Download and Customize Your Paid Invoice Template

Efficient billing is a key component of any successful business. Having a structured document for tracking payments and managing transactions helps maintain a professional image while ensuring accurate financial records. Whether you’re an entrepreneur, freelancer, or small business owner, organizing payments effectively can save time and reduce errors in your accounting process.

Customizable documents offer a practical solution for keeping track of completed transactions. These customizable forms allow you to enter specific details for each payment, ensuring that your records are clear, consistent, and easy to follow. With the right approach, you can create a document that meets your business needs and fits seamlessly into your workflow.

With the right tools, managing financial exchanges becomes simpler and more efficient. The ability to easily document completed transactions not only keeps you organized but also improves communication with clients. A well-designed document can enhance your professionalism, making it easier to track paid amounts and maintain accurate business records.

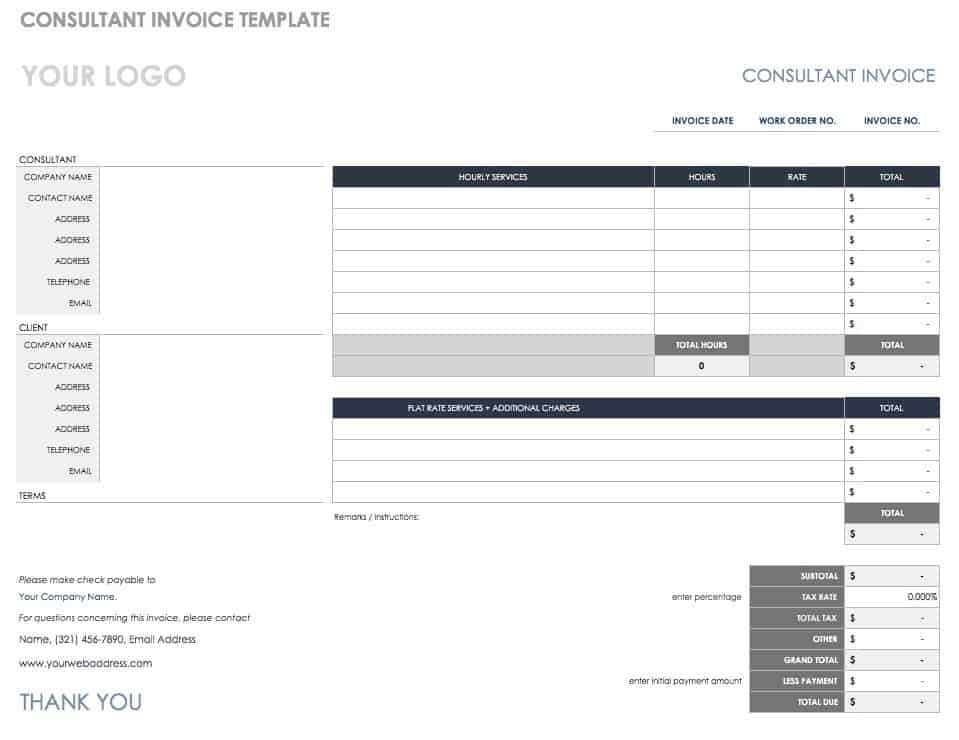

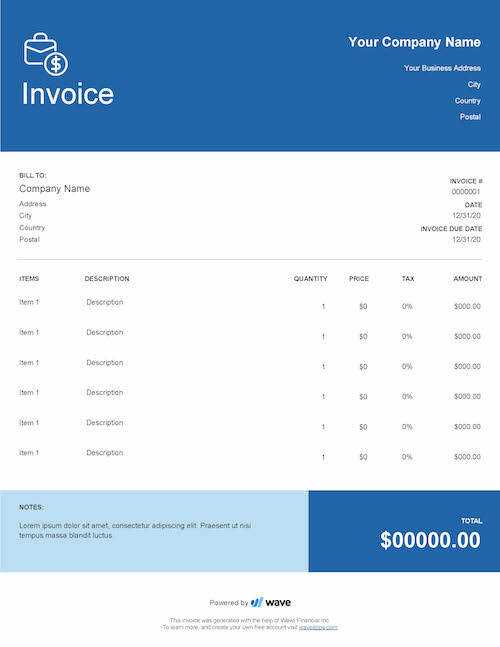

Paid Invoice Template Overview

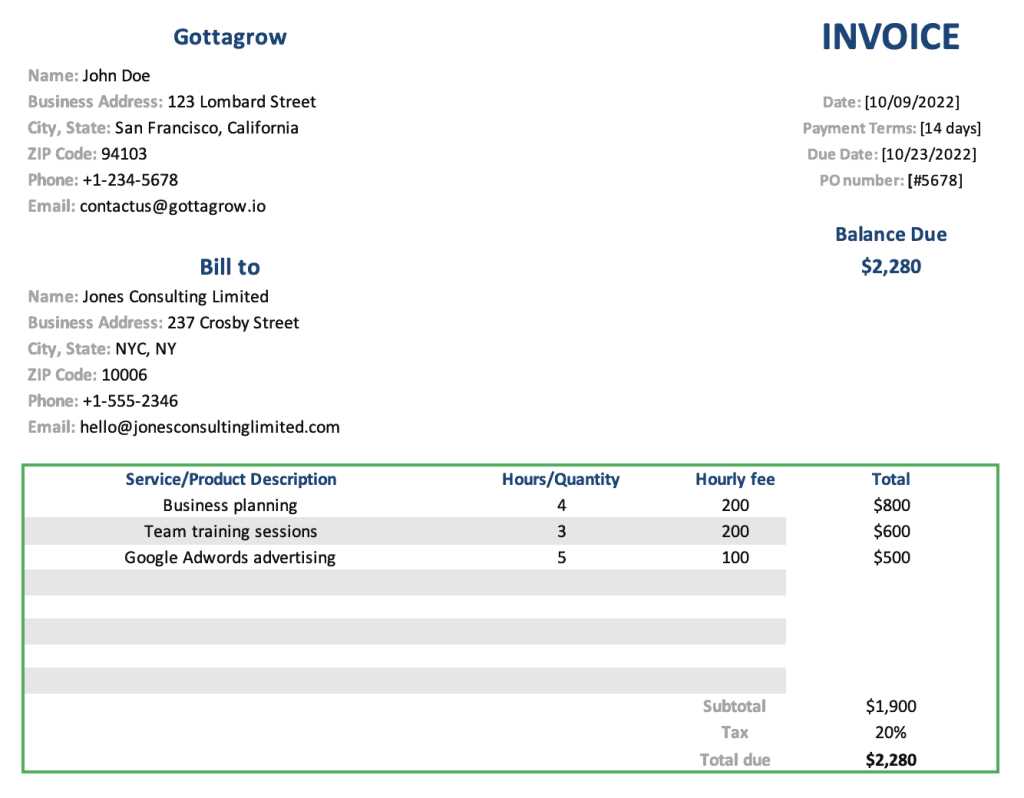

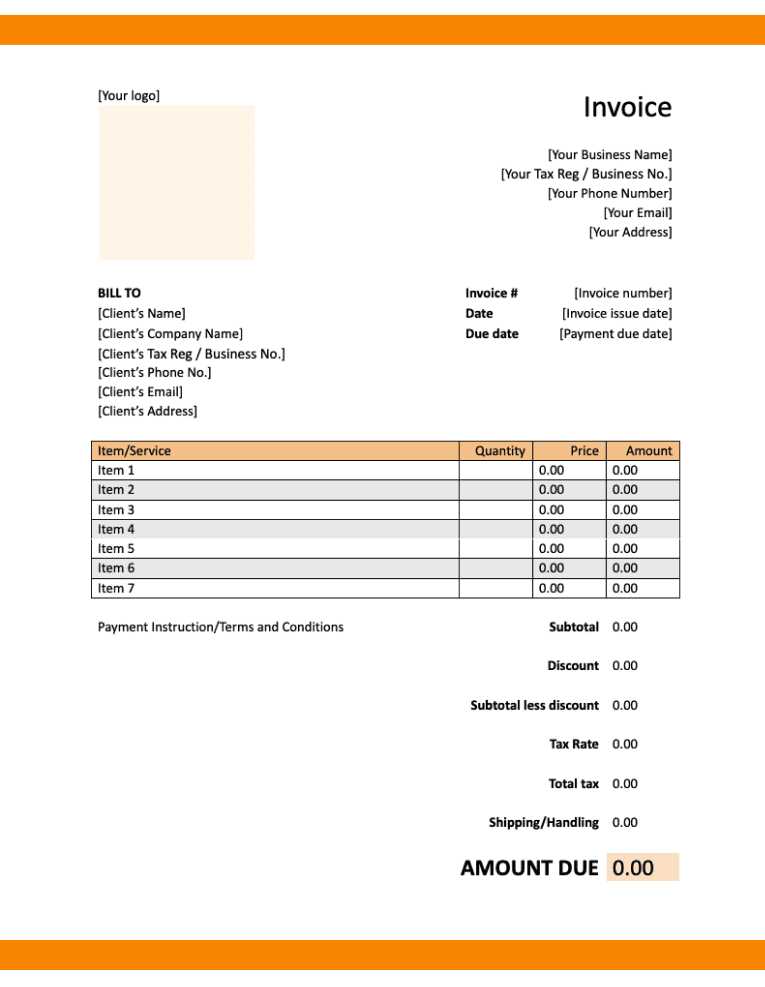

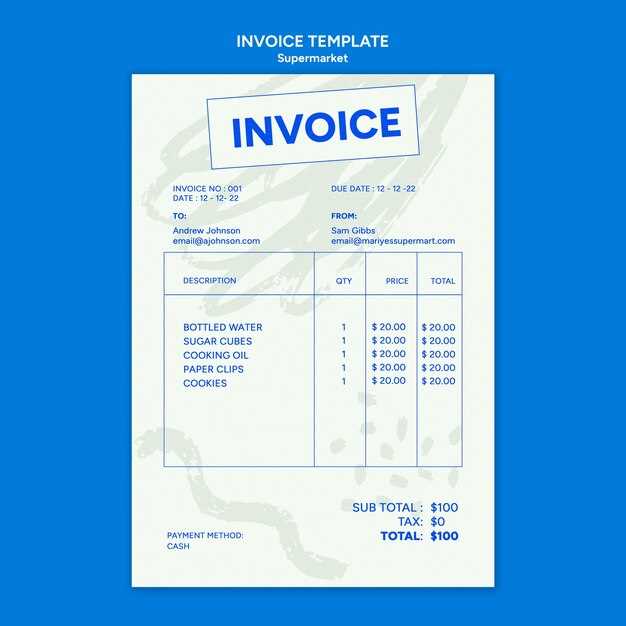

A well-structured document to record completed transactions is essential for any business. It ensures clarity, accuracy, and professionalism when dealing with clients. These documents help businesses keep track of payments received, simplifying the process of managing finances and reducing the risk of errors. A comprehensive document designed for this purpose should include specific sections that make tracking easier and more organized.

Generally, such documents are customizable, allowing business owners to tailor them to their specific needs. They provide a clean, professional layout that clearly indicates the amount received, the services provided, and the date of the transaction. This not only helps businesses maintain accurate financial records but also fosters trust and transparency with clients.

Key components typically found in these documents include:

- Business Information: Contact details of the company or freelancer issuing the document.

- Client Information: Details of the client or customer receiving the service or product.

- Description of Services: A breakdown of the goods or services provided, including quantities, rates, and dates.

- Payment Details: The total amount paid, method of payment, and date of payment.

