Easy Pay Invoice Template for Quick and Accurate Billing

Managing financial transactions efficiently is crucial for any business. Having a well-organized document for requesting payment helps ensure clarity and accuracy. By using the right structure, you can avoid confusion and delays, fostering trust between you and your clients.

Whether you’re a freelancer, a small business owner, or part of a larger organization, customizing your payment requests to match your specific needs is essential. This allows for seamless processing, reduces errors, and accelerates cash flow. With the right approach, you can streamline your billing process and focus on growing your business.

Choosing the right format and tailoring the details according to the nature of the transaction can make a significant difference. A well-crafted document is more than just a formality; it’s a vital tool that ensures both parties are on the same page and helps avoid misunderstandings.

How to Create a Pay Invoice Template

Creating a document for requesting payment is an essential step for any business. This structured approach ensures that all necessary details are included, making the payment process more efficient and reducing the chances of errors. By following a few basic steps, you can design a professional and functional document that suits your needs.

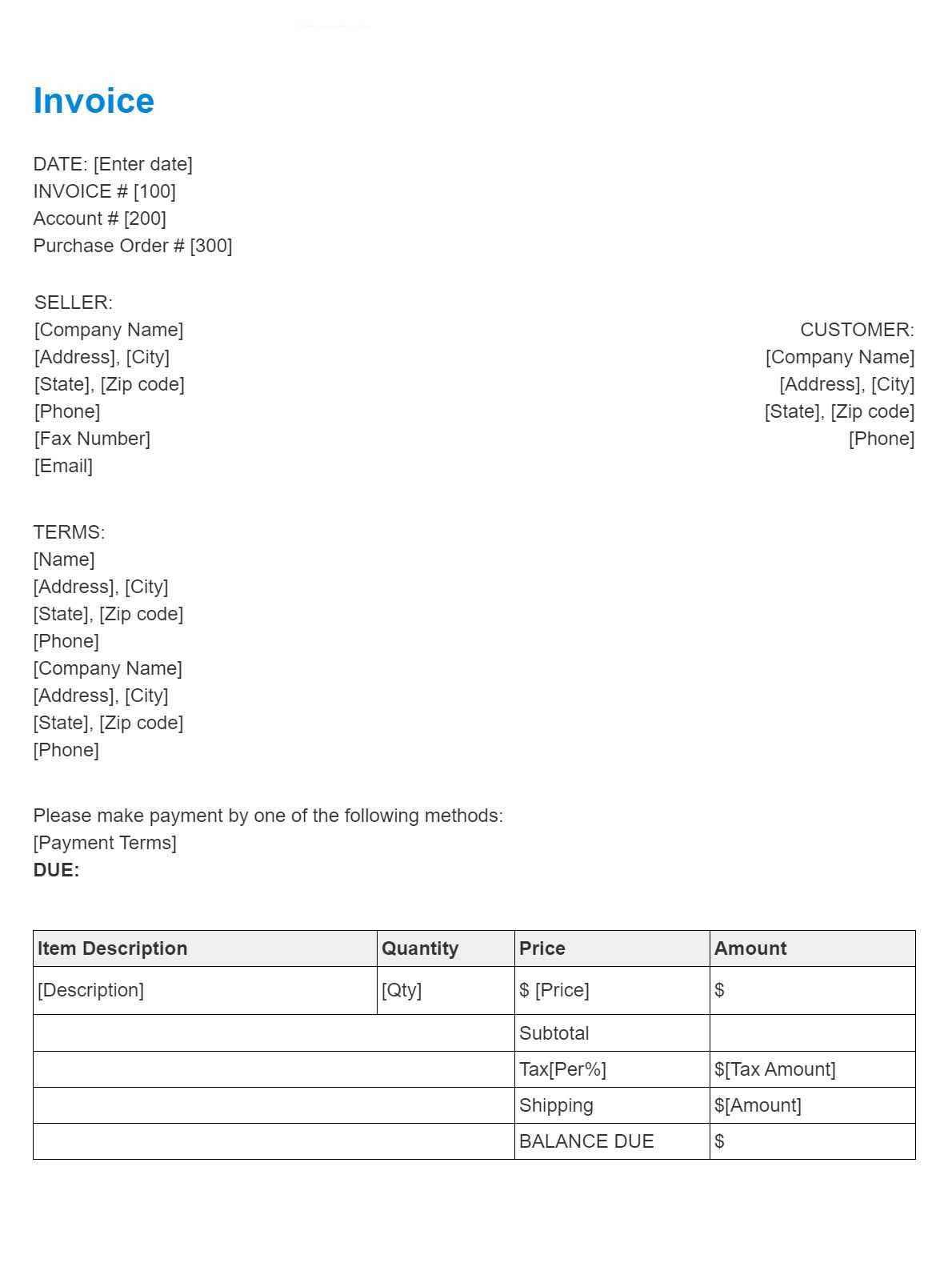

1. Start with Basic Information

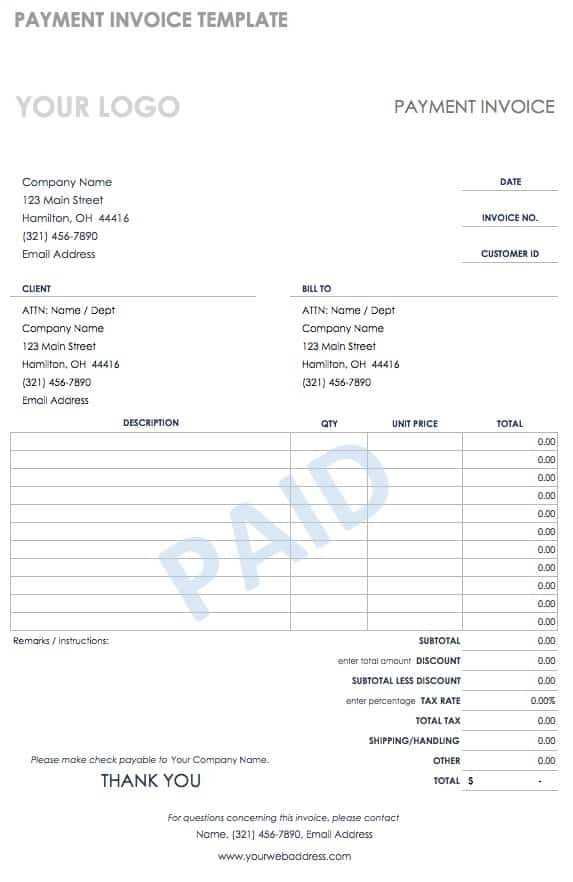

The first thing to include in your payment request is basic contact information for both parties. This helps identify who is involved in the transaction. Essential details to add are:

- Your company name and address

- Client’s name and contact information

- Document reference number (to track the request)

- Date of the request

2. Add Detailed Payment Information

Next, outline the specifics of the transaction. This section should clearly state the services or goods provided, along with the associated cost. Make sure to include:

- A description of the service or product

