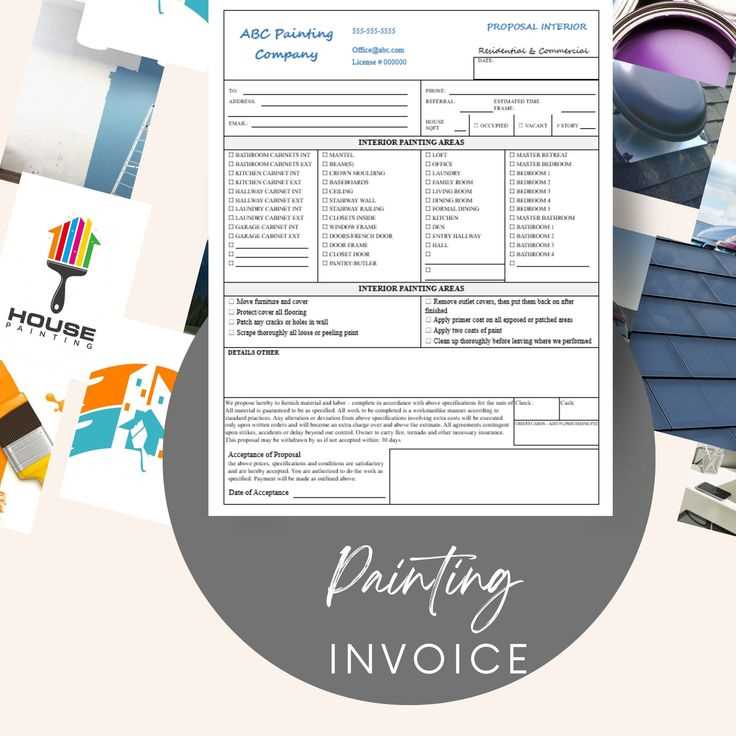

Download Customizable Painting Invoice Template in Word Format

Managing client payments is a crucial part of any business. Efficient billing ensures that you receive compensation for your services in a timely and organized manner. Using a well-structured document to outline the work completed and the amount owed not only improves professionalism but also helps avoid potential misunderstandings with clients.

By creating a clear, customizable document for your transactions, you can maintain consistency across all communications. This document can be tailored to fit the specific needs of your business, whether you are dealing with large-scale projects or smaller jobs. With the right format, managing financial records becomes simpler and more efficient, saving you time and effort in the long run.

Moreover, this type of tool allows you to easily track payments, apply taxes, and adjust for any discounts or additional charges. It offers a straightforward approach to documenting services rendered while keeping your business running smoothly and professionally.