- Transaction Status: A clear indication that the transaction is completed, typically marked as “paid” or “settled.”

By utilizing a well-organized document, businesses can keep their financial records in order, reduce confusion during audits, and provide clients with an easy-to-understand summary of their transactions. Furthermore, these documents can be stored electronically, making it easier to track payments over time and generate reports when needed.

Why Use a Paid Invoice Template

Managing financial records efficiently is crucial for any business. A well-designed document to confirm completed transactions simplifies this task, ensuring accuracy and professionalism. Whether you are a freelancer or a small business owner, using a structured format to track payments helps you stay organized and avoid mistakes that could affect your financial reporting.

Advantages of Using a Structured Document

Utilizing a customized, ready-made form for recording completed transactions offers numerous benefits:

- Time-saving: It eliminates the need to create a new layout for each transaction.

- Consistency: It ensures all details are consistently included, minimizing the chance of missing important information.

- Professionalism: A polished document enhances your credibility with clients and partners.

- Easy Tracking: Helps you quickly locate payment information when needed.

Key Features to Look For

When choosing a customizable document, you should consider certain key features that make the process easier:

| Feature | Benefit |

|---|---|

| Customizable Fields | Tailor the document to fit your business needs. |

| Clear Layout | Ensures all essential information is easy to read and understand. |

| Payment Status Indicator | Indicates when a transaction has been completed. |

| Professional Design | Enhances your business’s image and builds trust with clients. |

By using a pre-designed, adaptable document for recording payments, businesses can streamline their processes, improve client relations, and reduce the likelihood of errors. This approach not only saves time but also provides a reliable method for managing financial transactions effectively.

Key Features of Paid Invoice Templates

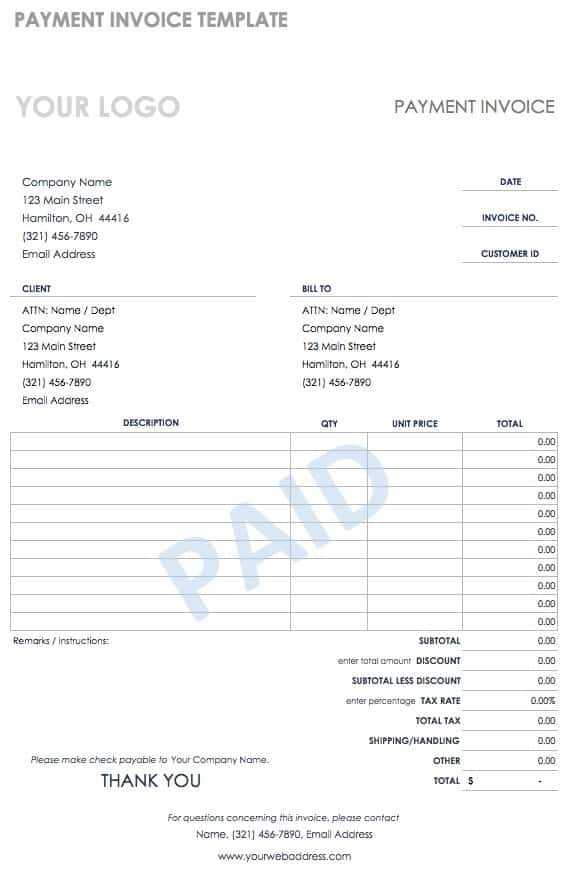

A well-structured document to confirm completed payments should offer certain features that make the tracking process seamless and reliable. These essential elements not only ensure accuracy but also provide a professional appearance, which is critical for maintaining positive client relationships. A document designed for this purpose should be flexible, easy to use, and capable of meeting the needs of any business, whether large or small.

