Effective Past Due Invoice Letter Template for Timely Payments

Managing unpaid bills is a critical aspect of maintaining healthy cash flow for any business. When clients fail to settle their accounts on time, it’s essential to reach out to them with a clear and professional message that encourages prompt payment. Properly written reminders can help recover funds while preserving positive client relationships.

Crafting a well-structured communication that addresses overdue balances requires a balance of professionalism and assertiveness. A carefully worded request not only reminds the client of their responsibility but also sets the tone for future transactions. Knowing when and how to send such messages is crucial for effective debt collection.

Whether you’re a small business owner or a freelancer, having a reliable method for following up on outstanding payments is key. Using an efficient approach ensures that you handle each situation with consistency and respect. In the following sections, we’ll explore how to write a message that promotes timely payments while maintaining goodwill.

Why Use a Reminder for Unpaid Bills

When payments are not received on time, businesses face the challenge of ensuring their cash flow remains uninterrupted. A formal reminder serves as an important tool to address this issue, helping to notify clients of their outstanding balance in a clear and professional manner. Sending such a communication can speed up the payment process while maintaining a positive relationship with the client.

Maintain Professionalism and Clarity

Sending a well-crafted reminder ensures that the message remains polite yet firm. This approach avoids any misunderstanding and emphasizes the importance of fulfilling financial obligations. A well-structured request is not just a demand for payment but a reminder of the mutual agreements made, helping to preserve trust and avoid potential conflicts.

Establish Clear Expectations for Future Payments

By regularly sending reminders for overdue balances, businesses can set a clear precedent for how financial matters are handled. This consistency makes it easier for clients to understand expectations and deadlines in future dealings. With a clear structure in place, businesses can avoid unnecessary delays and disputes, ensuring smoother operations and better long-term relationships.

Importance of Clear Payment Reminders

Clear communication regarding unpaid amounts is essential for any business aiming to maintain steady cash flow. When clients fail to meet payment deadlines, sending an effective reminder ensures that both parties are on the same page about financial responsibilities. A straightforward message can prevent misunderstandings and promote faster resolution of outstanding balances.

- Reduces Confusion: A clear reminder eliminates any potential for confusion regarding the payment terms or the amount owed. Clients are more likely to act promptly when they fully understand what is expected of them.

- Maintains Professionalism: A well-phrased reminder reflects a professional attitude and helps preserve the relationship with the client. It shows that your business takes financial matters seriously while still being courteous.

- Encourages Prompt Action: A concise and direct message emphasizes the importance of timely payment, making it more likely that clients will prioritize settling the balance.

- Protects Business Interests: Sending reminders regularly helps ensure that overdue amounts do not accumulate, safeguarding the business from cash flow issues and the risk of bad debt.

Without clear reminders, clients may not feel a sense of urgency to make payments, leading to delayed settlements. Regular, direct communication keeps financial matters transparent and avoids unnecessary follow-ups.

