Free Painter Invoice Template for Easy and Professional Billing

Managing billing and payment processes is essential for any skilled professional, particularly in the home improvement industry. Clear and accurate financial documents ensure that both the service provider and the client are on the same page, helping to maintain transparency and trust. Whether you’re just starting out or are a seasoned expert, using a structured approach to invoicing can save you time and avoid confusion.

With the right tools, creating a payment request becomes a seamless task, reducing the risk of errors and improving your workflow. Customizable forms that reflect your unique business style can make a big difference in how you present your services to clients. These documents also allow you to include important details such as rates, materials used, and payment terms.

Using a professional billing format not only enhances your reputation but also simplifies the financial side of your business. By selecting the right solution, you can ensure that your payment process is efficient, organized, and aligned with industry standards. Whether you’re dealing with large projects or smaller jobs, having a reliable method to request compensation is crucial for maintaining a healthy cash flow.

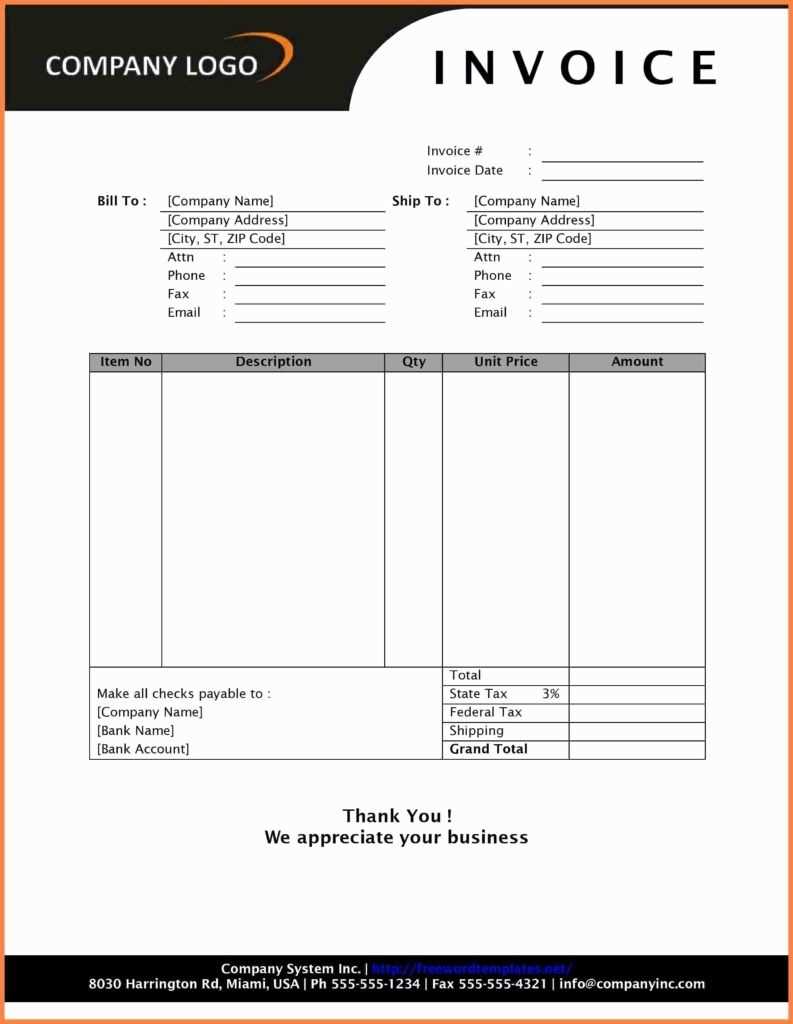

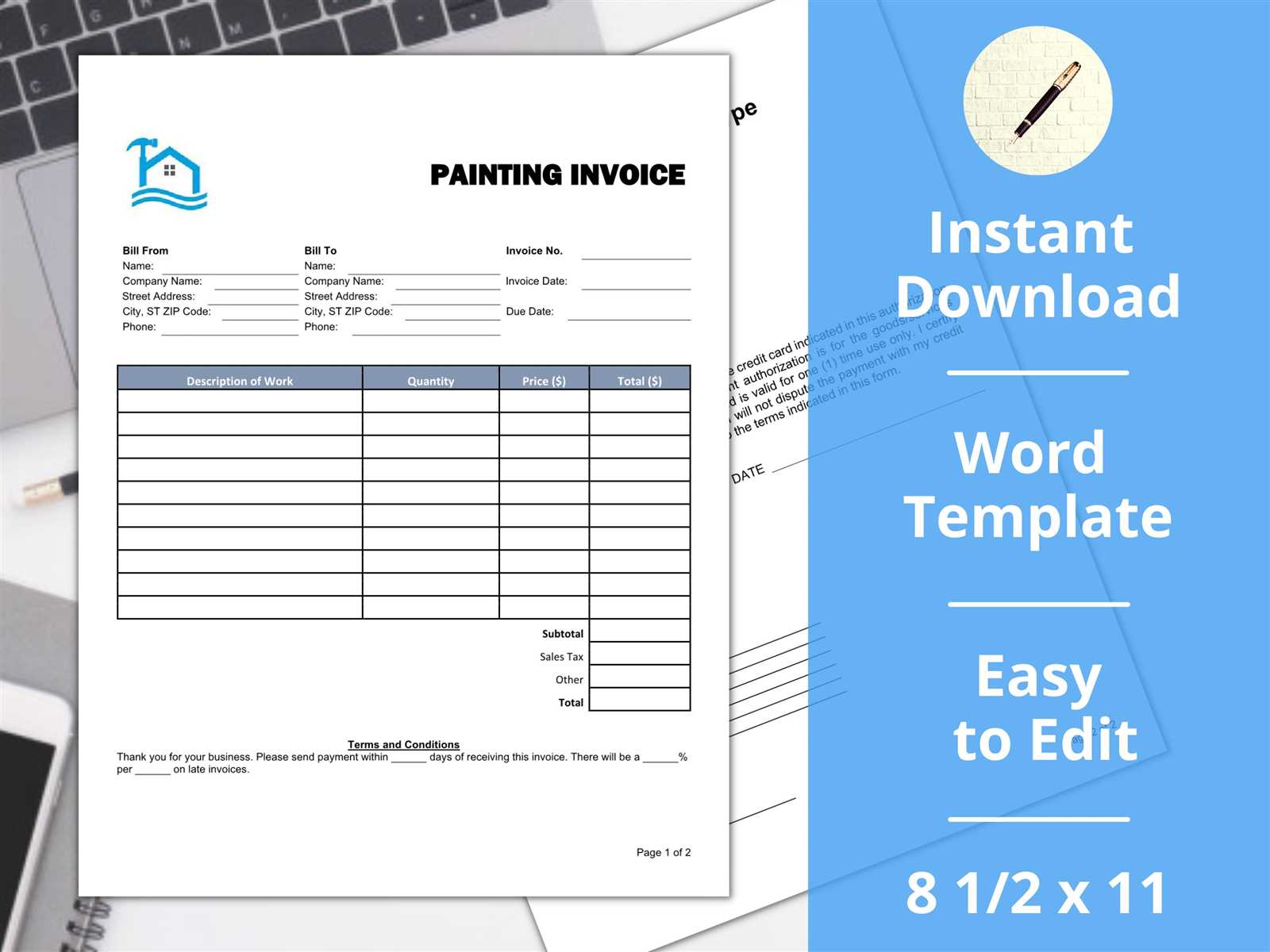

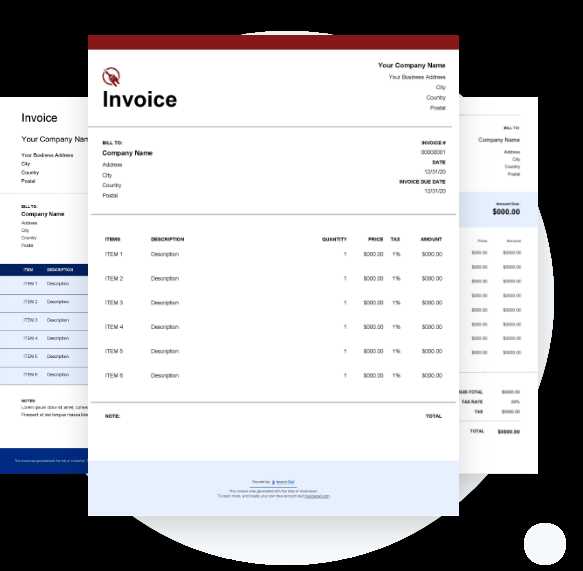

Painter Invoice Template Overview

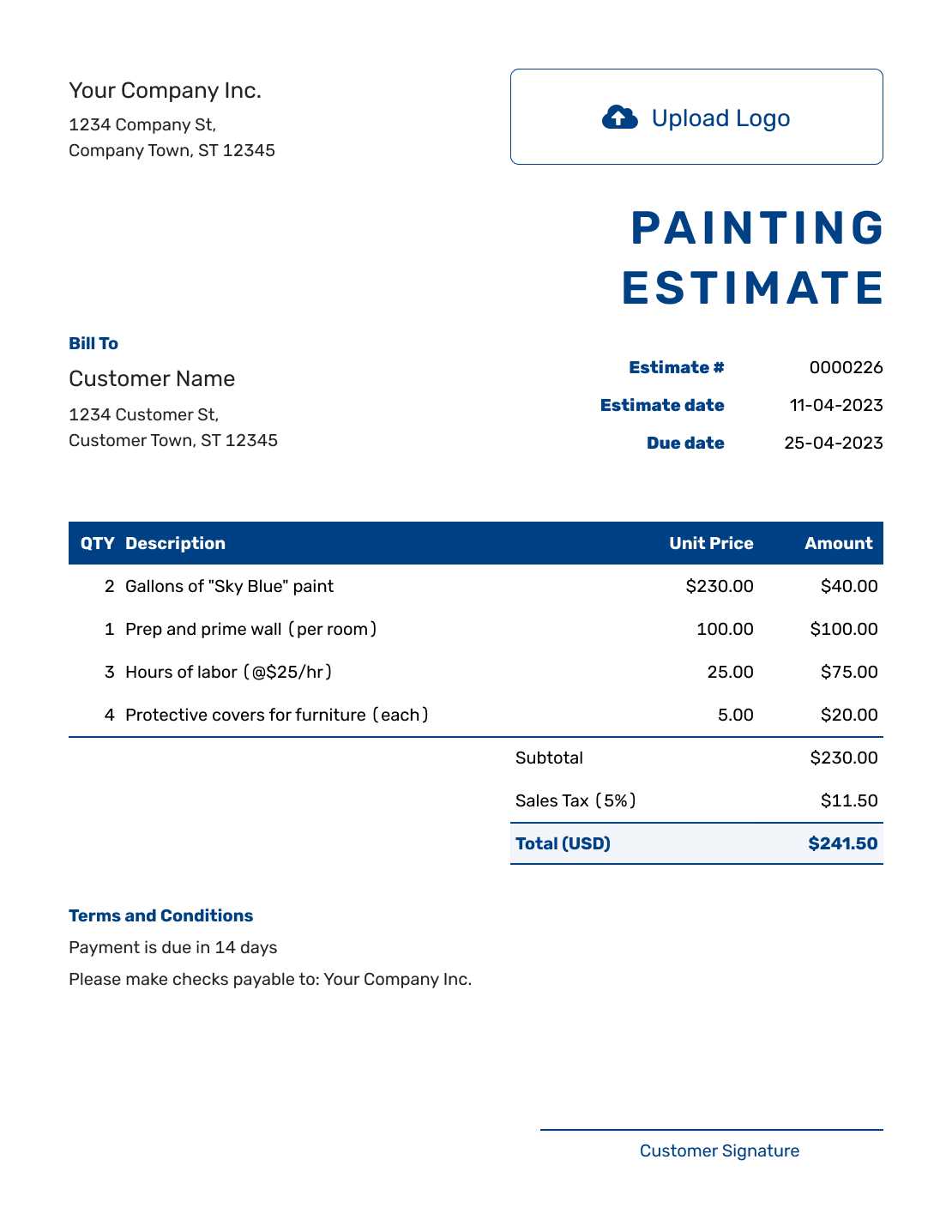