Essential Elements of an Effective Document

There are several key characteristics that can make such a document more useful and functional for your business:

- Customizable Fields: The ability to easily modify details to fit the specifics of each transaction.

- Clear Payment Breakdown: A clear section that lists all services or products, prices, and quantities to avoid confusion.

- Professional Design: An organized and visually appealing layout that presents all information in a straightforward, accessible manner.

- Payment Status Section: A clear indication of whether the transaction is completed or pending.

- Business and Client Information: Easily identifiable sections for both the business issuing the document and the client making the payment.

Additional Functional Features

In addition to the core elements, there are several advanced features that can further enhance the usefulness of such a document:

| Feature | Benefit |

|---|---|

| Automatic Calculation | Reduces the chance of human error by automatically calculating totals, taxes, and discounts. |

| Multiple Payment Methods | Allows clients to choose from various payment methods, such as credit cards, bank transfers, or digital wallets. |

| Easy to Save and Share | Facilitates easy digital storage and sharing with clients, which is crucial for record-keeping. |

| Custom Branding | Provides the option to include your business logo, colors, and contact details to reinforce your brand identity. |

By incorporating these features, busines

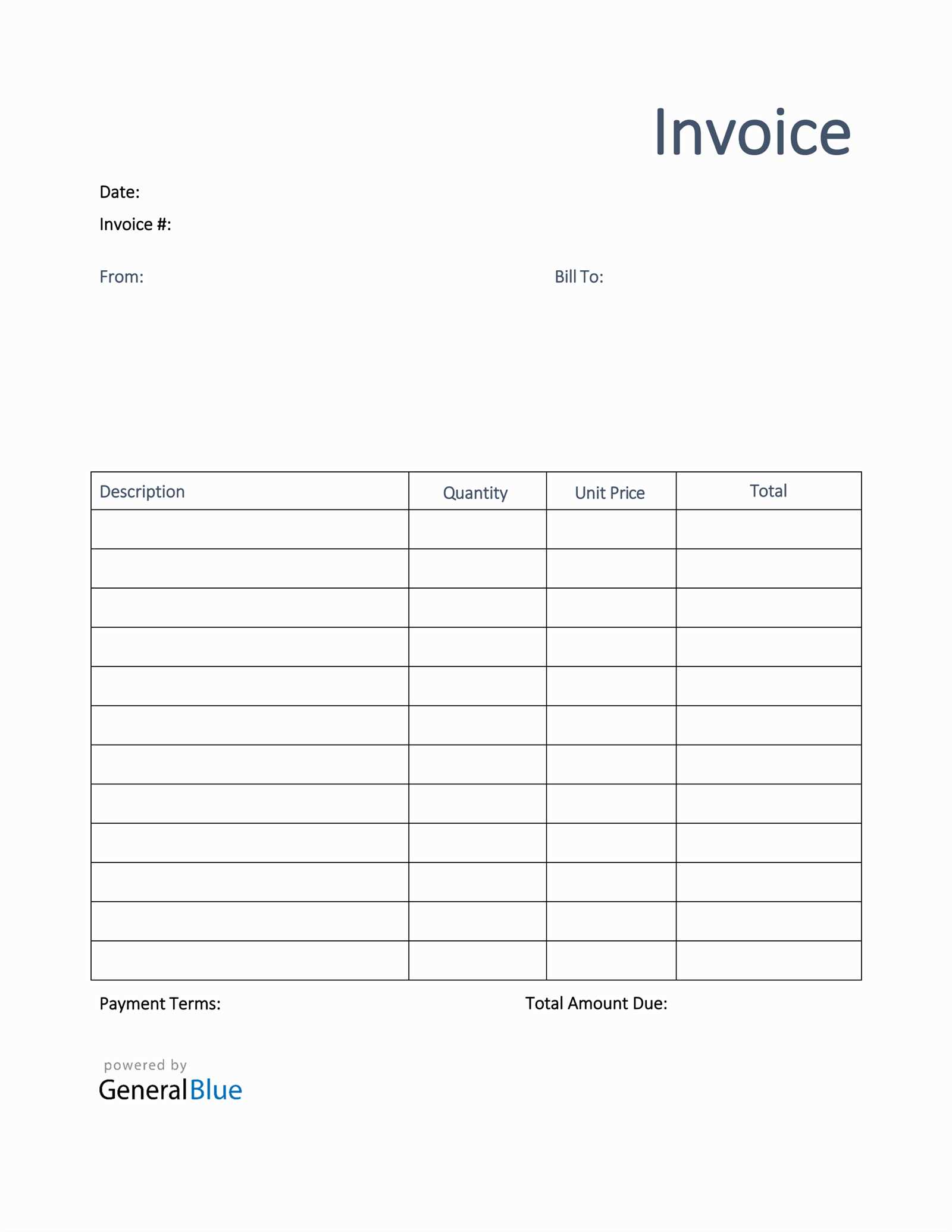

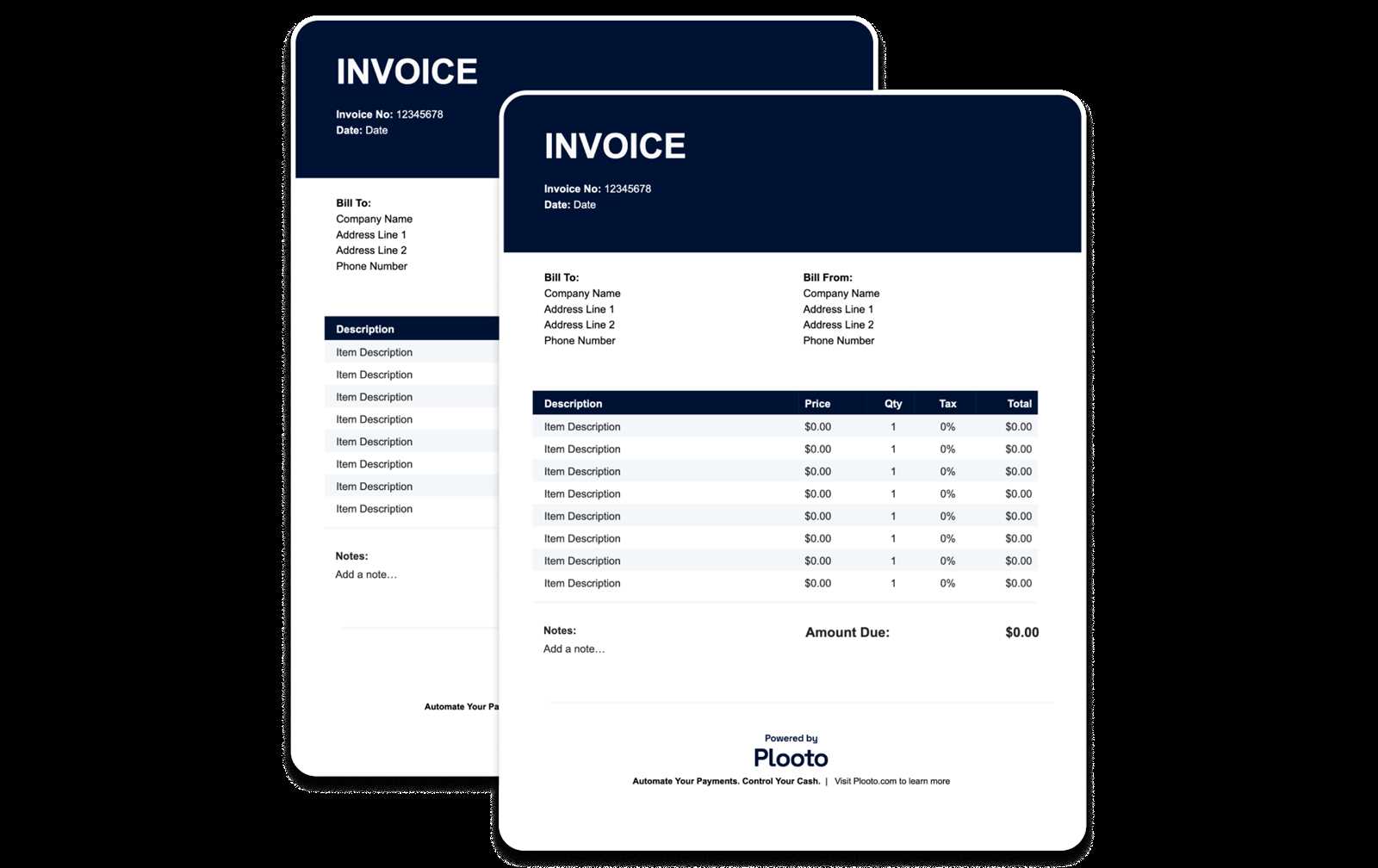

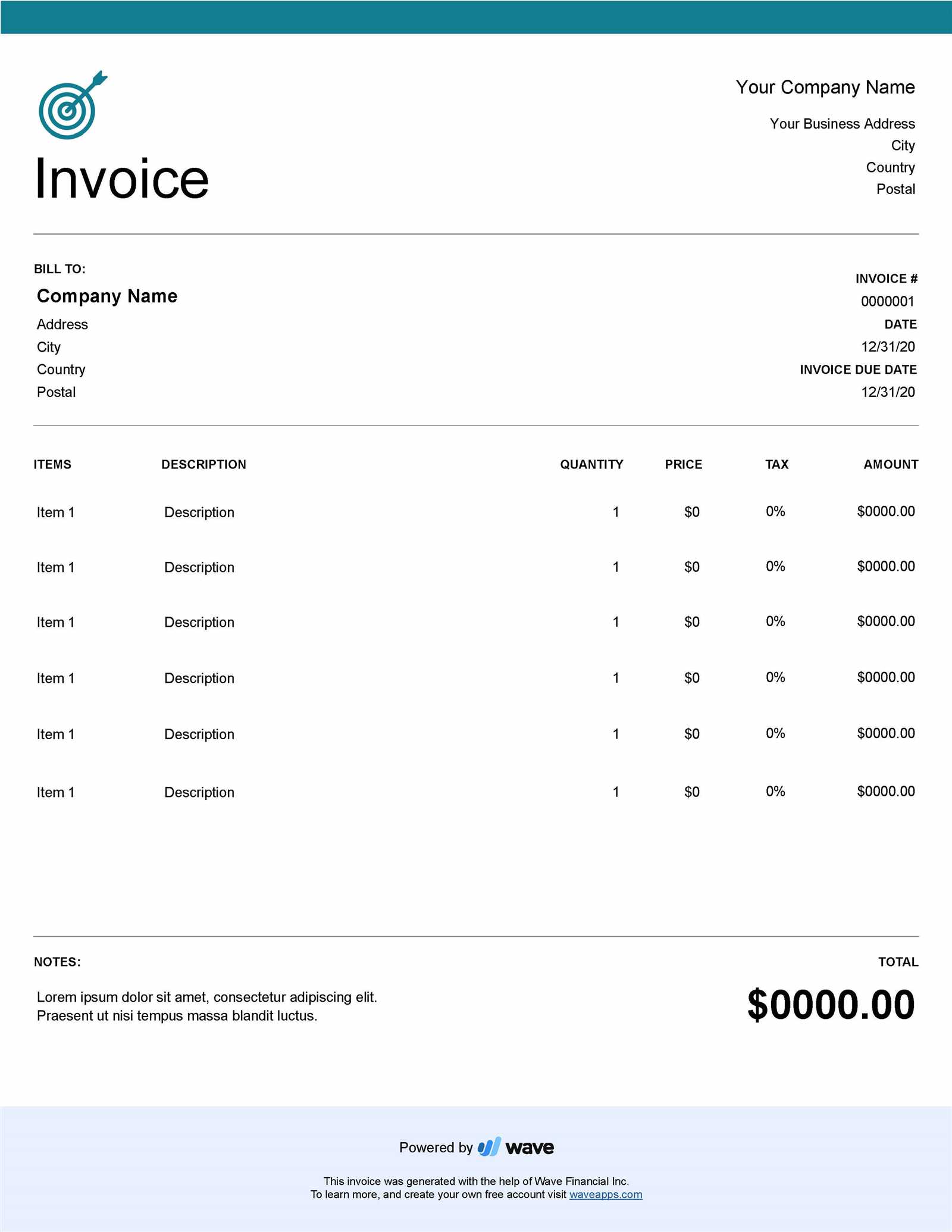

How to Customize Your Invoice Template

Customizing a document to confirm completed transactions is essential for making it fit your business needs and style. By tailoring the design and structure, you can ensure that all the necessary information is included and presented clearly. A well-customized form not only streamlines your billing process but also enhances your professionalism in the eyes of your clients.

The key to effective customization is understanding what elements need to be included in the document and how to modify them to suit your workflow. Whether you’re adding your company logo, adjusting the layout, or changing the wording, these changes can help align the document with your branding and make it more functional for both you and your clients.

