Get Your Free PDF Downloadable Blank Invoice Template

In today’s fast-paced business environment, having an efficient system for managing financial transactions is crucial. Whether you are a freelancer, a small business owner, or part of a larger organization, utilizing a structured document for charging clients can significantly enhance your operations. This resource not only aids in maintaining professionalism but also helps in keeping accurate records of sales and services rendered.

By employing a versatile form that can be easily modified, you empower yourself to address various client needs and preferences. Such a document can serve as a vital tool for ensuring clarity and transparency in financial dealings. Moreover, it simplifies the process of tracking payments and outstanding balances, allowing for better cash flow management.

With the right form at your disposal, the intricacies of billing become more manageable, giving you more time to focus on what truly matters–growing your business. In this article, we will explore the various aspects of creating and utilizing such a resource effectively.

Understanding Invoice Templates

In the realm of financial documentation, having a structured format is essential for clarity and professionalism. These structured documents serve as a formal means of requesting payment for goods and services provided, facilitating smooth transactions between businesses and clients. By employing a well-designed layout, organizations can enhance their billing practices, ensuring both efficiency and effectiveness.

The Importance of a Structured Format

A well-organized document provides numerous benefits. It not only conveys necessary information in an accessible manner but also establishes a standard for communication between parties. By using a consistent format, businesses can improve their overall workflow, reducing the time spent on administrative tasks.

Key Components of a Billing Document

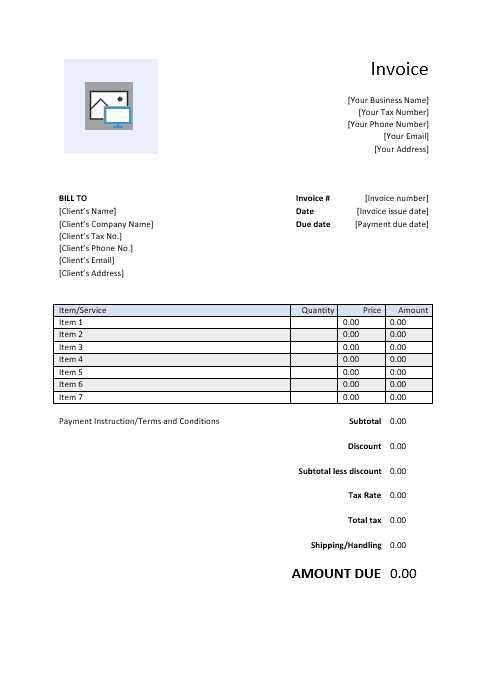

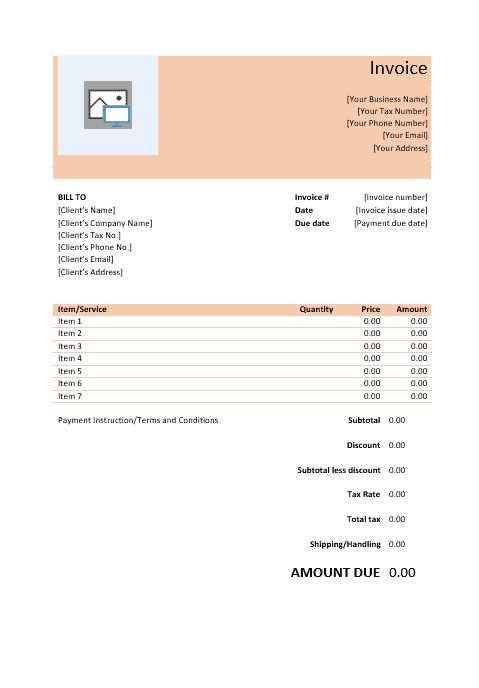

Understanding the essential elements that make up a billing document can greatly improve its utility. The following table outlines these critical components:

| Component | Description |

|---|---|

| Header | Contains the business name, logo, and contact information. |

| Client Information | Details about the recipient, including name and address. |

| Date | Date of issuance to establish the timeline for payment. |

| Itemized List | A detailed account of products or services provided, including quantities and prices. |

| Total Amount Due | The total cost owed, often highlighting applicable taxes or discounts. |

| Payment Terms | Conditions outlining when payment is expected and acceptable methods. |

By incorporating these elements into your financial documents, you ensure that both parties have a clear understanding of the transaction, which can help foster trust and reliability in business relationships.

