Paid Invoice Email Template for Efficient Payment Confirmation

When managing business transactions, clear and professional communication plays a crucial role in maintaining trust and efficiency. One of the most important aspects of this process is ensuring that customers are properly notified when their obligations have been fulfilled. Properly crafted messages help avoid confusion and reinforce a positive relationship with clients.

Providing a detailed and courteous acknowledgment of received payments not only confirms the transaction but also strengthens future interactions. Well-structured messages can include important information like payment breakdowns, deadlines, and the next steps, while also reflecting your company’s professionalism.

Utilizing well-designed communication formats ensures that your business maintains a streamlined and consistent approach, ultimately reducing administrative burden and fostering customer satisfaction. In this section, we will explore how to craft clear, effective messages that keep the process smooth and professional for both parties involved.

Creating a Clear Payment Confirmation Message

Clarity is key when communicating with clients about completed transactions. A well-written message ensures that the recipient understands the payment has been processed and outlines any important next steps or details. Clear communication helps to build trust and eliminates potential misunderstandings, making it easier for both parties to move forward with confidence.

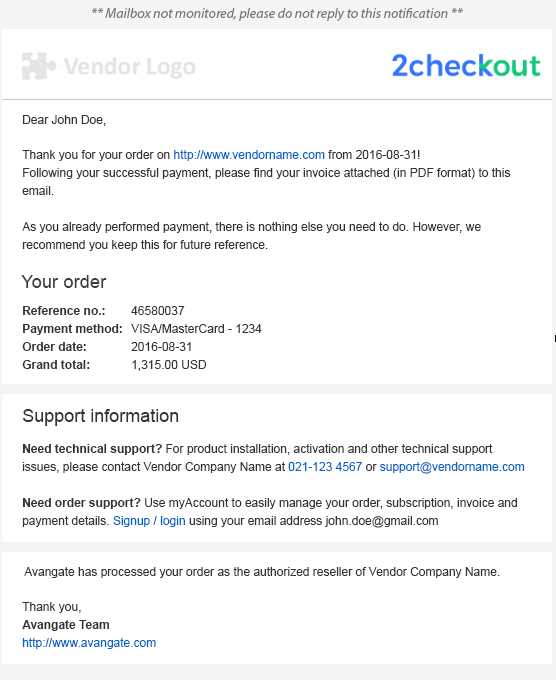

Structure is essential when crafting these types of messages. Start by acknowledging the payment and then provide any relevant details such as the amount, date, and method of payment. Including these specifics reassures the recipient that the transaction has been properly handled and that there is no need for further action.

Concise and direct language is also important. Avoid unnecessary jargon or overly complex explanations. The goal is to provide the necessary information in a way that is easy for the client to quickly understand. This not only ensures the message is effective but also contributes to a professional tone that reflects well on your business.

Why Payment Confirmation Messages Are Important

Sending clear communication after a transaction is crucial for maintaining a smooth and professional relationship with clients. It provides customers with the reassurance that their payment has been processed correctly and helps to avoid any confusion or disputes. By confirming the completion of a transaction, you demonstrate attention to detail and customer care, both of which enhance your business reputation.

Transparency and trust are built through these messages. They serve as a record for both parties, outlining the details of the transaction and confirming that everything has been settled. This not only reassures the customer but also creates a paper trail that can be referenced in case of any future queries or issues.

Efficient communication can help prevent delays in the next phase of business operations, such as processing future orders or providing additional services. Clear and timely messages allow businesses to move forward with confidence, knowing that payment matters have been properly addressed. This small but vital step can improve customer satisfaction and encourage repeat business.

Key Elements of a Payment Confirmation Message

For a payment acknowledgment to be effective, it must include certain essential components that ensure the recipient has all necessary information in a clear and organized format. These elements not only confirm the transaction but also provide the recipient with important details that help avoid confusion or further inquiries.

First and foremost, clarity in stating that the payment has been successfully processed is crucial. Along with this, include key information such as the amount paid, the date of the transaction, and the method used. This transparency helps the recipient understand the specifics of their payment.

