Effective Past Due Invoices Email Template for Timely Payment Reminders

When managing your business finances, timely payments are essential for maintaining a healthy cash flow. However, it’s common to encounter situations where clients delay or forget to settle their outstanding balances. In these cases, sending a well-crafted reminder is a critical step to ensure payments are made promptly. The right approach can help you maintain professionalism while encouraging clients to fulfill their obligations without damaging your relationship.

Crafting a professional reminder involves more than just asking for payment; it requires a balance of politeness and clarity. By setting the right tone and providing necessary information, you can improve the likelihood of a swift response. An effective message should highlight the importance of the matter and convey urgency without sounding confrontational.

Understanding how to structure these reminders and what elements to include can make all the difference. From choosing the right words to deciding the best time to reach out, every detail plays a role in achieving the desired outcome. This guide will provide you with the knowledge to approach overdue payments efficiently and respectfully, ensuring both you and your clients are satisfied with the process.

How to Write a Payment Reminder Message

When a client fails to make a payment on time, sending a reminder is necessary to prompt action. Crafting a message that is both courteous and effective is key to encouraging prompt payment while maintaining a positive relationship. It’s important to remain professional, clearly state the issue, and offer easy solutions to facilitate payment.

Start with a Clear Subject Line

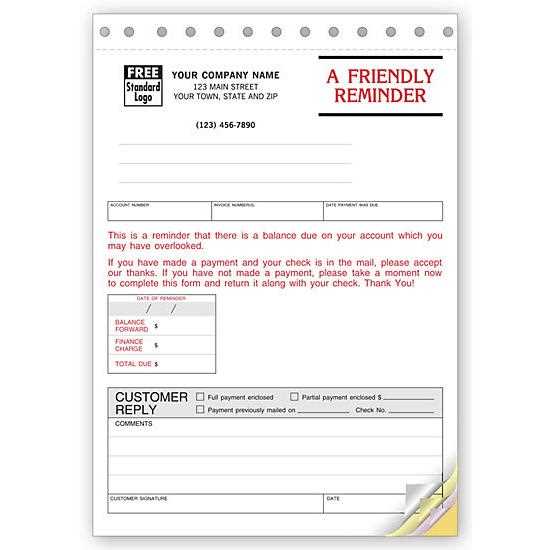

First impressions matter, and the subject line is the first thing your recipient will see. A direct yet polite subject will grab their attention without sounding too aggressive. For example, a subject like “Friendly Reminder Regarding Outstanding Balance” works well to convey urgency without being confrontational.