Step-by-step customization tips:

- Update Business Information: Make sure your contact details, business name, and address are prominently displayed at the top of the document.

- Add Client Details: Include fields for the client’s name, address, and contact information to ensure clarity and ease of communication.

- Modify the Service Description: Adjust the wording to accurately describe the goods or services provided, including the pricing, quantities, and dates.

- Personalize the Layout: Choose fonts, colors, and formatting that reflect your brand identity while maintaining clarity and readability.

- Incorporate Payment Terms: Clearly outline payment due dates, accepted methods, and any applicable late fees.

Tips for Efficiency:

- Save as a Master Copy: Once you’ve made your customizations, save the document as a master copy so you can reuse it for future transactions.

- Use Software for Quick Adjustments: Many software programs offer easy-to-use interfaces that allow for quick updates, so you don’t have to start from scratch every time.

- Check for Consistency: Make sure the design and language used in the document are consistent with your overall branding and communication style.

By following these steps, you can create a personalized, professional document that enhances the transaction experience for both you and your clients, while also improving the efficiency and accuracy of your payment tracking.

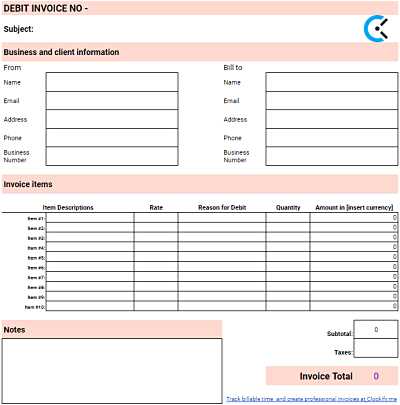

Free Paid Invoice Template Resources

Finding free, customizable documents for confirming completed transactions can save both time and money for small businesses and freelancers. These resources offer pre-designed forms that can be adapted to fit specific needs, helping businesses maintain professional standards without the expense of custom designs. Whether you need a basic format or something more advanced, there are numerous online platforms that provide these tools at no cost.

Where to Find Free Resources

There are several platforms that offer free, downloadable documents for recording payments. These websites allow you to either download pre-made files or use online tools to create your own. Here are some of the best places to start:

- Template Websites: Websites such as Template.net or Canva offer free, easy-to-use document templates that can be downloaded and customized.