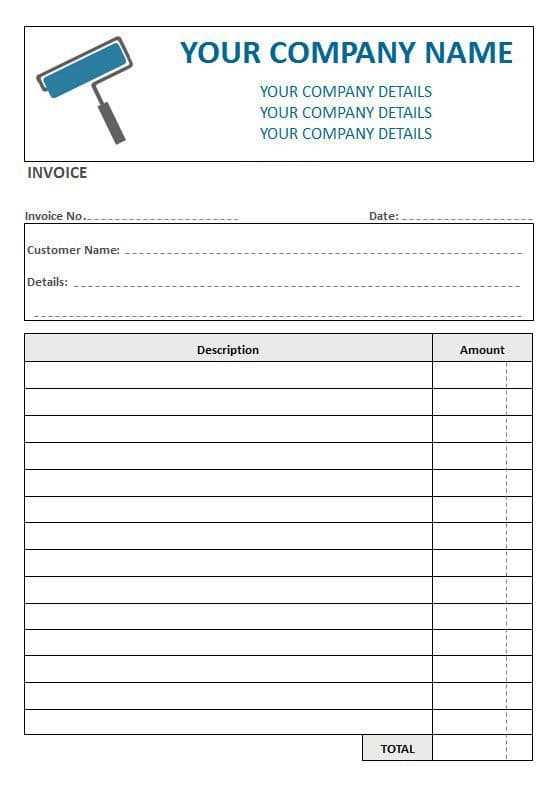

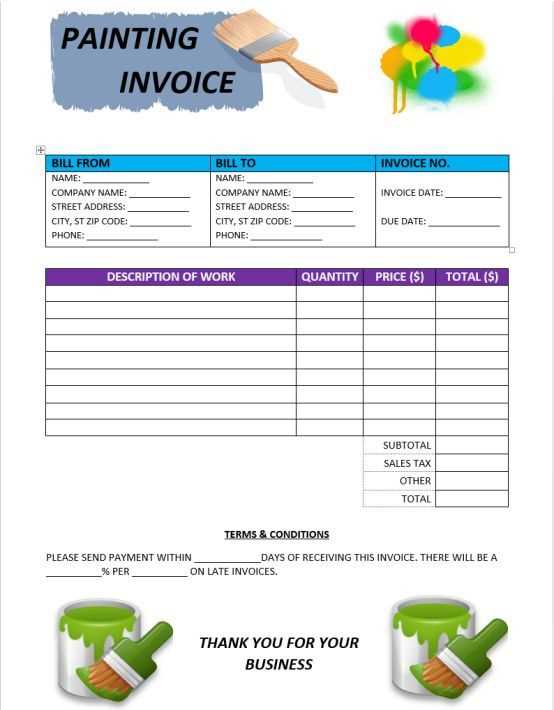

Painting Invoice Template Word

When it comes to managing financial transactions in the field of home improvement or decoration services, having a reliable document to outline costs and payment details is essential. A well-structured document can help both the service provider and the client keep track of the work completed, the agreed-upon rates, and any additional charges that may arise throughout the job.

Using a customizable document for billing allows for easy adjustments to suit specific needs. This tool can be created to match your business requirements, whether you are working on a single room, a whole property, or large-scale commercial projects. Below are key features that make this document an essential tool for your business:

- Clear Itemization: List every service provided and the corresponding costs.

- Professional Look: Maintain a consistent, polished appearance across all transactions.

- Easy Customization: Modify the format to fit your unique pricing model and services.

- Accurate Record Keeping: Track payments, add taxes, and manage discounts.

- Time-Saving: Quickly generate the document and reduce administrative workload.

By utilizing this customizable document, you can ensure both clarity and professionalism in your transactions, leading to better relationships with your clients and a more organized business operation overall.

What is a Painting Invoice Template?

A billing document used in home improvement services serves as a formal record that outlines the work completed, the costs associated with the services, and the payment terms. This tool helps service providers and clients stay on the same page regarding project costs and ensures clarity when it comes to financial transactions.

Key Elements of a Billing Document

Each document typically includes several essential components to make the transaction transparent and professional. The following table outlines the most common sections found in a typical document for decoration or repair services:

| Section | Description |

|---|---|

| Service Description | Details of the work performed, including the scope of the project or specific tasks completed. |

| Pricing | The cost for each task or service, as well as the overall total. |

| Payment Terms | Information on when the payment is due, including any applicable late fees or discounts for early payment. |

| Client Information | Details about the client, such as name, contact information, and address. |

| Service Provider Information | Details about the business or individual providing the services, including name, contact, and business address. |

Why Use This Document?

Having a standardized document for billing purposes helps businesses maintain organization, improve communication with clients, and ensure that payments are received promptly. It can be easily customized to reflect specific pricing structures or services offered, making it a versatile tool for service-based businesses. By using such a document, you can ensure that every transaction is clear, professional, and well-documented.

Why Use a Painting Invoice Template?

Having a well-organized document for billing is essential for businesses that provide services. It helps ensure clarity between service providers and clients, outlining the details of the work performed and the corresponding costs. Such a document can also streamline administrative tasks, making it easier to manage payments, track transactions, and maintain professionalism in all financial dealings.

Using a standardized format for each transaction offers several advantages:

- Consistency: A uniform structure ensures all essential details are included every time, avoiding confusion or missed information.

- Time Efficiency: Instead of creating a new document from scratch for each project, a pre-made structure allows for quick customization and saves time.

- Professional Appearance: A polished and well-designed document communicates reliability and attention to detail to clients, enhancing trust in your services.

- Accurate Record-Keeping: By using a consistent format, you can easily track past payments, outstanding balances, and project histories.

- Customization: While a standard format is helpful, these documents can be tailored to suit your specific pricing models and client agreements, allowing flexibility.

Incorporating such a document into your business workflow reduces the risk of mistakes, helps maintain a smooth financial process, and creates a more organized approach to managing client relations.