For any contractor providing painting or renovation services, creating an organized and professional payment request is essential for smooth business operations. A well-structured document helps clearly communicate the work completed, the materials used, and the amount due. This document serves as a record for both parties and ensures there are no misunderstandings regarding payment expectations.

Such documents can be easily customized to fit your specific needs and reflect the branding of your business. Whether you are working on residential projects or large-scale commercial contracts, having a standardized form can streamline your payment process and improve client satisfaction.

Key features of a well-designed payment request include:

- Clear business details: Including your name, business name, address, and contact information.

- Project description: A detailed account of the work completed, such as areas painted or services provided.

- Payment terms: Clear instructions on due dates, late fees, or discounts for early payments.

- Material costs: A breakdown of any materials or supplies used, if applicable.

- Clear totals: Itemized sections that summarize labor costs, material expenses, and the final amount due.

By using such a document, you not only make it easier for clients to understand the charges but also present yourself as a professional with attention to detail. The use of a standard structure also ensures that nothing important is overlooked during the billing process.

Why You Need an Invoice Template

Having a structured document for billing is essential for any service provider. It ensures consistency, professionalism, and clarity in communication with clients regarding the amount due and the scope of work completed. Without a standardized format, there’s a greater risk of errors, misunderstandings, and delayed payments, which can negatively impact your cash flow and reputation.

Time and Effort Savings

By using a pre-designed form, you can quickly fill in the details of the project and send it to clients without reinventing the wheel each time. This reduces the time spent on administrative tasks, allowing you to focus more on your craft. An efficient billing system helps streamline the entire payment process, from the creation of the document to the receipt of funds.

Professionalism and Trust

Sending a well-organized, clear request for payment demonstrates professionalism and can build trust with clients. It signals that you are serious about your business and committed to providing excellent service. A polished document shows that you value your work and expect to be compensated accordingly, which often encourages prompt payments.

Benefits of Using a Customizable Invoice

Having the ability to tailor your payment request documents allows you to better reflect your unique business needs and brand identity. Customization not only provides flexibility in presenting your services but also ensures that all necessary details are included for both clarity and accuracy. A personalized document helps foster a professional image while making the payment process more transparent for clients.

Enhanced Professionalism: By modifying the layout, colors, and design, you can create a document that aligns with your company’s branding. This contributes to a consistent client experience and leaves a lasting impression of quality and attention to detail.