- The quantity or hours worked

- The unit price and total amount

- Any applicable taxes or fees

- The total amount due

Including these details ensures that the recipient understands exactly what they are paying for and helps avoid any misunderstandings.

Benefits of Using a Pay Invoice Template

Utilizing a structured format for requesting payment offers several advantages that simplify financial transactions. By having a consistent and organized approach, businesses can enhance efficiency and professionalism. The use of pre-designed documents ensures that essential information is never overlooked, leading to smoother processes for both the service provider and the client.

Time-saving: One of the most significant benefits of using a ready-made document is the time saved in creating each request. Instead of starting from scratch, you can use a standard layout, filling in the details specific to each transaction. This reduces the overall administrative workload and speeds up the billing process.

Consistency: A standard structure ensures that every document follows the same format, making it easier for clients to understand and process. This consistency helps build credibility and trust, as clients know exactly what to expect with each request for payment.

Accuracy: By using a pre-designed structure, there is less chance of missing important details. This can help prevent errors such as incorrect amounts or missing client information, which could otherwise delay payments or cause confusion.

Professionalism: A well-organized document reflects professionalism and attention to detail. It demonstrates that the business is serious about its operations and values clear communication with clients, which can help strengthen client relationships.

Customizability: Even with a standardized structure, these documents can be easily customized to reflect your business’s branding and specific needs. Whether you want to include your logo or add special terms, you can tailor the layout without compromising on the key information.