How to Customize Your Painting Invoice

Customizing a billing document to suit your specific needs is essential for streamlining your financial processes. By adjusting various elements, you can ensure that the document reflects the unique details of each project, such as the types of services provided, pricing structures, and payment terms. Tailoring the format allows you to keep your records organized and make your business operations more efficient.

Here are some key elements you can modify to better match your services:

| Customizable Element | Description |

|---|---|

| Service Descriptions | Specify the tasks performed, including any additional work or special requests made by the client. |

| Pricing Structure | Adjust the rates based on hourly, flat rate, or project-based pricing models. Include any special fees or discounts. |

| Payment Terms | Define the due date for payment, late fees, and any deposit requirements or installment options. |

| Business Branding | Incorporate your logo, business name, and contact information to maintain a professional and cohesive brand image. |

| Tax Information | Include applicable tax rates for your services, ensuring compliance with local tax laws. |

With these adjustments, you can ensure that each document aligns with your business model and provides clear, detailed information to your clients. Customizing your billing documents not only enhances your professionalism but also helps avoid misunderstandings and keeps your accounting organized.

Key Elements of a Painting Invoice

A well-organized financial document is essential for both businesses and clients to ensure clear communication regarding the services provided and their associated costs. It serves as a record that outlines the details of the work completed, the charges, and the terms for payment. For a document to be effective, certain key components must be included to ensure clarity and prevent misunderstandings.

Essential Sections in a Billing Document

The following are critical elements that should be incorporated into any document used to request payment for services rendered:

- Service Description: Clearly list the work performed, specifying what tasks were completed and any additional services requested by the client.

- Pricing: Provide a detailed breakdown of costs, including the rate for each service and any additional charges for materials or special requests.

- Payment Terms: Specify when payment is due, including any late fees, deposit requirements, or installment options. This ensures both parties are on the same page regarding financial expectations.

- Client Information: Include the client’s name, contact information, and address to ensure proper identification and delivery of the document.

- Business Information: Include the name of the service provider, business contact details, and any relevant licensing or registration numbers to maintain professionalism.

- Taxes and Fees: If applicable, indicate any taxes that need to be applied to the total amount, as well as other fees that may have been incurred during the service.

Formatting and Presentation

Beyond the content, it’s crucial to ensure that the document is easy to read and professionally formatted. Use a clean layout with clear headings, bullet points, and sections. This not only makes the information accessible but also projects a professional image of your business.

Including all these key elements helps to create a transparent and professional document that facilitates smooth financial transactions and reinforces trust with your clients.

Benefits of Using Word for Invoices

When it comes to managing financial records, using a versatile and widely available tool for creating billing documents offers numerous advantages. The flexibility and familiarity of this software make it an excellent choice for small businesses and independent contractors who need a simple, customizable way to generate and manage payment requests.

Key Advantages of Using a Text Processor

Below are the main benefits of choosing this software for your payment documentation:

- Ease of Use: Most people are familiar with text-processing software, making it easy to create, modify, and update billing documents without requiring additional training or specialized knowledge.

- Customization Options: The program allows you to tailor documents with your business’s branding, specific pricing structures, and personal preferences, providing a professional look that fits your business model.

- Efficiency: Templates and pre-designed formats allow for quick creation of new documents, saving time on administrative tasks and making it easier to stay on top of payments.

- Professional Presentation: With features such as bold text, tables, and custom headers, you can format documents to look polished and organized, reinforcing a professional image with clients.

- Compatibility: Documents created in this software can be easily shared via email, printed, or saved in various formats (such as PDF) for distribution, making it simple to handle payments from anywhere.

- Document Security: Many programs allow you to password-protect files or track changes, adding a layer of security to sensitive financial information.

Time and Cost Savings

Using this software can help save both time and money. It’s cost-effective since the program is typically already available on most computers, and it eliminates the need for third-party invoicing software. Additionally, the ease of creating and customizing documents means you spend less time on administrative work, allowing you to focus on growing your business.

Overall, leveraging this tool for your financial documentation streamlines the billing process, increases efficiency, and ensures that your documents look professional and well-organized.