Flexibility and Control: Customizable forms give you control over which sections to include, whether it’s a detailed breakdown of costs, discounts, or specific payment terms. This flexibility ensures that every document is perfectly suited to the project and client at hand, reducing the risk of omissions or confusion.

Improved Accuracy: Customizing your request for payment means you can ensure that all relevant information is tailored to the specifics of each job, such as labor hours, materials, or special requests. This level of precision helps avoid errors and disputes, ultimately streamlining the billing process.

How to Create a Payment Request

Creating a clear and professional payment document is a straightforward process when you follow the right steps. Whether you’re billing for a one-time service or a long-term project, having a systematic approach ensures that your request is comprehensive, accurate, and easy to understand. A well-structured document not only improves communication but also promotes faster payments.

Step 1: Gather Essential Information

Before you begin, collect all the relevant details about the work completed. This includes your contact information, the client’s details, a description of the services or tasks performed, and any materials used. Be specific about the scope of work to avoid confusion later on.

Step 2: Itemize Services and Costs

Break down the work into individual items and assign a cost to each one. This helps clients see exactly what they’re paying for and ensures that you are compensated for every aspect of the job. Include the hourly rate for labor, materials, and any other charges such as travel fees or additional services.

Step 3: Add Payment Terms

Clearly state the payment terms, including the total amount due, due date, and accepted methods of payment. If you offer discounts for early payment or charge late fees, make sure these conditions are also outlined. Providing this information upfront can prevent any misunderstandings later on.

Step 4: Double-Check for Accuracy

Before sending the document, carefully review all the details for accuracy. Check the amounts, client information, and descriptions to ensure everything is correct. A small error could delay payment or cause unnecessary confusion, so it’s important to be thorough.

Step 5: Send the Document

Once your request is complete, send it to the client promptly. Whether via email or physical mail, make sure the document reaches them in a professional and timely manner. You may also want to follow up to confirm receipt and address any potential questions they may have.

Key Information to Include in a Payment Request

To ensure clarity and avoid misunderstandings, it’s essential to include specific details in any document that requests payment for services rendered. A well-organized and thorough document makes the process smooth for both the client and the service provider. Including the right information not only helps facilitate quicker payments but also serves as a reliable record for future reference.

Essential Details for a Clear Breakdown

Contact Information: Start by including your business name, address, phone number, and email address. Also, ensure that the client’s details are listed clearly. This information establishes the origin and destination of the payment request.

Project Description: Provide a concise description of the work completed or services provided. This could include specific tasks, the scope of the project, and any relevant dates such as start and completion times. Being detailed helps prevent confusion and provides transparency about what the payment covers.

Financial Information and Terms

Breakdown of Charges: List the costs for each service or product involved in the job. Include labor charges, material costs, and any additional fees. This allows the client to see how the total amount is calculated.

Payment Terms and Due Date: Clearly state the total amount due, the payment due date, and any applicable late fees or discounts for early payment. Also, mention the accepted methods of payment, whether it’s cash, bank transfer, or credit card.

By incorporating these key elements, you ensure that your payment request is both professional and effective, minimizing the chance of disputes and delays.

Free vs Paid Invoice Templates

When it comes to creating a payment request document, choosing between free and paid options depends on several factors, including your business needs, budget, and the level of customization required. Both free and paid solutions offer distinct advantages, but understanding the key differences can help you make an informed decision about which route is best for your business.

Advantages of Free Templates

Free templates are widely available and offer a quick, no-cost solution for creating basic payment requests. They are ideal for small businesses or independent contractors just starting out, as they provide an easy way to generate professional-looking documents without spending money. However, free options may have limitations in terms of design flexibility, features, or the ability to handle more complex billing scenarios.

Benefits of Paid Templates

Paid templates typically come with more advanced features, greater customization options, and higher-quality designs. These documents are often tailored to specific industries or business needs, offering greater flexibility and professionalism. Additionally, paid options may include integrated tools for tracking payments, tax calculations, and automated reminders, helping to streamline the billing process further.

| Feature | Free Option | Paid Option |

|---|---|---|

| Cost | Free | Varies (One-time or subscription) |

| Customization | Basic | Advanced |

| Design Quality | Simple | Professional |

| Automation | None or limited | Payment tracking, reminders, etc. |

| Ease of Use | Easy | Very easy with more features |

In summary, while free options are a great starting point, investing in paid solutions can significantly enhance your billing efficiency, offering more sophisticated tools and a more polished final product. The decision depends on your specific business requirements and long-term goals.

How to Personalize Your Payment Request

Customizing your payment request documents is an excellent way to reflect your business identity and create a professional image that resonates with your clients. Personalization allows you to make the document feel unique to each project, ensuring that it aligns with your branding and enhances client trust. By tailoring the document’s design, structure, and content, you not only make it more visually appealing but also more functional and relevant to the specific work you’ve completed.

