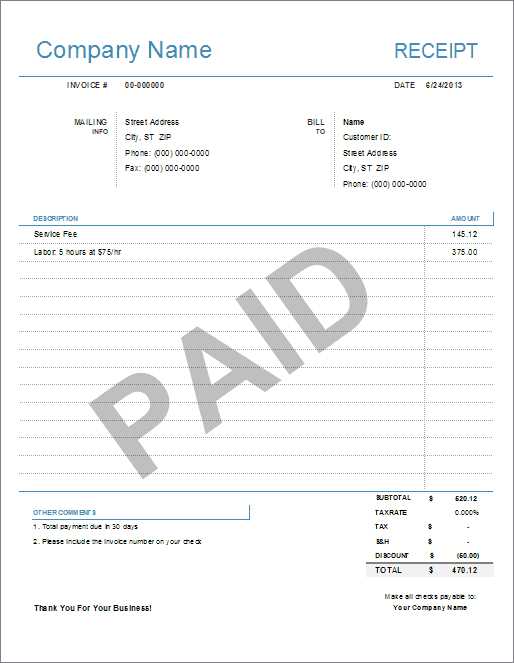

Free Paid Invoice Receipt Template for Easy Payment Tracking

When managing transactions, it’s essential to have a clear and reliable method for confirming completed payments. These documents serve as proof that an amount has been paid and can be crucial for both the payer and the recipient. They help maintain transparency and provide a record that can be referred to for future reference or legal purposes.

Whether you are a freelancer, small business owner, or a larger company, using a standardized approach to documenting financial exchanges can save time and avoid potential misunderstandings. By using a structured format, you can ensure all necessary details are included and that your records remain organized and professional.

In this article, we will explore how to create effective and customizable payment acknowledgement forms that will streamline your accounting processes and enhance communication with clients. With the right tools, you can easily generate these documents to suit your specific needs while maintaining a high level of professionalism.

What is a Paid Invoice Receipt?

When a financial transaction is completed, a document is often issued to acknowledge the payment. This document serves as confirmation that the agreed amount has been settled, ensuring both parties have a record of the transaction. It plays a key role in financial documentation and helps establish trust between businesses and their clients or customers.

Key Features of a Payment Confirmation Document

A payment acknowledgement document typically includes several essential pieces of information to ensure clarity and transparency. These details provide both the payer and the recipient with a clear record of the exchange:

- Payment Amount: The total sum paid by the client.

- Date of Transaction: The date the payment was made.

- Payment Method: The method used to complete the payment, such as credit card, bank transfer, or cash.

- Client and Provider Details: Information about both the customer and the business providing the goods or services.

- Service or Product Description: A brief outline of the goods or services that were paid for.

Why It’s Important to Have a Payment Confirmation

This document provides numerous benefits for businesses and clients alike:

- Proof of Payment: Acts as an official record that the client has fulfilled their financial obligation.

- Dispute Resolution: Can help resolve any future disputes regarding payments, ensuring both parties are on the same page.

- Tax and Accounting Records: Essential for accurate bookkeeping and preparing for tax filings.

By maintaining clear records, businesses can better manage their financial operations while offering clients confidence in the transaction process.

Why You Need a Paid Invoice Receipt

After completing a financial transaction, both businesses and customers benefit from having a document that confirms the payment has been made. This record not only provides peace of mind but also ensures clear communication between both parties. It serves as a tangible proof that the financial exchange has been finalized and helps avoid any misunderstandings down the line.

Key Reasons to Have a Payment Confirmation

- Legal Protection: A written confirmation can act as a legal safeguard in case of disputes, proving that payment has been made and received according to the agreed terms.

- Record Keeping: Having a structured document helps maintain accurate financial records, making it easier to track business transactions and prepare for audits or tax filings.

- Professionalism: Providing clear, organized payment confirmation documents reflects professionalism and builds trust with clients, enhancing business reputation.

- Transparency: Both the service provider and the client have a clear, shared understanding of the financial exchange, minimizing confusion about payments or balances.

Benefits for Business Operations

- Efficient Financial Management: With a standardized record, tracking payments becomes easier, improving cash flow management and reducing administrative errors.

- Client Relationships: Offering clear documentation of transactions strengthens relationships with clients, as they feel more confident in your business practices.

- Tax Compliance: Accurate payment records simplify tax reporting and help ensure that all business transactions are properly documented for tax purposes.

In short, having a well-structured payment confirmation is not just a formality but a crucial element in maintaining smooth and professional business operations.