How to Create an Invoice in Word

Creating a formal document for requesting payment is an essential part of managing business transactions. Using a text processor to design and generate such documents allows you to customize them easily while maintaining a professional appearance. Whether you’re a freelancer or a small business owner, learning how to generate a clear and effective document can streamline your billing process and ensure accuracy in financial records.

Step-by-Step Process

Follow these steps to create a well-organized billing document from scratch:

- Open the Text Processor: Start by opening the program on your computer. Create a new blank document to begin entering the required information.

- Set Up Your Header: At the top of the page, include your business name, address, contact information, and logo (if applicable). This makes your document look more professional and ensures clients can easily reach you.

- Add Client Information: Include the recipient’s name, address, and contact details. This ensures the document is correctly attributed to the right client.

- Detail the Services: List the services rendered or products sold. For each item, include a description, the unit price or hourly rate, and the total cost for each service. You can format this using a table for clarity.

- Include Payment Terms: Clearly state the due date, accepted payment methods, and any late fees or discounts. This section helps set expectations and encourages timely payment.

- Add Tax Information: If applicable, include any sales tax or other charges related to the services. Make sure the tax rate is clearly defined and the total amount is adjusted accordingly.

- Summarize the Total: Provide a final amount that includes the cost of services, taxes, and any additional charges. This should be clearly highlighted to make the total easily recognizable.

- Review and Save: Proofread the document to ensure all information is accurate and complete. Save it in the preferred format, such as PDF, for easy sharing with the client.

Customizing Your Document

Once you have the basic structure, you can further customize the document by adding additional details or modifying the layout to fit your branding. You can adjust fonts, colors, and spacing to create a document that matches your business’s style. This personalization not only improves the appearance but also reinforces your professional image.

Creating a clear and detailed document in a text editor ensures a smooth transaction process. It helps prevent misunderstandings and provides a solid record of the services provided and the agreed-upon costs.

Best Practices for Painting Invoices

Creating accurate and professional billing documents is essential for maintaining smooth financial transactions with clients. The way you present charges can significantly impact your business’s credibility and the likelihood of timely payments. By following certain best practices, you can ensure that your billing process is clear, consistent, and efficient, benefiting both your clients and your business.

Clarity and Detail in Service Descriptions

One of the most important aspects of any billing document is providing a clear and detailed description of the services rendered. Clients should be able to understand exactly what they are being charged for. Avoid vague descriptions and instead, break down the tasks into specific actions. For example, rather than simply listing “work completed,” specify “room preparation,” “wall priming,” or “final touch-ups.” This helps ensure transparency and reduces the risk of disputes.

- Be specific: Describe each service in clear terms, including materials used or time spent, if applicable.

- Breakdown of costs: Provide a cost for each individual task or unit of service to make it easier for clients to understand the overall price.

- Show quantities: If charging by square footage, hours worked, or quantity of materials, make sure this is clearly stated.

Payment Terms and Deadlines

Setting clear payment expectations is crucial for both parties. It’s important to specify the due date, payment methods, and any applicable fees. This eliminates confusion and ensures that the client knows when to pay and how to pay. Additionally, providing options for payment, such as online methods or checks, can help facilitate a smoother transaction.

- Set a clear due date: Always specify when the payment is due to avoid delays or misunderstandings.

- Include late fees: If your business policy includes penalties for late payments, be sure to clearly state these terms upfront.

- Offer multiple payment options: Provide flexibility in how clients can pay, such as bank transfers, online payments, or credit cards.

By following these best practices, you not only ensure that your billing documents are professional and organized but also reduce the chances of payment delays and misunderstandings. Clear communication and transparency will help foster positive relationships with your clients, leading to repeat business and a

Common Mistakes to Avoid in Invoices

Billing documents are an essential part of the financial process, but they must be accurate and complete to ensure timely payments and avoid confusion. Even small mistakes can lead to delays or disputes with clients. Being aware of common errors and how to avoid them can help streamline your payment process and maintain professional relationships with clients.

Errors in Pricing and Calculations

One of the most significant mistakes is inaccurate pricing. Incorrectly calculated totals, forgotten charges, or missing taxes can cause confusion and delay payments. Ensure every price is clearly stated, and all calculations are correct before finalizing the document. Additionally, rounding errors can add up over time, so double-checking each amount is essential.