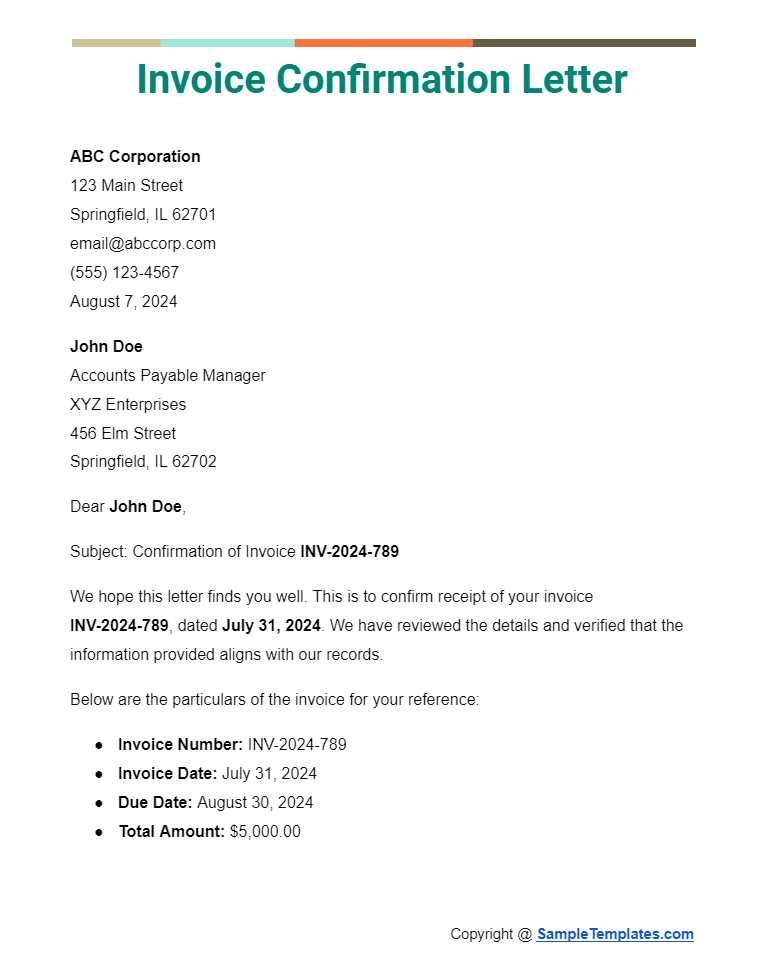

How to Write an Effective Payment Reminder

Crafting an effective communication for unsettled balances requires clarity, professionalism, and a firm but polite tone. An effective reminder should clearly state the amount owed, the payment terms, and any necessary actions the recipient needs to take. The goal is to encourage prompt payment while maintaining a positive business relationship.

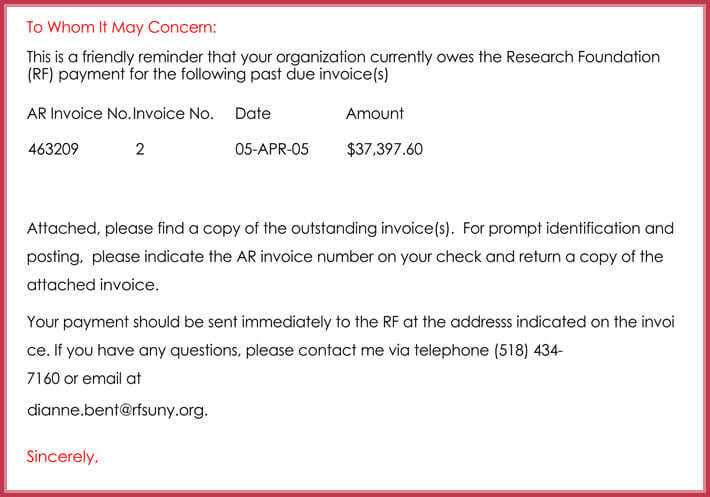

- Start with a Polite Greeting: Always begin with a professional and courteous salutation. Address the recipient by name to personalize the message.

- State the Purpose Clearly: Early in the message, mention that the purpose is to remind the client of the outstanding balance, specifying the amount and due date.

- Provide Payment Details: Include the invoice number, original payment terms, and payment method options to make it easy for the recipient to act.

- Set a Clear Deadline: Mention a reasonable time frame for payment. Be specific about when the payment should be made to avoid any ambiguity.

- Be Professional Yet Firm: Use polite language, but also be direct about the need for immediate action. Ensure the tone is respectful but clear in stating the importance of fulfilling financial obligations.

- Offer Assistance if Necessary: If there are any issues or questions, provide contact information for further clarification. This shows your willingness to resolve any potential concerns.

- End on a Positive Note: Conclude the message by thanking the client for their attention and cooperation. Reinforce the desire for continued business with them.