Key Elements of a Pay Invoice

When creating a document for requesting payment, certain elements are essential to ensure clarity and completeness. Including all necessary information helps avoid confusion and ensures that both the service provider and the client are on the same page. Each section serves a specific purpose, from identifying the parties involved to detailing the payment amount and terms.

1. Contact Information

At the top of the document, you should include the contact details for both parties. This information helps to clearly identify the buyer and the seller, making it easier for both parties to reference the document in case of any disputes or questions. Essential contact details include:

- Company or individual name

- Business address

- Phone number and email

- Client identification number (if applicable)

2. Description of Goods or Services

Another key component is a detailed breakdown of the products or services provided. This helps the client understand exactly what they are being charged for. Key points to include are:

- Clear description of each product or service

- Quantity or hours worked

- Unit price

- Total cost for each item

Accurate descriptions and quantities not only help the client verify the charges but also streamline the payment process by ensuring all figures are correct.

Customizing Your Pay Invoice Template

Adapting a standard billing document to suit your business needs is an important step in creating professional and effective payment requests. Customization not only adds a personal touch but also ensures that all the necessary details are present in a way that reflects your brand and communicates your terms clearly to clients.

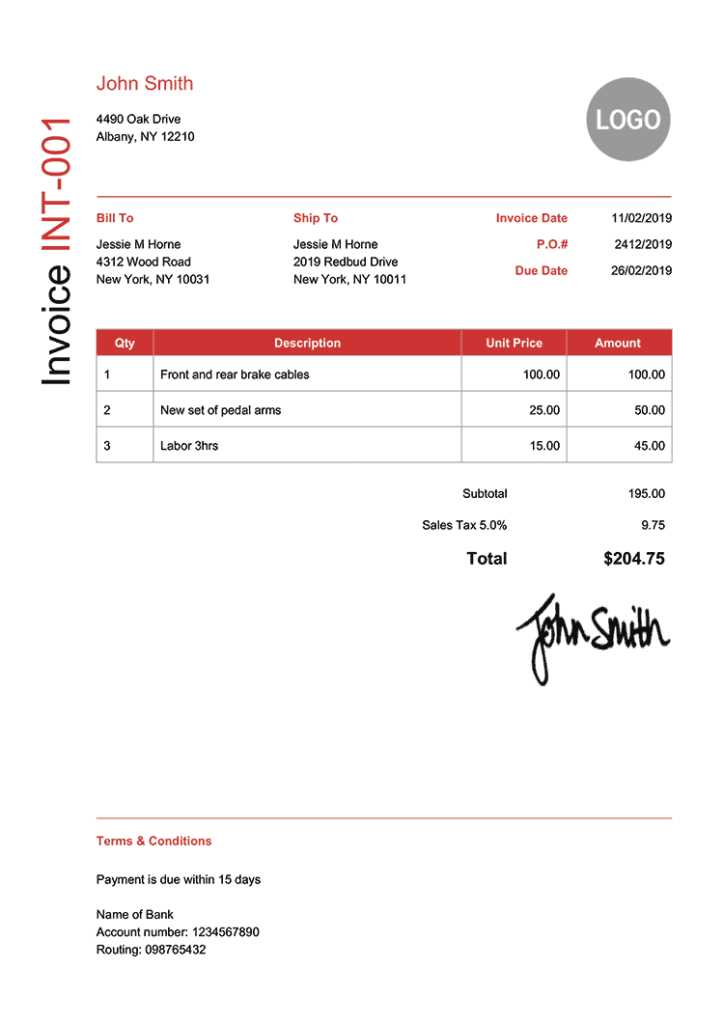

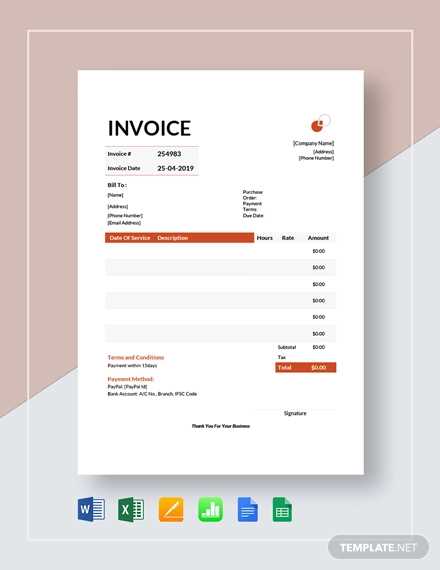

1. Personalizing the Design

One of the first aspects to customize is the visual layout. This includes incorporating your company’s logo, choosing a color scheme that aligns with your branding, and selecting a font that is both professional and easy to read. A well-designed document can help reinforce your brand identity while making the payment request look more official and trustworthy.