Customizing Your Design and Layout

The design of your payment request plays a crucial role in its impact. Start by incorporating your business logo and branding colors to make the document immediately recognizable as part of your professional image. You can adjust the layout to include your business name prominently at the top, followed by your contact information, ensuring that clients can easily reach you for any inquiries or future projects. Use clean, simple fonts and a logical structure to improve readability.

Adding Specific Project Details

One of the most important aspects of personalization is tailoring the document’s content to the specific job completed. Include detailed descriptions of the work performed, such as the rooms painted, the surfaces treated, or the equipment used. Add line items that clearly outline any materials purchased, their quantities, and their costs. You can also provide a personalized note thanking the client for their business or offering them a discount for future projects.

By adjusting both the visual and content aspects of your payment requests, you ensure that each one is not only professional but also reflects your commitment to quality and attention to detail. Personalizing your payment documents helps create a memorable experience for your clients and reinforces your brand’s professionalism.

Common Mistakes to Avoid in Payment Requests

When creating a payment document, attention to detail is crucial. Small errors or omissions can lead to confusion, delayed payments, or even damaged client relationships. To ensure a smooth process and prompt compensation, it’s important to avoid common mistakes that can undermine the professionalism of your billing. Here are some of the most frequent errors and how to prevent them.

- Incomplete Contact Information: Always include both your contact details and the client’s. Missing phone numbers, addresses, or email addresses can delay communication and complicate payment follow-ups.

- Unclear Payment Terms: Be specific about the payment due date, accepted methods of payment, and any penalties for late payment. Vague terms can lead to confusion and delay in receiving compensation.

- Not Itemizing Charges: Failing to break down the costs of labor, materials, and additional services can make clients uncertain about what they are being charged for. Always provide a detailed list of services and their corresponding costs.

- Missing Project Details: Not including a description of the work completed is a major oversight. The client needs to understand exactly what they are paying for, so include detailed descriptions of the services provided.

- Math Errors: Even minor arithmetic mistakes can lead to frustration or mistrust. Double-check the calculations to ensure that totals, taxes, and discounts are accurate.

- Not Customizing the Document: Using a generic, one-size-fits-all document can come across as unprofessional. Personalize your payment request to reflect the specific details of each job, your business branding, and your client’s needs.

By avoiding these common mistakes, you ensure that your payment requests are clear, professional, and efficient, leading to faster payments and stronger client relationships.

How to Calculate Rates for Painting Services

Setting the right rates for your services is crucial for maintaining a profitable business while ensuring that clients feel they are receiving good value. The process of calculating your charges involves considering various factors, including labor, materials, and any additional overhead costs. A clear pricing structure helps avoid confusion and ensures that you are compensated fairly for your work.

Consider Labor Costs

One of the primary factors in determining your rate is the cost of labor. This includes how much time you expect to spend on the job and the hourly or flat rate you charge for your work. When calculating this, consider your skill level, experience, and the complexity of the tasks at hand. If the project requires more intricate work or special skills, adjust your hourly rate accordingly.

Account for Materials and Additional Costs

Materials can significantly impact the final price of a project. Include the cost of any paints, tools, supplies, and equipment needed for the job. It’s also important to factor in any other expenses such as transportation or equipment rentals. By itemizing these costs, you ensure transparency with clients and avoid undercharging for essential resources. Don’t forget to include a markup on materials, as this helps cover handling and procurement time.

In addition to labor and materials, you should also account for any overhead costs like insurance, advertising, or administrative fees. Combining these elements will give you a clear and fair rate that reflects both your time and the costs associated with providing your services.