By following these steps, you can create a balanced and effective reminder that encourages clients to tak

Common Mistakes in Late Payment Letters

When reaching out to clients about unpaid balances, it’s essential to communicate clearly and professionally. However, many businesses make common mistakes in their approach that can hinder payment collection or damage the relationship with the client. Understanding these errors can help you avoid them and craft more effective reminders.

Key Mistakes to Avoid

| Mistake | Effect | How to Avoid |

|---|---|---|

| Using a Harsh Tone | Can alienate the client and damage the relationship. | Be firm but polite; maintain professionalism throughout the communication. |

| Vague Language | Leads to confusion about the amount owed or payment deadline. | Clearly state the amount, payment terms, and due date. |

| Not Providing Payment Details | Forces the client to look for invoice information, delaying payment. | Include all relevant details like invoice number and payment method. |

| Failure to Follow Up | Results in continued non-payment and unresolved balances. | Send regular follow-ups at appropriate intervals. |

| Overly Complicated Language | Confuses the client, potentially leading to delays. | Use simple, clear language that is easy to understand. |

Additional Pitfalls to Watch For

In addition to the common mistakes listed above, there are other factors to consider. For instance, waiting too long before sending a reminder can reduce the chances of receiving payment. Similarly, ignoring the client’s potential financial difficulties or not offering alternative payment arrangements may further delay settlement. By addressing these issues early and taking a constructive approach, you can minimize mistakes and improve payment recovery.

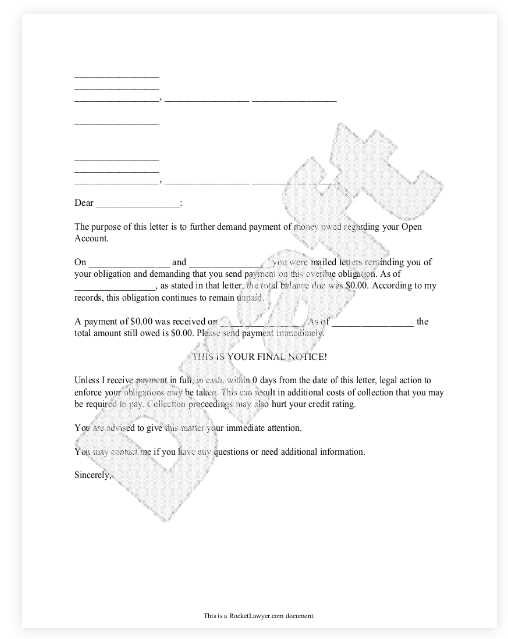

Legal Considerations for Payment Requests

When requesting payment from a client, it’s essential to understand the legal framework that governs such communications. Failing to follow proper procedures can lead to misunderstandings, disputes, or even legal consequences. It is important to ensure that all interactions are professional, clear, and compliant with relevant laws. Proper knowledge of these guidelines helps protect both the creditor and the debtor, ensuring that payments are received in a timely manner without infringing on rights or obligations.

Understanding Your Rights

As a service provider or business owner, you have the right to be compensated for goods or services rendered. However, it’s crucial to clearly communicate the terms of payment in advance. Contracts or agreements should outline payment schedules, interest on late payments, and any penalties for non-compliance. In the event of a delay, it is essential to follow legal procedures to request payment, such as issuing reminders, setting deadlines, and providing the debtor with information about potential legal actions if payment is not made.

Compliance with Debt Collection Laws

When pursuing outstanding payments, it is important to stay within the boundaries of debt collection laws. In many jurisdictions, there are strict regulations governing how businesses can contact individuals or companies about overdue obligations. Harassment, aggressive tactics, or misleading information can lead to legal penalties. Ensure that all communication remains respectful, accurate, and within the limits of the law. Additionally, make sure you are aware of any consumer protection laws that may apply to the specific type of transaction or client involved.