Benefits of Using Blank Invoices

Utilizing a customizable document for billing purposes offers numerous advantages that can enhance the efficiency and professionalism of financial transactions. Such documents provide a clear structure for communication between businesses and clients, streamlining the process of requesting payment and maintaining accurate records. By implementing a well-designed format, businesses can create a more organized and effective billing system.

Enhancing Professionalism

One of the primary benefits of using a customizable billing document is the increased professionalism it conveys. A properly formatted document reflects a commitment to quality and attention to detail. Clients are more likely to respond positively when they receive clear and organized requests for payment, leading to stronger business relationships and improved trust.

Improving Efficiency and Accuracy

Having a ready-to-use structure significantly reduces the time spent on administrative tasks. Businesses can quickly fill in the necessary details, allowing for faster processing of payments. Additionally, a consistent format minimizes the risk of errors, ensuring that all pertinent information is accurately conveyed. This not only helps in maintaining clear records but also aids in preventing misunderstandings that can arise from poorly formatted communications.

In summary, the use of a structured document for billing purposes fosters a more organized approach to financial transactions, enhancing both professionalism and efficiency.

How to Create Your Own Template

Designing a customized document for billing can greatly enhance your business’s efficiency and professionalism. By crafting your own layout, you can ensure that it meets your specific needs while maintaining a clear structure. Below are the essential steps to guide you in creating an effective billing document.

- Determine the Purpose: Identify the primary objectives of your document. Consider what information is necessary for your transactions and how you want to present it.

- Choose a Format: Decide whether you want to create your document using word processing software, spreadsheet applications, or graphic design tools. Each option offers unique benefits depending on your preferences.

- Include Key Elements: Ensure your layout contains the following crucial components:

- Business name and contact information

- Client details

- Date of issuance

- Itemized list of services or products

- Total amount due

- Payment terms and conditions

By following these steps, you can create a customized billing document that aligns with your business needs and enhances your overall efficiency in managing financial transactions.

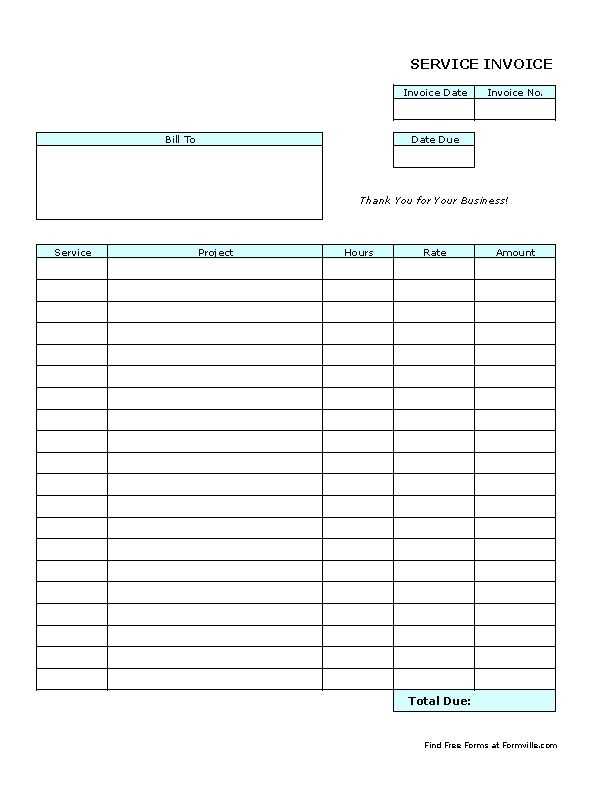

Key Elements of an Invoice

A well-structured document for billing plays a crucial role in maintaining clarity and professionalism in financial transactions. Understanding the essential components that make up such a document ensures that all necessary information is conveyed effectively. By incorporating these elements, businesses can facilitate smooth communication and enhance their overall billing process.

Essential Components

The following elements are vital for creating an effective billing document:

- Header: This section should prominently display the business name, logo, and contact details, establishing the document’s origin.

- Recipient Information: Include the client’s name, address, and any relevant identification numbers to personalize the document.

- Date: Clearly indicate the date of issuance to provide a timeline for the transaction.

- List of Goods or Services: Present a detailed account of what is being billed, including descriptions, quantities, and individual prices.

- Total Amount Due: Clearly state the overall cost, incorporating any applicable taxes or discounts to avoid confusion.

- Payment Terms: Specify the conditions under which payment should be made, including deadlines and accepted payment methods.

