How to Use a Partial Invoice Template for Efficient Billing

When managing financial transactions, businesses often need to handle payments in stages rather than receiving the full amount at once. This approach helps facilitate smoother operations, particularly for large projects or services that require extended completion times. A structured way to break down the amount owed allows both parties to stay organized and ensure that funds are appropriately distributed over time.

Creating a clear and professional document for each installment is essential for tracking amounts paid and remaining balances. It ensures transparency and provides a straightforward record for both clients and service providers. By adopting a well-organized system, you can avoid confusion and enhance communication throughout the payment process.

Utilizing a customizable document for these transactions simplifies the process, offering a reliable format for businesses of all sizes. Whether you’re working on a long-term project or just prefer flexible payment structures, this method supports a transparent and efficient billing cycle.

Partial Invoice Template Guide

When dealing with payments spread over multiple stages, having a clear and organized approach is key to managing financial transactions efficiently. This document helps outline the amounts due at different times, ensuring both the payer and recipient are on the same page regarding payment expectations and timelines. It serves as a reference for both parties to track progress and outstanding balances, making it easier to maintain accurate records throughout the process.

Key Elements to Include

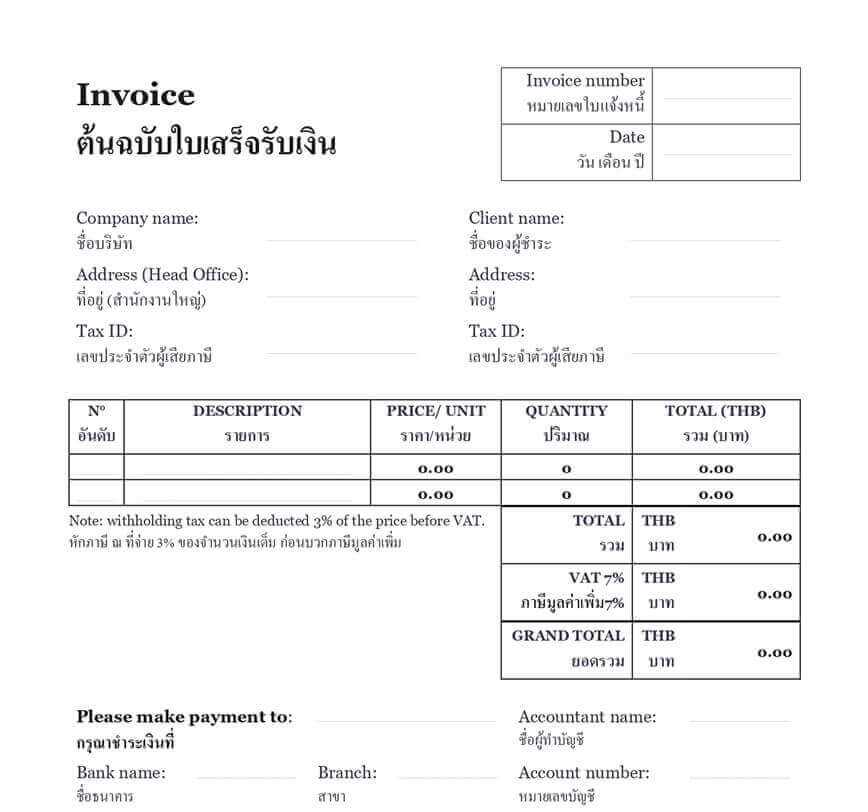

A well-organized document should contain all relevant information about the transaction. This includes the client’s details, a breakdown of services rendered, the amount due for each stage, and payment terms. Additionally, clear payment instructions and any agreed-upon deadlines should be included. Including the date of the transaction and specific references to prior payments or agreements helps maintain transparency and accountability.

Customizing Your Document for Different Needs

Each business may have unique requirements when it comes to structuring their payment documents. Some might prefer to highlight specific sections, while others may focus on keeping the document brief and to the point. The flexibility of this format allows for customization, whether you are working with long-term clients or managing smaller, one-off agreements. Tailoring the document to suit your specific needs ensures that it remains both functional and professional for any type of project or service.

Understanding Partial Invoices and Their Purpose

In business transactions where payments are split over time, it’s important to have a structured way of managing and documenting each stage of payment. This method ensures both the service provider and the client are aligned on the amounts due and the payment schedule. By clearly outlining the agreed-upon installments, both parties can maintain transparency and avoid confusion during the course of the agreement.

The primary purpose of this approach is to offer flexibility while ensuring that businesses receive compensation as work progresses. Instead of waiting for a full payment at the end, this system allows for partial compensation at various stages, helping to support cash flow and incentivize continued work. It also provides an organized record for tracking each payment made and how much is still outstanding.