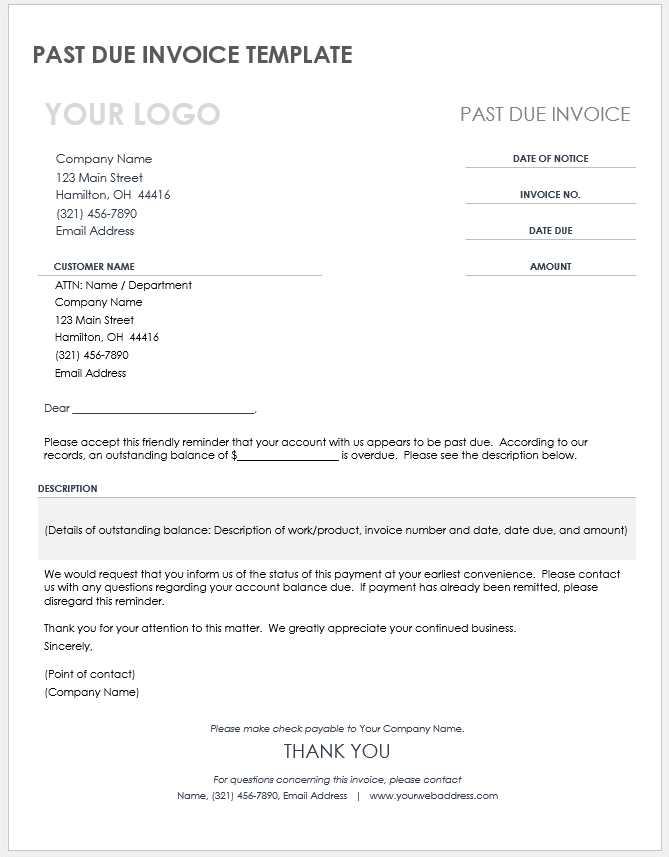

How to Customize Your Letter Template

Personalizing your payment request is crucial for ensuring clarity and professionalism while maintaining a cordial relationship with your clients. Customization allows you to tailor the message to the specific situation, making it more relevant to the recipient and potentially increasing the likelihood of prompt action. By adjusting the tone, content, and structure, you can address each case appropriately, whether it’s a friendly reminder or a more formal demand.

Start by including essential details such as the recipient’s name, the exact amount owed, and the specific terms of the agreement. Adjust the tone based on your relationship with the client–more formal if necessary, or a more relaxed approach if the client is a long-standing partner. Additionally, you may want to include relevant dates, such as the original payment date, and any actions that may follow if the situation isn’t resolved.

Incorporate any unique agreements or terms that might apply to this particular client or situation. For example, if there was a prior arrangement for extended payment terms or a discount for early settlement, make sure those details are reflected. Customizing this message ensures that it resonates with the client, while also keeping the communication professional and legally sound.

Best Practices for Professional Tone

Maintaining a professional tone in any communication, especially when addressing financial matters, is key to fostering positive business relationships. A respectful and clear message helps avoid misunderstandings and ensures that the recipient takes your request seriously. The right tone can motivate action while preserving your professional image and the client’s dignity.

Key Guidelines for a Professional Approach

- Be Polite and Courteous: Always use respectful language, even if the situation is urgent. Avoid sounding accusatory or confrontational.

- Use Neutral Language: Choose words that are neutral and non-judgmental. Instead of saying “you failed to pay,” consider phrasing it as “we noticed the payment has not yet been received.”

- Be Clear and Concise: Get straight to the point without unnecessary details or over-explanation. Clear communication helps the recipient understand their obligations quickly.

- Avoid Emotional Language: Keep the tone calm and professional, regardless of your personal feelings about the situation. Refrain from expressing frustration or disappointment.

- Offer Solutions, Not Threats: If further action is necessary, provide options for resolution rather than implying negative consequences. This keeps the focus on resolving the issue.

Structuring Your Message Effectively

- Start with a Friendly Greeting: Open with a courteous greeting, addressing the recipient by name if possible. A warm introduction sets a positive tone for the message.