- Add your company logo at the top for brand recognition.

- Use colors that align with your branding or convey professionalism.

- Choose a clean, readable font style and size.

2. Adjusting Terms and Conditions

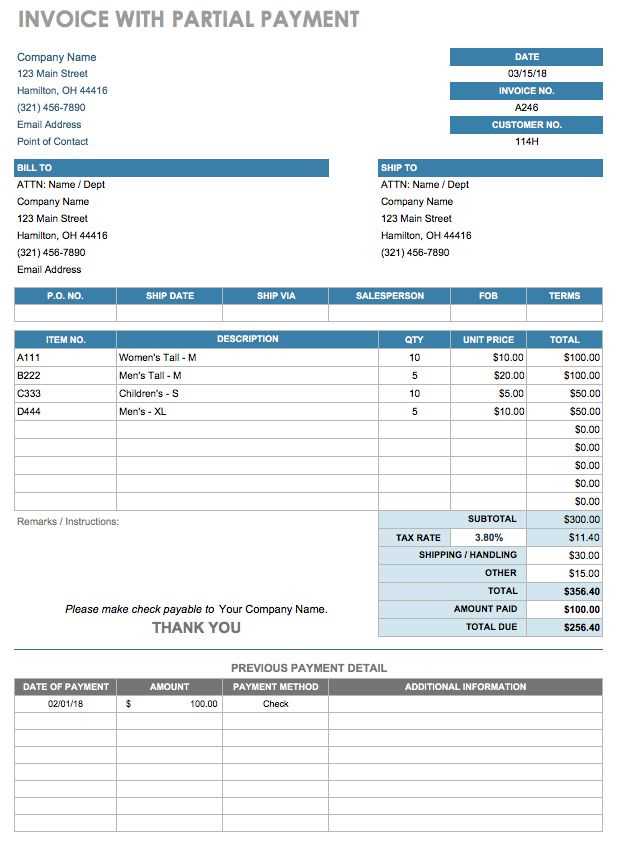

Another key area to customize is the payment terms. Each business may have different policies for payment due dates, late fees, or discounts. Clearly stating these terms in the document helps set expectations and avoids any potential confusion. You can modify sections such as:

- Payment due date

- Accepted payment methods (e.g., credit card, bank transfer)

- Late payment fees or interest

- Discounts for early payment

Flexibility: The ability to modify these terms allows you to create a document that fits your business model and client relationships. Adjusting these details for specific clients or projects ensures that the request aligns with agreed-upon conditions.

Best Practices for Invoice Design

Creating a well-designed payment request document is essential for maintaining professionalism and ensuring smooth transactions. A clear, visually appealing layout not only improves readability but also helps convey important details in an organized manner. By following best practices, you can ensure that your payment requests are effective, efficient, and easy for clients to process.