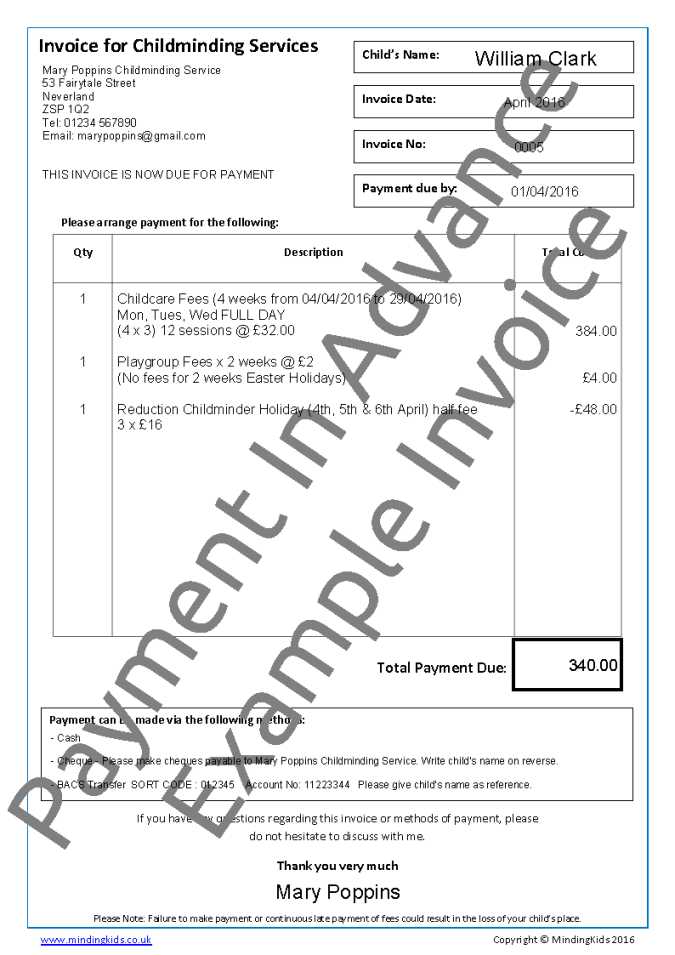

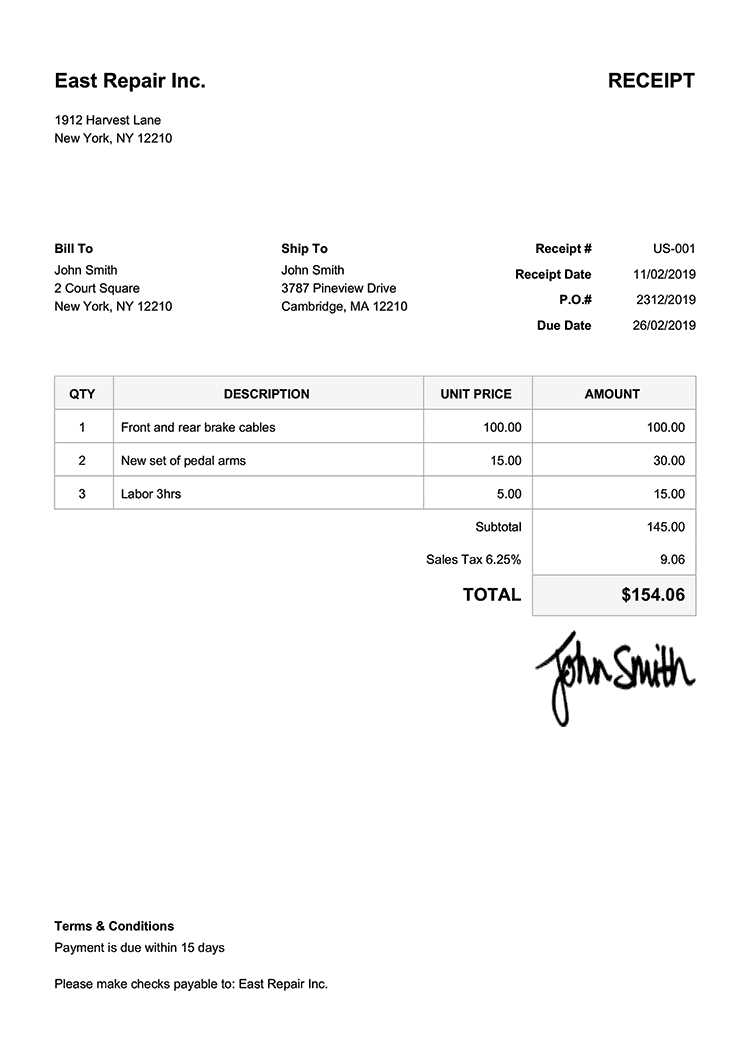

How to Create a Paid Invoice Receipt

Creating a professional document to confirm a completed payment is essential for any business transaction. This record serves to acknowledge that the agreed amount has been received, providing both parties with a clear understanding of the exchange. The process of creating such a document can be straightforward, as long as all necessary details are included. Here’s a simple guide on how to create a comprehensive payment confirmation document.

Steps to Create a Payment Confirmation Document

- Include Your Business Information: Start by adding your company or personal details at the top of the document. This should include your name, address, phone number, and email.

- Client’s Information: Add the recipient’s name, address, and contact details. This ensures that the document is personalized and easily traceable.

- List of Products or Services Provided: Include a brief description of the goods or services rendered. Clearly state the quantity, price, and any applicable taxes or fees.

- Payment Details: Specify the total amount paid, payment method (credit card, bank transfer, etc.), and the payment date. This helps confirm that the transaction is complete.

- Reference Number: Assign a unique reference or transaction number for easy tracking and future reference.

- Sign the Document: If necessary, add a signature or a digital signature to authenticate the document and provide extra legitimacy.

Tools to Simplify the Process

- Online Generators: Various free or paid online tools offer customizable forms to create these documents quickly.

- Word Processors: Software like Microsoft Word or Google Docs can be used to create a professional document from scratch or using pre-designed formats.

- Accounting Software: Many accounting platforms automatically generate payment confirmation documents, saving you time and reducing errors.

By following these steps, you can create a clear, professional payment confirmation document that benefits both your business and your clients. A well-structured record not only helps with organization but also establishes trust and transparency in your business dealings.