- State the Purpose Clearly: Early in the communication, clearly explain the reason for reaching out. Make sure the recipient understands why you are contacting them.

- Provide Relevant Details: Mention the amount owed, relevant dates, and any agreements that have been made. Keep this section factual and straightforward.

- Close with a Positive Note: End the message by expressing your hope for a quick resolution. Offer assistance or a contact for any questions to ma

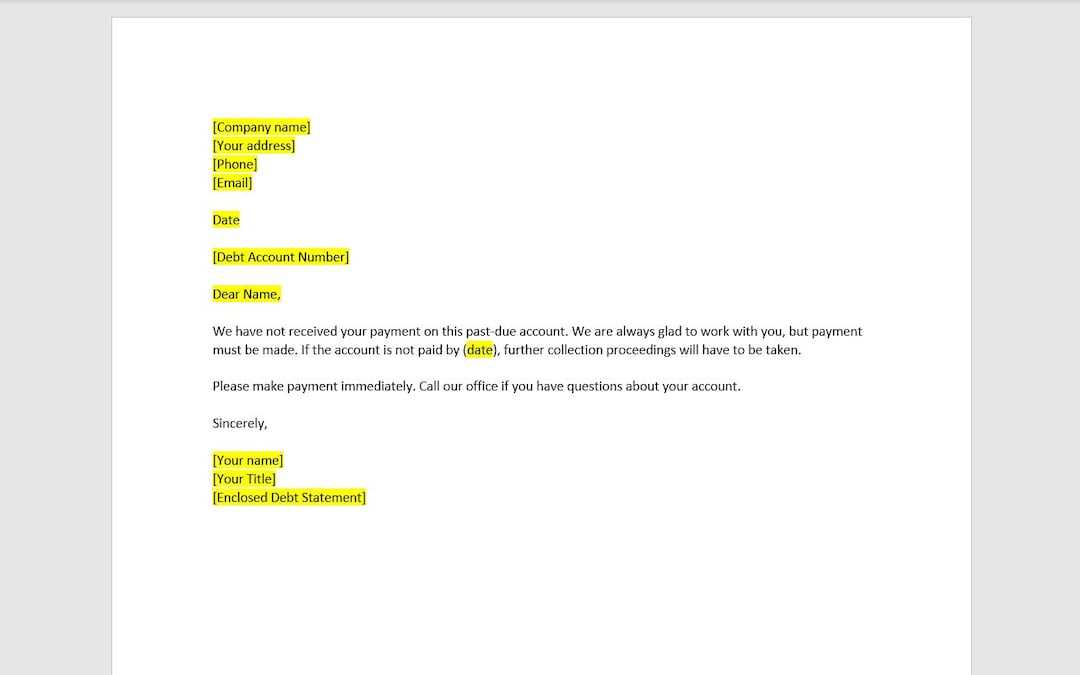

When to Send a Payment Reminder

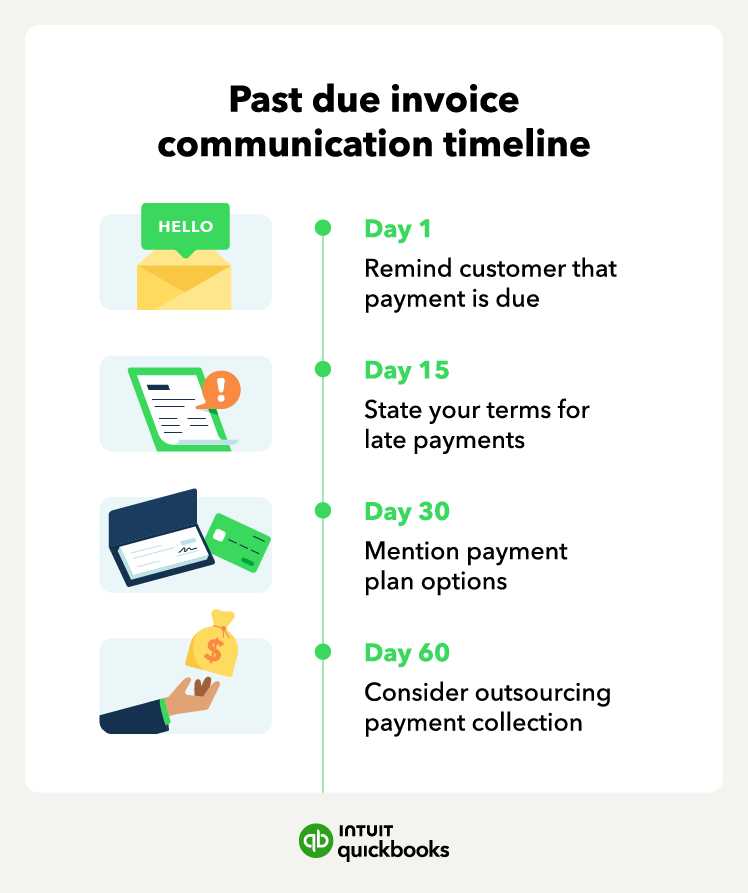

Timing is essential when requesting outstanding payments from clients. Sending reminders at the right moment ensures that your message is both effective and respectful. Waiting too long may result in more complications, while acting too early may not be necessary. Understanding the appropriate time to initiate contact is crucial in maintaining positive relationships and securing the payments you are owed.

Time After Payment Was Expected Action to Take Purpose of Contact 1-3 Days Friendly Reminder To gently remind the client that payment is pending, offering assistance if needed. 1 Week Formal Request To escalate the tone slightly, requesting payment and asking for confirmation of when it will be made. 2-3 Weeks Second Notice To express urgency while maintaining professionalism, and to remind the client of any agreed-upon terms. 1 Month Final Notice To formally state the seriousness of the situation, outlining potential next steps if payment is not received. How to Handle Non-Responsive Clients

Dealing with clients who fail to respond to payment requests can be a challenging situation for any business. When communication is ignored or unanswered, it’s important to remain professional and follow a structured approach to encourage resolution. Taking the right steps will help you avoid unnecessary conflict while still protecting your financial interests.

Stay Calm and Patient: If a client isn’t responding, avoid reacting impulsively or with frustration. It’s essential to remain composed and give the client the benefit of the doubt. Sometimes delays happen due to unforeseen circumstances. Patience allows you to approach the situation thoughtfully and avoid escalating the issue prematurely.

