Past Due Invoice Template Letter for Effective Payment Recovery

When payments are not received on time, it becomes essential to send a formal reminder to encourage prompt settlement. Clear communication and professionalism are key to ensuring that clients understand the urgency of the situation and are prompted to act swiftly. By using a well-structured reminder, businesses can maintain good relations with their clients while addressing the overdue payment issue efficiently.

Crafting an effective reminder involves focusing on clarity, conciseness, and a respectful tone. The goal is to convey the importance of settling the balance without damaging the business relationship. A well-written communication serves as both a gentle nudge and a formal request, helping to resolve the matter promptly.

Utilizing appropriate reminder formats ensures that the message is clear and that all necessary information is included. This process not only addresses the immediate concern but also sets a professional tone for any future communications regarding payments.

Past Due Invoice Template Letter Guide

When payments are not received on time, businesses must take action to remind clients of their outstanding balances. A carefully crafted reminder can help resolve the issue in a professional and efficient manner. This guide will outline the essential elements and structure for creating a clear and effective payment request.

Creating a successful reminder involves being clear, respectful, and concise. The communication should include important details such as the amount owed, payment terms, and any relevant deadlines. By addressing the matter politely and directly, businesses can encourage prompt payment without damaging their professional relationship with the client.

In this guide, we will also cover strategies for customizing the reminder to fit different scenarios, ensuring that it remains relevant and effective for various clients and situations. Whether it’s for a first-time reminder or a final request, understanding the proper structure will lead to better outcomes for both parties involved.

Why Send a Past Due Invoice

Timely payments are crucial for maintaining a healthy cash flow in any business. However, sometimes clients miss payment deadlines, and businesses must take action to recover the outstanding amounts. Sending a reminder helps ensure that the client is aware of their unpaid balance and prompts them to resolve the issue quickly. This practice also helps maintain professional relationships while protecting your business’s financial interests.

Benefits of Sending Payment Reminders

- Improves Cash Flow: Promptly addressing overdue payments ensures that your business has the necessary funds to continue operating smoothly.

- Strengthens Professional Relationships: By sending a polite and professional reminder, businesses can maintain a positive relationship with clients.

- Reduces Financial Stress: A quick reminder can prevent the accumulation of unpaid balances, reducing the potential for financial strain on your business.

- Encourages Timely Payments: Regular reminders encourage clients to pay on time, setting a precedent for future transactions.

When Should You Send a Payment Reminder?

- Initial Reminder: After the first missed payment, sending a friendly reminder helps keep the conversation open without causing tension.

- Second Reminder: If the payment remains unpaid, sending a more formal communication serves as a polite nudge to settle the outstanding amount.