- Incorrect Pricing: Always double-check your pricing for each service or product to avoid undercharging or overcharging your clients.

- Omitted Taxes or Fees: Ensure that any relevant taxes, handling fees, or additional costs are included and clearly labeled.

- Mathematical Errors: Verify all totals, tax calculations, and discounts to ensure the final amount is accurate.

Incomplete or Missing Information

Another common mistake is leaving out crucial details that are necessary for processing payment. Missing client information, service descriptions, or payment terms can delay or complicate the payment process. Be sure that all sections are filled out completely, including the service provider’s information, client contact details, and a full description of the work done.

- Missing Client Details: Ensure that the client’s name, address, and contact information are clearly stated.

- Vague Service Descriptions: Always describe the services provided in detail to avoid confusion or disputes over what is being charged for.

- Unclear Payment Terms: Include clear payment deadlines and any applicable late fees to avoid misunderstandings about when and how payments should be made.

By avoiding these common errors, you can create accurate, professional billing documents that will help facilitate smoother transactions and ensure that your clients know exactly what to expect. Paying attention to det

Understanding Payment Terms in Invoices

Clearly defined payment terms are a crucial part of any billing document, ensuring that both the service provider and the client understand the financial expectations. These terms outline the time frame for payment, methods of payment, and any penalties for late payments. Establishing transparent payment terms helps prevent misunderstandings and encourages timely settlements, keeping your cash flow steady.

Payment terms can vary based on the agreement between the service provider and the client, but there are common practices that businesses typically follow. Below is a table summarizing the most frequently used payment terms in business transactions:

| Payment Term | Description |

|---|---|

| Net 30 | The full payment is due 30 days after the billing date. This is one of the most common payment terms in many industries. |

| Net 60 | Payment is due 60 days from the date of the bill. This term is often used for larger projects or corporate clients. |

| Due on Receipt | Payment is expected immediately upon receiving the document. This term is typically used for smaller businesses or services rendered on short notice. |

| 50% Upfront | Clients are required to pay half of the total amount before work begins, with the remaining balance due upon completion. |

| Early Payment Discount | A discount is offered to clients who pay before the due date, encouraging early payment. For example, “2% discount if paid within 10 days.” |

| Late Fee | Charges applied if payment is made after the due date. The fee is typically a percentage of the total amount owed (e.g., 1.5% per month). |

Choosing the right payment terms depends on your business model, the client’s preferences, and

Tracking Payments with Invoice Templates

Properly tracking payments is essential for maintaining financial clarity and ensuring timely collection of funds. By incorporating tracking features into your billing documents, you can efficiently monitor which payments have been made, which are outstanding, and which are overdue. This helps you stay on top of your finances, avoid late payment issues, and maintain a professional relationship with your clients.

Most businesses rely on clear, organized billing records to track outstanding payments. When using a billing document template, it’s essential to include sections that allow you to easily mark or note payment statuses. Here are some key strategies for effectively tracking payments:

- Payment Status Column: Include a section where you can update the payment status of each document. Common categories include “Paid,” “Pending,” and “Overdue.” This lets you quickly assess the status of each transaction.

- Due Dates: Always list the payment due date on each document. By cross-referencing these dates with actual payment receipts, you can easily identify overdue payments.

- Payment Method: Note how the payment was made (e.g., bank transfer, credit card, check, etc.). This will help you track different payment types and resolve any potential payment issues.

- Partial Payments: For larger projects, clients may make partial payments. Track these payments by clearly documenting how much has been paid and what remains outstanding.

In addition to manual tracking, you can also create simple accounting systems or use spreadsheets to keep a record of all transactions. This approach provides a backup for your billing documents and ensures that payments are processed correctly. By using a consistent method to track payments, you can quickly spot any discrepancies and resolve them promptly.

Overall, effective tracking is key to running a smooth, professional business. By implementing a system to monitor payments, you ensure that your financial records are always accurate and up-to-date, helping you focus more on delivering great service to your clients.

How to Add Taxes to Your Invoice

When creating billing documents, it’s important to correctly apply any applicable taxes to ensure compliance with local regulations and to avoid potential legal issues. Including taxes not only keeps your business transparent but also helps you maintain accurate financial records. Properly documenting taxes on your financial statements ensures both you and your clients understand the total cost of services or products provided.