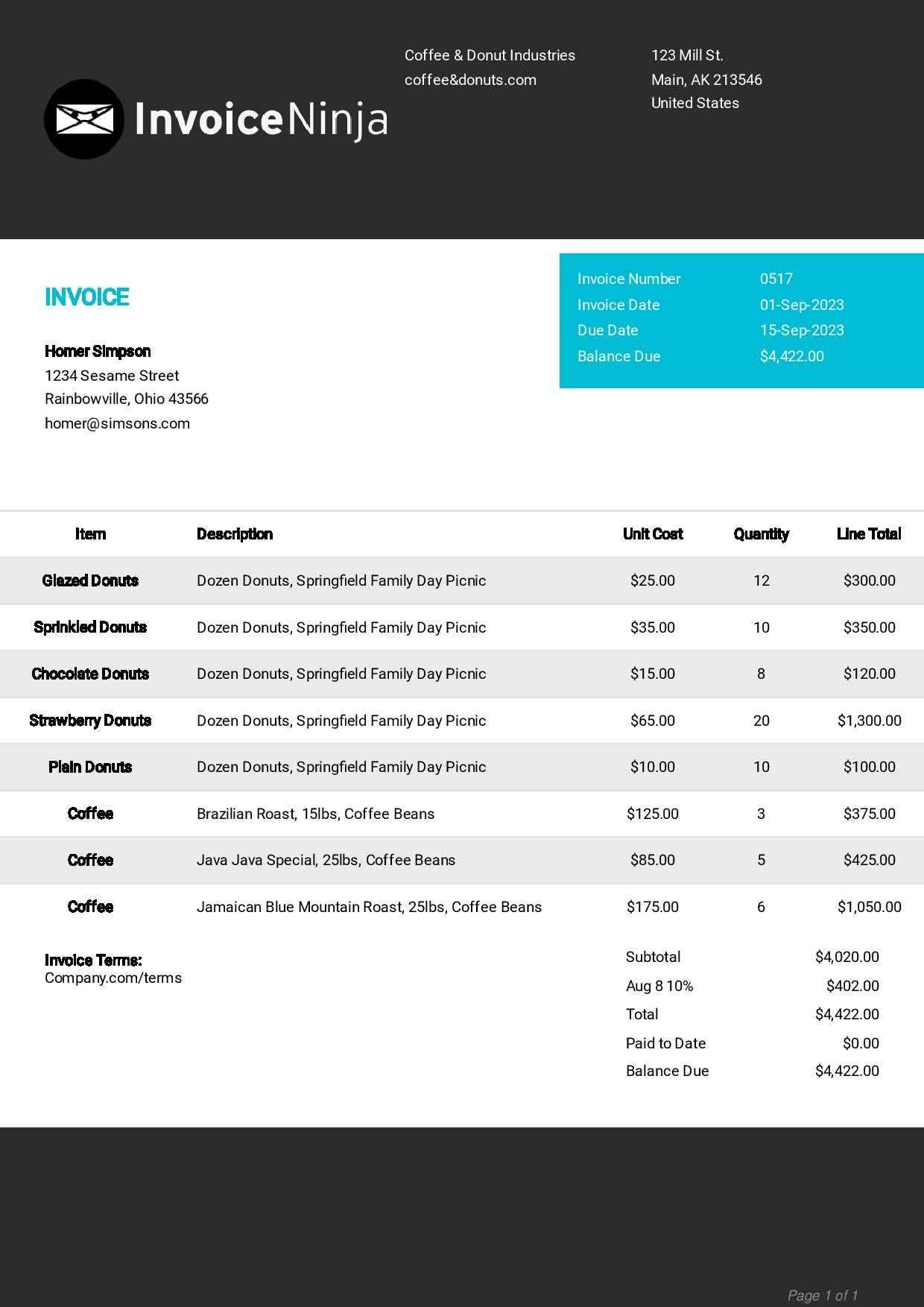

How to Add Taxes to Your Payment Request

Including taxes in your payment documents is essential for complying with local tax laws and ensuring that both you and your clients are clear on the final amount due. Tax calculations can vary depending on your location, the type of services provided, and the client’s status (e.g., business or individual). By correctly adding taxes, you avoid any confusion and maintain transparency in your financial transactions.

Understanding Tax Rates

The first step in adding taxes is to understand the applicable tax rate for your location and the services you provide. Tax rates can differ by region, and some services may be exempt or have a reduced rate. Make sure to research the specific tax laws for your business area or consult with a tax professional to ensure compliance.

How to Calculate and Add Taxes

Once you have the correct tax rate, you can easily calculate the tax amount by multiplying the taxable total (before tax) by the tax rate. After calculating the tax, simply add it to the subtotal of your payment document. Here’s an example breakdown:

| Item Description | Amount | |

|---|---|---|

| Labor Charges | $500 | |

| Materials Costs | $200 | |

| Subtotal | $700 | |

| Sales Tax (8%) | $56 | |

| Total Due | $756 |

| Method | Description |

|---|---|

| By Client | Group all payment documents under the respective client’s name. This makes it easy to find a specific request for any given client. |

| By Project | Organize documents by the specific project or service provided. This is helpful when you need to review all documents related to a particular job. |

| By Date | Arrange documents by the date they were issued. This system allows for chronological access, helping to track payment history over time. |

| By Status | Separate documents into categories like “Paid,” “Pending,” or “Overdue.” This can help you quickly track the payment status of each request. |

By using a system that fits your workflow, you ensure that all payment records are easy to locate, monitor, and reference whenever necessary. A well-organized approach not only improves your efficiency but also enhances your professional reputation with clients, as it shows that you manage your business with attention to detail.

Integrating Payment Options on Your Payment Request

Offering multiple payment options on your payment request makes it easier for clients to pay promptly, which can help improve cash flow and streamline the transaction process. By providing flexibility, you increase the likelihood of receiving payments on time and reduce any friction that might arise from clients not having a preferred payment method available.

There are several ways you can integrate payment methods into your payment requests, allowing your clients to choose the most convenient option. The key is to clearly display all available choices and provide simple instructions to ensure smooth transactions.

Common Payment Methods to Include

- Bank Transfer: Provide your bank account details, such as account number and sort code, for clients who prefer to make direct bank transfers.

- Credit or Debit Card: Many clients prefer paying with cards. Offering a payment gateway like PayPal, Stripe, or Square makes it easy to accept credit or debit card payments.