Benefits of Using Partial Invoices

Using a structured approach to billing with payments broken down over time offers several advantages for businesses and clients alike. This method not only ensures smoother cash flow but also fosters clearer communication between both parties. By dividing the total amount into manageable parts, businesses can maintain a consistent income stream while clients can make payments according to their financial situation.

Improved Cash Flow Management

Breaking down payments into smaller amounts allows for better financial planning. Instead of waiting for a lump sum at the end of a project, businesses receive payments incrementally, supporting ongoing operations and reducing the risk of cash flow shortages.

Clearer Payment Tracking

With each payment documented and tracked, both the client and service provider can easily monitor the progress of the transaction. This approach reduces confusion and ensures that any discrepancies can be addressed quickly.

| Benefit | Explanation |

|---|---|

| Cash Flow | Steady payments support ongoing operations and reduce financial strain. |

| Transparency | Both parties have a clear record of payments made and outstanding amounts. |

| Flexibility | Clients can pay in stages, making it easier for them to manage finances. |

How to Create a Partial Invoice

Creating a document that divides payments over time is essential for managing projects with multiple stages or extended timelines. This document should clearly outline the agreed-upon amounts due at different points, ensuring both parties are aligned and aware of the payment schedule. The key to an effective document is clarity and simplicity, making it easy for both the client and business to track payments and remaining balances.

To create this type of document, follow these essential steps:

| Step | Description |

|---|---|

| 1. Include Client Information | Provide details such as the client’s name, address, and contact information to ensure accurate record-keeping. |

| 2. Break Down the Project | Detail the services or products provided and specify the cost for each stage of the work. |

| 3. Define Payment Amounts | Specify the amount due at each stage, as well as any previously paid amounts if applicable. |

| 4. Set Payment Terms | Clearly outline the due dates, accepted payment methods, and any late fees or penalties for missed payments. |

| 5. Keep a Running Total | Track the amount paid and remaining balance to maintain transparency throughout the process. |

Key Elements of a Partial Invoice

When preparing a document to request staged payments, it is important to include specific information that ensures clarity and accuracy for both the client and the service provider. A well-structured document provides a clear breakdown of the amounts due, payment terms, and any important details that help avoid confusion during the payment process.

The following elements are crucial for a comprehensive and professional document:

Client Information – Always include the client’s name, address, and contact details. This ensures that the document is correctly attributed and can be easily referenced.

Payment Breakdown – Clearly list the services or products provided, along with the corresponding cost for each stage. This gives both parties a clear understanding of what is being paid for at each interval.

Amount Due – Specify the exact amount required at each payment stage, taking into account any previous payments that have already been made. This helps avoid misunderstandings about remaining balances.

Payment Terms – State the agreed-upon payment terms, including due dates, accepted payment methods, and any penalties for late payments. This section ensures both parties are aware of expectations and timelines.

By including these elements in each document, businesses can ensure a professional, transparent, and efficient billing process for all staged payments.

When Should You Use Partial Invoices

There are several situations where breaking down payments into smaller, manageable amounts is beneficial for both businesses and clients. This approach is especially useful in cases where projects are long-term, involve multiple stages, or require significant resources. By structuring payments over time, both parties can maintain cash flow and ensure that the work progresses smoothly.

Long-Term Projects – For projects that span several months or years, requesting payments at regular intervals helps ensure that the service provider is compensated as work progresses. This method prevents financial strain on the provider while offering clients a manageable payment schedule.

High-Value Contracts – Large-scale contracts, such as construction or consulting agreements, often require large upfront investments. Staging payments ensures the client is not overburdened while giving the business the necessary cash flow to continue operations and meet project milestones.

Custom or Tailored Work – When a project involves bespoke or customized services, the scope and value of the work may change over time. This method allows for flexibility in adjusting payments as the project evolves, ensuring both parties are on the same page regarding compensation.

Using this payment structure helps manage expectations, reduce the risk of non-payment, and build trust between the service provider and client.

Common Mistakes in Partial Invoicing

While dividing payments across multiple stages can be a helpful way to manage large projects, there are common pitfalls that can lead to confusion, delays, or even disputes. Many businesses and clients may overlook essential details when structuring these documents, which can negatively impact both parties.

Lack of Clear Payment Breakdown – One of the most frequent mistakes is not clearly itemizing the services or products provided at each stage. Without a detailed breakdown, clients may be unsure of what they are being charged for, which could lead to misunderstandings or delayed payments.