Here’s how you can accurately add taxes to your billing documents:

- Determine Applicable Tax Rates: Before adding taxes, make sure you know the correct tax rate for your location and the type of service or product. Tax rates can vary by region, so it’s important to check with your local tax authority.

- Breakdown the Tax: Clearly separate the cost of the service or product and the tax amount on your billing document. This ensures transparency for your client and avoids confusion. The tax should be listed as a percentage of the total or unit cost.

- Use a Tax Table: If your business applies multiple tax rates, it may be helpful to use a table that shows the tax breakdown for each service or product. This provides clients with a clear understanding of how the tax is calculated for each item.

For example, if the tax rate is 8%, and the total for services is $500, the tax amount would be $40. Make sure to clearly state this on the document, with the total amount due at the bottom reflecting both the service cost and the tax.

| Description | Amount | Tax Rate | Tax Amount |

|---|---|---|---|

| Services Rendered | $500 | 8% | $40 |

| Total Due | $540 |

By clearly indicating taxes in this manner, you make the document easier to understand for your client while also ensuring that you’re complying with tax regulations. Always keep records of the taxes you charge and pay, as this will be essential for bookkeeping and tax filings.

In conclusion, adding taxes to your billing document is a simple yet necessary step to keep your business compliant and transparent. Take the time to understand the tax requirements in your area and accurately reflect them in your documents.

What to Include in a Professional Invoice

Creating a professional billing document is key to ensuring smooth transactions and maintaining a trustworthy relationship with clients. A well-structured document not only reflects your business’s professionalism but also helps avoid misunderstandings regarding payments. Including all necessary details in a clear, organized format will ensure that clients have all the information they need to make timely payments and that your financial records remain accurate.

Essential Elements of a Professional Document

A comprehensive billing document should include the following critical components:

- Business Information: Always include your business name, address, phone number, email, and website. This allows clients to easily contact you if needed.

- Client Information: Include the name, address, and contact details of the client or company receiving the services. This ensures that the document is correctly attributed.

- Unique Document Number: Each document should have a unique reference number for tracking purposes. This helps both you and the client track the transaction easily.

- Service Details: Clearly describe the services provided or products sold, including quantities, descriptions, and individual costs. This ensures clarity and avoids disputes over what was delivered.

- Amount Due: List the subtotal, any taxes, and any additional charges separately. This provides transparency and helps clients understand how the total amount is calculated.

- Payment Terms: Specify the due date for payment, accepted payment methods, and any late fees or early payment discounts. This ensures that both parties understand the payment expectations.

- Notes and Additional Information: If necessary, include any special notes, reminders, or terms relevant to the project or payment process.

Example of a Professional Billing Document

Here is an example of how to structure the key elements in your document:

| Description | Details | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Business Name | XYZ Painting Services | ||||||||||||||||||