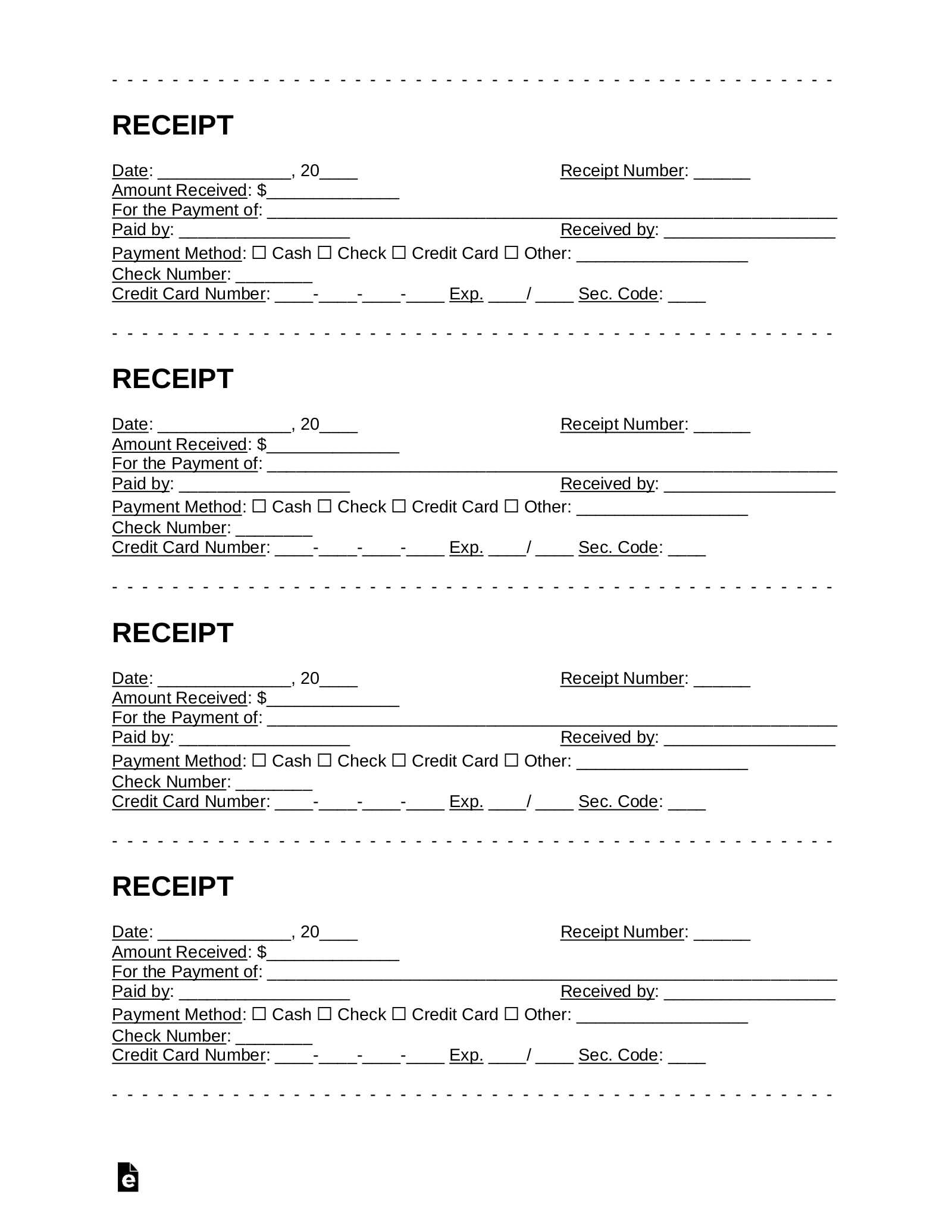

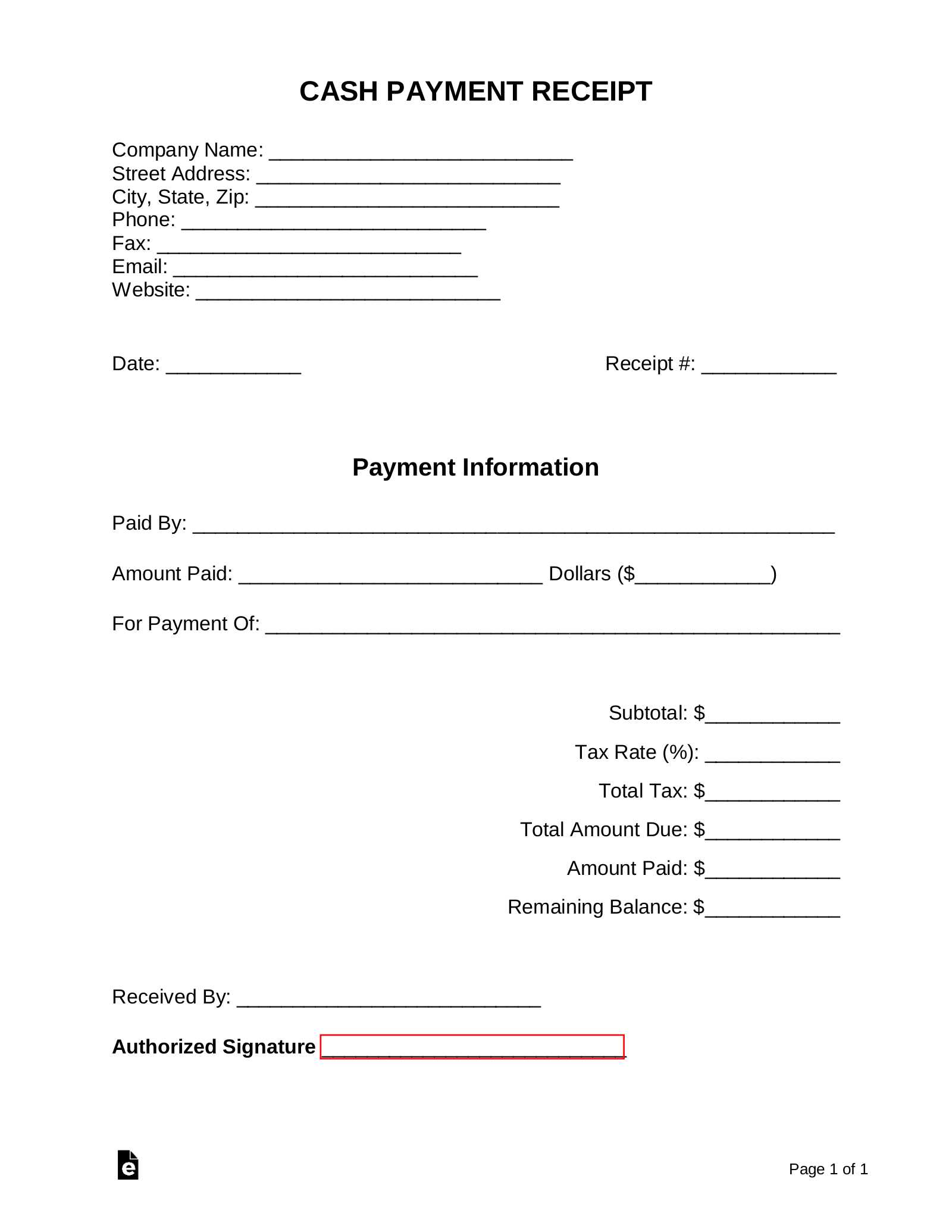

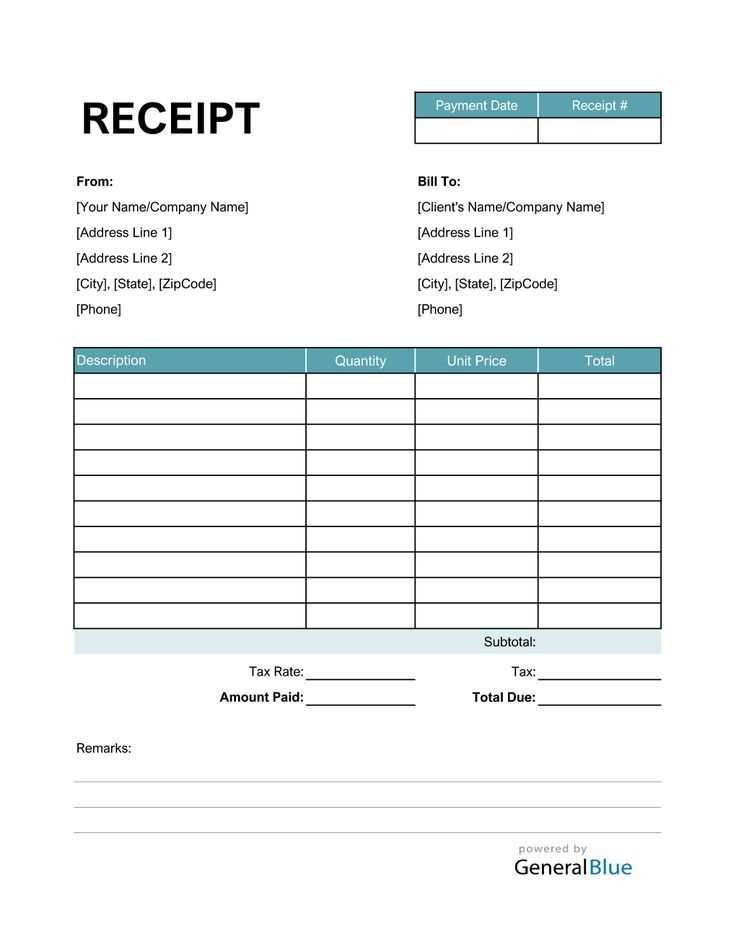

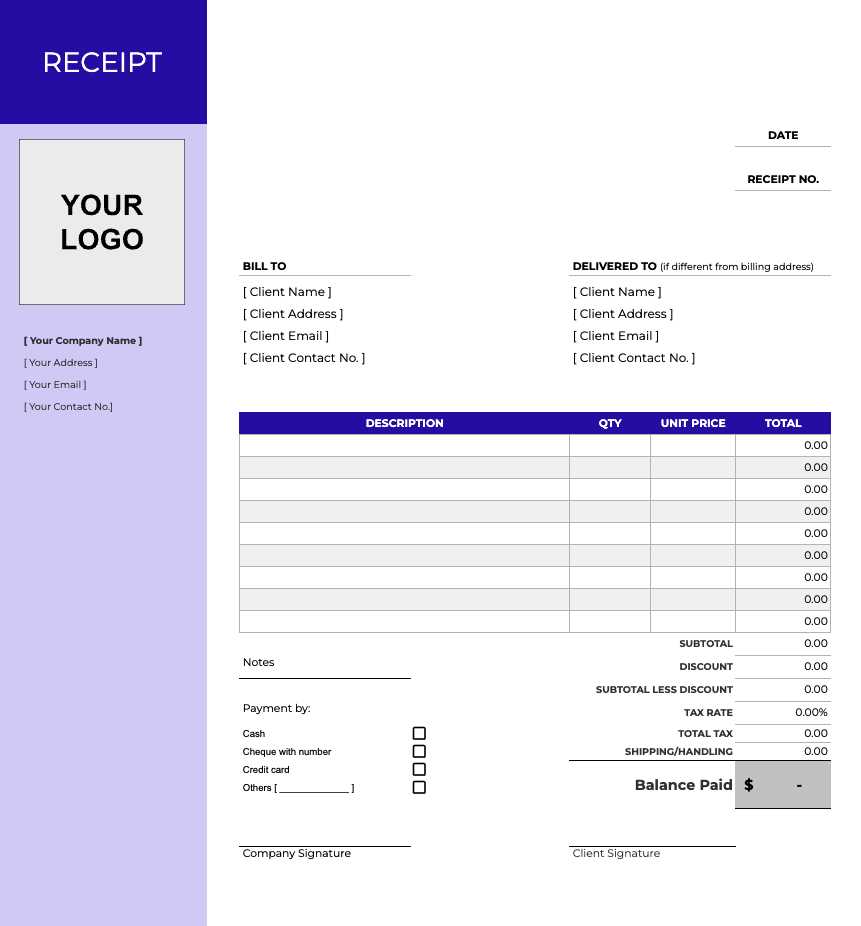

Essential Components of a Receipt Template

To create an effective document that confirms payment has been completed, it’s important to include several key elements. A well-structured record not only provides clarity and transparency for both parties involved but also ensures that all necessary details are captured for future reference. These essential components form the foundation of any professional payment confirmation document.

Key Elements to Include

- Business Information: At the top of the document, include the name, address, and contact details of the service provider or company issuing the document. This helps identify the source of the transaction.

- Client Information: Add the client’s full name, address, and any other relevant contact information to make the document personalized and easy to reference.

- Transaction Date: Clearly indicate the date the payment was made. This helps track when the transaction occurred and avoids any potential confusion later on.

- Amount Paid: Include the total amount received, along with any taxes or fees. Ensure the amount is clearly stated, with both the currency and the numerical value.

- Payment Method: Specify how the payment was made, such as via credit card, bank transfer, check, or cash. This adds another layer of clarity and helps keep track of different transaction types.

- Service or Product Description: Provide a brief description of the goods or services that were paid for, including quantities, unit prices, and any other relevant details. This ensures both parties understand the exchange fully.

Additional Features to Enhance Clarity

- Reference Number: A unique reference or transaction number makes it easier to track the payment, especially when handling multiple transactions.

- Signature or Authentication: Depending on the formality of the transaction, adding a signature or a digital authentication method can enhance the document’s credibility.