Forgetting to Track Previous Payments – Failing to account for amounts already paid is another common mistake. This oversight can cause confusion about remaining balances and make it difficult to track the overall payment schedule. It’s important to always update the remaining balance as payments are made.

Unclear Payment Terms – When the payment terms are vague or incomplete, both parties may have different expectations. Clearly outlining the due dates, accepted methods, and late fees is crucial to avoid disagreements and ensure timely payments.

By avoiding these common mistakes and maintaining clarity throughout the process, businesses can create smoother transactions and foster trust with clients.

Tips for Accurate Partial Billing

Ensuring accuracy in staged payment requests is essential to maintaining a smooth financial process and preventing disputes. By paying attention to the details, businesses can ensure that both they and their clients are clear on the amounts due and the terms of payment. Here are some practical tips to ensure accurate billing throughout the course of a project.

- Keep Detailed Records – Track every payment, including amounts paid and remaining balances, to avoid confusion later. Regular updates to the billing schedule will help keep everything organized.

- Be Transparent with Clients – Always provide a clear breakdown of the work completed and the amounts owed. Transparency ensures that both parties are on the same page and reduces the risk of misunderstandings.

- Use Clear Payment Terms – Clearly state the payment methods, due dates, and penalties for late payments. This makes it easier for clients to follow the payment schedule and avoid delays.

- Consider Automating the Process – Using billing software or systems can help automate calculations, track payments, and generate accurate documents, ensuring everything is consistent and up to date.

- Review All Information – Double-check the details on each document before sending it. Verify that the amounts, dates, and services listed are correct to avoid any issues down the line.

By following these tips, businesses can ensure their staged billing process is accurate, professional, and efficient, promoting better financial management and stronger client relationships.