- Google Docs: Many users share free, editable templates through Google Docs, which are simple to modify and save in various formats.

- Microsoft Office Templates: Microsoft’s website provides a selection of free document templates, which are compatible with both Word and Excel.

- Freelancer Communities: Freelance platforms like Upwork and Fiverr sometimes offer free resources or links to template websites.

Benefits of Using Free Resources

Using free resources not only saves on design costs but also provides immediate access to ready-to-use forms. These documents typically include all the essential elements required for financial tracking and can be quickly personalized to suit your business needs.

- Cost-effective: Free resources eliminate the need for hiring a designer or purchasing expensive software.

- Time-saving: Pre-designed documents allow for quick implementation and immediate use without having to start from scratch.

- Customizable: Most resources offer easy-to-edit options, allowing you to tailor the document to your business’s specific requirements.

- Variety of Formats: You can choose from a wide range of formats (Word, Excel, PDF) depending on your preferred method of use.

By taking advantage of these free resources, businesses can efficiently manage their financial documentation and ensure accuracy in their records, all while maintaining a professional appearance without any

Benefits of Using a Digital Invoice

In today’s fast-paced business environment, digital solutions have become essential for streamlining processes and improving efficiency. When it comes to recording completed payments and managing financial transactions, using an electronic document offers several advantages over traditional paper-based methods. Digital formats provide speed, accuracy, and ease of access, all of which are crucial for maintaining smooth operations and reducing administrative overhead.

Here are some key benefits of switching to an electronic document for tracking payments:

- Faster Processing: Digital documents can be created, sent, and received instantly, reducing the time needed for manual entry, postage, or handling delays.

- Improved Accuracy: Automation features such as auto-calculation reduce the risk of human error, ensuring that totals and details are correct every time.

- Cost Savings: By eliminating paper, ink, and postage costs, digital documentation offers a more affordable solution, especially for small businesses and freelancers.

- Easy Customization: With digital forms, you can quickly update content, adjust designs, and modify the layout to suit your branding needs without starting from scratch each time.

- Environmentally Friendly: Reducing paper waste contributes to a more sustainable business model, aligning with eco-friendly practices.

Enhanced Organization and Accessibility

Digital documents also offer improved organization and accessibility, making it easier to track payments, manage records, and retrieve information when needed.

- Cloud Storage: Digital documents can be stored securely in the cloud, ensuring that you always have access to your financial records from any device, anywhere.

- Searchable Data: Storing your documents digitally means you can easily search for specific transactions by date, client name, or amount, saving valuable time during audits or reviews.

- Automated Reminders: Digital tools often come with automated reminders for overdue payments, helping you maintain consistent cash flow without having to manually track outstanding balances.

Ultimately, switching to digital documents not only simplifies the payment process but also enhances business efficiency and client satisfaction. With these tools, you can manage your financials more effectively, increase productivity, and reduce the chances of errors or delays.

How Paid Invoice Templates Improve Organization

Maintaining clear, accurate, and consistent financial records is a critical aspect of running any business. A well-structured document designed for recording completed payments helps businesses stay organized by providing a reliable and systematic way to track transactions. By using these forms, business owners can streamline their administrative processes, reduce errors, and ensure that all financial data is easily accessible when needed.

One of the primary ways that these forms improve organization is by offering a consistent structure for all transactions. This ensures that every payment record includes the necessary details, such as the service or product description, amount, payment method, and client information. With a uniform format, business owners can quickly identify and retrieve important data without wasting time searching for scattered or incomplete information.

Centralized Record-Keeping

When managing payments manually, it can be easy to lose track of outstanding or completed transactions, especially if records are stored in different formats or locations. A structured document consolidates all this information in one place, allowing businesses to track every payment in an organized and systematic manner. This centralized approach significantly reduces the chances of missed or duplicated entries.

- Clear Payment Status: These documents clearly indicate whether a payment is pending, completed, or overdue, helping to avoid confusion and ensure timely follow-ups.

- Easy Access to Transaction History: Storing completed records digitally or physically allows for easy retrieval when reviewing past transactions for reference or audits.

- Consistent Data Entry: Using a standardized form eliminates the risk of missing important details, ensuring that all necessary information is included every time.

Streamlined Workflow and Time Savings

Another key advantage of using structured documents is that they streamline workflows, saving both time and effort. With a predefined format, businesses can quickly fill in the relevant information without having to create a new document each time. This allows for faster processing and less administrative work, freeing up time for other important tasks.

- Reusable Layouts: Many digital forms allow you to save customized versions, so you don’t have to start from scratch for each new transaction.

- Automation Features: Certain tools include automated calculations for totals, taxes, and discounts, reducing manual data entry and the risk of errors.

- Quick Client Communication: With all necessary details already in the document, businesses can easily share payment records with clients via email or other digital channels, accelerating the communication process.

By improving record-keeping, reducing errors, and accelerating workflows, these documents offer businesses a more organized and efficient way to manage their financial transactions. They ensure that all the necessary information is easily accessible, up-to-date, and ready for future refere

Common Mistakes When Creating Invoices

Even though documenting completed payments is a standard part of business operations, many entrepreneurs and freelancers make common mistakes when creating these records. Failing to include essential details, using unclear language, or not properly formatting the document can lead to confusion, delays, and even payment disputes. Being aware of these errors and learning how to avoid them can help ensure that the billing process runs smoothly and efficiently.

Key Mistakes to Avoid

- Missing Payment Terms: Not specifying payment deadlines, late fees, or accepted methods can cause confusion or delays in receiving payments.

- Inaccurate Information: Incorrect details such as amounts, dates, or client information can lead to errors in accounting or cause clients to question the validity of the transaction.

- Unclear Descriptions: Vague or incomplete descriptions of the services or products provided can result in misunderstandings and disputes over what was actually delivered.

- Not Including a Unique Identifier: Failing to include a unique reference number for each transaction can make it difficult to track or reconcile payments, especially for businesses with many clients.

- Omitting Contact Information: Not providing clear contact details can make it difficult for clients to reach out if they have questions or issues with the payment.