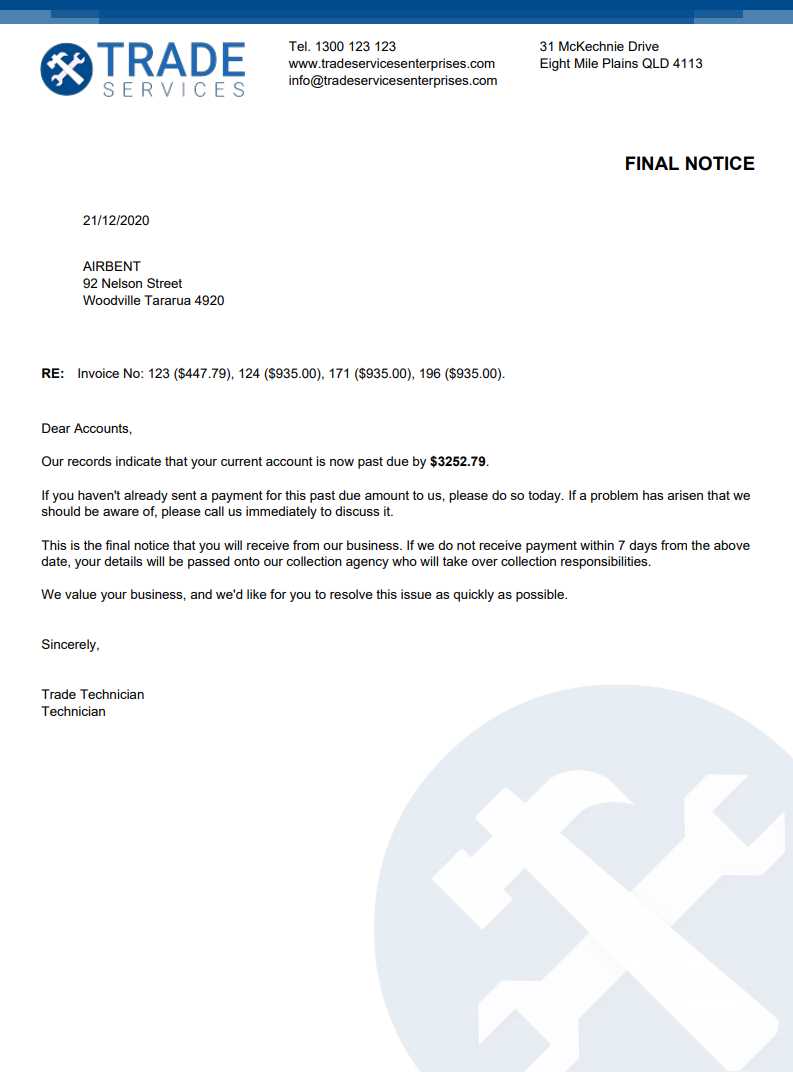

- Final Notice: A final reminder is necessary if previous attempts have failed, signaling that further action may be taken if payment is not received.

