Patient Invoice Template for Healthcare Providers

Managing financial transactions efficiently is essential for healthcare providers. Clear documentation of services and charges ensures smooth communication between medical professionals and their clients. By using standardized formats for billing, organizations can simplify the process, improve accuracy, and reduce misunderstandings.

Adopting a consistent structure for charging and tracking payments provides numerous benefits, including improved cash flow and easier management of financial records. Such systems also help maintain transparency, building trust between healthcare workers and those they serve.

In this guide, we will explore how to streamline the process of preparing and delivering financial documents. You will learn how to create customized solutions that meet both legal and professional standards while saving time and resources.

Patient Invoice Template Overview

Creating an effective billing document is an essential task for healthcare professionals. A well-structured financial record helps ensure that all services provided are accurately listed and billed, minimizing confusion and enhancing the payment process. The right format can make all the difference in ensuring that payments are processed quickly and correctly.

These records are not only essential for maintaining clear communication with clients but also play a vital role in keeping track of payments and ensuring compliance with relevant regulations. A professional and organized financial statement is key to streamlining operations and reducing administrative work.

By implementing a standardized billing system, healthcare providers can save time and reduce errors. With the right tools, it becomes easier to tailor the information presented according to specific services, charges, and payment methods, ensuring both clarity and accuracy.

Why Use a Patient Invoice Template

Adopting a structured approach to creating billing records offers significant advantages to healthcare providers. When payment details are clearly organized, it helps avoid mistakes and ensures that the financial process runs smoothly. Having a standardized format also minimizes the time spent on administrative tasks, allowing medical professionals to focus on providing care.

Enhanced Accuracy and Consistency

By using a consistent format, each charge and service is clearly listed and accounted for. This helps ensure that no details are overlooked and that the billing process remains accurate, which is crucial for maintaining trust with clients and ensuring timely payments. Moreover, having a uniform structure reduces the chance of errors in financial documentation.

Time and Resource Efficiency

With a ready-to-use structure, healthcare providers can easily customize each document to fit the specifics of the care provided. This not only saves time but also reduces the administrative burden, freeing up resources for other essential tasks. Having a reusable format increases overall efficiency and helps streamline the entire billing process.

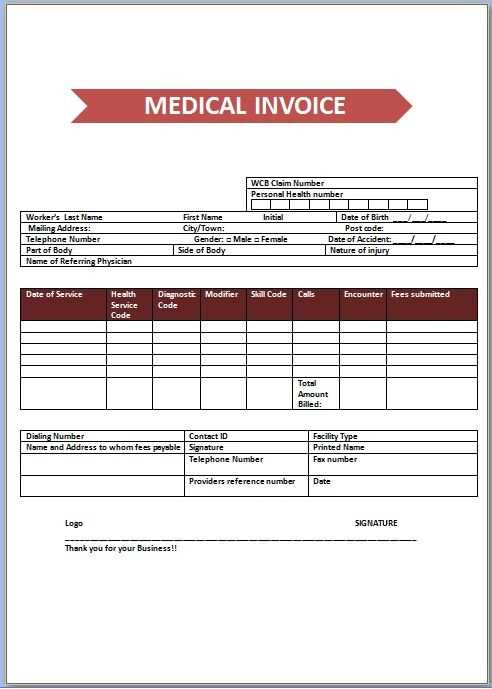

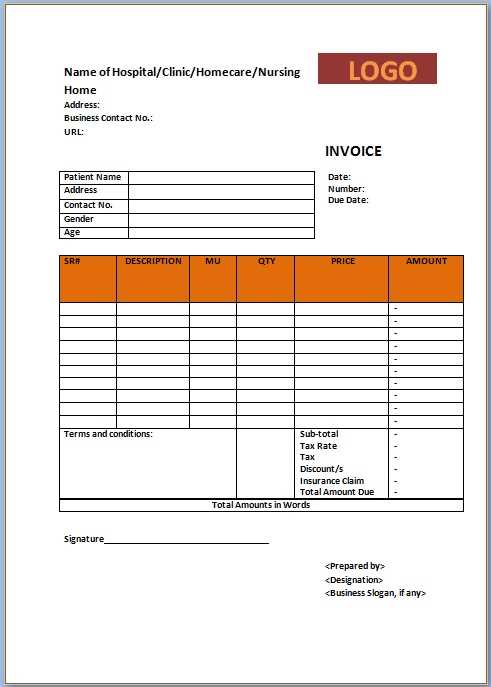

Key Elements of a Patient Invoice

For an efficient billing process, it is crucial to include all necessary information in a clear and organized manner. A well-designed financial document ensures that both the service provider and the recipient understand the details of the charges, the payment due, and the method of payment. By incorporating essential components, providers can streamline the financial transaction process and reduce the likelihood of disputes.