Structure Your Message Clearly

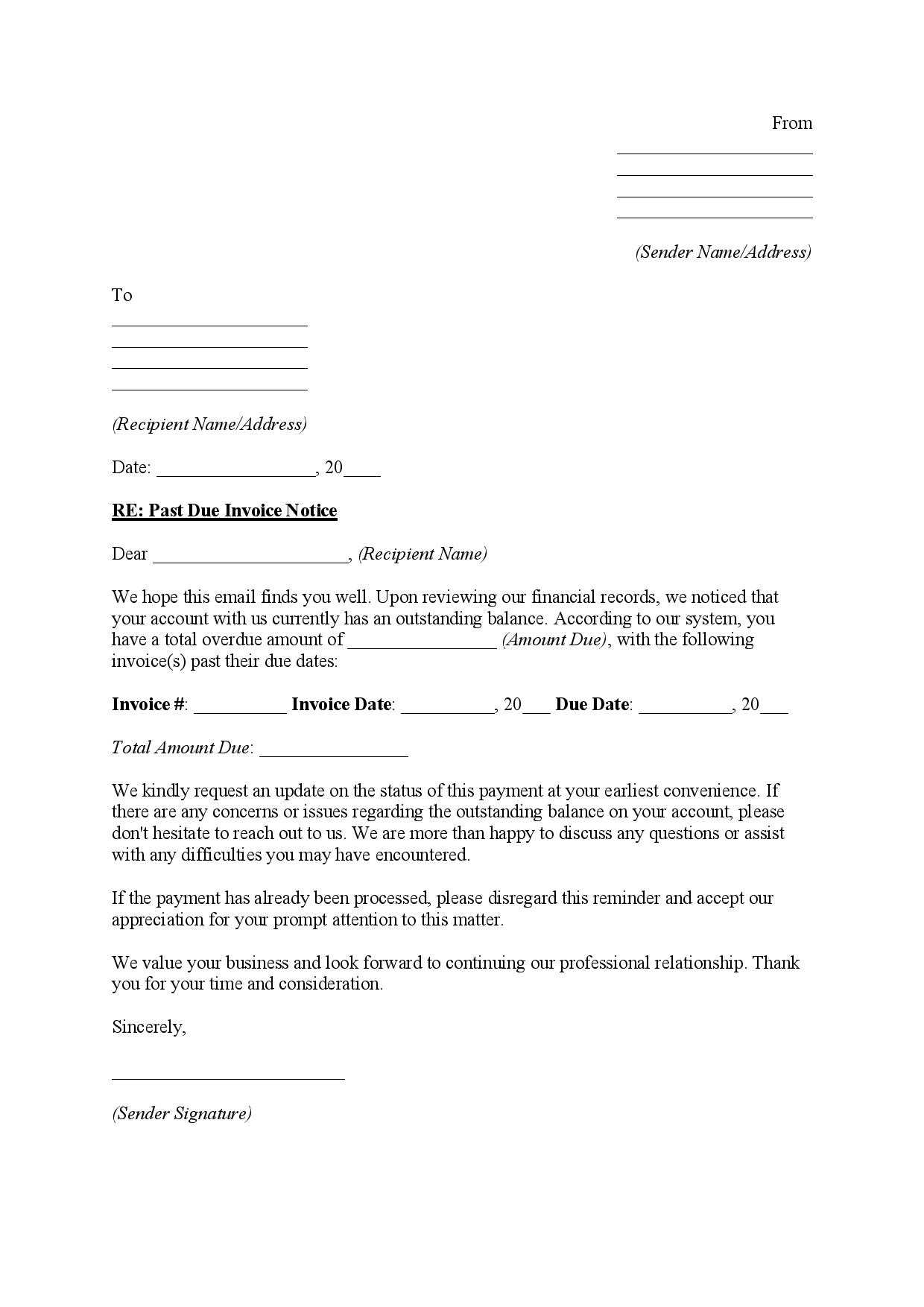

Begin with a polite greeting and identify the reason for reaching out. Acknowledge any previous communications if relevant. Be specific about the amount owed and the original payment date. Offering clear instructions on how to pay and providing contact details for questions ensures the process is as simple as possible for your client. Always include a friendly closing that encourages continued collaboration.

By focusing on clarity, respect, and professionalism, your reminder will be more likely to prompt the client to resolve the outstanding balance quickly and efficiently.

Importance of Sending Payment Reminders

Ensuring timely payments is crucial for maintaining steady cash flow and the overall financial health of any business. When clients overlook their financial obligations, it can create unnecessary stress and disrupt operations. Regular reminders help prevent these issues by prompting clients to act before the situation escalates. Sending reminders is not just about getting paid–it’s also about preserving professional relationships and maintaining a smooth business process.

- Improves cash flow: Regular reminders help keep payments on track, ensuring that your business has the funds it needs to operate effectively.

- Reduces late payments: Proactive communication minimizes the risk of clients forgetting about their financial responsibilities, leading to fewer delays.

- Strengthens client relationships: Sending friendly reminders demonstrates professionalism and fosters a sense of trust, which can lead to long-term business partnerships.

- Minimizes misunderstandings: Clear and polite reminders help clients understand exactly what is expected and when payments are due.

By regularly reaching out to clients, you encourage accountability while protecting the financial stability of your business. A well-timed reminder can prevent small issues from becoming larger disputes, ultimately improving both cash flow and client satisfaction.

Best Practices for Polite Payment Requests

When requesting payment from clients, maintaining a polite and respectful tone is essential to preserving positive relationships. A well-crafted message can encourage prompt action while demonstrating professionalism and courtesy. By following a few simple guidelines, you can ensure that your payment requests are effective without coming across as pushy or demanding.

Be Clear and Concise

While it’s important to be polite, it’s equally crucial to be direct. Avoid unnecessary jargon or overly complex language. Clearly state the amount owed, the original payment date, and any necessary details, such as payment methods or reference numbers. Clients should immediately understand the purpose of your message.

Maintain a Friendly and Professional Tone

Start with a warm greeting and express appreciation for their business. Even if the payment is overdue, it’s important to acknowledge the positive aspects of your working relationship. Phrases like “We value your partnership” or “Thank you for your continued trust” help maintain goodwill, making it easier for clients to respond positively to your request.

Timely follow-ups are essential, but ensuring they’re polite and considerate will go a long way in maintaining a respectful and professional rapport with clients.

Key Elements of an Effective Payment Reminder

When requesting outstanding payments, an effective message should be clear, respectful, and easy to act upon. The right structure and tone can make all the difference in ensuring a prompt response. Focusing on a few key elements will ensure that your message is professional, polite, and likely to get results.

Clear Subject Line

The subject line is the first thing your recipient will see, so it’s essential to make it clear and direct. A well-chosen subject sets the tone for the rest of the message. It should communicate the purpose of the communication without being too aggressive or confrontational. For instance, “Reminder: Outstanding Balance on Your Account” or “Friendly Reminder Regarding Payment” are polite yet effective subject lines.

Concise and Professional Message

Start by thanking the client for their business and briefly reminding them of the agreed-upon payment terms. Make sure to include specific details such as the amount owed, the original payment date, and any relevant reference numbers. Offer payment instructions and let them know how they can reach you if there are any questions or issues. A clear call to action is vital for guiding the client toward resolving the matter.

Politeness and professionalism are critical in keeping the communication positive. Avoid sounding demanding, and instead focus on maintaining a cooperative and respectful tone throughout the message.

Common Mistakes in Payment Reminder Messages

When requesting payment from clients, it’s easy to make missteps that could hinder your chances of receiving a timely response. A poorly written message can come across as unprofessional or may not convey the necessary information clearly. Being aware of common mistakes and avoiding them will help ensure that your communication remains effective and courteous.