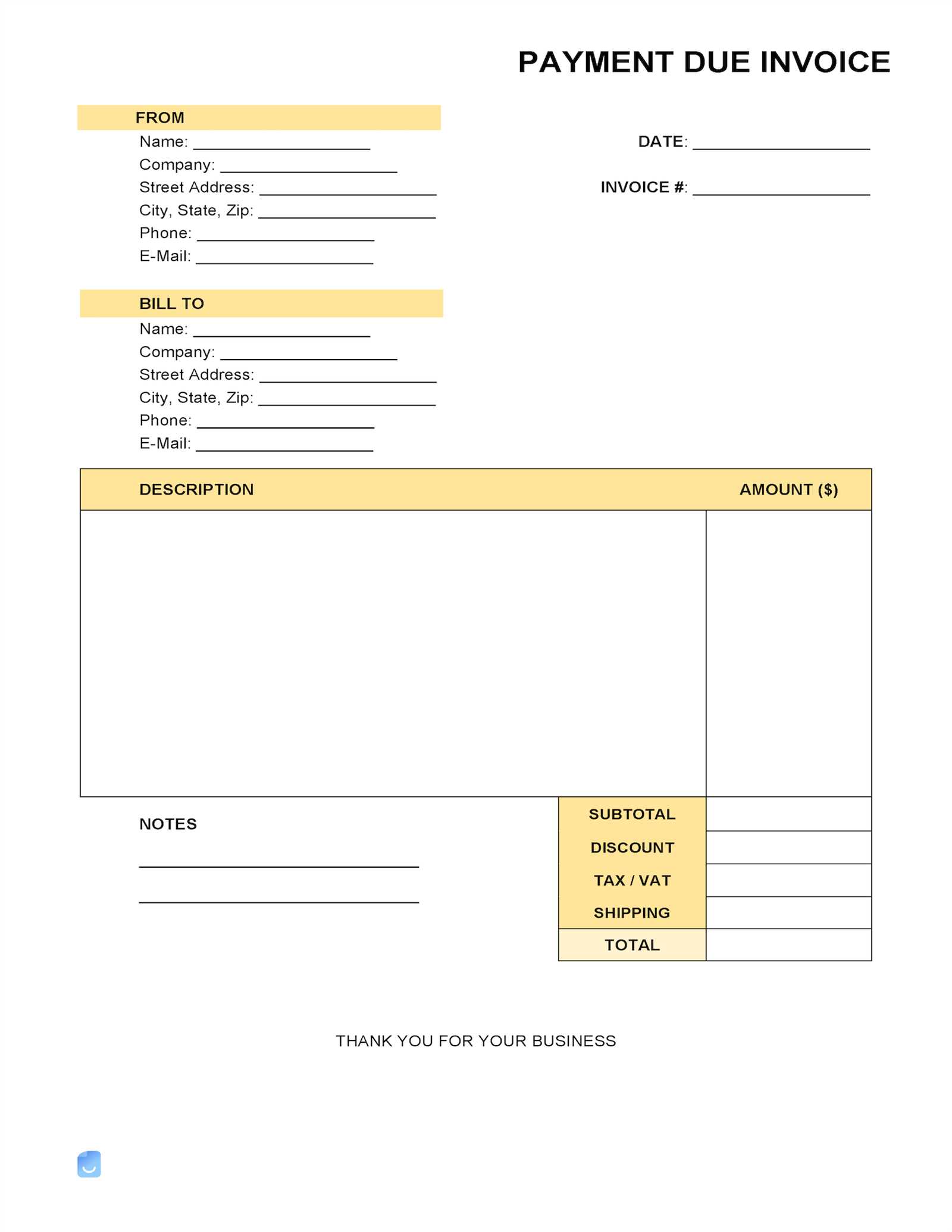

Formatting and Design Errors

- Unprofessional Appearance: Using inconsistent fonts, colors, or layouts can make the document look unprofessional and less trustworthy to clients.

- Cluttered Layout: A confusing or overly complicated layout can make it difficult for clients to quickly find key details, leading to frustration and unnecessary follow-up emails.

- Failure to Include a Payment Status: Not clearly marking the payment as “paid” or “settled” may lead to confusion regarding whether the transaction has been completed.

By being mindful of these common mistakes and taking care to include all the necessary details in an organized and professional manner, businesses can improve their billing processes, reduce errors, and ensure timely payments. A well-crafted document not only prevents misunderstandings but also enhances the professionalism and credibility of the business.

Best Software for Editing Invoice Templates

When it comes to managing financial records, having the right software can make all the difference. The best editing tools allow you to customize, create, and manage forms for documenting payments efficiently and professionally. Whether you need to adjust the layout, add new fields, or automate certain processes, the right program can streamline your workflow and save valuable time.

Here are some of the top software options available for editing and customizing payment documentation forms:

- Microsoft Word: A popular and user-friendly option, Word offers customizable layouts and is ideal for creating professional-looking documents. It includes pre-made designs that can be adjusted to suit your specific needs.

- Google Docs: A free, cloud-based tool that makes document editing and sharing easy. Google Docs allows for real-time collaboration, and many free templates are available for quick customization.

- Canva: Known for its design-focused features, Canva offers drag-and-drop functionality and a wide range of customizable templates. It’s perfect for businesses looking to create visually appealing and personalized forms.

- FreshBooks: This is an invoicing and accounting software that provides a simple way to create and send professional payment records. It also includes features like automatic calculation and reporting, making it ideal for small businesses.

- Zoho Invoice: A great option for freelancers and small businesses, Zoho Invoice offers customizable forms with the ability to add logos, payment terms, and client details. It also integrates with accounting tools for seamless financial management.

- Wave: A free software solution for small businesses, Wave provides easy-to-use templates and allows you to manage payments and track expenses. It also offers features like automatic payment reminders and reporting.

Each of these programs has unique features designed to improve the way you manage your financial documentation. Whether you need a simple editor or a more advanced solution that integrates with other financial tools, there’s a software option to fit every need and budget.

How to Send Paid Invoices Efficiently

Sending completed transaction records in a timely and organized manner is crucial for maintaining a professional relationship with clients and ensuring smooth cash flow. Efficiently distributing these documents can save time and reduce the risk of mistakes. By streamlining your process, you can quickly deliver the necessary information while keeping your operations running smoothly.

Here are some practical steps to send payment confirmation documents efficiently:

1. Use Digital Solutions

Rather than relying on paper copies, using digital formats allows you to send records instantly, eliminating the time and cost associated with printing and mailing. Many tools and platforms allow you to generate and send payment confirmations via email or other digital channels in just a few clicks.

- Email: Send completed records as PDF attachments directly to your clients’ inboxes. PDFs are universally accessible and preserve the formatting of your document.

- Cloud Storage: Use cloud-based platforms like Google Drive, Dropbox, or OneDrive to share links to the document, giving clients easy access to their transaction details at any time.

- Accounting Software: Many accounting platforms, like QuickBooks or FreshBooks, allow you to automatically send completed documents through their system, often with the option to track when the email has been opened.

2. Automate the Process

Automation is one of the most effective ways to save time and avoid human error. By setting up automated systems, you can ensure that completed payment records are sent as soon as the transaction is finalized.

- Automated Email Reminders: Set up automatic reminders for clients once the payment has been processed, informing them that their record is ready for review or that the transaction has been completed.

- Integrated Tools: Many platforms can automatically generate and send these documents once a payment has been recorded, ensuring no steps are missed and reducing administrative workload.

- Recurring Transactions: For clients with ongoing contracts, set up recurring payment records that will be sent automatically after each payment cycle.

3. Ensure Clear Communication

When sending a completed transaction record, it’s important to provide clear and concise information in the email or message accompanying the document. This minimizes confusion and ensures that your client understands the payment status and what to expect moving forward.

- Personalized Message: Include a brief message explaining that the payment has been received and the record is attached. A personal touch can enhance the client experience.

- Subject Line: Use a clear subject line such as “Pay

When to Use a Paid Invoice Template

Knowing when to use a standardized document for recording completed transactions is crucial for maintaining accurate financial records and ensuring smooth business operations. These pre-designed forms help streamline the billing process and provide a professional way to confirm that payments have been processed. Using them at the right time can prevent errors, delays, and confusion for both business owners and clients.

Here are some scenarios when utilizing a predefined form for documenting payments is most beneficial:

1. After Receiving Full Payment

Once a client has made a full payment for services or goods, it’s essential to send a clear, formal record to confirm the transaction. This helps close the loop and provides your client with a document for their own records. It also provides the business with an official acknowledgment that the transaction has been completed.

- Client Confirmation: A clear payment record reassures clients that their payment has been received and processed correctly.

- Tax and Accounting Purposes: These documents help with accurate financial tracking and tax reporting.

2. For Regular or Recurring Transactions

If your business involves ongoing or subscription-based services, using a standardized form each time a payment is made helps ensure consistency. This is particularly important for businesses offering monthly, quarterly, or annual services.

- Efficiency: Sending a consistent document every time ensures the process is fast and reduces the chance of errors in payment records.

- Automatic Follow-Ups: Many platforms that offer recurring billing can automatically send these documents as soon as a payment is made.