Essential Information for Identification

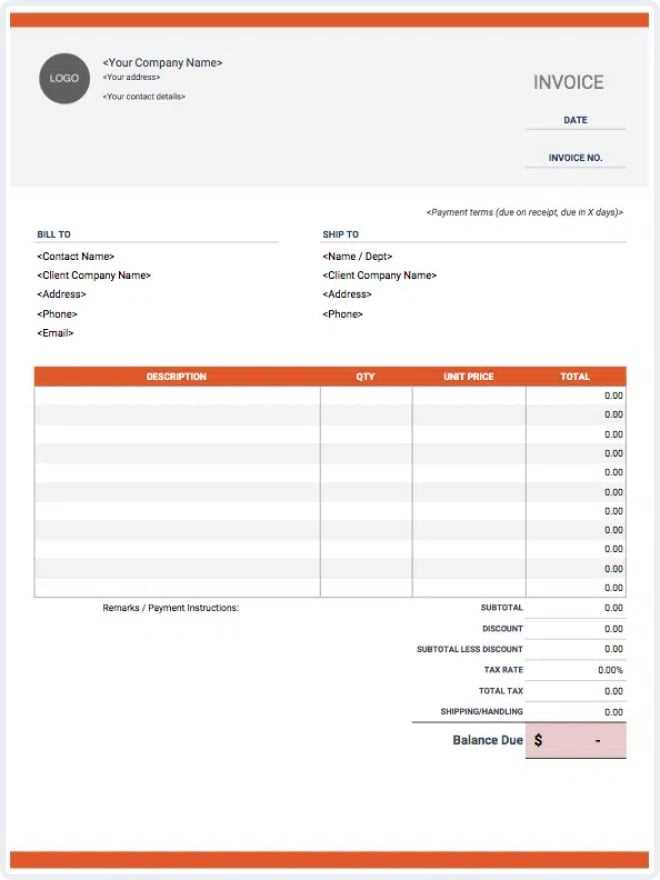

First and foremost, every financial document must clearly identify both the service provider and the recipient. This includes the name, address, and contact information for both parties. Additionally, it’s important to include a unique reference number for the document, which helps in tracking payments and avoiding confusion in case of multiple transactions.

Breakdown of Services and Costs

The next key element is the clear listing of the services provided and their corresponding costs. Each service should be described in detail, along with its individual charge. This transparency helps to prevent misunderstandings and ensures that the recipient knows exactly what they are being billed for. Additionally, payment terms, including any due dates or late fees, should be clearly stated to avoid delays in settlement.