Using a Harsh Tone

One of the biggest errors in payment requests is using a tone that sounds too aggressive or demanding. Even if the payment is overdue, approaching the situation with hostility can damage the relationship with the client. It’s important to remain polite, respectful, and understanding, while still clearly stating the purpose of your message.

Lack of Clear Information

If your message is vague or unclear about the amount owed, payment terms, or methods, it can create confusion and delay the process. Always include specific details, such as the outstanding balance, the original payment date, and any relevant reference numbers. This will help the client take action quickly and with certainty.

Failing to Proofread is another common mistake. Typos or grammatical errors can make your communication seem rushed or unprofessional. Always double-check your message before sending it to ensure clarity and accuracy.

By avoiding these mistakes, you can increase the likelihood of receiving a prompt response while maintaining strong client relationships.

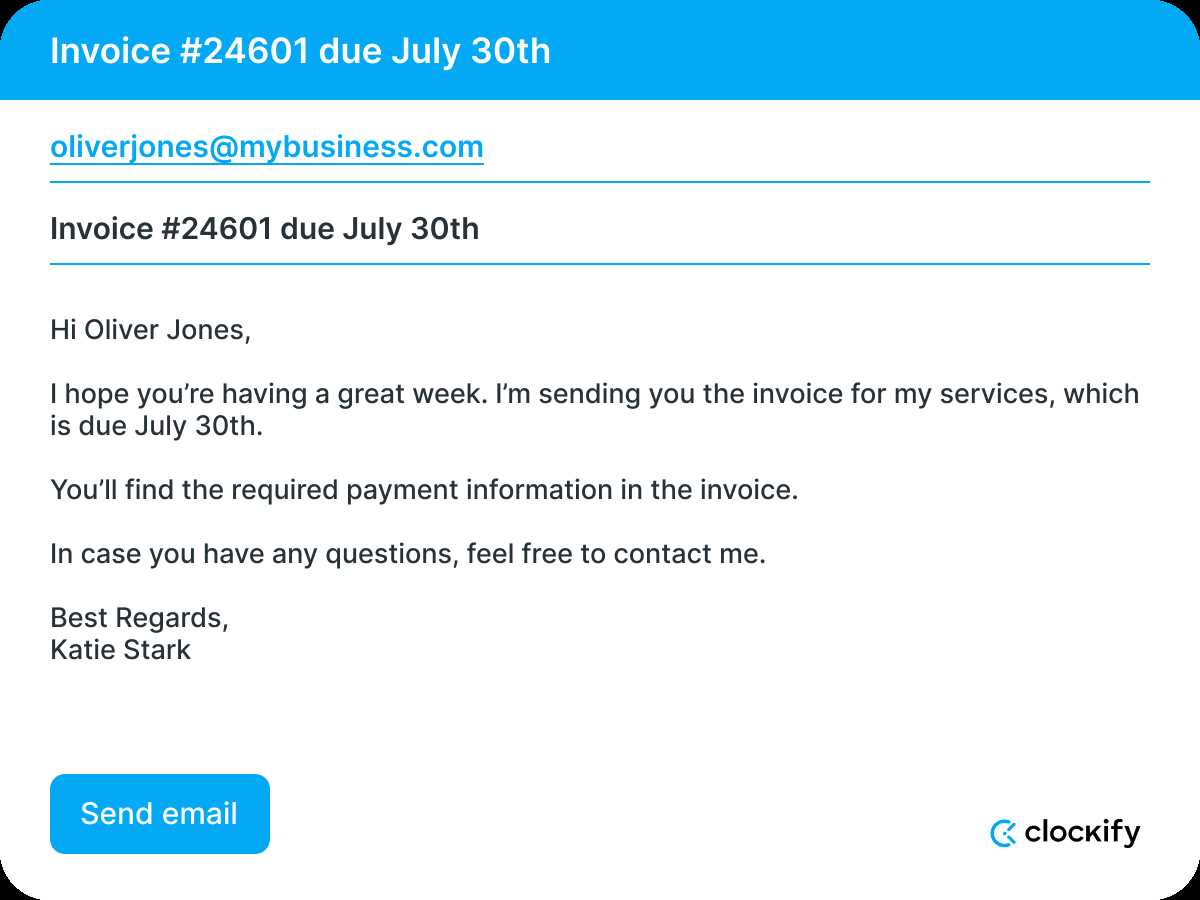

How to Customize Your Message

Each payment reminder should be tailored to the specific situation and the client you are addressing. A personalized approach not only increases the likelihood of a timely response but also shows that you are attentive to details and care about the relationship. Customizing your message allows you to convey the right tone and provide relevant information that speaks directly to the recipient’s needs.

Personalize the Greeting

Start by addressing the client by name to create a more personal and direct connection. A simple “Dear [Client’s Name],” adds a level of respect and professionalism to the message. Avoid using generic greetings like “Dear Customer,” which can seem impersonal and less engaging.