- Terms and Conditions: If applicable, include any relevant terms, such as payment policies, return/refund instructions, or guarantees, to clarify the expectations surrounding the payment.

By ensuring these elements are included, businesses can create a thorough and professional document that serves both functional and legal purposes, while maintaining transparency with clients.

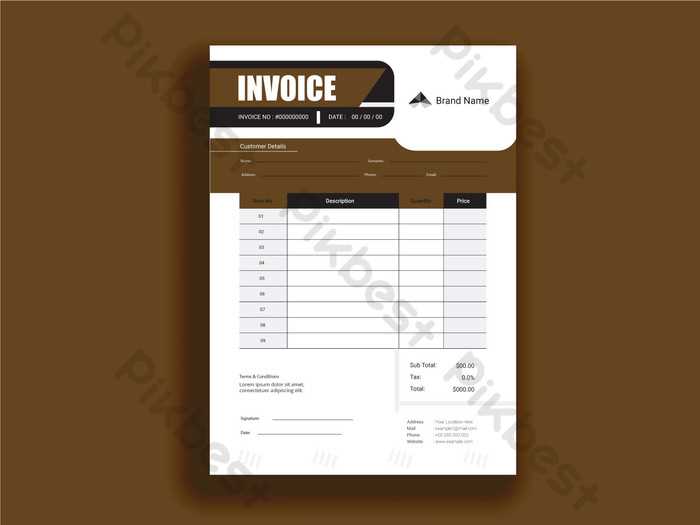

Benefits of Using a Template for Receipts

Using a pre-designed structure to document payments can significantly improve efficiency and consistency in business operations. A ready-made format ensures that all essential information is captured in a clear, organized manner, reducing the likelihood of errors and saving valuable time. This approach not only streamlines the process but also enhances professionalism and reliability in transactions.

Here are some key benefits of utilizing a pre-built structure for documenting financial exchanges:

| Benefit | Description |

|---|---|

| Time Efficiency | A pre-designed form reduces the time needed to create a document from scratch, allowing businesses to focus on other essential tasks. |

| Consistency | Using the same format for all transactions ensures that every document contains the necessary details, leading to more consistent records. |

| Reduced Errors | A standardized structure minimizes the chances of missing critical information, which can often lead to misunderstandings or disputes. |

| Professional Appearance | Providing well-organized, consistent documentation reflects professionalism and enhances trust with clients and partners. |

| Customization | Templates are often customizable, allowing businesses to adapt the format to their unique needs while maintaining structure and clarity. |

| Record Keeping | Using a consistent format makes it easier to track and store documents over time, which is especially important for accounting and tax purposes. |

By relying on an established structure, businesses can streamline their payment confirmation process, improve organization, and maintain a high level of professionalism. This leads to better customer satisfaction and more efficient financial management.