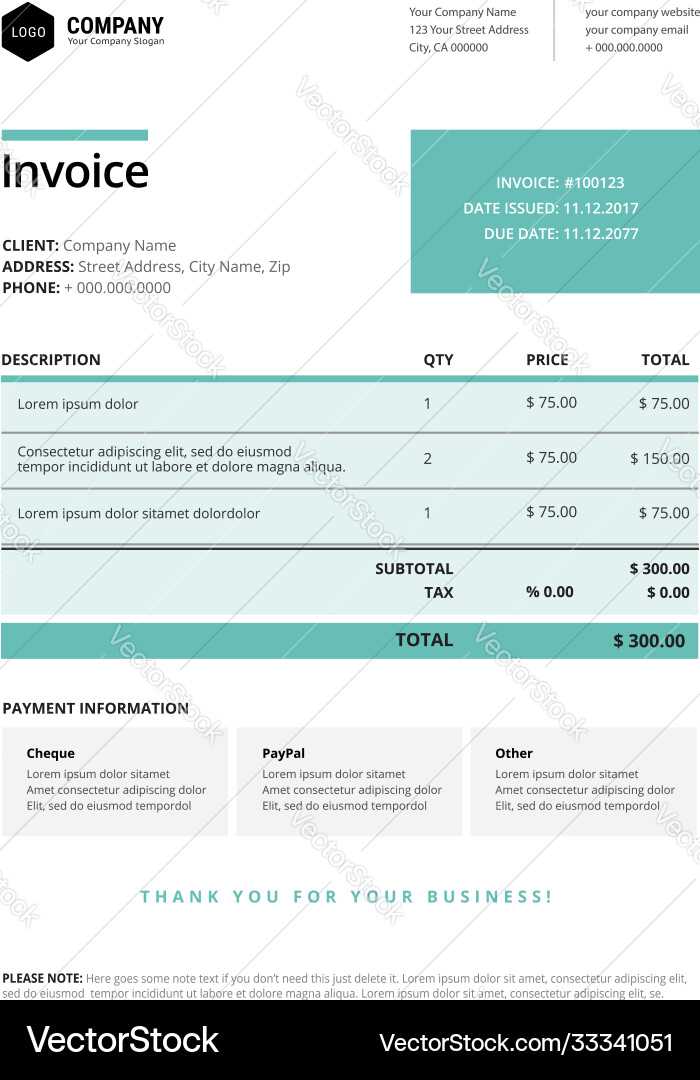

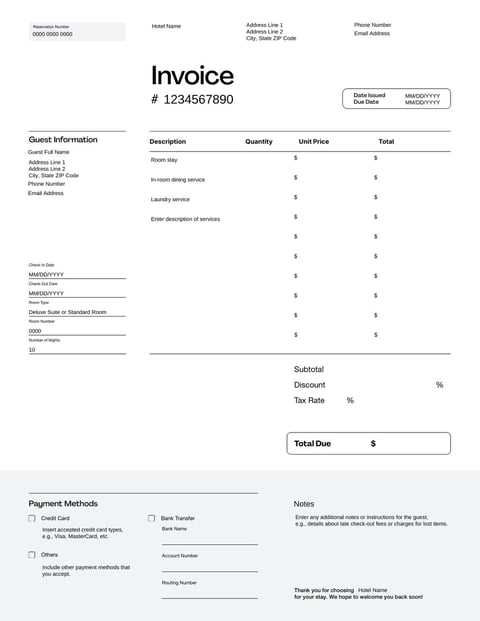

How to Customize Your Template

Customizing a financial record format allows healthcare providers to tailor the document to their specific needs while maintaining clarity and professionalism. By adjusting the design and structure, you can ensure that the document reflects your branding, includes all necessary information, and meets legal or regulatory requirements. A flexible system allows you to personalize each record for different types of care or patient categories.

Adjusting the Layout for Clarity

The layout of your document should be simple and easy to navigate. It’s important to use clear headings and sections, such as service description, costs, and payment details. By customizing these sections, you can ensure that the recipient easily understands the information. Prioritize readability by using appropriate fonts, spacing, and alignment.

Incorporating Branding Elements

Incorporating your practice’s logo, colors, and other branding elements helps make the document professional and recognizable. Adding such elements not only improves the visual appeal but also reinforces your identity. Be sure to keep these elements subtle and consistent to avoid cluttering the document.

Benefits for Healthcare Providers

Implementing a structured approach to billing offers numerous advantages for healthcare professionals, improving both efficiency and accuracy. When the financial documentation is clear and consistent, it helps streamline administrative tasks, reduces errors, and ensures that payments are processed in a timely manner. These benefits can significantly enhance the overall workflow within a healthcare practice.

- Time Savings: Standardized formats eliminate the need to create each document from scratch, saving time for administrative staff.

- Improved Cash Flow: Clear and accurate billing reduces payment delays, ensuring faster reimbursement for services rendered.

- Enhanced Client Communication: A well-organized statement makes it easier for clients to understand their charges and payment responsibilities.

- Minimized Errors: Using predefined formats helps eliminate mistakes, such as missing charges or incorrect calculations.

- Legal Compliance: Adhering to standardized billing practices helps ensure that records meet regulatory and legal requirements.

- Professional Image: Customizing financial documents with your branding improves your practice’s appearance and enhances trust with clients.

Common Errors in Patient Invoices

Despite the advantages of using a structured financial document, there are common mistakes that can occur during the creation and management of billing records. These errors can lead to confusion, delayed payments, and even legal issues. Identifying and correcting these issues early can help maintain an efficient billing process and improve client relationships.

Frequent Mistakes in Billing Records

- Incorrect Charges: Failing to correctly list all services or miscalculating fees can lead to discrepancies that cause delays in payments.

- Missing Contact Information: Not including the full contact details of both the provider and the recipient can make it difficult to resolve disputes or track payments.

- Omitting Payment Terms: Without clearly stated payment terms, such as due dates or penalties for late payments, it can result in confusion and delayed payments.

- Inconsistent Formatting: Using different formats for each document can lead to confusion, errors, and inefficiencies in the billing process.

- Failure to Include Insurance Details: For services covered by insurance, not including the necessary information can cause delays in claims processing.

How to Avoid These Errors

- Double-checking Details: Always review the charges and information to ensure everything is accurate and complete before sending out the document.

- Using Predefined Structures: Adopting a consistent format reduces the chances of mistakes and ensures all required fields are included.

- Clarifying Payment Terms: Make payment terms clear and easy to understand to avoid any misunderstandings or delays.

Legal Considerations for Invoicing

When creating financial documents for services rendered, it’s important to adhere to legal guidelines to ensure compliance with both local and national regulations. A proper understanding of these legal requirements helps protect both healthcare providers and recipients. Failure to meet these standards can lead to disputes, fines, or even legal action.

Key Legal Aspects to Consider

- Clear Documentation: Every charge and service should be clearly documented with enough detail to avoid misunderstandings and provide a transparent record for both parties.