Include Specific Payment Details

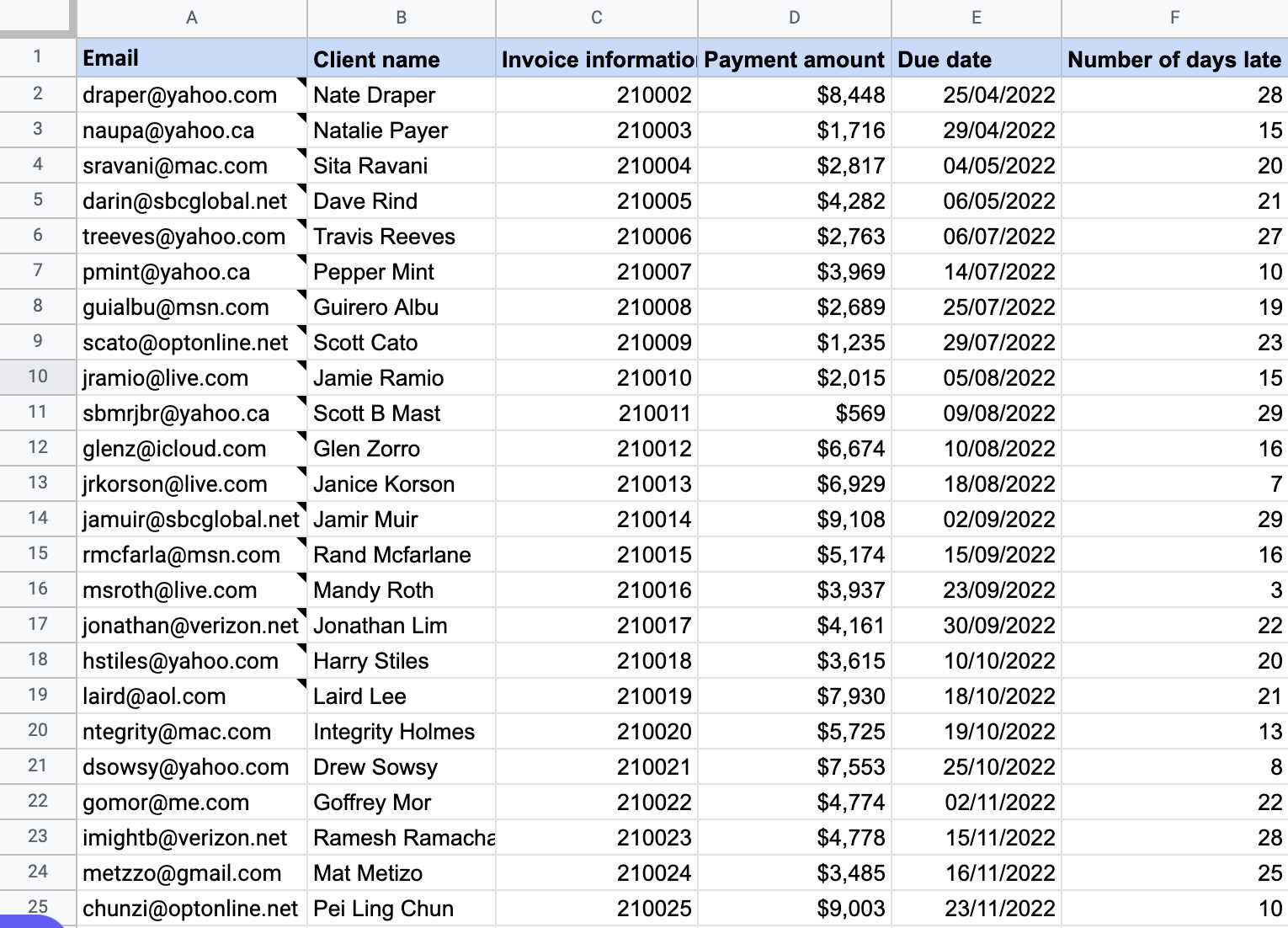

Providing specific details in your message makes it clear what the client is being asked to pay and helps avoid confusion. This includes the exact amount owed, the original due date, and any reference numbers related to the transaction. Below is an example of how to structure this information clearly:

| Item | Amount |

|---|---|

| Service/Product Name | $500.00 |

| Original Payment Date | October 1, 2024 |

| Reference Number | 12345 |

This table helps your client easily identify the payment in question and provides a visual reference that can be quickly understood. Including a clear call to action, such as “Please make payment by [date]” or “Click here to pay now,” ensures your request is actionable and easy to follow up on.