Additional details, such as an order number or reference code, can also be useful. Including a summary of the services or products purchased ensures the recipient knows exactly what they have paid for. Lastly, a friendly and professional tone will create a positive impression and strengthen the relationship between you and your client.

How to Personalize Payment Acknowledgment Messages Effectively

Personalizing communication helps to strengthen customer relationships and makes messages feel more tailored and considerate. When sending a transaction confirmation, a personalized approach can make the recipient feel valued and increase their trust in your business. Incorporating the client’s name, specific transaction details, and a customized message can elevate the overall experience.

Start by addressing the recipient directly using their first name. A personal greeting immediately sets a friendly tone for the message. Including information that relates directly to the client’s transaction–such as the items or services they purchased–adds an extra layer of relevance, showing attention to detail.

Here is an example of how to personalize:

| Field | Example |

|---|---|

| Greeting | Dear John, |

| Transaction Details | We have successfully processed your payment of $150 for the website design service. |

| Personalized Message | Thank you for your continued trust. We’re excited to continue working with you on your project! |

By integrating these personal touches, you make the message feel less automated and more like a direct communication from your business, which can help foster loyalty and satisfaction.

Common Mistakes in Payment Acknowledgment Messages

Even the most professional businesses can sometimes make mistakes when sending payment confirmations. These errors can create confusion or leave clients with a poor impression of your company’s attention to detail. It’s important to be mindful of common pitfalls that can undermine the effectiveness of these messages. Below are some of the most frequent mistakes to avoid.

1. Lack of Clarity in Payment Information

- Failing to clearly state the amount paid, payment method, or transaction reference.

- Not specifying the date or time of payment, which may cause confusion for the recipient.

- Overloading the message with too much technical detail, making it harder for the client to grasp the key points.

2. Unprofessional Tone or Language

- Using overly casual language that can come across as unprofessional.

- Using too much jargon or industry-specific terms that the recipient may not understand.

- Not including a polite sign-off, leaving the message feeling abrupt or impersonal.

By avoiding these common mistakes, you ensure that your payment confirmation is clear, professional, and positively received by your clients. Always review your message before sending to ensure accuracy and clarity.

Best Practices for Payment Confirmation Message Subject Lines

The subject line of a payment acknowledgment message is one of the first things your recipient will see. A well-crafted subject line sets the tone for the message and encourages the recipient to open it promptly. It should be clear, concise, and relevant to the content of the message, providing a quick preview of what the recipient can expect inside.

1. Keep It Clear and Direct

When writing the subject line, the focus should be on clarity. The recipient should be able to immediately understand the purpose of the message. Avoid vague or overly creative subject lines that may confuse or mislead the reader.

- Example: “Payment Confirmation for Your Recent Purchase”

- Example: “Thank You for Your Payment – Transaction Complete”

2. Include Key Details When Appropriate

In some cases, adding specific details such as an order number or payment amount can help the recipient quickly identify the transaction, especially if they have multiple purchases or accounts with your business.

- Example: “Payment of $150 Received for Order #12345”

- Example: “Payment Confirmation – $250 for Website Services”

Personalization can also play a role in creating an engaging subject line. Including the recipient’s name or referencing their specific transaction can make the message feel more tailored and relevant.

- Example: “John, Your Payment of $200 Has Been Processed”

By following these best practices, you can ensure your subject lines are both effective and professional, increasing the likelihood that your message will be read and acknowledged promptly.

How to Confirm Payment in Messages

Confirming a payment in a message is an important step in assuring your customer that their transaction has been successfully completed. This confirmation not only provides peace of mind but also reinforces the professionalism of your business. A well-crafted acknowledgment will include specific details of the transaction and clearly convey that the payment has been received and processed.

1. Acknowledge the Payment Clearly

The first step in confirming a payment is to directly state that it has been successfully received. This simple statement removes any doubt and helps the recipient feel confident that their transaction is complete.

- Example: “We have successfully received your payment of $200.”

- Example: “Your payment has been processed and confirmed.”