- Compliance with Tax Regulations: Ensure that all taxes, such as sales tax or value-added tax (VAT), are accurately included as required by law.

- Retention of Records: Many jurisdictions require businesses to retain financial records for a specific period. Failure to comply with these retention periods can result in penalties.

- Payment Terms: Clearly defined terms, including due dates, late fees, and payment methods, must be stated to avoid any legal disputes.

- Confidentiality and Privacy: Protecting client information in accordance with privacy laws (such as HIPAA in the U.S.) is essential when creating financial documents.

How to Ensure Compliance

- Consult with Legal Experts: Regularly consult with legal professionals to stay updated on regulations and ensure that billing records meet all legal standards.

- Use Standardized Formats: Employing a standardized approach helps ensure that all required legal information is consistently included in each record.

- Regular Audits: Conduct periodic reviews of your billing practices to identify and correct any potential legal issues.

Formatting Tips for Clear Invoices

A well-organized financial document plays a crucial role in ensuring that all details are easy to read and understand. Proper formatting enhances clarity, reduces errors, and improves the overall efficiency of the payment process. By following a few key principles, you can create a document that is both professional and user-friendly.

Use Clear Headings and Sections: Divide the document into clearly labeled sections, such as services, costs, payment terms, and contact information. This helps the reader navigate the document easily and find the information they need without confusion.

Choose Legible Fonts and Sizes: Select simple, professional fonts that are easy to read, such as Arial or Times New Roman. Ensure that the font size is large enough to be readable, but not too large to make the document seem unprofessional. A size between 10-12 points is generally ideal.

Align Information Properly: Proper alignment of text and numbers ensures that the document looks tidy and organized. Aligning all numerical values to the right makes it easier to compare charges and totals, while text should be aligned to the left or center for readability.

Include Sufficient Spacing: Use ample white space between sections to avoid a cluttered appearance. This makes the document easier to read and ensures that the recipient does not feel overwhelmed by too much information on a single page.

Highlight Key Information: Important details such as total amounts, payment due dates, and client contact information should be emphasized using bold or larger fonts. This draws attention to critical points and makes them easy to find.

Integrating Payments with Invoices

Streamlining the payment process through seamless integration with billing documents helps both providers and clients manage transactions efficiently. By offering multiple payment methods directly within the financial document, you can simplify the payment process and encourage timely settlements. Clear instructions and payment links included in the record can also reduce confusion and improve cash flow.

Common Payment Methods to Include

Incorporating a variety of payment options in the document allows clients to choose the most convenient method for them. Here are some commonly used options:

| Payment Method | Description |

|---|---|

| Credit/Debit Cards | Allowing clients to pay using their cards is quick and convenient for both parties. |

| Bank Transfers | Bank transfers offer a secure method for clients to settle larger amounts. |

| Online Payment Systems | Platforms such as PayPal or Stripe make digital payments easy, fast, and secure. |

| Checks | Although less common today, checks are still a valid option for many businesses. |

Providing Clear Payment Instructions

Including detailed payment instructions is essential for minimizing confusion. Make sure to specify how clients can complete payments, include links to online payment portals if available, and provide any necessary account or reference numbers. Also, clearly state the payment due date and any late fee policies to encourage timely payment.

Setting Payment Terms in Invoices

Establishing clear and precise payment terms is essential for ensuring smooth financial transactions. These terms outline the expectations for payment, including the due date, accepted payment methods, and any penalties for late payments. By setting these conditions in advance, businesses can reduce confusion and increase the likelihood of receiving timely payments.

Important Elements of Payment Terms

- Due Date: Clearly state when the payment is expected. This could be a specific date or a set period after the service is provided, such as “net 30” (30 days from the issue date).

- Late Fees: Specify any charges for late payments, such as a percentage of the total amount due after the due date. This encourages timely payment.

- Accepted Payment Methods: List all available payment methods, such as credit cards, bank transfers, or online payment systems, to ensure convenience for the recipient.

- Discounts for Early Payment: Consider offering a small discount if the payment is made before a certain date as an incentive for faster processing.

Tips for Setting Effective Payment Terms

- Be Clear and Direct: Avoid ambiguity by clearly stating all payment conditions and making them easy to understand.

- Align with Industry Standards: Ensure your terms are in line with common practices in your industry to avoid pushing away potential clients.

- Consider Flexibility: Offering flexible payment options, such as installment plans, can help clients meet payment obligations more easily.