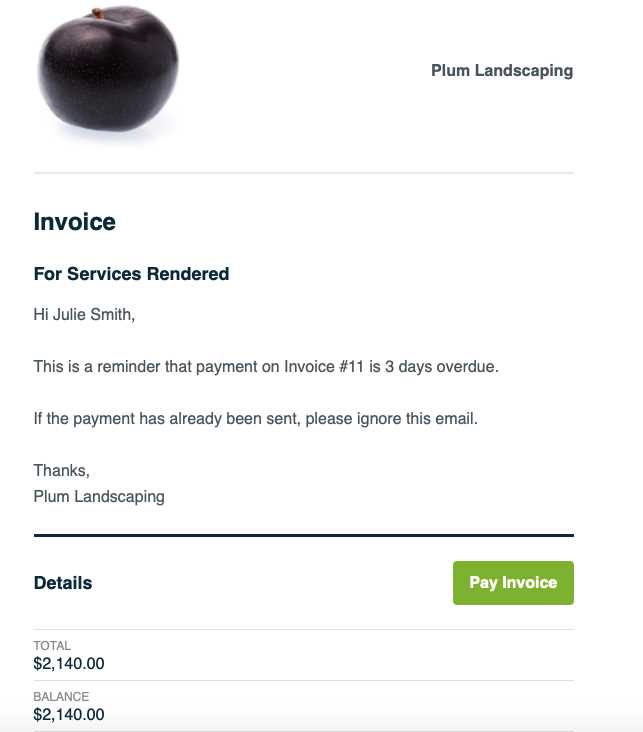

When to Send Payment Reminder Messages

Timing is crucial when requesting outstanding payments. Sending a message too early may come across as unnecessary, while waiting too long can lead to missed payments and further complications. Knowing when to send reminders helps you strike the right balance between professionalism and urgency, increasing the likelihood of a swift response.

- First Reminder: Send a polite reminder a few days before the original payment date, especially for clients who tend to pay on time. This can help avoid any misunderstandings and reinforce the payment terms.

- Second Reminder: If the payment has not been received by the agreed date, send a follow-up message within a week. At this stage, it’s important to maintain a friendly yet firm tone, reiterating the details of the payment.

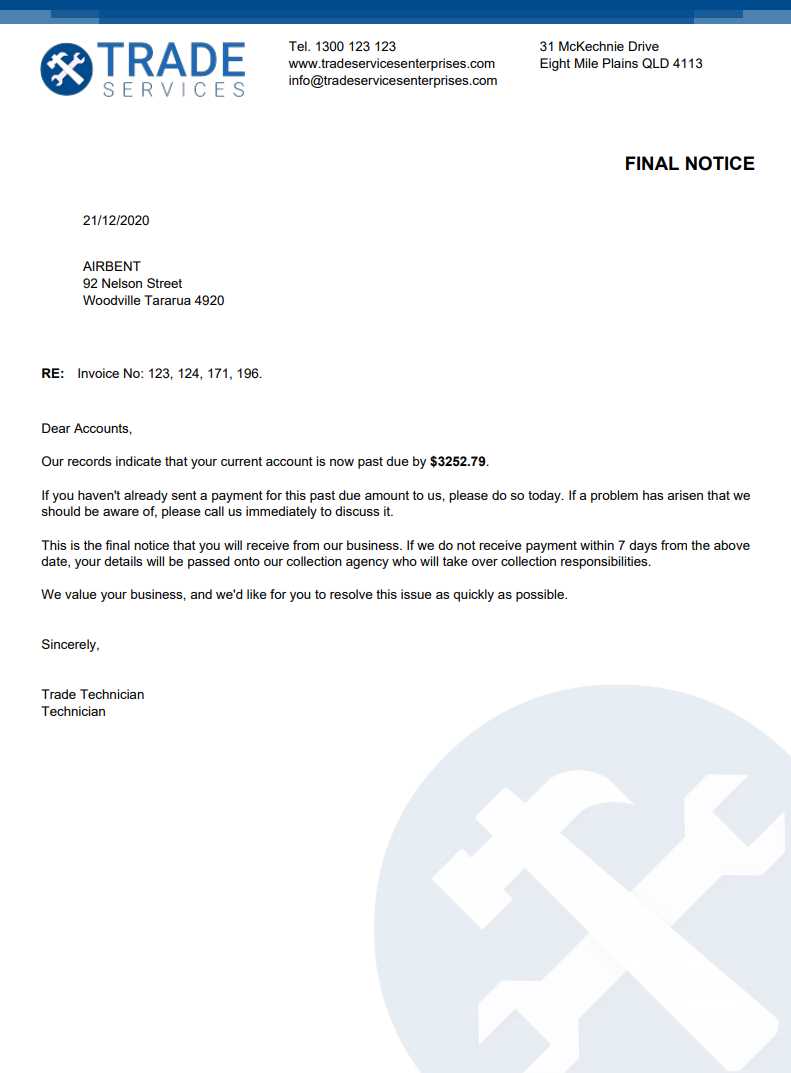

- Final Reminder: If the payment is still pending after a reasonable period, send a final reminder. Typically, this should be sent two to three weeks after the original due date. This message should clearly indicate the urgency of the matter and include any consequences if payment is not received soon.

- After Significant Delay: For clients who persistently delay payments, consider sending periodic reminders every 30 days or so, while adjusting the tone as necessary based on your relationship with the client.

It’s important to stay consistent with your follow-ups, but always adjust the message’s tone based on the duration of the delay and the client’s history. Early, regular communication can help keep payments on track and prevent issues from escalating.

Professional Tone in Payment Messages

When requesting outstanding payments, maintaining a professional tone is essential to ensure that your message is well-received. Striking the right balance between firmness and courtesy can encourage timely payment while preserving positive client relationships. How you communicate directly impacts the client’s response and the overall outcome.