Follow Up Multiple Times: It’s essential to send a few reminders at reasonable intervals. Start with a polite reminder, and then increase the formality of your communication as time progresses. If there’s still no response, you may need to escalate your request with a firmer tone, but always keep the message respectful.

Offer Solutions: If a client remains unresponsive, try offering flexible solutions, such as extended payment terms or a payment plan. This can sometimes prompt a response, as it shows your willingness to work with the client. Ensure that any agreements made are documented in writing to avoid future misunderstandings.

Take Legal Action Only if Necessary: If all attempts to reach the client have failed, and the matter is unresolved after a reasonable period, you may need to consider more formal actions, such as legal recourse or involving a collection agency. However, this should always be a last resort after exhausting all other options for communication.

Using a Template for Consistency

Having a standardized approach for sending payment reminders ensures that your communications are clear, professional, and consistent. By using a pre-defined format, you can streamline your process, reduce errors, and maintain a high level of professionalism in each interaction with clients. Consistency not only reflects well on your business but also helps clients recognize the seriousness of your payment requests.

Benefits of Using a Standardized Format

- Time Efficiency: A set structure allows you to quickly generate messages without needing to start from scratch each time, saving valuable time.

- Clear Communication: A consistent format ensures that all necessary details are included in every request, reducing the chance of miscommunication.

- Professionalism: A well-crafted, uniform approach projects a professional image and sets clear expectations for your clients.

- Improved Follow-ups: When using a set structure, it’s easier to track previous communications, ensuring that each follow-up remains consistent and timely.