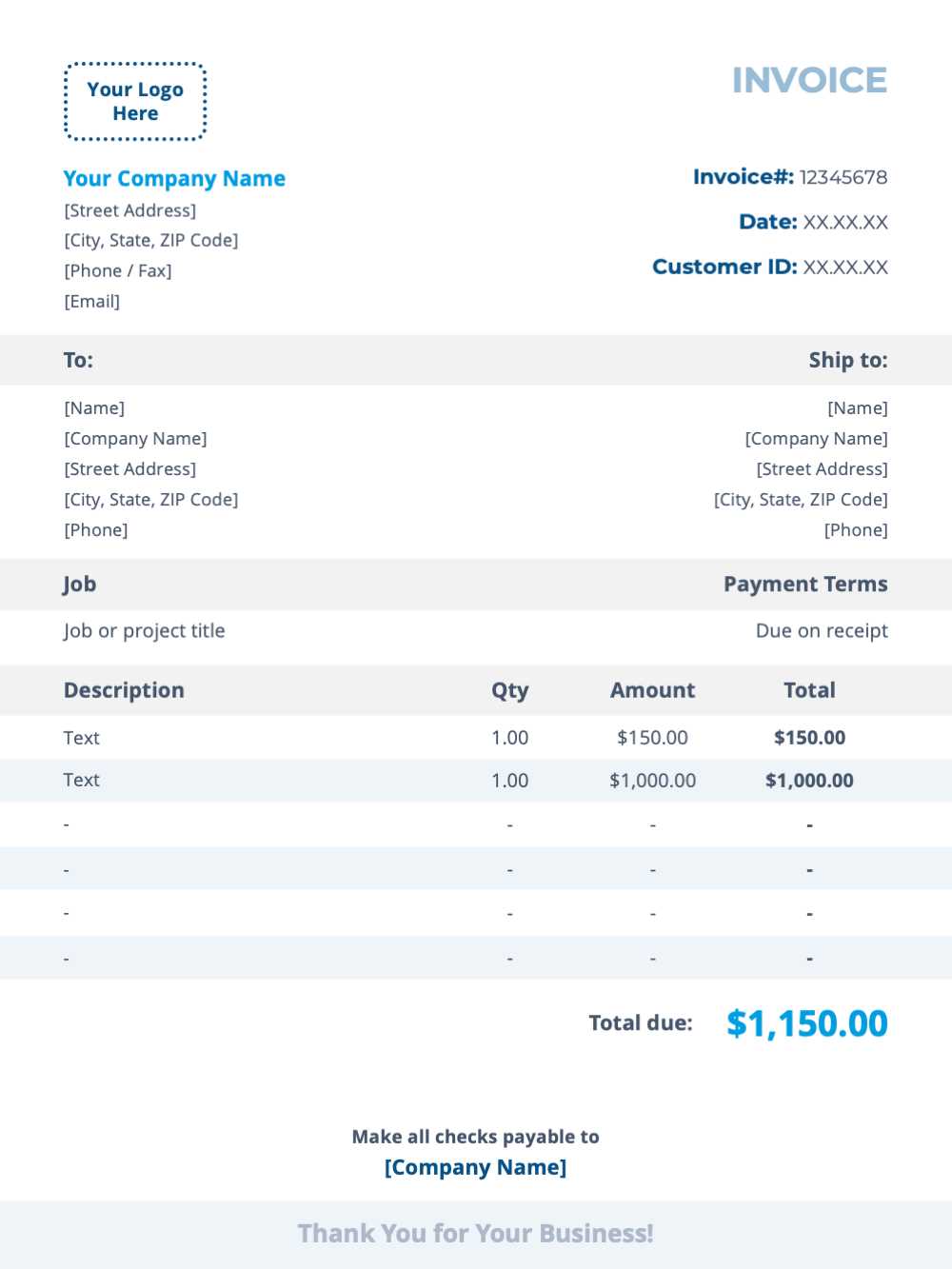

1. Keep the Layout Clean and Simple

A cluttered or overly complex design can confuse clients and delay payment. It’s important to keep the layout simple, focusing on the most relevant details. Use enough white space between sections to make the document easy to read. This includes:

- Organizing information into clear sections

- Avoiding excessive graphics or design elements

- Ensuring a logical flow of information

2. Prioritize Important Information

Highlighting key details, such as the amount due, due date, and payment terms, ensures that clients can quickly find the information they need. You can make important sections stand out by using bold fonts or larger text for specific headings. Additionally:

- Ensure that the total amount due is easily visible

- Include a clear payment deadline

- List accepted payment methods prominently

Consistency: A uniform approach to fonts, colors, and text placement helps create a professional appearance and enhances the client’s experience. The design should be consistent with your brand to reinforce recognition and trust.

How to Save Time with Templates

Using pre-designed formats for billing documents can significantly reduce the time spent on administrative tasks. Instead of creating each request from scratch, you can focus on adding specific details for each transaction, while the core structure remains consistent. This efficiency allows you to handle multiple requests quickly, minimizing delays and freeing up time for other important tasks.