Respectful Language

While it’s important to clearly communicate the purpose of your message, using respectful language can help avoid any tension or negative feelings. Always choose words that are polite, constructive, and focused on the solution. For example, instead of saying “You missed the payment,” opt for “We noticed the payment has not been received yet.” This phrasing conveys the same message but in a softer, more professional manner.

Clear, Polite Requests

Avoid sounding demanding or overly aggressive when asking for payment. Instead, phrase your request as a suggestion or reminder. For example, “We kindly ask that you settle the balance at your earliest convenience” is a polite way to encourage action without applying unnecessary pressure.

Empathy is also key. Acknowledging that your clients may have unforeseen circumstances that could delay payments can help maintain goodwill. A simple phrase like “We understand that sometimes things can get in the way” helps show understanding while still requesting payment.

By maintaining a professional tone throughout the message, you foster a respectful environment that can lead to quicker resolutions and stronger business relationships.

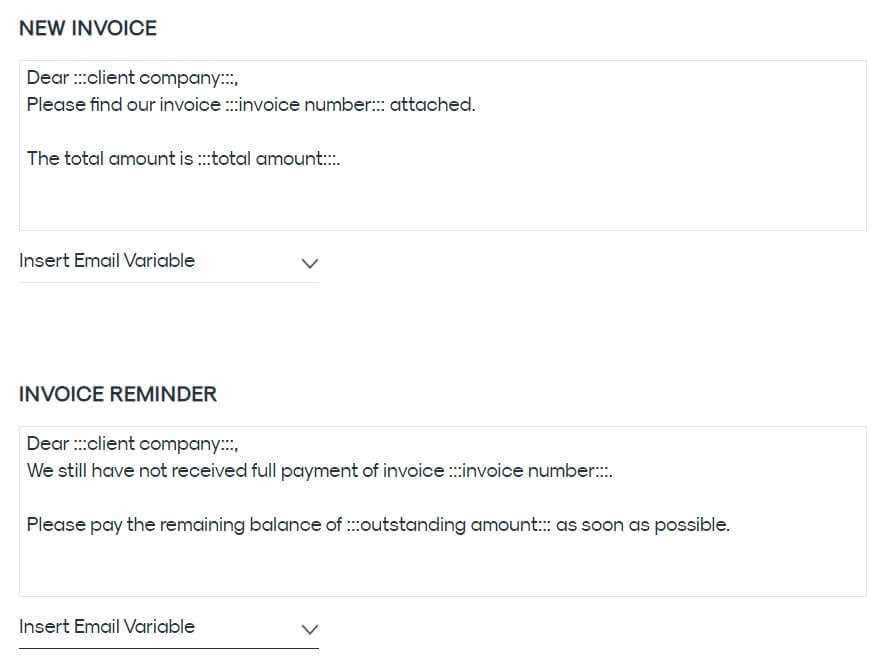

Automating Payment Reminder Messages

Automating the process of sending payment reminders can save time and ensure consistency in your communication. By setting up automated reminders, you can avoid the manual effort of tracking unpaid balances and following up individually with each client. This not only streamlines your workflow but also helps maintain a professional approach by ensuring timely follow-ups.

- Efficiency: Automating the reminder process frees up time for other tasks while ensuring that no payments are forgotten or delayed.

- Consistency: Automated systems send reminders at predetermined intervals, ensuring that all clients receive the same level of attention and professionalism.

- Customization: Many automation tools allow for customization, so each reminder can be tailored to fit the specific client and payment situation, while still maintaining a consistent tone.

- Reduced Human Error: Automation reduces the risk of overlooking clients who need to be reminded, improving the accuracy of follow-ups.

There are various tools available for automating payment reminders, from accounting software to dedicated CRM platforms. By integrating these tools with your payment system, you can trigger automatic reminders when payments become overdue. Additionally, some systems allow you to set multiple reminder stages, such as a first gentle nudge and then a stronger reminder if the payment is not settled.

Regular follow-ups through automation can enhance cash flow and reduce the administrative burden of payment tracking, while still keeping your communication professional and timely.

How to Address Late Payment Excuses

When a client offers an excuse for not settling a payment on time, it’s important to handle the situation delicately and professionally. While you need to ensure that payment is made, you also want to maintain a positive business relationship. Acknowledging their circumstances while being firm about the payment terms can help resolve the issue without escalating tensions.

Listen to Their Concerns

Before responding, take the time to understand the reason behind the delay. Some common excuses include cash flow problems, personal emergencies, or administrative errors. Listening carefully allows you to respond appropriately and shows empathy, which can help preserve the relationship. Consider the following approach:

- Empathy: “I understand that situations like these can arise unexpectedly, and we appreciate you letting us know.”

- Professionalism: “While we understand the challenges, we do need to resolve this matter as soon as possible to maintain smooth operations.”

Set Clear Expectations Moving Forward

Once you’ve acknowledged the excuse, it’s essential to set clear expectations for future payments. Politely remind the client of the payment terms and deadlines while offering solutions if necessary. For example, you might suggest:

- Flexible Payment Options: “If you’re experiencing financial difficulties, we can discuss a payment plan or partial payments.”