Additional Considerations

In addition to the essential components, consider including additional details such as payment instructions, notes for the client, and terms of service. These elements can further enhance the clarity and professionalism of your document, leading to better client relationships and timely payments.

Common Mistakes in Invoicing

Creating a document for billing purposes can be straightforward, yet many individuals and businesses often overlook crucial aspects that lead to errors. Recognizing these common pitfalls is essential for ensuring that financial communications are effective and professional. Addressing these mistakes can help improve cash flow and enhance client relationships.

Frequent Errors to Avoid

Here are some of the most common mistakes encountered during the billing process:

- Missing Information: Failing to include important details such as the client’s address or the date of issuance can create confusion and delay payments.

- Incorrect Amounts: Double-check calculations to ensure that the totals reflect the correct amounts, including taxes and discounts. Errors in figures can lead to disputes and frustration.

- Poor Formatting: An unorganized layout can make it difficult for clients to read and understand the document. A clear and structured format enhances readability.

- Vague Descriptions: Providing insufficient detail about the products or services rendered can result in misunderstandings. It’s important to be specific to avoid confusion.

- Ignoring Payment Terms: Clearly stating the conditions for payment, including due dates and accepted methods, helps to set expectations and encourages timely transactions.

Strategies for Improvement

To avoid these common mistakes, consider implementing the following strategies:

- Develop a checklist of essential elements to include in each document.

- Utilize software or tools designed for creating billing documents to reduce manual errors.

- Seek feedback from clients regarding clarity and organization to improve future communications.

By being aware of these common mistakes and actively working to eliminate them, businesses can streamline their billing processes and enhance their overall efficiency.

Choosing the Right Format

Selecting the appropriate layout for your billing document is crucial for ensuring that it is functional and user-friendly. The format can affect not only the aesthetic appeal of the document but also its usability and how well it meets the needs of both the sender and recipient. Various formats offer different benefits, and understanding these can help streamline the invoicing process.

Popular Formats to Consider

Here are some common formats you can choose from, along with their advantages:

- Word Processor Documents: These are easily customizable and allow for a high degree of personalization. They are ideal for small businesses that prefer to create documents from scratch.

- Spreadsheet Files: Utilizing a spreadsheet can simplify calculations and itemizations, making it easier to manage complex billing situations. This format is particularly useful for businesses with a large volume of transactions.

- PDF Files: While not mentioned directly, this format is widely used for its ability to maintain formatting across different devices. It is ideal for sending finalized documents that need to look the same on any screen.

- Online Invoicing Tools: Many businesses opt for web-based solutions that automate the process of creating and sending documents. These tools often include features for tracking payments and managing client information.

Factors to Consider

When choosing a format, keep the following factors in mind:

- Ease of Use: The format should be straightforward for both you and your clients. Consider how comfortable you and your recipients are with technology.

- Customization Options: Select a format that allows for flexibility in design and content, enabling you to adapt the document to suit your branding and client needs.

- Compatibility: Ensure that the chosen format can be easily opened and viewed by your clients, regardless of the devices they use.

By carefully considering the right format for your billing documents, you can enhance the efficiency of your financial processes and improve communication with your clients.