3. When Dealing with Multiple Clients

For businesses that handle many transactions across different clients, using predefined forms helps keep everything organized. Each document can be customized with the specific client information, but the core structure remains the same, saving time and ensuring that all relevant details are included.

- Organization: These forms make it easier to track each client’s payment status and history.

- Professionalism: Using a consistent format conveys professionalism and helps maintain clear records for future reference.

4. When Offering Discounts or Adjustments

If your business offers discounts or has special payment terms for certain clients, a well-designed document can make it easier to communicate these adjustments clearly. By including the new totals, terms, and any special instructions on the document, you ensure transparency and minimize misunderstandings.

- Clear Breakdown: The document will show the original amount, applied discounts, and the final payment due, reducing confusion.

- Customized Terms: It allows you to tailor the payment confirmation according to the specific terms agreed upon with the client.

Using a standardized document for confirming completed payments not only saves time but also helps

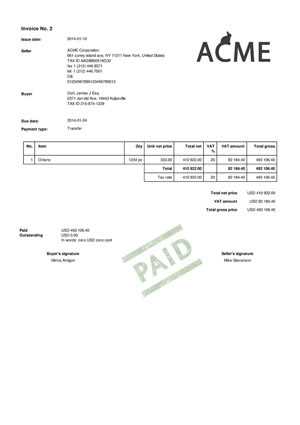

Legal Requirements for Paid Invoices

When documenting completed transactions, it’s crucial to ensure that your records meet legal requirements. Different regions and industries may have specific regulations governing the information that must be included in these documents. Failure to comply with these requirements can lead to legal complications, penalties, or delays in receiving payments. Understanding the legal standards for transaction records helps ensure that your business operates smoothly and in compliance with the law.

Here are some of the key legal considerations to keep in mind when creating and sending payment documentation:

1. Essential Information to Include

To be legally valid, these documents must contain certain critical details that confirm the transaction. Commonly required elements include:

- Business Information: The name, address, and contact details of your business, including registration number if applicable.

- Client Information: The name and contact information of the client receiving the goods or services.

- Clear Description: A detailed description of the goods or services provided, including quantities, rates, and dates of provision.

- Total Amount: The total amount charged, clearly broken down by individual charges, taxes, and discounts if applicable.

- Payment Terms: The agreed-upon payment deadline, method of payment, and any penalties for late payment.

- Unique Reference Number: A unique identifier for each transaction to help track and reference the record.

2. Tax Compliance

In many countries, it’s a legal requirement to include tax-related information on completed transaction records. This includes the applicable sales tax, VAT (Value Added Tax), or other regional tax rates. Depending on your location, you may also need to include your tax identification number or VAT registration number.

- Tax Identification Number: Ensure that your business has a registered tax number, and display it on your records if required by law.

- Tax Rates: List the tax rates applied to each item or service to comply with local regulations.

- Tax Breakdown: Show a clear breakdown of taxes to avoid confusion and ensure compliance during audits.

3. Record Retention and Reporting

In most jurisdictions, businesses are required to retain completed transaction records for a certain period of time. This can range from a few years to several years, depending on local laws. Th

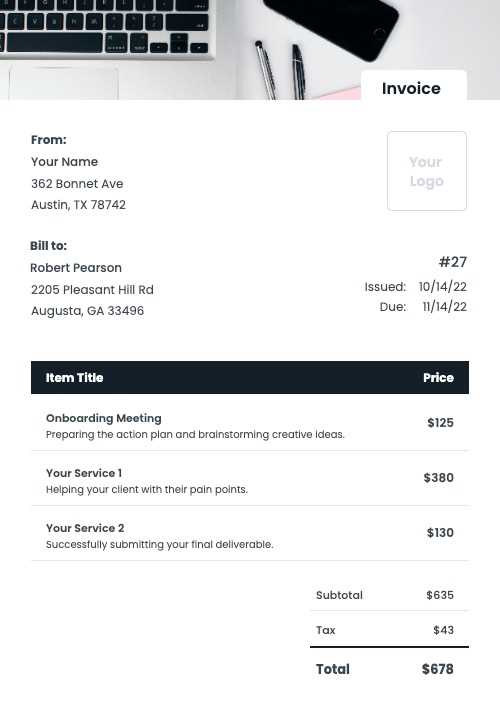

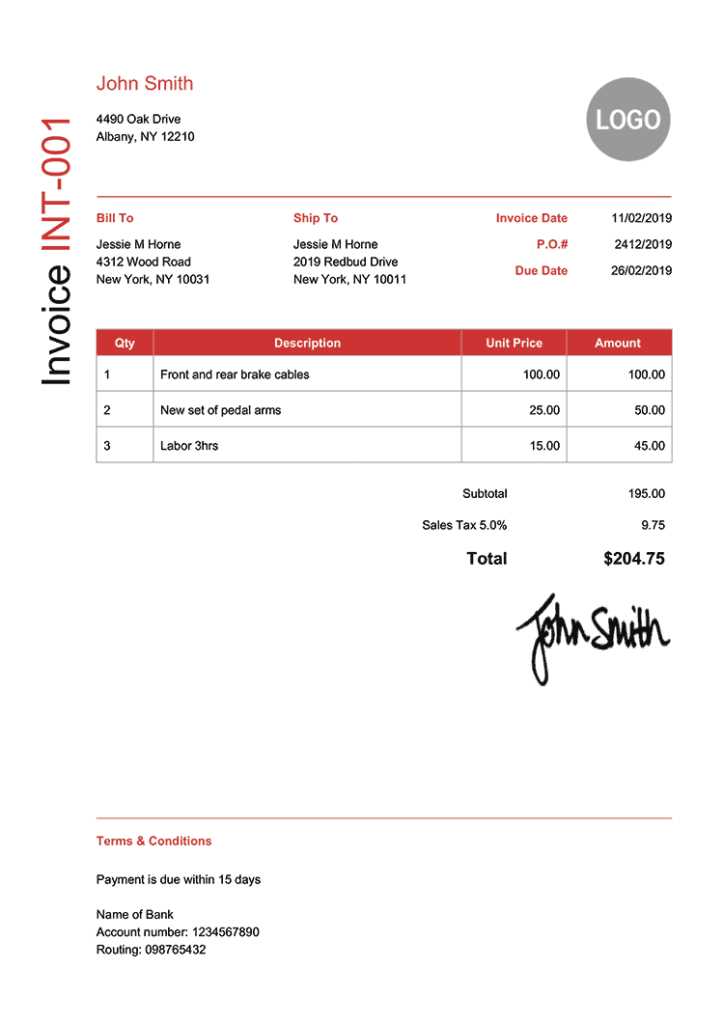

Formatting Tips for Professional Invoices

Creating well-organized and visually appealing documents for confirming completed transactions is crucial for maintaining a professional image and ensuring clarity for your clients. A clean, easy-to-read format can enhance your credibility and help avoid confusion. Whether you are designing a document from scratch or using a pre-made structure, paying attention to formatting is essential for efficiency and professionalism.

Here are some key formatting tips to help you create clear and professional payment confirmation records:

1. Use a Clear and Simple Layout

Keep the design clean and uncluttered. A simple layout allows important details to stand out and makes it easier for clients to understand the document quickly. Avoid overcrowding the page with unnecessary information or complex elements.

- Headings: Use clear and bold headings for key sections such as “Client Information,” “Description of Services,” and “Amount Due.” This helps to visually break up the content.

- Consistent Margins: Ensure consistent margins around the document to create a balanced and professional appearance.

- Whitespace: Don’t be afraid to use whitespace. Proper spacing improves readability and prevents the document from feeling too busy.