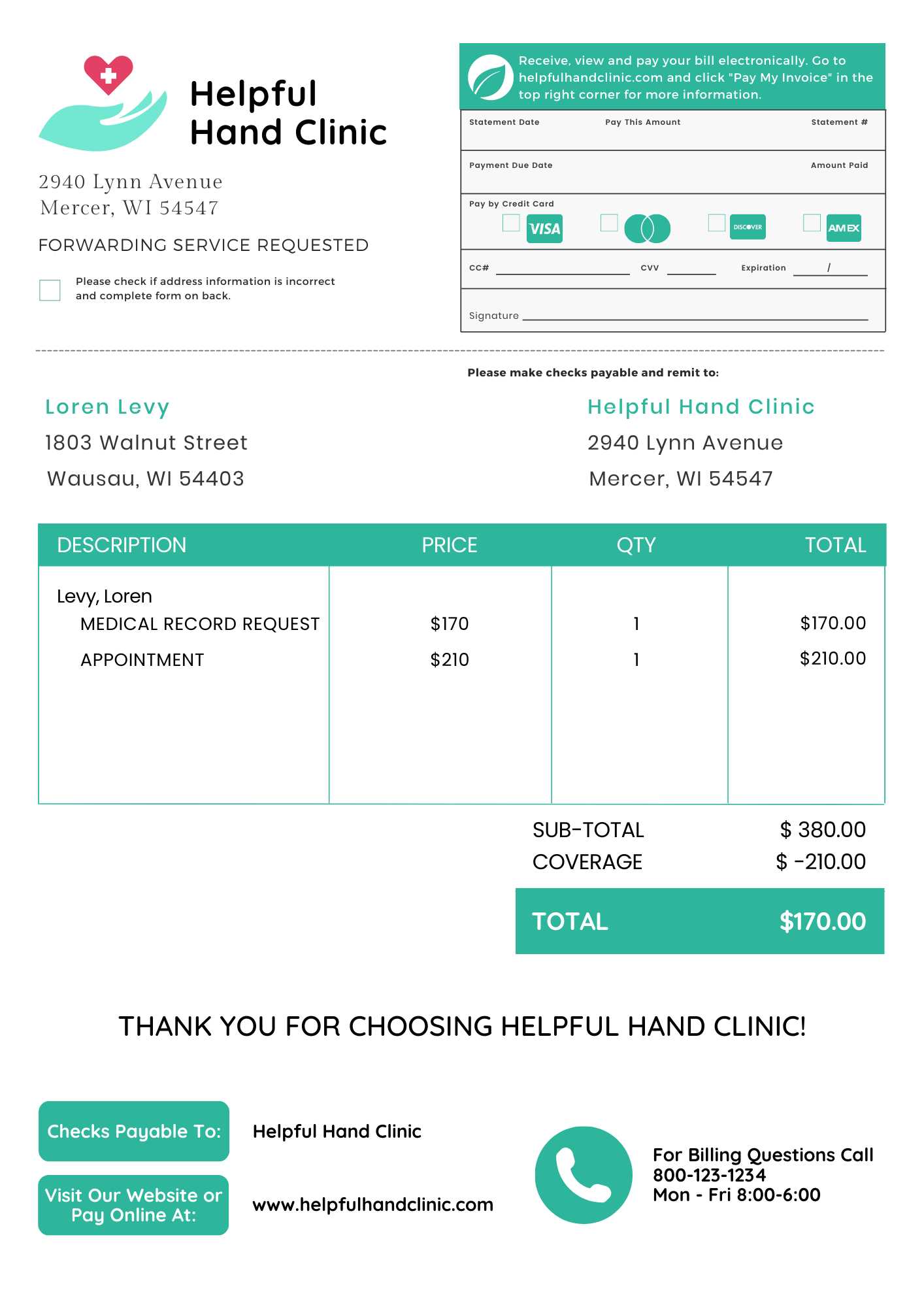

Managing Insurance Billing with Templates

Handling insurance-related billing can be complex due to the various requirements and documentation needed. By utilizing structured formats for generating bills, healthcare providers can streamline this process, ensuring that all necessary information is included and presented correctly. This approach not only reduces administrative errors but also improves the speed and accuracy of claims processing.

Key Steps in Insurance Billing

- Gather Complete Information: Before preparing the billing document, ensure all relevant details, such as patient information, service codes, and insurance policy numbers, are collected accurately.

- Verify Insurance Coverage: Confirm the patient’s insurance coverage and eligibility to prevent potential issues with claim rejections or delays.

- Document Services Provided: Clearly list the services rendered, including codes and descriptions, to match the insurance policy’s requirements for reimbursement.

- Specify Amounts Covered: Break down the charges, specifying the amount covered by the insurance company and any remaining balance that the patient is responsible for.

- Use Consistent Formats: Use a consistent layout that meets the insurance company’s specifications, ensuring that the information is easy to review and process.

Best Practices for Efficient Insurance Billing

- Stay Updated on Insurance Regulations: Regularly review changes in insurance policies and billing guidelines to ensure compliance with the latest requirements.

- Submit Claims Promptly: Aim to submit claims as soon as possible after services are provided to minimize delays in reimbursement.