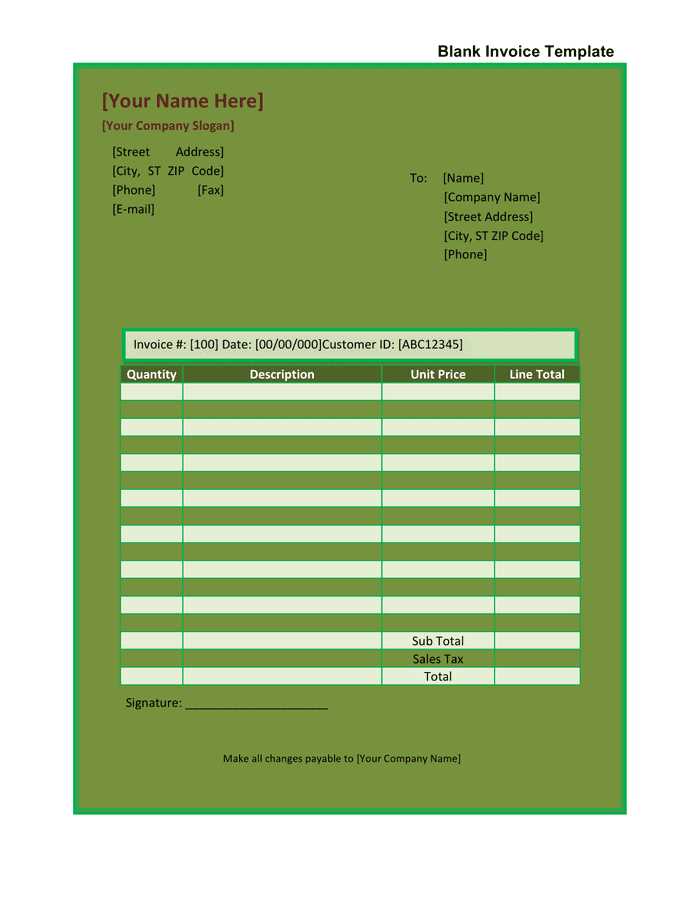

Customizing Your Invoice Design

Personalizing the look of your billing documents is essential for creating a professional impression and reinforcing your brand identity. A well-designed layout not only enhances visual appeal but also improves clarity, making it easier for clients to process and understand the information presented. Tailoring the aesthetics of your financial communications can foster trust and promote a positive client experience.

Key Elements to Personalize

When customizing the design of your documents, consider focusing on the following elements:

- Branding: Incorporate your logo, brand colors, and fonts to create a cohesive look that reflects your business’s identity. This helps clients recognize your communications at a glance.

- Layout: Choose a layout that is organized and easy to navigate. Use headings and sections to separate different types of information, ensuring clarity and readability.

- Fonts: Select clear and professional fonts that are easy to read. Consistency in font choice throughout the document reinforces a polished appearance.

- Colors: Utilize color schemes that complement your brand while ensuring that text remains legible. Subtle color highlights can draw attention to important details without overwhelming the reader.

Tips for Effective Customization

Here are some helpful tips to keep in mind when designing your documents:

- Keep It Simple: Avoid cluttering the design with excessive graphics or text. A clean and straightforward layout is more effective in communicating key information.

- Use White Space: Incorporate ample white space to separate different sections and enhance readability. This makes the document feel less crowded and more approachable.

- Test for Clarity: Before finalizing your design, seek feedback from others to ensure that the document is easy to understand and visually appealing.

By taking the time to customize the design of your billing documents, you can create a more engaging experience for your clients while effectively conveying important financial information.

PDF vs Word Invoice Templates

When it comes to creating billing documents, the choice of format can significantly impact usability and presentation. Each format offers unique features that cater to different needs, preferences, and business contexts. Understanding the strengths and weaknesses of each can help in selecting the most suitable option for your financial communications.

| Feature | PDF Format | Word Format |

|---|---|---|

| Stability | Maintains formatting across devices and platforms | Formatting may change depending on the software version |

| Editing | Limited editing capabilities, ideal for finalized documents | Easy to edit and customize content as needed |

| Professional Appearance | Offers a polished and professional look suitable for formal communications | Can be customized but may appear less formal |

| Compatibility | Widely compatible with various platforms, no special software needed | Requires word processing software for optimal use |

| Security | Can be password protected and encrypted for sensitive information | Less secure, as files can be easily edited without restrictions |

In summary, the choice between these formats depends on your specific requirements. For finalized documents that require consistent presentation and security, the former format is often preferred. Conversely, if you need flexibility in content management and frequent updates, the latter might be more appropriate. Evaluating the needs of your business will guide you in making the best decision for your financial documentation.