2. Provide Transaction Details

To make the confirmation even clearer, provide relevant details about the transaction. This can include the amount, payment method, transaction date, and any reference number that will help the recipient identify the payment.

- Example: “The amount of $200 was paid via credit card on September 1st, 2024.”

- Example: “Payment for Order #12345 has been successfully processed on July 15th, 2024.”

Including these specific details not only reassures the recipient but also provides a record they can refer to in the future. This simple step can prevent misunderstandings and strengthen customer satisfaction.

Professional Tone in Payment Communication

Maintaining a professional tone in transaction-related messages is essential for fostering trust and credibility with clients. The way you communicate not only reflects your business values but also affects how clients perceive the quality of your service. Clear, respectful, and courteous language helps establish a positive rapport and ensures that important details are understood without confusion.

Using a formal yet approachable tone is key. It’s important to strike the right balance–while you want to convey professionalism, the message should still feel personal and engaging. Avoid using overly casual language, as it might come across as disrespectful or inattentive to the client’s needs.

Respect and politeness are integral to maintaining a professional tone. Always express gratitude for the customer’s business, acknowledge their prompt payment, and offer assistance should they need further clarification. This kind of approach not only builds trust but also strengthens customer relationships, making clients more likely to return for future services.

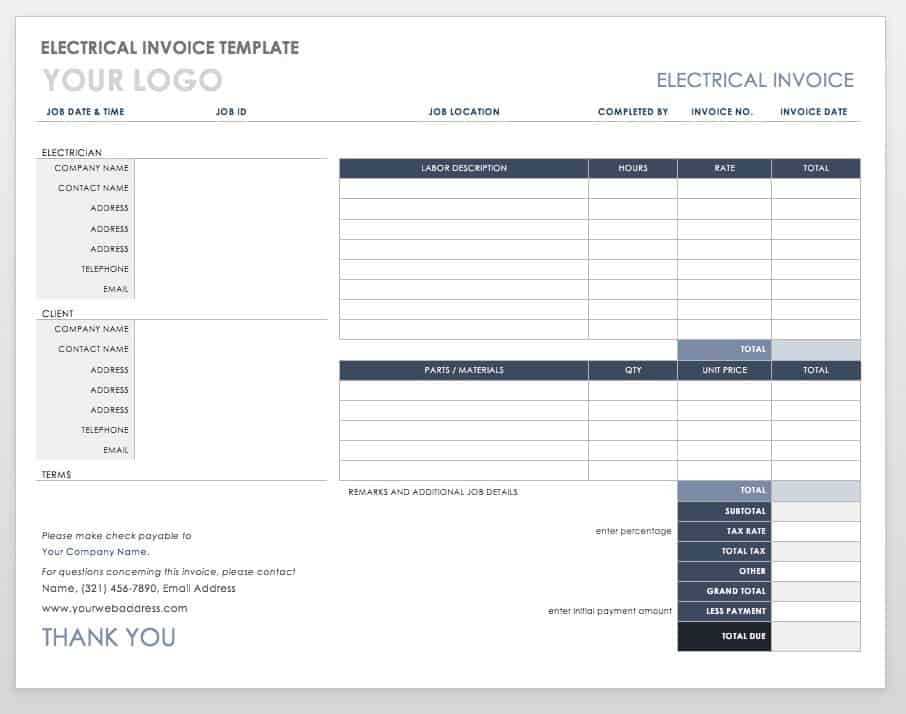

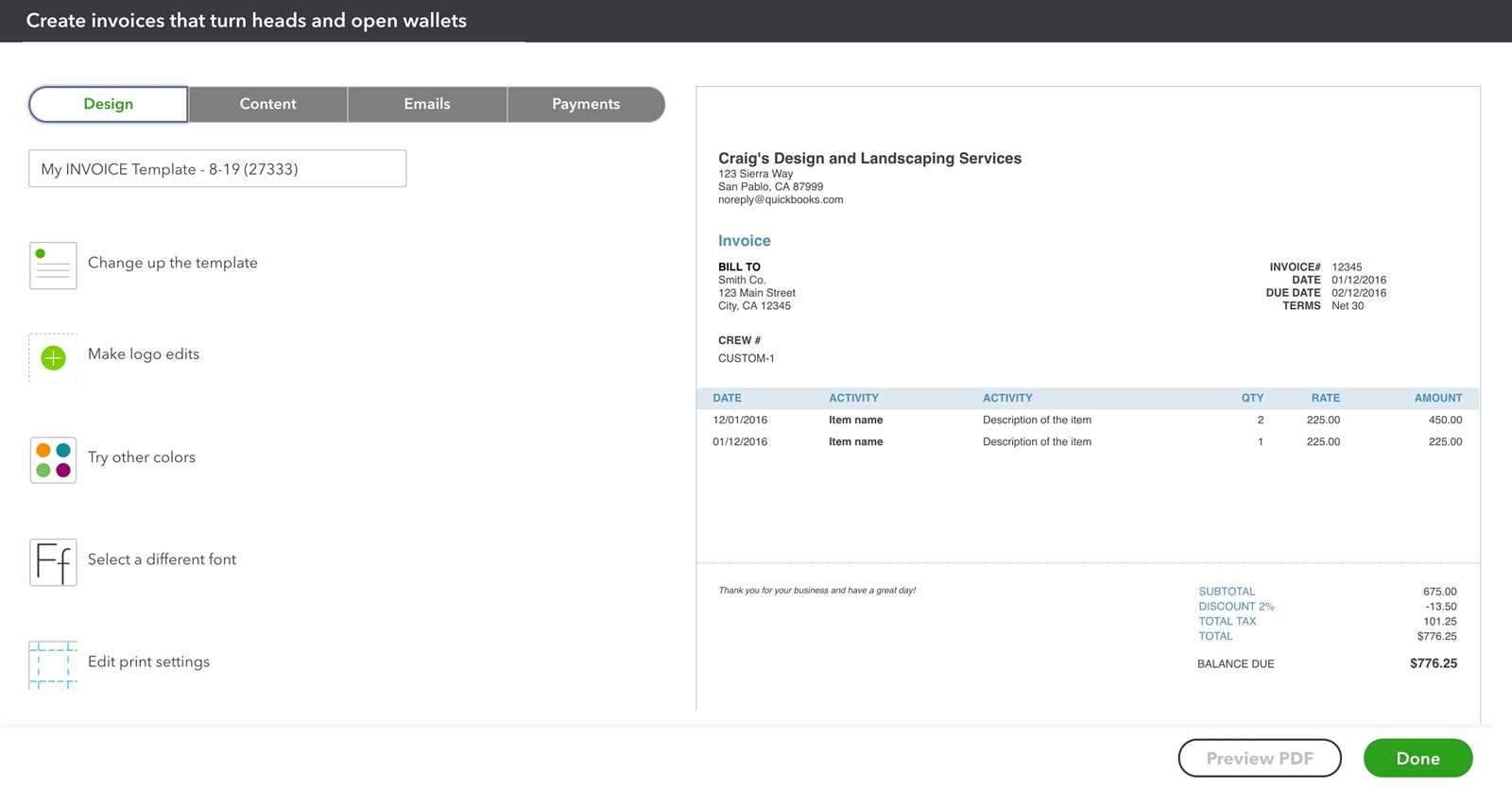

Using Pre-Designed Formats to Save Time

In a fast-paced business environment, efficiency is key. One way to streamline your workflow and save valuable time is by utilizing pre-designed formats for your communication. Instead of drafting messages from scratch each time, having a ready-to-go structure allows you to focus on the specific details without having to rework the entire message. This method ensures consistency while reducing the risk of errors or omissions.

Pre-designed formats can be customized easily to suit different transactions and clients, making them highly adaptable. By filling in the necessary details, such as payment amount or reference numbers, you can quickly generate accurate and professional messages. This process minimizes the amount of time spent on repetitive tasks, allowing you to handle more clients efficiently.

- Save time on repetitive tasks by reusing a proven structure.