- Track Claim Status: Keep track of submitted claims to monitor their status, and follow up promptly on any unpaid or denied claims.

- Maintain Clear Communication: Foster clear communication with the insurance company to address any discrepancies or issues that may arise during the billing process.

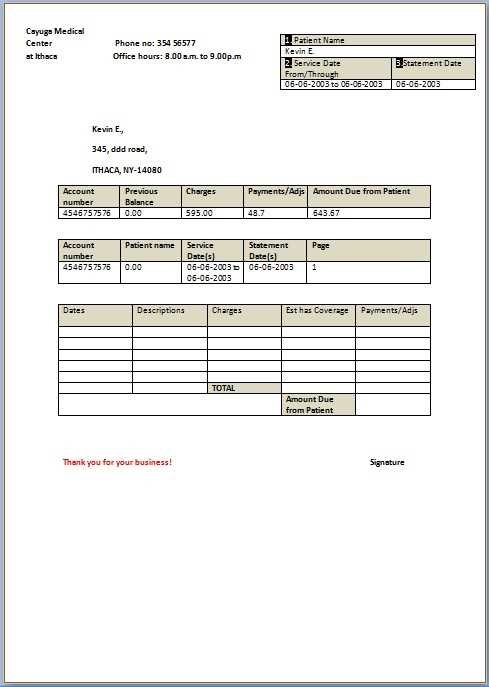

Tracking Payments and Unpaid Invoices

Effectively managing payments and monitoring outstanding balances is essential for maintaining healthy cash flow. By keeping track of completed transactions and identifying overdue amounts, businesses can ensure they are paid on time and take appropriate actions for any unpaid balances. Proper tracking reduces confusion, minimizes errors, and helps avoid missed payments.

Methods for Tracking Payments

- Automated Payment Systems: Using automated tools to track payments in real time helps ensure all transactions are recorded instantly and accurately.

- Spreadsheet Tracking: For smaller operations, keeping a detailed spreadsheet can serve as an effective method for manually monitoring payments and due dates.

- Payment Reminders: Setting up reminders for upcoming payments or overdue balances can help ensure clients settle their accounts promptly.

- Integrating with Accounting Software: Accounting software can integrate payments with billing records, providing a comprehensive overview of payment status and ensuring all amounts are correctly matched.

Handling Unpaid Balances

- Establish Clear Payment Terms: Clearly define payment expectations, including due dates and late fees, to encourage timely payment and set the tone for follow-up actions if payments are missed.

- Follow-Up Communications: Regularly follow up with clients who have overdue balances, offering solutions or payment plans if needed.

- Offer Flexible Payment Options: If clients are unable to pay in full, consider offering installment plans or other flexible arrangements to help them meet their financial obligations.

- Use Collection Services: In cases of extended non-payment, it may be necessary to engage a collection agency to recover outstanding amounts.

Using Digital Invoices for Efficiency

Embracing digital methods for managing billing documents offers numerous advantages, significantly improving the speed and accuracy of financial transactions. Digital solutions streamline the entire process, from creation and sending to tracking and payment collection, reducing the chances of errors and delays. These tools also provide convenient access and enhance the overall efficiency of managing financial records.

Advantages of Going Digital

- Faster Processing: Digital documents can be created, sent, and received instantly, eliminating the delays associated with paper-based methods.

- Reduced Errors: Automated calculations and pre-filled fields minimize the risk of human error, ensuring that all charges are correctly listed and totals are accurate.

- Easy Tracking: Digital platforms allow for real-time tracking of payments, helping businesses quickly identify overdue balances and follow up when necessary.

- Cost Savings: Going digital reduces the need for paper, printing, and postage costs, making it a more cost-effective solution for businesses.

- Environmental Benefits: By eliminating paper-based processes, digital methods contribute to sustainability efforts, reducing waste and conserving resources.

Implementing Digital Billing Systems

- Choose the Right Software: Select a reliable and secure digital billing solution that meets your business needs and integrates seamlessly with your existing accounting or payment systems.

- Offer Multiple Payment Methods: Digital platforms often support a variety of payment options, including credit cards, bank transfers, and online payment gateways, making it easier for clients to pay on time.

- Ensure Mobile Compatibility: Ensure your system is mobile-friendly so clients can access their billing details and make payments conveniently from any device.

- Set Up Automatic Reminders: Use the automation features of digital tools to send timely payment reminders and reduce the risk of overdue payments.