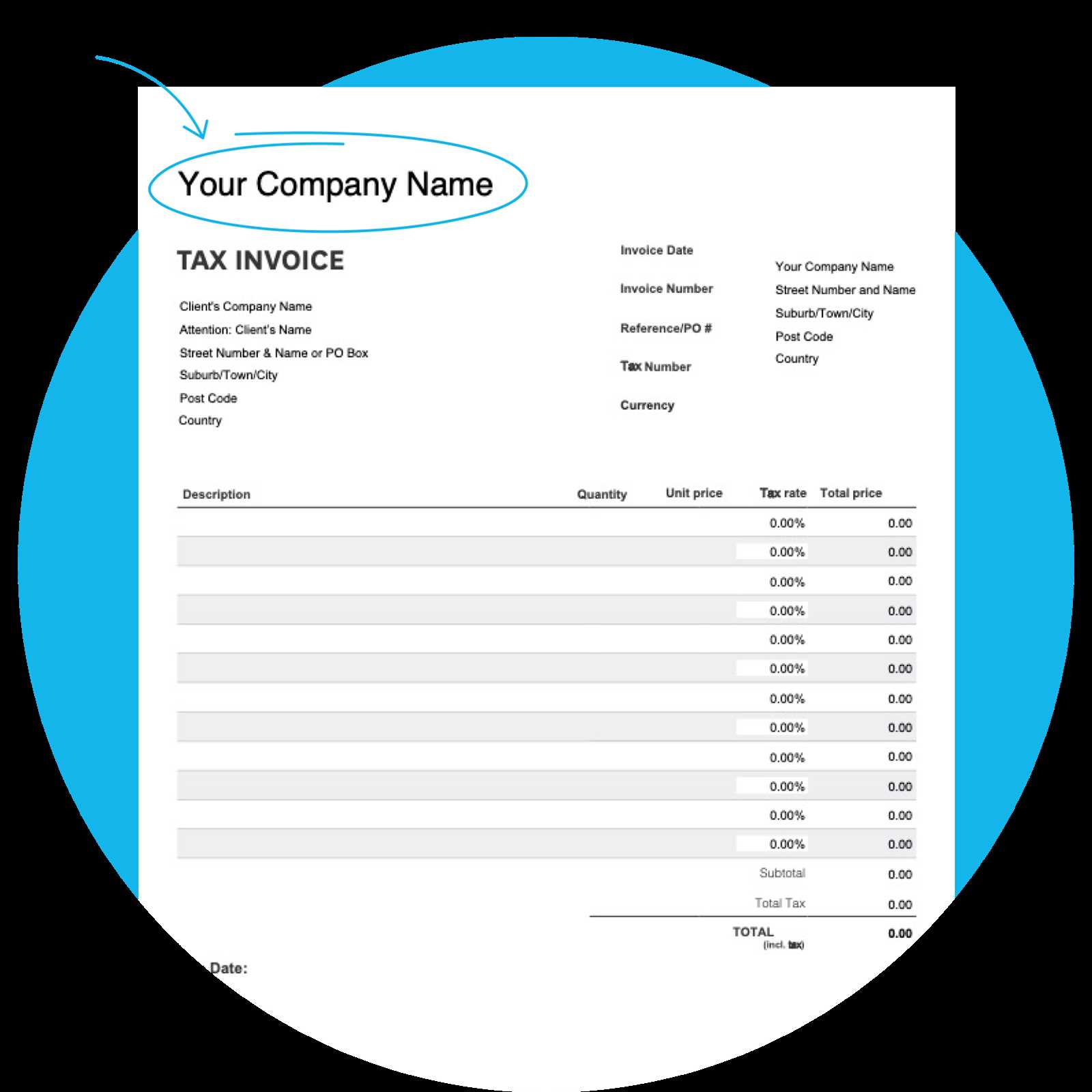

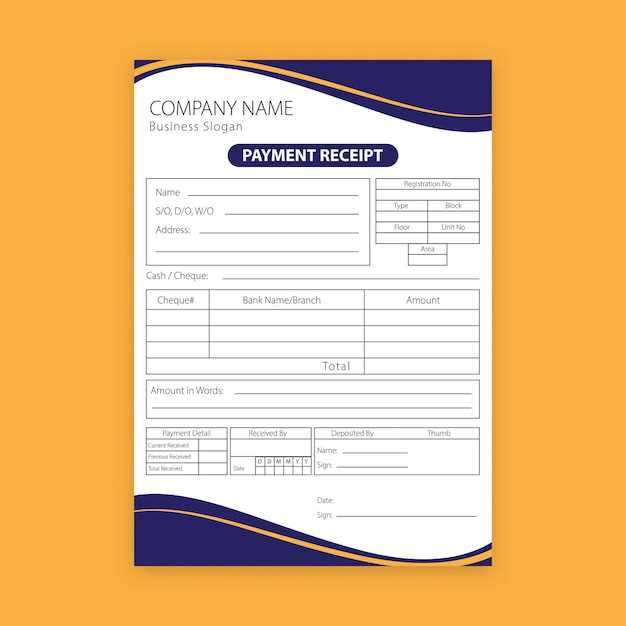

Customizing Your Paid Invoice Receipt

Every business has unique needs when it comes to documenting completed financial transactions. Customizing your payment confirmation document ensures it aligns with your brand identity and meets specific requirements. Whether you’re adding your company logo, adjusting the layout, or including additional information, a tailored approach helps create a professional and personalized document that suits your business operations.

Key Areas to Customize

When personalizing a payment confirmation document, consider the following components:

- Branding Elements: Adding your company logo, business colors, and fonts can make the document feel more cohesive with your overall brand identity.

- Client-Specific Information: Customize the format to include specific details about the transaction, such as loyalty program codes, custom discounts, or personalized service descriptions.

- Additional Legal or Policy Information: If applicable, include business policies, refund instructions, or warranty terms to provide clarity on how the transaction is handled.

- Custom Fields: If your business requires additional information (such as purchase order numbers, project details, or service codes), create fields to capture that data consistently.

Tools for Easy Customization

There are various tools and resources available to help you create and modify payment confirmation documents quickly:

- Word Processors: Programs like Microsoft Word or Google Docs allow for simple customization with templates and advanced formatting options.

- Online Builders: Many online platforms offer customizable templates with drag-and-drop features, allowing for quick adjustments without the need for design skills.

- Accounting Software: Many accounting programs offer options to personalize payment documents, ensuring they are automatically tailored to your specific business needs.

By tailoring these documents, you enhance your brand’s professionalism while ensuring they meet all your operational requirements. Customizing payment confirmation records also ensures that clients receive relevant, clear information about their transactions, helping to avoid confusion and foster trust.

How to Send Paid Invoice Receipts

Once a financial transaction is complete, it’s important to send a confirmation document to the client or customer. This ensures they have a clear record of the payment and serves as proof for both parties. The process of sending such documents can be streamlined and professional, whether done electronically or in paper form. Here are some effective methods for delivering these documents efficiently.

To send payment confirmation documents, follow these steps:

- Choose the Delivery Method: Decide whether you will send the document via email, postal mail, or through an online portal. Email is the most common and fastest method, while postal mail may be preferred for formal transactions or clients who request physical copies.

- Use a Clear Subject Line: If sending via email, use a straightforward subject line that includes the client’s name or the transaction reference number. This makes it easier for the recipient to identify the document.

- Include All Relevant Details: Ensure the document includes all the necessary information, such as the transaction date, amount paid, payment method, and any reference or order numbers. This clarity prevents confusion and ensures that the recipient understands the transaction details.

- Attach the Document: For email delivery, attach the confirmation document as a PDF or another widely accepted format. PDFs ensure that the document’s layout and content remain intact across different devices.

- Verify Contact Information: Double-check the recipient’s email address or physical address to ensure that the document reaches the right person without delay.