| Client Name | John Doe | ||||||||||||||||||

Docum

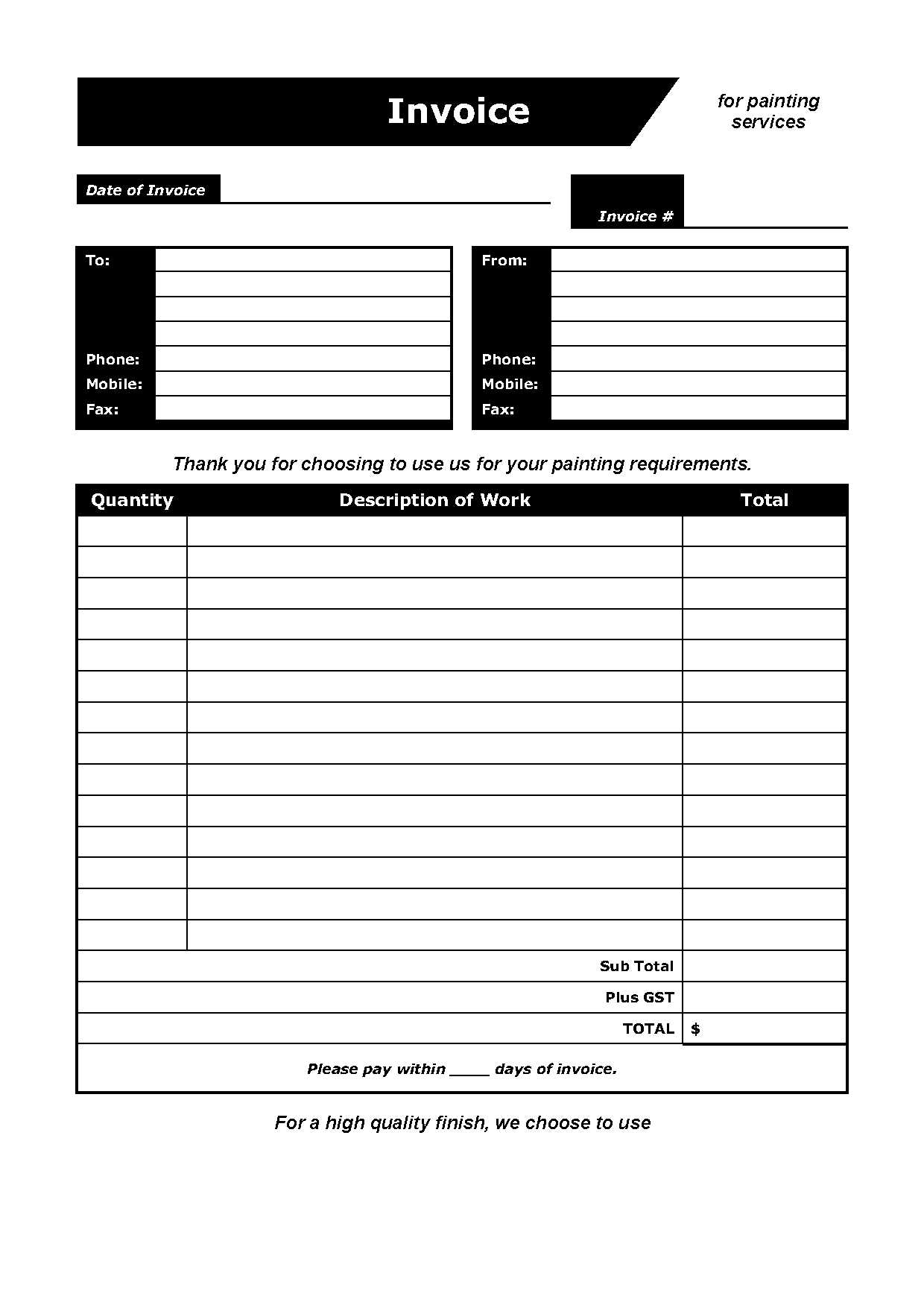

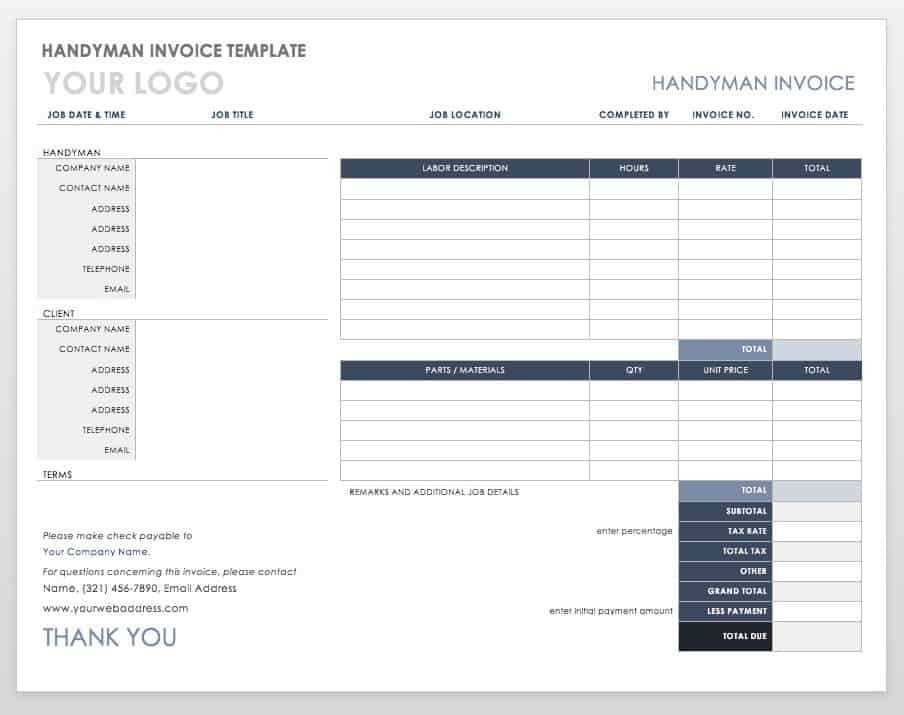

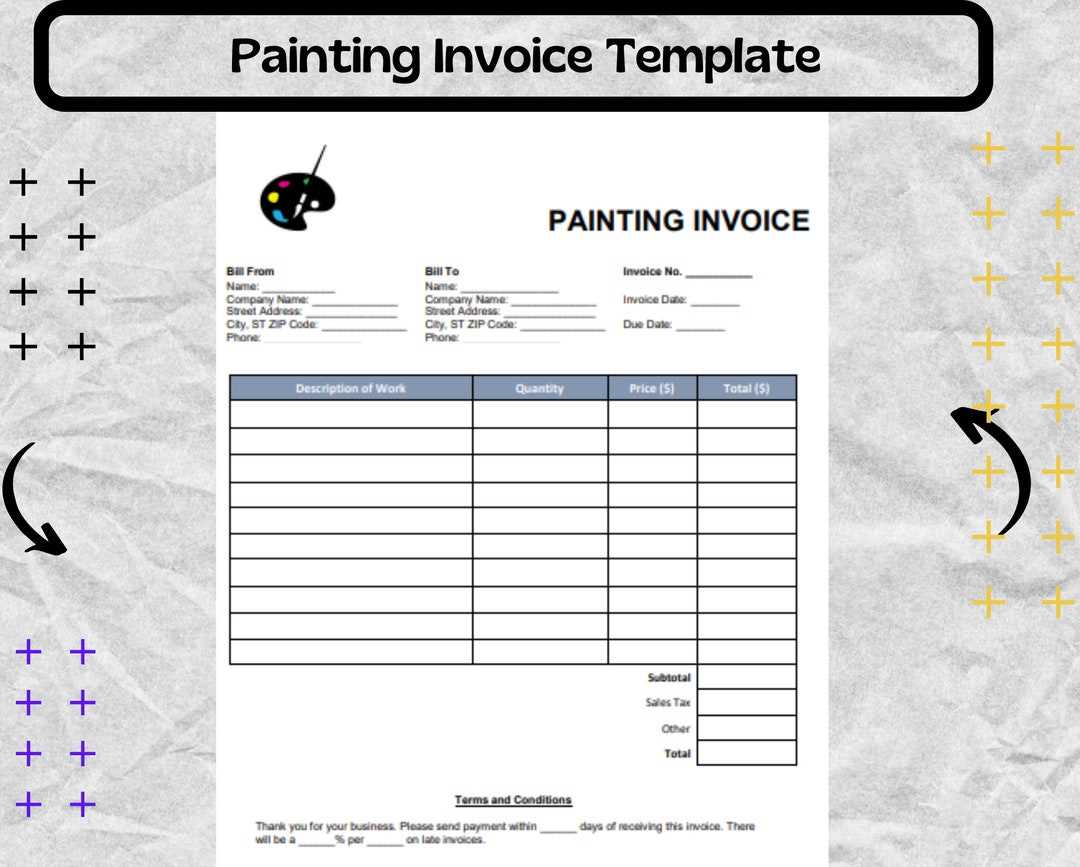

Free Painting Invoice Templates for Word

Using pre-designed documents for billing can significantly save time and reduce errors. With readily available, free templates, you can create professional-looking billing forms that streamline the payment process. These customizable documents allow you to quickly input your business and client details, ensuring that all necessary information is included for a smooth transaction. Why Use Pre-Designed Billing Documents?Pre-designed forms are highly efficient for businesses, especially small enterprises or freelancers, who need a quick solution for creating accurate and professional records. These ready-made formats often include the key sections needed, such as service descriptions, payment terms, and totals, which you can simply fill in. The benefits of using these documents include:

Example of a Free Template Layout

Here’s an example of how a typical free billing document might look, with all the necessary fields to ensure accurate documentation of transactions:

|