout.

Step 3: Export and Save

- Click the “Export” button to generate the document in your selected format.

- Save the file to your device, or directly send it via email to clients or team members.

Exporting records not only helps streamline documentation but also allows for better record-keeping and easier sharing. It ensures that all parties involved have the correct documents, and it simplifies integration with accounting tools and other platforms.

Perfex CRM Mobile App and Invoice Management

Managing billing documents and financial records on the go has become essential for businesses and professionals who need flexibility. A mobile application for handling these tasks offers the ability to access, update, and manage all billing information directly from your phone or tablet, ensuring you stay connected and productive no matter where you are. This mobility allows for quicker response times, easier client communication, and efficient tracking of payments and outstanding balances.

With a mobile app, you can create, review, and send financial records, as well as monitor their status. Whether you’re at a client meeting, traveling, or working from a remote location, you can easily access your account to manage transactions and make updates as needed. This level of convenience is particularly valuable for professionals who need to ensure their documentation is up-to-date and accurate at all times.

Key Features of Mobile App Invoice Management

- Access all billing records from anywhere, without being tied to a desktop computer.

- Create and edit documents in real-time, making it easy to generate new records or adjust existing ones.

- View payment statuses and track outstanding balances directly from your mobile device.

- Send completed documents instantly via email or other communication methods.

Benefits of Using the Mobile App

- Enhanced Flexibility: Work from any location, reducing the need for office-based workstations.

- Real-Time Updates: Make adjustments or generate new documents instantly, ensuring accuracy and timely billing.

- Better Client Communication: Quickly respond to client inquiries and provide instant updates on payment statuses or record details.

The mobile app allows businesses to manage their billing process in a more dynamic way, ensuring that all transactions are efficiently handled, no matter where you are. This approach helps save time, streamline operations, and improve client satisfaction through faster service and accurate documentation.

Custom Fields in Perfex Invoice Template

Custom fields allow businesses to personalize and tailor their financial documents to meet specific needs or capture additional data. By adding custom fields, you can incorporate unique information, such as project numbers, custom client notes, or specific billing details that aren’t part of the default structure. This level of customization ensures that each document aligns with your company’s particular requirements and enhances the clarity and precision of communication with clients.

Whether you need to include additional tax information, special discounts, or custom terms, custom fields offer the flexibility to include everything relevant to the transaction. This personalization not only improves the professionalism of the documents but also streamlines the billing process by making sure all important details are clearly presented in one place.

How to Add Custom Fields

- Navigate to the settings or configuration section of your platform.

- Look for the option to manage or customize document fields.

- Choose the type of field you want to add–text, date, number, or dropdown–and provide a label and any necessary values.

- Save your changes, and the custom field will now appear on your future records.

Benefits of Custom Fields

- Tailored Documents: Customize your documents to include specific details relevant to each transaction or client.

- Improved Efficiency: Reduce errors by having all necessary information pre-filled and automatically included in each document.

- Better Client Communication: Provide clients with exactly the information they need, whether it’s for internal tracking or special terms.

Customizing your documents in this way ensures that each record is not only accurate but also perfectly suited to your business’s unique needs. The ability to capture and display personalized data improves both the operational efficiency and professionalism of your billing system.

Security for Invoice Data

Ensuring the safety and privacy of financial records is critical for any business. Sensitive data such as transaction details, client information, and payment histories must be protected against unauthorized access, breaches, and potential cyber threats. Implementing robust security measures guarantees that your documents remain secure while maintaining the trust and confidence of your clients.

To protect your financial data, it’s important to use systems with strong encryption methods, access controls, and secure backup options. These layers of protection help safeguard sensitive information from both external attacks and internal errors. By utilizing secure platforms, businesses can mitigate risks while ensuring that their billing operations comply with data protection regulations and industry standards.

Key Security Features to Look For

- Data Encryption: Ensure that all sensitive data, including personal details and payment information, is encrypted both in transit and at rest.

- Access Control: Limit access to financial records based on user roles, allowing only authorized personnel to view or edit specific documents.

- Two-Factor Authentication: Add an extra layer of security by requiring two-factor authentication for users accessing the system.

- Regular Backups: Implement automated backups to ensure that all financial records are securely stored and can be restored in case of data loss.

Compliance and Best Practices

- GDPR and Data Protection: Ensure your system complies with data protection laws such as GDPR to avoid potential penalties and ensure client privacy.

- Regular Security Audits: Conduct routine security audits to identify vulnerabilities and ensure your system remains up to date with the latest security protocols.

- Secure Payment Processing: Use trusted payment gateways with strong security features to handle transactions and minimize risks associated with online payments.

Implementing these security measures ensures that your financial documents and client data are well-protected, helping you maintain business integrity and safeguard client relationships.

Best Practices for Using Invoice Documents

Creating professional and accurate financial records is essential for maintaining good relationships with clients and ensuring smooth operations. To maximize the efficiency of your billing process, it is important to follow best practices that enhance clarity, consistency, and accuracy in every document you generate. By adhering to these practices, businesses can streamline their workflow, minimize errors, and maintain professionalism in their financial transactions.

Whether you are generating new records or managing existing ones, it is important to ensure that all the necessary information is included, formatted correctly, and communicated clearly. Additionally, maintaining a consistent structure across all financial documents helps both you and your clients quickly understand the details of each transaction.

Best Practices for Document Creation

- Ensure Accuracy: Double-check all fields to make sure that amounts, dates, and client details are correct before finalizing.

- Use Clear Descriptions: Provide clear and detailed descriptions of services or products to avoid confusion and ensure clients understand what they are being charged for.

- Set Clear Payment Terms: Clearly state payment due dates, methods, and any late fees to avoid misunderstandings and delays.

- Include Contact Information: Make sure that your contact details, including email and phone number, are visible for easy communication in case of issues.

Maintaining Consistency

One of the key aspects of professionalism is consistency in design and layout. Ensure that your financial documents follow a uniform format for all clients, which helps reinforce your brand image and makes the document easy to understand. Consistent use of fonts, colors, and logos further enhances your company’s professionalism.

| Element | Best Practice |

|---|---|

| Header | Include your company name, logo, and contact details. |

| Client Information | Ensure all client details (name, address, email) are accurate and up-to-date. |

| Items/Services | Provide detailed descriptions of products or services with clear pricing. |

| Total | Double-check all calculations and include taxes and discounts where applicable. |

| Payment Terms | Clearly specify payment methods, due dates, and late fee policies. |

By following these best practices, businesses can ensure that their financial records are both professional and clear. This approach helps avoid misunderstandings, improves client trust, and streamlines the billing process, ultimately contributing to better business efficiency and customer satisfaction.