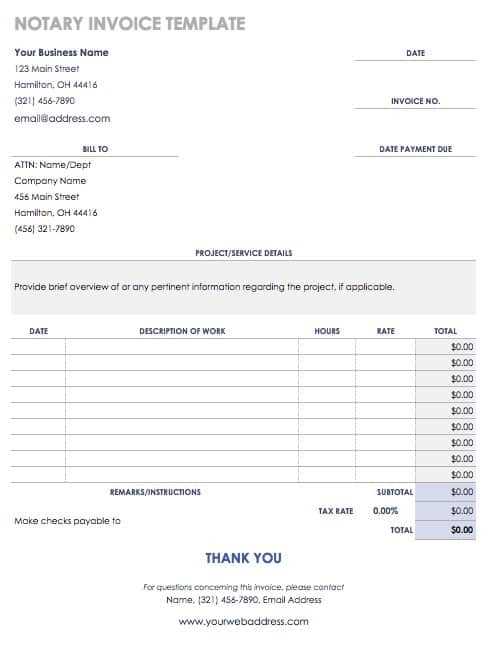

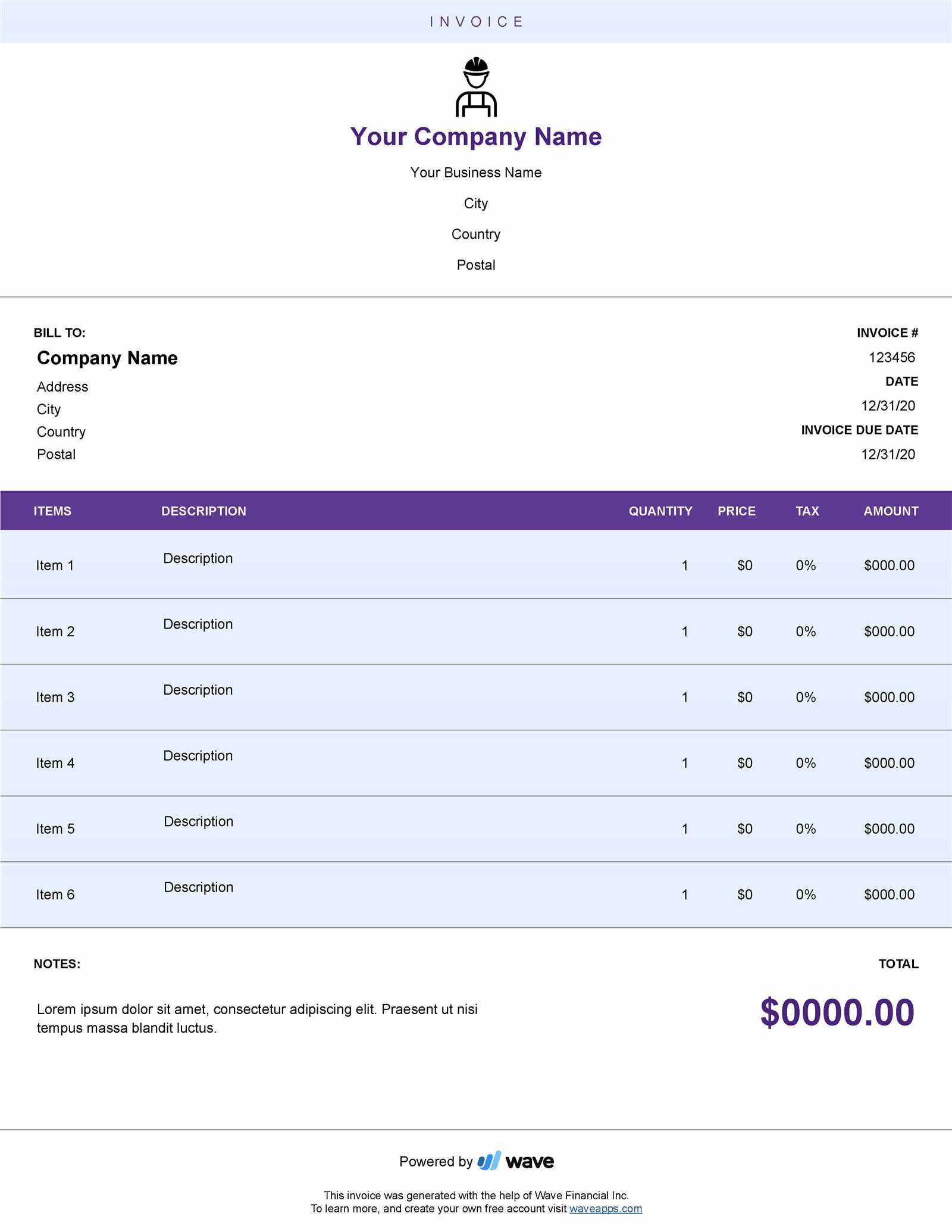

Customizing a Partial Invoice Template

Tailoring payment request documents to meet the specific needs of your business and clients can enhance professionalism and improve clarity. By customizing these documents, you ensure they reflect the unique aspects of your transaction, making the process more transparent and organized. Below are key elements to consider when personalizing these documents.

- Branding Elements – Include your company logo, contact information, and any branding colors or fonts to make the document visually aligned with your corporate identity.

- Payment Breakdown – Customize the sections to reflect the specific stages or milestones in the project. This allows clients to see exactly what they are being billed for at each phase of the work.

- Custom Terms and Conditions – Modify the payment terms to reflect your business’s policies. Include due dates, payment methods, and any penalties for late payments.

- Additional Information – Add relevant details such as project timelines, descriptions of work completed, or any special notes that help clarify the terms for the client.

- Field Customization – Adjust the fields to include specific reference numbers, job codes, or project identifiers to make tracking easier for both parties.

Customizing these documents not only makes them more relevant and specific to each transaction but also ensures smoother communication and better financial management.

Legal Considerations for Partial Invoices

When requesting staged payments, it’s crucial to be aware of the legal aspects that govern these transactions. Understanding the legal framework surrounding payment requests ensures that businesses remain compliant and protect themselves from potential disputes. Below are important legal considerations to keep in mind when using such payment documents.

- Clear Terms and Conditions – Always ensure that the terms of payment are explicitly outlined, including amounts, deadlines, and the work or services associated with each payment. This clarity helps avoid legal conflicts regarding obligations.

- Compliance with Local Laws – Different regions may have specific regulations governing payment requests. Be sure that your documents comply with local business laws to avoid legal challenges.

- Contractual Agreements – Ensure that any staged payment arrangement is covered under a formal contract with the client, specifying payment schedules and any consequences of non-payment.

- Late Payment Fees – If your payment documents include penalties for late payments, these should be legally enforceable. Make sure that the terms for late fees are clearly stated and comply with applicable laws.

- Record Keeping – Maintain thorough records of all transactions and agreements related to staged payments. This documentation can protect your business in case of legal disputes or audits.

By keeping these legal considerations in mind, businesses can avoid potential complications and ensure that their payment requests are both effective and legally sound.

Partial Invoices vs. Full Invoices

Understanding the difference between requesting staged payments and one-time payments is essential for businesses managing various types of transactions. Both methods serve different purposes, and knowing when to use each is key to maintaining healthy cash flow and managing client expectations effectively. This section explores the distinct characteristics of both approaches to payment requests.