When sending payment confirmation documents via email, always consider the following best practices to maintain professionalism:

- Personalize the Message: Address the client by name and include a brief message thanking them for their payment. This adds a personal touch and enhances customer relations.

- Confirm the Transaction: Remind the recipient of the specific transaction details–such as the items or services purchased and the payment amount–before attaching the document.

- Set Clear Expectations: Let the client know if there are any next steps required, such as processing their order or following up with any additional documentation.

By following these guidelines, businesses can ensure that payment confirmation documents are sent promptly and professionally, helping to mainta

Digital vs Paper Receipts: Pros and Cons

When it comes to confirming completed payments, businesses and customers can choose between two primary methods of documentation: digital or physical formats. Each option comes with its own advantages and challenges, and selecting the right one depends on factors such as convenience, cost, and environmental impact. Below, we’ll explore the pros and cons of both approaches to help you make an informed decision.

Digital Payment Confirmation

Advantages:

- Convenience: Digital documents can be sent instantly via email or other online platforms, allowing both parties to access the information quickly from anywhere.

- Cost-Effective: There are no printing or mailing costs involved, making it an affordable choice for businesses.

- Storage and Organization: Storing digital documents is simple and space-saving, as they can be organized in folders or backed up in cloud storage for easy access.

- Environmental Impact: By opting for electronic documents, businesses reduce paper waste, making it a more eco-friendly option.

Disadvantages:

- Technical Barriers: Both businesses and clients need access to digital devices and internet connections, which can be limiting for some customers.

- Security Concerns: Digital files are susceptible to hacking or data breaches, so extra care must be taken to secure sensitive financial information.

Paper Payment Confirmation

Advantages:

- Tangible Proof: A physical document can be kept as a permanent, hard copy that’s often preferred by clients who need a physical record for legal or accounting purposes.

- No Technical Requirements: Physical receipts don’t require internet access or electronic devices, making them more accessible for customers who prefer paper-based records.

Disadvantages:

- Cost and Time: Printing and mailing physical documents incur costs and additional time for preparation and delivery.

- Storage and Organization: Paper receipts require physical storage space and can easily become lost, damaged, or disorganized over time.

- Environmental Impact: Printing paper receipts contributes to paper waste, which can be an environmental concern, especially for businesses with high transaction

Common Mistakes to Avoid in Receipts

When creating a document to confirm a completed payment, it’s essential to ensure that all necessary details are included and accurate. Even small mistakes can lead to confusion, disputes, or legal issues. Avoiding common errors in your payment records helps maintain professionalism, ensures clear communication with clients, and prevents potential problems in the future.

Here are some of the most frequent mistakes businesses make when issuing payment confirmation documents:

- Incorrect Amounts: One of the most critical errors is listing the wrong amount. Double-check all figures, including taxes, discounts, and the total sum, to ensure they are accurate and match the actual payment.

- Missing or Inaccurate Dates: Failing to include the correct payment date or using an incorrect date can create confusion. Always make sure to record the exact date the payment was received.

- Unclear Payment Method: Not specifying how the payment was made (e.g., credit card, cash, bank transfer) can lead to misunderstandings. Clearly state the payment method to ensure transparency.

- Lack of Client Information: Omitting or misspelling client details (such as name, address, or contact information) can create issues with record-keeping and customer satisfaction. Always verify that client data is correct.

- Not Including a Unique Reference Number: Without a unique reference number or transaction ID, tracking and cross-referencing payments becomes difficult. Make sure each document has a unique identifier for easy tracking.

- Omitting Terms or Conditions: If there are specific terms related to the payment (such as refund policies or delivery timelines), leaving them out can lead to confusion. Include any relevant terms to avoid miscommunication.

- Unprofessional Format: A poorly formatted or difficult-to-read document can reduce the perceived professionalism of your business. Use clear, consistent fonts, and organize the information logically to enhance readability.

By paying attention to these common mistakes, you can ensure that your payment confirmation documents are accurate, clear, and professional, reducing the risk of confusion and fostering trust with your clients.