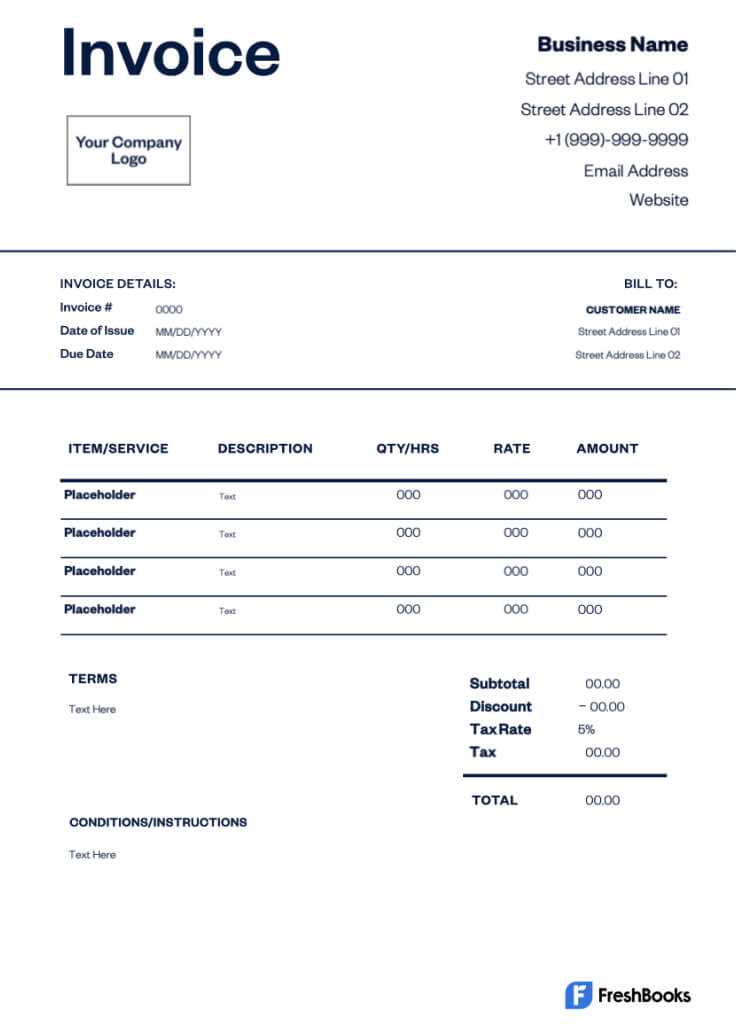

How to Fill Out an Invoice

Completing a billing document accurately is crucial for maintaining clear communication with clients and ensuring timely payments. Each section of the document plays a vital role in conveying essential information regarding the transaction. Understanding how to fill out each part correctly will enhance professionalism and reduce misunderstandings.

1. Include Your Business Information

Start by entering your company’s name, address, contact number, and email at the top of the document. This ensures the recipient knows who the sender is and how to reach you if needed.

2. Add Client Details

Next, provide the recipient’s name, company name, address, and contact information. This information helps to specify who the bill is directed to and avoids any confusion during the payment process.

3. Specify Dates

Include the date the document is issued as well as the due date for payment. Clearly indicating these dates will help both parties keep track of the timeline for the transaction.

4. Describe Products or Services

List the items or services provided, including a brief description, quantity, unit price, and total for each line item. This transparency ensures clients know what they are being charged for and helps in resolving any potential disputes.

5. Calculate the Total Amount

Add up all the line items and include any applicable taxes or discounts. Presenting a clear total helps clients understand the final amount due.

6. Include Payment Instructions

Clearly state your preferred payment methods and any necessary details, such as bank account information or payment links. This guidance simplifies the process for clients and encourages timely payments.

7. Review Before Sending

Finally, double-check all information for accuracy and completeness. Ensuring there are no errors will prevent delays and foster a professional relationship with clients.

By following these steps, you can confidently fill out a billing document that clearly communicates essential details and promotes efficient transactions.

Tracking Payments with Invoices

Monitoring financial transactions is essential for any business, as it helps maintain cash flow and provides insights into overall financial health. Utilizing a well-structured document can significantly enhance the tracking process by ensuring accurate records of amounts owed and received. Implementing a systematic approach will allow businesses to keep better tabs on their finances.

Establishing a Payment Tracking System

Creating an effective system for monitoring payments involves several key components:

- Organized Record Keeping: Maintain a dedicated ledger or digital system where all transaction records are kept. This ensures easy access to information regarding who owes what and the status of each transaction.

- Timely Issuance: Send out billing documents promptly after goods or services are provided. Timely communication reinforces the expectation of payment and aids in quicker turnaround times.

- Payment Due Dates: Clearly state payment deadlines to encourage timely responses. Highlighting due dates helps clients prioritize their payments and reduces the risk of late transactions.

Monitoring Payments

Tracking payments effectively requires consistent follow-up and clear communication:

- Regular Review: Periodically review outstanding amounts to identify any overdue payments. This practice enables businesses to address any issues proactively.

- Follow-Up Communications: Send reminders to clients with outstanding balances. Friendly reminders can prompt clients to fulfill their obligations without damaging relationships.

- Recording Payments: Once payments are received, update the tracking system immediately. Accurate records help in assessing financial performance and maintaining transparency.