Staged Payment Requests

Staged requests for payment are typically used for long-term projects or orders that require multiple steps to complete. They allow businesses to receive payments incrementally as milestones are reached, ensuring they maintain cash flow during the duration of the work. These types of payment schedules are often tied to the completion of specific phases or deliverables.

One-Time Payment Requests

On the other hand, one-time payment requests are issued when the full amount is due for a product or service rendered in its entirety. This approach is more straightforward, as the full amount is paid once the work is completed, providing the business with a lump sum. It is most often used for smaller projects or products that do not require extended delivery timelines.

Key Differences:

- Payment Structure: Staged payments are divided into smaller amounts, while full payments are made in one lump sum.

- Use Case: Staged payments are ideal for long-term or complex projects, whereas full payments suit simpler transactions.

- Cash Flow: Staged payments ensure continuous revenue, while full payments offer an immediate cash influx.

By understanding the advantages and differences of both payment methods, businesses can better tailor their approach to their clients’ needs and project demands.

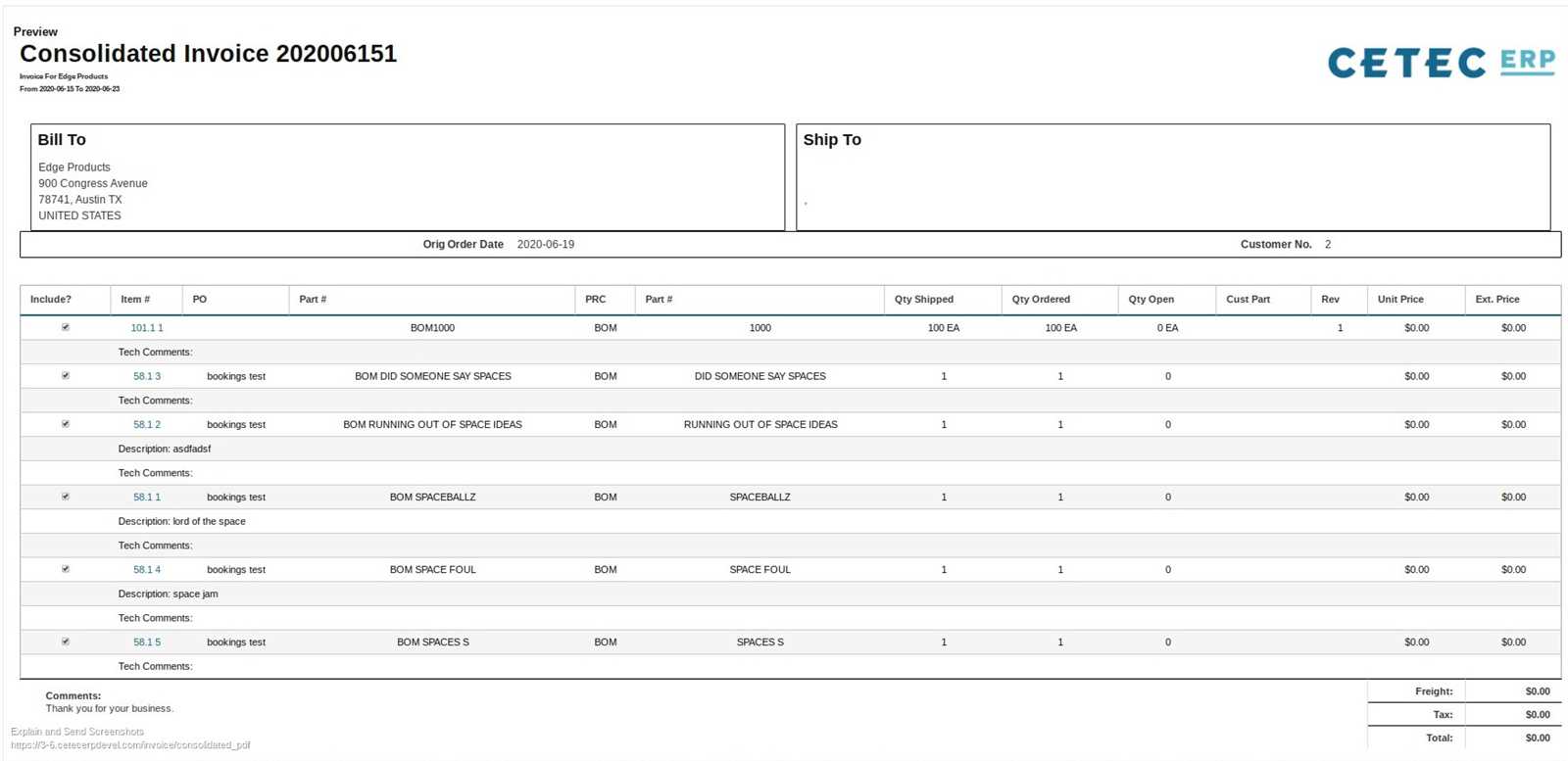

Integrating Partial Invoices with Accounting Software

Incorporating payment requests and billing systems into your financial management software can significantly streamline accounting processes. Automating the tracking and recording of payments, especially when they are received in stages, helps to reduce manual errors and improves overall accuracy in managing financial records. This section explores how integrating payment structures with accounting tools can simplify billing and enhance financial oversight.