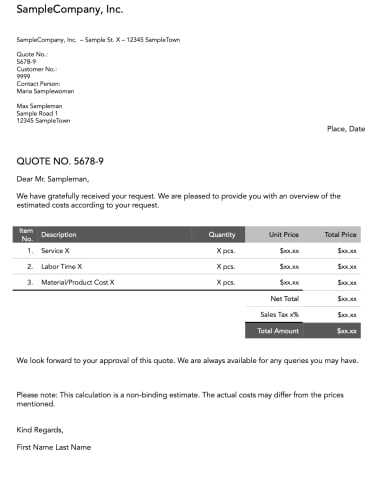

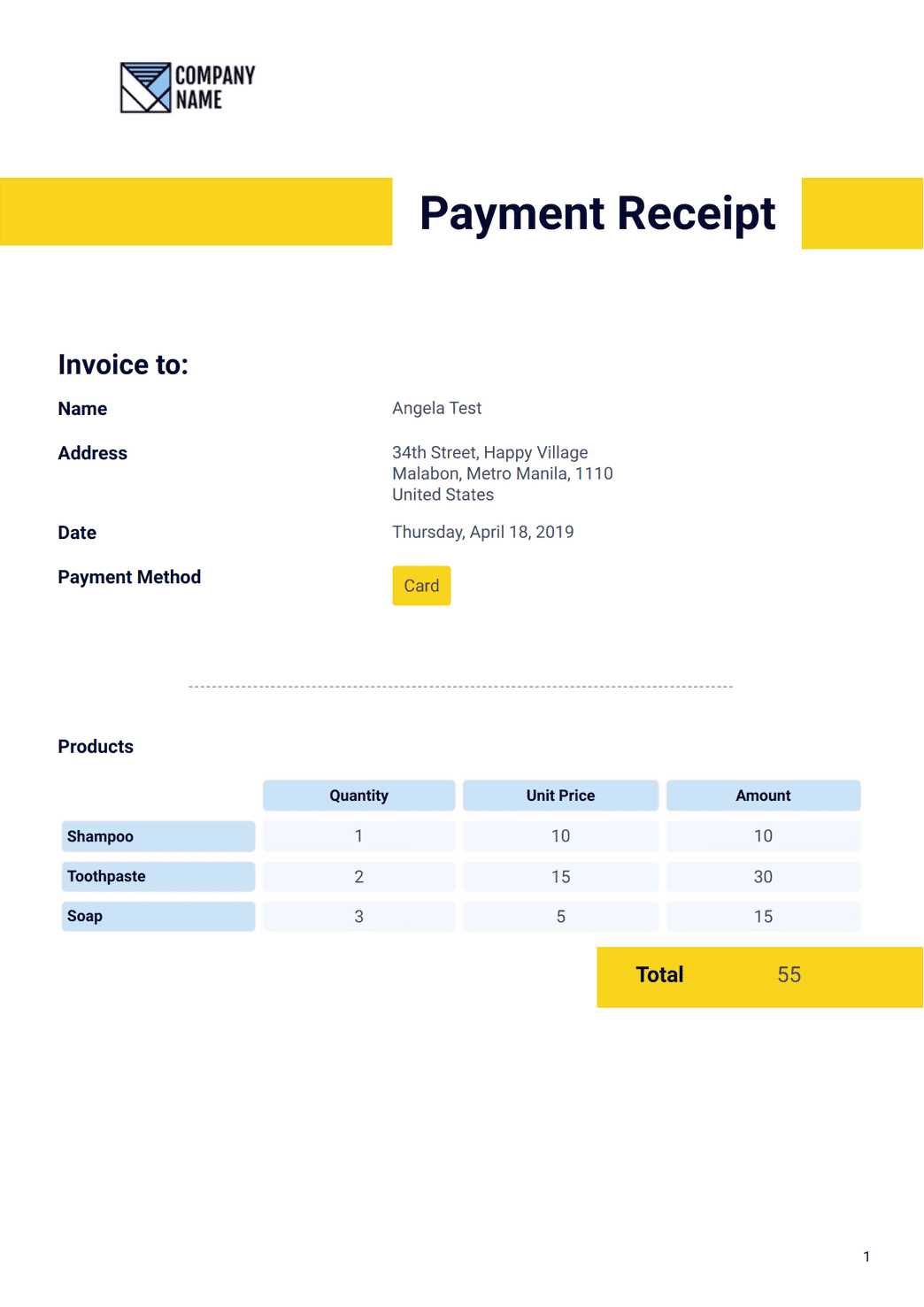

Free Paid Invoice Receipt Templates Online

For businesses looking to streamline their payment confirmation process, online resources provide free, customizable document formats that make creating professional records easy. These pre-designed options allow you to quickly generate payment documentation without having to start from scratch. Whether you need a simple, clean format or something more detailed, there are various websites offering free templates for businesses of all sizes.

Where to Find Free Payment Confirmation Templates

Several websites offer free, easy-to-edit options that can be downloaded and personalized for your business needs. Some popular resources include:

- Google Docs: Free and customizable document templates that can be edited online and shared with clients instantly.

- Microsoft Word: Many free formats are available through Microsoft Office’s online platform, ready to be modified for your specific needs.

- Canva: Known for its design-focused templates, Canva offers visually appealing payment confirmation forms that can be customized with your brand’s colors and logo.

- Template.net: A website offering a wide range of free document templates, including options for payment records that can be tailored to different industries.

- Zoho Invoice: Zoho offers free, easy-to-use templates that can be used within their invoicing software for businesses looking to manage their financial documentation.

Benefits of Using Free Online Templates

Using these free online formats provides several advantages for businesses, including:

- Time-Saving: Templates help you create payment confirmation documents quickly, eliminating the need for manual formatting and allowing you to focus on other business tasks.

- Professional Quality: Many online templates are designed by professionals, ensuring that the documents you send to clients have a polished, consistent look.

- Customizability: You can modify these templates to fit your unique branding, from adding your company logo to adjusting the layout to meet your needs.

- Cost-Effective: Free templates eliminate the need for hiring a designer or purchasing expensive software to generate professional documents.

By leveraging these free resources, businesses can easily create professional payment confirmation documents that are both functional and tailored to their specific needs, helping to improve customer satisfaction and operational efficiency.

How to Organize Paid Receipts Efficiently

Efficient organization of payment confirmation documents is crucial for both businesses and individuals. By keeping these records well-organized, you can ensure that they are easily accessible when needed for accounting, tax purposes, or customer queries. Whether you prefer digital or physical documents, having a structured system in place will help you save time and reduce the risk of losing important information.

Here are some effective methods for organizing payment confirmation documents:

Method Description Digital Storage Store all documents in a secure cloud storage system like Google Drive, Dropbox, or OneDrive. Organize them by folders, such as by client, date, or transaction type, for easy retrieval. File Naming Conventions Use consistent and descriptive file names, including transaction date, client name, and a reference number. This makes it easier to search for specific records when needed. Use of Accounting Software Leverage accounting tools like QuickBooks, Xero, or Zoho, which can automatically store and organize documents, creating a digital filing system that syncs with your financial records. Physical Filing System If you prefer hard copies, use a filing cabinet with clearly labeled folders. Organize receipts by date, client, or payment method for easy access. Ensure they are protected in folders or envelopes to prevent damage. Regular Backups For digital records, regularly back up your documents to ensure you don’t lose important files. For physical records, keep duplicates in a secure location as an additional precaution. By implementing these organizational strategies, you can create a streamlined system that helps you stay on top of your financial records. Whether you choose digital or paper formats, maintaining an organized approach ensures that your payment confirmat

Integrating Receipts with Accounting Software

Integrating payment confirmation documents directly into your accounting software can greatly streamline financial tracking and reporting. By automating this process, businesses can reduce manual entry errors, save time, and ensure that financial data is accurately recorded in real-time. This integration helps maintain seamless communication between your financial records and your payment documentation.

Why Integration Matters

Integrating these documents into your accounting software offers several advantages:

- Accuracy: Reduces the risk of human error by automatically updating transaction records and payment logs in your accounting system.

- Efficiency: Saves time by eliminating the need to manually input transaction data into accounting platforms.

- Real-time Updates: Integration ensures that financial information is always up to date, providing you with accurate reports and insights at any given moment.

- Improved Financial Visibility: Helps you easily track outstanding payments, reconcile accounts, and analyze business performance.

Popular Accounting Software for Integration

Many modern accounting tools offer built-in integrations or support third-party applications to automatically sync payment documentation. Some of the most widely used platforms include:

- QuickBooks: One of the most popular accounting platforms, QuickBooks offers integration with various document management systems, allowing seamless syncing of transaction records.

- Xero: Xero enables integration with a wide range of receipt and payment tracking tools, ensuring that your accounting system is always up to date.

- Zoho Books: Zoho’s accounting software allows you to link payment confirmation forms directly to your financial records, simplifying reconciliation and bookkeeping.

- Wave: A free accounting platform that provides easy integration with payment processors and receipt tracking tools.

By integrating payment documentation with your accounting software, you not only streamline operations but also improve the accuracy and efficiency of your financial reporting, helping your business stay organized and compliant.

Best Practices for Receipt Record Keeping

Properly organizing and maintaining payment confirmation records is crucial for efficient financial management. Whether you’re managing personal transactions or overseeing business finances, effective record-keeping ensures that you can quickly access important information for tax purposes, audits, and day-to-day accounting. Following best practices helps minimize errors, reduce the risk of losing documents, and keep your financial records accurate and up-to-date.

Here are some best practices to follow when managing payment confirmation documents:

- Maintain Consistent Documentation: Always ensure that every transaction is documented with sufficient detail, including the amount, date, payment method, and any relevant reference numbers. This consistency helps maintain clarity and allows for easy tracking of past transactions.

- Implement a Structured Filing System: Organize documents either digitally or physically in an easy-to-follow system. If you’re using physical copies, consider categorizing records by client, date, or payment type. For digital records, use folders and subfolders to ensure quick access to any file.