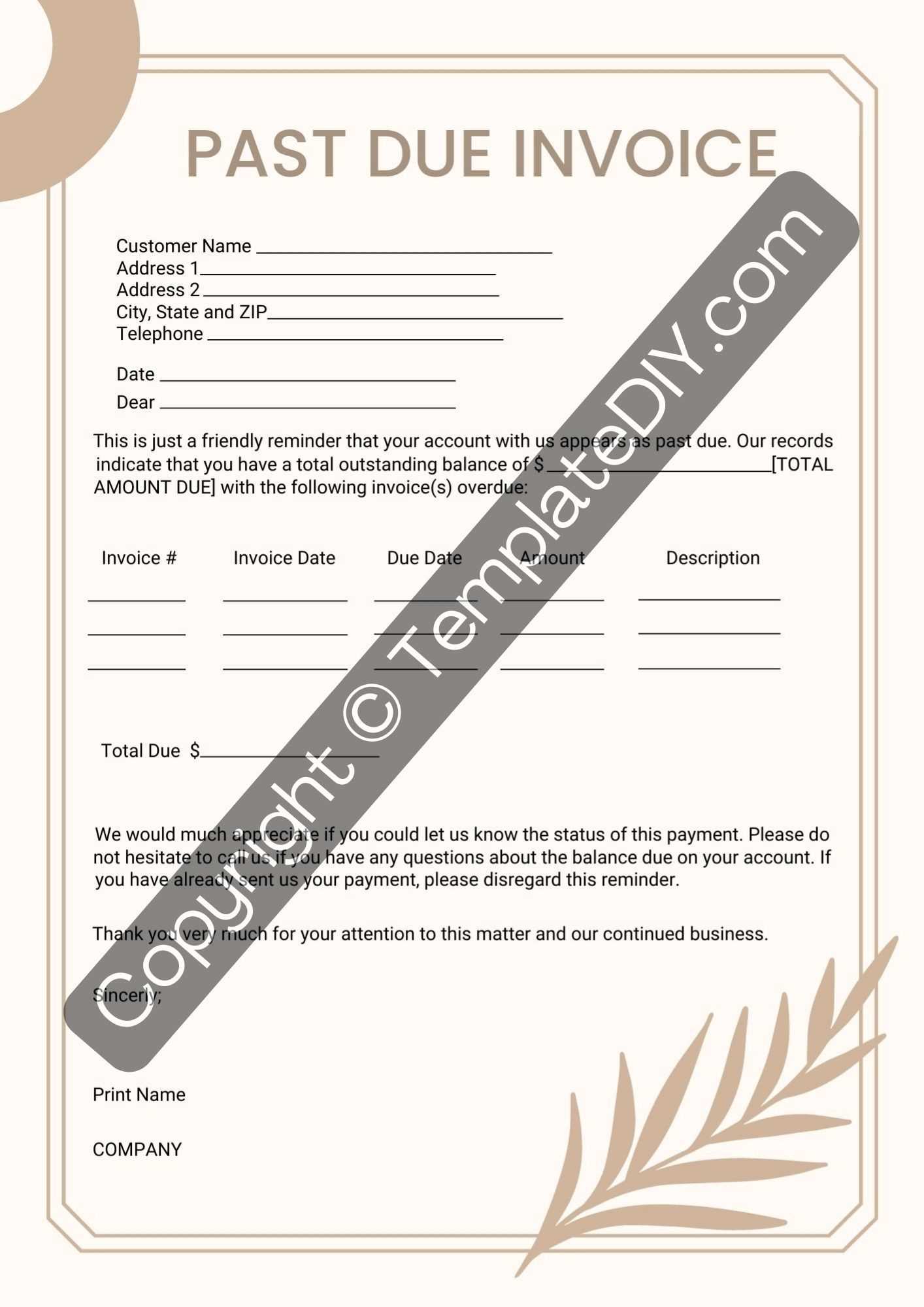

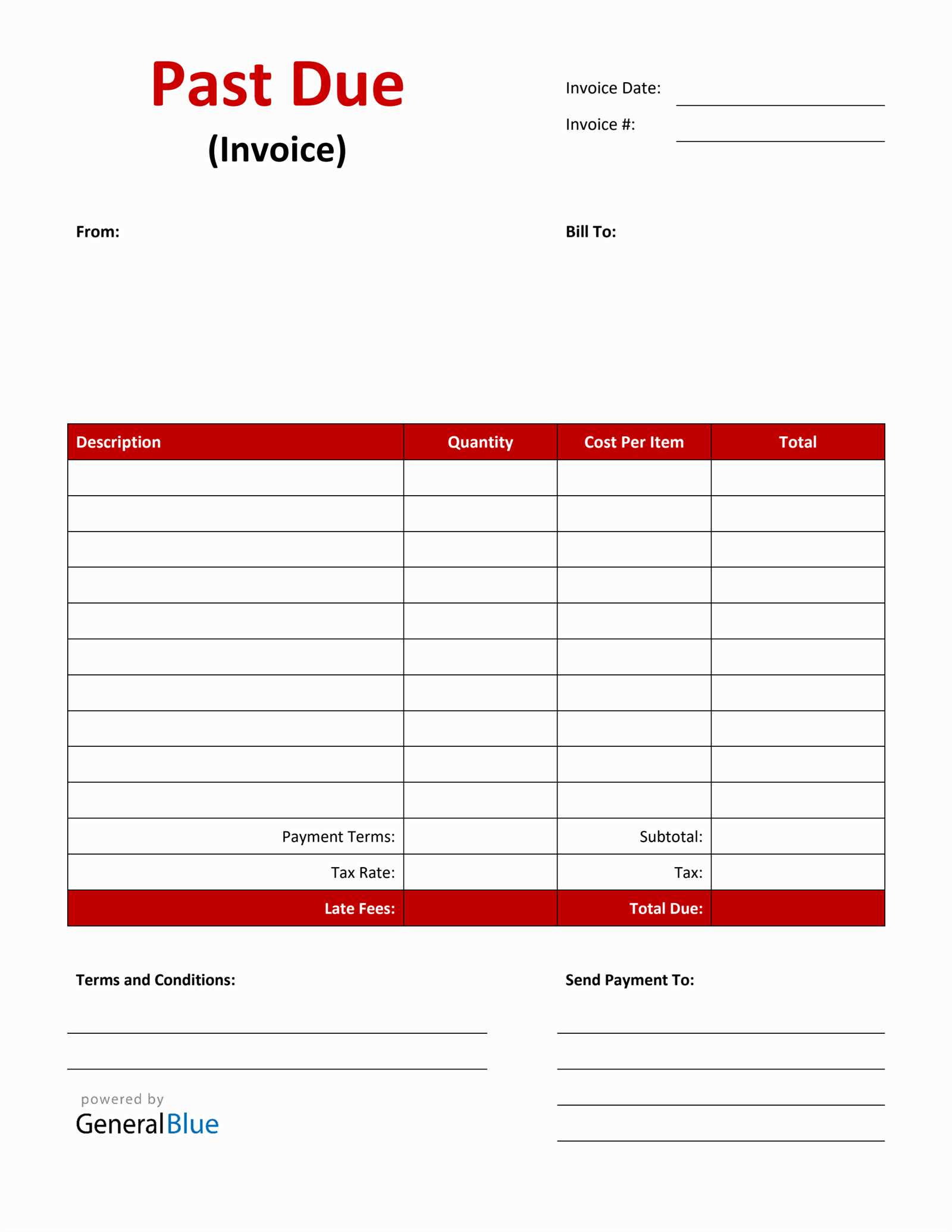

Key Elements of a Payment Reminder

A well-structured payment reminder helps clients understand their outstanding balance and encourages them to address it promptly. The effectiveness of this communication lies in including essential details that are clear and easy to understand. This section outlines the crucial elements every reminder should contain to ensure professionalism and clarity.

Essential Information to Include

| Element | Description | ||||||

|---|---|---|---|---|---|---|---|

| Client’s Information | Address the message to the client using their full name and contact details to ensure it reaches the correct person. | ||||||

| Outstanding Balance | Clearly state the total amount owed to avoid any confusion regarding what the client needs to pay. | ||||||

| How to Structure Your Letter

Creating a clear and professional payment reminder involves organizing the message in a logical and easy-to-follow format. Each section should serve a purpose, guiding the recipient smoothly from the reason for the communication to the actions needed. A well-structured message not only clarifies expectations but also enhances the chance of a prompt response. Start with a polite introduction that addresses the recipient by name and briefly references your previous interactions. This helps set a respectful tone and reminds them of your established business relationship. Following this, clearly state the purpose of the message, explaining the need for settling the outstanding balance. Details of the Balance should be clearly outlined, including the amount, any reference numbers, and due dates. This section should be precise, as clarity here helps avoid misunderstandings. Ensure that you also mention accepted payment methods, making it easier for the client to proceed without delay. Conclude with a polite but firm closing, reinforcing the importance of