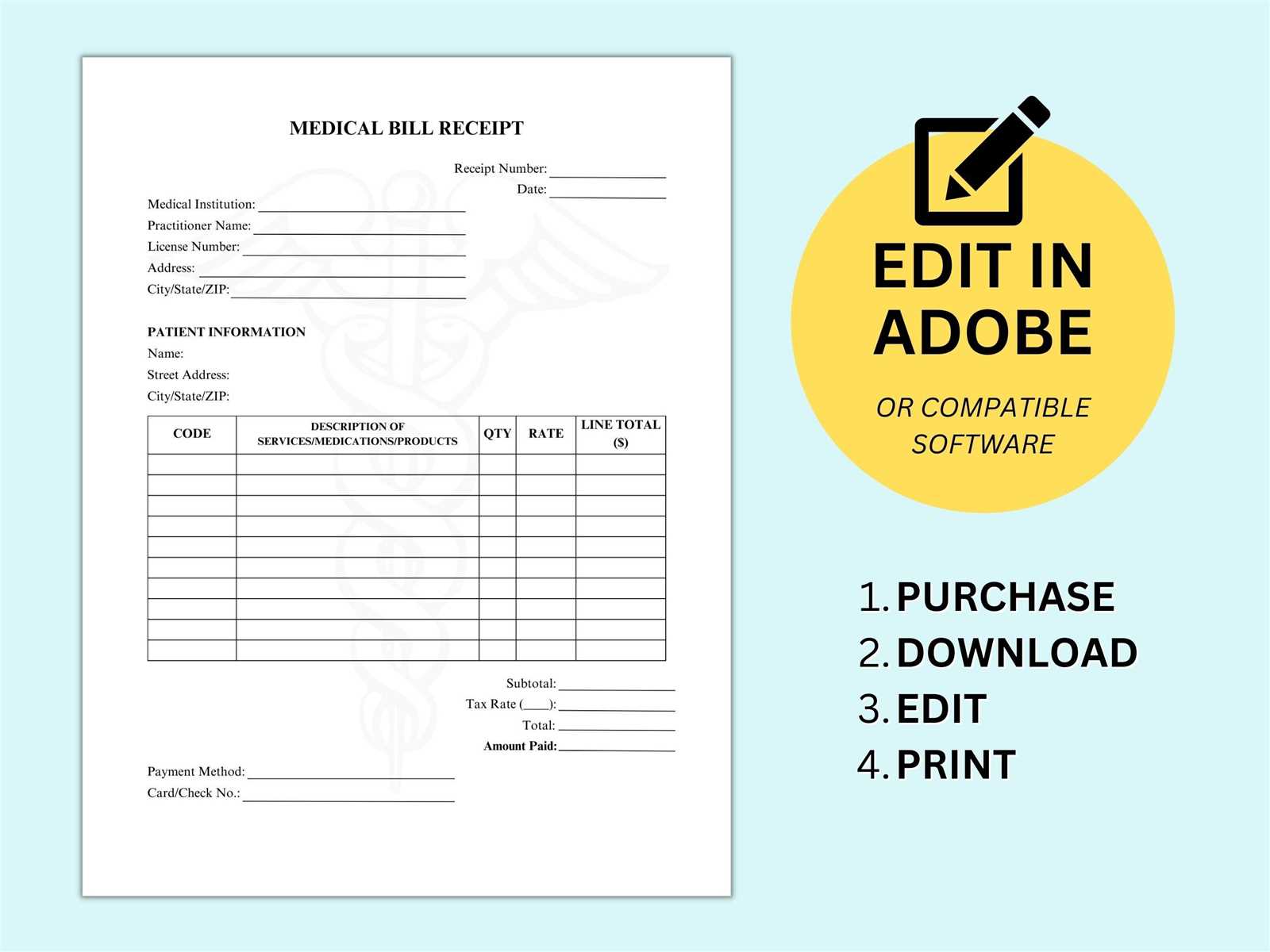

Creating Templates for Different Services

Designing billing documents that suit various types of services is essential for ensuring accuracy and consistency across all transactions. Different industries and service providers may have specific needs, so it’s crucial to tailor the structure of each document to reflect the unique nature of the services offered. This approach ensures clarity, reduces errors, and improves the overall professionalism of the billing process.

Customizing for Healthcare Providers

- Service Details: Include detailed descriptions of medical procedures, consultations, or treatments provided to the client.

- Insurance Information: Incorporate sections for billing insurance providers, including policy numbers, coverage details, and co-payment information.

- Payment Terms: Specify payment expectations, including payment deadlines and possible late fees, to ensure clients are aware of their obligations.

Customizing for Freelance Services

- Hourly or Fixed Rates: Clearly define whether the service is billed by the hour or at a fixed rate for the entire project.

- Project Milestones: Include progress-based payment plans that break down the project into stages with corresponding charges.

- Additional Costs: Account for any extra charges, such as materials, travel expenses, or specialized services, to provide a transparent breakdown of all fees.

Customizing for Consulting Firms

- Consultation Fees: Outline the specific charges for initial consultations, ongoing advice, or strategy sessions, ensuring clarity on the scope of services.

- Retainer Agreements: For long-term clients, include terms for retainer fees, detailing the services covered and any additional charges.