By implementing these strategies, businesses can effectively track payments, ensuring financial stability and fostering positive relationships with clients.

Tips for Professional Invoicing

Creating a polished billing document is crucial for establishing credibility and ensuring timely payments. A professional approach not only reflects positively on your business but also sets clear expectations for your clients. Here are some essential tips to enhance the quality and effectiveness of your billing process.

Key Components of a Professional Document

When designing your billing document, include the following critical elements:

| Component | Description |

|---|---|

| Your Business Information | Include your company name, address, contact number, and email to make it easy for clients to reach you. |

| Client Information | Clearly state the client’s name, address, and any other relevant details to personalize the document. |

| Unique Identifier | Assign a unique number to each billing document to facilitate tracking and reference in future communications. |

| Itemized List of Services | Provide a detailed breakdown of the services rendered or products provided, including quantities and rates. |

| Total Amount Due | Clearly indicate the total amount owed, including any taxes or additional charges. |

Best Practices for Sending Bills

To ensure your billing documents are received positively, consider these best practices:

- Consistency: Use a uniform format for all your billing documents. This promotes a professional image and aids in easy recognition.

- Clear Language: Use straightforward and professional language to avoid confusion. Avoid jargon and ensure that terms are easily understood.

- Delivery Method: Choose an appropriate method for sending the document, whether by email or traditional mail, based on your client’s preferences.

- Timeliness: Issue the billing document promptly after the completion of services or delivery of products. This encourages quicker payment responses.

By incorporating these tips into your billing practices, you can enhance professionalism and foster positive relationships with your clients, leading to improved payment efficiency.

Understanding Invoice Terms and Conditions

Grasping the specifics of billing terms and conditions is essential for both service providers and clients. These stipulations set the framework for the transaction, outlining expectations and responsibilities for all parties involved. By familiarizing yourself with these details, you can avoid misunderstandings and ensure a smoother payment process.

Typically, these stipulations cover crucial areas such as payment timelines, late fees, and acceptable methods of payment. They may also address the consequences of non-payment or disputes. Understanding these aspects can empower you to negotiate better agreements and maintain professional relationships.

Here are some common elements that you might encounter:

- Payment Terms: This section specifies when payment is due, whether immediately upon receipt or within a set period, such as 30 days.

- Late Payment Fees: Details regarding penalties for overdue payments are typically included, encouraging prompt settlement of dues.

- Accepted Payment Methods: Clear instructions on how clients can remit payment, such as via bank transfer, credit card, or check.

- Refund Policy: An outline of the circumstances under which refunds may be issued and the process to follow for requests.

- Dispute Resolution: Guidance on how to handle disagreements, including preferred communication methods and escalation procedures.

By carefully reviewing and understanding these provisions, you can enhance your ability to manage transactions effectively, ensuring both clarity and accountability throughout the payment process.

Integrating Invoices with Accounting Software

Connecting billing documents with financial management applications can significantly enhance efficiency and accuracy in managing transactions. By utilizing software that supports seamless integration, businesses can streamline their accounting processes, reduce manual entry, and improve overall financial oversight. This approach not only saves time but also minimizes errors, leading to more reliable record-keeping.

Benefits of Integration

Implementing integration between financial documents and accounting systems offers several advantages:

- Automation: Automating the transfer of data from billing to accounting reduces the need for manual input, saving time and effort.

- Improved Accuracy: Automatic synchronization minimizes the risk of human error, ensuring that financial records are consistently accurate.

- Real-Time Tracking: Integration allows for real-time updates, providing immediate visibility into cash flow and outstanding balances.

- Enhanced Reporting: Consolidating data facilitates more comprehensive financial analysis and reporting, allowing for informed decision-making.

- Simplified Tax Preparation: With organized records readily available, tax reporting becomes more straightforward, reducing the stress associated with tax season.

Common Integration Methods

There are various methods to achieve integration between billing and accounting systems:

| Integration Method | Description |

|---|---|

| API Integration | Utilizing application programming interfaces (APIs) to connect different software systems, allowing for seamless data transfer. |

| Import/Export Functions | Exporting data from one system and importing it into another, which can be done manually or through scheduled tasks. |

| Third-Party Integration Tools | Using middleware or integration platforms designed to connect various applications without extensive coding. |

By exploring these integration options, businesses can enhance their financial management capabilities, leading to more effective and streamlined operations.