- Clear Deadlines: “Please ensure that payment is made by [new date] to avoid any further complications.”

Stay firm but polite in your communication, emphasizing the importance of honoring agreements while remaining open to working with the client to resolve the situation. This balance ensures that you protect your business while keeping the relationship intact.

Subject Line Ideas for Payment Messages

The subject line of your message plays a critical role in ensuring that the recipient opens and reads it. A well-crafted subject can grab attention, convey urgency, and set the tone for the rest of the communication. When crafting a subject for a payment reminder, it’s essential to balance professionalism with clarity while avoiding overly harsh language.

Be direct but polite in your subject line to increase the chances that your message will be opened and acted upon. Below are some subject line ideas that are both effective and respectful:

- Reminder: Payment for [Service/Product] is Pending

- Friendly Reminder: Balance on Your Account

- Your [Company Name] Account: Payment Reminder

- Outstanding Payment for [Service/Product Name]

- Action Required: Payment for [Service/Product]

- We Value Your Business – Please Settle Your Balance

- Payment Reminder: [Amount] for [Service/Product]

- Quick Reminder: Pending Balance on Your Account

- Urgent: Your Payment for [Service/Product] is Overdue

By using a clear and polite subject line, you can create a sense of urgency while maintaining professionalism, increasing the likelihood that the recipient will address the outstanding balance promptly.

How to Follow Up After No Response

Sometimes, despite sending a payment reminder, clients may not respond or take action. In such cases, it’s important to follow up with a clear and polite message that encourages them to settle their balance. A well-timed and professional follow-up can make all the difference in ensuring that the matter is addressed promptly, without straining the client relationship.

Timing Your Follow-Up

Give your client some time to respond before sending a follow-up message. Typically, waiting a few days to a week after your initial reminder is appropriate. This provides the client with a reasonable window to act, while still ensuring you address the payment promptly. If there is still no response, send a second reminder with an even clearer call to action.

Crafting the Follow-Up Message

When drafting your follow-up, maintain professionalism and respect. Acknowledge the previous message and express understanding, while firmly reiterating the importance of settling the payment. Here’s an example approach:

- Start with a polite opening: “I hope this message finds you well.”

- Reference the previous communication: “I wanted to follow up on my previous message regarding the outstanding balance.”

- Be clear and direct: “Please arrange for the payment as soon as possible to avoid any further delays.”

- Offer assistance: “If you need any help with the payment process or have any questions, feel free to reach out.”

Always be firm yet courteous when following up. By showing both patience and professionalism, you encourage the client to act while maintaining a positive working relationship.

Legal Considerations for Overdue Payments

When payments remain unpaid beyond the agreed-upon timeframe, businesses may need to consider legal avenues to recover the outstanding amount. However, before taking any formal action, it’s important to understand the legal implications and follow the appropriate procedures to protect your business and avoid unnecessary legal complications.

Know Your Rights – As a business, you have the right to be paid for services or products provided under contract. Ensure that you are clear on the terms outlined in your agreement, including payment deadlines, penalties for non-payment, and any other conditions that apply. Familiarize yourself with local laws regarding payment terms and late fees, as these can vary depending on the jurisdiction.

Understand the Process – Before escalating to legal action, try to resolve the issue amicably through polite reminders and follow-ups. If communication fails and payment remains unresolved, you may need to pursue collections, file a claim in small claims court, or involve a collection agency. However, legal action should be considered as a last resort after all reasonable efforts to collect payment have been exhausted.

Late Fees and Interest – Many businesses charge interest or late fees if payments are not made within the agreed timeframe. Ensure that these charges are clearly outlined in your contracts, and that clients are aware of these fees upfront. While some jurisdictions may have limits on how much interest or penalty you can charge, it’s important to adhere to these regulations to avoid disputes or legal penalties.

Taking the legal route should always be done cautiously and with a clear understanding of the laws involved. Ensuring your contracts are clear, communication is documented, and appropriate procedures are followed can help protect your business while minimizing legal risks.

How to Handle Repeated Late Payments

Dealing with clients who consistently miss payment deadlines can be frustrating and potentially damaging to your business’s cash flow. When payments become a regular issue, it’s essential to take a more structured approach to manage the situation effectively. Addressing repeated delays requires a balance between maintaining professionalism and protecting your interests.

Assess the Situation

Before taking any action, it’s important to evaluate the cause of the repeated delays. Is this a short-term issue, or is it part of a larger pattern of behavior? Understanding the context behind the delays can help you decide on the best course of action. Some common reasons for repeated delays include:

- Cash Flow Problems: Clients may be experiencing financial difficulties and unable to pay on time.

- Poor Organization: Some clients may simply be disorganized or fail to prioritize payments.

- Disputes Over Terms: Ongoing misunderstandings or disagreements about the service or product provided.

Implement Stricter Payment Policies

If repeated delays continue despite gentle reminders and understanding, it may be time to implement stricter payment policies. Consider:

- Late Fees: Introduce penalties for late payments that are clearly outlined in your contracts.

- Shortened Payment Terms: Reduce the time frame for future payments or request partial upfront payments to avoid future issues.