How to Customize Your Standardized Approach

While consistency is key, personalizing your communication based on the client’s history and relationship with you is also important. A template doesn’t mean a one-size-fits-all approach. You can adjust the tone, language, and urgency depending on the client’s situation while keeping the basic structure intact. This combination of personalization and consistency helps maintain a positive working relationship while ensuring payments are add

Essential Elements of a Payment Reminder

When requesting payment, it’s important to include certain key details to ensure your message is clear, professional, and effective. A well-structured reminder ensures that the recipient understands the purpose of the communication and the steps needed to resolve the situation. These essential components help convey your expectations and encourage prompt action.

1. Clear Identification of the Amount Owed: Always specify the exact amount that is outstanding. This avoids any confusion and provides the recipient with a clear understanding of their obligation.

2. Reference to the Original Agreement: Include details about the original terms, such as the date when the payment was initially expected and any prior arrangements that were made. This helps the recipient recall the context of the transaction.

3. A Polite but Firm Request: Ensure that your language is respectful yet assertive. The tone should be professional, balancing courtesy with a clear request for payment.

4. A Clear Deadline: Specify a clear and reasonable date by which the payment should be made. This provides a sense of urgency without sounding overly demanding.

5. Contact Information: Provide easy access to any contact information, should the recipient have questions or require further clarification. This makes it easier for them to address any issues promptly.

6. A

How to Avoid Payment Delays

Timely payments are essential for maintaining a healthy cash flow and sustaining your business operations. To minimize the risk of late payments, it’s important to set up clear expectations from the beginning and adopt practices that encourage prompt action. By taking proactive steps, you can reduce the likelihood of delays and create a smoother payment process for both you and your clients.

1. Set Clear Payment Terms Early On: From the start of any transaction, ensure that your payment terms are clearly defined. Whether it’s specifying the amount, timeline, or method of payment, having these details agreed upon in writing helps prevent confusion and sets mutual expectations.

2. Invoice Promptly and Accurately: Send requests for payment as soon as the work is completed or goods are delivered. Be sure to double-check the accuracy of the information included, such as amounts, dates, and any additional charges, to avoid any delays caused by discrepancies.

3. Offer Multiple Payment Options: The easier it is for your clients to pay, the faster they are likely to do so. Offer a variety of payment methods, such as credit cards, bank transfers, or online payment systems, to accommodate your clients’ preferences.

4. Send Gentle Reminders: Follow up on unpaid amounts before the deadline, rather

How to Be Assertive Without Being Aggressive

When requesting payment, it’s essential to communicate your needs clearly and firmly while maintaining a respectful and professional tone. Being assertive means expressing your expectations and boundaries confidently, but without resorting to forceful or confrontational language. Striking this balance helps you achieve your goal of receiving payment, while also preserving a positive relationship with your client.

1. Use Clear and Direct Language: Avoid ambiguity when outlining what is expected. Clearly state the amount owed, the payment terms, and the deadline without being harsh. A direct but polite request sets the right tone and leaves no room for misunderstanding.

2. Maintain a Professional Tone: Stay calm and respectful, even when you need to express urgency. A professional tone shows that you are serious about receiving payment, but it also reflects your credibility and respect for the recipient.

3. Focus on the Facts: Avoid making the situation personal. Keep the focus on the outstanding amount, the terms of the agreement, and the steps needed to resolve the issue. This helps prevent your communication from coming across as emotionally charged or accusatory.

4. Offer Solutions, Not Threats: Instead of threatening actions, offer constructive solutions. For example, propose a payment plan or inquire if the client needs assistance with processing the payment. By focusing on solutions, you convey that you are reasonable and open to working together to resolve the situation.

5. Be Firm with Boundaries: While it’s important to be polite, don’t back down when it comes to your payment terms. Stand firm on the agreed-upon

How to Track Outstanding Invoices

Monitoring unpaid balances is essential for maintaining a steady cash flow. Implementing an efficient system for keeping track of outstanding payments ensures that your business remains financially healthy and can address overdue obligations promptly. The key is to stay organized and take proactive steps to follow up with clients while maintaining a professional approach.