- Detailed Breakdown: Provide a clear breakdown of time spent on research, meetings, and other tasks to justify the overall fees.

How to Send Invoices to Patients

Effectively delivering financial documents to clients is essential for ensuring timely payments and maintaining clear communication. By choosing the right method to send billing statements, you can improve the efficiency of the process and provide a more convenient experience for the recipient. It’s important to use secure, reliable, and professional means of communication to avoid errors and delays in payment.

One of the most common methods is sending documents electronically, which allows for quick delivery and easy tracking. Email, online payment platforms, and secure client portals are popular options for sending billing statements. These digital methods not only speed up the process but also reduce the environmental impact of paper-based billing.

Alternatively, for those who prefer traditional methods, printed versions of the billing documents can be sent by post. This approach requires more time and effort but may be necessary for clients who do not have access to digital communication tools.

Regardless of the method, it’s important to ensure that the document is clearly formatted, easy to read, and includes all necessary details such as service descriptions, payment amounts, and due dates. Providing multiple payment options, such as online payments, bank transfers, or checks, can also enhance the convenience of the process for your clients.

Invoice Templates for Different Specialties

Each industry has its own specific requirements when it comes to billing for services rendered. Customizing the structure and content of the billing documents according to the particular specialty not only ensures that all necessary information is included but also reflects the unique nature of the services provided. From healthcare to consulting, the format can vary significantly to address different needs.

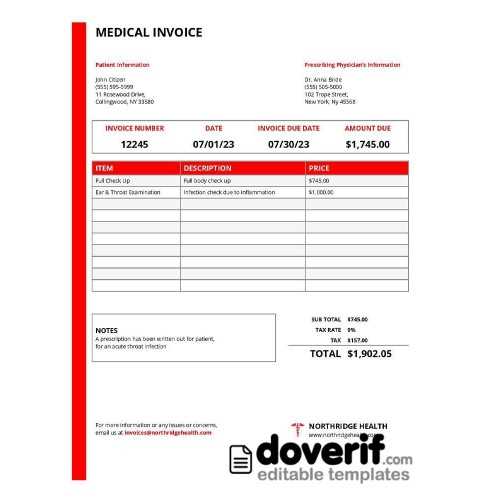

Healthcare and Medical Services

In healthcare, billing documents need to provide a detailed breakdown of medical procedures, consultations, and treatments. It’s important to include:

- Service Descriptions: Clearly list each treatment or service provided, including diagnosis codes and procedure names.

- Insurance Information: If applicable, include insurance claim details, co-pays, and out-of-pocket costs.

- Payment Terms: Set clear due dates, with additional instructions for insurance reimbursements or self-pay options.

Legal Services

For legal professionals, the billing document needs to detail the work done, often breaking down hours spent on research, meetings, and filing fees. Elements to include are:

- Hourly Rates: Specify hourly rates and the time spent on each task.

- Retainers: If a retainer is required, specify the amount and terms for its usage.

- Itemized Costs: List any additional costs such as court fees or travel expenses.

Freelancers and Consultants

Freelancers and consultants typically require a flexible billing system that can adapt to various projects. These documents often need to include:

- Project Milestones: Outline specific stages of the project, with payments due upon completion of each milestone.

- Time Tracking: For hourly work, a detailed time log of work performed is essential.

- Additional Expenses: Include any costs for tools, materials, or additional services outside the scope of the initial agreement.

Creative Services (Design, Writing, etc.)

For creative professionals, billing documents should reflect the scope of the creative work, including:

- Project Scope: Detail the deliverables, including the number of designs, revisions, or words in writing projects.

- Licensing or Usage Rights: If the work includes licensing, specify the terms for usage and ownership.

- Payment Structure: Whether it’s a flat rate or hourly charge, clearly outline how the billing will be calculated and when payments are due.

By tailoring the structure of billing statements to each specialty, service providers can enhance the clarity, accuracy, and professionalism of their financial documents, improving client satisfaction and ensuring timely payments.

Maintaining Compliance in Patient Billing

Ensuring compliance in billing is essential for service providers in regulated industries, such as healthcare. Adhering to legal, ethical, and industry-specific standards helps maintain transparency, avoid legal issues, and promote trust with clients. It’s important to ensure that all billing practices align with relevant laws and regulations, such as those set by government bodies and industry associations.

To maintain compliance, service providers should follow specific guidelines, including accurate record-keeping, transparent communication about costs, and proper handling of sensitive information. Regularly reviewing the latest rules and standards within the industry helps mitigate risks related to non-compliance.

Additionally, implementing automated systems that are designed to comply with regulations can help reduce errors, improve efficiency, and ensure that all necessary details are included in the billing process. By maintaining compliance, service providers can offer clients clear, reliable billing practices while avoiding costly legal disputes.