2. Include Key Information in a Logical Order

Organize your document in a way that guides the reader through the information in a logical sequence. This helps to prevent confusion and ensures that all necessary details are easy to locate.

- Header Section: Start with your business name, address, and contact details at the top, followed by the client’s information.

- Transaction Details: List the description of the goods or services provided, along with the quantities, individual prices, and the total amount.

- Payment Terms: Clearly state the payment terms and any due dates or late fees, followed by a unique reference number for easy tracking.

3. Choose a Professional Font

The font you use for the document plays a significant role in its readability and overall look. Choose a simple and professional font that’s easy to read on both print and digital formats.

- Legibility: Stick to classic fonts such as Arial, Times New Roman, or Helvetica. These fonts are clear and universally recognized for formal documents.

- Font Size: Use a font size of at least 10-12 points for the body text. Headers should be larger to help separate sections and guide the reader’s eye.

- Font Weight: Use bold or italic fonts sparingly to highlight important information, such as totals or due dates.

4. Incorporate Your Branding

Incorporating your business branding into the design of your document can reinforce your professionalism and create consistency across all communication channels.

- Logo: Include your business logo at the top of the document to increase brand recognition.

How to Track Payments Using Invoices

Effectively tracking payments is essential for maintaining accurate financial records and ensuring smooth cash flow in your business. By using detailed records that document each transaction, you can monitor whether payments have been received, identify outstanding balances, and streamline your accounting processes. With the right approach, these records serve as a powerful tool to stay organized and avoid potential disputes.

Here are some strategies to help you track payments efficiently through proper documentation:

1. Assign Unique Reference Numbers

Each transaction should be linked to a unique identifier that can be easily referenced in the future. This reference number not only simplifies tracking but also helps you quickly locate specific records when needed.

- Unique IDs: Use a consistent numbering system to ensure that every document has a unique identifier, such as INV-001, INV-002, and so on.

- Easy Tracking: This allows you to easily search for and find transaction details in your records without confusion.

2. Include Payment Due Dates and Terms

Clearly outlining payment due dates and terms helps set expectations and encourages timely payments. Having a clear record of these details also enables you to track overdue balances more effectively.

- Due Dates: Include a specific date by which the client should make payment to avoid confusion or disputes.

- Late Fees: If applicable, clearly state any penalties for late payments to encourage timely settlement.

- Payment Methods: List accepted payment methods (e.g., bank transfer, credit card) to avoid delays or confusion on how payments can be made.

3. Track Payment Status

When managing multiple transactions, it’s important to track the status of each payment. This can be done by regularly updating the payment status on your records, allowing you to see which transactions are pending, partially paid, or fully settled.

- Payment Status Fields: Include fields such as “Pending,” “Paid in Full,” or “Partial Payment” to indicate the current status of each transaction.

- Regular Updates: Ensure that these fields are updated after each payment is made or when additional payments are received.

- Automated Tracking: Many accounting software programs offer automated payment tracking, which can save time and reduce errors.

4. Record Payment Details

For thorough tracking, it’s essential to document all relevant details of each payment, including the amount paid, payment date, and the payment method. This will provide a comprehensive history of all transactions and help you identify any discrepancies.

- Amount Paid: Record the exact amount received to avoid discrepancies later on.

- Payment Method: Note

Automating Invoice Creation and Payment Tracking

Automating the process of generating transaction records and tracking payments can significantly streamline your business operations, save time, and reduce errors. With the right tools in place, you can ensure that every transaction is documented accurately, payments are tracked in real-time, and clients are reminded of due amounts, all without the need for manual intervention.

By incorporating automation into your workflow, you can focus more on growing your business and less on administrative tasks. Below are some strategies and tools to help you automate both the creation of financial records and the tracking of incoming payments:

1. Automate Document Creation

Generating payment confirmation documents manually can be time-consuming and prone to errors. By using automated software, you can quickly generate professional records with the correct details, such as client names, transaction amounts, and due dates. This also helps ensure consistency in formatting and eliminates the risk of overlooking important information.

- Pre-configured Templates: Use software that offers pre-configured document formats that can be customized to include your company’s branding, logo, and specific payment terms.

- Data Integration: Many tools integrate with your client database, automatically populating client details such as name, address, and previous transactions.

- Automated Calculations: Automatically calculate totals, taxes, and discounts to reduce manual input and prevent errors.

2. Automate Payment Tracking

Tracking payments manually can become overwhelming, especially as the number of clients grows. By automating the payment tracking process, you can monitor each transaction’s status and receive real-time updates on outstanding balances. This ensures that no payments are overlooked and helps you keep track of due dates more efficiently.

- Real-Time Updates: Use systems that automatically update the payment status once a payment is made, removing the need for manual updates and reducing the risk of oversight.

- Payment Reminders: Set up automatic reminders for clients when a payment is due, or when a payment has not been received within the agreed-upon timeframe.

- Integration with Payment Processors: Connect your payment tracking system to processors like PayPal, Stripe, or your bank account to automatically update transaction statuses when payments are received.

Automating the creation of financial records and tracking payments not only saves time but also improves accuracy, ensuring that your business stays organized and professional. With the right software, you can significantly reduce manual tasks, avoid errors, and keep clients informed, ultimately enhancing the efficiency of your overall business operations.

Integrating Paid Invoice Templates with Accounting Tools

Integrating your payment confirmation records with accounting tools can greatly simplify your financial management. By linking these documents directly to your accounting software, you can automate data entry, reduce errors, and ensure that all transactions are recorded accurately. This integration allows for a seamless flow of information between your billing system and your financial tracking system, ultimately improving efficiency and reducing the chances of discrepancies.

With the right integration, you can effortlessly track your revenue, monitor client payments, and generate financial reports. Below are some of the benefits and steps involved in integrating your payment records with accounting tools:

1. Streamlining Data Entry

One of the primary advantages of integrating payment documents with accounting software is the ability to automate data entry. When a transaction is recorded, the details such as client names, amounts, taxes, and dates can be automatically transferred to your accounting system, eliminating the need for manual input.

- Reduced Manual Work: Automating data entry minimizes human errors, saving time and ensuring that the records are consistent across both systems.

- Accuracy: Information from your payment documents is directly captured by the accounting system, ensuring that all data is accurately recorded and synchronized in real-time.

- Faster Processing: With fewer manual steps involved, you can process payments faster and update your financial records more efficiently.

2. Real-Time Financial Tracking

Integrating your payment documents with your accounting software ensures that your financial records are updated in real-time. As soon as a payment is made, the details are captured and reflected in your accounting system, allowing you to track outstanding balances and revenue more easily.

- Up-to-Date Records: As soon as a transaction is completed, both the payment status and amounts are updated in your accounting system without delay.

- Instant Reports: With real-time updates, you can generate reports on revenue, expenses, and taxes at any time, giving you a clear overview of your financial position.

- Better Cash Flow Management: Keeping track of incoming payments immediately helps you manage your business’s cash flow more effectively and avoid late fees or missed payments.

3. Simplifying Tax and Financial Reporting

When your payment records are integrated with your accounting software, generating financial reports becomes much simpler. Automated calculations and the integration of all transaction data help ensure that tax filings and year-end reports are accurate and easy to prepare.

- Tax Calculations: Accounting tools can automatically calculate applicable taxes, such as sales tax or VAT, ensuring that you remain compliant with local tax laws.

- Comprehensive Financial Overview: Having all your transaction data in one system provides a complete financial picture, making it easier to track profits, expenses, and tax liabilities.

- Time Savings: With the automation of report generation, you can quickly compile