1. Streamline Repetitive Tasks

With a standardized structure, many elements, such as contact information, item descriptions, and payment terms, can be pre-filled or easily copied from previous documents. This eliminates the need to rewrite common details for every request. Key benefits include:

- Pre-filled company details and client information

- Automated calculations for totals, taxes, and discounts

- Consistency in layout and structure

2. Customize Quickly for Each Client

While the overall structure remains the same, you can quickly tailor each document to suit the specifics of the transaction. By adjusting fields such as services provided, quantities, and total costs, you can create a customized document in just a few minutes. This level of flexibility allows for:

- Fast updates with minimal effort

- Personalized details for each client or project

- Eliminating manual entry errors

Efficiency: The time saved by using a pre-designed structure allows you to focus on the more important aspects of your business, such as improving customer relationships and managing operations. With less time spent on administrative work, you can boost overall productivity.

Common Mistakes in Invoice Creation

When preparing payment requests, even small errors can lead to confusion, delays, or disputes. It’s essential to pay attention to detail and ensure that all aspects of the document are accurate and complete. By avoiding common mistakes, you can streamline your billing process and maintain positive relationships with clients.

One of the most frequent mistakes is failing to include all necessary information, such as the correct billing details, payment terms, or item descriptions. Omitting these crucial elements can cause clients to question the legitimacy or accuracy of the request, which may delay payment. Another common error is miscalculating totals, taxes, or discounts, which can lead to financial discrepancies and frustration on both sides.

Another mistake is not clearly indicating payment due dates and methods. Without this information, clients may be uncertain about when and how to submit their payment. Additionally, it’s important to avoid overly complicated or unclear language in the document. Keeping the language simple and direct ensures that clients can easily understand the request and avoid unnecessary back-and-forth.

Choosing the Right Template for Your Business

Selecting the appropriate format for your payment requests is crucial for ensuring smooth financial transactions and presenting a professional image to clients. The right document can reflect your business’s unique needs, whether you’re a freelancer, a small business, or a large enterprise. By choosing the best structure, you can streamline your billing process and improve client satisfaction.

1. Understand Your Business Needs

The first step in choosing the right format is to consider the nature of your business and the type of transactions you handle. For example, if you offer products, your document may need more detailed descriptions of goods, quantities, and prices. For service-based businesses, you may focus more on hours worked, rates, and terms of engagement. Key considerations include:

- Type of business (product or service-based)

- Frequency of transactions (one-time or recurring)

- Complexity of pricing (fixed, hourly, or customized rates)

2. Consider Customization Options

Different formats offer varying levels of customization. Choose one that allows you to adjust sections according to each client or project’s unique needs. For example, some documents allow for easily adding or removing fields like discounts, taxes, or custom payment terms. When selecting a structure, consider the following:

- Ability to include your company’s logo and branding

- Flexibility in adjusting payment terms or conditions

- Ease of use for clients (clear layout and easy-to-understand details)

Consistency: While customization is important, ensure that the format remains consistent across all your payment requests. A uniform design will help clients recognize your brand and know exactly what to expect with every transaction.

Using Pay Invoice Templates for Freelancers

For freelancers, having a reliable and professional document for requesting payment is essential for maintaining a smooth workflow and ensuring timely compensation. A well-designed structure can simplify the billing process, reduce administrative tasks, and help freelancers keep track of their finances efficiently. Whether you work with one-time clients or recurring projects, using a standardized format allows you to focus more on your work and less on paperwork.

Efficiency: By using a pre-designed structure, freelancers can quickly generate documents without having to create each one from scratch. This time-saving benefit is especially important when juggling multiple clients and deadlines. Simply fill in the details for each project, such as hours worked, project milestones, or completed services, and the document is ready to send.

Professionalism: A well-organized document not only ensures that you get paid promptly but also presents you as a reliable and professional worker. Clear and accurate requests for payment reduce the likelihood of misunderstandings or disputes. You can further enhance your credibility by adding your personal branding, such as a logo or business name, to the document.

Customization: While using a standardized format, freelancers can easily tailor each request to fit the specific requirements of different clients. Whether it’s adjusting payment terms, adding a discount for early payment, or including specific project details, customization helps keep the relationship personal and professional.