Many modern accounting platforms offer features that allow businesses to track and manage payments across multiple stages. By connecting your payment request system with your accounting software, you can automatically update records as payments are received, ensuring that all transactions are reflected in real time. This integration saves time and ensures that no details are missed during the billing process.

Benefits of Integration:

- Real-Time Updates: As payments are processed, accounting records are instantly updated, ensuring accurate financial reporting.

- Efficiency: Automated tracking reduces the need for manual data entry, minimizing the risk of errors.

- Improved Cash Flow Management: By automatically recording received payments, businesses can more easily track cash flow and forecast future revenue.

Connecting your payment management system with your accounting software is a powerful step towards enhancing your financial processes and ensuring a smoother billing experience for both you and your clients.

How Partial Invoices Improve Cash Flow

Managing cash flow is critical for the success of any business, and a key strategy to optimize financial stability is through structured payment scheduling. Breaking down payment requests into stages allows companies to receive funds more quickly, reducing the time it takes to collect full payment. This approach can have a significant positive impact on liquidity and overall cash flow management.

By requesting payments in smaller amounts over a longer period, businesses can ensure a steady stream of income. This process allows for the gradual accumulation of revenue without having to wait for the full sum to be settled at once. Consequently, companies are less likely to experience cash flow gaps and can meet ongoing operational expenses more easily.

Key Benefits for Cash Flow:

- Faster Payments: Receiving incremental payments throughout a project or service period accelerates cash inflow, improving working capital.

- Reduced Financial Strain: Splitting large payments into smaller, more manageable portions helps businesses avoid the stress of delayed payments.

- Better Financial Planning: With regular, predictable payments, businesses can forecast their financial needs more accurately and plan accordingly.

Overall, structuring payment schedules with incremental amounts helps businesses stay financially agile and prepared to handle day-to-day expenses, leading to smoother operations and healthier cash flow.

Tracking Payments with Partial Invoices

Effectively monitoring payments is essential for maintaining financial control and ensuring a smooth cash flow process. When payments are split into multiple stages, tracking each payment becomes even more important. This enables businesses to stay on top of what has been paid, what is still outstanding, and ensures transparency between parties involved.

Tracking payments helps businesses avoid missing due amounts, which could potentially delay services or affect the completion of projects. A structured approach to monitoring payments ensures that companies can quickly identify discrepancies or delays and take appropriate action.

Effective Strategies for Tracking Payments

- Utilize Accounting Software: Use software to track each stage of payment and automatically update records as payments are made.

- Maintain Clear Records: Keep detailed documentation of all transactions, including amounts, dates, and payment methods.

- Set Payment Deadlines: Define clear deadlines for each payment stage to ensure timely receipts and reduce confusion.

Benefits of Organized Payment Tracking

- Improved Cash Flow Management: Ensuring payments are tracked reduces the risk of financial shortfalls.

- Transparency: Both businesses and clients can view the status of each payment, improving trust and communication.

- Quick Resolution of Issues: If a payment is missed or delayed, it can be quickly flagged and addressed, preventing project delays.

By organizing payment tracking and following these practices, businesses can manage their financial transactions efficiently, ensuring that they receive all payments in a timely manner.