- Online Payment Services: Include options like PayPal, Venmo, or other digital wallet services, which are becoming increasingly popular due to their convenience and speed.

- Checks: For clients who prefer traditional methods, include your mailing address for check payments. Ensure you specify the due date clearly to avoid delays.

- Cash: For smaller projects or local clients, cash payments might still be an option. Be sure to provide a receipt for cash transactions.

Including clear payment instructions next to each option is essential. For instance, if you accept online payments, provide clickable links or QR codes that lead directly to the payment portal. For bank transfers, offer an easy-to-read table with your banking details. This clarity can prevent delays caused by misunderstandings and help clients pay with minimal hassle.

Incorporating multiple payment methods into your payment requests shows your flexibility and commitment to customer satisfaction, which can lead to quicker payments and stronger client relationships.

Legal Requirements for Payment Requests

When preparing payment documents for your business, it’s essential to understand the legal requirements that govern these records. Complying with these rules ensures that your documents are valid, protect both parties in case of a dispute, and help you stay on the right side of the law. Different regions may have specific regulations, but there are common elements that apply in most areas to ensure that your payment requests are legally sound.

Key Information to Include

To meet legal standards, your payment request must include certain essential information. These details not only validate the document but also ensure transparency between you and your client. Common requirements include:

- Business Details: Include your business name, address, contact details, and tax identification number (TIN) if applicable.

- Client Information: Make sure to include the full name or business name of your client, along with their address and contact information.

- Description of Services: Provide a clear description of the services rendered, including the scope of work and any specific tasks completed.

- Dates: List the date the work was completed and the date the payment request was issued. You should also specify the payment due date.

- Payment Terms: Clearly outline the payment amount due, including any applicable taxes or fees, and specify your accepted payment methods and terms (e.g., due upon receipt, net 30 days).

- Tax Information: Ensure that your document reflects any relevant taxes, including sales tax, VAT, or other local taxes, if required by law.

Additional Legal Considerations

Aside from the basic information, there are other legal aspects to consider when preparing payment documents:

- Late Payment Penalties: If you charge fees for late payments, this should be clearly stated on the document, including how those fees are calculated.

- Terms of Contract: If applicable, reference any formal agreement or contract between you and the client, especially if the work was subject to contract terms.

- Client’s Consent: In some regions, it’s important to include a clause stating that the client has agreed to the terms of the payment request, either through signing the document or accepting it via email or other forms of communication.

Adhering to these legal requirements helps ensure that your payment requests are legitimate, professional, and enforceable. It also helps protect both parties in case of disputes and ensures smooth financial transac

How to Send Your Payment Request Professionally

Sending your payment documents in a professional manner not only reflects your business’s credibility but also helps maintain positive relationships with your clients. A well-delivered request ensures that your client knows exactly what is owed, how to make the payment, and when it is due. Whether you choose to send it digitally or by mail, it’s important to follow certain guidelines to ensure your document is received and processed promptly.

Steps to Send Your Payment Request Professionally

Here are some best practices for sending your payment document in a way that enhances your professionalism:

- Use a Clear and Informative Subject Line: If you are sending the document by email, ensure that the subject line is clear and to the point. Example: “Payment Request for [Service/Project Name] – Due [Date]”. This makes it easy for the recipient to recognize the purpose of the email immediately.

- Personalize the Email Message: Avoid sending a generic email. Address the client by their name, and include a polite message that briefly summarizes the work completed and the total amount due. A courteous and professional tone goes a long way in maintaining a good client relationship.

- Attach the Document: Make sure the document is attached in a widely accessible format, such as PDF. This format ensures that the file will open correctly on any device and prevents any formatting issues. Always double-check that the correct document is attached before sending.

- Provide Clear Payment Instructions: Clearly state how and where the client can make the payment. If you offer multiple payment methods, list them all with any necessary details, such as bank account information, online payment links, or mailing address for checks.

- Set a Follow-Up Date: In your message, you can politely note when you will follow up on the payment if it has not been received by the due date. Example: “If you have any questions or need further clarification, feel free to reach out. Otherwise, I will check back with you on [follow-up date] regarding the payment status.”

- Proofread Your Email and Document: Before sending anything, proofread both your email message and the attached document. Correct any errors or inconsistencies to ensure the document is professional and accurate.

Sending Payment Documents by Mail

While digital communication is quick and efficient, there are times when sending phys

Tracking Payments from Your Payment Requests

Effectively managing and tracking payments is crucial for maintaining a healthy cash flow and keeping your business operations running smoothly. Whether you’re a freelancer or managing a larger team, knowing which payments have been received and which are still pending helps you stay organized and avoid payment-related misunderstandings. With the right tracking system, you can ensure that no payment is overlooked and that you have a clear overview of your financial status at all times.