Free Resources for Invoice Templates

Accessing cost-free tools for creating billing documents can greatly assist individuals and small businesses in managing their finances effectively. Various online platforms offer a wealth of options, allowing users to generate well-structured statements without incurring expenses. These resources often come with customizable features to suit specific needs.

Popular Online Platforms

Several websites provide free resources for crafting financial statements. Here are some notable options:

- Canva: This graphic design platform offers a range of visually appealing layouts that can be easily personalized to create professional documents.

- Invoicely: A straightforward solution for generating and sending bills, providing a user-friendly interface and multiple customization options.

- Wave: An accounting software that includes tools for creating billing documents, allowing users to manage all financial aspects in one place.

Useful Features to Look For

When exploring these free resources, consider the following features to ensure they meet your requirements:

- Customization Options: The ability to modify layouts, colors, and fonts helps align documents with your branding.

- Download Formats: Look for services that allow exporting documents in various formats for easy sharing.

- User-Friendly Interface: A simple navigation experience can save time and reduce frustration during the creation process.

By leveraging these free resources, anyone can effectively manage their billing processes and present professional-looking documents without significant investment.

Legal Considerations for Invoices

When creating financial documents, it is essential to understand the legal implications associated with them. Proper compliance with regulations can protect businesses from disputes and ensure timely payments. Familiarizing oneself with the legal requirements surrounding these documents can help in establishing a professional relationship with clients and maintaining accurate records.

Here are some important legal aspects to consider:

| Aspect | Description |

|---|---|

| Identification Details | Both parties should be clearly identified, including names, addresses, and contact information, to avoid confusion. |

| Tax Information | Including relevant tax identification numbers ensures compliance with local tax laws and makes the document valid for tax purposes. |

| Payment Terms | Clearly outlining payment conditions, such as due dates and accepted methods, helps to prevent misunderstandings and delays. |

| Record Keeping | Maintaining copies of these documents is crucial for accounting purposes and can serve as evidence in case of disputes. |

By paying attention to these legal considerations, individuals and businesses can create effective financial documents that uphold their rights and responsibilities while fostering positive interactions with clients.

Best Practices for Sending Invoices

Sending accurate and timely financial documents is crucial for maintaining smooth business operations and ensuring prompt payments. By following best practices, you can enhance professionalism, reduce errors, and foster strong relationships with clients. It is essential to establish a systematic process for dispatching these records to avoid delays or misunderstandings.

Here are some key practices to consider when sending financial statements:

| Practice | Description |

|---|---|

| Timeliness | Send documents promptly after the completion of services or delivery of goods. This ensures clients are reminded of their payment responsibilities. |

| Clear Communication | Ensure that the document is clear, with easy-to-understand terms, amounts, and due dates to minimize confusion. |

| Proper Formatting | Maintain a clean and professional design that is easy to read and looks trustworthy. |

| Follow-up Reminders | Send polite reminders if payments are overdue. Set a system for following up without being too aggressive. |

| Multiple Delivery Methods | Offer different delivery options like email, physical mail, or online portals to ensure clients can easily receive and view the document. |

By adhering to these practices, you can improve payment processes and maintain a professional approach when handling financial transactions. This approach also helps build trust with clients, ensuring that both parties are aligned in their expectations.

Maintaining Accurate Record Keeping

Properly managing financial documents and transactions is essential for the smooth operation of any business. Keeping accurate and up-to-date records not only helps with tracking payments but also ensures compliance with tax regulations and financial audits. It provides a clear overview of your financial status and helps in making informed decisions.

To maintain precise and organized records, consider these best practices:

- Consistency: Keep records updated regularly to avoid errors and confusion. Consistent tracking helps identify trends and resolve issues quickly.

- Organized System: Use a logical and accessible filing system for both digital and physical records. Categorize them by type, date, or client to make retrieval easier when needed.

- Reconciliation: Regularly reconcile your financial documents with bank statements and payment logs. This practice ensures that all amounts are accurate and that discrepancies are addressed early.

- Backup: Always back up your digital records to prevent loss due to hardware failure or accidental deletion. Consider cloud storage for easy access and secure storage.

- Legal Compliance: Make sure your record-keeping system complies with relevant regulations, such as tax laws or industry standards, to avoid penalties.

By following these guidelines, businesses can ensure that their financial documentation remains reliable, accurate, and ready for any necessary review or audit. This level of organization fosters greater financial transparency and accountability within the company.