Ensuring Legal Compliance with Invoices

When preparing payment requests, it’s important to ensure that all documents comply with local regulations and industry standards. Proper documentation not only protects your business but also helps avoid legal disputes and delays in payment. By including the right information and following the necessary guidelines, you can ensure that your requests meet all legal requirements.

1. Include Required Legal Information

Different regions and industries may have specific legal requirements for billing documents. It’s crucial to include all mandatory information to ensure compliance. Some of the key details you must include are:

- Your business name, address, and registration number (if applicable)

- The client’s name and address

- Unique document reference number

- Date of issue and payment due date

- Tax identification number (if required by law)

2. Stay Updated with Tax Laws

Another important aspect is adhering to tax laws, especially when it comes to VAT or sales tax. Make sure to include the correct tax rates and ensure that your documents reflect any changes in tax legislation. Not doing so can result in penalties or delays in payments. You should also:

- Clearly state the tax rate applied to each item or service

- Ensure the total tax amount is shown separately

- Include any exemptions or tax breaks, if applicable

Record Keeping: Proper record-keeping is not only important for business organization but also necessary for tax filing and legal purposes. Keeping detailed and compliant billing records ensures that your business remains transparent and accountable.

Top Tools for Creating Invoices

When managing your billing process, using the right software can save time and ensure accuracy. There are several powerful tools available that allow businesses to quickly generate and send professional payment requests. These platforms often include useful features such as automatic calculations, customizable designs, and easy client tracking, all of which help streamline your workflow.

1. QuickBooks

QuickBooks is a popular accounting software that offers comprehensive features for managing payments and generating billing documents. It allows you to create detailed payment requests with custom branding, track outstanding payments, and even integrate with your bank accounts for easy reconciliation. Key features include:

- Automated billing and recurring payments

- Customizable document formats and payment terms

- Seamless integration with accounting and tax tools

2. FreshBooks

FreshBooks is another excellent option for small business owners and freelancers. Known for its user-friendly interface, it allows you to generate professional documents in minutes. FreshBooks also helps you track time, manage projects, and easily follow up on overdue payments. Features include:

- Customizable payment requests

- Time tracking and expense management

- Integration with payment gateways for easy transactions

Efficiency: Both of these tools offer cloud-based solutions, making it easy to access your documents from anywhere. Whether you’re on the go or working from your home office, you can quickly generate and send payment requests to clients with just a few clicks.

How to Track Payments Effectively

Tracking payments is essential for maintaining healthy cash flow and ensuring that all financial transactions are completed on time. Whether you are managing payments from multiple clients or overseeing large-scale projects, having an organized system in place can help you stay on top of your finances. By using the right tools and practices, you can ensure that every transaction is recorded accurately and promptly.

1. Use Accounting Software

One of the most effective ways to track payments is by using accounting software. These tools help automate the process, allowing you to keep a detailed record of all incoming payments, track outstanding balances, and generate reports for future reference. Some benefits include:

- Automatic tracking of payments and due dates

- Integration with bank accounts for seamless updates

- Easy generation of payment reports for tax purposes

2. Create a Payment Tracking System

If you prefer a more manual approach, creating a custom payment tracking system can be just as effective. This can be done using spreadsheets or simple database tools. A basic tracking system should include:

- Client name and contact details

- Payment due date and actual payment date

- Amount due and amount received

- Outstanding balance (if any)

Consistency: Regardless of whether you use software or spreadsheets, it’s important to update the payment records regularly. This ensures you never miss a payment and can easily follow up on overdue amounts.

3. Set Payment Reminders

Another useful method to track payments effectively is setting reminders for due dates. Many accounting platforms and apps can automatically remind you when payments are due, but if you’re using manual tracking, setting calendar reminders or task alerts can help you stay organized and prompt clients as needed.

- Set reminders for both due dates and late payments

- Follow up regularly with clients on overdue balances

- Ensure clear communication on payment expectations

Proactive Communication: By keeping a close eye on payment schedules and commu

Formatting Tips for Professional Invoices

Creating well-structured and professional payment requests not only helps ensure clarity but also enhances your business’s credibility. A properly formatted document is essential for preventing misunderstandings and speeding up payment processing. By following a few simple formatting tips, you can create a polished and easy-to-read document that clients will appreciate.