- Use Cloud Storage for Digital Records: For businesses and individuals who manage a high volume of transactions, cloud storage offers an excellent solution for storing digital records. It allows for easy access from any device while providing secure backup options in case of hardware failure.

- Regularly Back Up Data: Make sure to back up digital records periodically, especially if you’re managing critical financial data. Use automated backup solutions to ensure data security without the risk of losing important documents.

- Set Retention Periods: Establish clear guidelines for how long records should be kept. For tax and legal purposes, many businesses keep records for several years. Having a retention policy in place ensures that you’re not overwhelmed by outdated documents while still meeting compliance requirements.

- Ensure Security: Keep sensitive payment information protected. Whether you store physical records in locked cabinets or digital files in encrypted systems, maintaining the confidentiality and security of your data is essential to prevent unauthorized access.

- Stay Organized with Digital Tools: Consider using accounting software or specialized document management systems to streamline the process. Many of these tools offer features like automatic categorization, easy searchability, and integration with other financial tools, improving the overall organization of your records.

By following these best practices, you can ensure that your payment documentation is well-organized, secure, and accessible when needed. Whether for auditing, tax filings, or simply managing your finances, proper record-keeping will help your business stay efficient and compliant.

Legal Considerations for Invoice Receipts

When managing payment documentation, it is essential to understand the legal implications of providing and storing these records. In many jurisdictions, businesses are required to issue and maintain accurate financial documents that serve as proof of completed transactions. Failing to comply with legal requirements could result in penalties, disputes, or complications during audits. It’s important to know what information must be included, how long records should be kept, and the responsibilities for both businesses and clients in retaining such documents.

Here are key legal considerations when handling payment confirmations:

- Record Accuracy: The document should accurately reflect the transaction details, including the amount, date, payment method, and relevant parties involved. Inaccurate records can lead to disputes or legal issues, especially if the information is used in court or during tax audits.

- Compliance with Tax Laws: Businesses must issue payment documentation in accordance with local tax regulations. For example, tax rates, VAT details, or any other applicable charges must be clearly stated in the document. Failure to comply with tax laws may result in penalties or fines.

- Retention Periods: Different jurisdictions have specific requirements regarding how long payment records should be kept. For example, tax authorities often require businesses to retain transaction documents for a minimum of 5 to 7 years. Keeping records for the required duration ensures compliance during audits and tax inspections.

- Consumer Protection Laws: In many regions, businesses are obligated to provide clear and accurate payment documentation to protect consumers’ rights. Failure to do so could result in consumer complaints or legal actions. Be sure to include all necessary information that consumers may need to resolve disputes or verify transactions.

- Data Privacy and Security: When handling payment documentation, it is important to safeguard sensitive customer data. Ensure that personal details, payment methods, and transaction history are securely stored and protected from unauthorized access, in compliance with data protection laws like GDPR or CCPA.

- Digital Document Validity: In many legal frameworks, digital documents can be legally binding, provided they meet certain criteria. This includes ensuring that electronic signatures or digital stamps are valid, and that the document format is widely recognized and securely stored.

- Invoice Numbering System: A sequential and unique numbering system is required to track and identify each transaction record. This helps in maintaining organized documentation and ensures that no records are overlooked or duplicated during audits.

Understanding these legal considerations will help you avoid potential legal issues and ensure that your payment documentation complies with applicable laws. Whether you are a business owner or an individual managing transactions, keeping accurate, secure, and legally compliant records is essential to safeguarding your financial and legal interests.

How to Edit a Paid Invoice Receipt

Editing payment confirmation documents is a common task when discrepancies need to be resolved, or when a mistake is found after the document has been issued. Whether you need to correct an amount, update a client’s details, or add additional notes, having the ability to quickly and accurately edit these records is essential for maintaining clear financial communication. The process can be straightforward, but it’s important to make changes carefully to ensure the document remains valid and professional.

Here’s how to effectively edit a payment confirmation document:

- Choose the Right Software: Use a document editor like Microsoft Word, Google Docs, or specialized invoicing software to open the original document. These tools often allow for easy editing and formatting adjustments, ensuring the document remains clean and readable.

- Ensure Accuracy: Double-check all the details you need to edit, such as the payment amount, date, and any reference numbers. Accuracy is crucial to avoid confusion and maintain the integrity of the document. Make sure all changes align with the original agreement and transaction.

- Update Client Information: If the client’s name, address, or other contact information needs to be corrected, ensure that the update is consistent across the document. A mismatched name or incorrect address can cause confusion or problems when the document is used for future reference.

- Add Necessary Notes: If you need to explain a change or include additional details (such as a discount, tax breakdown, or payment method), add these notes clearly and professionally. Some document editors allow you to insert comments or footnotes, which can be useful for clarification.

- Save a New Version: When making edits, always save the document with a new file name or version number. This ensures you maintain a record of the original document and can track changes over time. For example, you can use a versioning system like “Receipt_001” and “Receipt_002” to differentiate between the original and edited versions.

- Use Digital Signatures if Necessary: If the document requires approval or validation, be sure to apply any necessary digital signatures after editing. This ensures the edited version is recognized as official and legally valid.

- Review Before Sending: Before sharing or printing the edited document, carefully review all changes for accuracy and clarity. Ensure that all updates reflect the correct transaction details and that the document appears professional and error-free.

By following these steps, you can make sure that your payment confirmation documents remain accurate, professional, and in compliance with any necessary legal or financial requirements. Always remember to preserve the integrity of the original document, and make edits only when absolutely necessary to ensure transparency and consistency.

Tracking Payments with Invoice Receipts

Effectively tracking payments is essential for maintaining accurate financial records and ensuring that all transactions are properly accounted for. By keeping detailed and organized documentation of each payment made, businesses and individuals can easily monitor outstanding balances, verify completed transactions, and reconcile their accounts. The right documentation allows for greater control and transparency over financial operations, helping to avoid confusion and disputes.

One of the most effective ways to track payments is through clear, organized records that reflect each transaction’s status. Below is a table that highlights key elements to include when documenting payments:

Payment Detail Description Transaction ID A unique identifier for each payment. This helps you easily reference specific transactions and track them throughout your records. Amount Paid The exact amount of money paid for a specific transaction, which is crucial for accounting and financial reporting. Payment Date The date the payment was received. This is essential for understanding when payments were made and tracking payment schedules. Payment Method The type of payment used (e.g., credit card, bank transfer, cash), which helps differentiate between various payment methods and simplifies reconciliation. Client Details Information about the client or customer making the payment, including their name and contact information, to ensure correct allocation of payments. Outstanding Balance The remaining balance after a payment has been made. Tracking this allows you to monitor payments received versus what is still owed. Payment Reference A reference or note identifying the specific goods or services tied to the payment. This ensures the payment is properly allocated to the correct transaction. Tracking payments with accurate and detailed records enables efficient account reconciliation and provides a clear overview of a client’s or business’s financial status. These documents also serve as important evidence during audits or if any disputes arise over payment claims. By staying organized and meticulous with payment tracking, businesses can ensure smooth financial operations and reduce the risk of errors or misunderstandings in their financial reporting.