- Service Suspension: If payments remain unresolved, consider suspending services or shipments until the balance is paid.

By taking proactive steps and adjusting your payment terms, you can help prevent the issue from continuing while still maintaining a professional relationship with your clients. It’s crucial to communicate these changes clearly and assertively while also providing clients with fair options to resolve any financial issues.

Impact of Timely Billing on Cash Flow

One of the most important factors influencing the financial health of a business is the timing of payment requests. When payments are collected promptly and efficiently, it ensures a steady cash flow, allowing businesses to meet their financial obligations, pay employees, invest in growth, and continue operations without interruption. On the other hand, delays in collecting payments can result in cash shortages and hinder business performance.

Improved Financial Stability

By sending accurate and timely payment reminders, you can create a predictable cash flow cycle. This allows for better financial planning, ensuring you have enough funds for operational expenses such as payroll, rent, and raw materials. Key benefits include:

- Regular income: Timely payments help businesses plan for regular expenses without the stress of unpredictable cash shortages.

- Reduced borrowing costs: With a steady cash inflow, you may avoid needing short-term loans or credit lines to cover gaps, thus reducing interest payments.

- Opportunity for reinvestment: Consistent cash flow provides the freedom to invest in new projects, equipment, or marketing campaigns that drive future growth.

Minimizing Payment Delays

Delayed payments can have a ripple effect on a business’s financial operations. Late payments not only disrupt the ability to cover current expenses but can also affect the overall business strategy. The consequences include:

- Late payment fees: Customers who delay payments may incur fees, but these penalties can also lead to a strained relationship, especially if they are a repeat customer.

- Limited working capital: A lack of available funds can prevent you from taking on new projects, paying suppliers on time, or scaling your business.

- Damaged credit rating: Continuous late payments can affect your business credit score, making it more difficult to secure loans or favorable terms with vendors.

By focusing on timely billing and following up on payments promptly, businesses can ensure smoother operations, better financial stability, and the opportunity to grow. A proactive approach to managing payments is key to achieving long-term success.

How to Offer Payment Options in Messages

When clients struggle to settle outstanding balances, offering flexible payment options can help facilitate a smoother resolution. By providing various ways to pay, you make it easier for clients to fulfill their obligations, while also maintaining a positive business relationship. Clearly outlining payment choices in your communication ensures transparency and encourages timely action.

Types of Payment Options to Offer

Depending on your business model and the client’s needs, you can offer several payment methods. It’s important to keep the options simple, secure, and convenient. Here are some common options to consider:

- Credit/Debit Card Payments: Convenient and fast, allowing customers to pay online instantly.

- Bank Transfers: Suitable for larger amounts, often with lower fees.

- Installment Plans: If a client is unable to pay the full amount, offering a payment plan can ease their financial burden.

- PayPal or Other Digital Wallets: A simple, secure option for international payments or clients who prefer digital platforms.

Presenting Payment Options Clearly

When communicating payment options, clarity is key. Ensure the client understands each option and the associated terms, such as deadlines or late fees. Below is an example of how to structure this information in your message:

| Payment Method | Details |

|---|---|

| Credit/Debit Card | Pay instantly online using any major credit or debit card. |

| Bank Transfer | Transfer funds directly to our account; please allow 3-5 business days for processing. |

| Installment Plan | Pay in 3 equal monthly installments. First payment due by [date]. |

| PayPal | Secure payments via PayPal. You can also use your PayPal credit account. |

By offering these options, you make it easier for clients to settle their balances while maintaining flexibility in how they manage payments. Always ensure your payment options are clearly stated, making the process as seamless as possible for both parties.

Building Strong Client Relationships with Billing

Effective billing is not just about collecting payments; it’s also an opportunity to strengthen your relationship with clients. By handling payment requests with professionalism, respect, and clarity, you can foster trust and loyalty. A well-managed billing process shows clients that you value their business and are committed to transparent and fair practices, which can lead to repeat business and referrals.

Transparency and Communication

One of the key elements of building a strong client relationship through billing is transparency. Make sure that all payment terms, deadlines, and conditions are clearly communicated upfront. Additionally, maintaining open lines of communication during the billing process allows clients to feel comfortable addressing any issues or concerns before they become problems.

How to Structure Billing Information for Clarity

Ensure that all your payment requests are easy to understand by providing a detailed breakdown of the charges. This will reduce confusion and give clients a sense of fairness. Below is an example of how to present billing information clearly:

| Service/Item | Description | Amount |

|---|---|---|

| Consultation | 2 hours of business consulting | $200.00 |

| Web Design | Design for landing page | $750.00 |

| Travel Expenses | Round-trip airfare and accommodations | $450.00 |

| Total | – | $1,400.00 |

Providing clear, itemized details on your billing documents helps clients easily understand what they’re paying for, making the process more straightforward and less likely to cause disputes. This approach builds trust and demonstrates your professionalism.

Additionally, offering timely follow-ups and payment options shows clients that you are organized and understanding, which will help to further strengthen your business relationships in the long term. Clients are more likely to continue working with you if they feel respected and valued throughout the payment process.