resolving the matter. Encourage the recipient to contact you with any questions, providing your preferred contact information to demonstrate your openness to communication. End on a positive note to maintain a professional tone, as this approach fosters goodwill and encourages future collaboration. Customizing the Invoice TemplateAdapting a payment reminder to fit specific needs allows businesses to communicate more effectively and professionally with their clients. By tailoring the content and layout, you can ensure that all necessary details are included while aligning with your company’s brand and tone. This personalization not only enhances clarity but also conveys a sense of professionalism and attentiveness. One way to customize a reminder is to incorporate your company’s logo and contact details prominently, ensuring that the recipient can easily identify the sender. Adjusting the color scheme and font style to match your brand helps reinforce a cohesive identity. Additionally, structuring the document to highlight essential information, such as payment amount and deadline, can make it more accessible and reader-friendly. Consider adding personalized greetings or specific notes relevant to the client’s previous interactions with your company. This small adjustment makes the communication feel more thoughtful and less automated. For recurring clients, it’s also beneficial to include a summary of previous payments, if applicable, to provide context and reinforce transparency in financial dealings. Best Practices for Clear CommunicationEffective communication in payment reminders is essential for maintaining good client relationships and ensuring timely responses. By following certain guidelines, you can craft messages that are polite yet firm, minimizing misunderstandings and encouraging prompt action. This section outlines practical tips for creating concise and clear payment reminders. Key Tips for Effective Messaging

|