- Ensure consistency in messaging across multiple transactions.

- Customize for each client while maintaining professionalism.

- Minimize the chances of errors or missing information.

By incorporating pre-designed formats into your daily operations, you free up more time to focus on other essential aspects of your business. This approach not only improves efficiency but also enhances your ability to deliver timely and accurate information to clients, building trust and satisfaction.

Ensuring Clarity in Payment Details

Providing clear and transparent payment information is essential for preventing misunderstandings and ensuring a smooth transaction process. When communicating payment confirmations or receipts, it’s important to outline all relevant details in a way that is easy for the recipient to understand. This clarity not only helps in resolving any questions quickly but also reinforces professionalism and trust in your business.

Being specific with transaction information is key. Customers should easily find and verify the key details of their payment, such as the amount, payment method, and date. This reduces the need for follow-up inquiries and helps both parties stay on the same page.

| Detail | Description |

|---|---|

| Transaction Amount | Clearly state the total amount paid, including any applicable taxes or discounts. |

| Payment Method | Specify how the payment was made (e.g., credit card, bank transfer, PayPal). |

| Transaction Date | Include the exact date the payment was processed. |

| Order/Reference Number | If applicable, include a reference or order number to help identify the transaction. |

By providing a detailed breakdown of these elements in your message, you ensure that the recipient has all the information they need in a clear and accessible format. This level of clarity can prevent confusion, promote transparency, and ultimately build stronger customer relationships.

How to Attach Payment Documents to Messages

Attaching payment-related documents to your communication is an effective way to provide your client with a clear and accessible record of the transaction. Ensuring that the document is properly formatted and easy to download or view is crucial for maintaining professionalism and clarity. This process also helps avoid confusion and provides both parties with a reference that can be reviewed at any time.

Here are a few steps to consider when attaching documents:

- Ensure the document is in a widely accessible format such as PDF or Word, which most recipients can open without issues.

- Make sure the document is correctly named, ideally with the client’s name and the transaction date or reference number. This makes it easier for both parties to find and refer back to.

- Before sending, double-check that the attachment is the correct document. Mistakes can create confusion or delay further processes.

- Limit the size of the document to avoid delivery issues. If it’s too large, consider compressing the file or providing a download link instead.

When attaching documents to a message, always refer to the attachment in the body of the message. This ensures the recipient knows exactly what to expect and can easily locate the document. For example, a sentence like, “Please find your payment receipt attached for your records” makes it clear and professional.

By following these simple guidelines, you can make sure that the attachment process is seamless and your clients receive the information they need without hassle.

When to Send a Payment Confirmation Message

Sending a timely payment confirmation is essential to maintaining a smooth workflow and keeping your clients informed. Knowing the right moment to send this communication ensures that your client has received all necessary information about their completed transaction without unnecessary delays. It also helps to avoid confusion, ensuring that both parties are on the same page regarding the status of the payment.

1. Immediately After Payment is Processed

Sending the confirmation right after the payment is processed is the most common practice. This approach reassures your client that the transaction has been completed successfully. It’s important to send this communication as soon as the payment has cleared to prevent any misunderstandings about the status of their account.

- For online transactions, send the confirmation as soon as the payment is verified.

- For manual payments, send the confirmation after the payment is recorded in your system.

2. Once Payment is Verified and Cleared

If you are dealing with more complex payment methods, such as bank transfers or checks, it may take some time for the payment to clear. In these cases, it’s best to wait until the payment is fully verified before sending the confirmation. This helps prevent any confusion or potential issues if the payment isn’t processed correctly.

- Wait for the verification process to be completed before sending confirmation.

- Make sure all payment details are accurate and confirmed before notifying the client.

By sending the payment acknowledgment at the right time, you demonstrate professionalism and keep the process transparent. This ensures your clients feel confident in their transactions and can move forward with future dealings smoothly.

Customizing Payment Confirmation Formats for Your Business

Customizing your communication formats for payment acknowledgments is a powerful way to ensure consistency and professionalism in your transactions. Tailoring these messages to fit your brand and specific needs can enhance the client experience and make your business stand out. By adjusting the structure, language, and key details, you create a unique touchpoint that reflects your company’s identity and fosters stronger client relationships.