Tracking payments not only helps you keep accurate records, but it also enables you to follow up on overdue payments in a timely and professional manner. Below are a few key strategies to efficiently track payments from your payment requests:

Manual Tracking Methods

If your business is small or you’re just starting out, manual tracking can be a simple and cost-effective solution. Here’s how you can do it:

- Payment Log: Create a dedicated log where you manually record each payment request issued, including the client’s name, the amount due, the due date, and the date the payment was received. You can keep this log in a physical notebook or a spreadsheet for easy reference.

- Check Payment Status: For each entry, mark whether the payment has been received, is pending, or overdue. Regularly check your log to ensure you follow up on any overdue payments.

- Set Reminders: Use calendar reminders or set up notifications on your phone or computer to remind you when payments are due or overdue. This way, you can contact clients on time if necessary.

Automated Tracking Systems

If you have a larger volume of payments to manage or want to save time, using an automated payment tracking system can help streamline the process:

- Accounting Software: Tools like QuickBooks, Xero, or FreshBooks allow you to automatically track payments, generate reports, and send reminders. These platforms can also sync with your bank account to update payment statuses in real-time.

- Online Payment Processors: Services like PayPal, Stripe, or Square can track payments for you as well. Most of these services offer dashboards where you can easily see all incoming payments, the status of each transaction, and even send automated receipts to clients.

- Customized Payment Tracking Systems: For larger businesses or more complex needs, you can set up customized systems that automatically flag overdue payments, send follow-up emails, and keep records in line with y

Using Payment Documents for Client Retention

Maintaining a strong relationship with your clients is key to growing your business. While high-quality services and excellent customer support are critical, the way you manage financial transactions can also impact client retention. Sending professional, clear, and consistent payment documents can enhance the overall experience for your clients, making them more likely to return for future work or recommend your services to others.

By using well-structured and thoughtfully designed documents, you demonstrate organization and professionalism. This small detail can have a lasting effect on how clients perceive your business and can contribute to long-term success. Here’s how you can leverage these financial documents to foster client loyalty:

Consistency in Presentation

Clients appreciate a seamless and professional experience. When you send clean, easy-to-read payment requests, it signals that you are detail-oriented and committed to delivering high-quality service. The benefits of consistent document presentation include:

- Building Trust: Consistently well-structured documents reinforce your credibility, making clients feel confident in your ability to handle their business transactions professionally.

- Reducing Confusion: Clear and uniform payment documents make it easier for clients to understand their financial obligations, reducing the likelihood of disputes over charges or services provided.

- Enhancing Client Experience: A simple, professional format makes it easier for clients to keep track of their payments, contributing to a better overall experience.

Personalization to Strengthen Relationships

Personalizing your payment requests can further elevate the client experience. When you tailor each document to a specific client, you show that you value their business and take the time to meet their needs. Some ways to personalize your documents include:

- Client Name and Details: Addressing clients by name and including any specific project or service details can make the document feel more tailored and less generic.

- Special Discounts or Offers: Including personalized discounts or offers for repeat clients can encourage them to return for future services, demonstrating that you appreciate their loyalty.

- Personalized Notes: Adding a thank-you note or a message about how much you value their business can foster a sense of appreciation, helping to build a more personal connection with your clients.

Streamlined Payment Process

Making it easy for your clients to settle their payments can go a long way in maintaining positive relationships. Providing multiple payment options and clear instructions not only speeds up the payment process but also reduces potential frustration, ensuring that clients don’t encounter unnecessary obst

Top Tools for Creating Payment Requests

Having the right tools at your disposal can significantly simplify the process of creating professional payment documents. Whether you’re a freelancer or managing a team, the right software can save you time, reduce errors, and help you present your business in a more professional light. The best tools for generating payment documents offer customization options, ease of use, and efficient tracking features, making it easier to create accurate and timely requests for payment.

Here are some of the top tools available for generating professional payment requests:

Tool Name Key Features Pricing FreshBooks Customizable documents, time tracking, expense management, automated reminders Starts at $15/month QuickBooks Easy-to-use templates, tax calculations, client management, financial reporting Starts at $25/month Zoho Invoice Customizable layout, multi-currency support, recurring billing, online payment integration Free (for up to 5 clients), Paid plans from $9/month Wave Free invoicing, online payments, financial tracking, simple and intuitive interface Free PayPal Invoicing Customizable documents, integrated payment processing, no monthly fee, mobile-friendly Free (transaction fees apply) Each of these tools offers distinct advantages depending on your specific business needs. Some are designed for simple, straightforward requests, while others include advanced features like automated reminders, recurring payments, or integrated payment processing to streamline the entire transaction process. Choosing the right tool depends on factors such as the size of your business, the complexity of your needs, and your budget.

For instance, if you have a small business and need a free, easy-to-use tool, Wave or Zoho Invoice may be ideal choices. If you’re managing a larger client base or need more advanced features, FreshBooks or QuickBooks may be more appropriate. PayPal Invoicing is a great option for businesses that want quick and easy integration with their existing PayPal accounts.

By using these tools, you can save time, reduce errors, and enhance the professionalism of your payment requests,