1. Use Clear and Consistent Layouts

A clean, organized layout is crucial for readability. Ensure your document is structured logically, with distinct sections for key details such as client information, services or products provided, payment terms, and totals. Consider the following:

- Start with a header that clearly displays your business name and contact information.

- Separate sections with ample white space to avoid a cluttered look.

- Use bold fonts for headings and totals to make them stand out.

2. Include All Essential Information

Ensure that your payment request contains all the necessary elements to avoid confusion. Missing information can lead to delays or disputes, so it’s important to be thorough. Include the following:

- Your business name, address, and contact details

- Client’s name and address

- Unique reference number for the document

- Clear breakdown of services/products, quantities, rates, and totals

- Payment terms, including due date and any late fees or discounts

Tip: Including a unique reference number helps track transactions easily, especially if you manage multiple clients or projects.

3. Use Professional Fonts and Colors

The choice of fonts and colors can greatly impact how your document is perceived. Opt for a clean, professional font and avoid excessive use of colors or graphics. Stick to neutral tones for a polished look. Some guide

Incorporating Branding into Your Invoice

Integrating your brand identity into your payment requests not only enhances your professionalism but also reinforces your business’s image. A branded document reflects your commitment to quality and can help establish trust with your clients. By incorporating elements of your brand, such as your logo, color scheme, and typography, you can create a cohesive experience for clients that goes beyond just the services or products you provide.

1. Include Your Logo and Company Name

One of the most straightforward ways to incorporate branding is by including your logo and company name prominently on the document. This not only makes your payment request more recognizable but also strengthens your brand’s presence. Consider placing your logo at the top of the document, along with your business name and contact information. This gives the document a professional look and makes it clear who the request is coming from. Some tips include:

- Ensure your logo is high-resolution and appropriately sized.

- Position your business name clearly, so it’s easy to spot.

- Use consistent branding across all your documents for a unified appearance.

2. Utilize Your Brand Colors and Fonts

Incorporating your brand’s colors and fonts can make your payment requests feel more aligned with your overall marketing materials. By sticking to the colors and typography that represent your business, you can create a seamless experience for clients from their initial interaction with your brand to the completion of a project. Keep the following in mind:

- Use your primary brand colors for headings, borders, and highlights.

- Ensure font choices match the style of your website and other materials–opt for professional, easy-to-read fonts.

- Don’t overdo it–maintain a balance between branding and functionality, keeping the document clean and readable.

Consistency: Your brand’s identity should be consistent across all client touchpoints. By incorporating your branding into your payment requests, you reinforce your business image, making it easier for clients to recognize and remember your company.

Free vs Paid Invoice Templates

When choosing a format for creating your payment requests, one of the primary considerations is whether to opt for a free or paid solution. Both options offer distinct advantages, depending on your business needs, the volume of transactions, and the level of customization you require. Understanding the differences between free and paid options will help you make an informed decision about what’s best for your business.

1. Advantages of Free Options

Free solutions are a popular choice for small businesses, freelancers, or those just starting out. These formats are often basic but can still cover the essential elements of a payment request. Key benefits include:

- No initial investment required

- Simple to use and widely available

- Quick setup and easy access

However, free options may have limitations in terms of design flexibility, branding options, and advanced features. If you are looking for a minimalist solution that gets the job done without extra features, a free format could be sufficient.

2. Advantages of Paid Solutions

Paid formats provide additional features and customization options that may be beneficial for businesses with more complex needs. These advanced solutions often include more professional designs, the ability to add your brand’s logo, and automated features that save time. Some advantages include:

- Fully customizable design to match your branding

- Advanced features such as automatic calculations and recurring billing

- Integration with accounting software and payment gateways

Customization: Paid solutions often allow greater flexibility in adjusting the document to meet your specific business needs. If you require more sophisticated features and enhanced control over the document’s appearance, a paid option may be worth the investment.

3. Choosing the Right Option for Your Business

Your choice between free and paid options depends largely on your business size, industry, and the volume of transactions you manage. For small or one-time projects, a free solution may suffice. However, as your business grows and you require more customization and automation, investing in a paid solution might become a more efficient and cost-effective choice in the long run.