1. Align with Your Brand Identity

Incorporating your brand elements into the payment acknowledgment messages helps maintain consistency across all communications. This includes using your company logo, brand colors, and fonts. When your clients recognize your brand, it reinforces your professional image and trustworthiness.

For example, you can include a header with your company logo and a footer with your contact details. A well-designed format can make your message look more polished and organized, leaving a lasting impression on your clients.

2. Tailor the Content for Specific Transactions

Personalizing the content of the message to match the specifics of each transaction will ensure the client feels valued and that their payment is accurately recorded. Include relevant information such as the payment method, transaction amount, and a breakdown of the services or products they’ve paid for. This attention to detail helps avoid confusion and adds clarity.

| Field | Customizable Example |

|---|---|

| Client Name | Dear John, |

| Transaction Details | Your payment of $250 for Web Development Services has been successfully processed. |

| Order Number | Order #56789 |

| Message | Thank you for your prompt payment. We appreciate your continued trust in our services! |

By adjusting these details for each client, you make the message feel personal and relevant, enhancing the overall customer experience.

Customizing your payment acknowledgment formats is an easy but impactful way to maintain professionalism while creating a personalized experience for your clients. It ensures that your communications are clear, engaging, and aligned with your brand’s identity.

Automating Payment Confirmation Messages

Automating payment acknowledgment communications can save significant time and effort, especially for businesses that handle a large number of transactions. By setting up an automated system, you can ensure that every client receives their confirmation promptly and consistently. This approach reduces the risk of human error and allows you to focus on other important aspects of your business, while still maintaining professionalism and accuracy in your communication.

Implementing automation for payment confirmations requires choosing the right tools and setting up templates that can be customized based on the transaction details. With the right system in place, you can send personalized messages automatically as soon as a payment is processed, creating a seamless experience for both you and your clients.

- Choose an automation tool: There are many platforms available that can integrate with your payment system to trigger automatic messages.

- Customize your messages: Even though the process is automated, ensure the messages include essential details such as payment amount, transaction date, and client name.

- Set triggers for automation: Define clear rules on when the system should send the confirmation, such as immediately after a payment is confirmed or after it clears.

- Test the automation: Before fully relying on automation, thoroughly test the system to make sure all messages are sent correctly and contain accurate information.

By automating this process, you not only save time but also improve the overall customer experience. Clients appreciate quick and efficient communication, and automation ensures they receive confirmation without delay. Plus, it enables you to scale your business operations without sacrificing quality or professionalism.

Improving Customer Relationships with Payment Confirmation Messages

Effective communication plays a critical role in fostering strong customer relationships. When you send a payment acknowledgment, it’s not just about confirming a transaction; it’s an opportunity to show appreciation and reinforce trust. By delivering clear, professional, and personalized messages, you can create a more positive experience for your clients, which encourages loyalty and strengthens long-term partnerships.

1. Showing Appreciation and Gratitude

One of the simplest ways to improve customer relationships is by expressing gratitude. Acknowledging your client’s payment in a friendly, appreciative manner can go a long way in making them feel valued. When clients feel appreciated, they are more likely to continue doing business with you.

- Example: “Thank you for your prompt payment! We truly appreciate your business.”

- Example: “Your support means a lot to us. Thank you for your continued trust!”

2. Building Trust with Transparency

Clear communication is essential for trust-building. When you send a confirmation message that includes all the relevant details, such as the amount paid, the method of payment, and a reference number, you reassure your client that everything is in order. Transparency helps to avoid misunderstandings and builds confidence in your business practices.

- Ensure accuracy: Double-check the payment amount and transaction details before sending.

- Provide details: Include all essential transaction information in the message for easy reference.

By making your communications clear, polite, and informative, you enhance the customer experience and establish a strong foundation for future interactions. A positive experience with one payment acknowledgment can lead to repeat business, referrals, and a long-lasting professional relationship.