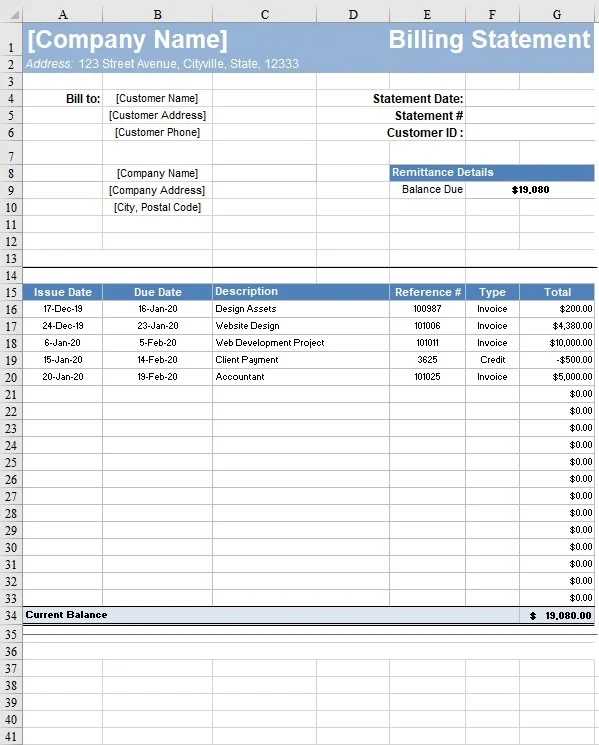

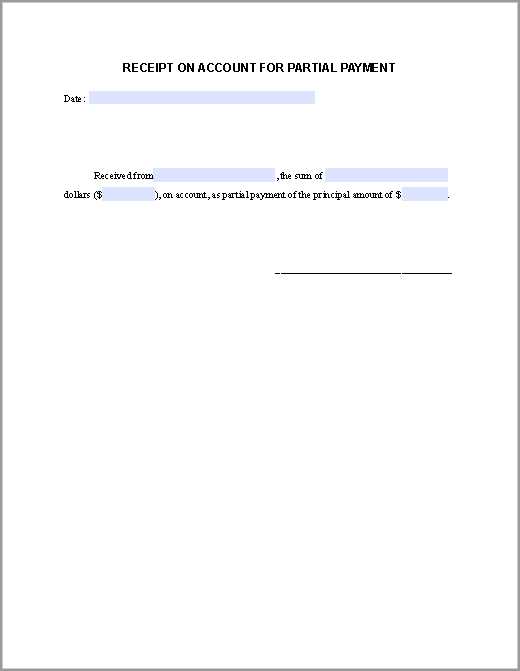

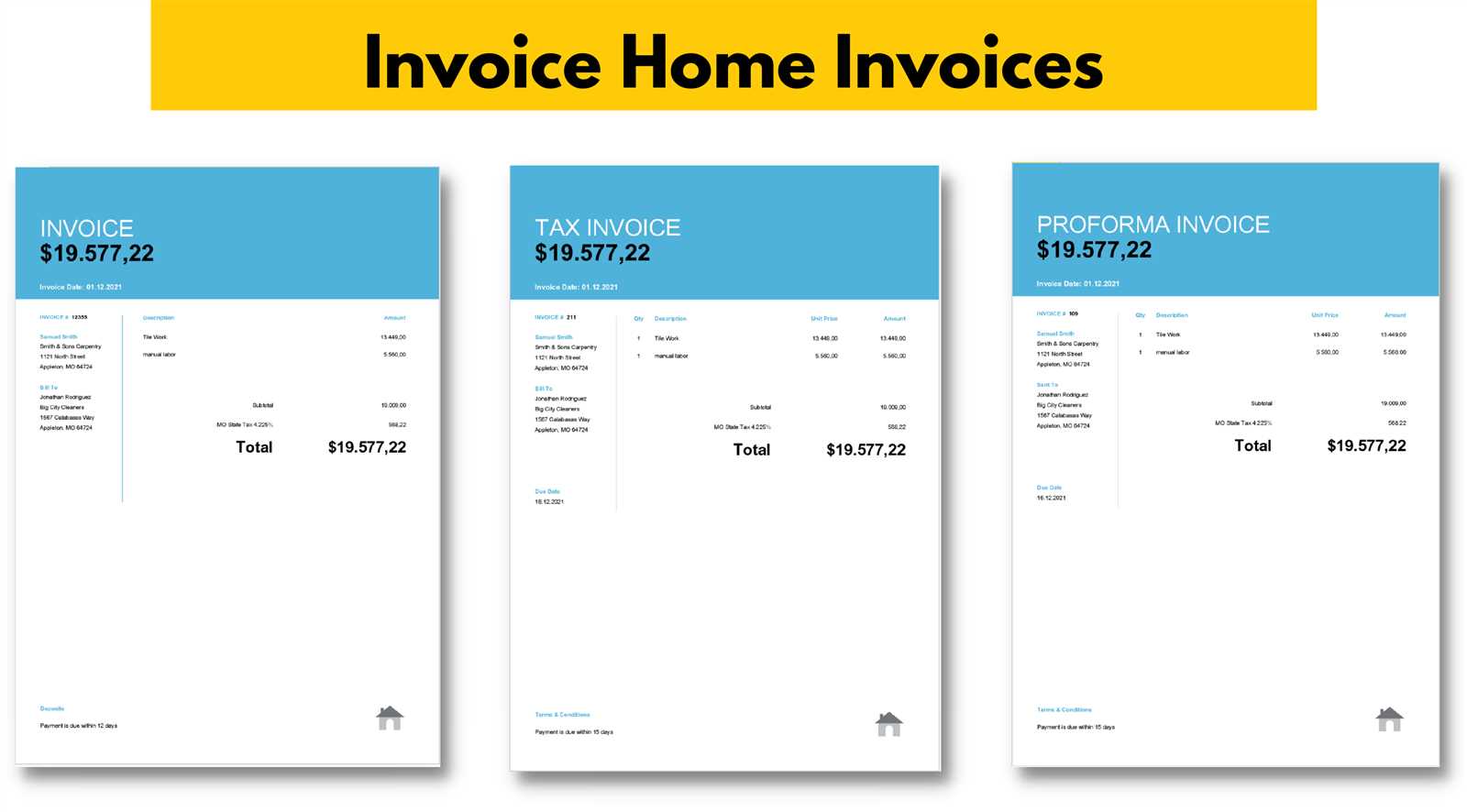

Examples of Partial Invoice Templates

When working with payments that are made in multiple stages, having a structured document to manage and record each installment is crucial. These documents are designed to reflect the progress of a transaction, allowing both the seller and buyer to track amounts paid and outstanding balances. Below are a few examples that show different ways to organize and present this information clearly.

| Example 1 | Description |

|---|---|

| Progress Payment Document | Used when the agreement involves multiple payments over time, outlining the completed work or delivered goods in each stage, with corresponding amounts due. |

| Example 2 | Description |

| Installment Payment Record | Shows the total amount due, the installments made so far, and the remaining balance, ensuring both parties are aware of what has been paid and what is pending. |

| Example 3 | Description |

| Percentage-Based Payment Statement | Details payments based on percentages of the overall price, useful for large projects with clear phases or milestones, allowing payments to be tied to specific deliverables. |

These examples demonstrate various ways to present staged payments in an organized manner, ensuring transparency and reducing confusion between parties involved in the transaction.

Ensuring Compliance in Partial Invoicing

When handling transactions with multiple payment stages, it is essential to adhere to legal and regulatory standards. Proper documentation ensures that all parties are protected and that financial records align with applicable laws. Without the right structure and attention to detail, businesses risk facing legal challenges or complications in the future.

Transparency is key when managing payments. Each stage should be clearly defined, with precise amounts indicated for both the payment received and any outstanding balance. This not only helps in tracking the transaction but also guarantees that both parties understand their obligations. Make sure the document reflects the agreed-upon terms to avoid misunderstandings.

Compliance with tax regulations is another important factor. Many regions require that tax calculations and reporting are accurate for each payment made. Be sure to include all necessary tax-related details, such as tax rates and amounts due. Failure to do so can lead to penalties and audits that could negatively affect business operations.