Start by setting clear payment terms at the outset of your agreement. Establishing a clear understanding of when payments are expected, and the consequences of delayed payments, can help manage expectations on both sides. Once this is established, it’s easier to identify when accounts are falling behind.

Use accounting software or an online tool to create and manage records. These platforms can automatically track payment status, send reminders, and generate reports, saving you time and reducing the chance of human error. Many systems allow you to categorize balances according to their age, which helps prioritize collections more effectively.

Regularly review account statuses to stay on top of unpaid balances. Set aside time weekly or monthly to check for any outstanding payments and identify which accounts need attention. Keeping an eye on accounts early will allow you to address issues before they escalate.

Establish clear communication with clients when a payment delay occurs. Politely but firmly follow up with reminders or phone calls to discuss the matter. Open communication channels help maintain a good relationship and can often resolve issues more efficiently.

By staying organized, using technology, and following up consistently, you can minimize the impact of unpaid balances and maintain a smooth financial operation. A proactive approach will help reduce the likelihood of recurring payment issues.

How to Handle Disputes Over Payments

When disagreements arise over financial transactions, it’s crucial to address the situation professionally and promptly. Disputes can stem from various reasons, such as misunderstandings, discrepancies in terms, or unsatisfactory products or services. Handling these conflicts efficiently helps maintain positive client relationships and ensures that you receive the payments owed to you.

First, always stay calm and objective when dealing with payment disputes. Take the time to review all relevant documentation, including agreements, communications, and transaction records, to understand both sides of the issue. Approach the client with a willingness to listen, as this can lead to a quicker resolution.

Communicate clearly and politely to resolve the matter. Open up a dialogue and ensure both parties fully understand the issue. Sometimes, a simple conversation can clarify misunderstandings and lead to a mutually agreeable solution. If the dispute relates to a specific service or product, consider offering an alternative or compromise, such as a discount or a partial refund, to settle the matter amicably.

Document everything throughout the process. Keep detailed records of all communications, agreements, and resolutions. This documentation will serve as proof if the situation escalates and helps to avoid future confusion or disputes.

If the disagreement cannot be settled easily, consider involving a neutral third party or mediator. A professional mediator can help facilitate a resolution and ensure both parties’ interests are fairly represented.

Below is a simple table outlining a process for handling payment disputes:

Step Action 1 Review all relevant documentation and details of the transaction 2 Reach out to the client with a professional, understanding tone 3 Tools to Automate Invoice Reminders

Managing unpaid balances can be time-consuming, but automating the reminder process can help streamline your workflow and ensure timely follow-ups. With the right tools, you can set up automated notifications to remind clients about outstanding payments without the need for manual intervention. This not only saves you time but also reduces the chances of errors or missed reminders.

There are various platforms available that can simplify this task. These tools integrate with your existing systems and can send reminders based on pre-set conditions, such as the age of an outstanding balance or a specific time interval. Below are some of the top options for automating payment reminders:

- Accounting Software – Most modern accounting software solutions include automated reminder features. These platforms typically offer customizable options to send reminders at specific intervals, whether it’s a few days after the payment date or closer to the payment term.

- Invoice Management Systems – These systems are designed to handle all aspects of invoicing and can include automated follow-ups for unpaid balances. They can send emails or SMS notifications, providing clear payment instructions to clients.

- Payment Processors – Some payment processors, like PayPal or Stripe, offer built-in tools that automate reminders and notifications for unpaid transactions. These can be linked directly to your payment gateway and send automatic reminders when payments are pending.

- CRM Platforms – Customer Relationship Management (CRM) software can also be used to automate reminders. Many CRMs allow you to track payments and set up workflows to remind clients of pending balances as part of your customer communication strategy.

In addition to these tools, consider usin