Record keeping is vital for both the seller and the buyer. Keeping detailed records of each payment stage ensures that all transactions are accounted for. This also aids in simplifying any future audits and makes it easier to reference past transactions in case of disputes.

Proper documentation can prevent potential issues with financial institutions, auditors, or tax authorities. By following the correct format and ensuring all required details are present, you can maintain a transparent and legally compliant process throughout the payment stages.

Improving Client Relationships with Partial Invoices

Breaking up the payment process into smaller, manageable stages can foster trust and enhance communication between businesses and their clients. This approach ensures clients feel supported throughout the project, knowing they are not overwhelmed by a large sum at once. By offering this flexibility, businesses can demonstrate their commitment to a long-term partnership built on mutual understanding and respect.

Building Trust and Transparency

One of the primary benefits of splitting payments is the opportunity to establish a transparent relationship with clients. With clear documentation detailing each payment stage, clients have a comprehensive overview of what they are paying for and when. This can help to prevent misunderstandings and foster a sense of security, ensuring both parties feel confident in the transaction process.

Enhancing Communication and Flexibility

Allowing clients to make incremental payments gives them the flexibility to manage their cash flow more effectively. This approach helps businesses remain in contact with clients throughout the course of a project, ensuring that adjustments or concerns can be addressed promptly. A flexible payment plan is particularly valuable for clients with varying budgets or cash flow challenges, improving overall satisfaction and encouraging repeat business.

Strengthening Client Loyalty becomes easier when clients feel their financial needs are taken into account. By offering smaller payment intervals, businesses can make their services more accessible and accommodating, leading to stronger relationships and greater client retention. When clients see that their business matters and that their needs are prioritized, they are more likely to return for future collaborations.